Heuristic Biases as Mental Shortcuts to Investment Decision-Making: A Mediation Analysis of Risk Perception

Abstract

:1. Introduction

2. Literature Review and Hypothesis Formulation

2.1. Article Selection Process

2.2. Definition of Variables

2.2.1. Heuristics

2.2.2. Overconfidence Bias

2.2.3. Representative Bias

2.2.4. Anchoring Bias

2.2.5. Availability Bias

2.2.6. Gamblers’ Fallacy

2.2.7. Peer Effect

2.2.8. Risk Perception

2.2.9. Investors’ Decision-Making

2.3. Hypothesis Formulation

2.4. Overconfidence Bias (OC) and Risk Perception

2.5. Availability Bias (AVAIL) and Risk Perception

2.6. Anchoring Bias (ANCH) and Risk Perception

2.7. Representativeness Bias (REP) and Risk Perception

2.8. Gamblers’ Fallacy Bias (GF) and Risk Perception

2.9. Risk Perception (RP) and Investment Decision-Making

2.10. Risk Perception as a Mediator

3. Research Methodology

3.1. Questionnaire Design

3.2. Sample and Data Collection Procedures

4. Analysis

4.1. Descriptive Analysis

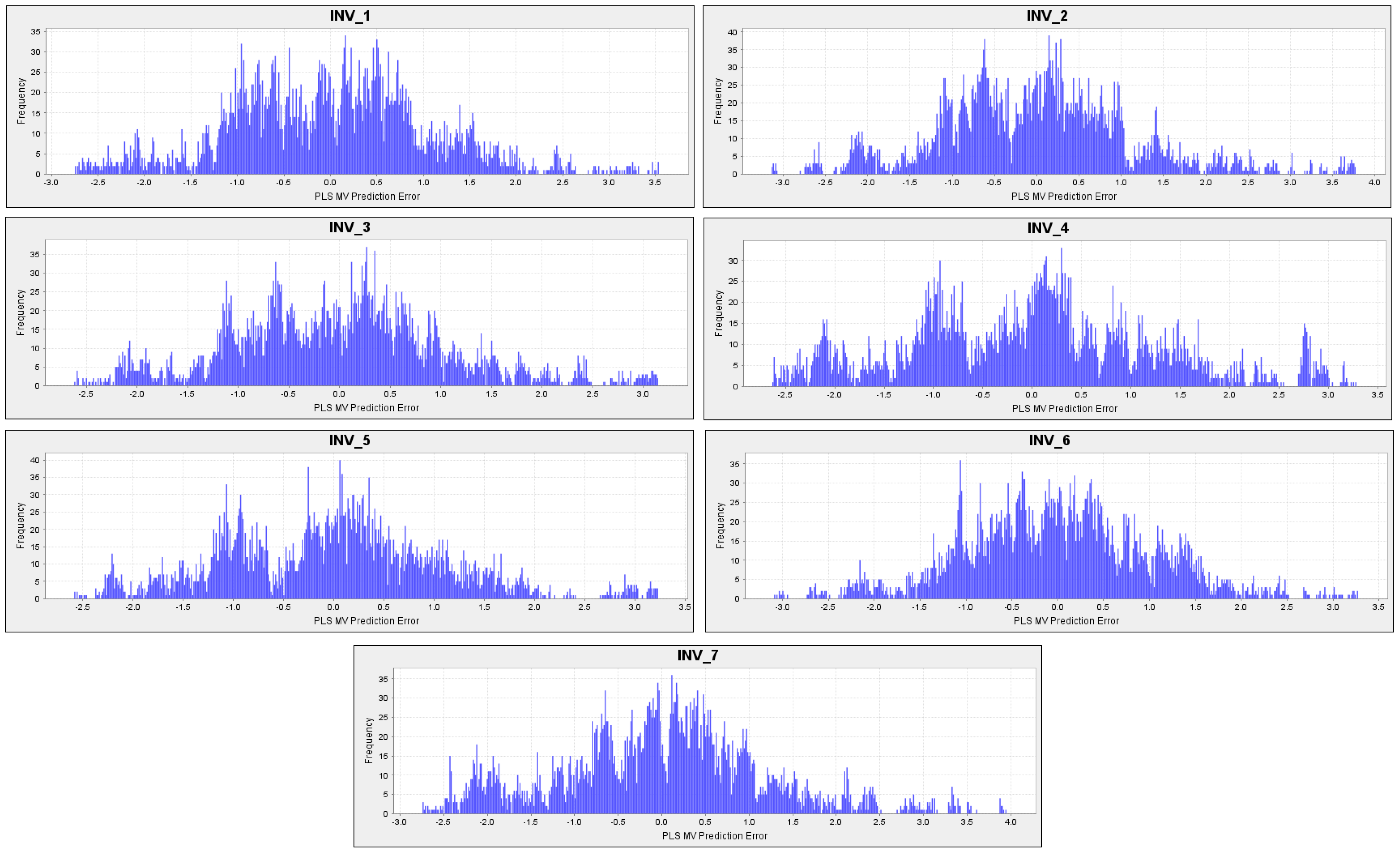

4.2. Analysis of Measurement Model

4.3. Analysis of Structural Model

5. Discussion and Implications

6. Conclusions, Limitations, and Future Research Opportunities

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Andersen, Jørgen Vitting. 2010. Detecting Anchoring in Financial Markets. Journal of Behavioral Finance 11: 129–33. [Google Scholar] [CrossRef]

- Aznar-Sánchez, José A., María Piquer-Rodríguez, Juan F. Velasco-Muñoz, and Francisco Manzano-Agugliaro. 2019. Worldwide Research Trends on Sustainable Land Use in Agriculture. Land Use Policy 87: 104069. [Google Scholar] [CrossRef]

- Baker, H. Kent, and John R. Nofsinger. 2002. Psychological Biases of Investors. Financial Services Review, July. Available online: https://www.semanticscholar.org/paper/Psychological-Biases-of-Investors-Baker-Nofsinger/0b1a81e897d3f7fc94f6030e8b7a673d8534e77e (accessed on 21 March 2023).

