Financial Innovation of Mass Destruction—The Story of a Countrywide FX Options Debacle

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

4. Results

4.1. The Economic Setup of the Debacle

4.2. The Dark Side of Zero-Cost OTC FX Option Structures

4.2.1. Product Design

4.2.2. Distribution

4.2.3. Transaction Execution

4.2.4. Negative Consequences of the Deals

4.3. Systemic Risk Mitigation?

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| No. | Company Name | Code | Industry GICS | Total Sales Revenue in 2008 | Net Profit/Net Loss in 2008 | Net Profit/Net Loss Change 2008/2007 | Total Assets as of 31 December 2008 | Average Employment in 2008 | Market Capitalisation as of the End of 2008 | Market Capitalisation Change 2008/2007 | Valuation of Derivatives as of the End of 2008 | Loss on Derivatives in 2008 | Debt Ratio Change 2008/2007 | Current Ratio Change 2008/2007 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Ciech | 1_Ci | Chemicals | 583.1 | 4.3 | −98% | 576.1 | 301 | 193.19 | −79.97% | 293.4 | 48.4 | 10.24% | −32.67% |

| 2. | Forte | 2_Fo | Household Durables | 136.0 | 1.3 | −94% | 126.9 | 2378 | 30.22 | −33.28% | −7.1 | N/A | −1.14% | 49.64% |

| 3. | Cersanit | 3_Ce | Household Durables | 395.4 | 1.2 | −100% | 576.6 | 292 | N/A | N/A | 12.1 | 15.1 | 14.69% | 28.93% |

| 4. | Odlewnie Polskie | 4_OdPL | Metals and Mining | 40.1 | −30.2 | −288% | 24.1 | 654 | 5.54 | −74.07% | N/A | 28.5 | 308.87% | −80.61% |

| 5. | Elwo | 5_Elwo | Machinery | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 34.2 | N/A | N/A |

| 6. | Sanwil | 6_Sa | Household Durables | 11.9 | −6.1 | −124% | 37.4 | 1 | 14.27 | N/A | −4.3 | 3.6 | N/A | N/A |

| 7. | Rudniki | 8_Ru | Chemicals | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 3.7 | N/A | −75.81% |

| 8. | Huta Pokój | 9_HuPo | Metals and Mining | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 37.0 | N/A | −59.81% |

| 9. | Ropczyce | 10_Rop | Fuels | 123.6 | −11.2 | −26% | 143.3 | 467 | 10.16 | −87.30% | 11.4 | 5.6 | N/A | −32.93% |

| 10. | Jastrzębska Spółka Węglowa | 11_JSW | Metals and Mining | 2176.4 | 229.4 | N/A | 2785.4 | N/A | N/A | N/A | N/A | 28.5 | N/A | −21.71% |

| 11. | Katowicki Holding Węglowy | 12_KHW | Metals and Mining | N/A | N/A | N/A | N/A | 20,000 | N/A | N/A | N/A | 56.9 | 36.43% | −21.43% |

| 12. | Węglokoks | 13_Weg | Metals and Mining | 790.8 | 13.2 | −96% | 346.3 | 154 | N/A | N/A | N/A | N/A | 77.99% | −52.48% |

| 13. | Huta Szkła Krosno | 14_Kro | Building Products | 67.7 | −39.8 | −327% | 94.5 | 3040 | N/A | N/A | −10.8 | 11.1 | 64.38% | −70.99% |

| 14. | Zakłady Azotowe Puławy | 15_ZAP | Chemicals | 636.6 | 53.2 | N/A | 624.1 | N/A | 691.00 | 58.75% | N/A | 5.7 | −14.02% | 20.07% |

| 15. | Paged | 16_Pag | Household Durables | 96.8 | −15.3 | −125% | 98.8 | 2240 | 11.27 | −85.33% | N/A | 14.8 | 71.82% | −35.71% |

| 16. | PLL LOT | 17_Lot | Aerospace and Defense | 76.1 | 2.5 | −97% | 109.7 | 477 | N/A | N/A | N/A | 113.9 | 92.37% | −58.62% |

| 17. | Police | 18_Pol | Chemicals | 684.2 | 8.2 | −99% | 531.3 | 3203 | 106.31 | −70.45% | N/A | 35.3 | 58.10% | −33.16% |

| 18. | Duda | 19_Dud | Food Products | 416.5 | −4.6 | −103% | 310.8 | 597 | N/A | N/A | −8.3 | 85.4 | N/A | N/A |

