Supply Chain Management and Risk Management in an Environment of Stochastic Uncertainty (Retail)

Abstract

:1. Introduction

2. Literature Review

3. Methods

- Monthly data on the placed demand (input flow of orders from stores) and monthly data on the volumes of outgoing deliveries (output flow of orders);

- Transportation costs for the delivery of orders from the DC to retail stores. Transportation costs are calculated as $1 x volume x distance. The transportation time from the DC to the store is 1 day;

- The number of incoming and outgoing deliveries. Since the delivered food products have different units of measurement, in our experiment, the volume of cargo in a package, measured in cubic meters, is taken as a single convenient unit;

- Inventory management policy. The DC applies a minimum and maximum inventory control practice. The minimum stock level is set for 5 days, the maximum is 10 days.

- The following panel of key performance indicators was used to analyze the BWE:

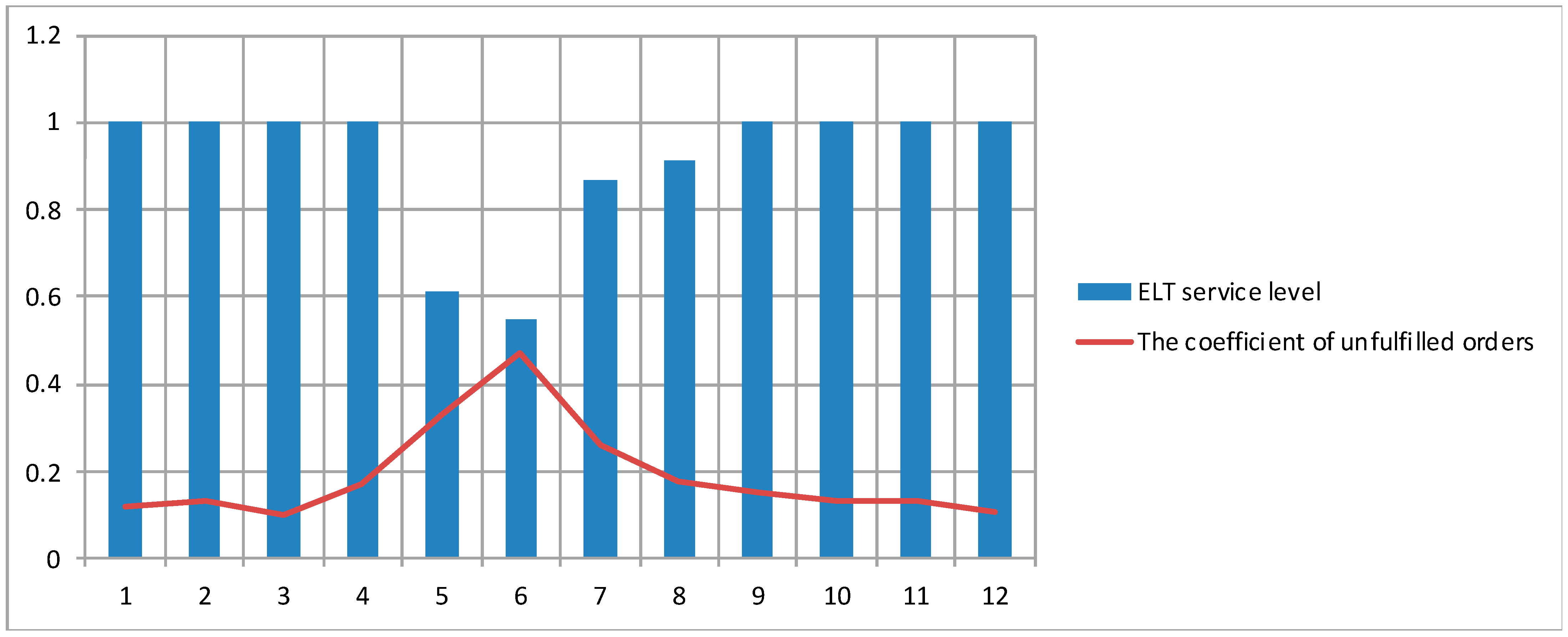

- ELT service level by the product;

- Sales dynamics for each of the serviced stores in thousands of $;

- Available inventory, including outstanding orders;

- Order completion time.

- The BWE indicator by products.

