Advancing Decarbonization Efforts in the Glass Manufacturing Industry through Mathematical Optimization and Management Accounting

Abstract

1. Introduction

Research Background

2. Background and Literature

2.1. Background

2.2. Activity-Based Costing and Theory of Constraints

2.3. Emission Reduction-Contributing Industries

3. Materials and Methods

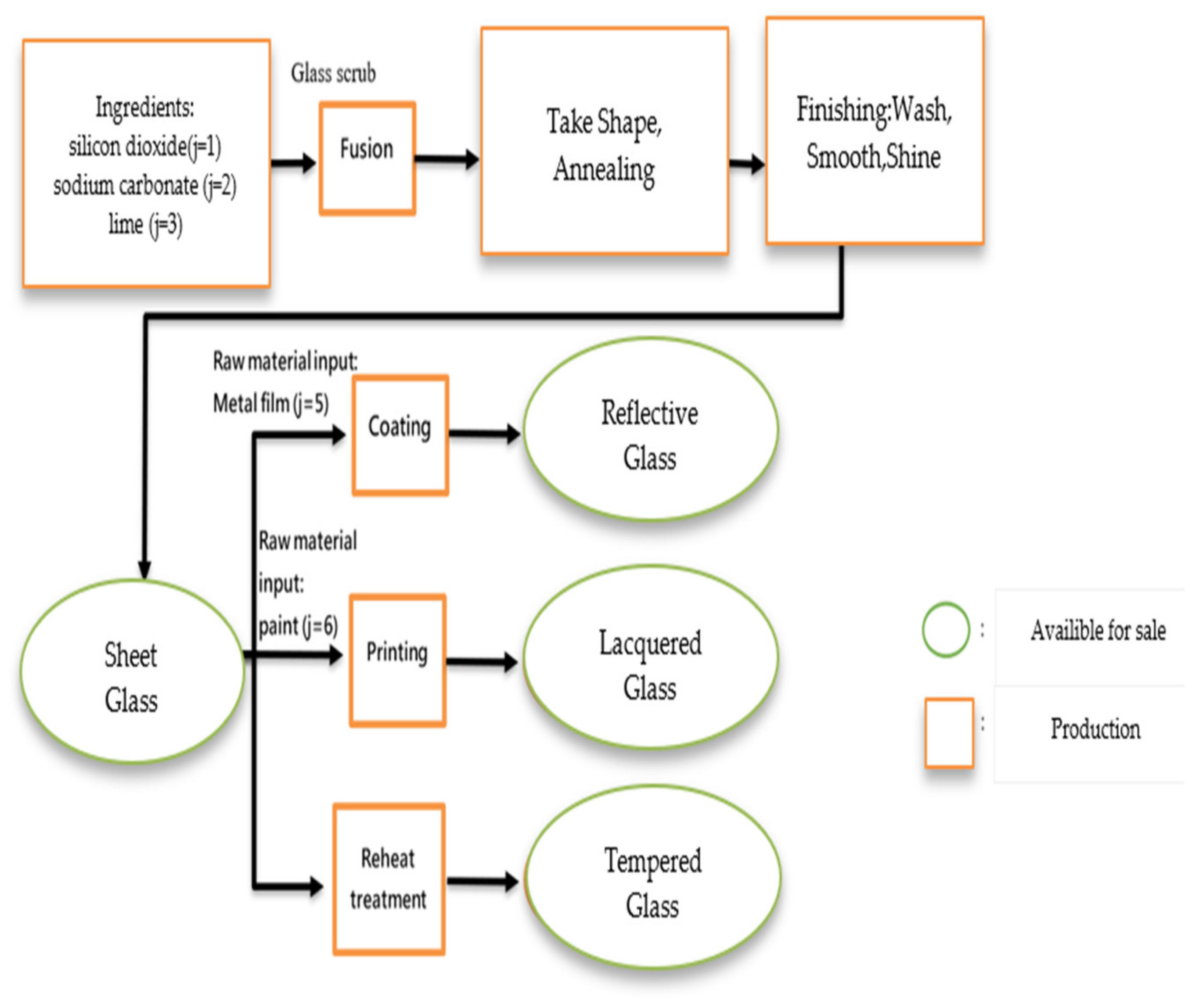

3.1. Glass Industry Production Process

3.2. Research Hypothesis

3.3. Basic Production Model

3.3.1. General Formula of Objective Function

| π | Profit Maximization by Companies: Businesses aim to achieve the highest possible profits. |

| t | The Definition of the Timeframe in the Model: The multi-period model is identified with labels t = 1 to 3, indicating a span of three time periods. |

| i | The Classification of Products: Within the product categories numbered 1 through 4, we have the following: for category 1 (i = 1), the product is flat glass; for category 2 (i = 2), the product is reflective glass; for category 3 (i = 3), the product is lacquered glass; and for category 4 (i = 4), the product is tempered glass. |

| Si | The Sale Price per Unit for Each Product: For products numbered 1 through 4, we have a distinct selling price per unit. |

| Pi | The Volume of Production for Each Product: The amount of each product (numbered 1 to 4) that is produced. |

| j | Types of Raw Materials Used: We categorize raw materials into seven types, labeled 1 through 7, with each type representing a different material such as silicon dioxide, sodium carbonate, lime, petroleum coke, metal film, paint, and waste glass. |

| Re | Waste Glass Usage Ratio: The fraction of waste glass in comparison to the total raw materials used. |

| MCj | The Cost per Unit of Raw Materials: For each of the seven types of raw materials (numbered 1 to 7), there is a specific cost associated. |

| qij | Raw Material Consumption per Product Unit: This details how much of each raw material (1 through 7) is required to produce one unit of each product (1 through 4). |

