Bankruptcy Prediction for Micro and Small Enterprises Using Financial, Non-Financial, Business Sector and Macroeconomic Variables: The Case of the Lithuanian Construction Sector

Abstract

1. Introduction

2. Increasing the Accuracy and Interpretability of Bankruptcy-Prediction Models

3. Research Methodology

3.1. Data Collection

3.1.1. The Period Considered and the Control Period

3.1.2. The Population

3.1.3. Sampling and Sample Size

- bankrupt enterprises. During the period (2009–2013), these enterprises either (i) went bankrupt or (ii) started bankruptcy processes;

- non-bankrupt enterprises. The enterprises (i) did not go bankrupt or start bankruptcy processes and (ii) continued their activities and showed no indications of activity failure. This means that the enterprises were operational in 2007 and continued their activity in 2021; the enterprises were not reformed, reorganised, restructured or liquidated; they did not participate in reorganisation, separation, etc.

- (1)

- Three-hundred and twenty-one bankrupt enterprises, i.e., enterprises that (i) went bankrupt or (ii) started bankruptcy processes during the period of 2009–2013.

- (2)

- Two hundred and sixty non-bankrupt enterprises, i.e., enterprises that (i) did not go bankrupt or start bankruptcy processes during the period considered and (ii) continued their activities and showed no indications of activity failure by the year 2021.

3.2. Selection of Independent Variables

3.2.1. Financial Ratios

3.2.2. Non-Financial Variables

3.2.3. Construction-Sector Variables

3.2.4. Macroeconomic Variables

3.2.5. Pre-Processing Stage: Selection of Statistical Tests

- (1)

- If the assumption of normality is violated, the Mann–Whitney U test is used. The null hypothesis H0 of the Mann–Whitney U test was as follows: the distributions of the independent variables of the bankrupt and non-bankrupt enterprises are equal. The alternate hypothesis H1 was as follows: the distributions of the independent variables of the bankrupt and non-bankrupt enterprises are different. The decision was made based on the following provisions: (i) H0 is rejected, distributions of the independent variables are not equal if p < α (α = 0.05); (ii) H0 is not rejected, distributions of the independent variables are equal if p ≥ α.

- (2)

- If the assumption of normality was valid, we used the t-test. This test was applied in empirical studies (Ravisankar et al. (2011); Pustylnick (2012); Špicas et al. (2015) and others), in which, using the relative financial ratios in the financial statements, prediction of the possibility of bankruptcy was analysed.

