The Italian Actuarial Climate Index: A National Implementation Within the Emerging European Framework

Abstract

1. Introduction

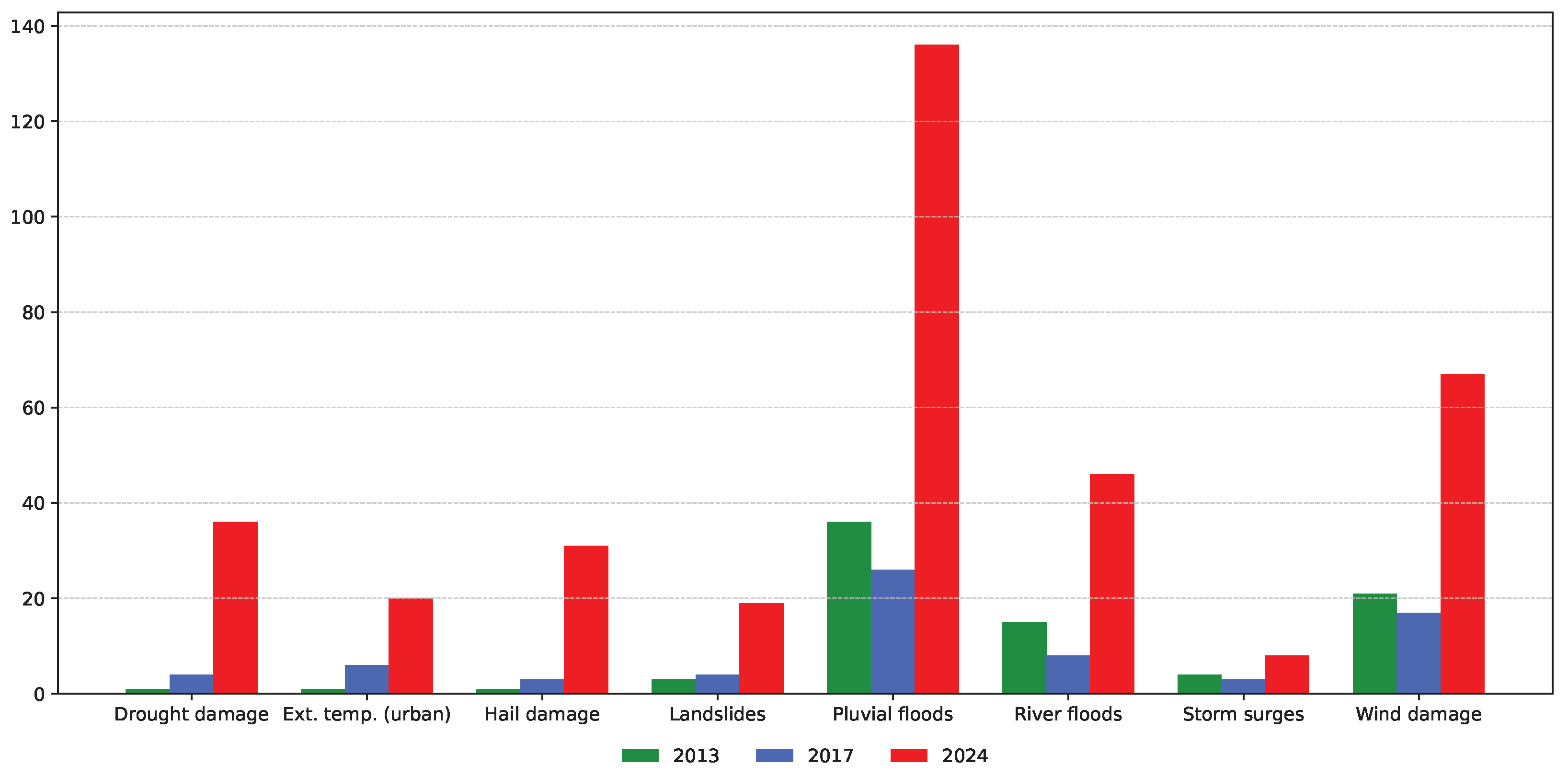

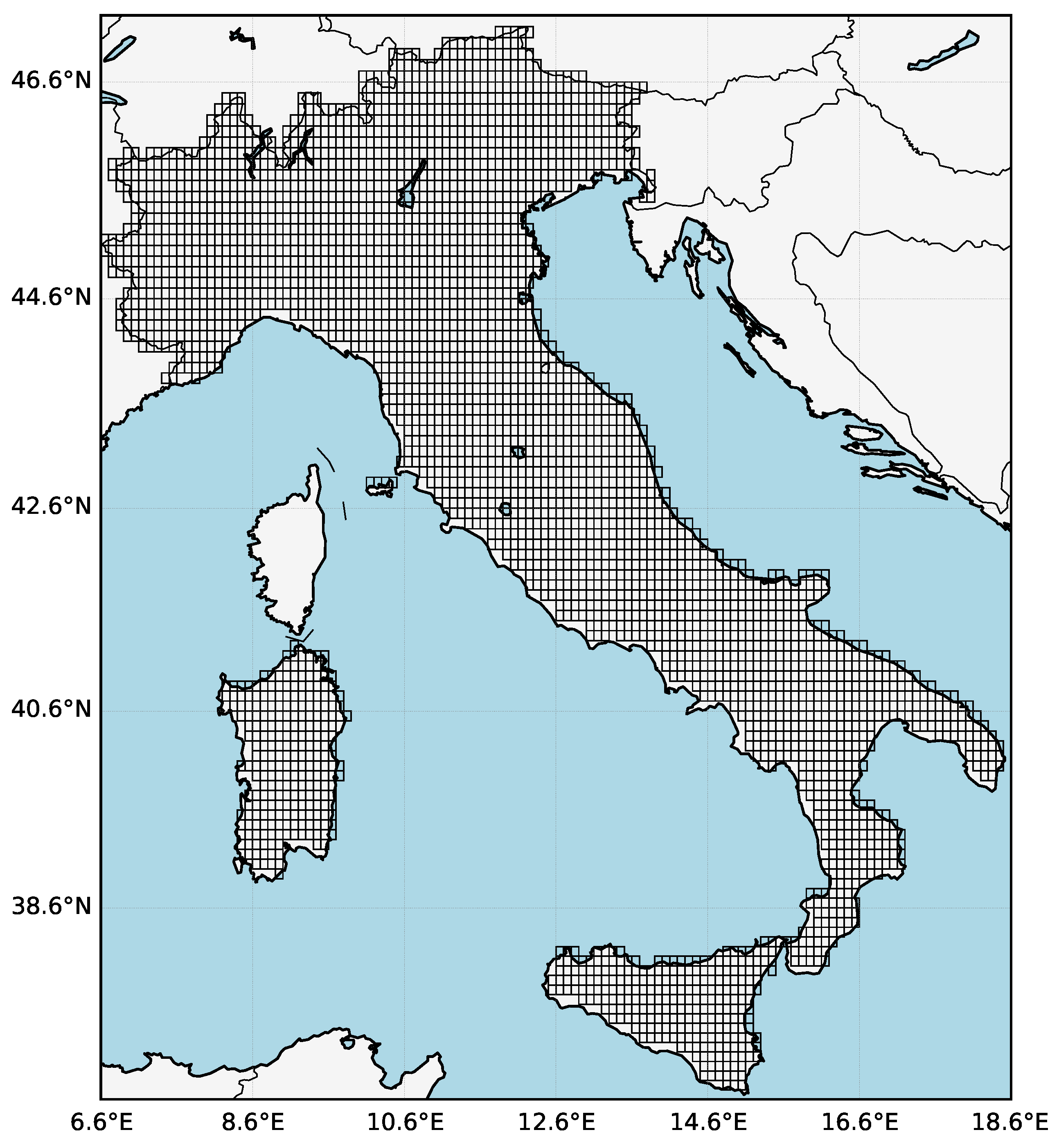

2. Climate Risk Exposure and the Protection Gap in Italy

3. Methodology Overview and Data Sources

4. Aggregation of Indicators for ITACI Computation

- the frequency of warm days and nights, defined as days when maximum daytime and nighttime temperatures exceed the 90th percentile;

- the frequency of cool days and nights, defined as days when minimum daytime and nighttime temperatures fall below the 10th percentile;

- the intensity of heavy precipitation events, measured as the highest five-day cumulative precipitation total within a given month;

- the duration of the longest sequence of dry days, where a day is considered dry if total daily precipitation is less than 1 mm;

- the frequency of high wind events, defined as days when the daily mean wind power, reconstructed from the eastward and northward components, exceeds a specified statistical threshold;

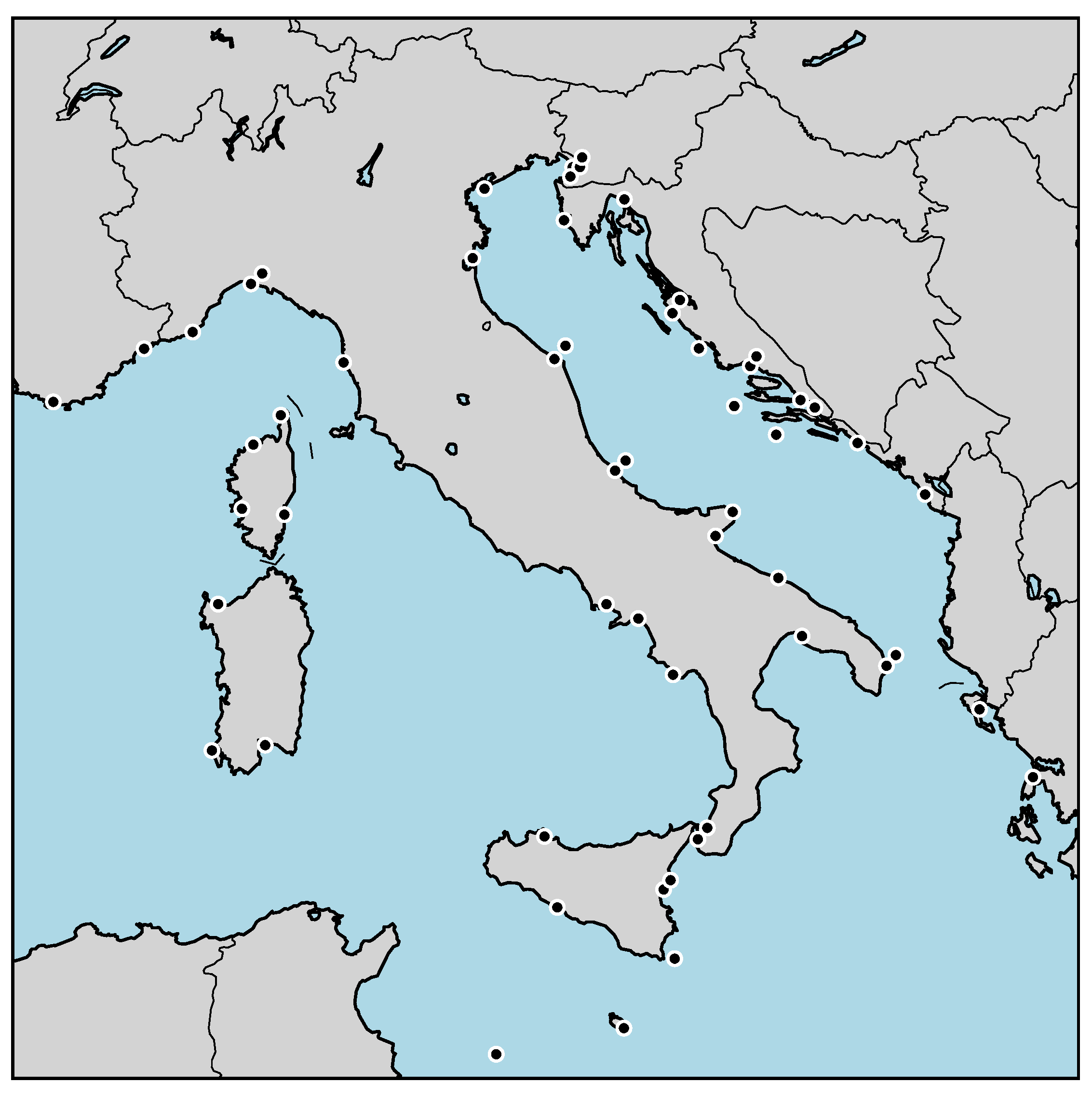

- the monthly mean sea level anomaly.

