1. Introduction

This paper grew out of a project looking into how to decrease political risk while complying with the European Union regulations on corporate reporting practices and obligations for mining in conflict-affected and high-risk areas (CAHRAs). These areas can be used as bases to fund conflicts and often result in human rights violations and environmental degradation, among other things. It is apparent that conflict and sustainability are connected in many ways, yet this connection often is overlooked in the methodologies and analyses that come from the political risk and sustainability analysis companies. This gap is important, not least because it means that investors who rely on those ratings and indices to decide on where and how to invest very likely miss the links as well, ironically potentially increasing their own risk. As the climate crisis, social inequality and political polarization grow, we would do well to ask the following: how is it that political risk and sustainability remain siloed in companies that provide risk analyses? Finding an explanatory foundation will help us to formulate better measures that can contribute to mitigating some of the threats we face.

I begin by presenting a general conceptualization of sustainability from the current mainstream business perspective as a focus on social, environmental and governance (ESG) business practices. I consider the 17 UN Sustainable Development Goals (SDGs) as fundamental in framing how ESG works in practice. Since the adoption of the SDGs in 2015, businesses worldwide have been working to achieve these goals, though usually with neither enough resources nor uniform measurement tools, and definitely with mixed results.

However, companies that analyze a variety of business-related risk areas tend to overlook sustainability as a political risk component as well as potential political risk exacerbator. Without mitigation and adaptation supports, more extreme weather events will increasingly cause people to migrate, movements that have serious potential to increase the stress on the resources of host populations and related conflict. The UN estimates that in 2018 alone there were 17.2 million new displacements because of heightened disasters.

1 The resource stress these large movements of people can cause is just one way that political risk can be tied to sustainability.

I first present a theoretical approach to understanding why sustainability has been largely decoupled from political risk by analysts and other experts. I next outline my materials and methods, and then present the results. I conclude the paper by providing some recommendations on further research and other steps we can take to move towards integrating political risk and sustainability analyses. Because of the importance of integrating political risk and sustainability rather than siloing them into mutually exclusive categories, this study contributes to the knowledge base by exploring the risk companies’ worldviews and making recommendations on how to challenge them. In this way, we can contribute to developing solutions that generate lasting sustainability rather than focusing on short-term business-centered practices that ultimately threaten sustainability.

2. Theoretical Approach

Political risk analysis and sustainability practices for companies can be complicated. Understanding and trying to simplify these practices were important before, but are ever more pressing during and after the COVID-19 reality. It is especially important to untangle the complex intersections between political risk and the ESG of corporate sustainability and related societal outcomes. This section provides a summary of the literature reviewed for this paper and a grounded theory exploratory approach on the political risk and sustainability question. First, I outline the social construction of risk and the role epistemic cultures have in maintaining enclaves of what is considered appropriate or ‘credible’ knowledge. I then turn to how corporate sustainability can be viewed as moving through sustainability stages and the importance of worldviews in how corporations practice sustainability as viewed through a close examination of their corporate communication as a set. This section concludes with the contribution ‘hybrid knowledge’ can make to the political risk and sustainability discussion.

2.1. A Socially Constructed Perspective of Risk

[because] common understandings of risk are related intrinsically to value, norms, morality, conventions, institutions, interests, power relations, knowledge claims and the production and negotiation of meaning, it makes sense to claim that factual scientific descriptions in terms of probability, causal relationships and material properties of objects hardly exhaust the meanings of and practices related to risk in society.

What Boholm addresses here is that risk is both subjective and objective, although the latter tends to be what risk experts use to inform risk analysis.

Communication is a key aspect of constructing risk. Because it is not an existing external given, risk requires continual communication (e.g., see

Zinn 2008;

Tulloch 2008;

Maguire and Hardy 2013;

Boholm 2015). This communication is closely tied to the worldviews formed around perceptions of risk. Based on the role of social agreements and individual perceptions coupled with the role of values, it follows that risk analysis is conducted through how the analysts value their risk objects and indicators. This valuation is conducted both individually by analysts and as based on the larger context in which the analysts operate, for example, as informed by the worldviews of the various risk ratings agencies. This claim refers back to the social construction of risk with the addition that these constructions are at least in part due to “the social relations of those perceiving and analyzing [the risks]” (

Johnson and Swedlow 2019, p. 2; see also

Maskrey et al. 2021). That means that the selection of the data and materials (whether for quantitative, qualitative or mixed assessments) as well as the way risk companies communicate these data and other materials also play key roles in which the intersection between political risk and sustainability is overlooked.

