Uncovering the Impact of Digitalization on the Performance of Insurance Distribution

Abstract

:1. Introduction

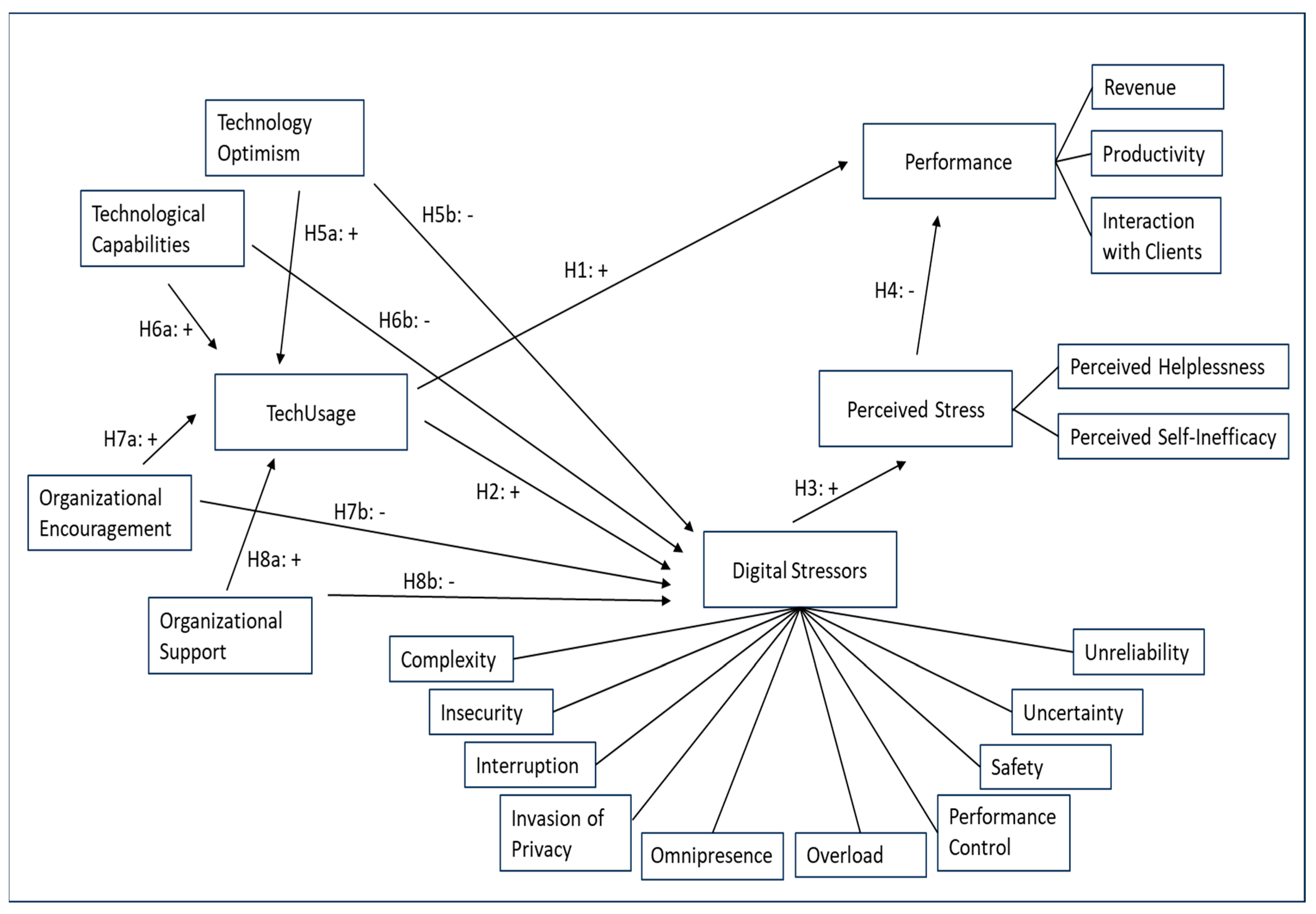

2. Hypotheses and Research Model

2.1. Use of Digital Technologies and Performance of a Salesperson

2.2. Digital Stressors, Perceived Stress, and Performance

2.3. Facilitating or Impeding Factors

3. Methodology

3.1. Operationalization and Survey Design

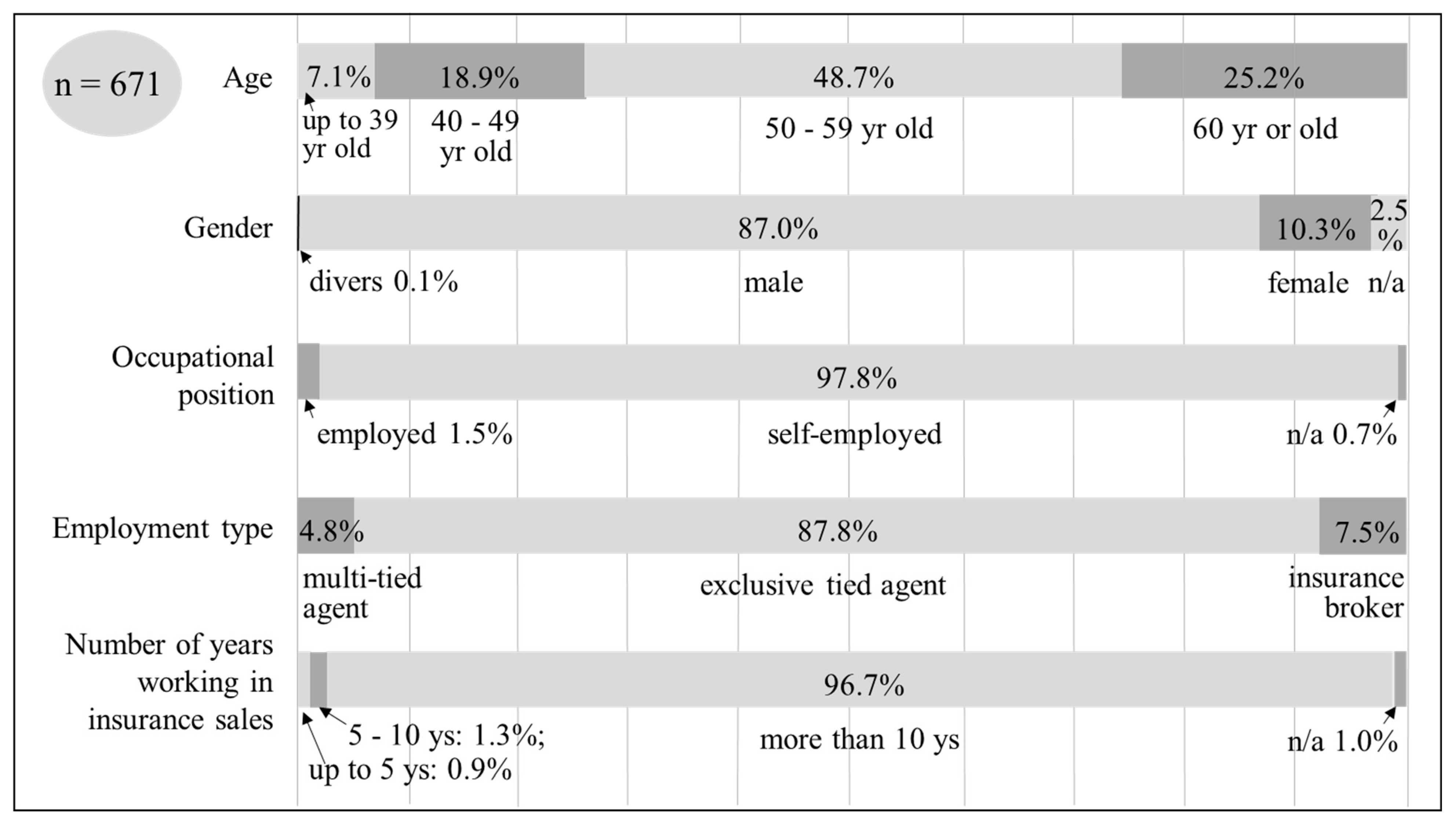

3.2. Data Collection

3.3. Data Analysis Using PLS-SEM

- K = construct´s number of indicators.

