CARL and His POT: Measuring Risks in Commodity Markets

Abstract

:1. Introduction

2. Methodology

2.1. POT Methods

2.2. CARL Models

3. Empirical Application

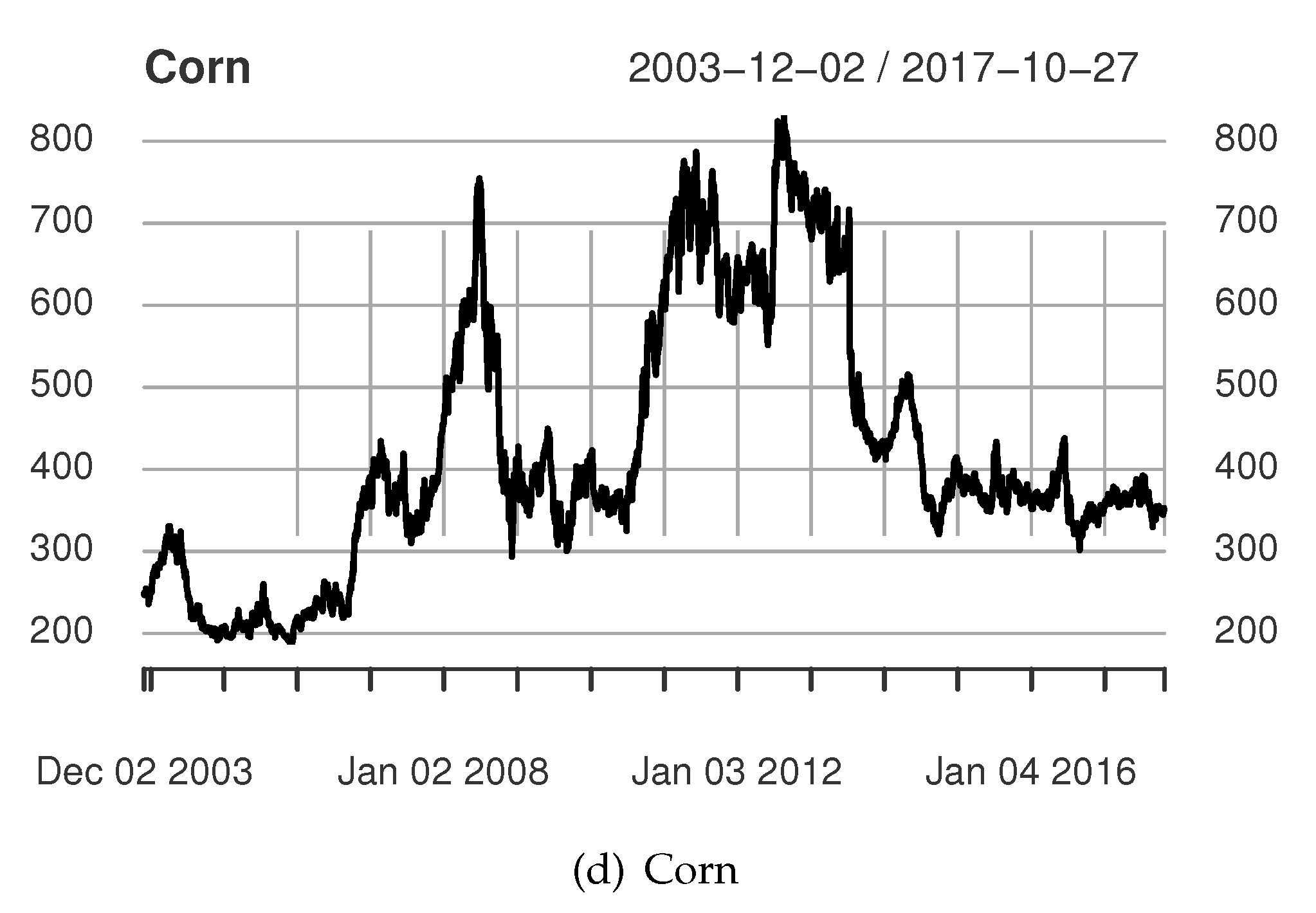

3.1. Data Description

3.2. ES Testing Procedures

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Acerbi, Carlo, and Dirk Tasche. 2002. On the coherence of expected shortfall. Journal of Banking & Finance 26: 1487–503. [Google Scholar]

- Algieri, Bernardina. 2014a. The influence of biofuels, economic and financial factors on daily returns of commodity futures prices. Energy Policy 69: 227–47. [Google Scholar] [CrossRef] [Green Version]

