1. Introduction

The Industrial Revolution 4.0 that is taking place nowadays means that organizations face not only new opportunities, but also challenges related to the identification of their role in creating a modern smart world (

Adamik and Sikora-Fernandez 2021). Now is a time of astonishing progress with digital technologies. While the transformations brought about by digital technologies are profoundly beneficial, digitization brings some thorny challenges, namely, in terms of employment and income distribution (

Gomes and Pereira 2020). In the 21st century, it is becoming increasingly clear that human activities and the activities of enterprises affect the environment. Therefore, it is important to learn about the methods by which companies minimize the negative effects of their activities (

Borowski 2021) by using robots. Digitization determines the creation of new or modified products, processes, techniques and the expansion of the company’s infrastructure, such as using robots (

Gajdzik and Wolniak 2021). Moreover, Industry 4.0 and the automation related thereof have a significant impact on competition between the companies (

Štefko et al. 2021).

Economy 4.0 is defined by the Fourth Industrial Revolution, which consists of historically the most advanced automation of the manufacturing processes in the cyber-physical environment. The environment is created by the following factors being combined online: people, machines, systems, processes, services and products. The driver of the revolution is an increase in innovativeness, efficiency and productivity, as well as more personalization of products and services. Authors have proved that automation contributes to the increase in prosperity (

Steigum 2011;

Acemoglu and Restrepo 2018,

2020;

Graetz and Michaels 2015;

Abeliansky and Prettner 2020;

Prettner 2019). Moreover, COVID-19 may accelerate the automation of jobs, as employers invest in technology to adapt their production processes to safeguard against current and potential future pandemics (

Chen and Lin 2020;

Chernoff and Warman 2020;

Chauhan 2021;

Ong 2020) and compensate for the unavailability of human workers (

Coombs 2020). The coronavirus pandemic has shifted all industries to remote-first, as business processes have been replaced by online business operations. Generally, sustainable business continuity becomes the most important priority just to ensure essential functions during and after a crisis, collapse, catastrophe, disaster, pandemic, etc. (

Siderska 2021).

The Fourth Industrial Revolution, accelerated by the impact of the COVID-19 pandemic, also carries some risk. One of the most important ones is replacing physical and mental work with automation and “artificial intelligence” in an unprecedented manner. Until the end of the twentieth century, machines replaced, above all, physical work, and in the twenty-first century, in combination with artificial intelligence, machines are now successfully competing with human intelligence. Experts predict that, by 2050, a lot of kinds of professions, not only those requiring simple physical skills, but also those requiring mental effort, may be more efficiently and better conducted by programmed machines than by people (see: e.g.,

Harari 2018, p. 39 and the following:

Remus and Levy 2016;

Parloff 2016). In 2013,

Frey and Osborne (

2013) calculated the probability of the continuing of 702 professions (factors) within 20 subsequent years. With a 90% probability, as many as 170 professions may disappear from the market, including accounting services, tax counselling, audit, the sales of insurance and financial products.

In such a situation, ensuring work, minimal income and decent living conditions occur is important. In the subject literature, certain methods of solving those problems are suggested. They may be divided into compensating activities and the loss of workplaces, as well as activities safeguarding the material situation of the unemployed.

Vivarelli and Pianta (

2000) provide a review of compensating activities, which include new machines and products, an increase in prices, new investment, and an increase in salaries or decreasing salaries. Within the activities geared towards providing security, solutions such as, among others, introducing a universal basic income, extending the catalogue of human activities considered to be labour (e.g., raising children, volunteering, voluntary organising of different kinds of things) and offering free-of-charge public services are suggested (

Morris and Hughes 2014;

Cottey 2014;

Van Parijs et al. 2006;

Atkinson 1995;

Walter 1989). These concepts are a subject of heated debates between the supporters and opponents of a welfare state (

Myerson 2014;

Matthews 2014;

Marchant et al. 2014).

Irrespective of the selection of the type of safeguarding activities, it is necessary to obtain financial means to cover their cost. In this light, introducing the additional taxation of enterprises which conduct the processes of labour automation is taken into account (

Huges 2014;

Cottey 2014).

Abbott and Bogenscheider (

2018) emphasize that such taxation should be neutral compared with the taxation before robotification in order not to worsen both the economic efficiency of enterprises as well as the fiscal situation of the state.

Moreover, taxes should also be considered in the international context with respect to high capital mobility and the threat of escaping to regions exhibiting more favourable tax conditions.

Those authors suggest the following tax solutions:

- (1)

A ban on applying tax breaks on the grounds of purchasing robots,

- (2)

Taxing “the robot” that replaces a physical person,

- (3)

Granting tax preferences to enterprises that employ people,

- (4)

An increase in the tax burden for entrepreneurs who do not employ people,

- (5)

An increase in the tax rate (income tax) imposed on these enterprises.

Gasteiger and Prettner (

2017), using the canonical overlapping generations (OLG) framework of

Diamond (

1965), prove that the taxation of robots may contribute to an increase in capital and per capita production in a state of balance, but does not lead to leaving economic stagnation. The authors share their previous opinion that robotification taxation should be considered within the international context, with the purpose of preventing the outflow of capital to regions with no such taxation.

