Spatial-Temporal Evolution and Risk Assessment of Land Finance: Evidence from China

Abstract

:1. Introduction

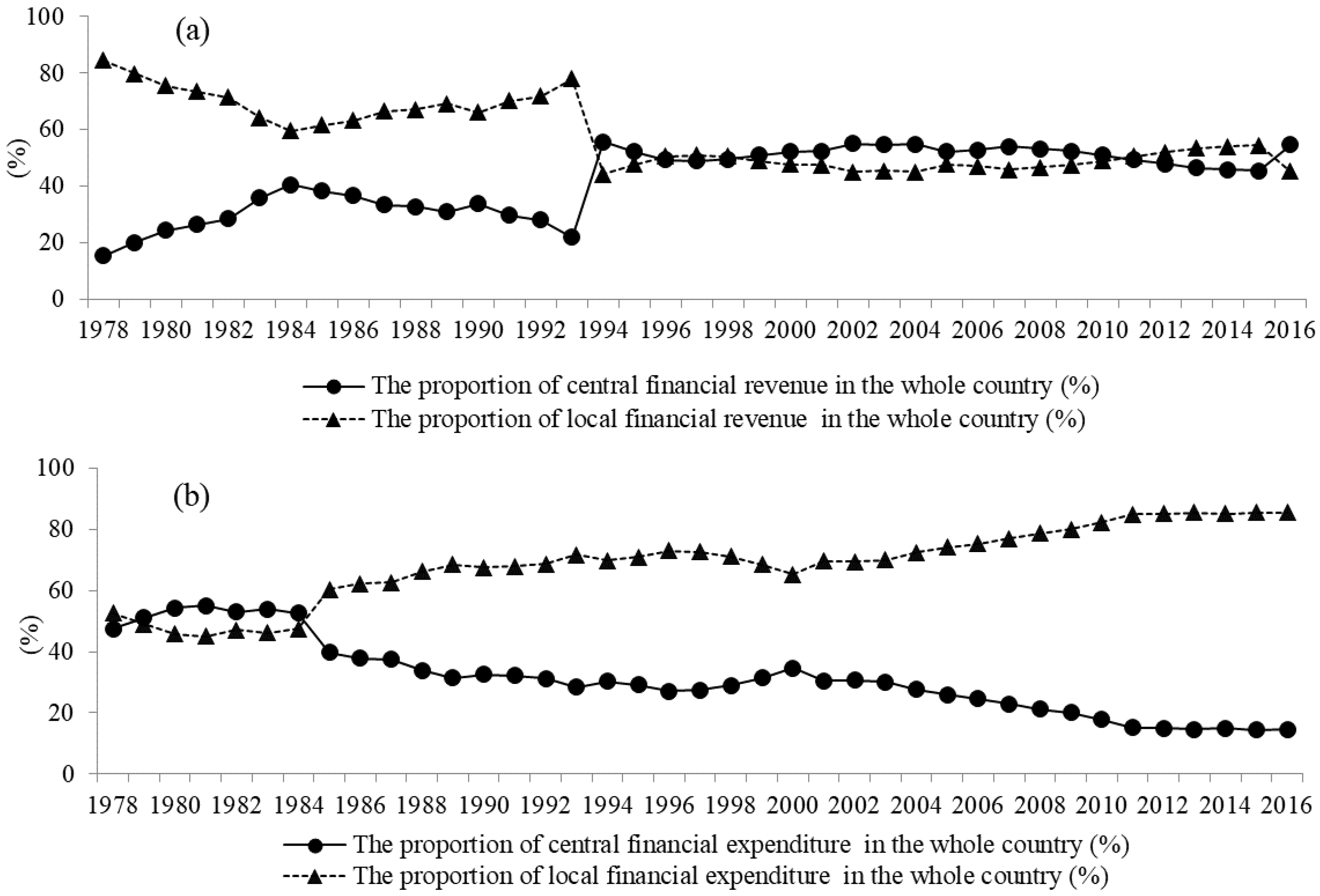

2. An Overview of Land Finance in China

3. Methods and Data

3.1. Measurement of Land Finance

+ land value added tax + farmland occupation tax + deed tax

+ real estate related tax.

