2. Related Literature

In previous scientific research, scholars have performed the following research on the behavioral decisions of decision-making subjects. Shi Q. et al. [

3] believe that the integration of game theory and decision theory will be an effective quantitative analysis tool for studying the rational distribution of interests and the conflict resolution mechanisms in cooperation. Zhao X. and Hong K. [

4] constructed a game model when studying the extreme controversial decision of real estate expropriation compensation, and focused on the discussion of fairness preference, loss avoidance preference, and other major behavioral preferences. Mai Q. et al. [

5] believe that engineering is a dynamic process in which decision-making subjects make behavioral decisions, and they divided decision-making into management decisions and technical decisions. They then classified the complex management decisions of major engineering projects into four types and studied their dynamic evolution laws in their paper. Li Q. et al. [

6] suggested that standardizing the behavior of project decision-making subjects and improving the cognitive ability of project decision-making subjects are important tasks for decision-making governance of major projects. Zeng X. and He S. [

7] discussed the conflict of interest between public and private parties in large-scale engineering PPP projects, and constructed an evolutionary game model. Sun L. and Sun S. [

8] combined the dynamic game method with conflict theory to study the decision-making system of participants in major engineering projects and conducted data simulation. Based on prospect theory, He S. [

9] constructed an evolutionary game model in which the government, social capital, and the public are the game subjects in major engineering projects. He, Z. et al. [

10] constructed an evolutionary game model between the government and the residents of large-scale engineering projects and conducted an evolutionary study on the conflicts of all parties. Using simulation analysis of the amplification of stakeholder conflict on complex networks, this paper provides a reference for stakeholder conflict management in large engineering projects in China. Ling N. et al. [

11] used prospect theory and the evolutionary game model to construct a learning evolutionary game model from the perspective of conflict and studied the evolutionary development law of engineering project teams in conflict situations. Sheng Z. [

12] hold the view that the individual morality, knowledge, and experience of decision-makers play very important roles in the decision-making of large-scale engineering projects in China, and it is necessary to standardize the behavior of decision-makers through some effective methods. Ahmad and Minkarah [

13] conducted an empirical investigation on investment decision-making behavior in the American construction industry. Among the 31 factors influencing bidding decision-making, they found that the subjective evaluation criteria of the decision-making body have the greater influence among these factors. Ahmad [

14] constructed a bidding decision model with mutually independent attributes and multi-criteria strategy technology. This model directly reflects the preference structure of the project decision-makers and their direct attitude towards project risks. Prospect theory, proposed by Kahneman et al. [

15], describes the psychological and behavioral characteristics of associated decision-making subjects under uncertain conditions and emphasizes that the decision-making individual’s preference attitude towards risk is an important factor in the associated decision-making activity. Wanous [

16] studied the use of utility function models to construct mathematical models that can reflect the different decision-making preferences and risk attitudes of project contractors when faced with engineering projects of different scales. Camerer [

17] focused on the analysis of the psychological characteristics and behavioral choices of decision-making subjects in his research. In a study of group decision-making, Milch et al. [

18] found that decision-makers have a frame effect and process loss decision behavior in the process of individual preference and group selection. Bendoly et al. [

19] proposed that individual decision-makers’ management ability, planning ability, and personal confidence and self-control ability play important roles in project group decision-making. Franklin et al. [

20] incorporated the subjective factors of the decision subject into the content of decision management in the process of research project risk decision-making. Baliga and Sjöström [

21] studied the equilibrium characteristics of the conflict game model when the subject of the game is the extremist. Ress-Caldwell and Pinnington [

22] compared the subjective views of decision-makers from different countries on different planning decisions. Park et al. [

23] constructed an expected utility and uncertainty risk decision model based on the Bayesian model. Attanasi G. et al. [

24] carried out repeated trust game research on belief-dependent preferences in behavioral preferences, further verifying the influence of behavioral preferences on the subject’s decision-making. Rudolf C.A. et al. [

25] mainly researched the supply chain risk management (SCRM) of large-scale engineering projects. They performed a new analysis of the supply risk of large-scale engineering projects. Kabirifar K. et al. [

26] used the TOPSIS method to analyze the multi-attribute group decision-making problem in EPC projects. The paper found that engineering design, project planning, and control are important factors that affect project performance. In their research paper, Khosravi P. et al. [

27] mainly discussed the relationship between EI and project performance in the context of large-scale engineering projects and studied the key role of EI in the context of project conflicts.

