COVID-19 Pandemic and Investor Herding in International Stock Markets

Abstract

:1. Introduction

2. Data and Testing Methodology

2.1. Data

2.2. Testing Methodology

3. Empirical Findings

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | Stock market classifications by MSCI are available at https://www.msci.com/market-classification (accessed on 11 August 2020) |

| 2 | Demirer et al. (2010) provide a review of the different testing methodologies based on return dispersion. |

| 3 | We also repeat our analysis by computing the cross-sectional standard deviation (CSSDt =

) statistic instead of CSAD. We obtained qualitatively, as well as quantitatively similar results, which are available upon request from the authors. |

| 4 | Since data is available for all the countries before 1 January of 2019, note we do not lose any observation while computing log-returns used in our model. |

| 5 | As suggested by an anonymous referee, we also conducted the rolling-window analysis by starting from 2018, and found our results to be similar not only qualitatively, but also quantitatively. Complete details of these results are available upon request from the authors. |

| 6 | Based on the valuable suggestion of an anonymous referee, we analyzed the comovement of the trading volumes for these markets during the identified periods of herding. For this purpose, we obtained the principal components of the trading volumes of all the stock markets for which data was available, as well as for countries categorized as advanced and emerging. Then we regressed the principal components on the herding dummies corresponding to either 10% or 5%, and found positive and statistically significant relationships. This suggests that trading volumes comove during periods of herding. Since, trading volume data was not available for all the stock markets considered, we have not reported these results explicitly in the paper due to lack of one-to-one correspondence with stock price indexes. However, these results are available upon request from the authors. |