| 19. | Amro | 20_Amr | Air Freight and Logistics | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 0.6 | N/A | N/A |

| 20. | Zelmer | 21_Zel | Machinery | 132.5 | 7.0 | −94% | 126.5 | 2522 | N/A | N/A | N/A | 8.3 | 49.21% | −33.59% |

| 21. | Grupa Lotos | 22_Lotos | Fuels | 4638.1 | −110.8 | −104% | 3473.2 | 1162 | 388.36 | −73.03% | N/A | 68.9 | 43.05% | −9.05% |

| 22. | Feroco | 26_Fer | Construction and Engineering | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 42.7 | 141.76% | −72.79% |

| 23. | Barlinek | 27_Bar | Paper and Forest Products | 159.1 | −9.3 | −104% | 319.7 | 2563 | N/A | N/A | N/A | 14.6 | 17.23% | −28.37% |

| 24. | Erbud | 28_Erb | Construction and Engineering | 297.8 | 3.0 | −97% | 184.4 | 351 | 84.09 | −74.06% | N/A | 13.4 | 15.02% | −13.30% |

| 25. | Fazos | 29_Faz | Construction and Engineering | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 11.3 | N/A | N/A |

| 26. | Azoty Tarnów | 30_Az | Chemicals | 389.4 | 20.6 | −97% | 456.6 | 2389 | 75.71 | N/A | N/A | 5.6 | −22.71% | 115.00% |

| 27. | Fota | 31_Fot | Automobiles | 197.4 | −12.8 | −153% | 126.8 | 1338 | 19.30 | −74.03% | −3.8 | 3.8 | 31.53% | −22.35% |

| 28. | Synthos | 32_Syn | Chemicals | 810.0 | 25.9 | −90% | 422.0 | 2000 | 165.73 | −66.15% | −3.3 | 3.3 | −7.72% | 330.10% |

| 29. | Pamapol | 33_Pam | Food Products | 107.9 | −11.6 | −108% | 128.6 | 518 | 20.05 | −87.01% | N/A | 3.1 | 14.25% | −14.40% |

| 30. | Sfinks Polska | 34_Sf | Hotels, Restaurants, and Leisure | 60.9 | −18.3 | −457% | 36.1 | 117 | 30.54 | −55.88% | N/A | 1.7 | 80.04% | −70.00% |

| 31. | Energopol-Południe | 35_EnP | Construction and Engineering | 25.1 | −3.0 | −128% | 24.1 | 338 | N/A | N/A | −1.7 | 1.5 | 13.83% | 41.89% |

| 32. | Pol-Mot Warfama | 36_Pmot | Machinery | 34.5 | −1.2 | −106% | 32.0 | 518 | 6.06 | N/A | N/A | N/A | −20.33% | 33.33% |

| 33. | Kolastyna | 37_Kol | Chemicals | 23.8 | −2.8 | −124% | 44.4 | 406 | 10.30 | −71.50% | N/A | N/A | 24.09% | 20.61% |

| 34. | Polimex-Mostostal | 38_Pmos | Construction and Engineering | 1224.3 | 40.0 | −90% | 966.6 | 6359 | 391.24 | −65.42% | N/A | N/A | 7.81% | −13.89% |

| 35. | Lena Lighting | 39_Len | Machinery | 35.0 | 0.5 | −98% | 34.2 | 138 | 8.92 | −75.12% | N/A | 0.9 | 16.02% | −21.38% |

| 36. | Decora | 40_Dec | Construction and Engineering | 86.6 | 0.0 | −100% | 80.3 | 746 | 29.93 | −72.41% | N/A | N/A | 18.60% | −22.22% |

| 37. | Pfleiderer Group | 41_Pfl | Paper and Forest Products | 420.2 | −4.1 | N/A | 523.9 | 585 | 25.91 | −86.91% | N/A | N/A | 9.35% | −33.64% |

| 38. | Kopex | 42_Kop | Construction and Engineering | 564.3 | 24.3 | −99% | 918.8 | 382 | N/A | N/A | N/A | N/A | N/A | N/A |

| 39. | KPPD | 43_KPPD | Paper and Forest Products | 59.7 | −0.2 | −94% | 32.2 | 1293 | 6.00 | −84.46% | N/A | 0.6 | 10.50% | −13.24% |

| 40. | Optopol Technology | 44_Opt | Health Care Providers and Services | 19.8 | 0.6 | −86% | 35.3 | 186 | N/A | N/A | N/A | N/A | −22.08% | 32.30% |