The purpose of this article is to assess labour robotification taxation from the standpoint of the profitability of running an economic activity, as well as in the context of imposing additional taxes compensating for the loss of income experienced by the employee made redundant. Profitability is expressed by means of profitability, indebtedness and liquidity indicators. Our analysis consists of conducting a simulation of the financial situation of microenterprises in Poland, running financial activity in new conditions, using example data from 2018. The financial activity constituting the subject of the analysis includes accounting and bookkeeping services, as well as the services in tax counselling and the sales of financial and insurance products.

The choice of the subject of the research stems from several facts. First of all, the choice of Poland is due to the fact that the country is one of the countries with the lowest density of robots in Europe. The statistics of the International Robotics Federation (

ZPB 2021) show that the density of robots in industry in 2019 in Poland—expressed in the number of robots per 10 thousand employees—was 46, and turned out to be much lower than the world average (almost 100 units), and also lower than the rates in other countries of the region, such as Slovakia and Slovenia. On the other hand, the countries of the Far East and Germany remain the world leaders in the field of robotification (

IFR 2021).

Figure 1 presents the robotification density in selected countries in 2019.

At the same time, the Polish government intends to encourage enterprises to increase the level of robotification by introducing special income tax relief from 2022. Therefore, it is worth examining whether robotification may be profitable for Polish entrepreneurs. Second of all, microenterprises in Poland performing economic activities constitute a significant part of the economy. Within the years of 2013–2018, the number of microenterprises in total in Poland increased from 1.7 to 2.1 million. In 2018, they constituted 47.7% of the number of enterprises in total. Microenterprises employed almost 4.2 million people, which constituted as much as 24.6% of the number of active professionals. In 2018, microenterprises conducting financial activities constituted 2.8% of the number of microenterprises in total. More than 90.6 thousand people worked in this sector, which constituted almost 2.2% of the number of people employed in microenterprises in total. Third of all, the activities conducted within the realm of financial activity are significant for socio-economic development, and are considered to be within the group of activities that will be replaced the fastest by robots. Fourth of all, the subject scope of the analysis (the choice of types of activity) stems from the accessibility of empirical data. They come from two main sources: (1) the compilations of the

Main Statistical Office (

2020) and (2) the National Court Register database, a browser of financial documents,

www.ekrs.ms.gov.pl (accessed on 16 November 2021). These data were complemented with interviews with the selected bookkeeping offices. The analysis was carried out on the basis of data from 2018 only. During the preparation of the paper, these data are the most up to date; moreover, they are only to be used to build a model for researching the profitability of work robotification. Historical analysis and projection may be the subject of separate further analyses in subsequent papers. Finally, limited access to the financial data of microenterprises, as well as to data concerning the robotification of labour in microenterprises, led to the problem being overlooked. Two hypotheses are made in this article:

- (1)

Labour robotification increases the profitability of performing business activity for microenterprises providing financial counselling services, with the robotification of labour decreasing the cost of labour;

- (2)

Additional taxation of income on a level partially compensating the loss of remuneration obtained heretofore does not lower the profitability of running the activity of the microenterprises researched.

The paper relies on theoretical and methodological triangulation, using inductive and deductive reasoning, as well as descriptive and comparative analysis. A bibliometric analysis, based on the scientific papers in the Web of Science database relating to robotification and taxation in 1945–2020, reveals the niche in the analysed research area. The article fills part of the research gap. Based on the conducted bibliometric test relating to robot tax research, as well as according to the authors’ best knowledge, we assume that empirical studies on such simulations from a micro perspective are non-existent.

On the basis of theoretical assumptions, we conducted simulations in which a microenterprise is described by a set of equations, presenting financial results achieved in conditions corresponding to the average for the entire financial services industry. This corresponds to simulating how the average microenterprise will achieve financial results after replacing the work of employees with robots. In these simulations, we took into account the size of the enterprise, measured by the number of employees. We assumed that robots have limited computing power: they are currently capable of replacing four to five people. When determining the costs, we tried to make the simulated microenterprise as real as possible. Therefore, some cost items have only been partially reduced. For example, despite the implementation of the robotization of work, some activities are still performed by a human, such as servicing a robot. The company still needs a place for customer service. Therefore, the costs of renting office space are still incurred, but to a lesser extent than before robotization. A detailed description of the simulated economic values and the assumptions in which the simulations were carried out can be found in

Section 3.

The article consists of three main sections, apart from the introduction and the conclusion. In the first section, the core of the robotification is explained, and the possible manner of calculating the profitability of the process, including its taxation, are presented. In the second section, a model of the profitability of the activity of the microenterprises providing financial services before the robotification of labour is presented. In the third section, the profitability of the enterprises researched after robotification is presented, incorporating the conditions of lease agreements and the purchase of a loan for a robot, as well as the conditions of additional taxation.

This study offers this model as the basis of, as well as a benchmark for, an assessment of the change in financial results, profitability, indebtedness and the size of workflows as a result of replacing labour with robots. The authors of the article contribute to the discussion through the prism of economic practice.

2. Robotification of Labour within Financial Activity

The concept of a robot is still debated in the literature on the subject. A popular classification of robots is the division of them into pre-programmed robots, humanoid robots, autonomous robots, teleoperated robots and augmenting robots. In this sense, robots relate to a physical form and are generally used in manufacturing and physical services (

Built Robotics 2021). This paper, on the other hand, concerns the financial services that take place on the Internet and with the use of special software. In the literature on the subject, the use of such software is treated differently—as the robotification (automation) of work, but also as a process that does not meet the definition of a robot. This article discusses the automation of business-related services, including financial services. The concepts of the automation and robotification of financial services are used interchangeably.

