COVID-19 Interruptions and SMEs Heterogeneity: Evidence from Poland

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Size

2.2. Age

2.3. Legal Form of the Business’ Operation

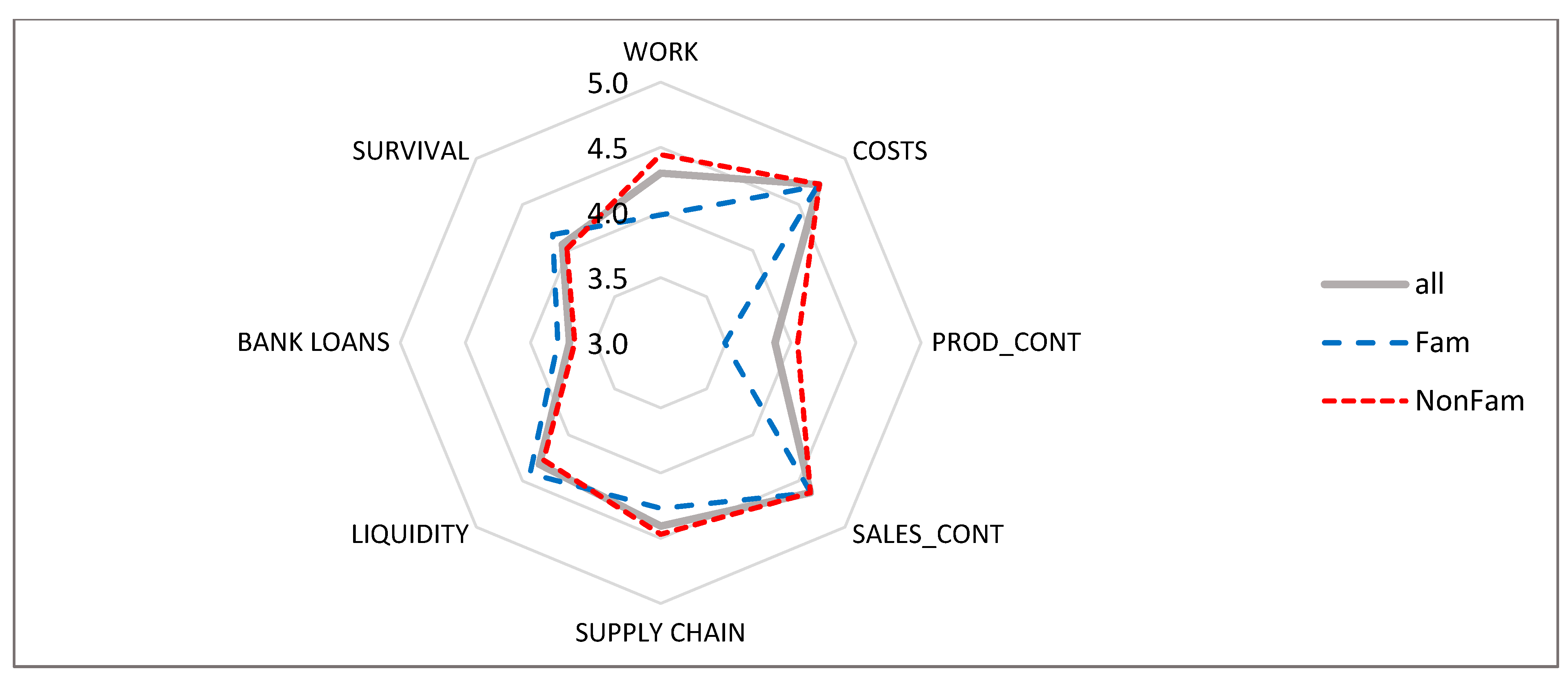

2.4. Family Ownership

3. Research Design and Method

3.1. Survey Design

3.2. Sample Composition: Businesses Characteristics

3.3. Method

4. Results

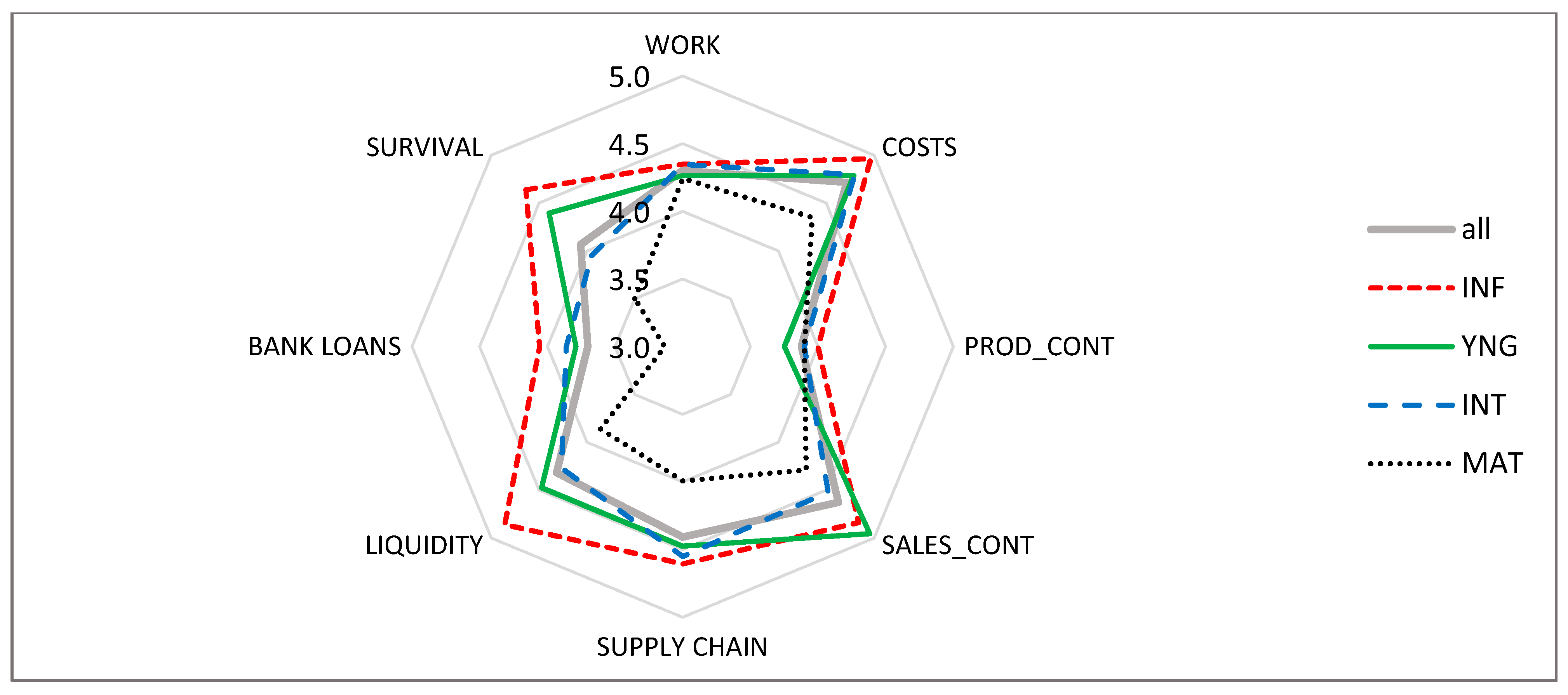

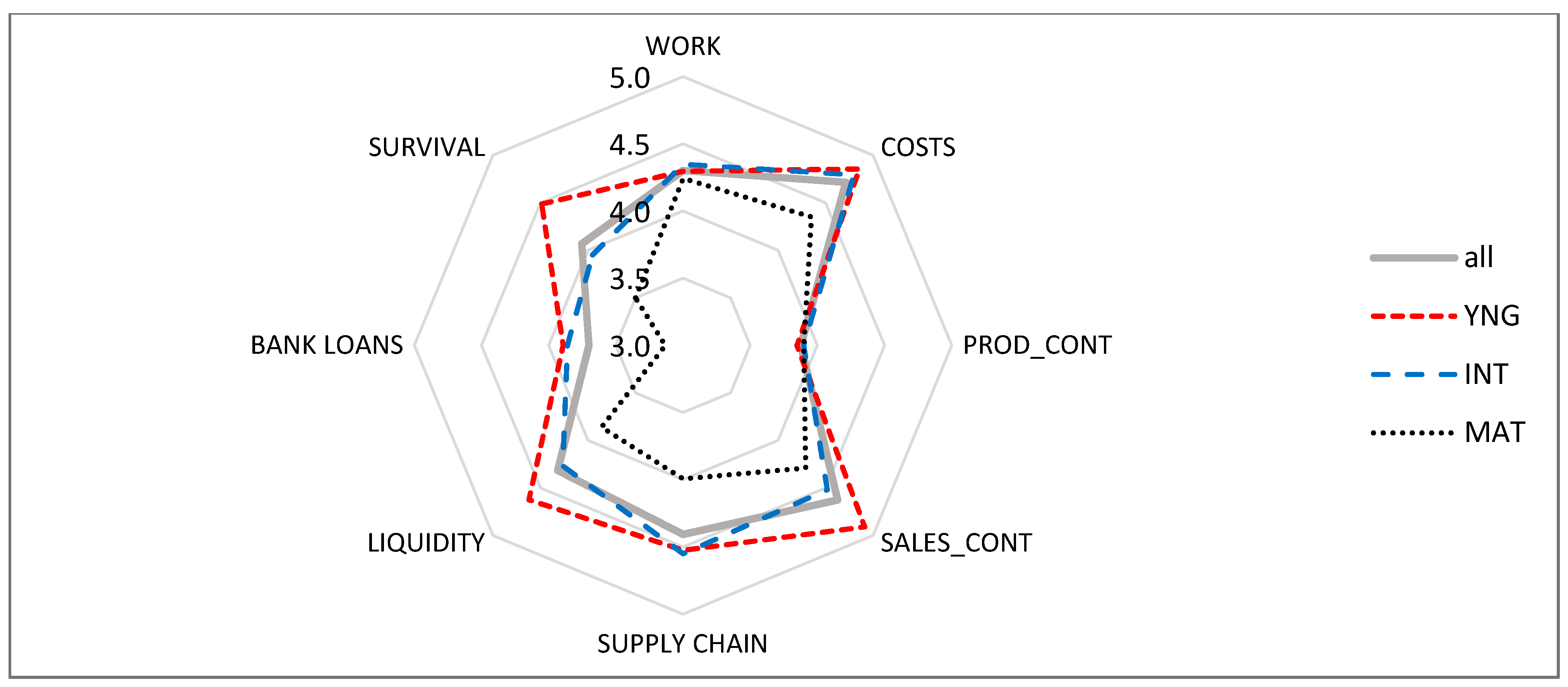

4.1. The COVID-19 Interruptions and Business Characteristics

4.2. Consolidated COVID-19 Effect

5. Discussion

6. Conclusions

6.1. Practical Implications

6.2. Further Works

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| SIZE | |||||||||||

| Micro | Small | Medium | in Total | ||||||||

| N | % | N | % | N | % | N | % | ||||

| AGE_1 | infant | 62 | 72.1% | 21 | 24.4% | 3 | 3.5% | 86 | 100% | ||

| X2: 129.390 *** | young | 59 | 43.1% | 61 | 44.5% | 17 | 12.4% | 137 | 100% | ||