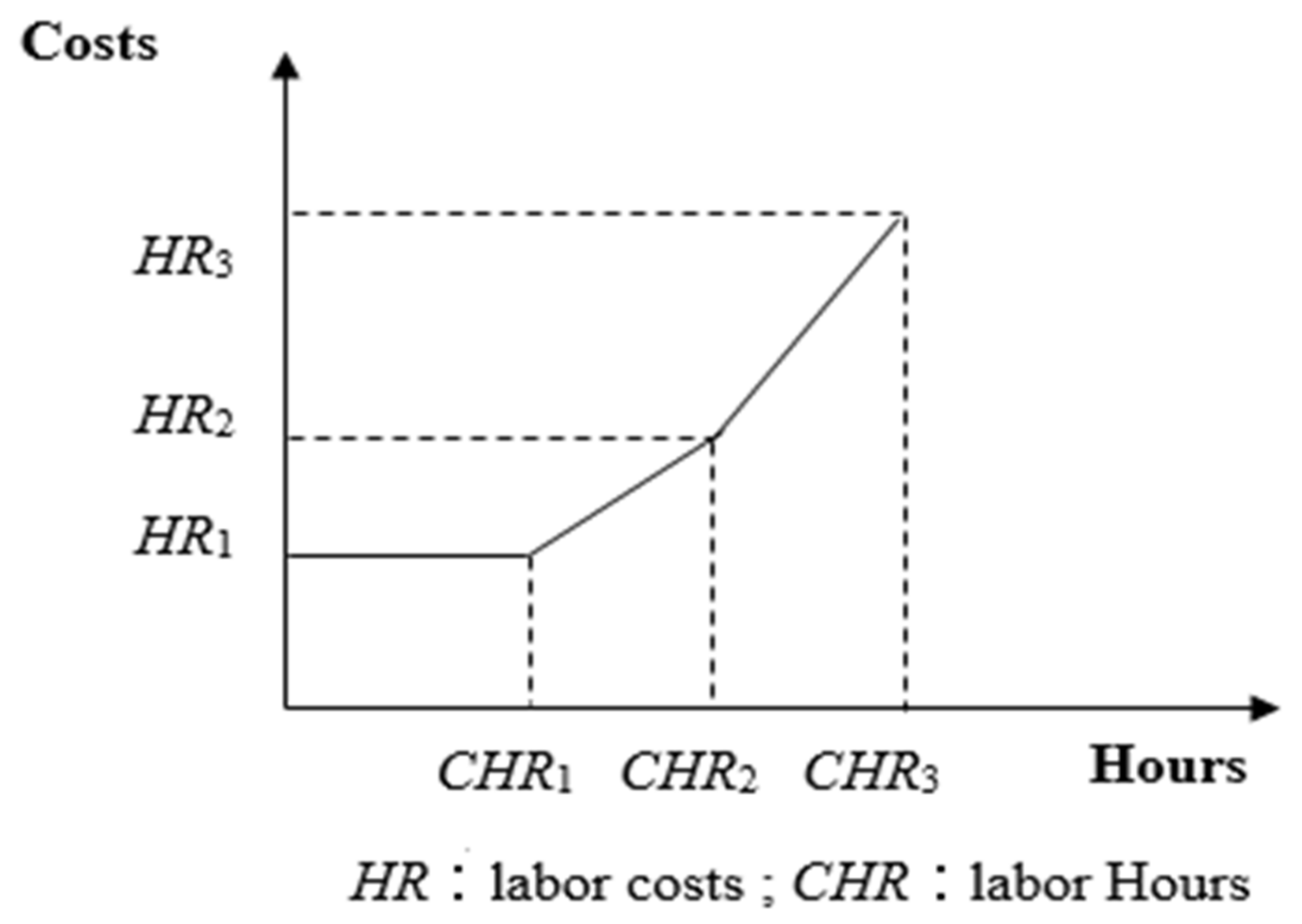

| HR1, HR2, HR3 | Direct and Overtime Labor Costs: There are three categories of labor costs: regular hours (HR1), first level of overtime (HR2), and second level of overtime (HR3), with a constraint that at most two of these can be non-zero for any given situation. |

| ε0, ε1, ε2 | Non-negative Variable Constraints: All variables in the set should be greater than or equal to zero, with the stipulation that no more than two of these variables can have values above zero at any given time. |

| Co | Cost for Each Job Operation: The expense incurred for executing one unit of a specific operation, designated as operations 5 and 6. |

