Economic Policy Uncertainty and Cryptocurrency Market as a Risk Management Avenue: A Systematic Review

Abstract

:1. Introduction

2. Material and Methods

3. Review of Related Research

3.1. Development of Cryptocurrency Market

3.2. EPU Index as a Risk Measure

3.3. Cryptocurrencies as Risk Management Avenue for Economic Policy Uncertainty

3.3.1. Role of Cryptocurrencies for Country EPUs

3.3.2. Role of Cryptocurrencies for Global EPU

4. Conclusions

Future Research Avenues

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | FRBP stands for Federal Reserve Bank of Philadelphia who proposed another measure for policy uncertainty exhibited USA’s economic uncertainty worsening in recent past (Al-Thaqeb and Ghanim 2019). |

| 2 | VIX stands for Volatility Index formed by CBOE (Chicago Boards Options Exchange). |

| 3 | SPX is the abbreviation of (Standard and Poor Index); both are considered as fear-gauge. |

References

- Abdelrhim, Mansour, Abdullah Elsayed, Mahmoud Mohamed, and Mahmoud Farouh. 2020. Investment Opportunities in The Time Of (COVID-19) Spread: The Case of Cryptocurrencies and Metals Markets. SSRN Electronic Journal, 1–19. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2021a. Financial contagion during COVID–19 crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef] [PubMed]

- Akhtaruzzaman, Md, Sabri Boubaker, Brian M. Lucey, and Ahmet Sensoy. 2021b. Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling 102: 105588. [Google Scholar] [CrossRef]

- Al Mamun, Md, Gazi Salah Uddin, Muhammad Tahir Suleman, and Sang Hoon Kang. 2020. Geopolitical risk, uncertainty and Bitcoin investment. Physica A: Statistical Mechanics and Its Applications 540: 123107. [Google Scholar] [CrossRef]

- Algaba, Andres, Samuel Borms, Kris Boudt, and Jeroen Van Pelt. 2020. The Economic Policy Uncertainty Index for Flanders, Wallonia and Belgium. SSRN Electronic Journal, 1–13. [Google Scholar] [CrossRef]

- Al-Thaqeb, Saud Asaad, and Barrak Ghanim Algharabali. 2019. The Journal of Economic Asymmetries Economic policy uncertainty: A literature review. The Journal of Economic Asymmetries 20: e00133. [Google Scholar] [CrossRef]

- Arbatli, Elif C., Steven J. Davis, Arata Ito, and Naoko Miake. 2019. Policy Uncertainty in Japan. Tokyo: National Bureau of Economic Research. [Google Scholar]

- Ariefianto, Moch Doddy. 2020. Assessing qualification of crypto currency as a financial assets: A case study on Bitcoin. Paper presented at International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, August 13–14; pp. 934–39. [Google Scholar] [CrossRef]

- Armelius, Hanna, Isaiah Hull, and Hanna Stenbacka Köhler. 2017. The timing of uncertainty shocks in a small open economy. Economics Letters 155: 31–34. [Google Scholar] [CrossRef] [Green Version]

- Awan, Tahir Mumtaz, Muhammad Shoaib Khan, Inzamam Ul Haq, and Sarwat Kazmi. 2021. Oil and stock markets volatility during pandemic times: A review of G7 countries. Green Finance 3: 15–27. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1–52. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Xiaoxi Wang. 2013. “Economic Policy Uncertainty in China”. unpublished paper. University of Chicago. [Google Scholar]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Reaction to COVID-19: Vol. Covid Econ. The Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Balli, Faruk, Anne de Bruin, Md Iftekhar Hasan Chowdhury, and Muhammad Abubakr Naeem. 2019. Connectedness of cryptocurrencies and prevailing uncertainties. Applied Economics Letters 27: 1316–22. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Lai T. Hoang. 2020. A crypto safe haven against Bitcoin. Finance Research Letters 38: 101431. [Google Scholar] [CrossRef]

- Beneki, Christina, Alexandros Koulis, Nikolaos A. Kyriazis, and Stephanos Papadamou. 2019. Research in International Business and Finance Investigating volatility transmission and hedging properties between Bitcoin and Ethereum. Research in International Business and Finance 48: 219–27. [Google Scholar] [CrossRef]

- Bouri, Elie, and Rangan Gupta. 2019. Predicting Bitcoin returns: Comparing the roles of newspaper- and internet search-based measures of uncertainty. Finance Research Letters 38: 101398. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Brian Lucey, and David Roubaud. 2019. Cryptocurrencies and the downside risk in equity investments. Finance Research Letters 33: 101211. [Google Scholar] [CrossRef]

- Bouri, Elie, Georges Azzi, and Anne Haubo Dyhrberg. 2017a. On the return-volatility relationship in the Bitcoin market around the price crash of 2013. Economics 11: 1–17. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Naji Jalkh, Peter Molnár, and David Roubaud. 2017b. Bitcoin for energy commodities before and after the December 2013 crash: Diversifier, hedge or safe haven? Applied Economics 49: 5063–73. [Google Scholar] [CrossRef]

- Bouri, Elie, Peter Molnár, Georges Azzi, David Roubaud, and Lars Ivar Hagfors. 2017c. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters 20: 192–98. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, Aviral Kumar Tiwari, and David Roubaud. 2017d. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters 23: 87–95. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Rangan Gupta, Chi Keung Marco Lau, David Roubaud, and Shixuan Wang. 2018. Bitcoin and Global Financial Stress: A Copula-Based Approach to Dependence and Causality-in-Quantiles. The Quarterly Review of Economics and Finance 69: 297–307. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Konstantinos Gkillas, and Rangan Gupta. 2020a. Trade uncertainties and the hedging abilities of Bitcoin. Economic Notes 49: 1–10. [Google Scholar] [CrossRef]

- Bouri, Elie, Syed Jawad Hussain Shahzad, and David Roubaud. 2020b. Cryptocurrencies as hedges and safe-havens for US equity sectors. Quarterly Review of Economics and Finance 75: 294–307. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Menelaos Karanasos, and Stavroula Yfanti. 2019. Macro-Financial Linkages in the High- Frequency Domain: The Effects of Uncertainty on Realized Volatility. Social Science Research Network, Working Paper 1922. Available online: https://www.econstor.eu/bitstream/10419/215002/1/cesifo1wp8000.pdf (accessed on 7 September 2021).