- = average non-redundant indicator correlation coefficient.

- K = the construct´s number of indicators.

- k = the indicator variable.

- = the standardized outer loading of indicator variable k.

- = the measurement error of indicator variable k.

- = the variance of the measurement error.

- K = the construct´s number of indicators.

- k = the indicator variable.

- = the standardized outer loading of indicator variable k.

4. Research Results

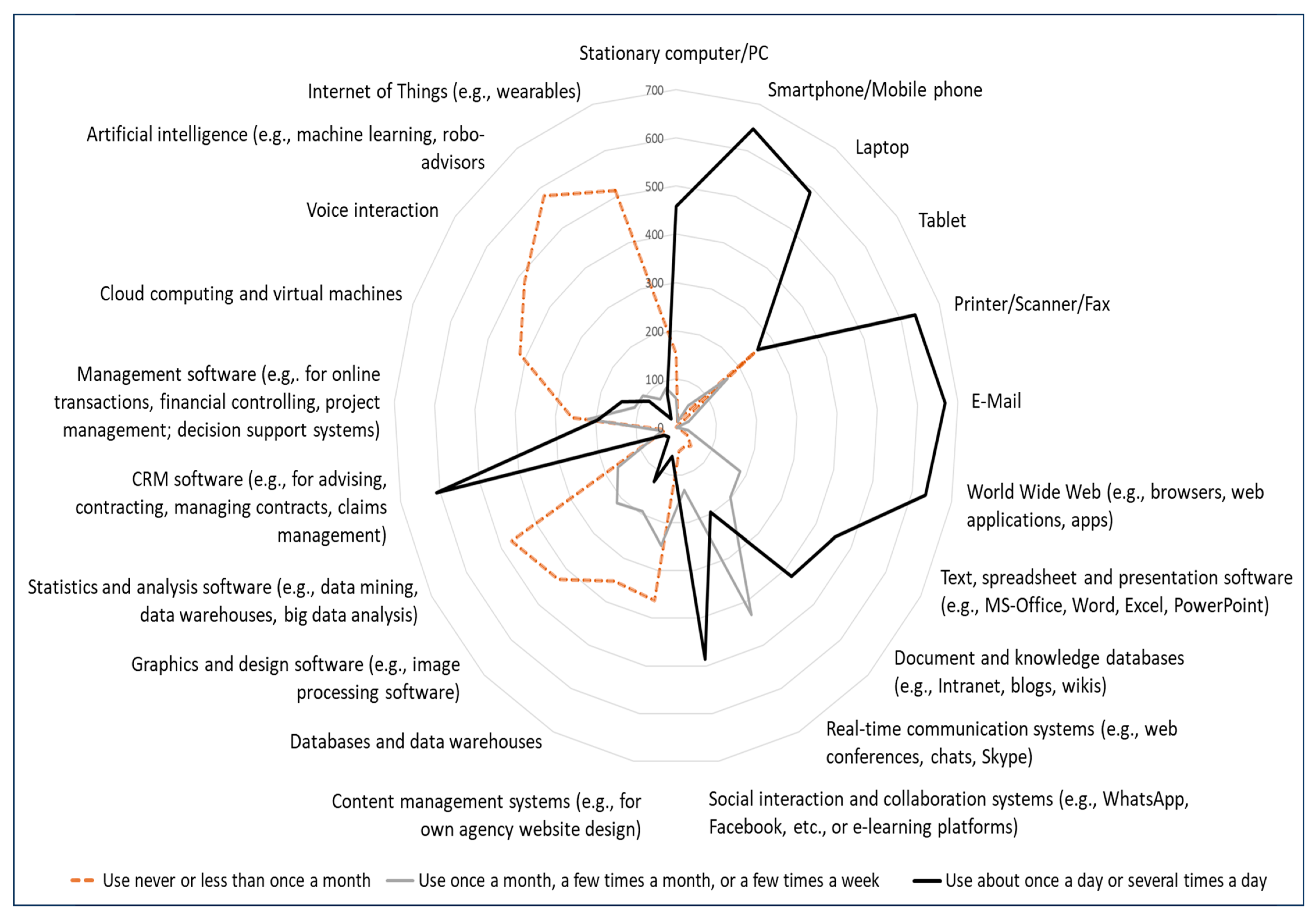

4.1. Descriptive Results

4.2. Measurement Model

4.3. Structural Model

5. Discussion

5.1. Main Findings

5.2. Limitations

5.3. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Operationalization of Constructs

| Constructs | Operationalization According to | |

| Technology Optimism, Technological Capabilities a | Parasuraman and Colby (2015) | |

| Organizational Support b, Organizational Encouragement c | Tarafdar et al. (2015) | |

| Complexity, Insecurity, Omnipresence d, Overload, Uncertainty | Tarafdar et al. (2007) | |

| Interruption | Galluch et al. (2015) | |

| Invasion of Privacy | Ayyagari et al. (2011) | |

| Performance Control | Gimpel et al. (2021) | |

| Safety, Unreliability | Fischer et al. (2021) | |

| Interaction with Clients e | Tarafdar et al. (2015) | |

| Productivity | Tarafdar et al. (2007) | |

| Revenue | Sundaram et al. (2007) | |

| Perceived helplessness, Perceived Self-Inefficacy f | Cohen and Williamson (1988) | |

| Note: The single-item-construct TechUsage is not displayed here. For some constructs, we use a different term than in the original source. They originally had the name: a: innovativeness, b: technical support provision, c: involvement facilitation, d: invasion, e: technology enabled performance, f: Perceived self-efficacy (had to be scored in the reverse direction). This was made either in order to avoid misunderstandings regarding the terminology in this paper or because this appeared appropriate due to the terminology used in the operationalizations of the constructs in the original sources. | ||

Appendix B. Item Loadings, Internal Consistency Reliability, and Convergent Validity in the Measurement Model of the Lower-Order Constructs

| Construct/Items | Cronbach’s Alpha | Composite Reliability | AVE | Loadings | M (SD) | |

| Technology Optimism (TechOpt) | 0.816 | 0.880 | 0.648 | |||

| Techopt-1: New technologies contribute to a better quality of life. | 0.867 | 3.501 (0.952) | ||||

| Techopt-2: Technology gives people more control over their lives. | 0.812 | 3.145 (1.005) | ||||

| Techopt-3: Technology makes me more productive in my personal life. | 0.842 | 3.634 (0.957) | ||||

| Techopt-4: Technology gives people more freedom to live and work where they please. | 0.687 | 4.061 (0.889) | ||||

| Technological Capabilities (TechCap) | 0.868 | 0.910 | 0.716 | |||

| Techcap-1: Other people come to me for advice on new technologies. | 0.820 | 2.882 (1.161) | ||||

| Techcap-2: In general, I am among the first in my circle of friends to acquire new technology when it appears. | 0.844 | 2.512 (1.185) | ||||

| Techcap-3: I can usually figure out new high-tech products and services without help from others. | 0.866 | 3.289 (1.104) | ||||

| Techcap-4: I keep up with the latest technological developments in my areas of interest. | 0.854 | 3.456 (1.016) | ||||

| Organizational Support (OrgSup) | 0.872 | 0.907 | 0.661 | |||

| OrgSup-1: Our organization encourages knowledge sharing to help deal with new technology. | 0.833 | 3.432 (1.017) | ||||

| OrgSup-2: Our organization emphasizes teamwork in dealing with new-technology-related problems. | 0.819 | 3.197 (1.109) | ||||

| OrgSup-3: Our organization provides sales force training before the introduction of new technology. | 0.787 | 3.625 (1.090) | ||||

| OrgSup-4: Our organization fosters a good relationship between IT department and sales force. | 0.781 | 3.130 (1.155) | ||||

| OrgSup-5: Our organization provides clear documentation to the sales force on using new technologies. | 0.844 | 3.177 (1.099) | ||||