| Cont.: 0.440 *** | itermediate | 47 | 25.1% | 78 | 41.7% | 62 | 33.2% | 187 | 100% | ||

| mature | 14 | 10.9% | 48 | 37.5% | 66 | 51.6% | 128 | 100% | |||

| In total | 182 | 33.8% | 208 | 38.7% | 148 | 27.5% | 538 | 100% | |||

| OWN_1 | SP | 134 | 68.7% | 52 | 26.7% | 9 | 4.6% | 195 | 100% | ||

| X2: 193.328 *** | LCC | 20 | 7.5% | 118 | 44.4% | 128 | 48.1% | 266 | 100% | ||

| Cont.: 0.514 *** | CP | 28 | 36.4% | 38 | 49.4% | 11 | 14.3% | 77 | 100% | ||

| In total | 182 | 33.8% | 208 | 38.7% | 148 | 27.5% | 538 | 100% | |||

| FAM | family | 88 | 52.7% | 56 | 33.5% | 23 | 13.8% | 167 | 100% | ||

| X2: 43.738 *** | non-family | 94 | 25.3% | 152 | 41.0% | 125 | 33.7% | 371 | 100% | ||

| Cont.: 0.247 *** | In total | 182 | 33.8% | 208 | 38.7% | 148 | 27.5% | 538 | 100% | ||

| AGE_1 | |||||||||||

| Infant | Young | Intermediate | Mature | in Total | |||||||

| N | % | N | % | N | % | N | % | N | % | ||

| OWN_1 | SP | 59 | 30.3% | 66 | 33.8% | 55 | 28.2% | 15 | 7.7% | 195 | 100% |

| X2: 76.817 *** | LCC | 15 | 5.6% | 51 | 19.2% | 106 | 39.8% | 94 | 35.3% | 266 | 100% |

| Cont.: 0.353 *** | CP | 12 | 15.6% | 20 | 26.0% | 26 | 33.8% | 19 | 24.7% | 77 | 100% |

| In total | 86 | 16.0% | 137 | 25.5% | 187 | 34.8% | 128 | 23.8% | 538 | 100% | |

| FAM | family | 29 | 17.4% | 42 | 25.1% | 66 | 39.5% | 30 | 18.0% | 167 | 100% |

| X2: 5.335 | non-family | 57 | 15.4% | 95 | 25.6% | 121 | 32.6% | 98 | 26.4% | 371 | 100% |

| Cont.: 0.099 | In total | 86 | 16.0% | 137 | 25.5% | 187 | 34.8% | 128 | 23.8% | 538 | 100% |

| OWN_1 | |||||||||||

| SP | LCC | CP | in Total | ||||||||

| N | % | N | % | N | % | N | % | ||||

| FAM | family | 91 | 54.5% | 41 | 24.6% | 35 | 21.0% | 167 | 100% | ||

| X2: 60.026 *** | non-family | 104 | 28.0% | 225 | 60.6% | 42 | 11.3% | 371 | 100% | ||

| Cont.: 0.317 *** | In total | 195 | 36.2% | 266 | 49.4% | 77 | 14.3% | 538 | 100% | ||