| 41. | Plastboks | 45_PlaB | Chemicals | 19.9 | 0.2 | −98% | 25.0 | 210 | 15.55 | 54.95% | N/A | N/A | −31.37% | −1.36% |

| 42. | Indykpol | 46_Ind | Food Products | 217.9 | −6.5 | −109% | 110.8 | 1320 | 20.71 | −79.66% | N/A | N/A | 26.80% | −28.07% |

| 43. | Mieszko | 47_Mie | Food Products | 65.4 | 1.6 | −85% | 63.9 | 755 | N/A | N/A | N/A | N/A | −4.24% | 24.55% |

| 44. | Trakcja | 48_Tra | Construction and Engineering | 226.2 | 15.9 | N/A | 214.7 | 286 | 181.38 | N/A | N/A | N/A | −16.97% | 27.34% |

| 45. | Mostostal Export | 49_Mos | Construction and Engineering | 48.2 | 10.7 | −74% | 60.2 | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| 46. | HTL-Strefa | 50_HTL | Health Care Providers and Services | 40.6 | 8.7 | 50% | 82.4 | 639 | N/A | N/A | N/A | N/A | −9.30% | −23.88% |

| 47. | Naftobudowa | 51_Naf | Construction and Engineering | 59.5 | 3.7 | −91% | 37.6 | 1136 | N/A | N/A | N/A | 3.0 | N/A | N/A |

| 48. | PJP Makrum | 52_Proj | Construction and Engineering | 59.9 | 4.0 | −88% | 45.9 | 795 | 22.63 | −66.15% | N/A | N/A | 35.98% | −24.85% |

| 49. | Śnieżka | 53_Sn | Construction and Engineering | 148.8 | 2.9 | −93% | 94.6 | 862 | 101.47 | −45.23% | N/A | N/A | 6.18% | −2.38% |

| 50. | Rafamet | 54_Rafam | Machinery | 33.5 | 0.6 | 29% | 44.4 | 458 | 16.35 | −43.40% | N/A | N/A | 8.68% | −11.54% |

| 51. | Zetkama | 55_Zet | Household Durables | 61.4 | 3.5 | −54% | 46.4 | 423 | N/A | N/A | N/A | N/A | N/A | N/A |

| 52. | Graal | 56_Gra | Food Products | 111.2 | 2.5 | −95% | 133.1 | N/A | N/A | N/A | 0.4 | N/A | 5.08% | 25.84% |

| 53. | PBG | 57_PBG | Construction and Engineering | 595.3 | 53.3 | −87% | 808.7 | 3977 | 756.90 | −35.53% | N/A | N/A | −5.85% | 7.41% |

| 54. | Amica | 58_Am | Machinery | 352.0 | 1.0 | −92% | 226.8 | 2512 | 18.40 | −60.83% | N/A | N/A | 11.48% | −5.36% |

| 55. | Koelner | 59_Koe | Construction and Engineering | 179.5 | −1.8 | −106% | 0.2 | 2154 | N/A | N/A | N/A | 0.6 | N/A | N/A |

| 56. | Alchemia | 60_Alch | Metals and Mining | 272.7 | 10.5 | −98% | 251.2 | 1868 | 502.71 | −27.92% | −22.0 | N/A | 41.74% | −32.27% |

| 57. | RAFAKO | 62_Raf | Machinery | 320.4 | −3.7 | N/A | 232.6 | 1797 | 57.25 | −74.01% | 10.6 | 5.1 | 3.05% | −8.22% |

| 58. | Famur | 63_Fam | Machinery | 310.0 | 16.8 | −96% | 372.7 | 3989 | 148.02 | −75.34% | N/A | N/A | 2.73% | −22.94% |

| 59. | ZREMB | 64_Zr | Machinery | 8.8 | 0.1 | −88% | 6.4 | 277 | 8.16 | N/A | 0.4 | N/A | −31.41% | 102.58% |

| 60. | Apator | 65_Ap | Machinery | 101.4 | 6.6 | −95% | 88.8 | 398 | 95.03 | −60.58% | N/A | N/A | 125.86% | −51.42% |

| 61. | Wielton | 66_Wie | Automobiles | 104.9 | 10.3 | −93% | 91.5 | 677 | 39.87 | N/A | N/A | N/A | −3.96% | −12.07% |

