Compensation Mechanism of Controllable Load Shifting during Peak-Down Period Based on Revenue Balance Method

Abstract

:1. Introduction

- A comprehensive evaluation index that reflects the shiftable capacity and regulation costs has been established. The priority order for controllable loads to participate in shift control is determined based on this index.

- Compensation is provided on a time-of-use basis, with adjustable penalties for abandoning wind or solar power. The compensation amount and price are adjusted according to the varying levels of obstruction at different times.

- Controllable load enterprise engages in negotiations individually, so as to determine differentiated compensation prices. The equal revenue principle is utilized when the new energy generation enterprise negotiates with each controllable enterprises to ensure fairness.

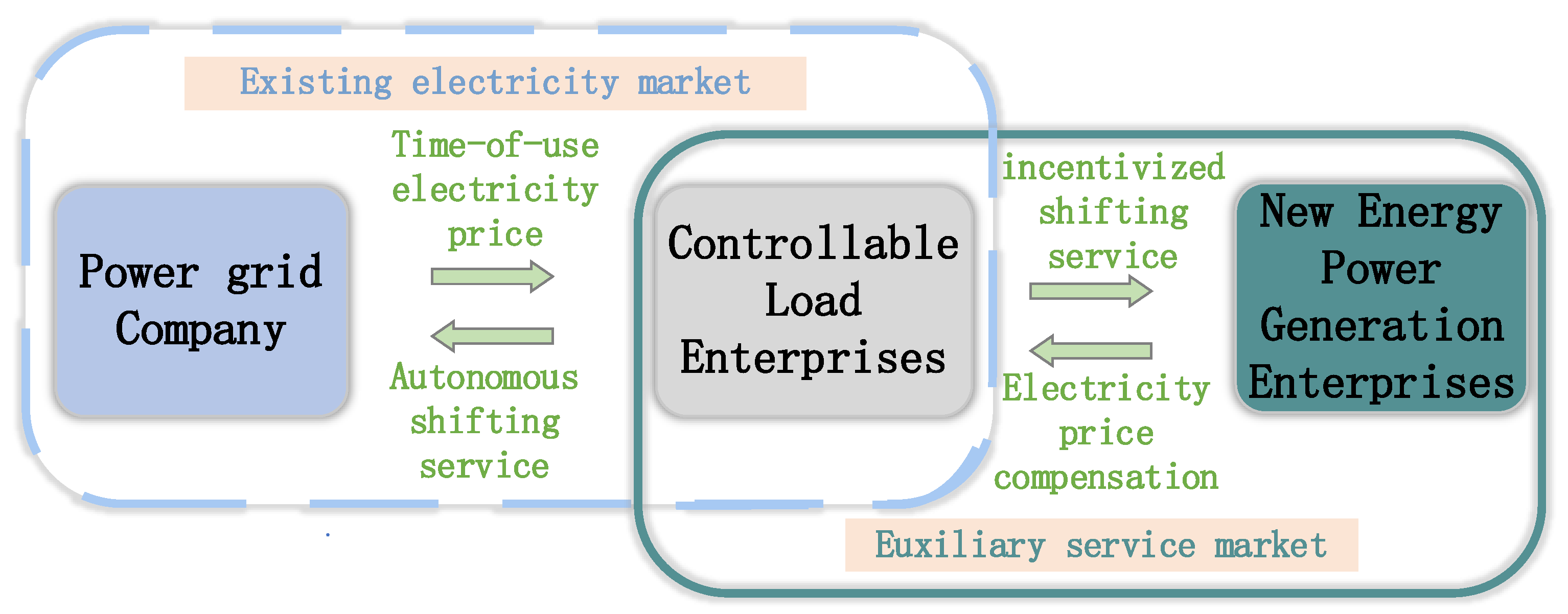

2. Construction of Trading Market and Compensation Mechanism of Controllable Load Participating in Shift Control during Peak-Down Period