| Organizational Encouragement (OrgEncour) | 0.815 | 0.879 | 0.646 | |||

| OrgEncour-1: Our salespeople are encouraged to try out new technologies. | 0.753 | 3.639 (1.031) | ||||

| OrgEncour-2: Our salespeople are rewarded for using new technologies. | 0.723 | 2.216 (1.129) | ||||

| OrgEncour-3: Our salespeople are consulted before introduction of new technology. | 0.859 | 2.749 (1.165) | ||||

| OrgEncour-4: Our salespeople are involved in technology change and/or implementation. | 0.871 | 2.758 (1.121) | ||||

| Complexity (Comp) | 0.866 | 0.903 | 0.652 | |||

| Comp-1: I do not know enough about digital technologies to handle my job satisfactorily. | 0.832 | 2.351 (1.061) | ||||

| Comp-2: I need a long time to understand and use new digital technologies. | 0.838 | 2.382 (1.041) | ||||

| Comp-3: I do not find enough time to study and upgrade my technology skills. | 0.787 | 2.710 (1.166) | ||||

| Comp-4: I find new recruits to this organization know more about digital technologies than I do. | 0.717 | 2.732 (1.151) | ||||

| Comp-5: I often find it too complex for me to understand and use new digital technologies. | 0.858 | 2.622 (1.113) | ||||

| Insecurity (Insec) | 0.730 | 0.832 | 0.556 | |||

| Insec-1: I feel constant threat to my job security due to digital technologies. | 0.796 | 2.394 (1.188) | ||||

| Insec-2: I have to constantly update my digital skills to avoid being replaced. | 0.620 | 3.428 (1.078) | ||||

| Insec-3: I am threatened by coworkers with newer digital technology skills. | 0.808 | 1.932 (1.008) | ||||

| Insec-4: I feel there is less sharing of knowledge among coworkers for fear of being replaced. | 0.743 | 1.864 (1.012) | ||||

| Interruption (Interr) | 0.916 | 0.947 | 0.856 | |||

| Interr-1: I receive too many interruptions during the tasks due to digital technologies. | 0.911 | 3.165 (1.048) | ||||

| Interr-2: I experience many distractions during the tasks due to digital technologies. | 0.936 | 3.151 (1.077) | ||||

| Interr-3: The interruptions caused by digital technologies come frequently. | 0.928 | 3.164 (1.106) | ||||

| Invasion of Privacy (InvPriv) | 0.901 | 0.931 | 0.772 | |||

| InvPriv-1: I feel uncomfortable that my use of digital technologies can be easily monitored. | 0.895 | 3.091 (1.304) | ||||

| InvPriv-2: I feel my privacy can be compromised because my activities using digital technologies can be traced. | 0.918 | 2.961 (1.286) | ||||

| InvPriv-3: I feel my employer could violate my privacy by tracking my activities using digital technologies. | 0.856 | 2.564 (1.350) | ||||

| InvPriv-4: I feel that my use of digital technologies makes it easier to invade my privacy. | 0.845 | 3.342 (1.233) | ||||

| Omnipresence (Omni) | 0.756 | 0.852 | 0.660 | |||

| Omni-1: I have to be in touch with my work even during my vacation due to digital technologies. | 0.694 | 3.414 (1.265) | ||||

| Omni-2: I have to sacrifice my vacation and weekend time to keep current on new digital technologies. | 0.850 | 2.413 (1.137) | ||||

| Omni-3: I feel my personal life is being invaded by digital technologies. | 0.882 | 2.877 (1.121) | ||||

| Overload (Overl) | 0.860 | 0.905 | 0.705 | |||

| Overl-1: I am forced by digital technologies to do more work than I can handle. | 0.866 | 2.776 (1.148) | ||||

| Overl-2: I am forced by digital technologies to work with very tight time schedules. | 0.872 | 2.794 (1.167) | ||||

| Overl-3: I am forced to change my work habits to adapt to new digital technologies. | 0.754 | 3.499 (1.079) | ||||

| Overl-4: I have a higher workload because of increased digital technology complexity. | 0.862 | 3.352 (1.153) | ||||

| Performance Control (PerfCont) | 0.846 | 0.908 | 0.767 | |||

| PerfCont-1: I feel that my professional performance is monitored using digital technologies. | 0.915 | 2.843 (1.310) | ||||

| PerfCont-2: I feel that my professional achievements can be compared with the achievements of my colleagues/competitors due to digital technologies. | 0.913 | 3.138 (1.353) | ||||

| PerfCont-3: I have the feeling that more of the mistakes I make during work can be discovered through digital technologies. | 0.795 | 2.618 (1.245) | ||||

| Safety (Safet) | 0.919 | 0.940 | 0.757 | |||

| Safet-1: I have to worry too often, whether I might download malicious programs. | 0.863 | 2.381 (1.162) | ||||

| Safet-2: I have to worry too often, whether I might receive malicious e-mails. | 0.898 | 2.566 (1.220) | ||||

| Safet-3: I fear that hackers might get access to company secrets through a mistake of mine. | 0.891 | 2.433 (1.205) | ||||

| Safet-4: I feel anxious when I get an e-mail from somebody that I do not know as it could be a malevolent attack. | 0.892 | 2.587 (1.273) | ||||

| Safet-5: E-Mails whose sender I do not know make me nervous. | 0.804 | 2.176 (1.175) | ||||

| Unreliability (Unrel) | 0.933 | 0.950 | 0.791 | |||

| Unrel-1: I think that I am too often confronted with unexpected behavior of digital technologies I use at work (e.g., breakdowns or long response times). | 0.833 | 3.281 (1.168) | ||||

| Unrel-2: I think that I lose too much time due to technical malfunctions. | 0.917 | 3.205 (1.217) | ||||

| Unrel-3: I think that I spend too much time trying to fix technical malfunctions. | 0.900 | 3.070 (1.250) | ||||

| Unrel-4: There is just too much of my time at work wasted coping with the unreliability of digital technologies. | 0.922 | 3.049 (1.267) | ||||

| Unrel-5: The daily hassles with digital technologies (e.g., slow programs or unexpected behavior) are really bothering me. | 0.871 | 2.999 (1.249) | ||||

| Perceived helplessness (PerHeLess) | 0.871 | 0.903 | 0.609 | |||

| PerHeLess-1: In the last month, how often have you been upset because of something that happened unexpectedly? | 0.806 | 2.210 (1.040) | ||||

| PerHeLess-2: In the last month, how often have you felt that you were unable to control the important things in your life? | 0.813 | 2.025 (1.110) | ||||

| PerHeLess-3: In the last month, how often have you felt nervous and “stressed”? | 0.811 | 2.219 (1.086) | ||||

| PerHeLess-4: In the last month, how often have you found that you could not cope with all the things that you had to do? | 0.693 | 1.615 (0.970) | ||||

| PerHeLess-5: In the last month, how often have you been angered because of things that were outside of your control? | 0.770 | 2.085 (1.060) | ||||

| PerHeLess-6: In the last month, how often have you felt difficulties were piling up so high that you could not overcome them? | 0.781 | 1.241 (1.110) | ||||

| Perceived Self-Inefficacy (PerSeIfIneff) * | 0.695 | 0.809 | 0.526 | |||

| PerSeIfIneff-1: In the last month, how often have you felt confident about your ability to handle your personal problems? | 0.710 | 1.271 (0.866) | ||||

| PerSeIfIneff-2: In the last month, how often have you felt that things were going your way? | 0.824 | 1.564 (0.866) | ||||

| PerSeIfIneff-3: In the last month, how often have you been able to control irritations in your life? | 0.468 | 1.644 (1.012) | ||||

| PerSeIfIneff-4: In the last month, how often have you felt that you were on top of things? | 0.837 | 1.286 (0.875) | ||||

| Revenue (Rev) | 0.875 | 0.914 | 0.727 | |||

| To what extent have digital technologies affected the quality of your performance with regard to: | ||||||

| Rev-1: Selling high profit-margin products | 0.822 | 3.171 (0.737) | ||||

| Rev-2: Generating a high level of sales. | 0.882 | 3.298 (0.728) | ||||

| Rev-3: Quickly generating sales of new company products or of new products from partner companies. | 0.839 | 3.215 (0.753) | ||||

