Social Media Strategy Processes for Centralized Payment Network Firms after a War Crisis Outset

Abstract

:1. Introduction

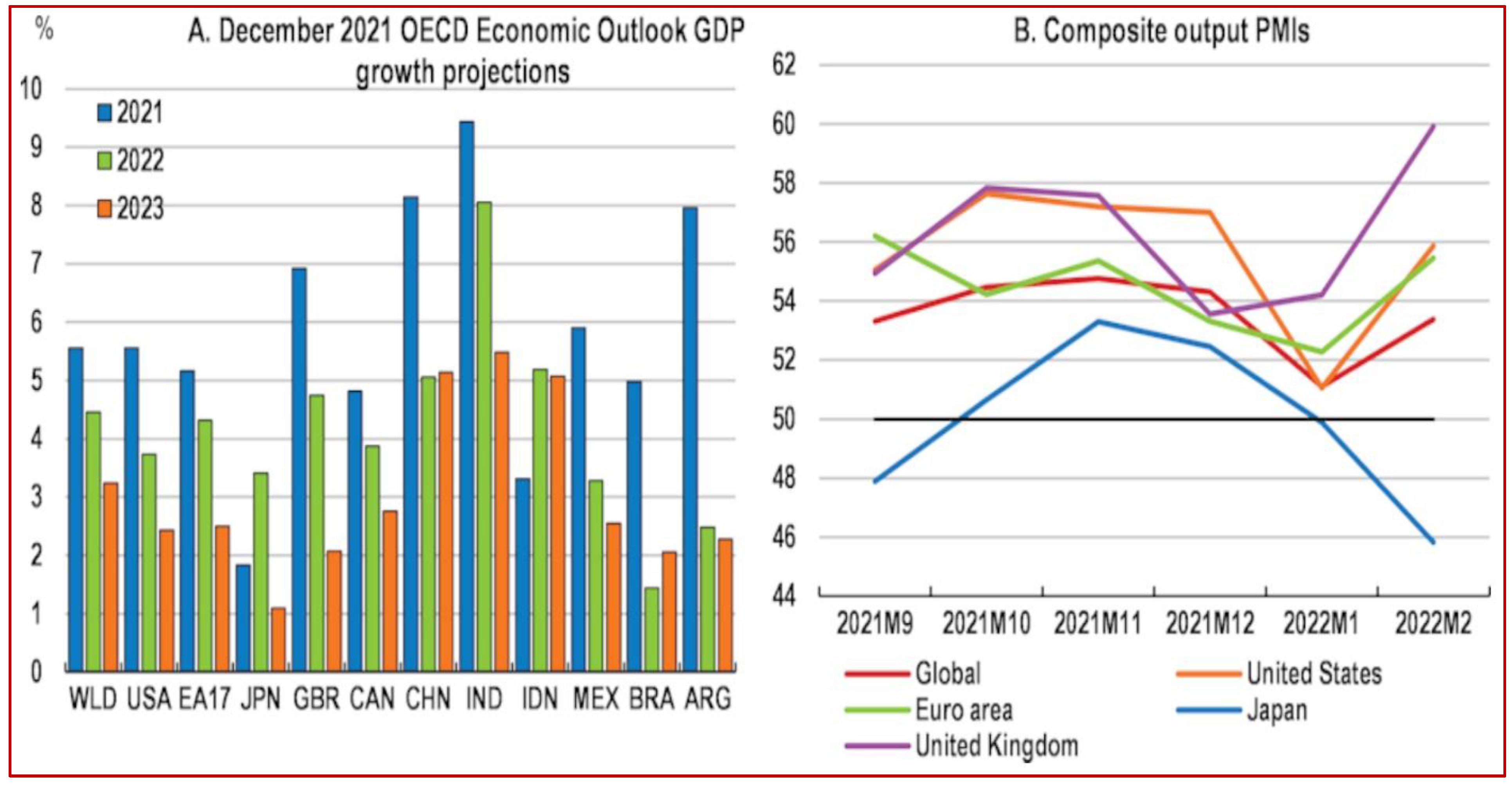

1.1. War Crisis Management

1.2. Crisis Management and Innovation as a Risk Mitigation Tool

1.3. Fintech Revolution during the War Crisis

1.4. Ukrainian War Crisis and Centralized Payment Networks’ Usage

1.5. Centralized Payment Network Firms (CPNs) Social Media Marketing

1.6. Social Media and Customer Website Analytics

- What is the impact of war on centralized payment network services?

- How can social media behavioral KPIs enlighten customers’ online behavior during a war crisis?

- How does social media analytics influence SEO tracking metrics?

- What is the contribution of social media platforms with regard to centralized payment networks’ digital branding?

- What are the recommended recovery actions that should be taken to diminish risk perceptions, improve digital marketing efforts, and enhance business visibility?