The idea of a robot tax is pretty new and mostly unformed; nevertheless, it is beginning to gain the attention of researchers, managers, workers and policy makers in Europe and the United States (

Walker 2019). As presented in

Figure 1, the importance of a robot tax may depend on the level of robotization in a given country. The growing importance of a robot tax is observed both in science and in practice.

The literature on a robot tax yielded very fragmented and ambiguous findings, and it is difficult to generalize the results (e.g.,

Walker 2019;

Abbott and Bogenscheider 2018;

Zhang 2019;

Silkin 2019;

Sobczak 2019). Therefore, the authors of this work have applied a bibliometric method to determine the state-of-the-art research perspectives in the analysed area. Due to its popular use in the academic world (

Zyznarska-Dworczak 2017,

2018), Web of Science is selected as the key database for this study. The bibliometric study covers research into topics related to robotification and tax, and the database thus created contains only 56 publications, covering research articles, conference papers and review papers relating to the research area. Such a small number of publications indicates the initial development of the phenomenon, which is currently distinguished by a growing trend of publications and their citations in 2000–2020 (See

Figure 2).

According to

Figure 2, the beginning of tax and robotics research goes back one decade, and since then the amount of research has been systematically growing. Nevertheless, at the end of 2020, there was an exceptionally strong increase in the number of publications on a robot tax, which is a derivative of progressive robotification in practice. However, due to the different level of robotization in individual countries (

Figure 1), scientific interests will also be diversified geographically (

Table 1). The top most productive countries in the analysed area are the USA (30% of publications), Canada (9%) and Japan (7%), whereas countries with a lower level of robotization have less research in this area, such as Taiwan, Australia, Germany, China, Russia and Poland (4–5%).

Despite growing interest in robot tax research, the publications in this area have not yet achieved a high level of citations (

Table 2).

Table 2 indicates a relatively small response for the number of citations, which results from the fact that research in this area has been undergoing for only one decade. However, the pace of changes is so strong that it may indicate the high importance in the future research of the robot tax problem. At the moment, only five publications have a total citation rate of over 10 (

Table 3).

The research perspective presented in the most cited publications about a robot tax refers to the macro approach, as well as the sector’s perspective of this phenomenon (the robot-using sector;

Zhang 2019). Much focus is on parameterization (

Vishnevsky and Chekina 2018), income stabilization (

Shen et al. 2012), digital technologies and artificial intelligence (

Shen et al. 2012), technical and organizational issues (

Oh et al. 2005) and the displacement effect and the capital reallocation effect (

Zhang 2019). Additionally, the analysis of other publications from the Web of Science database did not indicate a focus on the perspective of the impact of the robot tax on the company’s financial situation. Thus, on this basis, the authors took it as a research gap.

As practice shows, financial activity is one of those industries in which the robotification of labour is faster. Robotification is one of the methods of automating business services, including financial activity (

Sobczak 2019). By automating business services (Eng. Business Process Automation, BPA), one ought to understand the process of replacing business activities conducted by man with software (algorithms). This software is programmed to conduct specific operations on its own, with specific functions automated and strictly adhered to. In such a case, we still need a person to begin, interrupt and finish a particular operation. The automation of business processes may undergo the process of robotification (ang. Robotic Process Automation, RPA). Robotification consists of the replacement of human labour with robots, which copy and replace the activities conducted by said person. The robot, thus created, operates on IT systems, applications and other application software in the same manner as an office employee. It logs in using the user’s interfaces, downloads and processes data, and enters the data into systems. Similarly, as in industry, robots in the service environment are used, above all, to conduct routine, repetitive operations (

Grycuk 2017, p. 146), e.g., registering invoices, generating orders, migrating data between systems, closing and opening accounts or verifying users in systems.

The most advanced type of automation is so-called cognitive automation, i.e., with the use of artificial intelligence (

KPMG 2016). It allows our machines to infer, learn and make decisions in the same manner as people do. Cognitive automation increases the possibilities RPA gives, allowing for the automation of certain kinds of work performed by experts. The main goal of business service automation is optimizing the tasks and processes by increasing their quality, speed, efficiency and efficacy. Robotification also lowers the risk of the occurrence of mistakes, and is potentially a countermeasure in the case of the problems with obtaining relevant employees.

One ought to emphasise, however, that the possibility of the robotification of labour within a particular organization depends on many factors, and the process may not always turn out to be feasible or profitable. The activities conducted within a company should be first verified in terms of the validity of their automation (

Surma and Łasocha 2020). The validity thereof may be expressed by means of the difference between the total cost of the implementation and the maintenance of the RPA and the financial benefits of robotification. The main financial benefits may be achieved as a result of time being saved to realize the tasks set to date, as well as a decrease in the number of workplaces. The cost of implementing the RPA depends on (1) the length and complexity of a particular process (task) and, at the same time, the time necessary to implement the RPA by programmers, (2) the stability of automated service applications (creating a robot that would be better at handling its own mistakes, crashes, etc., requires more time and expert knowledge) and (3) the technology applied, whereby the cost may significantly vary depending on the possibility of gaining access (open source or license fees), exploitation and device requirements.