This perspective regarding worldviews is supported by the research on epistemic cultures. These epistemic cultures are the “constellation of methodological strategies, theoretical assumptions and practical-experimental settings which define in every specialty the ways how we know what we know” (

Böschen 2009, p. 508). Furthermore, within these epistemic cultures, knowledge is based on credibility (

Hessels et al. 2019;

Swedlow 2007). Who is doing the knowing matters, meaning it is not just whether someone is in a given field: those ‘outside’ of a discipline as well as those considered less ‘credible’ within a discipline can be excluded from deciding what counts as knowledge (

Swedlow 2007). In this way, selecting risk areas and assigning risk depends on what is valued by whom. Whether and how risk analysts attribute risk to objects and processes depends on “how groups and organisations in society frame an issue, how meaning is created, how arguments are made, how action is mobilised and how social and political processes emerge and develop, driven by, among other things, scientific facts and their interpretation” (

Boholm 2015, p. 13; see also

Taarup-Esbensen 2019). That ‘value’ is an important part of evaluating what is at risk further supports the idea that the objective approach of assuming risk in general as a separate factor that is independent from the external world falls short of a definition of risk that incorporates value. Instead, what is needed is an approach that brings together the factual (objective) aspects of risk with the human experience (subjective), i.e., an understanding of risk as socially constructed rather than something that can ‘simply’ be assigned a monetary ‘value’.

Boholm (

2015, p. 14) argues the need to bring together “natural characteristics, probability and cause and effect chains” along with “norms, values and subjective perceptions” as a way to bridge this divide.

Because of the complexities of contexts, it is an open question as to which objects get classified as risks (

Settembre-Blundo et al. 2021). Human observers are responsible for classifying risk; their own contexts and normative judgements impact which objects are valued and, therefore, increase the level of risk involved. These objects “cannot exist apart from their mode of symbolic, culturally informed representations or ‘valorisation’” (

Boholm 2015, p. 16; also see

Bolton and Landells 2015). I argue that examining the manner in how companies communicate political risk, we can get a clear sense of why particular objects are valorized and, thus, assigned a higher negative association with political risk and why others are not. This kind of approach assumes that risk is relational, i.e., that both the context and the analyst are central in assigning a value to an object, and that employing this kind of perspective broadens how we can understand the relationship between political risk and sustainability.

Hybrid knowledge responds to these boxed-in ideas of how we can approach risk for a variety of reasons. Epistemic cultures each have their own ways of constructing evidence, but would benefit from a deepening of “hybrid regimes of knowledge” by “looking at the complex interactions between institutional, discursive and practical rules affecting risk assessment” (

Böschen 2009, p. 509; also see

Seager 2008), an argument that lends itself to integrating political risk and sustainability. Boholm’s ideas on mixing objective and subjective knowledge play out here as well. Furthermore, a broader knowledge base on risk supports incorporating a broader set of stakeholders (

Stahl et al. 2003;

Sara et al. 2016), which inarguably can contribute to a broader range of knowledge.

This hybrid knowledge that is based on a socially constructed understanding of risk benefits the approach taken in this paper in two main ways. First, with integrating political risk and sustainability: hybrid knowledge incorporates more stakeholders which challenges epistemic cultures as narrowly bound enclaves. Second, within the sustainability spectrum discussed below: hybrid knowledge via a broader set of stakeholders likely would challenge the dominant human-centered approach set out by the neoclassical economic system.