3.3. Classificatory Devices

3.3.1. The Logistic Regression Model

3.3.2. Artificial Neural Network Model

3.3.3. Multivariate Adaptive Regression Splines Model

4. Research Results and Findings

4.1. Using Statistical Tests: Estimation of Independent Variables

4.2. Logistic Regression EBP Models

4.3. Two-Stage Hybrid-Model Development

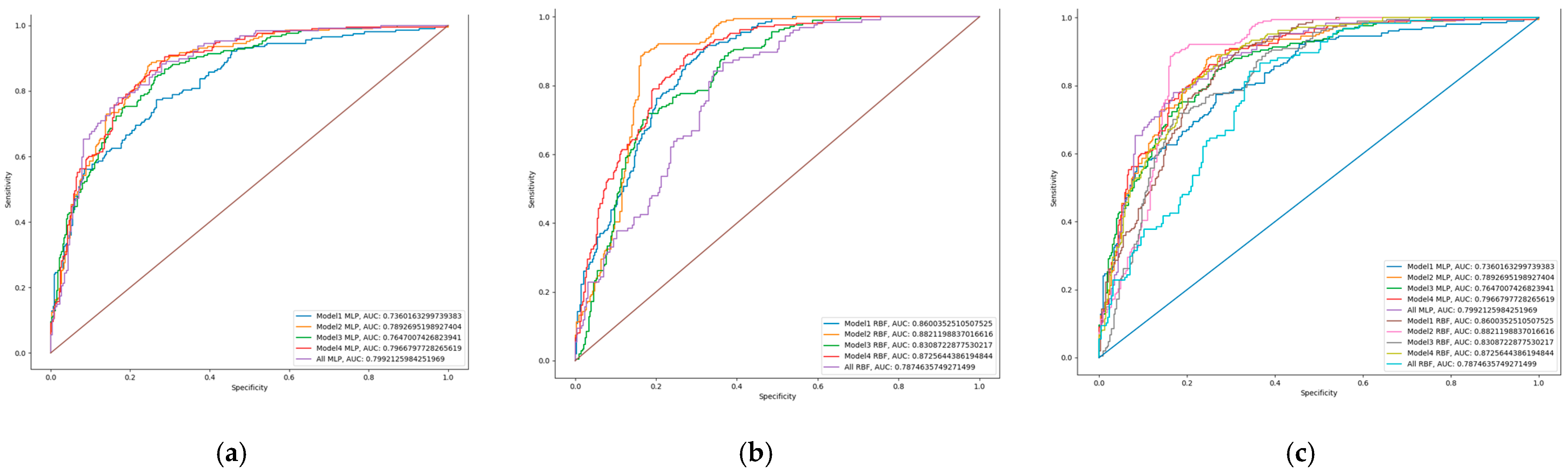

4.4. MLP and RBF Neural Network Models

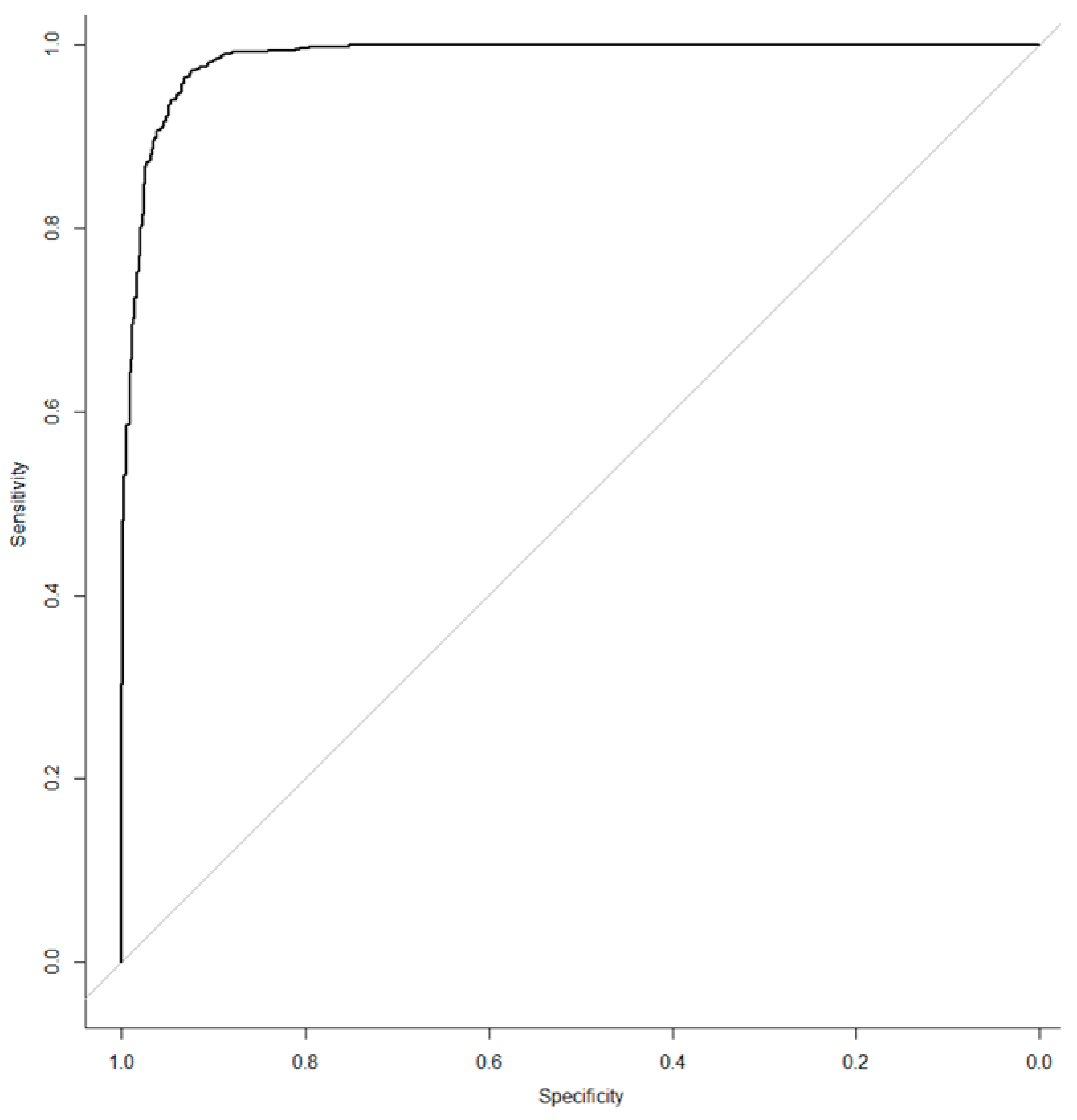

4.5. The MARS Model

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Financial Variable (Financial Ratio) | Calculation Formula |

|---|---|

| 1a. Profitability ratios (return from sales) | |

| Gross profit/sales | GP/S |

| EBIT/sales | EBIT/S |

| EBT/sales | EBT/S |

| Net profit/sales | NP/S |

| 1b. Profitability ratios (return on investment) | |

| Gross profit/total assets | GP/TA |

| EBIT/total assets | EBIT/TA |

| EBIT/current liabilities | EBIT/CL |

| EBT/total assets | EBT/TA |

| EBT/equity | EBT/Eq |

| EBT/(equity–current liabilities) | EBT/(Eq-CL) |

| Net profit/total assets | ROA |

| Net profit/equity | ROE |

| 2. Liquidity ratios | |

| Current assets/current liabilities | CA/CL |

| (Current assets–inventories)/current liabilities | (CA-INV)/CL |

| Inventories/current liabilities | INV/CL |

| Accounts receivable/total liabilities | AR/TL |

| Accounts receivable/(total liabilities–cash) | AR/(TL-Cash) |

| Cash/current liabilities | Cash/CL |

| (Cash–inventories)/current liabilities | (Cash-INV)/CL |

| Cash/total liabilities | Cash/TL |

| Cash/equity | Cash/Eq |

| Working capital/total assets | WC/TA |

| Working capital/equity | WC/Eq |

| (Current liabilities–cash)/total assets | (CL-Cash)/TA |

| 3. Solvency ratios | |

| Total liabilities/total assets | TL/TA |

| Equity/total assets | Eq/TA |

| Equity/(equity + long term liabilities) | Eq/(Eq+LTL) |

| Equity/total liabilities | Eq/TL |

| Fixed assets/equity | FA/Eq |

| Current assets/total liabilities | CA/TL |

| Current assets/(total liabilities–cash) | CA/(TL-Cash) |

| (Equity− Intangible Assets)/(Total Assets–Intangible Assets–Fixed assets–Cash) | (Eq-IA)/(TA-IA-FA-Cash) |

| 4. Activity ratios | |

| 4a. Activity ratios (assets turnover) | |

| Sales/inventories | S/INV |

| Sales/accounts receivable | S/AR |

| Sales/fixed assets | S/FA |

| Sales/current assets | S/CA |

| Sales/total assets | S/TA |

| Sales/cash | S/Cash |

| Sales/working capital | S/WC |

| 4b. Activity ratios (equity and liabilities turnover) | |

| Sales/equity | S/Eq |

| Sales/capital | S/C |

| Sales/current liabilities | S/CL |

| Sales/total liabilities | S/TL |

| 4c. Activity ratios (level of expenses) | |

| Cost of sales/sales | CS/S |

| Working capital/operating expenses | WC/OE |

| 5a. Structure ratios (total assets structure ratios) | |

| Current assets/total assets | CA/TA |

| Accounts receivable/inventories | AR/INV |

| Inventories/total assets | INV/TA |

| Cash/total assets | Cash/TA |

| 5b. Structure ratios (equity and liabilities structure ratios) | |

| Retained earnings/total assets | RE/TA |

| Current liabilities/(total liabilities−cash) | CL/(TL-Cash) |

| 6 Other ratios (size of enterprise) | |

| Logarithm of total assets | LogTA |

| Logarithm of total sales | LogS |

| Abbreviation | Variables | Description | Data Source |

|---|---|---|---|

| AUDIT | Audit of financial statements | Whether the annual financial statements were audited: (i) the audit has been carried out or (ii) the audit has not been carried out (Yes—1; No—0) | SECR 1 |

| SHARE | Sole shareholder | (i) The company has a single shareholder or (ii) more than one shareholder has acquired shares in the company (Yes—1; No—0) | SECR 1 |

| RECORDS | Number of records | The number of records published in the Register of Legal Entities | SECR 1 |

| SUBMISSION_FS | Late submission of financial statements | Financial statements were submitted late (days) | SECR 1 |

| AGE | The age of the enterprise | The difference between the financial year and the enterprise’s establishment year | SECR 1 |

| Abbreviation | Full Name, Description |

|---|---|

| ICW | Index of construction work carried out within the country (2015 = 100) |

| ICW_CHG | Annual change in index of construction work carried out within the country (2015 = 100) (%); calculation = [X(t)/X(t − 1)] − 1 |

| CW | Construction work carried out within the country at current prices (thousands of EUR) |

