No-Arbitrage Principle in Conic Finance

Abstract

1. Introduction

1.1. Bid–Ask Spreads

1.2. Two-Price Economy

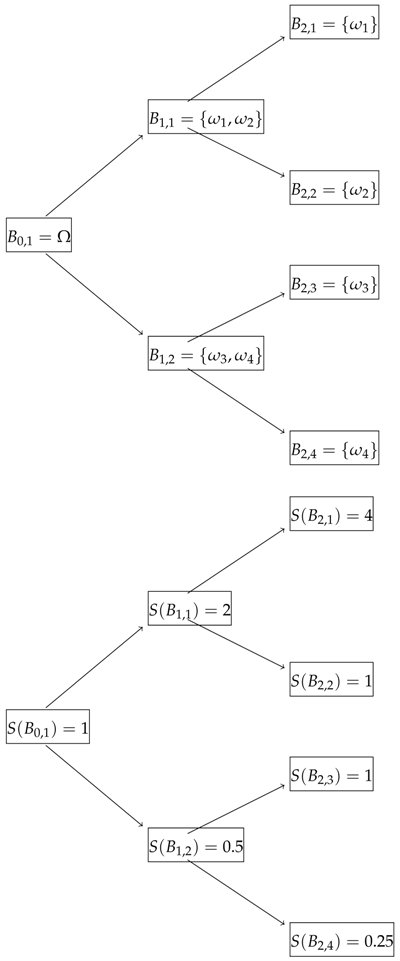

2. The Model (Multi-Period)

2.1. The Model Definitions

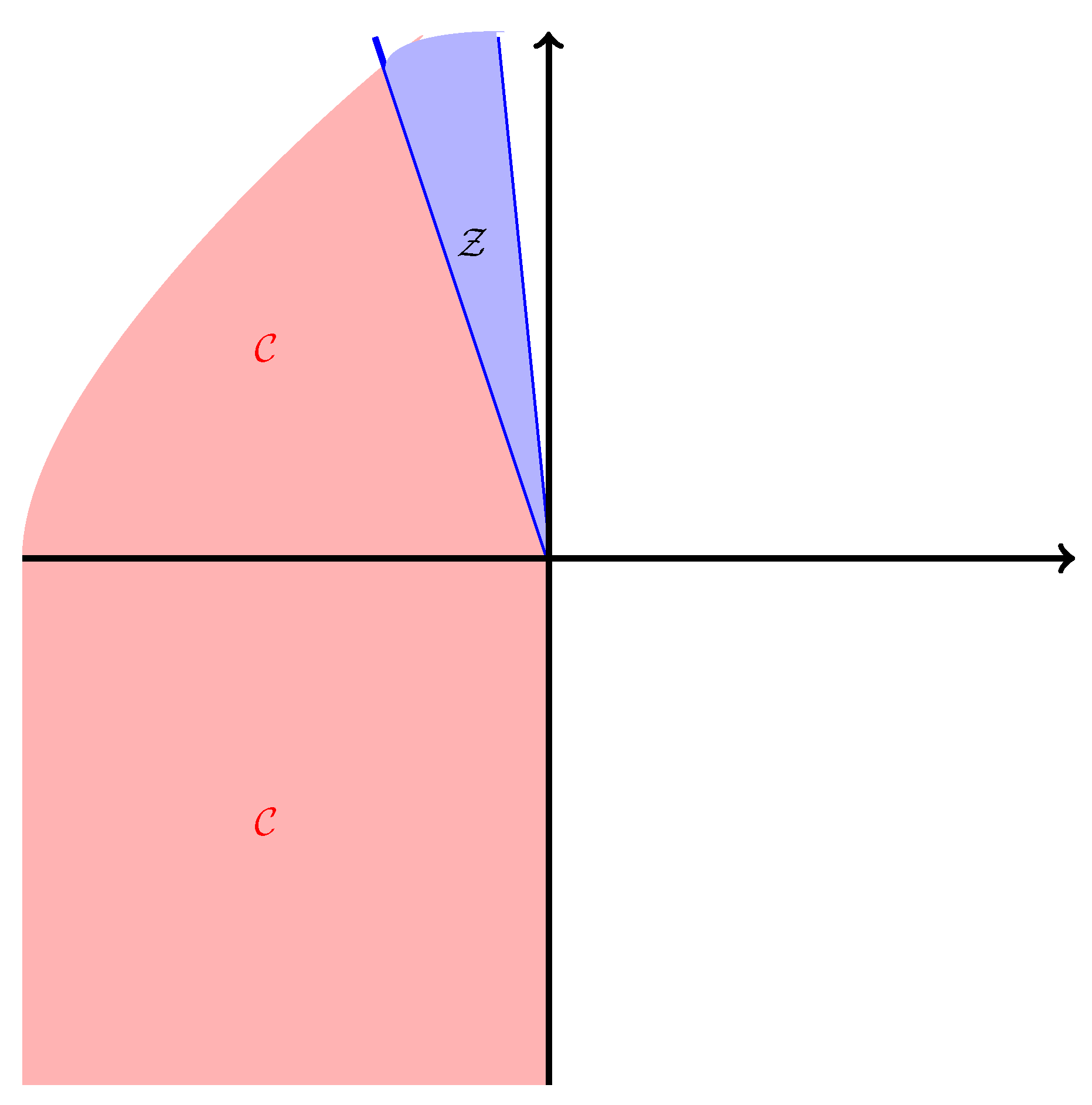

2.2. Set of Zero-Cost Cash Flows

2.3. The Characterization of No-Arbitrage

- (1)

- (Risk Aversion) u is strictly concave,

- (2)

- (Profit Seeking) u is strictly increasing and ,

- (3)

- (Bankruptcy Forbidden) for any .

3. FTAP for Multi-Period Model

- (1)

- Pricing factor is not unique. This is clear since the existence of a pricing factor in FTAP comes from the existence of a solution to the dual problem, and we know the dual problem does not necessary have a unique solution.

- (2)

- The pricing factor is related to the utility function u via the duality. In fact we saw specifically that .

- (3)

- The pricing factors can be used to generate prices for cash flows with no-arbitrage existing. We will explain this more in detail on the coming sub-section.