2.2. Corporate Sustainability as a Spectrum

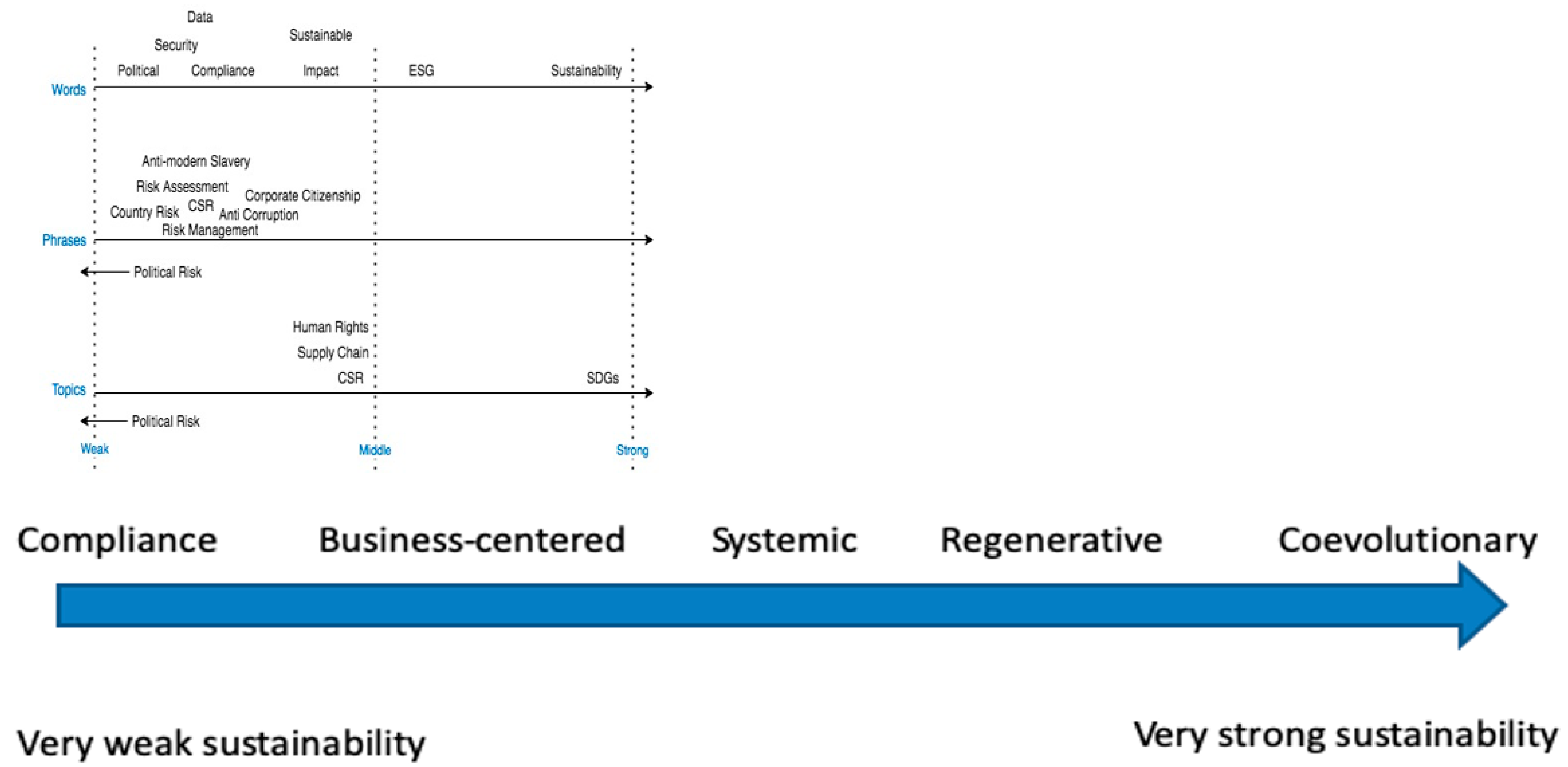

For this study, I turn specifically to

Landrum and Ohsowski’s (

2018) spectrum of stages along which corporate sustainability lands depending on how weak or strong the environment-related sustainability language is in their corporate reporting (see

Figure 1).

3 The authors outline the literature on worldviews as drivers of activities, stating that the way in which “a company defines and implements sustainability must be reflective of its worldview” and can be determined through how it communicates in its corporate reporting (

Landrum and Ohsowski 2018, p. 130). Landrum and Ohsowski analyze two kinds of corporate sustainability reports, finding that the dominant corporate sustainability worldview focuses on the business case for sustainability—which the authors describe as ‘do less bad’, and is the second weakest type just after only meeting minimum compliance requirements (

Landrum and Ohsowski 2018, p. 131).

Landrum and Ohsowski (

2018, p. 138) summarized the literature that supports why corporations emphasize business case sustainability in their reporting communication rather than challenge the status quo and move along the sustainability spectrum. In brief:

When behavioral and cultural responses (here, sustainability) become institutionalized, the status quo of human-centered economic and social systems makes it difficult to consider the more realistic approach that these systems are embedded in natural systems and not actually separate from them.