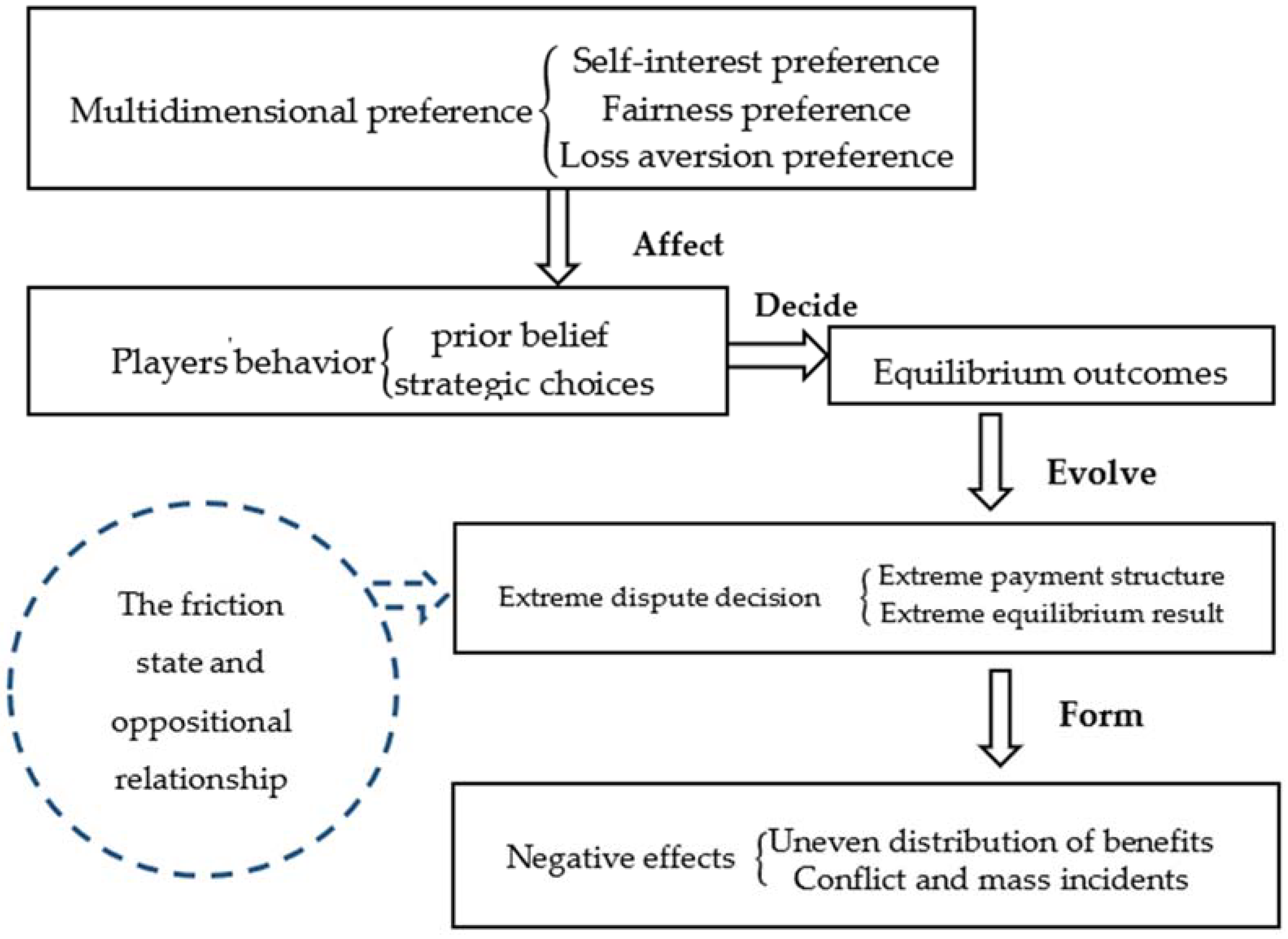

Through these related documents, we found that decision-making theories regarding large-scale engineering projects are becoming more and more abundant, and the research method of combining game theory and project decision-making has also been verified many times. Relevant scholars have used different decision-making methods and research perspectives to study project management decision-making. However, many scholars’ research on behavior preference is still in a single dimension of preference research, and they have not studied the common influence of multiple behavior preferences in one game model. Moreover, in the game model, more scholars study the two-sided game, while, in the real case scenario in the management of a large-scale project, there are at least three parties in the game. This paper argues that game theory plays an important role in research papers on project conflicts, and the importance of the behavioral game method to analyze the three subjects in project management should be noticed. Moreover, in contrast to the complex decision-making mathematical methods, the game expansion model can more clearly analyze the interaction between the belief and strategy, so as to find the optimal Nash equilibrium solution under various equilibrium conditions and help to analyze and solve real management problems.

According to the literature reviewed, the existing related research still has the following deficiencies:

Most of the literature only considers the influence of the subject’s individual preferences. However, in the face of complex project disputes, the preferences of the game subject often do not play a role alone. The subject’s multiple behavior preferences need to be taken into consideration in the decision-making process.

In most of the existing research, the game model only involves two players, but in reality, most of the situations are multi-agent and multi-stage dynamic games.

The traditional game background does not conform to the real situation. The game players playing the game under the premise of complete rationality is contrary to the real situation. In reality, most of the players in the game are in the context of incomplete information, and the players have the premise of bounded rationality.

To sum up, we conclude that game is an important mathematical simulation method in the decision-making theory system, but there are still many important limitations. For example, the theoretical model of game usually requires many assumptions, and when the assumptions are not satisfied, the game players will produce completely different game equilibrium results in the process of playing chess. Therefore, the construction of the game model needs to conform to the premise of the actual situation, so as to scientifically and reasonably simulate the real situation and play a reasonable guiding role in resolving the real dilemma.

After reading the relevant literature, we found that the traditional economic man hypothesis can no longer explain the existing economic phenomenon, and many projects have not been accepted by the public because of the huge benefits that can be obtained. It is precisely the various behavior preferences that influence the subject’s decision-making, which leads to different equilibrium results. In order to explain the extreme controversial decisions in project management more reasonably, the game model construction of this paper considers the common effect of multiple behavior preferences on the subject’s decision-making. Based on the equilibrium logic of behavioral game, the game subjects have a strategic and belief interaction, and both a minor change in the prior beliefs and the initial cognitive biases of the game subject may evolve into differentiated strategic belief judgment in the game strategy. Therefore, assuming certain game conditions and environments, this paper constructs a three-subject and three-stage incomplete information dynamic game model among the players of the project construction units, the public, and the government of large-scale engineering projects. We fully consider the collective effect of various behavior preferences when constructing the profit payment value function of all players. Then, we analyze the belief and strategy interaction of all players in the game and determine the path of equilibrium formation through simulating the game scenario when a dispute occurs in a large-scale project. This study attempts to determine how project disputes develop into extreme dispute decisions and infer the formation path and equilibrium characteristics of these dispute decisions.