| 62. | ACE | 67_ACE | Automobiles | 112.1 | 0.1 | −100% | 97.3 | 893 | 2.73 | −86.83% | −5.1 | 7.2 | 22.27% | −33.15% |

| 63. | Stelmet | 68_Ste | Paper and Forest Products | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 37.0 | 8.40% | −28.95% |

| 64. | NASK | 69_Nas | IT Service | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 4.0 | N/A | N/A |

| Total | 18,971.2 | 17,486.4 | 83,141 | 4311.3 | 762.7 |

| 1 | To express PLN in EUR in this paper, we use the annual average PLN/EUR exchange rate of 2008, which is PLN/EUR 3.5132, and it has been counted based on the daily weighted average exchange rates published by the National Bank of Poland. Various estimates were reported by the Polish Financial Supervision Authority, mass media, and business associations. |

| 2 | The biggest losses on derivative deals to date have been recorded by Societe Generale SA in the amount of USD 7.16 billion. |

| 3 | OTC-traded products are customized transactions, and counterparty risk is significant. This is why some protections are negotiated bilaterally between the counterparties. For example, dealers usually establish a line of credit for each customer, which limits their net exposure, and collateralization is widely used as well (see, e.g., Hull 2012; Marthinsen 2018). |

| 4 | For an elaboration on the information asymmetry concept (see, e.g., Gancarczyk 2009). |

| 5 | A critique of financial innovation in academic literature has been vividly expressed, especially since the global financial crisis. |

| 6 | The 2007–2008 global financial crisis has put financial innovation high on policy-makers’ and regulators’ agendas (Allen and Yago 2010; Afzal and Gauhar 2020). |

| 7 | Complexity confines the ability of market participants to accurately value assets (Carlin et al. 2013). |

| 8 | In alphabetical order: Allied Irish Bank PLC, Barings Bank PLC, Chase Manhattan Corp., China Aviation Oil (Singapore) Corp., Codelco Corp., Credit Suisse, Daiwa Bank Ltd., Deutsche Morgan Grenfell, Drexel Burnham Lambert, EOTT Energy, Partners LP, Griffin Trading Co., Kidder Peabody Group Inc., Long-Term Capital Management, Merrill Lynch, Metallgesellschaft AG, National Australia Bank Ltd., National Westminster Bank, Orange County, Procter and Gamble, Societe Generale SA, Sumitomo Corp., The Common Fund of the United States, and TransCanada Pipelines Ltd. |

| 9 | Options are asymmetrical derivatives that give buyers (long position) the right, but not the obligation, to buy (call options) or sell (put options) the underlying asset at an agreed price on (European options) of before (American options) a specific date in the future (Marthinsen 2018). |