2. Materials and Methods

2.1. Research Hypotheses

2.2. Sample and Data Retrieval

3. Results

3.1. Exploratory Model

FCM Analysis with Factors from the Model

3.2. Statistical Analysis

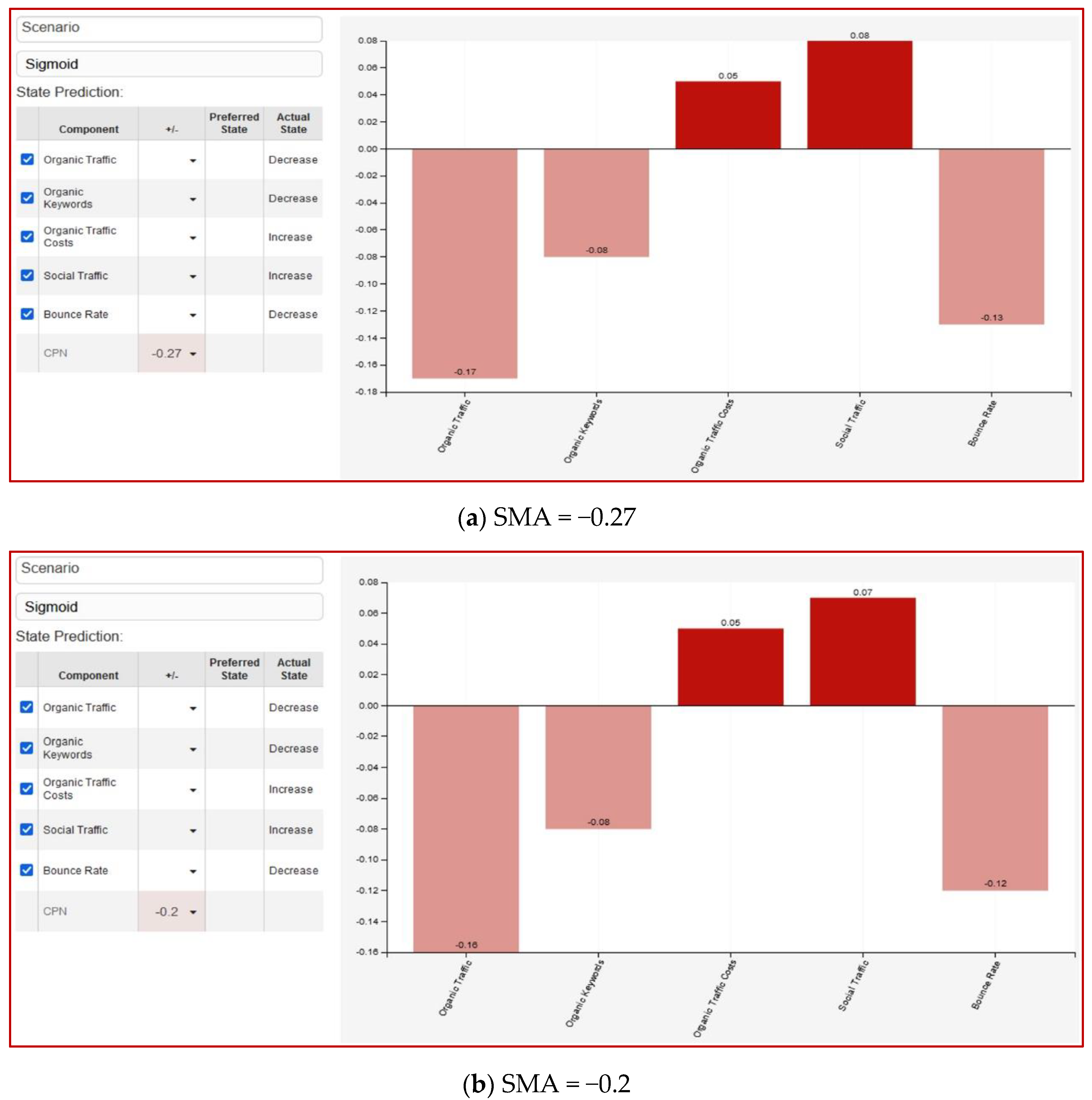

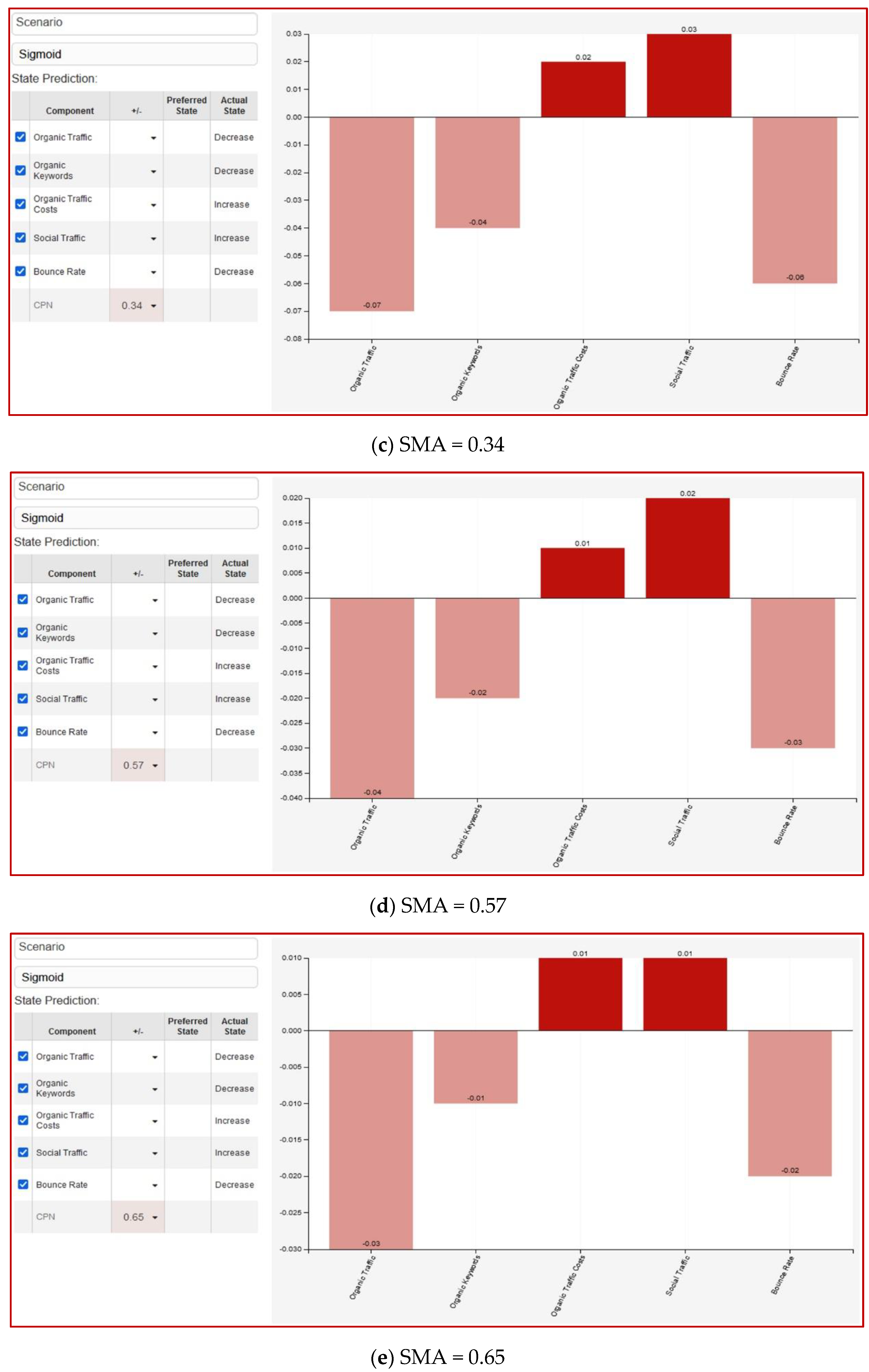

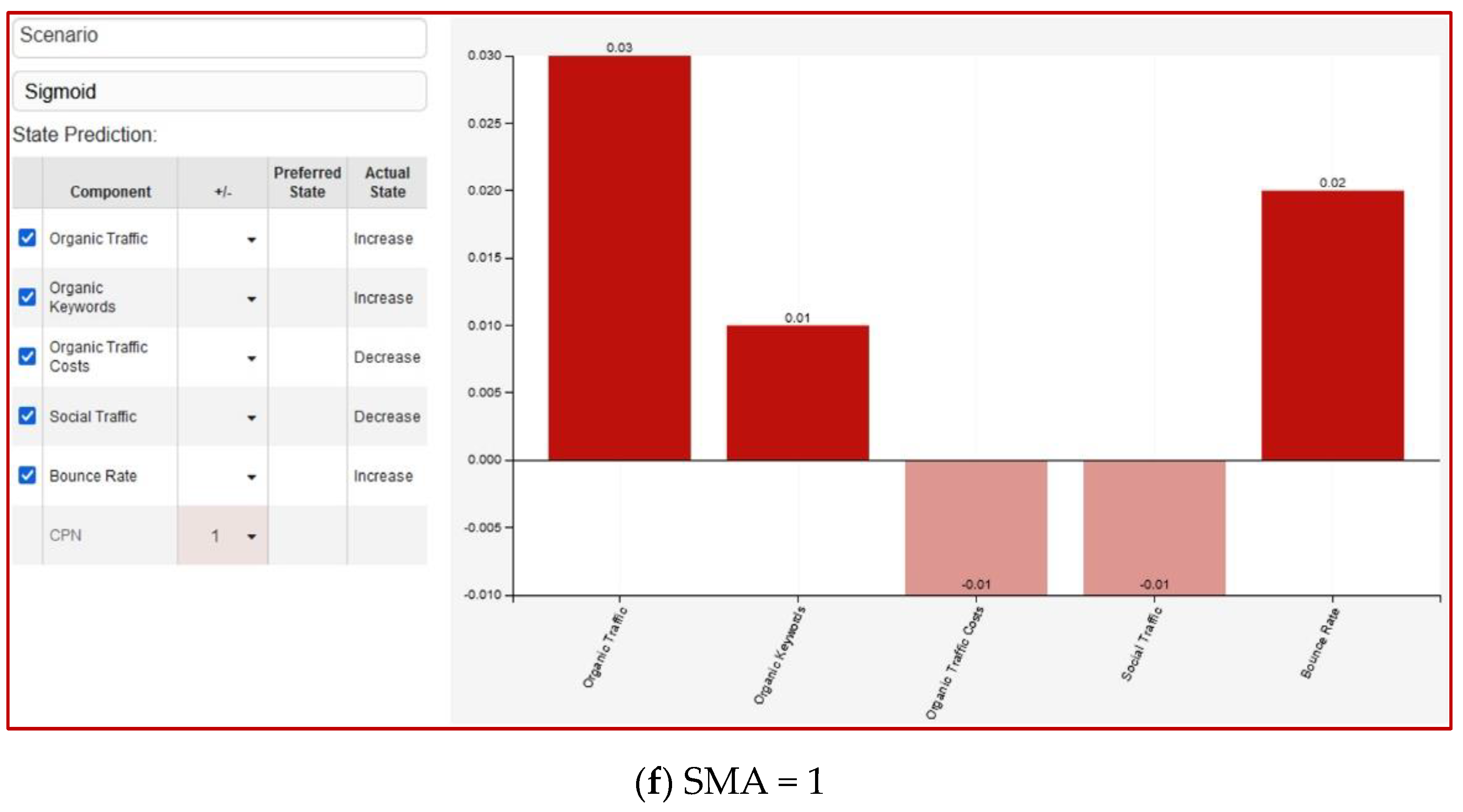

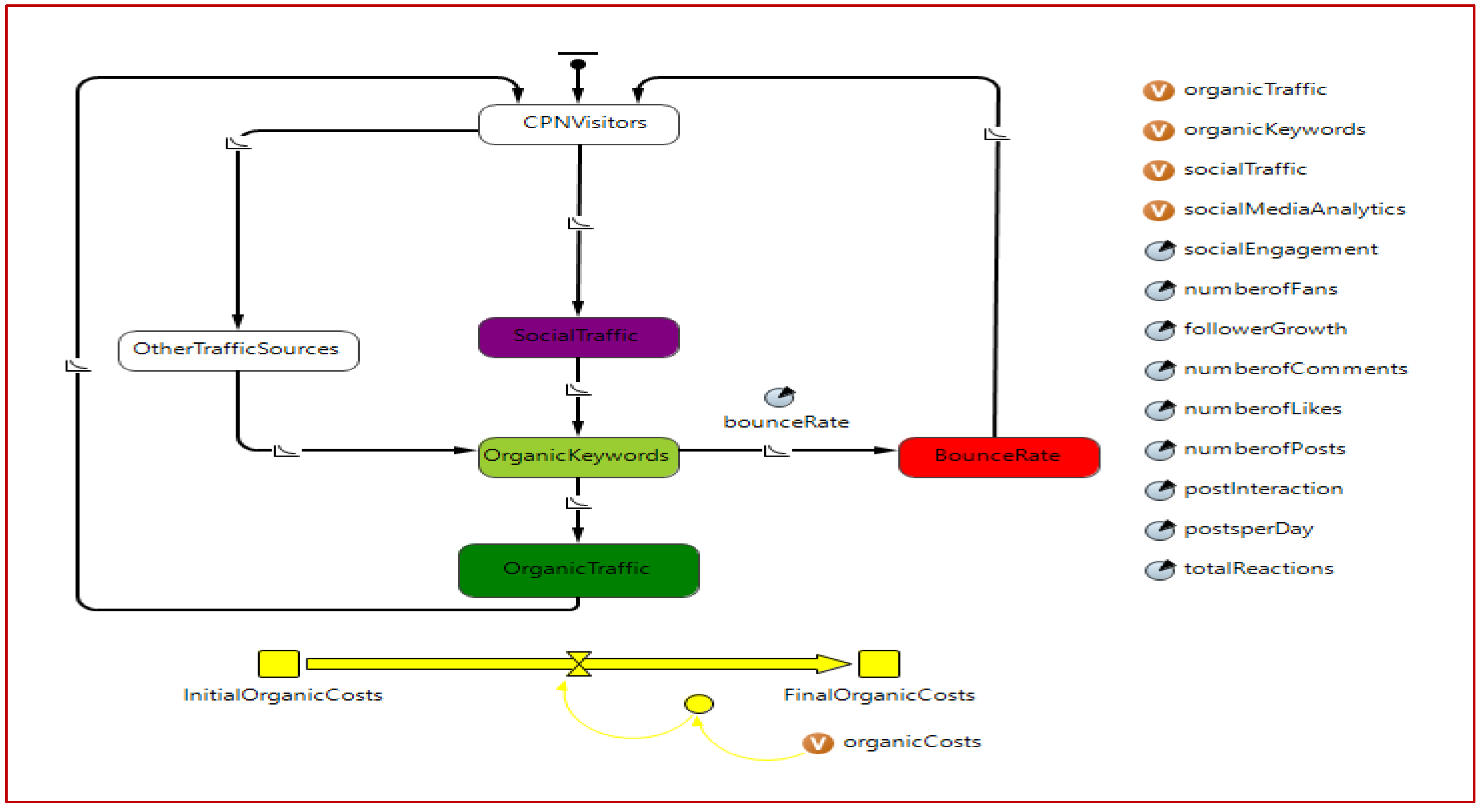

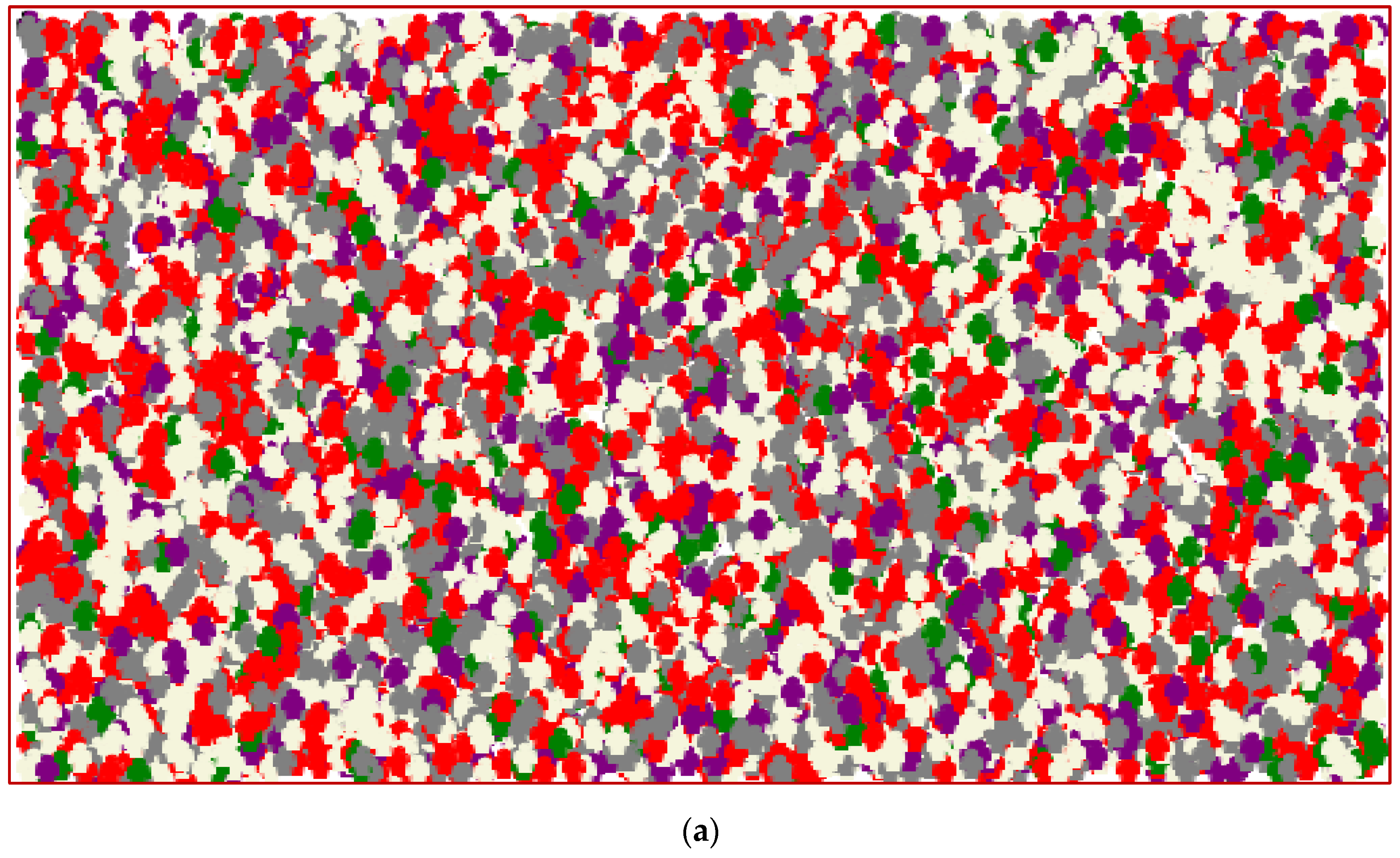

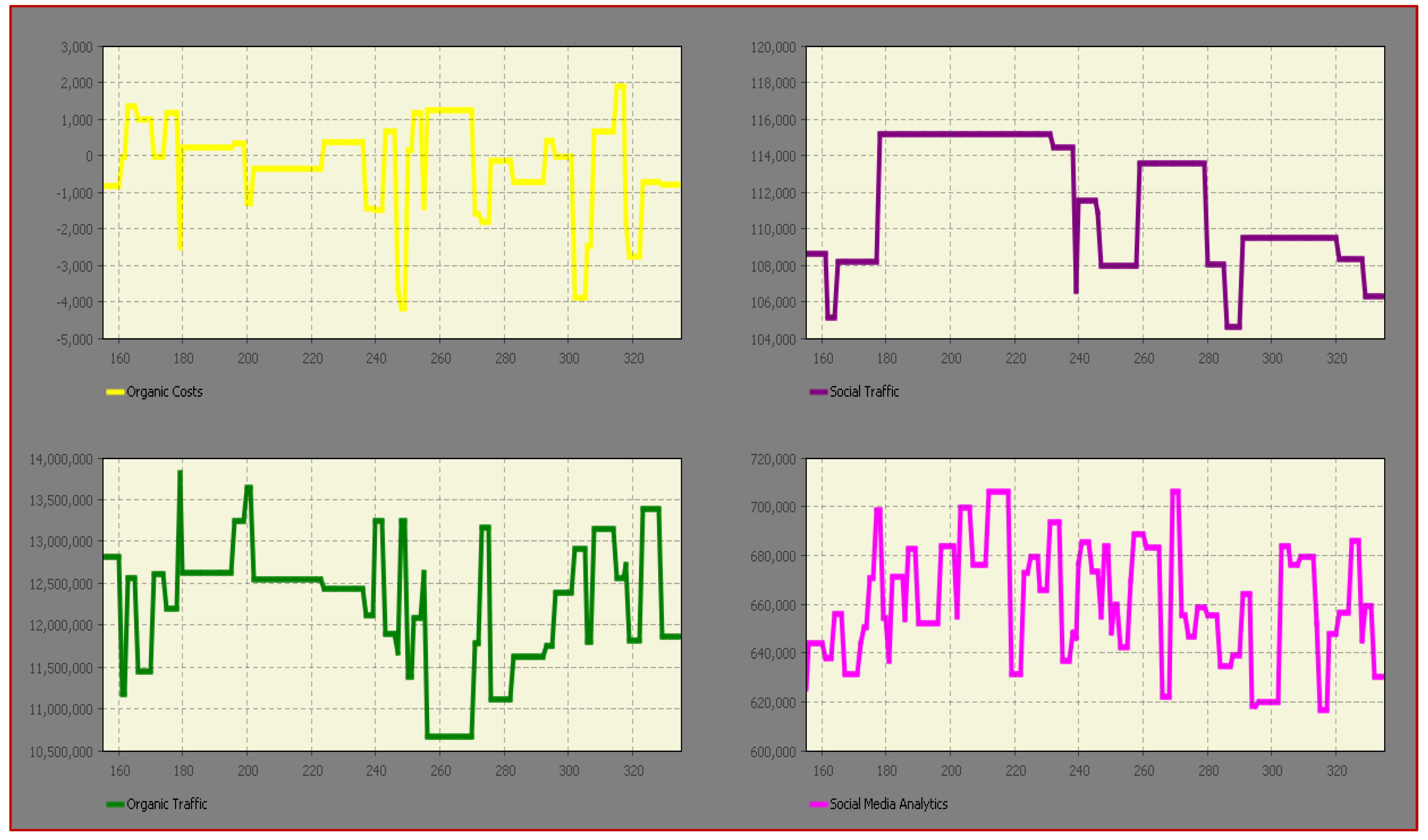

3.3. Simulation Model

4. Discussion

5. Conclusions

5.1. Conclusions

5.2. Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| public void enterState(short _state, boolean _destination) { switch(_state) { case CPNVisitors: // (Simple state (not composite)) statechart.setActiveState_xjal(CPNVisitors); { socialEngagement = normal(0.00032, 0.0004); numberofFans = normal(24069.3, 655557.22); followerGrowth = normal(132.14295, 225.359); numberofComments = normal(4.00367, 12.141); numberofLikes = normal(202.65334, 239.0577); numberofPosts = normal(1.92318, 11.9615); postInteraction = normal(0.00095, 0.0009); postsperDay = normal(0.2988, 1.8601); totalReactions = normal(235.97, 283.7756); socialMediaAnalytics = socialEngagement + numberofFans + followerGrowth + numberofComments + numberofLikes + numberofPosts + postInteraction + postsperDay + totalReactions ;} transition.start(); transition1.start(); return; case SocialTraffic: // (Simple state (not composite)) statechart.setActiveState_xjal(SocialTraffic); { bounceRate = normal(0.02007, 0.533164); bounceRate = socialEngagement*(0.002) + numberofFans*(−0.643) + followerGrowth*(0.472) + numberofComments*(0.007) + numberofPosts*(0.934) + totalReactions*(0.743); socialTraffic = normal(255904.58, 651846.114); socialTraffic = socialEngagement*(1.144) + numberofFans*(0.165) + followerGrowth*(0.225) + numberofComments*(0.445) + numberofPosts*(−0.988) + totalReactions*(−0.023) ;} transition3.start(); return; case OrganicKeywords: // (Simple state (not composite)) statechart.setActiveState_xjal(OrganicKeywords); { organicKeywords = normal(32227.48, 616364.616) ;} transition4.start(); transition5.start(); return; case OrganicTraffic: // (Simple state (not composite)) statechart.setActiveState_xjal(OrganicTraffic); { bounceRate = normal(0.02007, 0.533164); organicTraffic = normal(846987.5, 12396829.1); organicCosts = normal(4411200.442, 22115440.80); organicCosts = followerGrowth*(−0.454) + numberofComments*(0.591) + numberofLikes*(4.489) + numberofPosts*(−7.529) + postInteraction*(−1.137) + postsperDay*(7.513) + totalReactions*(−4.881) ;} transition7.start(); return; case BounceRate: // (Simple state (not composite)) statechart.setActiveState_xjal(BounceRate); transition6.start(); return; case OtherTrafficSources: // (Simple state (not composite)) statechart.setActiveState_xjal(OtherTrafficSources); { bounceRate = normal(0.02007, 0.533164); bounceRate = socialEngagement*(0.002) + numberofFans*(−0.643) + followerGrowth*(0.472) + numberofComments*(0.007) + numberofPosts*(0.934) + totalReactions*(0.743) ;} transition2.start(); return; default: super.enterState(_state, _destination); return; } } @Override @AnyLogicInternalCodegenAPI public void exitState(short _state, Transition _t, boolean _source, Statechart _statechart) { switch(_state) { case CPNVisitors: // (Simple state (not composite)) if (!_source || _t!= transition) transition.cancel(); if (!