4. Game Model Analysis

In the dynamic game with incomplete information, the prior belief of the game subject is very important. is set as the probability of prior prediction by the government and the project construction units to the public. means that the government and the project construction units predict that the public will choose to accept this decision, while means that the government and the project construction units assume that the public will choose to oppose and resist the project development strategy. According to the above model, the five equilibrium results can be summarized as follows: zero return type extreme dispute decision; optimal equilibrium solution; resistance type extreme dispute decision; rent-seeking type extreme dispute decision; and retarding type extreme dispute decision. Faced with these five equilibrium results, which have different constraints and premises, we infer the equilibrium characteristics and equilibrium conditions and attempt to identify scientific and effective methods to avoid such extreme results.

In the dynamic game model with incomplete information, when the government chooses (Not supporting) as the option of the project in the dispute decision, then, for large-scale engineering projects, this means that the decision-maker decides to stop the project development. Unlike ordinary construction projects, large-scale engineering projects are strongly related to the economic and political development of the country. The government’s evaluation criteria for strategic value are more diversified. The government cannot only consider a single economic value standard—many factors, such as ecological, environmental, and social development, need to be considered simultaneously. When facing a controversial decision, the government’s decision does not support the development operation of the project, which means that none of the related players of the game can obtain a benefit income from the project, so the income of all players is zero. Analyzed from the perspective of equilibrium value, the zero-profit equilibrium result of all players in the game will lead to the failure of project decision management, which is the most negative way to resolve the disputes. Moreover, it will bring many additional problems, and the failure of the project will hinder local economic development.

To analyze the realistic scenarios of such equilibrium results, we provide an example as follows: The Three Gorges Hydroelectric Power Station [

38] is the largest hydropower station in the world and the largest engineering project ever implemented in China. According to the public report of the China Three Gorges Corporation (CTGC), this project has brought huge economic benefits [

39]. However, in the project decision-making process, which has lasted for nearly a century, the government once made a decision not to support the continued construction of the project due to various complicated reasons, even in the context of huge benefits. From 1918, when the project was proposed by Sun Yat-sen, to 1949, when the Three Gorges Project proposed an early plan, the controversy of the project has been repeatedly discussed. The period from 1978 to 1988 was a period of in-depth study and argumentation for the Three Gorges Project. In the process of the argumentation of the project, which was constantly questioned and stalled, the government chose (Not support) many times in the face of controversy [

40]. At this time, all three parties in the game could not benefit from the project. This means that the equilibrium result at this time was 0 for all three parties. In fact, in the history of the construction of the Three Gorges Project, the operation of the project was suspended many times due to various complex factors. Meanwhile, the phased equilibrium strategy was the zero-benefit extreme controversial decision when the government chose (Not support) in the face of controversy.

- 2.

Equilibrium result 2: When (Supporting, Legal and reasonable operation, Acceptance) is the game equilibrium solution

Sometimes, there are preconditions for the government to choose to support project development in the dispute decision-making game. At the first node of the game, if there is a priori judgment between the government and the project construction units on the attitude of the public, the public is considered as a kind of cooperative mentality. Then, the fairness preference factor of the government and the fairness preference of the project construction units will promote the project construction units to choose the legal and reasonable operation. When the equilibrium condition is and , this means that the public will pay a huge cost if they resist the construction of reasonably developed projects. At this time, due to the instinct of seeking advantages and avoiding disadvantages, the public will choose the (Acceptance) strategy. In this strategy combination, project disputes are resolved peacefully, the waste of social capital is avoided, and Pareto optimality is realized.

To analyze the realistic scenarios of such equilibrium results, similarly, we take the Three Gorges Hydropower Station project as an example. After many disputes and discussions, the project was finally completed and successfully operated in 2009 [

40]. According to the latest 2020 Annual Report of the Group, the operation of the project was very successful [

41]. The emergence of this optimal strategy combination is inseparable from the strategic choice of the three parties in the game, such as the scientific demonstration carried out by the government, the continuous technological innovation of the project contractor, and the cooperation of the local citizens in the region [

40]. When the Three Gorges Project faced controversy, the government and the project construction units publicly discussed the feasibility of the project and the impact of the discussion on the local residents many times, conducted a large number of detailed investigations, and clarified the prior beliefs of the public (

). In the process of strict project decision-making and management, the government side and the project construction units carried out the demonstration and field research of the project fairly and openly many times [

40], which indicated that both sides had a high fairness preference (

and

). In reality, before the completion of the Three Gorges Dam, the local citizens would suffer huge economic losses due to floods every year. For example, in the 1998 flood, residents of the Yangtze River Basin region suffered as much as RMB 166 billion in direct economic losses [

42] (

and

). Therefore, based on the above equilibrium conditions, the three parties of the game finally reached the optimal strategy combination and realized the optimal solution of the game balance with the faith interaction and strategy selection of multiple parties in good faith.

- 3.