| CW_CHG | Annual change in construction work carried out within the country at current prices (%); calculation = [X(t)/X(t − 1)] − 1 |

| TCA | Turnover from construction activities in non-financial enterprises (thousands of EUR) |

| TCA_CHG | Annual change in turnover from construction activities in non-financial enterprises (%); calculation = [X(t)/X(t − 1)] − 1 |

| SCAinC | The share of the construction activity in the country in the total construction-activity revenue (at current prices) (%) |

| SCAinC_CHG | Annual change in the share of the construction activity in the country in the total construction-activity revenue (%); calculation = [X(t)/X(t − 1)] − 1 |

| IWS | Index of wages and salaries in construction enterprises (2015 = 100) |

| IWS_CHG | Annual change in index of wages and salaries in construction enterprises (2015 = 100) (%); calculation = [X(t)/X(t − 1)] − 1 |

| INPE | Index of number of persons employed in construction enterprises (2015 = 100) |

| INPE_CHG | Annual change in index of the number of persons employed in construction enterprises (2015 = 100); calculation = [X(t)/X(t − 1)] − 1 |

| Abbreviation | Variable, Calculation Formula |

|---|---|

| GP/S_CS | Gross profit margin (%). Calculation: gross profit/sales |

| NP/S_CS | Net profit margin (%). Calculation: net profit/sales |

| ROA_CS | Return on assets (ROA) (%) |

| ROE_CS | Return on equity (ROE) (%) |

| CA/CL_CS | Current ratio. Calculation: current assets/current liabilities |

| TL/TA_CS | Total liabilities-to-total assets ratio. Calculation: total liabilities/total assets |

| S/AR_CS | Receivables turnover ratio (times). Calculation: sales/accounts receivable |

| S/TA_CS | Total asset turnover (times). Calculation: sales/total assets |

| CCI_CS | Change in customer insolvency and late payments over the last three months (increasing) (%) |

| Abbreviation | Full Name, Description |

|---|---|

| GDP | GDP (at 2010 constant prices) |

| GDP_CHG | GDP yearly change (at 2010 constant prices) (%); calculation = [X(t)/X(t − 1)] − 1 |

| GDP_index | GDP index (at 2010 constant prices, 2010 = 100) |

| GDP_index_CHG | GDP index annual change (at 2010 constant prices, 2010 = 100) (%); calculation = [X(t)/X(t − 1)] − 1 |

| GDP(MP) | GDP at market prices (EUR per capita) |

| GDP(MP)_CHG | Annual change in GDP at market prices (Euro per capita) (%); calculation = [X(t)/X(t − 1)] − 1 |

| HICP | The harmonised index of consumer prices at constant tax rates (2015 = 100) |

| INF | Annual inflation |

| INF_A | Average annual inflation |

| HPI | House-price index (2015 = 100) |

| HPI_CHG | Annual change of house price index (%); calculation = [X(t)/X(t − 1)] − 1 |

| UR | Unemployment rate |

| CIPI | Construction-input-price index (CIPI) (%) |

| Variables | Variable Is Used in | ||

|---|---|---|---|

| LR Model | MARS Model | ||

| I. Financial Variables | |||

| 1a. Profitability ratios (return from sales) | |||

| EBIT/Sales | EBIT/S | x | |

| 1b. Profitability ratios (return on investment) | |||

| Gross Profit/Total Assets | GP/TA | x | |

| EBIT/Total Assets | EBIT/TA | x | |

| Net Profit/Total Assets | ROA | x | |

| 2. Liquidity ratios | |||

| Accounts Receivable/Total Liabilities | AR/TL | x | |

| (Cash−Inventories)/Current Liabilities | (CASH-INV)/CL | x | |

| (Current Liabilities−Cash)/Total Assets | (CL-Cash)/TA | x | |

| 3. Solvency ratios | |||

| Total Liabilities/Total Assets | TL/TA | x | x |

| 4. Activity ratios | |||

| 4a. Activity ratios (assets turnover) | |||

| Sales/Fixed Assets | S/FA | x | |

| Sales/Total Assets | S/TA | x | x |

| 4b. Activity ratios (equity and liabilities turnover) | |||

| Sales/Current Liabilities | S/CL | x | |

| Sales/Total Liabilities | S/TL | x | |

| 4c. Activity ratios (level of expenses) | |||

| Cost of Sales/Sales | CS/S | x | |

| 5a. Structure ratios (total-assets-structure ratios) | |||

| Current Assets/Total Assets | CA/TA | x | x |

| Inventory/Total Assets | INV/TA | x | |

| Cash/Total Assets | Cash/TA | x | |

| II. Macroeconomic Variables | |||

| GDP index | GDP_index | x | |

| The harmonised index of consumer prices at constant tax rates | HICP | x | x |

| Average annual inflation | INF_A | x | |

| House-price index | HPI | x | |

| III. Construction-Sector Variables | |||

| Macroeconomic indicators characterising the construction sector | |||

| Annual change in index of construction work carried out within the country | ICW_CHG | x | |

| Annual change in the share of the construction activity in the country in the total construction activity revenue | SCAinC_CHG | x | |

| IV. Financial Indicators for the Construction Sector | |||

| Gross profit margin (%) Gross profit/sales | GP/S_CS | x | |

| Total-asset-turnover ratio (times) Sales/total assets | S/TA_CS | x | |

| Change in customer insolvency and late payments over the last three months | CCI_CS | x | |

| V. Non-Financial Variables | |||

| The age of the enterprise | AGE | x | x |

| Sole shareholder | SHARE | x | |

| Number of records | RECORDS | x | |

| 1 | Until 2019, the State Data Agency of the Republic of Lithuania collected data on bankruptcy (more precisely, the number of bankruptcy proceedings initiated in the corresponding year)—source: The State Data Agency of the Republic of Lithuania. Bankruptcy processes instituted and completed by economic activity. Available online: http://university2.taylors.edu.my/tbr/uploaded/2015_vol5_issue2_p3.pdfhttps://osp.stat.gov.lt/statistiniu-rodikliu-analize?hash=46cbb9e7-57e9-485d-9ae3-56ae2458ccd4#/ (accessed on 22 July 2022). |

| 2 | The titles of the financial statements and financial items are used in accordance with International Financial Reporting Standards (IFRSs). |

| 3 | According to Statistics Lithuania, an operating enterprise (or) working enterprise is an enterprise operating with a specific number of employees and (or) annual revenue. |

| 4 | Construction work carried out refers to the value (VAT excluded) of all kinds of work performed when building a new structure or reconstructing, repairing (restoring) or demolishing an existing structure for a customer (sale) or for own needs—source: State Data Agency (Statistics Lithuania). (2023). Construction work carried out (Metadata). https://osp.stat.gov.lt/documents/10180/5118910/Statybos+%C4%AFmoni%C5%B3+atlikt%C5%B3+darb%C5%B3+rodikliai+%5BEN%5D+645.html (accessed on 24 April 2023). |