| Qo | Required Quantity for Material Handling: This refers to the amount needed for operation 5, which deals with handling materials. |

| Bo | Material Handling Batch Size: The number of units processed in a single batch for material handling operation 5. |

| dio | Product Demand for Setup Operations: The quantity of each product (i) needed for the setup operation labeled as number 6. |

| Bio | Setup Operation Batch Size: The total number of units of product i that are prepared in one batch for setup operation 6. |

| F | Fixed Overhead Costs: Expenses that remain constant regardless of the volume of production. |

| MRe | The Ratio of Recycled Waste Glass: This describes the share of waste glass from the last production cycle relative to the total mass of products produced in the same period. |

| UMQj | The upper limit of the available quantity of raw material j. |

| uio | Labor Hours per Product Unit: The amount of labor time required to manufacture one unit of product i during operation o. |

| CHR1, CHR2, CHR3 | The Allocation of Labor Hours: Typically, there are caps on labor hours categorized as the maximum regular labor hours (CHR1), hours for the first overtime phase (CHR2), and hours for the second overtime phase (CHR3). |

| , | Binary Variable Constraints: For a set of binary variables (0 or 1), if one variable is assigned the value 1, the remaining must be set to 0 to ensure exclusivity. |

| The quantity for each batch size in terms of tons during material handling operations is set at 5. | |

| The maximum energy allocation for these material handling operations is also established at 5. | |

| mhio | The machine hours required to produce a unit of product i under o operation. |

| LMPo | The maximum capacity of machines under job o (o = 1,2,3,4). |

| UNTQ1, UNTQ2 | The maximum carbon emissions for the first (CTFQ1) and second (CTFQ2) scenarios. |

| , , | Dummy variable (0,1); only one of the three can be 1. |

| ,, | The first carbon tax rate (1), the second carbon tax rate (2), and the third carbon tax rate (3). |

| Dummy variable (0,1); only one of the four can be 1. | |

| Tax-free carbon emissions. | |

| ,, | The amount of carbon emissions falling in the first segment (), the amount of carbon emissions falling in the second segment (), and the amount of carbon emissions falling in the third segment (). |

| , , | Tax-free carbon emissions () and the maximum carbon emissions in the first stage () and the second stage (). Exempt carbon emissions () and the upper limit of carbon emissions for the initial stage () and for the subsequent stage (). |

3.3.2. Direct Material Cost Function

| UMQj | The upper limit of the available quantity of raw material j. |

| ) | The 0.06 adjustment effectively represents the losses or inefficiencies in the use of this material during the production process. |

3.3.3. Direct Labor Cost Function

| uio | Labor Hours per Product Unit: The amount of labor time required to manufacture one unit of product i during operation o. |

| CHR1, CHR2, CHR3 | The Allocation of Labor Hours: Typically, there are caps on labor hours categorized as the maximum regular labor hours (CHR1), hours for the first overtime phase (CHR2), and hours for the second overtime phase (CHR3). |

| , | Binary Variable Constraints: For a set of binary variables (0 or 1), if one variable is assigned the value 1, the remaining must be set to 0 to ensure exclusivity. |

3.3.4. Material Handling Costs

| The quantity for each batch size in terms of tons during material handling operations is set at 5. | |

| The maximum energy allocation for these material handling operations is also established at 5. |

3.3.5. Batch Level Job—Set Job Cost Function

| Capacity for batch design operations (o = 6). | |

| The batch-level workload of each batch of product i produced under the setting operation, that is, the number of glass products to be applied in one setting (o = 6). |

3.3.6. Machine Hour Limit

| mhio | The machine hours required to produce a unit of product i under o operation. |