_source || _t!= transition1) transition1.cancel(); return; case SocialTraffic: // (Simple state (not composite)) if (!_source || _t!= transition3) transition3.cancel(); return; case OrganicKeywords: // (Simple state (not composite)) if (!_source || _t!= transition4) transition4.cancel(); if (!_source || _t!= transition5) transition5.cancel(); return; case OrganicTraffic: // (Simple state (not composite)) if (!_source || _t!= transition7) transition7.cancel(); return; case BounceRate: // (Simple state (not composite)) if (!_source || _t!= transition6) transition6.cancel(); return; case OtherTrafficSources: // (Simple state (not composite)) if (!_source || _t!= transition2) transition2.cancel(); return; default: super.exitState(_state, _t, _source, _statechart); return; } } |

References

- EU Sanctions against Russia Explained. Available online: https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/sanctions-against-russia-explained (accessed on 27 July 2022).

- EU Statement on Safety, Security, and Safeguards Implications of the Situation in Ukraine as Delivered at the International Atomic Energy Agency (IAEA) Board of Governors on 9 March 2022. Available online: https://www.eeas.europa.eu/eeas/eu-statement-safety-security-and-safeguards-implications-situation-ukraine-delivered_en (accessed on 27 July 2022).

- War and the World Economy: Stock Market Reactions to International Conflicts on JSTOR. Available online: https://www.jstor.org/stable/27638514 (accessed on 1 August 2022).

- The Impact on Trade and Development of the War in Ukraine. Available online: https://unctad.org/system/files/official-document/osginf2022d1_en.pdf (accessed on 27 July 2022).