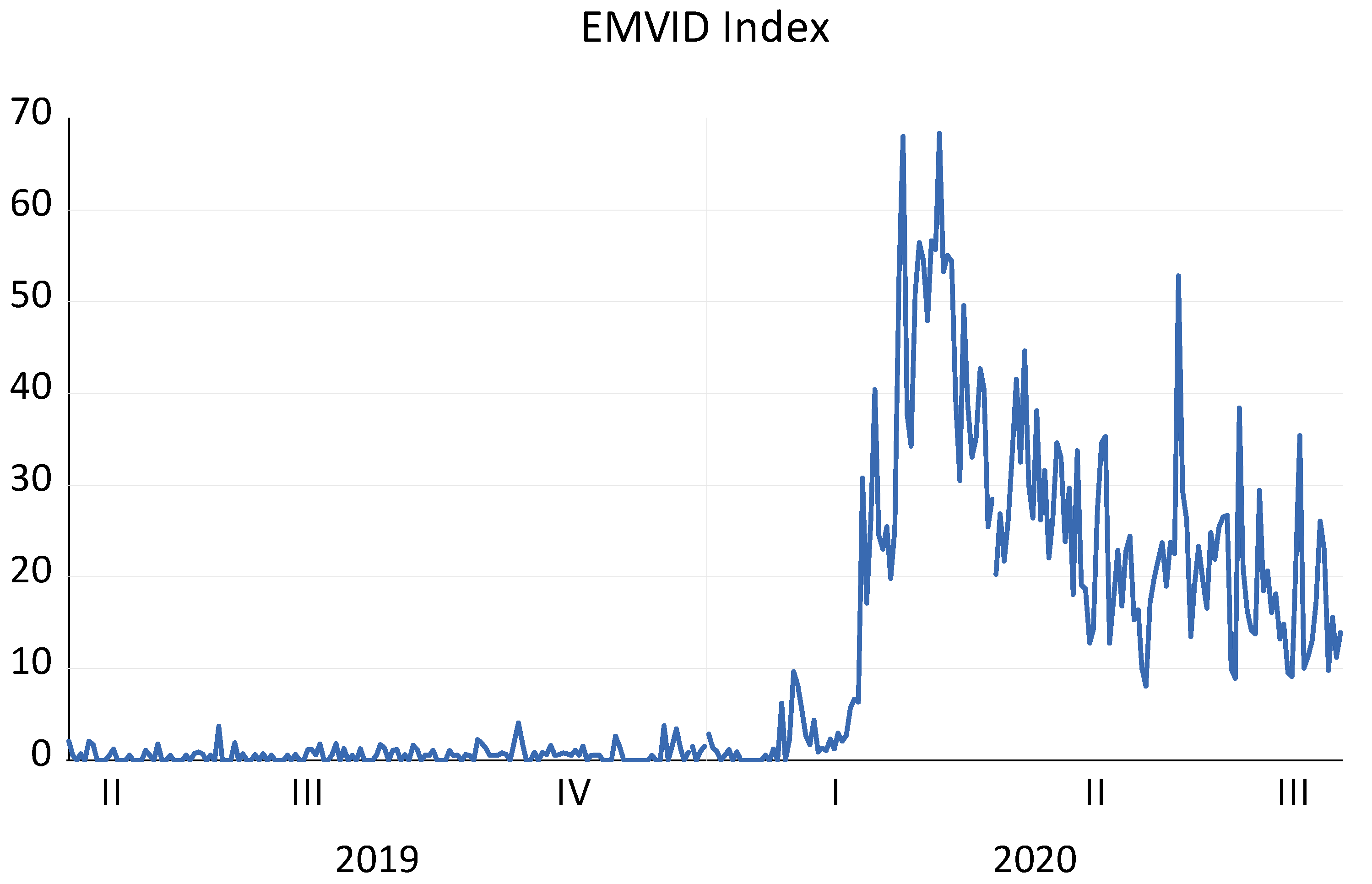

| 7 | The index is available at: http://policyuncertainty.com/infectious_EMV.html (accessed on 12 August 2020) |

Appendix A

| Dependent Variable | Statistic | All Countries | Advanced | Emerging | BRICS | PIIGS | Commodity Exporters |

|---|---|---|---|---|---|---|---|

| D1 | Mean | 0.116 | 0.120 | 0.163 | 0.245 | 0.190 | 0.013 |

| Std. dev. | 0.321 | 0.325 | 0.370 | 0.430 | 0.393 | 0.112 | |

| D2 | Mean | 0.085 | 0.085 | 0.132 | 0.172 | 0.152 | 0.000 |

| Std. dev. | 0.279 | 0.280 | 0.338 | 0.378 | 0.360 | 0.000 |

References

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2020. Financial contagion during COVID–19 crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef] [PubMed]

- Alexakis, Christos, Konstantinos Eleftheriou, and Patroklos Patsoulis. 2021. COVID-19 containment measures and stock market returns: An international spatial econometrics investigation. Journal of Behavioral and Experimental Finance 29: 100428. [Google Scholar] [CrossRef]

- Alhaj-Yaseen, Yaseen S., and Siu-Kong Yau. 2018. Herding tendency among investors with heterogeneous information: Evidence from China’s equity markets. Journal of Multinational Financial Management 47: 60–75. [Google Scholar] [CrossRef]

- Avery, Christopher, and Peter Zemsky. 1998. Multidimensional uncertainty and herd behavior in financial markets. American Economic Review 88: 724–48. [Google Scholar]

- Babalos, Vassilios, and Stavros Stavroyiannis. 2015. Herding, anti-herding behaviour in metal commodities futures: A novel portfolio-based approach. Applied Economics 47: 4952–66. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Stephen J. Terry. 2020. Covid-Induced Economic Uncertainty. NBER Working Paper No. 26983. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Balcilar, Mehmet, and Riza Demirer. 2015. Impact of Global Shocks and Volatility on Herd Behavior in an Emerging Market: Evidence from Borsa Istanbul. Emerging Markets Finance and Trade 51: 140–59. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rıza Demirer, and Shawkat Hammoudeh. 2013. Investor Herds and Regime Switching: Evidence from Gulf Arab Stock Markets. Journal of International Financial Markets, Institutions & Money 23: 295–321. [Google Scholar]

- Balcilar, Mehmet, Rıza Demirer, and Shawkat Hammoudeh. 2014. What Drives Herding in Developing Stock Markets? Relative Roles of Own Volatility and Global Factors. North American Journal of Economics and Finance 29: 418–40. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rıza Demirer, and Talat Ulussever. 2017. Does speculation in the oil market drive investor herding in emerging stock markets? Energy Economics 65: 50–63. [Google Scholar] [CrossRef]

- Banerjee, Abhijit V. 1992. A simple model of herd behavior. Quarterly Journal of Economics 107: 797–818. [Google Scholar] [CrossRef] [Green Version]

- Barro, Robert J., and José F. Ursúa. 2012. Rare Macroeconomic Disasters. Annual Review of Economics 4: 83–109. [Google Scholar] [CrossRef]

- Bikhchandani, Sushil, David Hirshleifer, and Ivo Welch. 1992. A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy 100: 992–1026. [Google Scholar] [CrossRef]

- Blasco, Natividad, Pilar Corredor, and Sandra Ferreruela. 2012. Does herding affect volatility? Implications for the Spanish stock market. Quantitative Finance 12: 311–27. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Oguzhan Cepni, David Gabauer, and Rangan Gupta. 2020. Return Connectedness across Asset Classes around the COVID-19 Outbreak. International Review of Financial Analysis 73: 101646. [Google Scholar] [CrossRef]

- Cakan, Esin, Rıza Demirer, Rangan Gupta, and Hardik A. Marfatia. 2019. Oil Speculation and Herding Behavior in Emerging Stock Markets. Journal of Economics and Finance 43: 44–56. [Google Scholar] [CrossRef] [Green Version]

