1. Introduction

Cryptocurrency investors frequently act irrationally in making investment decisions. This study explores how intergroup bias, subjective norms, and self-control factors influence the rationality of investment decisions. Empirical evidence has shown that investors do not always act rationally (

Ahmad and Wu 2022), including in the cryptocurrency market. Previous research has been conducted on the behavioral bias in the equity market (

Kumari et al. 2020;

Ahmad and Wu 2022;

Ahmad 2022;

Ahmed et al. 2022;

Lei and Salazar 2022;

Liang et al. 2022), commercial real estate market (

Kinatta et al. 2022), and cryptocurrency market (

Ryu and Ko 2019).

Ryu and Ko (

2019) have conducted exceptional research on cryptocurrency investment decisions, which shows that strong impulses and weak self-control impact speculative bitcoin investments. The study of behavioral bias can help in understanding individual investors from different environments, resulting in discrete investment decisions. An individual has a common tendency to imitate, refer, and observe other behavior, specifically in a declining or unstable market condition (

Yu et al. 2018;

Shah et al. 2019).

In this study, there are four types of behavioral bias: intergroup bias, subjective norms, overborrowing, and spending control. First, intergroup bias is a tendency to behave more positively and provide greater rewards for their group members than outside groups (

De Dreu and Kret 2016;

Fujino et al. 2020). Intergroup bias in this study is focused on bias originating from a secondary group of investors’ social environment, which is identical with lower intimacy and a lower frequency and duration of interaction—for example, religion-based groups or sports groups. Although group members have similar interests, the members’ purpose is to build social networks, bridging and bonding capital (

Lei and Salazar 2022) that can increase the members’ income and wealth status (

Zhang et al. 2018). This is consistent with the findings of

Chan et al. (

2022), which suggest that collectivist social values influence individual financial behavior due to a sense of solidarity in homogeneous communities. Furthermore, in a game task experiment, intergroup bias impacts individuals’ tendency to invest more in their group than in outside groups (

Fujino et al. 2020). Individual behavior that is more positive towards their group members potentially results in irrational investment decisions since the trust bias toward their group influences the investment decision. The social contagion theory supports this argument (

Bakker et al. 2010). Second, in the theory of planned behavior (TPB), subjective norms refer to beliefs about the expectations from peers and the most important persons to an individual, which motivates the individual to fulfill these expectations. Subjective norms in this study focus on a primary group of investors’ social environment: peers, the most important persons, and the price trend. Subjective norms are a significant determinant influencing investment decisions—for instance, adopting and using technology (

Ajzen 1991). Third, overborrowing reflects financial behavior related to high credit interest or excessive loans (

Kawamura et al. 2021). Overborrowing is frequently associated with the impulsive behavior of buying or investing without thinking about the future. Investors associated with high overborrowing behaviors have a propensity for investing in cryptocurrency, though in a high uncertainty period, they support an irrational investment decision. Finally, spending control bias is a compulsive buying behavior associated with unstable, self-inconsistent, and negative emotions and perceptions of oneself (

Liu and Zhang 2021). Weak spending control behavior can generate irrational investment decisions. However, studies on behavior bias in cryptocurrency investment decisions, particularly intergroup bias, subjective norms, and self-control bias, are still limited, and this motivates this study. To fill this gap, this study aims to expand on

Ryu and Ko (

2019) by examining whether intergroup bias, subjective norms, and self-control bias influence the investment decisions regarding whether to invest or not in the cryptocurrency market.

