A Smart Manufacturing Process for Textile Industry Automation under Uncertainties

Abstract

1. Introduction

- Q1:

- Are conventional manual fabric inspection machines suitable for the worldwide textile manufacturing industry in the current scenario?

- Ans:

- The textile manufacturing industry uses human-driven, semi-automatic machines for fabric inspection to identify and mark defects. This classical technique has many drawbacks, such as unreliable results because of poor training and coaching, inappropriate tools, fatigue, and many more. This study aims to reduce these drawbacks by implementing new innovative technologies for smart manufacturing systems.

- Q2:

- Is it profitable to install smart fabric inspection technology in mending sections in the textile manufacturing industry?

- Ans:

- Only human-based semi-automatic fabric inspection machines can identify significant defects due to factors like fatigue, lack of training, etc. Adopting smart machines may contribute to a significant reduction in defects, which can help achieve the profitability targets for the industry.

- Q3:

- How would adopting an automation policy be beneficial for cotton TC mills?

- Ans:

- Currently, cotton TC mills use fully human-based, semi-automated inspection methods. Our study suggests incorporating smart manufacturing technology, like installing a fully AI-based smart inspection machine. This strategy would initiate industry automation or human–machine interaction. An automation policy would be helpful for the industry to properly utilize labor and decrease the number of defects.

2. Related Works

2.1. Textile Industries across the Globe

2.2. Automation Policies in Fabric Inspection Processes

2.3. Demand Variability in Manufacturing Industries

2.4. Research Methodology

- Market survey: The initial step involves gathering market intelligence. This includes understanding customer needs, preferences, and buying patterns.

- Identify the demand pattern: Market research data are analyzed to discern demand trends. This might include identifying seasonality in demand, market growth or decline, and other patterns impacting demand.

- Collect the costing data from the retailer and manufacturer: To obtain a complete financial picture, costs are collected from both the retailer (who sells to end customers) and the manufacturer (who produces the goods). This includes production, materials, labor, and overhead expenses.

- Develop a mathematical model with a suitable demand pattern: With an understanding of demand and costs, a mathematical model is developed to forecast future behavior.

- Make strategic decisions: This is the core decision-making step based on the model’s insights. Key questions addressed include the following:

- How much to order?The model helps determine the best quantity for production or purchase to balance meeting demand and avoiding excess inventory.

- What is the optimal investment for quality improvement?Deciding the investment amount in product/service quality is considered; the model likely links this to projected sales and customer satisfaction.

- What is the optimal investment for setup cost reduction?The model assists in figuring out if investments to lower setup costs (like equipment changeovers) for production runs would be a worthwhile financial decision.

