Technical Analysis, Fundamental Analysis, and Ichimoku Dynamics: A Bibliometric Analysis

Abstract

1. Introduction

2. State of the Art

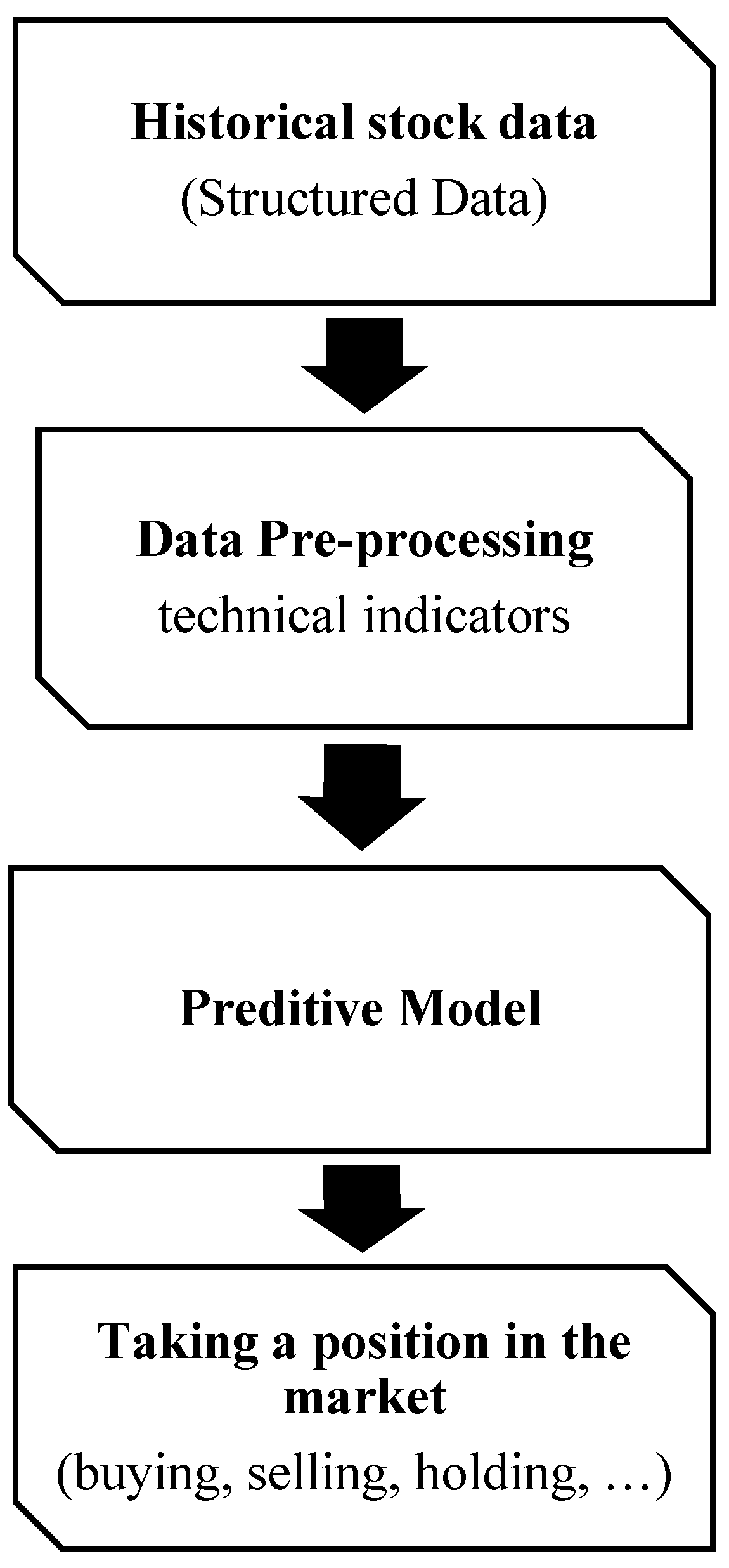

2.1. Technical Analysis

2.2. Fundamental Analysis

2.3. Ichimoku

3. Research Background

- Q.1—

- What is the research trend over the years?