- Baker, H. Kent, Satish Kumar, and Harsh Pratap Singh. 2018. Behavioural Biases among SME Owners. International Journal of Management Practice 11: 259–83. [Google Scholar] [CrossRef]

- Barber, Brad M., and Terrance Odean. 2000. Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. The Journal of Finance 55: 773–806. [Google Scholar] [CrossRef]

- Barber, Brad M., and Terrance Odean. 2001. Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment*. The Quarterly Journal of Economics 116: 261–92. [Google Scholar] [CrossRef]

- Barberis, Nicholas, and Ming Huang. 2001. Mental Accounting, Loss Aversion, and Individual Stock Returns. The Journal of Finance 56: 1247–92. [Google Scholar] [CrossRef] [Green Version]

- Barberis, Nicholas, and Richard Thaler. 2003. Chapter 18 A Survey of Behavioral Finance. In Handbook of the Economics of Finance. Financial Markets and Asset Pricing. Amsterdam: Elsevier, pp. 1053–128. [Google Scholar] [CrossRef]

- Barbosa, Saulo D., and Alain Fayolle. 2007. Where Is the Risk? Availability, Anchoring, and Framing Effects on Entrepreneurial Risk Taking. SSRN Scholarly Paper. Rochester, NY. Available online: https://papers.ssrn.com/abstract=1064121 (accessed on 24 March 2023).

- Barnes, James H., Jr. 1984. Cognitive Biases and Their Impact on Strategic Planning. Strategic Management Journal 5: 129–37. [Google Scholar] [CrossRef]

- Bartolini, Maicol, Eleonora Bottani, and Eric H. Grosse. 2019. Green Warehousing: Systematic Literature Review and Bibliometric Analysis. Journal of Cleaner Production 226: 242–58. [Google Scholar] [CrossRef]

- Ben-David, Daniel, and Orly Sade. 2001. Robo-advisor adoption, willingness to pay, and trust—Before and at the outbreak of the COVID-19 pandemic. Willingness to Pay, and Trust—Before and at the Outbreak of the COVID-19 Pandemic. Rochester: SSRN Scholarly Paper. [Google Scholar] [CrossRef]

- Bernstein, Peter L. 1995. Risk as a History of Ideas. Financial Analysts Journal 51: 7–11. [Google Scholar] [CrossRef]

- Bezzina, Frank, Simon Grima, and Josephine Mamo. 2014. Risk Management practices adopted by financial firms in Malta. Managerial Finance 40: 587–612. [Google Scholar] [CrossRef]

- Broihanne, Marie-Hélène, Maxime Merli, and Patrick Roger. 2014. Overconfidence, Risk Perception and the Risk-Taking Behavior of Finance Professionals. Finance Research Letters 11: 64–73. [Google Scholar] [CrossRef]

- Bromiley, Philip, and Shawn P. Curley. 1992. Individual Differences in Risk Taking. In Risk-Taking Behavior. Wiley Series in Human Performance and Cognition. Oxford: John Wiley & Sons, pp. 87–132. [Google Scholar]

- Busenitz, Lowell W., and Jay B. Barney. 1994. Biases and Heuristics in Strategic Decision Making: Differences between Entrepreneurs and Managers in Large Organizations. Academy of Management Proceedings 1994: 85–89. [Google Scholar] [CrossRef]

- Carrion, Gabriel Cepeda, Christian Nitzl, and José L. Roldán. 2017. Mediation Analyses in Partial Least Squares Structural Equation Modeling: Guidelines and Empirical Examples. In Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications. Edited by Hengky Latan and Richard Noonan. Cham: Springer International Publishing, pp. 173–95. [Google Scholar] [CrossRef]

- Chen, Gongmeng, Kenneth A. Kim, John R. Nofsinger, and Oliver M. Rui. 2007. Trading Performance, Disposition Effect, Overconfidence, Representativeness Bias, and Experience of Emerging Market Investors. Journal of Behavioral Decision Making 20: 425–51. [Google Scholar] [CrossRef]

- Chuang, Wen-I., and Bong-Soo Lee. 2006. An Empirical Evaluation of the Overconfidence Hypothesis. Journal of Banking & Finance 30: 2489–515. [Google Scholar] [CrossRef]

- Cohen, Jacob. 2013. Statistical Power Analysis for the Behavioral Sciences, 3rd ed. New York: Routledge. [Google Scholar] [CrossRef]

- Cooper, Arnold C., Carolyn Y. Woo, and William C. Dunkelberg. 1988. Entrepreneurs’ Perceived Chances for Success. Journal of Business Venturing 3: 97–108. [Google Scholar] [CrossRef]

- Costello, Anna, and Jason Osborne. 2019. Best Practices in Exploratory Factor Analysis: Four Recommendations for Getting the Most from Your Analysis. Practical Assessment, Research, and Evaluation 10: 7. [Google Scholar] [CrossRef]

- Couckuyt, Dries, and Amy Van Looy. 2019. A Systematic Review of Green Business Process Management. Business Process Management Journal 26: 421–46. [Google Scholar] [CrossRef]

- Daniel, Kent, David Hirshleifer, and Avanidhar Subrahmanyam. 1998. Investor Psychology and Security Market Under- and Overreactions. The Journal of Finance 53: 1839–85. [Google Scholar] [CrossRef] [Green Version]

- Daniel, Kent, David Hirshleifer, and Siew Hong Teoh. 2002. Investor Psychology in Capital Markets: Evidence and Policy Implications. Journal of Monetary Economics 49: 139–209. [Google Scholar] [CrossRef]

- De Bondt, Werner F. M., and Richard H. Thaler. 1995. Chapter 13 Financial Decision-Making in Markets and Firms: A Behavioral Perspective. In Handbooks in Operations Research and Management Science. Finance: Elsevier, vol. 9, pp. 385–410. [Google Scholar] [CrossRef]

- Dias, Rui, Nuno Teixeira, Veronika Machova, Pedro Pardal, Jakub Horak, and Marek Vochozka. 2020. Random walks and market efficiency tests: Evidence on US, Chinese and European capital markets within the context of the global COVID-19 pandemic. Oeconomia Copernicana 11: 585–608. [Google Scholar] [CrossRef]

