A Wavelet Analysis of the Dynamic Connectedness among Oil Prices, Green Bonds, and CO2 Emissions

Abstract

1. Introduction

2. Context of the Analysis and Literature Review

2.1. Context of the Analysis

2.2. Literature Review

3. Methodology

3.1. The Dataset

3.2. Wavelet Analysis

3.2.1. The Continuous Wavelet Transform (CWT)

3.2.2. Wavelet Power Spectrum

3.2.3. Wavelet Coherence

4. Application and Results

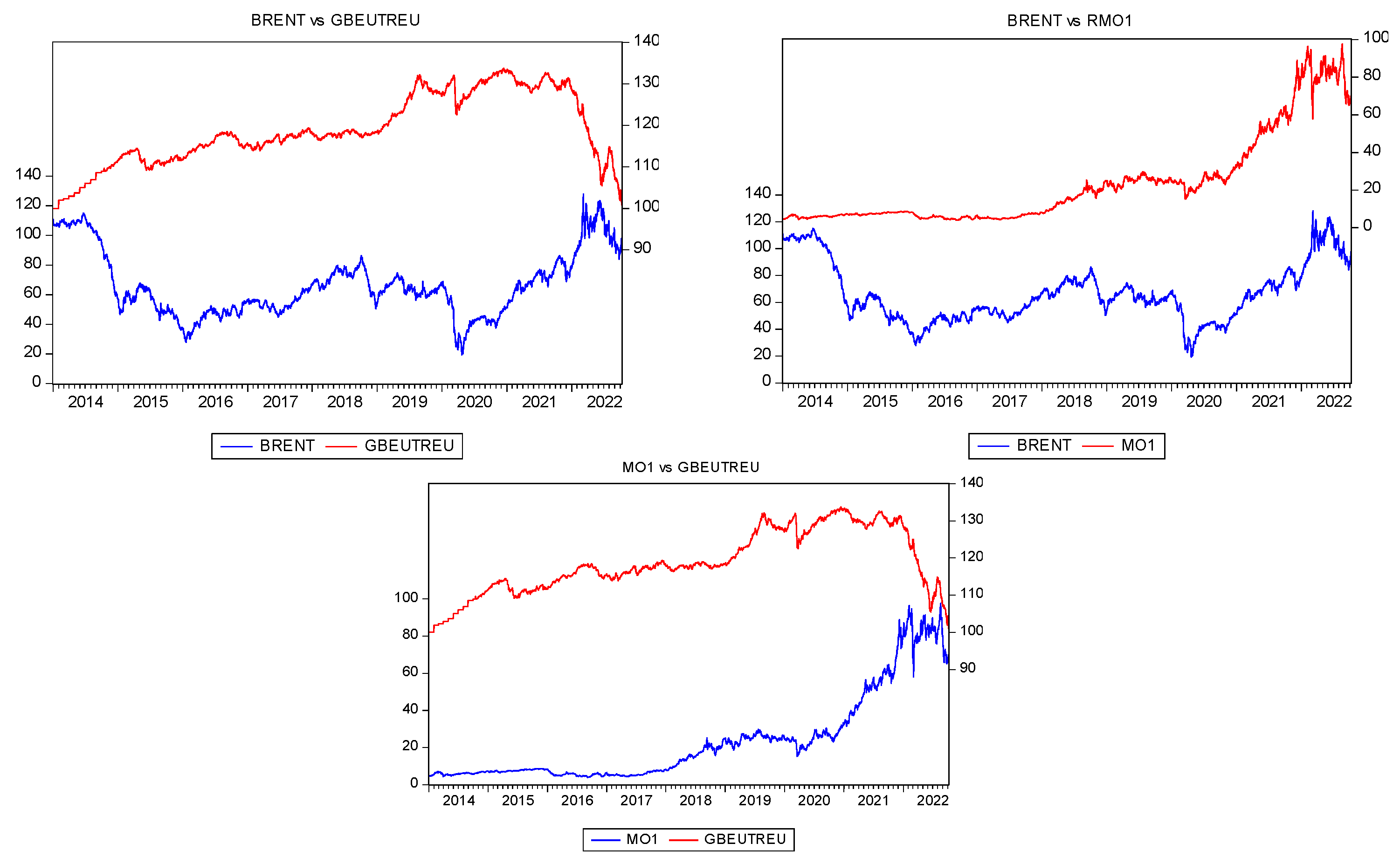

4.1. Unconditional Correlation Analysis

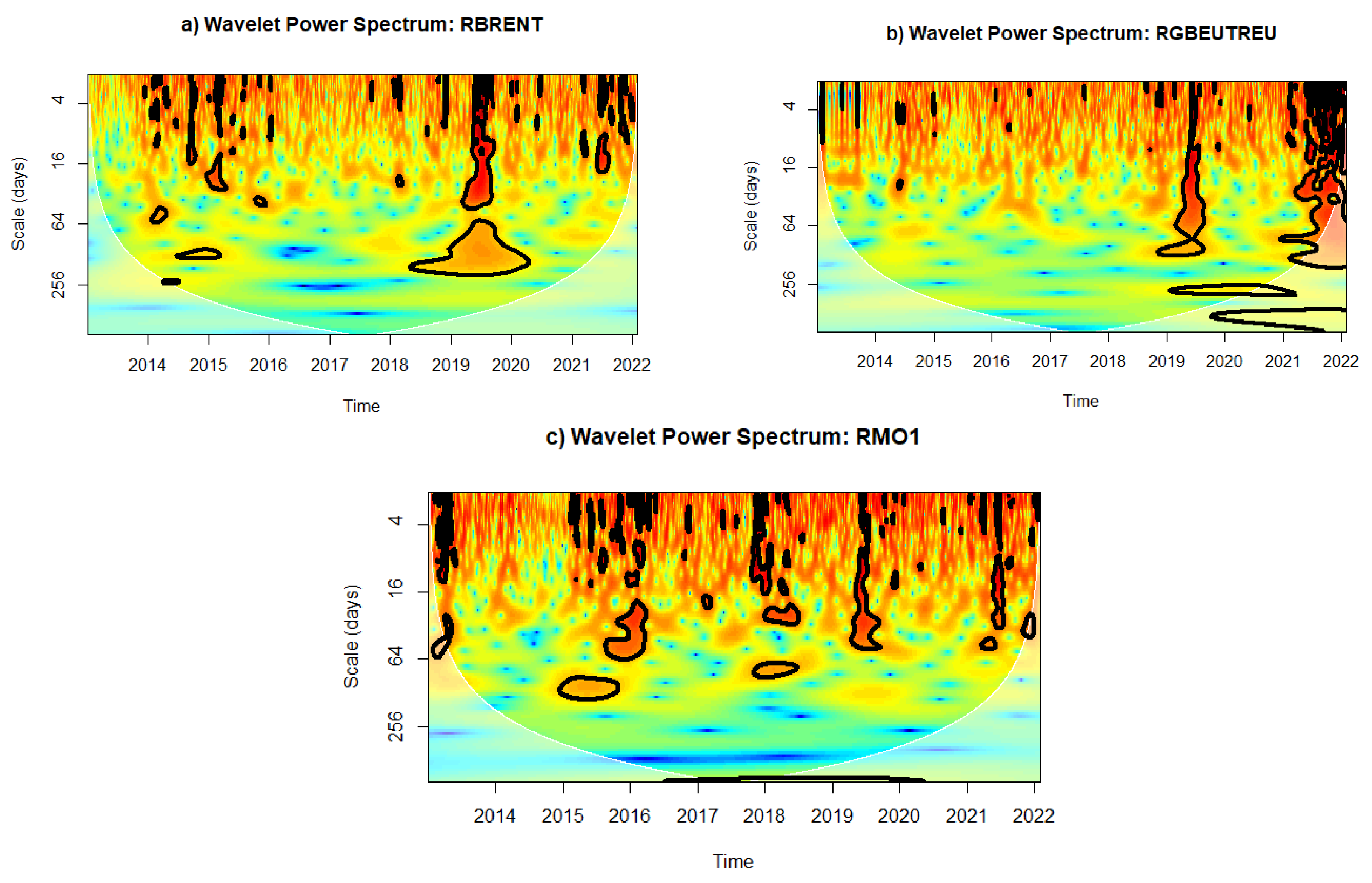

4.2. Wavelet Power Spectrum

4.3. Wavelet Coherence Approach

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Addison, Paul. 2017. The Illustrated Wavelet Transform Handbook. Boca Raton: CRC Press. ISBN 9781482251333. [Google Scholar]

- Agboola, Mary Oluwatoyin, Festus Victor Bekun, and Daniel Balsalobre-Lorente. 2021. Implications of Social Isolation in Combating COVID-19 Outbreak in Kingdom of Saudi Arabia: Its Consequences on the Carbon Emissions Reduction. Sustainability 13: 9476. [Google Scholar] [CrossRef]

- Aguiar-Conraria, Luís, and Maria Joana Soares. 2011. Oil and the Macroeconomy: Using Wavelets to Analyze Old Issues. Empirical Economics 40: 645–55. [Google Scholar] [CrossRef]