3. Problem Description and Assumptions

3.1. Problem Description

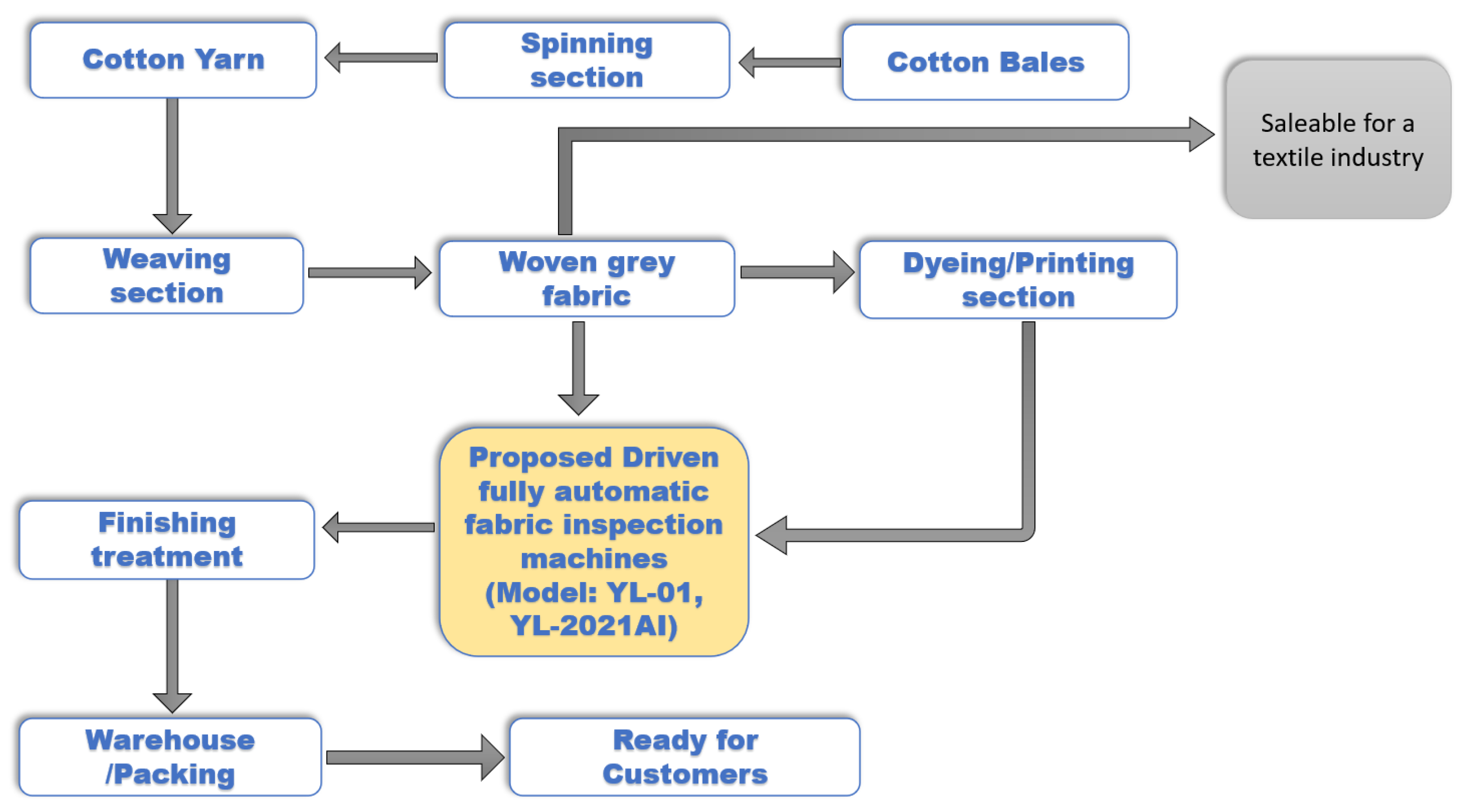

- The proposed model addresses problems related to fabric defect detection in the cotton mending section of TC mills. In addition, this study examines the impact of adopting SMT in that section. To assess the profitability of the supply chain and the impact of SMT on it, we develop four mathematical models, as shown in Table 1.

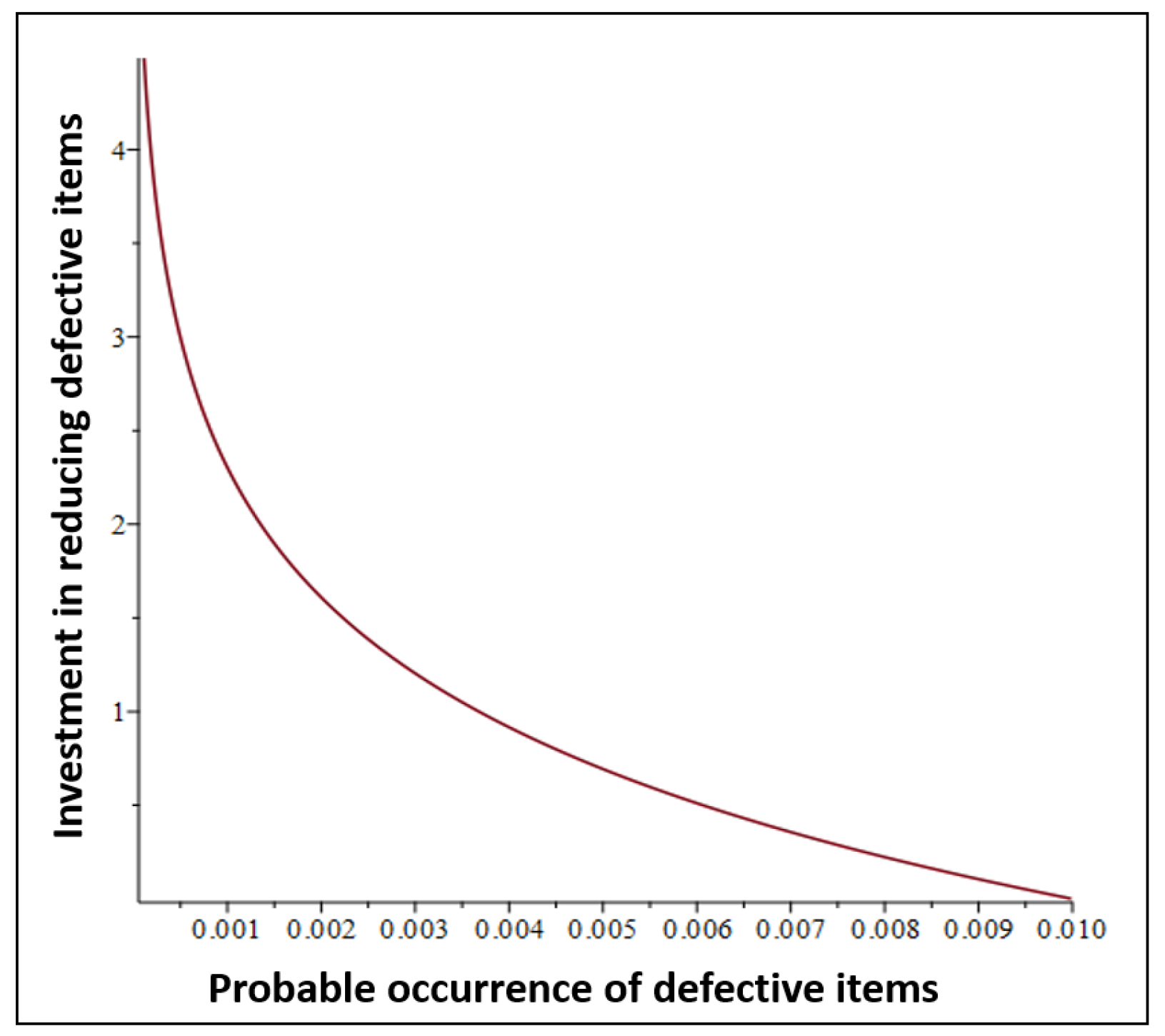

- Two decision variables—the order quantity and the occurrence of defective fabric —are considered in this study. Based on these two variables, we aim to maximize profit. In an integrated inventory model, the order quantity is the main strategic decision made by the decision maker. The optimal order quantity reflects the decision about how much to order to satisfy customer demand in an inventory cycle. The decision variable is used to improve product quality by handling the risk of the “out-of-control” probability of defective items.