Equilibrium result 3: When (Supporting, Legal and reasonable operation, Resistance) is the game equilibrium solution

The formation process of this strategy combination is analyzed as follows: under the precondition that the government chooses to support project development in the dispute decision-making game. In the first stage of the game, the government and the project construction units have a priori judgment on the attitude of the public as . If there is the fairness preference factor of the government functional department and the fairness preference of the project construction units , the project construction units will actively cooperate with the government to choose reasonable and legal development and construction. However, in the second stage of the game, when the equilibrium condition changes to andor and , the government and the project construction units find that the public may be of the “hardliner type”, so their prior beliefs change. Moreover, the multidimensional preferences of all players in the game are triggered. After the multi-party game, the local residents with a higher endowment effect choose (Resistance) as the strategy.

From the assumptions of the model, it is found that the prior condition and the multidimensional preference trigger points of the project construction units in the first stage of the game are the key factors for decision-making. The value of the prior condition will divide the public into the “cooperative type” and “hardliner type” at the early stage of decision-making. If the game pioneer identifies that the public has a cooperative and obedient attitude and also shows strong fairness preference, then, under the multidimensional influence of mutual good faith, self-interest preference, and fairness preference, the game pioneer will not regress or offer a compromise for the public’s confrontation and rejection. At this time, the first stage of a resistance-type extreme controversial decision is formed. Subsequently, all players in the game fall into a dilemma of mutual non-compromise. When the loss of the government and the project construction units increases, the players are affected by a change in prior beliefs and multidimensional preferences and finally form the resistance-type extreme dispute decision in the second stage.

The analysis of the transformation of prior beliefs and the influence of multidimensional preference is as follows. In the equilibrium condition, only when the public gives true reflection and belief feedback, the project construction units will find that the people have the hardliner-type attitude (

); then, a series of value losses caused by the rebelling people will have already reached a certain amount, which stimulates the loss avoidance preference of the government and the project construction units. Therefore, on the premise of avoiding the loss of self-interests, the government and the project construction units are afraid of further loss of their own interests. Thus, their beliefs and behavioral preferences change, and they choose to make some concessions to the public. After the project construction units makes the strategic choice of reasonable and legal development operation, if the public has a strong endowment effect, this means that the actual psychological utility profit value is less than the psychological expected profit value

, which will lead to the formation of the second stage of the resistance-type extreme dispute decision. See

Figure 3 for the formation path of the resistance type extreme dispute decision.

In the construction process of large-scale engineering projects, if there are cases of compensation for land acquisition and demolition, this equilibrium situation is very common. In past special extreme controversial decision-making scenarios, the related subjects were called “nail households”, and for these members of the public, with strong heterogeneity, the influence of behavioral preferences is crucial to decision-making results. Analyzing the equilibrium results of such extreme dispute decisions from the perspective of the final benefits of the game players, the public finally obtains unreasonable excessive compensation or other exchange conditions by forcefully resisting the other players, who have a high loss aversion preference. However, this action undermines the good social ethos of working hard to become rich. Using hardline attitudes and opportunistic methods, some individuals use project compensation to gather a large capital in a short time, which widens the gap between the rich and the poor within society. As a result, the unequal distribution of the rich and the poor in society presents a hidden danger for future economic development. In the project environment where the loss avoidance preference of the players is dominant, the extreme difference in returns will form the extreme equilibrium result. Corresponding to the extreme dispute decision of resistance in real life, this describes a situation whereby the project construction units develop the construction project legally and reasonable, but there are still some people who are dissatisfied with the vested income or have a very high endowment effect. As a result, they refuse to accept the project compensation plan and make fiercely defiant decisions, which seriously damage the economic and social value of the project, increase the economic cost of the project, affect the construction of the project, and bring negative social impacts.

To analyze the realistic scenarios of such equilibrium results, we take the following example. The Dali to Lijiang expressway is a high-speed transport channel connecting Dali City and Lijiang City, and the first expressway connecting Tibetan areas in China. Construction began on 22 December 2009, and it officially opened to traffic on 30 December 2013. The total length of the line is 259.18 km, with a total dynamic investment of RMB 18.799 billion [

43]. In the process of the project, extreme controversial decision issues occurred. The project involved 72 households that needed to be removed, but two of them refused to relocate because they were not satisfied with the compensation scheme, resulting in the project being postponed many times. From the date of 26 May 2011, when the government issued the house expropriation decision, the residents of the two “holdout households” finally protested for 1206 days, and the residents and the project construction party experienced nearly one year and ten months of dispute discussion, which was finally settled after the compensation scheme and other requirements demanded by the resisting residents were met [

44]. In this case, the project construction units and the public residents made a huge difference in the estimated value of the housing output value. For a house with a market evaluation value of RMB 460,000, the residents stated that the compensation amount should not be less than RMB 2 million; for another house with a market evaluation value of RMB 720,000, the residents stated that the compensation amount should be RMB 7.2 million [

45]. The stalemate in this incident attracted much attention from the media and society. The government and the project construction units stated that although the two houses could have been forcibly demolished according to the law after administrative reconsideration and administrative litigation, the consequences may have been very serious. They were concerned about the negative impact on society and the willing of the demolished households. Therefore, the project has been unable to resume construction for a long time, and the project construction party has to face losses of tens of thousands of RMB per day. After nearly two years of disputes and communication, although the government and the project construction units have complained many times and tried to communicate with the “nail households”, the results were not satisfactory to all three players.