- Caporin, Massimiliano, and Michael McAleer. 2013. Ten things you should know about the dynamic conditional correlation representation. Econometrics 1: 115–26. [Google Scholar] [CrossRef] [Green Version]

- Cerda, Rodrigo, Alvaro Silva, and José Tomás Valente. 2018. Impact of economic uncertainty in a small open economy: The case of Chile. Applied Economics 50: 2894–908. [Google Scholar] [CrossRef]

- Cheema, Muhammad A., Kenneth Szulczuk, and Elie Bouri. 2020. Predicting Cryptocurrency Returns Based on Economic Policy Uncertainty: A Multicountry Analysis Using Linear and Quantile-Based Models. SSRN Electronic Journal, 1–34. [Google Scholar] [CrossRef]

- Chen, Tiejun, Chi Keung Marco Lau, Sadaf Cheema, and Chun Kwong Koo. 2021. Economic Policy Uncertainty in China and Bitcoin Returns: Evidence From the COVID-19 Period. Frontiers in Public Health 9: 1–7. [Google Scholar] [CrossRef]

- Cheng, Hui-Pei, and Kuang-Chieh Yen. 2020. The relationship between the economic policy uncertainty and the cryptocurrency market. Finance Research Letters 35: 101308. [Google Scholar] [CrossRef]

- Choudhary, M. Ali, Farooq Pasha, and Mohsin Waheed. 2020. Measuring Economic Policy Uncertainty in Pakistan. Available online: https://mpra.ub.uni-muenchen.de/100013/1/MPRA_paper_100013.pdf (accessed on 7 September 2021).

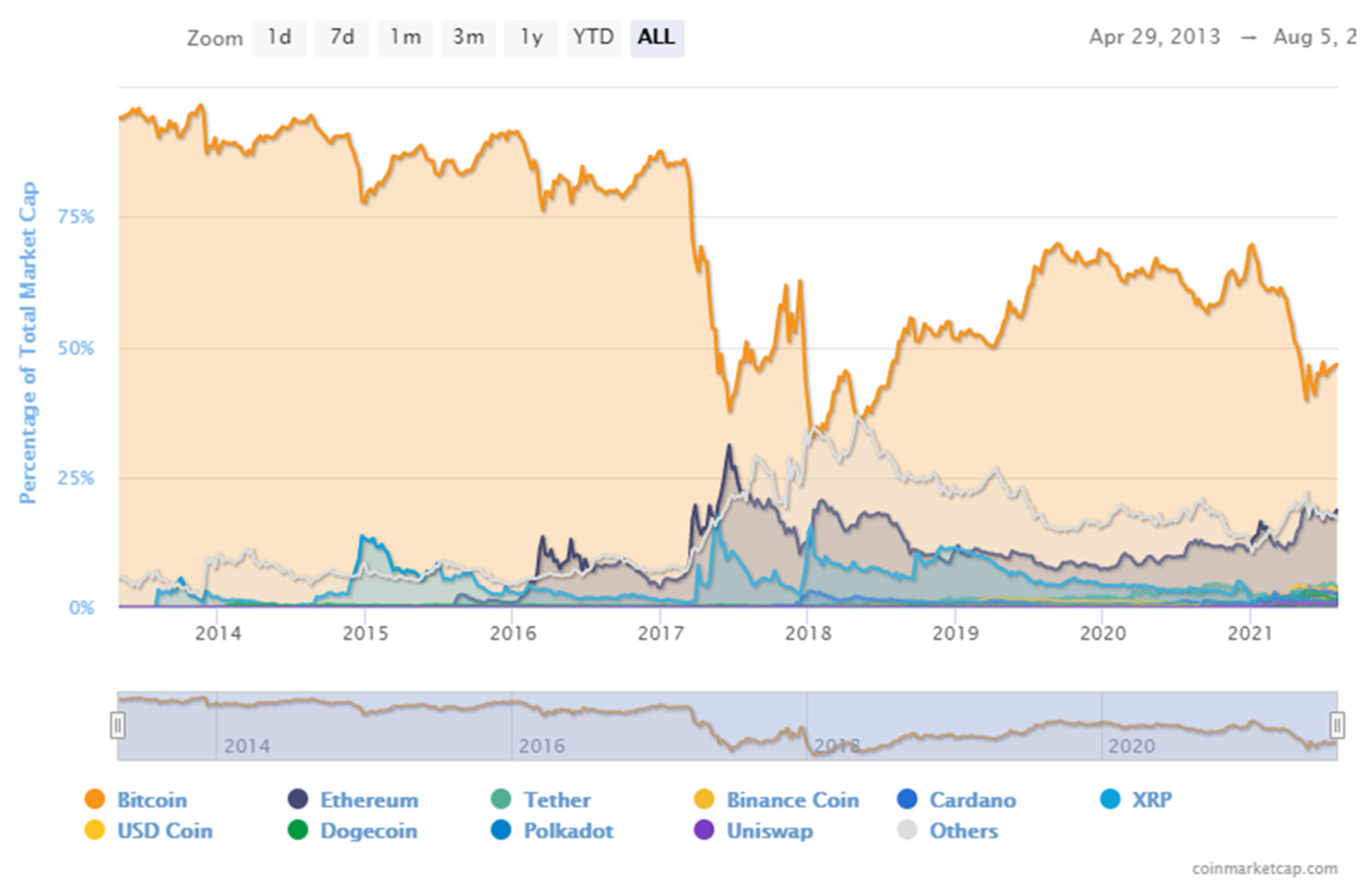

- CoinMarketCap. 2020. Percentage of Total Market Capitalization (Dominance). Available online: https://coinmarketcap.com/charts/#dominance-percentage (accessed on 5 August 2021).