- It reflects the statistics of the increase in the variability of demand for products during the modeling of the supply chain: from manufacturers to retail stores:

- BWE > 1 means that the outgoing variability prevails over incoming variability;

- 0 =< BWE < 1 means that incoming variability prevails over outgoing variability;

- BWE = 1 means that there is no BWE; and

- BWE = −1 means that the input variability is 0.

- The BWE is found using the following equation:

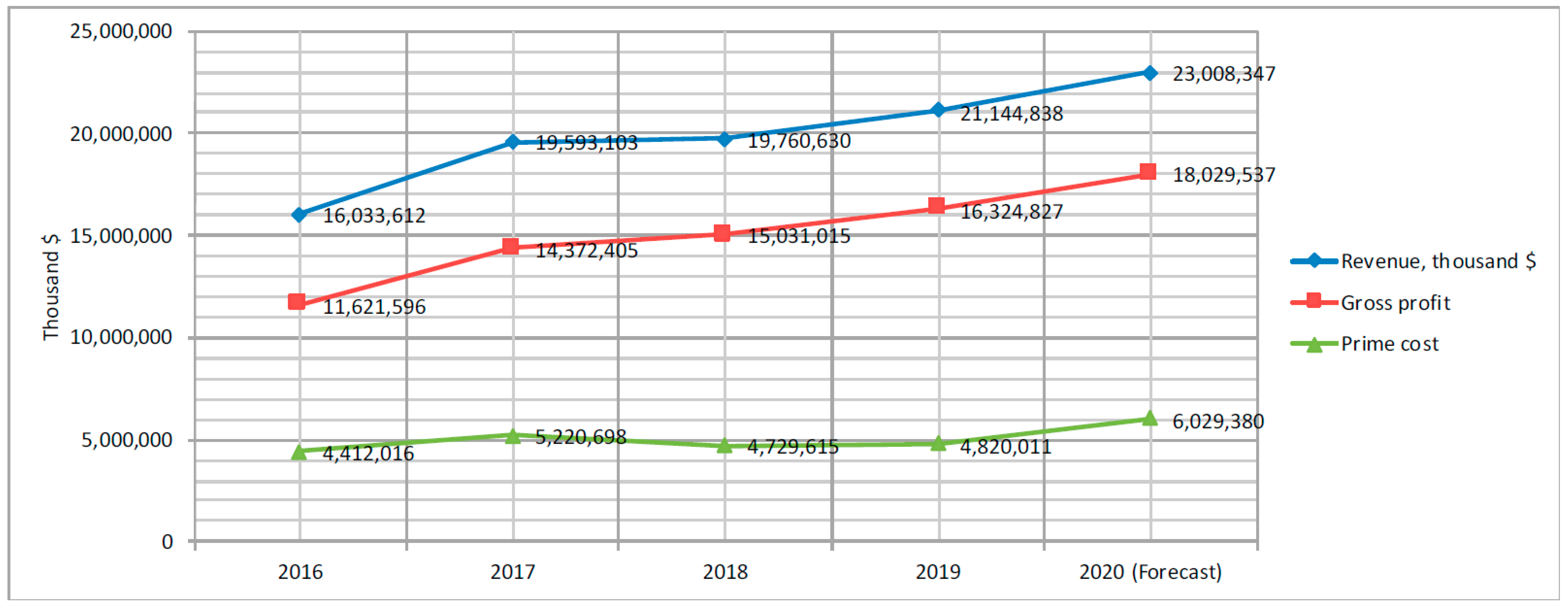

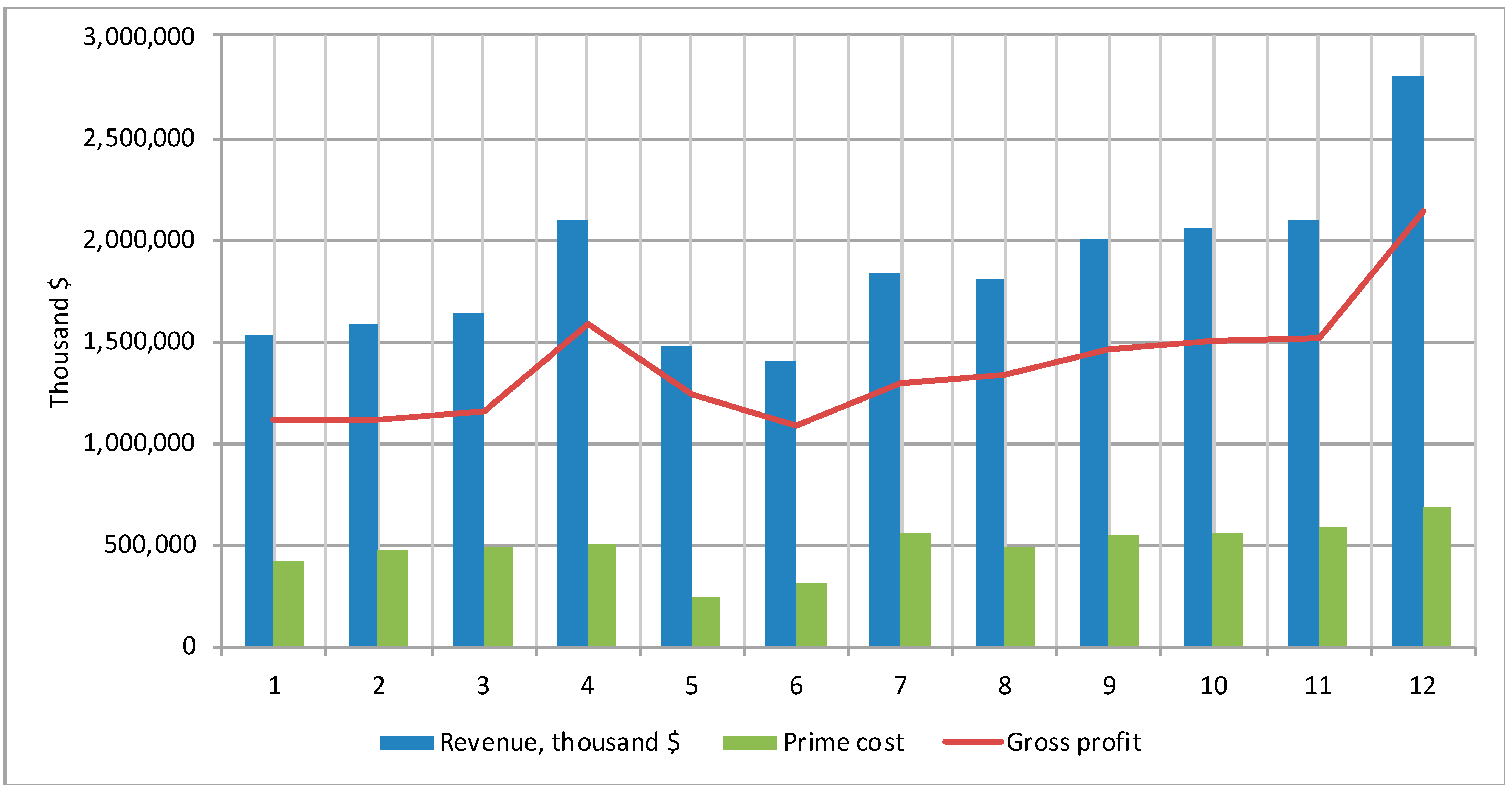

4. Results

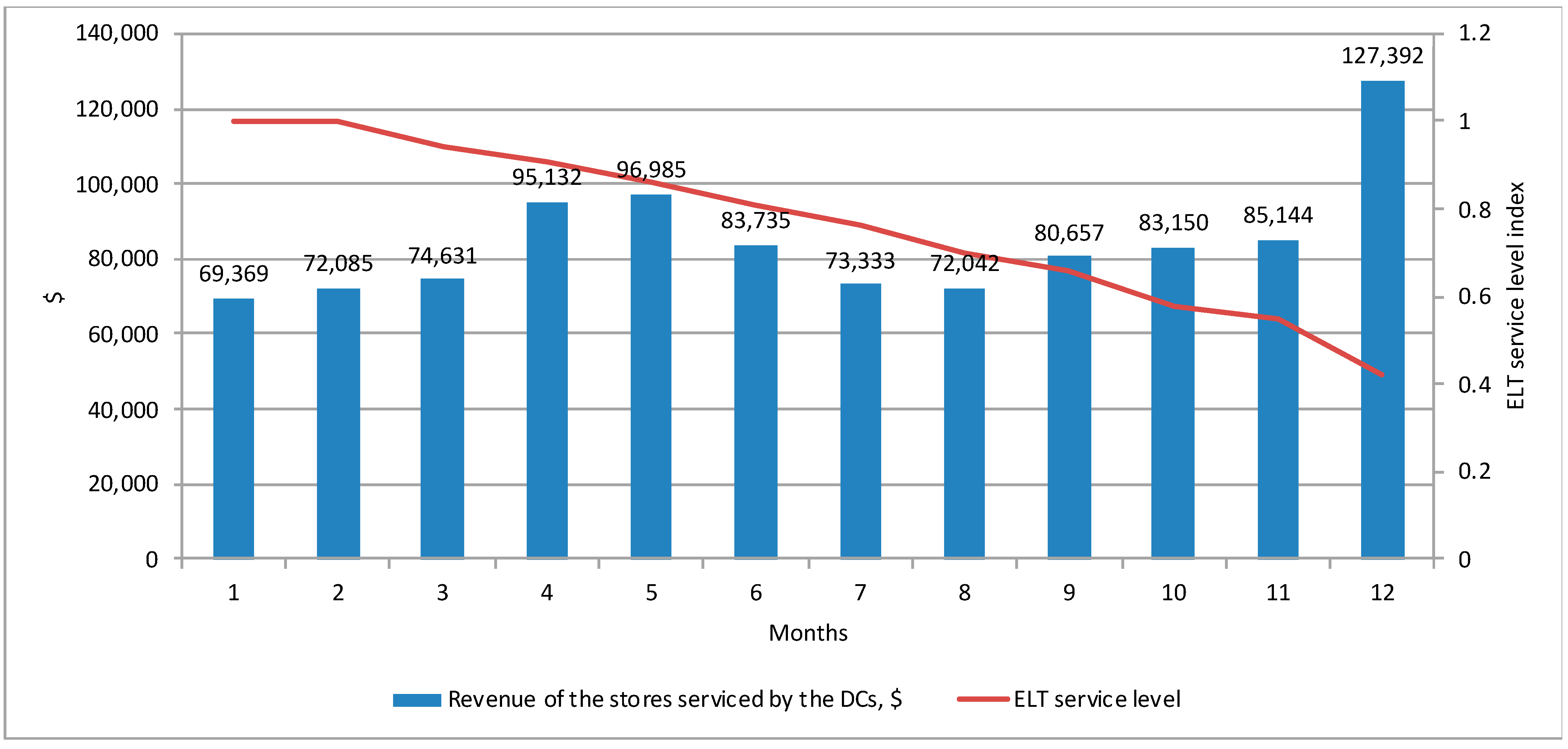

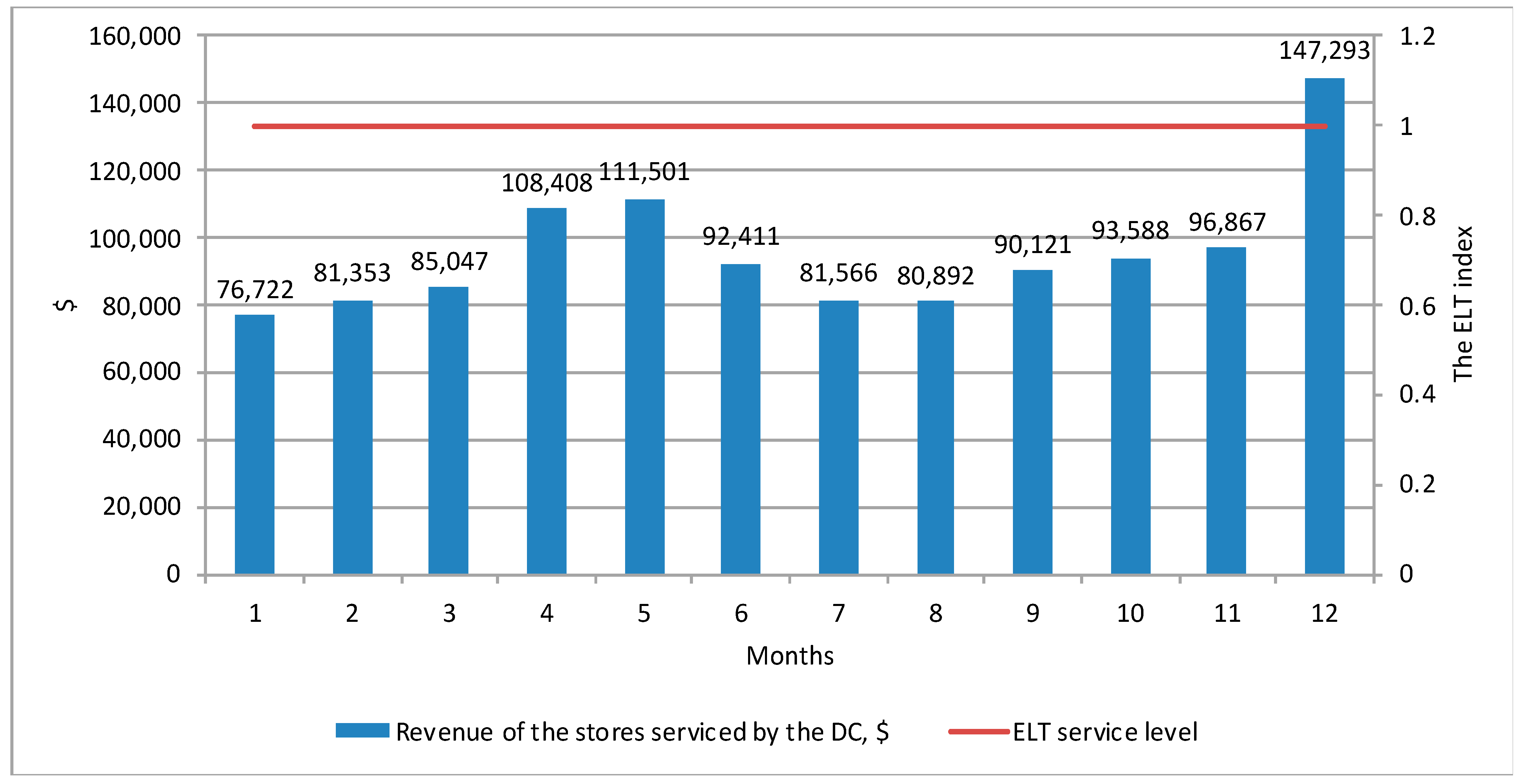

