Abstract

In response to the limited available information during the initial stages of coal spontaneous combustion and the influence of decision makers’ risk preferences on decision-making, this paper proposes an emergency decision-making method for coal spontaneous combustion that integrates grey correlation degree and TOPSIS with an enhanced prospect theory. Firstly, a normalized weighted evaluation matrix is established for the emergency response plan of coal spontaneous combustion, and the entropy method is utilized to determine the weights of various indexes. Then, considering the imperfect rationality of decision makers and their diverse individual risk preferences, they are categorized into three types: risk-seeking type, risk-neutral type, and risk-averse type. The corresponding risk coefficients are determined based on these different types. Positive and negative ideal solutions are taken as reference points, and matrices representing gains and losses are constructed. The grey correlation degree is introduced to calculate both positive and negative prospect values based on these matrices. Moreover, the prospect value for each emergency response plan is calculated, respectively, based on different types of decision makers, and the entropy method is used to assign weights to decision makers according to their respective risk preferences. Consequently, based on these prospect values and the weights, comprehensive prospect values for each emergency response plan are obtained and ranked to identify the optimal one. Finally, in order to validate the effectiveness of our proposed approach, a case study is conducted, and the results obtained from this case study are discussed and compared with those from other methods.

1. Introduction

In China, over 90% of coal mine fires are caused by spontaneous combustion. Around 54.9% of the main coal mines have a tendency for such incidents, while more than 70% of coal seams are prone to spontaneous combustion. This occurrence poses a significant risk in coal mining, resulting not only in the depletion of valuable coal resources and substantial economic losses but also emitting considerable amounts of CO, H2S, SO2, and other harmful gases that severely pollute the air and environment. Additionally, it frequently leads to gas and dust explosions [1,2,3,4], as well as geological disasters like subsidence and rock caving. Incomplete statistics show that there are annually over 4000 instances of spontaneous fire hazards in Chinese coal mines, leading to more than 360 mine disasters. Currently, there are still over 800 areas affected by fires caused by spontaneous combustion in China, which have been sealed off and made inaccessible with more than 200 million tons of untapped and underutilized coal reserves. Statistics indicate that global carbon dioxide emissions from coal mine fires amount to approximately 100 Mt per year, accounting for around 0.38% of global fossil fuel emissions. Due to the higher ground temperature and rock temperature in deep mining areas, the spontaneous combustion problem of coal will become more and more serious with the increase in mining depth. This will also present greater challenges for prevention measure implementation as well as emergency rescue efforts [5].

The decision-making problem of the emergency response plan for spontaneous combustion is a multi-objective decision-making problem. In order to minimize accident losses and casualties as much as possible, numerous scholars have conducted extensive research on emergency decision-making. Currently, various methods are employed for addressing such decision-making problems, including TOPSIS [6,7], entropy weight TOPSIS (EW-TOPSIS) [8,9,10], the fuzzy analytic hierarchy process (FAHP) [7,11,12,13,14], case-based reasoning (CBR) [15,16,17], etc. These methods have undergone continuous improvement and gained widespread usage; however, most of the relevant studies were conducted based on the assumption that decision-makers exhibit full rationality in their decision-making process without considering individual risk preferences. In addition, there are some decision evaluation methods in other industries that can be used for reference, such as the Bi-Algorithm MCDM Approach [18] and EBM-DEA Model [19], but their effectiveness and applicability need to be verified. It is well known that the occurrence of a coal mine fire leads to severe consequences and poses significant risks to both trapped individuals and rescue personnel due to the complexity of the decision-making environment and a lack of information. It can also have a major impact on surrounding buildings and work areas, so the role of combustion in resilience is fundamental. Cimellaro and Forcellini presented the concepts of disaster resilience and its quantitative evaluation and proposed a unified terminology for a common reference framework and implementation for evaluation [20,21]. This requires prompt decision-making, which in turn imposes substantial psychological pressure on decision-makers. Inconsistent opinions among commanders, rescue personnel, and experts often arise as a result of psychological factors such as risk aversion, loss aversion, probability judgment, hesitation, etc. Additionally, expert knowledge structures are always limited. Experts possess specialized knowledge in a certain field and subjective cognitive abilities, but they are not omniscient or omnipotent as assumed in traditional methods. So, the primary challenge in emergency management lies in making swift decisions when faced with incomplete information [22].

Decision-making is essentially a subjective behavior of individuals, as not all decision makers exhibit complete rationality. Prospect theory, proposed by Kahneman [23] and Tversky [24], effectively captures the psychological behavioral characteristics of decision makers, such as their aversion to losses, distortion in probability judgments, and risk aversion, and explains the phenomena that cannot be accounted for by expected utility theory [25]. Scholars have further developed prospect theory [15,26,27,28,29,30] to enhance its applicability across various domains, including financial investment [28], supplier evaluation [30], emergency decision-making related to gas explosions [31], geological disasters [15], and incidents like oil pipeline explosion accidents [32]. However, most existing prospect theories assume certain preferences on the part of decision-makers without fully considering the individual risk preferences of different decision-makers. This approach has not been applied to the emergency decision-making of coal spontaneous combustion.

In the decision-making process, the weight of an index holds paramount importance in ranking decision options. Numerous scholars have dedicated their attention to methodologies for determining index weights [33,34]. Common approaches encompass the least squares method [35], maximum Bayesian entropy method [36], and best worst method [34,37,38]. Nevertheless, these methods possess certain limitations that impede their practical application. The least squares and maximum Bayesian entropy methods prioritize the equity of weights over criterium weight and value distribution. The best worst method requires a reference point for both the optimal standard and suboptimal standard; however, unique standards may not exist in reality.

The proposed approach integrates grey correlation degree and TOPSIS with an enhanced prospect theory to incorporate theoretical insights into decision-making processes for coal spontaneous combustion emergencies, aiming to effectively address the aforementioned challenges.

The entropy method was employed to compute the weights of indexes in the emergency response plan, enabling a comprehensive consideration of the interrelationships and interactions among various indexes. Based on information entropy, this approach facilitates an objective reflection of their disparities and significance, thereby mitigating the impact of subjective factors to a certain extent. Thus, subjective errors can be avoided as far as possible.

Considering the bounded rationality of decision-makers, their inherent knowledge limitations, diverse risk attitudes, and the influence of psychological factors on decision-making processes, we categorized decision-makers based on their self-rated risk attitudes. We introduced a grey correlation degree to compute gains and losses matrices. Subsequently, we computed the prospect value of emergency disposal plans, respectively, and constructed a prospect value matrix using this information. Next, by employing the entropy method, we determined weights for different decision-makers based on the prospect value matrix. Finally, through calculating comprehensive prospect values, we selected an optimal emergency response plan accordingly.

To sum up, the main innovations of this paper are as follows: First, according to the self-evaluation of experts, the expert evaluation is divided into three risk types, and the decision weight of experts of different risk types is quantified for the first time. Secondly, the entropy weight is used to determine the weight of the index to replace the probability of the event to reduce the influence of subjective factors and human errors on the results. Third, the grey correlation coefficient is used to replace the distance between the index and the positive and negative ideal solutions, and the gain matrix and loss matrix are constructed, which can better reflect the correlation and similarity between the index and the positive and negative ideal solutions, so as to make the results more reliable.

The outline of this paper is organized as follows: In Section 2, four indexes of emergency response plans for spontaneous combustion are briefly introduced. In Section 3, the grey correlation degree, TOPSIS, and the improved prospect theory are introduced in detail, and the specific steps of the emergency decision-making method are presented. Section 4 presents a case study in which the proposed method is used on decision-making for coal spontaneous combustion. In Section 5, the results obtained from this case study are discussed and compared with representative methods. Finally, Section 6 presents our conclusions.

