Coupled Price–Volume Equity Models with Auto-Induced Regime Switching

Abstract

:1. Introduction

- In Section 2, we provide an extensive literature review mainly focusing on several ways of considering liquidity in financial markets that are relevant to our purposes.

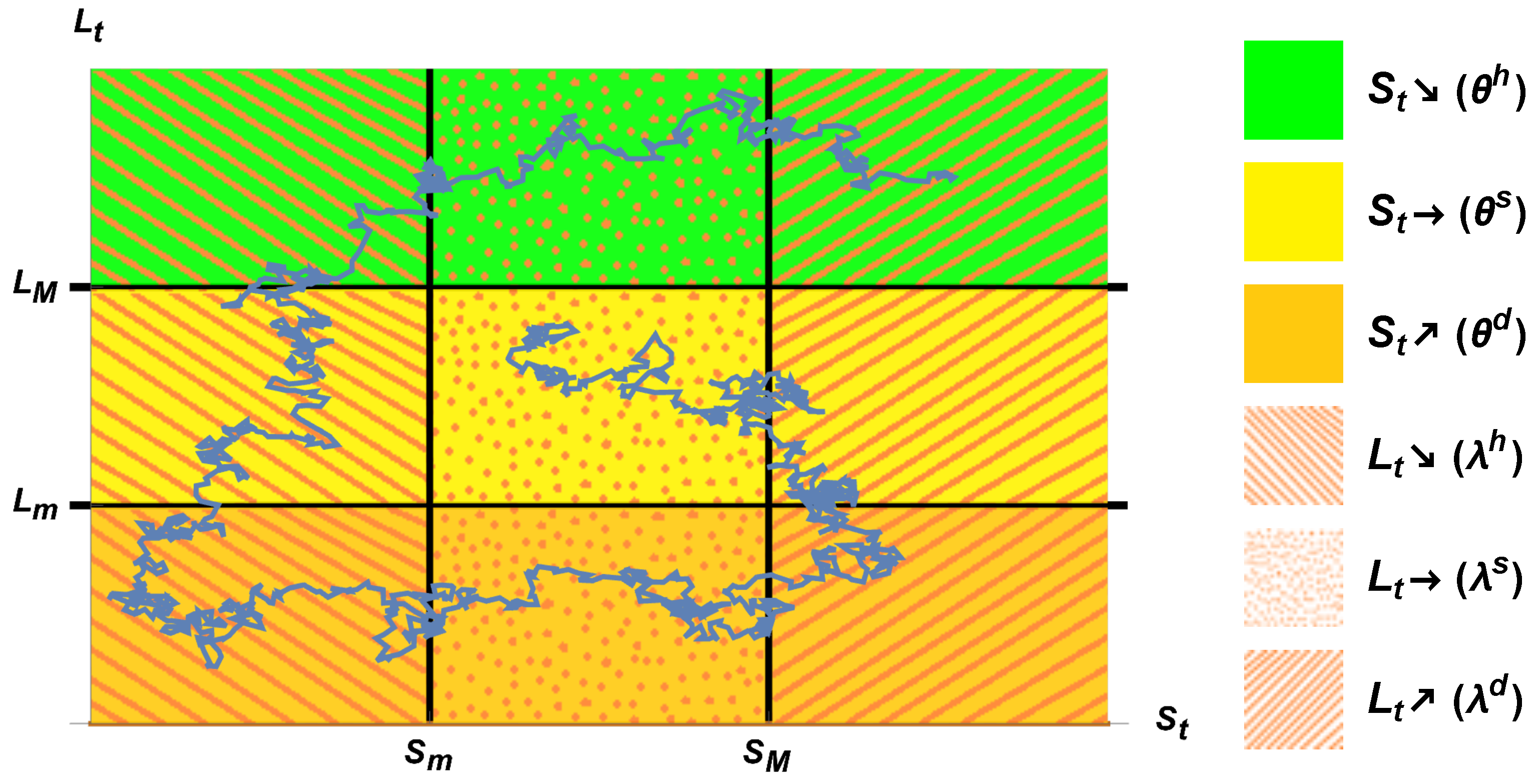

- Section 3 describes a joint model for price and liquidity—in our approach, liquidity will be taken as the volume of transactions per unit of time per day, in the subsequent practical application—as a regime switching system of SDE with the coefficients of the price model process switching as a consequence of the threshold crossing of the trajectory of the liquidity process and vice versa. We consider a series of plausible scenarios for the joint evolution dynamics of price and liquidity and we stress the need of considering double thresholds in order to prevent ambiguity in the definition of the threshold crossing stopping time.