Moreover, the manner of labour robotification taxation implemented by the state ought to be considered in the calculation. The solutions in that respect are varied. Tax reliefs for robotification were effective in the Far East countries, i.e., South Korea, Singapore and Taiwan, as well as in the United States and Italy (

MF 2021). However, high unemployment, over 17%, forced the South Korean authorities to introduce solutions that involved taxing corporations and discouraging the robotization of work in 2017 (

Silkin 2019). In the United States, labour robotification allows for avoiding the payment by the employer and a federal, state, and local employee of a tax on remuneration. Moreover, the regulations allow for the application of an accelerated amortization of the robot (

Abbott and Bogenscheider 2018, p. 150). In Poland, the government is planning to incorporate a so-called robotification tax break into income taxes. According to the project, one may deduct 50% of the cost borne by purchasing a robot from one’s tax payments (

MRiT 2020). In Russia, in turn, the Institute of Progressive Education suggested a 13% income tax deduction for the labour of robots (

Platforma Przemysłu Przyszłości 2020). The basis of taxation may be the average remuneration of a particular person in a particular profession. The taxation of labour robotification is also becoming a subject of debate in the European Union. In 2017, the European Parliament called for an EU-wide automation framework that would provide a framework for their development and implementation. Most European countries agreed that the increase in automation should be controlled, but were sceptical about its taxation. On the one hand, robotification may contribute to the loss of jobs for people but, on the other hand, its taxation may inhibit innovation and competition (

Silkin 2019).

The bibliometric test indicated that there is a research niche relating the profitability of the process of robotification in the microenterprises conducting financial activity. The assumptions adopted in the research are based on the research on robotification in the Polish industry conducted by the Institute of the Research on the Market Economy (

Łapiński et al. 2013, p. 23). The research shows that robotification increases manufacturing and sales, lowers the cost of manufacturing and improves profitability.

3. Modelling the Situation of the Microenterprise Implementing Labour Robotification

An average microenterprise was taken as the basis for simulating the activity of the enterprise implementing labour robotification (according to the Main Statistical Office research, these include “The activity of enterprises of the number of the employed up to 9 people in 2018”), which was taken from the “Financial and insurance activity” branch according to the Polish Classification of Activity in 2018. In the simulation, it was assumed that the robotification of an enterprise does not necessarily cause an increase in the number of customers (the scale of the sales was maintained), meaning that there was a strictly forecast decrease in the costs resulting from the reduction of employment. According to the hypotheses, the simulations assume the introduction of robotification by a business entity via two options: the purchase of a robot or the rental of a robot. The rates of purchasing and renting a robot were accepted in accordance with the current pricelists (

Antal 2018). It is, however, a cost that shall undergo a change as a result of the development of the robotification sector, as well as an increase in the capabilities of the robots themselves.

A model of a microenterprise contains a number of equations describing its financial situation. The simulations conducted aim to portray how the data taken into account in the equations shall behave at the moment of the change in the structure of the employment caused by robotification.

It required making the following assumptions:

- (1)

Within the company, there are at least two people employed;

- (2)

As a result of robotification, one person (the employer), as well as a technician responsible for the maintenance of a robot within the arrangement of one-quarter of a full-time job at average market rates, are employed;

- (3)

The size of offices is adjusted to the number of employees (in line with the average for Poland according to industry files). In the case of robotification, the area is twice as small (there remains the representative part and the server room);

- (4)

The level of the fixed assets and the assets is equal to the average level in the industry, according to the Polish Classification of Activity (according to the Main Statistical Office in 2020). In the case of purchasing a robot, it is considered in the fixed assets without changing the level of current assets;

- (5)

Foreign capital (a loan), not taking into account the loan to help purchase gold (of the purchasing variety), given to businesses, before and after robotification, is the same;

- (6)

The cost of mistakes and employee auditing constitute 5% of the sales (0% in the case of a robot);

- (7)

The rate of amortization was assumed to be at the level of 15%.

The equations describing the situation of a microenterprise (the accepted model of an enterprise) comprise the equations concerning the financial results, profitability, indebtedness, liquidity and profit. Values such as financial results, profitability and indebtedness were understood in the standard sense. The financial result describes the difference between revenues and costs, while costs incurred by the microenterprise include salary, office rental, amortization, materials, the cost of mistakes and audit, taxes and social insurance.

By reducing the number of employees at the time of the transition to robotization, the cost of their pay is 1.25 full-time jobs. One person employed in the company is responsible for customer service, and for financial services in the unusual situations for which the robot was unable to find an appropriate solution. Since the financial and accounting robots are complex systems, we have planned a part-time job for the person responsible for the ongoing maintenance of the robot. This can be either an employee of the company or a service provider who has been commissioned for servicing. Another cost component is the cost of renting an office. It was assumed that the enterprise incurs costs corresponding to renting a fully equipped workstation per employee at the average market prices for the country. When switching to robotization, the cost of renting an office is reduced by half. It was assumed that the enterprise’s employee and the technical employee will still need a place to work. Robots also physically occupy space in the company (in the so-called server room). In addition, the enterprise, when switching to robotization, may want to retain the option of changing the scale of operations (in the case of development, increasing the number of robots for which space in the server room will be needed, or in case that robotization fails, returning to the traditional business model). Amortization was adopted at the level corresponding to the average rate of amortization (14% for office machines and 20% for tools, instruments, movables and equipment). Because, in microenterprises providing financial services, most of the assets subject to amortization are office equipment, including computers, the rate of amortization at the level of 15% was adopted. The other cost components were calculated in the standard way. Profitability was calculated as ROA, while debt was assumed using a DR (debt ratio). At the time of the purchase of the robot using a loan, it was recognized both in total debt (loan amount) and total assets (as company assets). In the case of liquidity, we understand it as the ability to cover current liabilities with a surplus of funds that remain after paying fixed expenses (calculated as the sum of corporate costs without amortization, the interest paid on the loan on a robot, corporate taxes and a tax on robotification).