2. Index System of Emergency Response Plan for Spontaneous Combustion

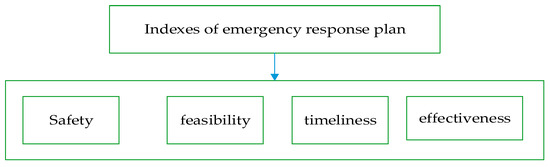

Based on existing research and consultation with relevant experts, the emergency response plan for coal spontaneous combustion should prioritize safety and feasibility [39] as its core components. Safety considerations must extend to those who are trapped as well as the rescuers. Feasibility is key to achieving successful rescue outcomes, and timeliness and effectiveness should also be considered. The index system for the emergency response plan is illustrated in Figure 1.

Figure 1.

The index system of the emergency response plan.

- (1)

- Safety: This primarily considers the ability to address current accidents and prevent potential risks, including the possibility of triggering new secondary disasters or causing harm to trapped individuals and rescuers. It encompasses organizational and personal factors, rational decision-making, adherence to emergency procedures, and the prediction of potential hazardous areas.

- (2)

- Feasibility: Feasibility assesses the practicality of implementing the emergency response plan, considering challenges in dangerous areas, physical exertion required by rescuers, the appropriateness of escape routes and shelter arrangements, as well as the effective protection of rescue equipment.

- (3)

- Timeliness: This refers to the promptness with which the emergency response plan can control and mitigate accidents, evaluating its efficiency in handling emergencies. It includes the swift generation/activation of an emergency response plan, quick and robust emergency support, and high-efficiency information reporting and approval processes.

- (4)

- Effectiveness: This primarily pertains to whether implementation will enhance disaster management, control development trends, and prevent secondary disaster incidents from occurring.

3. Related Theories and Emergency Decision-Making Method

3.1. Improved Prospect Theory

Prospect theory is currently considered the most authoritative behavioral decision-making theory due to its non-fully rational decision-making process, thereby aligning more closely with the behavioral decisions of real individuals.

3.1.1. The Improved Prospect Value

In contrast to classical prospect theory, this paper incorporates the heterogeneous risk preferences of experts, proposes a weighting scheme for different types of experts, and enhances the applicability of prospect theory in real-world scenarios. The improved prospect value is expressed as:

where and denote the probability weight function, represents the weight of the index, and denote the positive and negative prospect value function, is the number of all indexes, is the number of indexes with positive returns relative to the reference point, represents the weights of different types of experts, and denotes the number of expert types with different risk preference.

3.1.2. The Improved Prospect Value Function

Gain and loss matrices:

Based on the classical prospect theory, the gain matrix and the loss matrix are usually calculated using the distance from positive and negative ideal points, which does not accurately represent the similarity and relevance to positive and negative ideal matrices. The grey correlation degree was employed in this study to compute the matrices of gains and losses, which accurately depict the similarity between evaluation plans and positive/negative ideal solutions when compared to classical prospect theory. The formula is expressed as:

where and , respectively, represent the degree of risk preference of the decision-maker regarding gains and losses, with . The decision-maker’s inclination towards seeking risk increases as the values of and increase; risk avoidance increases as the values of and decrease. reflects the degree of loss aversion exhibited by decision-makers, with indicating a higher sensitivity to losses compared to gains. This suggests that the function image of the loss region in prospect theory is steeper than that of the gains. represents deviation from a specified reference point for . If , it indicates that the decision-maker’s psychological perception is oriented towards profit; conversely, if , it signifies a focus on losses in the decision-maker’s psychological perception. and , respectively, represent the grey correlation degree of evaluation plans with positive and negative ideal solutions.

The prospect theory posits an S-shaped function, , that is divided into two regions by a reference point: prospective gains and prospective losses. The value function exhibits concavity in the gain region, indicating decision makers’ risk aversion towards gains; it demonstrates convexity in the loss region, suggesting their risk-seeking behavior when facing losses. Moreover, the value function is steeper in the loss region compared to the gain region, implying that decision makers are more sensitive to losses than to gains. Reference points play a crucial role in determining the value function. In practice, most scholars utilize various reference points, such as the zero point, positive and negative ideal solutions, expected value, and dynamic value, for decision-making [40]. In this study, we employ positive and negative ideal solutions [41,42] as reference points to elucidate the relationship between decision makers’ psychology and their attitudes towards risk-seeking or risk-avoidance.

3.1.3. The Probability Weight Function of Gains and Losses

The analysis of the probability weight function demonstrates that when is small, its probability weight exceeds the probability value, thereby signifying a fundamental principle of additive behavior in relation to probabilities. This implies a tendency for consistently overestimating low-probability occurrences and exhibiting secondary additivity patterns. Moreover, the assigned weights of deterministic outcomes are greater than those of their complementary probabilistic counterparts. When approaching the threshold of determinism within this framework, decision-makers tend to subjectively dismiss or exaggerate specific scenarios. Essentially, highly unlikely events often go unnoticed and are considered implausible, while highly probable situations are magnified and seen as certainties.

The traditional prospect theory generally uses event probability to represent the weight, which is subjective and not objective enough for subjectively evaluating events. In this paper, the entropy weight method is utilized to objectify subjective information and mitigate the influence of subjective factors.

Certain aspects of cumulative prospect theory have been deemed impractical for Chinese decision makers due to variations in decision-making styles, necessitating appropriate adjustments [43]. Furthermore, other scholars have enhanced and supplemented the parameters of the value function [24,40,44,45].

According to previous studies, in this paper, when the decision maker tends to exhibit an appetite for risk, we set , [24,29,30,44], , and [44]; when the decision maker tends to be risk-neutral, we set , [46], , and [46]; and when the decision maker tends to be risk-averse, we set , [44], , and [44,45].

3.2. Entropy TOPSIS Method

The entropy-weighted TOPSIS method is utilized in this study to compute the positive and negative ideal solutions.

(1) There are emergency response plans and evaluation indexes. represents the fuzzy evaluation values of the index with respect to the decision plan , , . The fuzzy evaluation matrix of the indexes for the emergency response plan is expressed as:

(2) The entropy method was used to calculate the weights of the index, and the resultant normalized weighted matrix is presented as follows:

where represents the weights of the indexes, and represents the normalization results of fuzzy evaluation values.

(3) Entropy method

The normalized value of can be calculated by:

where and are the maximum and minimum of the fuzzy evaluation, respectively.

The entropy can be calculated by:

where .

The weight of the entropy of the index can be calculated as:

where is the differential coefficient, which can be calculated as .

(4) The positive and negative ideal solutions can be expressed as:

3.3. Grey Correlation Degree

The grey correlation degree accurately represents the similarity between evaluation indices and positive and negative ideal solutions. Therefore, this paper employs the grey correlation degree to quantify the gains and losses of evaluation solutions. The grey correlation degree between the alternative plan and the positive and negative ideal solutions with respect to can be mathematically expressed as follows:

where is the distinguishing coefficient, and ; normally, .