- Algieri, Bernardina. 2014b. A roller coaster ride: an empirical investigation of the main drivers of the international wheat price. Agricultural Economics 45: 459–75. [Google Scholar] [CrossRef]

- Algieri, Bernardina, and Arturo Leccadito. 2017. Assessing contagion risk from energy and non-energy commodity markets. Energy Economics 62: 312–22. [Google Scholar] [CrossRef]

- Algieri, Bernardina, and Arturo Leccadito. 2019. Ask CARL: Forecasting tail probabilities for energy commodities. Energy Economics 84: 104497. [Google Scholar] [CrossRef]

- Anatolyev, Stanislav, and Nikolay Gospodinov. 2010. Modeling financial return dynamics via decomposition. Journal of Business & Economic Statistics 28: 232–45. [Google Scholar]

- Antonakakis, Nikolaos, Tsangyao Chang, Juncal Cunado, and Rangan Gupta. 2018. The relationship between commodity markets and commodity mutual funds: A wavelet-based analysis. Finance Research Letters 24: 1–9. [Google Scholar] [CrossRef] [Green Version]

- Artzner, Philippe, Freddy Delbaen, Jean-Marc Eber, and David Heath. 1999. Coherent measures of risk. Mathematical Finance 9: 203–28. [Google Scholar] [CrossRef]

- Bhardwaj, Geetesh, Gary B. Gorton, and Kevin G. Rouwenhorst. 2016. Investor interestand the returns tocommodity investing. The Journal of Portfolio Management 42: 44–55. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, Amine Lahiani, and Muhammad Shahbaz. 2018. Testing for asymmetric nonlinear short- and long-run relationships between bitcoin, aggregate commodity and gold prices. Resources Policy 57: 224–35. [Google Scholar] [CrossRef] [Green Version]

- Davison, A. C., and R. L. Smith. 1990. Models for exceedances over high thresholds. Journal of the Royal Statistical Society. Series B (Methodological) 52: 393–442. [Google Scholar] [CrossRef]

- de Nicola, Francesca, Pierangelo De Pace, and Manuel A. Hernandez. 2016. Co-movement of major energy, agricultural, and food commodity price returns: A time-series assessment. Energy Economics 57: 28–41. [Google Scholar] [CrossRef]

- Fernandez-Perez, Adrian, Bart Frijns, and Alireza Tourani-Rad. 2016. Contemporaneous interactions among fuel, biofuel and agricultural commodities. Energy Economics 58: 1–10. [Google Scholar] [CrossRef]

- Giot, Pierre, and Sebastien Laurent. 2003. Market risk in commodity markets: A VaR approach. Energy Economics 25: 435–57. [Google Scholar] [CrossRef]

- Han, Heejoon. 2016. Quantile Dependence between Stock Markets and its Application in Volatility Forecasting. arXiv arXiv:1608.07193. [Google Scholar]

- Ji, Qiang, and Ying Fan. 2012. How does oil price volatility affect non-energy commodity markets? Special issue on Thermal Energy Management in the Process Industries. Applied Energy 89: 273–80. [Google Scholar] [CrossRef]

- Ji, Qiang, Elie Bouri, David Roubaud, and Syed Jawad Hussain Shahzad. 2018. Risk spillover between energy and agricultural commodity markets: A dependence-switching covar-copula model. Energy Economics 75: 14–27. [Google Scholar] [CrossRef]

- Kang, Sang Hoon, Ron McIver, and Seong-Min Yoon. 2017. Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Economics 62: 19–32. [Google Scholar] [CrossRef]

- Kratz, Marie, Yen H. Lok, and Alexander J. McNeil. 2018. Multinomial VaR backtests: A simple implicit approach to backtesting expected shortfall. Journal of Banking & Finance 88: 393–407. [Google Scholar]

- Kumar, Satish, Aviral Kumar Tiwari, I. D. Raheem, and Qiang Ji. 2019. Dependence risk analysis in energy, agricultural and precious metals commodities: a pair vine copula approach. Applied Economics, 1–18. [Google Scholar] [CrossRef] [Green Version]

- McNeil, Alexander J., Rudiger Frey, and Paul Embrechts. 2005. Quantitative Risk Management: Concepts, Techniques And Tools. Princeton Series in Finance; Princeton: Princeton University Press. [Google Scholar]