Next, we analyze the game process of the case. In the initial stage of the game, against the background of the large-scale engineering projects that are supported by the government, the government and project construction units that have been constructed reasonably and legally have an a priori belief for the public (). In this case, they believed that these 72 households had a cooperative mentality. Under the influence of interactive fairness preferences, the government and the project construction party reasonably and fairly compensated 70 households ( and ) and then encountered two “nail household heads” with individual endowment effects. The expected prices of these two households were higher than the normal expropriation conditions (). Therefore, out of strong dissatisfaction with their own vested interests, the members of these two nail households, the government, and the project construction units did not compromise, the project construction units lost millions, the benefits of all parties began to change, and the project was repeatedly postponed and could not proceed normally. As the stalemate of project disputes was prolonged, and the costs acquired by the government and project construction units continued to increase, and, the beliefs and behavior preferences of the government and project construction units changed, and the change in strategic value triggered the game participants’ loss avoidance preferences; in such cases, the government and project construction units realize that the public are the “hardliners”(), so they abandon their insistence on fairness, and instead compromise and are willing to pay high compensation in order to resume work as soon as possible. In the end, the result of the extreme dispute decision-making of resistance type is formed.

- 4.

Equilibrium result 4: When (Supporting, Violation and rent-seeking operation, Acceptance) is the game equilibrium solution

Here, we analyze of the results of such equilibrium. When the government still insists on supporting the project construction despite the dispute and predicts that the public will support the decision (

), if both the government and the project construction units have very low equity factors (

), the project construction units will choose the rent-seeking strategy according to the most basic profit-seeking behavioral game logic. The payoff function for the population becomes

. At this time, if the fairness preference of the public is also low (

), this means that the public will still choose the acceptance strategy. (The path diagram is shown in

Figure 4.)

Here, we analyze the process of such equilibrium. First of all, against the background that the government chooses to support the construction of the project from its controversial position, the project construction units have the decision-making power in the whole life cycle of the construction of the project—they have the strategic advantage over the public in the game process. When the project construction units have a prior judgment that the public is of the “cooperative type” mentality (

), if the fairness preference factor of the project construction units is small (

), they will choose the rent-seeking strategy based on the basic profit-seeking preference and obtain the benefits of

. The government’s gain is

, while the public’s gain is

. As shown in

Figure 4, rent-seeking type extreme dispute decision-making is an unfair dispute that is accompanied by certain decision-making characteristics, such as the lack of fairness preference of the players and the mismatched information, and other complex psychological preference factors. Moreover, under the premise of a complex and uncertain background, information asymmetry of all players in the game is also one of the factors that gives rise to the rent-seeking type extreme disputes. In addition to public social wealth, ecological and humanistic environmental values are also important components of public property, and many members of the public may have suffered serious unfair treatment unwittingly.

From the perspective of the profit results of the main players of the game, although the local residents have finally accepted the conditions and the three players have obtained their own benefits, in fact, the unfair distribution of benefits is the most important hidden danger that will affect social development in the future, because the rent-seeking behavior of the project construction units not only causes losses to other game players in terms of economic benefits, but also poisons the collective interests and social values of other stakeholders. The project construction units use the weak awareness of safeguarding rights of the public and the incomplete information game background between the two players to seek personal gains and weaken the fair share of other stakeholders’ interests. These kinds of actions will result in extremely unequal benefits. If the project construction units reduce the value of to near zero without limit or rent-seeking events, they are exposed to the public. Then, it can be found that the rent-seeking benefits of the project construction units are far greater than the benefits of the public, and the benefits that the public should obtain are restricted, resulting in extreme differences in the benefits of the game players. The strategy interaction with extreme characteristics eventually leads to a huge difference in the payoff value, forming the extreme payment structure and constituting the extreme dispute decision problem. On the contrary, the overall welfare of society is reduced, the distribution of social wealth becomes seriously unfair, and the unhealthy social practices of corruption and favoritism are prevalent, which greatly damage the corporate reputation value of the project construction units and the credibility of the government.

Analyzing the rent-seeking type extreme dispute decision, we can take the Guangdong-Hainan Railway project as an example. As the first railway across the Strait in China, the construction of the project received the attention and support of the central government. In August 1998, the State Council approved the feasibility study report and finally approved the commencement of the project, which was one of ten key projects that year. Due to the complexity of the overall project, it was divided into three parts, with a total of RMB 4.5 billion of dynamic investment. The project was officially put into operation in January 2003. However, less than a year after the project was put into operation, Tang Jianwei, the former leader of Guangdong Railway Co., Ltd., Guangdong, China, and five other persons in charge of the project, were sentenced by the Guangzhou Railway Intermediate Court of the first instance for taking bribes of RMB 6,574,430 million for private ownership of state-owned assets [

45]. The major loopholes in the project management process of the case were mainly reflected in the audit. Finally, after investigation and verification, the total amount of the Guangdong-Hai railway project exceeded the estimated amount of RMB 640 million [

46]. Such large-scale engineering projects lack project supervision and review, which gives the project builder the ability to steal public property in violation of regulations. At this time, due to the decision-making party’s low fairness preference and the information asymmetry of all parties in the game, such types of violations can be formed. When reviewing this case, the supervisory power of the audit supervision department was greatly restricted, and the public was deprived of the right to know. When the public decided to cooperate with the project construction, their benefits were shamefully stolen (

). In the context of a lack of awareness of fairness preference (

), the public encountered the project construction units with serious low fairness preference too (

). At the same time, the project construction units in this case took advantage of the complex environment of multi-party information asymmetry to collect personal gains wantonly (

), which resulted in seriously unfair distribution of the profits. Under such equilibrium conditions, the equilibrium result of the extreme dispute decision of the rent-seeking type was finally formed.