4.1. Operational Risks Analysis Results Employing the BWE

- The time for preparing orders has been reduced from 3 to 1 day;

- Minimum and maximum inventory levels have been increased to 10–15 days.

4.2. Results of the Analysis of the Risks of Supply Chain Failures

- Products received (incoming orders);

- Delivered goods (outgoing orders);

- Lost sales;

- The level of customer service.

5. Discussion

6. Conclusions

- Expanding the class of problems concerned ripple effect analysis, taking into account measures for recovery after a failure;

- Improving and applying more actively proactive methods of supply chain risk planning;

- Using digital twins and big data in the analysis of risks in supply chains.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Alborzi, F., H. Vafaei, M. H. Gholami, and M. M. S. Esfahani. 2011. A multi-objective model for supply chain network design under stochastic demand. International Journal of Industrial and Manufacturing Engineering 5: 2594–98. [Google Scholar]

- Amin, B., Y. Hakimah, S. Madjir, and D. Noviantoro. 2019. The role of transformation leadership in enhancing corporate sustainability capabilities and sustainable supply chain management. Polish Journal of Management Studies 20: 83–91. [Google Scholar] [CrossRef]

- Badea, A., G. Prostean, G. Goncalves, and H. Allaoui. 2014. Assessing risk factors in the collaborative supply chain with the analytic hierarchy process (AHP). Procedia—Social and Behavioral Sciences 124: 114–23. [Google Scholar] [CrossRef] [Green Version]

- Bier, T., A. Lange, and C. H. Glock. 2020. Methods for mitigating disruptions in complex supply chain structures: A systematic literature review. International Journal of Production Research 58: 1835–56. [Google Scholar] [CrossRef]

- Chernysheva, A. M., N. P. Gusakov, A. A. Trofimova, and M. A. Bulatenko. 2019. Diversification of transit risks of oil supplies bypassing Ukraine as the basis of energy security in Europe. International Journal of Energy Economics and Policy 9: 461–68. [Google Scholar] [CrossRef]