| Rev-4: Exceeding sales targets. | 0.866 | 3.105 (0.734) | ||||

| Productivity (Prod) | 0.883 | 0.928 | 0.810 | |||

| Prod-2: Digital technologies help me to improve my productivity. | 0.907 | 3.433 (1.024) | ||||

| Prod-3: Digital technologies help me to accomplish more work than would otherwise be possible. | 0.904 | 3.377 (1.060) | ||||

| Prod-4: Digital technologies help me to perform my job better. | 0.890 | 3.436 (1.014) | ||||

| Interaction with Clients (InteracCl) | 0.882 | 0.914 | 0.680 | |||

| InteracCl-1: Using digital technologies results in improved customer satisfaction. | 0.802 | 3.467 (0.892) | ||||

| InteracCl-2: Using digital technologies results in more time to meet with customers. | 0.836 | 2.936 (1.064) | ||||

| InteracCl-3: Using digital technologies helps me make my time with customers more productive. | 0.867 | 3.330 (1.021) | ||||

| InteracCl-4: Using digital technologies helps me communicate better with customers. | 0.793 | 3.772 (0.908) | ||||

| InteracCl-5: Using digital technologies helps improve my overall professionalism with customers. | 0.823 | 3.721 (0.958) | ||||

| Note: * Composite reliability (rho_a) is 0.771, which indicates a sufficient internal consistent reliability; Prod-1 was removed due to discriminant validity reasons in the lower-order construct; the digital stressor uncertainty was removed due to convergent validity reason in the higher-order construct; after removing item resp. construct all calculations in PLS were performed again. | ||||||

Appendix C. Discriminant Validity of Lower-Order Constructs: Heterotrait-Monotrait (HTMT) Ratio

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | ||

| 1 | Complexity | |||||||||||||||||||

| 2 | Insecurity | 0.717 | ||||||||||||||||||

| 3 | Interaction with Clients | 0.464 | 0.384 | |||||||||||||||||

| 4 | Interruption | 0.440 | 0.571 | 0.365 | ||||||||||||||||

| 5 | Invasion of Privacy | 0.413 | 0.557 | 0.297 | 0.463 | |||||||||||||||

| 6 | Omnipresence | 0.310 | 0.507 | 0.202 | 0.588 | 0.405 | ||||||||||||||

| 7 | Organizational Encouragement | 0.273 | 0.162 | 0.423 | 0.181 | 0.214 | 0.112 | |||||||||||||

| 8 | Organizational Support | 0.303 | 0.222 | 0.474 | 0.219 | 0.243 | 0.153 | 0.850 | ||||||||||||

| 9 | Overload | 0.588 | 0.671 | 0.474 | 0.723 | 0.500 | 0.669 | 0.212 | 0.269 | |||||||||||

| 10 | Perceived Helplessness | 0.498 | 0.625 | 0.347 | 0.628 | 0.497 | 0.576 | 0.183 | 0.224 | 0.698 | ||||||||||

| 11 | Perceived Self-Inefficacy | 0.346 | 0.448 | 0.320 | 0.301 | 0.264 | 0.265 | 0.150 | 0.184 | 0.326 | 0.581 | |||||||||

| 12 | Performance Control | 0.347 | 0.553 | 0.196 | 0.381 | 0.764 | 0.285 | 0.112 | 0.143 | 0.429 | 0.441 | 0.231 | ||||||||

| 13 | Productivity | 0.428 | 0.330 | 0.899 | 0.343 | 0.282 | 0.212 | 0.361 | 0.408 | 0.429 | 0.330 | 0.324 | 0.187 | |||||||

| 14 | Revenue | 0.421 | 0.433 | 0.702 | 0.297 | 0.296 | 0.180 | 0.371 | 0.376 | 0.359 | 0.302 | 0.373 | 0.239 | 0.659 | ||||||

| 15 | Safety | 0.487 | 0.571 | 0.216 | 0.386 | 0.462 | 0.450 | 0.085 | 0.124 | 0.428 | 0.480 | 0.238 | 0.412 | 0.190 | 0.224 | |||||

| 16 | Technological Capabilities | 0.721 | 0.312 | 0.431 | 0.094 | 0.143 | 0.148 | 0.347 | 0.317 | 0.206 | 0.157 | 0.184 | 0.122 | 0.405 | 0.370 | 0.210 | ||||

| 17 | Technology Optimism | 0.480 | 0.333 | 0.792 | 0.308 | 0.275 | 0.230 | 0.408 | 0.427 | 0.406 | 0.316 | 0.286 | 0.221 | 0.767 | 0.538 | 0.185 | 0.581 | |||

| 18 | TechUsage | 0.338 | 0.099 | 0.306 | 0.052 | 0.142 | 0.145 | 0.332 | 0.284 | 0.053 | 0.057 | 0.113 | 0.089 | 0.288 | 0.246 | 0.095 | 0.569 | 0.416 | ||

| 19 | Unreliability | 0.515 | 0.574 | 0.423 | 0.545 | 0.534 | 0.375 | 0.352 | 0.428 | 0.602 | 0.571 | 0.281 | 0.440 | 0.398 | 0.357 | 0.457 | 0.216 | 0.341 | 0.085 |

Appendix D. Discriminant Validity of Lower-Order Constructs: Fornell-Larcker Criterion

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | ||

| 1 | Complexity | 0.808 | ||||||||||||||||||

| 2 | Insecurity | 0.576 | 0.746 | |||||||||||||||||

| 3 | Interaction with Clients | −0.412 | −0.315 | 0.825 | ||||||||||||||||

| 4 | Interruption | 0.400 | 0.467 | −0.331 | 0.925 | |||||||||||||||

| 5 | Invasion of Privacy | 0.370 | 0.460 | −0.266 | 0.420 | 0.879 | ||||||||||||||

| 6 | Omnipresence | 0.300 | 0.419 | −0.162 | 0.518 | 0.369 | 0.813 | |||||||||||||

| 7 | Organizational Encouragement | −0.235 | −0.123 | 0.364 | −0.159 | −0.188 | −0.071 | 0.804 | ||||||||||||

| 8 | Organizational Support | −0.272 | −0.181 | 0.418 | −0.196 | −0.215 | −0.116 | 0.713 | 0.813 | |||||||||||

| 9 | Overload | 0.517 | 0.531 | −0.418 | 0.643 | 0.442 | 0.587 | −0.184 | −0.234 | 0.840 | ||||||||||

| 10 | Perceived Helplessness | 0.437 | 0.500 | −0.304 | 0.561 | 0.440 | 0.501 | −0.158 | −0.195 | 0.609 | 0.780 | |||||||||

| 11 | Perceived Self-Inefficacy | 0.300 | 0.341 | −0.273 | 0.267 | 0.224 | 0.227 | −0.120 | −0.162 | 0.284 | 0.498 | 0.725 | ||||||||

| 12 | Performance Control | 0.297 | 0.444 | −0.176 | 0.337 | 0.672 | 0.259 | −0.095 | −0.128 | 0.371 | 0.383 | 0.192 | 0.876 | |||||||

| 13 | Productivity | −0.382 | −0.272 | 0.796 | −0.308 | −0.253 | −0.155 | 0.311 | 0.359 | −0.377 | −0.289 | −0.272 | −0.169 | 0.900 | ||||||

| 14 | Revenue | −0.371 | −0.355 | 0.619 | −0.265 | −0.264 | −0.162 | 0.315 | 0.330 | −0.315 | −0.264 | −0.306 | −0.213 | 0.582 | 0.853 | |||||

| 15 | Safety | 0.437 | 0.471 | −0.194 | 0.354 | 0.421 | 0.396 | −0.071 | −0.114 | 0.383 | 0.429 | 0.205 | 0.360 | −0.172 | −0.200 | 0.870 | ||||

| 16 | Technological Capabilities | −0.619 | −0.251 | 0.376 | −0.084 | −0.128 | −0.018 | 0.291 | 0.279 | −0.179 | −0.136 | −0.156 | −0.108 | 0.355 | 0.324 | −0.186 | 0.846 | |||

| 17 | Technology Optimism | −0.410 | −0.264 | 0.674 | −0.270 | −0.238 | −0.114 | 0.337 | 0.365 | −0.347 | −0.267 | −0.234 | −0.182 | 0.655 | 0.458 | −0.161 | 0.491 | 0.805 | ||

| 18 | TechUsage | −0.315 | −0.091 | 0.287 | −0.050 | −0.136 | 0.087 | 0.298 | 0.269 | −0.050 | −0.045 | −0.094 | −0.085 | 0.271 | 0.231 | −0.090 | 0.531 | 0.374 | 1.000 | |

| 19 | Unreliability | 0.471 | 0.472 | −0.385 | 0.504 | 0.489 | 0.352 | −0.310 | −0.386 | 0.540 | 0.515 | 0.248 | 0.393 | −0.361 | −0.324 | 0.424 | −0.194 | −0.300 | −0.082 | 0.889 |

| Note: Square root of AVE is on the diagonal (bold highlighted). | ||||||||||||||||||||