References

- Abdullah, Nur Adiana Hiau, Muhammad M. Ma’aji, and Karren Lee Hwei Khaw. 2016. The Value of Governance Variables in Predicting Financial Distress among Small and Medium-Sized Enterprises in Malaysia. Asian Academy of Management Journal of Accounting and Finance 12: 77–91. [Google Scholar] [CrossRef]

- Al-Sobiei, Obaid Saad, David Arditi, and Gul Polat. 2005. Predicting the Risk of Contractor Default in Saudi Arabia Utilizing Artificial Neural Network (ANN) and Genetic Algorithm (GA) Techniques. Construction Management and Economics 23: 423–30. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I., and Gabriele Sabato. 2007. Modelling Credit Risk for SMEs: Evidence from the U.S. Market. Abacus 43: 332–57. [Google Scholar] [CrossRef]

- Angelini, Eliana, Giacomo di Tollo, and Andrea Roli. 2008. A Neural Network Approach for Credit Risk Evaluation. Quarterly Review of Economics and Finance 48: 733–55. [Google Scholar] [CrossRef]

- Bateni, Leila, and Farshid Asghari. 2020. Bankruptcy Prediction Using Logit and Genetic Algorithm Models: A Comparative Analysis. Computational Economics 55: 335–48. [Google Scholar] [CrossRef]

- Becerra-Vicario, Rafael, David Alaminos, Eva Aranda, and Manuel A. Fernández-Gámez. 2020. Deep Recurrent Convolutional Neural Network for Bankruptcy Prediction: A Case of the Restaurant Industry. Sustainability 12: 5180. [Google Scholar] [CrossRef]

- Behr, Patrick, and André Güttler. 2007. Credit Risk Assessment and Relationship Lending: An Empirical Analysis of German Small and Medium-Sized Enterprises. Journal of Small Business Management 45: 194–213. [Google Scholar] [CrossRef]

- Bhattacharjee, Arnab, and Jie Han. 2014. Financial Distress of Chinese Firms: Microeconomic, Macroeconomic and Institutional Influences. China Economic Review 30: 244–62. [Google Scholar] [CrossRef]

- Butkus, Mindaugas, Sigita Žakarė, and Diana Cibulskienė. 2014. Bankroto Diagnostikos Modelis Ir Jo Pritaikymas Bankroto Tikimybei Lietuvos Įmonėse Prognozuoti [Bankruptcy Diagnostic Model and Its Application to Predict Company’s Bankrupt Likelihood in Lithuania]. Applied Economics: Systematic Research 8: 111–32. [Google Scholar] [CrossRef]

- Cao, Yi, Xiaoquan Liu, Jia Zhai, and Shan Hua. 2020. A Two-Stage Bayesian Network Model for Corporate Bankruptcy Prediction. International Journal of Finance & Economics 27: 455–72. [Google Scholar]

- Chang, Yung Chia, Kuei Hu Chang, and Guan Jhih Wu. 2018. Application of eXtreme Gradient Boosting Trees in the Construction of Credit Risk Assessment Models for Financial Institutions. Applied Soft Computing Journal 73: 914–20. [Google Scholar] [CrossRef]

- Chen, Wei Sen, and Yin Kuan Du. 2009. Using Neural Networks and Data Mining Techniques for the Financial Distress Prediction Model. Expert Systems with Applications 36: 4075–86. [Google Scholar] [CrossRef]

- Cheng, Min Yuan, Nhat Duc Hoang, Lisayuri Limanto, and Yu Wei Wu. 2014. A Novel Hybrid Intelligent Approach for Contractor Default Status Prediction. Knowledge-Based Systems 71: 314–21. [Google Scholar] [CrossRef]

- Ciampi, Francesco, and Niccolò Gordini. 2013. Small Enterprise Default Prediction Modeling through Artificial Neural Networks: An Empirical Analysis of Italian Small Enterprises. Journal of Small Business Management 51: 23–45. [Google Scholar] [CrossRef]

- Crone, Sven F., and Steven Finlay. 2012. Instance Sampling in Credit Scoring: An Empirical Study of Sample Size and Balancing. International Journal of Forecasting 28: 224–38. [Google Scholar] [CrossRef]

- Crook, Jonathan N., David B. Edelman, and Lyn C. Thomas. 2007. Recent Developments in Consumer Credit Risk Assessment. European Journal of Operational Research 183: 1447–65. [Google Scholar] [CrossRef]

- De Andrés, Javier, Fernando Sánchez-Lasheras, Pedro Lorca, and Francisco Javier De Cos Juez. 2011a. A Hybrid Device of Self Organizing Maps (SOM) and Multivariate Adaptive Regression Splines (MARS) for the Forecasting of Firms’ Bankruptcy. Accounting & Management Information Systems/Contabilitate Si Informatica de Gestiune 10: 351–74. Available online: http://online-cig.ase.ro/jcig/art/10_3_4.pdf (accessed on 21 January 2021).

- De Andrés, Javier, Pedro Lorca, and Francisco Javier De Cos Juez. 2011b. A Hybrid Device of Self Organizing Maps (SOM) and Multivariate Adaptive Regression Splines (MARS) for the Forecasting of Firms’ Bankruptcy El Examen Del Examen MIR View Project CARMENExS: Calar Alto High-Resolution Search for M Dwarfs with Exo-Earths With. Available online: https://www.researchgate.net/publication/241752040 (accessed on 21 January 2021).

- De Andrés, Javier, Pedro Lorca, Francisco Javier De Cos Juez, and Fernando Sánchez-Lasheras. 2011c. Bankruptcy Forecasting: A Hybrid Approach Using Fuzzy c-Means Clustering and Multivariate Adaptive Regression Splines (MARS). Expert Systems with Applications 38: 1866–75. [Google Scholar] [CrossRef]

- Dong, Yiran, and Chao Ying Joanne Peng. 2013. Principled Missing Data Methods for Researchers. SpringerPlus 2: 222. [Google Scholar] [CrossRef]

- du Jardin, Philippe. 2009. Bankruptcy Prediction Models: How to Choose the Most Relevant Variables? Bankers, Markets & Investors 98: 39–46. [Google Scholar]

- du Jardin, Philippe. 2021. Dynamic Self-Organizing Feature Map-Based Models Applied to Bankruptcy Prediction. Decision Support Systems 147: 113576. [Google Scholar] [CrossRef]

- Dzidzevičiūtė, Laima. 2013. Possibilities of the Statistical Scoring Models’ Application at Lithuanian Banks. Ph.D. dissertation, Vilnius University, Vilnius, Lithuania; 237p. [Google Scholar]