- A capital investment is made to reduce the “out-of-control” probability of defective items in the manufacturing process. This investment upgrades the classical mending section via the installation of fully automatic and smart fabric inspection machines in the cotton section to improve the quality of the fabric.

- To address uncertain conditions in the supply chain network related to demand, two separate fuzzy numbers are used, namely the TFN and TrFN.

3.2. Assumptions

- A TE centralized SCM framework is established for the textile sector, featuring manufacturers and purchasers.

- The cotton manufacturing plant uses a make-to-order (MTO) policy for producing goods.

- AI-driven smart manufacturing machines are exclusively available to the cotton mill and are positioned in the fabric inspection area.

- The taffeta segment employs the human–machine inspection method.

- After the SMT-based inspection machine’s installation, fewer workers were responsible for the cotton inspection area compared to the taffeta area.

- Neither the manufacturer nor the purchaser anticipates any shortages.

4. Theoretical Formulation of the Proposed Model

4.1. The Cost Associated with the Retailer of the Fabric Item

4.2. The Cost Associated with the Cotton TC Mill to Manufacture Fabric Items

4.3. Core Unified Total Profit of SC System of Fabric Manufacturing in the Cotton TC Mill

4.4. Additional Expenditure Required to Improve the Core SC System of the Cotton TC Mill

4.5. SMT-Based Modern Unified Total Profit Function of the Cotton TC Mill and the Retailer

4.6. Use of Fuzzy Technique in a Unified Crisp Model

4.7. Defuzzification of Unified Fuzzy Model

4.8. Crispification of Case 1

4.9. Crispification of Case 2

4.10. Crispification of Case 3

4.11. Crispification of Case 4

5. Solution Approaches

5.1. Proposed KDPMG Algorithm

| Algorithm 1: Solution algorithm to obtain optimal results for Cases 1, 2, 3, and 4. |

| Step 1: Set all parameter values, and put . Step 2: Obtain from (11) and from (12). Step 2: Obtain from (13) and from (14). Step 3: Obtain from (15) and from (16). Step 4: Set and repeat Step 2 until Step 5: Set and repeat Step 3 until , and . Step 6: Obtain from (7) and from (8). Step 7: Obtain from (9) and from (10). |

5.2. Genetic Algorithm

- Initialization: The commencement of the process is marked by the establishment of an initial population comprising individuals that represent potential solutions to the problem under optimization.

- Selection: This phase involves identifying individuals from the existing population based on their fitness levels for the purpose of reproduction. Fitness reflects the efficacy of an individual in problem-solving and is commonly assessed using a fitness or objective function.

- Crossover: The crossover stage entails the exchange of genetic material between selected pairs of individuals to produce novel offspring, simulating the natural processes of reproduction and genetic recombination.

- Mutation: Random alterations are introduced to the genetic information of offspring to preserve genetic variability within the population and prevent premature convergence of the algorithm toward sub-optimal solutions.

- Evaluation: Following crossover and mutation, the fitness of the newly created offspring is evaluated using the fitness function.

- Replacement: Finally, a fresh cohort of individuals is formed by selecting the most robust individuals from the current population along with the newly generated offspring. This strategy ensures the progression of the population toward superior solutions across successive generations.

| Algorithm 2: Solution algorithm to obtain optimal results for Cases 1, 2, 3, and 4. |

| Step 1: Define the maximum generation (N) and the objective Functions (7)–(10). Step 2: Initialize the crossover and mutation probability (denoted as and ). Step 3: Repeat the following steps until . Step 4: Generate the new population with the help of crossover and mutation. Step 4.1: Generate the new population for and (for Cases 1 and 2). Step 4.2: Generate the new population for , , , and (for Cases 3 and 4). Step 5: Use crossover operation with probability and mutation operation with probability . Step 6: Accept the new solutions if their fitness improves. Step 7: Select the current best solutions for the next generation update. Step 8: . |