- Ahmed, Walid. 2022. On the Higher-Order Moment Interdependence of Stock and Commodity Markets: A Wavelet Coherence Analysis. The Quarterly Review of Economics and Finance 83: 135–51. [Google Scholar] [CrossRef]

- al Mamun, Md, Sabri Boubaker, and Duc Khuong Nguyen. 2022. Green Finance and Decarbonization: Evidence from around the World. Finance Research Letters 46: 102807. [Google Scholar] [CrossRef]

- Alhodiry, Ahmed, Husam Rjoub, and Ahmed Samour. 2021. Impact of Oil Prices, the U.S Interest Rates on Turkey’s Real Estate Market. New Evidence from Combined Co-Integration and Bootstrap ARDL Tests. PLoS ONE 16: e0242672. [Google Scholar] [CrossRef] [PubMed]

- Ali, Mumtaz, Turgut Tursoy, Ahmed Samour, Delani Moyo, and Abrahim Konneh. 2022. Testing the Impact of the Gold Price, Oil Price, and Renewable Energy on Carbon Emissions in South Africa: Novel Evidence from Bootstrap ARDL and NARDL Approaches. Resources Policy 79: 102984. [Google Scholar] [CrossRef]

- Alkathery, Mohammed, and Kausik Chaudhuri. 2021. Co-Movement between Oil Price, CO2 Emission, Renewable Energy and Energy Equities: Evidence from GCC Countries. Journal of Environmental Management 297: 113350. [Google Scholar] [CrossRef]

- Allen, Roy George Douglas. 1950. The Substitution Effect in Value Theory. The Economic Journal 60: 675. [Google Scholar] [CrossRef]

- Alshdadi, Abdulrahman, Malik Khizar Hayat, Ali Daud, Ameen Banjar, and Hussain Dawood. 2022. Measuring the Impact of COVID-19 Surveillance Variables over the International Oil Market. International Journal of Advanced and Applied Sciences 9: 27–33. [Google Scholar] [CrossRef]

- Apergis, Nicholas, and James Payne. 2015. Renewable Energy, Output, Carbon Dioxide Emissions, and Oil Prices: Evidence from South America. Energy Sources, Part B: Economics, Planning and Policy 10: 281–87. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Azhgaliyeva, Dina, Ranjeeta Mishra, and Zhanna Kapsalyamova. 2021. Oil Price Shocks and Green Bonds: A Longitudinal Multilevel Model. Tokyo: Asian Development Bank. [Google Scholar]

- Azhgaliyeva, Dina, Zhanna Kapsalyamova, and Ranjeeta Mishra. 2022. Oil Price Shocks and Green Bonds: An Empirical Evidence. Energy Economics 112: 106108. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, Daniel, Oana M. Driha, Festus Victor Bekun, Avik Sinha, and Festus Fatai Adedoyin. 2020. Consequences of COVID-19 on the Social Isolation of the Chinese Economy: Accounting for the Role of Reduction in Carbon Emissions. Air Quality, Atmosphere & Health 13: 1439–51. [Google Scholar] [CrossRef]

- Barsky, Robert, and Lutz Kilian. 2004. Oil and the Macroeconomy Since the 1970s. Journal of Economic Perspectives 18: 115–34. [Google Scholar] [CrossRef]

- Bassey, Enobong. 2015. Oil Price: Effect on Carbon Emission. Paper presented at the Carbon Management Technology Conference 2015: Sustainable and Economical CCUS Options, CMTC 2015, Sugar Land, TX, USA, November 17–19, vol. 1, pp. 37–51. [Google Scholar]

- Beirne, John, and Jana Gieck. 2014. Interdependence and Contagion in Global Asset Markets. Review of International Economics 22: 639–59. [Google Scholar] [CrossRef]

- Bloomfield, Peter. 2013. Fourier Analysis of Time Series: An Introduction, 2nd ed. New York: John Wiley & Sons. ISBN 04718899482. [Google Scholar]

- Bouoiyour, Jamal, Marie Gauthier, and Elie Bouri. 2023. Which Is Leading: Renewable or Brown Energy Assets? Energy Economics 117: 106339. [Google Scholar] [CrossRef]

- Bouri, Elie, Syed Jawad Hussain Shahzad, David Roubaud, Ladislav Kristoufek, and Brian Lucey. 2020. Bitcoin, Gold, and Commodities as Safe Havens for Stocks: New Insight through Wavelet Analysis. The Quarterly Review of Economics and Finance 77: 156–64. [Google Scholar] [CrossRef]

- Dibal, Peter Yusuf, Elizabeth Onwuka, James Agajo, and Caroline Alenoghena. 2018. Application of Wavelet Transform in Spectrum Sensing for Cognitive Radio: A Survey. Physical Communication 28: 45–57. [Google Scholar] [CrossRef]