- Dunegan, Kenneth J. 1993. Framing, Cognitive Modes, and Image Theory: Toward an Understanding of a Glass Half Full. Journal of Applied Psychology 78: 491–503. [Google Scholar] [CrossRef]

- Evans, Dorla A. 2006. Subject Perceptions of Confidence and Predictive Validity in Financial Information Cues. Journal of Behavioral Finance 7: 12–28. [Google Scholar] [CrossRef]

- Faul, Franz, Edgar Erdfelder, Axel Buchner, and Albert-Georg Lang. 2009. Statistical Power Analyses Using G*Power 3.1: Tests for Correlation and Regression Analyses. Behavior Research Methods 41: 1149–60. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Folkes, Valerie S. 1988. The Availability Heuristic and Perceived Risk. Journal of Consumer Research 15: 13–23. [Google Scholar] [CrossRef]

- Forlani, David, and John W. Mullins. 2000. Perceived Risks and Choices in Entrepreneurs’ New Venture Decisions. Journal of Business Venturing 15: 305–22. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Journal of Marketing Research 18: 382–88. [Google Scholar] [CrossRef]

- Gao, Lei, and Ulrich Schmidt. 2005. Self Is Never Neutral: Why Economic Agents Behave Irrationally. Journal of Behavioral Finance 6: 27–37. [Google Scholar] [CrossRef]

- Geisser, Seymour. 1974. A Predictive Approach to the Random Effect Model. Biometrika 61: 101–7. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., and Paul R. Milgrom. 1985. Bid, Ask and Transaction Prices in a Specialist Market with Heterogeneously Informed Traders. Journal of Financial Economics 14: 71–100. [Google Scholar] [CrossRef] [Green Version]

- Grable, John, Ruth Lytton, and Barbara O’Neill. 2004. Projection Bias and Financial Risk Tolerance. Journal of Behavioral Finance 5: 142–47. [Google Scholar] [CrossRef]

- Grima, Simon, Ramona Rupeika-Apoga, Murat Kizilkaya, Inna Romānova, Rebecca Dalli Gonzi, and Mihajlo Jakovljevic. 2021. A proactive approach to identify the exposure risk to COVID-19: Validation of the pandemic risk exposure measurement (PREM) model using real-world data. Risk Management and Healthcare Policy 14: 4775–87. [Google Scholar] [CrossRef] [PubMed]

- Gupta, Sanjay, Nidhi Walia, Simarjeet Singh, and Swati Gupta. 2022. A Systematic Literature Review and Bibliometric Analysis of Noise Trading. Qualitative Research in Financial Markets 15: 190–215. [Google Scholar] [CrossRef]

- Hair, Joe F., Matt C. Howard, and Christian Nitzl. 2020. Assessing Measurement Model Quality in PLS-SEM Using Confirmatory Composite Analysis. Journal of Business Research 109: 101–10. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to Use and How to Report the Results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jr., Marko Sarstedt, Christian M. Ringle, and Siegfried P. Gudergan. 2017. Advanced Issues in Partial Least Squares Structural Equation Modeling. Los Angeles: Sage publications. [Google Scholar]

- Haley, Usha C. V., and Stephen A. Stumpf. 1989. Cognitive Trails in Strategic Decision-Making: Linking Theories of Personalities and Cognitions*. Journal of Management Studies 26: 477–97. [Google Scholar] [CrossRef]

- Harris, Milton, and Artur Raviv. 2005. Allocation of Decision-Making Authority. Review of Finance 9: 353–83. [Google Scholar] [CrossRef] [Green Version]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2015. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef] [Green Version]

- Henseler, Jörg, Geoffrey Hubona, and Pauline Ash Ray. 2016. Using PLS Path Modeling in New Technology Research: Updated Guidelines. Industrial Management & Data Systems 116: 2–20. [Google Scholar] [CrossRef]

- Hirshleifer, David. 2001. Investor Psychology and Asset Pricing. The Journal of Finance 56: 1533–97. [Google Scholar] [CrossRef] [Green Version]

- Hoe, Siu Loon. 2008. Issues and Procedures in Adopting Structural Equation Modelling Technique. Journal of Quantitative Methods 3: 76–83. [Google Scholar]

- Hogarth, Robin M. 1981. Beyond Discrete Biases: Functional and Dysfunctional Aspects of Judgmental Heuristics. Psychological Bulletin 90: 197–217. [Google Scholar] [CrossRef]

- Huberman, Gur. 2001. Familiarity Breeds Investment. The Review of Financial Studies 14: 659–80. [Google Scholar] [CrossRef]

- Hunjra, Ahmed Imran, Kashif Ur Rehman, and Salman Ali Qureshi. 2012. Factors Affecting Investment Decision Making of Equity Fund Managers. SSRN Scholarly Paper. Rochester, NY. Available online: https://papers.ssrn.com/abstract=3229650 (accessed on 20 March 2023).

- Hvide, Hans K. 2002. Pragmatic Beliefs and Overconfidence. Journal of Economic Behavior & Organization, Psychological Aspects of Economic Behavior 48: 15–28. [Google Scholar] [CrossRef]

- Jain, Jinesh, Nidhi Walia, and Sanjay Gupta. 2019. Evaluation of Behavioral Biases Affecting Investment Decision Making of Individual Equity Investors by Fuzzy Analytic Hierarchy Process. Review of Behavioral Finance 12: 297–314. [Google Scholar] [CrossRef]

- Jain, Jinesh, Nidhi Walia, Manpreet Kaur, and Simarjeet Singh. 2021. Behavioural Biases Affecting Investors’ Decision-Making Process: A Scale Development Approach. Management Research Review 45: 1079–98. [Google Scholar] [CrossRef]

- Jain, Jinesh, Nidhi Walia, Simarjeet Singh, and Esha Jain. 2022. Mapping the Field of Behavioural Biases: A Literature Review Using Bibliometric Analysis. Management Review Quarterly 72: 823–55. [Google Scholar] [CrossRef]

