1. Introduction

Following the 2007/2008 food crisis, extreme changes were witnessed in the volume of trade and pricing of food commodities. These notable changes resulted in the global food pricing process gaining special attention among economists and policymakers [

1]. The primary blame for the extreme food price fluctuations was futures markets, which were created to hedge against price volatility [

2,

3,

4]. A futures contract of a futures market is used to protect the sellers and buyers in advance from price risk and enhance the performance of food markets. A futures contract is affected by several factors, such as supply shocks, demand shocks, and the number of speculators, etc. Supply or demand shocks can lead to volatility of future food prices, and therefore can be transferred as a jump in food spot prices, which has a strong negative impact on poor consumers in developing countries that meet their increased food demand by relying on importing food [

5].

The main objective of this paper is to answer the research question about which market dominates the world wheat futures market by using dynamic copula models that can determine the time-varying correlation of price discovery. Copula models apply to independent and identically distributed residuals from the filtration (i.i.d.); for this purpose, an error-correction type of model and generalized autoregressive conditional heteroskedasticity (ECM-GARCH) is applied. Using Johansen’s [

6] cointegration tests, an ECM is applied to test for the existence of an equilibrium relationship between the considered price discovery pairs. A Chi-square test within the Johansen’s framework of weak exogeneity for long-run parameters is used to explore which futures market leads the world wheat market. Model residuals are modeled by means of a GARCH specification, which allows for time-varying and clustering volatility. This paper is relevant for economic agents, policymakers, hedgers, grain farmers, and grain elevators for making their economic decisions, since price discovery location drives resource allocation, production, and trade decisions that are useful to them.

Wheat is the most produced and traded grain around the world. Global wheat production represents 26% of all cereals produced in 2017 and 41% of the world cereal trade [

7]. Middle East and North Africa countries are the highest wheat importers, with Egypt being the highest wheat importer globally, with 12.5 million metric tons (MMT) imported in 2018 [

8]. Historically, the USA has been leading the global wheat market with production and exports. The wheat futures market in the USA served as a benchmark for traders and farmers to consider before making production decisions to protect themselves against market risks. Currently, U.S. exports and world share production has decreased [

8] as a result of the strong entry of the former Soviet Union (Kazakhstan, Russia, and Ukraine (KRU)) and EU countries into the global wheat market [

9]. This is due to the following two reasons: First, the short distance between the former Soviet Union and EU countries and the Middle East and North African countries, which are the highest wheat importers [

8] has led to reduced transportation costs. Second, the offering prices of wheat from those countries are less than those provided by the USA [

8]. Work by Westcott and Hansen [

10] predicted the world trade and production share of the former Soviet Union, with significant increases in the world wheat trade share expected from year to year. As a result of new changes in the trade map, farmers, traders, and other market participants have started to make decisions and plan for future products and budgeting in advance, based on the European futures markets rather than that of the U.S. futures market, meaning the USA has started to lose its wheat market leadership in favor of the aforementioned former Soviet Union and EU countries [

9].

This paper is organized as follows: In

Section 2, we present a nomenclature table (

Table 1) describing the model parameters and variables; in

Section 3, we describe the literature review; in

Section 4, we describe the methodological approach;

Section 5 is devoted to the empirical implementation used to assess world wheat market leadership; and finally in

Section 6, we offer concluding remarks and insights.

3. Literature Review

More recently, the literature regarding agricultural economics has focused on assessing the behavior of food price discovery occurring in futures markets to study hedging effectiveness as a result of facilitating price information transfer to traders before deciding to trade, so that they can better manage price risk. A study by Narayan and Smyth [

11] provided a review of the recent econometric developments in the literature on price discovery and price predictability. They found changes in the literature on price discovery in terms of econometric developments. They indicated that there were five sets of studies on price discovery.