Appendix E. Discriminant Validity of Higher-Order Constructs: Heterotrait-Monotrait (HTMT) Ratio

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 1 | Digital Stressors (DigStressors) | |||||||

| 2 | Organizational Encouragement (OrgEncour) | 0.260 | ||||||

| 3 | Organizational Support (OrgSup) | 0.329 | 0.850 | |||||

| 4 | Perceived Stress (PercStress) | 0.790 | 0.216 | 0.270 | ||||

| 5 | Technological Capabilities (TechCap) | 0.320 | 0.347 | 0.317 | 0.222 | |||

| 6 | Technology Optimism (TechOpt) | 0.420 | 0.408 | 0.427 | 0.393 | 0.581 | ||

| 7 | TechUsage (single item) | 0.165 | 0.332 | 0.284 | 0.099 | 0.569 | 0.416 |

Appendix F. Inner Model: VIF Values

| DigStressors | PercStress | Perform | TechUsage | |

| Digital Stressors (DigStressors) | 1.000 | |||

| Organizational Encouragement (OrgEncour) | 2.097 | 2.078 | ||

| Organizational Support (OrgSup) | 2.108 | 2.107 | ||

| Perceived Stress (PercStress) | 1.005 | |||

| Technological Capabilities (TechCap) | 1.626 | 1.350 | ||

| Technology Optimism (TechOpt) | 1.488 | 1.429 | ||

| TechUsage | 1.458 | 1.005 |

Appendix G. Total Indirect Effects

| Total Indirect Effect from | on | ||

| Digital Stressors (DigStressors) | Perceived Stress (PercStress) | Performance (Perform) | |

| TechUsage | 0.067 * | ||

| Digital Stressors (DigStressors) | −0.226 *** | ||

| Technology Optimism (TechOpt) | −0.161 *** | 0.087 *** | |

| Technological Capabilities (TechCap) | 0.045 * | −0.083 ** | 0.148 *** |

| Organizational Support (OrgSup) | −0.120 ** | 0.049 ** | |

| Note: Path coefficients are standardized; only the significant total indirect effects are shown in this table; * p < 0.05, ** p < 0.01, *** p < 0.001. | |||

References

- Ahearne, Michael, Eli Jones, Adam Rapp, and John Mathieu. 2008. High Touch Through High Tech: The Impact of Salesperson Technology Usage on Sales Performance via Mediating Mechanisms. Management Science 54: 671–85. [Google Scholar] [CrossRef]

- Amerirad, Behnaz, Matteo Cattaneo, Ron S. Kenett, and Elisa Luciano. 2023. Adversarial Artificial Intelligence in Insurance: From an Example to Some Potential Remedies. Risks 11: 20. [Google Scholar] [CrossRef]

- Ayyagari, Ramakrishna, Varun Grover, and Russell Purvis. 2011. Technostress. Technological Antecedents and Implications. MIS Quarterly 35: 831–58. [Google Scholar] [CrossRef]

- Beloucif, Ahmed, Bill Donaldson, and Ugar Kazanci. 2004. Insurance broker-client relationships: An assessment of quality and duration. Journal of Financial Services Marketing 8: 327–42. [Google Scholar] [CrossRef]

- Bethlehem, Jelke. 2010. Selection bias in web surveys. International Statistical Review 78: 161–88. [Google Scholar] [CrossRef]

- BIPAR (The European Federation of Insurance Intermediaries). 2023. Insurance Intermediation. Available online: https://www.bipar.eu/images/uploads/general/BIPAR_Brochure_on_insurance_intermediation-January2023.pdf (accessed on 18 August 2023).

- Bohnert, Alexander, Albrecht Fritzsche, and Shirley Gregor. 2019. Digital agendas in the insurance industry: The importance of comprehensive approaches. The Geneva Papers on Risk and Insurance: Issues and Practice 44: 1–19. [Google Scholar] [CrossRef]

- Braun, Alexander, and Florian Schreiber. 2017. The Current Insurtech Landscape: Business Models and Disruptive Potential. St. Gallen: Institute of Insurance Economics, University of St. Gallen. [Google Scholar]

- BVK (Bundesverband Deutscher Versicherungskaufleute). 2023. Betriebswirtschaftliche Strukturen des Versicherungsvertriebs: BVK-Strukturanalyse 2022/2023. Ahrensburg: VersicherungsJournal Verlag. [Google Scholar]

- Califf, Christopher B., Saonee Sarker, and Suprateek Sarker. 2020. The Bright and Dark Sides of Technostress: A Mixed-Methods Study Involving Healthcare IT. MIS Quarterly 44: 809–56. [Google Scholar] [CrossRef]

- Cappiello, Antonella. 2020. The Digital (R)evolution of Insurance Business Models. American Journal of Economics and Business Administration 1: 1–13. [Google Scholar] [CrossRef]

- Chen, Adela, and Elena Karahanna. 2018. Life Interrupted: The Effects of Technology-Mediated Work Interruptions on Work and Nonwork Outcomes. MIS Quarterly 42: 1023–42. [Google Scholar]

- Cohen, Jacob. 1988. Statistical Power Analysis for the Behavioural Sciences, 2nd ed. New York, NY: Routledge. [Google Scholar]

- Cohen, Sheldon, and Denise Janicki-Deverts. 2012. Who’s Stressed? Distributions of Psychological Stress in the United States in Probability Samples from 1983, 2006, and 2009. Journal of Applied Social Psychology 42: 1320–34. [Google Scholar] [CrossRef]

- Cohen, Sheldon, and Gail M. Williamson. 1988. Perceived Stress in a Probability Sample of the United States. In The Social Psychology of Health. Edited by Shirlynn Spacapan and Stuart Oskamp. Newbury Park: Sage, pp. 31–67. [Google Scholar]

- Cohen, Sheldon, Tom Kamarck, and Robin Mermelstein. 1983. A Global Measure of Perceived Stress. Journal of Health and Social Behavior 24: 385–96. [Google Scholar] [CrossRef]

- Cummins, J.David, and Neil A. Doherty. 2006. The Economics of Insurance Intermediaries. Journal of Risk and Insurance 73: 359–96. [Google Scholar] [CrossRef]

- Dalla Pozza, Ilaria, Sandrine Heitz-Spahn, and Lionel Texier. 2017. Generation Y multichannel behaviour for complex services: The need for human contact embodied through a distance relationship. Journal of Strategic Marketing 25: 226–39. [Google Scholar] [CrossRef]

- D’Arcy, John, Tejaswini Herath, and Mindy K. Shoss. 2014. Understanding Employee Responses to Stressful Information Security Requirements: A Coping Perspective. Journal of Management Information Systems 31: 285–318. [Google Scholar] [CrossRef]

- Dominique-Ferreira, Sergio. 2018. The key role played by intermediaries in the retail insurance distribution. International Journal of Retail and Distribution Management 46: 1170–92. [Google Scholar] [CrossRef]

- Doney, Patricia M., and Joseph P. Cannon. 1997. An examination of the nature of trust in buyer-seller relationships. Journal of Marketing 61: 327–40. [Google Scholar]

