Smart and Resilient Transformation of Manufacturing Firms

Abstract

:1. Introduction

- RQ1:

- Which digital technologies and services make the highest impact on the network of manufacturing firms?

- RQ2:

- Which digital technologies and services comprise the gross annual turnover of manufacturing firms?

- RQ3:

- What are the main reasons for the successful or unsuccessful smart transformations of manufacturing firms?

2. Literature Review

2.1. Smart Manufacturing

2.2. Resilient Manufacturing

2.3. Digital Servitization

2.4. Finanical Performance in Manufacturing Firms

3. Methodology

3.1. Data Sample and Collection

3.2. Data Analysis

4. Results

5. Discussion

5.1. Theorethical Implications

5.2. Practical Implications

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the art and future trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef] [Green Version]

- Zivlak, N.; Rakic, S.; Marjanovic, U.; Ciric, D.; Bogojevic, B. The Role of Digital Servitization in Transition Economy: An SNA Approach. Teh. Vjesn.-Tech. Gaz. 2021, 26, 10. [Google Scholar] [CrossRef]

- The Economist. Apple Already Sold Everyone an iPhone. Now What? The Economist. 2022. Available online: https://www.economist.com/business/2022/07/31/apple-already-sold-everyone-an-iphone-now-what (accessed on 11 February 2021).

- Rakic, S.; Visnjic, I.; Gaiardelli, P.; Romero, D.; Marjanovic, U. Transformation of Manufacturing Firms: Towards Digital Servitization. In Advances in Production Management Systems. Artificial Intelligence for Sustainable and Resilient Production Systems; Dolgui, A., Bernard, A., Lemoine, D., von Cieminski, G., Romero, D., Eds.; Springer International Publishing: Cham, Switzerland, 2021; Volume 631, pp. 153–161. [Google Scholar] [CrossRef]

- Wang, Y. Innovation Ecosystem with Chinese Characteristics: Experiences and Lessons from Small and Medium-sized Manufacturing Enterprises. Teh. Vjesn.-Tech. Gaz. 2021, 28, 1291–1296. [Google Scholar] [CrossRef]

- Hauge, J.B.; Zafarzadeh, M.; Jeong, Y.; Li, Y.; Khilji, W.A.; Larsen, C.; Wiktorsson, M. Digital twin testbed and practical applications in production logistics with real-time location data. Int. J. Ind. Eng. Manag. 2021, 12, 129–140. [Google Scholar] [CrossRef]

- Wang, M. Manufacturing Capacity Evaluation of Smart Job-Shop Based on Neural Network. Int. J. Simul. Model. 2021, 20, 778–789. [Google Scholar] [CrossRef]

- Wang, N.; Li, X.J.; Nie, H. Digital Production Control of Manufacturing Workshop Based on Internet of Things. Int. J. Simul. Model. 2021, 20, 606–617. [Google Scholar] [CrossRef]

- Lu, Y. Industry 4.0: A survey on technologies, applications and open research issues. J. Ind. Inf. Integr. 2017, 6, 1–10. [Google Scholar] [CrossRef]

- Ibn-Mohammed, T.; Mustapha, K.B.; Godsell, J.; Adamu, Z.; Babatunde, K.A.; Akintade, D.D.; Acquaye, A.; Fujii, H.; Ndiaye, M.M.; Yamoah, F.A.; et al. A critical analysis of the impacts of COVID-19 on the global economy and ecosystems and opportunities for circular economy strategies. Resour. Conserv. Recycl. 2021, 164, 105169. [Google Scholar] [CrossRef]

- Singh, S.; Kumar, R.; Panchal, R.; Tiwari, M.K. Impact of COVID-19 on logistics systems and disruptions in food supply chain. Int. J. Prod. Res. 2020, 59, 1993–2008. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.-A.; Yang, S. Service Innovation and Smart Analytics for Industry 4.0 and Big Data Environment. Procedia CIRP 2014, 16, 3–8. [Google Scholar] [CrossRef] [Green Version]

- Kohtamäki, M.; Parida, V.; Patel, P.C.; Gebauer, H. The relationship between digitalization and servitization: The role of servitization in capturing the financial potential of digitalization. Technol. Forecast. Soc. Chang. 2019, 151, 119804. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Lamprecht, C.; Wortmann, F. Growth paths for overcoming the digitalization paradox. Bus. Horiz. 2020, 63, 313–323. [Google Scholar] [CrossRef]

- Frank, A.G.; Mendes, G.H.S.; Ayala, N.F.; Ghezzi, A. Servitization and Industry 4.0 convergence in the digital transformation of product firms: A business model innovation perspective. Technol. Forecast. Soc. Chang. 2019, 141, 341–351. [Google Scholar] [CrossRef]