The notion of paradox in business sustainability and the “competing tensions between desirable outcomes at multiple levels and scales” cause a sort of paralysis between consideration of short- and long-term views; the three components of ESG; company and societal interests; sustainability and economic development; and, stakeholders and shareholders.

Related to the second point, the authors add that there are also tensions between what companies express they are doing and what they are doing in practice, the competing worldviews of human-centered and natural worlds and neoclassical economic models (which underlie the weak stages) and other ways of organizing the system (as needed to manifest the strong versions of sustainability).

The spectrum is also a useful tool for identifying commitments to the social and governance aspects of corporate sustainability business models. Through a look at how ESG and other sustainability terms are communicated in corporate materials (for example, as weak versus strong commitments), we can see similar parallels with how companies communicate environmental commitments and activities. Focusing on the business case for ESG rather than on the strong categories of sustainability that rest on the system change required for sustainability throws up a barrier to acknowledging the intersection of political risk and sustainability as well. In part, this barrier is due to the resistance to external influences, as seen in the credibility argument in the epistemic culture discussion above.

3. Materials and Methods

As described earlier, I am interested in how companies communicate political risk and sustainability, whether these two concepts are siloed or integrated, and if siloed, how we can understand this practice. In order to do so, I employed a grounded theory approach through which I explored the materials based on the assumptions that arose while first looking at the materials rather than coming into the project with a predetermined set of criteria (e.g., see

Cepellos and Tonelli 2020;

Kratochwil 2019). When treating the materials as representative of risk analysis more broadly rather than as individual company documents, I began to see that political risk and sustainability were often being siloed and treated separately. After systematically going through the materials, this siloed pattern clearly emerged across the dataset.

To process the materials, I used a large-N interpretive approach that combines content analysis based on frequencies for pattern finding and interpretive analysis that re-embeds the content from the frequency lists into their respective original contexts.

4 By doing so, I also accommodate

Boholm’s (

2015, p. 19) advice that “qualitative interpretative approaches can add to our understanding about the social and cultural constructions of risk messages”, while at the same time not losing the patterns that are illuminated by the content frequencies. This element is important because frequency can be a good indicator for the salience of particular representations (

Hermann 2009), here representations of whether companies that analyze political risk include sustainability in these analyses (e.g., see

Hasim et al. 2017). As an iterative process, this approach is highly useful for this type of study because it allows me to move back and forth in the data from frequency patterns to context analysis (

Jackson 2019).

To select my sample, I started with a list of companies produced through a market competitor search and with other risk company lists such as the one compiled by Columbia University’s School of International and Public Affairs (

SIPA n.d.) as well as from print media and professional journals. I further expanded this information by using a snowball technique to identify other firms that conduct various kinds of risk analysis for business (e.g., companies that provide global supply chain logistics management). The final list of companies also contained professional services firms that include risk analysis in parts of their portfolios, companies that include risk in their sustainability advisory services and firms that conduct market intelligence. In total, 37 companies were included in the study covering a total of 443 online documents collected on 28 and 29 October 2019 (these dates were chosen as a matter of convenience for data collection).

Table 1 provides a list of the companies.

I processed the company documents using a trial version of WordStat in order to generate frequencies for words, phrases and topics (discussed in the Results section below). I next organized the companies according to whether these words, phrases and topics were part of their own corporate communication in order to identify the original contexts for each item in the frequencies. I then re-embedded each of the words, phrases and topic keywords accordingly. Together, the frequency counts and the re-embedding process formulate the large-N interpretive analysis.

These company documents are treated as a corpus of outward-facing engagement with external audiences, and thus, together they form a representative sample of how risk companies as a group communicate about political risk and sustainability. Rather than claiming correlation and causality as expected in a large-N study, the frequencies here are indicators of potential patterns that can then be interpreted based on context. Through these documents, we can assess what the companies’ sustainability worldviews are based on by exploring what they present as risk, and how. It is possible, then, to compile this information to get an overall sense of the epistemic culture that influences these worldviews.