2.1. Design of Auxiliary Service Market

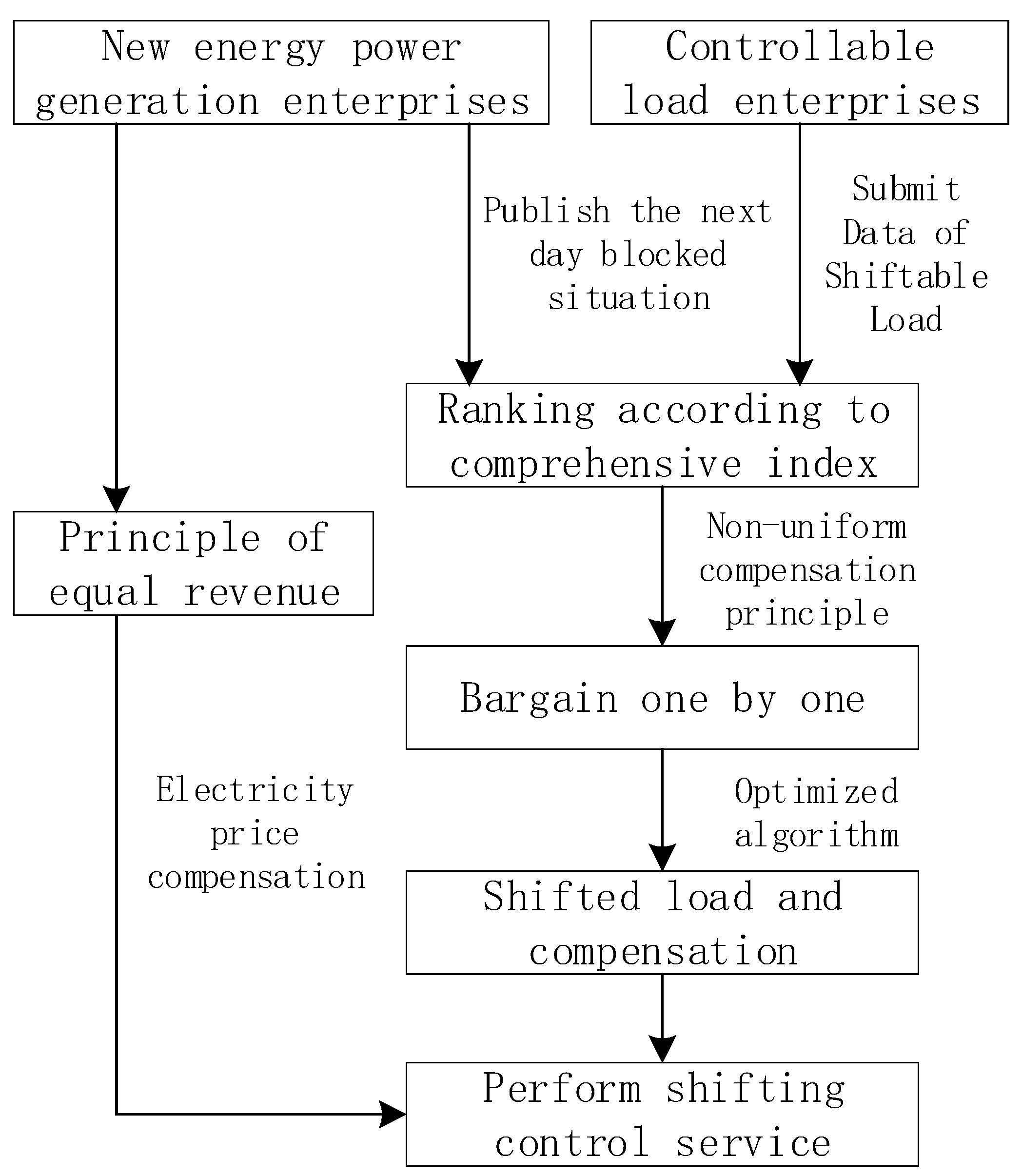

2.2. Design of Compensation Mechanism Framework

- Equal revenue principle:

- 2.

- Non-uniform compensation principle:

- 3.