| 10 | National Bank of Poland (NBP) average exchange rate. |

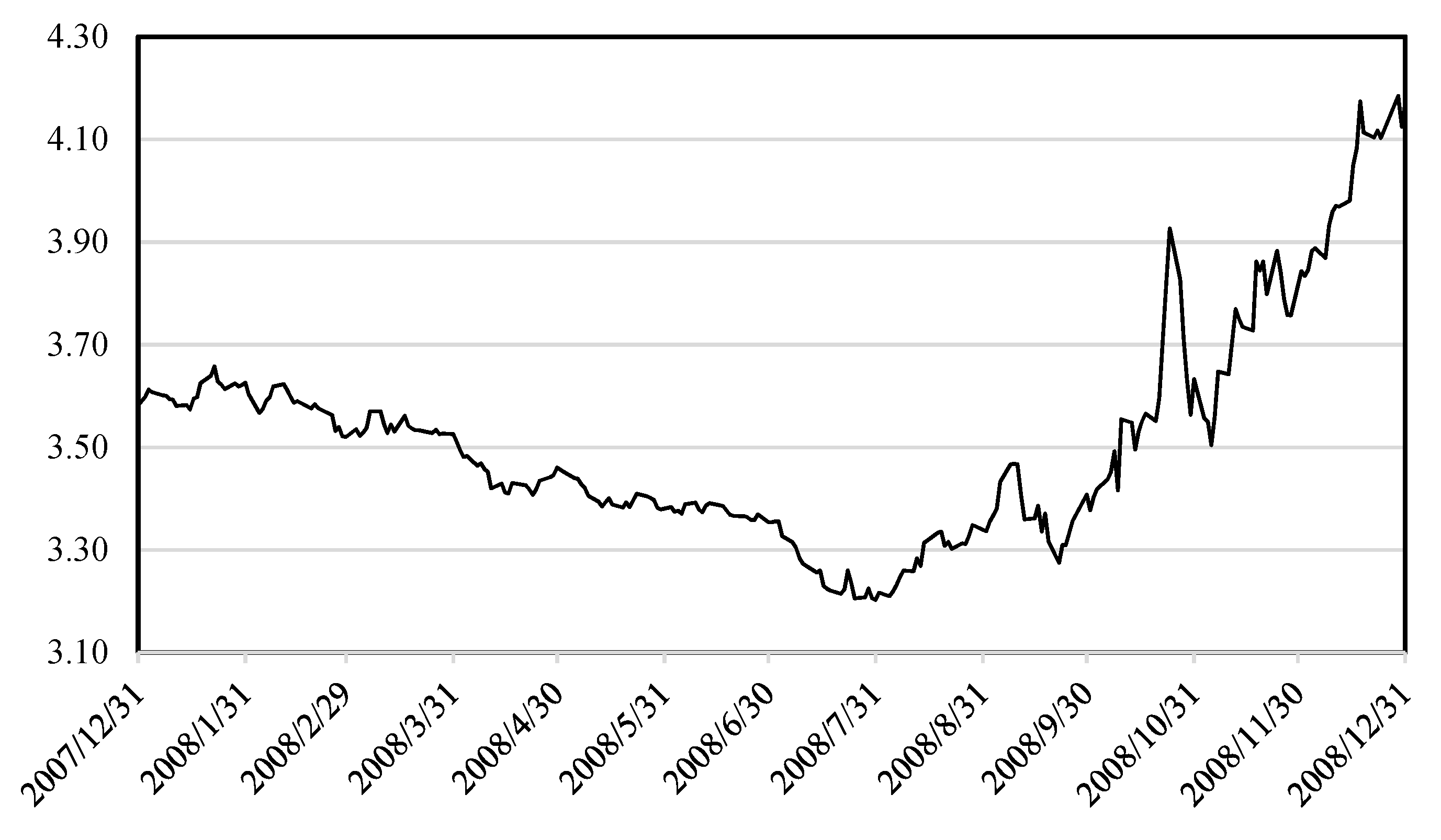

| 11 | The exchange rate crossed the 4 PLN/EUR barrier in December 2008. |

| 12 | On 24 September 2018, the decision of the FTSE Russell index agency, announced in 2017, came into force, reclassifying the Polish market from emerging to developed. On the other hand, MSCI Inc. still classifies Poland as an emerging market (as of November 2020). |

| 13 | When one understands innovation, based on the definition by Damanpour (1991, p. 556), as ‘the adoption of an internally generated or purchased device, system, policy, programme, process, product, or service that is new to the adopting organisation’, FX option strategies were innovative to Polish entrepreneurs in 2008—not only to particular companies, but to the emerging market economy of Poland as well. |

| 14 | No stop-loss for the company, only for the bank. |

| 15 | According to Statistics Poland, non-financial companies employing at least 50 people. |

| 16 | Factors other than the loss on derivatives may also have affected the result from financial activities. |

| 17 | The following companies were penalised, among others: Zakłady Azotowe Puławy S.A., Sfinks Polska S.A., Alchemia S.A., Paged S.A., Odlewnie Polskie S.A., Erbud S.A., Fabryka Mebli Forte S.A., Krośnieńskie Huty Szkła S.A., MIT Mobile Internet Technology S.A., and PKM Duda S.A. |

References

- Afzal, Ayesha, and Anusheh Ali Gauhar. 2020. The dark side of financial innovation: Deterrent for economic growth. Academy of Accounting and Financial Studies Journal 24: 1–11. [Google Scholar]

- Allen, Franklin. 2012. Trends in financial innovation and their welfare impact: An overview. European Financial Management 18: 4935–14. [Google Scholar] [CrossRef]

- Allen, Franklin, and Glenn Yago. 2010. Financing the Future: Market-Based Innovations for Growth. Upper Saddle River: Pearson Prentice Hall. [Google Scholar]

- Ancyparowicz, Grażyna. 2010. Współpraca banków z sektorem przedsiębiorstw w ochronie ryzyka kursowego w latach 2007–2009. Bezpieczny Bank 3: 22–44. [Google Scholar]