- Danko, T. P., V. M. Kiselev, L. A. Chaykovskaya, P. A. Smelov, and A. E. Gorokhova. 2020. Marketing positioning of countries in the field of innovations: Questions and answers. Entrepreneurship and Sustainability Issues 7: 2851–62. [Google Scholar] [CrossRef]

- Dolgui, A., D. Ivanov, and B. Sokolov. 2018. Ripple Effect in the Supply Chain: An Analysis and Recent Literature. International Journal of Production Research 56: 414–30. [Google Scholar] [CrossRef] [Green Version]

- DuHadway, S., S. Carnovale, and B. Hazen. 2019. Understanding risk management for intentional supply chain disruptions: Risk detection, risk mitigation, and risk recovery. Annals of Operations Research 283: 179–98. [Google Scholar] [CrossRef]

- Elluru, S., H. Gupta, H. Kaur, and S. P. Singh. 2019. Proactive and reactive models for disaster resilient supply chain. Annals of Operations Research 283: 199–224. [Google Scholar] [CrossRef]

- Fahimnia, B., C. S. Tang, H. Davarzani, and J. Sarkis. 2015. Quantitative models for managing supply chain risks: A review. European Journal of Operational Research 247: 1–15. [Google Scholar] [CrossRef]

- Fera, M., F. Fruggiero, A. Lambiase, R. Macchiaroli, and S. Miranda. 2017. The role of uncertainty in supply chains under dynamic modeling. International Journal of Industrial Engineering Computations 8: 119–40. [Google Scholar] [CrossRef]

- Finogenov, A. I., and A. V. Popov. 2019. Concept of planning development of coastal resort settlements under conditions of complex relief. Journal of Environmental Management and Tourism 10: 135–39. [Google Scholar] [CrossRef]

- Gayduk, V. I., M. D. Kovalchuk, A. A. Ermakov, and S. Y. Kamysheva. 2020. Risks of interaction between government bodies and business structures in the Russian agricultural sector. Revista Inclusiones 7: 188–205. [Google Scholar]

- Giannakis, M., and T. Papadopoulos. 2016. Supply chain sustainability: A risk management approach. International Journal of Production Economics 171: 455–70. [Google Scholar] [CrossRef]

- Gong, J., J. E. Mitchell, A. Krishnamurthy, and W. A. Wallace. 2014. An interdependent layered network model for a resilient supply chain. Omega 46: 104–16. [Google Scholar] [CrossRef]

- Hallikas, J., K. Lintukangas, and A. K. Kähkönen. 2020. The effects of sustainability practices on the performance of risk management and purchasing. Journal of Cleaner Production 263: 121579. [Google Scholar] [CrossRef]

- Heckmann, I., T. Comes, and S. Nickel. 2015. A critical review on supply chain risk—Definition, measure, and modeling. Omega 52: 119–32. [Google Scholar] [CrossRef] [Green Version]

- Ho, W., T. Zheng, H. Yildiz, and S. Talluri. 2015. Supply chain risk management: A literature review. International Journal of Production Research 53: 5031–69. [Google Scholar] [CrossRef]

- Huang, Z., Q. P. Zheng, E. L. Pasiliao, and D. Simmons. 2017. Exact algorithms on reliable routing problems under uncertain topology using aggregation techniques for exponentially many scenarios. Annals of Operations Research 249: 141–62. [Google Scholar] [CrossRef]

- Ivanov, D. 2018. Structural dynamics and resilience in supply chain risk management. In International Series in Operations Research & Management Science. Edited by C. C. Price. Berlin/Heidelberg: Springer International Publishing, vol. 265. [Google Scholar] [CrossRef]

- Ivanov, D., A. Dolgui, A. Das, and B. Sokolov. 2019. Digital Supply Chain Twins: Managing the Ripple Effect, Resilience, and Disruption Risks by Data-Driven Optimization, Simulation, and Visibility. International Series in Operations Research and Management Science 276: 309–32. [Google Scholar]

- Kaewunruen, S., J. Sresakoolchai, W. Ma, and O. Phil-Ebosie. 2021. Digital Twin Aided Vulnerability Assessment and Risk-Based Maintenance Planning of Bridge Infrastructures Exposed to Extreme Conditions. Sustainability 13: 2051. [Google Scholar] [CrossRef]