4. Price Bounds and Their Estimates

4.1. Definition of the Bounds

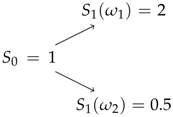

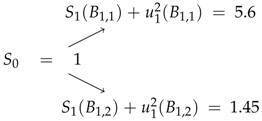

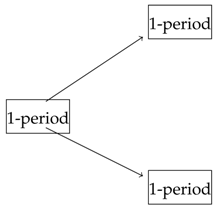

4.2. Computations in One-Period

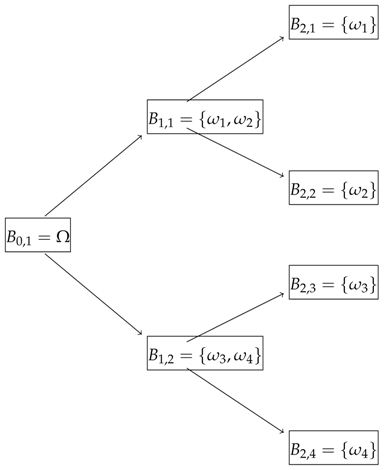

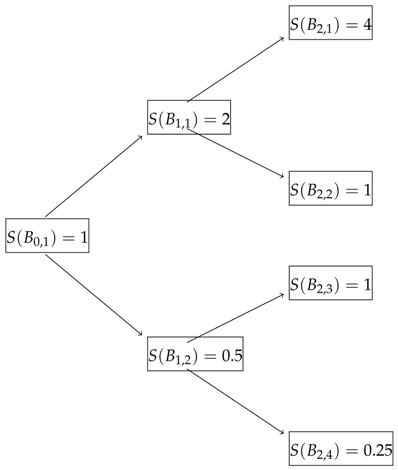

4.3. Two-Period Examples

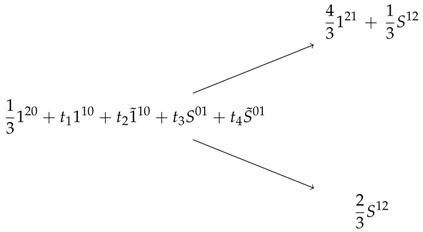

4.3.1. Involving Only 1-Period Bonds

4.3.2. Involving 2-Period Bond

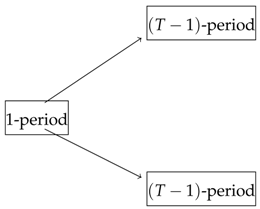

4.4. Complexity of Multi-Period Model

4.5. Estimate of Multi-Period Bounds (Breaking into One Periods)

| 1.3327 | 0.1371 | ||

| 0.5256 | 0.4847 | ||

| 0.2725 | 1.5377 | ||

| 0.0969 | 0.6964 |

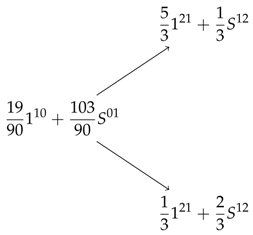

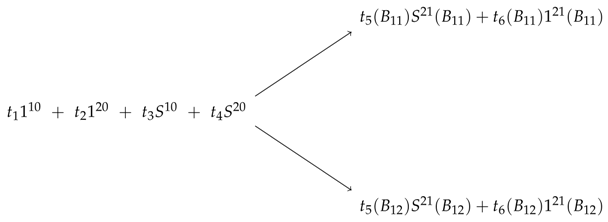

4.6. The General 2-Period Model

- (1)

- (2)

5. Multi-Period Case Theorem

6. Conclusions

- (a)

- using only one-period bonds,

- (b)

- involving all available bonds.

Author Contributions

Funding

Conflicts of Interest

Appendix A. Proofs

- (1)

- (2)

- We start the argument by looking in a few easier and more concrete cases.

- (a)

- Consider the case where a super-hedging bound of is found by only zero-coupon bonds (a 2-period bond or two 1-period bonds ). Then the price difference would be

- (b)

- If we assume that there is only one asset with two options (a 2-period or two 1-period ) then the difference in the hedging-price values is

- (c)

- Now if we use both bond and asset then we have an upper bound for the difference as

- (d)

- Therefore for a super-hedging with both bonds and finite number (M) of assets we have□

References

- Artzner, Philippe, Freddy Delbaen, Jean-Marc Eber, and David Heath. 1999. Coherent measures of risk. Mathematical Finance 9: 203–28. [Google Scholar] [CrossRef]

- Bion-Nadal, Jocelyne. 2009. Bid-ask dynamic pricing in financial markets with transaction costs and liquidity risk. Journal of Mathematical Economics 45: 738–50. [Google Scholar] [CrossRef]

- Carr, Peter, Helyette Geman, and Dilip B. Madan. 2001. Pricing and Hedging in Incomplete Markets. Journal of Financial Economics 62: 131–67. [Google Scholar] [CrossRef]

- Carr, Peter, and Qiji Jim Zhu. 2018. Convex Duality and Financial Mathematics. Berlin and Heidelberg: Springer. [Google Scholar]

- Cherny, Alexander, and Dilip B. Madan. 2009. New Measures for Performance Evaluation. Review of Financial Studies 22: 2571–606. [Google Scholar] [CrossRef]

- Cherny, Alexander, and Dilip B. Madan. 2010. Markets as a Counterparty: An Introduction to Conic Finance. International Journal of Theoretical and Applied Finance 13: 1149–77. [Google Scholar]

- Constantinides, George M. 1986. Capital Market Equilibrium with Transaction Costs. Journal of Political Economy 94: 842–62. [Google Scholar] [CrossRef]

- Copeland, Thomas E., and Dan Galai. 1983. Information Effects on the Bid-Ask Spread. Journal of Finance 38: 1457–69. [Google Scholar] [CrossRef]

