Pension Fund Management, Investment Performance, and Herding in the Context of Regulatory Changes: New Evidence from the Polish Pension System

Abstract

:1. Introduction

2. Background on Polish Pension Funds and Regulatory Changes

3. Literature Review

4. Material and Methods

5. Results and Discussion

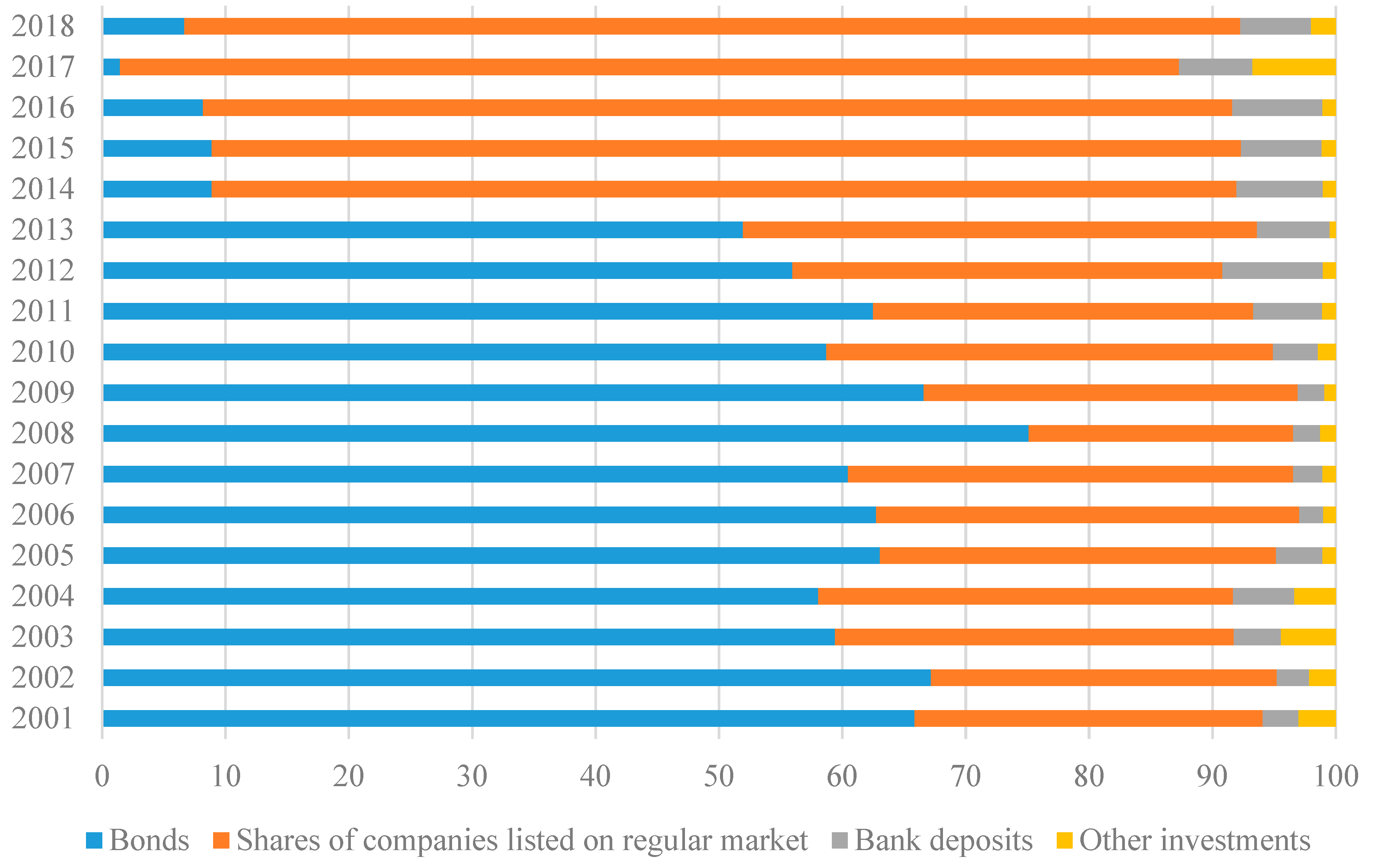

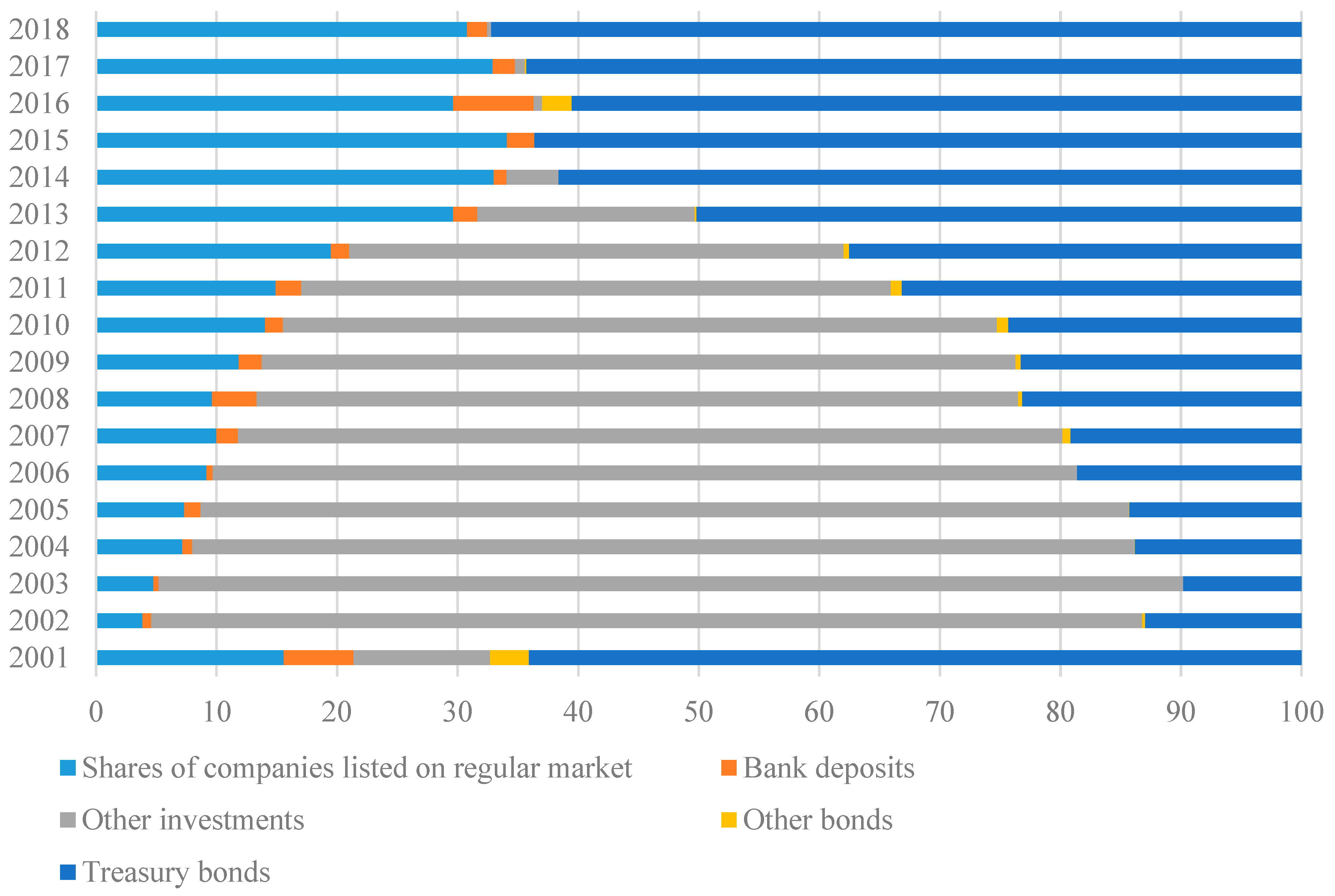

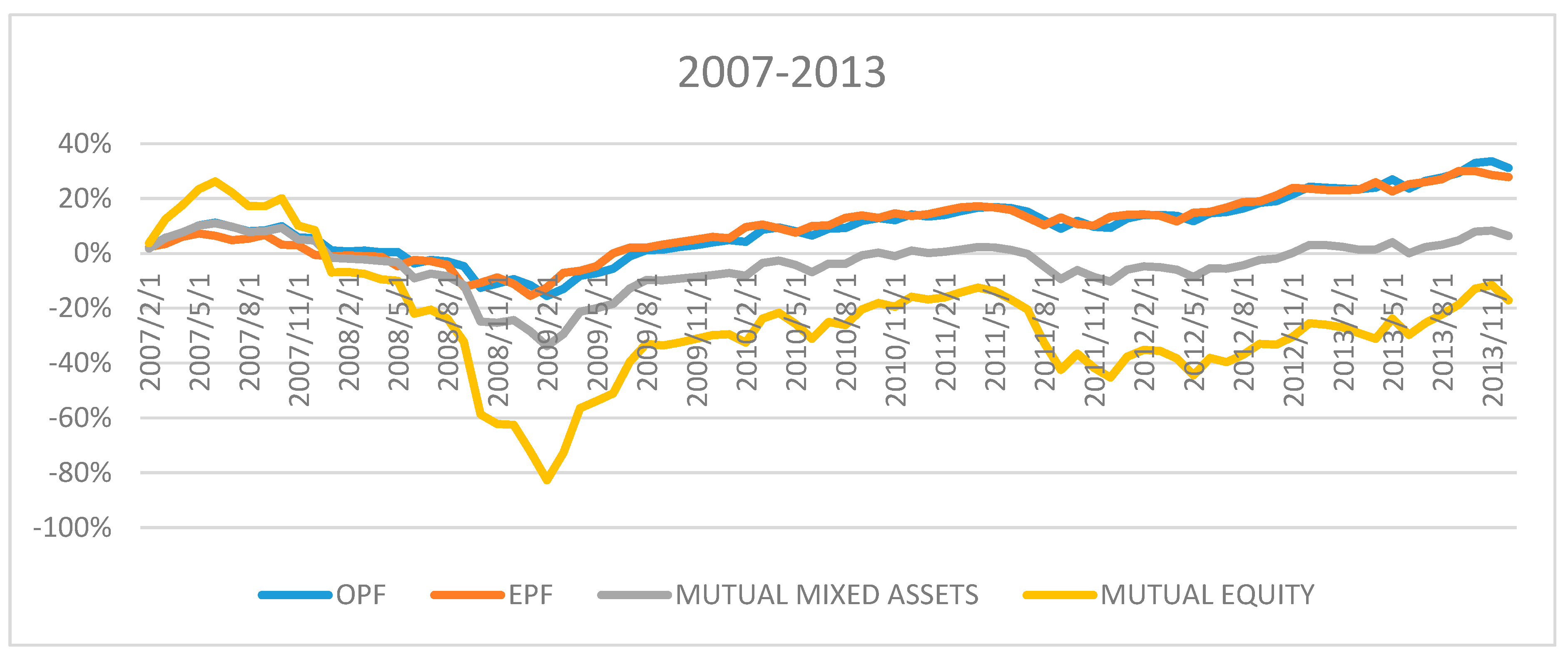

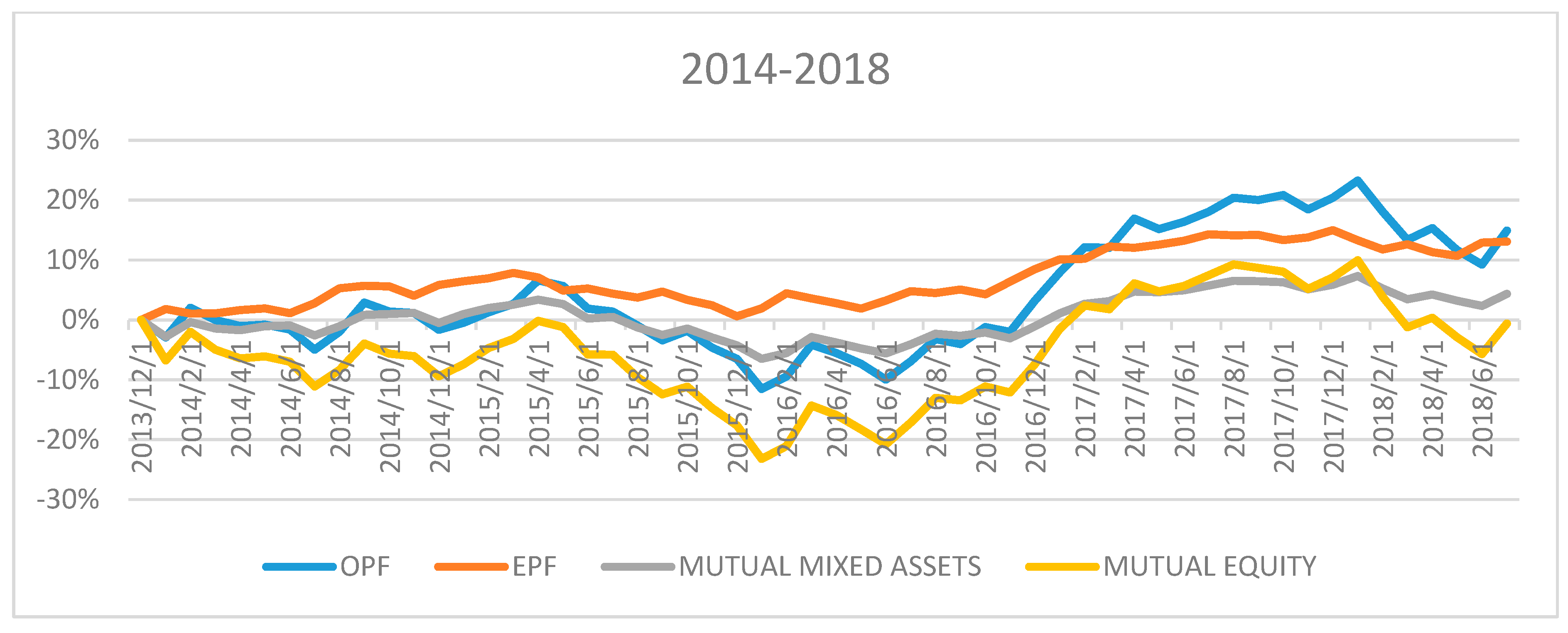

5.1. Management and Performance of Polish Pension Fund Group Portfolios

5.2. Herd Behavior

5.3. Management and Performance of OPFs’ Individual Portfolios—Robustness Tests

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Legal Basis | Scope of Introduced Changes |

|---|---|

| Act of 25 March 2011, amending certain acts related to the functioning of the social insurance system (Journal of Laws 2011, No. 75, item 398) | Contribution to the open pension fund was limited to 2.3% of gross salary (instead of the initial 7.3%). The remaining part of the contribution (previously due to OPFs) was to be transferred to special sub-accounts at ZUS, covered by inheritance right and indexed by the gross domestic product growth rate of the previous five years. |