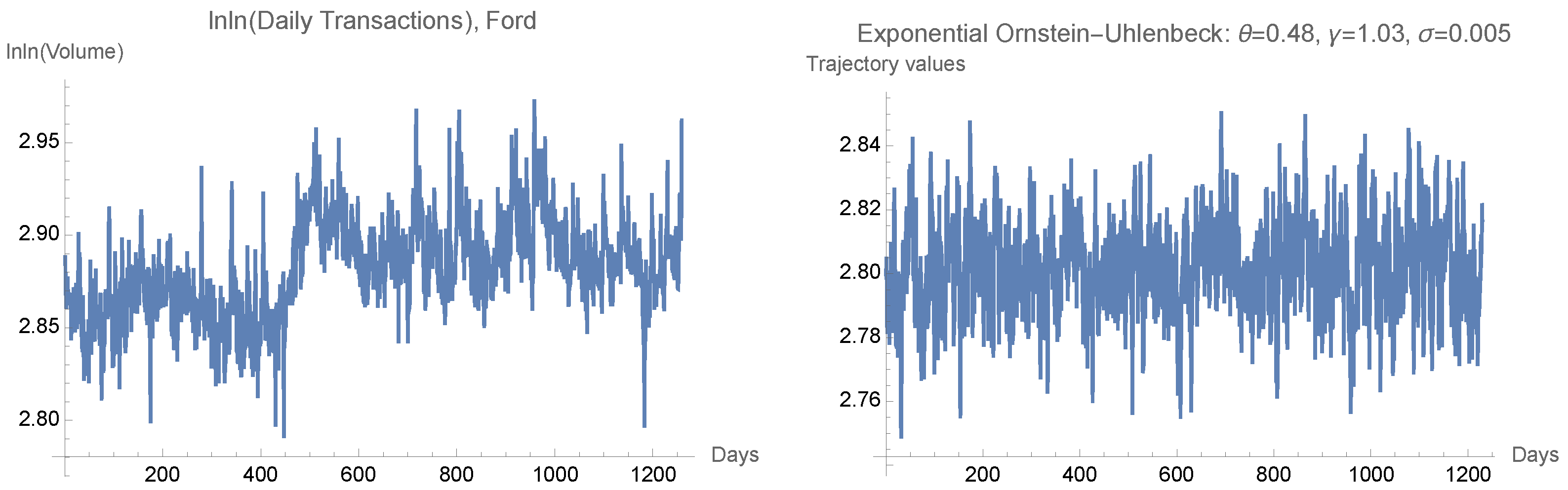

- In Section 4, we prove the existence of the regime switching coupled (Price, Volume) process by means of the Yamada–Watanabe theorem. The regime switching coupled (Price, Volume) process is defined by gluing together trajectories of price and volume processes at random points defined by the threshold crossings.

- Section 5 is the first section on the application part of this work. We consider data from the Ford Motor Company and we present and justify the use of the Ornstein–Uhlenbeck model for the liquidity (volume) by resorting to observed characteristics of the data and the expected properties of the observed time series volume of transactions per unit of time.

- Finally in Section 7, we summarize the main results of this work and we project further studies that seem justified by the obtained results.

2. A Dedicated Literature Review

- Liquidity as a measure of easiness to convert assets into cash;

- The influence of liquidity in portfolio performance;

- Liquidity and the its bid–ask spread proxy;

- Liquidity and its volume of transactions proxy.

3. The Coupled Price–Liquidity (Volume) Model

- A

- The interplay of the regimes and the thresholds, for the process , is given by the following relations satisfied by the parameter values, and consequently, the price drift coefficient:with a similar relation for the price volatility coefficient.

- B

- The interplay of the regimes and the thresholds for the process , that is, the liquidity process, is given by:with a similar relation for the liquidity volatility coefficient.