- Karmanov, M. V., I. A. Kiseleva, V. I. Kuznetsov, A. V. Zavrazhin, and I. V. Shubina. 2020. The process of innovation diffusion and adoption of innovations in the business modeling for travel companies. Journal of Environmental Management and Tourism 11: 346–54. [Google Scholar] [CrossRef]

- Kiseleva, I. A., V. I. Kuznetsov, N. A. Sadovnikova, A. V. Pikalov, and A. A. Dolgaya. 2020. Models for assessing the probability bankruptcy of enterprises. Journal of Critical Reviews 7: 1037–42. [Google Scholar] [CrossRef]

- Knemeyer, A. M., W. Zinn, and C. Eroglu. 2009. Proactive planning in case of catastrophic events in the supply chains. Journal of Operational Management 27: 141–53. [Google Scholar] [CrossRef]

- Kot, S., A. U. Haque, and E. Kozlovski. 2019. Strategic SCM’s Mediating Effect on the Sustainable Operations: Multinational Perspective. Organizacija 52: 219–35. [Google Scholar] [CrossRef] [Green Version]

- Kot, S., A. U. l Haque, and A. Baloch. 2020. Supply chain management in SMEs: Global perspective. Montenegrin Journal of Economics 16: 87–104. [Google Scholar] [CrossRef]

- Levina, T. V. 2014. Current issues of logistics risk management. Logistics and Supply Chain Management 4: 22–37. [Google Scholar]

- Lyshchikova, J. V., E. A. Stryabkova, A. S. Glotova, and T. N. Dobrodomova. 2019. The ‘smart region’ concept: The implementation of digital technology. Journal of Advanced Research in Law and Economics 10: 1338–45. [Google Scholar] [CrossRef]

- Martino, G., M. Fera, R. Iannone, and M. Salvatore. 2017. Supply Chain Risk Assessment in the Fashion Retail Industry: An Analytic Network Process Approach. International Journal of Applied Engineering Research 12: 140–54. [Google Scholar]

- Mekhum, W. 2019. The impact of sustainability concept on supply chain dynamic capabilities. Polish Journal of Management Studies 20: 267–76. [Google Scholar] [CrossRef]

- Modpak, V., and D. Marton. 2012. Modeling and evaluation of the complexity of assembly supply systems. Procedural Engineering 48: 428–35. [Google Scholar]

- Mohanty, R. P., G. Sahoo, and J. Dasgupta. 2012. Identification of risk factors in globally outsourced software projects using logistic regression and ANN. International Journal of Supply Chain Management 1: 2–11. [Google Scholar]

- Monostori, J. 2021. Mitigating the ripple effect in supply chains: Balancing the aspects of reliability, complexity and efficiency. CIRP Journal of Industrial Sciences and Technologies 32: 370–81. [Google Scholar]

- Nimsai, S., and P. Ho. 2019. Risk factor analysis of the value chain for sawn rubberwood timber exports to China. International Journal of Supply Chain Management 8: 14–22. [Google Scholar]

- Orazbayev, B. B., G. B. Imangazieva, and K. N. Orazbayeva. 2019. Formulation and solution to control problems of operation modes in delayed coking unit in the fuzzy environment based on the heuristic method. Journal of Theoretical and Applied Information Technology 97: 4768–79. [Google Scholar]

- Parks, Y., and H. Kim. 2016. A simulation-based evolutionary algorithmic approach to operational planning of global supply chains based on systematic risk management. Computing Ind. 83: 68–77. [Google Scholar] [CrossRef]

- Pavlova, E. V., I. A. Duborkina, A. P. Sokolova, I. G. Doronkina, and E. E. Konovalova. 2017. Dependence of the Russian economy on oil prices in the context of the volatility of the global oil market: Articulation of issue. International Journal of Energy Economics and Policy 7: 225–30. [Google Scholar]

- Ponomarov, S. Y., and M. C. Holcomb. 2009. Understanding the concept of supply chain resilience. The International Journal of Logistics Management 20: 124–43. [Google Scholar] [CrossRef]

- Qi, L., Z. J. M. Shen, and L. V. Snyder. 2010. The effect of supply disruptions on supply chain design decisions. Transportation Science 44: 274–89. [Google Scholar] [CrossRef] [Green Version]