- Figini, Silvia, Federico Bonelli, and Emanuele Giovannini. 2017. Solvency Prediction for Small and Medium Enterprises in Banking. Decision Support Systems 102: 91–97. [Google Scholar] [CrossRef]

- Giriūniene, Gintare, Lukas Giriūnas, Mangirdas Morkunas, and Laura Brucaite. 2019. A Comparison on Leading Methodologies for Bankruptcy Prediction: The Case of the Construction Sector in Lithuania. Economies 7: 82. [Google Scholar] [CrossRef]

- Grigaravičius, Saulius. 2003. Corporate Failure Diagnosis. Organizacijų Vadyba: Sisteminiai Tyrimai 28: 29–42. [Google Scholar]

- Gurný, Petr, and Martin Gurný. 2013. Comparison of Credit Scoring Models on Probability of Default Estimation for Us Banks. Prague Economic Papers 2: 163–81. [Google Scholar] [CrossRef]

- Han, Jun Tae, Jae Seok Choi, Myeon Jung Kim, and Jina Jeong. 2018. Developing a Risk Group Predictive Model for Korean Students Falling into Bad Debt. Asian Economic Journal 32: 3–14. [Google Scholar] [CrossRef]

- Henry, Elaine, Thomas R. Robinson, and Jan Hendrik van Greuning. 2011. Financial Analysis Techniques. In Financial Reporting and Analysis. Charlottesville: CFA Institute, pp. 337–58. [Google Scholar]

- Horak, Jakub, Jaromir Vrbka, and Petr Suler. 2020. Support Vector Machine Methods and Artificial Neural Networks Used for the Development of Bankruptcy Prediction Models and Their Comparison. Journal of Risk and Financial Management 13: 60. [Google Scholar] [CrossRef]

- Jang, Youjin, Inbae Jeong, and Yong K. Cho. 2021. Identifying Impact of Variables in Deep Learning Models on Bankruptcy Prediction of Construction Contractors. Engineering, Construction and Architectural Management 28: 3282–98. [Google Scholar] [CrossRef]

- Kanapickienė, Rasa, and Renatas Špicas. 2019. Credit Risk Assessment Model for Small and Micro-Enterprises: The Case of Lithuania. Risks 7: 67. [Google Scholar] [CrossRef]

- Kjosevski, Jordan, Mihail Petkovski, and Elena Naumovska. 2019. Bank-Specific and Macroeconomic Determinants of Non-Performing Loans in the Republic of Macedonia: Comparative Analysis of Enterprise and Household NPLs. Economic Research-Ekonomska Istrazivanja 32: 1185–203. [Google Scholar] [CrossRef]

- Korol, Tomasz. 2019. Dynamic Bankruptcy Prediction Models for European Enterprises. Journal of Risk and Financial Management 12: 185. [Google Scholar] [CrossRef]

- Kosmidis, Kosmas, and Antonios Stavropoulos. 2014. Corporate Failure Diagnosis in SMEs: A Longitudinal Analysis Based on Alternative Prediction Models. International Journal of Accounting and Information Management 22: 49–67. [Google Scholar] [CrossRef]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic Review of Variables Applied in Bankruptcy Prediction Models of Visegrad Group Countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef]

- Law on Statements of Entities of the Republic of Lithuania. 2017. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.154658/KjdlwjFyWw (accessed on 30 January 2023). (In Lithuanian).

- Lessmann, Stefan, Bart Baesens, Hsin Vonn Seow, and Lyn C. Thomas. 2015. Benchmarking State-of-the-Art Classification Algorithms for Credit Scoring: An Update of Research. European Journal of Operational Research 247: 124–36. [Google Scholar] [CrossRef]

- Liang, Deron, Chia Chi Lu, Chih Fong Tsai, and Guan An Shih. 2016. Financial Ratios and Corporate Governance Indicators in Bankruptcy Prediction: A Comprehensive Study. European Journal of Operational Research 252: 561–72. [Google Scholar] [CrossRef]

- Lin, Shu Ling. 2009. A New Two-Stage Hybrid Approach of Credit Risk in Banking Industry. Expert Systems with Applications 36: 8333–41. [Google Scholar] [CrossRef]

- Lorca, Pedro, Manuel Landajo, and Javier De Andrés. 2014. Nonparametric Quantile Regression-Based Classifiers for Bankruptcy Forecasting. Journal of Forecasting 33: 124–33. [Google Scholar] [CrossRef]

- Lundberg, Scott M., and Su In Lee. 2017. A Unified Approach to Interpreting Model Predictions. Advances in Neural Information Processing Systems 2017: 4766–75. [Google Scholar]

- Madley-Dowd, Paul, Rachael Hughes, Kate Tilling, and Jon Heron. 2019. The Proportion of Missing Data Should Not Be Used to Guide Decisions on Multiple Imputation. Journal of Clinical Epidemiology 110: 63–73. [Google Scholar] [CrossRef]

- Mai, Feng, Shaonan Tian, Chihoon Lee, and Ling Ma. 2019. Deep Learning Models for Bankruptcy Prediction Using Textual Disclosures. European Journal of Operational Research 274: 743–58. [Google Scholar] [CrossRef]

- Mare, Davide Salvatore. 2015. Contribution of Macroeconomic Factors to the Prediction of Small Bank Failures. Journal of International Financial Markets, Institutions and Money 39: 25–39. [Google Scholar] [CrossRef]

- Martínez-Sola, Cristina, Pedro J. García-Teruel, and Pedro Martínez-Solano. 2017. SMEs Access to Finance and the Value of Supplier Financing. Revista Espanola de Financiacion y Contabilidad 46: 455–83. [Google Scholar] [CrossRef]

- Megan, Ovidiu, and Cristina Circa. 2014. Insolvency Prediction Tools for Middle and Large Scale Romanian Enterprises. Transformations in Business and Economics 13: 661–75. [Google Scholar]

- Mileris, Ričardas. 2009. Statistinių Kredito Rizikos Vertinimo Modelių Efektyvumo Analizė [Analysis of Statistical Credit Risk Estimation Models Efficiency]. Ekonomika Ir Vadyba [Economics and Management 14: 1156–63. [Google Scholar]

- Mileris, Ričardas. 2012. Įmonių finansinių įsipareigojimų neįvykdymo tikimybės vertinimas nustatant kredito reitingus [Assessment of Enterprise Default Probability by Credit Rating Model]. Applied Economics: Systematic Research 6: 127–42. [Google Scholar] [CrossRef]

- Min, Jae H., and Chulwoo Jeong. 2009. A Binary Classification Method for Bankruptcy Prediction. Expert Systems with Applications 36: 5256–63. [Google Scholar] [CrossRef]