- Dickey, David, and Wayne Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar] [CrossRef]

- Dong, Feng, Yujin Gao, Yangfan Li, Jiao Zhu, Mengyue Hu, and Xiaoyun Zhang. 2022. Exploring Volatility of Carbon Price in European Union Due to COVID-19 Pandemic. Environmental Science and Pollution Research 29: 8269–80. [Google Scholar] [CrossRef] [PubMed]

- Dutta, Anupam, Elie Bouri, and Md Hasib Noor. 2018. Return and Volatility Linkages between CO2 Emission and Clean Energy Prices. Energy 164: 803–10. [Google Scholar] [CrossRef]

- Dutta, Anupam, Elie Bouri, and Md Hasib Noor. 2021. Climate Bond, Stock, Gold, and Oil Markets: Dynamic Correlations and Hedging Analyses during the COVID-19 Outbreak. Resources Policy 74: 102265. [Google Scholar] [CrossRef] [PubMed]

- Elie, Bouri, Jalkh Naji, Anupam Dutta, and Gazi Salah Uddin. 2019. Gold and Crude Oil as Safe-Haven Assets for Clean Energy Stock Indices: Blended Copulas Approach. Energy 178: 544–53. [Google Scholar] [CrossRef]

- Fatica, Serena, and Roberto Panzica. 2021. Green Bonds as a Tool against Climate Change? Business Strategy and the Environment 30: 2688–701. [Google Scholar] [CrossRef]

- Ftiti, Zied, Khaled Guesmi, and Ilyes Abid. 2016. Oil Price and Stock Market Co-Movement: What Can We Learn from Time-Scale Approaches? International Review of Financial Analysis 46: 266–80. [Google Scholar] [CrossRef]

- Garfield, Eugene. 1970. Citation Indexing for Studying Science. Nature 227: 669–71. [Google Scholar] [CrossRef]

- Ghorbali, Bassem, Kamel Naoui, and Abdelkader Derbali. 2022. Co-Movement Among COVID-19 Pandemic, Crude Oil, Stock Market of US, and Bitcoin: Empirical Evidence from WCA. In Artificial Intelligence and COVID Effect on Accounting. Singapore: Springer, pp. 33–51. [Google Scholar] [CrossRef]

- Giuliodori, Andrea, Pascual Berrone, and Joan Enric Ricart. 2022. Where Smart Meets Sustainability: The Role of Smart Governance in Achieving the Sustainable Development Goals in Cities. BRQ Business Research Quarterly, 234094442210912. [Google Scholar] [CrossRef]

- Grinsted, Aslak, John Moore, and Svetlana Jevrejeva. 2004. Application of the Cross Wavelet Transform and Wavelet Coherence to Geophysical Time Series. Nonlinear Process Geophys 11: 561–66. [Google Scholar] [CrossRef]

- Gustafsson, Robert, Anupam Dutta, and Elie Bouri. 2022. Are Energy Metals Hedges or Safe Havens for Clean Energy Stock Returns? Energy 244: 122708. [Google Scholar] [CrossRef]

- Habib, Yasir, Enjun Xia, Zeeshan Fareed, and Shujahat Haider Hashmi. 2021. Time–Frequency Co-Movement between COVID-19, Crude Oil Prices, and Atmospheric CO2 Emissions: Fresh Global Insights from Partial and Multiple Coherence Approach. Environment, Development and Sustainability 23: 9397–417. [Google Scholar] [CrossRef]

- Hamilton, James. 1983. Oil and the Macroeconomy since World War II. Journal of Political Economy 91: 228–48. [Google Scholar] [CrossRef]

- Henriques, Irene, and Perry Sadorsky. 2008. Oil Prices and the Stock Prices of Alternative Energy Companies. Energy Economics 30: 998–1010. [Google Scholar] [CrossRef]

- Hudgins, Lonnie, Carl Friehe, and Meinhard Mayer. 1993. Wavelet Transforms and Atmopsheric Turbulence. Physical Review Letters 71: 3279–82. [Google Scholar] [CrossRef] [PubMed]

- Husaini, Dzul Hadzwan, Hooi Hooi Lean, and Rossazana Ab-Rahim. 2021. The Relationship between Energy Subsidies, Oil Prices, and CO2 Emissions in Selected Asian Countries: A Panel Threshold Analysis. Australasian Journal of Environmental Management 28: 339–54. [Google Scholar] [CrossRef]