- Q.2—

- What are the main sources of publication for research articles?

- Q.3—

- Which authors and articles that have exerted the most influence on this topic?

- Q.4—

- Which countries have contributed the most to the knowledge base of these methodologies?

- Q.5—

- What are the most relevant keywords used in research studies related to the topic?

4. Results

4.1. Study Quantification

4.2. Geographic Distribution

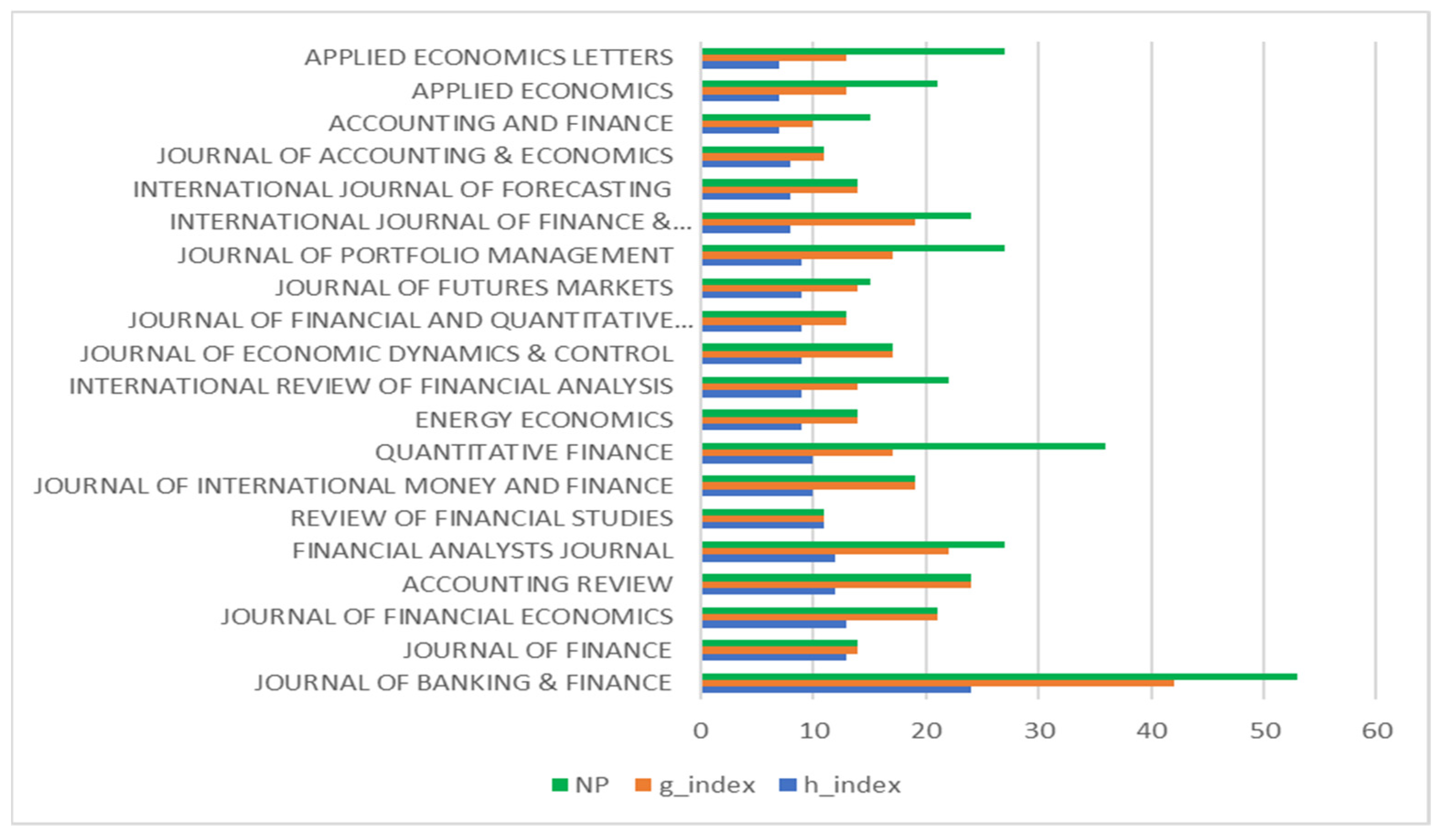

4.3. Scientific Mapping by Frequency

4.4. Ichimoku Analysis

5. Discussion

6. Conclusions

6.1. Limitations

6.2. Suggestions for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahmar, Ansari Saleh. 2017. Sutte Indicator: A technical indicator in stock market. Journal of Economics and Financial 7: 223–26. [Google Scholar]

- Ahmed, Anwer S., and Irfan Safdar. 2018. Dissecting stock price momentum using financial statement analysis. Journal Accounting and Finance 58: 3–43. [Google Scholar] [CrossRef]

- Alhashel, Bader S., Fahad W. Almudhaf, and J. Andrew Hansz. 2018. Can technical analysis generate superior returns in securitized property markets? Evidence from East Asia markets. Pacific-Basin Finance Journal 47: 92–108. [Google Scholar] [CrossRef]

- Almeida, Luís A. 2020. Technical indicators for rational investing in the technology companies: The evidence of FAANG stocks. Jurnal Pengurusan 59: 75–87. [Google Scholar] [CrossRef]

- Almeida, Luís A. G. 2022. Será a dinâmica Ichimoku eficiente? Uma evidência nos mercados de ações. Innovar 32: 41–56. [Google Scholar] [CrossRef]

- Almeida, Luís A. G. 2023. Risk and Bankruptcy Research: Mapping the State of the Art. Journal of Risk and Financial Management 16: 361. [Google Scholar] [CrossRef]