- Blessley, M.; Mudambi, S.M. A Trade War and a Pandemic: Disruption and Resilience in the Food Bank Supply Chain. Ind. Mark. Manag. 2022, 102, 58–73. [Google Scholar] [CrossRef]

- Unlu, A.; Kapucu, N.; Sahin, B. Disaster and Crisis Management in Turkey: A Need for a Unified Crisis Management System. Disaster Prev. Manag. Int. J. 2010, 19, 155–174. [Google Scholar] [CrossRef]

- Larsson, O.L. The Connections between Crisis and War Preparedness in Sweden. Secur. Dialogue 2021, 52, 306–324. [Google Scholar] [CrossRef]

- Freedman, L. Ukraine and the Art of Crisis Management. Survival 2014, 56, 7–42. [Google Scholar] [CrossRef] [Green Version]

- Sendai Framework for Disaster Risk Reduction 2015–2030. Available online: https://www.undrr.org/publication/sendai-framework-disaster-risk-reduction-2015-2030 (accessed on 27 July 2022).

- Iankova, K.; Longart, P. Marketing after COVID-19: Crisis Adaptation, Innovation and Sustainable Technological Advances. Trans. Mkt. J. 2022, 10, 1–3. [Google Scholar] [CrossRef]

- Tut, D. FinTech and the COVID-19 Pandemic: Evidence from Electronic Payment Systems. In MPRA Paper; University Library of Munich: Munich, Germany, 2020; Available online: https://EconPapers.repec.org/RePEc:pra:mprapa:102401 (accessed on 30 July 2022).

- Charaia, V.; Chochia, A.; Lashkhi, M. Promoting Fintech Financing for SME in S. Caucasian and Baltic States, During the COVID-19 Global Pandemic. J. Bus. Manag. Econ. Eng. 2021, 19, 358–372. [Google Scholar] [CrossRef]

- Sugandi, E.A. The COVID-19 Pandemic and Indonesia’s Fintech Markets. In ADBI Working Paper 1281; Asian Development Bank Institute: Tokyo, Japan, 2021; Available online: https://www.adb.org/publications/covid-19-pandemic-indonesia-fintech-markets (accessed on 30 July 2022).

- Warsaw School of Management—Higher School, Warsaw, Poland; Gajda, W.; Zaplatynskyi, V. Innovations in Crisis Management. MEST J. 2017, 5, 32–39. [Google Scholar] [CrossRef]

- Wang, W.; Cao, Q.; Qin, L.; Zhang, Y.; Feng, T.; Feng, L. Uncertain Environment, Dynamic Innovation Capabilities and Innovation Strategies: A Case Study on Qihoo 360. Comput. Hum. Behav. 2019, 95, 284–294. [Google Scholar] [CrossRef]

- Woolliscroft, J.O. Innovation in Response to the COVID-19 Pandemic Crisis. Acad. Med. 2020, 95, 1140–1142. [Google Scholar] [CrossRef]

- Głodziński, E.; Marciniak, S. Organizational Innovations in Crisis Management of Project-Based Enterprises. Econ. Bus. 2016, 28, 26–32. [Google Scholar] [CrossRef]

- Driving Innovation in Crisis Management for European Resilience. Available online: https://cordis.europa.eu/project/id/607798 (accessed on 28 July 2022).

- Rutsaert, P.; Regan, Á.; Pieniak, Z.; McConnon, Á.; Moss, A.; Wall, P.; Verbeke, W. The Use of Social Media in Food Risk and Benefit Communication. Trends Food Sci. Technol. 2013, 30, 84–91. [Google Scholar] [CrossRef]

- Regan, Á.; Raats, M.; Shan, L.C.; Wall, P.G.; McConnon, Á. Risk Communication and Social Media during Food Safety Crises: A Study of Stakeholders’ Opinions in Ireland. J. Risk Res. 2016, 19, 119–133. [Google Scholar] [CrossRef]

- Smith, L.; Liang, Q.; James, P.; Lin, W. Assessing the Utility of Social Media as a Data Source for Flood Risk Management Using a Real-Time Modelling Framework: Assessing the Utility of Social Media for Flood Risk Management. J. Flood Risk Manag. 2017, 10, 370–380. [Google Scholar] [CrossRef]

- Tang, Z.; Zhang, L.; Xu, F.; Vo, H. Examining the Role of Social Media in California’s Drought Risk Management in 2014. Nat. Hazards 2015, 79, 171–193. [Google Scholar] [CrossRef]

- Holderness, T.; Turpin, E. From Social Media to GeoSocial Intelligence: Crowdsourcing Civic Co-Management for Flood Response in Jakarta, Indonesia. In Social Media for Government Services; Nepal, S., Paris, C., Georgakopoulos, D., Eds.; Springer International Publishing: Cham, Switzerland, 2015; pp. 115–133. ISBN 978-3-319-27235-1. [Google Scholar]

- Alexander, D.E. Social Media in Disaster Risk Reduction and Crisis Management. Sci. Eng. Ethics 2014, 20, 717–733. [Google Scholar] [CrossRef]

- Kraus, S.; Clauss, T.; Breier, M.; Gast, J.; Zardini, A.; Tiberius, V. The Economics of COVID-19: Initial Empirical Evidence on How Family Firms in Five European Countries Cope with the Corona Crisis. IJEBR 2020, 26, 1067–1092. [Google Scholar] [CrossRef]

- Dahlke, J.; Bogner, K.; Becker, M.; Schlaile, M.P.; Pyka, A.; Ebersberger, B. Crisis-Driven Innovation and Fundamental Human Needs: A Typological Framework of Rapid-Response COVID-19 Innovations. Technol. Forecast. Soc. Chang. 2021, 169, 120799. [Google Scholar] [CrossRef]

- Dahles, H.; Susilowati, T.P. Business Resilience in Times of Growth and Crisis. Ann. Tour. Res. 2015, 51, 34–50. [Google Scholar] [CrossRef]

- Aboramadan, M.; Albashiti, B.; Alharazin, H.; Zaidoune, S. Organizational Culture, Innovation and Performance: A Study from a Non-Western Context. JMD 2019, 39, 437–451. [Google Scholar] [CrossRef]

- Dobni, C.B. Measuring Innovation Culture in Organizations: The Development of a Generalized Innovation Culture Construct Using Exploratory Factor Analysis. Eur. J. Innov. Manag. 2008, 11, 539–559. [Google Scholar] [CrossRef]

- Dawson, M.; Abbott, J.; Shoemaker, S. The Hospitality Culture Scale: A Measure Organizational Culture and Personal Attributes. Int. J. Hosp. Manag. 2011, 30, 290–300. [Google Scholar] [CrossRef]

- Büschgens, T.; Bausch, A.; Balkin, D.B. Organizational Culture and Innovation: A Meta-Analytic Review: Organizational Culture and Innovation. J. Prod. Innov. Manag. 2013, 30, 763–781. [Google Scholar] [CrossRef]

- Russia-Ukraine War Increases Financial Stability Risks, ECB Financial Stability Review Finds. Available online: https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220525~fa1be4764d.en.html (accessed on 28 July 2022).

- Sanctions List Search. Available online: https://sanctionssearch.ofac.treas.gov (accessed on 28 July 2022).

- Ante, L. The Non-Fungible Token (NFT) Market and Its Relationship with Bitcoin and Ethereum. FinTech 2022, 1, 216–224. [Google Scholar] [CrossRef]

- Where the World Regulates Cryptocurrency. Available online: https://www.statista.com/chart/27069/cryptocurrency-regulation-world-map/ (accessed on 27 July 2022).