5. Temporal and Spatial Dynamics of ITACI and Its Components

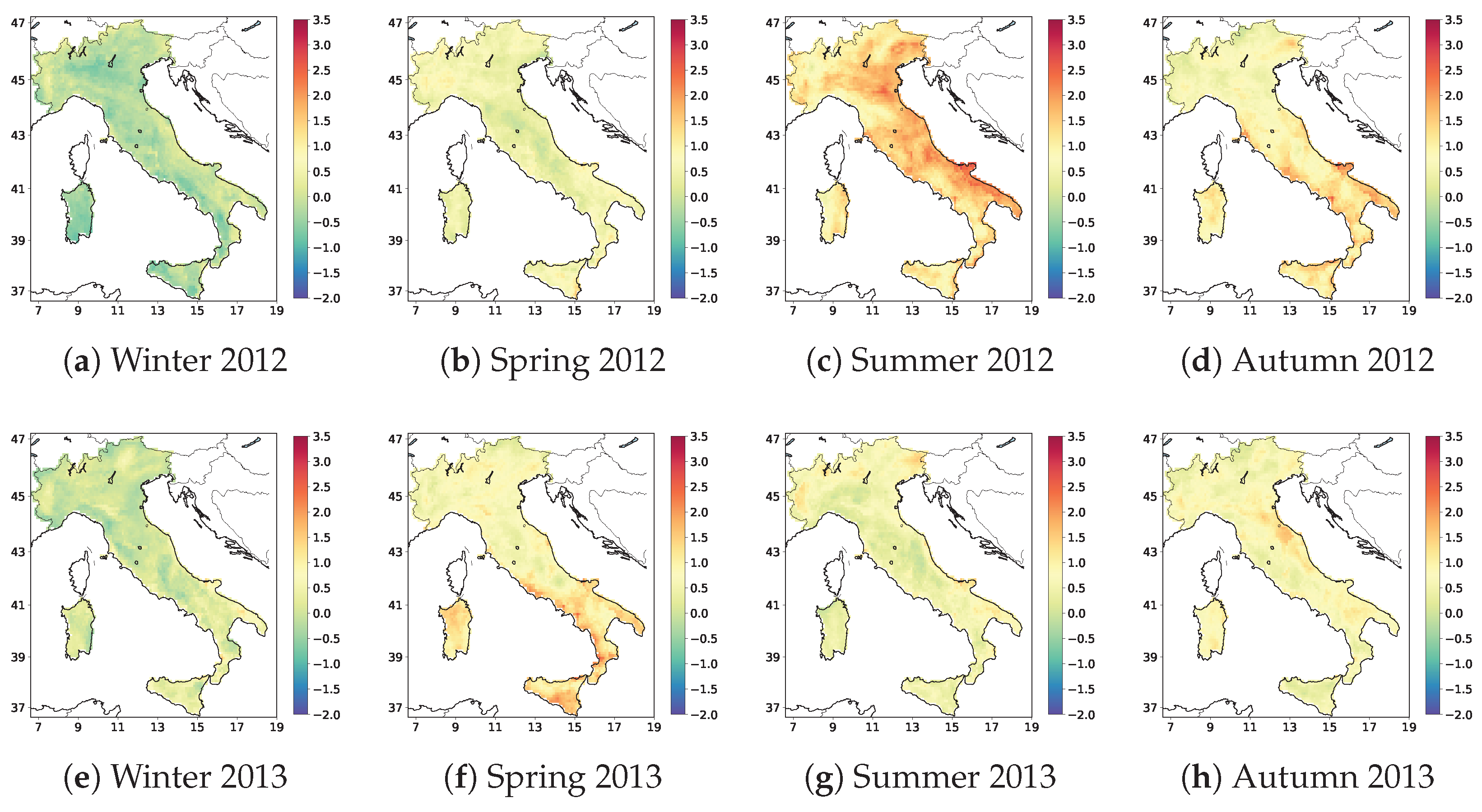

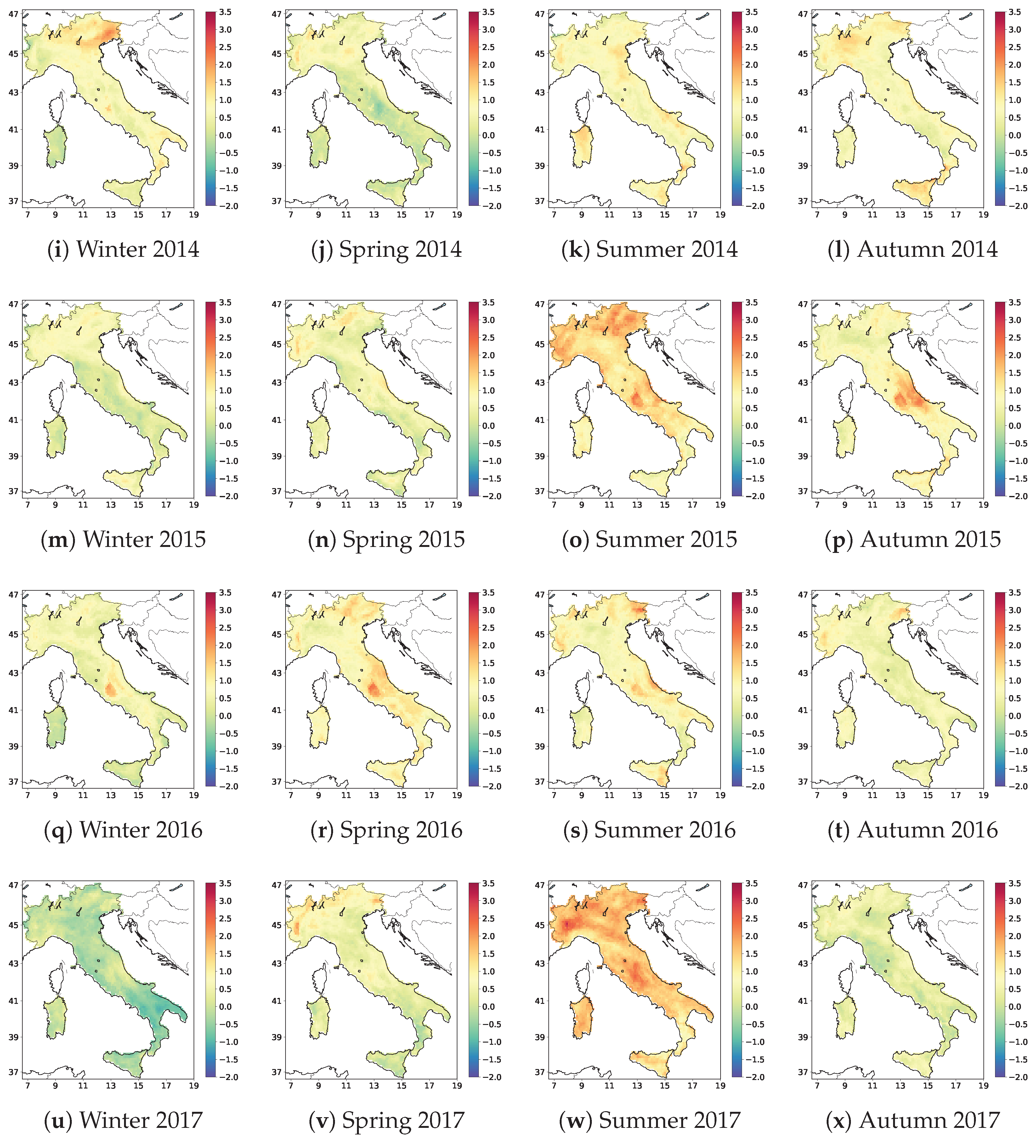

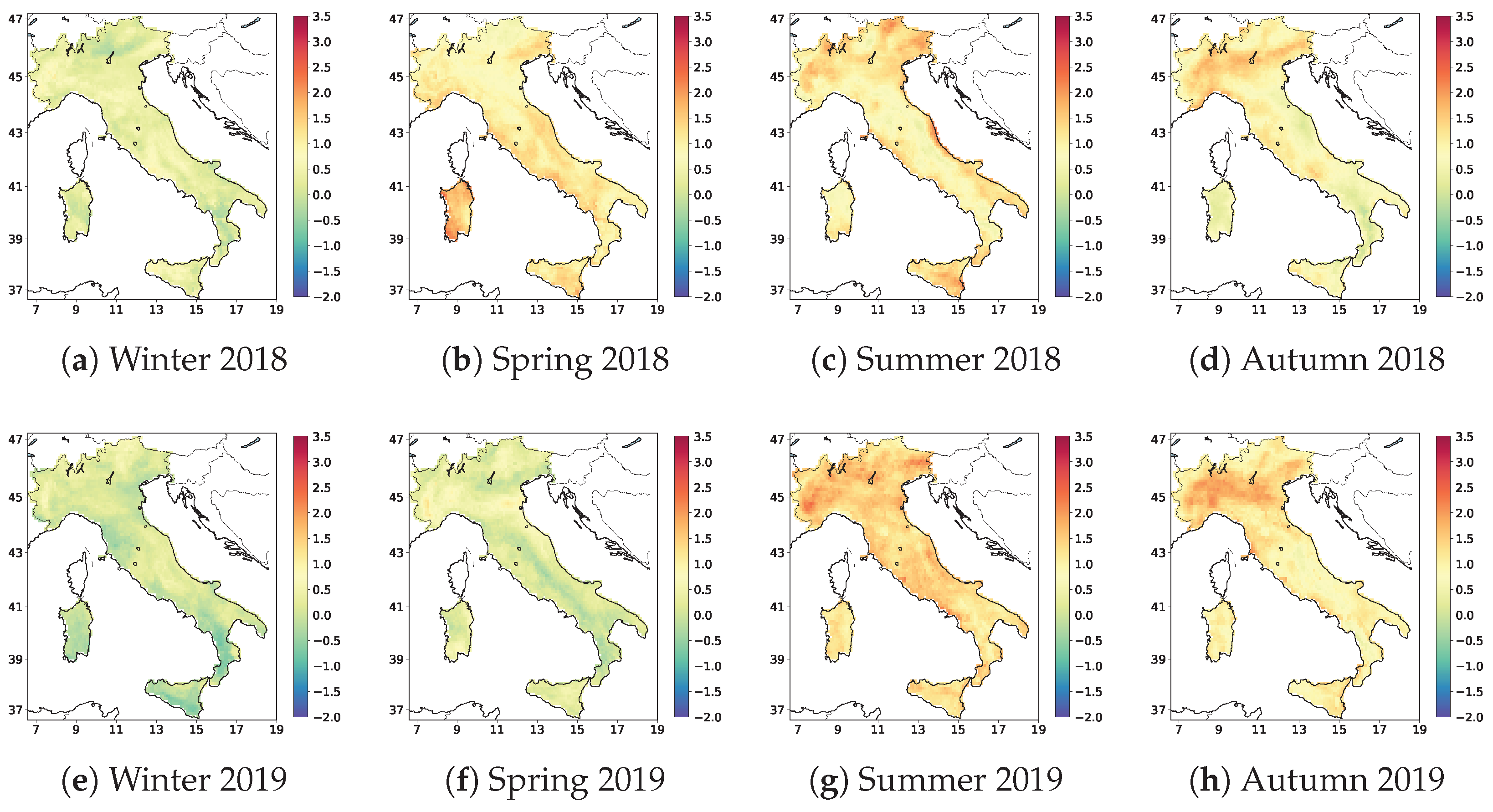

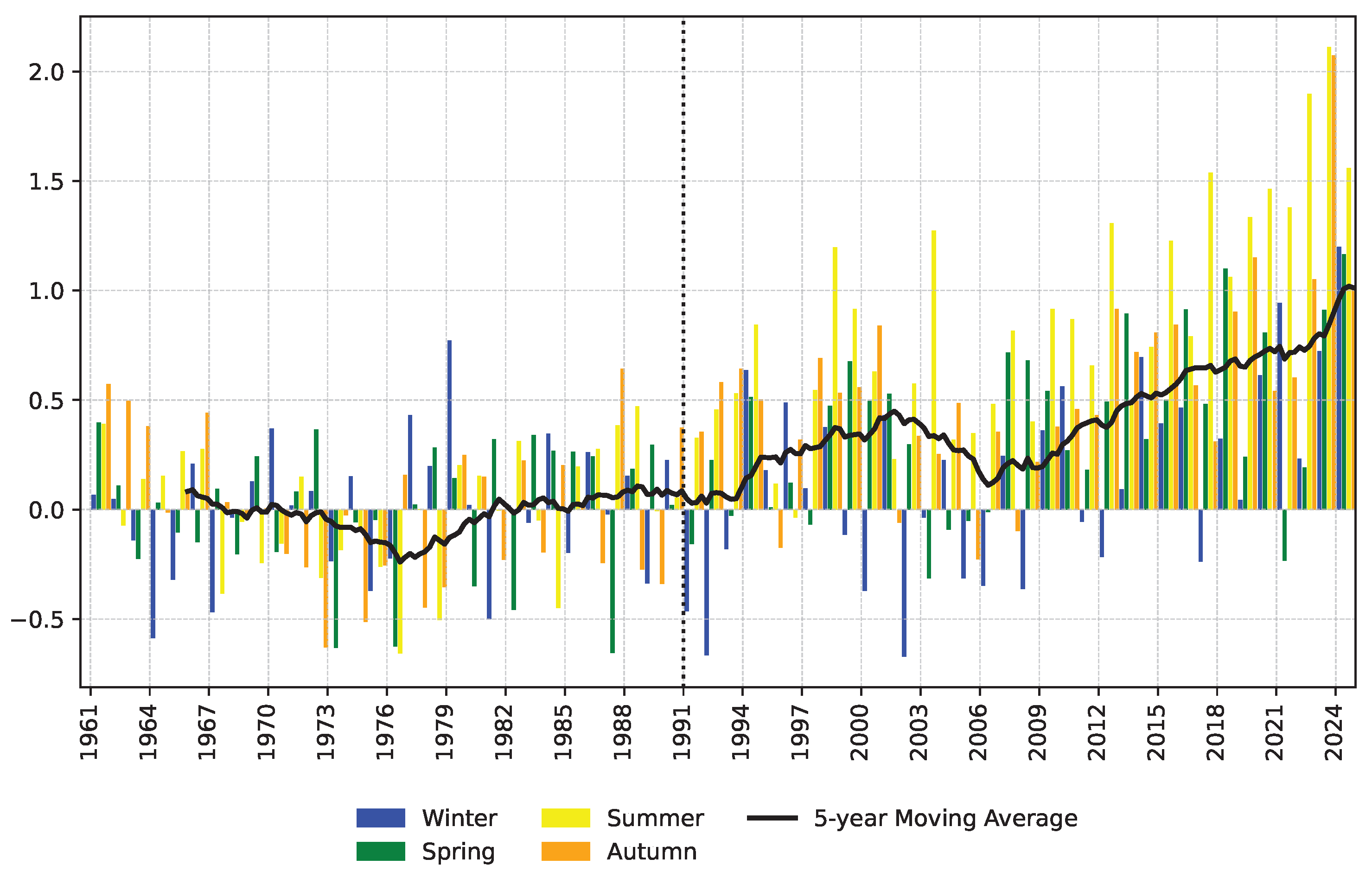

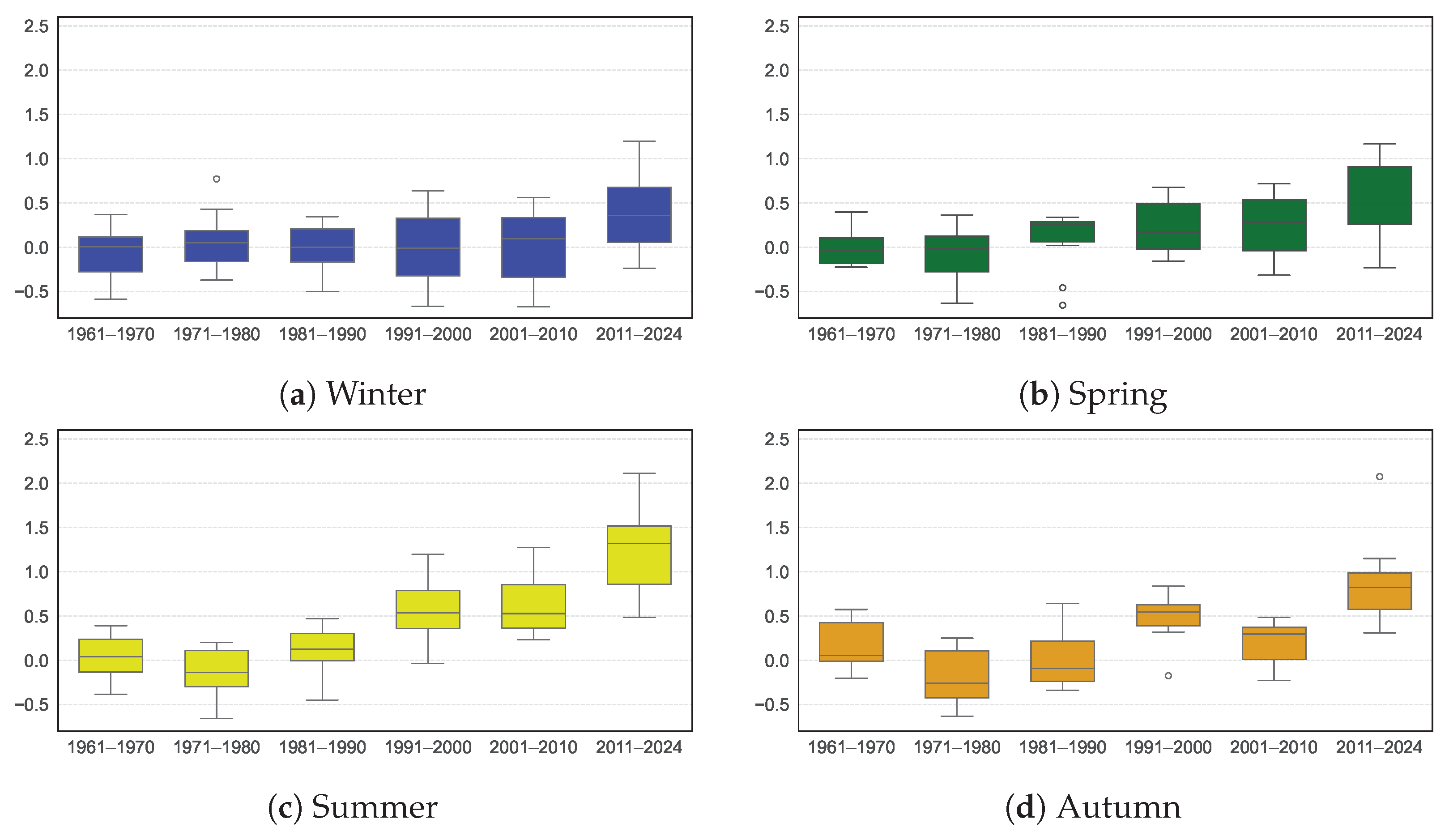

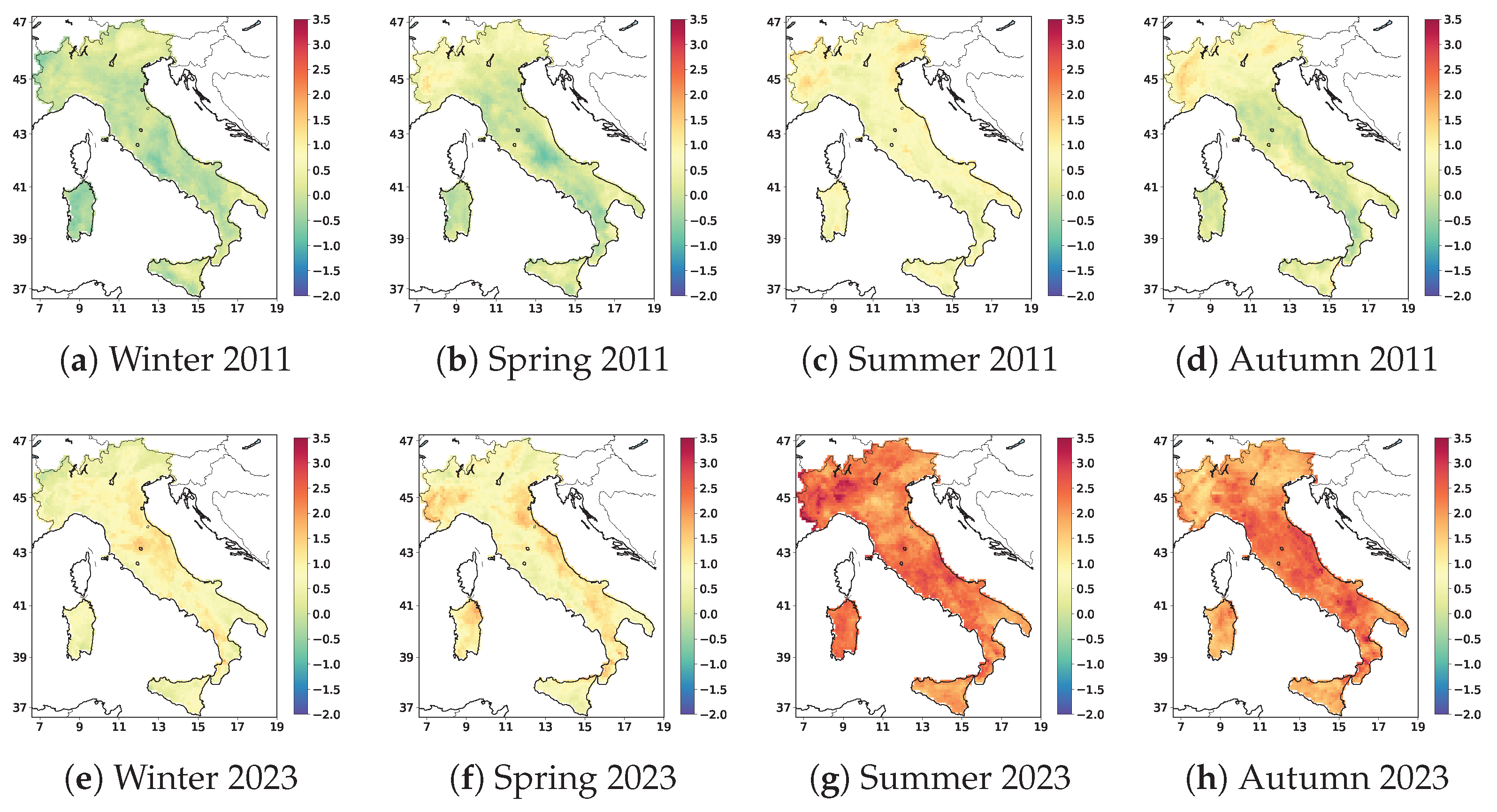

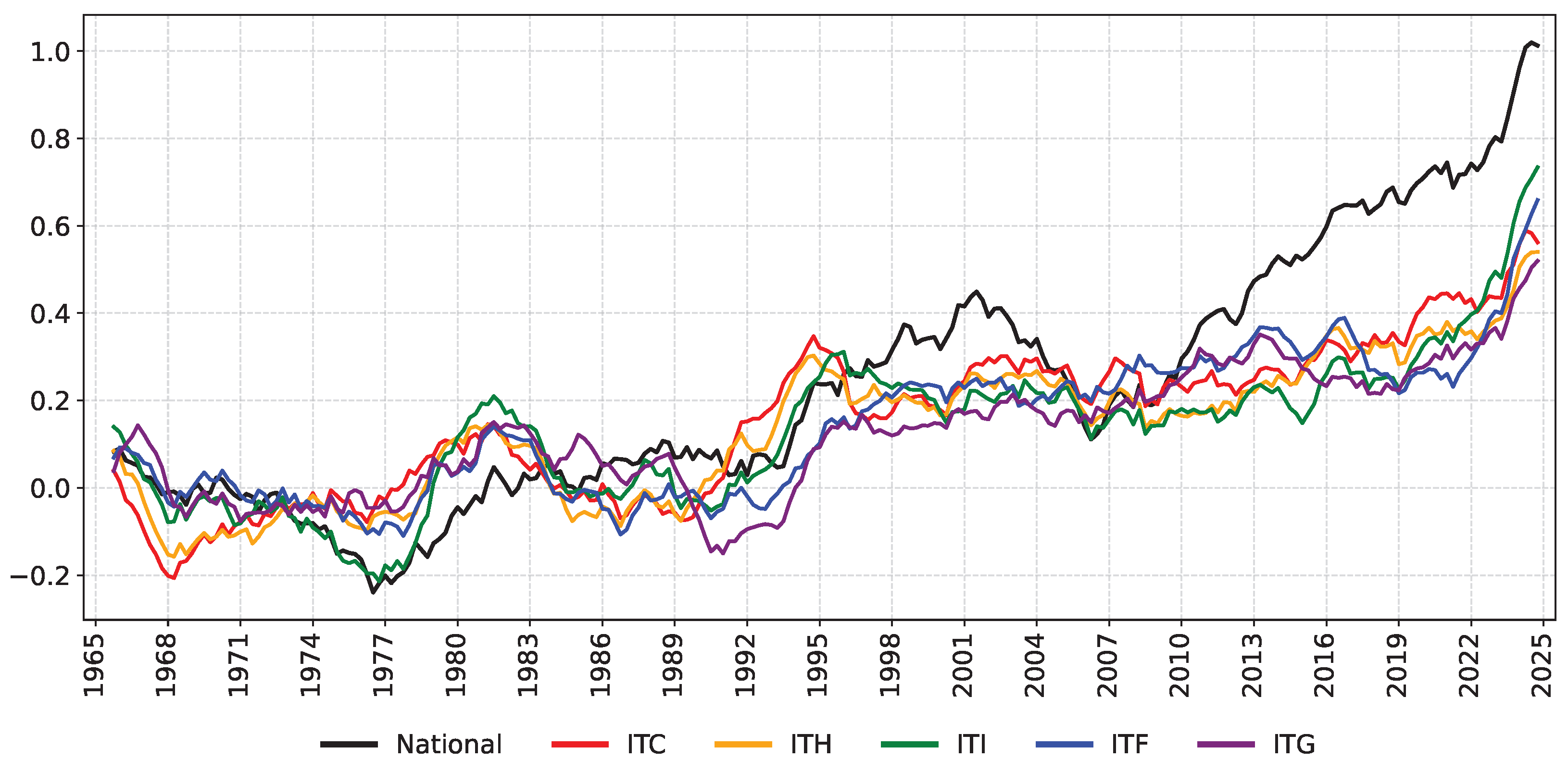

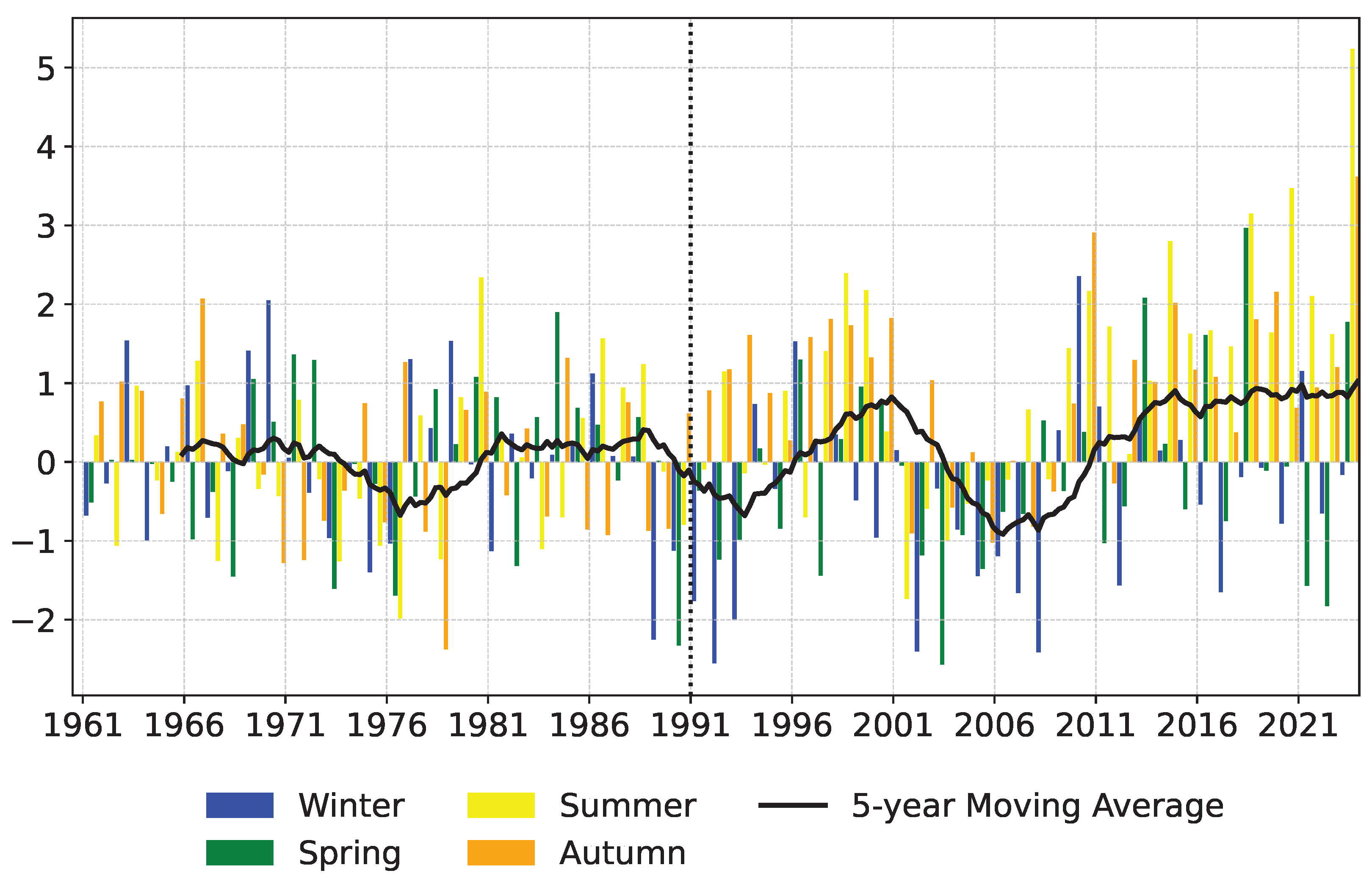

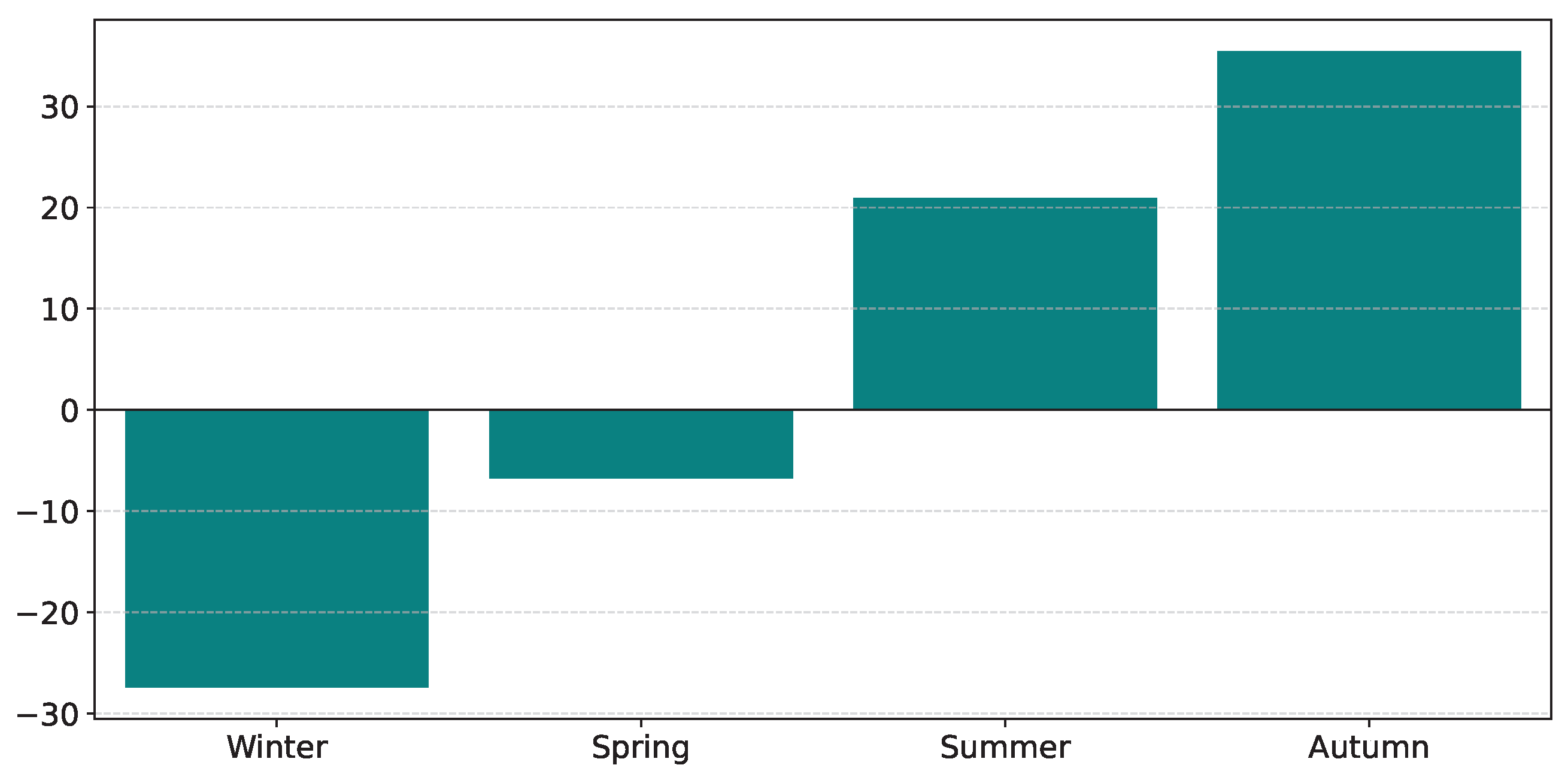

5.1. Spatio-Temporal Dynamics of the National ITACI

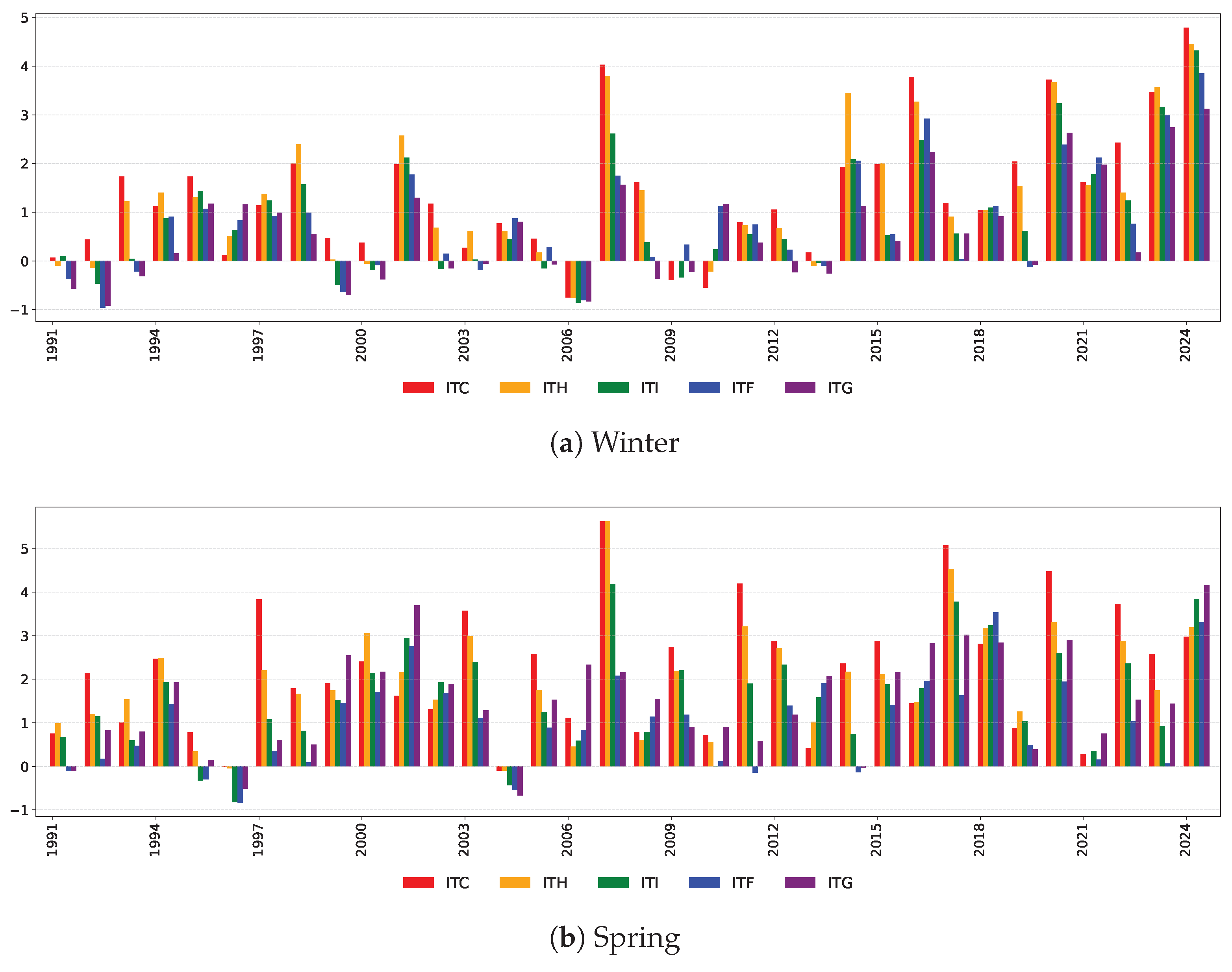

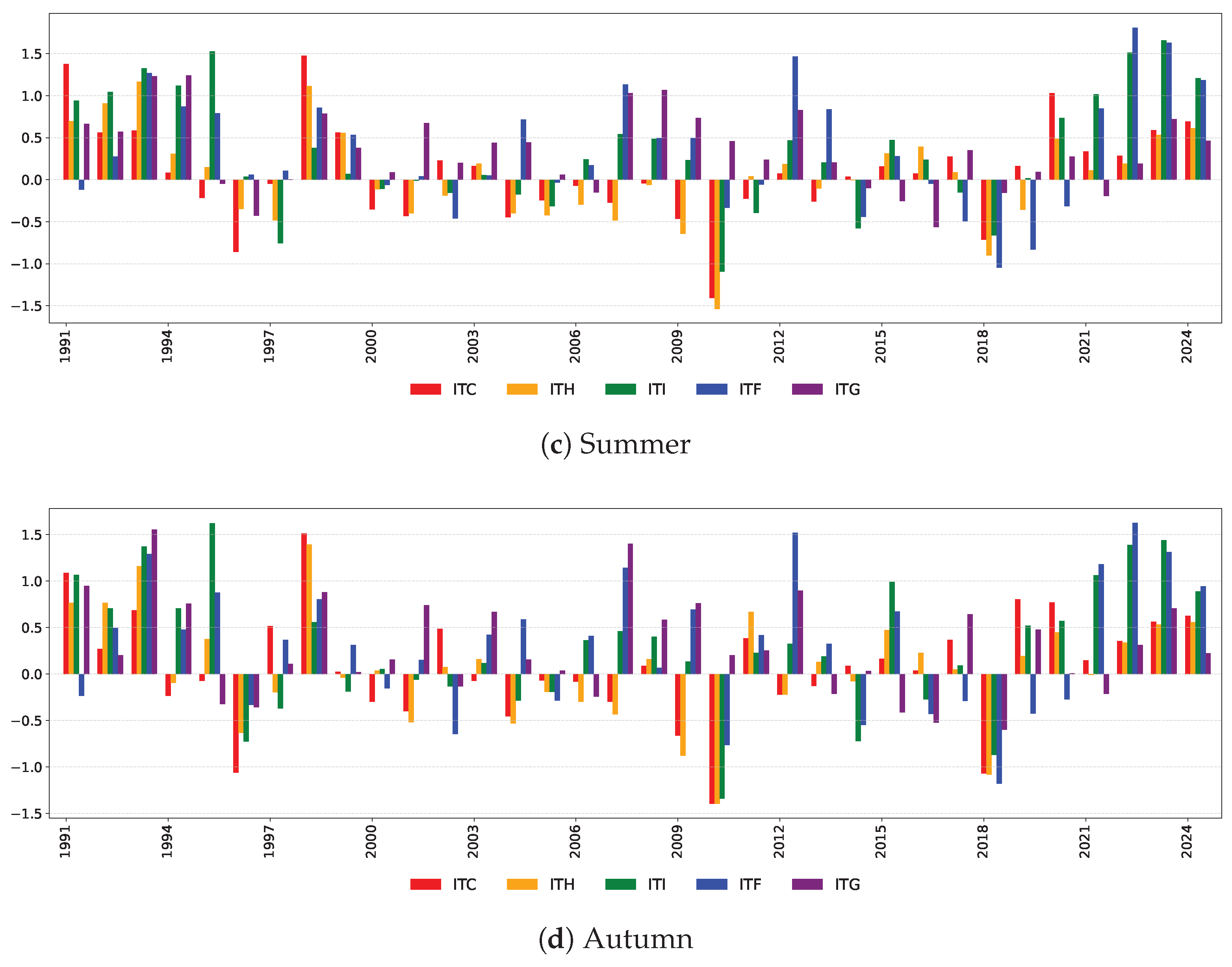

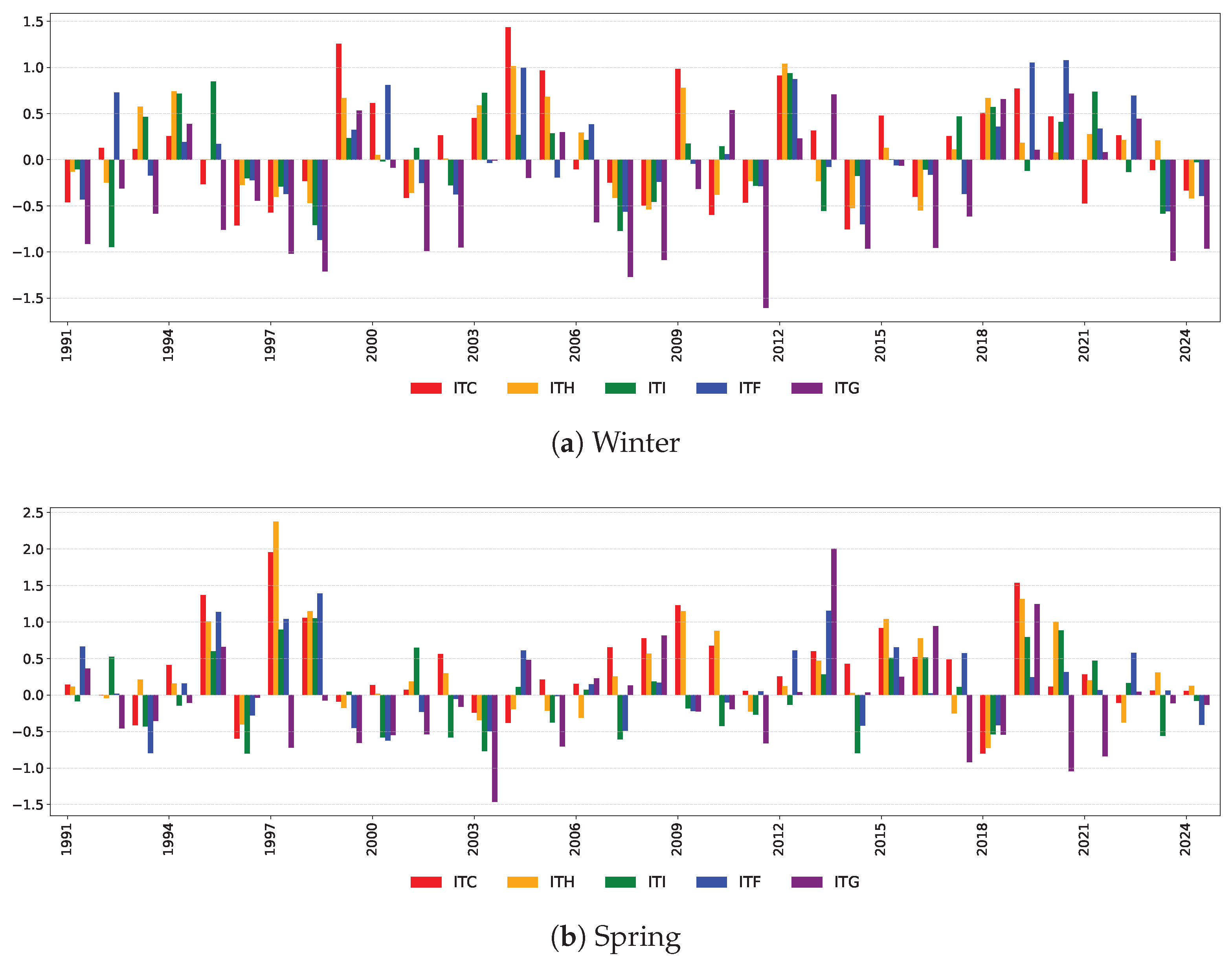

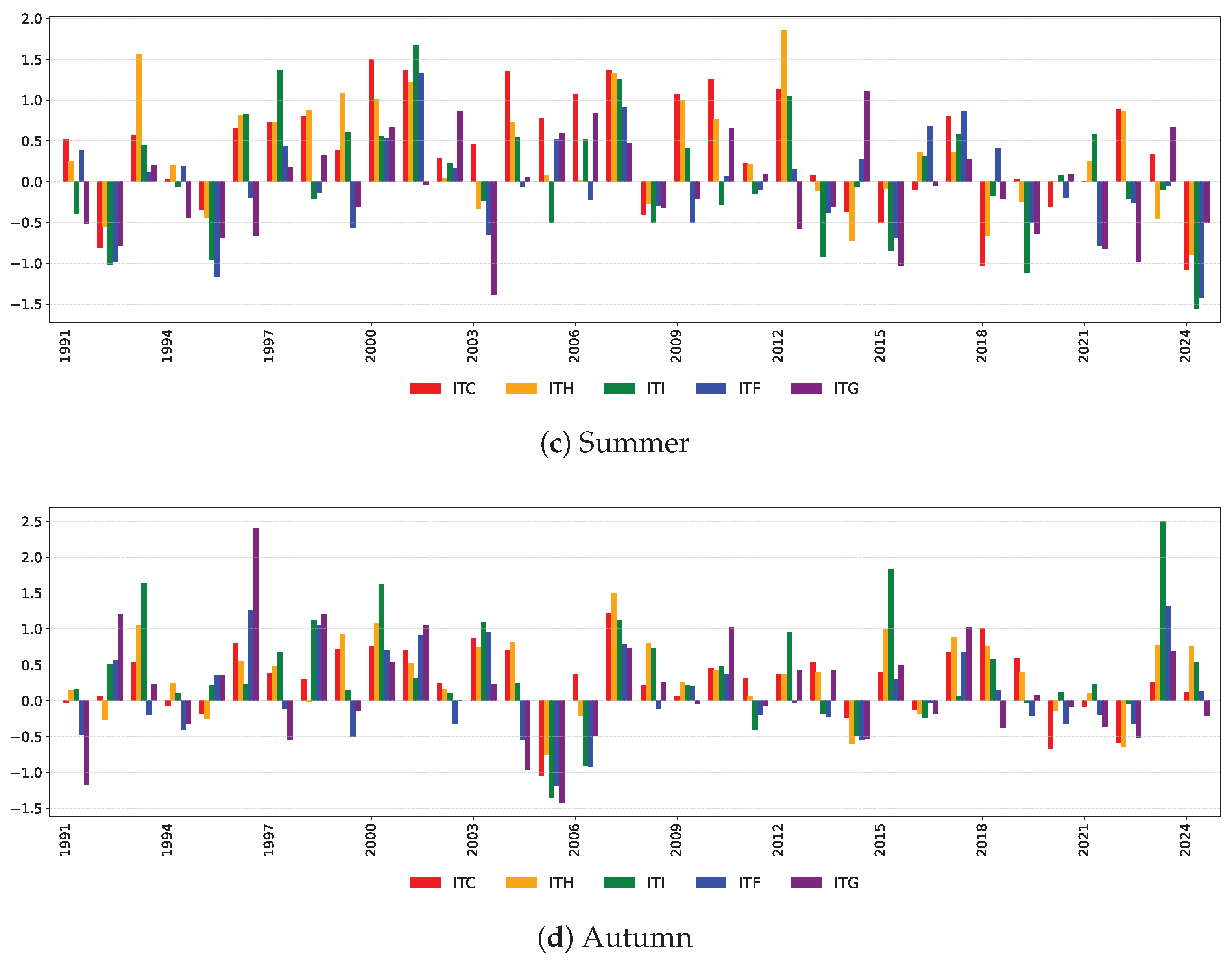

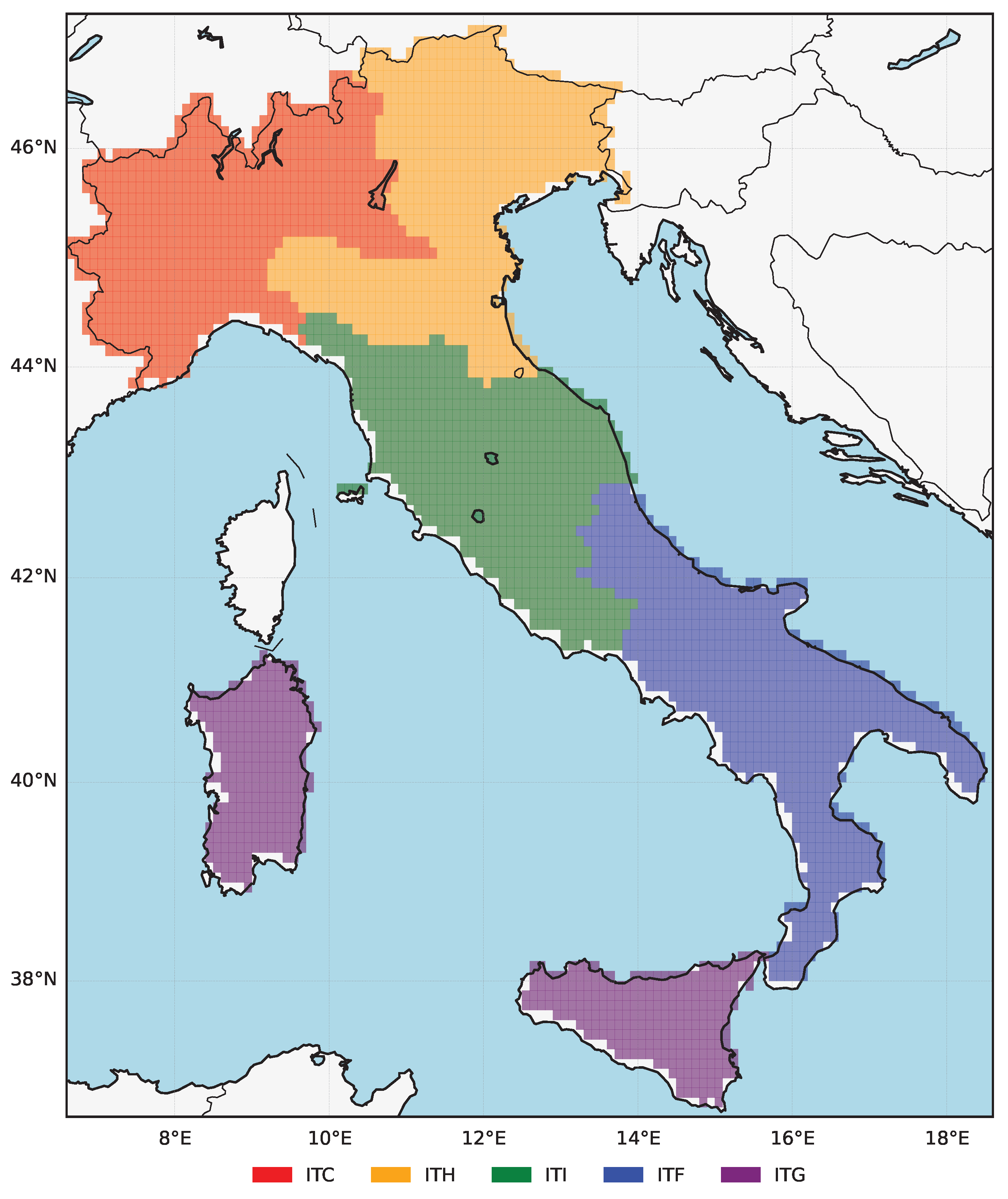

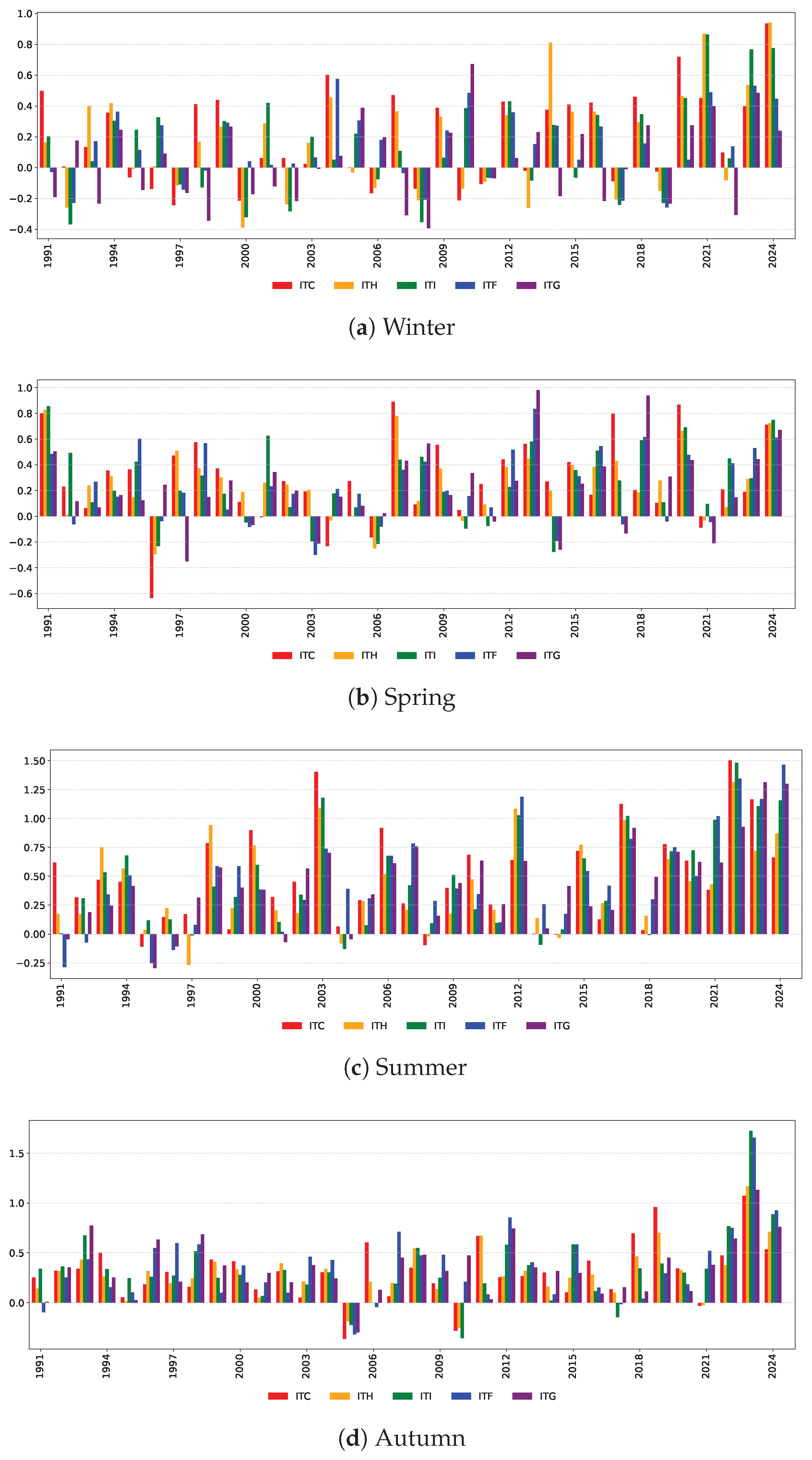

