The Impact of Blockchain on the Quality of Accounting Information: An Iraqi Case Study

Abstract

:1. Introduction

2. Theoretical Principles and Hypothesis Development

2.1. Explaining the Relationship between Blockchain and the Quality of Accounting Information

2.2. Explaining the Relationship between Blockchain and the Quality of Accounting Information in a Stock Market Is Stronger Than the Non-Listed Market

3. Research Methodology

3.1. Data Collection Methods

3.2. Population under Study

3.3. Research Variables

4. Data Analysis

4.1. Descriptive Statistics

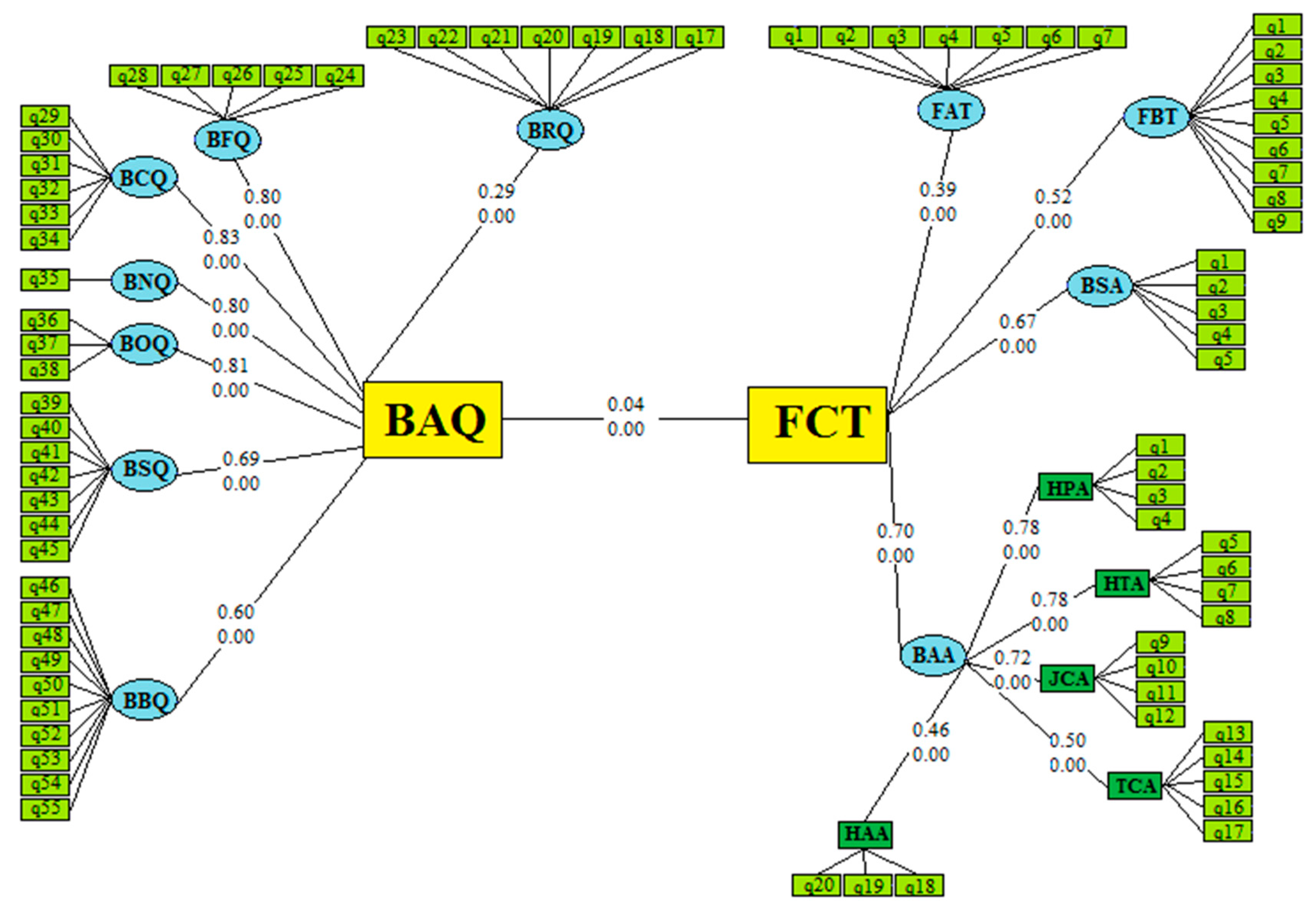

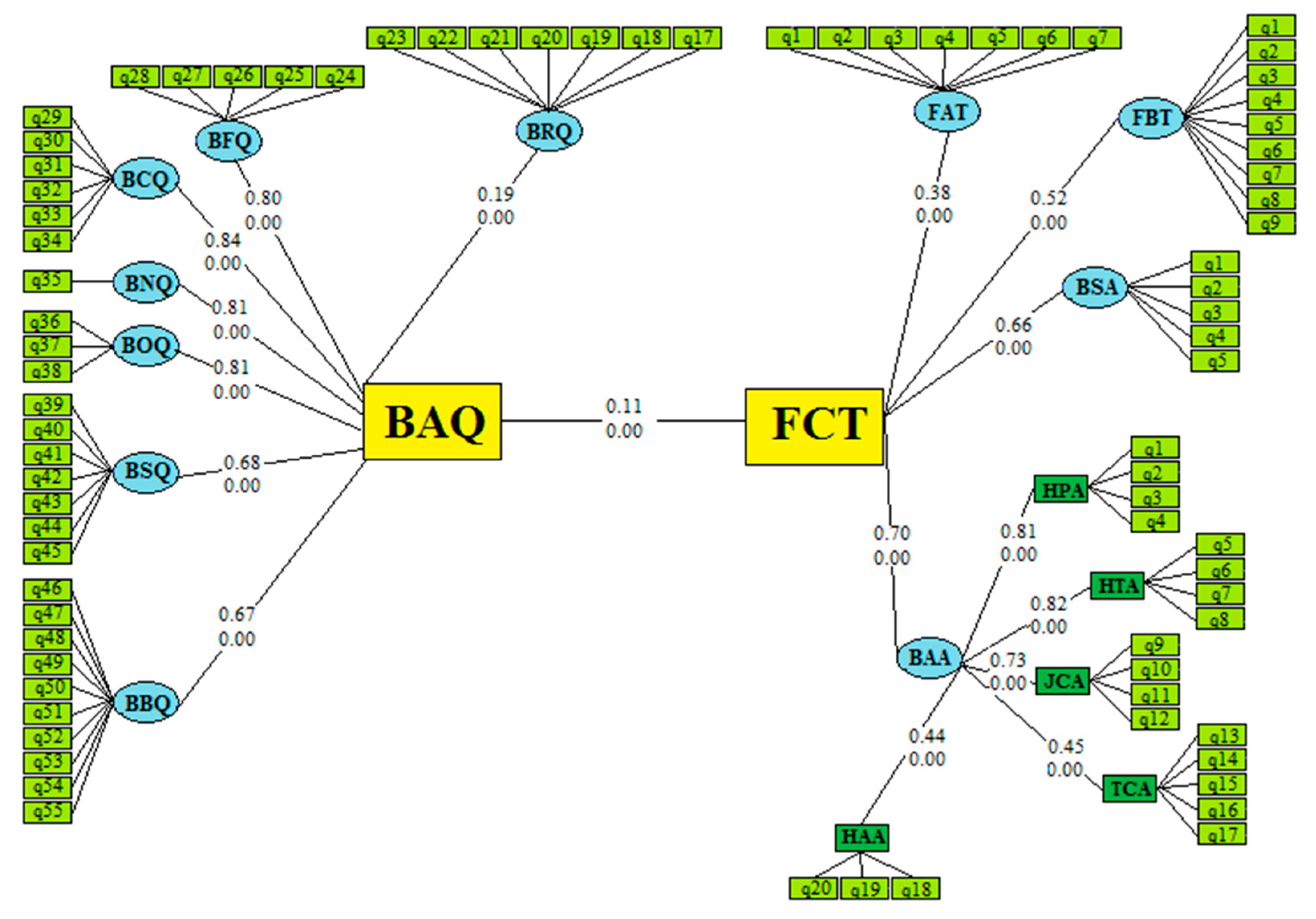

4.2. Inferential Statistics

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abdelraheem, Abubkr Ahmed Elhadi, Asaad Mubarak Hussaien, Mohammed Abaker Ahmed Mohammed, and Yosra Azhari Elamin Elbokhari. 2021. The effect of information technology on the quality of accounting information. Accounting 7: 191–96. [Google Scholar] [CrossRef]

- Abdul-Ghani, D. 2019. The Effect of the Use of Information Technology on the Qualitative Characteristics of Accounting Information: An Exploratory Study of a Sample from the Wilayat of Oum El Bouaghi. Unpublished Master’s Thesis, Faculty of EconomicSciences, Commercial Sciences and Management Sciences, Larbi Ben M’hidi University, Oum El Bouaghi, Algeria. [Google Scholar]

