Abstract

Amid the widespread impact of COVID-19, mobile financial services (MFS) have experienced extensive requests due to the failure to perform physical installments and the need for secure transactions. This trend cannot end the utility of cash but it may promote portable monetary administration toward a cashless world. MFS is anticipated to have a bright future as m-commerce increasingly becomes widely known. This study proposes the choice of making a trial and assessment research facility by using a fuzzy model as the most expository device. General forms of a triangular fuzzy number are subjective categories for a linguistic variable. Linguistic variables take on values defined in their term set, that is, the set of linguistic terms. The essential components, including personal innovativeness, transaction completeness, user-friendliness, anonymity, and privacy, are causal competitive advantages of the mobile payment system framework and may play a critical part in reacting to MFS. This study shows that transaction completeness, innovative interface design, privacy, and security facilitate MFS adoption. Furthermore, reliability is necessary to enhance trust in the MFS technology. This study draws on the outcomes of administrative suggestions and recommends a few observational strategies to improve the monetary administration in the MFS industry.

1. Introduction

COVID-19 will most likely accelerate digitalization leading to the absence of medium-term exercises from the division of financial services. Medium-sized banks may be affected the most because procuring fetched efficiencies with huge IT speculations will be difficult. These efficiencies are significant. Thus, managing an account division will favor profound rebuilding, winding up of banks, and solidifying the remaining ones. In the post-COVID-19 world, political deterrence to cross-border mergers will rise as states will become more protective of their national interest, and managing an account champion could be a major arrangement [1,2,3].

Customers have increasingly shifted to online shopping to purchase items they need. Online shoppers have recently increased at present, especially relative to essential supplies and basic family needs. Retailers have recently experienced a surge in online shopping for basic supplies as shoppers stock up on food products and other essentials [4,5]. The fast portable payment process has astonished the foremost cutting-edge administration experts [6,7].

We are currently living in uncommon times. Amid the COVID-19 emergency, computerized installments have maintained economic health, making a difference by allowing individuals to avoid contact with the infection. Installment suppliers have experienced the greatest impacts of the pandemic, including widespread increment in non-performing advances, a fall in incomes, and noteworthy requests from client benefit groups [8,9]. In a brief period, this trend will force installment suppliers to change by prioritizing noteworthy adaptability and modern short-term objectives.

The long-term impacts of the pandemic on worldwide installments are likely to be highly significant [10,11]. MFS-related administrations have developed an executioner application that can produce colossal sums of income and thus boost the entire portable trade industry [12,13]. Numerous ventures, such as money-related education, MFS administrators, start-ups, and innovation suppliers, have conducted various standardized and commercial endeavors to achieve this opportunity [1,14,15]. Portable exchanges are not restricted by time and effort. High productivity saves exchange time for clients [12,13,16]. The characteristic of a portable terminal is settled, allowing portable e-commerce to supply personalized portable exchange administrations. Versatile e-commerce can provide a wireless interface between clients and businesses [17,18]. The objective of this paper is to propose a multi-perspective system to help customers evaluate the MFS frameworks.

The World Health Organization (WHO) has prescribed using contactless installments wherever possible to help control the infection. This approach undermines the utility of cash by forcing numerous retailers to close their entryways and offer products only through online orders. Unused technology assessment and premonition are complex fundamental exercises within the context of complex advancements [19,20,21,22]. Many parameters must be considered to form a picture of the showcase. By definition, a multi-criterion examination may be a remarkable procedure for managing this complex issue [23,24,25,26,27]. The shift from cash to electronic installments will be accelerated by shoppers’ behavior due to the COVID-19 pandemic. This situation considers employing the portable installment industry as a case study.

This study uses the Taiwan mobile financial services (MFS) industry as the case study. The relationship between the different factors used to make a casual map that identifies the casual group and effect group is discussed. MFS industry operators are provided with certain strategic recommendations based on the research results. The remainder of this paper is as follows. Section 2 reviews prior research on the mobile payment industry. Section 3 presents the methodology, namely, fuzzy Decision-making Trial and Evaluation Laboratory (DEMATEL), and introduces the research design, research framework, research procedure, sample selection, and empirical results. Section 4 discusses certain empirical research. Finally, Section 5, provides the concluding remarks.

2. Mobile Financial Services

COVID-19 gives clients a justified reason to be watchful of open installment terminals. Computerized wallets, such as Apple Pay and Google Pay, allow installments without physically using a card to a terminal. Social distancing and other pandemic mitigation measures are likely to boost the use of advanced management of account administrations. With lockdowns, MFS suppliers have experienced a significant increment in requests for advanced exchanges [28,29,30,31]. This situation will drive numerous conventional installments suppliers to fast-track their advanced advancement endeavors. In MFS, portable clients use their phones to perform money-related exchanges; thus, MFS may be a promising and energizing space that has developed rapidly [32,33,34]. In contrast, the COVID-19 pandemic may have covered businesses and has proved a boon for most computerized administrations, such as extreme work applications, e-learning apparatuses, and e-commerce arrangements. In any case, one computerized innovation that is not performing as well is portable installments. Portable installments could be a modern installment strategy that employs a versatile gadget through a remote association to conduct an installment [35,36,37,38,39].

With the rapid development of artificial intelligence, related technologies have become a solid support for our society, through the performance of information processing algorithms and improvement of technologies and operations. The advances in certain subfields of artificial intelligence have provided additional expertise to intelligent agents through merging knowledge, reasoning, and planning. These combined skills and knowledge enable them to develop action plans and adapt to conditions. Automation is the key process for replicating human actions, which includes automatically improving the MFS and performance of the software functions.

MFS is a software agent that provides financial services and solutions to individuals anywhere and anytime. The derived concept of MFS includes the intelligent agent. Thus, natural language processing and machine learning are applied in artificial intelligence assistants. Customers input contextual information, voices, and images as the specific conditions to raise requests; this process enables the MFS to answer in natural language, providing recommendations and performing actions. Artificial intelligence assistants are designed as personalized applications that gather the preferences and fulfill the responsibilities specified by customers via online resources.

The interaction between humans and MFS commonly takes place through two methods: text and voice. Texting or online chat is a means of communication via the Internet; the text messages are transmitted instantly from the sender (the user) to the receiver (the MFS systems). Alternatively, voice is another direct way to interact with MFS, including speech recognition and voice recognition of human voices. Through speech recognition, MFS can capture spoken words and sentences and convert them into a digital format that can be read by machines. The quality of speech recognition is determined by two factors: accuracy and speed. Accuracy represents the error rate, which is used to identify the inaccuracy of transcription when spoken words are converted into digital data, though the reason for the errors may not be identified. Speed, that is, the dimension of real time, reflects how well MFS can keep up with human speakers. Although speech recognition and voice recognition focus on the human voice, voice recognition works by distinguishing and analyzing the differences between individuals, such as their anatomy, speaking accent, and pitch. The intelligent personal assistant can identify and verify speakers based on their speech patterns.

Expansive shippers and money-related education will have to make noteworthy speculations to control fraud prevention and discovery. MFS is characterized by the employment of a portable gadget [40,41]. For instance, a portable phone is used to perform an installment exchange in which cash is exchanged from one party (payer) to another (collector) through a mediator, such as a monetary institution, or directly, without a middle person [42]. Pousttchi and Zenker [12] clarified that mobile payment installment is installment exchange preparation in which a payer uses versatile communication procedures along with portable gadgets to start, authorize, and realize the installment [43,44,45]. Ondrus and Pigneur [14] characterized mobile payments as remote exchanges of money-related esteem from one party to another, employing a portable gadget that can physically shift from a versatile phone to any remote empowered gadgets (e.g., PDA and tablet) that can sagely handle a monetary exchange over a remote arrangement. Versatile payments are commonly anticipated to extend comfort to shoppers by reducing the need for coins and notes in small exchanges and expanding the accessibility of conceivable installment outcomes [46,47,48].

A mobile payment system has three fundamental actors: clients, dealers, and banks [49]. Clients obtained by administrations are accessible on the web. A vendor gives items or administration to the client on request. The item may be an online object that can be exchanged in the same way received by the client. From the merchants’ point of view, the portable installment framework is expected to decrease moderate exchange costs, increment item or beneficial deals, and increment-obtaining proficiency and buyer fulfillment [50,51,52,53]. Compared with the telecommunication (telecom) administrator, the bank is, additionally, a central component of the versatile installment industry chain [54]. Its budgetary capabilities and experience in credit items are basic to the full versatile installment framework [55,56]. The major assignment of the telecom administrator is to establish a portable installment stage and provide secure communication channels for portable installment [57,58]. They play a crucial role in versatile installment benefit improvement preparation, which serves as bridge-interfacing clients, money-related teaching, and benefit suppliers [42,59,60].

2.1. Assessment Criteria for Mobile Financial Services

Post-COVID-19 MFS suppliers unquestionably play a significant part in improving the endeavors to relieve antagonistic financial effects on struggling families. Moreover, the government must emphasize the appropriation for computerized installment administrations for social security installments and government worker compensation. Clients are key to versatile installment strategies’ acknowledgment [61,62]. In this paper, we rely on portable installment studies’ acknowledgment criteria to assess mobile payment methods in Taiwan from the perspective of clients’ prerequisites. Most papers on portable installments cover specialized issues [14,63,64]. These investigation reports focused on installment strategies [65,66,67] and innovation measures [68,69,70,71].

These reports also explored the components that may impact shoppers in tolerating portable installments [72,73]. Recently, while performing this investigation, a writing audit was conducted to supply a comprehensive definition of portable installments. We examined the components that seem to impact customers’ tolerance to portable installments. A portable installment framework can be surveyed along with three measurements: individual, innovative, and social measurements.

2.1.1. Individual Measurement

Individuals’ needs are divided into three categories: the personal innovativeness aspect, the degree of m-payment knowledge, and the transaction cost issue [74,75].

2.1.2. Personal Innovativeness

Personal innovativeness is characterized by identity development [76,77]. This identity development is used to determine shoppers’ imaginative inclinations to embrace broad innovative advancements. Rogers and Shoemaker [34] characterized innovativeness as a perceptible marvel relative to the time of appropriation. Agarwal and Prasad [78] delineated personal innovativeness as a characteristic that leads to creative behavior within a micro-computer, that is, “the eagerness of an individual to attempt any unused information technology.” The attempt to use and recognize advanced technology is closely related to the dispersal of advancements [15]. Thus, individual innovativeness could be a vital calculation in modern innovation selection behavior [79,80,81,82].