- If the price becomes larger than the highest threshold, then liquidity has a tendency to increase;

- If the price becomes smaller than the lowest threshold, then liquidity has a tendency to decrease;

- If liquidity becomes larger than the highest threshold, then the price has a tendency to increase;

- If the liquidity becomes smaller than the lowest threshold, then the price has a tendency to decrease.

4. On the Existence of a Regime Switching Process

- C

- Let be an increasing sequence of -stopping times, denoted by , such that we have, almost surely, and, for any , the function:is almost surely finite, that is, .

- D

- There exists , an increasing continuous function possibly dependent of , such that , such that:and

- E

- There exists , an increasing concave function, possibly dependent of , such that , such that:and

5. Price and Liquidity Models

5.1. Liquidity Models

- As pointed out previously, there are connections between the variation of the price and a consequent variation of the volume of transactions and vice versa. We propose in this work a model to describe the aforementioned connections.

- The daily number of transactions reflects the available share of the public capital of the firm that integrates the portfolios of common investors. It is expected that the proportion of this public capital, with respect to the whole public capital of the firm, fluctuates around a certain value; this intrinsic characteristic points to a possible mean reverting model.

- There appear to exist abrupt and very significant changes on the volume of transactions that are not immediately connected to the information flow on the value of the firm that influences the price changes. This may occur caused by several reasons: sudden need for cash of an agent with a large share of the public capital of the firm (see, again, Çetin and Rogers (2007); Glover et al. (2010); Gökay et al. (2011), (Guéant 2016, p. 171)); some herd investment phenomena associated with the emergence of an independent and new more rewarding source of profit; and some herd investment phenomena associated with the disappearance of an independent and previously well established source of profit. This characteristic seems to justify the coupling of a mean reverting model with some jump process; we will not consider jump processes in this work.