- Ramesh, K. T., S. P. Sarmah, and P. K. Tarei. 2019. An integrated framework for the assessment of inbound supply risk and prioritization of the risk drivers. Benchmarking: An International Journal 27: 1261–86. [Google Scholar] [CrossRef]

- Seuring, S. 2013. A review of modeling approaches for sustainable supply chain management. Decision Support Systems 54: 1513–20. [Google Scholar] [CrossRef]

- Siegel, M. 2018. Building sustainable organizations: Proactive risk management in organizations and their supply chains. Journal of Business Continuity and Emergency Planning 11: 373–84. [Google Scholar] [PubMed]

- Song, W., X. Ming, and H. C. Liu. 2017. Identifying critical risk factors of sustainable supply chain management: A rough strength-relation analysis method. Journal of Cleaner Production 143: 100–15. [Google Scholar] [CrossRef]

- Vishnu, C. R., R. Sridharan, and P. N. R. Kumar. 2019. Supply chain risk management: Models and methods. International Journal of Management and Decision Making 18: 31–75. [Google Scholar] [CrossRef]

- Zavalko, N. A., V. O. Kozhina, E. V. Yudina, O. N. Beketova, and A. V. Lavrenova. 2020. Innovative approaches to business modeling at an enterprise. Revista Inclusiones 7: 84–92. [Google Scholar]

- Zineb, E., B. Brahim, and A. Houdaifa. 2017. The impact of SCRM strategies on supply chain resilience: A quantitative study in the Moroccan manufacturing industry. International Journal of Supply Chain Management 6: 70–75. [Google Scholar]

| Documents | Sources |

|---|---|

| Monthly product sales reports | Data from the corporate automated accounting system 1C: Enterprise 8 |

| New year sales report | |

| Marketing campaign results reports | |

| Production plans for own products | |

| Plans for reconstruction, repairs of premises and vehicles |

| Statistical Data Groups | Information Content |

|---|---|

| Financial | information about the income earned and expenses incurred |

| Distance | information about the distance traveled by vehicles |

| Products | information about the products within the supply chain |

| Time | information about the time spent on processing tasks or downtime |

| Transportation | information about the vehicles used within the supply chain |

| Orders | information about all orders within the supply chain |

| Months | Placed Demand (Input Flow), Cubic Meters (IN) | The Volume of Outgoing Deliveries (Output Flow), Cubic Meters (OUT) |

|---|---|---|

| 1 | 435.6 | 386.7 |

| 2 | 536.2 | 688.8 |

| 3 | 712.8 | 544.9 |

| 4 | 614.4 | 698.2 |

| 5 | 817.7 | 788.4 |

| 6 | 660.3 | 756.9 |

| 7 | 598.8 | 550.3 |

| 8 | 640.2 | 671.9 |

| 9 | 666.4 | 551.7 |

| 10 | 718.6 | 652.9 |

| 11 | 720.5 | 788.1 |

| 12 | 822.1 | 865.8 |

| Variance σ2 | 11,076.75 | 16,564.46 |

| Mathematical expectation µ | 661.97 | 662.05 |

| σ2/µ | 16.73 | 25.02 |

| BWE | 1.495 | |

| Event | Closing Time | Opening Time after a Failure | Duration of Object Restoration |

|---|---|---|---|

| Fire at the DC | 28.04.2019 | 27.06.2019 | 60 |

| Failure at a dairy plant—a supplier of milk and fermented milk products | 03.07.19 | 10.07.19 | 7 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lochan, S.A.; Rozanova, T.P.; Bezpalov, V.V.; Fedyunin, D.V. Supply Chain Management and Risk Management in an Environment of Stochastic Uncertainty (Retail). Risks 2021, 9, 197. https://doi.org/10.3390/risks9110197

Lochan SA, Rozanova TP, Bezpalov VV, Fedyunin DV. Supply Chain Management and Risk Management in an Environment of Stochastic Uncertainty (Retail). Risks. 2021; 9(11):197. https://doi.org/10.3390/risks9110197

Chicago/Turabian StyleLochan, Sergey A., Tatiana P. Rozanova, Valery V. Bezpalov, and Dmitry V. Fedyunin. 2021. "Supply Chain Management and Risk Management in an Environment of Stochastic Uncertainty (Retail)" Risks 9, no. 11: 197. https://doi.org/10.3390/risks9110197