- Javed, Hassan, Tanveer Bagh, and Sadaf Razzaq. 2017. Herding Effects, Over Confidence, Availability Bias and Representativeness as Behavioral Determinants of Perceived Investment Performance: An Empirical Evidence from Pakistan Stock Exchange (PSX). Journal of Global Economics 6: 1–13. [Google Scholar] [CrossRef]

- Juliana, A. Pramezwary, D. M. Lemy, R. Pramono, A. Djakasaputra, and A. Purwanto. 2022. Hotel performance in the digital era: Roles of digital marketing, perceived quality and trust. Journal of Intelligent Management Decision 1: 36–45. [Google Scholar] [CrossRef]

- Kahneman, Daniel. 2003. A Perspective on Judgment and Choice: Mapping Bounded Rationality. The American Psychologist 58: 697–720. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kahneman, Daniel, and Amos Tversky. 1979. On the Interpretation of Intuitive Probability: A Reply to Jonathan Cohen. Cognition 7: 409–11. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Dan Lovallo. 1993. Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking. Management Science 39: 17–31. [Google Scholar] [CrossRef]

- Kengatharan, Lingesiya, and Kengatharan Navaneethakrishnan. 2014. The Influence of Behavioral Factors in Making Investment Decisions and Performance: Study on Investors of Colombo Stock Exchange, Sri Lanka. Asian Journal of Finance & Accounting 6: 1. [Google Scholar] [CrossRef]

- Keyes, Ralph. 1985. Chancing It: Why We Take Risks. Boston: Little Brown & Co. [Google Scholar]

- Khan, Mir Zat Ullah. 2017. Impact of availability bias and loss aversion bias on investment.docx–impact of availability bias and loss aversion bias on investment decision. Management and Administration 1: 17–28. [Google Scholar]

- Kim, Keunsoo, and Jinho Byun. 2011. Studies on Korean Capital Markets from the Perspective of Behavioral Finance. Asian Review of Financial Research 24. Available online: https://www.kci.go.kr/kciportal/ci/sereArticleSearch/ciSereArtiView.kci?sereArticleSearchBean.artiId=ART001581529 (accessed on 20 March 2023).

- Krueger, Norris, Jr., and Peter R. Dickson. 1994. How Believing in Ourselves Increases Risk Taking: Perceived Self-Efficacy and Opportunity Recognition. Decision Sciences 25: 385–400. [Google Scholar] [CrossRef]

- Kumar, Alok, and Ravi Dhar. 2001. A Non-Random Walk Down the Main Street: Impact of Price Trends on Trading Decisions of Individual Investors. Yale School of Management Working Papers, Yale School of Management Working Papers, June. Available online: https://ideas.repec.org//p/ysm/somwrk/ysm208.html (accessed on 21 March 2023).

- Kumar, Amit, Mark R. Schmeler, Amol M. Karmarkar, Diane M. Collins, Rosemarie Cooper, Rory A. Cooper, Hyekyoung Shin, and Margo B. Holm. 2013. Test-Retest Reliability of the Functional Mobility Assessment (FMA): A Pilot Study. Disability and Rehabilitation: Assistive Technology 8: 213–19. [Google Scholar] [CrossRef]

- Kumar, Satish, and Nisha Goyal. 2015. Behavioural Biases in Investment Decision Making–a Systematic Literature Review. Qualitative Research in Financial Markets 7: 88–108. [Google Scholar] [CrossRef]

- Lepone, Grace, and Zhini Yang. 2020. Do Early Birds Behave Differently from Night Owls in the Stock Market? Pacific-Basin Finance Journal 61: 101333. [Google Scholar] [CrossRef]

- Limaye. 2019. The Rise of Small-Town Investors in Indian Equity Markets. The Economic Times, September 24. Available online: https://economictimes.indiatimes.com/markets/stocks/news/the-rise-of-small-town-investors-in-indian-equity-markets/articleshow/71270423.cms(accessed on 23 March 2023).

- Lu, Timothy Jun, and Ning Tang. 2019. Social interactions in asset allocation decisions: Evidence from 401 (k) pension plan investors. Journal of Economic Behavior & Organization 159: 1–14. [Google Scholar]

- Mallik, Kiran Aziz, Muhammad Munir, and S. Sarwar. 2017. Impact of Overconfidence and Loss Aversion Biases on Investor Decision Making Behavior: Mediating Role of Risk Perception. Available online: https://www.semanticscholar.org/paper/IMPACT-OF-OVERCONFIDENCE-AND-LOSS-AVERSION-BIASES-Mallik-Munir/74f01b8795468a8ae425f3f128fdff2291d681e4 (accessed on 23 March 2023).

- March, James G., and Zur Shapira. 1987. Managerial Perspectives on Risk and Risk Taking. Management Science 33: 1404–18. [Google Scholar] [CrossRef] [Green Version]

- Marwaha, Steven, Matthew R. Broome, Paul E. Bebbington, Elizabeth Kuipers, and Daniel Freeman. 2014. Mood Instability and Psychosis: Analyses of British National Survey Data. Schizophrenia Bulletin 40: 269–77. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mishra, Anand Kumar, Rohit Bansal, Prince Kumar Maurya, Sanjay Kumar Kar, and Palvinder Kaur Bakshi. 2023. Predicting the Antecedents of Consumers’ Intention toward Purchase of Mutual Funds: A Hybrid PLS-SEM-Neural Network Approach. International Journal of Consumer Studies 47: 563–87. [Google Scholar] [CrossRef]

- Mittal, Amit, and Deepika Jhamb. 2016. Determinants of shopping mall attractiveness: The Indian context. Procedia Economics and Finance 37: 386–90. [Google Scholar] [CrossRef] [Green Version]

- Mittal, Amit, Arun Aggarwal, and Ruchi Mittal. 2020. Predicting university students’ adoption of mobile news applications: The role of perceived hedonic value and news motivation. International Journal of E-Services and Mobile Applications (IJESMA) 12: 42–59. [Google Scholar] [CrossRef]

- Mugerman, Yevgeny, Orly Sade, and Eyal Winter. 2020. Out-of-pocket vs. out-of-investment in financial advisory fees: Evidence from the lab. Journal of Economic Psychology 81: 102317. [Google Scholar] [CrossRef]