3.2. Average Growth Index

3.3. Global Moran’s I and Getis-Ord G

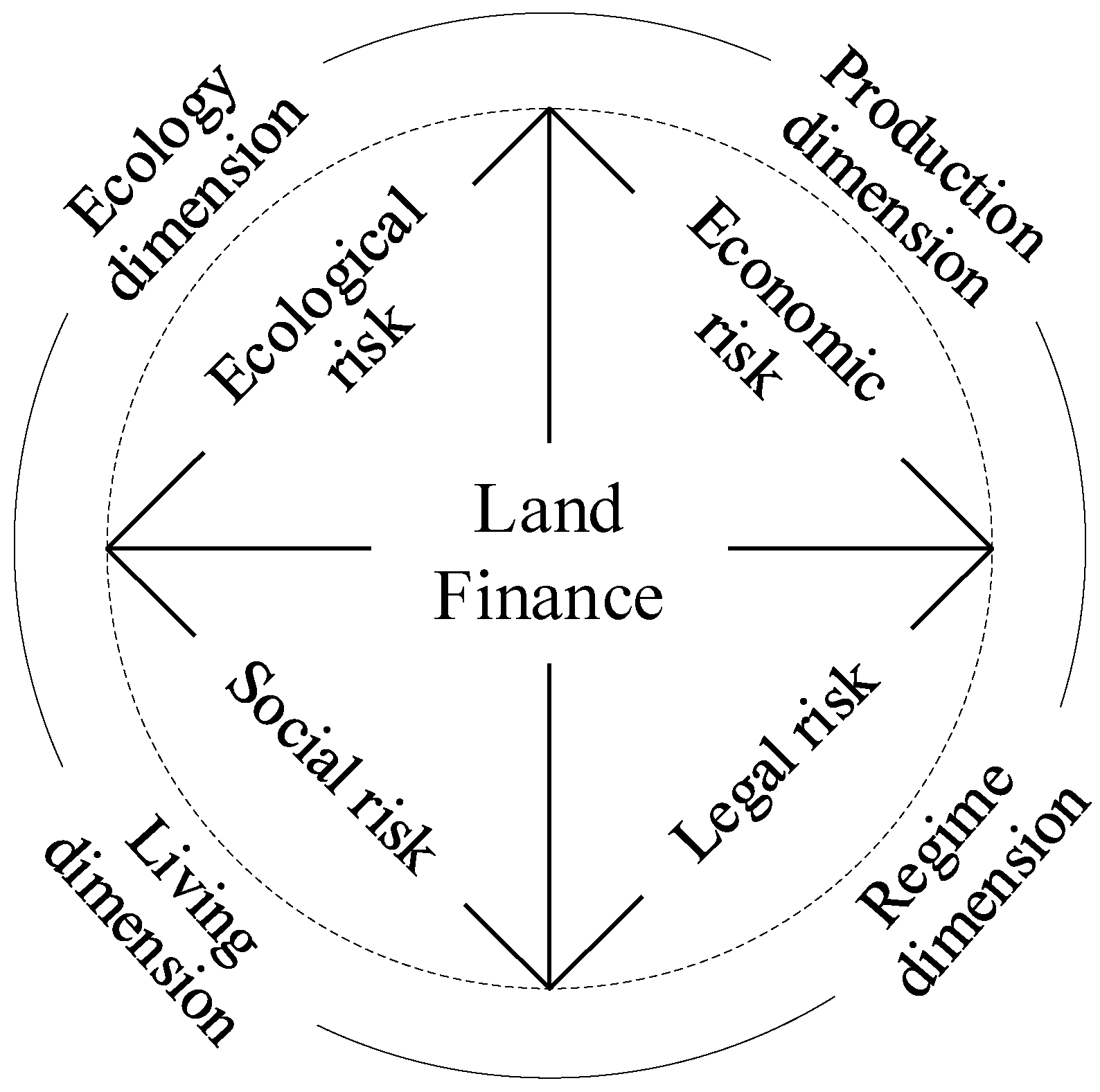

3.4. Composite Risk Index Model of Land Finance Risk

- Step 1. Constructing the assessment index system of land finance risk

- Step 2. Normalize the original data

- Step 3. Calculate the weight of each risk factor

- Step 4. Calculate the composite risk index

3.5. Grey Forecasting Model GM(1,1)

3.6. The SPR Model

3.7. Data and Software

4. Empirical Results

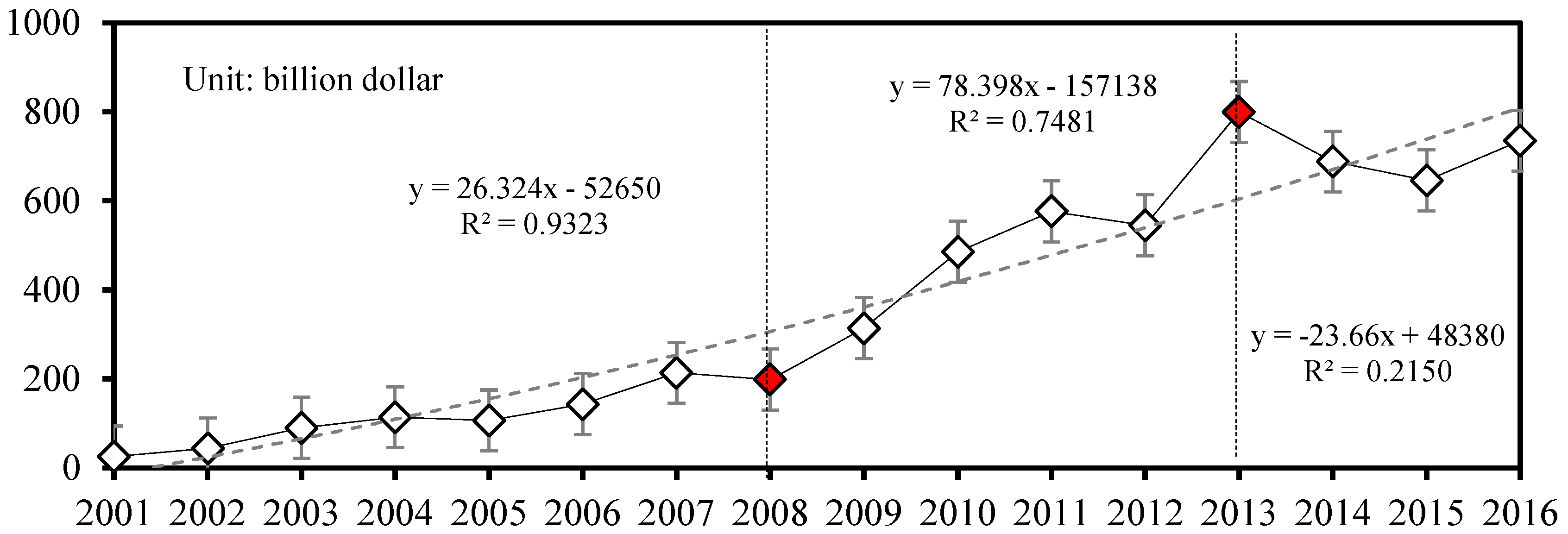

4.1. The General Tend of Land Finance

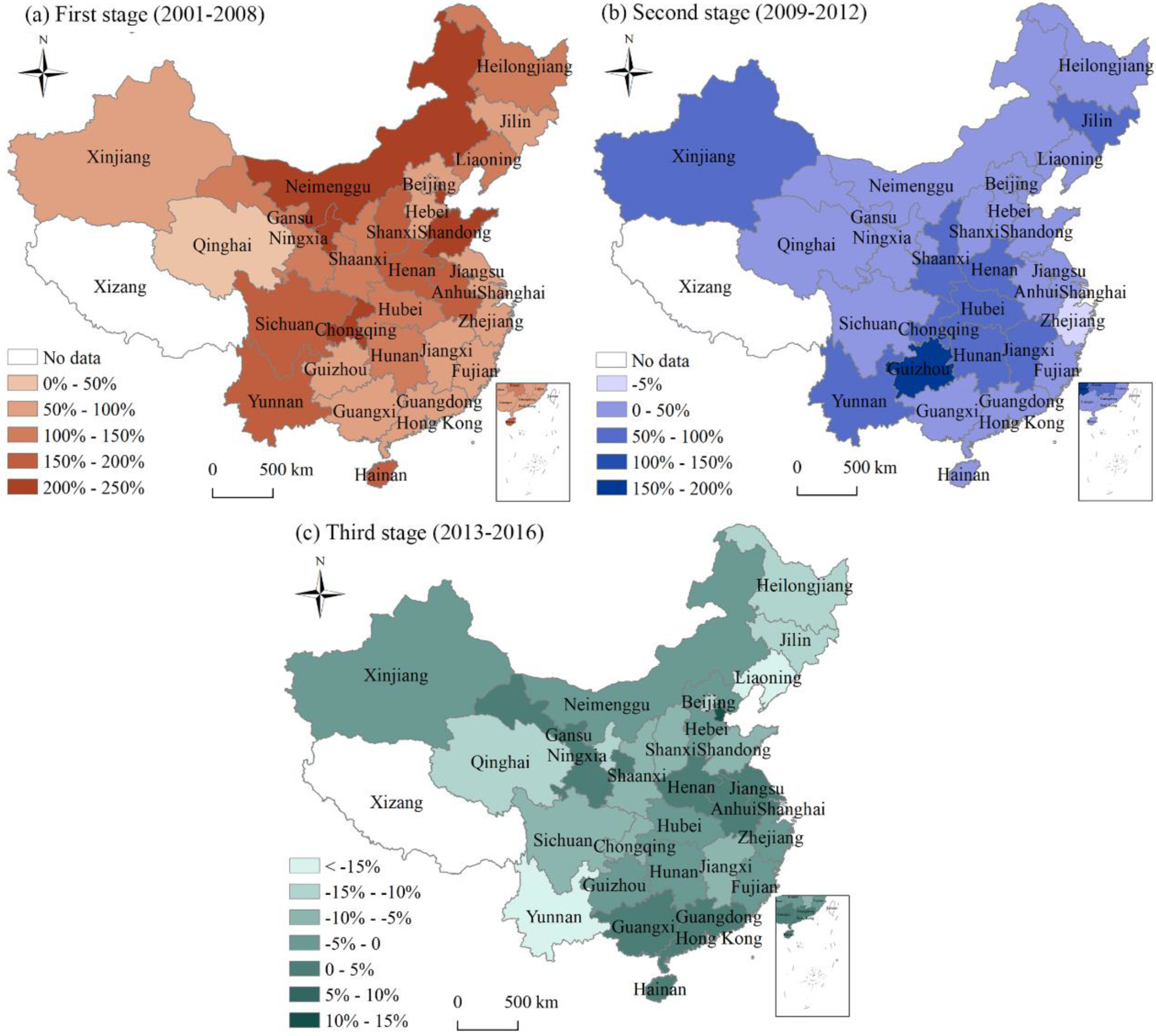

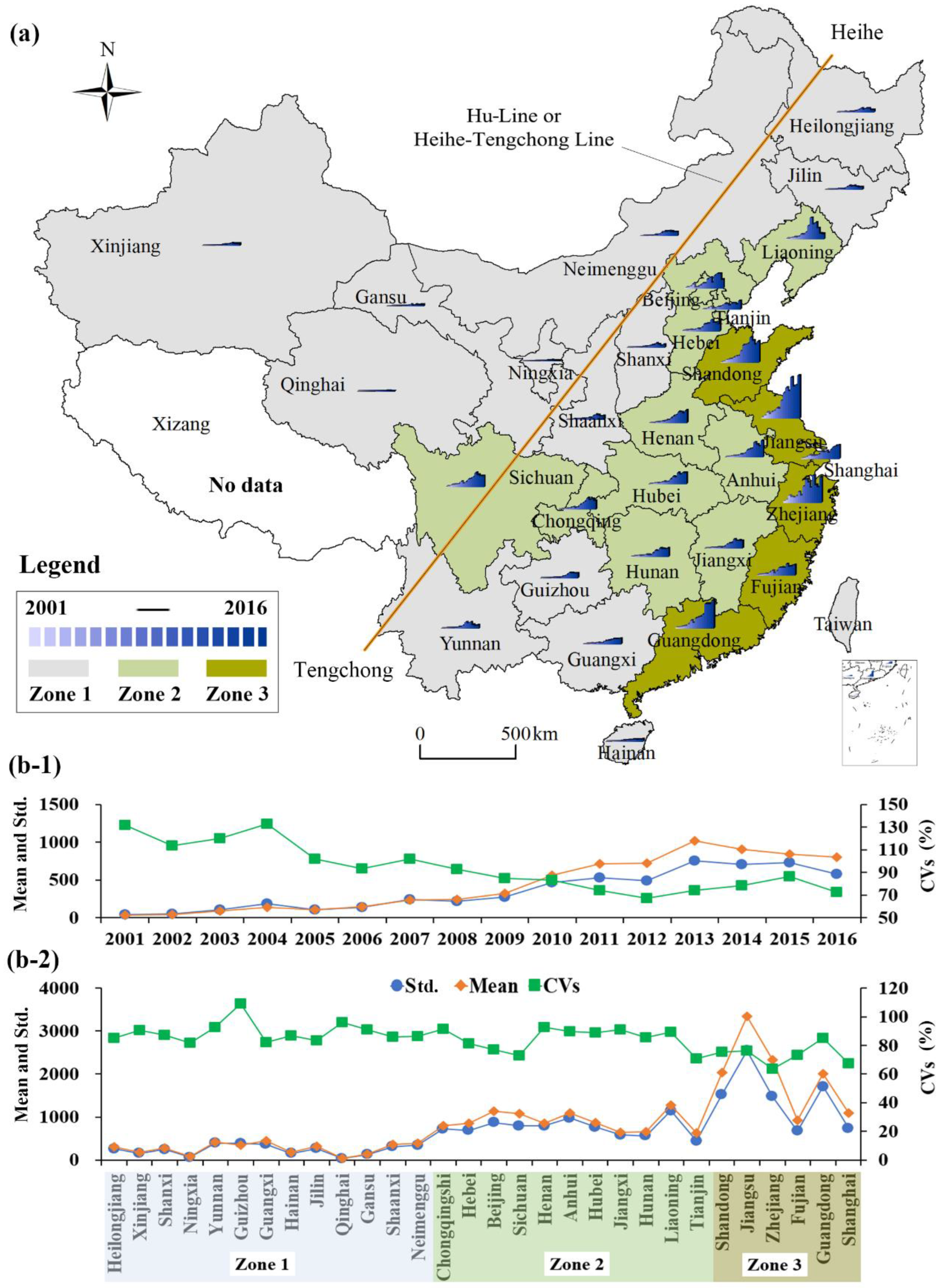

4.2. Spatial and Temporal Variation of Land Finance

4.3. Spatial Clustering Characteristic of Land Finance

4.4. Risk Assessment of Land Finance

4.5. The Key Risk Factors for Land Finance

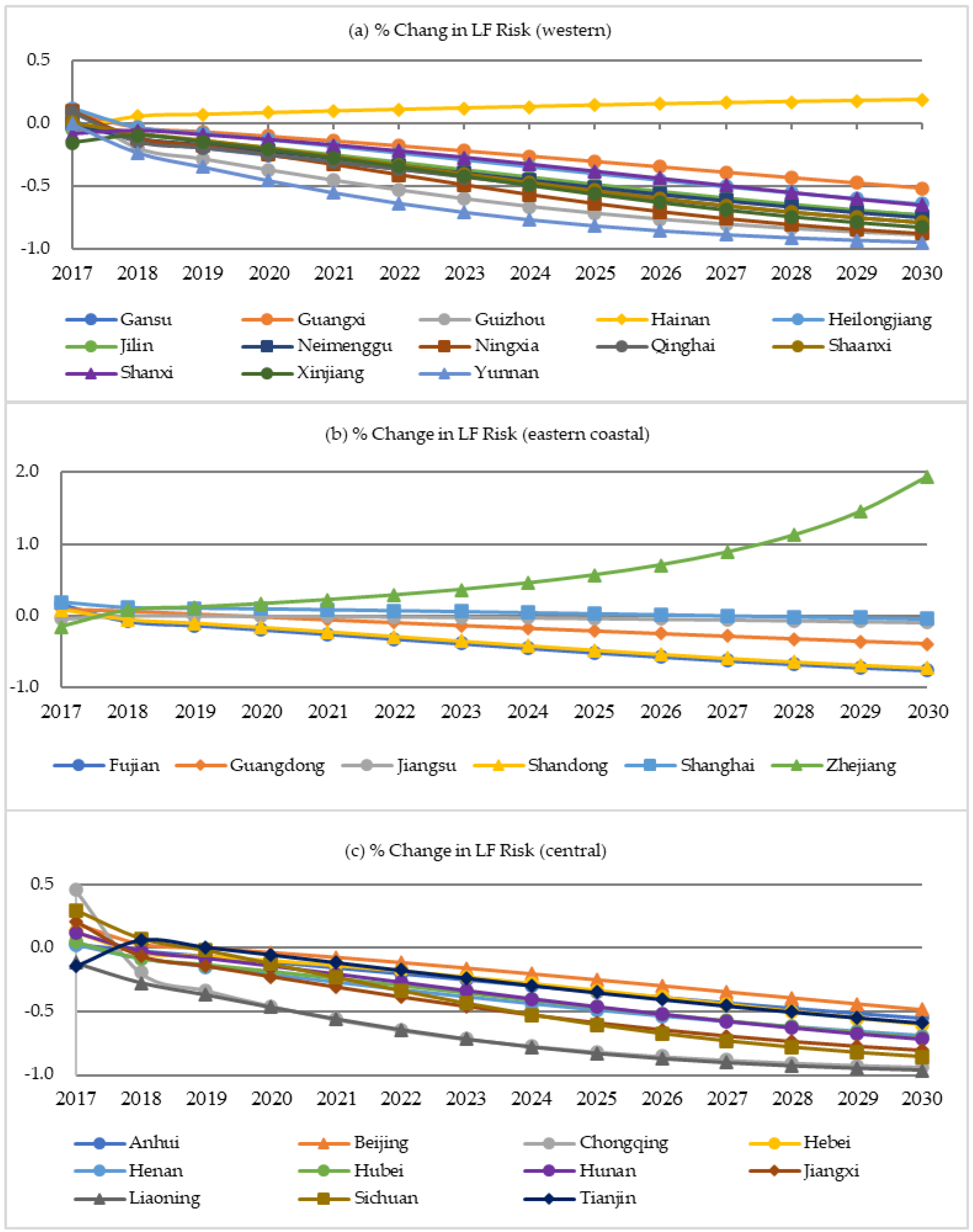

4.6. Forecast of Land Finance Risks and Early Warnings

5. Policy Implications

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | Generally, to scale variable into interval , we apply the formula where is the normalized value of (Basheera and Hajmeerb 2000). We normalize the original data into the interval to ensure the calculation of in the entropy method (Equation (15)) meaningful. |

| 2 | The province Xizang was excluded due to data availability. |

| 3 | http://www.ngcc.cn (accessd on 10 December 2021) |

| 4 | In March 2018, the Ministry of Natural Resources was established in accordance with the Institutional Reform Plan of the State Council approved at the first meeting of the 13th National People’s Congress; the responsibilities of the Ministry of Land and Resources were compiled into the newly established Ministry. The Ministry of Land and Resources was then no longer be retained. |

| 5 | The Notice on Regulating the State-Owned Land Use Rights Transfer Payments Management (The General Office of the State Council of the People’s Republic of China 2007). |