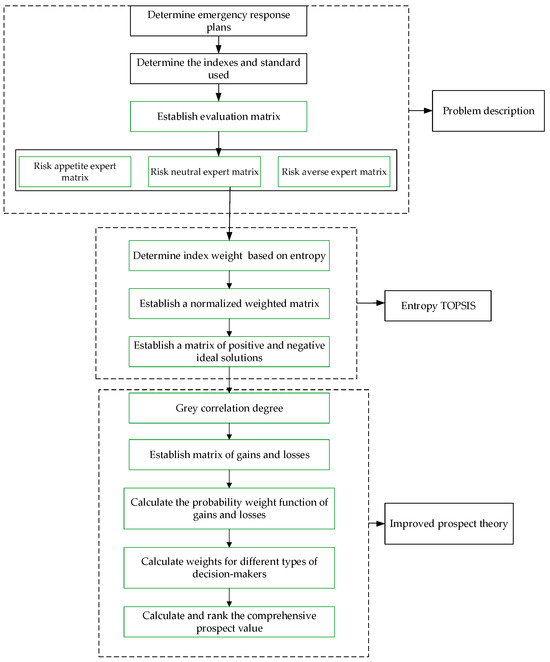

3.4. Emergency Decision-Making Method for Coal Spontaneous Combustion

3.4.1. Emergency Decision-Making Procedure for Coal Spontaneous Combustion

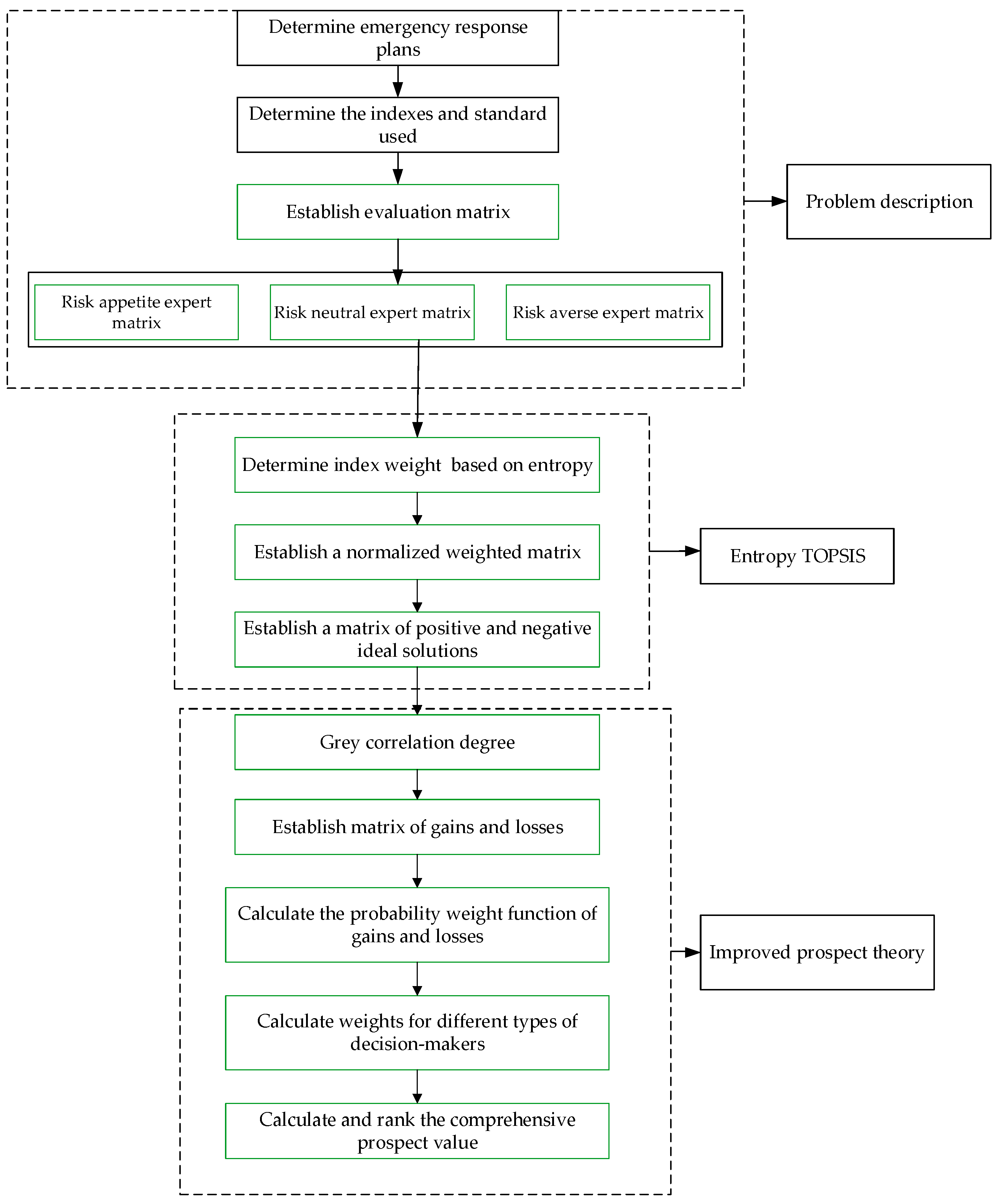

The procedure for emergency decision-making regarding coal spontaneous combustion, depicted in Figure 2, is presented based on the grey correlation degree, TOPSIS method, and an enhanced prospect theory approach.

Figure 2.

The procedure for emergency decision-making.

3.4.2. Specific Steps

Step1: Establish the evaluation matrix . The evaluation matrices for decision makers with different risk preferences are built according to Formula (8), respectively.

Step 2: Build the weighted normalized matrix for decision makers with different risk preferences according to Formula (9), respectively.

Step 3: Calculate the positive and negative ideal solutions of the weighted normalization matrix for decision makers with different risk preferences according to Formulas (13) and (14), respectively.

Step 4: Calculate the grey correlation degree , between the three evaluation scenarios and the positive and negative ideal solutions for decision makers with different risk preferences according to Formulas (15) and (16), respectively.

Step 5: Calculate the value function for decision makers with different risk preferences, and establish gains matrix and losses matrix according to Formulas (3), (4), and (5), respectively.

Step 6: Calculate the probability weight function , for decision makers with different risk preferences according to Formulas (6) and (7), respectively.

Step 7: Calculate the prospect value of the evaluation plans based on Formula (2) for decision makers with different risk preferences, respectively.

Step 8: The decision weights of different decision makers are calculated using the entropy method, and the comprehensive prospect value of the evaluation plan is determined based on Formula (1). The optimal emergency response plan is selected by ranking the comprehensive prospect value.

4. Case Study

The case data used in this paper is from major accident investigation reports published by the National Mine Safety Administration of China. The report provides detailed information on the general situation of the mine accident, including the circumstances, causes, responsibilities, and preventive measures. The preventive measures and suggestions in the accident report will be used to assess the accuracy and effectiveness of the decision outcomes in this paper.

4.1. Accident Overview

On 5 December 2018, during the middle shift, an employee named Lv was assigned to work in the underground material turnover warehouse. During this period, Lv discovered yellow smoke floating outside the closed wall along the track of the 230 fully mechanized top coal caving face (smoke within a range of 0.5 m below the roadway roof) (Shandong Bureau of the National Mine Safety Administration). Without any delay, Lv reported it to the mine control room, and the person on duty immediately reported it to the deputy mine manager, Feng. In response to this notification, Deputy Mine Manager Feng quickly went down to inspect the situation and found that there was air leakage in the gob area and the residual coal near the mining terminal line ignited spontaneously. Following appropriate safety procedures, Deputy Mine Manager Feng collaborated with other key personnel including the mine manager and production mine manager to develop an efficient plan for addressing this incident [47].

4.2. Coal Mine Overview

The coal mine is a low gas mine with no abnormal gas-effusing areas. Coal seam 3 is the primary coal seam available for extraction, and it tends to undergo spontaneous combustion (the spontaneous combustion period is 3–6 months and the shortest spontaneous combustion period is 47 days). It should be duly noted that there is a high explosiveness associated with the presence of coal dust in this mine (with an explosion index measuring at 35.57%). The roof and floor of the coal seam have been identified as having weak potential for bursting. This mine falls into the moderate category in terms of hydrogeology. To ensure the utmost safety measures, various systems have been implemented, including safety monitoring mechanisms, a personnel positioning system, an emergency adaptation system, communication and liaison tools, and a self-saving mechanism, as well as a water supply rescue and other specifically designed evacuation systems [47].