| Gradual increase of OPFs’ investment limits in shares, from the initial 40% to 90% in 2034. | |

| Prohibition of acquisitions for OPFs; new agreements were to be concluded only by correspondence. | |

| Act of 11 May 2012, amending the act on pensions and disability pensions from the Social Insurance Fund and certain other acts (Journal of Laws 2012, item 637, of 2017, item 38) | Raising the minimum retirement age and making it equal for women and men at 67 years. |

| Act of 6 December 2013, amending certain acts in connection with the definition of rules for the payment of pensions from funds accumulated in OPFs (Journal of Laws 2013, item 1717) | Redemption of all OPFs assets invested in State Treasury debt instruments. |

| Transfer of the OPFs’ assets as government bonds and other Treasury securities, or with government guarantees to ZUS in the form of entries on individual sub-accounts of future pensioners and their subsequent redemption (51.5% of OPF assets worth PLN 153.15 billion). | |

| Introduction of voluntary membership in the OPF with the possibility of resignation from membership (during so-called transfer windows). | |

| New amount of contribution to OPFs at 2.92% of gross salary. | |

| Mandatory transfer of funds accumulated in OPFs to ZUS 10 years before retirement age (the so-called ‘safety slider’). | |

| Change in the investment policy of OPFs (prohibition to buy bonds of the State Treasury or NBP, an order to invest at least 75% of assets in shares). Elimination of the mechanism of the minimum required rate of return of OPFs and the mechanism of compensating for the shortage by CPS. | |

| Prohibition to advertise OPFs under the penalty of a large fine (form PLN 1 M to 3 M). | |

| Reduction of the fee from the contribution of OPF participants to the CPSs to a maximum of 1.75% of the contribution. | |

| Act of 16 November 2016, amending the act on pensions and disability pensions from the Social Insurance Fund and certain other acts (Journal of Laws 2017, item 38) | Lowering the retirement age to pre-reform levels (60 for women and 65 for men). |