| 6 | The Notice on Improving the Level of Cultivated Land Protection and Comprehensively Strengthening the Construction and Management of Cultivated Land Quality (The Land Improvement Center of Ministry of Land and Resources 2012). |

| 7 | Hu Line was first identified by Dr. Huanyong Hu in 1935 (Hu 1935). |

| 8 | For more details in the three zones, see Table S3 in Supplementary Materials I. |

| 9 | Based on the LM test results reported in Table 4, we include only the spatial-fixed effects, but not the time-fixed effects in the fixed-effect regression. |

| 10 | We also investigate the models that include year dummy variables. The corresponding results from specifications [1]–[3] in Table 5 with year dummies are reported in Table S5 in Supplementary Materials I. Adding these year dummies does not affect the conclusion in risk assessment of land finance, except it slightly increases the of the fixed-effect model and significantly increases the of the random-effect model. |

| 11 | Due to the data availability, we conduct substage regressions based only on data of 2009–2016 (Stages 2 and 3). |

References

- Anselin, Luc. 1995. Local indicators of spatial association—LISA. Geographical Analysis 27: 93–115. [Google Scholar] [CrossRef]

- Anselin, Luc, Julie Le Gallo, and Hubert Jayet. 2008. Spatial panel econometrics. Spatial Panel Econometrics. In Advanced Studies in Theoretical and Applied Econometrics. Edited by László Mátyás and Patrick Sevestre. Berlin: Springe, pp. 625–60. [Google Scholar]

- Basheera, I. A., and M. Hajmeerb. 2000. Artificial neural networks: Fundamentals, computing, design, and application. Journal of Microbiological Methods 43: 3–31. [Google Scholar] [CrossRef]

- Cai, Meina, Pengfei Liu, and Hui Wang. 2020. Political trust, risk preferences, and policy support: A study of land dispossessed villagers in China. World Development 125: 104687. [Google Scholar] [CrossRef]

- Chen, Wendy Y., and Fox Zhi Yong Hu. 2015. Producing nature for public: Land-based urbanization and provision of public green spaces in China. Applied Geography 58: 32–40. [Google Scholar] [CrossRef]

