Unveiling the Role of Investment Tangibility on Financial Leverage: Insights from African-Listed Firms

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data and the Variables

2.2. Model Specification

2.3. Model Estimation

2.4. Economic Impact of Regression Results

2.5. Financial Constraints and Tax Shield

3. Results

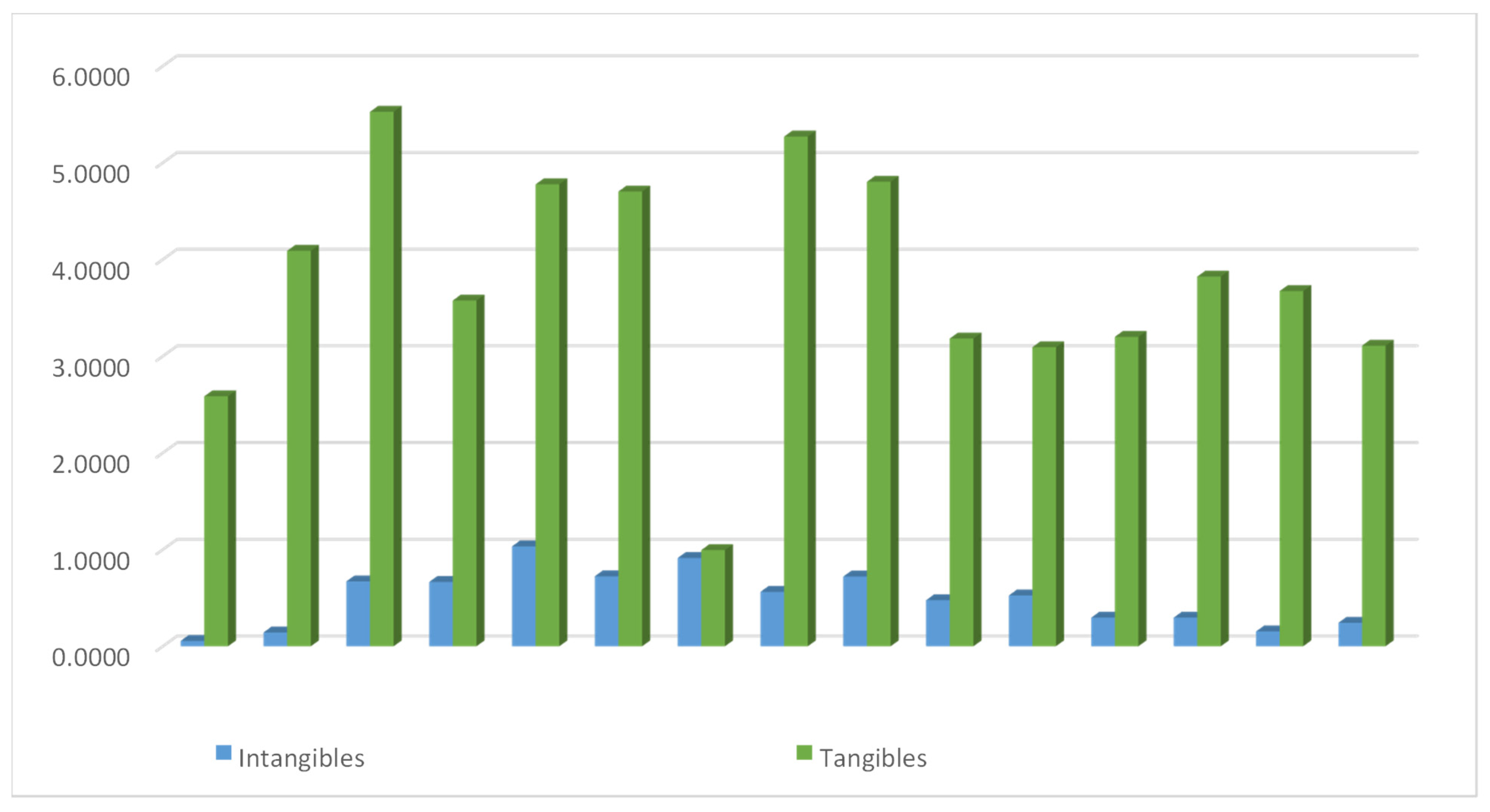

3.1. Trend Analysis

3.2. Descriptive Statistics

3.3. Regression Results

3.4. Economic Impact of Regression Results

3.5. Financial Constraints and Tax Shield

3.6. Model Specification Tests

4. Summary and Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Aivazian, Varouj A., Ying Ge, and Jiaping Qiu. 2005. The impact of leverage on firm investment: Canadian evidence. Journal of Corporate Finance 11: 277–91. [Google Scholar] [CrossRef]