This study has some limitations. I used English-language sources, primarily because English is my research language and I am unfamiliar with doing content analysis in other languages. Partnering with a multilingual research team would broaden this analysis. In addition, some of the companies provide fewer and/or shorter online documents, so re-embedding is a crucial part of understanding the documents in order to not skew the overall findings toward the frequency counts used by the software to generate words/phrases/topics, though the solution is imperfect. While the large-N interpretive approach provides a solid starting point for combining frequencies and interpretation that can be useful for larger studies, a machine learning approach that jumps off from here could be beneficial for incorporating more documents from more companies. Furthermore, that the companies in the list are primarily headquartered in the UK and USA and a handful of other western European countries is in part because of the focus on English-language documents. However, it also is in part because many of the risk companies on the original list of potential cases do not publish their materials online. I discuss in the conclusions the potential for a mixed methods approach that would bring in additional information, for example via interviews.

4. Results

The frequencies and re-embedding process provided several results that support the assumption that the companies in this study treat political risk and sustainability as distinct and convey a business-centered understanding of sustainability, as stipulated by the

Landrum and Ohsowski (

2018) sustainability spectrum research. A deep dive into the topics indicates this siloing, especially seen when the re-embedding process shows that the political risk topic itself is devoid of links to sustainability. In the case of types of sustainability and the sustainability spectrum, the documents examined here often leave sustainability undefined and vague and/or do not provide specific actions or commitments related to sustainability. This section presents the results in more detail, beginning with exploring the findings for the topics followed by a discussion of sustainability and the sustainability spectrum.

4.1. Topics

By generating the frequencies of the main topics and then re-embedding the topics into the companies’ documents, the initial findings in this study support the position that there is a definitive separation between political risk and sustainability in how risk analysis companies approach the two. WordStat modeled eight topics in the set of documents: Political Risk, Sustainable Development Goals (SDGs), Corporate Social Responsibility (CSR), Human Rights, Supply Chain, Code of Conduct, Services and Solutions, and People and Employees. An examination of the words under each topic as well as re-embedding each topic into their original place in the documents indicated that Code of Conduct, Services and Solutions, and People and Employees were unsurprisingly frequent topics because companies often cover these areas in their corporate communication as a matter of business. I excluded these topics from the analysis and kept the remaining five (see

Table 2). The following discussion illustrates how the corporate communication treats political risk and sustainability. First, I turn to the overall topics before moving to where this communication falls on the sustainability spectrum.

4.1.1. Political Risk

Because the majority of the companies in the study focus on providing some kind of political risk analysis and other related services, unsurprisingly, Political Risk is the most frequent topic modeled by WordStat. With only two words in the list possibly related to sustainability, as anticipated, Political Risk as a topic is not linked with sustainability in the companies’ materials used here. While the inclusion of PRI (the Principles for Responsible Investing) can often be linked to sustainability in terms of ESG, there is little deeper explanation in the documents as to what PRI means to the individual firms and how PRI is achieved in practice. Furthermore, the term ‘economic’ is used in a variety of ways unrelated to sustainability regardless of type of sustainability discussed in terms of the Sustainability Spectrum. This lack of connection between political risk and sustainability supports the idea that these two areas are generally treated as separate phenomena in risk analyses.

4.1.2. Sustainable Development Goals + Corporate Social Responsibility

The topic Sustainable Development Goals (SDGs) has no obvious link to political risk in the companies’ documents. As a keyword, political risk is not part of this topic, nor are the SDGs part of the Political Risk topic. Instead, the SDG topic’s main words mostly have to do with the climate and carbon emissions. This focus indicates several things. First, these companies are concerned with the dominant corporate sustainability issue of the day: reducing greenhouse gas (GHG) emissions. In reviewing the documents when re-embedding this topic, there was no indication that these companies make a link between the goal of lowering GHG emissions and the political (or relatedly, social) implications of policy choices on whether and how to reduce these emissions. Furthermore, CSR is often explicitly or implicitly linked to sustainability and/or ESG. While nearly every company represented in the dataset reported on corporate social responsibility (CSR) in some form, CSR is not tied to political risk, regardless of whether companies explicitly link CSR to sustainability or ESG issues or leave it as something vague.