- Colon, Francisco, Chaehyun Kim, Hana Kim, and Wonjoon Kim. 2021. The effect of political and economic uncertainty on the cryptocurrency market. Finance Research Letters 39: 101621. [Google Scholar] [CrossRef]

- Corbet, Shaen, Andrew Meegan, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2018a. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters 165: 28–34. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Brian Lucey, and Larisa Yarovaya. 2018b. Datestamping the Bitcoin and Ethereum bubbles. Finance Research Letters 26: 81–88. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Brian Lucey, Andrew Urquhart, and Larisa Yarovaya. 2019a. Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis 62: 182–99. [Google Scholar] [CrossRef] [Green Version]

- Corbet, Shaen, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2019b. KODAKCoin: A blockchain revolution or exploiting a potential cryptocurrency bubble? Applied Economics Letters 21: 518–24. [Google Scholar] [CrossRef]

- Da, Zhi, Joseph Engelberg, and Pengjie Gao. 2015. The sum of all FEARS investor sentiment and asset prices. Review of Financial Studies 28: 1–32. [Google Scholar] [CrossRef] [Green Version]

- Davis, Steven J. 2016. An Index of Global Economic Policy Uncertainity. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Demir, Ender, Giray Gozgor, Chi Keung Marco Lau, and Samuel A. Vigne. 2018. Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Finance Research Letters 26: 145–49. [Google Scholar] [CrossRef] [Green Version]

- Donadelli, Michael, and Lauren Persha. 2014. Understanding emerging market equity riskpremia: Industries, governance andmacroeconomic policy uncertainty. Research in International Business and Finance 30: 284–309. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2015a. Hedging capabilities of Bitcoin is it the virtual gold? Finance Research Letters 16: 139–44. [Google Scholar] [CrossRef] [Green Version]

- Dyhrberg, Anne Haubo. 2015b. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef] [Green Version]

- Evans, John L., and Stephen H. Archer. 1968. Diversification and the Reduction of Dispersion: An Empirical Analysis. The Journal of Finance 23: 761–67. [Google Scholar]

- Fang, Libing, Elie Bouri, Rangan Gupta, and David Roubaud. 2019. Does global economic uncertainty matter for the volatility and hedging effectiveness of Bitcoin? International Review of Financial Analysis 61: 29–36. [Google Scholar] [CrossRef]

- Fang, Tong, Zhi Su, and Libo Yin. 2020. Economic fundamentals or investor perceptions? The role of uncertainty in predicting long-term cryptocurrency volatility. International Review of Financial Analysis 71: 101566. [Google Scholar] [CrossRef]

- Fasanya, Ismail O., Johnson A. Oliyide, Oluwasegun B. Adekoya, and Taofeek Agbatogun. 2021. How does economic policy uncertainty connect with the dynamic spillovers between precious metals and Bitcoin markets? Resources Policy 72: 102077. [Google Scholar] [CrossRef]

- Foglia, Matteo, and Peng-Fei Dai. 2021. “Ubiquitous uncertainties”: Spillovers across economic policy uncertainty and cryptocurrency uncertainty indices. Journal of Asian Business and Economic Studies. [Google Scholar] [CrossRef]

- Geissdoerfer, Martin, Paulo Savaget, Nancy M.P. Bocken, and Erik Jan Hultink. 2017. The Circular Economy—A new sustainability paradigm? Journal of Cleaner Production 143: 757–68. [Google Scholar] [CrossRef] [Green Version]

- Ghirelli, Corinna, Javier J. Pérez, and Alberto Urtasun. 2019. A new economic policy uncertainty index for Spain. Economics Letters 182: 64–67. [Google Scholar] [CrossRef] [Green Version]

- Gil, Mauricio, and Daniel Silva. 2018. Economic Policy Uncertainty Indices for Colombia. In Deutch Bank Research. Available online: http://www.policyuncertainty.com/methodology.html (accessed on 7 September 2021).

- Haq, Inzamam Ul, and Tahir Mumtaz Awan. 2020. Impact of e-banking service quality on e-loyalty in pandemic times through interplay of e-satisfaction. Vilakshan XIMB Journal of Management 17: 39–55. [Google Scholar] [CrossRef]

- Haq, Inzamam Ul, Supat Chupradit, and Chunhui Huo. 2021. Do Green Bonds Act as a Hedge or a Safe Haven against Economic Policy Uncertainty? Evidence from the USA and China. International Journal of Financial Studies 9: 40. [Google Scholar] [CrossRef]

- Hardouvelis, Gikas A., Georgios Karalas, Dimitrios Karanastasis, and Panagiotis Samartzis. 2018. Economic Policy Uncertainty, Political Uncertainty and the Greek Economic Crisis. SSRN Electronic Journal. [Google Scholar] [CrossRef] [Green Version]

- Harwick, C. 2016. Cryptocurrency and the problem of intermediation. Independent Review 20: 569–88. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, M. Kabir Hassan, Zulkefly Abdul Karim, and Md Mamunur Rashid. 2021. Exploring the hedge and safe haven properties of cryptocurrency in policy uncertainty. Finance Research Letters, 102272. [Google Scholar] [CrossRef]

- Hassan, Tarek A., Stephan Hollander, Laurence Van Lent, and Ahmed Tahoun. 2019. Firm-level political risk: Measurement and effects. Quarterly Journal of Economics 134: 2135–202. [Google Scholar] [CrossRef] [Green Version]

- Hoang, Lai T., and Dirk G. Baur. 2020. How Stable Are Stablecoins? SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Jiang, Yonghong, Lanxin Wu, Gengyu Tian, and He Nie. 2021. Do cryptocurrencies hedge against EPU and the equity market volatility during COVID-19?—New evidence from quantile coherency analysis. Journal of International Financial Markets, Institutions and Money 72: 101324. [Google Scholar] [CrossRef]