- Grosso, C.; Checchinato, F.; Finotto, V.; Mauracher, C. Configuration challenges for the “Made in Italy” Agrifood industry. Int. J. Ind. Eng. Manag. 2021, 12, 142–153. [Google Scholar] [CrossRef]

- Ghobakhloo, M. Industry 4.0, digitization, and opportunities for sustainability. J. Clean. Prod. 2019, 252, 119869. [Google Scholar] [CrossRef]

- Fianko, S.K.; Amoah, N.; Jnr, S.A.; Dzogbewu, T.C. Green Supply Chain Management and Environmental Performance: The moderating role of Firm Size. Int. J. Ind. Eng. Manag. 2021, 12, 154–164. [Google Scholar] [CrossRef]

- Büchi, G.; Cugno, M.; Castagnoli, R. Smart factory performance and Industry 4.0. Technol. Forecast. Soc. Chang. 2019, 150, 119790. [Google Scholar] [CrossRef]

- Gajdzik, B. Frameworks of the Maturity Model for Industry 4.0 with Assessment of Maturity Levels on the Example of the Segment of Steel Enterprises in Poland. J. Open Innov. Technol. Mark. Complex. 2022, 8, 77. [Google Scholar] [CrossRef]

- Lalic, B.; Marjanovic, U.; Rakic, S.; Pavlovic, M.; Todorovic, T.; Medic, N. Big Data Analysis as a Digital Service: Evidence Form Manufacturing Firms. In Proceedings of the 5th International Conference on the Industry 4.0 Model for Advanced Manufacturing, Belgrade, Serbia, 1–4 June 2020; Wang, L., Majstorovic, V.D., Mourtzis, D., Carpanzano, E., Moroni, G., Galantucci, L.M., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 263–269. [Google Scholar] [CrossRef]

- Raptis, T.P.; Passarella, A.; Conti, M. Data Management in Industry 4.0: State of the Art and Open Challenges. IEEE Access 2019, 7, 97052–97093. [Google Scholar] [CrossRef]

- Tran-Dang, H.; Kim, D.-S. The Physical Internet in the Era of Digital Transformation: Perspectives and Open Issues. IEEE Access 2021, 9, 164613–164631. [Google Scholar] [CrossRef]

- Osterrieder, P.; Budde, L.; Friedli, T. The smart factory as a key construct of industry 4.0: A systematic literature review. Int. J. Prod. Econ. 2020, 221, 107476. [Google Scholar] [CrossRef]

- Gu, X.; Jin, X.; Ni, J.; Koren, Y. Manufacturing System Design for Resilience. Procedia CIRP 2015, 36, 135–140. [Google Scholar] [CrossRef] [Green Version]

- Zhang, W.; van Luttervelt, C. Toward a resilient manufacturing system. CIRP Ann. 2011, 60, 469–472. [Google Scholar] [CrossRef]

- Mourtzis, D.; Angelopoulos, J.; Panopoulos, N. Robust Engineering for the Design of Resilient Manufacturing Systems. Appl. Sci. 2021, 11, 3067. [Google Scholar] [CrossRef]

- Ambrogio, G.; Filice, L.; Longo, F.; Padovano, A. Workforce and supply chain disruption as a digital and technological innovation opportunity for resilient manufacturing systems in the COVID-19 pandemic. Comput. Ind. Eng. 2022, 169, 108158. [Google Scholar] [CrossRef]

- Eunike, A.; Wang, K.-J.; Chiu, J.; Hsu, Y. Real-time resilient scheduling by digital twin technology in a flow-shop manufacturing system. Procedia CIRP 2022, 107, 668–674. [Google Scholar] [CrossRef]

- Vandermerwe, S.; Rada, J. Servitization of business: Adding value by adding services. Eur. Manag. J. 1989, 6, 314–324. [Google Scholar] [CrossRef]

- Tukker, A. Eight types of product–service system: Eight ways to sustainability? Experiences from SusProNet. Bus. Strat. Environ. 2004, 13, 246–260. [Google Scholar] [CrossRef]

- Fliess, S.; Lexutt, E. How to be successful with servitization—Guidelines for research and management. Ind. Mark. Manag. 2019, 78, 58–75. [Google Scholar] [CrossRef]

- Pavlović, M.; Marjanović, U.; Rakić, S.; Tasić, N.; Lalić, B. The Big Potential of Big Data in Manufacturing: Evidence from Emerging Economies. In Advances in Production Management Systems. Towards Smart and Digital Manufacturing; Lalic, B., Majstorovic, V., Marjanovic, U., von Cieminski, G., Romero, D., Eds.; Springer International Publishing: Cham, Switzerland, 2020; Volume 592, pp. 100–107. [Google Scholar] [CrossRef]