- Andrzejewski, Mariusz. 2010. Wyniki badań stosowania asymetrycznych, złożonych instrumentów pochodnych oraz próba konstrukcji rozwiązania problemu toksycznych opcji walutowych w Polsce–ujęcie mikro- i makroekonomiczne. In Rachunkowość Wobec Kryzysu Gospodarczego. Edited by Bronisław Micherda. Warszawa: Difin, pp. 117–37. [Google Scholar]

- Ashton, John K., and Robert S. Hudson. 2008. Interest rate clustering in UK financial services markets. Journal of Banking & Finance 32: 1393–403. [Google Scholar] [CrossRef] [Green Version]

- Beck, Thorsten, Tao Chen, Chen Lin, and Frank M. Song. 2016. Financial innovation: The bright and the dark sides. Journal of Banking & Finance 72: 28–51. [Google Scholar] [CrossRef]

- Bergstresser, Daniel. 2008. The Retail Market for Structured Notes: Issuance Patterns and Performance 1995–2008. Boston: Harvard Business School. [Google Scholar]

- Carlin, Bruce I. 2009. Strategic price complexity in retail financial markets. Journal of Financial Economics 91: 278–87. [Google Scholar] [CrossRef]

- Carlin, Bruce I., Shimon Kogan, and Richard Lowery. 2013. Trading Complex Assets. Journal of Finance 68: 1937–60. [Google Scholar] [CrossRef]

- Coe, Kevin, and Joshua M. Scacco. 2017. Content Analysis, Quantitative. In The International Encyclopedia of Communication Research Methods. Edited by Jörg Matthes, Christine Davis and Robert F. Potter. Hoboken: John Wiley & Sons. [Google Scholar] [CrossRef]

- Culp, Christopher L., and Merton H. Miller. 1995. Metallgesellschaft and the Economics of Synthetic Storage. Journal of Applied Corporate Finance 7: 2–14. [Google Scholar] [CrossRef]

- Damanpour, Fariborz. 1991. Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal 34: 555–90. [Google Scholar] [CrossRef]

- Daszyńska-Żygadło, Karolina, and Radosław Pastusiak. 2014. Zagrożenia w wykorzystaniu innowacji bankowych na przykładzie opcji toksycznych. Studia Ekonomiczne 186: 59–71. [Google Scholar]

- Diaz-Rainey, Ivan, and Gbenga Ibikunle. 2012. A taxonomy of the ‘dark side’ of financial innovation: The cases of high frequency trading and exchange traded funds. International Journal of Entrepreneurship and Innovation Management 16: 51–72. [Google Scholar] [CrossRef] [Green Version]

- Edward, Franklin R., and Michael S. Canter. 1995. The collapse of Metallgesellschaft: Unhedgeable risks, poor hedging strategy, or just bad luck? Journal of Futures Markets 15: 211–64. [Google Scholar] [CrossRef]

- Eisner, Elliot W. 1991. The Enlightened Eye: Qualitative Inquiry and the Enhancement of Educational Practice. Toronto: Collier Macmillan Canada. [Google Scholar]

- Frame, W. Scott, and Lawrence White. 2004. Empirical studies of financial innovation: Mostly talk and not much action? Journal of Economic Literature 42: 116–44. [Google Scholar] [CrossRef] [Green Version]

- Gabaix, Xavier, and David Laibson. 2006. Shrouded attributes, consumer myopia, and information suppression in competitive markets. Quarterly Journal of Economics 121: 505–40. [Google Scholar] [CrossRef]

- Gancarczyk, Marta. 2009. Asymetria informacyjna. Ekonomika i Organizacja Przedsiębiorstwa 11: 32–38. [Google Scholar]

- Gennaioli, Nicola, Andrei Shleifer, and Robert Vishny. 2012. Neglected risks, financial innovation, and financial fragility. Journal of Financial Economics 104: 452–68. [Google Scholar] [CrossRef] [Green Version]

- Global Derivatives Study Group. 1993. Derivatives: Practices and Principles. Washington, DC: The Group of Thirty, Available online: https://group30.org/images/uploads/publications/G30_Derivatives-PracticesandPrinciples.pdf (accessed on 12 January 2021).