- Min, Jae H., and Young Chan Lee. 2005. Bankruptcy Prediction Using Support Vector Machine with Optimal Choice of Kernel Function Parameters. Expert Systems with Applications 28: 603–14. [Google Scholar] [CrossRef]

- Mittelstadt, Brent, Chris Russell, and Sandra Wachter. 2019. Explaining Explanations in AI. In FAT2019—Proceedings of the 2019 Conference on Fairness, Accountability, and Transparency. Atlanta and New York: ACM, pp. 279–88. [Google Scholar] [CrossRef]

- Mori, Hiroyuki, and Yasushi Umezawa. 2007. Credit Risk Evaluation of Power Market Players with Random Forest. IEEJ Transactions on Power and Energy 128: 3737–42. [Google Scholar] [CrossRef]

- Nikolic, Nebojsa, Nevenka Zarkic-Joksimovic, Djordje Stojanovski, and Iva Joksimovic. 2013. The Application of Brute Force Logistic Regression to Corporate Credit Scoring Models: Evidence from Serbian Financial Statements. Expert Systems with Applications 40: 5932–44. [Google Scholar] [CrossRef]

- Ohlson, James A. 1980. Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef]

- Olson, David L., Dursun Delen, and Yanyan Meng. 2012. Comparative Analysis of Data Mining Methods for Bankruptcy Prediction. Decision Support Systems 52: 464–73. [Google Scholar] [CrossRef]

- Pacelli, Vincenzo, and Michele Azzollini. 2011. An Artificial Neural Network Approach for Credit Risk Management. Journal of Intelligent Learning Systems and Applications 3: 103–12. [Google Scholar] [CrossRef]

- Papík, Mário, and Lenka Papíková. 2023. Impacts of Crisis on SME Bankruptcy Prediction Models’ Performance. Expert Systems with Applications 214: 119072. [Google Scholar] [CrossRef]

- Purvinis, Ojaras, Povilas Sukys, and Ruta Virbickaite. 2005. Bankruptcy Prediction in Lithuanian Enterprises Using Discriminant. Ekonomika ir Vadyba: Aktualijos ir Perspektyvos 5: 314–18. [Google Scholar]

- Pustylnick, Igor. 2012. An Algorithm for the Detection of Revenue and Retained Earnings Manipulation. Accounting & Taxation 4: 95–105. [Google Scholar]

- Ravisankar, Pediredla, Vadlamani Ravi, Gundumalla Raghava Rao, and Indranil Bose. 2011. Detection of Financial Statement Fraud and Feature Selection Using Data Mining Techniques. Decision Support Systems 50: 491–500. [Google Scholar] [CrossRef]

- Republic of Lithuania Law on Small and Medium-Size Business Development. 2017. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.68516/KMWjNSZEgy (accessed on 30 January 2023). (In Lithuanian).

- Ryser, Marc, and Stefan Denzler. 2009. Selecting Credit Rating Models: A Cross-Validation-Based Comparison of Discriminatory Power. Financial Markets and Portfolio Management 23: 187–203. [Google Scholar] [CrossRef]

- Sánchez-Lasheras, Fernando, Javier De Andrés, Pedro Lorca, and Francisco Javier De Cos Juez. 2012. A Hybrid Device for the Solution of Sampling Bias Problems in the Forecasting of Firms’ Bankruptcy. Expert Systems with Applications 39: 7512–23. [Google Scholar] [CrossRef]

- Špicas, Renatas, Rasa Kanapickienė, and Monika Ivaškevičiūtė. 2015. Filter Methods of Variable Selection for Enterprise Credit Risk Prediction. In Perspectives of Business and Entrepreneurship Development: Economic, Management, Finance and System Engineering from the Academic and Practitioners Views. Brno: Faculty of Business and Management, Brno University of Technology, pp. 147–60. [Google Scholar]

- Špicas, Renatas, Rasa Kanapickienė, Mindaugas Vijūnas, and Robertas Kirka. 2018. Development of Enterprise Credit Risk Assessment Model for Lithuanian Credit Unions. Transformations in Business & Economics 17: 152–77. [Google Scholar]

- Sueyoshi, Toshiyuki, and Mika Goto. 2009. DEA-DA for Bankruptcy-Based Performance Assessment: Misclassification Analysis of Japanese Construction Industry. European Journal of Operational Research 199: 576–94. [Google Scholar] [CrossRef]

- Tascón, María T., Francisco J. Castaño, and Paula Castro. 2018. A New Tool for Failure Analysis in Small Firms: Frontiers of Financial Ratios Based on Percentile Differences (PDFR). Revista Espanola de Financiacion y Contabilidad 47: 433–63. [Google Scholar] [CrossRef]

- Terdpaopong, Kanitsorn, and Dessalegn Getie Mihret. 2011. Modelling SME Credit Risk: Thai Empirical Evidence. Small Enterprise Research 18: 63–79. [Google Scholar] [CrossRef]

- Tinoco, Hernandez Mario, and Nick Wilson. 2013. Financial Distress and Bankruptcy Prediction among Listed Companies Using Accounting, Market and Macroeconomic Variables. International Review of Financial Analysis 30: 394–419. [Google Scholar] [CrossRef]

- Tseng, Fang-Mei, and Yi-chung Hu. 2010. Comparing Four Bankruptcy Prediction Models: Logit, Quadratic Interval Logit, Neural and Fuzzy Neural Networks. Expert Systems With Applications 37: 1846–53. [Google Scholar] [CrossRef]

- Tserng, H. Ping, Gwo Fong Lin, L. Ken Tsai, and Po Cheng Chen. 2011. An Enforced Support Vector Machine Model for Construction Contractor Default Prediction. Automation in Construction 20: 1242–49. [Google Scholar] [CrossRef]

- Uddin, Mohammad S., Guotai Chi, Mazin A.M. Al Janabi, and Tabassum Habib. 2022. Leveraging Random Forest in Micro-Enterprises Credit Risk Modelling for Accuracy and Interpretability. International Journal of Finance and Economics 27: 3713–3729. [Google Scholar] [CrossRef]

- Valvonis, Vytautas. 2008. Credit Risk Assessment and Management Model: Practice and Perspectives of Lithuanian Banks. Doctoral dissertation, Vilnius University, Vilnius, Lithuania; 204p. [Google Scholar]

- Vasiliauskaite, Asta, and Aurelijus Cvilikas. 2008. Fuzzy Sets Theory Adoption for Credit Risk Assessment in Leasing Sector. Applied Economics: Systematic Research 2: 85–98. [Google Scholar]

- Veganzones, David, and Eric Severin. 2021. Corporate Failure Prediction Models in the Twenty-First Century: A Review. European Business Review 33: 204–26. [Google Scholar] [CrossRef]

- West, David. 2000. Neural Network Credit Scoring Models. Computers and Operations Research 27: 1131–52. [Google Scholar] [CrossRef]