- Abu Afifa, Malik Muneer, Hien Vo Van, and Trang Le Hoang Van. 2022. Blockchain adoption in accounting by an extended UTAUT model: Empirical evidence from an emerging economy. Journal of Financial Reporting and Accounting. ahead-of-print. [Google Scholar] [CrossRef]

- Agrifoglio, Rocco, and Davide de Gennaro. 2022. New Ways of Working through Emerging Technologies: A Meta-Synthesis of the Adoption of Blockchain in the Accountancy Domain. Journal of Theoretical and Applied Electronic Commerce Research 17: 836–50. [Google Scholar] [CrossRef]

- Aifuwa, H. O., and K. Embele. 2019. Board Characteristics and Financial Reporting Quality. Journal of Accounting and Financial Management 5: 30–49. [Google Scholar]

- Albashabsheh, Aisar Ayed Nahar, Modafar Nayel Alhroob, Belal Eid Irbihat, and Sarfaraz Javed. 2018. Impact of accounting information system in reducing costs in Jordanian banks. International Journal of Research-Granthaalayah 6: 210–15. [Google Scholar] [CrossRef]

- Al-Dmour, Ahmed Hani, Maysam Abbod, and Naim Salameh Al Qadi. 2018. The Impact of the Quality of Financial Reporting On Non-Financial Business Performance and the Role of Organizations Demographic’ Attributes (Type, Size and Experience). Academy of Accounting and Financial Studies Journal 22: 1–16. [Google Scholar]

- Alrabei, Ali Mahmoud, and Doaa Shaish Ababnehi. 2021. The Moderating Effect of Information Technology on the Relationship between Audit Quality and the Quality of Accounting Information. “Jordanian Auditors’ Perception. Journal of Theoretical and Applied Information Technology 99: 3365–378. [Google Scholar]