- Jin, Jiayu, Liyan Han, Lei Wu, and Hongchao Zeng. 2020. The Hedging Effect of Green Bonds on Carbon Market Risk. International Review of Financial Analysis 71: 101509. [Google Scholar] [CrossRef]

- Kassouri, Yacouba, Faik Bilgili, and Sevda Kuşkaya. 2022. A Wavelet-Based Model of World Oil Shocks Interaction with CO2 Emissions in the US. Environmental Science & Policy 127: 280–92. [Google Scholar] [CrossRef]

- Kassouri, Yacouba, Kacou Yves Thierry Kacou, and Andrew Adewale Alola. 2021. Are Oil-Clean Energy and High Technology Stock Prices in the Same Straits? Bubbles Speculation and Time-Varying Perspectives. Energy 232: 121021. [Google Scholar] [CrossRef]

- Kilian, Lutz. 2009. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. American Economic Review 99: 1053–69. [Google Scholar] [CrossRef]

- Kirikkaleli, Dervis, and Hasan Güngör. 2021. Co-Movement of Commodity Price Indexes and Energy Price Index: A Wavelet Coherence Approach. Financial Innovation 7: 15. [Google Scholar] [CrossRef]

- Kumar, Surender, Shunsuke Managi, and Akimi Matsuda. 2012. Stock Prices of Clean Energy Firms, Oil and Carbon Markets: A Vector Autoregressive Analysis. Energy Economics 34: 215–26. [Google Scholar] [CrossRef]

- Lee, Chi-Chuan, Chien-Chiang Lee, and Yong-Yi Li. 2021. Oil Price Shocks, Geopolitical Risks, and Green Bond Market Dynamics. The North American Journal of Economics and Finance 55: 101309. [Google Scholar] [CrossRef]

- Li, Houjian, Deheng Zhou, Jiayu Hu, and Lili Guo. 2022. Dynamic Linkages among Oil Price, Green Bond, Carbon Market and Low-Carbon Footprint Company Stock Price: Evidence from the TVP-VAR Model. Energy Reports 8: 11249–58. [Google Scholar] [CrossRef]

- Lichtenberger, Andreas, Joao Paulo Braga, and Willi Semmler. 2022. Green Bonds for the Transition to a Low-Carbon Economy. Econometrics 10: 11. [Google Scholar] [CrossRef]

- Lin, Boqiang, and Yufang Chen. 2019. Dynamic Linkages and Spillover Effects between CET Market, Coal market and Stock Market of New Energy Companies: A Case of Beijing CET market in China. Energy 172: 1198–210. [Google Scholar] [CrossRef]

- Liu, Min. 2022. The Driving Forces of Green Bond Market Volatility and the Response of the Market to the COVID-19 Pandemic. Economic Analysis and Policy 75: 288–309. [Google Scholar] [CrossRef]

- Luo, Rundong, Yan Li, Zhicheng Wang, and Mengjiao Sun. 2022. Co-Movement between Carbon Prices and Energy Prices in Time and Frequency Domains: A Wavelet-Based Analysis for Beijing Carbon Emission Trading System. International Journal of Environmental Research and Public Health 19: 5217. [Google Scholar] [CrossRef]

- Maghyereh, Aktham, Basel Awartani, and Hussein Abdoh. 2019. The Co-Movement between Oil and Clean Energy Stocks: A Wavelet-Based Analysis of Horizon Associations. Energy 169: 895–913. [Google Scholar] [CrossRef]

- Mahmood, Haider, Alam Asadov, Muhammad Tanveer, Maham Furqan, and Zhang Yu. 2022. Impact of Oil Price, Economic Growth and Urbanization on CO2 Emissions in GCC Countries: Asymmetry Analysis. Sustainability 14: 4562. [Google Scholar] [CrossRef]

- Mahmood, Haider, and Maham Furqan. 2021. Oil Rents and Greenhouse Gas Emissions: Spatial Analysis of Gulf Cooperation Council Countries. Environment, Development and Sustainability 23: 6215–33. [Google Scholar] [CrossRef]

- Maji, Ibrahim Kabiru, Muzafar Shah Habibullah, and Mohd Yusof Saari. 2020. Does Oil Price Shocks Mitigate Sectoral Co2 Emissions in Malaysia? Evidence from Ardl Estimations. Kasetsart Journal of Social Sciences 41: 633–40. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero. 2022a. Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis. Sustainability 14: 12796. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero. 2022b. Dynamic Relationships among Green Bonds, CO2 Emissions, and Oil Prices. Frontiers in Environmental Science 10: 992726. [Google Scholar] [CrossRef]

- Mejía-Escobar, Juan Camilo, Juan David González-Ruiz, and Giovanni Franco-Sepúlveda. 2021. Current State and Development of Green Bonds Market in the Latin America and the Caribbean. Sustainability 13: 872. [Google Scholar] [CrossRef]