- Chen, Zhigang, Jing Tang, Jiayu Wan, and Yi Chen. 2017. Promotion incentives for local officials and the expansion of urban construction land in china: Using the Yangtze river delta as a case study. Land Use Policy 63: 214–25. [Google Scholar] [CrossRef]

- Deng, Ju-Long. 1982. Control problems of grey systems. Systems & Control Letters 1: 288–94. [Google Scholar] [CrossRef]

- Du, Jinfeng, and Richard B. Peiser. 2014. Land supply, pricing and local governments’ land hoarding in China. Regional Science and Urban Economics 48: 180–89. [Google Scholar] [CrossRef]

- Elhorst, J. Paul. 2010. Spatial Panel Data Models. In Handbook of Applied Spatial Analysis. Edited by Manfred M. Fischer and Arthur Getis. Berlin: Springer, pp. 377–407. [Google Scholar] [CrossRef]

- Foglia, Matteo, and Eliana Angelini. 2019. The Time-Spatial Dimension of Eurozone Banking Systemic Risk. Risks 7: 75. [Google Scholar] [CrossRef] [Green Version]

- Fu, Qiang. 2015. When fiscal recentralization meets urban reforms: Prefectural land finance and its association with access to housing in urban China. Urban Studies 52: 1791–809. [Google Scholar] [CrossRef]

- Fu, Qiang, and Nan Lin. 2013. Local state marketism: An institutional analysis of China’s urban housing and land market. Chinese Sociological Review 46: 3–24. [Google Scholar] [CrossRef]

- Gao, Jinlong, Yehua Dennis Wei, Wen Chen, and Jianglong Chen. 2014. Economic transition and urban land expansion in Provincial China. Habitat International 44: 461–73. [Google Scholar] [CrossRef]

- Geng, Bin, Xiaoling Zhang, Ying Liang, Haijun Bao, and Martin Skitmore. 2018. Sustainable land finance in a new urbanization context: Theoretical connotations, empirical tests and policy recommendations. Resources, Conservation and Recycling 128: 336–44. [Google Scholar] [CrossRef] [Green Version]

- Getis, Arthur, and J. Keith Ord. 1992. The analysis of spatial association by use of distance statistics. Geographical Analysis 24: 189–206. [Google Scholar] [CrossRef]