5.2. Price Models

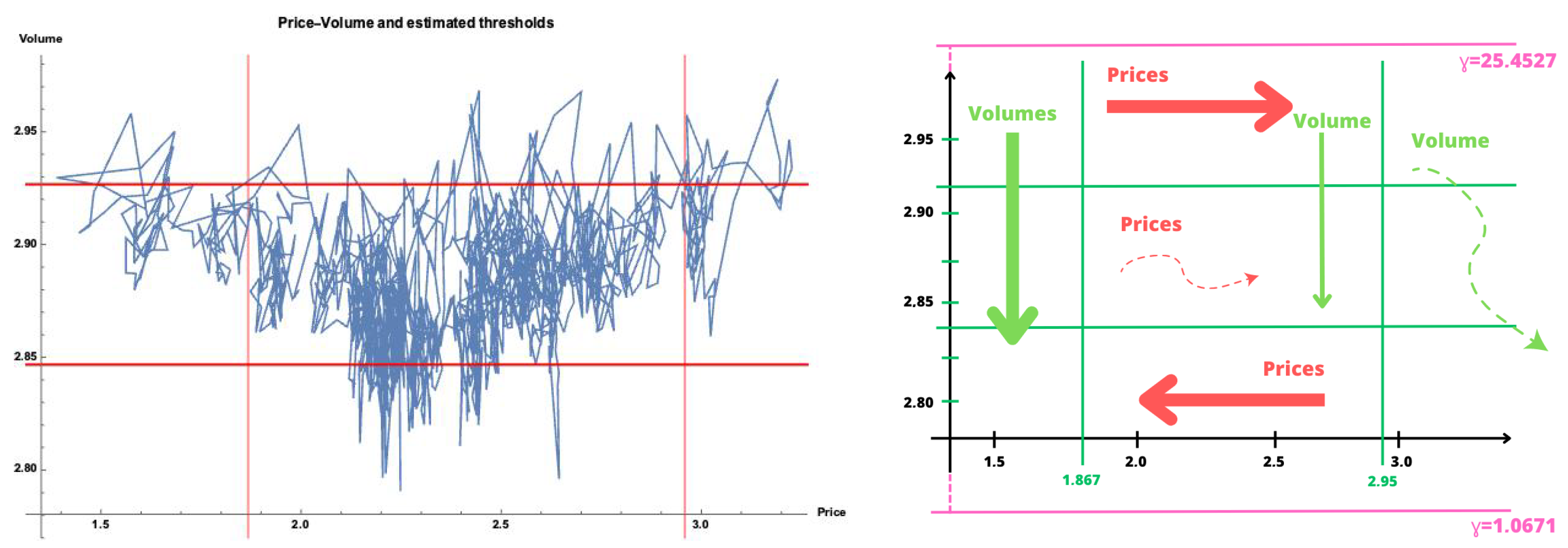

6. Parameter Estimation

6.1. On the Quasi-Likelihood Estimators

- We identify a domain of variation for the data and we choose accordingly two extreme values both for the thresholds of the price and the volume of transactions; an example of the criteria for the choice of the thresholds is to have at least ten observations above the upper threshold and ten observations below the lower threshold.

- For a given set of thresholds, we estimate the parameters and compute the value taken by the quasi-likelihood contrast functions on the estimated values of the parameters. The estimation of the parameters is done as follows. We consider the pairs (Price, Volume) for each date. We estimate three sets of the Price model parameters; the first set, with the Price data observations corresponding to the Volume observations that exceed the upper Volume threshold; the second set of parameters, with the Price data observations corresponding to the Volume observations in the region between the upper and the lower threshold; and the third set of parameters, with the Price data observations corresponding to the Volume observations in the region below the lower Volume threshold. We then estimate the three sets of Volume model parameters in a similar way as done with the Price parameter estimation but classifying the Volume data observations in three sets according to the positions of the corresponding Price observation with respect to the two thresholds: above the upper Price threshold, between the Price thresholds, and below the lower Price threshold.

- For the first round of research we reduce the difference between the lower and the upper threshold of both the Price and Volume data by a fixed quantity proportional to the initial separations between the thresholds. Furthermore, we repeat the parameter estimation procedure until the minimal distance between the thresholds—defined by the initial separation of thresholds divided by a fixed quantity—is attained. We identify the values of the thresholds corresponding to the maximum of the quasi-likelihood contrast function and, for the second round of research, we consider a neighborhood of the two sets of thresholds. We next proceed as in the first round and so on and so forth. After a finite number of rounds, the value of the quasi-likelihood contrast function is constant in an interval and we chose the thresholds corresponding to the middle point of this interval.

6.2. Parameter Estimation: Results and Interpretation

- INSIDE region to volume thresholds, − used observations: 988

- OUTER region to UPPER volume threshold, − observations used: 16

- OUTER region to LOWER volume threshold, − observations used: 67

- INSIDE region to price thresholds, , − observations used: 1110

- OUTER region to the UPPER price threshold, , − observations used: 57

- OUTER region to the LOWER price threshold, , − observations used: 79

7. Conclusions and Further Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| GBM | Geometric Brownian Motion |

| MDPI | Multidisciplinary Digital Publishing Institute |

| PDE | Partial Differential Equations |

| SDE | Stochastic Differential Equations |

References

- Aït-Sahalia, Yacine. 2002. Maximum likelihood estimation of discretely sampled diffusions: A closed-form approximation approach. Econometrica 70: 223–62. [Google Scholar] [CrossRef]

- Arnold, Ludwig. 1998. Random Dynamical Systems. Springer Monographs in Mathematics. Berlin: Springer. [Google Scholar] [CrossRef]

- Braumann, Carlos A. 2019. Introduction to Stochastic Differential Equations with Applications to Modelling in Biology and Finance. Hoboken: John Wiley & Sons. [Google Scholar]

- Casabán, Maria Consuelo, Rafael Company, Lucas Jódar, and José Ramon Pintos. 2011. Numerical analysis and computing of a non-arbitrage liquidity model with observable parameters for derivatives. Computers & Mathematics with Applications 61: 1951–56. [Google Scholar] [CrossRef]

- Çetin, Umut, and L. Chris G. Rogers. 2007. Modeling liquidity effects in discrete time. Mathematical Finance 17: 15–29. [Google Scholar] [CrossRef]

- Company, Rafael, Lucas Jódar, and José-Ramón Pintos. 2012. A consistent stable numerical scheme for a nonlinear option pricing model in illiquid markets. Mathematics and Computers in Simulation 2: 1972–85. [Google Scholar] [CrossRef]