The secondary mining area, where the mining accident occurred, comprises three coal seams with an average thickness of 5.11 m. These coal seams are prone to spontaneous combustion. Within this region, there were a total of 14 operational sections without any abnormal gas-emitting areas. The initial mining section in this specific zone is designated as 230 and operates as a fully mechanized top-coal caving face [47].

4.3. Emergency Response Plan

To ensure the efficiency of the emergency response strategy, this document promptly produced a list of the three most comparable emergency response plans using the case-based reasoning technique (CBR). The specific content and process have been described in detail in previously published literature [47].

- (1)

- Emergency response plan :

(1) Regularly monitor the composition and concentration of gas near the airtight wall. (2) Use yellow mud paste to repair any damages or leaks found in the sealing wall. (3) Construct an explosion-resistant wall outside the obstructing wall and implement measures to prevent gas accumulation and potential explosions. (4) Establish a permanent seal around both upper and lower auxiliary pathways within the fire zone to minimize air leakage. (5) Seal all gaps or openings in the new obstructing wall to enhance security measures. (6) Continuously introduce nitrogen into the fire area to extinguish flames [47].

- (2)

- Emergency response plan :

(1) Continuously monitor the gas composition and concentration near the airtight barrier and gob region, while also observing temperature fluctuations. (2) Execute mine shutdown protocols, with a focus on strengthening the airtight barrier within the gob area and applying white mortar to effectively seal any joints or leaks. (3) Ensure the secure sealing of connections between gob areas and neighboring mines. (4) Inject grout into the airtight wall to suppress fire incidents, while also replenishing grout in other relevant airtight walls [47].

- (3)

- Emergency response plan :

(1) Ensure that the working face is enclosed; (2) promptly supervise and control the fire’s expansion, determining its location; (3) inject carbon dioxide and nitrogen to extinguish the flames [47].

4.4. Emergency Decision-Making

4.4.1. Establish the Fuzzy Evaluation Matrix

The emergency plans were assessed by a panel of 15 experts, consisting of 5 experts with a risk appetite, 5 experts who are risk-neutral, and 5 experts who are risk-averse. Each index was divided into 5 levels, and the evaluation criteria can be found in Table 1. A higher score indicates better performance for the index. Taking the decision maker with a risk appetite as an example, one expert judged the emergency response plan to belong to grade III, three experts rated it as grade IV, and one expert assigned it to grade V. No expert classified the index under grades I or II. Therefore, based on this information, the probability vector for this particular index was calculated as (0.0, 0.0, 0.2, 0.6, 0.2), and fuzzy results were derived using Formula (17). The remaining indexes underwent similar evaluations. The fuzzy evaluation matrix was obtained utilizing Equation (8). When decision makers tend to be risk-seeking, the evaluation matrix is obtained as . When the decision makers tend to be risk-neutral, the evaluation matrix is obtained as . When decision makers tend to be risk-averse, the evaluation matrix is derived as .

Table 1.

The evaluation criteria of the index.

4.4.2. Establish the Weighted Normalized Matrix

The weights of each index for decision makers with different risk preferences were determined using the entropy method. Specifically, the weight assigned to the index for risk-appetite experts was obtained as , while was assigned to the index for risk-neutral experts, and indicated the weight assigned to the index for risk-averse experts.

The weighted normalized matrix was constructed based on Formula (9) to accommodate decision makers with varying risk preferences. denotes the weighted normalized matrix of experts specialized in risk appetite, represents the weighted normalized matrix of experts who are risk-neutral, and signifies the weighted normalized matrix of experts who exhibit risk aversion.

4.4.3. Calculate the Positive and Negative Ideal Solutions

The positive and negative ideal solutions for risk-appetite experts were derived as , , according to Formulas (13) and (14). Similarly, the positive and negative ideal solutions for risk-neutral experts were obtained as , , while the positive and negative ideal solutions for risk-averse experts were acquired as , .

4.4.4. Calculate the Grey Correlation Degree

According to Formulas (15) and (16), the grey correlation coefficients for risk-appetite experts were determined as , . Similarly, the grey correlation coefficients for risk-neutral experts and risk averse experts were obtained as , and , , respectively.

4.4.5. Establish Gain Matrix and Loss Matrix

According to Formulas (3)–(5), the gain matrix and loss matrix were obtained as follows: , for risk-appetited experts; , for risk-neutral experts; and , for risk-averse experts.

4.4.6. Calculate the Probability Weight

The probability weight was calculated using Formulas (6) and (7). The probability weights for decision makers with different risk preferences were derived as follows: , for experts who are risk-appetited; , for experts with a neutral attitude towards risk; , for experts who are risk-averse.

4.4.7. Calculate the Prospect Values

Formula (2) was utilized to compute the prospective values of the emergency response plans. The prospect values were , , and .

4.4.8. The Decision-Making Results

The entropy method was employed to calculate the decision weights of various decision makers, denoted as . Subsequently, Formula (1) was utilized to compute the comprehensive prospect value, represented as . Consequently, the decision outcome yielded .