The last element of the simulated enterprise includes net profit, viewed as financial result minus due taxes, including robotization tax (in cases where its imposition on a microenterprise is simulated). In Polish conditions, part of the sum total was established based on the law in force, as well as the current macroeconomic situation. The simulated business entity should be taken as one that is in a good financial situation, i.e., one that could potentially take a decision on the robotification of business activity. The problem of restructuring a business entity that, as a result of robotification, aims to achieve financial results to protect against bankruptcy requires the adoption of additional assumptions, and is not the subject of the current research.

Therefore, current liabilities are given at the level of one-twelfth of the cost, which reflects the average size of the liabilities, accepting the settlement period as monthly. Based on the data included in our model (the

Main Statistical Office 2020), the revenue was assumed to be at the level of PLN 104,500 on average per employee. Additionally, it was assumed that the company functions rationally and all employees on average obtain such income. The assumption of rationality concerns a situation where excess employment does not occur in a simulated microenterprise. Additionally, based on the same research, foreign capital was assumed to be at the level of PLN 10,000 for a two-person company.

In the case of a simulation of a company employing more people,

foreign capital was assumed to be at the level of PLN 109,000. The size of the capital stems from the additional examination of the level of the indebtedness conducted on the sample of those microenterprises which published such data. The cost of purchasing the robot was estimated to be at the level of PLN 100,000 for the purpose of the simulation (according to

ceo.com.pl (accessed on 16 November 2021)), and it was accepted that one robot may replace the labour of four people at most. Based on the tax law in force, taxes were taken as a linear tax at the level of 19% (the data for 2018 did not encompass the new corporate income tax rates). Moreover, the interest was accepted at the level of 8% annually, which is relative to the average cost of the interest on loans in 2018.

The simulation of the state of the micro-entity was conducted in two stages. In the first stage, the comparison included what the amounts presented before and after introducing robotification in the model of the enterprise looked like. At this stage, we calculated the characteristics of the microenterprise (i.e., financial result, profitability, indebtedness and financial liquidity) for the enterprise providing services in a traditional way, and for the enterprise introducing the robotization of work with the presented assumptions. The tax rate on robotification was accepted at the level of 0%. Indirectly based on the results obtained at this stage, one may answer a question as to what form of robotification is more beneficial for a microenterprise: the purchase of the robot (together with the docking station and the server) or the rental of a robot (e.g., leasing agreements). At the second stage, the functioning of the microenterprise was simulated. It is a microenterprise which, at the moment of the complete robotification of labour for the first year, pays an additional tax on robotification. Progressive tax was accepted, dependent on the scale of redundancies in the micro-entity. The tax on robotification was calibrated in such a way as to allow, in the case of a two-person company, for the tax burden not to undergo any changes; for the nine-person company, the tax burden ought not to exceed 50% of the result. Finally, the tax on robotification is calculated as:

- -

Four percentage points for each job position eradicated within micro-entities employing between three and five people;

- -

Six percentage points for each job position eradicated within micro-entities employing between six and nine people.

The purpose of the research was to conduct a financial simulation of the micro-entity by taking into account the accepted assumptions to verify the hypotheses being tested in the article.

4. Discussion of the Results

Simulations concerning the change in the financial situation of the microenterprise in terms of the implementation of the automation of services at the first stage were conducted in terms of the following options:

- -

Taking into account purchasing a robot (the server, the docking station, the software: the cost of one robot is PLN 100,000), able to replace up to four people;

- -

Taking into account the rental (leasing arrangements) of the robot whose cost for one job position has been calculated as the cost of employee remuneration.

In the business within which it was decided a robot ought to be purchased, the option of having one part-time employee employed for one-quarter of a full-time arrangement for the servicing of the robot was considered. The cost of servicing and repair is, however, considered within the cost of renting the robot.

The micro-entities which decide to implement robotification as a result of reducing cost achieve higher net profit as compared with the traditional companies, irrespective of the form of robotification. The replacement by a robot of a single employee allows for achieving profit adequate to a company employing five people (

Figure 3).

Comparing business entities managed in a traditional manner (activities performed by a human being) with business entities deciding to implement robotification, an improvement of profitability and liquidity are highly visible. The improvement is bigger the more people are employed by the business entity. It is well worth remembering that, during the simulation, an increase in revenue from the sales of services was not assumed (a business entity retained the clients and contracts heretofore existing). Thus, all increases are caused by an improvement in the result of using labour-saving technology—it is, thus, caused by a reduction in the cost of managing a business entity. It is well worth remembering that the simulation includes the condition in which all employees work towards ensuring obtaining equal profit reflecting the average—it is, thus, a very good situation also for traditional companies. The effect of the model assumptions concerning the effective labour allocation is the observed linear increase in profitability, as well as liquidity, as compared with the number of people employed in the business entity before the robotification. Regarding the profitability of managing the business activity (

Figure 4), an advantage of renting a robot is visible. This is because the cost of renting a robot is factored into the broader costs, rather than considering the robot to be part of the company’s fixed assets (as it is in the simulation where the company uses its own robot).