- Julio, Brandon, and Youngsuk Yook. 2012. Political uncertainty and corporate investment cycles. Journal of Finance 67: 45–83. [Google Scholar] [CrossRef]

- Kalyvas, Antonios, Panayiotis Papakyriakou, Athanasios Sakkas, and Andrew Urquhart. 2020. What drives Bitcoin’s price crash risk? Economics Letters 191: 108777. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019. High frequency volatility co-movements in cryptocurrency markets. Journal of International Financial Markets, Institutions and Money 62: 35–52. [Google Scholar] [CrossRef]

- Khaldi, Rohaifa, Abdellatif El Afia, and Raddouane Chiheb. 2019. Forecasting of BTC volatility: Comparative study between parametric and nonparametric models. Progress in Artificial Intelligence 8: 511–23. [Google Scholar] [CrossRef]

- Kido, Yosuke. 2016. On the link between the US economic policy uncertainty and. Economics Letters 144: 49–52. [Google Scholar] [CrossRef]

- Koki, Constandina, Stefanos Leonardos, and Georgios Piliouras. 2019. A Peek into the Unobservable: Hidden States and Bayesian Inference for the Bitcoin and Ether Price Series. arXiv arXiv:1909.10957. [Google Scholar]

- Koumba, Ur, Calvin Mudzingiri, and Jules Mba. 2020. Does uncertainty predict cryptocurrency returns? A copula-based approach. Macroeconomics and Finance in Emerging Market Economies 13: 67–88. [Google Scholar] [CrossRef]

- Kristjanpoller, Werner, and Elie Bouri. 2019. Asymmetric multifractal cross-correlations between the main world currencies and the main cryptocurrencies. Physica A: Statistical Mechanics and Its Applications 523: 1057–71. [Google Scholar] [CrossRef]

- Kroese, Lars, Suzanne Kok, and Jante Parlevliet. 2015. Beleidsonzekerheid in nederland. Economisch Statistiche Berichten 4715: 464–67. [Google Scholar]

- Kyriazis, Nikolaos A. 2021. The nexus of sophisticated digital assets with economic policy uncertainty: A survey of empirical findings and an empirical investigation. Sustainability 13: 5383. [Google Scholar] [CrossRef]

- Lucey, Brian M., Samuel A. Vigne, Larisa Yarovaya, and Yizhi Wang. 2021. The cryptocurrency uncertainty index. Finance Research Letters 10: 102147. [Google Scholar] [CrossRef]

- Luk, Paul, Michael Cheng, Philip Ng, and Ken Wong. 2017. Economic Policy Uncertainty Spillovers in Small Open Economies: The Case of Hong Kong. Pacific Economic Review 25: 21–46. [Google Scholar] [CrossRef]

- Manela, Asaf, and Alan Moreira. 2016. News implied volatility and disaster concerns. Journal of Financial Economics 123: 137–62. [Google Scholar] [CrossRef]

- Matkovskyy, Roman, Akanksha Jalan, and Michael Dowling. 2020. Effects of economic policy uncertainty shocks on the interdependence between Bitcoin and traditional financial markets. Quarterly Review of Economics and Finance 77: 150–55. [Google Scholar] [CrossRef]

- Mokni, Khaled. 2021. When, where, and how economic policy uncertainty predicts Bitcoin returns and volatility? A quantiles-based analysis. Quarterly Review of Economics and Finance 80: 65–73. [Google Scholar] [CrossRef]

- Mokni, Khaled, Ahdi Noomen Ajmi, Elie Bouri, and Xuan Vinh Vo. 2020. Economic policy uncertainty and the Bitcoin-US stock nexus. Journal of Multinational Financial Management 58: 1–13. [Google Scholar] [CrossRef]

- Murphy, Edward V., M. Maureen Murphy, and Michael V. Seitzinger. 2015. Bitcoi: Questions, Answers, and Analysis of Legal Issues; Washington, DC: Congressional Research Service.

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Journal for General Philosophy of Science 39: 53–67. [Google Scholar] [CrossRef]

- Newey, Whitney K., and Kenneth D. West. 1987. Hypothesis Testing with Efficient Method of Moments Estimation. International Economic Review 28: 777. [Google Scholar] [CrossRef]

- Nguyen, Khanh Q. 2020. Conditional Beta and Uncertainty Factor in the Cryptocurrency Pricing Model. arXiv arXiv:2010.12736. [Google Scholar]

- Nie, Wei-Ying, Hui-Pei Cheng, and Kuang-Chieh Yen. 2020. Investor Sentiment and the Cryptocurrency Market Investor Sentiment and the Cryptocurrency Market. Empirical Economics Letters 19: 1254–62. [Google Scholar]

- Papadamou, Stephanos, Nikolaos A. Kyriazis, and Panayiotis G. Tzeremes. 2021. Non-linear causal linkages of EPU and gold with major cryptocurrencies during bull and bear markets. North American Journal of Economics and Finance 56: 101343. [Google Scholar] [CrossRef]

- Parino, Francesco, Mariano G. Beiró, and Laetitia Gauvin. 2018. Analysis of the Bitcoin blockchain: Socio-economic factors behind the adoption. EPJ Data Science 7: 38. [Google Scholar] [CrossRef]

- Park, Minjung, and Sangmi Chai. 2020. The Effect of Information Asymmetry on Investment Behavior in Cryptocurrency Market. Proceedings of the 53rd Hawaii International Conference on System Sciences 3: 4043–52. [Google Scholar] [CrossRef] [Green Version]

- Paule-Vianez, Jessica, Camilo Prado-Román, and Raúl Gómez-Martínez. 2020. Economic policy uncertainty and Bitcoin. Is Bitcoin a safe-haven asset? European Journal of Management and Business Economics 29: 347–63. [Google Scholar] [CrossRef] [Green Version]