- Akande, Joseph Olorunfemi, Farai Kwenda, and Dimu Ehalaiye. 2018. Competition and commercial banks risk-taking: Evidence from Sub-Saharan Africa region. Applied Economics 50: 4774–87. [Google Scholar] [CrossRef]

- Akhtar, Shumi, and Barry Oliver. 2009. Determinants of capital structure for Japanese multinational and domestic corporations. International Review of Finance 9: 1–26. [Google Scholar] [CrossRef]

- Al-Slehat, Zaher Abdel Fattah, C. Zaher, and A. Fattah. 2020. Impact of financial leverage, size and assets structure on firm value: Evidence from industrial sector, Jordan. International Business Research 13: 109–20. [Google Scholar] [CrossRef]

- Ansong, Eric, and Richard Boateng. 2019. Surviving in the digital era–business models of digital enterprises in a developing economy. Digital Policy, Regulation and Governance 21: 164–78. [Google Scholar] [CrossRef]

- Antoniou, Antonios, Yilmaz Guney, and Krishna Paudyal. 2008. The determinants of capital structure: Capital market-oriented versus bank-oriented institutions. Journal of Financial and Quantitative Analysis 43: 59–92. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Bae, John, Sang-Joon Kim, and Hannah Oh. 2017. Taming polysemous signals: The role of marketing intensity on the relationship between financial leverage and firm performance. Review of Financial Economics 33: 29–40. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81: 637–54. [Google Scholar]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Boujelben, Saoussen, and Hassouna Fedhila. 2011. The effects of intangible investments on future OCF. Journal of Intellectual Capital 12: 480–94. [Google Scholar] [CrossRef]

- Campello, Murillo, and Erasmo Giambona. 2011. Capital Structure and the Redeployability of Tangible Assets. Amsterdam: Tinbergen Institute. [Google Scholar]

- Corrado, Carol, Charles Hulten, and Daniel Sichel. 2009. Intangible capital and US economic growth. Review of Income and Wealth 55: 661–85. [Google Scholar] [CrossRef]

- Crouzet, Nicolas, and Janice Eberly. 2023. Rents and intangible capital: A q+ framework. The Journal of Finance 78: 1873–916. [Google Scholar] [CrossRef]

- D’Amato, Antonio. 2021. Does intellectual capital impact firms’ capital structure? Exploring the role of firm risk and profitability. Managerial Finance 47: 1337–56. [Google Scholar] [CrossRef]

- Daskalakis, Nikolaos, and Eleni Thanou. 2010. Capital Structure of SMEs: To What Extent Does Size Matter? Available online: https://ssrn.com/abstract=1683161 (accessed on 23 July 2023).

- DeAngelo, Harry, and Ronald W. Masulis. 1980. Optimal capital structure under corporate and personal taxation. Journal of Financial Economics 8: 3–29. [Google Scholar] [CrossRef]

- Deari, Fitim. 2009. The determinants of capital structure: Evidence from Macedonian listed and unlisted companies. Analele Stiintifice ale Universitatii “Alexandru Ioan Cuza” din Iasi-Stiinte Economice 56: 91–102. [Google Scholar]

- Ehie, Ike C., and Kingsley Olibe. 2010. The effect of R&D investment on firm value: An examination of US manufacturing and service industries. International Journal of Production Economics 128: 127–35. [Google Scholar]

- El Menyari, Younesse. 2019. Financial development, foreign banks and economic growth in Africa. African Development Review 31: 190–201. [Google Scholar] [CrossRef]