- Anamika, Kulbhaskar K., Madhumita Chakraborty, and S. Sowmya Subramaniam. 2021. Does sentiment impact cryptocurrency? Journal of Behavioral Finance 24: 1950723. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Coccurullo. 2017. Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Arslan, Hafiz Muhammad, Ye Chengang, Bilal Muhammad Siddique, and Yusra Yahya. 2022. Influence of senior executives characteristics on Corporate Environmental Disclosures: A bibliometric analysis. Journal of Risk Financial Management 15: 136. [Google Scholar] [CrossRef]

- Bąk, Tomasz. 2017. Sygnały inwestycyjne na rynku polskich akcji generowane przez technikę Ichimoku na tle zmian PKB. Annales Universitatis Mariae Curie-Skłodowska, Sectio H–Oeconomia 51: 19. [Google Scholar] [CrossRef][Green Version]

- Bansal, Sanchita, Isha Garg, Mansi Jain, and Anshita Yadav. 2023. Improving the performance/competency of small and medium enterprises through intellectual capital. Journal of Intellectual Capital 24: 830–53. [Google Scholar] [CrossRef]

- Bazán-Palomino, Walter, and Daniel Svogun. 2023. On the drivers of technical analysis profits in cryptocurrency markets: A Distributed Lag approach. International Review of Financial Analysis 86: 102516. [Google Scholar] [CrossRef]

- Benlagha, Noureddine, and Wael Hemrit. 2023. Asymmetric determinants of Bitcoin’s wild price movements. Managerial Finance 49: 227–47. [Google Scholar] [CrossRef]

- Bhattacharjee, Subhradip, Amitava Panja, Moumita Panda, Subham Dutta, Susanta Dutta, Rakesh Kumar, Dinesh Kumar, Malu Ram Yadav, Tatiana Minkina, Valery P. Kalinitchenko, and et al. 2023. How Did Research on Conservation Agriculture Evolve over the Years? A Bibliometric Analysis. Sustainability 15: 2040. [Google Scholar] [CrossRef]