- da Costa Fernandes, S.; Pigosso, D.C.; McAloone, T.C.; Rozenfeld, H. Towards product-service system oriented to circular economy: A systematic review of value proposition design approaches. J. Clean. Prod. 2020, 257, 120507. [Google Scholar] [CrossRef]

- Rakic, S.; Pavlovic, M.; Marjanovic, U. A Precondition of Sustainability: Industry 4.0 Readiness. Sustainability 2021, 13, 6641. [Google Scholar] [CrossRef]

- Rakic, S.; Pero, M.; Sianesi, A.; Marjanovic, U. Digital Servitization and Firm Performance: Technology Intensity Approach. Eng. Econ. 2022, 33, 398–413. [Google Scholar] [CrossRef]

- Pirola, F.; Boucher, X.; Wiesner, S.; Pezzotta, G. Digital technologies in product-service systems: A literature review and a research agenda. Comput. Ind. 2020, 123, 103301. [Google Scholar] [CrossRef]

- Langley, D.J. Digital Product-Service Systems: The Role of Data in the Transition to Servitization Business Models. Sustainability 2022, 14, 1303. [Google Scholar] [CrossRef]

- Zähringer, D.; Niederberger, J.; Blind, K.; Schletz, A. Revenue creation: Business models for product-related services in international markets—The case of Zwick GmbH & Co. KG. Serv. Ind. J. 2011, 31, 629–641. [Google Scholar] [CrossRef]

- Eggert, A.; Hogreve, J.; Ulaga, W.; Muenkhoff, E. Revenue and Profit Implications of Industrial Service Strategies. J. Serv. Res. 2013, 17, 23–39. [Google Scholar] [CrossRef]

- Marjanovic, U.; Lalic, B.; Medic, N.; Prester, J.; Palcic, I. Servitization in manufacturing: Role of antecedents and firm characteristics. Int. J. Ind. Eng. Manag. 2020, 11, 133–144. [Google Scholar] [CrossRef]

- Visnjic, I.; Wiengarten, F.; Neely, A. Only the Brave: Product Innovation, Service Business Model Innovation, and Their Impact on Performance. J. Prod. Innov. Manag. 2014, 33, 36–52. [Google Scholar] [CrossRef] [Green Version]

- Vendrell-Herrero, F.; Bustinza, O.F.; Parry, G.; Georgantzis, N. Servitization, digitization and supply chain interdependency. Ind. Mark. Manag. 2017, 60, 69–81. [Google Scholar] [CrossRef] [Green Version]

- Martín-Peña, M.-L.; Sánchez-López, J.M.; Diaz-Garrido, E. Servitization and digitalization in manufacturing: The influence on firm performance. J. Bus. Ind. Mark. 2019, 35, 564–574. [Google Scholar] [CrossRef]

- Kharlamov, A.A.; Parry, G. The impact of servitization and digitization on productivity and profitability of the firm: A systematic approach. Prod. Plan. Control 2020, 32, 185–197. [Google Scholar] [CrossRef]

- Pezzotta, G.; Arioli, V.; Adrodegari, F.; Rapaccini, M.; Saccani, N.; Rakic, S.; Marjanovic, U.; West, S.; Stoll, O.; Meierhofer, J.; et al. Digital Servitization in the Manufacturing Sector: Survey Preliminary Results. In Advances in Production Management Systems. Smart Manufacturing and Logistics Systems: Turning Ideas into Action; Kim, D.Y., von Cieminski, G., Romero, D., Eds.; Springer Nature: Cham, Switzerland, 2022; Volume 664, pp. 310–320. [Google Scholar] [CrossRef]

- Rakic, S.; Marjanovic, U.; Pezzotta, G.; Gaiardelli, P.; Jankovic, A.; Adrodegari, F. Future Trends in Digital Services and Products: Evidence from Serbian Manufacturing Firms. In Advances in Production Management Systems. Smart Manufacturing and Logistics Systems: Turning Ideas into Action; Kim, D.Y., von Cieminski, G., Romero, D., Eds.; Springer Nature: Cham, Switzerland, 2022; Volume 664, pp. 341–350. [Google Scholar] [CrossRef]

- Cavalcante, I.M.; Frazzon, E.M.; Forcellini, F.A.; Ivanov, D. A supervised machine learning approach to data-driven simulation of resilient supplier selection in digital manufacturing. Int. J. Inf. Manag. 2019, 49, 86–97. [Google Scholar] [CrossRef]