The first set assesses the information share of trades across several markets and hedge effectiveness. The work by Harris et al. [

12] studied whether the New York, Pacific, and Midwest Stock Exchanges were contributing to price discovery. The study by Harris et al. [

13] analyzed the common factor weight attributable to three informationally-linked exchanges for the Dow Jones Industrial Average (DJIA) stocks over 1988–1995. De Jong and Schotman [

14] studied the contribution of the intraday variation in price discovery across different exchanges. Westerlund and Narayan [

15] explored how to predict stock returns using more powerful tests by analyzing data for 50 Standard & Poor’s (S&P) 500 stocks in 2013. These studies found evidence that prices in foreign markets respond and adjust to changes in price discovery that occur in their home country. Nonetheless, the second set of studies discovered that the relationship between the home and foreign market could be changed, particularly during extreme market events. One of these studies was carried out by Fernandes and Scherrer [

16], who analyzed the price discovery mechanism regulating the prices of common and preferred shares in the Sao Paulo Stock Exchange (BM&FBovespa), as well as the prices of American Depositary Receipt (ADR) program counterparts in the New York Stock Exchange (NYSE). Caporale et al. [

17] investigated the role of crude oil spot and futures prices in the process of price discovery by using daily data over the period from January 1992 to September 2012. These studies discovered that the relationship between the home and foreign market could be changed, particularly during extreme market events.

Most of the previous studies on this topic have indicated that price discovery occurs in futures markets, while a few studies have found the opposite results, showing that the futures markets respond to changes that occur in spot markets. A study by Dolatabadi et al. [

18] analyzed the price discovery in the spot and futures markets for five non-ferrous metals (aluminum, copper, lead, nickel, and zinc). Another study by Dolatabadi [

19] analyzed spot and futures prices for 17 commodity markets using the fractionally cointegrated vector autoregressive (FCVAR) model. A study by Garcia et al. [

4] assessed the effectiveness of the grain futures market in the United States (USA) from 2005–2010, by examining the ability of the grain future markets to perform their price discovery and mitigate the risk that could occur in the spot markets. The results indicated that, during a time of high price volatility, future and spot prices were uncoupled together, leading to non-convergence, and thus inefficient futures markets. However, the opposite results were found by Irwin et al. [

20] and Hamilton and Wu [

21], who evaluated the role of index funds in recent convergence problems of the Chicago Board of Trade (CBOT) corn, soybean, and wheat futures contracts, and studied if the positions of index traders could help to predict changes in the agricultural futures prices, respectively.

The third set of studies estimated the price discovery of credit spreads obtained from created default swap (CDS), equity, bond, and options markets. A study by Blanco et al. [

22] analyzed the behavior of CDS for a sample of firms and found support for the theoretical equivalence of CDS prices and credit spreads. The results showed that CDS led bond markets. Meanwhile, Bai and Collin-Dufresne [

23] examined the violation of the arbitrage relation between a cash bond and a CDS contract. Their results indicated that price discovery occurring in the bond market increased during the financial crisis of 2007/2008 and decreased dramatically in the CDS market. The study by Forte and Peña [

24] explored the dynamic relationships among stock market implied credit spread, CDS spreads, and bond spreads. The study by Norden and Weber [

25] analyzed the empirical relationship among credit default swap, bond, and stock markets during the period 2000–2002, and found evidence that the equities and CDSs led the bond market.

A fourth set of studies assessed the impact of dark trading on price discovery. In this set of studies, the market outcome was analyzed when the informed trader splits trades between exchange and dark pool markets [

26,

27,

28]. The authors found evidence that increased black trading negatively affected price discovery, and led to ineffective futures markets.

The fifth and last area of studies investigated which market led the price discovery for a particular product. A study by Westerlund et al. [

29] assessed the price discovery leadership for crude oil. The authors analyzed oil prices in Oman, the USA, and the United Kingdom. Their results indicated that Oman led this market and that price discovery occurred in the Oman market. Janzen and Adjemian [

9] examined the locations of world wheat price discovery and assessed the leadership roles in the world wheat market. These authors found evidence that, after August 2010, the U.S. futures wheat market started losing its leadership role in favor of the European’s futures market, represented by the Marché à Terme International de France (MATIF) Paris market.