- The principle of determining the compensation order through comprehensive evaluation:

3. Calculation Model for Compensation Quantity and Price

3.1. Objective Function

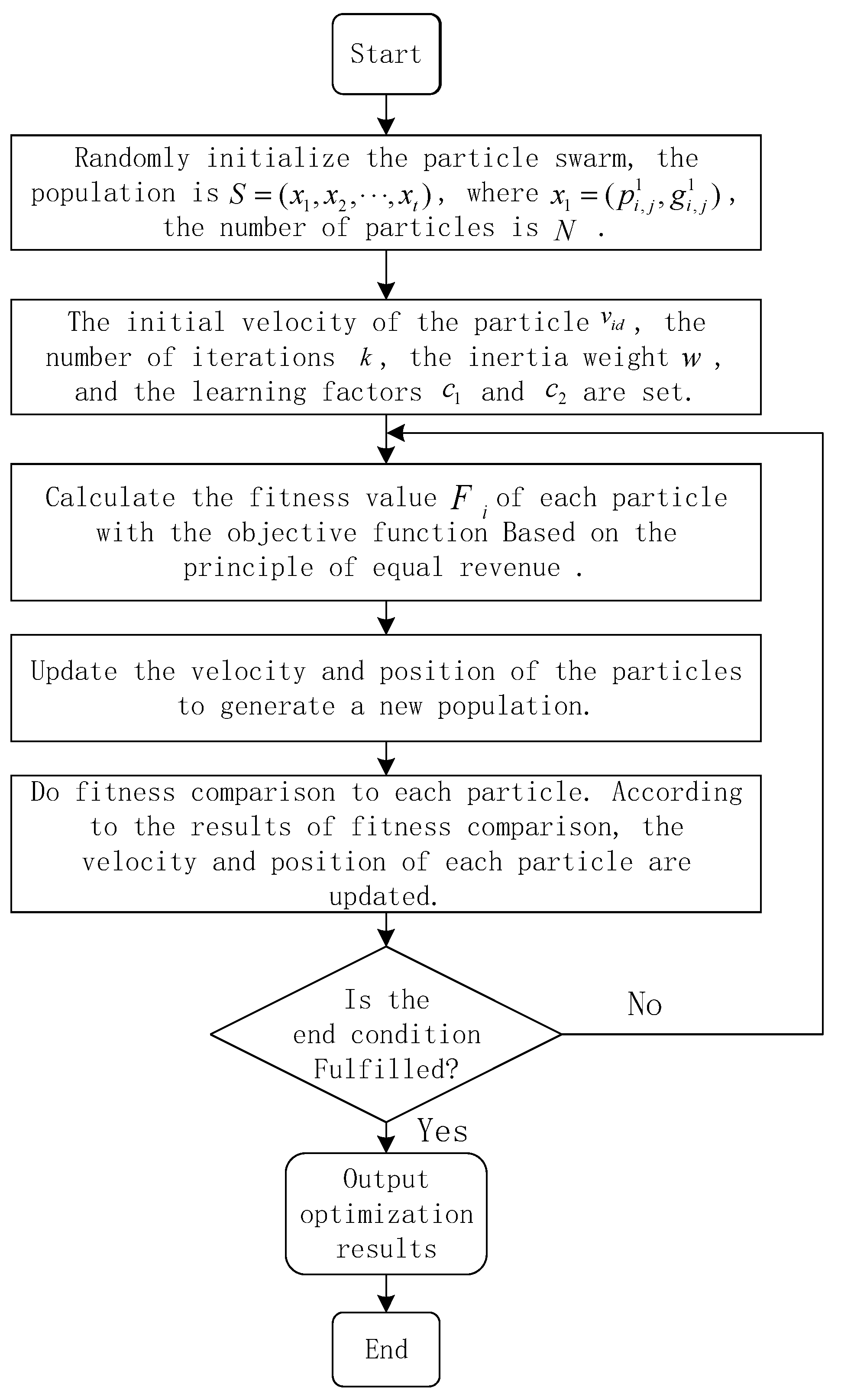

3.2. Model Solution

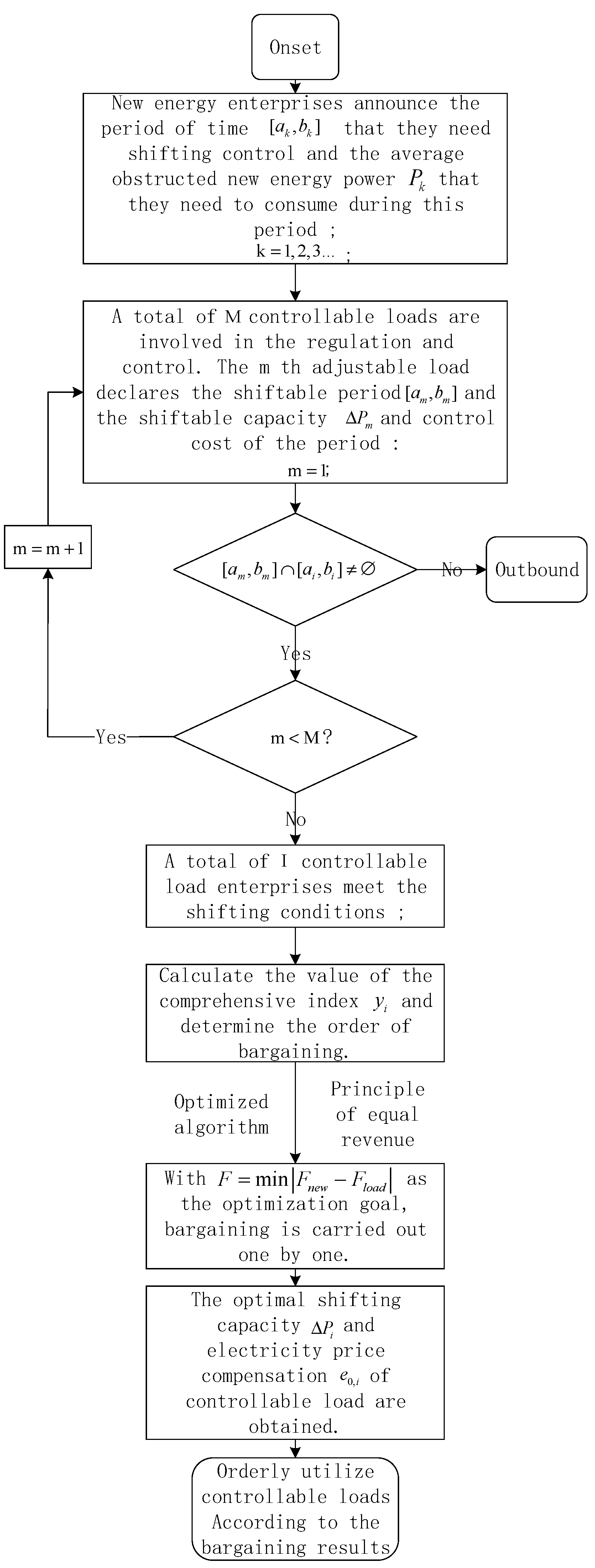

4. Controllable Load Shifting Control Compensation Method

5. Example Analysis

5.1. Parameter Settings

5.2. Load Submission

5.3. Bargaining One by One

5.4. Bargaining Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Han, X.; Chen, X.; McElroy, M.B.; Liao, S.; Nielsen, C.P.; Wen, J. Modeling Formulation and Validation for Accelerated Simulation and Flexibility Assessment on Large Scale Power Systems under Higher Renewable Penetrations. Appl. Energy 2019, 237, 145–154. [Google Scholar] [CrossRef]

- Cheng, D.; Zhang, W.; Liu, Y. Aggregate Modeling and Analysis of Air Conditioning Load Using Coupled Fokker–Planck Equations. J. Mod. Power Syst. Clean Energy 2018, 6, 1277–1290. [Google Scholar] [CrossRef]

- Avramidis, I.I.; Capitanescu, F.; Deconinck, G. Practical Approximations and Heuristic Approaches for Managing Shiftable Loads in the Multi-Period Optimal Power Flow Framework. Electr. Power Syst. Res. 2021, 190, 106864. [Google Scholar] [CrossRef]