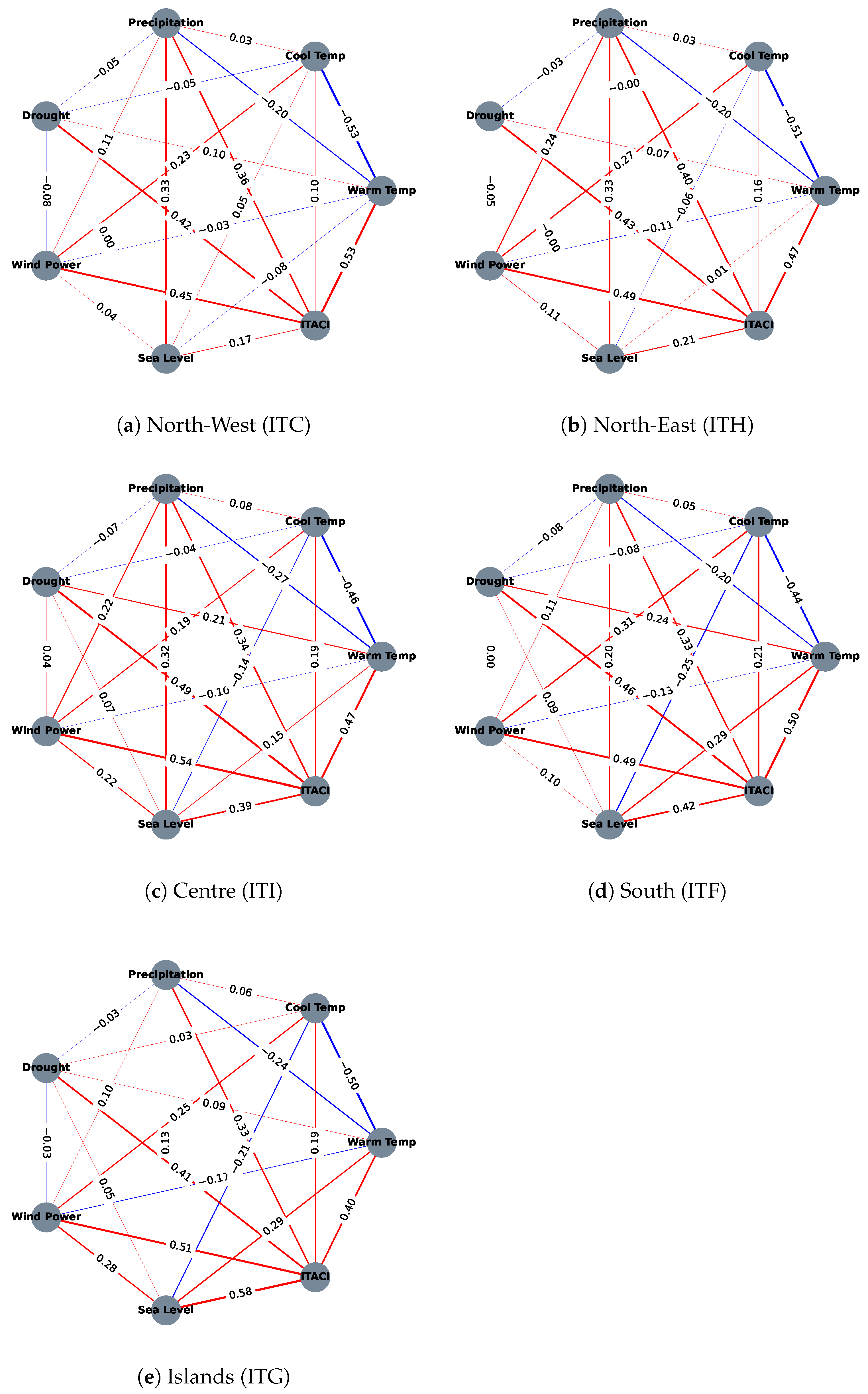

5.2. ITACI Patterns Across Italian Macro-Regions

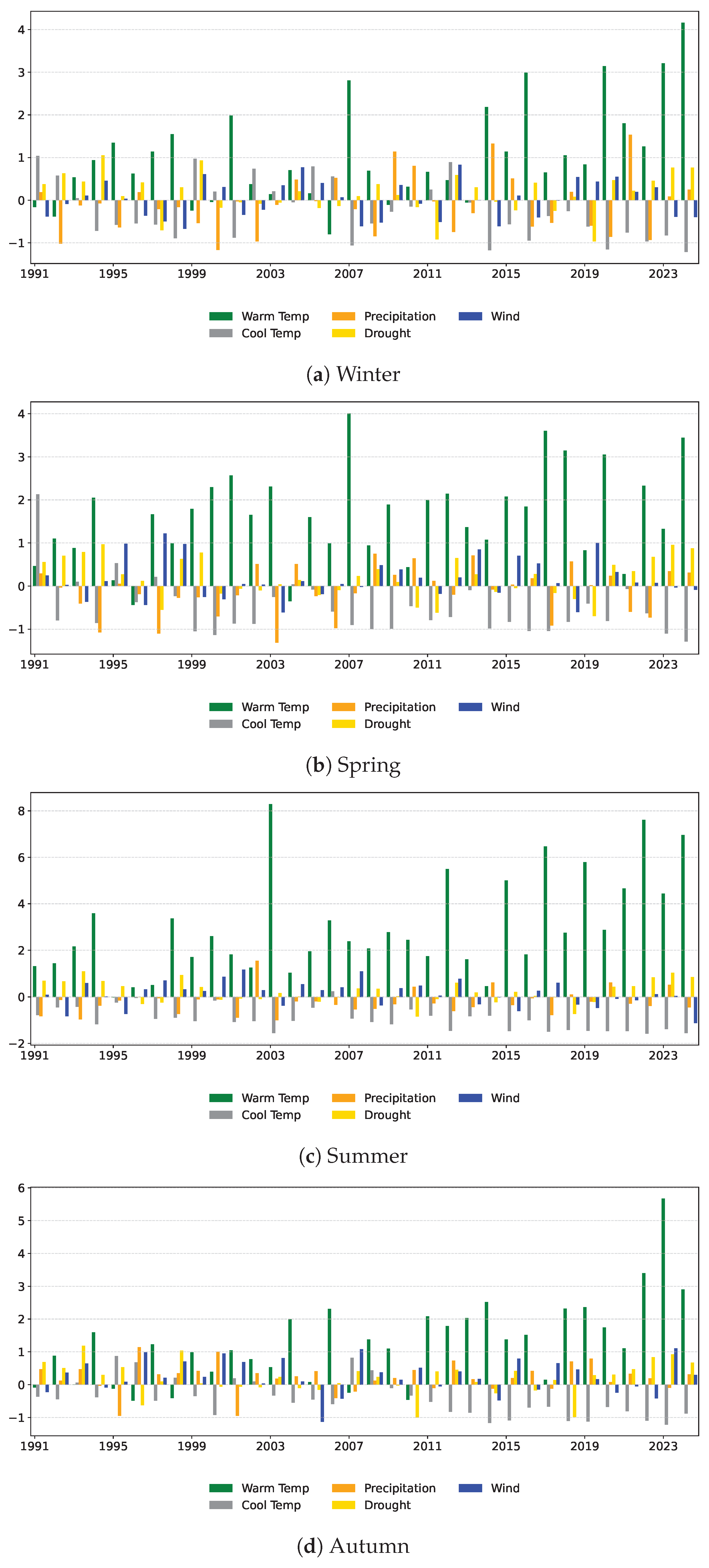

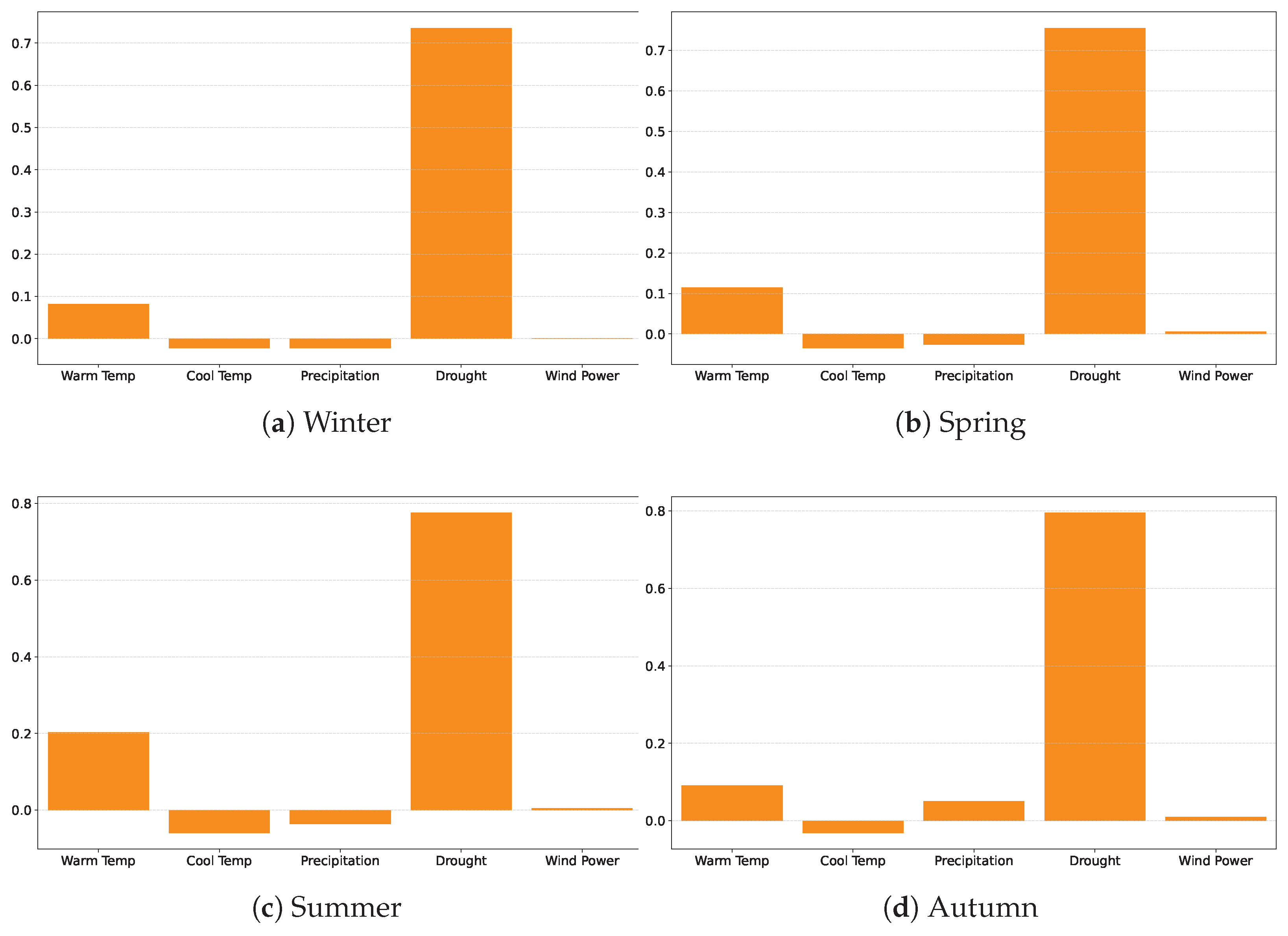

5.3. Drivers of ITACI Dynamics: Indicator-Level Analysis

- National Analysis

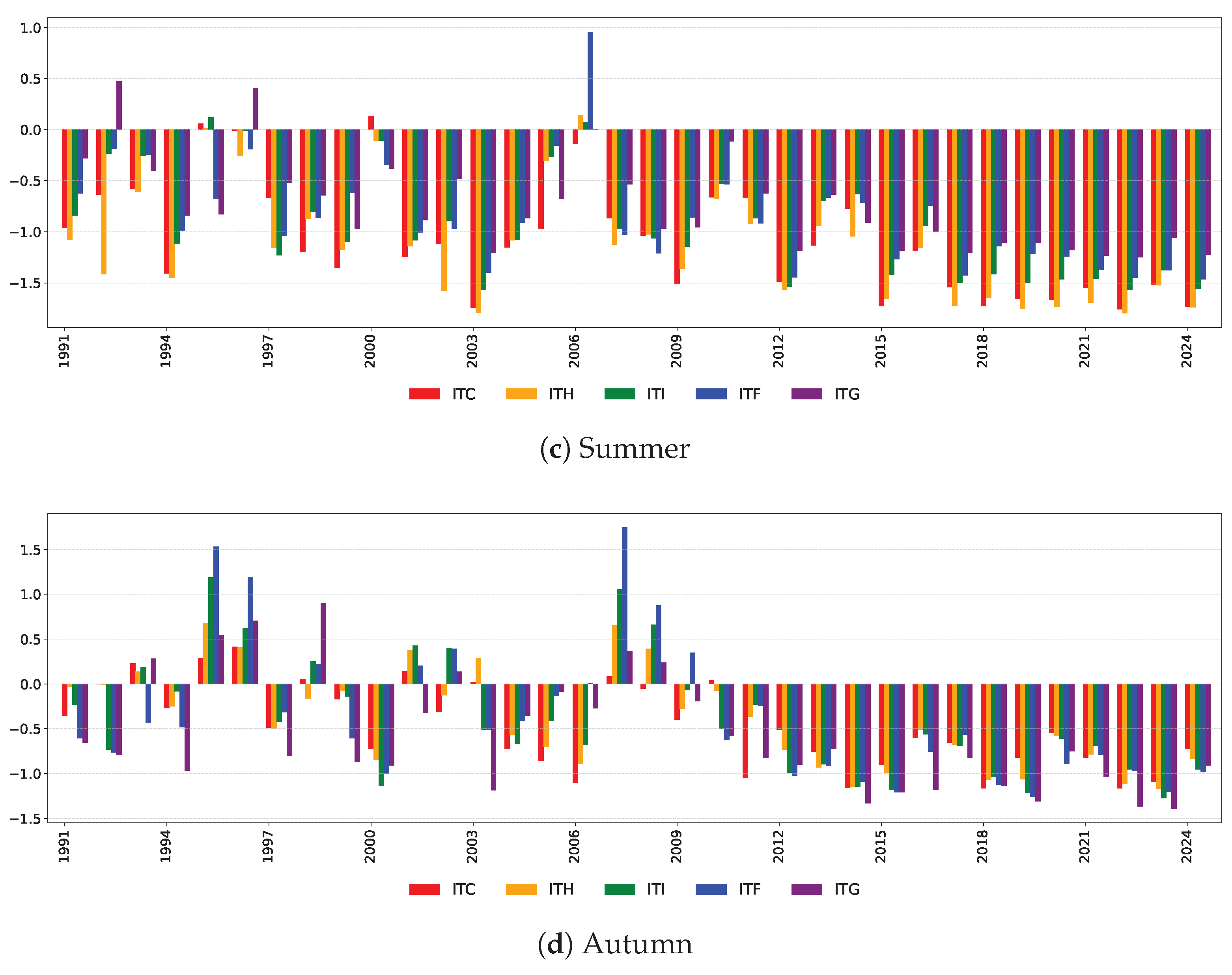

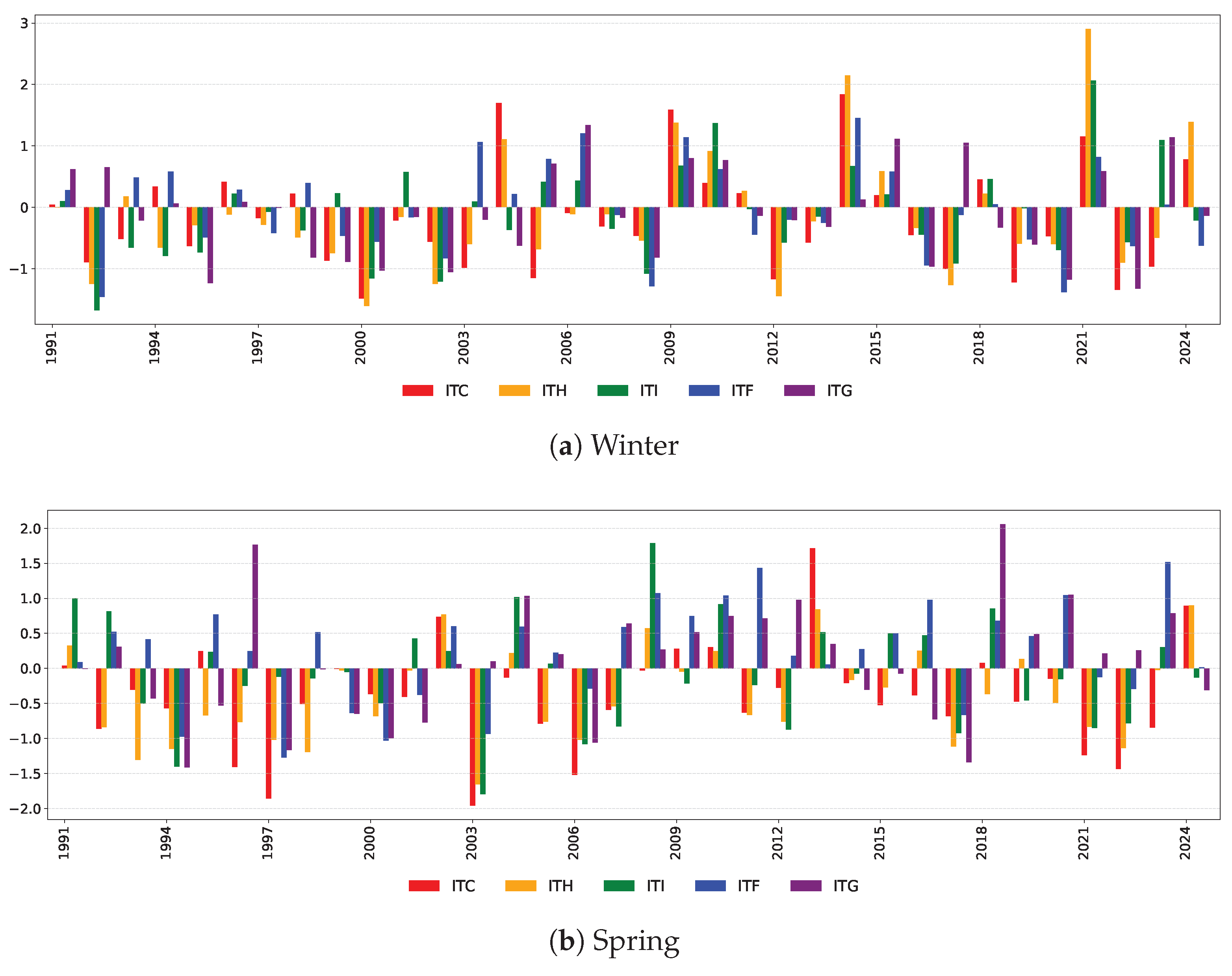

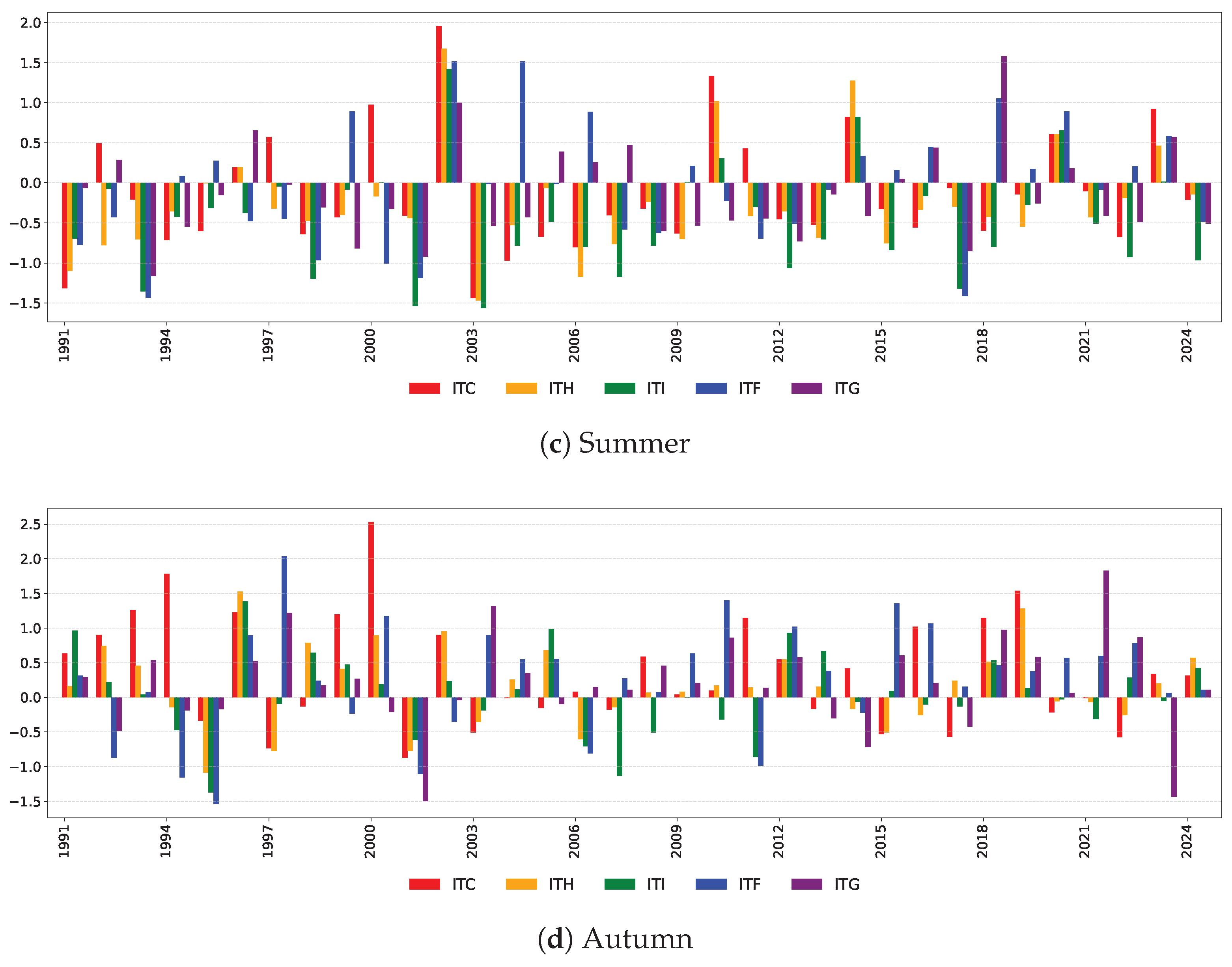

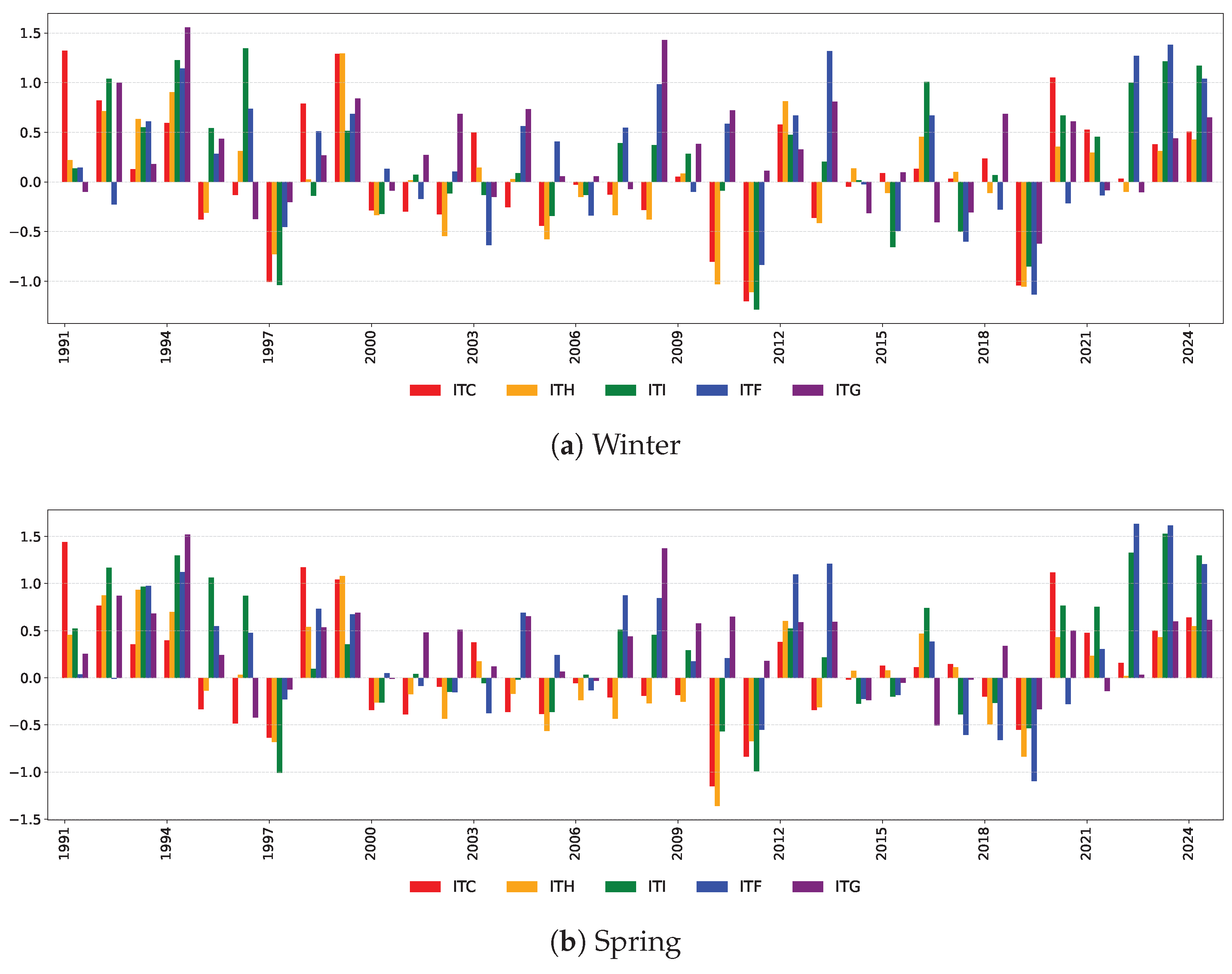

- Regional Analisys

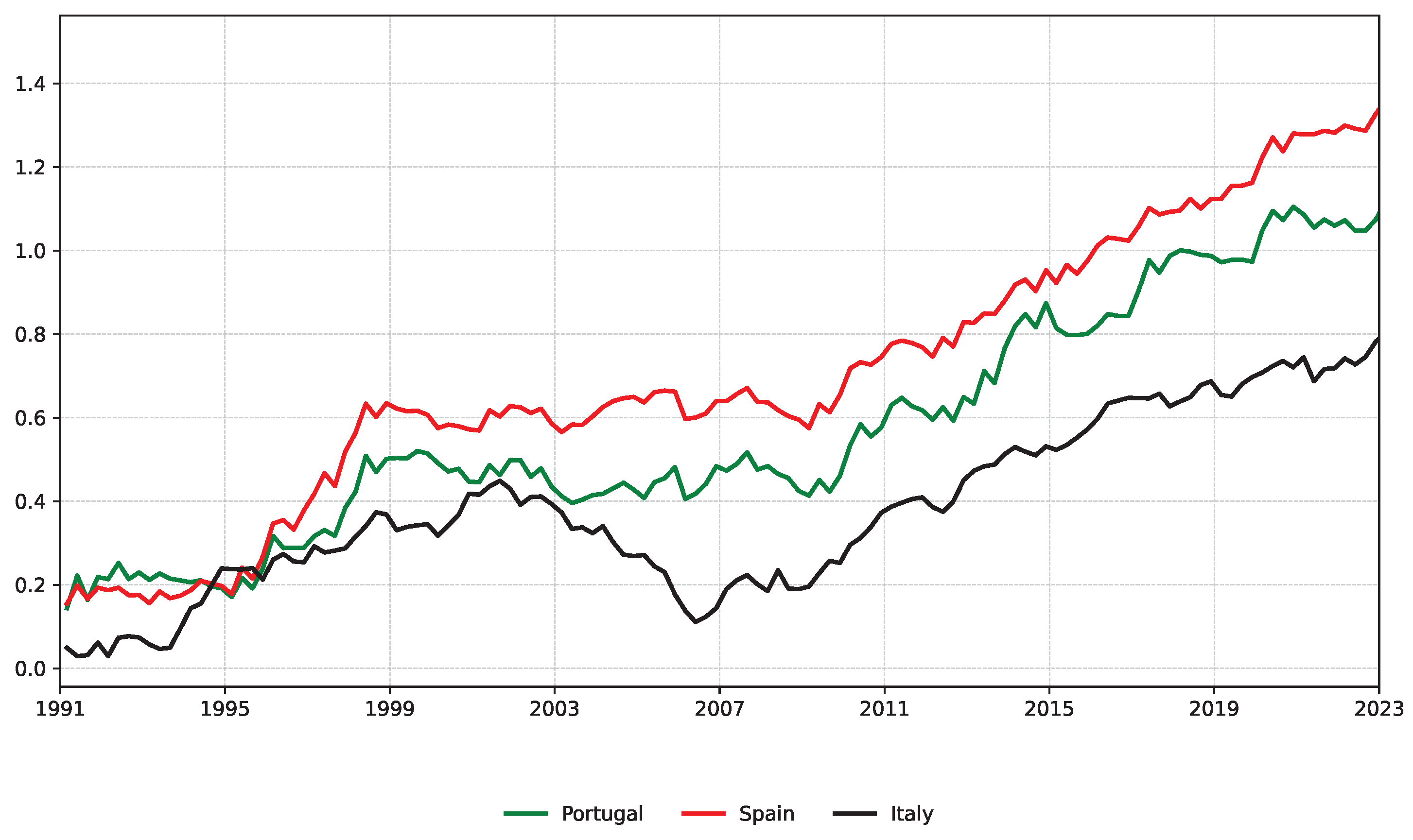

6. Comparative Analysis with European Indices

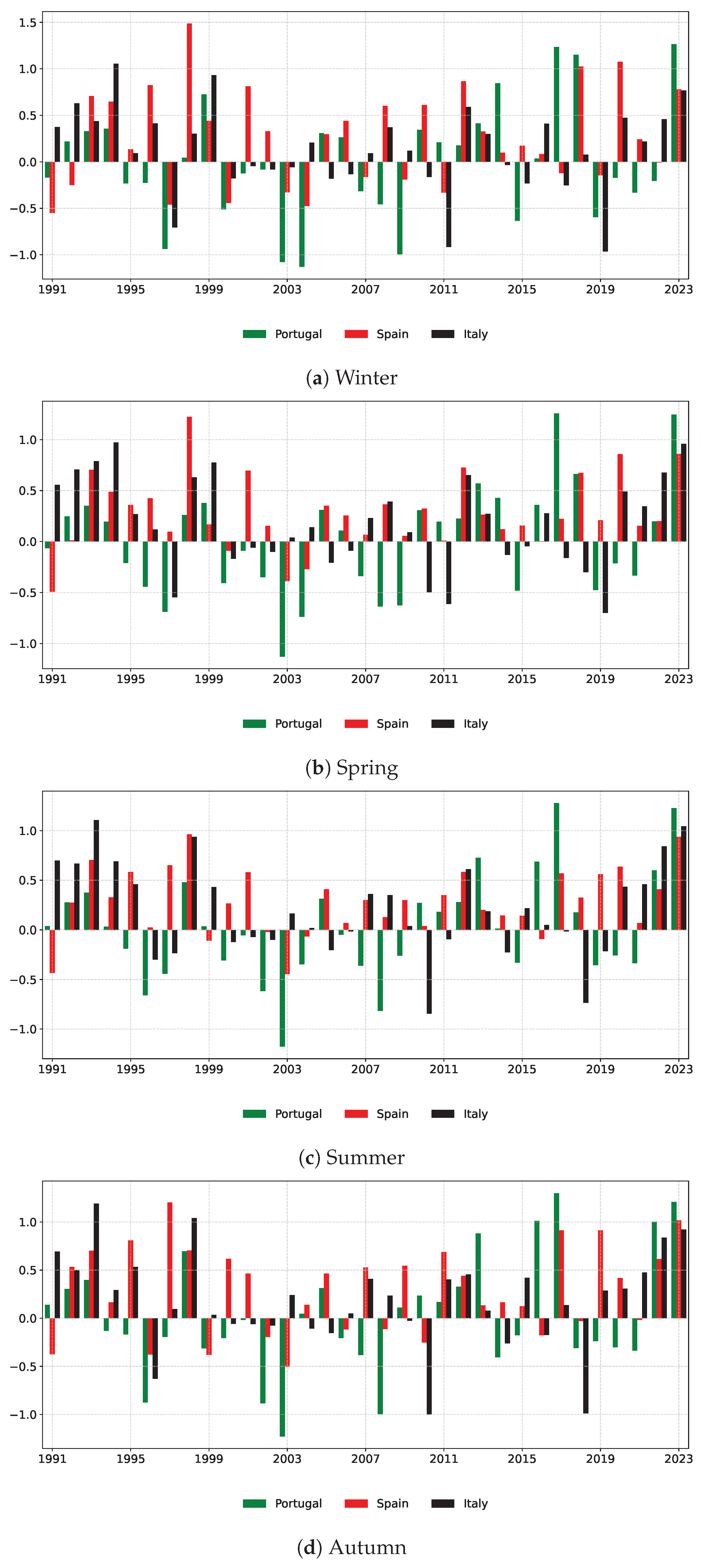

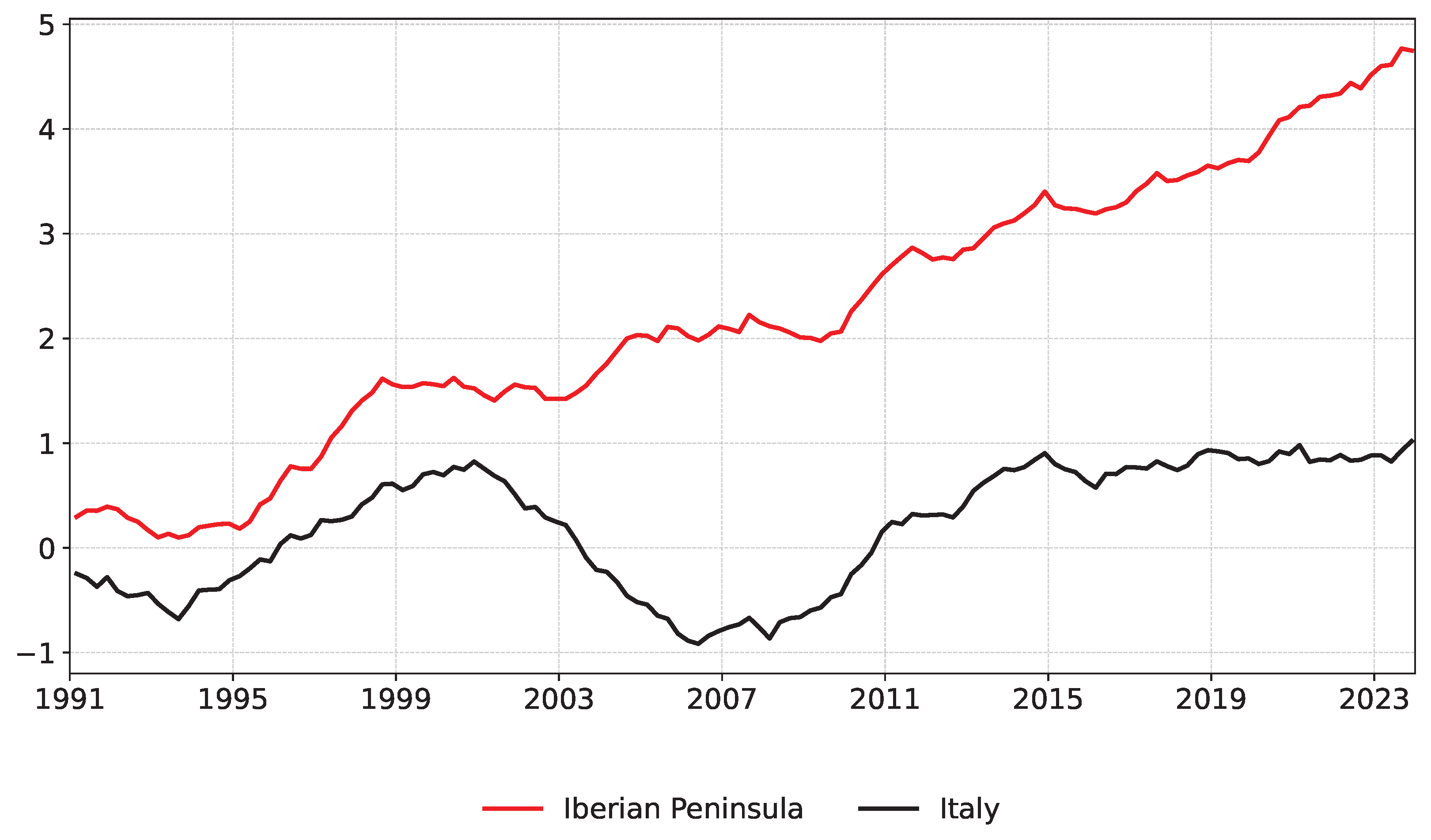

6.1. Cross-Country Trends in the Composite Climate Index

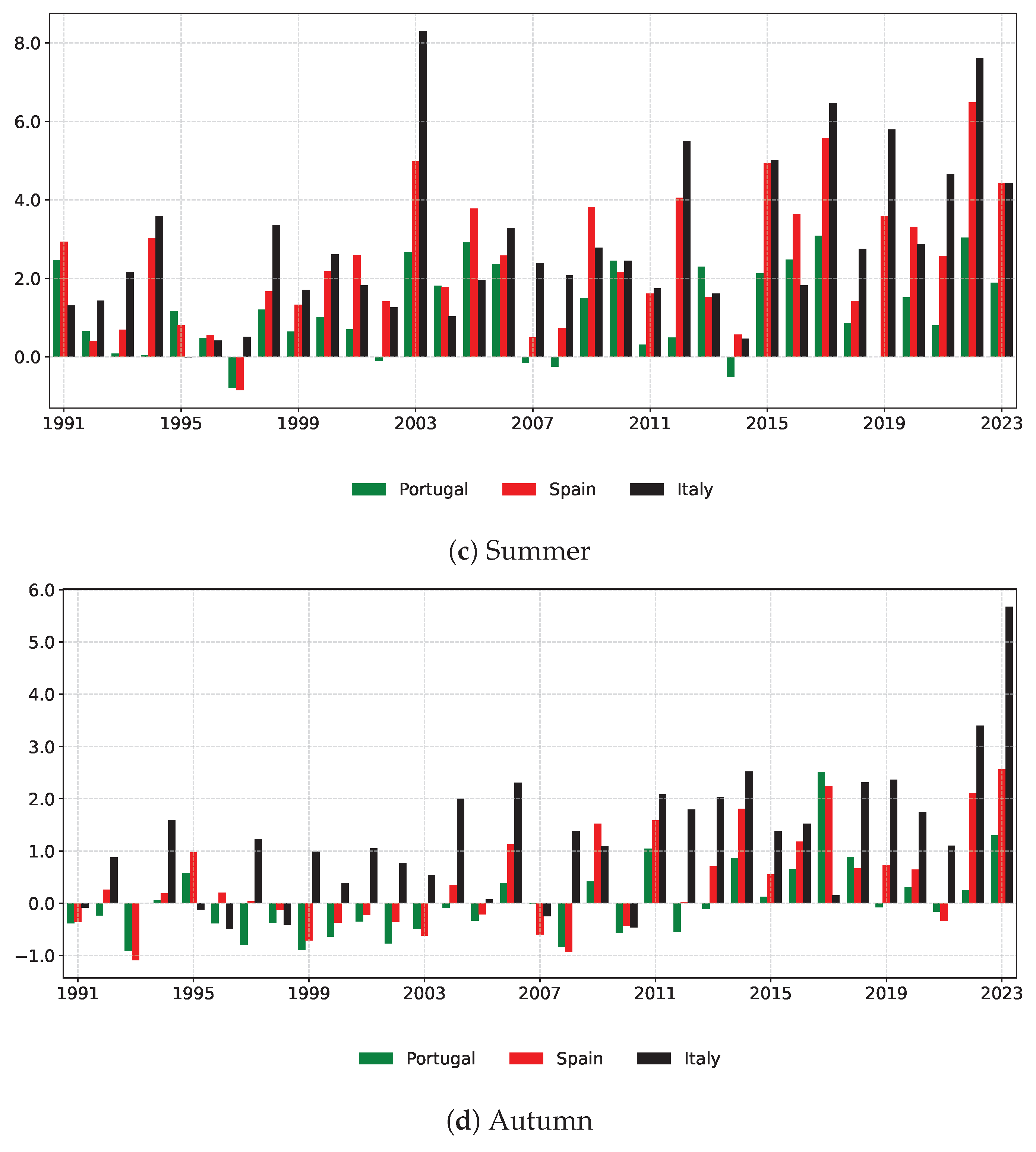