- Company, Rafael, Lucas Jódar, Enrique Ponsoda, and Cristina Ballester. 2010. Numerical analysis and simulation of option pricing problems modeling illiquid markets. Computers & Mathematics with Applications 59: 2964–75. [Google Scholar] [CrossRef]

- Crauel, Hans, and Matthias Gundlach, eds. 1999. Stochastic Dynamics. New York: Springer. [Google Scholar] [CrossRef]

- Cuoco, Domenico, and Jak a Cvitanić. 1998. Optimal consumption choices for a “large” investor. Journal of Economic Dynamics and Control 22: 401–36. [Google Scholar] [CrossRef]

- Cvitanić, Jakša, and Jin Ma. 1996. Hedging options for a large investor and forward-backwar SDE’s. The Annals of Applied Probability 6: 370–98. [Google Scholar] [CrossRef]

- Di Nunno, Giulia, and Bernt Øksendal, eds. 2011. Advanced Mathematical Methods for Finance. Heidelberg: Springer. [Google Scholar] [CrossRef]

- Dolfin, Marina, Leone Leonida, and Eleonora Muzzupappa. 2021. A kinetic theory model of the dynamics of liquidity profiles on interbank networks. Symmetry 13: 363. [Google Scholar] [CrossRef]

- Dong, Ziming, and Dan Tang. 2023. Pricing vulnerable basket spread options with liquidity risk. Review of Derivatives Research 26: 23–50. [Google Scholar] [CrossRef]

- Epps, Thomas W. 1975. Security price changes and transaction volumes: Theory and evidence. The American Economic Review 65: 586–97. [Google Scholar] [CrossRef]

- Epps, Thomas W., and Mary Lee Epps. 1976. The stochastic dependence of security price changes and transaction volumes: Implications for the mixture-of-distributions hypothesis. Econometrica 44: 305–21. [Google Scholar] [CrossRef]

- Esquível, Manuel L., and Pedro P. Mota. 2014. On some auto-induced regime switching double-threshold glued diffusions. Journal of Statistical Theory and Practice 8: 760–71. [Google Scholar] [CrossRef]

- Esquível, Manuel L., Nadezhda P. Krasii, and Pedro P. Mota. 2020. Auto and externally induced regime switching diffusions. Communications on Stochastic Analysis 14: 27–47. [Google Scholar]

- Georgescu, Oana-Maria, Dimitrios Laliotis, Miha Leber, and Javier Población. 2020. A liquidity shortfall analysis framework for the european banking sector. Mathematics 8: 787. [Google Scholar] [CrossRef]

- Glover, Kristoffer J., Peter W. Duck, and David P. Newton. 2010. On nonlinear models of markets with finite liquidity: Some cautionary notes. SIAM Journal on Applied Mathematics 70: 3252–71. [Google Scholar] [CrossRef]

- Gökay, Selim, Alexandre F. Roch, and H. Mete Soner. 2011. Liquidity models in continuous and discrete time. In Advanced Mathematical Methods for Finance. Heidelberg: Springer, pp. 333–65. [Google Scholar]

- Guéant, Olivier. 2016. The Financial Mathematics of Market Liquidity. From Optimal Execution to Market Making. Chapman & Hall/CRC Financial Mathematics Series. Boca Raton: CRC Press. [Google Scholar]

- Johnson, Timothy C. 2008. Volume, liquidity, and liquidity risk. Journal of Financial Economics 87: 388–417. [Google Scholar] [CrossRef]

- Jones, Charles M., Gautam Kaul, and Marc L. Lipson. 1994. Transactions, volume, and volatility. The Review of Financial Studies 7: 631–51. [Google Scholar] [CrossRef]

- Kallenberg, Olav. 2002. Foundations of Modern Probability, 2nd ed. New York: Springer. [Google Scholar]

- Karatzas, Ioannis, and Steven E. Shreve. 1991. Brownian Motion and Stochastic Calculus, 2nd ed. New York: Springer. [Google Scholar]

- Karpoff, Jonathan M. 1987. The relation between price changes and trading volume: A survey. The Journal of Financial and Quantitative Analysis 22: 109–26. [Google Scholar] [CrossRef]