- Arnaboldi, Michela, Cristiano Busco, and Suresh Cuganesan. 2017. Accounting, accountability, social media and big data: Revolution or hype? Accounting, Auditing & Accountability Journal 30: 762–76. [Google Scholar] [CrossRef] [Green Version]

- Ball, Ray, and Lakshmanan Shivakumar. 2005. Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics 39: 83–128. [Google Scholar] [CrossRef]

- Beatty, Anne, Scott Liao, and Jeff Jiewei Yu. 2013. The spillover effect of fraudulent financial reporting on peer firms’ investments. Journal of Accounting and Economics 55: 183–205. [Google Scholar] [CrossRef]

- Beest, F. V., G. J. M. Braam, and Suzanne Boelens. 2009. Quality of Financial Reporting: Measuring Qualitative Characteristics. Working Paper. Nijmegen, The Netherlands: Radboud University Nijmegen. [Google Scholar]

- Bocean, Claudiu George, and Anca Antoaneta Vărzaru. 2022. A Two-Stage SEM–Artificial Neural Network Analysis of Integrating Ethical and Quality Requirements in Accounting Digital Technologies. Systems 10: 121. [Google Scholar] [CrossRef]

- Bonsón, Enrique, and Michaela Bednárová. 2019. Blockchain and its implications for accounting and auditing. Meditari Accountancy Research 27: 725–40. [Google Scholar] [CrossRef]

- Burgstahler, David C., Luzi Hail, and Christian Leuz. 2006. The importance of reporting incentives: Earnings management in European private and public firms. The Accounting Review 81: 983–1016. [Google Scholar] [CrossRef]

- Carson, Brant, Giulio Romanelli, Patricia Walsh, and Askhat Zhumaev. 2018. Blockchain beyond the hype: What is the strategic business value. McKinsey & Company 1: 1–13. [Google Scholar]

- Casino, Fran, Thomas K. Dasaklis, and Constantinos Patsakis. 2019. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telematics and Informatics 36: 55–81. [Google Scholar] [CrossRef]

- Chen, Anthony, and James Jianxin Gong. 2019. Accounting comparability, financial reporting quality, and the pricing of accruals. Advances in Accounting 45: 100415. [Google Scholar] [CrossRef]

- Chen, Ciao-Wei, Daniel W. Collins, Todd D. Kravet, and Richard D. Mergenthaler. 2018. Financial statement comparability and the efficiency of acquisition decisions. Contemporary Accounting Research 35: 164–202. [Google Scholar] [CrossRef]

- Cheung, Esther, Elaine Evans, and Sue Wright. 2010. An historical review of quality in financial reporting in Australia. Pacific Accounting Review 22: 147–69. [Google Scholar] [CrossRef]

- Coyne, Joshua G., and Peter L. McMickle. 2017. Can blockchains serve an accounting purpose? Journal of Emerging Technologies in Accounting 14: 101–11. [Google Scholar] [CrossRef]

- Daemigah, Ali. 2020a. A Meta-Analysis of Audit Fees Determinants: Evidence from an Emerging Market. Iranian Journal of Accounting Auditing and Finance 4: 1–17. [Google Scholar] [CrossRef]

- Daemigah, Ali. 2020b. Does Financial Statements Information Contribute to Macroeconomic Indicators? Iranian Journal of Accounting, Auditing and Finance 4: 61–79. [Google Scholar] [CrossRef]

- Dai, Jun, and Miklos A. Vasarhelyi. 2017. Toward blockchain-based accounting and assurance. Journal of Information Systems 31: 5–21. [Google Scholar] [CrossRef]

- De Franco, Gus, Sagar P. Kothari, and Rodrigo S. Verdi. 2011. The benefits of financial statement comparability. Journal of Accounting Research 49: 895–931. [Google Scholar] [CrossRef] [Green Version]

- Demirkan, Sebahattin, Irem Demirkan, and Andrew McKee. 2020. Blockchain technology in the future of business cyber security and accounting. Journal of Management Analytics 7: 189–208. [Google Scholar] [CrossRef]

- Durnev, Art, and Claudine Mangen. 2009. Corporate investments: Learnings from restatements. Journal of Accounting Research 47: 679–720. [Google Scholar] [CrossRef]

- Elsharif, Tarek Abdelhafid. 2019. The elements of accounting information systems and the impact of their use on the relevance of financial information in Wahda Bank—Benghazi, Libya. Open Journal of Business and Management 7: 1429–50. [Google Scholar] [CrossRef] [Green Version]

- Fatima, Samza, Muhammad Ishtiaq, and Adnan Javed. 2021. Impact of accounting information system on corporate governance: Evidence from Pakistani textile sector. International Journal of Law and Management 63: 431–42. [Google Scholar] [CrossRef]

- Feltham, G. A. 1972. Information Evaluation. Studies in Accounting Research, No. 5. Sarasota: American Accounting Association. [Google Scholar]

- Financial Accounting Standards Board (FASB). 2010. Conceptual Framework for Financial Reporting; Chapter 1, the Objective of General Purpose Financial Reporting, and Chapter 3, Qualitative Characteristics of Useful Financial Information, a Replacement of FASB Concept No. 1 and No. 2. Statement of Financial Accounting Concepts No. 8. Norwalk: FASB. [Google Scholar]

- Gajevszky, Andra. 2015. Assessing financial Reporting Quality: Evidence from Romania. Audit Financiar 13: 69–80. [Google Scholar]

- Garanina, Tatiana, Mikko Ranta, and John Dumay. 2022. Blockchain in accounting research: Current trends and emerging topics. Accounting, Auditing & Accountability Journal 35: 1507–33. [Google Scholar] [CrossRef]

- Givoly, Dan, and Dan Palmon. 1982. Timeliness of annual earnings announcements: Some empirical evidence. The Accounting Review 57: 486–508. [Google Scholar]

- Hernandez, Kevin. 2017. Blockchain for Development–Hope or Hype? Institute of Development Studies 17: 1–4. Available online: https://opendocs.ids.ac.uk/opendocs/handle/20.500.12413/12945 (accessed on 31 January 2023).