6. A Case Study of JCT Limited, Phagwara

Domestic System of Quality Evaluation for Fabric

7. Results Analysis and Discussion

7.1. Numerical Simulations

7.2. Input Parameters for Numerical Experiments

7.3. Comparison of KDPMG and GA

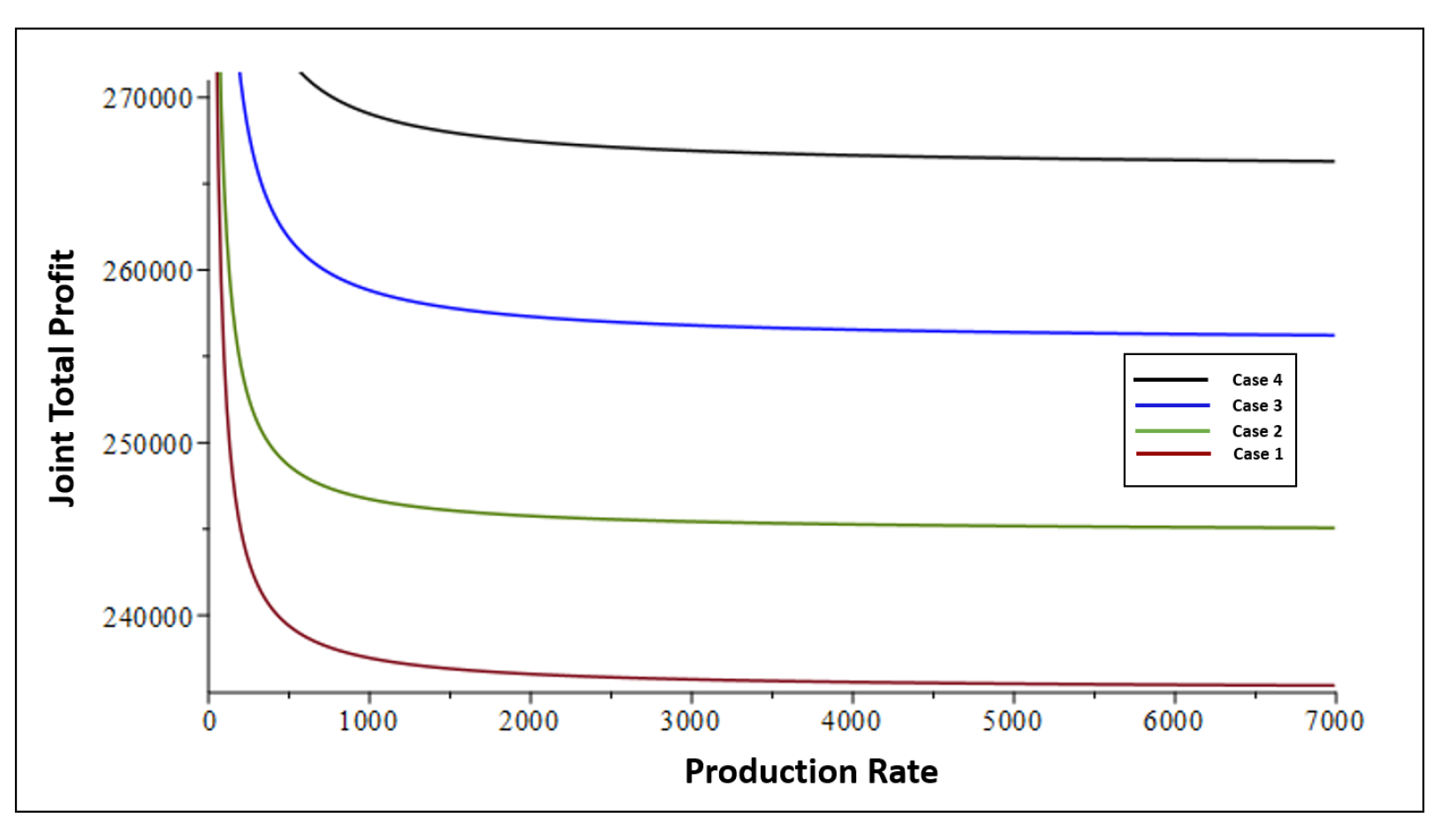

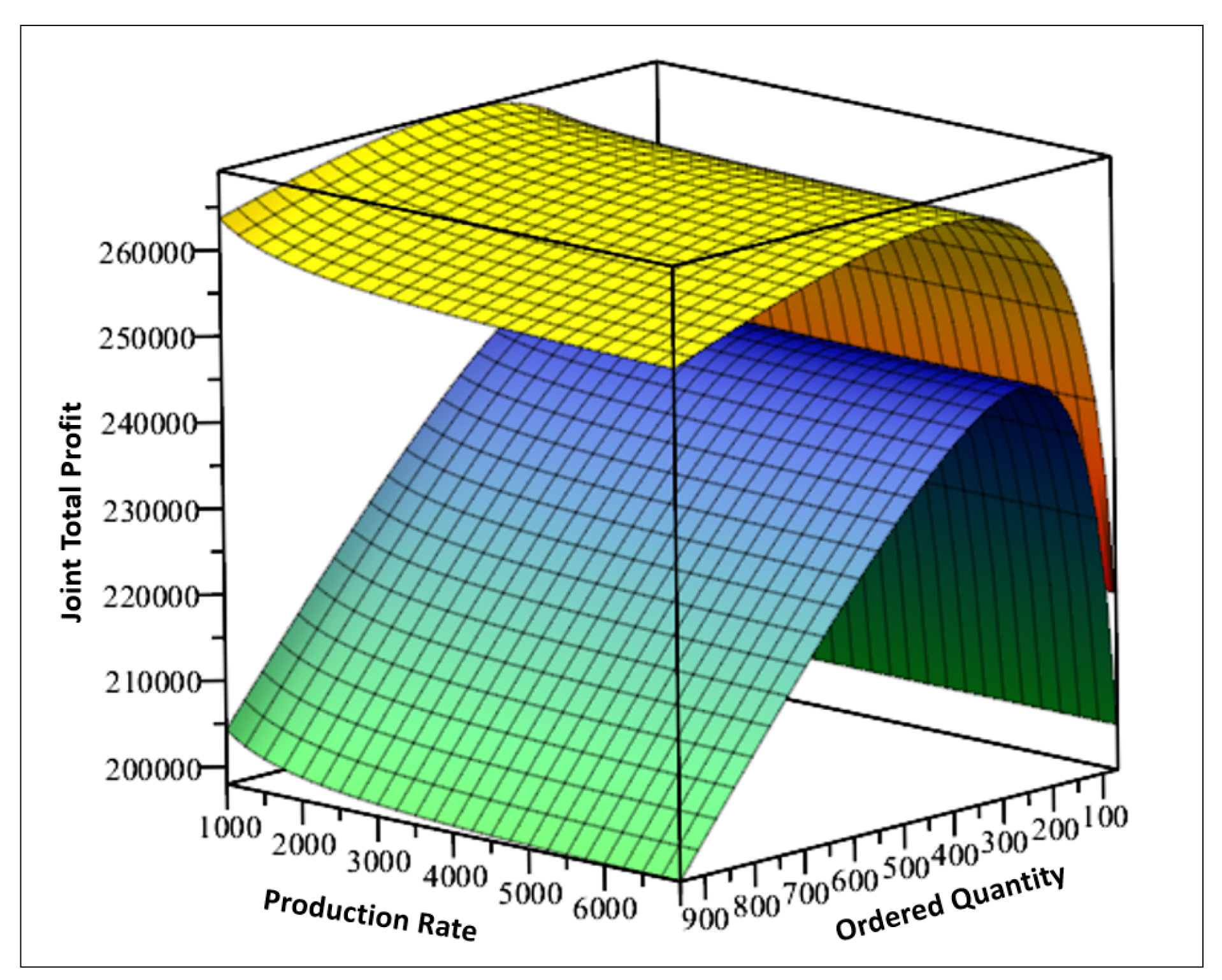

7.4. Results Discussion with Graphic Presentations

7.5. Sensitivity Analysis

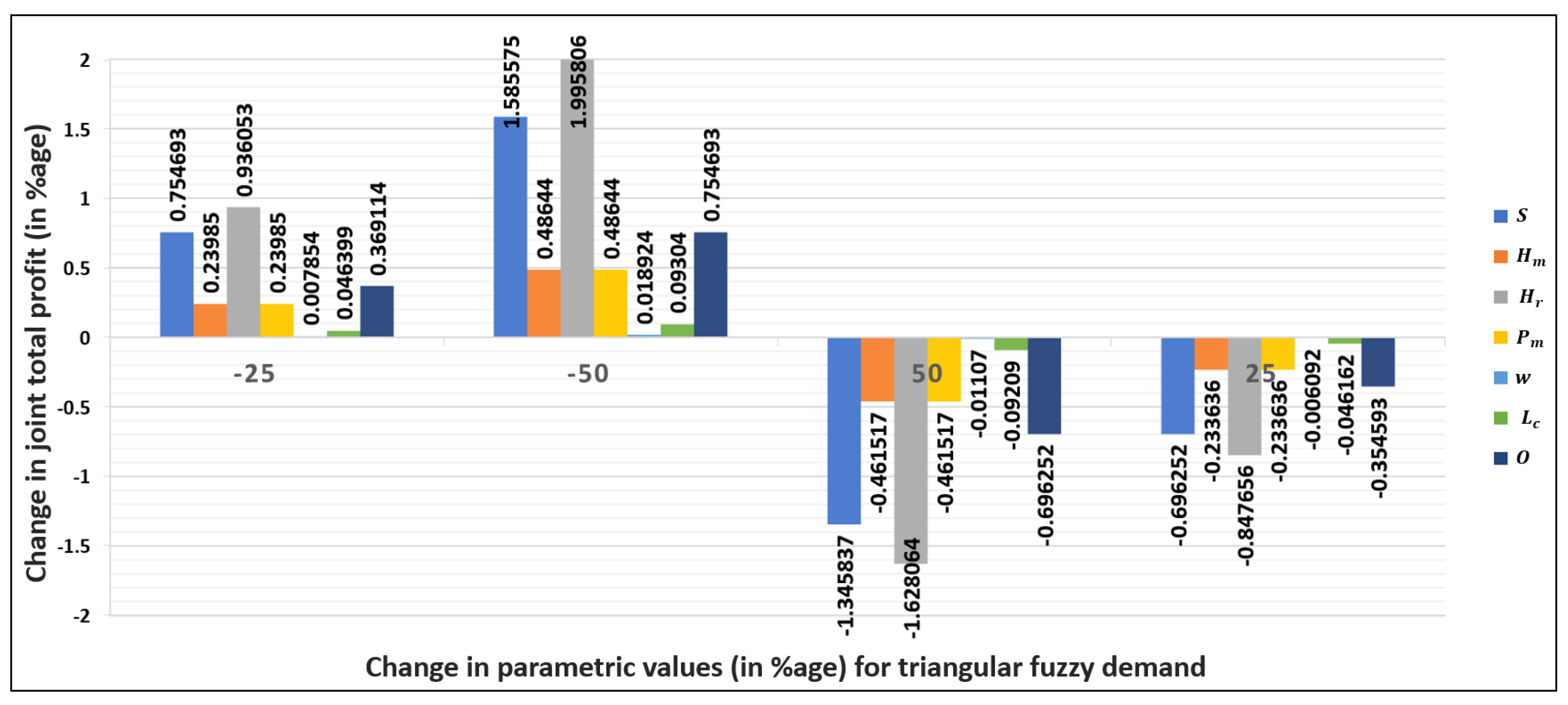

- However, a change of 50% for Case 3 results in variations of 1.62% and 1.92%. In contrast, variations of −1.59% and 1.95% are observed in total profit by making a change of ±50% in the holding cost.

- A thorough analysis of these figures reveals that the holding costs of cotton TC mills and retailers are more sensitive compared to other costs such as production, labor, and ordering costs.

- For reference, in both scenarios, a change of ±25% in all these costs results in variations of 0.23%, 0.05%, and 0.35% in total profit, respectively, while a change of ±50% in all these costs results in variations of 0.4%, 0.09%, and 0.7% in total profit, respectively.

- Figure 8 and Figure 9 depict the influence of the cost parameters related to the mending section of the mill, which has a great influence on the overall profit function. In both demand functions, changes of ±50% and ±25% in the mending section’s cost vary the total profit by 0.01% and 0.007%, respectively.