A kind of a barrier preventing the micro-entities from purchasing a robot is a significant increase in debt. The indicator of indebtedness for companies employing above three people after the robotification conducted by means of purchasing a robot exceeds a safe level: foreign capital, as well as a loan, exceeds the wealth possessed by the simulated business entity (

Figure 5). The risk does not occur in the case of the option of renting a robot, with the company retaining a relatively high level of the increase in the resulting savings. However, the purchase of the robot allows for achieving better liquidity (

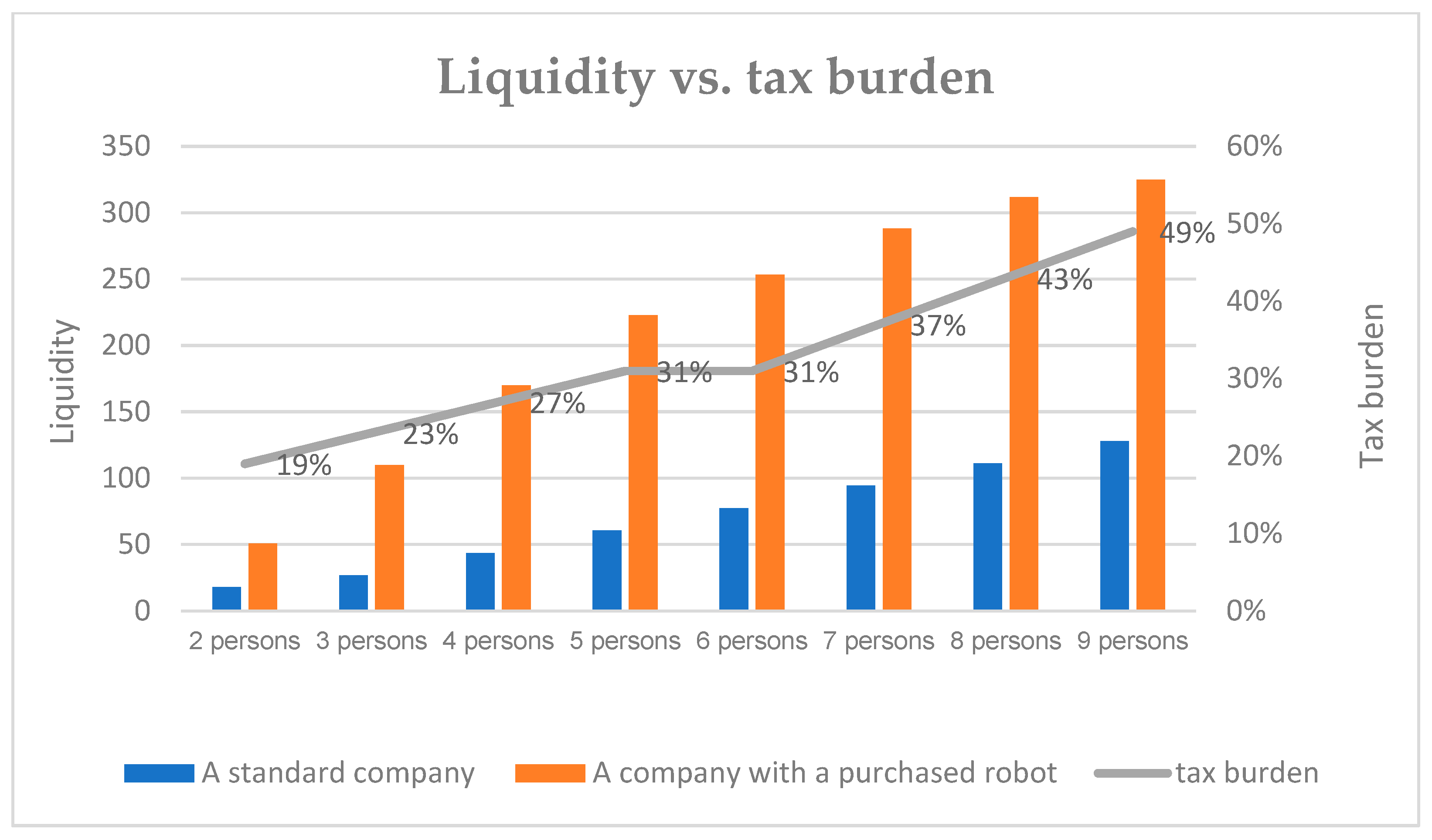

Figure 6) because the loan for the purchase of a robot will be repaid in the form of expenses (financial gear).

At the second stage of the simulation, the option of renting a robot was selected for the purpose of the increased tax levy.