- Golpîra, H.; Bahramara, S. Internet-of-Things-Based Optimal Smart City Energy Management Considering Shiftable Loads and Energy Storage. J. Clean. Prod. 2020, 264, 121620. [Google Scholar] [CrossRef]

- Anwar, M.B.; Qazi, H.W.; Burke, D.J.; Riaz, M.Y.; Hameed, R.; Fang, H. Harnessing the Flexibility of Demand-Side Resources. IEEE Trans. Smart Grid 2019, 10, 4151–4163. [Google Scholar] [CrossRef]

- Azeem, M.; Malik, T.N.; Muqeet, H.A.; Hussain, M.M.; Ali, A.; Khan, B.; Rehman, A.U. Combined Economic Emission Dispatch in Presence of Renewable Energy Resources Using CISSA in a Smart Grid Environment. Electronics 2023, 12, 715. [Google Scholar] [CrossRef]

- Palma, A.L.; Notte, L.L.; Landi, G.; Pietra, B.D. Application of a demand-response-optimized electrical load profile to a plant supplying an energy micro-community. In Proceedings of the 2022 Workshop on Blockchain for Renewables Integration (BLORIN), Palermo, Italy, 2–3 September 2022; pp. 97–101. Available online: https://ieeexplore.ieee.org/document/10028501 (accessed on 1 August 2024).

- Alahyari, A.; Ehsan, M.; Mousavizadeh, M.S. A Hybrid Storage-Wind Virtual Power Plant (VPP) Participation in the Electricity Markets: A Self-Scheduling Optimization Considering Price, Renewable Generation, and Electric Vehicles Uncertainties. J. Energy Storage 2019, 25, 100812. [Google Scholar] [CrossRef]

- Liu, G.; Yang, D.; Li, B. Demand Response Dynamic Pricing and Economic Scheduling Considering Energy Consumption Characteristics. In Proceedings of the 2022 Asian Conference on Frontiers of Power and Energy (ACFPE), Chengdu, China, 21–23 October 2022. [Google Scholar] [CrossRef]

- Lu, X.; Zhou, K.; Yang, S.; Wang, C.; Chen, Y. Multi-Objective Optimal Load Dispatch of Microgrid with Stochastic Access of Electric Vehicles. J. Clean. Prod. 2018, 195, 187–199. [Google Scholar] [CrossRef]

- Huang, Y.; Ip, R.K.F.; Gao, F. Optimization Model on Peak-Valley Time Electricity Consumption. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Macao, China, 15–18 December 2019. [Google Scholar] [CrossRef]

- Majidi, M.; Mohammadi-Ivatloo, B.; Anvari-Moghaddam, A. Optimal Robust Operation of Combined Heat and Power Systems with Demand Response Programs. Appl. Therm. Eng. 2019, 149, 1359–1369. [Google Scholar] [CrossRef]

- Bagherpour, R.; Mozayani, N.; Badnava, B. Optimizing Dynamic Pricing Demand Response Algorithm Using Reinforcement Learning in Smart Grid. In Proceedings of the 2020 25th International Computer Conference, Computer Society of Iran (CSICC), Tehran, Iran, 1–2 January 2020. [Google Scholar] [CrossRef]

- Gaber, I.; Ibrahim, R. Hourly Electricity Price Prediction Applying Deep Learning for Electricity Market Management. In Proceedings of the 2023 IEEE International Conference on Environment and Electrical Engineering and 2023 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Madrid, Spain, 6–9 June 2023; pp. 1–5. [Google Scholar] [CrossRef]

- Colucci, R.; Mahgou, I.; Al-Najada, H.; Mahgoub, I. Survey of Strategies to Optimize Battery Operation to Minimize the Electricity Cost in a Microgrid with Renewable Energy Sources and Electric Vehicles. IEEE Access 2024, 12, 8246–8261. [Google Scholar] [CrossRef]

- Karn, H.; Kumari, S.; Varshney, L.; Garg, L. Energy Management Strategy for Prosumers under Time of Use Pricing. In Proceedings of the 2020 IEEE International Students’ Conference on Electrical, Electronics and Computer Science (SCEECS), Bhopal, India, 22–23 February 2020. [Google Scholar]