| LMPo | The maximum capacity of machines under job o (o = 1,2,3,4). |

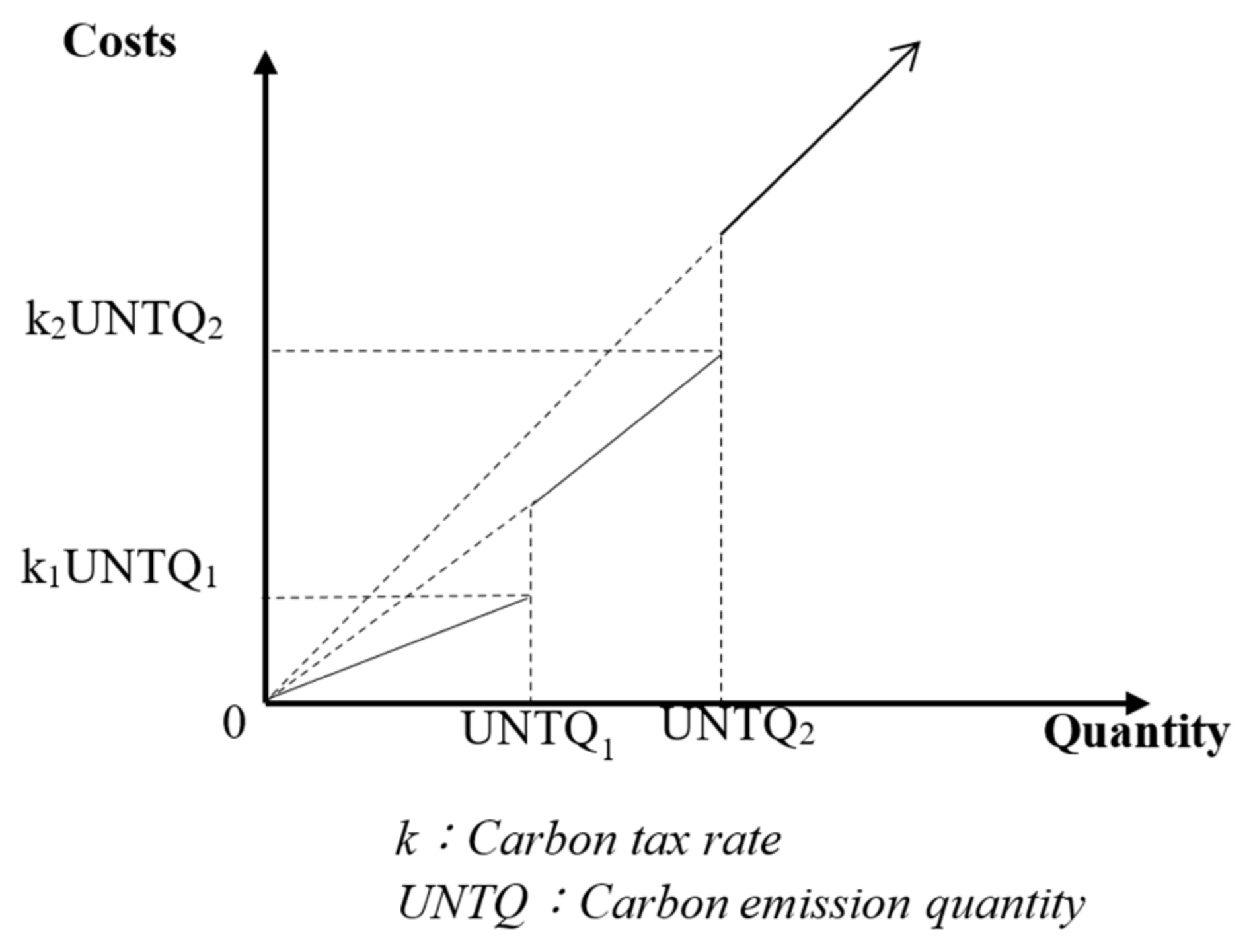

3.4. Carbon Tax Cost Function

3.4.1. Discontinuous Carbon Tax Cost Function

| ,, | The first carbon tax rate ((1), the second carbon tax rate (2), and the third carbon tax rate (3). |

| ,, | The amount of carbon emissions falling in the first segment (), the amount of carbon emissions falling in the second segment (), and the amount of carbon emissions falling in the third segment (). |

| UNTQ1, UNTQ2 | The maximum carbon emissions for the first (CTFQ1) and second (CTFQ2) scenarios. |

| , , | Dummy variable (0,1); only one of the three can be 1. |

3.4.2. Discontinuous Carbon Tax Cost Function of Carbon-Containing Rights

3.4.3. Discontinuous Carbon Tax Cost Function with Allowance

| ,, | The first carbon tax rate (1), the second carbon tax rate (2), and the third carbon tax rate (3). |

| Dummy variable (0,1); only one of the four can be 1. | |

| Tax-free carbon emissions. | |

| ,, | The amount of carbon emissions falling in the first segment (), the amount of carbon emissions falling in the second segment (), and the amount of carbon emissions falling in the third segment (). |

| , , | Tax-free carbon emissions (), the maximum carbon emissions in the first stage () and the second stage (). Exempt carbon emissions () and the upper limit of carbon emissions for the initial stage () and for the subsequent stage (). |

3.4.4. Discontinuous Carbon Tax Cost Function of Carbon Rights and Tax Allowances

4. Model Research Results and Analysis

4.1. Model Data Assumptions

4.2. The Optimal Solution and Analysis of the Model

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sengupta, P. Refractories for Glass Manufacturing. In Refractories for the Chemical Industries; Springer: Cham, Switzerland, 2020; pp. 175–189. [Google Scholar]

- Hubert, M. Industrial Glass Processing and Fabrication. In Springer Handbook of Glass; Musgraves, J.D., Hu, J., Calvez, L., Eds.; Springer: Cham, Switzerland, 2019; pp. 993–1018. [Google Scholar]

- Edwards, K.L.; Axinte, E.; Tabacaru, L.L. A critical study of the emergence of glass and glassy metals as “green” materials. Mater. Des. 2013, 50, 713–723. [Google Scholar] [CrossRef]

- Boyd, D.C.; Thompson, D.A.; Vetelino, J.F.; Agarwala, V.S. Glass. In Kirk-Othmer Encyclopedia of Chemical Technology; Wiley: Hoboken, NJ, USA, 2004; p. 12. [Google Scholar]

- British Glass. About Glass. Available online: https://www.britglass.org.uk/about-glass (accessed on 1 January 2024).

