Fuzzy Governance Model

Abstract

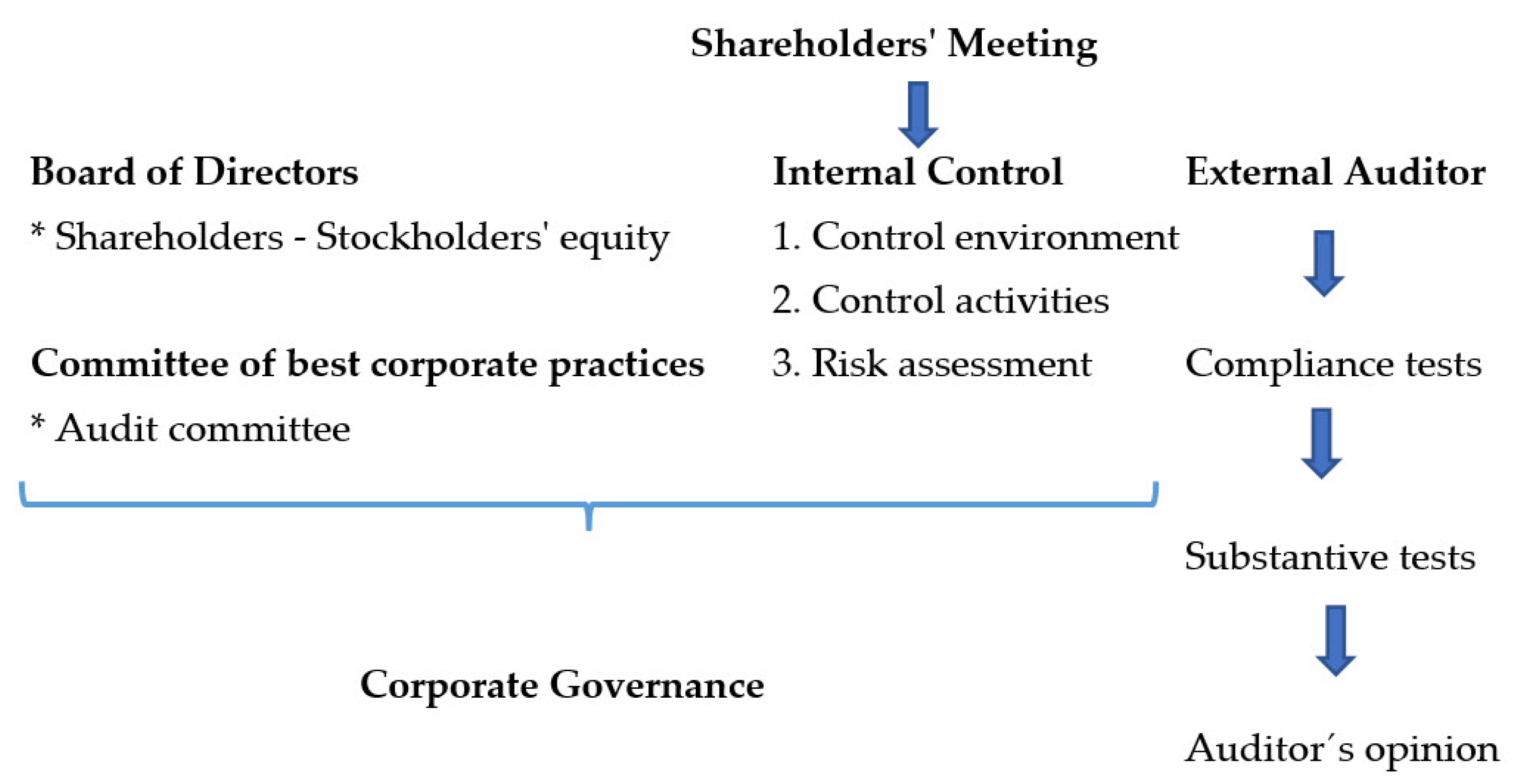

:1. Introduction

2. Literature Review

2.1. Board of Directors

- To ensure that board members are informed and act ethically and in good faith, with due diligence and care, in the best interest of the company and the shareholders.

- To review and guide corporate strategy, objective setting, major plans of action, risk policy, capital plans, and annual budgets.

- To ensure the integrity of the accounting and financial reporting systems of the corporations, including their independent audit.

- To ensure that the board members are nominated and elected through a formal and transparent process.

- To select, compensate, monitor, and replace key executives and oversee succession planning.

- To ensure the set-up of an appropriate internal control system.

- To oversee disclosure and communications processes.