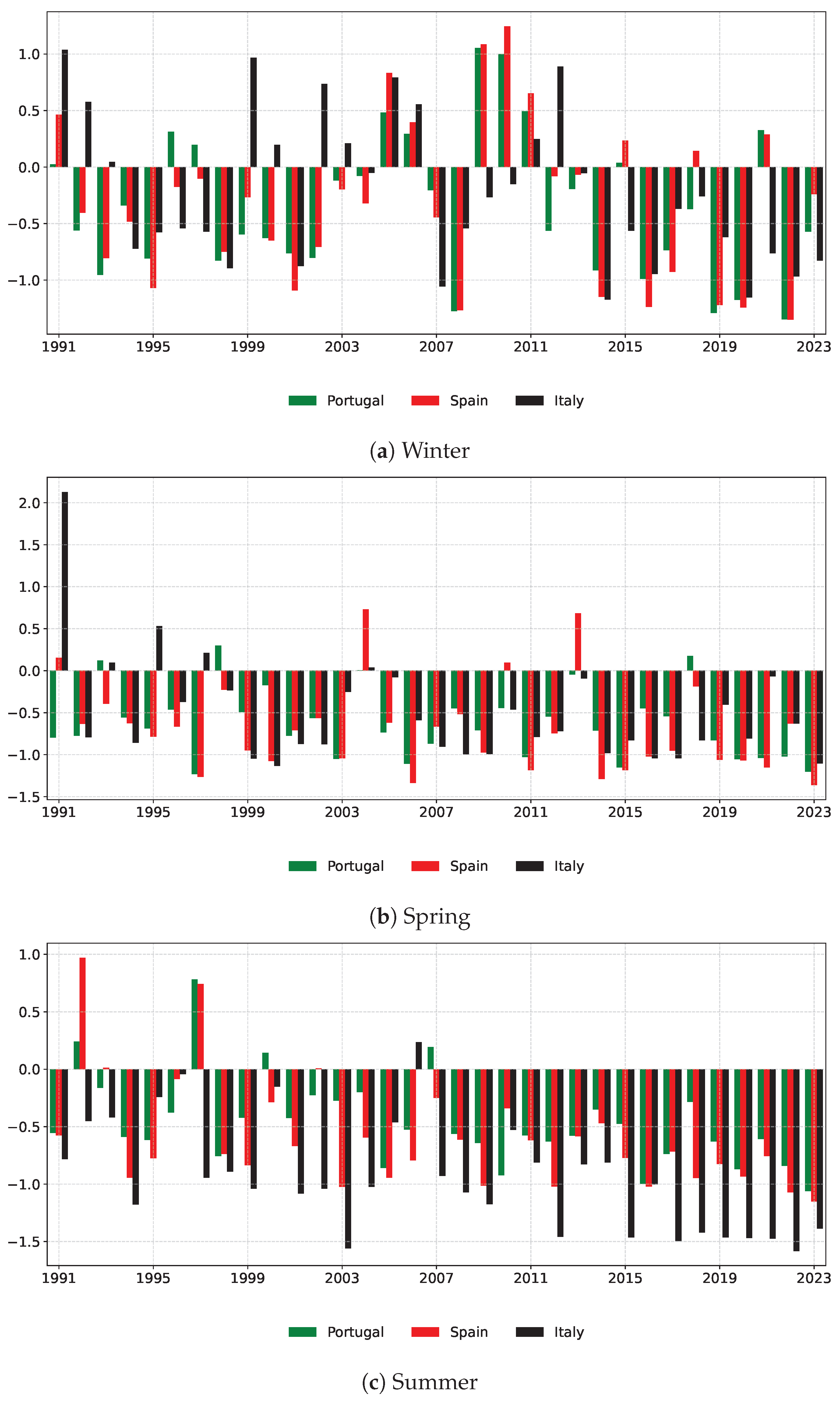

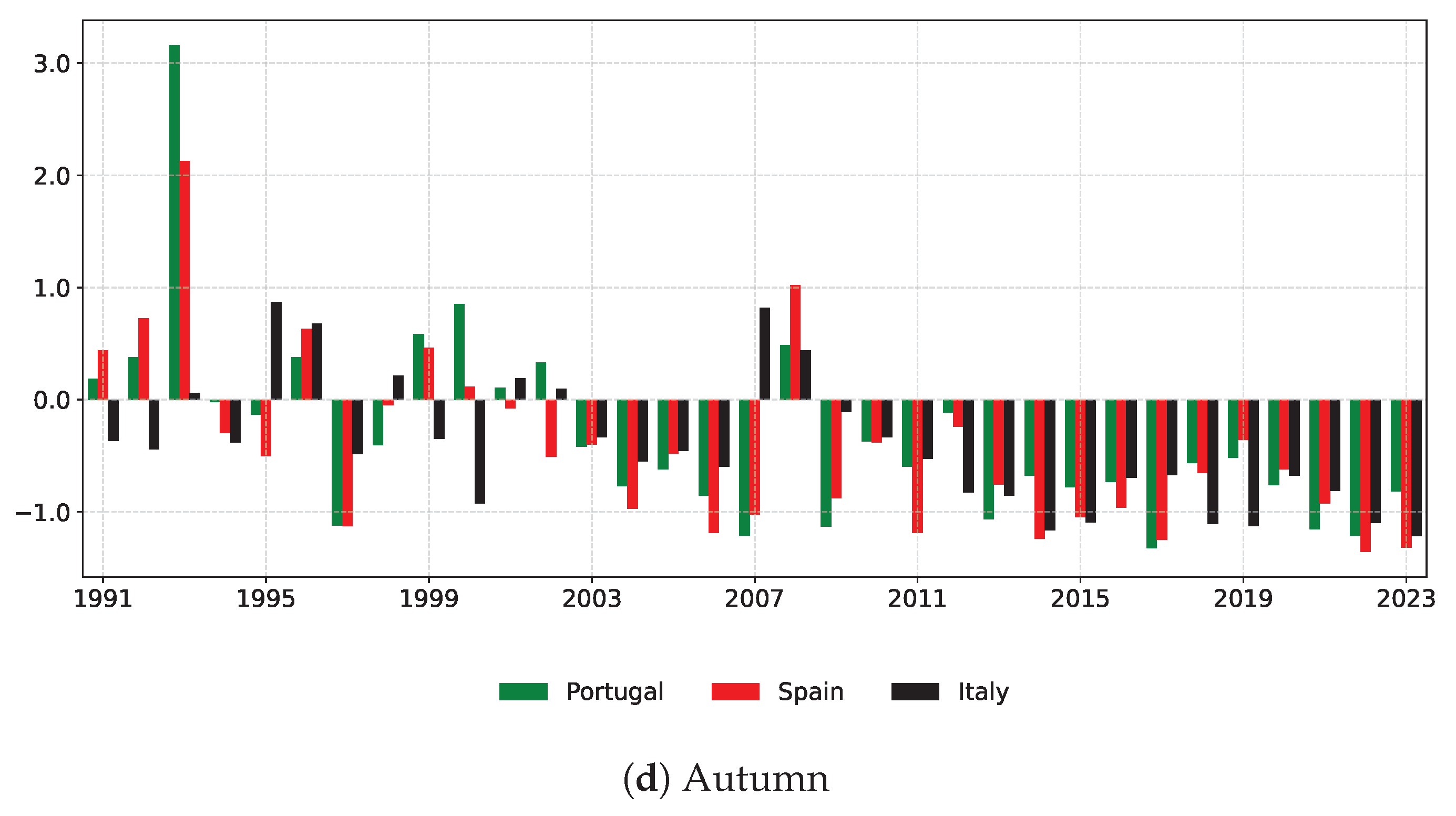

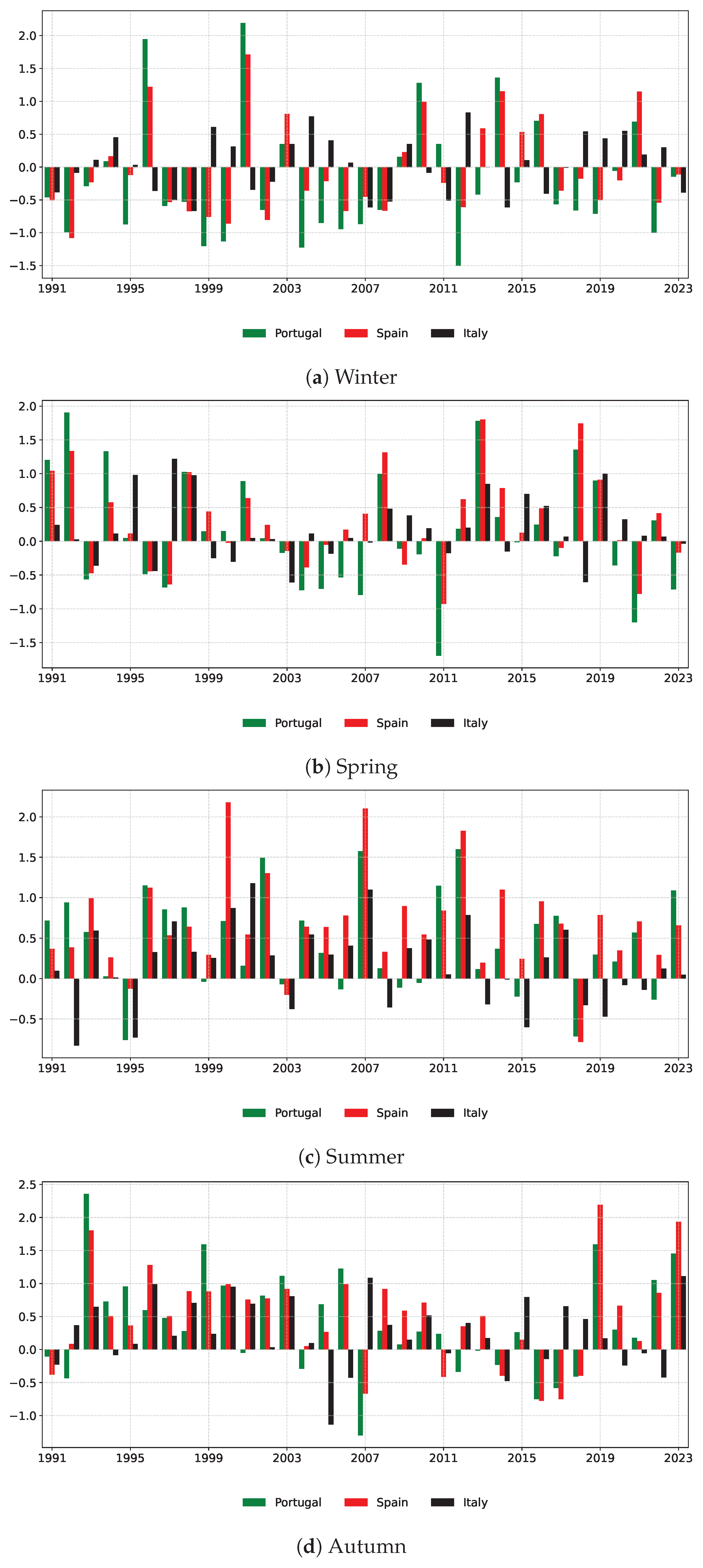

6.2. Cross-Country Trends in Individual Climate Indicators

- Thermal Indicators: Warm and Cool Temperatures

- Hydrological Indicators: Precipitation and Drought

- Wind Power Indicator

6.3. Sea Level Dynamics in a Comparative Perspective: The Italian Specificities

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Spatial Distribution of the Seasonal ITACI from 2012 to 2022

Appendix B. Standardised Anomalies Across Macroareas by Climate Indicator

| 1 | As defined by EIOPA (2019), “Physical risks from climate change arise from a number of factors, and relate to specific weather events (such as heatwaves, floods, wildfires, and