- Fang, Wen-Shwo, and Hsiu-Kan Lin. 2010. Do R&D expenditure, royalty and technology licensing expenses increase operational performance of the biotech industry in Taiwan? Problems and Perspectives in Management 8: 80–91. [Google Scholar]

- Ferrando, Annalisa, and Carsten Preuss. 2018. What finance for what investment? Survey-based evidence for European companies. Economia Politica 35: 1015–53. [Google Scholar] [CrossRef]

- Flannery, Mark J., and Kristine Watson Hankins. 2013. Estimating dynamic panel models in corporate finance. Journal of Corporate Finance 19: 1–19. [Google Scholar] [CrossRef]

- Ghirmay, Teame. 2004. Financial development and economic growth in Sub-Saharan African countries: Evidence from time series analysis. African Development Review 16: 415–32. [Google Scholar] [CrossRef]

- Goyal, Vidhan K., Kenneth Lehn, and Stanko Racic. 2002. Growth opportunities and corporate debt policy: The case of the US defense industry. Journal of Financial Economics 64: 35–59. [Google Scholar] [CrossRef]

- Graham, John. R., Mark T. Leary, and Michael R. Roberts. 2015. A century of capital structure: The leveraging of corporate America. Journal of Financial Economics 118: 658–83. [Google Scholar] [CrossRef]

- Hall, Bronwyn H., and Josh Lerner. 2010. The financing of R&D and innovation. In Handbook of the Economics of Innovation. Amsterdam: North-Holland, vol. 1, pp. 609–39. [Google Scholar]

- Hall, Thomas W. 2012. The collateral channel: Evidence on leverage and asset tangibility. Journal of Corporate Finance 18: 570–83. [Google Scholar] [CrossRef]

- Hamada, Robert S. 1972. The effect of the firm’s capital structure on the systematic risk of common stocks. The Journal of Finance 27: 435–52. [Google Scholar] [CrossRef]

- Harris, Milton, and Artur Raviv. 1991. The theory of capital structure. The Journal of Finance 46: 297–355. [Google Scholar] [CrossRef]

- Heyman, Dries, Marc Deloof, and Hubert Ooghe. 2008. The financial structure of private held Belgian firms. Small Business Economics 30: 301–13. [Google Scholar] [CrossRef]

- Horsch, Philipp, Philip Longoni, and David Oesch. 2021. Intangible capital and leverage. Journal of Financial and Quantitative Analysis 56: 475–98. [Google Scholar] [CrossRef]

- Jona-Lasinio, Cecilia, and Valentina Meliciani. 2018. Productivity growth and international competitiveness: Does intangible capital matter? Intereconomics 53: 58–62. [Google Scholar] [CrossRef]

- Koralun-Bereźnicka, Julia. 2013. How does asset structure correlate with capital structure?: Cross-idustry and cross-size analysis of the EU countries. Universal Journal of Accounting and Finance 1: 19–28. [Google Scholar] [CrossRef]

- Köksal, Bülent, Cüneyt Orman, and Arif Oduncu. 2013. Determinants of Capital Structure: Evidence from a Major Emerging Market Economy. MPRA Paper 48415. Munich: University Library of Munich. [Google Scholar]

- Lang, Larry, Eli Ofek, and RenéM Stulz. 1996. Leverage, investment, and firm growth. Journal of Financial Economics 40: 3–29. [Google Scholar] [CrossRef]

- Lev, Baruch. 2001. Intangibles: Management, Measurement, and Reporting. Washington, DC: The Brookings Institution. Lanham: Rowman & Littlefield. [Google Scholar]

- Liaqat, Idrees, Muhammad Asif Khan, József Popp, and Judit Oláh. 2021. Industry, firm, and country level dynamics of capital structure: A case of Pakistani firms. Journal of Risk and Financial Management 14: 428. [Google Scholar] [CrossRef]

- Lim, Steve C., Antonio J. Macias, and Thomas Moeller. 2020. Intangible assets and capital structure. Journal of Banking & Finance 118: 105873. [Google Scholar]