Figure 7 shows what the liquidity of the simulated business entity looks like. It is a business entity which decided to rent a robot compared with the business entity which retained the traditional model of providing services. Additionally, the tax burden was also presented, resulting from imposing the additional tax on robotification. As one may observe, the liquidity of the business entity which rents a robot is remarkably higher than the liquidity of the business entity providing traditional services. It happens despite a significant tax burden reaching the level of 49% of the result. The case of profit is similar, where, despite an increased tax levy, the business entity after the robotification achieves higher profit. As in the variety of renting the robot, wealth does not change; therefore, the profitability coefficient remains at the same level.

The taxes on robotification are calculated in a progressive manner on the number of job positions eradicated.

The preliminary results of the research show that the first adopted hypothesis was partially confirmed. The attractiveness depends on the form of financing the robot and its value. For example, replacing work with just one robot worth PLN 100,000 (approx. EUR 22,000) purchased on credit reduces operating costs and significantly increases its attractiveness in terms of profitability and liquidity, while deteriorating the debt ratio. Despite the increase in the cost of purchasing a robot in the case of enterprises with six or more employees, and a lower increase in the liquidity and profitability ratios, these ratios remain more favourable for a long time than the variety without a robot. In the case of companies that lease a robot, a higher level of profitability and liquidity ratios can be noticed, while the debt ratio remains better than the variety without a robot. It seems that this form of robotification is the most beneficial for microenterprises.

Performed simulations demonstrate that the second hypothesis was also confirmed. We may notice two effects related to the taxation of microenterprises:

- -

The robotification of work, due to the reduction of operating costs, leads to an increase in the tax base and an increase in income tax compared to the variety without a robot. However, this burden will decrease with the increase in the cost of purchasing the robot and the introduction of investment incentives for the purchase of the robot;

- -

Robotification at the same time leads to a significant decrease in revenue from social security contributions compared to the variant without a robot.

As a result of the imposition of an additional tax related to the number of employees made redundant as a result of the robotification of work, the liquidity and profitability ratios decreased. However, still, a microenterprise introducing robotification by leasing a robot remains more profitable than a company run in a traditional manner.

The results of the simulation of the conducted study have a practical dimension, both in the macro and micro perspectives. The benefits and threats associated with the Fourth Industrial Revolution largely result from technological advancement, which, in turn, determines the functioning of the service market and the labour market. The conclusions from the study should also be very useful for the micro-companies providing financial services when making business decisions about replacing human work with robotification. The article creates a financial model that can be used to simulate attractiveness also due to other variables important from the point of view of running a business (costs, taxes, loan value, etc.). The model was created for microenterprises in Poland on the basis of average data for 2018; however, it is universal and, after changing the data, it can be applied to companies from other industries, including companies operating in foreign markets. The prospect of robotification in enterprise management gains particular importance in the conditions of a pandemic, which accelerates and sometimes forces the introduction and effective use of modern solutions based on work robotization.

5. Discussion

The novelty of the presented approach lies in the use of financial service automation in micro-entities as a basis to assess the efficiency of financial risk management. According to the authors’ best knowledge, and based on the conducted bibliometric test relating to robot tax research (see point 2), empirical studies on such simulations from a micro perspective are almost non-existent. Moreover, there is limited access to the financial data of microenterprises and data on the robotification of work in these companies, which points towards this problem being a research niche. Nevertheless, this study is part of the mainstream research demonstrating changes in the activities of modern enterprises under the influence of technological transformation. Moreover, the importance of research has also been heightened by the new conditions of economic activity in the COVID-19 pandemic, such as the risk of going-concern losses and the need to reduce employment due to market uncertainty, the unavailability of employees, remote service, work from home, etc. (i.e.,

Hassan and Resmi 2021;

Wang and Wang 2021). Our findings indicate that, in view of these new conditions of business, small entities have to reassess the financial risk and the impact of the decision regarding service robotification on the financial results and the chances of survival in the market.

In this study, we give an example of the simulation of changes in the activities of microenterprises providing financial services due to the robotization of work. The obtained results of this research can help process automation decision makers to understand the financial risk of the adoption of robots. Moreover, the proposed financial model can also be used to simulate the attractiveness due to other variables relevant to business (costs, taxes, loan value, etc).

The purpose of the paper is to contribute to the understanding of the potential impact of replacing human labour with robots on the financial situation of an entity. As presented, based on the Web of Science database, there is still a research niche in the area of robotification, the need to reduce its impact on the state’s revenues through taxation and, finally, the impact of taxation on the microenterprise, which, due to the necessary investment outlays, is not yet automated. As presented in

Figure 1, Poland has very low robotization rate, which is why Polish enterprises were the subjects of research. Some countries, such as Slovenia, Slovakia, France, China and Italy, also have low robotization rates, which is several times lower than the rate in Singapore and South Korea. Thus, an upward trend can be expected. Therefore, the approach presented in the paper may be universal as a basic approach showing that, with the given assumptions, it is possible and justified to apply a rational additional tax to companies that replace human work with robots. At the same time, it will be possible to compare the impact of robotification on the financial situation of domestic and foreign companies in historical terms.

The proposed model is a starting point for a discussion on its implementation in different years and in different countries. However, the verification and updating of domestic and foreign legal rules will be required. At the same time, it will be possible to compare the impact of robotification on the financial situation of domestic and foreign companies in historical terms. The use of this model to project the impact of robotification on companies is also possible, but it may be burdened with a greater error due to the volatility of tax regulations. Such research will be the subject of future papers.