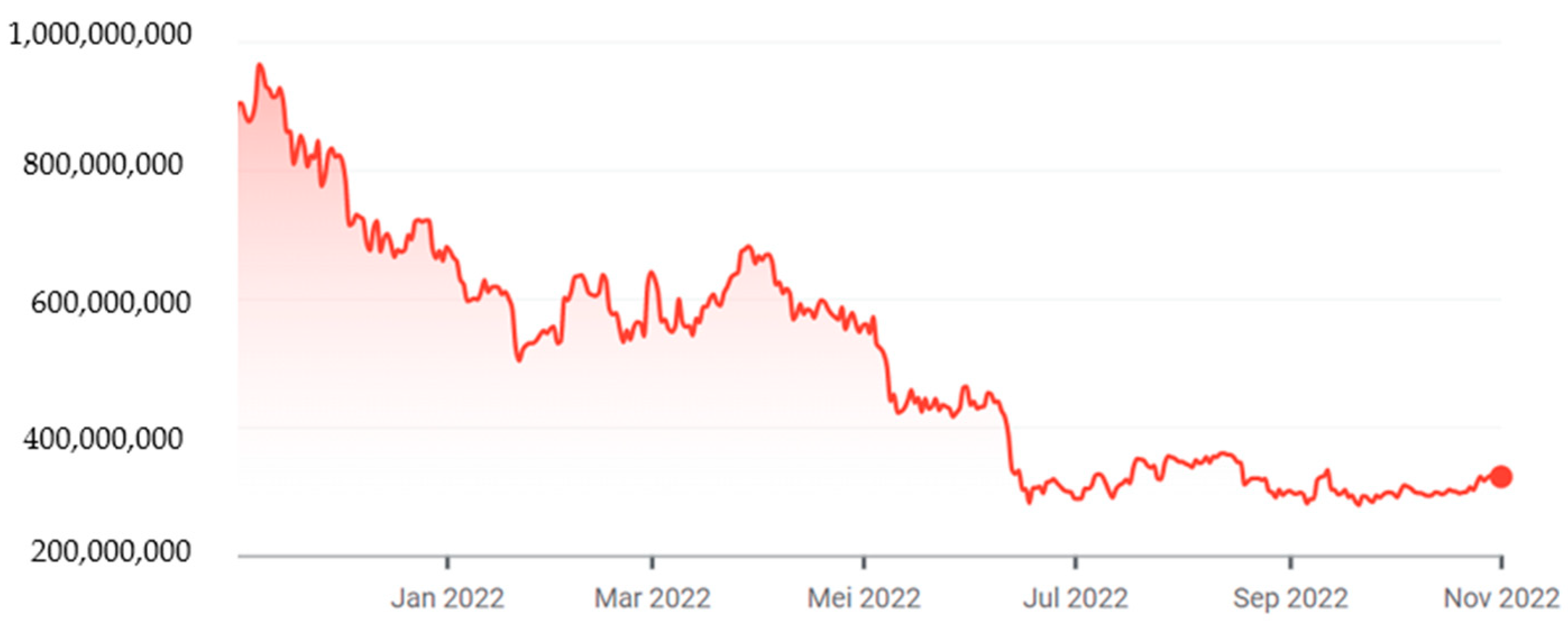

From 2021 until the third quarter of 2022, cryptocurrency markets faced enormous challenges, with a very significant decline in market value, even though there have been several small surges in the past few weeks. This study collected a survey from crypto owners regarding their decisions during that period. The first half of 2022 was a terrible period for the cryptocurrency market. Bitcoin and Ethereum, the two largest cryptocurrencies, declined by more than 50 percent from their highs in November 2021 (

Gailey and Haar 2022). Based on

Figure 1, the Bitcoin market, compared to the Indonesian Rupiah, had decreased by around 67% since its highest position on 8 November 2021 (963 million to 314 million on 20 August 2022, when the data collection was performed). The bearish market has the potential to influence investors’ perceptions as market participants as well as the social environment in which investors interact. Then, it has an impact on rational or irrational investors’ behavior in cryptocurrency investment decisions. Uncertainty conditions generally lead to various positive or negative attitudes in the social environment that can influence investors’ investment decisions. Investors who decided to invest or not invest in cryptocurrencies over the past year show that the dual-system perspective, which is a reflexive and reflective system, runs in harmony in the decision-making process. The reflexive system is fast, impulsive, automatic, and unconscious, whereas the reflective system is slow, controlled, conscious, and analytical (

Ryu and Ko 2019). The factors of intergroup bias, subjective norms, overborrowing, and spending control bias can trigger the dual-system perspective, resulting in rational or irrational behaviors in the investment decisions.