- Long, Michael S., and Ileen B. Malitz. 1985. Investment patterns and financial leverage. In Corporate Capital Structures in the United States. Chicago: University of Chicago Press, pp. 325–52. [Google Scholar]

- Maditinos, Dimitrios, Dimitrios Chatzoudes, Charalampos Tsairidis, and Georgios Theriou. 2011. The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital 12: 132–51. [Google Scholar] [CrossRef]

- Magli, Francesca, Alberto Nobolo, and Matteo Ogliari. 2018. The effects on financial leverage and performance: The IFRS 16. International Business Research 11: 76–89. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, uncertainty, and divergence of opinion. The Journal of Finance 32: 1151–68. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1963. Corporate income taxes and the cost of capital: A correction. The American Economic Review 53: 433–43. [Google Scholar]

- Muñoz, Francisco. 2013. Liquidity and firm investment: Evidence for Latin America. Journal of Empirical Finance 20: 18–29. [Google Scholar] [CrossRef]

- Myers, Stewart C. 1977. Determinants of corporate borrowing. Journal of Financial Economics 5: 147–75. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Norkio, Antti. 2023. Intangible capital and financial leverage in SMEs. Managerial Finance ahead-of-print. [Google Scholar] [CrossRef]

- Park, Yoon Soo, Lars Konge, and Anthony R. Artino Jr. 2020. The positivism paradigm of research. Academic Medicine 95: 690–94. [Google Scholar] [CrossRef] [PubMed]

- Piekkola, Hannu. 2011. Intangible capital: The key to growth in Europe. Intereconomics 46: 222–28. [Google Scholar] [CrossRef]

- Rampini, Adriano A., and Sridhar Viswanathan. 2013. Collateral and capital structure. Journal of Financial Economics 109: 466–92. [Google Scholar] [CrossRef]

- Roodman, David. 2006. How To Do xtabond2: An Introduction to Difference and System GMM in Stata. Center for Global Development Working Paper 103. Available online: https://www.cgdev.org/publication/how-do-xtabond2-introduction-difference-and-system-gmm-stata-working-paper-103 (accessed on 23 July 2023).

- Rubinstein, Mark E. 1973. A mean-variance synthesis of corporate financial theory. The Journal of Finance 28: 167–81. [Google Scholar]

- Ruiwen, Zhang, and Guan Honghui. 2010. An empirical test of the impact of intangible assets on enterprise performance of Chinese social services listed companies. Paper presented at the 7th International Conference on Innovation & Management, Amsterdam, The Netherlands, October 23–25; pp. 1373–77. [Google Scholar]

- Smith, Clifford W., Jr., and Jerold B. Warner. 1979. On financial contracting: An analysis of bond covenants. Journal of Financial Economics 7: 117–61. [Google Scholar] [CrossRef]

- Song, Han-Suck. 2005. Capital Structure Determinants an Empirical Study of Swedish Companies. Stockholm: KTH Royal Institute of Technology. [Google Scholar]

- Sun, Qi, and Mindy Z. Xiaolan. 2019. Financing intangible capital. Journal of Financial Economics 133: 564–88. [Google Scholar] [CrossRef]

- Thum-Thysen, Anna, Peter Voigt, Beñat Bilbao-Osorio, Christoph Maier, and Diana Ognyanova. 2019. Investment dynamics in Europe: Distinct drivers and barriers for investing in intangible versus tangible assets? Structural Change and Economic Dynamics 51: 77–88. [Google Scholar] [CrossRef]

- Vengesai, Edson, and Farai Kwenda. 2018. The impact of leverage on discretionary investment: African evidence. African Journal of Economic and Management Studies 9: 108–25. [Google Scholar] [CrossRef]