- Kessler, Mathieu. 1997. Estimation of an ergodic diffusion from discrete observations. Scandinavian Journal of Statistics 24: 211–29. [Google Scholar] [CrossRef]

- Kloeden, Peter E., and Eckhard Platen. 1992. Numerical Solution of Stochastic Differential Equations. Volume 23 of Applications of Mathematics (New York). Berlin: Springer. [Google Scholar] [CrossRef]

- Kontŭs, Eleonora, and Damir Mihanović. 2019. Management of liquidity and liquid assets in small and medium-sized enterprises. Economic Research-Ekonomska Istraživanja 32: 3253–71. [Google Scholar] [CrossRef]

- Le Gall, Jean-François. 1984. One-dimensional stochastic differential equations involving the local times of the unknown process. In Stochastic Analysis and Applications (Swansea, 1983). Volume 1095 of Lecture Notes in Math. Berlin: Springer, pp. 51–82. [Google Scholar] [CrossRef]

- Lejay, Antoine, and Paolo Pigato. 2017. Data and Methods for A Threshold Model for Local Volatility: Evidence of Leverage and Mean Reversion Effects on Historical Data. Technical Report RT-0494. Inria Nancy-Grand Est. Berlin: Weierstrass Institute. [Google Scholar]

- Lejay, Antoine, and Paolo Pigato. 2018. Statistical estimation of the oscillating brownian motion. Bernoulli 24: 3568–602. [Google Scholar] [CrossRef]

- Lejay, Antoine, and Paolo Pigato. 2019a. A threshold model for local volatility: Evidence of leverage and mean reversion effects on historical data. International Journal of Theoretical and Applied Finance 22: 24. [Google Scholar] [CrossRef]

- Lejay, Antoine, and Paolo Pigato. 2019b. Maximum likelihood drift estimation for a threshold diffusion. Scandinavian Journal of Statistics 47: 609–37. [Google Scholar] [CrossRef]

- Liptser, Robert S., and Albert N. Shiryaev. 2001. Statistics of Random Processes. I, Expanded ed. Volume 5 of Applications of Mathematics (New York). Berlin: Springer, General Theory, Translated from the 1974 Russian original by A. B. Aries, Stochastic Modelling and Applied Probability. [Google Scholar]

- Liu, Hong, and Jiongmin Yong. 2005. Option pricing with an illiquid underlying asset market. Journal of Economic Dynamics and Control 29: 2125–56. [Google Scholar] [CrossRef]

- Mota, Pedro P. 2007. Brownian Motion with Drift Threshold Model. Ph.D. thesis, FCT UNL, Monte de Caparica Portugal, Caparica, Portugal. Available online: http://hdl.handle.net/10362/1766 (accessed on 11 January 2020).

- Mota, Pedro P. 2013. On a continuous-time stock price model with two mean reverting regimes. In Advances in Regression, Survival Analysis, Extreme Values, Markov Processes and Other Statistical Applications. Edited by João Lita da Silva, Frederico Caeiro, Isabel Natário and Carlos Braumann. Berlin/Heidelberg: Springer, pp. 297–305. [Google Scholar]

- Mota, Pedro P., and Manuel L. Esquível. 2014. On a continuous time stock price model with regime switching, delay, and threshold. Quantitative Finance 14: 1479–88. [Google Scholar] [CrossRef]

- Mota, Pedro P., and Manuel L. Esquível. 2016. Model selection for stock prices data. Journal of Applied Statistics 43: 2977–87. [Google Scholar] [CrossRef]

- Mota, Pedro P., Manuel L. Esquível, and Nadezhda P. Krasii. 2021. Some double diffusion models for stock prices. Global and Stochastic Analysis 8: 53–66. [Google Scholar]

- Øksendal, Bernt. 2003. Stochastic Differential Equations, 6th ed. Universitext. Berlin: Springer. [Google Scholar] [CrossRef]

- Pedersen, Asger Roer. 1995a. Consistency and asymptotic normality of an approximate maximum likelihood estimator for discretely observed diffusion processes. Bernoulli 1: 257–79. [Google Scholar] [CrossRef]