2.1.3. m-Payment Knowledge

The concept of “profession” is related to m-payment. Numerous earlier investigations considered this concept an unequivocal determinant of users’ common competence and cognitive capacity [65]. Thus, whether any relationship exists between the information and purpose of using m-payment was examined [83,84]. We applied “absorptive capacity” to explain this phenomenon. Absorptive capacity alludes to a customer’s capacity to assess and use external information [54] and measures a customer’s capacity to retain, absorb, and abuse the development [85,86,87,88].

2.1.4. Transaction Cost

This cost refers to the fetched amount paid by the buyer and included within the exchange [47,55]. The viewed costs of creating collaborative connections exceed those related to creating and actualizing legally binding connections. These fetched components influence the accomplice assessment in social trades because they are transient. The fetched concept is derived from the cost–benefit design based on the behavioral choice hypothesis [84]. The cost–benefit design outlines that individuals’ behavior is impacted by their discernment. The ease of use and convenience are the benefits, whereas the viewed fetched and chances are the costs. In selecting a portable installment framework for small installments, the taken toll incorporates the exchange cost, enlistment charge, or taken toll for an unused gadget when it is required to use the framework and the wellbeing risks.

2.1.5. Technological Measurement

When planning a mobile payment framework, various aspects must be considered: client attraction toward the exchange framework, the degree of unwavering quality compared with other installment frameworks, and the exchange’s completeness of adjustment to the framework.

2.1.6. User-Friendliness

This inquiry about receiving innovation acknowledgments shows that the technology acceptance model (TAM) clarifies clients’ neighborly development. TAM was proposed by Davis in 1989 [89] and has made a difference in understanding the interceding part of viewed convenience, ease of use, and the connections between framework characteristics and the likelihood of framework use. TAM builds on five concepts: perceived ease of use (PEOU), perceived usefulness (PU), attitude toward use (AT), behavioral intention (BI), and actual use (AU). Davis (1989) proposed that TAM clarifies and anticipates client acknowledgment of data frameworks and innovation. He [89] defined PU as “the degree to which an individual accepts that employing a specific framework would upgrade his or her work performance” and PEOU as “the degree to which a person accepts that employing a specific framework would be free of effort.” Within TAM, PU could be a major figure, whereas PEOU could be an auxiliary calculation in deciding framework use. Here, Davis [89] held that PEOU incorporates a positive, circuitous effect on framework use through PU. Other key components inside the illustration consolidate AT, BI, and AU. A user’s AT is determined by PU and PEOU in information innovation use. As TAM is an intention-based view, BI is included in the illustration and theorized as a key calculation between AT and AU. Numerous experiments have extended TAM and may prove crucial to investigate consumers’ deliberate behavior toward innovation or framework use, such as the World Wide Web (WWW) [46] and Look Motors on the Internet [46]. Considering the given definition, we can conclude client attraction comprises time and utilities, which are central characteristics of m-payment [32].

2.1.7. Reliability

Unwavering quality constitutes fitting work that is appropriately planned and soundly used [47,72]. Thus, we define unwavering quality as performing appropriate and legitimate installment. To sustain unwavering quality, we use three requested solid capacities: individual recognizable proof-number search, account secret word, and security card.

2.1.8. Transaction Completeness

Payments must be completed to avoid exchange irregularities. A synchronous, moment-clearing, and settlement instrument must be introduced in e-payment frameworks to maintain a strategic distance from exchange inadequacy [90,91].

2.1.9. Social Measurement

The mobile installment framework should address the social measurement to fulfill individual desires and specialized measurements of the portable installment framework.

2.1.10. Privacy

Consumers’ concerns about protection and the security of portable installments are commonly related to verification and secrecy issues and auxiliary use and unauthorized access to installments and client information [92,93]. The degree of protection and security includes users’ security when storing or withdrawing cash; information, security of application programs, and databases [94]; security during exchanges and installments; security of the Web and framework; and security upkeep and administration [92].

2.1.11. Anonymity

Shopper anonymity implies that the vendor and visited location register (VLR) do not require the consumers’ real identity [95]. In a remote arrangement, a buyer must provide his/her real identity to the benefit arrangement for confirmation. This information must be secured to obstruct extortion [43].

2.1.12. Compatibility

Compatibility is the degree to which an improvement is seen as consistent with existing values, past experiences, and needs of potential adopters. Compatibility is defined as the degree to which an improvement is seen as unfaltering with the existing values, needs, and past experiences of potential adopters [34]. Beliefs that contradict the values and standards of a social framework will not be accepted promptly unlike an advancement that conforms to these values and standards. The selection of a non-conforming advancement frequently requires the earlier selection of a new esteem framework, which could be handled moderately [34,96].

The research purpose requires that the respondents are either using, have used, or have heard of MFS. Table 1 below provides the operational definitions of each criterion for effective measurement.

Table 1.

Operational definitions of each criterion.

3. Research Method

In real life, humans’ subjective cognition of abstract things is often vague and unquantifiable. It often distorts the valid cognition of respondents through using quantitative scales. Multi-criteria decision-making method (MCDM) includes several techniques that allow rating various criteria and then ranking them based on the opinions of industry experts. The MCDM method can significantly reduce the cost and time to create an appropriate framework for problem-solving. To solve the managerial issue, the study applies the DEMATEL. It is a suitable method that helps in gathering group knowledge to form a structural model and in visualizing the casual relationship between sub-systems through a casual diagram. The judgment of decision-makers is often given as crisp values. However, crisp values cannot adequately reflect vagueness in the real world. Thus, this study combined fuzzy logic and DEMATEL to address this issue.

3.1. Research Objective

The aforementioned theoretical models contributed to our understanding of user acceptance factors. These studies examine a set of potentially relevant factors that drive consumer acceptance of MFS. Moreover, a research gap is evident regarding multi-criteria analysis of mobile payment acceptance and the development of an understanding of the cause–effect relationship of complex social science problems in fuzzy environments. This research proposes a DEMATEL and fuzzy theory as the main analytical tool. Below, we discuss the research method, namely, fuzzy DEMATEL, in detail.

3.2. Expert Interview

Twenty-one experts were invited to evaluate the criteria. We anticipated the interview would last two hours. The first part presented the previous results (i.e., the first MCDM model). The objective was to recall knowledge and open a discussion. This presentation is based on a report distributed to the experts before the interview. We wanted the experts to have a common understanding of the results before evaluating the mobile payment. This analysis was conducted asynchronously with the experts. We collected empirical data from several key experts in different industries. The industry representation was optimal as we covered all relevant industry sectors (financial, telecom, retail, and technology). A great majority of the experts participated in the previous interview campaign. Therefore, they were familiar with our approach.

3.3. Fuzzy Decision-Making Trial and Evaluation Laboratory Method

The contribution of this theory is used as a mathematical structure to express qualitative and quantitative data and provide a realistic judgment [97,98,99,100]. Let the decision-maker define problems and compare the data [26,101]. Fuzzy theory results in things that are not only “yes” and “no” but leads to a concept of degree between “yes” and “no” [88,102,103,104]. The linguistic variable of fuzzy theory is used as the experts’ scoring scale to solve the inconsistency of subjective cognition and make the question degree closer to reality [105,106,107,108]. Then, designing fuzzy numbers (FNs) represented by different linguistic variables, let the respondents select the most appropriate meaning [109,110]. Next, through the defuzzification process of transforming FNs to a numerical value and decision-making, we combine the traditional MCDM method and fuzzy theory to solve the problem of nurses’ competency appropriately [111,112,113]. We obtained three measurements and nine reasonable criteria to assess the portable installment framework [97]. The DEMATEL examination steps are based on the inquiry from researchers, including Chou et al. [97] and Chiang and Birtch [113]. As a result, the examination preparation is divided into six steps as follows:

- (1)

- Defining the characteristics of the quality factor, and establish an evaluation scale.

The assessment scale for causal relations and a pair-wise comparison of the quality variables are built on [68,72]. We alluded to the scale planned by Yue et al. [108] and Büyüközkan and Göçer [111] and accepted 0, 1, 2, 3, and 4 as five levels of estimation.

- (2)

- Obtaining interdependent data for all factors using the expert opinion method.

These pair-wise comparisons between any two components are indicated by a given score of 0–4: “no influence” (0), “low influence” (1), “medium influence” (2), “high influence” (3), and “very high influence” (4) [109,110].

- (3)

- Calculating the arithmetic mean matrix.

Assume that the number of factors and the value are from professionals who judge the factors based on 0, 1, 2, 3, and 4 five-level evaluation scale: and (i = 1, 2, 3, …, n; j = 1, 2, 3, …, n) represents the degree of influence of factor to factor . Then, sum up and average all from experts [107,111]. The arithmetic mean matrix is calculated using the formula provided below.

- (4)

- Calculating the causal matrix.

The casual connection network and total-relation lattice outline the interrelated effect on each calculation as shown in Equation (1) below [111]. The normalized direct-relation lattice can be obtained as :

- (5)

- Using the causal matrix.

Let be the quality of the given y calculation for direct/indirect network , and i, j = 1, 2, …, n [98]. Summing up the columns including the direct/indirect matrix (T), Equation (4) is provided below. It incorporates the coordinate and roundabout effect, which is the degree of the coordinate or the circuitous effect on other variables. When the normalized direct-relation is obtained, the total-relation matrix can be calculated. It ought to be guaranteed that the convergence of . The total-relation lattice appears as Conditions (4) and (5) [103,104] as follows:

- (6)

- Causal diagram.

The causal graph is delineated in a two-dimensional design, where the full and contrast are the level and vertical pivots, respectively. This realistic design can rearrange the complex causal relation into an effectively justifiable visual structure to help us easily understand the issues [114,115]. When is positive and found over the x hub, the quality calculation m has a place to the sort of cause. However, if is negative and found under the x pivot, then the quality figure has a place to the sort of effect.

