A Foundation for Logarithmic Utility Function of Money

Abstract

1. Introduction

2. Materials and Methods

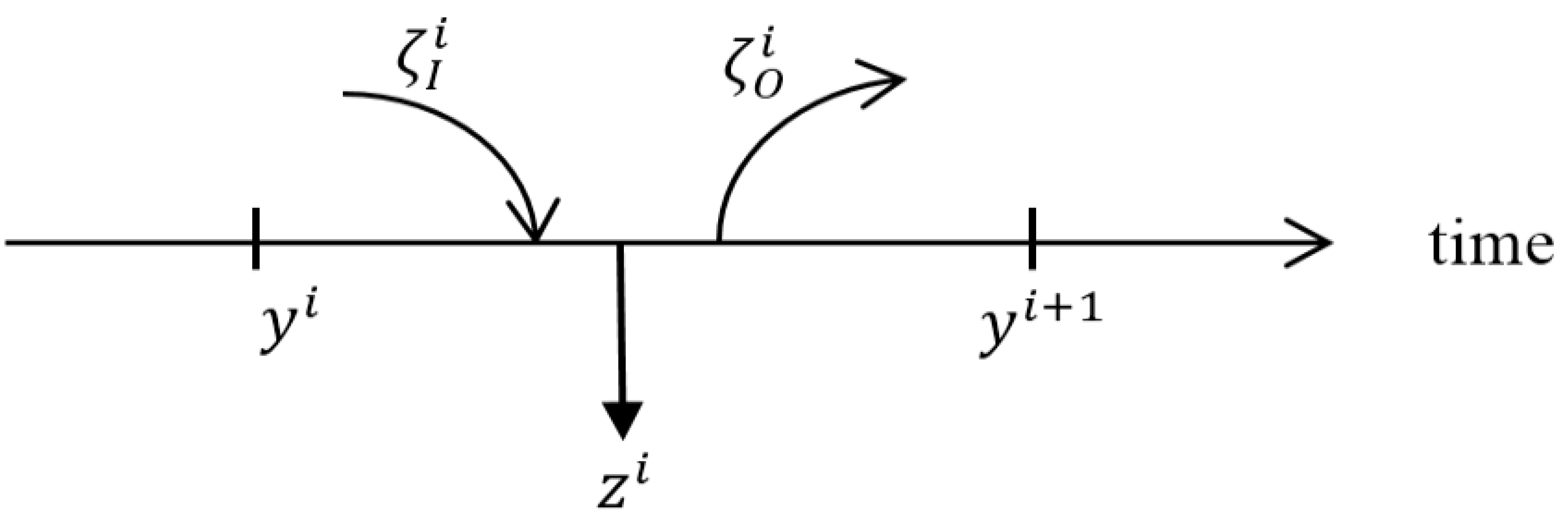

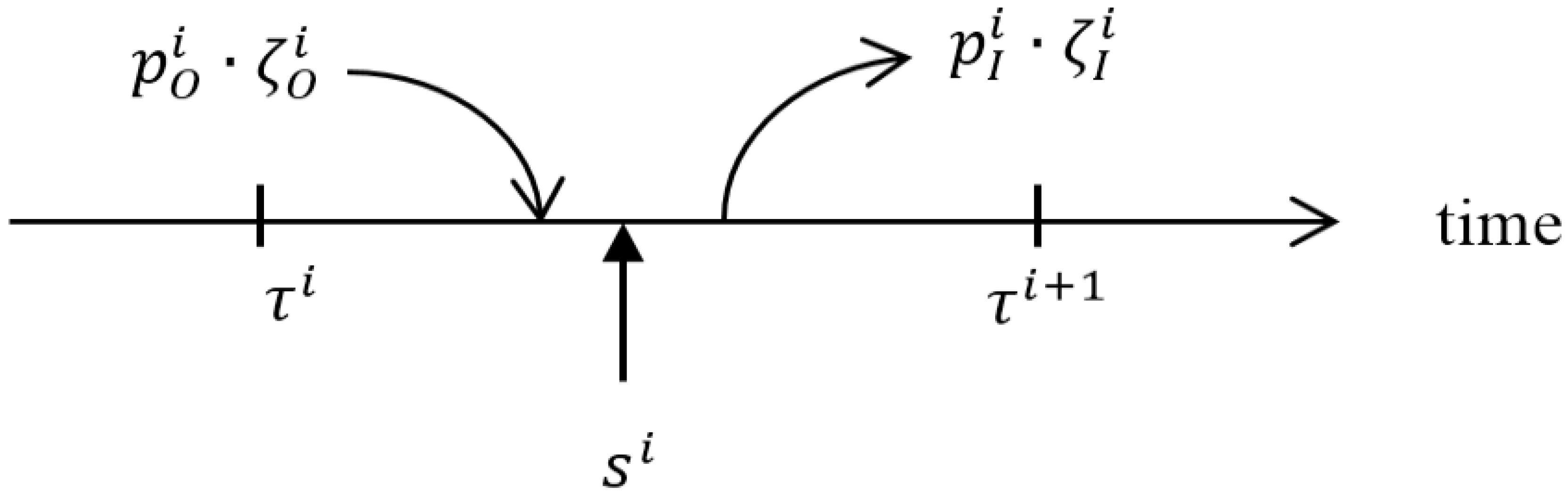

2.1. Flows of Goods and Money. Perishable Goods

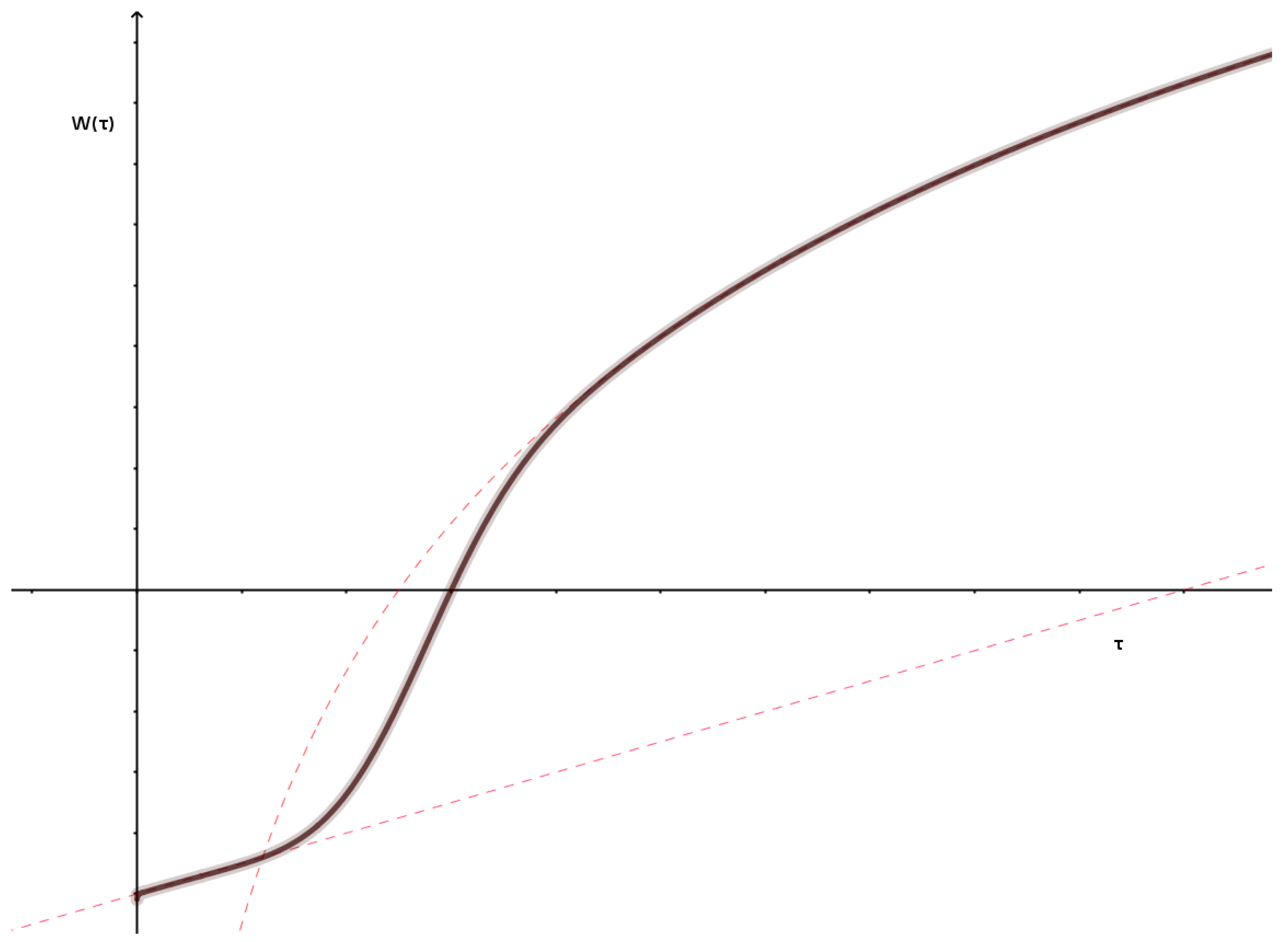

2.2. Money in Utility Model for a Market of Perishable Goods

2.3. Homogeneity Conditions and Consequences

3. Discussion

- Introduction of money into the utility function as an additional good. The utility derived from the possession of such a good can be assumed, as is done in a large part of the literature, as a means of preserving the current capacity to consume and transferring it to future periods. The fact that these periods are not explicitly considered in the utility function does not imply the invalidity of such utility.