- Vengesai, Edson, and Farai Kwenda. 2020. Firm Investment Behaviour and Stock Market Liquidity: Evidence from African Listed Firms. African Journal of Business & Economic Research 15: 165–84. [Google Scholar]

| Variable | Obs. | Mean | SD | 25% | Median | 75% |

|---|---|---|---|---|---|---|

| PPE | 5,557,000 | 0.2148 | 0.2630 | 0.0570 | 0.1444 | 0.2800 |

| LTD/TA | 6,368,000 | 0.0848 | 0.1136 | 0.0000 | 0.0351 | 0.1313 |

| TD/TA | 6,644,000 | 0.5010 | 0.1953 | 0.3612 | 0.4969 | 0.6381 |

| R&D | 1,999,000 | 0.0455 | 0.1361 | 0.0000 | 0.0000 | 0.0000 |

| Advertising | 1,139,000 | 0.4609 | 10,876 | 0.0415 | 0.1460 | 0.4126 |

| CF | 5,848,000 | 0.3922 | 0.6214 | 0.0858 | 0.2700 | 0.5588 |

| Sales | 6,549,000 | 51.151 | 63.849 | 13.275 | 28.807 | 61.229 |

| Tobin Q | 5,887,000 | 14.908 | 0.8242 | 0.9395 | 12.349 | 17.775 |

| EBIT | 6,167,000 | 0.4808 | 0.6005 | 0.1246 | 0.3041 | 0.6175 |

| DEPR | 5,600,000 | 0.1364 | 0.0986 | 0.0717 | 0.1129 | 0.1754 |

| Beta | 4,176,000 | 0.7672 | 58.145 | −0.1194 | 0.6043 | 16.347 |

| Leverage | Leverage | |

|---|---|---|

| LTD/NFA | TD/NFA | |

| Lev (t − 1) | 0.344 *** (149.66) | 0.431 *** (307.11) |

| PPE | −0.0892 *** | −0.0241 *** |

| (−51.28) | (−7.36) | |

| R&D | −0.0321 *** | −0.0702 *** |

| (−35.99) | (27.42) | |

| Advertising | −0.00417 *** | −0.0142 *** |

| (−8.24) | (−7.84) | |

| Beta | −0.000675 *** | −0.000492 *** |

| (−63.05) | (−7.61) | |

| Tobin’s Q | −0.00444 *** | −0.00488 *** |

| (−15.40) | (−6.29) | |

| EBIT | −0.00173 *** | −0.0124 *** |

| (−3.62) | (−4.72) | |

| DEPR | 0.00499 ** | 0.0828 *** |

| (3.06) | (5.62) | |

| AR (2) Hansen test | 0.0890.99 | 0.650.98 |

| Variable | Leverage | |

|---|---|---|

| LTD | TA | |

| PPE | −0.2065 | −0.0325 |

| R&D | −0.0372 | −0.0473 |

| Advertising | −0.0399 | −0.079 |

| Beta | −0.0085 | −0.0146 |

| EBIT | −0.0914 | −0.0381 |

| Depreciation | 0.0043 | 0.0418 |

| Constant | t-Statistic | Std. Err | |

|---|---|---|---|

| PPE | −0.0976 *** | (−15.09) | 0.006495 |

| R&D | −0.0409 *** | (17.83) | 0.00229 |

| Advertising | −0.0105 *** | (−14.88) | 0.0007 |

| Beta | −0.00061 *** | (−3.53) | 0.00017 |

| Tobin’s Q | −0.00461 *** | (−8.39) | 0.00055 |

| EBIT | −0.0165 *** | (−5.55) | 0.0029773 |

| DEPR | 0.238 *** | (11.02) | 0.02157 |

| Leverage | 0.544 *** | (110.37) | 0.004927 |

| CF | 0.00577 ** | (3.41) | 0.00169 |

| Tax shield | −0.00330 *** | (−26.85) | 0.00122 |

| AR (2) | 0.60 | ||

| Hansen test | 0.79 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vengesai, E. Unveiling the Role of Investment Tangibility on Financial Leverage: Insights from African-Listed Firms. Risks 2023, 11, 192. https://doi.org/10.3390/risks11110192

Vengesai E. Unveiling the Role of Investment Tangibility on Financial Leverage: Insights from African-Listed Firms. Risks. 2023; 11(11):192. https://doi.org/10.3390/risks11110192

Chicago/Turabian StyleVengesai, Edson. 2023. "Unveiling the Role of Investment Tangibility on Financial Leverage: Insights from African-Listed Firms" Risks 11, no. 11: 192. https://doi.org/10.3390/risks11110192