- Dragano, Nico, and Thorsten Lunau. 2020. Technostress at work and mental health: Concepts and research results. Current Opinion in Psychiatry 33: 407–13. [Google Scholar] [CrossRef]

- Dumm, Randy E., and Robert E. Hoyt. 2003. Insurance distribution channels: Markets in transition. Journal of Insurance Regulation 22: 27–47. [Google Scholar]

- Eastman, Jaqueline K., Alan D. Eastman, and Kevin L. Eastman. 2002. Insurance Sales Agents and the Internet: The Relationship Between Opinion Leadership, Subjective Knowledge, and Internet Attitudes. Journal of Marketing Management 18: 259–85. [Google Scholar] [CrossRef]

- Eckert, Christian, Christoph Neunsinger, and Katrin Osterrieder. 2022. Managing customer satisfaction: Digital applications for insurance companies. The Geneva Papers on Risk and Insurance: Issues and Practice 47: 569–602. [Google Scholar] [CrossRef]

- Eckert, Christian, Johanna Eckert, and Armin Zitzmann. 2021. The status quo of digital transformation in insurance sales: An empirical analysis of the german insurance industry. Zeitschrift für die gesamte Versicherungswissenschaft 110: 133–55. [Google Scholar] [CrossRef]

- Eckardt, Martina. 2007. Insurance Intermediation: An Economic Analysis of the Information Services Market. Heidelberg: Physica-Verlag. [Google Scholar]

- Eckardt, Martina, and Solvia Räthke-Döppner. 2010. The Quality of Insurance Intermediary Services—Empirical Evidence for Germany. Journal of Risk and Insurance 77: 667–701. [Google Scholar] [CrossRef]

- Eling, Martin, and Martin Lehmann. 2018. The Impact of Digitalization on the Insurance Value Chain and the Insurability of Risks. The Geneva Papers on Risk and Insurance: Issues and Practice 43: 359–96. [Google Scholar] [CrossRef]

- Fischer, Thomas, and René Riedl. 2017. Technostress Research: A Nurturing Ground for Measurement Pluralism? Communications of the Association for Information Systems 40: 75–401. [Google Scholar] [CrossRef]

- Fischer, Thomas, Martin Reuter, and René Riedl. 2021. The Digital Stressors Scale: Development and Validation of a New Survey Instrument to Measure Digital Stress Perceptions in the Workplace Context. Frontiers in Psychology 12: 607598. [Google Scholar] [CrossRef]

- Flückiger, Isabelle, and Meryem Duygun. 2022. New technologies and data in insurance. The Geneva Papers on Risk and Insurance: Issues and Practice 47: 495–98. [Google Scholar] [CrossRef]

- Forman, Chris, and Anne Gron. 2009. Vertical Integration and Information Technology Investment in the Insurance Industry. Journal of Law, Economics, & Organization 27: 180–218. [Google Scholar]

- Fritzsch, Simon, Philipp Scharber, and Gregor Weiß. 2021. Estimating the relation between digitalization and the market value of insurers. Journal of Risk and Insurance 88: 529–67. [Google Scholar] [CrossRef]

- Fritzsche, Albert, and Alexander Bohnert. 2022. Implications of bundled offerings for business development and competitive strategy in digital insurance. The Geneva Papers on Risk and Insurance: Issues and Practice 47: 817–34. [Google Scholar] [CrossRef]

- Galluch, Pamela S., Varun Grover, and Jason B. Thatcher. 2015. Interrupting the Workplace: Examining Stressors in an Information Technology Context. Journal of the Association for Information Systems 16: 1–47. [Google Scholar] [CrossRef]

- Garven, James R. 2002. On the implication of the internet for insurance markets and institutions. Risk Management and Insurance Review 5: 105–16. [Google Scholar] [CrossRef]

- GDV (Gesamtverband der Deutschen Versicherungswirtschaft). 2022. Branche in Zahlen, Statistiken zur deutschen Versicherungswirtschaft. Available online: https://www.gdv.de/gdv/statistiken-zur-deutschen-versicherungswirtschaft-2022-statistisches-taschenbuch--97258 (accessed on 12 October 2022).

- Gefen, David, Edward E. Rigdon, and Detmar Straub. 2011. An update and extension to SEM guidelines for administrative and social science research. MIS Quarterly 35: iii-A7. [Google Scholar] [CrossRef]

- Gimpel, Henner, Julia Lanzl, Christian Regal, Nils Urbach, Julia Becker, Torsten M. Kühlmann, Mathias Certa, and Patricia Tegtmeier. 2021. Extending the Concept of Technostress: The Hierarchical Structure of Digital Stress. In The Digital Workplace: Antecedents and Consequences of Technostress. Edited by Julia Becker. Bayreuth: University of Bayreuth, pp. 157–243. [Google Scholar]

- Gimpel, Henner, Julia Lanzl, Tobias Manner-Romberg, and Niclas Nüske. 2018. Digital Stress in Germany. A Survey of Employed People on Stress and Strain Caused by Working with Digital Technologies. Working Paper 101. Düsseldorf: Hans-Böckler-Stiftung. [Google Scholar]

- Greineder, Michael, Tobias Riasanow, Markus Bohm, and Helmut Krcmar. 2020. Generic Insurtech Ecosystem and Its Strategic Implications for the Digital Transformation of the Insurance Industry. Munich: Technical University of Munich. [Google Scholar]

- Hair, Joseph F., G.Thomas.M. Hult, Christian M. Ringle, Marko Sarstedt, Nichola P. Danks, and Soumya Ray. 2021. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R. A Workbook. Cham: Springer Nature Switzerland AG. [Google Scholar]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hall, Jeffrey A., Ric G. Steele, Jennifer L. Christofferson, and Teodora Mihailova. 2021. Development and initial evaluation of a multidimensional digital stress scale. Psychological Assessment 33: 230–42. [Google Scholar] [CrossRef]

- Hampton, Keith N., Weixu Lu, and Inyoung Shin. 2016. Digital Media and Stress: The Cost of Caring 2.0. In Information, Communication & Society. Document Version: Accepted Manuscript (AM). New Brunswick: Rutgers University. [Google Scholar] [CrossRef]

- Heinzel, Vanessa. 2021. Coping with Sales Pressure—Eine literaturbasierte Analyse von Strategien zur Stressbewältigung im Vertrieb. Junior Management Science 6: 279–98. [Google Scholar]

- Hilliard, James I., Laureen Regan, and Sharon Tennyson. 2013. Insurance distribution. In The Handbook of Insurance, 2nd ed. Edited by Georges Dionne. New York: Springer, pp. 689–727. [Google Scholar]

- Höckmayr, Gergana K. 2012. Wandel der Beratungsqualität auf dem Versicherungsvermittlermarkt: Eine ökonomische Analyse der Veränderungen aufgrund der Anforderungen der EU-Vermittlerrichtlinie. Zeitschrift für die gesamte Versicherungswissenschaft 101: 75–102. [Google Scholar] [CrossRef]

- Insurance Europe. 2022. European Insurance in Figures, 2020 Data. Available online: https://insuranceeurope.eu/publications/2569/european-insurance-in-figures-2020-data (accessed on 18 August 2023).