- Mensi, Walid, Shawkat Hammoudeh, Duc Khuong Nguyen, and Seong-Min Yoon. 2014. Dynamic spillovers among major energy and cereal commodity prices. Energy Economics 43: 225–43. [Google Scholar] [CrossRef]

- Mensi, Walid, Aviral Tiwari, Elie Bouri, David Roubaud, and Khamis H. Al-Yahyaee. 2017. The dependence structure across oil, wheat, and corn: A wavelet-based copula approach using implied volatility indexes. Energy Economics 66: 122–39. [Google Scholar] [CrossRef]

- Nazlioglu, Saban, and Ugur Soytas. 2012. Oil price, agricultural commodity prices, and the dollar: A panel cointegration and causality analysis. Energy Economics 34: 1098–104. [Google Scholar] [CrossRef]

- Pickands, James, III. 1975. Statistical inference using extreme order statistics. Annals of Statistics 3: 119–31. [Google Scholar] [CrossRef]

- Pindyck, Robert S., and Julio J. Rotemberg. 1990. The excess co-movement of commodity prices. The Economic Journal 100: 1173–89. [Google Scholar] [CrossRef]

- Rehman, Mobeen Ur, Elie Bouri, Veysel Eraslan, and Satish Kumar. 2019. Energy and non-energy commodities: An asymmetric approach towards portfolio diversification in the commodity market. Resources Policy 63: 1–19. [Google Scholar] [CrossRef]

- Rydberg, Tina Hviid, and Neil Shephard. 2003. Dynamics of trade-by-trade price movements: Decomposition and models. Journal of Financial Econometrics 1: 2–25. [Google Scholar] [CrossRef] [Green Version]

- Sadorsky, Perry. 1999. Oil price shocks and stock market activity. Energy Economics 21: 449–69. [Google Scholar] [CrossRef]

- Shahzad, Jawad, Jose Arreola Hernandez, Khamis Al-Yahyaee, and Rania Jammazi. 2018. Asymmetric risk spillovers between oil and agricultural commodities. Energy Policy 118: 182–98. [Google Scholar] [CrossRef]

- Smith, Richard L. 1989. Extreme value analysis of environmental time series: An application to trend detection in ground-level ozone. Statistical Science 4: 367–77. [Google Scholar] [CrossRef]

- Tadesse, Getaw, Bernardina Algieri, Matthias Kalkuhl, and Joachim von Braun. 2014. Drivers and triggers of international food price spikes and volatility. Food Policy 47: 117–28. [Google Scholar] [CrossRef] [Green Version]

- Tang, Ke, and Wei Xiong. 2012. Index investment and the financialization of commodities. Financial Analysts Journal 68: 54–74. [Google Scholar] [CrossRef]

- Taylor, James W., and Keming Yu. 2016. Using auto-regressive logit models to forecast the exceedance probability for financial risk management. Journal of the Royal Statistical Society: Series A (Statistics in Society) 179: 1069–92. [Google Scholar] [CrossRef] [Green Version]

- Tiwari, Aviral Kumar, Nader Trabelsi, Faisal Alqahtani, and Ibrahim D. Raheem. 2020. Systemic risk spillovers between crude oil and stock index returns of g7 economies: Conditional value-at-risk and marginal expected shortfall approaches. Energy Economics 86: 104646. [Google Scholar] [CrossRef]

| Statistic | WTI | Natural Gas | Gold | Corn |

|---|---|---|---|---|

| Mean | 0.017 | −0.019 | 0.033 | 0.009 |

| Min | −13.065 | −14.893 | −9.821 | −26.862 |

| Max | 16.410 | 26.771 | 8.625 | 12.757 |

| Standard Deviation | 2.363 | 3.201 | 1.188 | 1.948 |

| Kurtosis | 7.134 | 7.536 | 8.186 | 15.195 |

| Skewness | 0.115 | 0.685 | −0.371 | −0.691 |

| Jarque-Bera | 2500.4 | 3274.2 | 4002.4 | 21,964.9 |

| J-B p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| ADF p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| N. of observations | 3500 | 3500 | 3500 | 3500 |