4. Results and Discussion

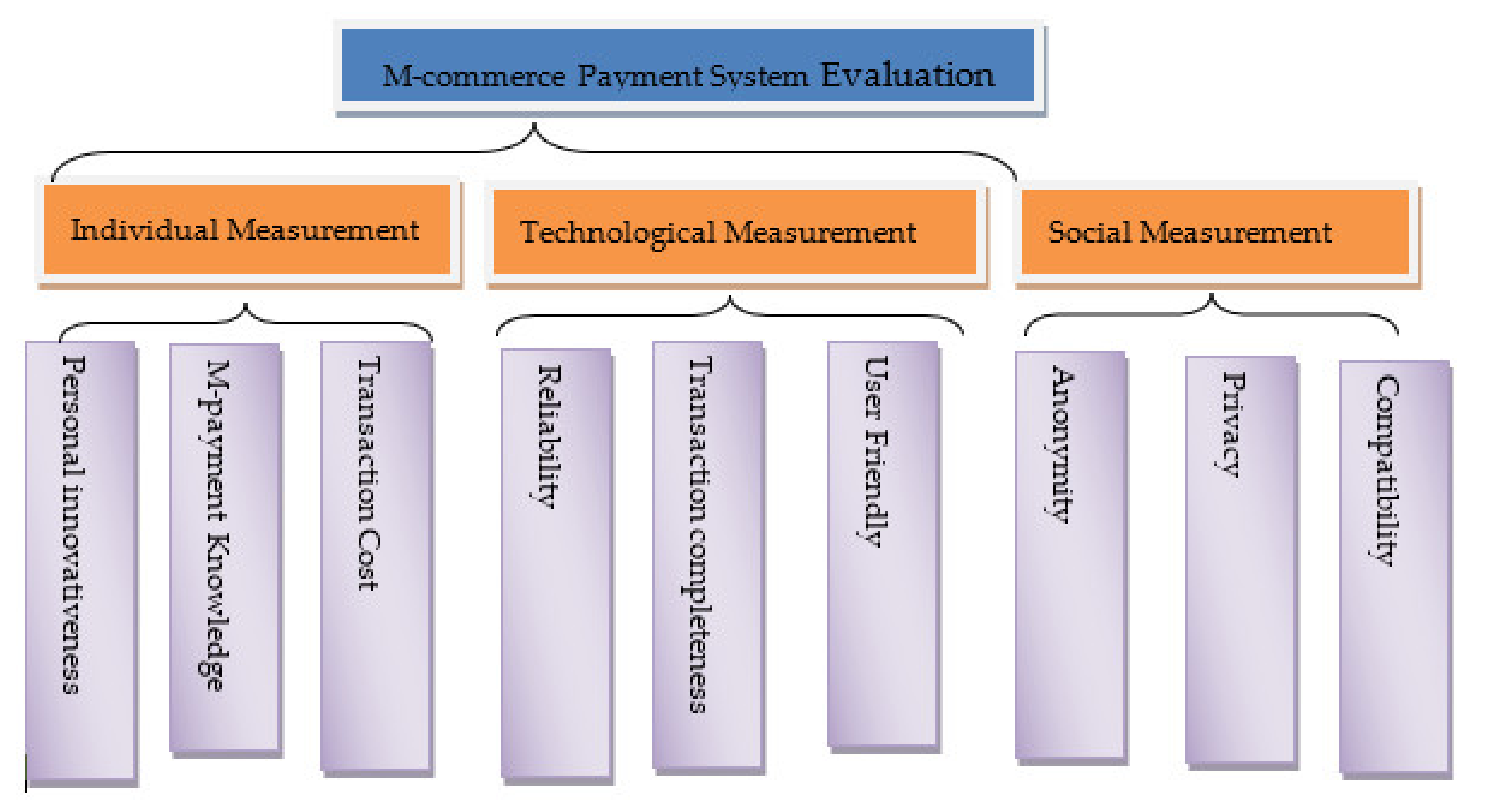

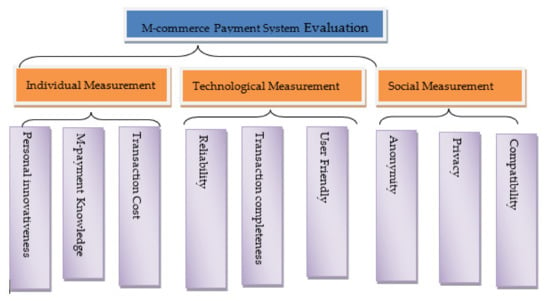

COVID-19 has affected numerous businesses regardless of size. Nevertheless, organizations confront specific challenges as an emergency that is set to be supplanted or expanded by another within the frame of a profound, extended retreat. Although the pandemic has spread globally, the offline-to-online switch has long been developed [115,116,117,118,119,120,121]. This paper distinguishes and analyzes the basic victory variables of portable installment framework usage. Twenty-one specialists were invited to assess the criteria. This investigation incorporates three measurements and nine assessment criteria. Figure 1 illustrates the progressive structure of this investigation about choice issues.

Figure 1.

M-commerce payment system evaluation framework.

Step 1: Generating the arithmetic mean matrix.

This matrix is also called the initial average matrix that utilizes data from the collected questionnaire to calculate the arithmetic mean matrix. We obtained the arithmetic mean matrix by separately adding up all the interrelated factors for every aspect and then averaging their sum. To measure the relationships between the factors demonstrated by , the experts were asked to make pair-wise comparison sets. Then, the arithmetic mean matrix for the first-tier measurements can be obtained follows: Arithmetic mean matrix framework can be obtained for the first-level measurement as follows:

Step 2: Normalizing the causal fuzzy matrix.

The linear scale transformation is used to transform the criterion scale into comparable scales. The normalized direct-relation fuzzy matrix can be obtained as . This research assumes at least one i such that . Equations (2) and (3) are used to calculate the average matrix . We normalized the arithmetic mean matrix as follows:

Step 3: Establishing and analyzing the causal model.

After obtaining the normalized direct-relation , the total-relation matrix can be calculated to ensure the convergence of . The causal matrix is calculated as follows:

Step 4: Using the causal matrix.

We convey the causal chart by mapping a dataset of .

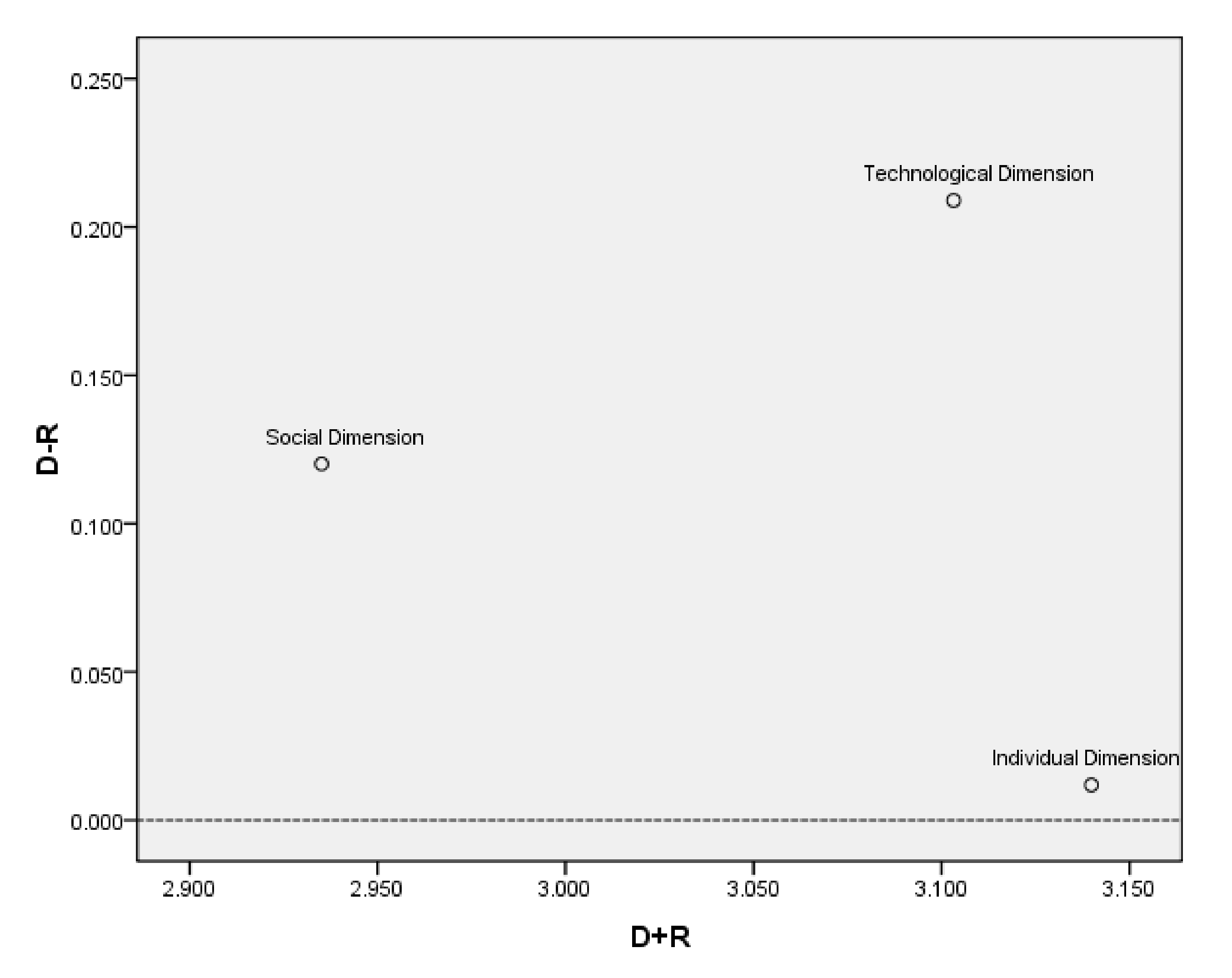

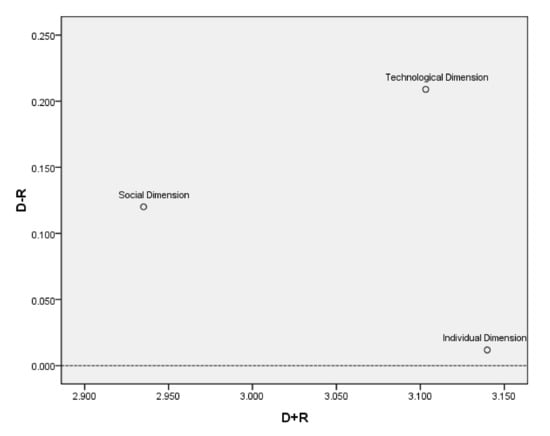

Table 2 above clarifies the coordinate and roundabout impacts of three first-level measurements. Figure 2 shows the graph of the three first-level measurements.