- Pedersen, Asger Roer. 1995b. A new approach to maximum likelihood estimation for stochastic differential equations based on discrete observations. Scandinavian Journal of Statistics 22: 55–71. [Google Scholar]

- Pigato, Paolo. 2019. Extreme at-the-money skew in a local volatility model. Finance and Stochastics 23: 827–59. [Google Scholar] [CrossRef]

- Prokhorov, Yuri Vasil’evich, and Albert Nikolaevich Shiryaev, eds. 1998. Probability Theory III. In Encyclopaedia of Mathematical Sciences. Berlin: Springer, Volume 45. [Google Scholar] [CrossRef]

- Rianço, Nelson S., Manuel L. Esquível, Pedro P. Mota, and Carlos A. Veiga. 2009. On a price-liquidity threshold regime switching model (preliminary report). In Proceedings of the 6th St. Petersburg Workshop on Simulation. Edited by Sergeĭ Mikhaĭlovich Ermakov, Viatcheslav Melas and Andrey Pepelyshev. St. Petersburg: VVM com. Ltd., vol. I, pp. 419–24. [Google Scholar]

- Rogers, L. Chris G., and David Williams. 2000. Diffusions, Markov Processes, and Martingales. Cambridge Mathematical Library. Cambridge: Cambridge University Press, vol. 2, Itô calculus, Reprint of the second (1994) edition. [Google Scholar] [CrossRef]

- Schwartz, Eduardo S. 1997. The stochastic behavior of commodity prices: Implications for valuation and hedging. The Journal of Finance 52: 923–73. [Google Scholar] [CrossRef]

- Tauchen, George E., and Mark Pitts. 1983. The price variability-volume relationship on speculative markets. Econometrica 51: 485–505. [Google Scholar] [CrossRef]

- Yamada, Toshio, and Shinzo Watanabe. 1971. On the uniqueness of solutions of stochastic differential equations. Journal of Mathematics of Kyoto University 11: 155–67. [Google Scholar] [CrossRef]

- Ying, Charles C. 1966. Stock market prices and volumes of sales. Econometrica 34: 676–85. [Google Scholar] [CrossRef]

| Scenarios | I | II | III | IV | V | VI | VII | VIII |

| Liquidity on highest price subdomain | ↑ | ↓ | ↓ | ↓ | ↓ | ↓ | ↓ | ↓ |

| Liquidity on lowest price subdomain | ↓ | ↓ | ↓ | ↓ | ↓ | ↑ | ↑ | ↑ |

| Price on highest liquidity subdomain | ↓ | ↓ | ↓ | ↑ | ↑ | ↓ | ↓ | ↑ |

| Price on lowest liquidity subdomain | ↑ | ↓ | ↑ | ↓ | ↑ | ↓ | ↑ | ↓ |

| Scenarios | IX | X | XI | XII | XIII | XIV | XV | XVI |

| Liq. on highest price subdomain | ↓ | ↑ | ↑ | ↑ | ↑ | ↑ | ↑ | ↑ |

| Liq. on lowest price subdomain | ↑ | ↓ | ↓ | ↓ | ↑ | ↑ | ↑ | ↑ |

| Pri. on highest liquidity subdomain | ↑ | ↓ | ↑ | ↑ | ↓ | ↓ | ↑ | ↑ |

| Pri. on lowest liquidity subdomain | ↑ | ↓ | ↓ | ↑ | ↓ | ↑ | ↓ | ↑ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Esquível, M.L.; Krasii, N.P.; Mota, P.P.; Shamraeva, V.V. Coupled Price–Volume Equity Models with Auto-Induced Regime Switching. Risks 2023, 11, 203. https://doi.org/10.3390/risks11110203

Esquível ML, Krasii NP, Mota PP, Shamraeva VV. Coupled Price–Volume Equity Models with Auto-Induced Regime Switching. Risks. 2023; 11(11):203. https://doi.org/10.3390/risks11110203

Chicago/Turabian StyleEsquível, Manuel L., Nadezhda P. Krasii, Pedro P. Mota, and Victoria V. Shamraeva. 2023. "Coupled Price–Volume Equity Models with Auto-Induced Regime Switching" Risks 11, no. 11: 203. https://doi.org/10.3390/risks11110203