- Qin, Meng, Chi-Wei Su, and Ran Tao. 2021. Bitcoin: A new basket for eggs? Economic Modelling, February 94: 896–907. [Google Scholar] [CrossRef]

- Raheem, Ibrahim D. 2021. COVID-19 pandemic and the safe haven property of Bitcoin. Quarterly Review of Economics and Finance 81: 370–75. [Google Scholar] [CrossRef]

- Rubbaniy, Ghulame, Ali Awais Khalid, and Aristeidis Samitas. 2021. Are Cryptos Safe-Haven Assets during COVID-19? Evidence from Wavelet Coherence Analysis. Emerging Markets Finance and Trade 57: 1741–56. [Google Scholar] [CrossRef]

- Scotti, Chiara. 2016. Surprise and uncertainty indexes: Real-time aggregation. Journal of Monetary Economics 82: 1–19. [Google Scholar] [CrossRef] [Green Version]

- Shaikh, Imlak. 2020. Policy uncertainty and Bitcoin returns. Borsa Istanbul Review 20: 257–68. [Google Scholar] [CrossRef]

- Sorić, Petar, and Ivana Lolić. 2017. Economic uncertainty and its impact on the Croatian economy. Public Sector Economics 41: 443–77. [Google Scholar] [CrossRef]

- Su, Chi-Wei, Meng Qin, Ran Tao, and Xiaoyan Zhang. 2020. Is the status of gold threatened by Bitcoin? Economic Research-Ekonomska Istrazivanja 33: 420–37. [Google Scholar] [CrossRef]

- Wang, Gang-Jin, Chi Xie, Danyan Wen, and Longfeng Zhao. 2019a. When Bitcoin meets economic policy uncertainty (EPU): Measuring risk spillover effect from EPU to Bitcoin. Finance Research Letters 31: 489–97. [Google Scholar] [CrossRef]

- Wang, Pengfei, Wei Zhang, Xiao Li, and Dehua Shen. 2019b. Is cryptocurrency a hedge or a safe haven for international indices? A comprehensive and dynamic perspective. Finance Research Letters Journal 31: 1–18. [Google Scholar] [CrossRef]

- Wang, Yaw-Huei, and Kuang-Chieh Yen. 2019. The information content of the implied volatility term structure on future returns. European Financial Management 25: 380–406. [Google Scholar] [CrossRef]

- Wu, Shan, Mu Tong, Zhongyi Yang, and Abdelkader Derbali. 2019. Does gold or Bitcoin hedge economic policy uncertainty? Finance Research Letters 31: 171–78. [Google Scholar] [CrossRef]

- Wu, Wanshan, Aviral Kumar Tiwari, Giray Gozgor, and Huang Leping. 2021. Does economic policy uncertainty affect cryptocurrency markets? Evidence from Twitter-based uncertainty measures. Research in International Business and Finance 58: 101478. [Google Scholar] [CrossRef]

- Yen, Kuang-Chieh, and Hui-Pei Cheng. 2021. Economic policy uncertainty and cryptocurrency volatility. Finance Research Letters 38: 101428. [Google Scholar] [CrossRef]

- Yu, Miao, and Jinguo Song. 2018. Volatility forecasting: Global economic policy uncertainty and regime switching. Physica A: Statistical Mechanics and Its Applications 511: 316–23. [Google Scholar] [CrossRef]

- Zalla, Ryan. 2017. Economic Policy Uncertainty in Ireland. Atlantic Economic Journal 45: 269–71. [Google Scholar] [CrossRef]

| Authors | EPU Index | |

|---|---|---|

| 1 | Baker et al. (2016) | USA, Brazil, Canada, Australia, France, India, Germany, United Kingdome, South Korea, Russia, Mexico, Italy, and Europe. |

| 2 | Algaba et al. (2020) | Belgium |

| 3 | Cerda et al. (2018) | Chile |

| 4 | Baker et al. (2013) | China |

| 5 | Gil and Silva (2018) | Columbia |

| 6 | Sorić and Lolić (2017) | Croatia |

| 7 | Hardouvelis et al. (2018) | Greece |

| 8 | Zalla (2017) | Ireland |

| 9 | Luk et al. (2017) | Hong Kong |

| 10 | Arbatli et al. (2019) | Japan |

| 11 | Kroese et al. (2015) | Netherlands |

| 12 | Choudhary et al. (2020) | Pakistan |

| 13 | Davis (2016) | Global and Singapore |

| 14 | Ghirelli et al. (2019) | Spain |

| 15 | Armelius et al. (2017) | Sweden |

| No | Title | Authors & Year | Reason | Employed Methodology | Frequency | Data Source | Data Coverage | Findings |

|---|---|---|---|---|---|---|---|---|

| 1 | Policy uncertainty and Bitcoin returns | (Shaikh 2020) | Bitcoin returns and EPU, MPU and VIX | Quantile Regression and Marko Regime-Switching | Monthly/Daily | www.coindesk.com www.policyuncertainity.com | 2010–2018 | Bitcoin return’s responsiveness to EPU |

| 2 | Gold & Bitcoin as a hedge again EPU | (Wu et al. 2019) | Hedge and safe-haven | GARCH Model and Quantile Regression | Daily | www.investing.com www.policyuncertainity.com | 2012–2018 | Gold and Bitcoin are not strong hedge and safe-haven |

| 3 | Measuring risk spillover from EPU to Bitcoin | (Wang et al. 2019a) | Risk Spillover | Multivariate Quantiles Model & Granger Causality Test | Daily | www.coindesk.com www.policyuncertainity.com | 2010–2018 | Negligible risk spillover from EPU to Bitcoin |

| 4 | Does EPU predicts the Bitcoin returns. | (Demir et al. 2018) | Predictive Power of EPU on Bitcoin returns | OLS and QQ Regression | Daily | www.coindesk.com www.policyuncertainity.com | 2010–2017 | EPU holds strong Predictive power on Bitcoin Returns |