- Gontarski, Waldemar. 2009. Toxic Currency Options. An Outline of the Theory of Law Illustrated with the Example of Polish Currency Options. Warsaw: Publishing House of the Polish Lawyers’ Association. [Google Scholar]

- Henderson, Brian J., and Neil D. Pearson. 2011. The Dark Side of financial innovation: The case of a retail financial product. Journal of Financial Economics 100: 227–47. [Google Scholar] [CrossRef]

- Hull, John C. 2012. Option, Futures, and Other Derivatives. Hoboken: Prentice Hall. [Google Scholar]

- Jacque, Laurent L. 2010. Global Derivative Debacles: From Theory to Malpractice. Singapore: World Scientific. [Google Scholar] [CrossRef]

- Jarrow, Robert A., and Maureen O’Hara. 1989. Primes and scores: An essay on market imperfections. Journal of Finance 44: 1263–87. [Google Scholar] [CrossRef]

- Karkowski, Paweł. 2009. Toksyczne Opcje. Od Zaufania do Bankructwa. Warsaw: Green Capital. [Google Scholar]

- Kasiewicz, Stanisław. 2010. Lustrzane odbicie zarządzania ryzykiem operacyjnym. Bezpieczny Bank 3: 80–91. [Google Scholar]

- Konopczak, Michał, Piotr Mielust, and Paweł Wieprzowski. 2011. Rynkowe aspekty problemów na pozagiełdowym rynku walutowych instrumentów pochodnych w Polsce w czasie globalnego kryzysu finansowego. Bank i Kredyt 42: 97–124. [Google Scholar]

- Kuprianov, Anatoli. 1995. Derivatives debacles: Case studies of large losses in derivatives markets. FRB Richmond Economic Quarterly 81: 1–39. [Google Scholar]

- Łasak, Piotr. 2019. Nadzór nad Sektorem Bankowym w Polsce w Świetle Zmian na Globalnym Rynku Finansowym. Kraków: Wydawnictwo Uniwersytetu Jagiellońskiego. [Google Scholar]

- Liberadzki, Kamil. 2010. Problem opcji walutowych w Polsce. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Poznaniu 143: 183–92. [Google Scholar]

- Marthinsen, John. 2018. Risk Takers: Uses and Abuses of Financial Derivatives. Berlin: Walter de Gruyter. [Google Scholar] [CrossRef]

- Merton, Robert C. 1982. On the microeconomic theory of investment under uncertainty. In Handbook of Mathematical Economics. Edited by Kenneth J. Arrow and Michael Intriligator. Amsterdam: North-Holland, pp. 601–69. [Google Scholar] [CrossRef]

- Merton, Robert C. 1992. Financial innovation and economic performance. Journal of Applied Corporate Finance 4: 12–22. [Google Scholar] [CrossRef]

- Miller, Merton H. 1986. Financial innovation: The last twenty years and the next. The Journal of Financial and Quantitative Analysis 21: 459–71. [Google Scholar] [CrossRef]

- Neuendorf, Kimberly A. 2002. The Content Analysis Guidebook. Thousand Oaks: Sage. [Google Scholar]

- Niedziółka, Paweł. 2009a. Analiza uwarunkowań powstania problemu opcji walutowych w Polsce—Perspektywa przedsiębiorstwa. Studia i Prace Kolegium Zarządzania i Finansów 96. Available online: https://ssl-kolegia.sgh.waw.pl/pl/KZiF/czasopisma/zeszyty_naukowe_studia_i_prace_kzif/Documents/z.%2096.pdf#page=75 (accessed on 12 January 2021).

- Niedziółka, Paweł. 2009b. Potencjalne rozwiązania problemu opcji walutowych w Polsce. Studia i Prace Kolegium Zarządzania i Finansów 94. Available online: https://ssl-kolegia.sgh.waw.pl/pl/KZiF/czasopisma/zeszyty_naukowe_studia_i_prace_kzif/Documents/z.%2094.pdf#page=161 (accessed on 12 January 2021).

- Pieta, Bartosz. 2013. Rzeczywiste źródła toksyczności opcji walutowych. Nauki o Finansach 1: 106–14. [Google Scholar]

- Puszer, Blandyna. 2012. Opcje walutowe w strategii finansowej polskich przedsiębiorstw. Studia Ekonomiczne 122: 205–19. [Google Scholar]

- Rogalski, Richard J., and James K. Seward. 1991. Corporate issues of foreign currency exchange warrants. Journal of Financial Economics 30: 347–66. [Google Scholar] [CrossRef]

- Sobolewski, Paweł, and Dobiesława Tymoczko. 2010. Development of the Financial System in Poland in 2008. Warsaw: Narodowy Bank Polski. [Google Scholar]

- The Wall Street Journal. 2008. Bad Bets, Big Losses. March 5. Available online: https://www.wsj.com/articles/SB120117383602713211 (accessed on 1 January 2021).