8. Managerial Insights

9. Conclusions

- It is evident from Table 3 that the cotton textile manufacturing plant achieves higher profit using the framework outlined in Case 4 compared to Cases 1, 2, and 3. In simple terms, the choice of the trapezoidal fuzzy demand function with the KDPMG algorithm yields better results than the triangular fuzzy demand function. Moreover, the CPU time for the KDPMG algorithm is significantly shorter than that for the GA, as shown in Table 2.

- Using a triangular fuzzy demand pattern, the model with SMT achieves 8.62% higher profit than without SMT adoption. Similarly, in a trapezoidal fuzzy demand pattern, SMT adoption in cotton plants can achieve an 8.69% higher profit. However, the comparison between Cases 2 and 4 reveals that the trapezoidal fuzzy demand pattern generates 3.94% more profit than the triangular fuzzy demand pattern.

- The probability of the occurrence of defective items is reduced by 6.9% in the case of the trapezoidal demand function compared to the triangular fuzzy demand function. So, it is worth mentioning that the choice of the fuzzy number to deal with uncertain scenarios can have a drastic impact on the overall outcome of the framework. Furthermore, capital investment in smart fabric inspection technology for the mending section to reduce fabric defect detection has undoubtedly proven to be advantageous in contrast to classical techniques.

10. Future Scope

- In this study, it is important to acknowledge certain aspects that were not taken into account. In reality, supply chain systems comprise a multitude of different parties, each playing a significant role in the overall functioning of the system. It would be beneficial to expand this study by incorporating a multi-echelon and multi-retailer-seller approach, thus capturing a broader view of supply chain dynamics. By doing so, the model presented in this study would undoubtedly gain a greater level of sophistication and relevance.

- In this article, we primarily focus on the implementation of SMT in the fabric inspection section of the textile industry. This problem can be extended by implementing SMT in other sections of textile manufacturing plants, such as fabric manufacturing, packaging, and others. If each module of the supply chain adopts SMT, the profitability of the industry will increase and it will be able to compete in a tech-savvy era.

- The emergence of the I4.0 era has opened up a plethora of opportunities and created a seamless connection between the manufacturing industry and advanced technologies. As a result, it becomes imperative for future research endeavors to explore the implementation of optimal production delivery strategies, as this would undoubtedly prove to be a fascinating and crucial area of investigation based on the proposed model’s findings.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Abbreviations | |

| TE | Two-echelon |

| SC | Supply chain |

| MTO | Make-to-order |

| JCT | Jagatjit Cotton Textiles |

| TFN | Triangular fuzzy number |

| TrFN | Trapezoidal fuzzy number |

| SDM | Signed-distance method |

| SMT | Smart manufacturing technology |

| I4.0 | Fourth Industrial Revolution |

| AI | Artificial Intelligence |

| TC | Textile and clothing |

| Decision Variables | |

| Q | Ordered quantity of fabric items (units/year) |

| Probability of defective fabric items occurring | |

| Parameters | |

| D | Demand for fabric items (units/year) |

| O | Ordering cost of fabric items (USD/order) |

| Cost of holding a fabric item by the mill (USD/unit/year) | |

| Cost of holding a fabric item by the retailer (USD/unit/year) | |

| Cost of producing a fabric item by the mill (USD/unit/year) | |

| Cost of purchasing a fabric item by the retailer (USD/units/year) | |

| P | Manufacturing pace of producing fabric items in the mill (units/year) |

| Initial probability of defective fabric items occurring | |

| R | Market price of fabric items (USD/unit/year) |

| S | Setup cost of the cotton TC mill per order |

| Manpower working in the classical mending section of the mill, | |

| Manpower working in the smart mending section of the mill, | |

| Labor cost of manpower | |

| w | Mending cost per production cycle |

Appendix A

Appendix A.1. Triangular Fuzzy Number

Appendix A.2. Trapezoidal Fuzzy Number

Appendix A.3

Defuzzification of Triangular and Trapezoidal Fuzzy Demand Functions Using SDM

Appendix B. Proof of Theorem 1

Appendix C

Appendix C.1. Calculation of Lemma 1

Appendix C.2. Calculation of Lemma 2

Appendix C.3. Calculation of Lemma 3

Appendix C.4. Calculation of Lemma 4

References

- Arora, S.; Majumdar, A. Machine learning and soft computing applications in textile and clothing supply chain: Bibliometric and network analyses to delineate future research agenda. Expert Syst. Appl. 2022, 200, 117000. [Google Scholar] [CrossRef]

- Riahi, Y.; Saikouk, T.; Gunasekaran, A.; Badraoui, I. Artificial intelligence applications in supply chain: A descriptive bibliometric analysis and future research directions. Expert Syst. Appl. 2021, 173, 114702. [Google Scholar] [CrossRef]

- Dey, B.K.; Sarkar, B.; Seok, H. Cost-effective smart autonomation policy for a hybrid manufacturing-remanufacturing. Comput. Ind. Eng. 2021, 162, 107758. [Google Scholar] [CrossRef]

- Sarkar, B.; Mridha, B.; Pareek, S. A sustainable smart multi-type biofuel manufacturing with the optimum energy utilization under flexible production. J. Clean. Prod. 2022, 332, 129869. [Google Scholar] [CrossRef]

- Nouinou, H.; Asadollahi-Yazdi, E.; Baret, I.; Nguyen, N.Q.; Terzi, M.; Ouazene, Y.; Yalaoui, F.; Kelly, R. Decision-making in the context of Industry 4.0: Evidence from the textile and clothing industry. J. Clean. Prod. 2023, 391, 136184. [Google Scholar] [CrossRef]