| 5 | Is Bitcoin a new egg in the basket? | (Qin et al. 2021) | Risk mitigation role of Bitcoin | Granger Causality Test | Monthly | www.yahoofinance.com www.policyuncertainity.com | 2010–2019 | Mixed (positive/negative) impact on Bitcoin returns |

| 6 | EPU and Cryptocurrency returns | (Cheng and Yen 2020) | Risk management and responsiveness | Predictive Regression Model | Daily | www.coinmarketcap.com www.policyuncertainity.com | 2014–2019 | Positive association between Chinese EPU and Cryptocurrency market |

| 7 | Uncertainty predict cryptocurrency returns | (Koumba et al. 2020) | EPU impact of Cryptocurrency returns in financial crisis Risk Management | D-Vine Copula | Daily | www.coingeko.com www.policyuncertainity.com | 2015–2018 | Ethereum is better hedge in cryptocurrency market |

| 8 | Cryptocurrency volatility, hedging effectiveness and EPU | (Fang et al. 2019) | Long-run global volatility hedging | GARCH-MIDAS | Monthly | www.coindesk.com www.policyuncertainity.com | 2010–2018 | EPU as a source of plunged volatility in Bitcoin market |

| 9 | Cryptocurrency and downsize risk | (Bouri et al. 2019) | Diversifier role of Bitcoin | DCC-GARCH Model | Daily | www.coinmarketcap.com www.datastream.com | 2015–2018 | Bitcoin, Ethereum and Litecoin are hedge. |

| 10 | Global financial stress and Bitcoin returns | (Bouri et al. 2018) | Bitcoin return Predictability | Copula based Model Granger Causality Cross-Quantilogram | Daily | www.coindesk.com | 2010–2017 | Right tail dependence between uncertainty and Bitcoin |

| 11 | Bitcoin and major stock indexes | (Bouri et al. 2017c) | Bitcoin as a hedge and safe0haven | DCC-GARCH Model | Daily/weekly | www.datastream.com | 2011–2015 | Strong safe-haven properties of Bitcoin in Asia |

| 12 | Linkage of Bitcoin and Commodities | (Bouri et al. 2017b) | Bitcoin as Hedge, Safe-haven and Diversifier | DCC-GARCH Model | Daily | www.coindesk.com | 2010–2015 | Hedge and safe-haven in Pre-Bitcoin price crash and diversifier in post-period |

| 13 | Bitcoin and Global EPU | (Bouri et al. 2017d) | Hedging properties of Bitcoin | Wavelet Quantile-on-Quantile approach | Daily | www.coindesk.com www.datastream.com | 2011–2016 | Bitcoin is a hedge against global uncertainty |

| 14 | Volatility and cryptocurrency return relationship | (Bouri et al. 2017a) | Co-Movements and hedging | Asymmetric GARCH Model | Daily | wwwbitstamp.com | 2011–2016 | No Asymmetric return volatility relationship |

| 15 | Predicting Bitcoin returns | (Bouri and Gupta 2019) | New-based and internet search-based EPU measures predictability | EGARCH | Monthly | www.cryptocompare.com www.policyuncertainty.com | 2010–2019 | Bitcoin works as hedge against both measures. |

| 16 | Bitcoin and international indices | (Wang et al. 2019b) | Hedge and safe-haven properties | DCC-GARCH | Daily | www.coinmarketcap.com | 2013–2018 | Cryptocurrencies are more safe-haven than a hedge |

| 17 | EPU and Bitcoin Investment | (Al Mamun et al. 2020) | Impact of EPU on securities correlation patterns | DCC-GJR-GARCH | Daily | www.coindesk.com | 2010–2016 | EPU and GPU hold strong impact during unfavorable economic and financial periods |

| 18 | Bitcoin prices crash and EPU association | (Kalyvas et al. 2020) | EPU risk hedging | NCSKEW & DUVOL | Daily/Intra-day | www.bitcoincharts.com | 2011–2018 | Bitcoin can hedge EPU risks |

| 19 | Trade and Economic uncertainties and Bitcoin return | (Bouri et al. 2020a) | Hedging the TPU and EPU | Realized volatility Linear regression | Monthly | www.bitstamp.net | 2011–2019 | Bitcoin proves as hedge and diversifier |

| 20 | Effect of political and economic uncertainty on Cryptocurrency market | (Colon et al. 2021) | Hedging and risk management | OLS regression | Monthly | www.coinmarketcap.com www.policyuncertainty.com | 2013–2019 | Cryptocurrencies are strong hedge against GPU and weak against EPU |

| 21 | Conditional beta and uncertainty factory in cryptocurrency pricing model | (Nguyen 2020) | Pricing Model of cryptocurrency | Two-Pass Regression | Daily | www.coinmarketcap.com www.policyuncertainty.com | 2016–2020 | Conditional beta is better than unconditional beta |

| 22 | Role of uncertainty in predicting the long-term cryptocurrency volatility | (Fang et al. 2020) | Hedging ability and impact of uncertainty measures on cryptocurrency volatility | GARCH-MIDAS | Daily & Monthly | www.coinmarketcap.com www.policyuncertainty.com | 2013–2019 | NVIX is more important than GEPU. Works as a hedge against NVIX and S & P 500. |

| 23 | Effect of information asymmetry on investment in cryptocurrency market | (Park and Chai 2020) | Influence of information asymmetry on investment behavior | Probability of informed trading & Vector Error Correction model | Daily | www.coinmarketcap.com www.policyuncertainty.com | 2015–2019 | Investor’s decision making is based on sentiment rather than information about cryptocurrencies. |

| 24 | Influence of EPU on the linkage between conventional assets and Bitcoin | (Matkovskyy et al. 2020) | Correlation patterns for hedging | EWMA Models GAS Model | Daily & Monthly | www.bitstamp.net www.policyuncertainty.com | 2015–2018 | Bitcoin is a hedging instrument against US EPU |

| 25 | Investors’ sentiment and cryptocurrency market | (Nie et al. 2020) | Sentiment and cryptocurrency volatility | Multiple regression models | Monthly | www.coinmarketcap.com | 2014–2018 | High sentiment high trading and lower sentiment lower trading |