References

- Adamska-Mieruszewska, Joanna, and Magdalena Mosionek-Schweda. 2015. Rozwój Indywidualnych Oszczędności Emerytalnych w Kontekście Skłonności Polaków Do Oszczędzania. Praca i Zabezpieczenie Społeczne 8: 3–19. [Google Scholar]

- Arellano, Manuel. 1987. Computing Robust Standard Errors for Within—Groups Estimators. Oxford Bulletin of Economics and Statistics 49: 431–34. [Google Scholar] [CrossRef]

- Bielawska, Kamila, Agnieszka Chłoń-Domińczak, and Dariusz Stańko. 2017. Retreat from Mandatory Pension Funds in Countries of the Eastern and Central Europe in Result of Financial and Fiscal Crisis. Causes, Effects and Recommendations for Fiscal Rules. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/83345 (accessed on 5 November 2020).

- Blake, David, Lucio Sarno, and Gabriele Zinna. 2017. The Market for Lemmings: The Herding Behavior of Pension Funds. Journal of Financial Markets 36: 17–39. [Google Scholar] [CrossRef]

- Bohl, Martin T., Judith Lischewski, and Svitlana Voronkova. 2011. Pension Funds’ Performance in Strongly Regulated Industries in Central Europe: Evidence from Poland and Hungary. Emerging Markets Finance and Trade 47: 80–94. [Google Scholar] [CrossRef]

- Choe, Hyuk, Bong Chan Kho, and René M. Stulz. 1999. Do Foreign Investors Destabilize Stock Markets? The Korean Experience in 1997. Journal of Financial Economics 54: 227–64. [Google Scholar] [CrossRef]

- Chybalski, Filip. 2007. Analiza Podobieństwa Portfeli Inwestycyjnych OFE z Wykorzystaniem Metod Taksonomicznych. Prace Naukowe Akademii Ekonomicznej We Wrocławiu 1159: 56–68. [Google Scholar]

- Chybalski, Filip. 2012. Uwarunkowania Konkurencji Na Rynku Funduszy Ememrytalnch Na Przykładzie OFE. Studia Ekonomiczne Regionu Łódzkiego, 243–55. Available online: http://212.51.210.149/handle/11652/835 (accessed on 5 November 2020).

- Coggin, T. Daniel, Frank J. Fabozzi, and Shafiqur Rahman. 1993. The Investment Performance of U.S. Equity Pension Fund Managers: An Empirical Investigation. The Journal of Finance 48: 1039–55. [Google Scholar] [CrossRef]

- Dopierała, Łukasz, Magdalena Mosionek-Schweda, and Daria Ilczuk. 2019. Mutual Funds as Instruments for Pension Security-the Case of Poland. Zeszyty Naukowe Politechniki Poznańskiej. Organizacja i Zarządzanie 80: 19–34. [Google Scholar] [CrossRef]

- Dopierała, Łukasz, Magdalena Mosionek-Schweda, and Daria Ilczuk. 2020. Does the Asset Allocation Policy Affect the Performance of Climate-Themed Funds? Empirical Evidence from the Scandinavian Mutual Funds Market. Sustainability 12: 654. [Google Scholar] [CrossRef] [Green Version]

- Dybał, Mariusz. 2018. Pracownicze Programy Emerytalne w Polsce. Ekonomia-Wroclaw Economic Review 23: 91–106. [Google Scholar] [CrossRef] [Green Version]

- Fama, Eugene F., and Kenneth R. French. 2018. Choosing Factors. Journal of Financial Economics 128: 234–52. [Google Scholar] [CrossRef]

- Frey, Stefan, Patrick Herbst, and Andreas Walter. 2007. Measuring Mutual Fund Herding—A Structural Approach. SSRN Electronic Journal. [Google Scholar] [CrossRef] [Green Version]

- Gökçen, Umut, and Atakan Yalçin. 2015. The Case against Active Pension Funds: Evidence from the Turkish Private Pension System. Emerging Markets Review 23: 46–67. [Google Scholar] [CrossRef] [Green Version]

- Grinblatt, Mark, Sheridan Titman, and Russ Wermers. 1995. Momentum Investment Strategies, Portfolio Performance, and Herding: A Study of Mutual Fund Behavior. The American Economic Review 85: 1088–105. [Google Scholar]

- Hoepner, Andreas G. F., and Lisa Schopohl. 2018. On the Price of Morals in Markets: An Empirical Study of the Swedish AP-Funds and the Norwegian Government Pension Fund. Journal of Business Ethics 151: 665–92. [Google Scholar] [CrossRef] [Green Version]

- Holzmann, Robert, and Richard Hinz. 2005. Old-Age Income Support in the 21st Century. Old-Age Income Support in the 21st Century. Washington: The World Bank. [Google Scholar] [CrossRef]

- Karpio, Andrzej, and Dorota Żebrowska-Suchodolska. 2014. Efektywność Inwestycyjna Funduszy Emerytalnych Na Tle FIO Stabilnego Wzrostu. Zeszyty Naukowe Uniwersytetu Szczecińskiego: Finanse, Rynki Finansowe, Ubezpieczenia 75: 221–31. Available online: https://www.ceeol.com/search/article-detail?id=472627 (accessed on 10 November 2020).