- Blume, Lawrence, David Easley, and Maureen O’Hara. 1994. Market statistics and technical analysis: The role of volume. Journal of Finance 49: 153–81. [Google Scholar] [CrossRef]

- Brock, William, Josef Lakonishok, and Blake LeBaron. 1992. Simple technical trading rules and the stochastic properties of stock returns. Journal Finance 47: 1731–64. [Google Scholar] [CrossRef]

- Brown, Stephen J., William N. Goetzmann, and Alok Kumar. 1998. The Dow theory: William Peter Hamilton’s track record reconsidered. Journal of Finance 53: 1311–33. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On persistence in mutual fund performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Che-Ngoc, Ha, Nga Do-Thi, and Thao Nguyen-Trang. 2022. Profitability of Ichimoku-based trading rule in Vietnam stock market in the context of the COVID-19 outbreak. Computational Economics, 1–19. [Google Scholar] [CrossRef]

- Cohen, Gil, and Elinor Cabiri. 2015. Can technical oscillators outperform the BandH strategy? Applied Economics 47: 3189–97. [Google Scholar] [CrossRef]

- Corbet, Shaen, Veysel Eraslan, Brian Lucey, and Ahmet Sensoy. 2019. The effectiveness of technical trading rules in cryptocurrency markets. Finance Research Letters 31: 32–37. [Google Scholar] [CrossRef]

- Cowles, Alfred. 1933. Can stock market forecasters forecast? Econometrica Journal of the Econometric Society 1: 309–24. [Google Scholar] [CrossRef]

- Deb, Pragyan, Davide Furceri, Jonathan D. Ostry, and Nour Tawk. 2022. The economic effects of COVID-19 containment measures. Open Economies Review 33: 1–32. [Google Scholar] [CrossRef]

- Deng, Shangkun, and Akito Sakurai. 2014. Short-term foreign exchange rate trading based on the support/resistance level of Ichimoku Kinkohyo. Paper presented at Information Science, Electronics and Electrical Engineering (ISEEE), Sapporo, Japan, April 26–28, vol. 1, pp. 337–40. [Google Scholar] [CrossRef]

- Deng, Shangkun, Chongyi Xiao, Yingke Zhu, Jingyuan Peng, Jie Li, and Zonghua Liu. 2023. High-frequency direction forecasting and simulation trading of the crude oil futures using Ichimoku KinkoHyo and Fuzzy Rough Set. Expert Systems with Applications 215: 119326. [Google Scholar] [CrossRef]

- Deng, Shangkun, Haoran Yu, Chenyang Wei, Tianxiang Yang, and Shimada Tatsuro. 2021. The profitability of Ichimoku Kinkohyo based trading rules in stock markets and FX markets. International Journal of Finance and Economics 26: 5321–36. [Google Scholar] [CrossRef]

- Dias, Ishanka K., Jayasuriya M. R. Fernando, and Narada D. Fernando. 2022. Does investor sentiment predict bitcoin return and volatility? A quantile regression approach. International Review of Financial Analysis 84: 102383. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Egghe, Leo. 2006. Theory and practice of the g-index. Scientometrics 69: 131–52. [Google Scholar] [CrossRef]

- Elliott, Nicole. 2007. Ichimoku Charts: An Introduction to Ichimoku Kinko Clouds. Hampshire: Harriman House Limited. [Google Scholar]

- Eugster, Patrick, and Mathias W. Uhl. 2022. Technical analysis: Novel insights on contrarian trading. European Financial Management, 1–31. [Google Scholar] [CrossRef]

- Fafuła, Aleksander, and Krzysztof Drelczuk. 2015. Buying stock market winners on Warsaw Stock Exchange-quantitative backtests of a short term trend following strategy. Paper presented at Computer Science and Information Systems, Lodz, Poland, September 13–16; pp. 1361–66. [Google Scholar]