- Gong, Zaiwu, and Jeffrey Yi-Lin Forrest. 2014. Special issue on meteorological disaster risk analysis and assessment: On basis of grey systems theory. Natural Hazards 71: 995–1000. [Google Scholar] [CrossRef] [Green Version]

- Guo, Gang. 2009. China’s local political budget cycles. American Journal of Political Science 53: 621–32. [Google Scholar] [CrossRef]

- Han, Li, and James Kai-Sing Kung. 2015. Fiscal incentives and policy choices of local governments: Evidence from China. Journal of Development Economics 116: 89–104. [Google Scholar] [CrossRef]

- Han, Wenjing, Xiaoling Zhang, and Zhengfeng Zhang. 2019. The role of land tenure security in promoting rural women’s empowerment: Empirical evidence from rural China. Land Use Policy 86: 280–89. [Google Scholar] [CrossRef]

- He, Canfei, Yi Zhou, and Zhiji Huang. 2016. Fiscal decentralization, political centralization, and land urbanization in China. Urban Geography 37: 436–57. [Google Scholar] [CrossRef]

- He, Chunyang, Norio Okada, Qiaofeng Zhang, Peijun Shi, and Jingshui Zhang. 2006. Modeling urban expansion scenarios by coupling cellular automata model and system dynamic model in Beijing, China. Applied Geography 26: 323–45. [Google Scholar] [CrossRef]

- Hu, Huanyong. 1935. Distribution of China’s population: Accompanying charts and density map. Acta Geographica Sinica 2: 33–74. (In Chinese). [Google Scholar]

- Hu, Fox Z. Y., and Jiwei Qian. 2017. Land-based finance, fiscal autonomy, and land supply for affordable housing in urban China: A prefecture-level analysis. Land Use Policy 69: 454–60. [Google Scholar] [CrossRef]

- Huang, Dingxi, and Roger C. K. Chan. 2018. On ‘Land Finance’ in urban China: Theory and practice. Habitat International 75: 96–104. [Google Scholar] [CrossRef]

- Huang, Zhiji, Yehua Dennis Wei, Canfei He, and Han Li. 2015. Urban land expansion under economic transition in China: A multilevel modeling analysis. Habitat International 47: 69–82. [Google Scholar] [CrossRef]

- Hui, Eddie Chi Man, Hai Jun Bao, and Xiao Ling Zhang. 2013. The policy and praxis of compensation for land expropriations in China: An appraisal from the perspective of social exclusion. Land Use Policy 32: 309–16. [Google Scholar] [CrossRef]

- Javed, Saad Ahmed, and Sifeng Liu. 2018. Predicting the research output/growth of selected countries: Application of Even GM (1,1) and NDGM models. Scientometrics 115: 395–413. [Google Scholar] [CrossRef]

- Jia, Junxue, Qingwang Guo, and Jing Zhang. 2014. Fiscal decentralization and local expenditure policy in China. China Economic Review 28: 107–22. [Google Scholar] [CrossRef]

- Jin, Cheng, and Yuqi Lu. 2009. Evolvement of spatial pattern of economy in Jiangsu province at county level. Acta Geographica Sinica 64: 713–24. [Google Scholar]

- Li, Pei, Yi Lu, and Jin Wang. 2016. Does flattening government improve economic performance? Evidence from China. Journal of Development Economics 123: 18–37. [Google Scholar] [CrossRef]

- Li, Tingting, Hualou Long, Shuangshuang Tu, and Yanfei Wang. 2015. Analysis of income inequality based on income mobility for poverty alleviation in rural China. Sustainability 7: 16362–78. [Google Scholar] [CrossRef] [Green Version]

- Li, Yan, and Chao Peng. 2018. Research on the causes and responsive measures of China’s fiscal expenditure solidification. Journal of World Economic Research 7: 82–91. [Google Scholar] [CrossRef]

- Lian, Hongping, and Raul P. Lejano. 2014. Interpreting Institutional Fit: Urbanization, Development, and China’s “Land-Lost”. World Development 61: 1–10. [Google Scholar] [CrossRef]

- Liu, Tao, and George C. S. Lin. 2014. New geography of land commodification in Chinese cities: Uneven landscape of urban land development under market reforms and globalization. Applied Geography 51: 118–30. [Google Scholar] [CrossRef]

- Liu, Yansui, Lijuan Wang, and Hualou Long. 2008. Spatio-temporal analysis of land-use conversion in the eastern coastal China during 1996–2005. Journal of Geographical Sciences 18: 274–82. [Google Scholar] [CrossRef]

- Lu, Juan, Bin Li, and He Li. 2019. The influence of land finance and public service supply on peri-urbanization: Evidence from the counties in China. Habitat International 92: 102039. [Google Scholar] [CrossRef]

- Ma, Shuang, and Ren Mu. 2020. Forced off the farm? Farmers’ labor allocation response to land requisition in China. World Development 132: 104980. [Google Scholar] [CrossRef]

- Meng, Hao, Xianjin Huang, Hong Yang, Zhigang Chen, Jun Yang, Yan Zhou, and Jianbao Li. 2019. The influence of local officials’ promotion incentives on carbon emission in Yangtze River Delta, China. Journal of Cleaner Production 213: 1337–45. [Google Scholar] [CrossRef]

- Mullan, Katrina, Pauline Grosjean, and Andreas Kontoleon. 2011. Land Tenure Arrangements and Rural–Urban Migration in China. World Development 39: 123–33. [Google Scholar] [CrossRef]

- Pan, Fenghua, Fengmei Zhang, Shengjun Zhu, and Dariusz Wójcik. 2017. Developing by borrowing? Interjurisdictional competition, land finance and local debt accumulation in China. Urban Studies 54: 897–916. [Google Scholar] [CrossRef]

- Pan, Jiun-Nan, Jr-Tsung Huang, and Tsun-Feng Chiang. 2015. Empirical study of the local government deficit, land finance and real estate markets in China. China Economic Review 32: 57–67. [Google Scholar] [CrossRef]

- Qi, Wei, Shenghe Liu, Meifeng Zhao, and Zhen Liu. 2016. China’s different spatial patterns of population growth based on the “Hu Line”. Journal of Geographical Sciences 26: 1611–25. [Google Scholar] [CrossRef]

- Qin, Yu, Hongjia Zhu, and Rong Zhu. 2016. Changes in the distribution of land prices in urban China during 2007–12. Regional Science and Urban Economics 57: 77–90. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 1994. How to make a decision: The analytic hierarchy process. European Journal of Operational Research 24: 19–43. [Google Scholar] [CrossRef]

- Shannon, Claude E., and Warren Weaver. 1949. The mathematical theory of communication. Chicago: University of Illinois Press. [Google Scholar]

- Shi, Yaobo, Chun-Ping Chang, Chyi-Lu Jang, and Yu Hao. 2018. Does economic performance affect officials’ turnover? Evidence from municipal government leaders in China. Quality & Quantity 52: 1873–91. [Google Scholar] [CrossRef]

- Smith, Graeme. 2013. Measurement, promotions and patterns of behavior in Chinese local government. Journal of Peasant Studies 40: 1027–50. [Google Scholar] [CrossRef]