Appendix B

| Variables | Kołmogorov–Smirnov | Shapiro–Wilk | ||||

|---|---|---|---|---|---|---|

| Statistic | df | Sig. | Statistic | df | Sig. | |

| WORK | 0.192 | 538 | 0.000 | 0.917 | 538 | 0.000 |

| COSTS | 0.194 | 538 | 0.000 | 0.905 | 538 | 0.000 |

| PROD_CONT | 0.152 | 538 | 0.000 | 0.920 | 538 | 0.000 |

| SALES_CONT | 0.177 | 538 | 0.000 | 0.905 | 538 | 0.000 |

| SUPPLY CHAIN | 0.189 | 538 | 0.000 | 0.920 | 538 | 0.000 |

| LIQUIDITY | 0.167 | 538 | 0.000 | 0.925 | 538 | 0.000 |

| BANK LOANS | 0.168 | 538 | 0.000 | 0.936 | 538 | 0.000 |

| SURVIVAL | 0.193 | 538 | 0.000 | 0.929 | 538 | 0.000 |

| Variables | WORK | COSTS | PROD _CONT | SALES _CONT | SUPPLY CHAIN | LIQ | BANK LOANS | SURV |

|---|---|---|---|---|---|---|---|---|

| SIZE | 0.188 | 0.000 *** | 0.411 | 0.001 ** | 0.644 | 0.000 *** | 0.002 ** | 0.000 *** |

| small-medium | 1.000 | 1.000 | 0.058 | 0.156 | 0.162 | |||

| small-micro | 0.000 *** | 0.004 ** | 0.000 *** | 0.001 ** | 0.000 ** | |||

| medium-micro | 0.006 ** | 0.009 ** | 0.000 *** | 0.211 | 0.001 ** | |||

| AGE_1 | 0.970 | 0.021 * | 0.823 | 0.017 * | 0.012 * | 0.000 *** | 0.000 *** | 0.000 *** |

| mat-young | 0.237 | 0.032 * | 0.108 | 0.017 * | 0.000 *** | 0.000 *** | ||

| mat-interm | 0.082 | 1.000 | 0.024 * | 0.189 | 0.000 *** | 0.071 | ||

| mat-inf | 0.027* | 0.132 | 0.034 * | 0.000 *** | 0.000 *** | 0.000 *** | ||

| young-interm | 1.000 | 0.269 | 1.000 | 1.000 | 1.000 | 0.059 | ||

| young-inf | 1.000 | 1.000 | 1.000 | 0.611 | 1.000 | 1.000 | ||

| interm-inf | 1.000 | 0.722 | 1.000 | 0.048 * | 1.000 | 0.009 ** | ||

| AGE_2 | 0.924 | 0.013 * | 0.925 | 0.006 ** | 0.005 ** | 0.000 *** | 0.000 *** | 0.000 *** |

| mat-interm | 0.041 * | 0.924 | 0.012 * | 0.095 | 0.000 *** | 0.036 | ||

| mat-young | 0.016 * | 0.008 ** | 0.009 ** | 0.000 *** | 0.000 *** | 0.000 *** | ||

| interm-young | 1.000 | 0.087 ** | 1.000 | 0.109 | 1.000 | 0.002 ** | ||

| OWN_1 | 0.283 | 0.000 *** | 0.252 | 0.001 ** | 0.385 | 0.000 *** | 0.000 *** | 0.000 *** |

| OWN_2 | 0.326 | 0.000 *** | 0.266 | 0.002 ** | 0.077 | 0.000 *** | 0.000 *** | 0.000 *** |

| LLC-CP | 1.000 | 0.735 | 0.623 | 0.544 | 1.000 | |||

| LLC-SP | 0.000 *** | 0.001 ** | 0.000 *** | 0.000 *** | 0.000 *** | |||

| CP-SP | 0.008 ** | 0.511 | 0.003 ** | 0.020 * | 0.000 *** | |||

| FAM | 0.004 ** | 0.858 | 0.001 ** | 0.83 | 0.196 | 0.378 | 0.308 | 0.366 |

| st.err | t | Sig. | ||

|---|---|---|---|---|

| Intercept | 43.271 *** | 2.024 | 21.377 | 0.000 |

| SIZE | −1.074 | 0.662 | −1.622 | 0.105 |

| AGE_1 | −0.960 * | 0.483 | −1.988 | 0.047 |

| OWN_2 | −1.865 ** | 0.676 | −2.758 | 0.006 |

| FAM | 1.395 | 0.957 | 1.457 | 0.146 |

| R-squared = 0.053 Adj. R-squared = 0.046 F = 7.403 *** | ||||

References

- Acharya, Viral, and Sascha Steffen. 2020. The risk of being a fallen angel and the corporate dash for cash in the midst of COVID. The Review of Corporate Finance Studies 9: 430–71. [Google Scholar] [CrossRef]

- Amore, Mario Daniele, Fabio Quarato, and Valerio Pelucco. 2021. Family Ownership during the COVID-19 Pandemic. SSRN Electronic Journal 1–38. [Google Scholar] [CrossRef]

- Antony, Jiju, Maneesh Kumar, and Ashraf Labib. 2008. Gearing Six Sigma into UK manufacturing SMEs: Results from a pilot study. Journal of the Operational Research Society 59: 482–93. [Google Scholar] [CrossRef]

- Arregle, Jean-Luc, Michael. A. Hitt, David G. Sirmon, and Philippe Very. 2007. The development of organizational social capital: Attributes of family firms. Journal of Management Studies 44: 73–95. [Google Scholar] [CrossRef]

- Bartik, Alexander W., Marianne Bertrand, Zoë B. Cullen, Edward L. Glaeser, Michael Luca, and Chirstopher T. Stanton. 2020a. How Are Small Businesses Adjusting to COVID-19? Early Evidence from a Survey (No. w26989). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Bartik, Alexander. W., Marianne Bertrand, Zoë B. Cullen, Edward L. Glaeser, Michael Luca, and Chirstopher T. Stanton. 2020b. The impact of COVID-19 on small business outcomes and expectations. Proceedings of the National Academy of Sciences 117: 17656–66. [Google Scholar] [CrossRef]

- Bartz, Wiebke, and Adalbert Winkler. 2016. Flexible or fragile? The growth performance of small and young businesses during the global financial crisis—Evidence from Germany. Journal of Business Venturing 31: 196–215. [Google Scholar] [CrossRef]

- Beninger, Stefanie, and June N. Francis. 2021. Resources for Business Resilience in a COVID-19 World: A Community-Centric Approach. Business Horizons 1–28. [Google Scholar] [CrossRef]

- Bognini, Paola, Małgorzata Iwanicz-Drozdowska, Oliviero Roggi, and Viktor Elliot. 2020. Global Report on Business Continuity Planning and Management (BCP/BCM). Survey Results. Available online: https://ssrn.com/abstract=3764401 (accessed on 1 July 2021).