5. Discussion

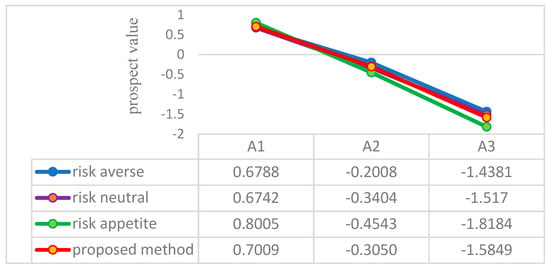

5.1. Comparative Analysis of Decision Makers with Different Risk Types

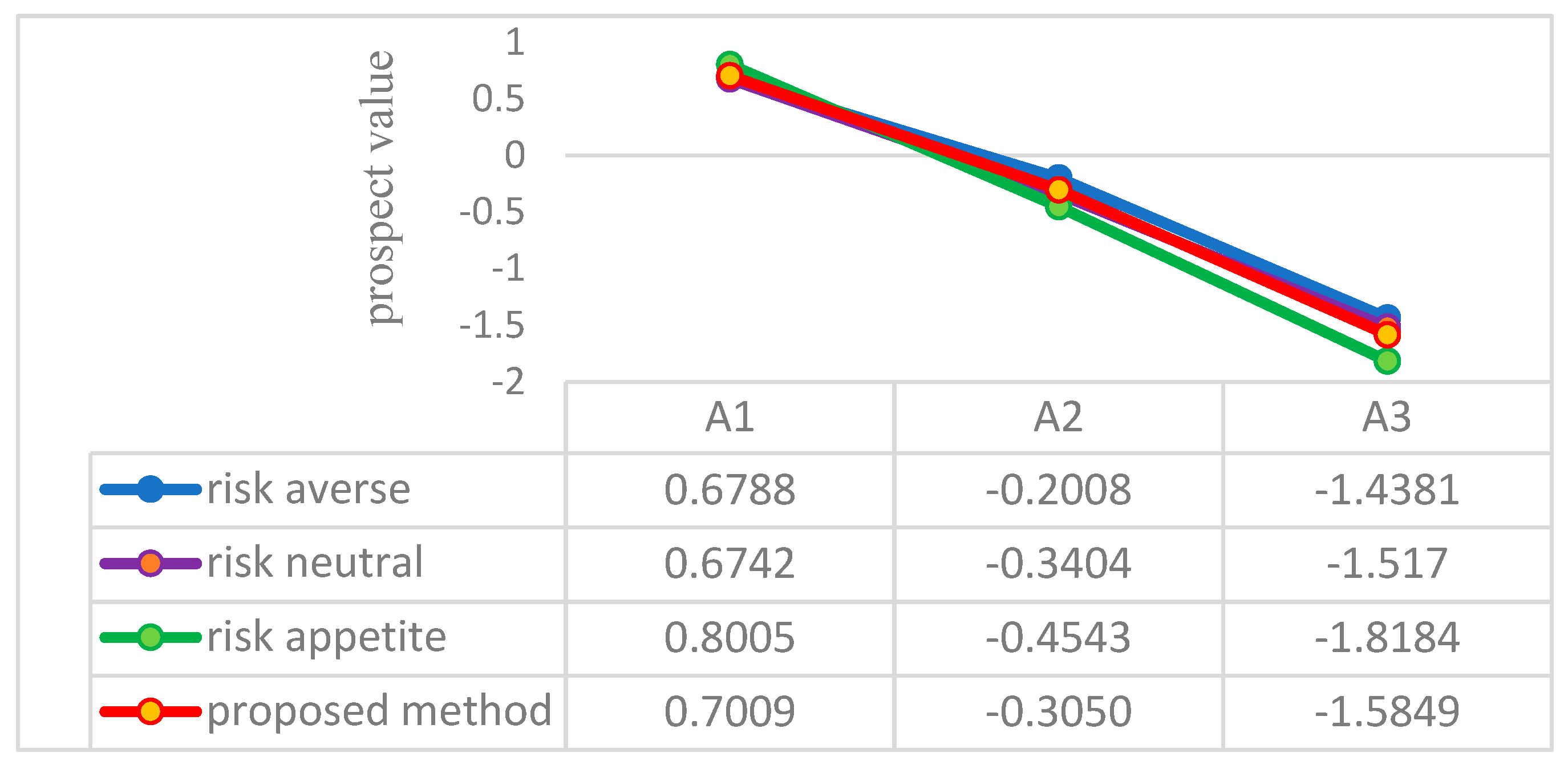

Assuming a universal risk appetite among decision makers, the prospect value was denoted as . In the scenario of all decision makers being risk-neutral, the prospect value was represented by . Assuming risk aversion among all decision makers, the prospect value was determined to be . The comparative analysis of decision makers with varying risk preferences is illustrated in Figure 3.

Figure 3.

The comparative analysis of decision makers with different risk types.

The comprehensive prospect values of decision makers, as calculated by the proposed method in this paper, exhibit higher magnitudes compared to those of risk-averse decision makers but lower magnitudes compared to those of risk-neutral and risk-appetited decision makers (as shown in Figure 3). However, the resulting decisions for emergency response plans remain essentially unchanged. Furthermore, the emergency response plan generated by the proposed method is practically identical to the one actually implemented during the accident. In practice, experts possess diverse individual preferences and there is often an imbalance in terms of their numbers across different preference categories. Additionally, experts tend to be dynamic. In the process of emergency decision-making, on one hand, experts can promote diverse thinking and interdisciplinary collaboration. A team of experts with diverse backgrounds and perspectives can effectively communicate and collaborate based on their respective areas of expertise. On the other hand, the emergency situation may prevent all necessary experts from being contacted or arriving at the scene immediately, and some experts may have limited experience or expertise [22], resulting in a restricted pool of expert opinions that can be referred to. Therefore, assigning weights to decision makers allows for a complementary and balanced integration of their decisions, effectively mitigating subjective factors such as personal risk preferences.