2.2. Audit Committee

2.3. Best Corporate Practices

2.4. Internal Control Policies and Procedures

2.5. Test of Compliance in the Independent Auditor’s Examination

2.6. Corporate Governance as a Management System

3. Materials and Methods

3.1. Fuzzy Logic

3.2. Linguistic Variables

4. Results

4.1. A Governance Fuzzy Model

- Some qualitative categories only allow for binary evaluations and other attributes, so the linguistic labels in Table 1 will be used for the analysis.

- Categories such as company leadership can consider the use of information from some reputational evaluation instrument.

- It is suggested to take the highest value obtained in categories corresponding to numbers of board members, reports of external auditors, and periodicity, among others.

- Financial categories should be given greater attention since they deal with indicators of the economic position of the company; for example, profitability, liquidity, and leverage, among others. In order to evaluate each financial aspect, the highest value among all the obtained data is proposed.

- Categories such as audit functions, conflict of interest, and code of ethics, among others, are dichotomous values; therefore, only Very good and Very bad will be considered in the evaluation.

- This tool has the following advantages:

- (a)

- Economic: This is the greatest advantage since its low cost allows for its application in different contexts and situations and leads to low-cost audits.

- (b)

- Meticulous: It is a tool based on the auditor’s professional judgment and experience to select non-random samples and reduce the number of categories to obtain meticulous information with satisfactory results.

4.2. Application

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- García, M.; Vico, A. Los escándalos financieros y la auditoría: Pérdida y recuperación de la confianza en una profesión en crisis. Rev. Valencia. Econ. Hacienda 2003, 7, 25–48. [Google Scholar]

- Ibarra Palafox, F. Enron o érase una vez en los Estados Unidos en El Poder de la Transparencia. In Nueve Derrotas a la Opacidad; Salazar, P., Ed.; UNAM-IFAI: Ciudad de México, Mexico, 2007; Volume 251, pp. 1–44. [Google Scholar]

- Álvarez Gayou, J. Cómo Hacer Investigación Cualitativa, Fundamentos y Metodología; Paidós Educador: Mexico City, Mexico, 2003; p. 222. [Google Scholar]

- IMCP. Normas Internacionales de Auditoría; Instituto Mexicano de Contadores Públicos: Ciudad de México, Mexico, 2020.

- IMCP. Normas y Procedimientos de Auditoría y Normas Para Atestiguar; Instituto Mexicano de Contadores Públicos: Ciudad de México, Mexico, 2006.

- Vieytes, R. Campos de Aplicación y Decisiones de Diseño en la Investigación; Merlino, A., Ed.; Investigación Cualitativa en Ciencias Sociales, Cengaje Learning: Buenos Aires, Argentina, 2009; pp. 43–84. [Google Scholar]

- Zadeh, L.A. Outline of a New Approach to the Analysis of Complex Systems and Decision Processes. IEEE Trans. Syst. Man Cybern. 1973, 3, 28–44. [Google Scholar] [CrossRef] [Green Version]

- CCE. Código de Mejores Prácticas Corporativas; Consejo Coordinador Emprearial: Miguel Hidalgo, Mexico, 2010. [Google Scholar]

- OCDE. Principios de Gobierno Corporativo de la OCDE; Organización Para la Cooperación y el Desarrollo Económico: París, France, 2004. [Google Scholar]

- ASF. Fundamentos Conceptuales Sobre la Gobernanza; Auditoría Superior de la Federación, OLACEFS, Organización Latinoamericana y del Caribe de Entidades Fiscalizadoras Superiores: Ciudad de México, Mexico, 2015; pp. 12–42. [Google Scholar]

- Visoso, F. La Sociedad Anónima en la ley General de Sociedades Mercantiles y en la ley del Mercado de Valores; Porrúa: Mexico City, Mexico, 2007. [Google Scholar]

- Canals, J. Pautas de Buen Gobierno en los Consejos de Administración; Universia Business Review. 2004. Available online: http://www.redalyc.org/articulo.oa?id=43300102 (accessed on 18 December 2020).