Previous studies have focused on measuring price discovery occurring in futures markets using different econometric approaches. A work by Narayan and Smyth [

11] indicated that there were three steps for estimating price discovery. The first step involves investigating the long-run relationship between two prices, and if a link between both prices is found, the changes in one price will be transmitted to the other. The second step involves examining the cointegration to assess the existence of an equilibrium relationship between the pairs of prices studied. The third step is testing for weak exogeneity of long-run parameters, which can show which price is responsible for maintaining an equilibrium by responding to the deviations, and therefore the market causing price discovery is determined. The estimation can be applied using two methodological approaches. First, by using an error correction model [

30] to assess the long-run equilibrium price with the relative speed of adjustment. Second, by analyzing the information share (IS) and the component share (CS) from the error-correction model [

9,

31].

Most of the previous studies that have measured price discovery occurring in futures markets have depended on using the IS and CS based on a vector error-correction model (VECM), first applied by Engle and Granger [

32]. IS and CS can be estimated using a combination of a reduced-form VECM [

9,

31]. A VECM is widely used to study price transmission, especially in the agricultural sector, as it can assess the shocks that happen in one market that can be transmitted to other markets. Garbade and Silber [

33] and Figuerola-Ferretti and Gonzalo [

34] studied the characteristics of price movements in spot markets and future markets for storable commodities. They applied the CS approach based on the cointegrated vector autoregressive (CVAR) model [

35] by extending the CS approach proposed by Garbade and Silber [

33] to assess price discovery. The CVAR model has also been extended by developing fractionally cointegrated vector autoregressive (FCVAR) model to examine market leadership, and if a dominant market is determined, the follower markets can, thus, be forecasted and predicted using the information obtained from the dominating market [

18,

19].

CS and IS are static approaches [

11,

31,

36] which cannot test price discovery nor allow the parameters to change with changing market conditions (e.g., in the time of a crisis or extreme market event). To overcome this limitation, studies by Yan and Zivot [

31], Putniņš [

37], and Janzen and Adjemian [

9] have explored the dominant price discovery by assessing which market was the first to reflect new information about a fundamental value. They used the information leadership share (ILS) method based on CS and IS, to test price discovery by assessing the dynamic response of shocks transmitted from one price series to another.

Other studies have tested price discovery using time-varying and clustering volatility through generalized autoregressive conditional heteroskedasticity (GARCH) models. Research by Avino et al. [

38] studied time varying price discovery to estimate the information share (IS) using daily data of bond yields, CDS mid-quotes, equity prices, and option-implied volatilities for Marks and Spencer Plc. These authors used BEKK-GARCH specification for the VECM to estimate the daily time varying IS.

4. Materials and Methods

Research by Lehecka et al. [

39] focused on studying corn futures markets, while research by Bunek [

40] and Janzen and Adjemian [

9] looked at wheat futures markets. These authors found evidence that grain prices significantly changed as a reaction to information generated by USDA reports on expected grain production conditions, the area cultivated, inventories, etc. Janzen and Adjemian [

9] indicated that price discovery is generated in a market that is adjusting to crises or shocks more rapidly than others.

For this purpose, this study depends on examining the price discovery of futures markets in the USA (the Chicago Board of Trade (CBOT), Kansas, and Minneapolis) and France (Marché à Terme International de France, MATIF). MATIF represents the futures exchange in France, which is currently merged with the Euronext NV (European New Exchange Technology) to Euronext Paris. Euronext Paris (formerly MATIF) is the Euronext milling wheat future prices that is commonly used as an indicator for wheat prices in Europe [

9]. In this regard, we assessed the dependency between the U.S. futures markets and France using copula models to analyze the correlation between variables in the central area of the distribution, as well as the distribution in the tail, and assessed the links among the extreme market events. The statistical copula provides the natural way to characterize the dependence between variables, which is commonly used in the financial economics literature, for example in [

41,

42,

43]. However, copula models have started to gain popularity in the food sector, particularly for studying food price transmission and measuring the connectedness of the agri-food sector [

44,

45,

46].

A multivariate copula overcomes the deficiency of using the univariate distribution, which is characterized by excess, kurtosis, skewness, and non-morality [

46]. Additionally, food prices show asymmetric transmission, implying multivariate nonmorality [

41]. Given the certainty that multivariate distribution is scarce, copula models depend on univariate distribution, instead of multivariate ones.