- Mensah, Isaac Adjei, Mei Sun, Cuixia Gao, Akoto Yaw Omari-Sasu, Dongban Zhu, Benjamin Chris Ampimah, and Alfred Quarcoo. 2019. Analysis on the Nexus of Economic Growth, Fossil Fuel Energy Consumption, CO2 Emissions and Oil Price in Africa Based on a PMG Panel ARDL Approach. Journal of Cleaner Production 228: 161–74. [Google Scholar] [CrossRef]

- Morlet, Jean, Georges Arens, Eliane Fourgeau, and Dominique Glard. 1982. Wave Propagation and Sampling Theory—Part I: Complex Signal and Scattering in Multilayered Media. Geophysics 47: 203–21. [Google Scholar] [CrossRef]

- Mujtaba, Aqib, and Pabitra Kumar Jena. 2021. Analyzing Asymmetric Impact of Economic Growth, Energy Use, FDI Inflows, and Oil Prices on CO2 Emissions through NARDL Approach. Environmental Science and Pollution Research 28: 30873–86. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Elie Bouri, Mabel D. Costa, Nader Naifar, and Syed Jawad Hussain Shahzad. 2021a. Energy Markets and Green Bonds: A Tail Dependence Analysis with Time-Varying Optimal Copulas and Portfolio Implications. Resources Policy 74: 102418. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Imen Mbarki, Majed Alharthi, Abdelwahed Omri, and Syed Jawad Hussain Shahzad. 2021b. Did COVID-19 Impact the Connectedness Between Green Bonds and Other Financial Markets? Evidence from Time-Frequency Domain with Portfolio Implications. Frontiers in Environmental Science 9: 1–15. [Google Scholar] [CrossRef]

- Nenonen, Suvi, Aapo Koski, Ari-Pekka Lassila, and Suvi Lehikoinen. 2019. Towards Low Carbon Economy—Green Bond and Asset Development. Paper presented at the IOP Conference Series: Earth and Environmental Science, Trondheim, Norway, November 6–7, vol. 352. [Google Scholar]

- Omane-Adjepong, Maurice, Paul Alagidede, and Nana Kwame Akosah. 2019. Wavelet Time-Scale Persistence Analysis of Cryptocurrency Market Returns and Volatility. Physica A: Statistical Mechanics and Its Applications 514: 105–20. [Google Scholar] [CrossRef]

- Ozturk, Melek, and Şeyma Çalışkan Cavdar. 2021. The Contagion of Covid-19 Pandemic on The Volatilities of International Crude Oil Prices, Gold, Exchange Rates and Bitcoin. Journal of Asian Finance, Economics and Business 8: 171–79. [Google Scholar] [CrossRef]

- Qureshi, Saba, Muhammad Aftab, Elie Bouri, and Tareq Saeed. 2020. Dynamic Interdependence of Cryptocurrency Markets: An Analysis across Time and Frequency. Physica A: Statistical Mechanics and Its Applications 559: 125077. [Google Scholar] [CrossRef]

- Rannou, Yves, Mohamed Amine Boutabba, and Pascal Barneto. 2021. Are Green Bond and Carbon Markets in Europe Complements or Substitutes? Insights from the Activity of Power Firms. Energy Economics 104: 105651. [Google Scholar] [CrossRef]

- Rao, Amar, Mansi Gupta, Gagan Deep Sharma, Mandeep Mahendru, and Anirudh Agrawal. 2022. Revisiting the Financial Market Interdependence during COVID-19 Times: A Study of Green Bonds, Cryptocurrency, Commodities and Other Financial Markets. International Journal of Managerial Finance 18: 725–55. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos, and Andrea Ugolini. 2020. Price Connectedness between Green Bond and Financial Markets. Economic Modelling 88: 25–38. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos, Miguel Angel Rivera-Castro, and Andrea Ugolini. 2017. Wavelet-Based Test of Co-Movement and Causality between Oil and Renewable Energy Stock Prices. Energy Economics 61: 241–52. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos. 2013. Modeling EU Allowances and Oil Market Interdependence. Implications for Portfolio Management. Energy Economics 36: 471–80. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos. 2015. Is There Dependence and Systemic Risk between Oil and Renewable Energy Stock Prices? Energy Economics 48: 32–45. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos. 2018. Green Bond and Financial Markets: Co-Movement, Diversification and Price Spillover Effects. Energy Economics 74: 38–50. [Google Scholar] [CrossRef]