| Correlation | WTI | Natural Gas | Gold | Corn |

|---|---|---|---|---|

| WTI | 1 | |||

| Natural gas | 0.244 | 1 | ||

| Gold | 0.242 | 0.074 | 1 | |

| Corn | 0.241 | 0.107 | 0.174 | 1 |

| WTI | Gold | Natural Gas | Corn | |

|---|---|---|---|---|

| Pearson Test; TVPOT-CARL-IND Model | 0.0716 | 0.0696 | 0.0493 | 0.0883 |

| Pearson Test; TVPOT-CARL-IND-X Model | 0.3282 | 0.1630 | 0.2558 | 0.0412 |

| Pearson Test; TVPOT-CARL-ABS Model | 0.5879 | 0.0129 | 0.0897 | 0.0061 |

| Pearson Test; TVPOT-CARL-ABS-X Model | 0.7000 | 0.0541 | 0.2124 | 0.0564 |

| Pearson Test; GARCH Model | 0.2583 | 0.0787 | 0.0600 | 0.0000 |

| Pearson Test; HS | 0.0000 | 0.0102 | 0.1954 | 0.0878 |

| Pearson Test; FHS | 0.0307 | 0.0303 | 0.0152 | 0.0735 |

| Pearson Test; QAV Model | 0.0000 | 0.0019 | 0.2236 | 0.0108 |

| Nass Test; TVPOT-CARL-IND Model | 0.0726 | 0.0705 | 0.0502 | 0.0893 |

| Nass Test; TVPOT-CARL-IND-X Model | 0.3281 | 0.1639 | 0.2562 | 0.0420 |

| Nass Test; TVPOT-CARL-ABS Model | 0.5859 | 0.0133 | 0.0908 | 0.0064 |

| Nass Test; TVPOT-CARL-ABS-X Model | 0.6975 | 0.0550 | 0.2131 | 0.0574 |

| Nass Test; GARCH Model | 0.2587 | 0.0797 | 0.0609 | 0.0000 |

| Nass Test; HS | 0.0000 | 0.0106 | 0.1956 | 0.0659 |

| Nass Test; FHS | 0.0314 | 0.0310 | 0.0157 | 0.0810 |

| Nass Test; QAV Model | 0.0000 | 0.0020 | 0.2113 | 0.0112 |

| LRT Test; TVPOT-CARL-IND Model | 0.0479 | 0.0465 | 0.0284 | 0.0552 |

| LRT Test; TVPOT-CARL-IND-X Model | 0.2791 | 0.1212 | 0.2180 | 0.0193 |

| LRT Test; TVPOT-CARL-ABS Model | 0.5583 | 0.0051 | 0.0647 | 0.0017 |

| LRT Test; TVPOT-CARL-ABS-X Model | 0.6912 | 0.0294 | 0.1736 | 0.0329 |

| LRT Test; GARCH Model | 0.3190 | 0.0786 | 0.0296 | 0.0000 |

| LRT Test; HS | 0.0000 | 0.0049 | 0.1780 | 0.0628 |

| LRT Test; FHS | 0.0178 | 0.0102 | 0.0196 | 0.0722 |

| LRT Test; QAV Model | 0.0000 | 0.0004 | 0.1877 | 0.0284 |

| WTI | Gold | Natural Gas | Corn | |

|---|---|---|---|---|

| Pearson Test; TVPOT-CARL-IND Model | 0.2318 | 0.2374 | 0.1576 | 0.2739 |

| Pearson Test; TVPOT-CARL-IND-X Model | 0.1231 | 0.3822 | 0.2025 | 0.2738 |

| Pearson Test; TVPOT-CARL-ABS Model | 0.2986 | 0.0605 | 0.1253 | 0.0377 |

| Pearson Test; TVPOT-CARL-ABS-X Model | 0.3281 | 0.1279 | 0.1489 | 0.2723 |

| Pearson Test; GARCH Model | 0.0153 | 0.0000 | 0.1265 | 0.0000 |

| Pearson Test; HS | 0.0000 | 0.0375 | 0.0221 | 0.2518 |

| Pearson Test; FHS | 0.0356 | 0.0596 | 0.0444 | 0.2658 |

| Pearson Test; QAV Model | 0.0000 | 0.0003 | 0.1213 | 0.0142 |

| Nass Test; TVPOT-CARL-IND Model | 0.2336 | 0.2391 | 0.1600 | 0.2754 |

| Nass Test; TVPOT-CARL-IND-X Model | 0.1256 | 0.3820 | 0.2045 | 0.2757 |

| Nass Test; TVPOT-CARL-ABS Model | 0.2996 | 0.0627 | 0.1278 | 0.0395 |