- Haroon, O.; Rizvi, S.A.R. COVID-19: Media Coverage and Financial Markets Behavior—A Sectoral Inquiry. J. Behav. Exp. Financ. 2020, 27, 100343. [Google Scholar] [CrossRef]

- Haapio, H.; Mero, J.; Karjaluoto, H.; Shaikh, A.A. Implications of the COVID-19 Pandemic on Market Orientation in Retail Banking. J. Financ. Serv. Mark. 2021, 26, 205–214. [Google Scholar] [CrossRef]

- Panjaitan, F.A.B.K.; Sayyid, M.; Maqsudi, A.; Andjarwati, T. The Impact of the COVID-19 Pandemic on the Batik Industry: An Empirical Study in Indonesia. J. Asian Financ. Econ. Bus. 2021, 8, 923–930. [Google Scholar] [CrossRef]

- Almeida, F.; Duarte Santos, J.; Augusto Monteiro, J. The Challenges and Opportunities in the Digitalization of Companies in a Post-COVID-19 World. IEEE Eng. Manag. Rev. 2020, 48, 97–103. [Google Scholar] [CrossRef]

- Guo, H.; Yang, Z.; Huang, R.; Guo, A. The Digitalization and Public Crisis Responses of Small and Medium Enterprises: Implications from a COVID-19 Survey. Front. Bus. Res. China 2020, 14, 19. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J. Note: Mayday, Mayday, Mayday! Responding to Environmental Shocks: Insights on Global Airlines’ Responses to COVID-19. Transp. Res. Part E Logist. Transp. Rev. 2020, 143, 102098. [Google Scholar] [CrossRef]

- Bertoni, F.; Bonini, S.; Capizzi, V.; Colombo, M.G.; Manigart, S. Digitization in the Market for Entrepreneurial Finance: Innovative Business Models and New Financing Channels. Entrep. Theory Pract. 2021, 46, 104225872110384. [Google Scholar] [CrossRef]

- FinTech—Worldwide|Statista Market Forecast. Available online: https://www.statista.com/outlook/dmo/fintech/worldwide (accessed on 28 July 2022).

- Gozman, D.; Liebenau, J.; Mangan, J. The Innovation Mechanisms of Fintech Start-Ups: Insights from SWIFT’s Innotribe Competition. J. Manag. Inf. Syst. 2018, 35, 145–179. [Google Scholar] [CrossRef]

- Our Top 2021 Unicorn Reports. Available online: https://www.cbinsights.com/research/report/unicorn-research-reports/ (accessed on 28 July 2022).

- Stewart, H.; Jürjens, J. Data Security and Consumer Trust in FinTech Innovation in Germany. ICS 2018, 26, 109–128. [Google Scholar] [CrossRef]

- Jagtiani, J.; John, K. Fintech: The Impact on Consumers and Regulatory Responses. J. Econ. Bus. 2018, 100, 1–6. [Google Scholar] [CrossRef]

- Lee, Ae Ri; Ahn, Hyo Young Fintech Users’ Information Privacy Concerns and User Resistance: Investigating the Interaction Effect with Regulatory Focus. J. Korea Inst. Inf. Secur. Cryptol. 2016, 26, 209–226. [CrossRef] [Green Version]

- Nambisan, S.; Zahra, S.A.; Luo, Y. Global Platforms and Ecosystems: Implications for International Business Theories. J. Int. Bus. Stud. 2019, 50, 1464–1486. [Google Scholar] [CrossRef]

- Archibugi, D.; Filippetti, A.; Frenz, M. Economic Crisis and Innovation: Is Destruction Prevailing over Accumulation? Res. Policy 2013, 42, 303–314. [Google Scholar] [CrossRef] [Green Version]

- Suryono, R.R.; Budi, I.; Purwandari, B. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information 2020, 11, 590. [Google Scholar] [CrossRef]

- Alber, N.; Dabour, M. The Dynamic Relationship between FinTech and Social Distancing under COVID-19 Pandemic: Digital Payments Evidence. IJEF 2020, 12, 109. [Google Scholar] [CrossRef]

- Daud, S.N.M.; Ahmad, A.H.; Khalid, A.; Azman-Saini, W.N.W. FinTech and Financial Stability: Threat or Opportunity? Financ. Res. Lett. 2022, 47, 102667. [Google Scholar] [CrossRef]

- Akram, U.; Fülöp, M.T.; Tiron-Tudor, A.; Topor, D.I.; Căpușneanu, S. Impact of Digitalization on Customers’ Well-Being in the Pandemic Period: Challenges and Opportunities for the Retail Industry. Int. J. Environ. Res. Public Health 2021, 18, 7533. [Google Scholar] [CrossRef]

- Kim, S.; Yim, M.Y.-C. Exploring Consumers’ Attitude Formation toward Their Own Brands When in Crisis: Cross-National Comparisons between USA and China. JPBM 2022, 31, 56–72. [Google Scholar] [CrossRef]

- Bank Customer Trust Levels Worldwide in 2021, by Country. 2021. Available online: https://www.statista.com/statistics/1097139/consumer-trust-score-of-banks-worldwide-by-country/ (accessed on 8 September 2022).

- Fungáčová, Z.; Hasan, I.; Weill, L. Trust in Banks. J. Econ. Behav. Organ. 2019, 157, 452–476. [Google Scholar] [CrossRef]

- Kowalski, M.; Lee, Z.W.Y.; Chan, T.K.H. Blockchain Technology and Trust Relationships in Trade Finance. Technol. Forecast. Soc. Chang. 2021, 166, 120641. [Google Scholar] [CrossRef]

- Trust in Fintech Brands vs Other Financial Services Providers in the United States in 2021, by Age Group. 2021. Available online: https://www.statista.com/statistics/1312809/trust-in-fintech-sector-united-states/ (accessed on 8 September 2022).

- Nangin, M.A.; Barus, I.R.G.; Wahyoedi, S. The Effects of Perceived Ease of Use, Security, and Promotion on Trust and Its Implications on Fintech Adoption. JCS 2020, 5, 124–138. [Google Scholar] [CrossRef]

- An Update to Our Message for the SWIFT Community. 2022. Available online: https://www.swift.com/news-events/news/message-swift-community (accessed on 8 September 2022).

- Mariotti, S.A. Warning from the Russian–Ukrainian War: Avoiding a Future That Rhymes with the Past. J. Ind. Bus. Econ. 2022. [Google Scholar] [CrossRef]

- Total Value of Investments into Fintech Companies Worldwide from 2010 to 2021. Available online: https://www.statista.com/statistics/719385/investments-into-fintech-companies-globally/ (accessed on 28 July 2022).

- Gomber, P.; Koch, J.-A.; Siering, M. Digital Finance and FinTech: Current Research and Future Research Directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Digital 2022: Global Overview Report. Available online: https://datareportal.com/reports/digital-2022-global-overview-report (accessed on 28 July 2022).

- Hammerschlag, Z.; Bick, G.; Luiz, J.M. The Internationalization of African Fintech Firms: Marketing Strategies for Successful Intra-Africa Expansion. IMR 2020, 37, 299–317. [Google Scholar] [CrossRef]

- Bilgin, Y. The Effect of Social Media Marketing Activities on Brand Awareness, Brand Image and Brand Loyalty. Bus. Manag. Stud. Int. J. 2018, 6, 128–148. [Google Scholar] [CrossRef]

- Yadav, M. Social Media as a Marketing Tool: Opportunities and Challenges. Indian J. Mark. 2017, 47, 16. [Google Scholar] [CrossRef]

- Dolega, L.; Rowe, F.; Branagan, E. Going Digital? The Impact of Social Media Marketing on Retail Website Traffic, Orders and Sales. J. Retail. Consum. Serv. 2021, 60, 102501. [Google Scholar] [CrossRef]

- Sashi, C.M.; Brynildsen, G.; Bilgihan, A. Social Media, Customer Engagement and Advocacy: An Empirical Investigation Using Twitter Data for Quick Service Restaurants. IJCHM 2019, 31, 1247–1272. [Google Scholar] [CrossRef]

- Achen, R.M. Measuring Social Media Marketing: Moving towards a Relationship-Marketing Approach. Manag. Sport Leis. 2017, 22, 33–53. [Google Scholar] [CrossRef]

- Ul Islam, J.; Rahman, Z. The Impact of Online Brand Community Characteristics on Customer Engagement: An Application of Stimulus-Organism-Response Paradigm. Telemat. Inform. 2017, 34, 96–109. [Google Scholar] [CrossRef]

- Di Gangi, P.M.; Wasko, M.M. Social Media Engagement Theory: Exploring the Influence of User Engagement on Social Media Usage. J. Organ. End User Comput. 2016, 28, 53–73. [Google Scholar] [CrossRef] [Green Version]

- Seo, E.J.; Park, J.-W.; Choi, Y.J. The Effect of Social Media Usage Characteristics on E-WOM, Trust, and Brand Equity: Focusing on Users of Airline Social Media. Sustainability 2020, 12, 1691. [Google Scholar] [CrossRef] [Green Version]

- Füller, J.; Matzler, K.; Hoppe, M. Brand Community Members as a Source of Innovation: Brand Community Members as a Source of Innovation. J. Prod. Innov. Manag. 2008, 25, 608–619. [Google Scholar] [CrossRef]

- Daily Time Spent on Social Networking by Internet Users Worldwide from 2012 to 2022. Available online: https://www.statista.com/statistics/433871/daily-social-media-usage-worldwide/ (accessed on 28 July 2022).