storms) and longer-term shifts in the climate (such as changes in precipitation, extreme weather variability, sea level rise, and rising mean temperatures). Some examples of physical risks crystallising include the following: increased frequency, severity, or volatility of extreme weather events impacting property and casualty insurance and increased frequency and severity of flooding leading to physical damage to the value of financial assets or collateral held by banks, such as household and commercial property.” See also EIOPA (2022), which provides consistent definitions and examples. |

| 2 | Data extracted from the Excel file provided by EIOPA as part of the 2024 Insurance Protection Gap Dashboard, available at: https://www.eiopa.europa.eu/tools-and-data/dashboard-insurance-protection-gap-natural-catastrophes_en (accessed on 16 April 2025). |

| 3 | A seminar on the topic was organised by IVASS, entitled “Parametric insurance: between market, technology and law”, and held on 10 May 2024. |

| 4 | Air quality indicators are not included in the ITACI framework in order to ensure full comparability with the other indices in the ACI family (ACI, FACI, IACI), which are exclusively based on climate-driven variables. While air quality is highly relevant for environmental and health studies, it falls outside the scope of this climate-focused index and may be considered in future extensions. |

| 5 | Consistently, December refers to the previous year . |

| 6 | Since anomalies are expressed in different units, magnitude comparisons are meaningful only within the same indicator across seasons. |

| 7 | The numerical time series of the IACI for Portugal and Spain is publicly available at https://e-actuaries.eu/downloads/iberian-actuarial-climate-index/ (accessed on 16 April 2025), whereas the FACI series for France has not been released. |

References

- Aiello, Maria A., Cristina Angelico, Piero Cova, and Valentina Michelangeli. 2024. Climate-related Risks for Italy: An Analysis Based on the Latest NGFS Scenarios. Banca d’Italia, Occasional Papers 847. Available online: https://www.bancaditalia.it/pubblicazioni/qef/2024-0847/QEF_847_24.pdf?language_id=1 (accessed on 26 April 2024).