- Sklyar, A.; Kowalkowski, C.; Tronvoll, B.; Sörhammar, D. Organizing for digital servitization: A service ecosystem perspective. J. Bus. Res. 2019, 104, 450–460. [Google Scholar] [CrossRef]

- Janković, A.; Adrodegari, F.; Saccani, N.; Simeunović, N. Improving service business of industrial companies through data: Conceptualization and application. Int. J. Ind. Eng. Manag. 2022, 13, 78–87. [Google Scholar] [CrossRef]

- Li, A.Q.; Rich, N.; Found, P.; Kumar, M.; Brown, S. Exploring product–service systems in the digital era: A socio-technical systems perspective. TQM J. 2020, 32, 897–913. [Google Scholar] [CrossRef] [Green Version]

- Lerch, C.; Gotsch, M. Digitalized Product-Service Systems in Manufacturing Firms: A Case Study Analysis. Res. Manag. 2015, 58, 45–52. [Google Scholar] [CrossRef]

| Size | Number of Employees | (%) |

|---|---|---|

| Small | 20–49 | 39.0 |

| Medium | 50–249 | 40.0 |

| Large | >250 | 21.0 |

| NACE | Industry Sector | (%) |

|---|---|---|

| 10 | Food production | 27.0 |

| 25 | Production of fabricated metal products, except machinery and equipment | 10.0 |