| 26 | Cryptocurrency as a financial asset | (Ariefianto 2020) | Is cryptocurrency really a financial asset class? | Multiple Regression | Monthly | www.ppolicyuncertainty.com www.yahoofinance.com | 2014–2020 | Notion of cryptocurrency as financial asset is spurious |

| 27 | EPU and Cryptocurrency Returns | (Cheema et al. 2020) | Predictive power of EPU toward Cryptocurrency returns | OLS, Augmented regression Quantile regression | Monthly | www.coinmarketcap.com www.policyuncertainty.com | 2013–209 | Cryptocurrencies cannot be a hedge or safe-haven during higher risky periods. |

| 28 | Non-linear Linkage EPU and Cryptocurrencies | (Papadamou et al. 2021) | Non-linear linage | Non-parametric quantile and Granger causality test | Daily | www.coinmarketcap.com www.policyuncertainty.com | 2017–2019 | Cryptocurrencies are tightly connected with EPU in both Bearish and Bullish Market |

| 29 | EPU and Bitcoin returns (volatility) | (Paule-Vianez et al. 2020) | Is Bitcoin a safe-have asset? | Linear regression with OLS | Daily | www.investing.com www.policyuncertainty.com | 2010–2019 | Identical to gold thus, safe-haven. |

| 30 | Influence of EPU on Cryptocurrency Market | (Wu et al. 2021) | Risk management and hedging | Rolling Window Approach Granger Causality Test | Daily | www.policyuncertainty.com www.yahoofinance.com | 2015–2020 | Positive association between Twitter based uncertainty and Cryptocurrencies |

| 31 | EPU and Bitcoin-US stocks nexus | (Mokni et al. 2020) | Impact EPU on the correlation of Bitcoin and US stocks | DCC-EGARCH | Daily | www.coinmarketcap.com www.policyuncertainty.com | 2014–2020 | Mixed diversification properties with US stocks |

| 32 | Cryptocurrencies and policy uncertainty | (Hasan et al. 2021) | Risk management | OLS Quantile regression Quantile on Quantile regression | Weekly | www.investing.com https://brianmlucey.wordpress.com | 2013–2021 | Do not act as a hedge or safe-haven |

| 33 | Impact of EPU on Cryptocurrencies | (Wu et al. 2021) | Hedging properties and responsiveness to EPU shocks | Granger Causality test | Daily | www.yahoofinance.com www.economicpolicyuncertainity.com | 2015–2020 | Bitcoin, Ripple, and Ethereum act as a hedge. |

| 34 | Impact of EPU on Bitcoin returns and volatility | (Mokni 2021) | Portfolio diversification, Hedge, and safe-haven properties | symmetric and asymmetric causality quantiles | Monthly | www.economicpolicyuncertainity.com www.coinmarketcap.com | 2010–2019 | EPU improves Bitcoin returns in most countries. |

| 35 | Cryptocurrency uncertainty index | (Lucey et al. 2021) | Co-movement between risk proxies | Pearson correlation | Monthly | new source introduced | 2014–2021 | Positive co-movements between uncertainty measures. |

| 36 | EPU and Cryptocurrency volatility | (Yen and Cheng 2021) | Risk management and responsiveness | Stochastic volatility Model | Monthly | www.coinmarketcap.com www.policyuncertainity.com | 2014–2019 | Negative association between Chinese EPU and Cryptocurrency market volatility |

| 37 | Impact of EPU on the cryptocurrency market | (Colon et al. 2021) | Risk mitigate and hedging properties | OLS regression | month | www.economicpolicyuncertainity.com www.coinmarketcap.com | 2013–2019 | Strong and week hedge and safe-haven EPU and geopolitical risk |

| 38 | Cryptocurrency and policy uncertainty | (Foglia and Dai 2021) | Spillover and risk mitigation | Time-varying parameter vector autoregression | Monthly | www.economicpolicyuncertainity.com | 2013–2019 | EPU predicts cryptocurrency uncertainty |

| 39 | EPU and Bitcoin returns during COVID-19 | (Chen et al. 2021) | Risk mitigation and hedging properties | Predictive Model (OLS-GQS generalized quantile regression) | Daily | www.economicpolicyuncertainity.com | 2019–2020 | Bitcoin is a hedge for EPU risk. |

| 40 | Connectedness among EPU, precious metals, and Bitcoin | (Fasanya et al. 2021) | Risk mitigation and hedging and safe properties | Non-parametric quintile approach Dynamic spillover | Daily | www.economicpolicyuncertainity.com www.investing.com | 2010–2020 | Both precious metals and Bitcoin do not act as a hedge or safe haven. |

| 41 | EPU and Digital currencies | (Kyriazis 2021) | Hedging, safe-haven, and diversifier properties | ARCH Model | Daily | www.economicpolicyuncertainity.com www.coinmarketcap.com | 2017–2020 | Litecoin and Ethereum are diversifiers for Bitcoin and Bitcoin is a safe haven and hedge for EPU. |

| 42 | Connectedness between Cryptocurrency and EPU | (Jiang et al. 2021) | Hedging and risk management | Quantile cross-spectral | Daily | www.economicpolicyuncertainity.com www.coingeko.com | 2015–2020 | Cryptocurrencies act as a hedge for higher-EPU but not in moderate or low EPU. |

| 43 | Cryptocurrencies and EPU | (Rubbaniy et al. 2021) | Safe-haven properties | Wavelet coherence analysis | Daily | www.economicpolicyuncertainity.com www.coinmarketcap.com | 2019–2021 | Cryptocurrencies are safe-haven |

| 44 | Bitcoin and EPU during COVID-19 | (Raheem 2021) | Safe-haven properties of Bitcoin | OLS regression | Daily | www.economicpolicyuncertainity.com www.coindesk.com | 2019–2020 | Bitcoin act as a safe haven during COVID-19 |