Table 2.

Sum of , , , and impacts using three measurements.

Figure 2.

Graph of appearing causal relations among three measurements.

Table 3 above shows that technological and social measurements are the net causes, whereas the individual measurement is the net collector. Figure 2 illustrates that technological measurement may be the foremost basic measurement. Social and individual measurements are influenced by each other and the technological measurement. Using the value provided by the direct/indirect matrix main aspect, we performed the interrelation analysis of the main aspects, which was the interrelation impact on every aspect. The coordinate points for the above qualities of each three measurements were input into the graph to complete the DEMATEL causal diagram as shown in Figure 2. Figure 2 illustrates the graph of these three measurements. It is clear that technological measurement might be the most critical measurement. To facilitate MFS in the post-COVID-19 world successfully, technological measurement was the key aspect. Figure 2 shows that the technological measurement may be the foremost basic measurement. The social and individual measurements are influenced by each other and by the technological measurement. Table 4 and Table 5 and Figure 3 depict the cause–effect relationships between the three second-tier criteria of the individual measurement. Table 6 and Table 7 and Figure 4 depict the cause–effect relationships between the three second-level criteria of technological measurement. Table 8 and Table 9 and Figure 5 summarize the causal relationships between the three second-tier criteria of the social measurement.

Table 3.

Sum of and impacts using three measurements.

Table 4.

Sum of , , , and impacts using the second-tier criteria of the individual measurement.

Table 5.

Sum of and impacts using the three criteria of the individual measurement.

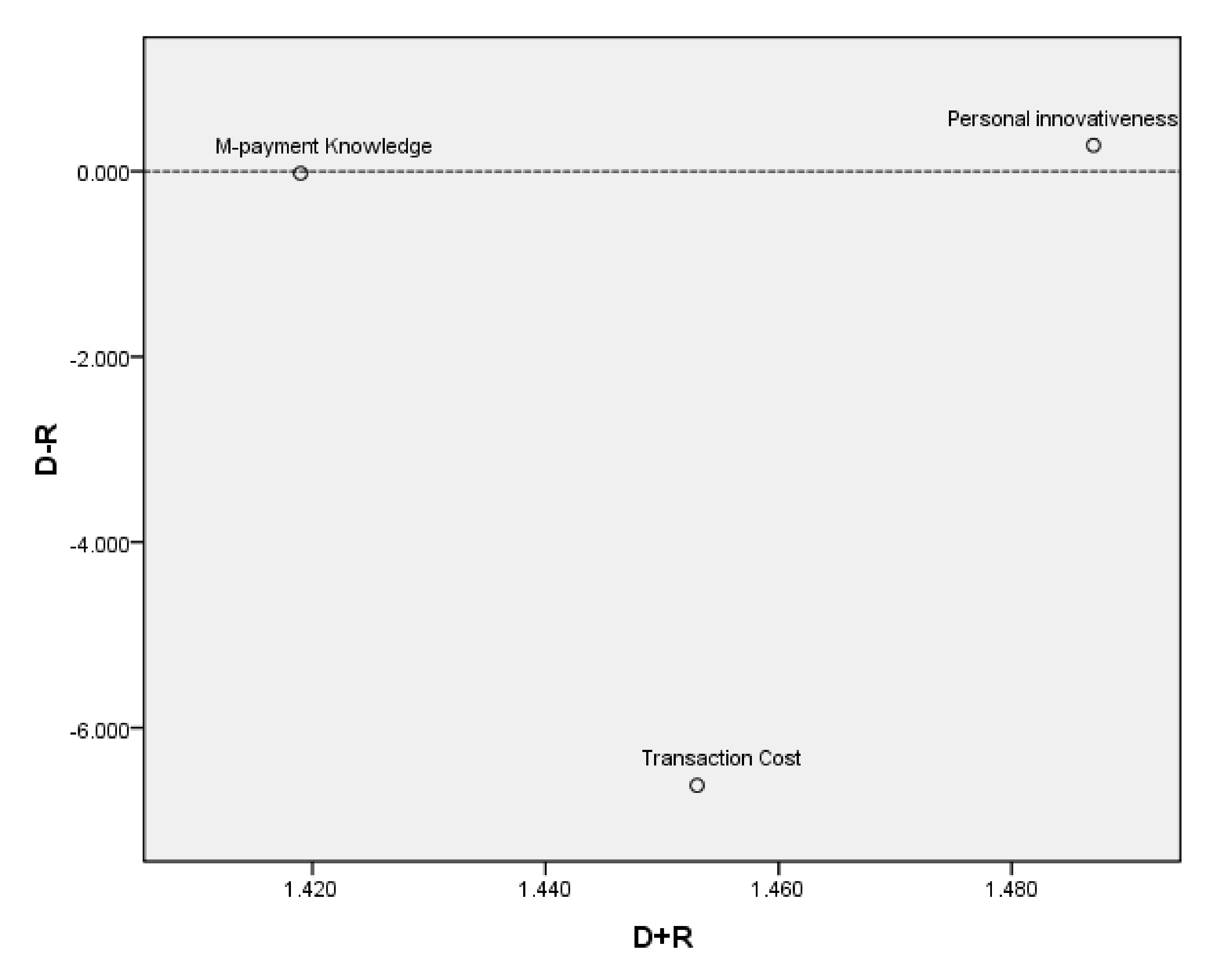

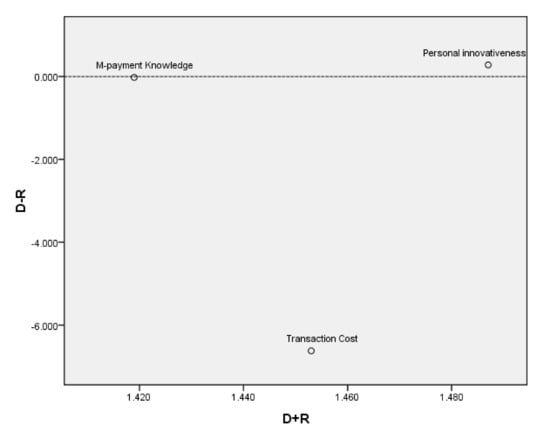

Figure 3.

Graph of causal relationships between the second tier criteria of the individual measurement.

Table 6.

Sum of , , , and impacts using the second-tier criteria of the technological measurement.

Table 7.

Sum of and impacts using the three criteria of the technological measurement.

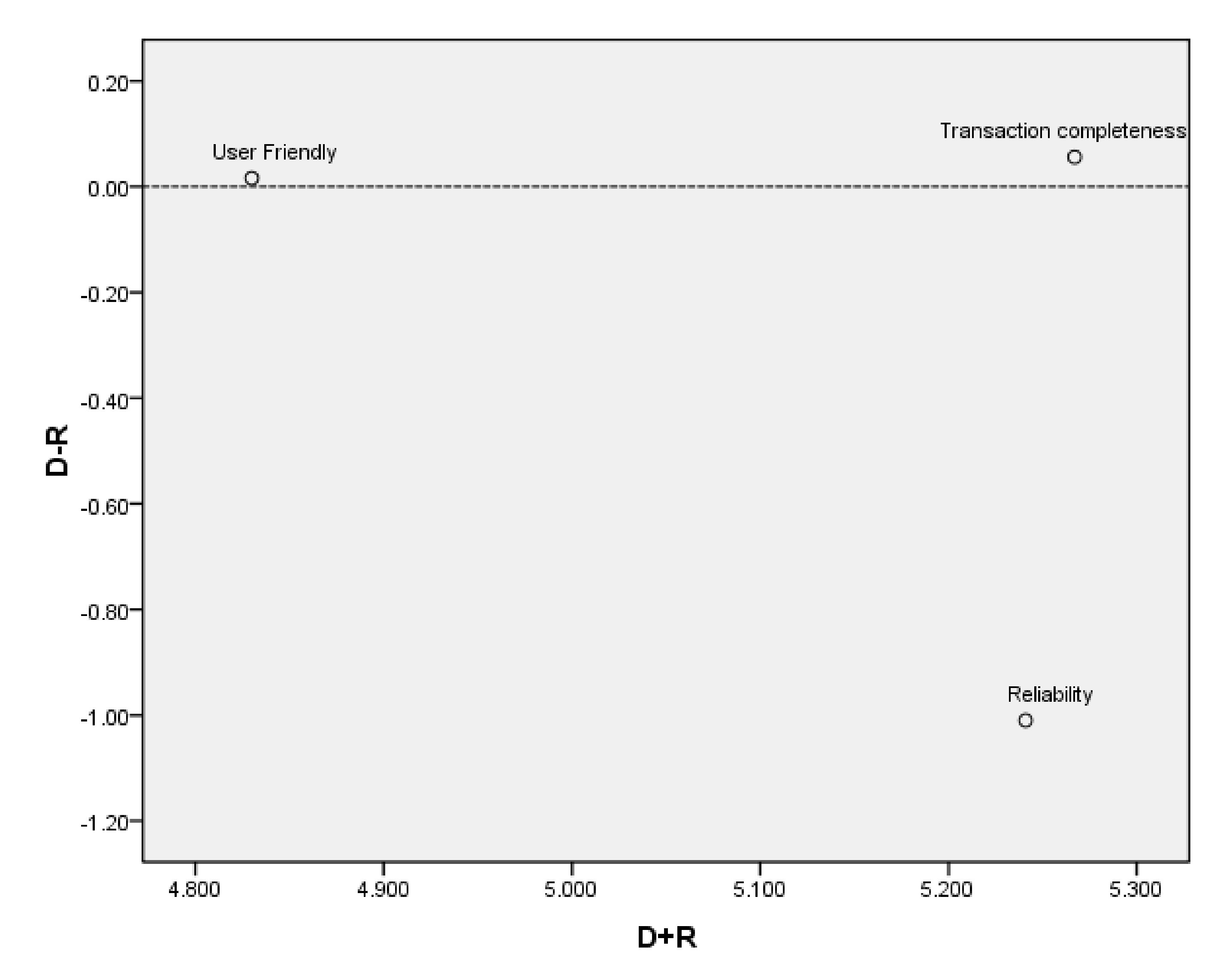

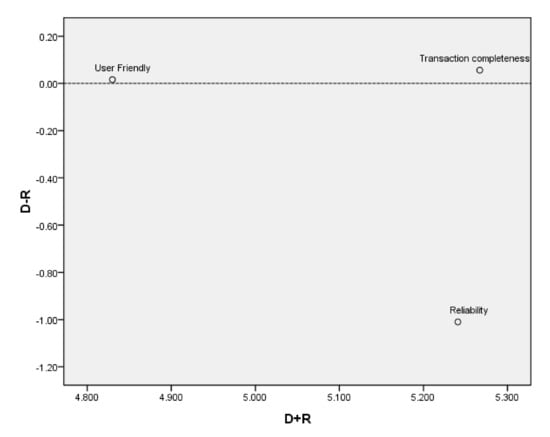

Figure 4.