- Ren, Xiaohang, Yiying Li, Cheng yan, Fenghua Wen, and Zudi Lu. 2022a. The Interrelationship between the Carbon Market and the Green Bonds Market: Evidence from Wavelet Quantile-on-Quantile Method. Technological Forecasting and Social Change 179: 121611. [Google Scholar] [CrossRef]

- Ren, Xiaohang, Yiying Li, Yinshu Qi, and Kun Duan. 2022b. Asymmetric Effects of Decomposed Oil-Price Shocks on the EU Carbon Market Dynamics. Energy 254: 124172. [Google Scholar] [CrossRef]

- Ren, Xiaohang, Yue Dou, Kangyin Dong, and Yiying Li. 2022c. Information Spillover and Market Connectedness: Multi-Scale Quantile-on-Quantile Analysis of the Crude Oil and Carbon Markets. Applied Economics 54: 4465–85. [Google Scholar] [CrossRef]

- Ren, Yi-Shuai, Seema Narayan, and Chao-qun Ma. 2021. Air Quality, COVID-19, and the Oil Market: Evidence from China’s. Economic Analysis and Policy 72: 58–72. [Google Scholar] [CrossRef]

- Rittler, Daniel. 2012. Price Discovery and Volatility Spillovers in the European Union Emissions Trading Scheme: A High-Frequency Analysis. Journal of Banking & Finance 36: 774–85. [Google Scholar] [CrossRef]

- Robledo, Sebastian, German Osorio, and Carolina Lopez. 2014. Networking En Pequeña Empresa: Una Revisión Bibliográfica Utilizando La Teoria de Grafos. Revista Vínculos 11: 6–16. [Google Scholar] [CrossRef]

- Rodriguez-Fernandez, Mercedes. 2016. Social Responsibility and Financial Performance: The Role of Good Corporate Governance. BRQ Business Research Quarterly 19: 137–51. [Google Scholar] [CrossRef]

- Royal, Saransh, Kamaljit Singh, and Ramesh Chander. 2022. A Nexus between Renewable Energy, FDI, Oil Prices, Oil Rent and CO2 Emission: Panel Data Evidence from G7 Economies. OPEC Energy Review 46: 208–27. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2009. Renewable Energy Consumption, CO2 Emissions and Oil Prices in the G7 Countries. Energy Economics 31: 456–62. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2012. Correlations and Volatility Spillovers between Oil Prices and the Stock Prices of Clean Energy and Technology Companies. Energy Economics 34: 248–55. [Google Scholar] [CrossRef]

- Saeed, Tareq, Elie Bouri, and Hamed Alsulami. 2021. Extreme Return Connectedness and Its Determinants between Clean/Green and Dirty Energy Investments. Energy Economics 96: 105017. [Google Scholar] [CrossRef]

- Shah, Muhammad Ibrahim, Matteo Foglia, Umer Shahzad, and Zeeshan Fareed. 2022. Green Innovation, Resource Price and Carbon Emissions during the COVID-19 Times: New Findings from Wavelet Local Multiple Correlation Analysis. Technological Forecasting and Social Change 184: 121957. [Google Scholar] [CrossRef]

- Singh, Sanjeet, Pooja Bansal, and Nav Bhardwaj. 2022. Correlation between Geopolitical Risk, Economic Policy Uncertainty, and Bitcoin Using Partial and Multiple Wavelet Coherence in P5 + 1 Nations. Research in International Business and Finance 63: 101756. [Google Scholar] [CrossRef]

- Su, Chi Wei, Yingfeng Chen, Jinyan Hu, Tsangyao Chang, and Muhammad Umar. 2022. Can the Green Bond Market Enter a New Era under the Fluctuation of Oil Price? Economic Research-Ekonomska Istrazivanja 36: 536–61. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, Emmanuel Joel Aikins Abakah, David Gabauer, and Richard Adjei Dwumfour. 2021. Green Bond, Renewable Energy Stocks and Carbon Price: Dynamic Connectedness, Hedging and Investment Strategies during COVID-19 Pandemic. SSRN Electronic Journal 1: 1–42. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, Emmanuel Joel Aikins Abakah, David Gabauer, and Richard Adjei Dwumfour. 2022. Dynamic Spillover Effects among Green Bond, Renewable Energy Stocks and Carbon Markets during COVID-19 Pandemic: Implications for Hedging and Investments Strategies. Global Finance Journal 51: 100692. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Gilbert Compo. 1998. A Practical Guide to Wavelet Analysis. Bulletin of the American Meteorological Society 79: 61–78. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Peter Webster. 1999. Interdecadal Changes in the ENSO–Monsoon System. Journal of Climate 12: 2679–90. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2017. Citation-Based Clustering of Publications Using CitNetExplorer and VOSviewer. Scientometrics 111: 1053–70. [Google Scholar] [CrossRef]