- Chang, Eric C., Joseph W. Cheng, and Ajay Khorana. 2000. An Examination of Herd Behaviour in Equity Markets: An International Perspective. Journal of Banking and Finance 24: 1651–99. [Google Scholar] [CrossRef]

- Chari, Varadarajan V., and Patrick J. Kehoe. 2004. Financial crises as herds: Overturning the critiques. Journal of Economic Theory 119: 129–50. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2010. An empirical analysis of herd behavior in global stock markets. Journal of Banking & Finance 34: 1911–21. [Google Scholar]

- Christie, William G., and Roger D. Huang. 1995. Following the Pied Piper: Do individual Returns Herd around the Market? Financial Analyst Journal 51: 31–37. [Google Scholar] [CrossRef]

- De Long, J. Bradford, Andrei Shleifer, Lawrence H. Summers, and Robert J. Waldmann. 1990. Noise Trader Risk in Financial Markets. Journal of Political Economy 98: 703–38. [Google Scholar] [CrossRef]

- Demirer, Riza, Ali M. Kutan, and Chun-Da Chen. 2010. Do Investors Herd in Emerging Stock Markets? Evidence from the Taiwanese Market. Journal of Economic Behavior & Organization 76: 283–95. [Google Scholar]

- Demirer, Rıza, and Ali M. Kutan. 2006. Does Herding Behavior Exist in Chinese Stock Market? Journal of International Financial Markets, Institutions and Money 16: 123–42. [Google Scholar] [CrossRef]

- Demirer, Rıza, Karyl B. Leggio, and Donald Lien. 2019. Herding and Flash Events: Evidence from the 2010 Flash Crash. Finance Research Letters 31: 476–79. [Google Scholar] [CrossRef]

- Devenow, Andrea, and Ivo Welch. 1996. Rational Herding in Financial Economics. European Economic Review 40: 603–15. [Google Scholar] [CrossRef]

- Fernandez-Perez, Adrian, Aaron Gilbert, Ivan Indriawan, and Nhut H. Nguyen. 2020. COVID-19 Pandemic and Stock Market Response: A Culture Effect. Journal of Behavioral and Experimental Finance 29: 100454. [Google Scholar] [CrossRef]

- Froot, Kenneth A., and Maurice Obstfeld. 1991. Intrinsic Bubbles: The Case of Stock Prices. American Economic Review 81: 1189–214. [Google Scholar]

- Froot, Kenneth A., David S. Scharfstein, and Jeremy C. Stein. 1992. Herd on the street: Informational inefficiencies in a market with short-term speculation. Journal of Finance 47: 1461–84. [Google Scholar] [CrossRef]

- Gleason, Kimberly C., Ike Mathur, and Mark A. Peterson. 2004. Analysis of intraday herding behaviour among the sector ETFs. Journal of Empirical Finance 11: 681–94. [Google Scholar] [CrossRef]

- Goodell, John W. 2020. COVID-19 and finance: Agendas for future research. Finance Research Letters 35: 101512. [Google Scholar] [CrossRef] [PubMed]

- Gourio, Francois. 2012. Disaster Risk and Business Cycles. The American Economic Review 102: 2734–66. [Google Scholar] [CrossRef] [Green Version]

- Haldar, Anasuya, and Narayan Sethi. 2020. The News Effect of COVID-19 on Global Financial Market Volatility. Bulletin of Monetary Economics and Banking 24: 33–58. [Google Scholar]

- Hey, John D., and Andrea Morone. 2004. Do Markets Drive Out Lemmings-or Vice Versa? Economica 71: 637–59. [Google Scholar] [CrossRef]

- Maug, Ernst G., and Narayan Y. Naik. 1996. Herding and Delegated Portfolio Management. New York: Mimeo, London Business School, Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=7362 (accessed on 9 September 2021).

- Milcheva, Stanimira. 2021. Volatility and the Cross-Section of Real Estate Equity Returns during COVID’19. The Journal of Real Estate Finance and Economics, 1–28. [Google Scholar] [CrossRef]

- Nofsinger, J., and R. Sias. 1999. Herding and feedback trading by institutional and individual investors. Journal of Finance 54: 2263–95. [Google Scholar] [CrossRef]

- Ozkan, Oktay. 2021. Impact of COVID-19 on stock market efficiency: Evidence from developed countries. Research in International Business and Finance 58: 101445. [Google Scholar] [CrossRef] [PubMed]

- Salisu, Afees A., Ahamuefula E. Ogbonna, Tirimisiyu F. Oloko, and Idris A. Adediran. 2021. A New Index for Measuring Uncertainty Due to the COVID-19 Pandemic. Sustainability 13: 3212. [Google Scholar] [CrossRef]

- Scherf, Matthias, Xenia Matschke, and Marc Oliver Rieger. 2021. Stock market reactions to COVID-19 lockdown: A global analysis. Finance Research Letters, 102245. [Google Scholar] [CrossRef]