| Nass Test; TVPOT-CARL-ABS-X Model | 0.3287 | 0.1304 | 0.1477 | 0.2736 |

| Nass Test; GARCH Model | 0.0163 | 0.0000 | 0.1290 | 0.0000 |

| Nass Test; HS | 0.0000 | 0.0393 | 0.0235 | 0.2529 |

| Nass Test; FHS | 0.0373 | 0.0617 | 0.0463 | 0.2629 |

| Nass Test; QAV Model | 0.0000 | 0.0004 | 0.1167 | 0.0152 |

| LRT Test; TVPOT-CARL-IND Model | 0.1421 | 0.1507 | 0.0925 | 0.2749 |

| LRT Test; TVPOT-CARL-IND-X Model | 0.0456 | 0.2799 | 0.1314 | 0.2754 |

| LRT Test; TVPOT-CARL-ABS Model | 0.2064 | 0.0183 | 0.0622 | 0.0107 |

| LRT Test; TVPOT-CARL-ABS-X Model | 0.2274 | 0.0695 | 0.1735 | 0.2733 |

| LRT Test; GARCH Model | 0.0496 | 0.0003 | 0.0466 | 0.0000 |

| LRT Test; HS | 0.0000 | 0.0125 | 0.0398 | 0.2483 |

| LRT Test; FHS | 0.0092 | 0.0139 | 0.0466 | 0.2652 |

| LRT Test; QAV Model | 0.0000 | 0.0000 | 0.0769 | 0.0357 |

| WTI | Gold | Natural Gas | Corn | ||

|---|---|---|---|---|---|

| Pearson Test; TVPOT-CARL-IND Model | 0.2394 | 0.0612 | 0.0603 | 0.0562 | |

| Pearson Test; TVPOT-CARL-IND-X Model | 0.5092 | 0.0964 | 0.1462 | 0.0606 | |

| Pearson Test; TVPOT-CARL-ABS Model | 0.7089 | 0.0131 | 0.0474 | 0.0084 | |

| Pearson Test; TVPOT-CARL-ABS-X Model | 0.7518 | 0.0804 | 0.0839 | 0.1046 | |

| Nass Test; TVPOT-CARL-IND Model | 0.2399 | 0.0622 | 0.0613 | 0.0571 | |

| Nass Test; TVPOT-CARL-IND-X Model | 0.5078 | 0.0974 | 0.1472 | 0.0615 | |

| Nass Test; TVPOT-CARL-ABS Model | 0.7063 | 0.0135 | 0.0482 | 0.0087 | |

| Nass Test; TVPOT-CARL-ABS-X Model | 0.7508 | 0.0814 | 0.0849 | 0.1056 | |

| LRT Test; TVPOT-CARL-IND Model | 0.2022 | 0.0365 | 0.0408 | 0.0351 | |

| LRT Test; TVPOT-CARL-IND-X Model | 0.4673 | 0.0635 | 0.1125 | 0.0387 | |

| LRT Test; TVPOT-CARL-ABS Model | 0.6808 | 0.0055 | 0.0307 | 0.0028 | |

| LRT Test; TVPOT-CARL-ABS-X Model | 0.6110 | 0.0510 | 0.0566 | 0.0796 | |

| Pearson Test; TVPOT-CARL-IND Model | 0.2200 | 0.3348 | 0.2215 | 0.2693 | |

| Pearson Test; TVPOT-CARL-IND-X Model | 0.1260 | 0.4058 | 0.4691 | 0.2488 | |

| Pearson Test; TVPOT-CARL-ABS Model | 0.3967 | 0.0307 | 0.2348 | 0.0630 | |

| Pearson Test; TVPOT-CARL-ABS-X Model | 0.4063 | 0.3113 | 0.3827 | 0.3606 | |

| Nass Test; TVPOT-CARL-IND Model | 0.2219 | 0.3352 | 0.2234 | 0.2707 | |

| Nass Test; TVPOT-CARL-IND-X Model | 0.1285 | 0.4053 | 0.4676 | 0.2504 | |

| Nass Test; TVPOT-CARL-ABS Model | 0.3963 | 0.0323 | 0.2366 | 0.0651 | |

| Nass Test; TVPOT-CARL-ABS-X Model | 0.4058 | 0.3121 | 0.3825 | 0.3607 | |

| LRT Test; TVPOT-CARL-IND Model | 0.1522 | 0.2396 | 0.1328 | 0.1818 | |

| LRT Test; TVPOT-CARL-IND-X Model | 0.0547 | 0.3092 | 0.3878 | 0.1621 | |

| LRT Test; TVPOT-CARL-ABS Model | 0.3227 | 0.0069 | 0.1629 | 0.0229 | |