| No. | Data Frequencies | Number of Studies | % |

|---|---|---|---|

| 1 | Daily | 25 | 56.82% |

| 2 | Monthly | 13 | 29.55% |

| 3 | Daily/Intra-day | 1 | 2.27% |

| 4 | Monthly/Daily | 3 | 6.82% |

| 5 | Weekly | 1 | 2.27% |

| 6 | Daily/weekly | 1 | 2.27% |

| N | 44 | 100% |

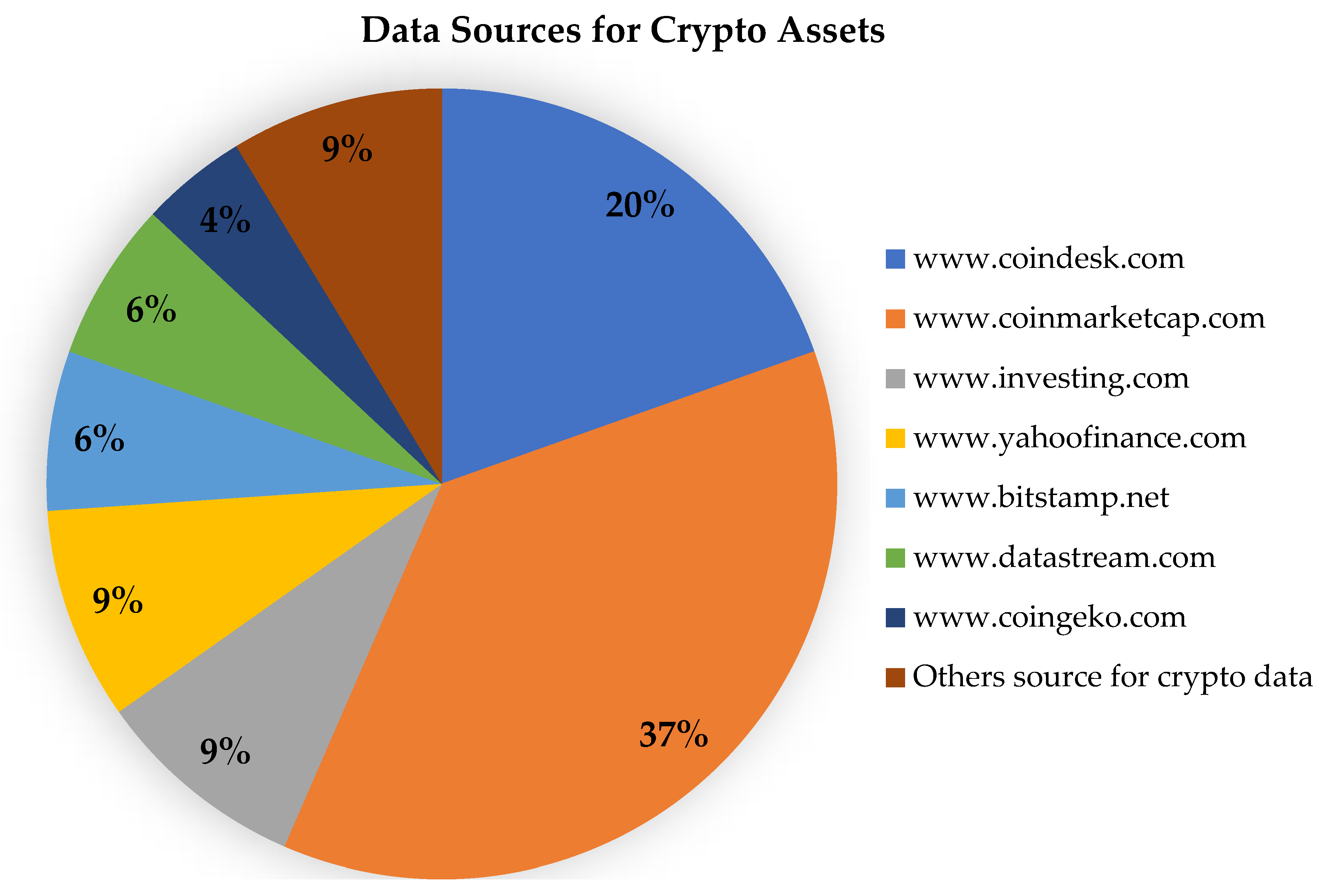

| No. | Sources | Number of Studies |

|---|---|---|

| 1 | www.Coindesk.com | 9 |

| 2 | www.Coinmarketcap.com | 17 |

| 3 | www.Investing.com | 4 |

| 4 | www.Yahoofinance.com | 4 |

| 5 | www.Bitstamp.net | 3 |

| 6 | www.Datastream.com | 3 |

| 7 | www.Coingeko.com | 2 |

| 8 | Others source for crypto data | 4 |

| 9 | www.Policyuncertainity.com | 32 |

| Numbers | Gaps |

|---|---|

| 1 | Topics and objectives |

| |

| 2 | Research methodologies |

| |

| 3 | Data Coverage and frequency |

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Haq, I.U.; Maneengam, A.; Chupradit, S.; Suksatan, W.; Huo, C. Economic Policy Uncertainty and Cryptocurrency Market as a Risk Management Avenue: A Systematic Review. Risks 2021, 9, 163. https://doi.org/10.3390/risks9090163

Haq IU, Maneengam A, Chupradit S, Suksatan W, Huo C. Economic Policy Uncertainty and Cryptocurrency Market as a Risk Management Avenue: A Systematic Review. Risks. 2021; 9(9):163. https://doi.org/10.3390/risks9090163

Chicago/Turabian StyleHaq, Inzamam Ul, Apichit Maneengam, Supat Chupradit, Wanich Suksatan, and Chunhui Huo. 2021. "Economic Policy Uncertainty and Cryptocurrency Market as a Risk Management Avenue: A Systematic Review" Risks 9, no. 9: 163. https://doi.org/10.3390/risks9090163