The distributed copula is a multivariate distribution function based on Sklar’s [

47] theorem that defines the univariate marginal on the unit cube

, the uniformly marginal distribution of two or more variables is drawn between the parenthesis. The theorem shows that multivariate distribution functions, characterizing dependence between

variables, can be decomposed into

univariate distributions and a copula model, which fully captures the dependence structure between variables. Sklar’s theorem depends on modeling univariate distributions, which leads to a better formulation of models [

45].

and

represent the univariate distribution models for two random variables

and

, while the joint distributing function can be represented by

copula model

which can be captured as follows:

where

is a two-dimensional distribution function for the

and v uniformed

distribution margin. The joint density function could be expressed as:

where

represents the density of copula and

and

are the univariate density functions of the random variables

and

.

There are two copula specifications that represent different dependence structures, i.e., elliptical and Archimedean copulas. Elliptical copulas represent elliptical distribution, while Archimedean copulas are a group of associative copulas that have tails to reduce the dimensionality of the distributions during the dependency measurement. Copula models can also be categorized as static and time varying. A static copula estimates the dependency between variables with a supposing constant over time, while a dynamic copula estimates the dependency supposing the time variance within a changing environment. The GoF tests are used to select the best fit copula with our data. In addition, the time-varying dependence tests are conducted to assess whether the dynamic copulas could be considered. The test of rank correlation breaks between u and v are applied at some unknown date and is based on the “sup” test statistic [

48]:

where

and

,

t is the number of observations. The critical value of

can be estimated by a bootstrap process explained in detail by Patton [

48]. The ARCH LM test for time-varying volatility [

49] is also applied. This test is based on autocorrelation independence, defined by an autoregressive model and expressed as the following:

, where

is the error term. With this test, the constant copula can be tested by the following statistic:

,

, where

,

and

is the OLS estimate for the covariance matrix. We have applied the bootstrap process following a Patton [

48] estimation to identify the test critical values. These tests show the restriction of the copula by static, providing evidence in favor of dynamic copulas. The GoF tests support the use of the dynamic student’s

t, which can be used to capture the correlation between variables over time, as shown in Equation (4) below [

48]:

The GoF tests are conducted for a set of copulas to identify the copulas that fit the data used for the analysis. The results indicate that the best fit static copulas are Gaussian and Student’s t. The log-likelihood values have been estimated for different types of copula models to select the highest four log-likelihood values for a more in-depth analysis. The highest four copulas are Gaussian, Student t, Plackett, and symmetrize Joe–Clayton (SJC).

The analysis is based on price discovery pairs (France represented by MATIF and the USA represented by the CBOT, Kansas, and Minneapolis), therefore, we considered the bivariate

Gaussian copula, which can be specified as:

where

represents the correlation coefficient of the corresponding bivariate normal distribution,

, and

denotes the univariate normal distribution function. The shortcoming of the Gaussian copula is that it supposes the variables

and

are independent in the extreme tails of the distribution. Since the Gaussian copula does not have lower and upper tail dependence, it assesses the dependence of the correlation between variables in the central region of the distribution. A bivariate student’s t copula can be formulated as:

where

represents the correlation coefficient of the corresponding bivariate

t-distribution,

denotes the bivariate distribution function, and

the degrees of freedom. The Student’s

t copula is that it supposes the variables

and

assume positive and symmetric lower and upper tail dependence.

We have applied semi-parametric copulas that can be estimated through a two-stage estimation procedure. The marginal distribution models are estimated in the first stage to allow for deriving standardized, independent, and identically distributed

residuals from the filtration, which will be transformed to

using the non-parametric empirical cumulative distribution function (CDF). In the second stage, copula parameters can be estimated conditional upon the results from the first stage. The two-stage procedures technique can be expressed as follows [

48]:

where

are the marginal distribution parameters, while the copula estimated parameters is represented by the vector

. Since statistical copula could only be estimated by stationary time series, unit root tests were conducted. Augmented Dickey and Fuller [

50] and KPSS [

51] tests for unit root showed that the data series were non-stationary and contained a unit root. The cointegration test were conducted using Johansen’s model [