- Lee, I. Social Media Analytics for Enterprises: Typology, Methods, and Processes. Bus. Horiz. 2018, 61, 199–210. [Google Scholar] [CrossRef]

- Sakas, D.P.; Kamperos, I.D.G.; Reklitis, D.P.; Giannakopoulos, N.T.; Nasiopoulos, D.K.; Terzi, M.C.; Kanellos, N. The Effectiveness of Centralized Payment Network Advertisements on Digital Branding during the COVID-19 Crisis. Sustainability 2022, 14, 3616. [Google Scholar] [CrossRef]

- RISE Social Media Analytics. Available online: https://cordis.europa.eu/project/id/823866 (accessed on 28 July 2022).

- Batrinca, B.; Treleaven, P.C. Social Media Analytics: A Survey of Techniques, Tools and Platforms. AI Soc. 2015, 30, 89–116. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Ye, X. Social Media Analytics for Natural Disaster Management. Int. J. Geogr. Inf. Sci. 2018, 32, 49–72. [Google Scholar] [CrossRef]

- Rathore, A.K.; Kar, A.K.; Ilavarasan, P.V. Social Media Analytics: Literature Review and Directions for Future Research. Decis. Anal. 2017, 14, 229–249. [Google Scholar] [CrossRef]

- The Adoption of Social Media Analytics for Crisis Management—Challenges and Opportunities. Available online: https://www.researchgate.net/publication/325416290_The_Adoption_of_Social_Media_Analytics_for_Crisis_Management_-_Challenges_and_Opportunities (accessed on 28 July 2022).

- Park, D.; Kim, W.G.; Choi, S. Application of Social Media Analytics in Tourism Crisis Communication. Curr. Issues Tour. 2019, 22, 1810–1824. [Google Scholar] [CrossRef]

- Chon, M.-G.; Kim, S. Dealing with the COVID-19 Crisis: Theoretical Application of Social Media Analytics in Government Crisis Management. Public Relat. Rev. 2022, 48, 102201. [Google Scholar] [CrossRef]

- Franco-Riquelme, J.N.; Rubalcaba, L. Innovation and SDGs through Social Media Analysis: Messages from FinTech Firms. JOItmC 2021, 7, 165. [Google Scholar] [CrossRef]

- Fischhoff, B.; Slovic, P.; Lichtenstein, S.; Read, S.; Combs, B. How Safe Is Safe Enough? A Psychometric Study of Attitudes Toward Technological Risks and Benefits. Policy Sci. 1978, 9, 127–152. [Google Scholar] [CrossRef]

- Sakas, D.P.; Kamperos, I.D.G.; Reklitis, P. Estimating Risk Perception Effects on Courier Companies’ Online Customer Behavior during a Crisis, Using Crowdsourced Data. Sustainability 2021, 13, 12725. [Google Scholar] [CrossRef]

- Kurko, M. Best Payment Gateways. Increase Your Sales by Accepting Credit Card Purchases. 2022. Available online: https://www.thebalancesmb.com/best-payment-gateways-5079334 (accessed on 10 July 2022).

- Authorizenet. 2022. Available online: https://www.authorize.net/ (accessed on 10 July 2022).

- Braintree. 2022. Available online: https://www.braintreepayments.com/ (accessed on 10 July 2022).

- Paypal. 2022. Available online: https://www.paypal.com/ (accessed on 10 July 2022).

- Square. 2022. Available online: https://squareup.com/ (accessed on 10 July 2022).

- Stripe. 2022. Available online: https://stripe.com/ (accessed on 10 July 2022).

- Semrush. 2022. Available online: https://www.semrush.com/projects (accessed on 10 July 2022).

- Fanpage Karma. 2022. Available online: https://www.fanpagekarma.com/ (accessed on 10 July 2022).

- Khoumbati, K.; Themistocleous, M. Application of fuzzy simulation for the evaluation of enterprise application integration in healthcare organisations. Transform. Gov. People Process Policy 2007, 1, 230–241. [Google Scholar] [CrossRef] [Green Version]

- Case, D.M.; Blackburn, T.; Stylios, C. Modelling Construction Management Problems with Fuzzy Cognitive Maps. In Fuzzy Hybrid Computing in Construction Engineering and Management; Fayek, A.R., Ed.; Emerald Publishing Limited: Bingley, UK, 2018; pp. 413–449. [Google Scholar] [CrossRef]

- Bao, Z.; Shang, B. Self-efficacy and continuance intention of Web 2.0 platforms: A meta-analysis. Data Technol. Appl. 2021, 55, 511–526. [Google Scholar] [CrossRef]

- Voorveld, H.A.M.; Neijens, P.C.; Smit, E.G. Consumers’ responses to brand websites: An interdisciplinary review. Internet Res. 2009, 19, 535–565. [Google Scholar] [CrossRef]

- Retzlaff, C.O.; Ziefle, M.; Calero-Valdez, A. The history of agent-based modeling in the social sciences. In Digital Human Modeling and Applications in Health, Safety, Ergonomics and Risk Management: Human Body, Motion and Behavior; Duffy, V.G., Ed.; HCII 2021. Lecture notes in computer science; Springer: Cham, Switzerland, 2021; p. 12777. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Kanellos, N.; Migkos, S.P. Innovative Cryptocurrency Trade Websites’ Marketing Strategy Refinement, via Digital Behavior. IEEE Access 2022, 10, 63163–63176. [Google Scholar] [CrossRef]

- Wang, Y.; Deng, Q.; Rod, M.; Ji, S. A thematic exploration of social media analytics in marketing research and an agenda for future inquiry. J. Strateg. Mark. 2021, 29, 471–491. [Google Scholar] [CrossRef]

- Garg, P.; Guptra, B.; Dzever, S.; Sivarajah, U.; Kumar, V. Examining the Relationship between Social Media Analytics Practices and Business Performance in the Indian Retail and IT Industries: The Mediation Role of Customer Engagement. Int. J. Inf. Manag. 2020, 52, 102069. [Google Scholar] [CrossRef]

- Madila, S.S.; Dida, M.A.; Kaijage, S. A Review of Usage and Applications of Social Media Analytics. J. Inf. Syst. Eng. Manag. 2021, 6, em0141. [Google Scholar] [CrossRef]

- Jayaram, D.; Manrai, A.K.; Manrai, L.A. Effective use of marketing technology in Eastern Europe: Web analytics, social media, customer analytics, digital campaigns and mobile applications. J. Econ. Financ. Adm. Sci. 2015, 20, 118–132. [Google Scholar] [CrossRef] [Green Version]

- Enenkel, M.; Saenz, S.M.; Dookie, D.S.; Braman, L.; Obradovich, N.; Kryvasheyeu, Y. Social Media Data Analysis and Feedback for Advanced Disaster Risk Management. arXiv 2018, arXiv:1802.02631. [Google Scholar] [CrossRef]