- Wu, Tsui Chih, and Ming Fu Hsu. 2012. Credit Risk Assessment and Decision Making by a Fusion Approach. Knowledge-Based Systems 35: 102–10. [Google Scholar] [CrossRef]

- Yap, Bee Wah, Seng Huat Ong, and Nor Huselina Mohamed Husain. 2011. Using Data Mining to Improve Assessment of Credit Worthiness via Credit Scoring Models. Expert Systems with Applications 38: 13274–83. [Google Scholar] [CrossRef]

- Yeh, Ching Chiang, Der Jang Chi, and Ming Fu Hsu. 2010. A Hybrid Approach of DEA, Rough Set and Support Vector Machines for Business Failure Prediction. Expert Systems with Applications 37: 1535–41. [Google Scholar] [CrossRef]

- Yoshino, Naoyuki, and Farhad Taghizadeh-Hesary. 2014. Analytical Framework on Credit Risks for Financing Small and Medium-Sized Enterprises in Asia. Asia-Pacific Development Journal 21: 1–21. [Google Scholar] [CrossRef]

- Zavgren, Christine V. 1985. Assessing the Vulnerability To Failure of American Industrial Firms: A Logistic Analysis. Journal of Business Finance & Accounting 12: 19–45. [Google Scholar] [CrossRef]

- Zhang, Faming, Pandu R. Tadikamalla, and Jennifer Shang. 2016. Corporate Credit-Risk Evaluation System: Integrating Explicit and Implicit Financial Performances. International Journal of Production Economics 177: 77–100. [Google Scholar] [CrossRef]

- Zhang, Junni L., and Wolfgang K. Härdle. 2010. The Bayesian Additive Classification Tree Applied to Credit Risk Modelling. Computational Statistics and Data Analysis 54: 1197–205. [Google Scholar] [CrossRef]

- Zhou, Jianguo, and Jiming Tian. 2007. Credit Risk Assessment Based on Rough Set Theory and Fuzzy Support Vector Machine. In Advances in Intelligent Systems Research. Amsterdam: Atlantis Press, pp. 926–31. [Google Scholar] [CrossRef]

- Zhu, You, Chi Xie, Bo Sun, Gang Jin Wang, and Xin Guo Yan. 2016. Predicting China’s SME Credit Risk in Supply Chain Financing by Logistic Regression, Artificial Neural Network and Hybrid Models. Sustainability 8: 433. [Google Scholar] [CrossRef]

- Zmijewski, Mark E. 1984. Methodological Issues Related to the Estimation of Financial Distress Prediction Models. Journal of Accounting Research. Studies on Current Econometric Issues in Accounting Research 22: 59–82. [Google Scholar] [CrossRef]

- Zopounidis, Constantin, and Michael Doumpos. 1999. Business Failure Prediction Using the Utadis Multicriteria Analysis Method. Journal of the Operational Research Society 50: 1138–48. [Google Scholar] [CrossRef]

| Independent Variables | Model: | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| M1.1 | M1.2 | M2.1 | M2.2 | M3.1 | M3.2 | M4 | |||||||||

| Coef. | Sign. | Coef. | Sign. | Coef. | Sign. | Coef. | Sign. | Coef. | Sign. | Coef. | Sign. | Coef. | Sign. | ||

| Constant | −2.212 | 0.000 | −2.550 | 0.000 | 1.271 | 0.574 | 2.427 | 0.205 | −3.068 | 0.023 | −0.719 | 0.748 | −2.372 | 0.567 | |

| Financial variables (Financial ratios) | |||||||||||||||

| 1a. Profitability ratios (return from sales) | |||||||||||||||

| EBIT/Sales | EBIT/S | −0.554 | 0.003 | ||||||||||||

| 1b. Profitability ratios (return on investment) | |||||||||||||||

| Gross Profit/Total Assets | GP/TA | 0.504 | 0.000 | 1.652 | 0.000 | ||||||||||

| EBIT/Total Assets | EBIT/TA | 1.155 | 0.000 | ||||||||||||

| Net Profit/Total Assets | ROA | 1.040 | 0.000 | ||||||||||||

| 2. Liquidity ratios | |||||||||||||||

| Accounts Receivable/Total Liabilities | AR/TL | 0.139 | 0.000 | 1.140 | 0.000 | 0.268 | 0.000 | ||||||||

| (Cash − Inventories)/Current Liabilities | (CASH-INV)/CL | −0.330 | 0.109 | ||||||||||||

| 3. Solvency ratios | |||||||||||||||

| Total Liabilities/Total Assets | TL/TA | 3.334 | 0.000 | 4.136 | 0.000 | 3.440 | 0.000 | 3.532 | 0.000 | 3.875 | 0.000 | 2.806 | 0.000 | 2.720 | 0.000 |

| 4. Activity ratios | |||||||||||||||

| 4a. Activity ratios (assets turnover) | |||||||||||||||

| Sales/Total Assets | S/TA | 1.390 | 0.000 | 0.306 | 0.000 | ||||||||||

| 4b. Activity ratios (equity and liabilities turnover) | |||||||||||||||

| Sales/Current Liabilities | S/CL | −0.453 | 0.000 | ||||||||||||

| Sales/Total Liabilities | S/TL | −0.064 | 0.003 | −0.311 | 0.000 | −0.107 | 0.000 | ||||||||

| 4c. Activity ratios (Level of expenses) | |||||||||||||||

| Cost of Sales/Sales | CS/S | 0.911 | 0.000 | 1.841 | 0.000 | −0.778 | 0.002 | ||||||||

| 5a. Structure ratios (total assets structure ratios) | |||||||||||||||

| Current Assets/Total Assets | CA/TA | −1.188 | 0.000 | −3.048 | 0.000 | −2.013 | 0.000 | −2.030 | 0.000 | −2.178 | 0.000 | −2.192 | 0.000 | −2.395 | 0.000 |

| Inventory/Total Assets | INV/TA | 2.934 | 0.000 | 4.128 | 0.000 | 1.265 | 0.061 | 3.086 | 0.000 | 2.691 | 0.000 | ||||

| Macroeconomic variables | |||||||||||||||

| GDP index | GDP_index | −0.096 | 0.000 | ||||||||||||

| The harmonised index of consumer prices at constant tax rates | HICP | −0.023 | 0.327 | −0.036 | 0.081 | ||||||||||

| Average annual inflation | INF_A | 0.158 | 0.000 | 0.251 | 0.000 | ||||||||||

| Construction-sector variables | |||||||||||||||

| Macroeconomic indicators characterising the construction sector | |||||||||||||||

| Annual change of index of construction work carried out within the country | ICW_CHG | 0.012 | 0.218 | ||||||||||||

| Annual change in the share of the construction activity in the country in the total-construction-activity revenue | SCAinC_CHG | −0.041 | 0.148 | ||||||||||||