- Mugerman, Yevgeny, Orly Sade, and Moses Shayo. 2014. Long Term Savings Decisions: Financial Reform, Peer Effects and Ethnicity. Journal of Economic Behavior & Organization 106: 235–53. [Google Scholar] [CrossRef]

- Nardi, Peter M. 2018. Doing Survey Research: A Guide to Quantitative Methods, 4th ed. New York: Routledge. [Google Scholar] [CrossRef]

- Nga, Joyce K. H., and Leong Ken Yien. 2013. The Influence of Personality Trait and Demographics on Financial Decision Making among Generation Y. Young Consumers 14: 230–43. [Google Scholar] [CrossRef]

- Nitzl, Christian, Jose L. Roldan, and Gabriel Cepeda. 2016. Mediation Analysis in Partial Least Squares Path Modeling: Helping Researchers Discuss More Sophisticated Models. Industrial Management & Data Systems 116: 1849–64. [Google Scholar] [CrossRef]

- Nofsinger, John R. 2001. The Impact of Public Information on Investors. Journal of Banking & Finance 25: 1339–66. [Google Scholar] [CrossRef]

- Nofsinger, John R. 2017. Overconfidence. In The Psychology of Investing, 6th ed. New York: Routledge. [Google Scholar]

- Odean, Terrance. 1998. Volume, Volatility, Price, and Profit When All Traders Are Above Average. The Journal of Finance 53: 1887–934. [Google Scholar] [CrossRef]

- Pandit, Kul Chandra. 2021. Trading Practice and Behavioral Biases of Individual Investors in Nepalese Stock Market. Nepalese Journal of Management Research 1: 55–62. [Google Scholar] [CrossRef]

- Parker, Donald F., and Thomas A. Decotiis. 1983. Organizational Determinants of Job Stress. Organizational Behavior and Human Performance 32: 160–77. [Google Scholar] [CrossRef] [Green Version]

- Paruchuri, Srikanth, and Vilmos F. Misangyi. 2015. Investor Perceptions of Financial Misconduct: The Heterogeneous Contamination of Bystander Firms. Academy of Management Journal 58: 169–94. [Google Scholar] [CrossRef]

- Patria, Harry, Sari Wahyuni, and Ratih Dyah Kusumastuti. 2019. Intellectual Structure and Scientific Evolution of Strategic Decision in the Field of Business and Management from 1971 to 2018. Asian Journal of Business and Accounting 12: 233–86. [Google Scholar] [CrossRef]

- Phan, Khoa Cuong, and Jian Zhou. 2014. Factors Influencing Individual Investors’ Behavior: An Empirical Study of the Vietnamese Stock Market. American Journal of Business and Management 3: 77–94. [Google Scholar] [CrossRef]

- Pidgeon, Nick, Christopher Hood, David Jones, Barry Turner, and Rose Gibson. 1992. Risk perception. In Risk: Analysis, Perception and Management: Report of a Royal Society Study Group. London: Royal Society, pp. 89–134. [Google Scholar]

- Pompian, Michael M. 2011. Behavioral Finance and Wealth Management: How to Build Investment Strategies That Account for Investor Biases. Hoboken: John Wiley & Sons. [Google Scholar]

- Rakesh, H. M. 2013. Gambler’ s Fallacy and Behavioral Finance in the Financial Markets: A Case Study of Bombay Stock Exchange. Available online: https://www.semanticscholar.org/paper/Gambler-%E2%80%99-s-Fallacy-and-Behavioral-Finance-In-The-%3A-RakeshH/58033251991668bf0cd7ca22e8c11ce047a5fc1c (accessed on 23 March 2023).

- Ramadorai, Tarun. 2013. Capacity Constraints, Investor Information, and Hedge Fund Returns. Journal of Financial Economics 107: 401–16. [Google Scholar] [CrossRef]

- Rasool, Nosheen, and Safi Ullah. 2020. Financial Literacy and Behavioural Biases of Individual Investors: Empirical Evidence of Pakistan Stock Exchange. Journal of Economics, Finance and Administrative Science 25: 261–78. [Google Scholar] [CrossRef]

- Ricciardi, Victor. 2004. A Risk Perception Primer: A Narrative Research Review of the Risk Perception Literature in Behavioral Accounting and Behavioral Finance. Rochester: SSRN Scholarly Paper. [Google Scholar] [CrossRef] [Green Version]

- Ricciardi, Victor. 2008. The Psychology of Risk: The Behavioral Finance Perspective. Rochester: SSRN Scholarly Paper. Available online: https://papers.ssrn.com/abstract=1155822 (accessed on 23 March 2023).

- Ringle, Christian, Dirceu da Silva, and Diógenes Bido. 2015. Structural Equation Modeling with the SmartPLS. Rochester: SSRN Scholarly Paper. Available online: https://papers.ssrn.com/abstract=2676422 (accessed on 23 March 2023).

- Russo, J. Edward, and Paul Schoemaker. 1992. Managing Overconfidence. Sloan Management Review 33: 7–17. [Google Scholar]

- Saggese, Sara, Fabrizia Sarto, and Corrado Cuccurullo. 2016. Evolution of the Debate on Control Enhancing Mechanisms: A Systematic Review and Bibliometric Analysis. International Journal of Management Reviews 18: 417–39. [Google Scholar] [CrossRef]

- Sarwar, Aamir, and Ghadeer Afaf. 2016. A Comparison between Psychological and Economic Factors Affecting Individual Investor’s Decision-Making Behavior. Edited by David McMillan. Cogent Business & Management 3: 1232907. [Google Scholar] [CrossRef]

- Scholz, Peter, David Grossmann, and Joachim Goldberg. 2021. Robo Economicus? The Impact of Behavioral Biases on Robo-Advisory. In Robo-Advisory: Investing in the Digital Age, edited by Peter Scholz. Palgrave Studies in Financial Services Technology. Cham: Springer International Publishing, pp. 53–69. [Google Scholar] [CrossRef]

- Schwenk, Charles H. 1986. Information, Cognitive Biases, and Commitment to a Course of Action. Academy of Management Review 11: 298–310. [Google Scholar] [CrossRef]

- Shefrin, Hersh M., and Richard H. Thaler. 1988. The Behavioral Life-Cycle Hypothesis. Economic Inquiry 26: 609–43. [Google Scholar] [CrossRef]

- Shikuku, Omery C. 2014. The Effect of Behavioural Factors on Individual Investor Choices at the Nairobi Securities Exchange. Thesis, University of Nairobi. Available online: http://erepository.uonbi.ac.ke/handle/11295/75873 (accessed on 20 March 2023).