- Hongdan, Han, Radha K. Shiwakoti, Robin Jarvis, Chima Mordi, and David Botchie. 2023. Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. International Journal of Accounting Information Systems 48: 100598. [Google Scholar] [CrossRef]

- Hope, Ole-Kristian, Wayne B. Thomas, and Dushyantkumar Vyas. 2013. Financial reporting quality of US private and public firms. The Accounting Review 88: 1715–42. [Google Scholar] [CrossRef]

- Ito, J., N. Narula, and R. Ali. 2017. The Blockchain will Do to the Financial System What the Internet Did to Media. Available online: https://hbr.org/2017/03/the-blockchain-will-do-to-banks-and-law-firms-what-the-internet-did-tomedia (accessed on 22 March 2022).

- Janvrin, Diane, and Tawei Wang. 2019. Implications of Cybersecurity on Accounting Information. Journal of Information Systems 33: A1–A2. [Google Scholar] [CrossRef]

- Kabir, Mohammad Rokibul, Farid A. Sobhani, Norhayati Mohamed, and Mehrab Ashrafi. 2022. Impact of integrity and internal audit transparency on audit quality: The moderating role of blockchain. Management & Accounting Review 2: 203–33. [Google Scholar]

- Khorashadi, Zadeh, Mohammad Hadi, Amin Karkon, and Hamid Golnari. 2017. The effect of information technology on the quality of accounting information. Journal of System Management 3: 61–76. [Google Scholar]

- Kieso, Donald. E., Jerry. J. Weygandt, and Terry. D. Warfield. 2020. Intermediate Accounting, 2nd ed. IFRS Edition. New York: Wiley. [Google Scholar]

- Kitsantas, Thomas, and Evangelos Chytis. 2022. Blockchain Technology as an Ecosystem: Trends and Perspectives in Accounting and Management. Journal of Theoretical and Applied Electronic Commerce Research 17: 1143–61. [Google Scholar] [CrossRef]

- Kokina, Julia, Ruben Mancha, and Dessislava Pachamanova. 2017. Blockchain: Emergent industry adoption and implications for accounting. Journal of Emerging Technologies in Accounting 14: 91–100. [Google Scholar] [CrossRef]

- Kross, William, and Douglas A. Schroeder. 1984. An empirical investigation of the effect of quarterly earnings announcement timing on stock returns. Journal of Accounting Research 22: 153–76. [Google Scholar] [CrossRef]

- Liu, Manlu, Kean Wu, and Jennifer Jie Xu. 2019. How will blockchain technology impact auditing and accounting: Permissionless versus permissioned blockchain. Current Issues in Auditing 13: A19–A29. [Google Scholar] [CrossRef] [Green Version]

- Lucas, Henry C., Jr., Wonseok Oh, and Bruce. W. Weber. 2009. The defensive use of IT in a newly vulnerable market: The New York Stock Exchange, 1980–2007. The Journal of Strategic Information Systems 18: 3–15. [Google Scholar] [CrossRef]

- Mai, Huong Nguyen. 2021. Blockchain technology and auditing—A Survey on Awareness and Understanding of Auditors in Finland about Blockchain and Auditing. Ph.D. thesis, Vaasa University of Applied Sciences, Vaasa, Finland. [Google Scholar]

- Marrone, Mauricio, and James Hazelton. 2019. The disruptive and transformative potential of new technologies for accounting, accountants and accountability: A review of current literature and call for further research. Meditari Accountancy Research 27: 677–94. [Google Scholar] [CrossRef]

- Murodovich, Gaybullaev Rakhim, and Bobomurodova Sarvinoz Ziyadullaevna. 2022. Prospects for Use of Digital Information Technologies in Accounting. American Journal of Social and Humanitarian Research 3: 244–53. [Google Scholar]

- Nelson, S. P., and S. N. Shukeri. 2011. Corporate governance and audit report timelines: Evidence from Malaysia. In Accounting in Asia (Research in Accounting in Emerging Economies). Edited by S. Susela Devi and Keith Hooper. Bingley: Emerald Group Publishing Limited, vol. 11, pp. 109–27. [Google Scholar]

- Nissenbaum, Helen. 1997. Toward an approach to privacy in public: Challenges of information technology. Ethics & Behavior 7: 207–19. [Google Scholar] [CrossRef]

- Norton, Curtis L., and Gary A. Porter. 2011. Introduction to Financial Accounting, 8th ed. London: South-Western Cengage Learning. [Google Scholar]

- O’Leary, Daniel E. 2017. Configuring blockchain architectures for transaction information in blockchain consortiums: The case of accounting and supply chain systems. Intelligent Systems in Accounting, Finance and Management 24: 138–47. [Google Scholar] [CrossRef]

- Oji, Oliver, and Grace N. Ofoegbu. 2017. Effect of audit committee qualities on financial reporting of listed companies in Nigeria: A perspective study. International Journal of Scientific and Research Publications 7: 278–90. [Google Scholar]

- Pilkington, M. 2016. Blockchain technology: Principles and applications. In Handbook of Research on Digital Transformations. Cheltenham: Edward Elgar. [Google Scholar]

- Psaila, S. 2017. Blockchain: A Game Changer for Audit Processes. Available online: https://www2.deloitte.com/mt/en/pages/audit/articles/mt-blockchain-a-game-changer-for-audit.html (accessed on 25 March 2022).