- Optimization of consumer utility over a single period in a market for perishable goods. Regardless of whether the money can be used later, the optimization model focuses only on the decisions to be made in a given time interval. In this case, the variables on which the consumer can decide are the amount of goods he consumes and the money he does not spend. Not considering durable goods implies that the only way of storing value between periods is money.

- conditions are assumed for the utility functions of goods and money and the invertibility of the differential of the equilibrium equations. These conditions are not demanding and are usually considered in classical models of optimization of consumer behavior, where properties such as monotony and cuasi-concavity are generally taken for granted, producing equivalent results.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Asada, T. Money in Economic Analysis. In Mathematical Models in Economics-Volume II; EOLSS Publications: Paris, France, 2010; p. 112. [Google Scholar]

- Toledo, W. El dinero en los modelos macroeconómicos. Rev. de Econ. Inst. 2006, 8, 97–116. [Google Scholar]

- Hicks, J.R. Critical Essays in Monetary Theory; Clarendon Press: Oxford, UK, 1967; p. 219. [Google Scholar]

- Feenstra, R.C. Functional equivalence between liquidity costs and the utility of money. J. Monet. Econ. 1986, 17, 271–291. [Google Scholar] [CrossRef]

- Bridel, P. Patinkin, Walras and the 'money-in-the-utility-function’ tradition. Eur. J. Hist. Econ. Thought 2002, 9, 268–292. [Google Scholar] [CrossRef]

- Samuelson, P.A. An Exact Consumption-loan of Interest with or without the Social Contrivance of Money. J. Polit. Econ. 1958, 66, 467–482. [Google Scholar] [CrossRef]

- Clower, R.W. A Reconsideration of Microfoundations of Monetary Theory. In Money and Markets: Essays by Robert Clower; Walker, D.A., Ed.; Cambridge University Press: Cambridge, UK, 1967; pp. 81–89. [Google Scholar]

- Lucas, R. Expectations and the Neutrality of Money. J. Econ. Theory 1972, 4, 103–124. [Google Scholar] [CrossRef]