- Stiebert, S.; Echeverría, D.; Gass, P. Emission Omissions: Carbon Accounting Gaps in the Built Environment; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2019. [Google Scholar]

- Nugent, D.; Sovacool, B.K. Assessing the lifecycle greenhouse gas emissions from solar PV and wind energy: A critical meta-survey. Energy Policy 2014, 65, 229–244. [Google Scholar] [CrossRef]

- Mendecka, B.; Lombardi, L. Life cycle environmental impacts of wind energy technologies: A review of simplified models and harmonization of the results. Renew. Sustain. Energy Rev. 2019, 111, 462–480. [Google Scholar] [CrossRef]

- Vandini, M.; Chinni, T.; Fiorentino, S.; Galusková, D.; Kaňková, H. Glass production in the Middle Ages from Italy to Central Europe: The contribution of archaeometry to the history of technology. Chem. Pap. 2018, 72, 2159–2169. [Google Scholar] [CrossRef]

- Office of Industrial Technologies. Glass Industry of the Future: Energy and Environmental Profile of the US Glass Industry; US Department of Energy: Washington, DC, USA, 2002.

- Rehren, T.; Connolly, P.; Schibille, N.; Schwarzer, H. Changes in glass consumption in Pergamon (Turkey) from Hellenistic to late Byzantine and Islamic times. J. Archaeol. Sci. 2015, 55, 266–279. [Google Scholar] [CrossRef]

- Scalet, B.M.; Munoz, M.G.; Sissa, A.; Roudier, S.; Delgado, L. Best Available Techniques (BAT) Reference Document for the Manufacture of Glass; European Commission, Joint Research Centre: Brussels, Belgium, 2013. [Google Scholar]

- Conradt, R. Prospects and physical limits of processes and technologies in glass melting. J. Asian Ceram. Soc. 2019, 7, 377–396. [Google Scholar] [CrossRef]

- Nascimento, M.L.F. Brief history of the flat glass patent–Sixty years of the float process. World Pat. Inf. 2014, 38, 50–56. [Google Scholar] [CrossRef][Green Version]

- Robinius, M.; Otto, A.; Heuser, P.; Welder, L.; Syranidis, K.; Ryberg, D.S.; Grube, T.; Markewitz, P.; Peters, R.; Stolten, D. Linking the power and transport sectors—Part 1: The principle of sector coupling. Energies 2017, 10, 956. [Google Scholar] [CrossRef]

- Gürbüz, H.; Şöhret, Y.; Akçay, H. Environmental and enviroeconomic assessment of an LPG fueled SI engine at partial load. J. Environ. Manag. 2019, 241, 631–636. [Google Scholar] [CrossRef] [PubMed]

- Şöhret, Y.; Gürbüz, H. A comparison of gasoline, liquid petroleum gas, and hydrogen utilization in an spark ignition engine in terms of environmental and economic indicators. J. Energy Resour. Technol. 2021, 143, 052301. [Google Scholar] [CrossRef]

- Napp, T.A.; Gambhir, A.; Hills, T.P.; Florin, N.; Fennell, P.S. A review of the technologies, economics and policy instruments for decarbonising energy-intensive manufacturing industries. Renew. Sustain. Energy Rev. 2014, 30, 616–640. [Google Scholar] [CrossRef]

- Bataille, C.; Åhman, M.; Neuhoff, K.; Nilsson, L.J.; Fischedick, M.; Lechtenböhmer, S.; Solano-Rodriquez, B.; Denis-Ryan, A.; Stiebert, S.; Waisman, H.; et al. A review of technology and policy deep decarbonization pathway options for making energy-intensive industry production consistent with the Paris agreement. J. Clean. Prod. 2018, 187, 960–973. [Google Scholar] [CrossRef]

- Wesseling, J.H.; Lechtenböhmer, S.; Åhman, M.; Nilsson, L.J.; Worrell, E.; Coenen, L. The transition of energy intensive processing industries towards deep decarbonization: Characteristics and implications for future research. Renew. Sustain. Energy Rev. 2017, 79, 1303–1313. [Google Scholar] [CrossRef]

- Hübner, T.; Guminski, A.; Rouyrre, E.; von Roon, S. Branchensteckbrief der NE-Metallindustrie; SISD-E-1791-5; FfE: Sunnyvale, CA, USA, 2019. [Google Scholar]

- Hübner, T.; Guminski, A.; von Roon, S.; Rouyrre, E. Branchensteckbrief der Zement- und Kalkindustrie; SISD; FfE: Sunnyvale, CA, USA, 2019. [Google Scholar]

- Schlemme, J.; Schimmel, M.; Achtelik, C. Branchensteckbrief der Eisen- und Stahlindustrie; SISD; FfE: Sunnyvale, CA, USA, 2019. [Google Scholar]

- Leisin, M. Branchensteckbrief der Glasindustrie; SISD; FfE: Sunnyvale, CA, USA, 2019. [Google Scholar]

- Delgado Sancho, L.; Sissa, A.Q.; Scalet, B.M.; Roudier, S.; Garcia Muñoz, M. Best Available Techniques (BAT) Reference Document for the Manufacture of Glass Industrial Emissions Directive 2010/75/EU: Integrated Pollution Prevention and Control; Publications Office: Luxembourg, 2013. [Google Scholar]

- Schaeffer, H.A.; Langfeld, R. Werkstoff Glas: Alter Werkstoff MIT Grosser Zukunft; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Springer, C.; Hasanbeigi, A. Emerging Energy Efficiency and Carbon Dioxide Emissions-Reduction Technologies for the Glass Industry; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2017. [Google Scholar]

- EU Emissions Trading System (ETS) Data Viewer—European Environment Agency. Available online: https://www.eea.europa.eu/data-and-maps/dashboards/emissions-trading-viewer-1 (accessed on 24 May 2021).