- Shiller, Robert J. 1999. Chapter 20 Human Behavior and the Efficiency of the Financial System. In Handbook of Macroeconomics. Amsterdam: Elsevier, pp. 1305–40. [Google Scholar] [CrossRef]

- Shmueli, Galit, Marko Sarstedt, Joseph F. Hair, Jun-Hwa Cheah, Hiram Ting, Santha Vaithilingam, and Christian M. Ringle. 2019. Predictive Model Assessment in PLS-SEM: Guidelines for Using PLSpredict. European Journal of Marketing 53: 2322–47. [Google Scholar] [CrossRef]

- Shmueli, Galit, Soumya Ray, Juan Manuel Velasquez Estrada, and Suneel Babu Chatla. 2016. The Elephant in the Room: Predictive Performance of PLS Models. Journal of Business Research 69: 4552–64. [Google Scholar] [CrossRef]

- Singh, Kamlesh, Mohita Junnarkar, and Jasleen Kaur. 2016. Measures of Positive Psychology: Development and Validation. Berlin and Heidelberg: Springer. [Google Scholar]

- Slovic, Paul, Baruch Fischhoff, and Sarah Lichtenstein. 1982. Why Study Risk Perception? Risk Analysis 2: 83–93. [Google Scholar] [CrossRef]

- Sood, Kirti, Prachi Pathak, Jinesh Jain, and Sanjay Gupta. 2022. How Does an Investor Prioritize ESG Factors in India? An Assessment Based on Fuzzy AHP. Managerial Finance 49: 66–87. [Google Scholar] [CrossRef]

- Statman, Meir. 1995. Behavioral Finance versus Standard Finance. Aimr Conference Proceedings 1995: 14–22. [Google Scholar] [CrossRef]

- Statman, Meir. 1999. Behaviorial finance: Past battles and future engagements. Financial Analysts Journal 55: 18–27. [Google Scholar] [CrossRef] [Green Version]

- Staw, Barry M., Lance E. Sandelands, and Jane E. Dutton. 1981. Threat Rigidity Effects in Organizational Behavior: A Multilevel Analysis. Administrative Science Quarterly 26: 501–24. [Google Scholar] [CrossRef]

- Sutcliffe, Kathleen M. 1994. What Executives Notice: Accurate Perceptions in Top Management Teams. Academy of Management Journal 37: 1360–78. [Google Scholar] [CrossRef]

- Tabachnick, Barbara G., and Linda S. Fidell. 2013. Using Multivariate Statistics. London: Pearson. [Google Scholar]

- Taylor, Shelley E., and Jonathon D. Brown. 1988. Illusion and Well-Being: A Social Psychological Perspective on Mental Health. Psychological Bulletin 103: 193–210. [Google Scholar] [CrossRef] [PubMed]

- Thaler, Richard H. 2000. From Homo Economicus to Homo Sapiens. Journal of Economic Perspectives 14: 133–41. [Google Scholar] [CrossRef] [Green Version]

- Tversky, Amos, and Daniel Kahneman. 1974. Judgment under Uncertainty: Heuristics and Biases. Science 185: 1124–31. [Google Scholar] [CrossRef] [PubMed]

- Van den Steen, Eric. 2004. Rational Overoptimism (and Other Biases). American Economic Review 94: 1141–51. [Google Scholar] [CrossRef] [Green Version]

- Verma, Rakesh Kumar, and Rohit Bansal. 2021. Stock Market Reaction on Green-Bond Issue: Evidence from Indian Green-Bond Issuers. Vision 2021: 09722629211022523. [Google Scholar] [CrossRef]

- Wagner, Suzanne Evans. 2014. Linguistic Correlates of Irish-American and Italian-American Ethnicity in High School and Beyond. Language & Communication 35: 75–87, New perspectives on linguistic variation and ethnic identity in North America. [Google Scholar] [CrossRef]

- Wang, Maobin, Chun Qiu, and Dongmin Kong. 2011. Corporate Social Responsibility, Investor Behaviors, and Stock Market Returns: Evidence from a Natural Experiment in China. Journal of Business Ethics 101: 127–41. [Google Scholar] [CrossRef]

- Waweru, Nelson Maina, Evelyne Munyoki, and Enrico Uliana. 2008. The Effects of Behavioural Factors in Investment Decision-Making: A Survey of Institutional Investors Operating at the Nairobi Stock Exchange. International Journal of Business and Emerging Markets 1: 24–41. [Google Scholar] [CrossRef]

- Williams, Brett, Andrys Onsman, and Ted Brown. 2010. Exploratory Factor Analysis: A Five-Step Guide for Novices. Australasian Journal of Paramedicine 8: 1–13. [Google Scholar] [CrossRef] [Green Version]

- Wulandari, Dewi Ayu, and Rr Iramani. 2014. Studi experienced regret, risk tolerance, overconfidance dan risk perception pada pengambilan keputusan investasi. Journal of Business & Banking 4: 55–66. [Google Scholar] [CrossRef]

- Xue, Wen-Jun, and Li-Wen Zhang. 2017. Stock Return Autocorrelations and Predictability in the Chinese Stock Market—Evidence from Threshold Quantile Autoregressive Models. Economic Modelling 60: 391–401. [Google Scholar] [CrossRef] [Green Version]

- Zahera, Syed Aliya, and Rohit Bansal. 2018. Do Investors Exhibit Behavioral Biases in Investment Decision Making? A Systematic Review. Qualitative Research in Financial Markets 10: 210–51. [Google Scholar] [CrossRef] [Green Version]

- Zahera, Syed Aliya, and Rohit Bansal. 2019. A study of prominence for disposition effect: A systematic review. Qualitative Research in Financial Markets 11: 2–21. [Google Scholar] [CrossRef]