- Fama, Eugene F. 1970. Efficient capital markets: A review of theory and empirical work. Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1992. The cross-section of expected stock returns. The Journal of Finance 47: 427–65. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Marshall E. Blume. 1966. Filter rules and stock-market trading. The Journal of Business 39: 226–41. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1996. Multifactor explanations of asset pricing anomalies. Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Feldman, Todd, and Shuming Liu. 2023. A new behavioral finance mean variance framework. Review of Behavioral Finance 15: 355–70. [Google Scholar] [CrossRef]

- Gerritsen, Dirk F., Elie Bouri, Ehsan Ramezanifar, and David Roubaud. 2020. The profitability of technical trading rules in the Bitcoin market. Finance Research Letters 34: 101263. [Google Scholar] [CrossRef]

- Ghosh, Pushpendu, Ariel Neufeld, and Jajati Keshari Sahoo. 2022. Forecasting directional movements of stock prices for intraday trading using LSTM and random forests. Finance Research Letters 46: 102280. [Google Scholar] [CrossRef]

- Goutte, Stéphane, Hoang-Viet Le, Fei Liu, and Hans-Jörg von Mettenheim. 2023. Deep learning and technical analysis in cryptocurrency market. Finance Research Letters 54: 103809. [Google Scholar] [CrossRef]

- Gradojevic, Nikola, Dragan Kukolj, Robert Adcock, and Vladimir Djakovic. 2023. Forecasting Bitcoin with technical analysis: A not-so-random forest? International Journal of Forecasting 39: 1–17. [Google Scholar] [CrossRef]

- Graham, Benjamin, and David Dodd. 1934. Security Analysis. New York: McGraw-Hill. [Google Scholar]

- Gurrib, Ikhlaas, Firuz Kamalov, and Elgilani E. Elshareif. 2020. Can the leading US energy stock prices be predicted using Ichimoku clouds? Gurrib I: 41–51. [Google Scholar] [CrossRef]

- Hanauer, Matthias X., Marina Kononova, and Marc Steffen Rapp. 2022. Boosting agnostic fundamental analysis: Using machine learning to identify mispricing in European stock markets. Finance Research Letters 48: 102856. [Google Scholar] [CrossRef]

- Hirsch, Jorge E. 2005. An index to quantify an individual’s scientific research output. Proceedings of the National Academy of Sciences USA 102: 16569–72. [Google Scholar] [CrossRef]

- Hou, Kewei, Chen Xue, and Lu Zhang. 2015. Digesting anomalies: An investment approach. The Review of Financial Studies 28: 650–705. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance 48: 65–91. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 2001. Profitability of momentum strategies: An evaluation of alternative explanations. Journal of Finance 56: 699–720. [Google Scholar] [CrossRef]

- Jha, Manish, Hongyi Liu, and Asaf Manela. 2021. Natural disaster effects on popular sentiment toward finance. Journal of Financial and Quantitative Analysis 56: 2584–604. [Google Scholar] [CrossRef]

- Koo, Malcolm. 2021. Systemic lupus erythematosus research: A bibliometric analysis over a 50-year period. International Journal of Environmental Research and Public Health 18: 7095. [Google Scholar] [CrossRef] [PubMed]

- Kemeç, Abidin, and Ayşenur T. Altınay. 2023. Sustainable Energy Research Trend: A Bibliometric Analysis Using VOSviewer, RStudio Bibliometrix, and CiteSpace Software Tools. Sustainability 15: 3618. [Google Scholar] [CrossRef]

- Kushairi, Norliza, and Aidi Ahmi. 2021. Flipped classroom in the second decade of the Millenia: A bibliometrics analysis with Lotka’s law. Education and Information Technologies 26: 4401–31. [Google Scholar] [CrossRef]

- Lin, Zhe. 2018. Modelling and forecasting the stock market volatility of SSE composite index using GARCH models. Future Generation Computer Systems 79: 960–72. [Google Scholar] [CrossRef]

- Liu, Tianquan, Yiming Wang, and Yu Yan. 2022. Underreaction and overreaction in Bitcoin market. Applied Economics Letters 30: 1685–91. [Google Scholar] [CrossRef]