- 5.

Equilibrium result 5: When (Supporting, Illegal rent-seeking, Resistance) is the game equilibrium solution

Here, we analyze the formation path of such equilibrium. When the government chooses to support the project construction during a controversial decision and predicts that the public will support the decision (

), if both the government and the project construction units have very low equity factors (

), the project builder will choose the rent-seeking strategy according to the most basic behavioral game profit-seeking logic. In reality, the public may find that the behavior of the government and the project construction units has brought great damage to their own interests, and because of their endowment effect (

) and their high preference for fairness

, they deeply feel that they are being treated unfairly. Therefore, they choose to resist all the compensation schemes (

) and the game decisions made by the government and the project construction units. At this point, the project cannot bring any benefits to the three players, and all three players need to pay costs, so the benefits of all three players are negative. (The formation path diagram is shown in

Figure 5.)

Here, we analyze the process of such equilibrium. In reality, many projects have been terminated due to the strong resistance of the public at the beginning. The public’s anger can be high due to the discovery of rent-seeking behavior by the government or the project construction units. Therefore, what is reflected in the benefits is not only that the player does not gain any benefits from the project, but there is also a serious crisis of confidence in the government, a significant decline in the credibility of the government, and a decline in the corporate reputation of the project construction units. Since the comprehensive value of the project cannot be developed following this kind of equilibrium result, this article considers this as a retarding-type extreme controversial decision. When the project construction units lack a sense of fairness and justice, and have no supervision or constraints, they can easily engage in rent-seeking behavior. As a result, the interests of the social public are greatly threatened. When they cannot choose to ignore and remain silent, they turn to the strategy of resistance. Since the public have to pay the cost of resistance, it is expressed as negative in terms of the game benefits of the public. However, the negative effects that appear in the real situation are not limited to this. The public needs to pay the cost of resistance, and the project construction units have to bear the losses caused by the resistance and the decline in their corporate reputation. The government’s credibility is also affected. The follow-up development of society will be difficult, which means that this is the worst equilibrium result for the three players in the game.

Analyzing the retarding-type extreme dispute decision and the equilibrium result, we can learn from the classic case of the Incineration Plant of Fanyu in Guangzhou. In February 2009, the Guangzhou municipal government announced that the Panyu waste incineration power plant would be a key construction project in Guangzhou, with an estimated total investment of RMB 932.56 million. After more than three years of research and demonstration, the government did not publicize the procedures of project planning, approval, and site selection during the demonstration. In February 2009, the Guangzhou municipal government issued the “Notice on the Construction of the Panyu District Domestic Waste Incineration Power Plant Project”, in which the project site selection, the scale of the project, and the construction time were directly announced. In September, the person in charge of the Environmental Sanitation Bureau stated that once the environmental assessment was completed, the Panyu waste incineration power plant would start construction. The public, who had been uninformed about the construction of the project before, received this news suddenly and immediately stated their opposition. In October, government functional departments held a press conference on related issues, but after the meeting, more people were dissatisfied with the government’s decision-making and began to doubt the fairness and credibility of the government’s decision-making process. The public launched a protest march and strongly demanded that the project should be suspended. In November, government departments continued to receive complaints and objections from more than a hundred people from multiple surrounding buildings on project development issues [

47]. The results of the public opinion survey indicated that 97.1% of the residents interviewed clearly expressed their opposition to the construction of the project, but the government and project construction units still stated that the project must continue to advance. As the dispute continues to advance, information about the complex relationship between the government and the project construction units that has continuously emerged during the promotion of the policy project has made the public angrier and gradually pushed the controversy to extremes. The public has begun to firmly believe that there are violation deals between the government and the project construction party. The government’s credibility has fallen sharply, all players in the game have made their decision-making choices clear, and all players are determined not to compromise or make concessions. Finally, under the pressure of increasing public opinion and intense public sentiment, the relevant departments of the Guangzhou municipal government announced the suspension of the project in December 2012, but the site selection problem of the waste incineration plant project was still not properly solved [

48].

Reviewing the game process in the case, we found that in the initial stage of the project, the project information published by the government and the project builder was not transparent, and the project decision-making process was not open, which reflected the decision-makers’ prior judgment that the public was “cooperative” and showed a low preference for fairness (), (). The main reason for the formation of disputes in this case was the strong awareness of rights protection of the public, and the public’s preference for fairness was very high. Moreover, the public’s strong attitude towards disputes was mainly due to the possible illegal operations between the government and the project construction units, resulting in the resolute attitude of the public to make decisions (). From the perspective of the formation process of this extreme dispute decision, the mutual uncompromising and resolute opposition of the three parties resulted in the suspension of the project, the garbage disposal problem could not be dealt with, and none of the players gained benefits, which ultimately led to the retarding-type extreme dispute decision.

5. The Equilibrium Characteristics of Different Extreme Dispute Decisions

From the above study of the dynamic game model under incomplete information and the analysis of the formation path of extreme dispute decision-making, we can identify the equilibrium conditions for the formation of extreme dispute decision-making problems. According to these equilibrium stability conditions, we can deduce the equilibrium characteristics of extreme dispute games. According to the previous analysis, there are four extreme dispute decision-making scenarios in the dynamic game model: rent-seeking type extreme dispute decision, retarding-type extreme dispute decision, resistance-type extreme dispute decision, and zero-return type extreme dispute decision. Analyzing the internal mechanism one by one can help us to resolve the dispute in a targeted way and prevent the dispute from becoming extreme.