6], which indicated that the price discovery pairs that occurred in the U.S. and France’s futures markets considered were found to maintain equilibrium parity. The univariate ECM-GARCH models were applied to obtain the standardized, independent, and identically distributed

residuals. The wheat price discovery for the U.S. and France’s price pairs used for the analysis are formulated as an error-correction type of model (ECM), while the results can be obtained from GARCH (1,1), allowing for volatility clustering. ECM-GARCH (1,1) can be expressed as follows:

where

is the first difference of logged U.S. and France’s prices discovery and

are short-run dynamic parameters that measure the influence of past price discovery differences on current differences;

represents the error correction term derived from the long-run equilibrium relationship, while the long-run price dynamics can be measured by

. The normally distributed error terms are presented by

.

The goodness of fit tests on the marginal models were applied and essential for copula model estimation. The LM tests of serial independence of the first four moments using 10 lags of and were conducted by regressing and for k = 1, 2, 3, 4. Furthermore, the Kolmogorov–Smirnov (KS) test was used to assess whether the transformed series were correctly transformed .

5. Results and Discussion

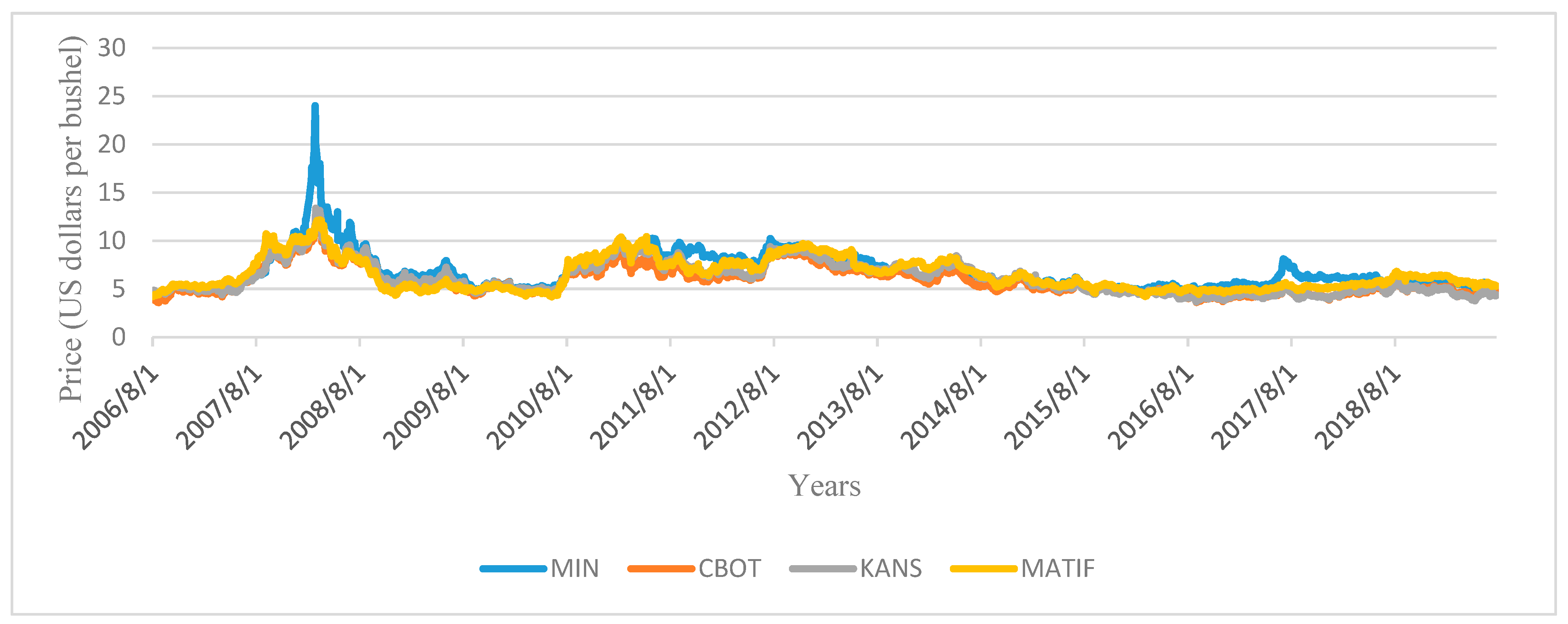

The analysis is based on daily settlement prices occurring in France, as represented by the MATIF futures market for milling wheat contracts and in the USA as represented by wheat contracts in Chicago for soft red winter wheat (CBOT futures market), Kansas for hard red winter wheat (Kansas futures market), and Minneapolis (Minneapolis futures market) for hard red spring wheat. Our wheat price discovery is obtained from the Agriculture and Horticulture Development Board (AHDB) for the period from 1 August 2006 to 24 July 2019, yielding a total of 2484 observations (see