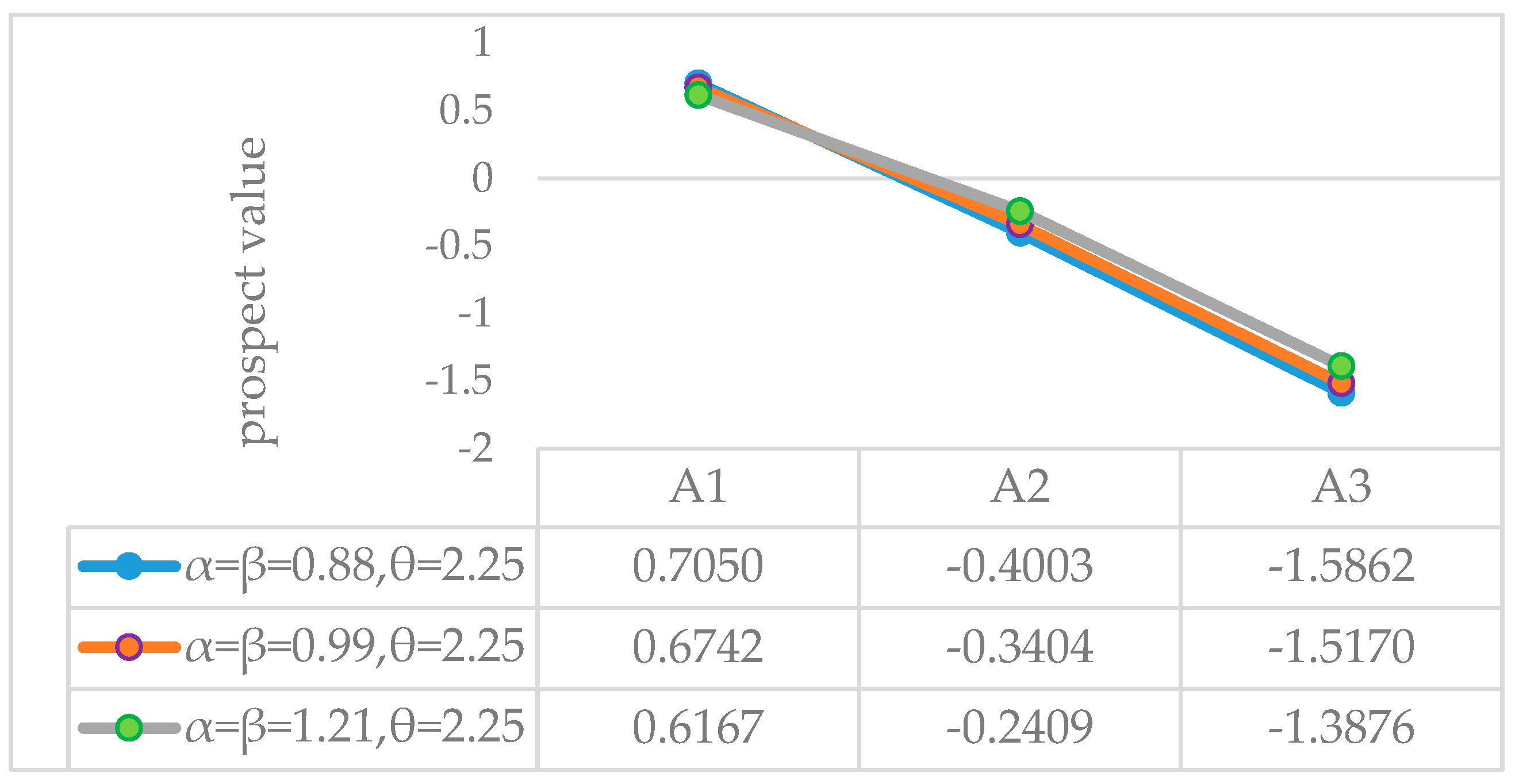

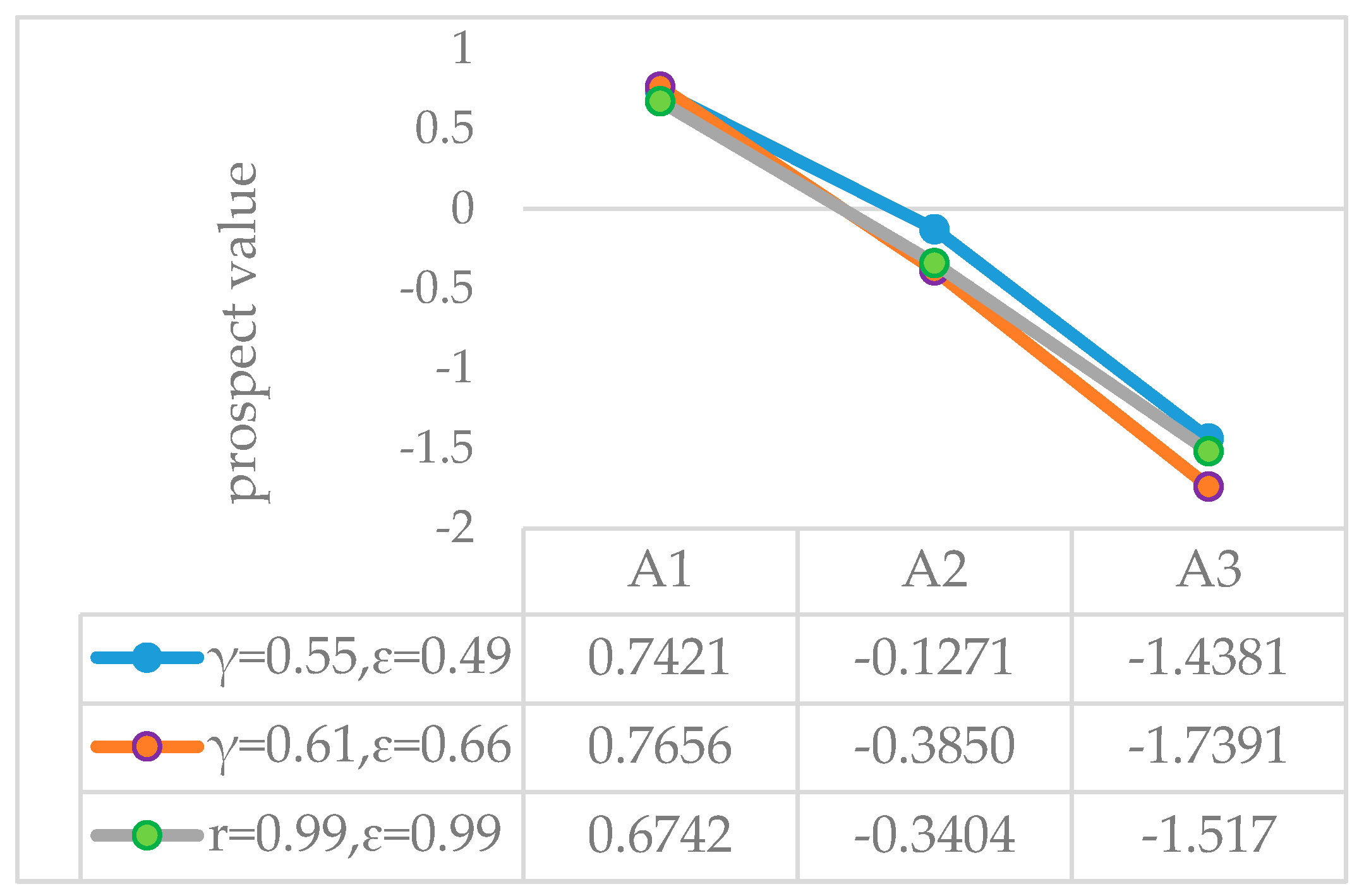

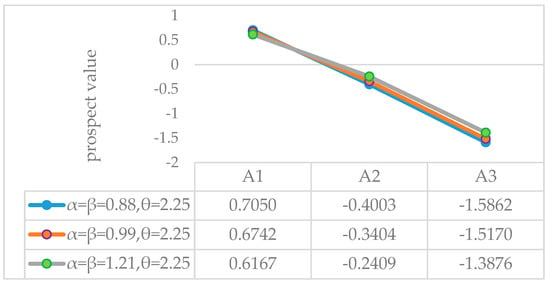

5.2. Comparative Analysis of Risk Coefficients

The impact of decision makers’ risk preference coefficients (α, β, θ) on decision outcomes was investigated by keeping the risk attitude coefficients (γ, ε) fixed and varying the preference coefficients (α, β, θ) across different decision makers. The results are depicted in Figure 4. According to Figure 4, it can be observed that the ranking remains unchanged. When α = β = 0.88, θ = 2.25, the prospect value of the optimal emergency response plan is maximum. When α = β = 1.21, θ = 2.25, the prospect value of the optimal emergency response plan is minimum. According to previous studies [39], even when the weight information is completely unknown and all decision maker preference coefficients exceed 0.2, the optimal solution remains unaffected. In this study, all preference coefficients of decision makers exceeded 0.2, and our findings support those reported in the literature [44,48]. This suggests that the decision outcomes in this study are independent of the decision maker’s preference coefficients (α, β, θ), possibly due to their adoption of similar reference points. Moreover, comparative analysis also reveals a limited sensitivity in risk preference coefficients.

Figure 4.

The comparative analysis of risk preference coefficients (α, β, θ).

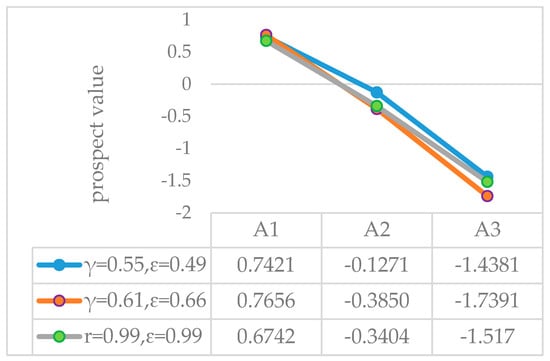

The fixed preference coefficients (α, β, θ) of the decision maker were adjusted, while the risk attitude coefficients (γ, ε) were varied. The ranking evaluation results, depicted in Figure 5, remain consistent. When γ = 0.61 and ε = 0.66, the prospect value of the optimal emergency response plan is maximum; when γ = 0.99 and ε = 0.99, the prospect value of the optimal emergency response plan is minimum. This suggests that the decision outcomes are minimally influenced by the risk attitude coefficients (γ, ε) of the decision maker, which is consistent with previous findings [44]. One possible explanation for this phenomenon could be their use of the same reference points.

Figure 5.

The comparative analysis of the risk attitude coefficients (γ, ε).

5.3. Comparative Analysis Using Different Calculation Methods for Index Weights

Numerous researchers have conducted extensive studies to enhance the accuracy of decision outcomes by improving the calculation method for index weights in the probability weight function. Commonly employed methods for determining weights include the least squares method [6,16,49], rough numbers [26], and the best worst method [37]. In this study, we utilized the entropy method to calculate index weights due to its ability to mitigate subjective factors inherent in decision-making processes involving human subjects. By utilizing the entropy method, we aimed to minimize the influence of subjectivity on decision-making.

To validate the effectiveness of our proposed methodology, a comparative analysis was conducted with commonly used methods. According to the methods described in the literature, the results of different calculation methods for index weights are listed in Table 2, and based on this, the final decision results were obtained and also listed in Table 2. The results obtained from Table 2 consistently supported the feasibility of our approach. This can also be attributed to a reduced impact of risk coefficients assigned by decision-makers at identical reference points, as verified in Section 5.2.

Table 2.

Comparative analysis of calculation methods for index weights.