- Jap, Sandy D. 2000. The strategic role of the salesforce in developing customer satisfaction across the relationship cycle. Journal of Personal Selling & Sales Management 11: 95–108. [Google Scholar]

- Kasten, Nadine, and Reinhard Fuchs. 2018. Methodische Aspekte der Stressforschung. In Handbuch Stressregulation und Sport. Edited by Rainhard Fuchs and Markus Gerber. Berlin: Springer, pp. 179–201. [Google Scholar]

- Klein, Eva M., Elmar Brähler, Michael Dreier, Leonard Reinecke, Kai W. Müller, Gabriele Schmutzer, Klaus Wölfling, and Manfred E. Beutel. 2016. The German version of the Perceived Stress Scale—Psychometric characteristics in a representative German community sample. BMC Psychiatry 16: 1–10. [Google Scholar] [CrossRef]

- Kock, Ned. 2015. Common method bias in PLS-SEM: A full collinearity assessment approach. International Journal of e-Collaboration 11: 1–10. [Google Scholar] [CrossRef]

- Köhne, Thomas. 2024. Versicherungsmarketing, Marketing und Vertrieb im Versicherungsunternehmen in Theorie und Praxis, 2nd ed. Wiesbaden: Springer Fachmedien Wiesbaden GmbH. [Google Scholar]

- Köhne, Thomas, and Christoph Brömmelmeyer. 2018. The New Insurance Distribution Regulation in the EU—A Critical Assessment from a Legal and Economic Perspective. The Geneva Papers on Risk and Insurance: Issues and Practice 43: 704–39. [Google Scholar] [CrossRef]

- Lanfranchi, Davide, and Laura Grassi. 2022. Examining insurance companies’ use of technology for innovation. The Geneva Papers on Risk and Insurance: Issues and Practice 47: 520–37. [Google Scholar] [CrossRef] [PubMed]

- Lanzl, Julia. 2023. Social Support as Technostress Inhibitor. Even More Important During the COVID-19 Pandemic? Business & Information Systems Engineering 65: 329–43. [Google Scholar]

- Maier, Christian, Sven Laumer, and Andreas Eckhardt. 2015. Information technology as daily stressor: Pinning down the causes of burnout. Journal of Business Economics 85: 349–87. [Google Scholar] [CrossRef]

- Maier, Christian, Sven Laumer, Andreas Eckhardt, and Tim Weitzel. 2014. Explaining technical and social stressors in techno-social systems: Theoretical foundation and empirical evidence. In Technostress: Theoretical Foundation and Empirical Evidence. Edited by Christian Maier. Bamberg: University of Bamberg, pp. 95–131. [Google Scholar]

- Marano, Pierpaolo. 2021. Management of Distribution Risks and Digital Transformation of Insurance Distribution—A Regulatory Gap in the IDD. Risks 9: 143. [Google Scholar] [CrossRef]

- Marano, Pierpaolo, and Shu Li. 2023. Regulating Robo-Advisors in Insurance Distribution: Lessons from the Insurance Distribution Directive and the AI Act. Risks 11: 12. [Google Scholar] [CrossRef]

- Marsh, Elizabeth, Elvira P. Vallejos, and Alexa Spence. 2022. The digital workplace and its dark side: An integrative review. Computers in Human Behavior 128: 1–21. [Google Scholar] [CrossRef]

- Meunier, Sophie, Laurance Bouchard, Simon Coulombe, Marina M. Doucerain, Tyler Pacheco, and E. Auger. 2022. The Association between Perceived Stress, Psychological Distress, and Job Performance During the COVID-19 Pandemic: The Buffering Role of Health-Promoting Management Practices. Trends in Psychology 30: 549–69. [Google Scholar] [CrossRef]

- Müller, Florian, Henrik Naujoks, Harshveer Singh, Gunther Schwarz, Andrew Schwedel, and Kirsty Thomson. 2015. Global Digital Insurance Benchmarking Report 2015. Pathways to Success in a Digital World. Available online: www.bain.com/images/GLOBAL-DIGITAlINSURANCE-2015.pdf (accessed on 19 September 2016).

- Nastjuk, Ilja, Simon Trang, Julius-Viktor Grummeck-Braamt, Marc T. P. Adam, and Monideepa Tarafdar. 2023. Integrating and Synthesising Technostress Research: A Meta-Analysis on Technostress Creators, Outcomes, and IS Usage Contexts. European Journal of Information Systems 33: 361–82. [Google Scholar] [CrossRef]

- Nicoletti, Bernardo. 2021. Insurance 4.0: Benefits and Challenges of Digital Transformation. Cham: Springer Nature Switzerland AG. [Google Scholar]

- Owens, Emer, Barry Sheehan, Martin Mullins, Martin Cunneen, Juliane Ressel, and German Castignani. 2022. Explainable Artificial Intelligence (XAI) in Insurance. Risks 10: 230. [Google Scholar] [CrossRef]

- Parasuraman, A. Parsu, and Charles L. Colby. 2015. An Updated and Streamlined Technology Readiness Index: TRI 2.0. Journal of Service Research 18: 59–74. [Google Scholar] [CrossRef]

- Petter, Stacey, Detmar Straub, and Arun Rai. 2007. Specifying Formative Constructs in Information Systems Research. MIS Quarterly 31: 623–56. [Google Scholar] [CrossRef]

- Podsakoff, Philip M., Scott B. MacKenzie, Jeong-Yeon Lee, and Nathan P. Podsakoff. 2003. Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies. Journal of Applied Psychology 88: 879–903. [Google Scholar] [CrossRef] [PubMed]

- Puranik, Harshad, Joel Koopman, and Heather C. Vough. 2020. Pardon the Interruption: An Integrative Review and Future Research Agenda for Research on Work Interruptions. Journal of Management 46: 806–42. [Google Scholar] [CrossRef]

- Ragu-Nathan, T.S., Monideepa Tarafdar, Bhanu S. Ragu-Nathan, and Qiang Tu. 2008. The Consequences of Technostress for End Users in Organizations: Conceptual Development and Empirical Validation. Information Systems Research 19: 417–33. [Google Scholar] [CrossRef]

- Ravid, Daniel M., David L. Tomczak, Jerod C. White, and Tara S. Behrend. 2020. EPM 20/20: A Review, Framework, and Research Agenda for Electronic Performance Monitoring. Journal of Management 46: 100–26. [Google Scholar] [CrossRef]

- Rayburn, Steven W., Vishag Badrinarayanan, Sidney T. Anderson, and Aditya Gupta. 2021. Continuous techno-training and business-to-business salesperson success: How boosting techno-efficacy enhances sales effort and performance. Journal of Business Research 133: 66–78. [Google Scholar] [CrossRef]

- Reiff, Julia A.M., Erika Spieß, and Katharina F. Pfaffinger. 2021. Dealing With Stress in a Modern Work Environment. Resources Matter. Cham: Springer. [Google Scholar]

- Riedl, René, Harald Kindermann, Andreas Auinger, and Andrija Javor. 2012. Technostress from a Neurobiological Perspective, System Breakdown Increases the Stress Hormone Cortisol in Computer Users. Business & Information Systems Engineering 4: 61–69. [Google Scholar]

- Salo, Markus, Henri Pirkkalainen, Cecil Eng Huang Chua, and Tina Koskelainen. 2022. Formation and Mitigation of Technostress in the Personal Use of IT. MIS Quarterly 46: 1073–107. [Google Scholar] [CrossRef]

- Sarstedt, Marko, Christian M. Ringle, and Joseph F. Hair. 2022. Partial Least Squares Structural Equation Modeling. In Handbook of Market Research. Edited by Christian Homburg, Martin Klarmann and Arnd Vomberg. Cham: Springer, pp. 587–632. [Google Scholar]

- Sarstedt, Marko, Jun-Hwa Cheah, Joseph F. Hair, Jan-Michael Becker, and Christian M. Ringle. 2019. How to specify, estimate, and validate higher-order constructs in PLS-SEM. Australasian Marketing Journal 27: 197–211. [Google Scholar] [CrossRef]

- Semmer, Norbert K., and Dieter Zapf. 2018. Theorien der Stressentstehung und -bewältigung. In Handbuch Stressregulation und Sport. Edited by Rainhard Fuchs and Markus Gerber. Berlin: Springer, pp. 23–50. [Google Scholar]

- Schwarzbach, Christoph, Theresa Eden, Oliver Werth, Ute Lohse, Michael H. Breitner, and Johan-Matthias von der Schulenburg. 2023. Digital Transformation in Back-Offices of German Insurance Companies. International Journal of Innovation & Technology Management 20: 1–27. [Google Scholar]

- Shu, Qin, Qiang Tu, and Kanliang Wang. 2011. The Impact of Computer Self-Efficacy and Technology Dependence on Computer-Related Technostress: A Social Cognitive Theory Perspective. International Journal of Human-Computer Interaction 27: 923–39. [Google Scholar] [CrossRef]

- Sosa Gómez, Iván, and Oscar Montes Pineda. 2023. What is an InsurTech? A scientific approach for defining the term. Risk Management and Insurance Review 26: 125–73. [Google Scholar] [CrossRef]

- Sosa, Iván, and Oscar Montes. 2022. Understanding the InsurTech dynamics in the transformation of the insurance sector. Risk Management and Insurance Review 25: 35–68. [Google Scholar] [CrossRef]

- State of New Hampshire (Employee Assistance Program). 2022. Perceived Stress Scale Score. Available online: https://www.das.nh.gov/wellness/docs/percieved%20stress%20scale.pdf (accessed on 24 February 2022).