- Tufano, Peter. 2003. Financial innovation. In Handbook of the Economics of Finance. Edited by George M. Constantinides, Milton Harris and René Stulz. New York: Elsevier, vol. 1, pp. 307–35. [Google Scholar]

- White, Marilyn D., and Emily E. Marsh. 2006. Content analysis: A flexible methodology. Library Trends 55: 22–45. [Google Scholar] [CrossRef] [Green Version]

- Wisła, Rafał. 2008. Rynek Finansowych Instrumentów Pochodnych w Polsce w Latach 1991–2006. Kraków: Wydawnictwo Uniwersytetu Jagiellońskiego. [Google Scholar]

- WNP. 2021. Erbud Wygrał z Bankiem Millennium. Otrzyma około 100 mln zł. November 11. Available online: https://www.wnp.pl/budownictwo/erbud-wygral-z-bankiem-millennium-otrzyma-okolo-100-mln-zl,510005.html (accessed on 17 November 2021).

- Yin, Robert K. 2004. Case Study Research: Design and Methods (Applied Social Research Methods). London and Singapore: Sage. [Google Scholar]

- Zatoń, Wojciech. 2010. Żal i inne aspekty psychologiczne podejmowania decyzji finansowych na przykładzie problemu opcji walutowych w przedsiębiorstwach w Polsce w 2008 roku. In Prognozowanie w Zarządzaniu Firmą. Edited by Paweł Dittmann and Ewa Szabela-Pasierbińska. Wrocław: Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, vol. 103, pp. 274–86. [Google Scholar]

| Sampling Units | Types of Documents | No. of Units of Analysis |

|---|---|---|

| Press releases | Daily newspaper release * | 296 |

| Magazine ** | 41 | |

| Web service *** | 225 | |

| Public authorities accounts **** | Statement | 9 |

| Announcement | 3 | |

| Report | 10 | |

| Corporate statements ***** | Balance sheet | 54 |

| Profit and loss account | 54 | |

| Introduction and notes to the financial statements | 54 | |

| Statutory auditor’s opinion | 1 | |

| Letter from the management board or other | 1 | |

| Report of the management board on its activities | 5 | |

| Current report (other than annual) | 2 | |

| Total | 755 |

| No. | Industry by GICS | Listed Company | Non-Listed Company | Total |

|---|---|---|---|---|

| 1 | Construction and Engineering | 12 | 3 | 15 |

| 2 | Machinery | 9 | 1 | 10 |

| 3 | Chemicals | 7 | 1 | 8 |

| 4 | Food Products | 5 | 1 | 6 |

| 5 | Metals and Mining | 2 | 4 | 6 |

| 6 | Household Durables | 5 | 0 | 5 |

| 7 | Fuels | 2 | 0 | 2 |

| 8 | Paper and Forest Products | 3 | 1 | 4 |

| 9 | Automobiles | 3 | 1 | 4 |

| 10 | Health Care Providers and Services | 2 | 0 | 2 |

| 11 | Containers and Packaging | 0 | 1 | 1 |

| 12 | Building Products | 1 | 0 | 1 |

| 13 | Hotels, Restaurants, and Leisure | 1 | 0 | 1 |

| 14 | IT Services | 0 | 2 | 2 |

| 15 | Air Freight and Logistics | 0 | 1 | 1 |

| 16 | Aerospace and Defense | 0 | 1 | 1 |

| Total | 52 | 17 | 69 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sławik, A.; Bohatkiewicz-Czaicka, J. Financial Innovation of Mass Destruction—The Story of a Countrywide FX Options Debacle. Risks 2022, 10, 28. https://doi.org/10.3390/risks10020028

Sławik A, Bohatkiewicz-Czaicka J. Financial Innovation of Mass Destruction—The Story of a Countrywide FX Options Debacle. Risks. 2022; 10(2):28. https://doi.org/10.3390/risks10020028

Chicago/Turabian StyleSławik, Anna, and Joanna Bohatkiewicz-Czaicka. 2022. "Financial Innovation of Mass Destruction—The Story of a Countrywide FX Options Debacle" Risks 10, no. 2: 28. https://doi.org/10.3390/risks10020028

APA StyleSławik, A., & Bohatkiewicz-Czaicka, J. (2022). Financial Innovation of Mass Destruction—The Story of a Countrywide FX Options Debacle. Risks, 10(2), 28. https://doi.org/10.3390/risks10020028