- Lo, Andrew W., Harry Mamaysky, and Jiang Wang. 2000. Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. Journal of Finance 55: 1705–65. [Google Scholar] [CrossRef]

- Lutey, Matthew, and Dave Rayome. 2022. Ichimoku Cloud Forecasting Returns in the US. Global Business and Finance Review 27: 17. [Google Scholar] [CrossRef]

- Mandelbrot, Benoit. 1963. The variation of certain speculative prices. The Journal of Business 36: 394–419. [Google Scholar] [CrossRef]

- Menkhoff, Lukas. 2010. The use of technical analysis by fund managers: International evidence. Journal of Banking and Finance 34: 2573–86. [Google Scholar] [CrossRef]

- Metghalchi, Massoud, Massomeh Hajilee, and Linda A. Hayes. 2019. Return predictability and market efficiency: Evidence from the Bulgarian stock market. Eastern European Economics 57: 251–68. [Google Scholar] [CrossRef]

- Murphy, Kevin J. 1999. Executive compensation. Handbook of Labor Economics 3: 2485–563. [Google Scholar] [CrossRef]

- Nametala, Ciniro A. L., Jonas Villela de Souza, Alexandre Pimenta, and Eduardo Gontijo Carrano. 2023. Use of econometric predictors and artificial neural networks for the construction of stock market investment bots. Computational Economics 61: 743–73. [Google Scholar] [CrossRef]

- Neely, Christopher J., Paul A. Weller, and Robert D. Dittmar. 1997. Is technical analysis in the foreign exchange market profitable? A genetic programming approach. Journal of Financial and Quantitative Analysis 32: 405–26. [Google Scholar] [CrossRef]

- Nor, Safwan M., and Guneratne B. Wickremasinghe. 2017. Market efficiency and technical analysis uring different market phases: Further evidence from Malaysia. Investment Management and Financial Innovations 14: 359–66. [Google Scholar]

- Nti, Isaac K., Adebayo F. Adekoya, and Benjamin A. Weyori. 2020. A systematic review of fundamental and technical analysis of stock market predictions. Artificial Intelligence Review 53: 3007–57. [Google Scholar] [CrossRef]

- Park, Cheol-Ho, and Scott H. Irwin. 2007. What do we knowabout the profitability of technical analysis? Journal of Economic Surveys 21: 786–826. [Google Scholar] [CrossRef]

- Pätäri, Eero, and Mika Vilska. 2014. Performance of moving average trading strategies over varying stock market conditions: The Finnish evidence. Applied Economics 46: 2851–72. [Google Scholar] [CrossRef]

- Rosillo, Rafael, David De la Fuente, and José A. Lopez Brugos. 2013. Technical analysis and the Spanish stock exchange: Testing the RSI, MACD, momentum and stochastic rules using Spanish market companies. Applied Economics 45: 1541–50. [Google Scholar] [CrossRef]

- Rubi, Maksuda A., Shanjida Chowdhury, Abdul A. A. Rahman, Abdelrhman Meero, Nurul M. Zayed, and Anwarul Islam. 2022. Fitting Multi-Layer Feed Forward Neural Network and Autoregressive Integrated Moving Average for Dhaka Stock Exchange Price Predicting. Emerging Science Journal 6: 1046–61. [Google Scholar] [CrossRef]

- Şengüler, Hasan, and İnel Mehmet. 2022. Finansal Verilere Dayalı Marka Değeri Belirlemeye Yönelik Yapay Zekâ Temelli Ampirik Bir Çalışma. Sosyoekonomi 30: 395–424. [Google Scholar] [CrossRef]

- Shawn, Lim K. J., Selin Yanyali, and Joseph Savidge. 2015. Do Ichimoku Cloud Charts Work and Do They Work Better in Japan? International Federation of Technical Analysts Journal 16: 18–24. [Google Scholar]