Graph of appearing causal relationships between the second tier criteria of the technological measurement.

Table 8.

Sum of , , , and impacts using the second-tier criteria of the social measurement.

Table 9.

Sum of and impacts using the three criteria of the social measurement.

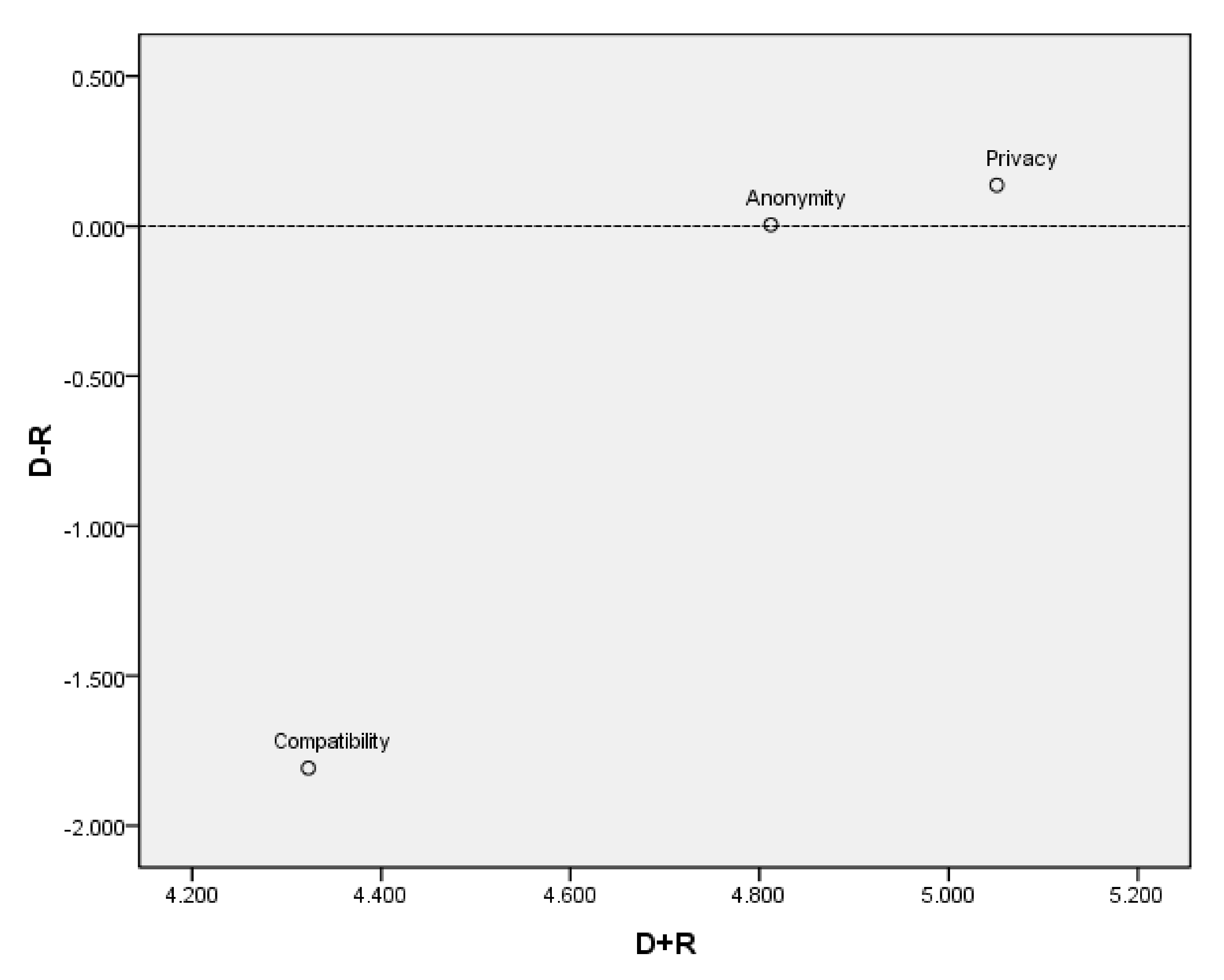

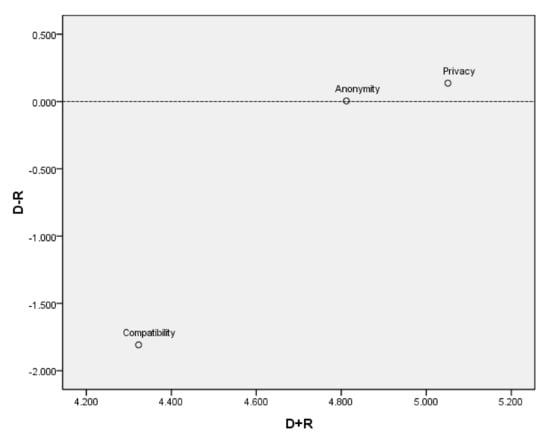

Figure 5.

Graph of appearing causal relationships between the second-tier criteria of the social measurement.

Table 4 and Table 5 show that individual innovativeness is the net cause, whereas m-payment knowledge and exchange fetched are the net recipients. Figure 3 illustrates that personal innovativeness may be the foremost basic measurement. M-payment knowledge and transaction cost are influenced by each other and by individual innovativeness. The eagerness to enhance may be a work of identity and environmental perception. Thus, innovativeness is the degree to which a user is intrigued by attempting and tolerating unused things, modern ideas, and an inventive item or benefit.

Table 6 and Table 7 show that transaction completeness and user-friendliness are the net causes, whereas reliability is the net recipient. Figure 4 shows that transaction completeness may be the foremost basic measurement. Additionally, reliability is influenced by each other and by transaction completeness and user-friendliness.

Thus, portable installment benefit suppliers must provide legitimate capacities in agreement with consumer needs. As a result, clients can be obtained and time and effort can be saved in addition to increasing installment proficiency in improved client fulfillment and dependability.

Table 8 and Table 9 show that anonymity and privacy are the net causes, whereas compatibility is the net recipient. Figure 5 illustrates that privacy may be the foremost basic measurement. Compatibility is influenced by anonymity and privacy. Among these factors, the security of payments is one of the most extreme concerns for customers. Security of exchange is important for payments of a considerable sum. Portable installment makes it accessible to conduct exchange regardless of time and place. This aspect is the greatest advantage of this mode of installment, which is characterized by mobilization and individualization.

5. Conclusions and Remarks

When the WHO released an explanation on 9 March prescribing that individuals turn to computerized installments to fight the spread of COVID-19, the shift toward cashless social orders was expedited. Contactless advanced installments at the point of transaction, such as facial acknowledgment, quick response codes, and near-field communications (NFC), can lessen the spread of infection through cash trades. Advanced installments restrict in-person exchanges and guarantee buyers to purchase essentials from the comfort of their homes. Increased e-commerce activities are significantly making a difference to small businesses to maintain income streams in uncertain times. Versatile installments are making a difference to put jolt stores into consumers’ hands more quickly. A mobile payment framework is composed of numerous connection components.

MFS is composed of many interacting elements. This paper employed the fuzzy DEMATEL method to analyze the model and considered suggestions as to the key influencing factors in MFS evolution. The determinants of MFS were subtracted from the column total to obtain (degree of cause and effect). The higher the positive degree of cause and effect , the easier the item directly influences the other factors. The higher the negative degree of cause and effect, the easier the item is influenced by other factors. From the value, the following showed the important items that influenced other factors: personal innovativeness, transaction completeness, user-friendliness, anonymity, and privacy, whereas m-payment knowledge, transaction cost, reliability, and compatibility were the main items influenced by other factors.

MFS will develop rapidly because of the potential operational efficiencies, comfort, security assurance, and coordination available to the buyer irrespective of location. MFS benefits are discussed approximately as they infer to supplant ordinary cash in the physical world, implying installment within the virtual world. Moreover, electronic installment cannot be distorted, anticipating that the plan is inside and out, because electronic cash may be less difficult and more affordable to use than scheduled cash. The most important part of convenient installment affirmation is in the clients’ hands. In this article it appears that it is vital to plan mobile payments framework that responds to customers effectively. Thus, a profound understanding of customer appropriation inspiration is necessary to create and dispatch portable installment administrations effectively [54].

The success of MFS can barely be anticipated considering a single measurement. Individual innovativeness is a creative personality of an individual relative to unused technology, characterized as the traveler’s receptivity to online travel shopping. Ching and Hayashi [51] found that individual innovativeness predicts buyer appropriation of online shopping. Individual innovativeness is an individual characteristic that significantly influences users’ availability to embrace a present-day thing or creative changes and organizations. Therefore, high individual innovativeness positively impacts PEOU and perceived comfort. Client attraction is one of the selected components of the framework victory. The exchange completeness is an imperative versatile installment framework driver. The versatile installment framework must improve the framework and substance quality. System quality includes 24 h availability, online response time, page stacking speed, and visual presence. Substance quality incorporates contemporaneity, understandability, convenience, and exactness [12,13]. Shoppers are unpredictable and may not follow completed exchanges. An imaginative interface plan will encourage m-commerce selection. Predominant substance organization, less complex and compelling presentation, and interface arrangement will enable proper selection. A high degree of interface comfort can enable clients to reach their targets better and faster.