5.4. Comparative Analysis Using Different Methods for Decision-Making

The results of different decision-making methods are listed in Table 3, according to the methods described in the literature. Relative proximity is used for PT-TOPSIS [39] and EW-TOPSIS [8], while prospect values are used for other methods. From Table 3, we can see that the final decision results obtained by the proposed method are consistent with the decision outcomes of various prospect theory models, including prospect theory TOPSIS (PT-TOPSIS) [39], entropy weight TOPSIS (EW-TOPSIS) [8], classical prospect theory (PT) [24], fuzzy prospect theory (FPT) [33], and rough numbers-based prospect theory (RPT) [26]. This consistency exists because all these models pay more attention to the risk preferences of decision makers. This validates the practicality and efficiency of the proposed method. The agreement with the decision outcomes of entropy weight TOPSIS (EW-TOPSIS) method is primarily attributed to this paper’s adoption of the entropy approach in constructing the evaluation matrix, which is consistent with the weights utilized in EW-TOPSIS. Moreover, this method possesses several advantages:

Table 3.

Comparative analysis of different decision-making methods.

(1) It incorporates the grey correlation degree into the prospect theory, effectively capturing similarity between evaluation plans and positive/negative ideal solutions, resulting in more realistic outcomes.

(2) When calculating prospect value, it fully considers the risk preference types of decision makers and introduces an entropy-based approach to compute weights for decision makers with different risk preferences instead of assuming all decision makers are risk-neutral.

6. Conclusions

During the initial phase of an accident, rapid and precise emergency decision-making remains crucial in emergency management. Taking into account the inherent subjectivity and limited rationality of decision makers, along with factors like incomplete knowledge, experience gaps, and varying individual risk preferences, this paper proposes a decision-making methodology for coal spontaneous combustion emergency response plans. This approach combines grey correlation degree and TOPSIS within an enhanced prospect theory framework. A case study is conducted to confirm the effectiveness and feasibility of the proposed methodology.

The present study quantified the weights of decision makers with diverse risk preferences for the first time. The comparison of our proposed method with one that assumes uniform preference among all decision makers reveals that our weight determination approach enhances decision accuracy, bringing it closer to real-world scenarios. Furthermore, when compared and analyzed against other representative decision-making methods, we obtained similar outcomes, thus validating the effectiveness of our proposed method.

The present study examines the impact of preference coefficients (α, β, θ) and risk attitude coefficients (γ, ε) on decision outcomes. Our findings indicate that the influence of risk preference types on decision results is limited when controlling for a consistent reference point.

Although some research results have been achieved, there are still limitations to this paper. The sensitivity of the preference coefficients (α, β, θ) and risk attitude coefficients (γ, ε) is not high at the same reference point. The risk types of decision makers are determined by decision makers themselves, but there is a lack of compliance verification standards and methods.

The approach can be programmed in future research to achieve swift and astute decision-making, following advancements in computer technology and big data analytics. Subsequent research will aim to investigate the impact of experts’ varying risk preferences on emergency decision-making at different reference points, while also exploring the potential for dynamically adjusting decision outcomes.

In future studies, we will focus on the sensitivity of this proposed method and attempt to develop a set of objective methods and criteria for determining the type of decision maker.

The decision-making method proposed in this paper can not only be applied to decision-making for coal spontaneous combustion emergency response plans but also extended to other major coal mine disasters. It can also provide reference for disaster decision-making in other fields, such as tunnel accidents.

Author Contributions

Methodology, G.J. and Q.Z.; validation, Q.Z.; investigation, J.Z.; resources, G.J.; writing—original draft preparation, J.Z.; writing—review and editing, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

The research was funded by the National Natural Science Foundation of China, grant number U1904210, 52374196, and the Key Research and Development Project of Henan Province (221111321000).

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

The authors appreciate all the experts who participated in the survey.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Zhao, X.G.; Dai, G.L. Experimental study on spontaneous combustion characteristics of oxidized coal. J. Saf. Sci. Technol. 2020, 16, 55–60. [Google Scholar]

- Xia, T.; Zhou, F.; Wang, X.; Zhang, Y.; Li, Y.; Kang, J.; Liu, J. Controlling factors of symbiotic disaster between coal gas and spontaneous combustion in longwall mining gobs. Fuel 2016, 182, 886–896. [Google Scholar] [CrossRef]

- Wen, H.; Wang, H.; Liu, W.; Cheng, X. Comparative study of experimental testing methods for characterization parameters of coal spontaneous combustion. Fuel 2020, 275, 117880. [Google Scholar] [CrossRef]

- Shi, Q.L. Study on the Theory and Properties of Colloidal Foam for Controlling and Preventing Coal Spontaneous Combustion. Ph.D. Thesis, China University of Mining and Technology, Xuzhou, China, 2019. [Google Scholar]

- Wen, H.; Wu, K.; Cao, X.G. Fire prevention and control technology with inhibition inertia foam to prevent coal spontaneous combustion in high ground temperature deep mine. Coal Sci. Technol. 2014, 42, 108–111. [Google Scholar] [CrossRef]

- Xu, Z.; Zhang, X. Hesitant fuzzy multi-attribute decision making based on TOPSIS with incomplete weight information. Knowl. Based Syst. 2013, 52, 53–64. [Google Scholar] [CrossRef]

- Qiu, M.; Huang, F.; Wang, Y.; Guan, T.; Shi, L.; Han, J. Prediction model of water yield property based on GRA, FAHP and TOPSIS methods for Ordovician top aquifer in the Xinwen coalfield of China. Environ. Earth Sci. 2020, 79, 214. [Google Scholar] [CrossRef]

- Guo, Y.; Shi, Q.; Guo, C. A Performance-Oriented Optimization Framework Combining Meta-Heuristics and Entropy-Weighted TOPSIS for Multi-Objective Sustainable Supply Chain Network Design. Electronics 2022, 11, 3134. [Google Scholar] [CrossRef]

- Chen, P. Effects of the entropy weight on TOPSIS. Expert Syst. Appl. 2021, 168, 114186. [Google Scholar] [CrossRef]

- Liu, Y.; Li, L.; Tu, Y.; Mei, Y. Fuzzy TOPSIS-EW Method with Multi-Granularity Linguistic Assessment Information for Emergency Logistics Performance Evaluation. Symmetry 2020, 12, 1331. [Google Scholar] [CrossRef]

- Cengiz, L.D.; Ercanoglu, M. A novel data-driven approach to pairwise comparisons in AHP using fuzzy relations and matrices for landslide susceptibility assessments. Environ. Earth Sci. 2022, 81, 222. [Google Scholar] [CrossRef]

- Zhou, X.; Ren, S.; Zhang, S.; Zhang, J.; Wang, Y. Risk Evaluation Model of Coal Spontaneous Combustion Based on AEM-AHP-LSTM. Mathematics 2022, 10, 3796. [Google Scholar] [CrossRef]

- Hu, J.; Xu, B.; Chen, Z.; Zhang, H.; Cao, J.; Wang, Q. Hazard and risk assessment for hydraulic fracturing induced seismicity based on the Entropy-Fuzzy-AHP method in Southern Sichuan Basin, China. J. Nat. Gas Sci. Eng. 2021, 90, 103908. [Google Scholar] [CrossRef]

- Liu, Y.; Eckert, C.M.; Earl, C. A review of fuzzy AHP methods for decision-making with subjective judgements. Expert Syst. Appl. 2020, 161, 113738. [Google Scholar] [CrossRef]

- Yao, X.; Guo, H.; Zhu, J.; Shi, Y. Dynamic selection of emergency plans of geological disaster based on case-based reasoning and prospect theory. Nat. Hazards 2022, 110, 2249–2275. [Google Scholar] [CrossRef]

- Li, H.M.; Li, F.; Zuo, J.; Sun, J.B.; Yuan, C.H.; Ji, L.; Ma, Y.; Yao, D.S. Emergency Decision-Making System for the Large-Scale Infrastructure: A Case Study of the South-to-North Water Diversion Project. J. Infrastruct. Syst. 2022, 28, 04021051. [Google Scholar] [CrossRef]