- Majumdar, A.; Ali, S.M.; Agrawal, R.; Srivastava, S. A triple helix framework for strategy development in circular textile and clothing supply chain: An Indian perspective. J. Clean. Prod. 2022, 367, 132954. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; Kim, S.J. A smart production system with an autonomation technology and dual channel retailing. Comput. Ind. Eng. 2022, 173, 108607. [Google Scholar] [CrossRef]

- Dey, B.K.; Seok, H. Intelligent inventory management with autonomation and service strategy. J. Intell. Manuf. 2022, 35, 307–330. [Google Scholar] [CrossRef] [PubMed]

- Rožanec, J.M.; Zajec, P.; Trajkova, E.; Šircelj, B.; Brecelj, B.; Novalija, I.; Dam, P.; Fortuna, B.; Mladenić, D. Towards a Comprehensive Visual Quality Inspection for Industry 4.0. IFAC-PapersOnLine 2022, 55, 690–695. [Google Scholar] [CrossRef]

- Thakur, R.; Panghal, D.; Jana, P.; Rajan; Prasad, A. Automated fabric inspection through convolutional neural network: An approach. Neural Comput. Appl. 2023, 35, 3805–3823. [Google Scholar] [CrossRef]

- Dey, B.K.; Pareek, S.; Tayyab, M.; Sarkar, B. Autonomation policy to control work-in-process inventory in a smart production system. Int. J. Prod. Res. 2021, 59, 1258–1280. [Google Scholar] [CrossRef]

- Rathore, B. Textile Industry 4.0 Transformation for Sustainable Development: Prediction in Manufacturing & Proposed Hybrid Sustainable Practices. Eduzone Int. Peer Rev. Multidiscip. J. 2022, 11, 223–241. [Google Scholar]

- Pourkaramdel, Z.; Fekri-Ershad, S.; Nanni, L. Fabric defect detection based on completed local quartet patterns and majority decision algorithm. Expert Syst. Appl. 2022, 198, 116827. [Google Scholar] [CrossRef]

- Dlamini, S.; Kao, C.-Y.; Su, S.-L.; Jeffrey Kuo, C.-F. Development of a real-time machine vision system for functional textile fabric defect detection using a deep YOLOv4 model. Text. Res. J. 2022, 92, 675–690. [Google Scholar] [CrossRef]

- Mahmood, T.; Ashraf, R.; Faisal, C.N. An efficient scheme for the detection of defective parts in fabric images using image processing. J. Text. Inst. 2022, 114, 1041–1049. [Google Scholar] [CrossRef]

- Fouda, Y.M. Integral images-based approach for fabric defect detection. Opt. Laser Technol. 2022, 147, 107608. [Google Scholar] [CrossRef]

- Çelik, H.İ.; Dülger, L.C.; Öztaş, B.; Kertmen, M.; Gültekin, E. A Novel Industrial Application of CNN Approach: Real Time Fabric Inspection and Defect Classification on Circular Knitting Machine. Text. Appar. 2022, 32, 344–352. [Google Scholar] [CrossRef]

- Majumder, A.; Guchhait, R.; Sarkar, B. Manufacturing quality improvement and setup cost reduction in a vendor-buyer supply chain model. Eur. J. Ind. Eng. 2017, 11, 588–612. [Google Scholar] [CrossRef]

- Xu, Z.; Pokharel, S.; Elomri, A. An eco-friendly closed-loop supply chain facing demand and carbon price uncertainty. Ann. Oper. Res. 2023, 320, 1041–1067. [Google Scholar] [CrossRef]

- Fathollahi-Fard, A.M.; Dulebenets, M.A.; Hajiaghaei–Keshteli, M.; Tavakkoli-Moghaddam, R.; Safaeian, M.; Mirzahosseinian, H. Two hybrid meta-heuristic algorithms for a dual-channel closed-loop supply chain network design problem in the tire industry under uncertainty. Adv. Eng. Inform. 2021, 50, 101418. [Google Scholar] [CrossRef]

- Lu, Z.; Zhang, Y.; Xu, H.; Chen, H. Fabric defect detection via a spatial cloze strategy. Text. Res. J. 2023, 93, 1612–1627. [Google Scholar] [CrossRef]

- Talu, M.F.; Hanbay, K.; Varjovi, M.H. CNN-based fabric defect detection system on loom fabric inspection. Text. Appar. 2022, 32, 208–219. [Google Scholar] [CrossRef]

- Kahraman, Y.; Durmuşoğlu, A. Classification of defective fabrics using capsule networks. Appl. Sci. 2022, 12, 5285. [Google Scholar] [CrossRef]

- Tayyab, M.; Jemai, J.; Lim, H.; Sarkar, B. A sustainable development framework for a cleaner multi-item multi-stage textile production system with a process improvement initiative. J. Clean. Prod. 2020, 246, 119055. [Google Scholar] [CrossRef]

- Sahoo, P.; Ashwani. COVID-19 and Indian economy: Impact on growth, manufacturing, trade and MSME sector. Glob. Bus. Rev. 2020, 21, 1159–1183. [Google Scholar] [CrossRef]

- Vishwakarma, A.; Dangayach, G.S.; Meena, M.L.; Gupta, S. Analysing barriers of sustainable supply chain in apparel & textile sector: A hybrid ISM-MICMAC and DEMATEL approach. Clean. Logist. Supply Chain 2022, 5, 100073. [Google Scholar]

- Chourasiya, R.; Pandey, S.; Malviya, R.K. Developing a framework to analyse the effect of sustainable manufacturing adoption in Indian textile industries. Clean. Logist. Supply Chain 2022, 4, 100045. [Google Scholar] [CrossRef]