- ANIA. 2024. L’Assicurazione Italiana 2023–2024. Available online: https://www.ania.it/documents/35135/439653/LAssicurazione-Italiana-2024_WEB.pdf/bf8d4d10-b3ce-45d0-62c7-76d57492be13?t=1719994663305 (accessed on 15 June 2025).

- Aon. 2024. 2024 Weather, Climate and Catastrophe Insight. Available online: https://assets.aon.com/-/media/files/aon/reports/2024/climate-and-catastrophe-insights-report.pdf (accessed on 15 July 2025).

- Borile, Federica, Nadia Pinardi, Vladyslav Lyubartse, Mahmud H. Ghani, Antonio Navarra, Jacopo Alessandri, Emanuela Clementi, Giovanni Coppini, Lorenzo Mentaschi, Giorgia Verri, and et al. 2025. The Eastern Mediterranean Sea Mean Sea Level Decadal Slowdown: The Effects of the Water Budget. Frontiers in Climate 7: 1472731. Available online: https://www.frontiersin.org/articles/10.3389/fclim.2025.1472731/full (accessed on 24 March 2024). [CrossRef]

- Casualty Actuarial Society. 2024. Virtual Climate Risk Seminar, Session 4: Actuaries Climate Index 2.0: Improving Geographic Coverage and Extremes Tracking. Available online: https://www.casact.org/event/2024-cas-virtual-climate-risk-seminar (accessed on 3 September 2025).

- Cheung, Eric C. K., Ryan H. L. Ip, Ho On Tam, and Jae-Kyung Woo. 2024. Cointegration Analysis of Crop Yields and Extreme Weather Factors Using Actuaries Climate Index with Application of Bonus–Malus System. North American Actuarial Journal, 1–19. [Google Scholar] [CrossRef]

- Copernicus Climate Change Service (C3S). 2025. ERA5-Land Hourly Data from 1950 to Present. Available online: https://cds.climate.copernicus.eu/datasets/reanalysis-era5-land?tab=download (accessed on 10 October 2024).

- Curry, Charles L. 2015. Extension of the Actuaries Climate Index to the UK and Europe: A Feasibility Study. Institute and Faculty of Actuaries. Available online: https://www.actuaries.org.uk/system/files/field/document/UK_ACI_scoping_FINAL.pdf (accessed on 1 September 2023).

- De Vivo, Carmela, Giuliana Barbato, Marta Ellena, Vincenzo Capozzi, Giorgio Budillon, and Paola Mercogliano. 2023. Climate-Risk Assessment Framework for Airports under Extreme Precipitation Events: Application to Selected Italian Case Studies. Sustainability 15: 7300. [Google Scholar] [CrossRef]

- EIOPA. 2019. Application Guidance on ORSA. Available online: https://www.eiopa.europa.eu/document/download/d5ae4db7-cc30-40db-ad5e-045876e3c7b3_en?filename=Opinion%20on%20Sustainability%20within%20Solvency%20II%20%28EIOPA-BoS-19/241%29%E2%80%8B.pdf (accessed on 10 June 2025).

- EIOPA. 2022. Application Guidance on Running Climate Change Materiality Assessment and Using Climate Change Scenarios in the ORSA. Available online: https://www.eiopa.europa.eu/document/download/5a671bdb-aef7-4c4f-ae31-00c70e640d27_en?filename=Application%20guidance%20on%20running%20climate%20change%20materiality%20assessment%20and%20using%20climate%20change%20scenarios%20in%20ORSA.pdf (accessed on 10 June 2025).

- EIOPA. 2024. The Dashboard on Insurance Protection Gap for Natural Catastrophes in a Nutshell. Available online: https://www.eiopa.europa.eu/tools-and-data/dashboard-insurance-protection-gap-natural-catastrophes_en (accessed on 15 May 2025).

- European Commission. 2015. Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 Supplementing Directive 2009/138/EC of the European Parliament and of the Council on the Taking-Up and Pursuit of the Business of Insurance and Reinsurance (Solvency II). Official Journal of the European Union L 12: 1–797. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32015R0035 (accessed on 20 January 2025).

- European Commission. 2021. Commission Delegated Regulation (EU) 2021/1256 of 21 April 2021 Amending Delegated Regulation (EU) 2015/35 as Regards the Integration of Sustainability Risks in the Governance of Insurance and Reinsurance Undertakings. Official Journal of the European Union L 277: 14–16. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32021R1256 (accessed on 20 January 2025).

- European Parliament and Council. 2003. Regulation (EC) No 1059/2003 of 26 May 2003 on the Establishment of a Common Classification of Territorial Units for Statistics (NUTS). Consolidated version of 1 January 2024. Official Journal of the European Union L 154: 1–41. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:02003R1059-20240101 (accessed on 20 August 2025).

- Expert Team on Climate Change Detection and Indices. 2023. List of Climate Change Indices. Available online: https://etccdi.pacificclimate.org/list_27_indices.shtml (accessed on 10 May 2025).

- Figueiredo, Rui, Mario L. V. Martina, David B. Stephenson, and Benjamin D. Youngman. 2018. A Probabilistic Paradigm for the Parametric Insurance of Natural Hazards. Risk Analysis 38: 2400–14. [Google Scholar] [CrossRef]

- Fox-Kemper, Baylor, Helen T. Hewitt, Cunde Xiao, Guðfinna Aðalgeirsdóttir, Sybren S. Drijfhout, Tamsin L. Edwards, Nicholas R. Golledge, Mark Hemer, Robert E. Kopp, Gerhard Krinner, and et al. 2021. Ocean, Cryosphere and Sea Level Change. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Edited by Valérie Masson-Delmotte, Panmao Zhai, Anna Pirani, Sarah L. Connors, Clotilde Péan, Sophie Berger, Nada Caud, Yang Chen, Leah Goldfarb, Melissa I. Gomis and et al. Cambridge and New York: Cambridge University Press, pp. 1211–362. [Google Scholar] [CrossRef]

- Gao, Lisa, and Peng Shi. 2025. Risk modeling of property insurance claims from weather events. ASTIN Bulletin: The Journal of the IAA 55: 242–62. [Google Scholar] [CrossRef]

- Garrido, José, Xavier Milhaud, and Anani Olympio. 2024. The Definition of a French Actuarial Climate Index; One More Step Towards a European Index. Preprint. Available online: https://www.researchgate.net/publication/376982040 (accessed on 15 March 2024).

- Hernández-Rojas, Luis F., Adriana L. Abrego-Perez, Fernando E. Lozano Martínez, Carlos F. Valencia-Arboleda, Maria C. Diaz-Jimenez, Natalia Pacheco-Carvajal, and Juan J. García-Cárdenas. 2023. The Role of Data-Driven Methodologies in Weather Index Insurance. Applied Sciences 13: 4785. [Google Scholar] [CrossRef]

- IPCC. 2013. Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Edited by Thomas F. Stocker, Dahe Qin, Gian-Kasper Plattner, Melinda M. B. Tignor, Simon K. Allen, Judith Boschung, Alexander Nauels, Yu Xia, Vincent Bex and Pauline M. Midgley. Cambridge and New York: Cambridge University Press, p. 1535. Available online: https://www.ipcc.ch/report/ar5/wg1/ (accessed on 20 August 2025).

- ISTAT. 2022. Attività Antropiche e Salute delle Coste. Indicatori Territoriali di Rischio e Sostenibilità per Aree Costiere e Insulari in Italia e nell’Unione Europea. Available online: https://www.istat.it/wp-content/uploads/2022/09/Attivit%C3%A0-antropiche-e-salute-delle-coste_Ebook.pdf (accessed on 10 May 2025).

- IVASS. 2021. Regulation No. 38 of 3 July 2018, on the System of Governance Pursuant to Articles 30, 31 and 32 of Legislative Decree No. 209 of 7 September 2005 – Private Insurance Code, as Amended by the Measure of 9 June 2021. Available online: https://www.ivass.it/normativa/nazionale/secondaria-ivass/regolamenti/2018/n38/index.html?com.dotmarketing.htmlpage.language=1 (accessed on 15 March 2025).

- IVASS. 2025. Audizione del Prof. Riccardo Cesari Consigliere dell’Istituto per la Vigilanza sulle Assicurazioni—IVASS. Commissione VIII (Ambiente, Territorio e Lavori Pubblici) della Camera dei Deputati. Available online: https://www.ivass.it/media/interviste/intervista/rc-9-4-25-catastrofali/?dotcache=refresh (accessed on 15 April 2025).

- Lin, Xiao, and W. Jean Kwon. 2020. Application of Parametric Insurance in Principle-Compliant and Innovative Ways. Risk Management and Insurance Review 23: 121–50. [Google Scholar] [CrossRef]

- Liu, Zhonglu, Shuguang He, Wenjiao Men, and Haibo Sun. 2024. Impact of Climate Risk on Financial Stability: Cross-Country Evidence. International Review of Financial Analysis 92: 103096. [Google Scholar] [CrossRef]

- Lomelí-Quintero, Victor-Manuel, Felicitas Calderón-Vega, Cesar Mösso, Agustin Sánchez-Arcilla, and Adrian-David García-Soto. 2023. Impact Costs Due to Climate Change along the Coasts of Catalonia. Marine Science and Engineering 11: 1939. [Google Scholar] [CrossRef]

- Melet, Angélique, Roderik de Wal, Angel Amores, Arne Arns, Alisée A. Chaigneau, Irina Dinu, Ivan D. Haigh, Tim H. J. Hermans, Piero Lionello, Marta Marcos, and et al. 2024. Sea Level Rise in Europe: Observations and Projections. In Sea Level Rise in Europe: 1st Assessment Report of the Knowledge Hub on Sea Level Rise (SLRE1). Edited by Bart van den Hurk, Nadia Pinardi, Thorsten Kiefer, Kate Larkin, Petra Manderscheid and Kristin Richter. Göttingen: Copernicus Publications, vol. 3, chap. 4. [Google Scholar] [CrossRef]

- Meli, Matteo. 2024. The Potential Recording of North Ionian Gyre’s Reversals as a Decadal Signal in Sea Level During the Instrumental Period. Scientific Reports 14: 4907. [Google Scholar] [CrossRef] [PubMed]

- Meli, Matteo, and Claudia Romagnoli. 2022. Evidence and Implications of Hydrological and Climatic Change in the Reno and Lamone River Basins and Related Coastal Areas (Emilia-Romagna, Northern Italy) over the Last Century. Water 14: 2650. [Google Scholar] [CrossRef]

- Mills, Evan. 2005. Insurance in a Climate of Change. Science 309: 1040–44. [Google Scholar] [CrossRef]

- Milne, Glenn A., W. Roland Gehrels, Chris W. Hughes, and Mark E. Tamisiea. 2009. Identifying the Causes of Sea-Level Change. Nature Geoscience 2: 471–78. [Google Scholar] [CrossRef]

- Permanent Service for Mean Sea Level. 2025. PSMSL Tide Gauge Data. Available online: https://www.psmsl.org/data/obtaining/ (accessed on 1 March 2025).

- Tsimplis, Michael N., and Trevor F. Baker. 2000. Sea Level Drop in the Mediterranean Sea: An Indicator of Deep Water Salinity and Temperature Changes? Geophysical Research Letters 27: 1731–34. [Google Scholar] [CrossRef]

- Vigo, Maria Isabel, J. M. Sánchez-Reales, Mario Trottini, and Benjamin Fong Chao. 2011. Mediterranean Sea Level Variations: Analysis of the Satellite Altimetric Data, 1992–2008. Journal of Geodynamics 52: 271–78. [Google Scholar] [CrossRef]

- Wijesena, Sachini, and Biswajeet Pradhan. 2025. Advancements in Weather Index Insurance: A Review of Data-Driven Approaches to Design, Pricing and Risk Management. Earth Systems and Environment 9: 2355–79. [Google Scholar] [CrossRef]

- Zerbini, Susanna, Fabio Raicich, Claudio Maria Prati, Sara Bruni, Sara Del Conte, Maddalena Errico, and Efisio Santi. 2017. Sea-Level Change in the Northern Mediterranean Sea from Long-Period Tide Gauge Time Series. Earth-Science Reviews 167: 72–87. [Google Scholar] [CrossRef]

- Zhou, Fujin, Thijs Endendijk, and W. J. Wouter Botzen. 2023. A Review of the Financial Sector Impacts of Risks Associated with Climate Change. Annual Review of Resource Economics 15: 233–56. [Google Scholar] [CrossRef]

- Zhou, Nan, and José Luis Vilar-Zanón. 2024. Impact Assessment of Climate Change on Hailstorm Risk in Spanish Wine Grape Crop Insurance: Insights from Linear and Quantile Regressions. Risks 12: 20. [Google Scholar] [CrossRef]

- Zhou, Nan, and José Luis Vilar-Zanón. 2025. Climate Change and Crop Insurance: Geographical Heterogeneity in Hailstorm Risk for Wine Grapes in Spain. European Actuarial Journal, 1–32. [Google Scholar] [CrossRef]

- Zhou, Nan, José Luis Vilar-Zanón, José Garrido, and Antonio José Heras-Martinez. 2023. On the Definition of an Actuarial Climate Index for the Iberian Peninsula. Anales del Instituto de Actuarios Españoles 29: 37–59. Available online: https://revistas.actuarios.org/index.php/aiae/article/view/55 (accessed on 1 September 2023). [CrossRef]

| Indicator | Symbol * | Variable(s) | Detection Criterion | Aggregation Rule |

|---|---|---|---|---|

| Warm Days | Max temperature (6:00 a.m.–6:00 p.m.) | Daytime 90th perc. (moving window) | Count of daily exceedances per month | |

| Warm Nights | Max temperature (7:00 p.m.–5:00 a.m.) | Nighttime 90th perc. (moving window) | Count of daily exceedances per month | |

| Cool Days | Min temperature (6:00 a.m.–6:00 p.m.) | Daytime 10th perc. (moving window) | Count of daily exceedances per month | |

| Cool Nights | Min temperature (7:00 p.m.–5:00 a.m.) | Nighttime 10th perc. (moving window) | Count of daily exceedances per month | |

| Precipitation Extremes | Total daily precipitation | No threshold | Max of 5-day rolling sums within the month | |

| Drought | Total daily precipitation | mm | Max dry spell per year, interpolated monthly | |

| Wind Power | Wind components , | Daily threshold () | Normalised count of daily exceedances | |

| Sea Level | Monthly sea level | – | Mean across tide gauge stations |

| Macro-Area | Included Regions | NUTS1 Code | Area | Coastline * (km) | Cell Nr. ** |

|---|---|---|---|---|---|

| North-West | Piedmont, Aosta Valley, Liguria, Lombardy | ITC | 378 | 716 | |

| North-East | Trentino-Alto Adige, Veneto, Friuli-Venezia Giulia, Emilia-Romagna | ITH | 397 | 704 | |

| Centre | Tuscany, Umbria, Marche, Lazio | ITI | 1206 | 653 | |

| South | Abruzzo, Molise, Campania, Apulia, Basilicata, Calabria | ITF | 2445 | 769 | |

| Islands | Sicily, Sardinia | ITG | 3754 | 504 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rogo, B.; Garrido, J.; Demartis, S. The Italian Actuarial Climate Index: A National Implementation Within the Emerging European Framework. Risks 2025, 13, 192. https://doi.org/10.3390/risks13100192

Rogo B, Garrido J, Demartis S. The Italian Actuarial Climate Index: A National Implementation Within the Emerging European Framework. Risks. 2025; 13(10):192. https://doi.org/10.3390/risks13100192

Chicago/Turabian StyleRogo, Barbara, José Garrido, and Stefano Demartis. 2025. "The Italian Actuarial Climate Index: A National Implementation Within the Emerging European Framework" Risks 13, no. 10: 192. https://doi.org/10.3390/risks13100192

APA StyleRogo, B., Garrido, J., & Demartis, S. (2025). The Italian Actuarial Climate Index: A National Implementation Within the Emerging European Framework. Risks, 13(10), 192. https://doi.org/10.3390/risks13100192