- Sullivan, Ryan, Allan Timmermann, and Halbert White. 1999. Data snooping, technical trading rule performance, and the bootstrap. Journal of Finance 54: 1647–91. [Google Scholar] [CrossRef]

- Tao, Laifa, Tong Zhang, Di Peng, Jie Hao, Yuan Jia, Chen Lu, Yu Ding, and Liang Ma. 2021. Long-term degradation prediction and assessment with heteroscedasticity telemetry data based on GRU-GARCH and MD hybrid method: An application for satellite. Aerospace Science and Technology 115: 106826. [Google Scholar] [CrossRef]

- Taylor, Mark P., and Helen Allen. 1992. The use of technical analysis in the foreign exchange market. Journal of International Money and Finance 11: 304–14. [Google Scholar] [CrossRef]

- Van Horne, James C., and George G. C. Parker. 1967. The random walk theory: An empirical test. Financial Analyst Journal 23: 87–92. [Google Scholar] [CrossRef]

- Walkshäusl, Christian. 2019. The fundamentals of momentum investing: European evidence on understanding momentum through fundamentals. Accounting and Finance 59 Suppl. S1: 831–57. [Google Scholar] [CrossRef]

- Wang, Feifei, Xuemin Sterling Yan, and Lingling Zheng. 2023. Do sophisticated investors follow fundamental analysis strategies? Evidence from hedge funds and mutual funds. Review of Accounting Studies 2: 1–50. [Google Scholar] [CrossRef]

- Wang, Jying-Nan, Hung-Chun Liu, Jiangze Du, and Yuan-Teng Hsu. 2019. Economic benefits of technical analysis in portfolio management: Evidence from global stock markets. International Journal of Finance and Economics 24: 890–902. [Google Scholar] [CrossRef]

- Wang, Jiqian, Feng Ma, Elie Bouri, and Yangli Guo. 2022. Which factors drive Bitcoin volatility: Macroeconomic, technical, or both? Journal of Forecasting 42: 970–88. [Google Scholar] [CrossRef]

- Wen, Zhuzhu, Elie Bouri, Yahua Xu, and Yang Zhao. 2022. Intraday return predictability in the cryptocurrency markets: Momentum, reversal, or both. The North American Journal of Economics and Finance 62: 101733. [Google Scholar] [CrossRef]

- Yan, Xuemin, and Lingling Zheng. 2017. Fundamental analysis and the cross-section of stock returns: A data-mining approach. Review of Financial Studies 30: 1382–423. [Google Scholar] [CrossRef]

- Yu, Zhimin. 2023. Cross-Section of Returns, Predictors Credibility, and Method Issues. Journal of Risk and Financial Management 16: 34. [Google Scholar] [CrossRef]

- Zhang, Wengang, Chongzhi Wu, Haiyi Zhong, Yongqin Li, and Lin Wang. 2021. Prediction of undrained shear strength using extreme gradient boosting and random forest based on Bayesian optimization. Geoscience Frontiers 12: 469–77. [Google Scholar] [CrossRef]

- Zhao, Jing Yi, and Min Li. 2023. Worldwide trends in prediabetes from 1985 to 2022: A bibliometric analysis using bibliometrix R-tool. Frontiers in Public Health 11: 1072521. [Google Scholar] [CrossRef]

- Zhu, Junwen, and Weishu Liu. 2020. A tale of two databases: The use of Web of Science and Scopus in academic papers. Scientometrics 123: 321–35. [Google Scholar] [CrossRef]

| SMA | |

| EMA | |

| MACD | |

| RSI |

| Return on equity (ROE) | |

| Debt/equity ratio (D/E) | |

| Market capitalization (MC) | |

| Price/sales ratio (P/S) | |

| Price/book ratio (P/B) | |

| Earnings per share (EPS) | |

| Price/earnings ratio (P/E) | |

| Return on assets (ROA) |

| Authors | Article Title | Journal | Local Citations |

|---|---|---|---|

| Brock et al. (1992) | Simple technical trading rules and the stochastic properties of stock returns | Journal of Finance | 235 |