The results of the analysis can also be used to make political and legislative decisions to mitigate the negative effects of robotification in the form of job losses and income. The paper shows that, with the given assumptions, it is possible and justified to apply a rational additional tax on companies that replace human work with robots.

6. Conclusions

The Fourth Industrial Revolution involves the significant automation of the processes in business entities, and the COVID-19 pandemic has contributed to the acceleration of those processes, additionally portraying the need for automating business in light of the inaccessibility of human capital. As a consequence, all the initiatives undertaken by enterprises seeking to transform themselves are observed, and they imply the need for recalculating the financial risk of robotification, as well as new financial forecasting methods, taking into account the influence of artificial intelligence and robots on the financial performance of business entities.

Our study makes several contributions to the writing on the subject matter, as well as to practice. It indicates a new approach to the analysis of the profitability of the robotification of financial services; thus, it also sheds a light on the efficiency of managing microenterprises, which are little inclined towards investing in new technology. This paper also contributes to the literature on the macroeconomic aspects of robotification by giving a new perspective on the inflows from the change of taxes upon the replacement of human labour by robots in small entities, a topic that has not been deeply investigated yet. Moreover, the research indicates, at the same time, that the significance of the anticipation of the impact of automating the financial services of micro-entities ought to be considered also from a macroeconomic standpoint, taking into account the fiscal impact of the changes. The companies providing financial and insurance services in Poland in 2018 are 60.5 thousand in number, with an income of almost PLN 101 bn (according to data from the

Main Statistical Office 2020), which means they generate PLN 1.2 bn in tax (with 19% of linear tax). At the same time, one may anticipate that the robotification of financial services may be implemented in 12,000 business entities, as a result of which 25,000 people may lose their jobs. The suggestion included in this article of a tax on account of robotification (resulting in the scale of redundancies of employees indicated) is almost PLN 200 million annually, with the assumption of the rates simulated. The amount of extra tax could be given to the people who were laid off (with 20% of the management cost), and this would amount to PLN 6.1 thousand annually or PLN 500 monthly.

The results of the simulations carried out indicate the possibility of introducing additional taxation of labour robotization in industries related to financial services at the level of microenterprises. In the case of large and very large enterprises, work robotization requires more specialized computer systems, which can be an additional barrier to robotization. Moreover, the assessment of the consequences for the state budget is slightly different, due to the possibility of activating the mechanisms of collective redundancies. This is an additional cost of social protection for dismissed workers, and can be used by management as an alternative to increasing the tax burden on robotization.

When analysing the simulation results, it should be remembered that it concerns a company in good financial condition achieving financial results equal to the industry average. The simulation of the robotization of work in such an enterprise will not always be appropriate for a specific microenterprise. Simulation research simply does not focus on individuals, but merely shows the average tendency or situation of the entity under study. Hence, in specific cases, there may be differences greater than the presented results.

The results of the research conducted are of practical value and universal applicability. They should be extremely useful for microenterprises providing financial services who are taking business decisions concerning the replacement of labour by means of robotification. Our research is an example of its practical use and understanding, but it may be widely used by companies from different sectors and diverse countries. Nonetheless, the simulations conducted concern a company in a good financial state, in relation to which a barrier against robotification—despite a significant expected improvement of the financial results—might turn out to be behavioural factors of people managing micro-entities, such as an unwillingness to change and “the destruction” of good business under the current circumstances. However, a strong counterbalance should be not only the financial benefits stemming from robotification, but also an improvement in the quality, speed and efficiency of the activities.

7. Limitations

The article has several limitations. First, only Poland was analyzed. This is due to the fact that Poland is one of the least roboticized industrialized countries in Europe and in the world. In 2019, the robotification density in Poland was only 46 pieces per 10,000 employees, and was much lower than the global average (almost 100), and was lower than the density in countries such as Slovakia (169) and Slovenia (157). The Polish government plans to introduce a special tax relief in income taxes from 2022 to stimulate the development of robotification. Consequently, it is worth examining whether the robotification of work can be profitable for Polish entrepreneurs.

Another restriction concerns the limitation of research to microenterprises operating in the financial services (business-related) sector. This choice is due to the fact that, on the one hand, the activities of these companies are important for the Polish economy and employment and, on the other hand, in line with labour market forecasts (

Frey and Osborne 2013), financial services will be roboticized as soon as possible. Moreover, so far, no attempt has been made to empirically investigate the impact of robotification on the activities of these enterprises.

Another limitation concerns the research period, because the analysis was carried out only on the basis of data from 2018. The article attempts to build a model to estimate the impact of the robotification of work on the profitability of running microenterprises in the financial services sector, and for this, data from one year are sufficient. It should also be emphasized that building such a model requires taking into account the very detailed legal solutions in force in a given year with regard to the construction of taxes and compulsory social security contributions. Therefore, the authors decided that this article will focus on one year. As a result, the developed model cannot be automatically applied to the analysis in the years preceding 2018. The analysis in each year requires the adjustment of the model to the applicable regulations in a given country.

Another limitation concerns the statistical data on the financial situation of microenterprises in Poland operating in the financial services sector. Although these data are regularly collected by the national statistical office, they concern only selected balance sheet items and selected costs and revenues. Therefore, in this article, it was possible to calculate only selected indicators. Additionally, some averaged statistical data were adjusted on the basis of direct interviews with microenterprises, e.g., accounting offices.