- Stöckli, Emanuel, Christian Dremel, and Falk Übernickel. 2018. Exploring characteristics and transformational capabilities of InsurTech innovations to understand insurance value creation in a digital world. Electronic Markets 28: 287–305. [Google Scholar] [CrossRef]

- Sundaram, Suresh, Andrew Schwarz, Eli Jones, and Wynme W. Chin. 2007. Technology use on the front line: How information technology enhances individual performance. Journal of the Academy of Marketing Science 35: 101–12. [Google Scholar] [CrossRef]

- Tams, Stefan, Jason B. Thatcher, and Varun Grover. 2018. Concentration, Competence, Confidence, and Capture: An Experimental Study of Age, Interruption-based Technostress, and Task Performance. Journal of the Association for Information Systems 19: 857–908. [Google Scholar] [CrossRef]

- Tarafdar, Monideepa, Cary L. Cooper, and Jean-François Stich. 2017. The technostress trifecta—techno eustress, techno distress and design: Theoretical directions and an agenda for research. Information Systems Journal 29: 6–42. [Google Scholar] [CrossRef]

- Tarafdar, Monideepa, Ellen Bolman Pullins, and T.S. Ragu-Nathan. 2014. Examining impacts of technostress on the professional salesperson’s behavioural performance. Journal of Personal Selling & Sales Management 34: 51–69. [Google Scholar]

- Tarafdar, Monideepa, Ellen Bolman Pullins, and T. S. Ragu-Nathan. 2015. Technostress: Ngative effect on performance and possible mitigations. Information Systems Journal 25: 103–32. [Google Scholar] [CrossRef]

- Tarafdar, Monideepa, Qiang Tu, and T.S. Ragu-Nathan. 2010. Impact of Technostress on End-User Satisfaction and Performance. Journal of Management Information Systems 27: 303–34. [Google Scholar] [CrossRef]

- Tarafdar, Monideepa, Qiang Tu, Bhanu S. Ragu-Nathan, and T.S. Ragu-Nathan. 2007. The Impact of Technostress on Role Stress and Productivity. Journal of Management Information Systems 24: 301–28. [Google Scholar] [CrossRef]

- Taylor, John M. 2015. Psychometric Analysis of the Ten-Item Perceived Stress Scale. Psychological Assessment 27: 90–101. [Google Scholar] [CrossRef] [PubMed]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly 27: 425–78. [Google Scholar] [CrossRef]

- Vieira, Valter A. 2022. The mediating role of happiness on the effect of locomotion and effort on salesperson’s performance and cross-selling: The case of financial insurance. Journal of Financial Services Marketing 27: 346–59. [Google Scholar] [CrossRef]

- Wu, Migao, Pavel Andreev, and Morad Benyoucef. 2024. The state of lead scoring models and their impact on sales performance. Information Technology and Management 25: 69–98. [Google Scholar] [CrossRef] [PubMed]

- Yu, Tsu-Wey, and Lu-Ming Tseng. 2016. The role of salespeople in developing life insurance customer loyalty. International Journal of Retail & Distribution Management 44: 22–37. [Google Scholar]

- Zeier Röschmann, Angela. 2018. Digital insurance brokers—Old wine in new bottles? How digital brokers create value. Zeitschrift für die gesamte Versicherungswissenschaft 107: 273–91. [Google Scholar] [CrossRef]

| Construct and Item Loadings | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Digital Stressors (DigStressors) | Perceived Stress (PercStress) | ||||||||||

| Complexity (Comp): 0.712 Insecurity (Insec): 0.766 Interruption (Interr): 0.738 Invasion of Privacy (InvPriv): 0.701 Omnipresence (Omni): 0.646 Overload (Overl): 0.806 Performance Control (PerfCont): 0.611 Safety (Safet): 0.643 Unreliability (Unrel): 0.741 | Perceived Helplessness (PerHeLess): 0.924 Perceived Self-Inefficacy (PerSeIfIneff): 0.792 | ||||||||||

| Realibility and validity | |||||||||||

| Construct | α | CR | AVE | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 1 | Digital Stressors (DigStressors) | 0.876 | 0.901 | 0.504 | 0.710 | ||||||

| 2 | Organizational Encouragement (OrgEncour) | 0.815 | 0.879 | 0.646 | −0.236 | 0.804 | |||||

| 3 | Organizational Support (OrgSup) | 0.872 | 0.907 | 0.661 | −0.300 | 0.712 | 0.813 | ||||

| 4 | Perceived Stress (PercStress) * | 0.665 | 0.850 | 0.740 | 0.646 | −0.164 | −0.209 | 0.860 | |||

| 5 | Technological Capabilities (TechCap) | 0.868 | 0.910 | 0.716 | −0.297 | 0.291 | 0.279 | −0.165 | 0.846 | ||

| 6 | Technology Optimism (TechOpt) | 0.816 | 0.880 | 0.648 | −0.374 | 0.337 | 0.365 | −0.291 | 0.491 | 0.805 | |

| 7 | TechUsage (single item) | −0.135 | 0.298 | 0.269 | −0.074 | 0.531 | 0.374 | 1.000 | |||

| Construct/Items | VIF | Weight | p-Value | Bias-Corrected and Accelerated Confidence Interval | |

|---|---|---|---|---|---|

| 2.5% | 97.5% | ||||

| Performance (Perform) | |||||

| Revenue (Rev) | 1.681 | 0.371 | 0.000 | 0.182 | 0.568 |

| Productivity (Prod) | 2.833 | 0.320 | 0.011 | 0.051 | 0.551 |

| Interaction with Clients (InteracCl) | 3.038 | 0.441 | 0.001 | 0.193 | 0.690 |

| Hypotheses | Path Coefficients | Result | |

|---|---|---|---|

| H1 | TechUsage → Perform | 0.273 *** | Supported |

| H2 | TechUsage → DigStressors | 0.103 * | Supported |

| H3 | DigStressors → PercStress | 0.646 *** | Supported |

| H4 | PercStress → Perform | −0.350 *** | Supported |

| H5a | TechOpt → TechUsage | 0.113 ** | Supported |

| H5b | TechOpt → DigStressors | −0.261 *** | Supported |

| H6a | TechCap → TechUsage | 0.435 *** | Supported |

| H6b | TechCap → DigStressors | −0.173 *** | Supported |

| H7a | OrgEncour → TechUsage | 0.117 * | Supported |

| H7b | OrgEncour → DigStressors | 0.006 | Not supported |

| H8a | OrgSup → TechUsage | 0.023 | Not supported |

| H8b | OrgSup → DigStressors | −0.189 *** | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Köhne, T.; Köhne, M. Uncovering the Impact of Digitalization on the Performance of Insurance Distribution. Risks 2024, 12, 129. https://doi.org/10.3390/risks12080129

Köhne T, Köhne M. Uncovering the Impact of Digitalization on the Performance of Insurance Distribution. Risks. 2024; 12(8):129. https://doi.org/10.3390/risks12080129

Chicago/Turabian StyleKöhne, Thomas, and Marija Köhne. 2024. "Uncovering the Impact of Digitalization on the Performance of Insurance Distribution" Risks 12, no. 8: 129. https://doi.org/10.3390/risks12080129

APA StyleKöhne, T., & Köhne, M. (2024). Uncovering the Impact of Digitalization on the Performance of Insurance Distribution. Risks, 12(8), 129. https://doi.org/10.3390/risks12080129