Figure 1). We split the data into the following three periods: the first period, from 1 August 2006 to 31 July 2008; the second period, after August 2010 to assess the impact of extreme droughts that occurred in the Black Sea region (specifically in KRU) at the beginning of August 2010, resulting in supply shocks and leading to export bans that affected global price discovery [

9,

52]; and the third period, after 2015 when KRU wheat exports increased dramatically, with Russian exports surpassing U.S. exports in particular [

9]. For this purpose, the data series were split to before and after 2015 to measure the effects of the changing international trade map on wheat price discovery. Prices are expressed in US Dollars per bushel and studied in pairs. Logarithmic transformations of price series are used in the empirical analysis.

Table 2 presents summarized statistics for the first differenced logged price series, and the results provide evidence of non-normal price series characterized by skewness, kurtosis, and ARCH effects.

Johansen’s [

6] cointegration tests are applied to examine the existence of an equilibrium relationship between the pairs of prices studied. The results suggest that there is a long-run relationship between the U.S. and France’s wheat price discovery (see

Table 3). A Chi-square test, presented in

Table 4, of weak exogeneity for long-run parameters within the Johansen’s framework shows, on the one hand, that price discovery occurring in the MATIF (France) futures market, in the first and second periods, are responsible for maintaining such equilibrium by responding to the deviations that can occur. In the third period, on the other hand, the price discovery occurring in the U.S. futures markets is considered to be responsible for maintaining such equilibrium.

As a result, in the first and second periods, U.S. futures markets may be considered to be price leaders and the MATIF (France) futures market should be classified as a price follower. In contrast, in the third period, the MATIF (France) market may be considered to be a price leader and U.S. futures markets should be classified as price followers. This reflects the changing trade map of the KUR and EU dominating the global wheat trade after 2015. The existence of cointegration suggests the presence of information flows from U.S. futures market areas (CBOT, Kansas, and Minneapolis) to France (MATIF). Given that the price time series are transformed in logarithms, the cointegration parameters can be implemented as price elasticities. In the first period, price transmission elasticities are strong for the three models, that is, CBOT-MATIF (0.983), Kansas-MATIF (0.943), and Minneapolis-MATIF (0.942). In the second period, the price transmission elasticity between the U.S. and France’s futures markets remains high, equaling 0.956, 0.942, and 0.837 of the CBOT-MATIF, Kansas-MATIF, and Minneapolis-MATIF, respectively. In the third period, when the leadership moved from U.S. futures wheat markets to MATIF (France) futures markets, reflective of EU and KRU wheat markets, the elasticities are 0.570, 0.566, and 0.284 for the CBOT-MATIF, Kansas-MATIF, and Minneapolis-MATIF models, respectively.

Marginal models are specified as univariate error-correction types of models. The results of the univariate ECM-GARCH model estimation are presented in

Table 5,

Table 6 and

Table 7 for the pairs of price discoveries considered. In the first and second periods, short-run parameters show that current changes in U.S. futures markets have a relevant autoregressive component. As noted above, U.S. futures market prices are exogenous for long-run parameters in the first and second periods. The conditional mean equation shows that the current changes in the MATIF futures market are explained by past changes in the U.S. futures market, as well as by the deviations from the long-run equilibrium. The conditional variance equation shows that past market shocks contribute to increased U.S. and MATIF futures market price volatility. The GARCH (1,1) model parameters are all positive, which indicates that in- and out-sample variance estimates are positive. Since

1, we conclude that the GARCH process is stationary.