- VET-Bericht. Treibhausgasemissionen 2018 Emissionshandelspflichtige Stationäre Anlagen und Luftverkehr in Deutschland; VET-Bericht, DEHSt: Berlin, Germany, 2018. [Google Scholar]

- Schmitz, A.; Kamiński, J.; Maria Scalet, B.; Soria, A. Energy consumption and CO2 emissions of the European glass industry. Energy Policy 2011, 39, 142–155. [Google Scholar] [CrossRef]

- Hu, P.; Li, Y.; Zhang, X.; Guo, Z.; Zhang, P. CO2 emission from container glass in China, and emission reduction strategy analysis. Carbon Manag. 2018, 9, 303–310. [Google Scholar] [CrossRef]

- Frassine, C.; Rohde, C.; Hirzel, S. Energy Saving Options for Industrial Furnaces—The Example of the Glass Industry. ECEEE Ind. Summer Study Proc. 2016, 467–476. [Google Scholar]

- Worrell, E.; Galitsky, C.; Masanet, E.; Crijns-Graus, W. Energy efficiency improvement and cost saving opportunities for the glass industry. In An Energy Star Guide for Energy and Plant Managers; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2008. [Google Scholar]

- Papadogeorgos, I.; Schure, K.M. Decarbonisation Options for the Dutch Container and Tableware Glass Industry; PBL Netherlands Environmental Assessment Agency: The Hague, The Netherlands, 2019. [Google Scholar]

- Cooper, R.; Kaplan, R.S. Measure costs right: Make the right decisions. CPA J. 1988, 60, 38. [Google Scholar]

- Kim, Y.-W.; Ballard, G. Activity-Based Costing and its Application to Lean Construction. In Proceedings of the 9th Annual Conference of the International Group for Lean Construction, Singapore, 6–8 August 2001. [Google Scholar]

- Tsai, W.-H. Activity-based costing model for joint products. Comput. Ind. Eng. 1996, 31, 725–729. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Yang, C.-H.; Chang, J.-C.; Lee, H.-L. An activity-based costing decision model for life cycle assessment in green building projects. Eur. J. Operat. Res. 2014, 238, 607–619. [Google Scholar] [CrossRef]

- Fichman, R.G.; Kemerer, C.F. Activity based costing for component-based software development. Inf. Technol. Manag. 2002, 3, 137–160. [Google Scholar] [CrossRef]

- Roztocki, N. Using the Integrated Activity-Based Costing and Economic Value Added Information System for Project Management. In Proceedings of the Seventh Americas Conference on Information Systems; AISeL eLibrary: Atlanta, GA, USA, 2001. [Google Scholar]

- AlMaryani, M.A.H.; Sadik, H.H. Strategic management accounting techniques in Romanian companies: Some survey evidence. Procedia Econ. Financ. 2012, 3, 387–396. [Google Scholar] [CrossRef]

- Almeida, A.; Cunha, J. The implementation of an Activity-Based Costing (ABC) system in a manufacturing company. Procedia Manuf. 2017, 13, 932–939. [Google Scholar] [CrossRef]

- Goldratt, E.M.; Cox, J. The Goal: A Process of Ongoing Improvement; North River Press: Great Barrington, MA, USA, 1986. [Google Scholar]

- Radovilsky, Z.D. A quantitative approach to estimate the size of the time buffer in the theory of constraints. Int. J. Prod. Econ. 1998, 55, 113–119. [Google Scholar] [CrossRef]

- Pember, A.; Lemon, M. Measuring and Managing Environmental Sustainability: Using Activity-Based Costing/Management (ABC/M); The Consortium for Advanced Management—International: Austin, TX, USA, 2012. [Google Scholar]

- Wesumperuma, A.; Ginige, A.; Ginige, A.; Hol, A. Green activity based management (ABM) for organisations. In ACIS 2013 Proceeding; AIS eLibrary: Atlanta, GA, USA, 2013. [Google Scholar]

- Moisello, A.M. Costing for decision making: Activity-based costing vs. theory of constraints. Int. J. Knowl. Cult. Chang. Organ. Annu. Rev. 2012, 12, 1. [Google Scholar] [CrossRef]

- Jaedicke, R.K. Improving breakeven analysis by linear programming techniques. NAA Bull. 1961, 42, 5–12. [Google Scholar]