- Karpio, Andrzej, and Dorota Żebrowska-Suchodolska. 2017. The Investment Effectiveness of Polish Pension Funds During the Changes of Market Benchmark. Annales Universitatis Mariae Curie-Skłodowska, Sectio H, Oeconomia 51: 149. [Google Scholar] [CrossRef] [Green Version]

- Kominek, Zbigniew. 2012. Regulatory Induced Herding? Evidence from Polish Pension Funds. Economic Change and Restructuring 45: 97–119. [Google Scholar] [CrossRef]

- Kurach, Radosław. 2019. Do They Beat the Market in the New Regulatory Environment—The Case of Polish Pension Funds. Economic Research-Ekonomska Istraživanja 32: 370–83. [Google Scholar] [CrossRef] [Green Version]

- Kyrolainen, Petri Juhani, and Jukka Perttunen. 2003. Investors’ Activity and Trading Behavior. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Lakonishok, Josef, Andrei Shleifer, and Robert W. Vishny. 1992. The Impact of Institutional Trading on Stock Prices. Journal of Financial Economics 32: 23–43. [Google Scholar] [CrossRef] [Green Version]

- Lobão, Júlio, and Ana Paula Serra. 2007. Herding Behavior: Evidence from Portuguese Mutual Funds. In Diversification and Portfolio Management of Mutual Funds. Edited by Greg N. Gregoriou. London: Palgrave Macmillan, pp. 167–97. [Google Scholar] [CrossRef]

- Marcinkiewicz, Edyta. 2015. Zachowania Stadne i Konkurencja Na Rynku OFE. Badanie Empiryczne z Wykorzystaniem Wielowymiarowej Analizy Statystycznej. Marketing i Rynek 5: 1067–80. [Google Scholar]

- Merli, Maxime, and Tristan Roger. 2013. What Drives the Herding Behavior of Individual Investors? Finance 34: 67. [Google Scholar] [CrossRef] [Green Version]

- Mikulec, Artur. 2004. Ocena Efektywności Inwestowania Otwartych Funduszy Emerytalnych. Wiadomości Statystyczne 9: 26–39. Available online: https://www.infona.pl/resource/bwmeta1.element.ekon-element-000000123369 (accessed on 10 November 2020).

- Mohamed, Arouri, Raphaëlle Bellando, Sébastien Ringuedé, and Anne-Gael Vaubourg. 2012. Institutional Herding in Stock Markets: Empirical Evidence from French Mutual Funds. SSRN Electronic Journal 1992: 1–42. [Google Scholar] [CrossRef]

- Newey, Whitney K., and Kenneth D. West. 1994. Automatic Lag Selection in Covariance Matrix Estimation. The Review of Economic Studies 61: 631–53. [Google Scholar] [CrossRef]

- Oehler, Andreas, and George Goeth-Chi Chao. 2000. Institutional Herding in Bond Markets. Diskussionsbeiträge-Bank-Und Finanzwirtschaftliche Forschung (BAFIFO), 13. Available online: https://www.econstor.eu/bitstream/10419/22491/1/bafifo13.pdf (accessed on 9 November 2020).

- Polish Financial Supervision Authority. 2020. Website of the Polish Financial Supervision Authority. Available online: https://www.knf.gov.pl/en/ (accessed on 5 June 2020).

- Rutecka, Joanna. 2014. System Emerytalny Po Zmianach Od 2014 Roku. Ubezpieczenia Społeczne. Teoria i Praktyka 1: 2–7. Available online: http://www.academia.edu/download/47475806/System_emerytalny_po_zmianach_od_2014_ro20160724-1677-15l6y0r.pdf (accessed on 4 November 2020).

- Sierocka, Iwona. 2010. Pracownicze Programy Emerytalne. Białystok: Temida 2. [Google Scholar]

- Superintendency of Pension Funds. 2000. Security Through Competition. Performance Analysis of the Second Pillar. Warsaw: Superintendency of Pension Funds. [Google Scholar]

- Szczepański, Marek, and Tomasz Brzęczek. 2016. Zarządzanie Ryzykiem w Pracowniczych Programach Emerytalnych. Poznań: Polskie Towarzystwo Ekonomiczne. [Google Scholar]

- Urząd Komisji Nadzoru Finansowego. 2014. Informacja o Działalności Inwestycyjnej Funduszy Emerytalnych w Okresie 31.03.2011-31.03.2014. Warszawa: Urząd Komisji Nadzoru Finansowego. [Google Scholar]

- Urząd Komisji Nadzoru Finansowego. 2017. Informacja o Działalności Inwestycyjnej Funduszy Emerytalnych w Okresie 31.03.2014-31.03.2017. Warszawa: Urząd Komisji Nadzoru Finansowego. [Google Scholar]

- Voronkova, Svitlana, and Martin T. Bohl. 2005. Institutional Traders’ Behavior in an Emerging Stock Market: Empirical Evidence on Polish Pension Fund Investors. Journal of Business Finance and Accounting 32: 1537–60. [Google Scholar] [CrossRef]

- Ważna, Elżbieta. 2017. Efektywność Inwestowania Otwartych Funduszy Inwestycyjnych w Polsce w Latach 2007–2014. Zeszyty Naukowe Uczelni Vistula 56: 64–83. Available online: http://yadda.icm.edu.pl/yadda/element/bwmeta1.element.desklight-4df279ea-97d2-4dcf-b1ae-87cf1be6a3f7 (accessed on 3 November 2020).

- Witkowska, Dorota, and Krzysztof Kompa. 2015. Ocena Efektywności Funduszy Emerytalnych z Wykorzystaniem Metod Porządkowania Liniowego. Metody Ilościowe w Badaniach Ekonomicznych/Szkoła Główna Gospodarstwa Wiejskiego 16: 191–200. [Google Scholar]

- Witkowska, Dorota. 2017. Zmiana Warunków Funkcjonowania a Efektywność Inwestycyjna Otwartych Funduszy Emerytalnych. Łódź: Wydawnictwo Uniwersytetu Łódzkiego. [Google Scholar]

- Zaremba, Adam. 2020. Fama-French Factors: Market (MKT), Size (SMB), Value (HML), Momentum (WML), Profitability (RMW), Investment (CMA). Available online: http://adamzaremba.pl/downloadable-data/ (accessed on 15 June 2020).