- 1.

Zero-return type extreme dispute decision

Due to the highly complex nature of the disputes in the decision-making of large-scale engineering projects, the key to correct decision-making is to scientifically and dynamically evaluate the compound endogenous value of the projects. Especially when faced with extreme disputes, if the government decides not to support the construction of the project, then the zero-return type extreme dispute decision with zero benefit for all players becomes the equilibrium result. When the government, the game pioneer in the game model, makes the decision to choose (Not supporting) during the project dispute game, the large-scale project without the support of the government can only be shelved and the strategic value cannot be realized. Therefore, the equilibrium feature at this time is that the revenue payment value of all players is zero (0,0,0).

When the government is faced with disputes and discussions, it usually needs to make decisions that not only consider the gains and losses of economic value, but also harmonious social development, ecological environmental protection, and the scientific and technological level. In other words, when the government chooses not to support the development of the project after comprehensive consideration, sometimes, it is faced with complex contradictions and, sometimes, it is faced with technical problems that cannot be resolved. For example, the Three Gorges Project, which has been under discussion for more than a century, has been halted several times due to consideration of the technical problems, environmental protection, or immigration issues.

- 2.

Resistance extreme dispute decision

Through the above research, the formation path of the extreme dispute decision of resistance has been identified and summarized, and we have then analyzed the equilibrium characteristics of this kind of equilibrium. We found that, under the premise that the government supports the development and construction of the project, there is a priori judgment or , and if there is a fair preference between the government and the project builder , the local government will choose legal and reasonable operation. When the equilibrium condition is or and , the public chooses the strategy (resistance), and the prior beliefs of the game leader change, realizing, and the multidimensional preference of the three players is triggered. The psychological utility function of profit value is expressed as (,, ) and the equilibrium result is the pure strategy Nash equilibrium of the game.

It can be seen from the analysis of the game subject benefit results of this type of extreme controversial decision that when the loss threshold is still within the acceptable range of the government and the project construction units, as long as there is and , although they need to pay more costs and bear more losses due to the , neither the government nor the project construction unit will choose to compromise with the public, because, in line with their prior beliefs, they still believe that the public is of a cooperative-type mentality. Therefore, the government and the project construction units would rather suffer the loss and benefit reduced toand , and the benefit to the public would still be . Moreover, when the psychological utility value of the loss exceeds the threshold value, namely and , the government and the project construction units trigger the loss avoidance preference and choose to compromise with the hardline public and pay unreasonable excess compensation. Three players result in (), (), (), so the rebellious behavior of the rebellious public has obtained additional profits from the government and the project construction units for the game player compensation amount function utility value.

The analysis shows that this type of equilibrium characteristic is mainly closely related to prior beliefs and loss aversion preferences, while resistance-type extreme dispute decision-making has a unique extreme payment structure because of the influence of individual behavior preferences. The different prior beliefs and fairness preferences of the game players determine the choice of strategic behavior. The preference of loss avoidance triggered by the endowment effect is the key cause of the extreme controversial decision, and the preference of loss aversion of project construction units determines the difference in the final payment value of the strategy equilibrium.

The endowment effect reflects the extreme difference in the value perception of the three players in the game. The huge difference in the psychological threshold boundary between the two players is a common cause of this type of extreme dispute. Some members of the public grasp the interactive characteristics of the profit-seeking and lose aversion strategies of the project construction units, and force other game participants to accept unreasonable excess compensation or other exchange conditions. Moreover, the stronger the endowment effects of the public, the larger value of the loss avoidance factor . In addition, the greater the loss aversion factor and of the government and the project construction units, the more additional compensation the public can obtain.

The dilemma of the rebels in the real situation is very diversified, with a complex cultural environment background and individual value orientation and other factors, and it is difficult to simply distinguish right from wrong. Chen Xiao [

49] analyzed the problems of rebellious residents in China’s land and house expropriation. According to statistics, 66% of the important cases of people’s protests in China from 2003 to 2014 related to the construction of public welfare projects. However, as the previous analysis shows, the game subject in extreme controversial decision-making with strong resistance is not only the interest-seeking preference acting on the interaction of belief and strategy, but the evolution of the related subjects’ behavior of a more multidimensional interest structure and complex psychological preference.

- 3.

Rent-seeking type extreme dispute decision

Through the integration analysis of the interaction of the strategic beliefs of all game players above, when the prior condition is met and the interaction fairness preference of game players is weak, the strategy selection (Supporting, Rent-seeking, Acceptance) is the pure strategy Nash equilibrium of the game, and the three-party benefits are expressed as: ; ; . In reality, such equilibrium can be classified as a rent-seeking extreme dispute decision. From the perspective of the results and benefits, the project construction unit gains high profits through rent-seeking behavior, but, at the same time, damages the vital interests of local residents and results in huge hidden dangers for social and economic development. In this environment, the extreme difference between the two sides will form the extreme payment structure.

This equilibrium result reflects the inherent characteristics of such extreme controversial decisions, which is the special prior beliefs and the subject’s multiple behavioral preferences. The value of , which represents the project construction units’ interests, is the internal reason for the rent-seeking behavior of the project construction units in the process of project construction. However, according to the assumption that and exist, no matter how large the final rent-seeking profit value is, the loss of fair preference of the project construction units is the key factor leading to such extreme disputes.