- Su, Shiliang, Dan Li, Xiang Yu, Zhonghao Zhang, Qi Zhang, Rui Xiao, Junjun Zhi, and Jiaping Wu. 2011. Assessing land ecological security in Shanghai (China) based on catastrophe theory. Stochastic Environmental Research & Risk Assessment 25: 737–46. [Google Scholar] [CrossRef]

- Tang, Peng, Xiaoping Shi, Jinlong Gao, Shuyi Feng, and Futian Qu. 2019. Demystifying the key for intoxicating land finance in China: An empirical study through the lens of government expenditure. Land Use Policy 85: 302–9. [Google Scholar] [CrossRef]

- Tao, Ran, Fubing Su, Mingxing Liu, and Guangzhong Cao. 2010. Land leasing and local public finance in China’s regional development: Evidence from prefecture-level cities. Urban Studies 47: 2217–36. [Google Scholar] [CrossRef]

- The General Office of the State Council of the People’s Republic of China. 2007. The Notice on Regulating the State-Owned Land Use Rights Transfer Payments Management. Available online: http://www.gov.cn/zwgk/2006-12/25/content_478251.htm (accessed on 6 June 2020).

- The Land Improvement Center of Ministry of Land and Resources. 2012. Notice on Improving the Level of Cultivated Land Protection and Comprehensively Strengthening the Construction and Management of Cultivated Land Quality. Beijing: The Land Improvement Center of Ministry of Land and Resources. [Google Scholar]

- Tsui, Kai Yuen. 2011. China’s infrastructure investment boom and local debt crisis. Eurasian Geography and Economics 52: 686–711. [Google Scholar] [CrossRef]

- Wang, De, Li Zhang, Zhao Zhang, and Simon Xiaobin Zhao. 2011. Urban infrastructure financing in reform-era China. Urban Studies 48: 2975–98. [Google Scholar] [CrossRef]

- Wang, Hong, Zhiqiu Gao, Jingzheng Ren, Yibo Liu, Lisa Tzu-Chi Chang, Kevin Cheung, Yun Feng, and Yubin Li. 2018. An urban-rural and sex differences in cancer incidence and mortality and the relationship with PM2.5 exposure: An ecological study in the southeastern side of Hu line. Chemosphere 216: 766–73. [Google Scholar] [CrossRef]

- Wang, Shaojian, Chuanglin Fang, and Yang Wang. 2016. Spatiotemporal variations of energy-related CO2 emissions in China and its influencing factors: An empirical analysis based on provincial panel data. Renewable and Sustainable Energy Reviews 55: 505–15. [Google Scholar] [CrossRef]

- Wang, Wen, and Fangzhi Ye. 2016. The political economy of land finance in China. Public Budgeting & Finance 36: 91–110. [Google Scholar] [CrossRef]

- Wang, Yiming, and Steffanie Scott. 2013. Illegal farmland conversion in China’s urban periphery: Local regime and national transitions. Urban Geography 29: 327–47. [Google Scholar] [CrossRef]

- Wen, Haizhen, and Yunlong Tao. 2015. Polycentric urban structure and housing price in the transitional China: Evidence from Hangzhou. Habitat International 46: 138–46. [Google Scholar] [CrossRef]

- Wu, Fulong. 2014. Commodification and housing market cycles in Chinese cities. Journal International Journal of Housing Policy 15: 6–26. [Google Scholar] [CrossRef] [Green Version]

- Wu, Qun, Yongle Li, and Siqi Yan. 2015. The incentives of China’s urban land finance. Land Use Policy 42: 432–42. [Google Scholar] [CrossRef]

- Xu, Nannan. 2019. What gave rise to China’s land finance? Land Use Policy 87: 104015. [Google Scholar] [CrossRef]

- Yang, X. Jin. 2013. China’s Rapid Urbanization. Science 342: 310. [Google Scholar] [CrossRef]

- Ye, Fangzhi, and Wen Wang. 2013. Determinants of land finance in China: A study based on provincial-level panel data. Australian Journal of Public Administration 72: 293–303. [Google Scholar]

- Yuan, Chaoqing, Sifeng Liu, and Zhigeng Fang. 2016. Comparison of China’s primary energy consumption forecasting by using ARIMA (the autoregressive integrated moving average) model and GM(1,1) model. Energy 100: 384–90. [Google Scholar] [CrossRef]

- Zhang, Bangbang, Jiaxiang Li, Wenmiao Tian, Haibin Chen, Xiangbin Kong, Wei Chen, Minjuan Zhao, and Xianli Xia. 2020. Spatio-temporal variances and risk evaluation of land finance in China at the provincial level from 1998 to 2017. Land Use Policy 99: 104804. [Google Scholar] [CrossRef]

- Zhang, Ting-Ting, Sheng-Lan Zeng, Yu Gao, Zu-Tao Ouyang, Bo Li, Chang-Ming Fang, and Bin Zhao. 2011. Assessing impact of land uses on land salinization in the Yellow River Delta, China using an integrated and spatial statistical model. Land Use Policy 28: 857–66. [Google Scholar] [CrossRef]

- Zhang, Tingwei. 2000. Land market forces and government’s role in sprawl—The case of China. Cities 17: 123–35. [Google Scholar] [CrossRef]

- Zheng, Heran, Xin Wang, and Shixiong Cao. 2014. The land finance model jeopardizes China’s sustainable development. Habitat International 44: 130–36. [Google Scholar] [CrossRef]

- Zhong, Taiyang, Xiaoling Zhang, Xianjin Huang, and Fang Liu. 2019. Blessing or curse? Impact of land finance on rural public infrastructure development. Land Use Policy 85: 130–41. [Google Scholar] [CrossRef]

- Zhou, De, Jianchun Xu, Li Wang, and Zhulu Lin. 2015. Assessing urbanization quality using structure and function analyses: A case study of the urban agglomeration around Hangzhou Bay (UAHB), China. Habitat International 49: 165–76. [Google Scholar] [CrossRef]

- Zhou, De, Zhulu Lin, and Siew Hoon Lim. 2019. Spatial characteristics and risk factor identification for land use spatial conflicts in a rapid urbanization region in China. Environmental Monitoring and Assessment 191: 677. [Google Scholar] [CrossRef] [PubMed]

- Zhou, De, Zhulu Lin, Liming Liu, and David Zimmermann. 2013. Assessing secondary soil salinization risk based on the PSR sustainability framework. Journal of Environmental Management 128: 642–54. [Google Scholar] [CrossRef]