- Qatawneh, Adel Mohammed Abd-Rbuh. 2021. An Assessment of the Impact of IT on Accounting Information Systems: An Empirical Study of Listed Banks in Jordan. Ph.D. dissertation, Cardiff Metropolitan University, Cardiff, UK. [Google Scholar]

- Ruzza, Daniel, Francesca Dal Mas, Maurizio Massaro, and Carlo Bagnoli. 2020. The Role of Blockchain for Intellectual Capital Enhancement and Business Model Innovation. In Intellectual Capital in the Digital Economy. London: Routledge, pp. 256–65. [Google Scholar]

- Sačer, Ivana Mamić. 2013. Information Technology and Accounting Information Systems’ Quality in Croatian Middle and Large Companies. Journal of Information and Organizational Sciences 37: 117–26. Available online: https://hrcak.srce.hr/file/164977 (accessed on 31 January 2023).

- Salehi, Mahdi, Ali Daemi Gah, Farzana Akbari, and Nader Naghshbandi. 2021. Does accounting details play an allocative role in predicting macroeconomic indicators? Evidence of Bayesian and classical econometrics in Iran. International Journal of Organizational Analysis 29: 194–219. [Google Scholar] [CrossRef]

- Schmitz, Jana, and Giulia Leoni. 2019. Accounting and auditing at the time of blockchain technology: A research agenda. Australian Accounting Review 29: 331–42. [Google Scholar] [CrossRef]

- Shanker, Sheila. 2020. The Effectiveness of Information Technology on Accounting Applications. Newspapers, United State. Available online: https://smallbusiness.chron.com (accessed on 20 July 2022).

- Surbhi, S. 2018. Difference Between Data and Information. Key Differences. Available online: https://keydifferences.com (accessed on 5 January 2022).

- Thoa, Dau Thi Kim, and Vo Van Nhi. 2022. Improving the quality of the financial accounting information through strengthening of the financial autonomy at public organizations. Journal of Asian Business and Economic Studies 29: 66–82. [Google Scholar] [CrossRef]

- Wang, Juanling. 2022. Research on the construction of accounting information audit quality control system based on blockchain. Security and Privacy 6: e227. [Google Scholar] [CrossRef]

- Wisna, Nelsi. 2013. The Effect of Information Technology on the Quality of Accounting Information system and its impact on the Quality of Accounting Information. Research Journal of Finance and Accounting 4: 2222–847. [Google Scholar]

- Xu, Yang, Ju Ren, Yan Zhang, Cheng Zhang, Bo Shen, and Yaoxue Zhang. 2019. Blockchain empowered arbitrable data auditing scheme for network storage as a service. IEEE Transactions on Services Computing 13: 289–300. [Google Scholar] [CrossRef]

- Yli-Huumo, Jesse, Deokyoon Ko, Sujin Choi, Sooyong Park, and Kari Smolander. 2016. Where is current research on blockchain technology? A systematic review. PLoS ONE 11: e0163477. [Google Scholar] [CrossRef] [PubMed] [Green Version]

| No. | Percentage | No. | Percentage | ||

|---|---|---|---|---|---|

| Gender | Work Experience | ||||

| Male | 873 | 57.13 | 5 years and less | 470 | 30.76 |

| Female | 655 | 42.87 | 6–10 years | 524 | 34.29 |

| Age | 11–15 years | 355 | 23.23 | ||

| 20–25 years | 586 | 18.72 | More than 15 years | 179 | 11.71 |

| 26–30 years | 236 | 15.45 | Education | ||

| 31–35 years | 616 | 40.31 | Less than a bachelor’s degree | 397 | 25.98 |

| 35 years and above | 390 | 25.52 | Bachelor’s degree | 626 | 40.97 |

| Field of study | Masters | 343 | 22.45 | ||

| Accounting and auditing | 800 | 52.36 | Ph.D | 162 | 10.60 |

| Economy | 249 | 16.30 | Job title | ||

| Financial management | 267 | 17.47 | Manager | 363 | 23.76 |

| Other | 212 | 13.87 | Accountants | 572 | 37.43 |

| Type of company | Auditor | 353 | 23.10 | ||

| Listed | 686 | 44.90 | other | 240 | 15.71 |

| Non-listed | 842 | 55.10 | Total | 1528 | 100 |

| Cronbach’s Alpha | Composite Reliability Coefficient | AVE |

|---|---|---|

| 0.918 | 0.873 | 0.699 |

| Index | Sign | Calculation | Acceptable | Ideal |

|---|---|---|---|---|

| χ2 significance | χ2 | <0.001 | 0.05 < p ≤ 1.00 | 0.01 < p ≤ 0.05 |

| Optimized chi-square | χ2/df | 1.345 | 0 < χ2/df ≤ 5 | 0 ≤ χ2/df ≤ 3 |

| good of fit | GFI | 0.975 | 0.80 ≤ GFI < 0.95 | 0.95 ≤ GFI ≤ 1.00 |

| Adjusted goodness of fit | AGFI | 0.903 | 0.80 ≤ GFI < 0.95 | 0.95 ≤ GFI ≤ 1.00 |