- Burnard, Kevin, and Ran Bhamra. 2011. Organisational resilience: Development of a conceptual framework for organisational responses. International Journal of Production Research 49: 5581–99. [Google Scholar] [CrossRef]

- Canhoto, Anna, and Liyuan Wei. 2021. Stakeholders of the World, Unite!: Hospitality in the time of COVID-19. International Journal of Hospitality Management 102922. [Google Scholar] [CrossRef]

- Carletti, Elena, Tommaso Oliviero, Marco Pagano, Loriana Pelizzon, and Marti G. Subrahmanyam. 2020. The COVID-19 shock and equity shortfall: Firm-level evidence from Italy. The Review of Corporate Finance Studies 9: 534–68. [Google Scholar] [CrossRef]

- Cepel, Martin, Beata Gavurova, Jan Dvorsky, and Jaroslav Belas. 2020. The impact of the COVID-19 crisis on the perception of business risk in the SME segment. Journal of International Studies 13: 248–63. [Google Scholar] [CrossRef] [PubMed]

- Cheema-Fox, Alex, Bridget LaPerla, George Serafeim, and Hui Wang. 2021. Corporate Resilience and Response during COVID-19. Harward Business School Working Paper No 20-108. Available online: https://www.hbs.edu/ris/Publication%20Files/20-108_6f241583-89ac-4d2f-b5ba-a78a4a17babb.pdf (accessed on 1 July 2021).

- Chudziński, Paweł, Szymon Cyfert, Wojcieh Dyduch, and Maciej Zastempowski. 2020. Projekt Sur(vir)val: Czynniki przetrwania przedsiębiorstw w warunkach koronakryzysu. E-mentor 5: 34–44. [Google Scholar] [CrossRef]

- Coface. 2021. Raport Roczny Coface: Niewypłacalności firm w Polsce w 2020 Roku. Available online: http://img.go.coface.com/Web/COFACE/%7B635f800d-875e-49d9-96b9-c9eff82dff87%7D_Niewyplacalnosci_w_Polsce_w_2020_ROCZNY_Raport_Coface_ok.pdf (accessed on 1 July 2021).

- Cots, Elisabet Garriga. 2011. Stakeholder social capital: A new approach to stakeholder theory. Business Ethics: A European Review 20: 328–41. [Google Scholar] [CrossRef]

- Cyert, Richard M., and James G. March. 1963. A Behavioral Theory of the Firm. Hoboken: Prentice Hall. [Google Scholar]

- Dai, Weiqi, and Wiboon Kittilaksanawong. 2014. How are different slack resources translated into firm growth? Evidence from China. International Business Research 7: 1–12. [Google Scholar] [CrossRef] [Green Version]

- Davidsson, Per. 2017. Opportunities, propensities, and misgivings: Some closing comments. Journal of Business Venturing Insights 8: 123–24. [Google Scholar] [CrossRef] [Green Version]

- De Massis, Alfredo, and Emanuela Rondi. 2020. COVID-19 and the Future of Family Business Research. Journal of Management Studies 57: 1727–31. [Google Scholar] [CrossRef]

- De Vito, Antonio, and Juan-Pedro Gómez. 2020. Estimating the COVID-19 cash crunch: Global evidence and policy. Journal of Accounting and Public Policy 39: 106741. [Google Scholar] [CrossRef]

- Deloitte. 2020. Deloitte Global Cost and Enterprise Transformation Survey. Available online: https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/deloitte-covid-19-survey-shifts-cost-strategies.html (accessed on 5 October 2020).

- Demmou, Lilas, Guido Franco, Sara Calligaris, and Dennis Dlugosch. 2020. Corporate Sector Vulnerabilities during the COVID-19 Outbreak: Assessment and Policy Responses. VoxEU. org. May 23. Available online: https://voxeu.org/article/corporate-sector-vulnerabilities-during-covid-19-outbrea (accessed on 1 July 2021).

- Denis, David J. 2011. Financial flexibility and corporate liquidity. Journal of Corporate Finance 17: 667–74. [Google Scholar] [CrossRef]

- Didier, Tatiana, Fuderico Huneeus, Mauricio Larrain, and Sergio Schmukler. 2021. Financing Firms in Hibernation during the COVID-19 Pandemic. Journal of Financial Stability 53: 1–14. [Google Scholar] [CrossRef]

- Eggers, Fabian. 2020. Masters of disasters? Challenges and opportunities for SMEs in times of crisis. Journal of Business Research 116: 199–208. [Google Scholar] [CrossRef]

- Eggers, Fabian, David J. Hansen, and Amy E. Davis. 2012. Examining the relationship between customer and entrepreneurial orientation on nascent firms’ marketing strategy. International Entrepreneurship and Management Journal 8: 203–22. [Google Scholar] [CrossRef]

- European Commission. 2019. 219 SBA Fact Sheet Poland. Available online: https://ec.europa.eu/docsroom/documents/38662/attachments/22/translations/en/renditions/native (accessed on 1 July 2021).