- Paredes, L.; Meade, O. Derecho Mercantil. Parte General y Sociedades; Grupo Editorial Patria: Mexico City, Mexico, 2008. [Google Scholar]

- Macedo, J.; Macedo, J. Ley General de Sociedades Mercantiles. Anotada, Comentada, Concordada con Jurisprudencia y Tesis; Cárdenas Editor y Distribuidor; Cárdenas Editor y Distribuidor: Mexico City, Mexico, 1993. [Google Scholar]

- Ruiz, A.; Steinwascher, W. Gobierno corporativo, diversificación estratégica y desempeño empresarial en México. MPRA 2007, 3819, 1–16. [Google Scholar]

- Tamborino, G. Control Interno el Pilar del Gobierno Corporativo. Caso Portugal/España; Cuaderno de Trabajo; Departamento de Contabilidad y Auditoría do ISCAC-IInstituto Superior de Contabilidade e Administração de Coimbra -IPC-Coimbra-Portugal: Coimbra, Portugal, 2011. [Google Scholar]

- Mancilla-Rendón, E. ¿Si no está en el objeto social, no es deducible? In Mitos Fiscales; Burgóa, Ed.; Thompson Reuters: Mexico City, Mexico, 2017; pp. 37–48. [Google Scholar]

- Ganga, F.; Vera, J. El gobierno corporativo consideraciones y cimientos teóricos. Cuad. Adm. 2008, 21, 93–126. [Google Scholar]

- Nicolăescu, E. Developments in corporate governance and regulatory interest in protecting audit quality. Econ. Manag. Financ. Mark. 2013, 8, 198–203. [Google Scholar]

- Johnstone, K.; Li, C.; Rupley, K. Changes in corporate governance associated with the revelation of internal control material weaknesses and their subsequent remediation. Contemp. Account. Res. 2011, 28, 331–383. [Google Scholar] [CrossRef]

- Calderón, M. Mejora de la Práctica Legal para Mitigar Riesgos en las Empresas Privadas en México. In Derecho Mercantil; Balino, P., Pablo, J., Páez, M., Alexandro, M., Eds.; Editorial Porrúa: Mexico City, Mexico, 2014; pp. 323–389. [Google Scholar]

- OCDE. Directrices de la OCDE Sobre el Gobierno Corporativo de las Empresas Públicas; Organización para la Cooperación y el Desarrollo Económico: París, France, 2011. [Google Scholar]

- Alonso Almeida, M.; Da Silva, J. Códigos de buen gobierno corporativo en Iberoamérica: Análisis comparativo entre Brasil y México. Rev. Base (Adm. Contab.) UNISINOS 2010, 7, 55–68. [Google Scholar] [CrossRef]

- González, G.; Guzmán, A.; Prada, F.; Trujillo, M. Prácticas de gobierno corporativo en las asambleas generales de accionistas de empresas listadas en Colombia. Cuad. Adm. 2014, 27, 37–64. [Google Scholar] [CrossRef] [Green Version]

- Martín Granados, V.; Mancilla-Rendón, E. Control en la administraciń para una información financiera confiable. Contab. Negocios 2010, 5, 68–75. [Google Scholar]

- Chen, Y.-S.; Mardjono, E.S.; Yang, Y.-F. Competition and Sustainability: Evidence from Professional Service Organization. Sustainability 2020, 12, 7266. [Google Scholar] [CrossRef]

- Moreno-Albarracín, A.L.; Licerán-Gutierrez, A.; Ortega-Rodríguez, C.; Labella, Á.; Rodríguez, R.M. Measuring What Is Not Seen—Transparency and Good Governance Nonprofit Indicators to Overcome the Limitations of Accounting Models. Sustainability 2020, 12, 7275. [Google Scholar] [CrossRef]

- Carmona, D.; Sánchez, L. Teoría de sistemas complejos dinámicos. Una nueva reflexión sobre mercados financieros. In La obra Desarrollo, Estructuras Económicas, Políticas Públicas y Gestión; y Sánchez, V., Ed.; Reflexión Interdisciplinar: Ciudad de México, Mexico, 2018; pp. 101–129. [Google Scholar]

- Mekler, M.G. Sistemas Complejos. Revista Digital Universitaria. 2012, 13, pp. 1-xx–8-xx. Available online: http://www.revista.unam.mx/vol.13/num4/art44/art44.pdf (accessed on 15 December 2020).

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef] [Green Version]

- Lozano Gutiérrez, C.; Fuentes Martín, F. Tratamiento Borroso del Intangible en la Valoración de Empresas en Internet; Universidad Politécnica de Cartagena: Cartagena, Spain, 2003. [Google Scholar]

- Ram, M.; Chandna, R. Sensitivity analysis of a hydroelectric production power plant under reworking scheme using fuzzy AHP approach. J. Ind. Prod. Eng. 2018, 35, 481–485. [Google Scholar] [CrossRef]

- Domínguez, S.; Carnero, M.C. Fuzzy Multicriteria Modelling of Decision Making in the Renewal of Healthcare Technologies. Mathematics 2020, 8, 944. [Google Scholar] [CrossRef]