- Zucchi. 2018. Why Is Financial Literacy so Important Today? Bank of North Dakota (blog). October 12. Available online: https://bnd.nd.gov/why-is-financial-literacy-so-important-today/ (accessed on 23 March 2023).

| Loadings | SD | Mean | Adapted From | Indicators | |

|---|---|---|---|---|---|

| 0.846 | 1.392 | 2.796 | Kengatharan and Navaneethakrishnan (2014) | You believe that your skills and knowledge of the stock market can help you to outperform the market | OC 1 |

| 0.846 | 1.453 | 2.94 | Phan and Zhou (2014) | You can predict the timing to enter and exit the market. Thus, you can outperform the market | OC 2 |

| 0.892 | 1.404 | 2.923 | Phan and Zhou (2014) | You believe that your knowledge about the stock market can help you outperform your peers | OC 3 |

| 0.849 | 1.399 | 2.923 | Huberman (2001) | You prefer to invest only in familiar stocks | REP 1 |

| 0.839 | 1.447 | 2.915 | Waweru et al. (2008) | You buy ‘hot’ stocks and avoid stocks that have performed poorly in the recent past | REP 2 |

| 0.892 | 1.372 | 2.828 | Marwaha et al. (2014) | If other stocks of a company are performing well and the same company offers new shares, you will buy the same | REP 4 |

| 0.809 | 1.467 | 2.798 | Marwaha et al. (2014) | Even if your best-researched stock does not perform according to your expectations, you still hold the same | REP 5 |

| 0.885 | 1.375 | 3.052 | Kengatharan and Navaneethakrishnan (2014); Waweru et al. (2008) | You rely on your previous experiences in the market for your next investment | ANCH 1 |

| 0.85 | 1.45 | 3.017 | Baker and Nofsinger (2002) | You usually invest in a stock which has fallen considerably from its previous closing or all-time high | ANCH 2 |

| 0.842 | 1.391 | 3.037 | Kengatharan and Navaneethakrishnan (2014) | You forecast the changes in stock prices in the future based on recent stock prices | ANCH 3 |

| 0.871 | 1.449 | 3.01 | Waweru et al. (2008) | You use the purchase price of stocks as a reference point in trading | ANCH 4 |

| 0.754 | 1.394 | 3.334 | Shikuku (2014); Waweru et al. (2008) | You prefer to buy local stocks than the trade in international stocks | AVAIL 1 |

| 0.771 | 1.44 | 3.282 | Parker and Decotiis (1983); Khan (2017) | You prefer to invest in a stock that well-known experts have evaluated | AVAIL 2 |

| 0.705 | 1.356 | 3.18 | Parker and Decotiis (1983); Khan (2017) | Your investment decision depends on new and favourable (positive) information released regarding the stock | AVAIL 3 |

| 0.727 | 1.336 | 3.234 | Parker and Decotiis (1983); Khan (2017) | You prefer to buy stocks on the days when the value of the index increases | AVAIL 5 |

| 0.743 | 1.38 | 3.252 | Parker and Decotiis (1983); Khan (2017) | You prefer to sell stocks on the days when the value of the index decreases | AVAIL 6 |

| 0.89 | 1.473 | 2.768 | Waweru et al. (2008) | You are normally able to anticipate the end of good or poor | GF 1 |

| 0.913 | 1.479 | 2.781 | Rakesh (2013) | You tend to ignore the benefits that can accrue by investing in different investment options | GF 2 |

| 0.725 | 1.373 | 3.192 | Khan (2017) | You usually have a fear of investing in stocks that have a sure gain | RP 1 |

| 0.725 | 1.417 | 3.287 | Khan (2017); Mallik et al. (2017) | You are cautious about stocks which show sudden changes in price or trading activity | RP 2 |

| 0.735 | 1.404 | 3.157 | Khan (2017); Mallik et al. (2017) | You usually have worry investing in stocks that have had a past negative performance in trading | RP 3 |

| 0.688 | 1.414 | 3.279 | Khan (2017) | You usually consider the credibility of brokerage firms that provide the financial services | RP 4 |

| 0.775 | 1.477 | 3.309 | Khan (2017); Mallik et al. (2017) | You are often not afraid to invest in stocks that have shown a past positive performance in trading | RP 5 |

| 0.761 | 1.417 | 2.519 | Sarwar and Afaf (2016); Khan (2017) | In general, you feel satisfied with the way you are making investment decisions | INV 1 |

| 0.715 | 1.41 | 2.544 | Sarwar and Afaf (2016) | Your decision-making helps you to achieve your investment objectives | INV 2 |

| 0.734 | 1.4 | 2.544 | Sarwar and Afaf (2016) | You are confident about the accuracy of your investment decisions. | INV 3 |

| 0.726 | 1.362 | 2.556 | Sarwar and Afaf (2016) | Your investments decisions can mostly earn a higher-than-average return in the market | INV 4 |

| 0.662 | 1.327 | 2.621 | Sarwar and Afaf (2016) | You make all investment decisions on your own | INV 5 |

| 0.747 | 1.37 | 2.551 | Sarwar and Afaf (2016); Khan (2017) | You consider all possible factors (viz., interest rate, inflation, global factors, political factors, etc.) while making investment decisions | INV 6 |

| 0.708 | 1.417 | 2.541 | Sarwar and Afaf (2016) | Return on your portfolio justifies your investment decision | INV 7 |