In the third period, the short-run parameters show that current changes in the MATIF futures market have a relevant autoregressive component. The conditional mean equation shows that the current changes in the U.S. futures markets are explained by past changes in the MATIF futures market, as well as by the deviations from the long-run equilibrium. The conditional variance equation shows that past market shocks contribute to increased U.S. and MATIF futures market price volatility. The GARCH process is stationary, as 1. The GARCH (1,1) model parameters are all positive, which indicates that in- and out-sample variance estimates are positive.

The Ljung–Box test for autocorrelation, presented in

Table 5,

Table 6 and

Table 7, allow for the null hypothesis of no autocorrelated residuals to be accepted. We also implement the Kolmogorov–Smirnov (KS) test to confirm that the transformed series are Unif (0,1) [

48]. The results of the time-varying dependence are presented in

Table 8, which show the presence of breaks between the pair prices; thus, the tests support the use of the dynamic copulas.

Next, we discuss the results of static and dynamic copula in

Table 9,

Table 10,

Table 11 and

Table 12. Copula models are a flexible, alternative technique for studying short-run dependency among the two pairs of prices discoveries considered. Results of the static Gaussian copula indicate that there is a positive correlation between the price discoveries occurring in U.S. and MATIF futures markets in the first, second, and third periods. However, the dependency between price discoveries decreased in the second period and continued decreasing in the third period.

The time varying student’s t copula shows how dependency among the pairs of prices considered changes over time (

Table 12). The dynamic student’s t copula, shown in

Figure 2,

Figure 3 and

Figure 4, explains the changing of the dependency over time. In the first period, the dependency between price discovery in the U.S. and MATIF futures markets always fluctuates (

Figure 2,

Figure 3 and

Figure 4 in panel A) in the range from 0.40 to 0.60, which reflects the 2007/2008 food crisis and another wave of the food crisis in the beginning of 2010.

In the second period, a higher dependency is observed (

Figure 2,

Figure 3 and

Figure 4 in panel B) that fluctuates less than in the first and third periods, in a range from 0.50 to 0.70. This may be explained by the fact that MATIF has generated an increasing share of information about wheat market conditions, which is reflected in the price discovery occurring in this market. Hedgers, traders, and farmers interested in trade within the European continental markets became more active in this market, acting based on information provided by the MATIF market on the value of the wheat. The information provided by the market led to more trading activity, especially following the wheat supply shock in KRU, during the summer of 2010, which may have resulted in the start of shifts of the wheat price leadership from the USA to MATIF [

9].

In the third period, time-varying student’s t tail dependence, displayed in

Figure 2,

Figure 3 and

Figure 4 in panel C, shows a lower dependency between future markets in MATIF (Paris) and the USA than the first and second periods. This result supports what was described above by the ECM-GARCH, i.e., that the wheat market leadership has been taken over by the MATIF instead of acting as a complimentary market to the U.S. futures markets. The third period shows that the prices are as highly fluctuated as in the first period, which is in the order of the range from 0.20 to 0.60. This may be explained by the extreme market events that occurred in KRU wheat markets, including the ban of food exports to Russia that was imposed by the USA and some of the EU countries, as well as the economic crisis faced by Russia as a result of the extreme decline in world oil prices. Given that the Russian economy highly depends on energy exports, this led to a major depreciation of the Russian currency (ruble) and other currencies in some former Soviet Union countries against the US Dollar, which was followed by increased food prices. The higher food prices caused government jurisdictions within Russia to boost agricultural production and reduce their dependence on imports. This led to significant increases in agricultural production and more grain exports, especially wheat, with a more than 50% increase [

53,

54]. This resulted in major changes to the world’s wheat trade map after 2015.

After the wheat supply shocks in 2010 and shifts to the world wheat trade map in 2015, hedgers, traders, and farmers looked into the MATIF (Paris) wheat futures market as a reflection of KRU and EU wheat markets for hedging effectiveness and to protect themselves against market risks with regard to future production decisions. The U.S. wheat market acted as a world benchmark and has been substituted by MATIF wheat markets as a result of increased KRU and EU wheat trading share.