- Zhu, Lei, Huimin Li, and Dazhi Zheng. 2020. Institutional Industry Herding in China. Chinese Economy 53: 246–64. [Google Scholar] [CrossRef]

| Type of Instrument | 12.5.1998 | 03.2.2004 | 26.4.2011 | 17.1.2014 |

|---|---|---|---|---|

| Bonds, bills and other securities issued by the State Treasury or the Polish Central Bank | No limits | 0% | ||

| Shares of companies listed on the regulated stock exchange, including subscription rights, rights to shares and bonds convertible to shares since 2004 | 40% regulated stock market; 10% parallel and free market; 5% free market | 40% | Planned 90% | Min. 75% until 31.12.2014; min. 55% until 31.12.2015; 35% until 31.12.2016; 15% until 31.12.2017 |

| Shares of companies listed on the OTC market | 10% | |||

| National Investment Funds | 10% | 40% | - | - |

| Investment certificates and units of investment funds | 10% investment certificates; 15% participation units | |||

| Bonds and other debt securities issued by local government units | 15% (5% not admitted to public trading) | 40% (20% bonds other than dematerialized) | ||

| Fully secured bonds issued by entities other than local government units | 10% (5% not admitted to public trading) | 20% (10% not admitted to public trading) | 40% (10% bonds other than dematerialized) | |

| Covered bonds | 30% since 2001 | 40% | ||

| Depositary Receipts | - | 10% | ||

| Bank deposits and bank securities | 20% | |||

| OPF | EPF | MUTUAL MIXED ASSETS | MUTUAL EQUITY | |

|---|---|---|---|---|

| Panel A: 2007–2013 | ||||

| Alpha | 0.0024 *** | 0.0023 *** | −0.0006 | −0.0026 *** |

| WIG | 0.3453 *** | 0.3257 *** | 0.4615 *** | 0.9564 *** |

| SMB | −0.0307 | −0.0172 | 0.0027 | 0.0531 * |

| HML | −0.0549 * | −0.0605 * | −0.0548 ** | −0.0391 |

| RMW | −0.0064 | −0.0167 | −0.0023 | 0.0216 |

| CMA | 0.0535 ** | 0.0404 | 0.0217 | 0.0272 |

| UMD | 0.0153 | −0.0099 | −0.0166 * | 0.0154 |

| GLOB | −0.0054 | 0.0079 | 0.0587 *** | 0.0718 ** |

| BOND | −3.4474 *** | −3.5877 *** | −2.1113 ** | −0.4699 |

| SPREAD | 4.4712 ** | 2.9832 | 1.5102 | −1.2760 |

| CRPB | −0.1812 * | 0.0131 | −0.0412 | −0.8058 ** |

| Observations | 84 | 84 | 84 | 84 |

| R2 | 0.949 | 0.949 | 0.977 | 0.989 |

| Adj. R2 | 0.942 | 0.942 | 0.974 | 0.988 |

| Panel B: 2014–2018 | ||||

| Alpha | 0.0033 ** | 0.0054 *** | 0.0022 | −0.0001 |

| WIG | 0.8695 *** | 0.3677 *** | 0.4396 *** | 1.0191 *** |

| SMB | 0.1325 *** | 0.0452 ** | 0.0526 ** | 0.1799 *** |

| HML | −0.0392 | −0.0346 | −0.0177 | 0.0069 |

| RMW | −0.0371 | 0.0167 | 0.0453 ** | 0.0737 *** |

| CMA | −0.0742 *** | −0.0274 | −0.0271 | −0.0199 |

| UMD | 0.0497 *** | −0.03390 ** | −0.0177 | 0.0428 * |

| GLOB | 0.0997 *** | 0.0342 | 0.0912 *** | 0.1201 *** |

| BOND | −0.1355 | −4.9385 *** | −3.1372 | −0.3179 |

| SPREAD | −3.1892 | −0.0101 | −0.4150 | −2.7651 |

| CRPB | 0.3549 * | 0.0413 | −0.0051 | 0.0579 |

| Observations | 53 | 53 | 53 | 53 |

| R2 | 0.985 | 0.938 | 0.956 | 0.987 |

| Adj. R2 | 0.982 | 0.924 | 0.945 | 0.984 |

| Asset Classes | Deposits | Government Bonds | Corporate Bonds | Polish Shares |