- Sharif, Arshian, Chaker Aloui, and Larisa Yarovaya. 2020. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis 70: 101496. [Google Scholar]

- Bikhchandani, Sushil, and Mr Sunil Sharma. 2001. Herd behavior in financial markets: A review. IMF Staff Papers 47: 279–310. [Google Scholar] [CrossRef] [Green Version]

- Shleifer, Andrei, and Lawrence H. Summers. 1990. The noise trader approach to finance. Journal of Economic Perspectives 4: 19–33. [Google Scholar] [CrossRef] [Green Version]

- Sibande, Xolani, Rangan Gupta, Riza Demirer, and Elie Bouri. 2021. Investor Sentiment and (Anti-)Herding in the Currency Market: Evidence from Twitter Feed Data. Journal of Behavioral Finance, 1–17. [Google Scholar] [CrossRef]

- Stavroyiannis, Stavros, and Vassilios Babalos. 2017. Herding, Faith-Based Investments and the Global Financial Crisis: Empirical Evidence from Static and Dynamic Models. Journal of Behavioural Finance 18: 478–89. [Google Scholar] [CrossRef]

- Teraji, Shinji. 2003. Herd behavior and the quality of opinions. Journal of Socio-Economics 32: 661–73. [Google Scholar] [CrossRef]

- Uwilingiye, Josine, Esin Cakan, Riza Demirer, and Rangan Gupta. 2019. A Note on the Technology Herd: Evidence from Large Institutional Investors. Review of Behavioral Finance 11: 294–308. [Google Scholar] [CrossRef]

- Wachter, Jessica A. 2013. Can time-varying risk of rare disasters explain aggregate stock market volatility? Journal of Finance 68: 987–1035. [Google Scholar] [CrossRef] [Green Version]

| Sample | Parameters | All Countries | Advanced | Emerging | BRICS | PIIGS | Commodity Exporters |

|---|---|---|---|---|---|---|---|

| Full-Sample | α0 | 0.008 *** | 0.005 *** | 0.01 *** | 0.009 *** | 0.006 *** | 0.006 *** |

| α1 | 0.288 *** | 0.258 *** | 0.269 *** | 0.248 *** | 0.146 *** | 0.176 *** | |

| α2 | 0.994 *** | 0.301 * | 1.474 *** | 1.388 *** | 0.915 *** | 1.964 *** | |

| Pre-COVID | α0 | 0.006 *** | 0.004 *** | 0.007 *** | 0.006 *** | 0.005 *** | 0.005 *** |

| α1 | 0.231 *** | 0.172 *** | 0.22 | −0.012 | 0.004 | 0.131 | |

| α2 | 1.527 | −0.539 | 3.715 | 12.887 * | 8.59 | 1.774 | |

| During-COVID | α0 | 0.007 *** | 0.006 *** | 0.008 *** | 0.008 *** | 0.005 *** | 0.007 *** |

| α1 | 0.354 *** | 0.255 *** | 0.442 | 0.339 | 0.313 | 0.279 | |

| α2 | −0.36 | −0.334 | −0.881 | −0.473 * | −1.306 | −0.205 |

| Dependent Variable | Parameters | All Countries | Advanced | Emerging | BRICS | PIIGS | Commodity Exporters |

|---|---|---|---|---|---|---|---|

| D1 | β0 | −2.456 *** | −2.093 *** | −2.204 *** | −1.026 *** | −2.464 *** | −2.632 *** |

| β1 | 0.064 *** | 0.050 *** | 0.070 *** | 0.027 *** | 0.092 *** | 0.022 ** | |

| D2 | β0 | −2.551 *** | −2.166 *** | −2.599 *** | −1.420 *** | −2.460 *** | |

| β1 | 0.056 *** | 0.042 *** | 0.075 ** | 0.034 *** | 0.077 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bouri, E.; Demirer, R.; Gupta, R.; Nel, J. COVID-19 Pandemic and Investor Herding in International Stock Markets. Risks 2021, 9, 168. https://doi.org/10.3390/risks9090168

Bouri E, Demirer R, Gupta R, Nel J. COVID-19 Pandemic and Investor Herding in International Stock Markets. Risks. 2021; 9(9):168. https://doi.org/10.3390/risks9090168

Chicago/Turabian StyleBouri, Elie, Riza Demirer, Rangan Gupta, and Jacobus Nel. 2021. "COVID-19 Pandemic and Investor Herding in International Stock Markets" Risks 9, no. 9: 168. https://doi.org/10.3390/risks9090168

APA StyleBouri, E., Demirer, R., Gupta, R., & Nel, J. (2021). COVID-19 Pandemic and Investor Herding in International Stock Markets. Risks, 9(9), 168. https://doi.org/10.3390/risks9090168