| 73% | Male | Gender |

| 27% | Female | |

| 9% | Below 20 | Age |

| 48% | 20–35 | |

| 31% | 35–50 | |

| 12% | Above 50 | |

| 8% | Undergraduate or lower | Educational Qualification |

| 23% | Graduate | |

| 69% | Postgraduate or higher | |

| 6% | Below two lakhs | Annual Income |

| 35% | 2 lakhs to 5 lakhs | |

| 48% | 5 lakhs to 10 lakhs | |

| 11% | 10 lakhs and above | |

| 23% | Below 2 years | Experience in the stock market |

| 41% | 2–5 years | |

| 29% | 5 to 10 years | |

| 7% | 10 years or above |

| AVE | Composite Reliability | Outer Loadings | Items | Construct |

|---|---|---|---|---|

| 0.708 | 0.879 | 0.858 | OC_1 | Overconfidence |

| 0.869 | OC_2 | |||

| 0.795 | OC_3 | |||

| 0.597 | 0.881 | 0.855 | AVAIL_1 | Availability |

| 0.754 | AVAIL_2 | |||

| 0.749 | AVAIL_3 | |||

| 0.773 | AVAIL_5 | |||

| 0.725 | AVAIL_6 | |||

| 0.708 | 0.906 | 0.834 | ANCH_1 | Anchoring |

| 0.82 | ANCH_2 | |||

| 0.912 | ANCH_3 | |||

| 0.795 | ANCH_4 | |||

| 0.665 | 0.887 | 0.87 | REP_1 | Representativeness |

| 0.737 | REP_2 | |||

| 0.743 | REP_4 | |||

| 0.899 | REP_5 | |||

| 0.747 | 0.854 | 0.943 | GF_1 | Gamblers’ fallacy |

| 0.778 | GF_2 | |||

| 0.697 | 0.92 | 0.795 | RP_1 | Risk Perception |

| 0.812 | RP_2 | |||

| 0.776 | RP_3 | |||

| 0.854 | RP_4 | |||

| 0.929 | RP_5 | |||

| 0.613 | 0.916 | 0.845 | INV_1 | Investment decision-making |

| 0.775 | INV_2 | |||

| 0.821 | INV_3 | |||

| 0.631 | INV_4 | |||

| 0.75 | INV_5 | |||

| 0.871 | INV_6 | |||

| 0.764 | INV_7 |

| RP | OC | INV | GF | ANCH | AVAIL | |

|---|---|---|---|---|---|---|

| 0.332 | ANCH | |||||

| 0.039 | 0.217 | GF | ||||

| 0.359 | 0.387 | 0.74 | INV | |||

| 0.39 | 0.122 | 0.145 | 0.226 | OC | ||

| 0.428 | 0.723 | 0.431 | 0.334 | 0.529 | RP | |

| 0.454 | 0.233 | 0.414 | 0.192 | 0.213 | 0.32 | REP |

| REP | RP | OC | INV | GF | ANCH | AVAIL | |

|---|---|---|---|---|---|---|---|

| 0.772 | AVAIL | ||||||

| 0.841 | −0.334 | ANCH | |||||

| 0.864 | 0.025 | −0.212 | GF | ||||

| 0.783 | 0.358 | 0.389 | −0.74 | INV | |||

| 0.841 | 0.388 | 0.12 | 0.145 | −0.226 | OC | ||

| 0.835 | −0.429 | −0.722 | −0.426 | −0.336 | 0.531 | RP | |

| 0.816 | −0.457 | 0.23 | 0.419 | 0.191 | 0.214 | −0.323 | REP |

| Decision | VAF | Type of Mediation | Mediation | Significant (Yes/No) | p-Value | t Statistics | ß | Path | Effect | Hypothesis |

|---|---|---|---|---|---|---|---|---|---|---|

| Supported | 45.74% | Complementary | Partial | YES | 0 | 3.66 | 0.086 | OC🡪RP🡪INV | Indirect | H1 |

| YES | 0.005 | 2.826 | 0.102 | OC🡪INV | Direct | |||||

| Supported | 17.16% | Complementary | Partial | YES | 0 | 4.846 | −0.098 | AVAIL🡪RP🡪INV | Indirect | H2 |

| YES | 0 | 7.516 | −0.473 | AVAIL🡪INV | Direct | |||||

| Supported | 35.00% | Complementary | Partial | YES | 0.012 | 2.524 | 0.049 | ANCH🡪RP🡪INV | Indirect | H3 |

| YES | 0.013 | 2.492 | 0.091 | ANCH🡪INV | Direct | |||||

| Supported | - | - | Full | YES | 0.001 | 3.301 | 0.072 | REP🡪RP🡪INV | Indirect | H4 |

| NO | 0.21 | 1.253 | 0.053 | REP🡪INV | Direct | |||||

| Supported | 51.34% | Complementary | Partial | YES | 0 | 3.904 | 0.096 | GF🡪RP🡪INV | Indirect | H5 |

| YES | 0.01 | 2.562 | 0.091 | GF🡪INV | Direct |

| LM | PLS | PLS | Indicator |

|---|---|---|---|

| MAE | MAE | Q2 Predict | |

| 0.862 | 0.854 | 0.408 | INV_1 |

| 0.878 | 0.873 | 0.349 | INV_2 |

| 0.813 | 0.829 | 0.456 | INV_3 |

| 1.008 | 0.987 | 0.229 | INV_4 |

| 0.851 | 0.842 | 0.353 | INV_5 |

| 0.767 | 0.801 | 0.457 | INV_6 |

| 0.905 | 0.911 | 0.308 | INV_7 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jain, J.; Walia, N.; Singla, H.; Singh, S.; Sood, K.; Grima, S. Heuristic Biases as Mental Shortcuts to Investment Decision-Making: A Mediation Analysis of Risk Perception. Risks 2023, 11, 72. https://doi.org/10.3390/risks11040072

Jain J, Walia N, Singla H, Singh S, Sood K, Grima S. Heuristic Biases as Mental Shortcuts to Investment Decision-Making: A Mediation Analysis of Risk Perception. Risks. 2023; 11(4):72. https://doi.org/10.3390/risks11040072

Chicago/Turabian StyleJain, Jinesh, Nidhi Walia, Himanshu Singla, Simarjeet Singh, Kiran Sood, and Simon Grima. 2023. "Heuristic Biases as Mental Shortcuts to Investment Decision-Making: A Mediation Analysis of Risk Perception" Risks 11, no. 4: 72. https://doi.org/10.3390/risks11040072

APA StyleJain, J., Walia, N., Singla, H., Singh, S., Sood, K., & Grima, S. (2023). Heuristic Biases as Mental Shortcuts to Investment Decision-Making: A Mediation Analysis of Risk Perception. Risks, 11(4), 72. https://doi.org/10.3390/risks11040072