|---|---|---|---|---|

| Fixed effect model | ||||

| Lagged distance | −0.2927 *** | −0.1820 *** | 0.0001 | −0.2153 *** |

| Lagged return distance | 0.0829 | 0.1995 | 0.0242 | −0.2998 ** |

| WIBOR | 2.4301 | −3.4997 | −0.0447 | 0.4999 |

| WIG | −0.0031 | −0.0112 | 0.0031 | 0.0127 |

| BOND | 2.7049 | −3.3870 | −0.1569 | 3.9392 *** |

| SPREAD | 16.3471 ** | −19.3926 *** | 1.3856 | −0.1748 |

| CRPB | −0.3214 *** | 0.2294 ** | 0.0087 | 0.0894 |

| CONSTANT | −0.0221 | 0.0332 *** | 0.0005 | −0.0194 *** |

| LSDV R2 | 0.134 | 0.091 | 0.029 | 0.076 |

| Random effect model | ||||

| Lagged distance | −0.2246 *** | −0.1027 *** | 0.0002 | −0.1516 *** |

| Lagged return distance | 0.0715 | 0.0344 | 0.0060 | −0.1015 * |

| WIBOR | 2.4520 | −4.9325 *** | −0.1622 | 1.7763 * |

| WIG | −0.0034 | −0.0096 | 0.0031 | 0.0115 |

| BOND | 2.0691 | −2.0069 | −0.0862 | 3.2234 *** |

| SPREAD | 15.0285 *** | −20.4087 *** | 1.1985 | 2.2199 |

| CRPB | −0.3345 *** | 0.2491 ** | 0.0084 | 0.0816 |

| CONSTANT | −0.0191 | 0.0310 *** | 0.0006 | −0.0201 *** |

| R2 | 0.112 | 0.058 | 0.017 | 0.052 |

| Observations | 506 | 506 | 506 | 506 |

| Hausman test | 12.5018 | 16.9896 | 2.6169 | 13.0276 |

| Asset Classes | Deposits | Corporate Bonds | Polish Shares | Global Shares |

|---|---|---|---|---|

| Fixed effect model | ||||

| Lagged distance | −0.2014 *** | −0.1472 *** | −0.0803 *** | −0.0603 *** |

| Lagged return distance | 0.0116 | 0.0292 | −0.0529 | −0.0044 |

| WIBOR | −5.7654 *** | −5.3346 *** | 2.3581 | 1.6993 |

| WIG | −0.0080 | −0.0265 ** | −0.0374 ** | 0.0157 |

| GLOB | −0.0652 *** | −0.0317 *** | 0.0581 *** | 0.0138 |

| CRPB | −0.1952 ** | −0.0870 * | 0.2697 *** | 0.0222 |

| CONSTANT | 0.0095 *** | 0.0071 *** | −0.0023 | −0.0032 |

| LSDV R2 | 0.114 | 0.133 | 0.066 | 0.027 |

| Random effect model | ||||

| Lagged distance | −0.0639 *** | −0.0557 ** | −0.0084 | −0.0308 ** |

| Lagged return distance | 0.0067 | 0.0015 | 0.0019 | −0.0057 |

| WIBOR | −4.0722 *** | −6.3287 *** | 2.3650 ** | 1.1416 |

| WIG | −0.0008 | −0.0276 ** | −0.0366 ** | 0.0139 |

| GLOB | −0.0571 *** | −0.0360 *** | 0.0597 *** | 0.0110 |

| CRPB | −0.1495 ** | −0.0976 ** | 0.2701 *** | 0.0103 |

| CONSTANT | 0.0058 *** | 0.0086 *** | −0.0020 | −0.0025 |

| R2 | 0.055 | 0.108 | 0.051 | 0.014 |

| Observations | 550 | 550 | 550 | 550 |

| Hausman test | 35.3076 | 15.4841 | 7.2282 | 4.9271 |

| AEGON | Allianz | Aviva | AXA | Generali | MetLife | |

|---|---|---|---|---|---|---|

| Panel A: 2007–2013 | ||||||

| Alpha | 0.0021 *** | 0.0027 *** | 0.0022 *** | 0.0022 *** | 0.0025 *** | 0.0029 *** |