- Chen, W.; Wang, X.; Wang, W.; Zhu, Y.; Cai, Z.; Yang, S. A heterogeneous GRA-CBR-based multi-attribute emergency decision-making model considering weight optimization with dual information correlation. Expert Syst. Appl. 2021, 182, 115208. [Google Scholar] [CrossRef]

- Wang, C.-N.; Yang, F.-C.; Vo, T.M.N.; Nguyen, V.T.T.; Singh, M. Enhancing Efficiency and Cost Effectiveness: A Ground-breaking Bi-Algorithm MCDM Approach. Appl. Sci. 2023, 13, 9105. [Google Scholar] [CrossRef]

- Nguyen, V.T.T.; Wang, C.; Yang, F.; Vo, T.M.N. Efficiency Evaluation of Cyber Security Based on EBM-DEA Model. Eurasia Proc. Sci. Technol. Eng. Math. 2022, 17, 38–44. [Google Scholar] [CrossRef]

- Cimellaro, G.P.; Reinhorn, A.M.; Bruneau, M. Framework for Analytical Quantification of Disaster Resilience. Eng. Struct. 2010, 32, 3639–3649. [Google Scholar] [CrossRef]

- Forcellini, D. An Expeditious Framework for Assessing the Seismic Resilience (SR) of Structural Configurations. Structures 2023, 56, 105015. [Google Scholar] [CrossRef]

- Du, Y.W.; Wang, S.S.; Yang, N.; Zhou, W. Multiple attribute large-group decision-making method with incomplete information by considering expert’s knowledge structure. Chin. J. Manag. Sci. 2017, 25, 167–178. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Kahneman, A.T.D. Advances in Prospect Theory: Cumulative Representation of Uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar]

- Song, Z.J.; Wang, H.; Zhao, H.M.; Chen, Y.H. Method and application for multi-scenario hybrid risk decision making based on utility-risk entropy. Syst. Eng. Electron. 2018, 40, 2751–2757. [Google Scholar] [CrossRef]

- Jia, F.; Wang, X. Rough-Number-Based Multiple-Criteria Group Decision-Making Method by Combining the BWM and Prospect Theory. Math. Probl. Eng. 2020, 2020, 1–16. [Google Scholar] [CrossRef]

- Zhao, H.; Guo, S.; Zhao, H. Comprehensive assessment for battery energy storage systems based on fuzzy-MCDM considering risk preferences. Energy 2019, 168, 450–461. [Google Scholar] [CrossRef]

- Ge, B.; Zhang, X.; Zhou, X.; Tan, Y. A Cumulative Prospect Theory Based Counterterrorism Resource Allocation Method under Interval Values. J. Syst. Sci. Syst. Eng. 2019, 28, 478–493. [Google Scholar] [CrossRef]

- Lee, M.C.; Park, J. Compensating Qualitative Rating Distortion of User Experience Evaluation Based on Prospect Theory. Sustainability 2019, 11, 6815. [Google Scholar] [CrossRef]

- Xing, H.; Song, L.; Yang, Z. An Evidential Prospect Theory Framework in Hesitant Fuzzy Multiple-Criteria Decision-Making. Symmetry 2019, 11, 1467. [Google Scholar] [CrossRef]

- Li, L.L. Study on the Secondary Explosion Rule in Disaster Area and Emergency Decision-Making Model of Coal Mine Gas Explosion. Ph.D. Thesis, China University of Mining and Technology (Beijing), Beijing, China, 2019. [Google Scholar]

- Liu, W.J. Research on Emergency Response Group Decision-Making Based on Prospect Theory. Master’s Thesis, Jiangnan University, Wuxi, China, 2018. [Google Scholar]

- Liu, P.; Jin, F.; Zhang, X.; Su, Y.; Wang, M. Research on the multi-attribute decision-making under risk with interval probability based on prospect theory and the uncertain linguistic variables. Knowl. Based Syst. 2011, 24, 554–561. [Google Scholar] [CrossRef]

- Omrani, H.; Alizadeh, A.; Naghizadeh, F. Incorporating decision makers’ preferences into DEA and common weight DEA models based on the best–worst method (BWM). Soft. Comput. 2020, 24, 3989–4002. [Google Scholar] [CrossRef]

- Liu, Q.; Jin, S.; Yao, L.; Shen, D. The revisited total least squares problems with linear equality constraint. Appl. Numer. Math. 2020, 152, 275–284. [Google Scholar] [CrossRef]

- Chaji, A. Analytic approach on maximum Bayesian entropy ordered weighted averaging operators. Comput. Ind. Eng. 2017, 105, 260–264. [Google Scholar] [CrossRef]

- Pamučar, D.; Ecer, F.; Cirovic, G.; Arlasheedi, M.A. Application of Improved Best Worst Method (BWM) in Real-World Problems. Mathematics 2020, 8, 1342. [Google Scholar] [CrossRef]

- Vafadarnikjoo, A.; Tavana, M.; Botelho, T.; Chalvatzis, K. A neutrosophic enhanced best–worst method for considering decision-makers’ confidence in the best and worst criteria. Ann. Oper. Res. 2020, 289, 391–418. [Google Scholar] [CrossRef]

- Wang, J. Research on Coal Mine Emergency Response Decision-Making under Uncertain Environment. Ph.D. Thesis, Liaoning Technical University, Fuxin, China, 2019. [Google Scholar]

- Lu, C.; Zhao, M.; Khan, I.; Uthansakul, P. Prospect Theory based Hesitant Fuzzy Multi-Criteria Decision Making for Low Sulphur Fuel of Maritime Transportation. Comput. Mater. Contin. 2021, 66, 1511–1528. [Google Scholar] [CrossRef]

- Li, A.; Zhao, Z. Crane Safety Assessment Method Based on Entropy and Cumulative Prospect Theory. Entropy 2017, 19, 44. [Google Scholar] [CrossRef]

- Zhang, N.; Fang, Z.; Liu, X. Grey Situation Group Decision-Making Method Based on Prospect Theory. Sci. World J. 2014, 2014, 703597. [Google Scholar] [CrossRef]

- Zeng, J.M. An experimental test on cumulative prospect theory. J. Jinan Univ. Nat. Sci. Med. Ed. 2007, 28, 44–47. [Google Scholar]

- Ma, J.; Sun, X.X. Modified value function in prospect theory based on utility curve. Inf. Control 2011, 40, 501–506. [Google Scholar]

- Gao, J.W.; Guo, F.J. Intuitionistic fuzzy stochastic multi-criteria decision-making method based on modified prospect theory. Control Decis. 2019, 34, 317–324. [Google Scholar] [CrossRef]

- Xu, H.; Zhou, J.; Xu, W. A decision-making rule for modeling travelers’ route choice behavior based on cumulative prospect theory. Transp. Res. Part C Emerg. Technol. 2011, 19, 218–228. [Google Scholar] [CrossRef]

- Zeng, J.; Jing, G.; Zhu, Q.; Sun, H. Emergency Response Plan for Spontaneous Combustion Based on Case-Based Reasoning. Processes 2023, 11, 2151. [Google Scholar] [CrossRef]

- Tan, R.; Zhang, W.; Yang, L.; Chen, S. Multi-Attribute Decision-Making Method Based on Prospect Theory in Heterogeneous Information Environment and Its Application in Typhoon Disaster Assessment. Int. J. Comput. Int. Syst. 2019, 12, 881. [Google Scholar] [CrossRef]

- Zhao, H.; Guo, S.; Zhao, H. Comprehensive Performance Assessment on Various Battery Energy Storage Systems. Energies 2018, 11, 2841. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).