- Wang, Xiong, Jingyao Li, and Xiaohang Ren. 2022. Asymmetric Causality of Economic Policy Uncertainty and Oil Volatility Index on Time-Varying Nexus of the Clean Energy, Carbon and Green Bond. International Review of Financial Analysis 83: 102306. [Google Scholar] [CrossRef]

- Wei, Ping, Yiying Li, Xiaohang Ren, and Kun Duan. 2022. Crude Oil Price Uncertainty and Corporate Carbon Emissions. Environmental Science and Pollution Research 29: 2385–400. [Google Scholar] [CrossRef]

- Wen, Xiaoqian, Elie Bouri, and David Roubaud. 2017. Can Energy Commodity Futures Add to the Value of Carbon Assets? Economic Modelling 62: 194–206. [Google Scholar] [CrossRef]

- Zaghdoudi, Taha. 2017. Oil Prices, Renewable Energy, CO2 Emissions and Economic Growth in OECD Countries. Economics Bulletin 37: 1844–50. [Google Scholar]

- Zhang, Baoshuai, and Yuqin Zhou. 2022. Oil Prices, Emission Permits Trade of Carbon, and the Dependence between Their Quantiles. International Journal of Circuits, Systems and Signal Processing 16: 38–45. [Google Scholar] [CrossRef]

- Zheng, Yan, Min Zhou, and Fenghua Wen. 2021. Asymmetric Effects of Oil Shocks on Carbon Allowance Price: Evidence from China. Energy Economics 97: 105183. [Google Scholar] [CrossRef]

- Zhou, Xuefeng, Asif Razzaq, Korhan Gokmenoglu, and Faheem Ur Rehman. 2022. Time Varying Interdependency between COVID-19, Tourism Market, Oil Prices, and Sustainable Climate in United States: Evidence from Advance Wavelet Coherence Approach. Economic Research-Ekonomska Istrazivanja 35: 3337–59. [Google Scholar] [CrossRef]

- Zou, Xiaohua. 2018. An Analysis of the Effect of Carbon Emission, GDP and International Crude Oil Prices Based on Synthesis Integration Model. International Journal of Energy Sector Management 12: 641–55. [Google Scholar] [CrossRef]

| Variable | Ticker | Description |

|---|---|---|

| Oil Brent price | CO1 Comdty | Generic 1st Crude Oil, Brent |

| Green Bond Index | GBEUTREU Index | Bloomberg MSCI Euro Green Bond Index Total Return Index Value Unhedged |

| CO2 futures price | MO1 Comdty | CO2 futures price, Euros per ton |

| Index | Mean | Max | Min | Std. Dev. | Skew. | Kurt. | JB | ADF | LBQ (25) | LBQ2 (25) |

|---|---|---|---|---|---|---|---|---|---|---|

| RBRENT | −0.000063 | 0.1908 | −0.2798 | 0.0256 | −0.982 | 19.46 | 26198.4 * | −47.16 * | 48.36 [0.003] | 836.81 [0] |

| RGBEUTREU | 0.000004 | 0.0196 | −0.0196 | 0.0027 | −0.164 | 11.13 | 6315.4 * | −44.18 * | 61.73 [0] | 1655.0 [0] |

| RMO1 | 0.001145 | 0.162 | −0.1944 | 0.0292 | −0.527 | 7.61 | 2133.5 * | −50.34 * | 38.42 [0.042] | 306.21 [0] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marín-Rodríguez, N.J.; González-Ruiz, J.D.; Botero, S. A Wavelet Analysis of the Dynamic Connectedness among Oil Prices, Green Bonds, and CO2 Emissions. Risks 2023, 11, 15. https://doi.org/10.3390/risks11010015

Marín-Rodríguez NJ, González-Ruiz JD, Botero S. A Wavelet Analysis of the Dynamic Connectedness among Oil Prices, Green Bonds, and CO2 Emissions. Risks. 2023; 11(1):15. https://doi.org/10.3390/risks11010015

Chicago/Turabian StyleMarín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero. 2023. "A Wavelet Analysis of the Dynamic Connectedness among Oil Prices, Green Bonds, and CO2 Emissions" Risks 11, no. 1: 15. https://doi.org/10.3390/risks11010015

APA StyleMarín-Rodríguez, N. J., González-Ruiz, J. D., & Botero, S. (2023). A Wavelet Analysis of the Dynamic Connectedness among Oil Prices, Green Bonds, and CO2 Emissions. Risks, 11(1), 15. https://doi.org/10.3390/risks11010015