- Balakrishnan, J.; Cheng, C.H. Discussion: Theory of constraints and linear programming: A re-examination. Int. J. Prod. Res. 2000, 38, 1459–1463. [Google Scholar] [CrossRef]

- Fahimnia, B.; Sarkis, J.; Choudhary, A.; Eshragh, A. Tactical supply chain planning under a carbon tax policy scheme: A case study. Int. J. Prod. Econ. 2015, 164, 206–215. [Google Scholar] [CrossRef]

- Demeere, N.; Stouthuysen, K.; Roodhooft, F. Time-driven activity-based costing in an outpatient clinic environment: Development, relevance and managerial impact. Health Policy 2009, 92, 296–304. [Google Scholar] [CrossRef] [PubMed]

- Hsieh, C.-L.; Tsai, W.-H.; Chang, Y.-C. Green activity-based costing production decision model for recycled paper. Energies 2020, 13, 2413. [Google Scholar] [CrossRef]

- Schulze, M.; Seuring, S.; Ewering, C. Applying activity-based costing in a supply chain environment. Int. J. Prod. Econ. 2012, 135, 716–725. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Lin, W.-R.; Fan, Y.-W.; Lee, P.-L.; Lin, S.-J.; Hsu, J.-L. Applying a mathematical programming approach for a green product mix decision. Int. J. Prod. Res. 2012, 50, 1171–1184. [Google Scholar] [CrossRef]

- Zheng, C.W.; Abu, M.Y. Application of activity based costing for palm oil plantation. J. Mod. Manuf. Syst. Technol. 2019, 2, 1–14. [Google Scholar] [CrossRef]

- Stavropoulos, P.; Panagiotopoulou, V.C.; Papacharalampopoulos, A.; Aivaliotis, P.; Georgopoulos, D.; Smyrniotakis, K. A Framework for CO2 Emission Reduction in Manufacturing Industries: A Steel Industry Case. Designs 2022, 6, 22. [Google Scholar] [CrossRef]

- Xu, Y.; Zhang, T.; Lv, L. Assessing Carbon Emission Reduction Potential: A Case Study of Low Carbon Demand Response Technology in Fangshan District, Beijing. Sustainability 2024, 16, 1413. [Google Scholar] [CrossRef]

- Novak Mavar, K.; Gaurina-Međimurec, N.; Hrnčević, L. Significance of Enhanced Oil Recovery in Carbon Dioxide Emission Reduction. Sustainability 2021, 13, 1800. [Google Scholar] [CrossRef]

- De Souza, J.F.T.; Pacca, S.A. Carbon reduction potential and costs through circular bioeconomy in the Brazilian steel industry. Resour. Conserv. Recycl. 2021, 169, 105517. [Google Scholar] [CrossRef]

- Felício, L.; Henriques, S.T.; Guevara, Z.; Sousa, T. From electrification to decarbonization: Insights from Portugal’s experience (1960–2016). Renew. Sustain. Energy Rev. 2024, 198, 114419. [Google Scholar] [CrossRef]

| Products | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Symbol | Sheet Glass | Reflective Glass | Lacquered Glass | Tempered Glass | Capacity Cap | ||||

| Minimum demand (production volume)/ton | Pi | >280,000 | >28,333 | >30,000 | >52,500 | ||||

| Sales price/ton | Si | USD 243 | USD 384 | USD 486 | USD 332 | ||||

| Unit-level material price | |||||||||

| silicon dioxide (j = 1) | MC1 = USD 52/ton | qi1 | 0.7 | 0.7 | 0.7 | 0.7 | |||

| sodium carbonate (j = 2) | MC2 = USD 439/ton | qi2 | 0.2 | 0.2 | 0.2 | 0.2 | |||

| lime (j = 3) | MC3 = USD 56/ton | qi3 | 0.1 | 0.1 | 0.1 | 0.1 | |||

| fuel: Petroleum Coke (j = 4) | MC4 = USD 420/ton | qi4 | 0.2 | 0.25 | 0.25 | 0.3 | |||

| metallic film raw material (j = 5) | MC5 = USD 600/ton | qi5 | 0 | 0.1 | 0 | 0 | |||

| paint (j = 6) | MC6 = USD 660/ton | qi6 | 0 | 0 | 0.2 | 0 | |||

| glass (j = 7) | MC7 = USD 100/ton | qi7 | 1 | 1 | 1 | 1 | |||

| Unit-level Activity | o | ||||||||

| labor hours | Ingredients for Processing | 1 | ui1 | 2 | 2 | 2 | 2 | ||

| coating | 2 | ui2 | 0 | 2 | 0 | 0 | |||

| 3 | ui3 | 0 | 0 | 2 | 0 | ||||

| reheat | 4 | ui4 | 0 | 0 | 0 | 1.5 | |||

| machine hours | Ingredients for Processing | 1 | mhi1 | 5 | 5 | 5 | 5 | LMP1 = 2,394,594 | |

| coating | 2 | mhi2 | 0 | 3 | 0 | 0 | LMP2 = 163,680 | ||

| 3 | mhi3 | 0 | 0 | 3 | 0 | LMP3 = 169,912 | |||

| reheat | 4 | mhi4 | 0 | 0 | 0 | 2 | LMP4 = 135,589 | ||

| Products | |||||||||

| o | Symbol | Sheet Glass | Reflective Glass | Lacquered Glass | Tempered Glass | Capacity Cap | |||