Positive or negative attitudes towards cryptocurrency investment originate from the investors’ social environment and create a more significant gap when the market is in a declining condition. The cryptocurrency market has unique characteristics that are different from those of conventional markets—for example, stocks and property markets. Cryptocurrencies provide a new alternative investment. Individuals believe that digital money is the money of the future (

Bhatt 2022), and the number of users is increasing progressively. However, cryptocurrencies are risky speculative investments despite their inherent digital future potential. Most Southeast Asian countries, including Indonesia, Malaysia, and Vietnam, consider cryptocurrency illegal as a medium of exchange but legal as an investment or commodity. In addition, Thailand has just started to tighten the regulation of cryptocurrencies (

Cointelegraph 2022). Therefore, it is critical for investors and potential investors to understand the applicable regulations and make decisions with a complete understanding of the potential risks.

Individual investors from the same geographic area were more likely to adopt biased behavior than cross-country investors (

Choi 2016). Indonesia has seen a 280 percent growth in the number of crypto investors since 2020, from 1.5 million to 4.2 million individuals, with a daily trading volume reaching USD 117.4 million (

Blockchain Association of Indonesia 2022). A study by

Gemini (

2022) entitled “Global State of Crypto Report” found that 41 percent of Indonesians between the ages of 18 and 75 with an income of more than USD 14,000 per year own cryptocurrencies. The research also found that 61 percent of Indonesian respondents agree that crypto is the future of money, which is the highest rate in the Asia Pacific (

Gemini 2022). This study uses data from the Indonesian cryptocurrency market for three main reasons. First, there has been an acceleration of digital economic growth in Indonesia after the COVID-19 pandemic. As the largest economy in Southeast Asia, Indonesia has shown a significant increase in the value of the digital industry, from USD 41 billion in 2019 to USD 77 billion in 2022. It is driven primarily by e-commerce (

Google, Temasek, Bain & Company 2022). The digital financial services increase is dominated by digital investment, which increased to 31% CAGR (Compound Annual Growth Rate) in 2022 and will increase to an estimated 74% CAGR in 2025 (

Google, Temasek, Bain & Company 2022). These data show the significant potential of Indonesia’s digital investment in Southeast Asia. Second, the number of individual Indonesian investors investing in cryptocurrency is greater than those investing in stocks in 2022. As of June 2022, the number of cryptocurrency investors was 15.1 million versus 9.1 million stock investors, despite the fact crypto investment is still relatively new in Indonesia (

CNBC Indonesia 2022). Third, cryptocurrency investors in Asia are dominated by the young generation (

Fujiki 2020,

2021;

Santoso and Modjo 2022), so they fit the Indonesian demographic profile. Based on data for 2022, 78 percent of Indonesian crypto owners are between the age of 18 and 44 (

TripleA 2022). Therefore, the Indonesian market provides a unique setting for researchers to analyze the influence of individual bias behavior on cryptocurrency investment decisions.

The findings of this study provide novel evidence supporting the dual-system perspective and contagion theory by emphasizing the importance of understanding the influence of intergroup bias, subjective norms, and self-control bias on investors’ rational or irrational behavior in the decision-making process. Recent studies investigate the effect of subjective norms and self-control (

Ryu and Ko 2019), financial literacy and investment experience (

Zhao and Zhang 2021;

Fujiki 2021), and attitude towards and trust in cryptocurrency investment decisions (

Stix 2021). This research is different from these studies in the following ways. First, although the

Ryu and Ko (

2019) study was conducted during the declining market of cryptocurrencies, the

Ryu and Ko (

2019) study did not discuss the intergroup bias factor and did not analyze which factors determine investment decisions in cryptocurrencies. Second, although

Zhao and Zhang (

2021),

Fujiki (

2021), and

Stix (

2021) found that several factors were proven to influence crypto owners’ investment decisions, their studies did not address intergroup bias, subjective norms, and self-control bias as factors influencing the decisions. Thus, this study is novel, since this study demonstrates that intergroup bias and subjective norms result in different stimuli for crypto owners’ investment decisions. Intergroup bias contributes to the decision to invest in the market despite the declining conditions. On the other hand, subjective norms contribute to the decision to not invest in cryptocurrencies when market conditions experience a significant decline. This study also finds that overborrowing can result in the irrational behavior of investors who keep investing in cryptocurrency in declining conditions.