| WIG | 0.3430 *** | 0.3321 *** | 0.3656 *** | 0.3271 *** | 0.3223 *** | 0.3477 *** |

| SMB | −0.0415 | −0.0508 * | −0.0556 * | −0.0480 * | 0.0076 | −0.0358 |

| HML | −0.0550 | −0.0449 | −0.0657 ** | −0.0477 | −0.0251 | −0.0595 * |

| RMW | −0.0047 | −0.0161 | 0.0012 | 0.0049 | −0.0194 | 0.0096 |

| CMA | 0.0742 *** | 0.0561 ** | 0.0646 *** | 0.0570 ** | 0.0304 | 0.0494 * |

| UMD | 0.0145 | 0.0303 ** | 0.0161 | 0.0195 * | 0.0038 | 0.0072 |

| GLOB | −0.0023 | −0.0148 | 0.0068 | −0.0188 | 0.0105 | 0.0039 |

| BOND | −3.3684 *** | −3.9718 *** | −2.8231 *** | −3.2165 *** | −4.2561 *** | −3.4261 *** |

| SPREAD | 4.0215 | 4.8896 * | 3.9432 * | 4.0718 * | 5.0825 *** | 4.3206 ** |

| CRPB | −0.1933 | −0.2331 | −0.1658 | −0.1496 | −0.0440 | 0.1477 |

| Observations | 84 | 84 | 84 | 84 | 84 | 84 |

| R2 | 0.939 | 0.933 | 0.951 | 0.948 | 0.952 | 0.948 |

| Adj. R2 | 0.931 | 0.924 | 0.945 | 0.941 | 0.946 | 0.941 |

| Panel B: 2014–2018 | ||||||

| Alpha | 0.0011 | 0.0048 *** | 0.0028 * | 0.0051 *** | 0.0028 * | 0.0032 |

| WIG | 0.7734 *** | 0.8086 *** | 0.8477 *** | 0.8150 *** | 0.8257 *** | 0.8840 *** |

| SMB | 0.0523 | 0.1601 *** | 0.1196 *** | 0.0886 ** | 0.1093 *** | 0.1388 *** |

| HML | −0.0226 | −0.0763 ** | −0.0406 | −0.0310 | 0.0496 * | −0.0167 |

| RMW | −0.0496 | −0.0487 | −0.0052 | −0.0591 ** | −0.0252 | 0.0009 |

| CMA | −0.0850 *** | −0.0824 ** | −0.0601 ** | −0.0582 * | −0.0895 ** | −0.0556 |

| UMD | 0.0174 | 0.0433 ** | 0.0411 ** | 0.0444 ** | 0.0388 * | 0.0650 * |

| GLOB | 0.0743 * | 0.0934 *** | 0.0763 *** | 0.0744 *** | 0.0788 *** | 0.0934 *** |

| BOND | −3.9412 | −2.0145 | 2.1470 | −1.4401 | 0.3951 | −0.1140 |

| SPREAD | 3.7168 | −2.0158 | −5.1605 | −3.5094 | −4.0616 | −2.7850 |

| CRPB | 0.1861 | 0.5762 ** | 0.3962 * | 0.2728 | 0.5108 *** | 0.3255 |

| Observations | 53 | 53 | 53 | 53 | 53 | 53 |

| R2 | 0.966 | 0.973 | 0.980 | 0.977 | 0.982 | 0.9715 |

| Adj. R2 | 0.958 | 0.967 | 0.975 | 0.971 | 0.977 | 0.9647 |

| NN | Nordea | Peakao | PKO BP | Pocztylion | PZU | |

|---|---|---|---|---|---|---|

| Panel A: 2007–2013 | ||||||

| Alpha | 0.0030 *** | 0.0029 *** | 0.0023 *** | 0.0026 *** | 0.0020 ** | 0.0025 *** |

| WIG | 0.3780 *** | 0.3425 *** | 0.3525 *** | 0.3364 *** | 0.3418 *** | 0.3647 *** |

| SMB | −0.0485 * | −0.0376 | −0.0050 | −0.0368 | −0.0355 | −0.0328 |

| HML | −0.0935 ** | −0.0648 * | −0.0428 | −0.0603 * | −0.0545 | −0.0750 * |

| RMW | −0.0069 | 0.0011 | −0.0165 | −0.0121 | −0.0118 | −0.0163 |

| CMA | 0.0889 *** | 0.0482 ** | 0.0452 | 0.0580 ** | 0.0679 ** | 0.0458 |

| UMD | 0.0029 | 0.0239 ** | 0.0419 *** | 0.0107 | 0.0165 | 0.0223 * |

| GLOB | 0.0143 | −0.0005 | −0.0258 | −0.0046 | −0.0011 | −0.0024 |

| BOND | −3.0917 ** | −3.6558 *** | −3.7743 *** | −3.5185 *** | −3.1979 *** | −3.5111 *** |

| SPREAD | 4.7760 ** | 4.6772 ** | 4.5654 * | 5.4740 ** | 3.9660 * | 3.6991 |

| CRPB | −0.1724 | −0.1495 | −0.2709 ** | −0.2070 * | 0.1963 | −0.1778 |

| Observations | 84 | 84 | 84 | 84 | 84 | 84 |

| R2 | 0.946 | 0.945 | 0.932 | 0.940 | 0.936 | 0.944 |

| Adj. R2 | 0.938 | 0.938 | 0.923 | 0.931 | 0.927 | 0.936 |

| Panel B: 2014–2018 | ||||||

| Alpha | 0.0017 | 0.0027 | 0.0016 | 0.0059 ** | 0.0037 ** | 0.0046 * |

| WIG | 0.9115 *** | 0.8658 *** | 0.9738 *** | 0.8628 *** | 0.9172 *** | 0.9404 *** |

| SMB | 0.1510 *** | 0.1243 *** | 0.1273 *** | 0.1190 ** | 0.2134 *** | 0.1680 *** |

| HML | −0.0210 | −0.0493 | −0.0229 | −0.0645 | −0.0677 * | −0.0261 |

| RMW | −0.0405 | −0.0242 | −0.0261 | −0.075 | −0.0409 | −0.0473 |

| CMA | −0.0634 * | −0.0978 *** | −0.0465 | −0.077 | −0.0961 ** | −0.0717 |

| UMD | 0.0645 *** | 0.0683 *** | 0.0645 *** | 0.0264 | 0.0595 *** | 0.0654 ** |

| GLOB | 0.1246 *** | 0.0916 *** | 0.0980 *** | 0.1286 *** | 0.0856 *** | 0.1808 *** |

| BOND | 3.1843 | 0.7746 | 1.2531 | 0.0365 | −3.0456 | 3.0128 |

| SPREAD | −5.6159 | −1.6956 | −3.8552 | −5.5034 | 0.0202 | −8.0206 |

| CRPB | 0.3764 ** | 0.3451 | 0.2477 | −0.0126 | 0.4608 ** | 0.5360 * |

| Observations | 53 | 53 | 53 | 53 | 53 | 53 |

| R2 | 0.982 | 0.979 | 0.975 | 0.953 | 0.975 | 0.961 |

| Adj. R2 | 0.978 | 0.973 | 0.970 | 0.942 | 0.969 | 0.951 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dopierała, Ł.; Mosionek-Schweda, M. Pension Fund Management, Investment Performance, and Herding in the Context of Regulatory Changes: New Evidence from the Polish Pension System. Risks 2021, 9, 6. https://doi.org/10.3390/risks9010006

Dopierała Ł, Mosionek-Schweda M. Pension Fund Management, Investment Performance, and Herding in the Context of Regulatory Changes: New Evidence from the Polish Pension System. Risks. 2021; 9(1):6. https://doi.org/10.3390/risks9010006

Chicago/Turabian StyleDopierała, Łukasz, and Magdalena Mosionek-Schweda. 2021. "Pension Fund Management, Investment Performance, and Herding in the Context of Regulatory Changes: New Evidence from the Polish Pension System" Risks 9, no. 1: 6. https://doi.org/10.3390/risks9010006

APA StyleDopierała, Ł., & Mosionek-Schweda, M. (2021). Pension Fund Management, Investment Performance, and Herding in the Context of Regulatory Changes: New Evidence from the Polish Pension System. Risks, 9(1), 6. https://doi.org/10.3390/risks9010006