| Residual root mean square | RMR | 0.042 | 0 < RMR ≤ 0.10 | 0 ≤ RMR ≤0.05 |

| Comparative fit index | CFI | 0.974 | 0.90 ≤ CFI < 0.97 | 0.97 ≤ CFI ≤ 1.00 |

| Root mean square of the estimation error | RMSEA | 0.028 | 0.05 < RMSEA ≤ 0.08 | 0 ≤ RMSEA ≤ 0.05 |

| Components | Question | Cronbach’s Alpha | Factor Analysis |

|---|---|---|---|

| 1. Familiarity with blockchain technology (total questions) | 41 | 0.785 | 0.792–0.887 |

| A. Familiarity with blockchain technology, part 1 | 7 | 0.836 | 0.792–0.887 |

| B. Familiarity with blockchain technology, part 2 | 9 | 0.883 | 0.879–0.997 |

| C. Blockchain applications for accounting | 20 | 0.915 | 0.772–0.934 |

| C1. Hope (expectation of) to perform | 4 | 0.921 | 0.883–0.957 |

| C2. Hope to try | 4 | 0.842 | 0.705–0.898 |

| C3. Job communication | 4 | 0.895 | 0.781–0.905 |

| C4. Confidence | 5 | 0.989 | 0.879–0.998 |

| C5. Compatibility | 3 | 0.859 | 0.772–0.914 |

| D. Blockchain applications for auditing | 5 | 0.902 | 0.883–0.957 |

| 2. Quality of information (total questions) | 39 | 0.889 | 0.762–0.911 |

| Relevance | 7 | 0.941 | 0.883–0.928 |

| Faithful representation | 5 | 0.902 | 0.835–0.917 |

| Comparability | 6 | 0.899 | 0.805–0.815 |

| Timeliness | 1 | 0.974 | 0.872–0.989 |

| Verifiability | 3 | 0.912 | 0.874–0.943 |

| Understandability | 7 | 0.879 | 0.809–0.907 |

| Blockchain on the quality of information | 10 | 0.908 | 0.887–0.946 |

| Components | Latin Equivalent | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| 1. Familiarity with blockchain technology (total questions) | FCT | 842 | 2.695 | 0.326 | 1.544 | 3.635 |

| A. Familiarity with blockchain technology, part 1 | FAT | 842 | 2.434 | 0.399 | 1.286 | 3.714 |

| B. familiarity with blockchain technology, part 2 | FBT | 842 | 2.26 | 0.522 | 1.000 | 4.444 |

| C. Blockchain applications for accounting | BAA | 842 | 2.862 | 0.549 | 1.150 | 4.550 |

| C1. Hope (expectation of) to perform | HPA | 842 | 2.475 | 0.950 | 1.000 | 5.000 |

| C2. Hope to try | HTA | 842 | 2.611 | 0.926 | 1.000 | 5.000 |

| C3. Job communication | JCA | 842 | 2.819 | 0.781 | 1.000 | 5.000 |

| C4. Confidence | TCA | 842 | 3.148 | 0.684 | 1.000 | 5.000 |

| C5. Compatibility | HAA | 842 | 3.29 | 0.828 | 1.000 | 5.000 |

| D. Blockchain applications for auditing | BSA | 842 | 3.221 | 0.733 | 1.000 | 5.000 |

| 2. Quality of information (total questions) | BAQ | 842 | 3.188 | 0.573 | 1.224 | 4.697 |

| Relevance | BRQ | 842 | 3.181 | 0.739 | 1.000 | 5.000 |

| Faithful representation | BFQ | 842 | 3.224 | 0.861 | 1.000 | 5.000 |

| Comparability | BCQ | 842 | 3.215 | 0.793 | 1.000 | 5.000 |

| Timeliness | BNQ | 842 | 3.178 | 1.074 | 1.000 | 5.000 |

| Verifiability | BOQ | 842 | 3.227 | 0.811 | 1.000 | 5.000 |

| Understandability | BSQ | 842 | 3.203 | 0.645 | 1.000 | 5.000 |

| Blockchain on the quality of information | BBQ | 842 | 3.086 | 0.823 | 1.000 | 5.000 |

| Components | Latin Equivalent | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| 1. Familiarity with blockchain technology (total questions) | FCT | 686 | 2.708 | 0.319 | 1.544 | 3.634 |

| A. Familiarity with blockchain technology, part 1 | FAT | 686 | 2.434 | 0.392 | 1.285 | 3.571 |

| B. familiarity with blockchain technology, part 2 | FBT | 686 | 2.259 | 0.499 | 1.000 | 4.444 |

| C. Blockchain applications for accounting | BAA | 686 | 2.862 | 0.563 | 1.150 | 4.550 |

| C1. Hope (expectation of) to perform | HPA | 686 | 2.489 | 0.970 | 1.000 | 5.000 |