- Córdova, J.F.D.; Molina, E.C.; López, P.N. Fuzzy logic and financial risk. A proposed classification of financial risk to the cooperative sector. Contaduría y Adm. 2017, 62, 1687–1703. [Google Scholar] [CrossRef]

- Kwak, W.; Shi, Y.; Lee, C.F. The Fuzzy Set and Data Mining Applications in Accounting and Finance. In Handbook of Quantitative Finance and Risk Management; Lee, C.F., Lee, A.C., Lee, J., Eds.; Springer: Boston, MA, USA, 2010. [Google Scholar] [CrossRef]

- Ji, X.; Yu, L.; Fu, J. Evaluating Personal Default Risk in P2P Lending Platform: Based on Dual Hesitant Pythagorean Fuzzy TODIM Approach. Mathematics 2020, 8, 8. [Google Scholar] [CrossRef] [Green Version]

- Martínez, C. Uso de las Técnicas de Preprocesamiento de Datos e Inteligencia Artificial (Lógica difusa) en la Clasificación-Predicción del Riesgo Bancario. Bachelor’s Thesis, Universidad de Los Andes, Mérida, Venezuela, 2007. [Google Scholar]

- Cruz Martínez, A.; Alarcón Armenteros, A. La lógica difusa en la modelización del riesgo operacional. Una solución desde la inteligencia artificial en la banca cubana. Cofín Habana 2017, 11, 122–135. [Google Scholar]

- Bojadziev, G.; Bojadziev, M. Fuzzy Logic for Business, Finance and Management, 2nd ed.; World Scientific Publishing Co.: London, UK, 2007. [Google Scholar]

- Saad, R.; Ahmad, M.Z.; Abu, M.S.; Jusoh, M.S. Hamming Distance Method with Subjective and Objective Weights for Personnel Selection. Sci. World J. 2014, 2014, 865495. [Google Scholar] [CrossRef] [PubMed]

- Mullor, J.R.; Sansalvador, S.M.E.; Trigueros, P.J.A. Lógica borrosa y su aplicación a la contabilidad. Rev. Española Financ. Contab. 2000, 103, 83–106. [Google Scholar]

| Linguistic Variables | Fuzzy Triangular Numbers | Fuzzy -Set: [] |

|---|---|---|

| Very good | (66.4, 83, 100) | [66.4, 100] |

| Good | (49.8, 66.4, 83) | [49.8, 83] |

| Regular | (33.2, 49.8, 66.4) | [33.2, 66.4] |

| Bad | (16.6, 33.2, 49.8) | [16.6, 49.8] |

| Very bad | (0, 16.6, 33.2) | [0, 33.2] |

| Attribute | |||||

|---|---|---|---|---|---|

| Cost | Regular | Regular | Very bad | Bad | Good |

| Quality | Regular | Very good | Regular | Good | Regular |

| Delivery time | Very bad | Good | Very bad | Bad | Very good |

| Attribute | |||||

|---|---|---|---|---|---|

| : Cost | [33.2, 66.4] | [33.2, 66.4] | [0, 33.2] | [16.6, 49.8] | [49.8, 83] |

| : Quality | [33.2, 66.4] | [66.4, 100] | [33.2, 66.4] | [49.8, 83] | [33.2, 66.4] |

| : Delivery time | [0, 33.2] | [49.8, 83] | [0, 33.2] | [16.6, 49.8] | [66.4, 100] |

| Attribute | Ideal I | |

|---|---|---|

| Good | [49.8, 83] | |

| Good | [49.8, 83] | |

| Good | [49.8, 83] |

| Agent | |

|---|---|

| 0.22 | |

| 0.55 | |

| 0.11 | |

| 0.33 | |

| 0.55 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mancilla-Rendón, E.; Lozano, C.; Torres-Esteva, E. Fuzzy Governance Model. Mathematics 2021, 9, 481. https://doi.org/10.3390/math9050481

Mancilla-Rendón E, Lozano C, Torres-Esteva E. Fuzzy Governance Model. Mathematics. 2021; 9(5):481. https://doi.org/10.3390/math9050481

Chicago/Turabian StyleMancilla-Rendón, Enriqueta, Carmen Lozano, and Enrique Torres-Esteva. 2021. "Fuzzy Governance Model" Mathematics 9, no. 5: 481. https://doi.org/10.3390/math9050481

APA StyleMancilla-Rendón, E., Lozano, C., & Torres-Esteva, E. (2021). Fuzzy Governance Model. Mathematics, 9(5), 481. https://doi.org/10.3390/math9050481