- Sakas, D.P.; Reklitis, D.P.; Trivellas, P.; Vassilakis, C.; Terzi, M.C. The Effects of Logistics Websites’ Technical Factors on the Optimization of Digital Marketing Strategies and Corporate Brand Name. Processes 2022, 10, 892. [Google Scholar] [CrossRef]

| Organic Traffic | Organic Keywords | Organic Traffic Costs | Social Traffic | Bounce Rate | Social Engagement | Number of Fans | Follower Growth | Number of Comments | Number of Likes | Number of Posts | Post Interaction | Posts per Day | Total Reactions | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Organic Traffic | 1 | 0.319 | −0.538 ** | −0.562 | −0.569 | 0.506 | −0.556 * | 0.182 | −0.121 | 0.656 * | 0.071 | 0.315 | 0.056 | 0.650 * |

| Organic Keywords | 0.319 | 1 | −0.220 | 0.167 | −0.262 | 0.335 | −0.533 | −0.454 | 0.492 | 0.341 | 0.024 | 0.579 * | 0.029 | 0.337 |

| Organic Traffic Costs | −0.538 ** | −0.220 | 1 | −0.434 | 0.607 | −0.432 | 0.020 | −0.564 * | 0.297 | −0.256 | −0.066 | −0.482 | −0.059 | −0.268 |

| Social Traffic | −0.562 | 0.167 | −0.434 | 1 | −0.233 | 0.673 | 0.180 | 0.118 | 0.322 | −0.344 | −0.026 | 0.761 * | −0.024 | −0.204 |

| Bounce Rate | −0.569 | −0.262 | 0.607 | −0.233 | 1 | 0.142 | −0.042 | −0.079 | 0.582 | 0.733 | 0.624 | −0.209 | 0.626 | 0.570 |

| Social Engagement | 0.506 | 0.335 | −0.432 | 0.673 | 0.142 | 1 | −0.420 | 0.151 | 0.512 | 0.836 ** | 0.136 | 0.838 ** | 0.141 | 0.824 ** |

| Number of Fans | −0.556 * | −0.533 | 0.020 | 0.180 | −0.042 | −0.420 | 1 | 0.228 | −0.200 | −0.724 ** | 0.230 | −0.240 | 0.232 | −0.738 ** |

| Follower Growth | 0.182 | −0.454 | −0.564 * | 0.118 | −0.079 | 0.151 | 0.228 | 1 | −0.193 | −0.021 | 0.069 | 0.093 | 0.069 | −0.039 |

| Number of Comments | −0.121 | 0.492 | 0.297 | 0.322 | 0.582 | 0.512 | −0.200 | −0.193 | 1 | 0.284 | 0.026 | 0.595 * | 0.035 | 0.268 |

| Number of Likes | 0.656 * | 0.341 | −0.256 | −0.344 | 0.733 | 0.836 ** | −0.724 ** | −0.021 | 0.284 | 1 | 0.144 | 0.504 | 0.145 | 0.997 ** |

| Number of Posts | 0.071 | 0.024 | −0.066 | −0.026 | 0.624 | 0.136 | 0.230 | 0.069 | 0.026 | 0.144 | 1 | 0.130 | 1.000 ** | 0.111 |

| Post Interaction | 0.315 | 0.579 * | −0.482 | 0.761 * | −0.209 | 0.838 ** | −0.240 | 0.093 | 0.595 * | 0.504 | 0.130 | 1 | 0.136 | 0.487 |

| Posts per Day | 0.056 | 0.029 | −0.059 | −0.024 | 0.626 | 0.141 | 0.232 | 0.069 | 0.035 | 0.145 | 1.000 ** | 0.136 | 1 | 0.112 |

| Total Reactions | 0.650 * | 0.337 | −0.268 | −0.204 | 0.570 | 0.824 ** | −0.738 ** | −0.039 | 0.268 | 0.997 ** | 0.111 | 0.487 | 0.112 | 1 |

| Mean | Min | Max | Std. Deviation | |

|---|---|---|---|---|

| Organic Traffic | 12,396,829.1 | 10,597,332.6 | 13,557,164.8 | 846,987.5 |

| Organic Keywords | 616,364.616 | 551,015.8 | 689,284.2 | 32,227.48 |

| Organic Traffic Costs | 22,115,440.80 | 14,987,699.4 | 31,237,574.8 | 4,411,200.442 |

| Social Traffic | 651,846.114 | 465,269.2 | 1,188,802 | 255,904.58 |

| Bounce Rate | 0.533164 | 0.4906 | 0.5509 | 0.02007 |

| Social Engagement | 0.0004 | 0.000094 | 0.001083 | 0.00032 |

| Number of Fans | 655,557.22 | 612,388.08 | 66,924.91 | 24,069.3 |

| Follower Growth | 225.359 | 30.21 | 461.13 | 132.14295 |

| Number of Comments | 12.141 | 4.42 | 17.25 | 4.00367 |

| Number of Likes | 239.0577 | 64.75 | 662.83 | 202.65334 |

| Number of Posts | 11.9615 | 8.33 | 15.83 | 1.92318 |

| Post Interaction | 0.0009 | 0.000151 | 0.003241 | 0.00095 |

| Posts per Day | 1.8601 | 1.30 | 2.45 | 0.2988 |

| Total Reactions | 283.7756 | 81.75 | 805.25 | 235.97 |

| Variables | t | Sig. | F | p-Value |

|---|---|---|---|---|

| Equal variances assumed | −0.525 | 0.605 | 2.140 | 0.157 |

| Equal variances not assumed | −0.858 | 0.402 |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 0.914 | 3.548 | 0.163 |

| Social Engagement | −0.207 | 0.884 | ||

| Number of Fans | −0.135 | 0.814 | ||

| Follower Growth | 0.089 | 0.716 | ||

| Number of Comments | −0.0326 | 0.304 | ||

| Number of Likes | 4.606 | 0.239 | ||

| Number of Posts | 21.400 | 0.052 | ||

| Post Interaction | 0.407 | 0.568 | ||

| Posts per Day | −21.553 | 0.052 | ||

| Total Reactions | −3.950 | 0.274 |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 0.903 | 3.096 | 0.191 |

| Social Engagement | −2.483 | 0.171 | ||

| Number of Fans | 0.014 | 0.981 | ||

| Follower Growth | −0.174 | 0.515 | ||

| Number of Comments | 0.225 | 0.481 | ||

| Number of Likes | 1.742 | 0.638 | ||

| Number of Posts | −2.199 | 0.781 | ||

| Post Interaction | 1.802 | 0.076 | ||

| Posts per Day | 2.110 | 0.791 | ||

| Total Reactions | −0.278 | 0.935 |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 0.999 | 246.523 | 0.000 ** |

| Social Engagement | 0.433 | 0.077 | ||

| Number of Fans | −0.208 | 0.051 | ||

| Follower Growth | −0.454 | 0.001 ** | ||

| Number of Comments | 0.591 | 0.000 ** | ||

| Number of Likes | 4.489 | 0.001 ** | ||

| Number of Posts | −7.529 | 0.003 ** | ||

| Post Interaction | −1.137 | 0.001 ** | ||

| Posts per Day | 7.513 | 0.003 ** | ||

| Total Reactions | −4.881 | 0.001 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 1.000 | - | 0.000 ** |

| Social Engagement | 1.144 | 0.000 ** | ||

| Number of Fans | 0.165 | 0.000 ** | ||

| Follower Growth | 0.225 | 0.000 ** | ||

| Number of Comments | 0.445 | 0.000 ** | ||

| Number of Posts | −0.988 | 0.000 ** | ||

| Total Reactions | −0.023 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 1.000 | - | 0.000 ** |

| Social Engagement | 0.002 | 0.000 ** | ||

| Number of Fans | −0.643 | 0.000 ** | ||

| Follower Growth | 0.472 | 0.000 ** | ||

| Number of Comments | 0.007 | 0.000 ** | ||

| Number of Posts | 0.934 | 0.000 ** | ||

| Total Reactions | 0.743 | 0.000 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sakas, D.P.; Giannakopoulos, N.T.; Terzi, M.C.; Kamperos, I.D.G.; Nasiopoulos, D.K.; Reklitis, D.P.; Kanellos, N. Social Media Strategy Processes for Centralized Payment Network Firms after a War Crisis Outset. Processes 2022, 10, 1995. https://doi.org/10.3390/pr10101995

Sakas DP, Giannakopoulos NT, Terzi MC, Kamperos IDG, Nasiopoulos DK, Reklitis DP, Kanellos N. Social Media Strategy Processes for Centralized Payment Network Firms after a War Crisis Outset. Processes. 2022; 10(10):1995. https://doi.org/10.3390/pr10101995

Chicago/Turabian StyleSakas, Damianos P., Nikolaos T. Giannakopoulos, Marina C. Terzi, Ioannis Dimitrios G. Kamperos, Dimitrios K. Nasiopoulos, Dimitrios P. Reklitis, and Nikos Kanellos. 2022. "Social Media Strategy Processes for Centralized Payment Network Firms after a War Crisis Outset" Processes 10, no. 10: 1995. https://doi.org/10.3390/pr10101995