The difference in the value in the game process represents the intrinsic driving factor of economic interests, and also reflects the amount of rent-seeking profit. However, the interaction between belief and strategy in the game shows that the intrinsic drive of economic interests is not the fundamental reason that the project construction units choose to operate the project for private benefit; rather, the lack of fairness preference in the psychological behavior is the root cause of this type of extreme controversy, because, from the further study of the strategic interaction in the dynamic game, the key factor for the public to choose zero return or return is the fairness factor . According to the expression of the utility function model, when , this means that the value of the equity factor of the public is less than the ratio of the loss of their own income to the residual income, and the public will choose to accept the decision result.

Analyzing the reasons for the formation of this decision based on the actual situation, there are mainly the following possibilities. The first is the internal reasons of the social public; represents the fairness factor of the public, and a small value indicates that the public lack awareness of interaction and fairness. In addition, the reasons for the low value of may be divided into two parts: one is that the value of , which represents the size of the benefit value stolen by rent-seeking, is small; the other may be that, against the background of incomplete information, there is obvious information asymmetry between the social public and other players. The value of the public consciousness is less than the benefit value stolen by other players in the real situation (). Both of these situations occur in reality, among which the lack of fairness awareness and incomplete information about real profit are the main reasons for which the public choose to accept unfair treatment even after being violated by rent-seeking behavior.

In conclusion, it can be seen that the root cause of rent-seeking type extreme dispute decisions is mainly the subject’s lack of recognition of fairness, and the equilibrium result will cause people to suffer unequal treatment and result in serious damage to social collective value. In practical cases around the world, engineering corruption scandals within large engineering projects are not uncommon. In the bribery index released by Transparency International, public engineering and construction projects rank the worst. Soheil M. and Cavil S. [

50], Kenny [

51], Loosemore M. and Phua F. [

52], and other studies found that once the rent-seeking phenomenon occurs, it is likely to penetrate into all stages of the project and bring extreme negative effects. The development and construction of large-scale engineering projects is an important strategic deployment related to the country’s economic construction. Project construction units and the public cannot easily affect the results of their decision-making, so it is more likely that the power suppresses their rights and the interests. When the three players of the game interact with specific behavioral preferences and beliefs, a minimal change in belief preferences will lead to the violation of rent-seeking behavior of the project construction units, which will suppress the public’s rights and interests to infinity close to zero, and there will be an extreme income structure in which the project construction units’ income is close to

and the public’s income tends to zero.

- 4.

Retarding extreme dispute decision

The three-player strategy of the game in the retarding-type extreme dispute decision is (Supporting, Violation and rent-seeking operation, Resistance). The characteristics of this kind of equilibrium are obvious: from the equilibrium result, the returns of all players in the game are negative; from the perspective of multidimensional preference analysis, the fairness factor of the government and project construction units is very small (). The endowment effect of the public is high (), and the preference () is high too. Moreover, the prior beliefs of the game antecedents also change from to . Due to the huge difference between the government, the project construction units, and the local public in their cognition of the value of the project, players adopt passive and confrontational interactions in the process of strategic decision-making, so that the three players cannot obtain the value-added benefits from the project.

Traditional sociologists often assume that related subject groups with common interests will make active and effective decisions consistent with collective interests in order to realize common interests, but public choice theory finds that this assumption cannot explain and predict the results of collective behavior. This is because, when individual behavior has different behavioral preferences, Pareto optimal results cannot be guaranteed. On the contrary, because of the complex effects of multidimensional preferences, there may be many results that damage collective interests.

In the real situation, with the continuous improvement of the economic level, the public’s demands for their own interests are gradually diversified and complicated. This is evidenced by a relevant case in China. In June 2012, the Sichuan Hongda Group started the construction of the Shifang Hongda molybdenum and copper project, which was a major industrial project determined by the government functional departments during the 12th Five-Year Plan period. The construction of the original project was expected to take two years, and the second phase of the project was aimed to be completed and put into use from 2015 to 2016. However, the reality was that in July 2012, just three days after the construction of this project started, a mass social event shocked the social public in China. The main reason was that local residents were worried that the deep processing and comprehensive utilization of molybdenum and copper and other polymetallic resources would cause serious pollution to the local people’s living environment. When the group interest conflicts with individual interests, the stimulation of extreme behavior preference of a few people eventually evolves into an extreme conflict event. In the case of extreme asymmetry information from various players in decision-making, due to the errors and omission of information, players can quickly stand in complete opposition in the process of belief and strategy interaction. The government believes that the public is a “completely self-interested hardliner”, while the public considers the government and the project construction units as “violation rent-seeking predators”. In recent years, with the interest in environmental protection and policy improvement, many projects have been exposed concerning violations of construction units, facing resistance from the public. These kinds of rent-seeking behavior eventually lead to the suspension of many projects, and these projects may be terminated due to the strong resistance of the public. In terms of utility benefits, the game players do not gain any benefit from the project. As the project fails to be successfully operated and the economy does not benefit, this is a typical retarding-type extreme dispute decision.

In this type of extreme dispute decision issue, the lack of communication among the government, project construction units, and the public is very serious. In the above case, government decision-making information and the project decision-making process were not made public, and public announcements were not implemented, which caused panic and anger among the public. Thus, due to the serious information mismatches among the game players, whether the government and the project construction units really engaged in serious violation behavior or not, the public already felt unfairly treated and disenfranchised in the game process. Therefore, during this phase, the self-interest preferences were no longer the dominant decision-making factor of the public, but the multidimensional set of preferences of fairness and loss aversion at the same time. These multidimensional preferences cause public emotions to become easily aroused and produce excessive behaviors, which make the dispute decisions extreme.