| Batch-Level Activity | |||||||||

| Material handling | C5 = USD 10,000/batch | 5 | Q5 | 1 | PC5 = 20,000 | ||||

| η5 | 10,000 | ||||||||

| Set | C6 = USD 27,000/batch | 6 | di6 | 2 | 3 | 4 | 3 | PC6 = 500,000 | |

| Γi6 | 100 | 50 | 50 | 70 | |||||

| Direct labor cost | |||||||||

| Cost | HR1 = USD 4,988,641 | HR2 = USD 9,243,464 | HR3 = USD 15,762,636 | ||||||

| Labor hour | CHR1 = 28,345 | CHR2 = 39,334 | CHR3 = 53,433 | ||||||

| Wage rate | USD 176/h | USD 235/h | USD 295/h | ||||||

| Carbon tax | CTei | 0.5 | 0.8 | 0.8 | 0.7 | ||||

| Cost of each segment | CT1 = USD 1,166,667 | CT2 = USD 4,526,489 | CT3 = USD 164,929,976 | ||||||

| Upper limit of carbon emissions in each stage | CTQ1= 233,333 | CTQ2 = 452,648 | CTQ3 = 13,194,398 | ||||||

| Various tax rates | ctr1 = USD 150/ton | ctr2 = USD 300/ton | ctr3 = USD 375/ton | ||||||

| Carbon credit cost | = USD 250/ton | ||||||||

| Recycling operations (use ratio of glass) | |||||||||

| Single-period | = 0.3 | ||||||||

| Multi-period | = 0.3 | = 0.5 | = 0.7 | ||||||

| Recycling glass from the previous period | = 0.1 | ||||||||

| Model 1 (Discontinuous carbon tax) | |

| 259,623,667 | |

| Tax | 34,999,967 |

| Model 2 (Discontinuous carbon tax with carbon rights) | |

| 284,623,566 | |

| Tax | 34,999,933 |

| Carbon right | +25,000,103 |

| Model 3 (Discontinuous carbon tax with allowance) | |

| 262,123,666 | |

| Tax | 32,499,980 |

| Model 4 (Discontinuous Carbon Tax Including Tax Allowance and Carbon Rights) | |

| 287,123,566 | |

| Tax | 32,499,936 |

| Carbon right | +25,000,103 |

| Model 1 (Discontinuous carbon tax) | |||||

| Phase 1 | Phase 2 | Phase 3 | |||

| 259,330,467 | 569,324,000 | 730,956,333 | |||

| Tax | 34,999,967 | Tax | 32,182,080 | Tax | 27,610,627 |

| Model 2 (Discontinuous carbon tax with carbon rights) | |||||

| Phase 1 | Phase 2 | Phase 3 | |||

| 284,330,467 | 599,020,667 | 768,272,000 | |||

| Tax | 34,999,967 | Tax | 32,182,080 | Tax | 27,610,533 |

| Carbon right | +25,000,063 | Carbon right | +29,696,533 | Carbon right | +37,315,767 |

| Model 3 (Discontinuous carbon tax with allowance) | |||||

| Phase 1 | Phase 2 | Phase 3 | |||

| 261,830,467 | 571,824,000 | 733,456,333 | |||

| Tax | 32,499,967 | Tax | 29,682,080 | Tax | 25,110,627 |

| Model 4 (Discontinuous Carbon Tax Including Tax Allowance and Carbon Rights) | |||||

| Phase 1 | Phase 2 | Phase 3 | |||

| 286,830,267 | 601,520,667 | 770,772,000 | |||

| Tax | 32,499,980 | Tax | 29,682,070 | Tax | 25,110,537 |

| Carbon right | +25,000,033 | Carbon right | +29,696,550 | Carbon right | +37,315,767 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, W.-H.; Chang, S.-C.; Li, X.-Y. Advancing Decarbonization Efforts in the Glass Manufacturing Industry through Mathematical Optimization and Management Accounting. Processes 2024, 12, 1078. https://doi.org/10.3390/pr12061078

Tsai W-H, Chang S-C, Li X-Y. Advancing Decarbonization Efforts in the Glass Manufacturing Industry through Mathematical Optimization and Management Accounting. Processes. 2024; 12(6):1078. https://doi.org/10.3390/pr12061078

Chicago/Turabian StyleTsai, Wen-Hsien, Shuo-Chieh Chang, and Xiang-Yu Li. 2024. "Advancing Decarbonization Efforts in the Glass Manufacturing Industry through Mathematical Optimization and Management Accounting" Processes 12, no. 6: 1078. https://doi.org/10.3390/pr12061078

APA StyleTsai, W.-H., Chang, S.-C., & Li, X.-Y. (2024). Advancing Decarbonization Efforts in the Glass Manufacturing Industry through Mathematical Optimization and Management Accounting. Processes, 12(6), 1078. https://doi.org/10.3390/pr12061078