Generally, the results from estimating the ECM-GARCH and semi-parametric copula models indicate that, until August 2010, the USA was the wheat market leadership, while after this date the leadership started moving from the U.S. to the European market. After 2015, the leadership moved to the European market, with the increasing wheat export share by the KRU and EU countries. This means that price discovery is primarily located by the MATIF futures market, which is used as an indicator for wheat prices in Europe and representing the European wheat market.

These results are consistent with de la Hamaide [

55] and Janzen [

56] financial reports, which put forward that the MATIF (Paris) futures market was the first to reflect new information regarding world wheat market conditions and values. They also pointed out that the U.S. leadership within the global wheat market has transitioned from the USA to the European continent.

6. Conclusions

Futures markets are created to hedge against market risks by providing farmers, traders, and policymakers information that can serve as a shield against the risks of price volatility. Thus, they are the first thing to blame in the event of instability in a market, which is what really happened after the global 2007/2008 food crisis, as futures markets did not protect food markets from destabilization. Farmers, traders, speculators, and policymakers are always looking to futures markets to hedge against market risks.

In this paper, we assess the world wheat market leadership after August 2010, when, because of drought, supply shocks occurred in KRU countries, leading to major changes in price discovery, as well as shifts to world wheat trade after 2015, with the share of KRU and EU increasing dramatically.

For this purpose, in this paper, we test the price discovery in three wheat futures markets in the United States and one futures market from the European continent, with each market representing a different class of wheat. Chicago’s futures market (CBOT) represents the soft red winter wheat (SRW) futures contracts, while Minneapolis represents hard red spring wheat (HRS) futures contracts. The Kansas futures market represents hard red winter wheat futures contracts (HRW) and the EU’s futures market represents the milling wheat futures contracts traded at Paris (MATIF).

An ECM is used to study the cointegration between price discovery occurring in the U.S. and the EU futures market. Johansen’s [

6] cointegration tests are applied using a Chi-square test to examine for weak exogeneity for long-run parameters. Static and dynamic copula models are also used to assess dependence between the price discoveries of the futures markets considered. Since copulas use the univariate distribution to obtain a multivariate distribution for jointness with a particular dependence structure, ECM-GARCH is used for univariate models to obtain the i.i.d. distribution.

The results indicate that cointegration between U.S. and MATIF (Paris) price discovery in these futures markets exists. Results from estimating a Chi-square test imply that, before and after August 2010, the wheat futures market in the USA was leading the world wheat market. After 2015, however, the leadership of the wheat futures markets transitioned from the U.S. to the MATIF futures market, because of a higher share of EU and KRU wheat trade than the USA. Thus, the volume of MATIF wheat futures contracts increased. The results also indicate a positive link between the share of price discovery and the increasing trade volume, since the wheat trading volume by Europe, particularly by KRU, has been increasing dramatically the last few years.

Results of the static and dynamic copula models show that positive correlations are always observed between the price discoveries in both the U.S. and MATIF futures markets. This increased in the second period (after 2008) and decreased in the third period (after 2015), as the dependency between the two pairs of prices decreased, moving the leadership of the wheat market from the USA to MATIF. Low dependency in the third period may be explained by the KRU and EU’s shift in their share of wheat trade, which led to a drop in U.S. wheat leadership to KRU and the EU. This means that, after 2015, the KRU and EU started to dominate the world wheat market with increased production and world trade share. The dynamic copula illustrates that the prices fluctuate highly in the first and third periods and less in the second period. The first period of our analysis encompassed the first food crisis of 2007/2008, while the third period covered the economic crisis in Russia as a result of the decline in oil prices, as well as the food product export ban from the United States and some European Union countries. As a result, the Russian ruble floated, which led to the influence of many former Soviet Union countries and high food prices. This forced the Russian government to reduce the country’s dependence on importing food products and to encourage local production, especially for meats and cereals, which led to increased grain production, especially wheat, and an increase in exports by more than 50%. This increase in the wheat supply of the European continental market resulted in decreased price discovery in the MATIF market, while the price discovery was kept at the same level in the U.S. futures markets.

Studying price discovery during economic crises, expansions, and recessions, particularly by using regime-switching models, can and should be applied in future studies. Markov-switching GARCH and regime dependent adjustment speeds are additional methods that could complement the present estimation results.