Transaction completeness is an important MFS driver. MFS should enhance the system and content quality. System quality includes 24 h availability, online response time, page loading speed, and visual appearance. Content quality includes contemporaneity, understandability, timeliness, and preciseness. Consumers want to be anonymous and prefer not to leave any traces of completed transactions. Innovative interface design will facilitate m-commerce adoption. The better the content organization and the simpler and more effective the presentation and interface design, the more likely the product will be well-received. A high degree of interface usability can be reached, enabling users to reach their goals better and faster.

Clients are concerned with the assurance and security of flexible systems. Their concerns are commonly related to affirmation and mystery issues and assistant utility, unauthorized installments, and client data [121]. Security is essential for flexible installment and can be challenged amid unstable installment information management or transmission. Portable installment has specific security and security challenges due to their contrasting fundamental advances. The buy preparation should be error-free because it includes a budgetary exchange. Unwavering quality is explicitly necessary for installment innovation.

Similar to any experimental investigation, this study has limitations. First, the observational information was collected from only one country. Various countries have striking contrasts within the utility of versatile installments and administrations. They have significant differences in the use of mobile payments and services. Thus, the findings may vary across countries. Second, the methodology of this study, namely, the fuzzy DEMATEL, also presents limitations in terms of the small sample size. Hence, future research can be conducted to test the adoption factors presented in this study using different methods and larger sample sizes.

Author Contributions

Conceptualization, C.-c.S.; methodology, C.-c.S.; software, C.-c.S.; validation, C.-c.S.; formal analysis, C.-c.S.; investigation, C.-c.S. and S.-c.C.; resources, C.-c.S. and S.-c.C.; data curation, C.-c.S. and S.-c.C.; writing—original draft preparation, C.-c.S.; writing—review and editing, C.-c.S.; visualization, C.-c.S.; supervision, C.-c.S.; project administration, C.-c.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Téllez Isaac, J.; Zeadally, S.; Sierra, J.C. Implementation and performance evaluation of a payment protocol for vehicular ad hoc networks. Electron. Commer. Res. 2010, 10, 209–233. [Google Scholar] [CrossRef]

- Gao, S.; Krogstie, J.; Siau, K. Developing an Instrument to Measure the Adoption of Mobile Services. Mob. Inf. Syst. 2011, 7, 45–67. [Google Scholar] [CrossRef]

- Shin, Y.R.; Huh, E.N. mCSQAM: Service Quality Assessment Model in Mobile Cloud Services Environment. Mob. Inf. Syst. 2016, 2016, 2517052. [Google Scholar] [CrossRef] [Green Version]

- Cui, M.; Fei, Y.; Liu, Y. A Survey on Secure Deployment of Mobile Services in Edge Computing. Secur. Commun. Netw. 2021, 2021, 8846239. [Google Scholar] [CrossRef]

- Liao, G.; Zhou, J.; Huang, J.; Mo, F.; Wang, H.; Yi, S. Design and Evaluation of Smart Mobile Services for Cross-Channel Shopping. Mob. Inf. Syst. 2016, 2016, 3602980. [Google Scholar] [CrossRef] [Green Version]

- Benou, P.; Vassilakis, C. The conceptual model of context for mobile commerce applications. Electron. Commer. Res. 2010, 10, 139–165. [Google Scholar] [CrossRef]

- Cao, C.; Zhu, X. Strong anonymous mobile payment against curious third-party provider. Electron. Commer. Res. 2019, 19, 501–520. [Google Scholar] [CrossRef]

- Abdo, J.B.; Bourgeau, T.; Demerjian, J.; Chaouchi, H. Extended Privacy in Crowdsourced Location-Based Services Using Mobile Cloud Computing. Mob. Inf. Syst. 2016, 2016, 7867206. [Google Scholar]

- Cui, S.; Zhao, H.; Chen, H.; Zhang, C. The Mobile Charging Vehicle Routing Problem with Time Windows and Recharging Services. Comput. Intell. Neurosci. 2018, 2018, 5075916. [Google Scholar] [CrossRef]

- Akingbesote, A.O.; Adigun, M.O.; Xulu, S.; Jembere, E. Performance Modeling of Proposed GUISET Middleware for Mobile Healthcare Services in E-Marketplaces. J. Appl. Math. 2014, 2014, 248293. [Google Scholar] [CrossRef] [Green Version]

- Son, Y.; Lee, Y. Offloading Method for Efficient Use of Local Computational Resources in Mobile Location-Based Services Using Clouds. Mob. Inf. Syst. 2017, 2017, 1856329. [Google Scholar] [CrossRef]

- Pousttchi, K.; Zenker, M. Current Mobile Payment Procedures on the German Market from the View of Customer Requirements. In Proceedings of the 14th International Workshop on Database and Expert Systems Applications, Prague, Czech Republic, 1–5 September 2003. [Google Scholar]

- Pousttchi, K. A modeling approach and reference models for the analysis of mobile payment use cases. Electron. Commer. Res. Appl. 2008, 7, 182–201. [Google Scholar] [CrossRef]

- Ondrus, J.; Pigneur, Y. A Disruption Analysis in the Mobile Payment Market. In Proceedings of the 38th Hawaii International Conference on System Sciences, Big Island, HI, USA, 3–6 January 2005. [Google Scholar]

- Rogers, E.M. Diffusion of Innovations, 4th ed.; The Free Press: New York, NY, USA, 1995. [Google Scholar]

- Buccafurri, F.; Lax, G. Implementing disposable credit card numbers by mobile phones. Electron. Commer. Res. 2011, 11, 271–296. [Google Scholar] [CrossRef]

- Fontecha, J.; Hervás, R.; Bravo, J. Mobile Services Infrastructure for Frailty Diagnosis Support based on Gower’s Similarity Coefficient and Treemaps. Mob. Inf. Syst. 2013, 10, 127–146. [Google Scholar] [CrossRef] [Green Version]

- Ibrahim, A.A.Z.A.; Wasim, M.U.; Varrette, S.; Bouvry, P. PRESENCE: Monitoring and Modelling the Performance Metrics of Mobile Cloud SaaS Web Services. Mob. Inf. Syst. 2018, 2018, 1351386. [Google Scholar] [CrossRef]

- Chen, B.; Nguyen, L.H.; Roscoe, A.W. Reverse Authentication in Financial Transactions and Identity Management. Mob. Netw. Appl. 2013, 18, 712–727. [Google Scholar] [CrossRef]

- Chen, C.C.; Tseng, M.L.; Lin, Y.H. Using Fuzzy DEMATEL to Develop a Causal and Effect Model of Hot Spring Service Quality Expectation. In Proceedings of the 2008 IEEE IEEM, Singapore, 8–11 December 2008. [Google Scholar]

- Kaushik, V.; Kumar, A.; Gupta, H. Modelling and prioritizing the factors for online apparel return using BWM approach. Electron. Commer. Res. 2020. [Google Scholar] [CrossRef]

- Yang, K.C.C. Exploring factors affecting the adoption of mobile commerce in Singapore. Telemat. Inform. 2005, 22, 257–277. [Google Scholar] [CrossRef]

- Juang, W.S. A Practical Anonymous Payment Scheme for Electronic Commerce. Comput. Math. Appl. 2003, 46, 1787–1798. [Google Scholar] [CrossRef]

- Ondrus, J.; Pigneur, Y. A Multi-Stakeholder Multi-Criteria Assessment Framework of Mobile Payments: An Illustration with the Swiss Public Transportation Industry. In Proceedings of the 39th Hawaii International Conference on System Sciences, Kauai, HI, USA, 4–7 January 2006. [Google Scholar]

- Fang, C.H.; Cheng, Y.S.; Chen, G.L. Application of DEMATEL in Discussion of Key Competency of Talents in Manufacturing Industries. In Proceedings of the 2008 IEEE ICMIT, Bangkok, Thailand, 21–24 September 2008. [Google Scholar]

- Hsu, L.; An, H.; Hsu, F.; Lu, T.C. Using DEMATEL to Explore the Interaction Effect of Team Innovation Factors. In Proceedings of the 2008 IEEE IEEM, Singapore, 8–11 December 2008. [Google Scholar]

- Akhyani, F.; Birjandi, K.A.; Sheikh, R. New approach based on proximity/remoteness measurement for customer classification. Electron. Commer. Res. 2020. [Google Scholar] [CrossRef]

- Luo, S.; Sun, Y.; Ji, Y. Stackelberg Game Based Incentive Mechanisms for Multiple Collaborative Tasks in Mobile Crowdsourcing. Mob. Netw. Appl. 2016, 21, 506–522. [Google Scholar] [CrossRef]

- Marinč, M. Banks and information technology: Marketability vs. relationships. Electron. Commer. 2013, 13, 71–101. [Google Scholar] [CrossRef]

- Wiklund Axelsson, S.; Nyberg, L.; Näslund, A.; Melander Wikman, A. The Anticipated Positive Psychosocial Impact of Present Web-Based E-Health Services and Future Mobile Health Applications: An Investigation among Older Swedes. Int. J. Telemed. Appl. 2013, 2013, 509198. [Google Scholar] [CrossRef]

- Cai, Y.; Song, L.; Wang, T.; Chang, Q. Financial Time Series Forecasting Using Directed-Weighted Chunking SVMs. Math. Probl. Eng. 2014, 2014, 170424. [Google Scholar] [CrossRef]

- Liou, J.J.H.; Yen, L.; Tzeng, G.H. Building an effective safety management system for airlines. J. Air Transport Manag. 2007, 14, 20–26. [Google Scholar] [CrossRef]

- Me, G. Security overview for m-payed virtual ticketing. In Proceedings of the 14th IEEE 2003 International Symposium on Personal Indoor and Mobile Radio Communications, Beijing, China, 7–10 September 2003. [Google Scholar]

- Rogers, E.M.; Shoemaker, E. Communication of Innovations, a Cross-Cultural Approach, 2nd ed.; The Free Press: New York, NY, USA, 1971. [Google Scholar]