The omission of linking sustainability as an emissions problem and a political risk is a telling example of what these companies are missing. Not only is sustainability more than reducing emissions, GHG emissions are more than simply measuring, for example, air quality. There are many levels of tensions and policies that can arise related to GHG emissions from health care policy to budget allocations and so on—each with the potential to contribute to political risk and each with the potential to impact different communities differently. These kinds of impacts can threaten sustainability efforts and can cause more tensions and exacerbate existing problems. While phrases that cluster in this topic obviously include ‘sustainable development’ and ‘sustainable development goals’, the re-embedding process indicates that these terms are devoid of a link to ‘political risk’ in any meaningful way. These kinds of omissions point to an epistemic political risk culture and worldview that make it difficult to link political risk and sustainability, both conceptually and in practice.

4.1.3. Human Rights + Supply Chain

Human Rights (HRs) are primarily framed as part of the business model and potential impact. In the documents in the study, good HRs are about more than reporting and compliance, but the emphasis is on trying not to violate HRs. Political risk comes into play, for example, when companies warn about the potential loss of reputation due to doing business in politically unstable countries that violate human rights. However, by and large, these concerns are siloed away from sustainability. For example, the frequency of ‘procurement’ in the word list for the Supply Chain topic and the contexts that emerge when the word is re-embedded indicate at least some companies’ practice reflexivity in terms of their own sourcing policies for products and services used inhouse. This focus on procurement is tied to the notion that purchasing power has a role to play in sustainability. The narratives provided in the documents, however, are less about ecology-centered systemic rethinking and more about business-centered, weak sustainability, because procurement remains human-centered rather than about a shift to ecology-centered business decision making that leads to systemic change.

This focus on HRs in internal procurement is tied to the Supply Chain topic, similar to how the SDGs and CSR overlap in these documents. Oftentimes, how HRs are framed is nested into how companies approach modern anti-slavery commitments, though this only becomes evident during the re-embedding process. Here, links between HRs and basic ideas about ‘Do No Harm’ emerge largely as tied to supply chains and the standard anti-slavery and anti-human trafficking statements that are common business practice now, but with little detail to how these commitments are carried out.

There is also some indication that companies care about and try to support women’s empowerment as part of diversity, equity and inclusion programs. However, this empowerment seems to be important because companies are concerned with reputational risk. During the re-embedding process, both the anti-slavery and pro-women contexts indicate a business-centered concern rather than one that is meant to generate systemic change and the details on what companies are actually doing to meet these commitments vary significantly.

Re-embedding exposes how HRs are mostly linked to business practices and in terms of compliance and ethics but not necessarily in terms of sustainability and not directly linked to political risk. HRs might be part of a broader sustainability agenda, but companies are generally not making that connection explicit in their documents. While many of the companies covered in this study refer to company policies regarding internal HRs agendas, such as those pertaining to DEI, here, the link between HRs and supply chains stands out as a sustainability issue. To mention political risk, sustainability and supply chains together is the exception rather than the rule. When they are mentioned together is usually is broadly about SDG 16: Peace, Justice and Strong Institutions.

4.2. Sustainability in Words, Phrases and Topics

By using the companies’ own communication about political risk and sustainability, this spectrum can be an indication of these companies’ worldviews in general, and further illuminate why sustainability and political risk are treated separately. Re-embedding the words, phrases and topics to account for how the companies communicate about sustainability reinforces the finding that political risk and sustainability are siloed. Moreover, this process allows us to explore what kind of sustainability these companies convey when they do talk about sustainability—offering insight into what needs to be addressed in order to move towards an ecology-centered sustainability. Oftentimes, the words, phrases and topics related to sustainability are by and large not defined in the documents nor are impacts actions explicitly communicated, leaving the audience with an unclear understanding of how and to what extent, if at all, these companies implement sustainable practices.

Table 3 presents the frequencies that underlie the re-embedding process.

During the re-embedding process, I first identified three initial categories of sustainability (weak, middle, strong) within the frequencies for words/phrases/topics. These categories arose from how closely the words, phrases and topics in the frequency lists were associated with sustainability and with company actions toward impact (see

Figure 2). The categories are premised on the idea that transformational change requires transformational actions (see, e.g.,

Randers et al. 2018). Therefore, if companies talk about sustainability without offering concrete actionable solutions, then their commitment to sustainability is not strong. The weak category indicates that companies stated something about sustainability but leave what this means open to interpretation and offer no concrete actions tied to the reference. The middle category covers when companies made a link between the words, phrases or topics and a corporate sustainability policy but without offering clarification on how the policy is implemented. In the strong category, companies listed a specific, direct sustainability action or an SDG target that was explicitly attached to the words, phrases or topics. After that assessment, I considered which stage of the sustainability spectrum the categorizations represented. Although a comparison within this set of documents indicates the variation in how companies treat sustainability, the companies focus on business-centered approaches and Landrum and Ohsowski’s weak version of sustainability was predominant (see

Figure 3 for the comparison).