| C2. Hope to try | HTA | 686 | 2.576 | 0.956 | 1.000 | 5.000 |

| C3. Job communication | JCA | 686 | 2.775 | 0.797 | 1.000 | 5.000 |

| C4. Confidence | TCA | 686 | 3.164 | 0.668 | 1.000 | 5.000 |

| C5. Compatibility | HAA | 686 | 3.304 | 0.819 | 1.000 | 5.000 |

| D. Blockchain applications for auditing | BSA | 686 | 3.276 | 0.722 | 1.000 | 5.000 |

| 2. Quality of information (total questions) | BAQ | 686 | 3.225 | 0.578 | 1.224 | 4.697 |

| Relevance | BRQ | 686 | 3.203 | 0.747 | 1.000 | 5.000 |

| Faithful representation | BFQ | 686 | 3.282 | 0.868 | 1.000 | 5.000 |

| Comparability | BCQ | 686 | 3.278 | 0.801 | 1.000 | 5.000 |

| Timeliness | BNQ | 686 | 3.212 | 1.078 | 1.000 | 5.000 |

| Verifiability | BOQ | 686 | 3.269 | 0.814 | 1.000 | 5.000 |

| Understandability | BSQ | 686 | 3.244 | 0.639 | 1.000 | 5.000 |

| Blockchain on the quality of information | BBQ | 686 | 3.090 | 0.856 | 1.000 | 5.000 |

| FAT | FBT | HPA | HTA | JCA | TCA | HAA | BAA | BSA | FCT | BRQ | BFQ | BCQ | BNQ | BOQ | BSQ | BBQ | BAQ | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FAT | 1.00 | |||||||||||||||||

| FBT | 0.13 *** | 1.00 | ||||||||||||||||

| HPA | 0.05 | 0.36 *** | 1.00 | |||||||||||||||

| HTA | −0.01 | 0.31 *** | 0.74 *** | 1.00 | ||||||||||||||

| JCA | 0.01 | 0.15 *** | 0.50 *** | 0.57 *** | 1.00 | |||||||||||||

| TCA | 0.08 | −0.05 | 0.08 ** | 0.09 *** | 0.18 *** | 1.00 | ||||||||||||

| HAA | 0.02 | −0.01 | 0.07 ** | 0.01 | 0.06 ** | 0.46 *** | 1.00 | |||||||||||

| BAA | 0.04 | 0.26 *** | 0.78 *** | 0.78 *** | 0.72 *** | 0.50 *** | 0.46 *** | 1.00 | ||||||||||

| BSA | 0.03 | −0.06 * | 0.06 * | −0.01 | 0.01 | 0.39 *** | 0.59 *** | 0.30 *** | 1.00 | |||||||||

| FCT | 0.39 *** | 0.52 *** | 0.52 *** | 0.44 *** | 0.37 *** | 0.43 *** | 0.53 *** | 0.70 *** | 0.67 *** | 1.00 | ||||||||

| BRQ | 0.06 | −0.03 | 0.01 | −0.03 | 0.06 | 0.14 *** | 0.09 ** | 0.07 ** | 0.10 *** | 0.09 *** | 1.00 | |||||||

| BFQ | 0.003 | 0.02 | −0.06 | −0.05 ** | 0.01 | 0.05 | 0.04 | −0.01 | 0.02 | 0.02 | 0.09 *** | 1.00 | ||||||

| BCQ | 0.01 | 0.02 | −0.04 | −0.05 | 0.01 | 0.03 | 0.03 | −0.01 | 0.01 | 0.01 | 0.10 *** | 0.77 *** | 1.00 | |||||

| BNQ | −0.03 | 0.01 | −0.04 | −0.04 | −0.02 | 0.04 | 0.06 * | −0.01 | 0.04 | 0.01 | 0.07 ** | 0.57 *** | 0.64 *** | 1.00 | ||||

| BOQ | 0.03 | −0.01 | −0.05 | −0.04 | −0.01 | 0.08 | 0.07 ** | 0.004 | 0.06 * | 0.04 | 0.11 *** | 0.63 *** | 0.66 *** | 0.62 *** | 1.00 | |||

| BSQ | −0.04 | −0.005 | 0.01 | 0.01 | −0.02 | 0.09 *** | 0.12 *** | 0.06 * | 0.13 *** | 0.09 ** | 0.11 *** | 0.44 *** | 0.45 *** | 0.43 *** | 0.55 *** | 1 | ||

| BBQ | −0.03 | 0.02 | −0.05 | −0.02 | −0.05 | −0.04 | −0.04 | −0.06 * | −0.05 | −0.05 | 0.05 | 0.33 *** | 0.36 *** | 0.35 *** | 0.32 *** | 0.51 *** | 1.00 | |

| BAQ | −0.001 | 0.01 | −0.05 | −0.05 | −0.01 | 0.08 | 0.07 | 0.01 | 0.06 * | 0.04 *** | 0.29 *** | 0.80 *** | 0.83 *** | 0.80 *** | 0.81 *** | 0.69 *** | 0.60 *** | 1.00 |

| FAT | FBT | HPA | HTA | JCA | TCA | HAA | BAA | BSA | FCT | BRQ | BFQ | BCQ | BNQ | BOQ | BSQ | BBQ | BAQ | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FAT | 1.00 | |||||||||||||||||