| 28 | Production of machinery and equipment n.e.c. | 9.0 |

| 13 | Production of textile | 7.0 |

| 22 | Production of rubber and plastics | 7.0 |

| 27 | Production of electrical equipment | 7.0 |

| 29 | Production of motor vehicles, trailers, and semi-trailers | 6.0 |

| Other sectors | 27.0 |

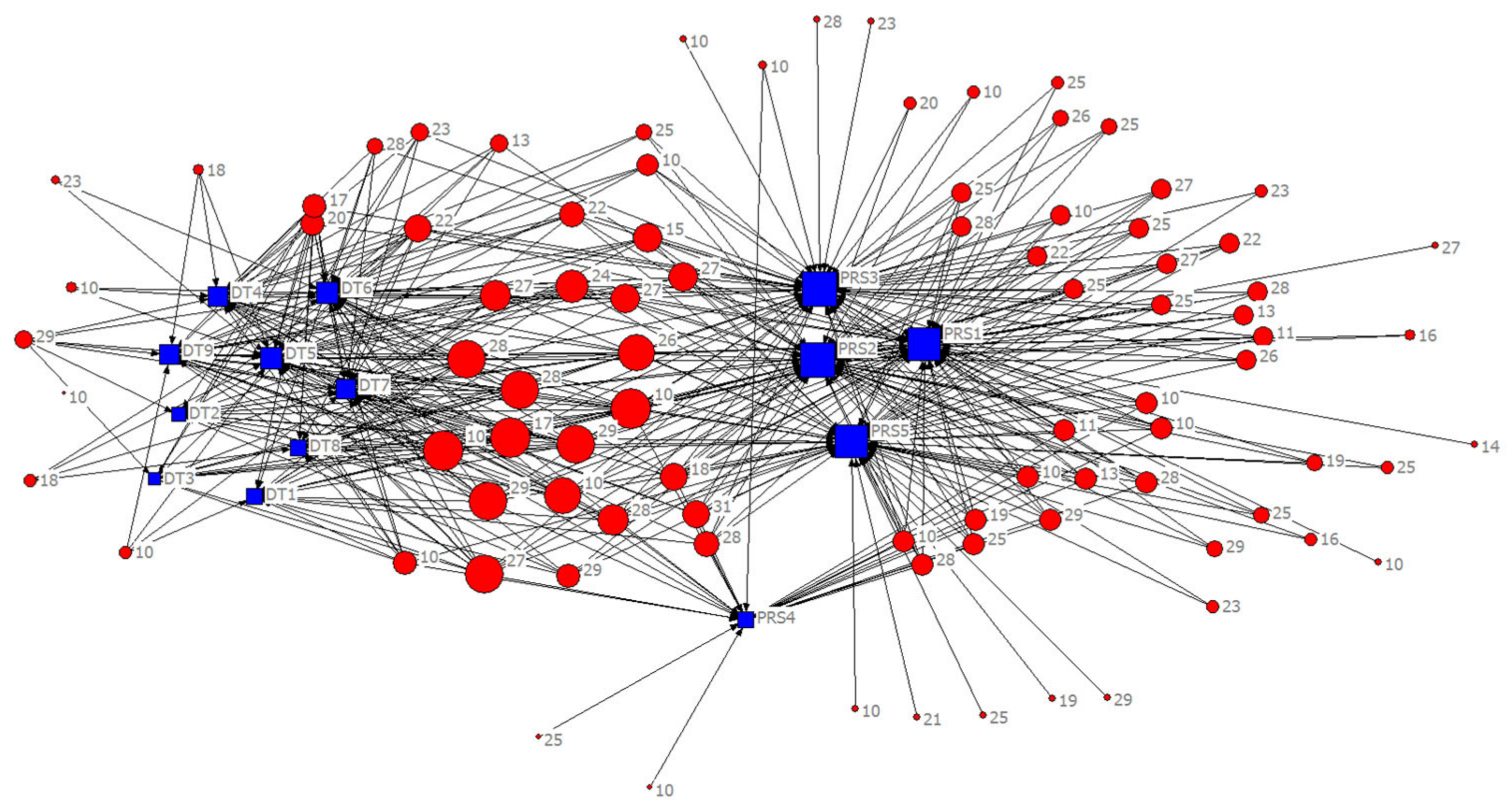

| Node | Eigenvector Centrality | Betweenness Centrality |

|---|---|---|

| PRS1 | 0.376 | 0.069 |

| PRS2 | 0.403 | 0.086 |

| PRS3 | 0.410 | 0.107 |

| PRS4 | 0.179 | 0.026 |

| PRS5 | 0.386 | 0.101 |

| DT1 | 0.165 | 0.005 |

| DT2 | 0.147 | 0.002 |

| DT3 | 0.127 | 0.002 |

| DT4 | 0.227 | 0.015 |

| DT5 | 0.231 | 0.022 |

| DT6 | 0.234 | 0.019 |

| DT7 | 0.228 | 0.013 |

| DT8 | 0.157 | 0.003 |

| DT9 | 0.213 | 0.010 |

| GAT | |

|---|---|

| PRS1 | 0.132 * |

| PRS2 | 0.069 |

| PRS3 | 0.074 |

| PRS4 | 0.001 |

| PRS5 | 0.174 * |

| GAT | |

|---|---|

| DT1 | 0.169 * |

| DT2 | 0.140 |

| DT3 | 0.090 |

| DT4 | 0.152 * |

| DT5 | 0.003 |

| DT6 | 0.023 |

| DT7 | 0.044 |

| DT8 | 0.069 |

| DT9 | 0.168 * |

| Answers/Firm | Firm A | Firm B |

|---|---|---|

| Answer 1 | CEO | Project manager |

| Answer 2 | Lack of knowledge | The product has no need for those services |

| Answer 3 | According to defined standards | To increase the value chain |

| Answer 4 | No developed awareness for service implementation | The service development strategy has been developed according to the smart transformation |

| Answer 5 | Better relations with customers | Competition advantage and resilience to market change |

| Answers/Firm | Firm C | Firm D |

|---|---|---|

| Answer 1 | Sales manager | Sales manager |

| Answer 2 | Services that are not offered are proved to be unprofitable | They do not just use one service |

| Answer 3 | Services are offered depending on the market B2B or B2C | Services are implemented in accordance with user needs |

| Answer 4 | The strategy is in the development phase | The strategy is defined so that the company is oriented towards results |

| Answer 5 | Competition advantage and customer loyalty | Profit and competition advantage |

| Answers/Firm | Firm E | Firm F |

|---|---|---|

| Answer 1 | Production manager | CEO |

| Answer 2 | Lack of the awareness | Lack of resources |

| Answer 3 | They offer only product-related services that are closely related to product characteristics | Services are implemented to increase product value |

| Answer 4 | They do not have a developed strategy | The service development strategy is directed towards the satisfaction of customers |

| Answer 5 | Traditional relations with customers | Customer loyalty and resilience to the market change |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sofic, A.; Rakic, S.; Pezzotta, G.; Markoski, B.; Arioli, V.; Marjanovic, U. Smart and Resilient Transformation of Manufacturing Firms. Processes 2022, 10, 2674. https://doi.org/10.3390/pr10122674

Sofic A, Rakic S, Pezzotta G, Markoski B, Arioli V, Marjanovic U. Smart and Resilient Transformation of Manufacturing Firms. Processes. 2022; 10(12):2674. https://doi.org/10.3390/pr10122674

Chicago/Turabian StyleSofic, Aleksandar, Slavko Rakic, Giuditta Pezzotta, Branko Markoski, Veronica Arioli, and Ugljesa Marjanovic. 2022. "Smart and Resilient Transformation of Manufacturing Firms" Processes 10, no. 12: 2674. https://doi.org/10.3390/pr10122674