- Delbaen, Freddy, and Walter Schachermayer. 1994. A General Version of the Fundamental Theorem of Asset Pricing. In The Mathematics of Arbitrage. Berlin and Heidelberg: Springer, pp. 149–205. [Google Scholar]

- Eberlein, Ernst, Thomas Gehrig, and Dilip B. Madan. 2009. Accounting to Acceptability: With Applications to the Pricing of One’s Own Credit Risk. Robert H. Smith School Research Paper No. RHS 06-113. SSRN Electronic Journal. [Google Scholar] [CrossRef][Green Version]

- Eberlein, Ernst, and Dilip B. Madan. 2009. Hedge fund performance: Sources and measures. International Journal of Theoretical and Applied Finance 12: 267–82. [Google Scholar] [CrossRef]

- Eberlein, Ernst, and Dilip B. Madan. 2012. Unbounded liabilities, capital reserve requirements and the tax payer put option. Quantitative Finance 12: 709–24. [Google Scholar] [CrossRef]

- Eberlein, Ernst, Dilip B. Madan, and Wim Schoutens. 2011. Modeling risk weighted assets and the risk sensitivity of related capital requirements. Journal of Risk, 16. [Google Scholar] [CrossRef][Green Version]

- Guasoni, Paolo, Emmanuel Lepinette, and Miklós Rasonyi. 2011. The Fundamental Theorem of Asset Pricing Under Transaction Costs. Boston U. School of Management Research Paper, No. 2011-7. Mathematical Finance 14: 19–48. [Google Scholar]

- Harrison, J. Michael, and David Kreps. 1979. Martingales and arbitrage in multi-period securities markets. Journal of Economic Theory 20: 381–408. [Google Scholar] [CrossRef]

- Harrison, J. Michael, and Stanley R. Pliska. 1981. Martingales and stochastic integrals in the theory of continuous trading. Stochastic Processes and Their Applications 11: 215–60. [Google Scholar] [CrossRef]

- Jacka, Saul D. 1992. A martingale representation, result and an application to incomplete financial markets. Mathematical Finance 2: 239–50. [Google Scholar] [CrossRef]

- Jouini, Elyès, and Hédi Kallal. 1995. Martingales and Arbitrage in Securities Markets with Transaction Costs. Journal of Economic Theory 66: 178–97. [Google Scholar] [CrossRef]

- Madan, Dilip B, and Wim Schoutens. 2011. Conic coconuts: The pricing of contingent capital notes using conic finance. Mathematics and Financial Economics 4: 87–106. [Google Scholar] [CrossRef]

- Madan, Dilip B., and Wim Schoutens. 2012. Structured products equilibria in conic two-price markets. Mathematics and Financial Economics March 6: 37–57. [Google Scholar] [CrossRef]

- Madan, Dilip B. 2012. A two price theory of financial equilibrium with risk management implications. Annals of Finance 8: 489–505. [Google Scholar] [CrossRef]

- Madan, Dilip B. 2015. Asset pricing theory for two price economies. Annals of Finance 11: 1–35. [Google Scholar] [CrossRef]

- Rogers, Leonard Christopher Gordon. 1994. Equivalent martingale measures and no-arbitrage. Stochastics and Stochastics Reports 51: 41–49. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vazifedan, M.; Zhu, Q.J. No-Arbitrage Principle in Conic Finance. Risks 2020, 8, 66. https://doi.org/10.3390/risks8020066

Vazifedan M, Zhu QJ. No-Arbitrage Principle in Conic Finance. Risks. 2020; 8(2):66. https://doi.org/10.3390/risks8020066

Chicago/Turabian StyleVazifedan, Mehdi, and Qiji Jim Zhu. 2020. "No-Arbitrage Principle in Conic Finance" Risks 8, no. 2: 66. https://doi.org/10.3390/risks8020066

APA StyleVazifedan, M., & Zhu, Q. J. (2020). No-Arbitrage Principle in Conic Finance. Risks, 8(2), 66. https://doi.org/10.3390/risks8020066