| Fama and French (1993) | Common risk factors in the returns on stocks and bonds | Journal of Financial Economics | 154 |

| Lo et al. (2000) | Foundations of technical analysis: computational algorithms, statistical inference, and empirical implementation | Journal of Finance | 119 |

| Jegadeesh and Titman (1993) | Returns to buying winners and selling losers: implications for stock market efficiency | Journal of Finance | 113 |

| Sullivan et al. (1999) | Data-snooping, technical trading rule performance, and the bootstrap | Journal of Finance | 110 |

| Carhart (1997) | On persistence in mutual fund performance | Journal of Finance | 109 |

| Taylor and Allen (1992) | The use of technical analysis in the foreign exchange market | Journal of International Money and Finance | 103 |

| Fama and French (1992) | The cross-section of expected stock returns | Journal of Finance | 99 |

| Park and Irwin (2007) | What do we know about the profitability of technical analysis? | Journal of Economic Surveys | 97 |

| Neely et al. (1997) | Is technical analysis in the foreign exchange market profitable? A genetic programming approach | Journal of Financial and Quantitative Analysis | 83 |

| Author | h_index | g_index | TC | NP | PY_start |

|---|---|---|---|---|---|

| Menkhoff L | 7 | 12 | 744 | 12 | 1994 |

| Manahov V | 5 | 5 | 69 | 5 | 2014 |

| Marshall B | 5 | 5 | 243 | 5 | 2006 |

| Zhou G | 5 | 7 | 359 | 7 | 2009 |

| He XZ | 4 | 6 | 90 | 6 | 2005 |

| Kimura H | 4 | 5 | 130 | 5 | 2015 |

| Metghalchi | 4 | 7 | 83 | 7 | 2010 |

| Narayan P | 4 | 4 | 44 | 4 | 2015 |

| Neely C | 4 | 8 | 233 | 8 | 1999 |

| NomikosN | 4 | 4 | 139 | 4 | 2007 |

| Osler C | 4 | 4 | 180 | 4 | 1997 |

| Shynkevich A | 4 | 6 | 89 | 6 | 2012 |

| Sobreiro V | 4 | 5 | 130 | 5 | 2015 |

| Weller P | 4 | 6 | 230 | 6 | 1999 |

| Westerhoff F | 4 | 10 | 118 | 11 | 2003 |

| Almudhaf F | 3 | 3 | 10 | 4 | 2017 |

| Anghel D | 3 | 3 | 15 | 5 | 2014 |

| Bask M | 3 | 4 | 20 | 4 | 2007 |

| Bekiros S | 3 | 5 | 33 | 5 | 2007 |

| Bessembinder H | 3 | 3 | 272 | 3 | 1998 |

| Year | Articles |

|---|---|

| 2014 | 1 |

| 2015 | 1 |

| 2016 | 0 |

| 2017 | 0 |

| 2018 | 2 |

| 2019 | 0 |

| 2020 | 4 |

| 2021 | 2 |

| 2022 | 6 |

| 2023 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almeida, L.; Vieira, E. Technical Analysis, Fundamental Analysis, and Ichimoku Dynamics: A Bibliometric Analysis. Risks 2023, 11, 142. https://doi.org/10.3390/risks11080142

Almeida L, Vieira E. Technical Analysis, Fundamental Analysis, and Ichimoku Dynamics: A Bibliometric Analysis. Risks. 2023; 11(8):142. https://doi.org/10.3390/risks11080142

Chicago/Turabian StyleAlmeida, Luís, and Elisabete Vieira. 2023. "Technical Analysis, Fundamental Analysis, and Ichimoku Dynamics: A Bibliometric Analysis" Risks 11, no. 8: 142. https://doi.org/10.3390/risks11080142

APA StyleAlmeida, L., & Vieira, E. (2023). Technical Analysis, Fundamental Analysis, and Ichimoku Dynamics: A Bibliometric Analysis. Risks, 11(8), 142. https://doi.org/10.3390/risks11080142