4.2.1. Words

I placed the words into two groups: sustainable (sustainable, sustainability and ESG) and other (impact, security, data, political and compliance). Overall, the ‘other’ group was composed of terms that were not associated with the sustainability terms. For example, when companies mentioned ‘security’, it was in reference to geopolitics, military or terrorism, with few mentions of the more obvious sustainability-related security issues, such as food security or human rights.

There were mixed results for the explicitly ‘sustainable’ group of words. ‘Sustainable’ edged towards weak or missing, along with a mix of middle and strong. In the weak category, companies tended to mention sustainable in reference to sustainable development or human rights but without anything about company policy or action. For the middle category, companies tended to refer to the SDGs but without a clear indication of their actions and results, for example when mentioning SDGs in relation to human rights, without providing details on what this relationship means and whether they met their company goals. For the strong category, companies reported their actions and progress towards their sustainability goals, which were also made explicit. For example, some companies were moving toward making ESG material in how they handle it both internally and for their clients. As for ‘sustainability’, companies communicated it along the same lines as they did ‘sustainable’, though with a slightly higher tendency toward strong. ‘ESG’ had the lowest frequency in this group, and tended towards the middle. At times, it was difficult to know what the reference was. For example, in some cases when using ‘sustainable’, it was unclear if the company meant ESG or if they were referring to financial viability more generally. This type of communication is likely difficult for the layperson to untangle as well. I did not code those instances.

Overall, the analysis of the word groups indicates that, regardless of which level of sustainability the companies referenced in their documents, the overall emphasis in the dataset is on the business case, with sustainability as human-centered, rather than ecology-centered.

4.2.2. Phrase and Topics

The phrase list had few phrases explicitly linked to sustainability (e.g., as described in the word group sustainable/sustainability/ESG above). In the cases where the phrases and sustainability are linked explicitly, it is often to the weak version of sustainability. For example, companies might tie risk management to ESG but without explaining how that works in practice. The topic model fell in the middle and weak categories, e.g., mentioning human rights but only as a signatory to an anti-slavery statement. The phrases and topics re-embedding support the word list conclusions.

4.3. Political Risk and Business-Centered Sustainability

The categorization process, especially with the word list, makes it possible to generate some overview findings of the companies in terms of their worldviews and the stages of the sustainability spectrum. Overall, as with Landrum and Ohsowski’s sustainability spectrum, the data indicate that the business case worldview is predominant in the dataset documents. While some of the companies in the study provide explanations on how they are implementing sustainability programs, the language in the documents show a view that is very business-oriented. As discussed earlier, this kind of position indicates a tie to the neoclassical economic worldview, which could inhibit companies from moving along the sustainability spectrum away from a human-centered approach and toward a more ecology-centered form of sustainability. It also could be an indication that the epistemic culture of companies that cover risk precludes them from readily accepting sustainability as linked to political risk.

Figure 3 juxtaposes the worldviews in the corporate documents against the sustainability spectrum, illustrating that the companies’ sustainability discourse ranges between Compliance and Business-centered.

5. Conclusions and Recommendations

This paper explored online corporate communication from companies that provide risk analysis. The aim was to see if political risk and sustainability are siloed, and if so, how. Social construction offers a relational view of what risk means and how it is valued—a challenge to the traditional view of risk as something that can be calculated solely in so-called objective terms. Research on sustainability as a spectrum indicates that there are stages of corporate sustainability in practice. The results presented here are in line with the literature on weak and strong sustainability and sustainability as a spectrum, finding that business case sustainability is dominant because current worldviews limit the ability of corporations to shift toward a more ecology-centered understanding of sustainability. This type of worldview also limits risk companies from integrating sustainability into their understanding of political risk. The epistemic cultures aspect shows how the limits of what counts as a credible knowledge base restricts companies from including ‘outside’ knowledge into existing approaches. By identifying what is most frequently communicated by these companies about political risk in particular and in which contexts, the iterative re-embedding analysis used here untangles the siloed treatment of political risk and sustainability. The iterative approach used here can help us to understand why this is happening and to identify ways to challenge the gap in the political risk analysis sector.