- Al-Dala’in, T.; Summons, P.; Luo, S. The Relationship between a Mobile Device and a Shopper’s Trust for E-payment Systems. In Proceedings of the 1st International Conference on Information Science and Engineering, Nanjing, China, 18–20 December 2019. [Google Scholar]

- Jamali, G.; Ebrahimi, M.; Abbaszadeh, M.A. TQM Implementation: An Investigation of Critical Success Factors. In Proceedings of the 2010 International Conference on Education and Management Technology, Cairo, Egypt, 2–4 November 2010. [Google Scholar]

- Jayasingh, S.; Eze, U.C. Exploring the Factors Affecting the Acceptance of Mobile Coupons in Malaysia. In Proceedings of the 2009 Eighth International Conference on Mobile Business, Dalian, China, 27–28 June 2009. [Google Scholar]

- Karjaluoto, H.; Shaikh, A.A.; Saarijärvi, H.; Saraniemi, S. How perceived value drives the use of mobile financial services apps. Int. J. Inf. Manag. 2019, 47, 252–261. [Google Scholar] [CrossRef]

- Lee, Y.K.; Park, J.H.; Chung, N.; Blakeney, A. A unified perspective on the factors influencing usage intention toward mobile financial services. J. Bus. Res. 2012, 65, 1590–1599. [Google Scholar] [CrossRef]

- Petrova, K.; Mehra, R. Mobile Payment: An Exploratory Study of Customer Attitudes. In Proceedings of the Sixth International Conference on Wireless and Mobile Communications, Valencia, Spain, 20–25 September 2010. [Google Scholar]

- Tzeng, G.H.; Chiang, C.H.; Li, C.W. Evaluating intertwined effects in e-learning programs: A novel hybrid MCDM model based on factor analysis and DEMATEL. Expert Syst. Appl. 2007, 32, 1028–1044. [Google Scholar] [CrossRef]

- Balocco, R.; Ghezzi, A.; Bonometti, G.; Renga, F. Mobile Payment Applications: An Exploratory Analysis of the Italian Diffusion Process. In Proceedings of the 7th International Conference on Mobile Business, Barcelona, Spain, 7–8 July 2008. [Google Scholar]

- Hwang, R.J.; Shiau, S.H.; Jan, D.F. A new mobile payment scheme for roaming services. Electron. Commer. Res. Appl. 2007, 6, 184–191. [Google Scholar] [CrossRef]

- Peffers, K.; Tuunanen, T. Planning for IS applications: A practical, information theoretical method and case study in mobile financial services. Inf. Manag. 2005, 42, 483–501. [Google Scholar] [CrossRef]

- Zhou, Q.; Lim, F.J.; Yu, H.; Xu, G.; Ren, X.; Liu, D.; Wang, X.; Mai, X.; Xu, H. A study on factors affecting service quality and loyalty intention in mobile banking. J. Retail. Consum. Serv. 2021, 60, 102424. [Google Scholar] [CrossRef]

- Moon, J.W.; Kim, Y.G. Extending the TAM for a World-Wide-Web context. Inf. Manag. 2001, 38, 217–230. [Google Scholar] [CrossRef]

- Zhang, Q. Mobile Payment in Mobile E-commerce. In Proceedings of the 7th World Congress on Intelligent Control and Automation, Chongqing, China, 25–27 June 2008. [Google Scholar]

- Zmijewska, A. Evaluating Wireless Technologies in Mobile Payments: A Customer Centric Approach. In Proceedings of the International Conference on Mobile Business (ICMB’05), Sydney, Australia, 11–13 July 2005. [Google Scholar]

- Wang, C.H. An Integrated Fuzzy Multi-Criteria Decision Making Approach for Realizing the Practice of Quality Function Deployment. In Proceedings of the 2010 IEEE IEEM, Macau, China, 7–10 December 2010. [Google Scholar]

- Ho, H.; Fong, S.; Yan, Z. User Acceptance Testing of Mobile Payment in Various Scenarios. In Proceedings of the IEEE International Conference on e-Business Engineering, Xi’an, China, 22–24 October 2008. [Google Scholar]

- Ching, A.T.; Hayashi, F. Payment card rewards programs and consumer payment choice. J. Bank. Financ. 2010, 34, 1773–1787. [Google Scholar] [CrossRef] [Green Version]

- Kiconco, R.I.; Rooks, G.; Snijders, C. Learning mobile money in social networks: Comparing a rural and urban region in Uganda. Comput. Hum. Behav. 2020, 103, 214–225. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Japutra, A.; Molinillo, S.; Singh, N.; Sinha, N. Assessment of mobile technology use in the emerging market: Analyzing intention to use m-payment services in India. Telecomm. Policy 2020, 44, 102009. [Google Scholar] [CrossRef]

- Massoth, M.; Bingel, T. Performance of different mobile payment service concepts compared with a NFC-based solution. In Proceedings of the 2009 Fourth International Conference on Internet and Web Applications and Services, Venice/Mestre, Italy, 24–28 May 2009. [Google Scholar]

- Liaw, S.S.; Huang, H.M. An investigation of user attitudes toward search engines as an information retrieval tool. Comput. Hum. Behav. 2003, 19, 751–765. [Google Scholar] [CrossRef]

- Li, Y.; Luo, S. Research on Mobile Payment in the E-Commerce. In Proceedings of the 2008 International Conference on Management of e-Commerce and e-Government, Nanchang, China, 17–19 October 2008. [Google Scholar]

- Abane, A.M.; Mariwah, S.; Owusu, S.A.; Kasim, A.; Robson, E.; Hampshire, K. Mobile phone use and the welfare of community health nurses in Ghana: An analysis of unintended costs. World Dev. Perspect. 2021, 23, 100317. [Google Scholar] [CrossRef]

- Choi, H.; Park, J.; Kim, J.; Jung, Y. Consumer preferences of attributes of mobile payment services in South Korea. Telemat. Inform. 2020, 51, 101397. [Google Scholar] [CrossRef]

- Khanra, S.; Dhir, A.; Kaur, P.; PJoseph, R. Factors influencing the adoption postponement of mobile payment services in the hospitality sector during a pandemic. J. Hosp. Tour. Manag. 2021, 46, 26–39. [Google Scholar] [CrossRef]

- Freytag, A.; Fricke, S. Sectoral linkages of financial services as channels of economic development-An input–output analysis of the Nigerian and Kenyan economies. Rev. Dev. Financ. 2017, 7, 36–44. [Google Scholar] [CrossRef]

- Kim, C.; Mirusmonov, M.; Lee, I. An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 2010, 26, 310–322. [Google Scholar] [CrossRef]

- Rahimian, V.; Habibi, J. MPaySmart: A Customer Centric Approach in Offering Efficient Mobile Payment Services. In Proceedings of the 2008 IEEE Asia-Pacific Services Computing Conference, Yilan, Taiwan, 9–12 December 2008. [Google Scholar]

- Huang, Z.; Chen, K.F. Electronic Payment in Mobile Environment. In Proceedings of the 13th International Workshop on Database and Expert Systems Applications, Aix-en-Provence, France, 2–6 September 2002. [Google Scholar]

- Schierz, P.G.; Schilke, O.; Wirtz, B.W. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electron. Commer. Res. Appl. 2010, 9, 209–216. [Google Scholar] [CrossRef]

- Aziz, Q. Payments through Mobile Phone. In Proceedings of the 2nd International Conference on Emerging Technologies, Peshawar, Pakistan, 13–14 November 2006. [Google Scholar]

- Dahlberg, T.; Öörni, A. Understanding Changes in Consumer Payment Habits-Do Mobile Payments and Electronic Invoices Attract Consumers. In Proceedings of the 40th Hawaii International Conference on System Sciences, Big Island, HI, USA, 3–6 January 2007. [Google Scholar]

- Dahlberg, T.; Mallat, N.; Ondrus, J.; Zmijewska, A. Past, present and future of mobile payments research: A literature review. Electron. Commer. Res. Appl. 2008, 7, 165–181. [Google Scholar] [CrossRef] [Green Version]

- Ken, Y.; Huang, T.; Wu, C.H.; Shiu, S.H. A novel Integrated SEM Based on DEMATEL for Evaluating Technology License Income Performance. In Proceedings of the PICMET 09-2009 Portland International Conference on Management of Engineering & Technology, Portland, OR, USA, 2–6 August 2009. [Google Scholar]

- Lim, A.S. Inter-consortia battles in mobile payments standardization. Electron. Commer. Res. Appl. 2008, 7, 202–213. [Google Scholar] [CrossRef]

- Liu, Z.; Ben, S.; Zhang, R. Factors affecting consumers’ mobile payment behavior: A meta-analysis. Electron. Commer. Res. 2019, 19, 575–601. [Google Scholar] [CrossRef]

- López, C.; Ishizaka, A. A hybrid FCM-AHP approach to predict impacts of offshore outsourcing location decisions on supply chain resilience. J. Bus. Res. 2019, 103, 495–507. [Google Scholar] [CrossRef] [Green Version]

- Jian, Y. Analysis of Influencing Factors of Building Energy Efficiency Based on DEMATEL Method, Analysis of Influencing Factors of Building Energy Efficiency Based on DEMATEL Method. In Proceedings of the Optics Photonics and Energy Engineering (OPEE), 2010 International Conference, Wuhan, China, 10–11 May 2010. [Google Scholar]

- Jeng, D.J.F.; Huang, K.H. Strategic project portfolio selection for national research institutes. J. Bus. Res. 2015, 68, 2305–2311. [Google Scholar] [CrossRef]

- Au, Y.A.; Kauffman, R.J. The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electron. Commer. Res. Appl. 2008, 7, 141–164. [Google Scholar] [CrossRef]

- Zarmpou, T.; Saprikis, V.; Markos, A. Modeling users’ acceptance of mobile services. Electron. Commer. Res. 2012, 12, 225–248. [Google Scholar] [CrossRef]

- Hirschman, E.C. Innovativeness, novelty seeking, and consumer change. J. Consum. Res. 1980, 7, 283–295. [Google Scholar] [CrossRef]

- Wu, W.W. Choosing knowledge management strategies by using a combined ANP and DEMATEL approach. Expert Syst. Appl. 2008, 35, 828–835. [Google Scholar] [CrossRef]