- Zhou, Wei, and Jian-Min He. 2013. Generalized GM (1,1) model and its application in forecasting of fuel production. Applied Mathematical Modelling 37: 6234–43. [Google Scholar] [CrossRef]

| Type (C) | Risk Variable (X—Normalized Variable) | Variable Description | Expected Sign | |

|---|---|---|---|---|

| Social risks | X1 | Urbanization rate (%) | The proportion of the population living in urban areas. It represents the urbanization level of a country or region. | + |

| X2 | Increase of developed land (hm2) | The amount of agricultural land and unused land converts to developed land per year. | + | |

| X3 | Average housing price growth rate (%) | The growth rate in year t equals the average price of commodity house in year t minus the average price of commodity house in year t − 1 divided by the average price of commodity house in year t − 1. | + | |

| X4 | The income disparity between urban and rural residents (%) | The ratio of the disposable income of urban residents per capita to the net income of rural residents per capita. The ratio represents the risk of income differentiation between urban and rural residents. | + | |

| X5 | Degree of development of land markets (%) | The proportion of the total amount of land transferred through bidding, auction, and sale, representing the degree of development of land markets. | − | |

| X6 | Cultivated land per capita (hm2/capita) | Cultivated land area/total population, representing cultivated area per capita. | − | |

| Economic risks | X7 | Degree of land transfer dependence (%) | The proportion of land finance scaled by local revenue. It represents the dependence of the local government on land finance. | + |

| X8 | Deficit ratio (%) | The proportion of fiscal deficit in GDP, representing the comparison of the annual revenue and expenditure of local governments. | + | |

| X9 | Macro tax burden (%) | The proportion of government revenue in GDP, representing a country’s overall level of the tax burden and overall economic strength. | + | |

| X10 | The asset-liability ratio of real estate enterprises (%) | The ratio of total ending liabilities to total assets, representing the ability of an enterprise to conduct business activities with funds provided by creditors. | + | |

| Legal risks | X11 | Number of land violation cases (#) | It measures the level of corruption of local government in land management. | + |

| X12 | Number of illegal land occupation cases (#) | It measures the management level of local government in the field of land law enforcement and supervision. | + | |

| X13 | Percentage of cultivated land in illegal occupation cases (%) | It measures the extent of damage to cultivated land resources caused by local government’s illegal occupation. | + | |

| Ecological risks | X14 | Percentage of cultivated land area (%) | The proportion of cultivated land in total land area. | − |

| X15 | Cultivated land decrease rate (%) | The ratio of the annual decrease in cultivated land to the total cultivated land, representing the extent of damage of annual cultivated land. | − | |

| Accuracy Level | Small Error Probability (p) | Posterior Error Ratio (c) |

|---|---|---|

| Good | p > 0.95 | < 0.35 |

| Qualified | 0.8 < p ≤ 0.95 | < 0.5 |

| Barely qualified | 0.7 < p ≤ 0.8 | < 0.65 |

| Fail | p ≤ 0.7 |

| Stages | Year | Moran’s I | p-Value | Getis-Ord G | p-Value | ||

|---|---|---|---|---|---|---|---|

| First stage (2001–2008) | 2001 | 0.2324 | 2.3532 | 0.0220 | 0.2052 | 2.1001 | 0.0357 |

| 2002 | 0.3835 | 3.8478 | 0.0050 | 0.2454 | 3.1507 | 0.0016 | |

| 2003 | 0.3786 | 3.9569 | 0.0050 | 0.2516 | 3.0904 | 0.0020 | |

| 2004 | 0.4436 | 3.9794 | 0.0020 | 0.1937 | 2.3292 | 0.0198 | |

| 2005 | 0.4357 | 4.1799 | 0.0010 | 0.2314 | 3.1887 | 0.0014 | |

| 2006 | 0.3790 | 3.5902 | 0.0040 | 0.2176 | 3.0099 | 0.0026 | |

| 2007 | 0.2386 | 2.3183 | 0.0220 | 0.2008 | 2.4984 | 0.0125 | |

| 2008 | 0.3365 | 3.1345 | 0.0030 | 0.1921 | 2.4350 | 0.0149 | |

| Second stage (2009–2012) | 2009 | 0.3669 | 3.5018 | 0.0040 | 0.2169 | 2.7887 | 0.0053 |

| 2010 | 0.3410 | 3.2383 | 0.0040 | 0.2071 | 2.8024 | 0.0051 | |

| 2011 | 0.2696 | 2.6398 | 0.0090 | 0.1876 | 2.3521 | 0.0187 | |

| 2012 | 0.2598 | 2.5950 | 0.0110 | 0.1947 | 2.8730 | 0.0041 | |

| Third stage (2013–2016) | 2013 | 0.2806 | 2.7945 | 0.0060 | 0.2023 | 3.0680 | 0.0022 |

| 2014 | 0.2748 | 2.7005 | 0.0110 | 0.1933 | 2.8582 | 0.0043 | |

| 2015 | 0.2858 | 2.9026 | 0.0060 | 0.1997 | 2.9262 | 0.0034 | |

| 2016 | 0.3686 | 3.7056 | 0.0030 | 0.2251 | 3.5199 | 0.0004 |

| Determinants | Statistics | Determinants | Statistics |

|---|---|---|---|

| LM test spatial error | 7.444 *** | LM test spatial lag | 3.203 * |

| Robust test LM spatial error | 4.468 ** | Robust LM test spatial lag | 0.226 |

| Hausman test | Negative |

| Basic Level Indicators (X—Normalized Variable) | Fixed-Effects [1] | Random-Effects [2] | Random-Effects [3] | |

|---|---|---|---|---|

| X1 | Urbanization rate | 0.99 *** | 0.4642 *** | 0.4563 *** |

| (0.139) | (3.4856) | (5.3473) | ||

| X2 | Increase of developed land | 0.12 *** | 0.1483 *** | 0.1552 *** |

| (0.029) | (4.4383) | (4.9131) | ||

| X3 | Average housing price growth rate | 0.03 | −0.0111 | |

| (0.026) | (−0.3778) | |||

| X4 | The income disparity between urban & rural residents | 0.16 *** | 0.052 | |

| (0.056) | (0.8732) | |||

| X5 | Degree of land market development | −0.09 *** | −0.0928 *** | −0.0854 ** |

| (0.035) | (−2.6519) | (−2.5372) | ||

| X6 | Per capita cultivated land | 1.32 * | 0.0906 | |

| (0.795) | (0.8169) | |||

| X7 | Degree of land transfer dependence | 0.29 *** | 0.2669 *** | 0.2606 *** |

| (0.028) | (8.854) | (9.2761) | ||

| X8 | Deficit rate | −0.11 | −0.0305 | |

| (0.116) | (−0.3144) | |||

| X9 | Macro tax burden | 0.39 *** | 0.2264 *** | 0.2291 *** |

| (0.073) | (2.8354) | (2.9582) | ||

| X10 | The asset-liability ratio of real estate enterprises | −0.00 | 0.0745 * | |

| (0.042) | (1.6478) | |||

| X11 | Number of land violation cases | 0.02 | 0.0038 | |

| (0.028) | (0.1212) | |||

| X12 | Number of illegal land occupation cases | 0.08 ** | 0.0864 ** | 0.0808 ** |

| (0.034) | (2.2771) | (2.4077) | ||

| X13 | Percentage of cultivated land in illegal occupation cases | −0.04 | −0.0338 | |