- Lucas, R. Equilibrium in Pure Currency Economy. In Models of Monetary Economics; Kareken, J.H., Wallace, N., Eds.; Federal Reserve Bank of Minneapolis: Minneapolis, MN, USA, 1980; pp. 131–146. [Google Scholar]

- Lucas, R. Models of Business Cycles; Basil Blackwell: Oxford, UK, 1987. [Google Scholar]

- Lucas, R.E., Jr.; Stokey, N.L. Money and Interest in a Cash in Advance Economy. Econometrica 1987, 55, 491–514. [Google Scholar] [CrossRef]

- Patinkin, D. Money, Interest and Prices; Harper & Row: New York, NY, USA, 1965. [Google Scholar]

- Sidrauski, M. Rational choice and patterns of growth in a monetary economy. Am. Econ. Rev. 1967, 57, 534–544. [Google Scholar]

- Hansen, B. A Survey of General Equilibrium System; McGraw-Hill: New York, NY, USA, 1970. [Google Scholar]

- Irgoin, C.A. Modelo Money in Utility Function (Miu); Contribuciones a la Economía: País, Spain, 2010. [Google Scholar]

- Fukuda, S.I. The role of monetary policy in eliminating non-convergent dynamic paths. Int. Econ. Rev. 1997, 38, 249–261. [Google Scholar] [CrossRef]

- Pratt, J.W. Risk aversion in the small and in the large. Econometrica 1964, 32, 122–136. [Google Scholar] [CrossRef]

- Arrow, K.J. Aspects of a Theory of Risk Bearing, Yrjo Jahnsson Lectures, Helsinki; Reprinted Frontiers in Human Neuroscience in Essays in the Theory of Risk Bearing; Markham Publishing Co.: Chicago, IL, USA, 1965. [Google Scholar]

- Holt, C.; Laury, S. Risk aversion and incentive effects. Am. Econ. Rev. 2002, 92, 1644–1655. [Google Scholar] [CrossRef]

- Bosch-Domènech, A.; Silvestre, J. Does risk aversion or attraction depend on income? An experiment. Econ. Lett. 1999, 65, 265–273. [Google Scholar] [CrossRef]

- Seidl, C. Poverty measurement: A survey. In Welfare and Efficiency in Public Economics; Springer: Berlin/Heidelberg, Germany, 1988; pp. 71–147. [Google Scholar]

- Just, D.R.; Michelson, H.C. Wealth as welfare: Are wealth thresholds behind persistent poverty? Rev. Agric. Econ. 2007, 29, 419–426. [Google Scholar] [CrossRef]

- Yesuf, M.; Bluffstone, R.A. Poverty, risk aversion, and path dependence in low-income countries: Experimental evidence from Ethiopia. Am. J. Agric. Econ. 2009, 91, 1022–1037. [Google Scholar] [CrossRef]

- Paravisini, D.; Rappoport, V.; Ravina, E. Risk aversion and wealth: Evidence from person-to-person lending portfolios. Manag. Sci. 2017, 63, 279–297. [Google Scholar] [CrossRef]

- Heinemann, F. Measuring risk aversion and the wealth effect. Res. Exp. Econ. 2008, 12, 293–313. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Navarro-González, F.J.; Villacampa, Y. A Foundation for Logarithmic Utility Function of Money. Mathematics 2021, 9, 665. https://doi.org/10.3390/math9060665

Navarro-González FJ, Villacampa Y. A Foundation for Logarithmic Utility Function of Money. Mathematics. 2021; 9(6):665. https://doi.org/10.3390/math9060665

Chicago/Turabian StyleNavarro-González, Francisco J., and Yolanda Villacampa. 2021. "A Foundation for Logarithmic Utility Function of Money" Mathematics 9, no. 6: 665. https://doi.org/10.3390/math9060665

APA StyleNavarro-González, F. J., & Villacampa, Y. (2021). A Foundation for Logarithmic Utility Function of Money. Mathematics, 9(6), 665. https://doi.org/10.3390/math9060665