By exploring corporate communication to find political risk, sustainability and their potential intersection, I was able to point to several places where my initial assumptions were implicated, indicating expanding this research would be beneficial for integrating political risk and sustainability analysis. Overall, the findings presented above indicate that (1) there are multiple levels at which political risk and sustainability are siloed, (2) in both areas, corporate communication emphasizes a business-centered approach and (3) challenging conventional worldviews that are blocked in by epistemic cultures could bridge the gap between political risk and sustainability in risk analyses, and move the worldview for sustainability toward an ecology-centered one. While the three-level sustainability scale was clear, it did show at the same time that while some companies are pursuing sustainability and the SDGs more rigorously, overwhelmingly, this activity falls into a weak stage of corporate sustainability worldview. These kinds of activities are communicated as positive, but could actually be inhibiting companies to move quickly away from human-centered sustainability and faster toward one centered on the natural world that humans are a part of.

As noted in the Materials and Methods section, there are several limitations to this exploratory study that could be managed with additional empirical research. In addition to broadening the scope of study to include sources in more languages than English, it could be helpful to expand the company selection to include those headquartered in the global south or ones that are directed by risk analysts that fall outside of the usual epistemic community (as discussed in more detail below). However, besides the challenges to including multiple languages in one study and related issues to understanding epistemic cultures, this expanded approach might face barriers to the number of public-facing documents available online. By using this study as a jumping off point, however, it would be possible to incorporate a complementary approach to the large-N interpretivism used here to include public speeches, policy documents or other open materials risk companies outside of those that currently dominate the discourse, which might provide a way to interpret their worldviews.

Recommendations Going Forward

It would be highly beneficial to broaden and deepen the gene pool (so to speak) of analysts and to de-silo risk and sustainability knowledge: What kinds of backgrounds do risk analysts have? Are we bringing in people with non-traditional backgrounds? What knowledge counts? Whose knowledge is it? Where is it from? Un-siloed, interdisciplinary teams might be unconventional for many, but that is where the really interesting work can happen. In addition, relational, socially constructed understandings of risk mean bringing in a variety of stakeholders. For that reason, in addition to looking at the materials used in this study, it could be interesting to conduct interviews and surveys with employees as well as ethnographic reviews of the decision-making processes around choosing analysis indicators and other aspects of risk and sustainability covered here.

Another important area is the underlying power constructs. The risk literature points to power relations—among other very power-related terms, such as value, institutions, decision-making and so on—as being an important aspect of understanding why we have the types of risk perceptions we do. Sustainability, not least when explored in relation to political conflict, has similar power dynamics. In both cases, the corporate communication studied here not only does not address these issues of power, it instead reinforces existing power dynamics through its content. For example, when political risk is associated with ‘security’ at the same time security’s context during the re-embedding process is ‘geopolitical’ or ‘military’, who do we think of as deserving security? Who is the protector and who is protected? What about when we think about ‘food security’ instead of security as related to physical violence? These issues need addressing for sustainability to manifest.

Other aspects of human rights than those covered above, such as systemic racism, did not appear in the WordStat lists. That might change in future research that uses company materials that have been produced since the data collection for this study and the growing visibility of Black Lives Matter and other social justice movements, such as those for indigenous rights and climate protection. However, given the findings in this study, inclusion of the recognition of racial and other inequalities and inequities would likely also be business-centered.

Lastly, one business area that seems to be a particularly viable landing ground for this type of integration is supply chains. I first became interested in how political risk is approached in the business sector when I started looking into CAHRAs, as described at the beginning of this paper. The aim of that project was to assist in incorporating the SDGs into companies’ supply/value chains and into investor decision processes. Until we have responsible sourcing (supported by responsible investing, production and consumption), people will continue to struggle with a failing global ecosystem and growing political risk, not least due to climate-related displacement of people and other stressors that make living difficult. This instability is only underlined by the pain caused by a global political economy that continues to be structurally and politically unprepared to deal with a global pandemic. Until corporate sustainability practices are a leading factor in sourcing, political risk will continue to grow, and in turn continue to jeopardize opportunities for sustainability. In this way, changing epistemic risk cultures is key to realizing sustainability.