- Everitt, Brian S., Sabine Landau, Morven Lesse, and Daniel Stahl. 2011. Cluster Analysis, 5th ed. Chichester: John Wiley and Sons. [Google Scholar]

- Foss, Nicola J., and Tina Saebi. 2017. Fifteen years of research on business model innovation: How far have we come, and where should we go? Journal of Management 43: 200–27. [Google Scholar] [CrossRef] [Green Version]

- Freeman, John, Glenn R. Carroll, and Michael T. Hannan. 1983. The Liability of Newness: Age Dependence in Organizational Death Rates. American Sociological Review 48: 692–710. [Google Scholar] [CrossRef]

- Furceri, Davide, and Aleksandra Zdzienicka. 2011. The real effect of financial crises in the European transition economies1. Economics of Transition 19: 1–25. [Google Scholar] [CrossRef] [Green Version]

- George, Gerard. 2005. Slack resources and the performance of privately held firms. Academy of Management Journal 48: 661–76. [Google Scholar] [CrossRef]

- Gilbert, Clark G. 2005. Unbundling the structure of inertia: Resource versus routine rigidity. Academy of Management Journal 48: 741–63. [Google Scholar] [CrossRef] [Green Version]

- Gollier, Christian, Pierre-François F. Koehl, and Jean-Charles Rochet. 1997. Risk-Taking Behavior with Limited Liability and Risk Aversion. The Journal of Risk and Insurance 64: 347. [Google Scholar] [CrossRef]

- Gourinchas, Pierre-Olivier, Sebnem Kalemli-Özcan, Veronika Penciakova, and Nick Sander. 2020. COVID-19 and SME failures. National Bureau of Economic Research Working Paper No. 27877. Available online: https://www.nber.org/papers/w27877 (accessed on 1 July 2021). [CrossRef]

- Gourinchas, Pierre-Olivier, Sebnem Kalemli-Özcan, Veronika Penciakova, and Nick Sander. 2021. COVID-19 and SMEs: 2021 “Time Bomb”? National Bureau of Economic Research Working Paper No. 28418. Available online: https://www.nber.org/papers/w28418 (accessed on 1 July 2021).

- Gu, Xin, Shan Ying, Weiqiang Zhang, and Yewei Tao. 2020. How Do Firms Respond to COVID-19? First Evidence from Suzhou, China. Emerging Markets Finance and Trade 56: 2181–97. [Google Scholar] [CrossRef]

- Habbershon, Timothy G., Mary Williams, and Ian MacMillan. 2003. A Unified systems perspective of family firm performance. Journal of Business Venturing 18: 451–65. [Google Scholar] [CrossRef]

- Hansmann, Henry, and Reinier Kraakman. 1991. Toward Unlimited Shareholder Liability for Corporate Torts. The Yale Law Journal 100: 1879. [Google Scholar] [CrossRef] [Green Version]

- Horvath, Michael, and Michael J. Woywode. 2005. Entrepreneurs and the Choice of Limited Liability. Journal of Institutional and Theoretical Economics 161: 681. [Google Scholar] [CrossRef]

- IRM. 2020. COVID–19 Global Risk Management Response. Institute of Risk Management. Available online: https://www.theirm.org/media/8903/irm-covid-response-survey-initial-report-final.pdf (accessed on 25 October 2020).

- Juergensen, Jill, Jose Guimón, and Rajneesh Narula. 2020. European SMEs amidst the COVID-19 crisis: Assessing impact and policy responses. Journal of Industrial and Business Economics 47: 499–510. [Google Scholar] [CrossRef]

- KPMG. 2020. Poland. Government and Institution Measures in Response to COVID-19. September 30. Available online: https://home.kpmg/xx/en/home/insights/2020/04/poland-government-and-institution-measures-in-response-to-covid.html (accessed on 10 August 2021).

- Kraus, Sascha, Thomas Clauss, Matthias Breier, Johanna Gast, Alessandro Zardini, and Victor Tiberius. 2020. The economics of COVID-19: Initial empirical evidence on how family firms in five European countries cope with the corona crisis. International Journal of Entrepreneurial Behavior & Research 26: 1067–92. [Google Scholar] [CrossRef]

- Lubatkin, Michael H., Yan Ling, and William S. Schulze. 2007. An Organizational Justice-Based View of Self-Control and Agency Costs in Family Firms. Journal of Management Studies 44: 955–71. [Google Scholar] [CrossRef]

- Maak, Thomas. 2007. Responsible leadership, stakeholder engagement, and the emergence of social capital. Journal of Business Ethics 74: 329–43. [Google Scholar] [CrossRef] [Green Version]

- Matos, Stelvia, and Bruno S. Silvestre. 2013. Managing stakeholder relations when developing sustainable business models: The case of the Brazilian energy sector. Journal of Cleaner Production 45: 61–73. [Google Scholar] [CrossRef]

- McGeever, Niall, John McQuinn, and Samantha Myers. 2020. SME Liquidity Needs during the COVID-19 Shock (No. 2/FS/20). Dublin: Central Bank of Ireland. [Google Scholar]

- Mercer. 2020. Globally, How Are Companies Adapting to the COVID-19 Business and Workforce Environment? Available online: https://app.keysurvey.com/reportmodule/REPORT2/report/41488264/41196046/59f27889c1eafb1ba976d193e88cb690?Dir=&Enc_Dir=60e929fb&av=IxnIBAm77ac%3D&afterVoting=888b4feadd76&msig=32162cb48db989d5d550fdc13ba64dc0 (accessed on 15 October 2020).