| FBT | 0.17 *** | 1.00 | ||||||||||||||||

| HPA | 0.05 | 0.31 *** | 1.00 | |||||||||||||||

| HTA | 0.02 | 0.30 *** | 0.78 *** | 1.00 | ||||||||||||||

| JCA | −0.02 | 0.16 *** | 0.58 *** | 0.63 *** | 1.00 | |||||||||||||

| TCA | 0.04 | −0.06 * | 0.08 ** | 0.09 ** | 0.10 ** | 1.00 | ||||||||||||

| HAA | −0.01 | −0.004 | 0.07 ** | 0.03 | 0.03 | 0.44 *** | 1.00 | |||||||||||

| BAA | 0.03 | 0.24 *** | 0.81 *** | 0.82 *** | 0.73 *** | 0.45 *** | 0.44 *** | 1.00 | ||||||||||

| BSA | −0.002 | −0.06 | 0.06 | 0.002 | −0.05 | 0.38 *** | 0.61 *** | 0.27 *** | 1.00 | |||||||||

| FCT | 0.38 *** | 0.52 *** | 0.53 *** | 0.49 *** | 0.35 *** | 0.40 *** | 0.53 *** | 0.70 *** | 0.66 *** | 1.00 | ||||||||

| BRQ | 0.001 | −0.05 | −0.01 | −0.03 | −0.02 | 0.01 | −0.02 | −0.02 | 0.01 | −0.02 | 1.00 | |||||||

| BFQ | −0.04 | 0.02 | −0.07 ** | −0.04 | −0.05 | −0.08 ** | −0.09 ** | −0.10 ** | −0.11 *** | −0.11 *** | −0.02 | 1.00 | ||||||

| BCQ | −0.04 | −0.005 | −0.08 ** | −0.06 | −0.05 | −0.09 ** | −0.07 * | −0.10 *** | −0.10 *** | −0.12 *** | −0.01 | 0.79 *** | 1.00 | |||||

| BNQ | −0.07 ** | 0.01 | −0.07 * | −0.06 | −0.09 *** | −0.08 *** | −0.04 | −0.10 ** | −0.05 | −0.09 ** | −0.02 | 0.58 *** | 0.69 *** | 1.00 | ||||

| BOQ | −0.01 | −0.01 | −0.08 | −0.04 | −0.08 ** | −0.07 * | −0.06 | −0.10 ** | −0.05 | −0.08 ** | −0.01 | 0.62 *** | 0.66 *** | 0.64 *** | 1.00 | |||

| BSQ | −0.10 ** | 0.01 | −0.001 | 0.02 | −0.06 | −0.003 | 0.03 | −0.002 | 0.04 | −0.01 | 0.02 | 0.42 *** | 0.43 *** | 0.43 *** | 0.56 *** | 1.00 | ||

| BBQ | −0.06 | 0.02 | −0.08 ** | −0.04 | −0.06 * | −0.06 | −0.03 | −0.08 ** | −0.06 | −0.08 ** | 0.06 | 0.41 *** | 0.41 *** | 0.40 *** | 0.39 *** | 0.56 *** | 1.00 | |

| BAQ | −0.07 * | 0.003 | −0.09 ** | −0.05 | −0.09 ** | −0.08 ** | −0.06 | −0.11 *** | −0.07 ** | 0.11 *** | 0.19 *** | 0.80 *** | 0.84 *** | 0.81 *** | 0.81 *** | 0.68 *** | 0.67 *** | 1.00 |

| Variable | Model 1 | Model 2 | Model 3 | |||

|---|---|---|---|---|---|---|

| Coefficient | p-Value | Coefficient | p-Value | Coefficient | p-Value | |

| FCT | 0.849 | 0.000 | 0.865 | 0.000 | 0.823 | 0.000 |

| Gender | 0.161 | 0.000 | 0.139 | 0.002 | 0.182 | 0.000 |

| Age | 0.092 | 0.000 | 0.084 | 0.001 | 0.102 | 0.000 |

| Education | 0.062 | 0.001 | 0.077 | 0.004 | 0.047 | 0.062 |

| Major | 0.046 | 0.003 | 0.065 | 0.007 | 0.035 | 0.095 |

| Position | 0.075 | 0.000 | 0.057 | 0.031 | 0.099 | 0.000 |

| Experience | 0.094 | 0.021 | 0.088 | 0.039 | 0.075 | 0.033 |

| F Test | 5738.00 | 0.000 | 3292.55 | 0.000 | 2454.80 | 0.000 |

| Obs | 1528 | 842 | 686 | |||

| R2 Adj. | 5.750 | 95.910 | 95.440 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alkafaji, B.K.A.; Dashtbayaz, M.L.; Salehi, M. The Impact of Blockchain on the Quality of Accounting Information: An Iraqi Case Study. Risks 2023, 11, 58. https://doi.org/10.3390/risks11030058

Alkafaji BKA, Dashtbayaz ML, Salehi M. The Impact of Blockchain on the Quality of Accounting Information: An Iraqi Case Study. Risks. 2023; 11(3):58. https://doi.org/10.3390/risks11030058

Chicago/Turabian StyleAlkafaji, Bashaer Khudhair Abbas, Mahmoud Lari Dashtbayaz, and Mahdi Salehi. 2023. "The Impact of Blockchain on the Quality of Accounting Information: An Iraqi Case Study" Risks 11, no. 3: 58. https://doi.org/10.3390/risks11030058

APA StyleAlkafaji, B. K. A., Dashtbayaz, M. L., & Salehi, M. (2023). The Impact of Blockchain on the Quality of Accounting Information: An Iraqi Case Study. Risks, 11(3), 58. https://doi.org/10.3390/risks11030058