| (0.022) | (−1.3608) | |||

| X14 | Percentage of cultivated land area | −2.39 * | 0.1231 | |

| (1.319) | (1.2962) | |||

| X15 | Cultivated land decrease rate | −0.07 * | −0.0419 | |

| (0.036) | (−1.0392) | |||

| Constant | −0.3173 *** | −0.2109 *** | ||

| (−2.7230) | (−5.4626) | |||

| ) | 0.23 *** | 0.3211 *** | 0.3053 *** | |

| (0.056) | −5.6324 | (5.5732) | ||

| 0.151 | 0.461 | 0.441 | ||

| Variables | Direct Effects | Indirect Effects | Total Effects |

|---|---|---|---|

| X1 | 0.4826 *** | 0.2120 *** | 0.6946 *** |

| (3.4504) | (2.8132) | (3.4517) | |

| X2 | 0.1511 *** | 0.0677 *** | 0.2188 *** |

| (4.4625) | (2.6900) | (3.9534) | |

| X3 | −0.0082 | −0.0036 | −0.0118 |

| (−0.2829) | (−0.2657) | (−0.2796) | |

| X4 | 0.0535 | 0.0248 | 0.0783 |

| (0.9086) | (0.8819) | (0.9093) | |

| X5 | −0.0943 *** | −0.0418 ** | −0.1361 *** |

| (−2.6796) | (−2.2177) | (−2.6230) | |

| X6 | 0.1010 | 0.0443 | 0.1453 |

| (0.8733) | (0.8212) | (0.8661) | |

| X7 | 0.2746 *** | 0.1218 *** | 0.3965 *** |

| (8.4662) | (3.6707) | (7.0936) | |

| X8 | −0.0360 | −0.0157 | −0.0518 |

| (−0.3618) | (−0.3597) | (−0.3638) | |

| X9 | 0.2421 *** | 0.1046 *** | 0.3467 *** |

| (3.0106) | (2.8163) | (3.1360) | |

| X10 | 0.0771 | 0.0344 | 0.1115 |

| (1.6440) | (1.5054) | (1.6328) | |

| X11 | 0.0031 | 0.0008 | 0.0039 |

| (0.0980) | (0.0569) | (0.0856) | |

| X12 | 0.0913 ** | 0.0414 * | 0.1327 ** |

| (2.1911) | (1.7745) | (2.0949) | |

| X13 | −0.0358 | −0.0160 | −0.0518 |

| (−1.4555) | (−1.3470) | (−1.4434) | |

| X14 | 0.1309 | 0.0584 | 0.1892 |

| (1.3166) | (1.2162) | (1.3045) | |

| X15 | −0.0466 | −0.0199 | −0.0665 |

| (−1.1569) | (−1.0998) | (−1.1544) | |

| 0.4613 | 0.4613 | 0.4613 |

| Basic Level Indicators (X) | Zone 1 | Zone 2 | Zone 3 | Stage 2 | Stage 3 |

|---|---|---|---|---|---|

| (Western) | (Central) | (Eastern coastal) | (2009–2012) | (2013–2016) | |

| X1 | 0.0743 | 0.7820 *** | 2.4984 *** | 0.1591 | 0.4986 *** |

| (1.5280) | (5.6217) | (5.9812) | (1.3943) | (3.8610) | |

| X2 | −0.0067 | 0.0564 ** | 0.0569 | 0.1250 *** | 0.1128 *** |

| (−0.4440) | (2.0638) | (1.0797) | (3.4127) | (2.5767) | |

| X3 | −0.0114 | 0.0758 *** | 0.0735 | −0.0361 | 0.0604 |

| (−1.2663) | (2.8920) | (0.9658) | (−1.3251) | (1.4918) | |

| X4 | −0.0638 *** | 0.1153 * | −0.2369 | −0.0401 | −0.0616 |

| (−3.3762) | (1.9566) | (−0.7532) | (−0.4882) | (−0.3569) | |

| X5 | 0.0238 ** | 0.0880 *** | −0.5373 *** | −0.0266 | 0.0586 |

| (2.0121) | (2.6426) | (−3.5224) | (−0.6582) | (1.4548) | |

| X6 | 0.0002 | −3.0799 *** | 15.3790 *** | −0.0410 | −0.0686 |

| (0.0038) | (−2.6226) | (4.7366) | (−0.5715) | (−0.5883) | |

| X7 | 0.1516 *** | 0.3360 *** | 0.6436 *** | 0.2193 *** | 0.4353 *** |

| (14.1764) | (13.6490) | (8.2513) | (6.4781) | (9.8544) | |

| X8 | 0.0005 | −0.2254 | 0.1196 | −0.0996 | −0.0217 |

| (0.0162) | (−1.3303) | (0.1605) | (−1.1050) | (−0.2103) | |

| X9 | 0.0861*** | 0.5962 *** | 1.0444 *** | 0.0114 | 0.0941 |

| (3.7270) | (8.8572) | (4.3906) | (0.1177) | (1.1225) | |

| X10 | −0.0112 | −0.1004 ** | 0.2981 | 0.0770 * | 0.1311 ** |

| (−0.9659) | (−2.3699) | (1.2947) | (1.8345) | (1.9899) | |

| X11 | −0.0037 | −0.0163 | −0.0064 | −0.0120 | −0.0164 |

| (−0.2799) | (−0.8015) | (−0.0922) | (−0.1851) | (−0.5081) | |

| X12 | −0.0094 | 0.0056 | −0.0176 | −0.0564 | 0.0408 |

| (−0.4266) | (0.1806) | (−0.2761) | (−0.7179) | (1.3165) | |

| X13 | 0.0065 | −0.0138 | −0.0535 | 0.0137 | −0.0247 |

| (0.8757) | (−0.7090) | (−0.8270) | (0.4421) | (−0.9511) | |

| X14 | −0.0282 | −0.0862 | −1.2151 *** | 0.0261 | 0.0929 |

| (−0.4866) | (−0.1481) | (−3.2706) | (0.3771) | (0.8823) | |

| X15 | −0.0045 | −0.1000 ** | −0.1621 | 0.0178 | −0.2839 |

| (−0.4319) | (−2.0330) | (−1.0324) | (0.5112) | (−0.3991) | |

| Constant | 0.0774 * | 0.3500 | −3.1251 *** | 0.0071 | −0.1440 |

| (1.8369) | (0.8631) | (−5.1530) | (0.0621) | (−0.3150) | |

| Spatial weights (ρ) | 0.1501 ** | 0.1464 ** | −0.0982 | 0.2562 *** | 0.0536 |

| (2.3648) | (2.0125) | (−1.0179) | (2.7880) | (0.6676) | |

| 0.085 | 0.006 | 0.715 | 0.659 | 0.561 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, D.; Tian, R.; Lin, Z.; Liu, L.; Wang, J.; Feng, S. Spatial-Temporal Evolution and Risk Assessment of Land Finance: Evidence from China. Risks 2022, 10, 196. https://doi.org/10.3390/risks10100196

Zhou D, Tian R, Lin Z, Liu L, Wang J, Feng S. Spatial-Temporal Evolution and Risk Assessment of Land Finance: Evidence from China. Risks. 2022; 10(10):196. https://doi.org/10.3390/risks10100196

Chicago/Turabian StyleZhou, De, Ruilin Tian, Zhulu Lin, Liming Liu, Junfeng Wang, and Shijia Feng. 2022. "Spatial-Temporal Evolution and Risk Assessment of Land Finance: Evidence from China" Risks 10, no. 10: 196. https://doi.org/10.3390/risks10100196