- Agarwal, R.; Prasad, J. A Conceptual and Operational Definition of Personal Innovativeness in the Domain of Information Technology. Inf. Syst. Res. 1998, 9, 204–215. [Google Scholar] [CrossRef]

- Yu, H.C.; His, K.H.; Kuo, P.J. Electronic payment systems: An analysis and comparison of types. Technol. Soc. 2002, 24, 331–347. [Google Scholar] [CrossRef]

- Hung, S.Y.; Ku, C.Y.; Chang, C.M. Critical factors of WAP services adoption: An empirical study. Electron. Commer. Res. Appl. 2003, 2, 46–60. [Google Scholar] [CrossRef]

- Venkataramani, G.; Gopalan, S. Mobile phone based RFID architecture for secure electronic Payments using RFID credit card. In Proceedings of the Second International Conference on Availability, Reliability and Security, Vienna, Austria, 10–13 April 2007. [Google Scholar]

- Valcourt, E.; Robert, J.M.; Beaulieu, F. Investigating mobile payment: Supporting technologies, methods, and use. In Proceedings of the IEEE International Conference on wireless and mobile computing, Montreal, QC, Canada, 22–24 August 2005. [Google Scholar]

- Krueger, M. The Future of M-Payments:Business Options and Policy Issues; Institute for Prospective Technological Studies: Seville, Spain, 2001. [Google Scholar]

- Stroborn, K.; Heitmann, A.; Leibold, K.; Frank, G. Internet payments in Germany: A classificatory framework and empirical evidence. J. Bus. Res. 2004, 57, 1431–1437. [Google Scholar] [CrossRef]

- Mallat, N. Exploring consumer adoption of mobile payments: A qualitative study. J. Strategic Inf. Syst. 2007, 16, 413–432. [Google Scholar] [CrossRef]

- Mallat, N.; Tuunainen, V.K. Merchant Adoption of Mobile Payment Systems. In Proceedings of the International Conference on Mobile Business, Sydney, Australia, 11–13 July 2005. [Google Scholar]

- Lai, P.M.; Chuah, K.B. Developing an Analytical Framework for Mobile Payments Adoption in Retailing: A Supply-Side Perspective. In Proceedings of the 2010 International Conference on Management of e-Commerce and e-Government, Chengdu, China, 23–24 October 2010. [Google Scholar]

- Wang, Z.; Zhang, S.; Qiu, L. A low-carbon-orient product design schemes MCDM method hybridizing interval hesitant fuzzy set entropy theory and coupling network analysis. Soft Comput. 2020, 24, 5389–5408. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 12, 319–340. [Google Scholar] [CrossRef] [Green Version]

- Chou, Y.; Lee, C.; Chung, J. Understanding m-commerce payment systems through the analytic hierarchy process. J. Bus. Res. 2004, 57, 1423–1430. [Google Scholar] [CrossRef]

- Kim, C.; Tao, W.; Shin, N.; Kim, K.S. An empirical study of customers’ perceptions of security and trust in e-payment systems. Electron. Commer. Res. Appl. 2010, 9, 84–95. [Google Scholar] [CrossRef]

- Mohammadi, S.; Jahanshahi, H. A study of major Mobile payment systems’ functionality in Europe. In Proceedings of the 11th International Conference on Computer and Information Technology, Khulna, Bangladesh, 24–27 December 2008. [Google Scholar]

- Min, C.H. The study on the Security Services in Mobile Payment Systems. In Proceedings of the Third 2008 International Conferences on Convergence and Hybrid Information Technology, Busan, Korea, 11–13 November 2008. [Google Scholar]

- Wood, S.L.; Swait, J. Psychological indicators of innovation adoption: Cross-classification based on need for cognition and need for change. J. Consum. Psychol. 2002, 12, 1–13. [Google Scholar] [CrossRef]

- Lamba, D.; Yadav, D.K.; Barve, A. Prioritizing barriers in reverse logistics of E-commerce supply chain using fuzzy-analytic hierarchy process. Electron. Commer. Res. 2020, 20, 381–403. [Google Scholar] [CrossRef]

- Saxena, A.; Das, M.L.; Gupta, A. Molecular assessment and Histological changes in Dichanthium genotypes caused by moisture. In Proceedings of the International Conference on Mobile Business, Sydney, Australia, 11–13 July 2005. [Google Scholar]

- Chou, Y.C.; Yen, H.Y.; Dang, V.T.; Sun, C.C. Assessing the Human Resource in Science and Technology for Asian Countries: Application of Fuzzy AHP and Fuzzy TOPSIS. Symmetry 2019, 11, 251. [Google Scholar] [CrossRef] [Green Version]

- Cui, L.; Chan, H.K.; Zhou, Y.; Dai, J.; Lim, J.J. Exploring critical factors of green business failure based on Grey-Decision Making Trial and Evaluation Laboratory (DEMATEL). J. Bus. Res. 2019, 98, 450–461. [Google Scholar] [CrossRef]

- Delice, E.K.; Can, G.F. Correction to: A new approach for ergonomic risk assessment integrating KEMIRA, best–worst and MCDM methods. Soft Comput. 2020, 24, 15093–15110. [Google Scholar] [CrossRef]

- Hussain, A.; Chun, J.; Khan, M. A novel multicriteria decision making (MCDM) approach for precise decision making under a fuzzy environment. Soft Comput. 2021, 25, 5645–5661. [Google Scholar] [CrossRef]

- Indira, K.; Kavithadevi, M.K. Efficient Machine Learning Model for Movie Recommender Systems Using Multi-Cloud Environment. Mob. Netw. Appl. 2019, 24, 1872–1882. [Google Scholar] [CrossRef]

- Wu, W.W.; Lee, Y.T. Developing global managers’ competencies using the fuzzy DEMATEL method. Expert Syst. Appl. 2007, 32, 499–507. [Google Scholar] [CrossRef]

- Sivaraman, G.; Vishnukumar, P.; Raj, M.E.A. MCDM based on new membership and non-membership accuracy functions on trapezoidal-valued intuitionistic fuzzy numbers. Soft Comput. 2020, 24, 4283–4293. [Google Scholar] [CrossRef]

- Yasmin, M.; Tatoglu, E.; Kilic, H.S.; Zaim, S.; Delen, D. Big data analytics capabilities and firm performance: An integrated MCDM approach. J. Bus. Res. 2020, 114, 1–15. [Google Scholar] [CrossRef]

- Fajiang, Y.; Jing, C.; Yang, X. An efficient anonymous remote attestation scheme for trusted computing based on improved CPK. Electron. Commer. Res 2019, 19, 689–718. [Google Scholar] [CrossRef]

- Huang, C.Y.; Shyu, J.Z.; Tzeng, G.H. Reconfiguring the innovation policy portfolios for Taiwan’s SIP Mall industry. Technovation 2007, 27, 744–765. [Google Scholar] [CrossRef]

- Suresh, K.; Dillibabu, R. A novel fuzzy mechanism for risk assessment in software projects. Soft Comput. 2020, 24, 1683–1705. [Google Scholar] [CrossRef]

- Yue, N.; Xie, J.; Chen, S. Some new basic operations of probabilistic linguistic term sets and their application in multi-criteria decision making. Soft Comput. 2020, 24, 12131–12148. [Google Scholar] [CrossRef]

- Abdullah, L.; Najib, L. A new preference scale mcdm method based on interval-valued intuitionistic fuzzy sets and the analytic hierarchy process. Soft Comput. 2016, 20, 511–523. [Google Scholar] [CrossRef]

- Qin, Y.; Qi, Q.; Scott, P.J. Multiple criteria decision making based on weighted Archimedean power partitioned Bonferroni aggregation operators of generalised orthopair membership grades. Soft Comput. 2020, 24, 12329–12355. [Google Scholar] [CrossRef] [Green Version]

- Büyüközkan, G.; Göçer, F. Smart medical device selection based on intuitionistic fuzzy Choquet integral. Soft Comput. 2019, 23, 10085–10103. [Google Scholar] [CrossRef]

- Chen, F.H.; Hsu, T.S.; Tzeng, G.H. A balanced scorecard approach to establish a performance evaluation and relationship model for hot spring hotels based on a hybrid MCDM model combining DEMATEL and ANP. Int. J. Hosp. Manag. 2011, 30, 908–932. [Google Scholar] [CrossRef]

- Chiang, F.F.T.; Birtch, T.A. Reward climate and its impact on service quality orientation and employee attitudes. Int. J. Hosp. Manag. 2011, 30, 3–9. [Google Scholar] [CrossRef]

- Hsieh, J.K. The effects of transforming mobile services into mobile promotions. J. Bus. Res. 2020, 121, 195–208. [Google Scholar] [CrossRef]

- Wei, F. Research on Security of Mobile Payment Model Based on Trusted Third Party. In Proceedings of the 2010 Second International Conference on Networks Security, Wireless Communications and Trusted Computing, Wuhan, China, 24–25 April 2010. [Google Scholar]

- Ondrus, J.; Pigneur, Y. An Assessment of NFC for Future Mobile Payment Systems. In Proceedings of the Sixth International Conference on the Management of Mobile Business, Toronto, ON, Canada, 9–11 July 2007. [Google Scholar]

- Ondrus, J.; Camponovo, G.; Pigneur, Y. A Proposal for a Multi-Perspective Analysis of the Mobile Payment Environment. In Proceedings of the International Conference on Mobile Business, Sydney, Australia, 11–13 July 2005. [Google Scholar]

- Peha, J.M.; Ildar Khamitov, M. PayCash: A secure efficient internet payment system. Electron. Commer. Res. Appl. 2004, 3, 381–388. [Google Scholar] [CrossRef] [Green Version]

- Liu, R.X.; Xie, S.M. Innovation Management and Industrial Engineering. In Proceedings of the 2009 International Conference on Information Management, Kuala Lumpur, Malaysia, 3–5 April 2009. [Google Scholar]

- Khiaonarong, T. Electronic payment systems development in Thailand. Int. J. Inf. Manag. 2000, 20, 59–72. [Google Scholar] [CrossRef]

- Katsaros, P. A roadmap to electronic payment transaction guarantees and a Colored Petri Net model checking approach. Inf. Softw. Technol. 2009, 51, 235–257. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).