- Ministerstwo Rozwoju. 2020. Podstawowe Wskaźniki Makroekonomiczne, Polska, Wrzesień 2020. Available online: https://www.gov.pl/attachment/bc0e9744-1fdf-475c-a137-d141df473769 (accessed on 1 July 2021).

- Mishina, Yuri, Timothy G. Pollock, and Joseph F. Porac. 2004. Are more resources always better for growth? Resource stickiness in market and product expansion. Strategic Management Journal 25: 1179–97. [Google Scholar] [CrossRef]

- Moyo, Nggabutho. 2020. Antecedents of employee disengagement amid COVID-19 pandemic. Polish Journal of Management Studies 22: 323–34. [Google Scholar] [CrossRef]

- Myant, Martin, and Jan Drahokoupil. 2012. International Integration, Varieties of Capitalism and Resilience to Crisis in Transition Economies. Europe-Asia Studies 64: 1–33. [Google Scholar] [CrossRef]

- Nohira, Nitin, and Ranjay Gulati. 1996. Is slack good or bad for innovation? Academy of Management Journal 39: 1245–64. [Google Scholar] [CrossRef] [Green Version]

- Nurunnabi, Mohammad. 2020. Recovery planning and resilience of SMEs during the COVID-19: Experience from Saudi Arabia. Journal of Accounting & Organizational Change 16: 643–53. [Google Scholar] [CrossRef]

- Pal, Rudrajeet, Hakan Torstensson, and Heikki Mattila. 2014. Antecedents of organizational resilience in economic crises—An empirical study of Swedish textile and clothing SMEs. International Journal of Production Economics 147: 410–28. [Google Scholar] [CrossRef]

- Pekao. 2020. Krajobraz po bitwie. Wyniki Sektora Przedsiębiorstw w Pierwszym Półroczu 2020 Roku–Najnowszy Raport Banku Pekao S.A. (The Landscape fter the Battle. Results of the Corporate Sector in the First Half of 2020-the Latest Report of Bank Pekao S. A. Available online: https://media.pekao.com.pl/pr/569211/krajobraz-po-bitwie-wyniki-sektora-przedsiebiorstw-w-pierwszym-polroczu-2020-roku-najnowszy-raport-banku-pekao-s-a (accessed on 15 October 2020).

- PwC. 2020. PwC Global COVID-19 CFO Pulse Report, June 2020. Available online: https://www.pwc.com/gx/en/issues/crisis-solutions/covid-19/global-cfo-pulse.html (accessed on 2 October 2020).

- Qiu, Joseph. 2020. Pandemic risk: Impact, modelling, and transfer. Risk Management and Insurance Review 23: 293–304. [Google Scholar] [CrossRef]

- Salvato, C., M. Sargiacomo, M. D. Amore, and A. Minichilli. 2020. Natural disasters as a source of entrepreneurial opportunity: Family business resilience after an earthquake. Strategic Entrepreneurship Journal 14: 594–615. [Google Scholar] [CrossRef]

- Sanchez, Ron. 1995. Strategic flexibility in product competition. Strategic Management Journal 16: 135–59. [Google Scholar] [CrossRef]

- Soluk, Jonas, Nadine Kammerlander, and Alfredo De Massis. 2021. Exogenous shocks and the adaptive capacity of family firms: Exploring behavioral changes and digital technologies in the COVID-19 pandemic. R&D Management, 1–17. [Google Scholar] [CrossRef]

- Somers, Scott. 2009. Measuring Resilience Potential: An Adaptive Strategy for Organizational Crisis Planning. Journal of Contingencies and Crisis Management 17: 12–23. [Google Scholar] [CrossRef]

- Torres, Ariana P., Maria I. Marshall, and Sandra Sydnor. 2019. Does social capital pay off? The case of small business resilience after Hurricane Katrina. Journal of Contingencies and Crisis Management 27: 168–81. [Google Scholar] [CrossRef]

- Vlados, Charis, Epaminondas Koronis, and Dimos Chatzinikolaou. 2021. Entrepreneurship and Crisis in Greece from a neo-Schumpeterian Perspective: A Suggestion to Stimulate the Development Process at the Local Level. Research in World Economy 12: 1. [Google Scholar] [CrossRef]

- World Bank. 2021. Global Economic Prospects. Available online: https://www.worldbank.org/en/publication/global-economic-prospects (accessed on 1 July 2021).

| Variable | Question |

|---|---|

| Did the COVID-19 pandemic result in difficulties in the following aspects of firm’s performance? | |

| WORKERS | limited accessibility of workers |

| COSTS | additional costs of the implementation of required safety measures |

| PROD_CONT | inability to continue production |

| SALES_CONT | inability to continue sales |

| SUPPLY CHAIN | delayed delivery of production components/materials, etc., or produced goods to the customers |

| LIQUIDITY | worsening of financial liquidity |

| BANK LOANS | limited accessibility of bank loans |

| SURVIVAL | The overall impact of COVID-19 threatened the survival of our company |