This study contributes to the cryptocurrency literature in the following ways. First, this study contributes to the development of cryptocurrency literature in Asia, which is synonymous with a collectivist culture that is vulnerable to the contagion effect of investment behavior. It provides empirical evidence supporting dual-system and social contagion theories by identifying intergroup bias, subjective norms, and overborrowing bias as the impulsive factors contributing to the cryptocurrency investment decisions. Second, an analysis of individual investors’ biased behavior is performed in an extreme declining period which is still limited. During periods of significant market decline, the risk associated with cryptocurrency investments for owners with vulnerable risks, such as contagion risk and financial risk, increases. Therefore, irrational investors are more inclined to invest in cryptocurrency during adverse periods. Finally, this study enhances the behavioral finance literature on the rational and irrational behavior of crypto owners in making investment decisions by providing evidence of the effect of intergroup bias, subjective norms, and overborrowing bias on cryptocurrency investment decisions.

The discussion of this study is divided into several sections.

Section 2 discusses the literature review and hypothesis development.

Section 3 describes the research methodology, including the sample selection and analysis model.

Section 4 shows the results of the statistical tests, the interpretation of the results, and theoretical and practical implications. Finally,

Section 5 describes the conclusions, the limitations of the study, and potential future research.

5. Conclusions and Limitations

This study investigates whether intergroup bias, subjective norms, and self-control bias are predictors of crypto owners’ investment decisions over the past year of the declining cryptocurrency market. Self-control bias in this study explores two types of behaviors: overborrowing and spending control. The results reveal that intergroup bias and overborrowing are the most impulsive factors contributing to the cryptocurrency investment decision over the past year, especially in the heaviest period. The empirical results indicate that intragroup bias due to the contagion effect from secondary groups of investors’ social environments—for example, religious-based groups or sports clubs—encouraged investors to invest in the cryptocurrency market even though the market was in adverse conditions. Intergroup bias behavior that is more positive towards one’s group members than those outside the group potentially results in irrational behavior, since the trust bias toward one’s group influences the investment decision. The other finding is that overborrowing bias causes investors to behave irrationally, since instead of solving their debt problems, they prefer to spend their money on cryptocurrency investment in adverse market conditions.

In contrast, this study reveals that the subjective norm from the primary group of one’s social environment—for example, peers, the most important persons—and the market price influence the decision not to invest in the adverse cryptocurrency market. The subjective norm factor indicates the reflective system, which is slow, controlled, and analytical in making investment decisions during significant cryptocurrency price declines. The different results between the influence of subjective norms, intergroup bias, and overborrowing biased behaviors explain that there is a dual-system perspective, reflexive and reflective, which investors experience simultaneously and which influences investment decisions. When the impulsive and reflexive system reacts most strongly, investors can generate irrational behavior and make irrational investment decisions. However, the reflective perspective encourages rational behavior. Finally, spending control bias is unconfirmed as a predictor of cryptocurrency investment decisions.

This research has some limitations. First, the location of the crypto owner population cannot be determined. Alternatively, internet users are used as the population of crypto owners in this study. Since not all internet users are crypto owners, there is the possibility for differences between internet users and crypto owners. Second, with regard to the number of crypto owners that responded to this study, it is still necessary to gather additional samples from all over Indonesia in order for them to accurately represent cryptocurrency investors. Third, this study does not distinguish between investors who make direct or indirect investments through funding. Therefore, there is a potential for investment decisions to be biased due to the influence of fund managers. Finally, the model’s ability to anticipate the decision not to invest in cryptocurrency is greater than its ability to predict the decision to invest. In addition, the results of this study must be interpreted with caution due to the possibility of other factors predicting the decision during a gloomy phase. Therefore, it is anticipated that future studies will enhance the predictive model by incorporating more variables that have the ability to affect the choice to invest in cryptocurrencies during a gloomy phase.

For future studies, our research recommends developing a model including other biased behaviors and investors’ demographic variables that affect vulnerable decisions by cryptocurrency investors. Future research needs to explore the other dimension of bias behaviors, which are still extensive and should investigate the influence of biased behaviors on cryptocurrency investment decisions in international settings.