| LRT Test; TVPOT-CARL-ABS-X Model | 0.3278 | 0.2071 | 0.2921 | 0.2799 |

| WTI | Gold | Natural Gas | Corn | ||

|---|---|---|---|---|---|

| Pearson Test; TVPOT-CARL-IND Model | 0.3600 | 0.0551 | 0.0090 | 0.0259 | |

| Pearson Test; TVPOT-CARL-IND-X Model | 0.1534 | 0.0937 | 0.1236 | 0.0831 | |

| Pearson Test; TVPOT-CARL-ABS Model | 0.6923 | 0.0144 | 0.0397 | 0.0112 | |

| Pearson Test; TVPOT-CARL-ABS-X Model | 0.6961 | 0.0600 | 0.0553 | 0.0303 | |

| Nass Test; TVPOT-CARL-IND Model | 0.3597 | 0.0561 | 0.0094 | 0.0266 | |

| Nass Test; TVPOT-CARL-IND-X Model | 0.1543 | 0.0947 | 0.1246 | 0.0841 | |

| Nass Test; TVPOT-CARL-ABS Model | 0.6898 | 0.0149 | 0.0405 | 0.0116 | |

| Nass Test; TVPOT-CARL-ABS-X Model | 0.6971 | 0.0609 | 0.0562 | 0.0311 | |

| LRT Test; TVPOT-CARL-IND Model | 0.3238 | 0.0348 | 0.0034 | 0.0111 | |

| LRT Test; TVPOT-CARL-IND-X Model | 0.1564 | 0.0597 | 0.0858 | 0.0578 | |

| LRT Test; TVPOT-CARL-ABS Model | 0.6521 | 0.0058 | 0.0220 | 0.0042 | |

| LRT Test; TVPOT-CARL-ABS-X Model | 0.6970 | 0.0356 | 0.0313 | 0.0156 | |

| Pearson Test; TVPOT-CARL-IND Model | 0.6558 | 0.1940 | 0.0228 | 0.0776 | |

| Pearson Test; TVPOT-CARL-IND-X Model | 0.1213 | 0.2612 | 0.3367 | 0.1966 | |

| Pearson Test; TVPOT-CARL-ABS Model | 0.0371 | 0.0430 | 0.1741 | 0.0649 | |

| Pearson Test; TVPOT-CARL-ABS-X Model | 0.7857 | 0.0784 | 0.2262 | 0.1238 | |

| Nass Test; TVPOT-CARL-IND Model | 0.6518 | 0.1961 | 0.0241 | 0.0800 | |

| Nass Test; TVPOT-CARL-IND-X Model | 0.1238 | 0.2627 | 0.3372 | 0.1987 | |

| Nass Test; TVPOT-CARL-ABS Model | 0.0389 | 0.0449 | 0.1764 | 0.0671 | |

| Nass Test; TVPOT-CARL-ABS-X Model | 0.7809 | 0.0807 | 0.2281 | 0.1262 | |

| LRT Test; TVPOT-CARL-IND Model | 0.5764 | 0.1160 | 0.0065 | 0.0288 | |

| LRT Test; TVPOT-CARL-IND-X Model | 0.1112 | 0.1625 | 0.2079 | 0.1200 | |

| LRT Test; TVPOT-CARL-ABS Model | 0.0249 | 0.0139 | 0.0919 | 0.0192 | |

| LRT Test; TVPOT-CARL-ABS-X Model | 0.7339 | 0.0447 | 0.1262 | 0.0654 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Algieri, B.; Leccadito, A. CARL and His POT: Measuring Risks in Commodity Markets. Risks 2020, 8, 27. https://doi.org/10.3390/risks8010027

Algieri B, Leccadito A. CARL and His POT: Measuring Risks in Commodity Markets. Risks. 2020; 8(1):27. https://doi.org/10.3390/risks8010027

Chicago/Turabian StyleAlgieri, Bernardina, and Arturo Leccadito. 2020. "CARL and His POT: Measuring Risks in Commodity Markets" Risks 8, no. 1: 27. https://doi.org/10.3390/risks8010027

APA StyleAlgieri, B., & Leccadito, A. (2020). CARL and His POT: Measuring Risks in Commodity Markets. Risks, 8(1), 27. https://doi.org/10.3390/risks8010027