| Variable | N | % | |

|---|---|---|---|

| SIZE (by the number of employees) | |||

| micro | up to 9 persons | 182 | 33.8 |

| small | 10–49 persons | 208 | 38.7 |

| medium | 50–249 persons | 148 | 27.5 |

| AGE_1 (by the years of operation, four categories of firms’ age) | |||

| infant | (up to 5 years) | 86 | 16.0 |

| young | (6–10 years) | 137 | 25.5 |

| intermediate | (11–20 years) | 187 | 34.8 |

| mature | (21 years or more) | 128 | 23.8 |

| AGE_2 (by the years of operation, three categories of firms’ age) | |||

| young | up to 10 years | 223 | 41.5 |

| intermediate | (11–20 years) | 187 | 34.8 |

| mature | (21 years or more) | 128 | 23.8 |

| OWN_1 (by the owners’ responsibility, dichotomous) | |||

| LLC | limited, perform as limited liability companies | 266 | 49.4 |

| non-LLC | other than LLC, with unlimited owners’ responsibility | 272 | 50.6 |

| OWN_2 (owners’ responsibility, three categories) | |||

| LLC | limited, perform as limited liability companies | 266 | 49.4 |

| SP | unlimited, perform as sole proprietorship | 195 | 36.2 |

| CP | unlimited, perform as civil law partnerships | 77 | 14.3 |

| FAM (family business, as declared by the surveyed firms) | |||

| family | 167 | 31.0 | |

| non-family | 371 | 69.0 | |

| In total | 538 | 100 | |

| WORK | COSTS | PROD_CONT | SALES_CONT | SUPPLY CHAIN | LIQUIDITY | BANK LOANS | SURVIVAL | |

|---|---|---|---|---|---|---|---|---|

| SIZE | 0.188 | 0.000 *** | 0.411 | 0.001 ** | 0.644 | 0.000 *** | 0.002 ** | 0.000 *** |

| AGE_1 | 0.970 | 0.021 * | 0.823 | 0.017 * | 0.012 * | 0.000 *** | 0.000 *** | 0.000 *** |

| AGE_2 | 0.924 | 0.013 * | 0.925 | 0.006 ** | 0.005 ** | 0.000 *** | 0.000 *** | 0.000 *** |

| OWN_1 | 0.283 | 0.000 *** | 0.252 | 0.001 ** | 0.385 | 0.000 *** | 0.000 *** | 0.000 *** |

| OWN_2 | 0.326 | 0.000 *** | 0.266 | 0.002 ** | 0.077 | 0.000 *** | 0.000 *** | 0.000 *** |

| FAM | 0.004 ** | 0.858 | 0.001 ** | 0.830 | 0.196 | 0.378 | 0.308 | 0.366 |

| COVID-19 Interruption | Whole Sample N = 538 | HIGH N = 196 | MODERATE N = 209 | LOW N = 133 | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| WORK | 4.30 | 1.76 | 5.31 | 1.47 | 4.25 | 1.49 | 2.90 | 1.55 |

| COSTS | 4.72 | 1.67 | 5.95 | 1.05 | 4.61 | 1.39 | 3.07 | 1.31 |

| PROD_CONT | 3.88 | 1.90 | 5.51 | 1.34 | 3.44 | 1.61 | 2.17 | 0.87 |

| SALES_CONT | 4.63 | 1.82 | 6.16 | 0.82 | 4.56 | 1.43 | 2.47 | 1.01 |

| SUPPLY CHAIN | 4.41 | 1.70 | 5.81 | 1.14 | 4.07 | 1.38 | 2.87 | 1.15 |

| LIQUIDITY | 4.32 | 1.73 | 5.74 | 1.17 | 4.18 | 1.32 | 2.44 | 0.88 |

| BANK LOANS | 3.70 | 1.39 | 4.48 | 1.31 | 3.70 | 1.16 | 2.56 | 1.02 |

| SURVIVAL | 4.07 | 1.63 | 5.31 | 1.29 | 3.86 | 1.30 | 2.56 | 1.04 |

| SIZE | AGE_1 | AGE_2 | OWN_1 | OWN_2 | FAM | |

|---|---|---|---|---|---|---|

| p-values of K-W test | 0.071 | 0.007 ** | 0.005 ** | 0.045 * | 0.004 ** | 0.316 |

| p-values of post-hoc tests (pair-wise comparisons) | ||||||

| HIGH-MOD | 0.603 | 1.000 | 0.832 | 0.060 | ||

| HIGH-LOW | 0.005 ** | 0.005 ** | 0.038 * | 0.004 ** | ||

| MOD-LOW | 0.121 | 0.032 * | 0.362 | 0.760 | ||

| mean-ranks of K-W test | ||||||

| HIGH | 253.22 | 249.02 | 252.60 | 254.53 | 244.26 | 280.26 |

| MODERATE | 271.24 | 268.01 | 263.16 | 269.07 | 276.99 | 262.90 |

| LOW | 290.76 | 302.02 | 304.37 | 292.24 | 294.92 | 264.01 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wieczorek-Kosmala, M.; Błach, J.; Doś, A. COVID-19 Interruptions and SMEs Heterogeneity: Evidence from Poland. Risks 2021, 9, 161. https://doi.org/10.3390/risks9090161

Wieczorek-Kosmala M, Błach J, Doś A. COVID-19 Interruptions and SMEs Heterogeneity: Evidence from Poland. Risks. 2021; 9(9):161. https://doi.org/10.3390/risks9090161

Chicago/Turabian StyleWieczorek-Kosmala, Monika, Joanna Błach, and Anna Doś. 2021. "COVID-19 Interruptions and SMEs Heterogeneity: Evidence from Poland" Risks 9, no. 9: 161. https://doi.org/10.3390/risks9090161