| Financial indicators for the construction sector | |||||||||||||||

| Gross profit margin | GP/S_CS | 0.111 | 0.089 | 0.438 | 0.000 | 0.311 | 0.000 | ||||||||

| Total-asset-turnover ratio (times) | S/TA_CS | −3.575 | 0.237 | ||||||||||||

| Change in customer insolvency and late payments over the last three months | CCI_CS | 0.038 | 0.000 | ||||||||||||

| Non-financial variables | |||||||||||||||

| The age of the enterprise | AGE | −0.137 | 0.000 | ||||||||||||

| The sole shareholder | SHARE | −0.785 | 0.000 | ||||||||||||

| Chi-square p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||||

| Cox-and-Snell R square | 0.543 | 0.583 | 0.590 | 0.562 | 0.570 | 0.568 | 0.585 | ||||||||

| Nagelkerke R square | 0.738 | 0.793 | 0.803 | 0.763 | 0.774 | 0.771 | 0.792 | ||||||||

| Model test sample (dataset): | |||||||||||||||

| The total percentage of the model’s correctly classified cases | 68.1 | 75.8 | 90.4 | 91.7 | 69.4 | 84.2 | 77.7 | ||||||||

| The percentage of the model’s correctly classified bankrupt-enterprises cases | 82.8 | 85.7 | 85.2 | 80.3 | 85.7 | 90.0 | 89.0 | ||||||||

| The percentage of the model’s correctly classified non-bankrupt-enterprises cases | 59.0 | 69.7 | 93.8 | 98.8 | 59.3 | 80.4 | 70.3 | ||||||||

| AUC | 0.751 | 0.821 | 0.952 | 0.985 | 0.746 | 0.907 | 0.838 | ||||||||

| Model training sample (dataset): | |||||||||||||||

| The total percentage of the model’s correctly classified cases | 71.4 | 79.2 | 94.2 | 94.2 | 75.3 | 86.2 | 80.2 | ||||||||

| The percentage of the model’s correctly classified bankrupt-enterprises cases | 84.7 | 89.8 | 91.7 | 85.6 | 90.6 | 89.5 | 90.6 | ||||||||

| The percentage of the model’s correctly classified non-bankrupt-enterprises cases | 63.1 | 72.6 | 95.7 | 99.5 | 65.8 | 84.2 | 73.4 | ||||||||

| AUC | 0.803 | 0.868 | 0.988 | 0.996 | 0.817 | 0.935 | 0.876 | ||||||||

| Model | M1.2+ M1 MLP | M1.2+ M1 RBF | M2.2+ M2 MLP | M2.2+ M2 RBF | ||||

| Stage | St. I | St. II | St. I | St. II | St. I | St. II | St. I | St. II |

| M1.2 | M1 MLP | M1.2 | M1 RBF | M2.2 | M2 MLP | M2.2 | M2 RBF | |

| Model-test sample (dataset): | ||||||||

| The total percentage of the model’s correctly classified cases (Accuracy rate) | 75.8 | 76.4 | 75.8 | 78.1 | 91.7 | 80.6 | 91.7 | 79.4 |

| The percentage of the model’s correctly classified bankrupt-enterprises cases (Sensitivity) | 85.7 | 61.6 | 85.7 | 76.4 | 80.3 | 71.9 | 80.3 | 92.1 |

| The percentage of the model’s correctly classified non-bankrupt-enterprises cases (Specificity) | 69.7 | 85.6 | 69.7 | 79.2 | 98.8 | 85.9 | 98.8 | 71.6 |

| AUC | 0.821 | 0.736 | 0.821 | 0.860 | 0.985 | 0.789 | 0.985 | 0.882 |

| Model | M3.2+ M3 MLP | M3.2+ M3 RBF | M4+ M4 MLP | M4+ M4 RBF | ||||

| Stage | St. I | St. II | St. I | St. II | St. I | St. II | St. I | St. II |

| M3.2 | M3 MLP | M3.2 | M3 RBF | M4 | M4 MLP | M4 | M4 RBF | |

| Model-test sample (dataset): | ||||||||

| The total percentage of the model’s correctly classified cases (Accuracy rate) | 84.2 | 78.4 | 84.2 | 74.1 | 77.7 | 80.6 | 77.7 | 79.3 |

| The percentage of the model’s correctly classified bankrupt-enterprises cases (Sensitivity) | 90.0 | 67.6 | 90.0 | 77.6 | 89.0 | 75.2 | 89.0 | 82.4 |

| The percentage of the model’s correctly classified non-bankrupt-enterprises cases (Specificity) | 80.4 | 85.3 | 80.4 | 71.9 | 70.3 | 84.1 | 70.3 | 77.4 |

| AUC | 0.907 | 0.765 | 0.907 | 0.831 | 0.838 | 0.797 | 0.838 | 0.873 |

| Model | M(ALL.MLP) | M(ALL.RBF) | M(MARS) |

|---|---|---|---|

| Model-test sample (dataset): | |||

| The total percentage of the cases correctly classified by the models | 81.6 | 70.1 | 93.9 |

| The percentage of the bankrupt-enterprise cases correctly classified by the models | 74.8 | 76.4 | 93.8 |

| The percentage of the non-bankrupt-enterprise cases correctly classified by the model | 84.1 | 66.9 | 93.9 |

| AUC | 0.799 | 0.787 | 0.987 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kanapickienė, R.; Kanapickas, T.; Nečiūnas, A. Bankruptcy Prediction for Micro and Small Enterprises Using Financial, Non-Financial, Business Sector and Macroeconomic Variables: The Case of the Lithuanian Construction Sector. Risks 2023, 11, 97. https://doi.org/10.3390/risks11050097

Kanapickienė R, Kanapickas T, Nečiūnas A. Bankruptcy Prediction for Micro and Small Enterprises Using Financial, Non-Financial, Business Sector and Macroeconomic Variables: The Case of the Lithuanian Construction Sector. Risks. 2023; 11(5):97. https://doi.org/10.3390/risks11050097

Chicago/Turabian StyleKanapickienė, Rasa, Tomas Kanapickas, and Audrius Nečiūnas. 2023. "Bankruptcy Prediction for Micro and Small Enterprises Using Financial, Non-Financial, Business Sector and Macroeconomic Variables: The Case of the Lithuanian Construction Sector" Risks 11, no. 5: 97. https://doi.org/10.3390/risks11050097

APA StyleKanapickienė, R., Kanapickas, T., & Nečiūnas, A. (2023). Bankruptcy Prediction for Micro and Small Enterprises Using Financial, Non-Financial, Business Sector and Macroeconomic Variables: The Case of the Lithuanian Construction Sector. Risks, 11(5), 97. https://doi.org/10.3390/risks11050097