- Sharma, A.; Singh, B.J. Understanding LSS 4.0 through golden circle model and reviewing its scope in Indian textile industry. Int. J. Six Sigma Compet. Advant. 2022, 14, 120–137. [Google Scholar] [CrossRef]

- Shaneeb, P.; Sumathy, M. Impact of intellectual capital on financial performance in Indian textile industries. Acad. Account. Financ. Stud. J. 2021, 25, 1–14. [Google Scholar]

- Darji, I.S.; Dahiya, S. Financial performance of the textile industry in India: The case of Haryana. Res. J. Text. Appar. 2023, 27, 36–53. [Google Scholar] [CrossRef]

- Alruwais, N.; Alabdulkreem, E.; Mahmood, K.; Marzouk, R.; Assiri, M.; Abdelmageed, A.A.; Abdelbagi, S.; Drar, S. Hybrid mutation moth flame optimization with deep learning-based smart fabric defect detection. Comput. Electr. Eng. 2023, 108, 108706. [Google Scholar] [CrossRef]

- Rasheed, A.; Zafar, B.; Rasheed, A.; Ali, N.; Sajid, M.; Dar, S.H.; Habib, U.; Shehryar, T.; Mahmood, M.T. Fabric defect detection using computer vision techniques: A comprehensive review. Math. Probl. Eng. 2020, 2020, 8189403. [Google Scholar] [CrossRef]

- Sarkar, B.; Sarkar, M.; Ganguly, B.; Cárdenas-Barrón, L.E. Combined effects of carbon emission and production quality improvement for fixed lifetime products in a sustainable supply chain management. Int. J. Prod. Econ. 2021, 231, 107867. [Google Scholar] [CrossRef]

- Lagzaie, L.; Hamzehee, A. Providing a Multiproduct and Multiperiodic Model for Closed-Loop Green Supply Chain under Conditions of Uncertainty Based on a Fuzzy Approach for Solving Problem of Business Market. Complexity 2022, 11, 2780073. [Google Scholar] [CrossRef]

- Abdi, A.; Fathollahi-Fard, A.M.; Hajiaghaei-Keshteli, M. A set of calibrated metaheuristics to address a closed-loop supply chain network design problem under uncertainty. Int. J. Syst. Sci. Oper. Logist. 2021, 8, 23–40. [Google Scholar] [CrossRef]

- Komatina, N.; Tadic, D.; Duric, G.; Aleksić, A. Determination of manufacturing process failures priority under type 2 fuzzy environment: Application of genetic algorithm and Variable neighborhood search. Proc. Inst. Mech. Eng. Part E J. Process. Mech. Eng. 2023. [Google Scholar] [CrossRef]

- Chauhan, R.; Majumder, A.; Kumar, V. The impact of adopting customization policy and sustainability for improving consumer service in a dual-channel retailing. J. Retail. Consum. Serv. 2023, 75, 103504. [Google Scholar] [CrossRef]

- Yang, X. Nature-Inspired Optimization Algorithms, 2nd ed.; Elsevier: London, UK, 2021; Volume 6, pp. 91–100. ISBN 978-012-416-743-8. [Google Scholar]

| Model | Description |

|---|---|

| Case 1 | SC without SMT with TFN |

| Case 2 | SC without SMT with TrFN |

| Case 3 | SC with SMT with TFN |

| Case 4 | SC with SMT with TrFN |

| Model | Unified Total Profit | CPU Time (In Seconds) | ||

|---|---|---|---|---|

| KDPMG Algorithm | GA | KDPMG Algorithm | GA | |

| Case 1 | 236,035.924 | 236,035.127 | 0.018 | 0.67 |

| Case 2 | 245,167.565 | 245,167.130 | 0.002 | 0.14 |

| Case 3 | 256,392.849 | 256,375.634 | 0.006 | 0.29 |

| Case 4 | 266,482.519 | 266,239.801 | 0.008 | 0.22 |

| Q | Unified Total Profit | ||

|---|---|---|---|

| Case 1 | 248.385 | - | 236,035.924 |

| Case 2 | 249.92 | - | 245,167.565 |

| Case 3 | 404.522 | 256,392.849 | |

| Case 4 | 412.466 | 2.7 × 10−5 | 266,482.519 |

| With SMT Technology | Q | Unified Total Profit | |

|---|---|---|---|

| TrFN demand | ↑ * | ↓ * | ↑ |

| % change | 1.96 | −6.9 | 3.94 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kaur, G.; Dey, B.K.; Pandey, P.; Majumder, A.; Gupta, S. A Smart Manufacturing Process for Textile Industry Automation under Uncertainties. Processes 2024, 12, 778. https://doi.org/10.3390/pr12040778

Kaur G, Dey BK, Pandey P, Majumder A, Gupta S. A Smart Manufacturing Process for Textile Industry Automation under Uncertainties. Processes. 2024; 12(4):778. https://doi.org/10.3390/pr12040778

Chicago/Turabian StyleKaur, Gurpreet, Bikash Koli Dey, Pankaj Pandey, Arunava Majumder, and Sachin Gupta. 2024. "A Smart Manufacturing Process for Textile Industry Automation under Uncertainties" Processes 12, no. 4: 778. https://doi.org/10.3390/pr12040778

APA StyleKaur, G., Dey, B. K., Pandey, P., Majumder, A., & Gupta, S. (2024). A Smart Manufacturing Process for Textile Industry Automation under Uncertainties. Processes, 12(4), 778. https://doi.org/10.3390/pr12040778