- Dong, J.; Nie, S.; Huang, H.; Yang, P.; Fu, A.; Lin, J. Research on Economic Operation Strategy of CHP Microgrid Considering Renewable Energy Sources and Integrated Energy Demand Response. Sustainability 2019, 11, 4825. [Google Scholar] [CrossRef]

- Zhu, Y.; Xu, Q.; Liu, V. Peak Shaving Strategy of Electric Vehicle in Industrial Park Considering Differentiated Subjective Willingness. In Proceedings of the 2024 IEEE 7th International Electrical and Energy Conference (CIEEC), Harbin, China, 10–12 May 2024; pp. 4004–4009. [Google Scholar] [CrossRef]

- Zalzar, S.; Bompard, E.F. An Incentive-Based Settlement Mechanism for Participation of Flexible Demands in Day-Ahead Markets. In Proceedings of the 2019 International Conference on Smart Energy Systems and Technologies (SEST), Porto, Portugal, 9–11 September 2019. [Google Scholar] [CrossRef]

- Muhssin, M.T.; Cipcigan, L.M.; Sami, S.S.; Flynn, D.; Abeysekera, M. Potential of Demand Side Response Aggregation for the Stabilization of the Grid’s Frequency. Appl. Energy 2018, 220, 643–656. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, J.; He, L.; Jiang, Q.; Hu, Y. Ancillary Market Mechanism for Load Participation in Peak Load Shifting of Power System with High Penetration of Renewable Energy. In Proceedings of the 2022 IEEE International Conference on Energy Internet (ICEI), Stavanger, Norway, 28–29 December 2022. [Google Scholar] [CrossRef]

- Sheng, M.; Gao, H. Peaking Control Strategy of Stackelberg Game for Buildings Based on Cluster Classification Incentive. In Proceedings of the 2023 China Automation Congress (CAC), Chongqing, China, 17–19 November 2023; pp. 4662–4667. [Google Scholar] [CrossRef]

| The Obstruction Period That Needs Load Shifting | The Average Obstructed Power That Needs to Be Absorbed (MW) |

|---|---|

| 0:00–2:00 | 270 |

| 2:00–4:00 | 430 |

| Period Characteristics | Time Period | Electricity Price (CNY/MWh) |

|---|---|---|

| Peak hours | 7:00–9:00, 18:00–24:00 | 744 |

| Usual hours | Time other than peak hours and valley hours | 500 |

| Valley hours | 2:00–4:00, 11:00–17:00 | 256 |

| Controllable Load Enterprises | Shiftable Period | Shiftable Capacity (MW) | Unit Labor Cost (CNY/h) | Labor Quantity | Unit Energy Consumption Cost (CNY/MWh) | Material Cost (CNY/MWh) |

|---|---|---|---|---|---|---|

| Controllable load1 | 7:00–9:00→2:00–4:00 | 250 | 500 | 3 | 45 | 200 |

| Controllable load2 | 7:00–9:00→2:00–4:00 | 350 | 300 | 3 | 40 | 150 |

| Controllable load3 | 7:00–9:00→2:00–4:00 | 200 | 700 | 6 | 64 | 300 |

| Controllable load4 | 7:00–9:00→0:00–2:00 | 180 | 600 | 3 | 25 | 200 |

| Controllable load5 | 7:00–9:00→0:00–2:00 | 300 | 300 | 3 | 20 | 150 |

| Controllable Load Enterprises | Shifting Period | Shiftable Power Index | Shift Control Cost Index | Comprehensive Index |

|---|---|---|---|---|

| Controllable load 5 | 0:00–2:00 | 1 | 0.815 | 0.907 |

| Controllable load 4 | 0:00–2:00 | 0.6 | 1 | 0.8 |

| Controllable load 2 | 2:00–4:00 | 1 | 0.931 | 0.966 |

| Controllable load 1 | 2:00–4:00 | 0.714 | 0 | 0.857 |

| Controllable load 3 | 2:00–4:00 | 0.571 | 0.815 | 0.693 |

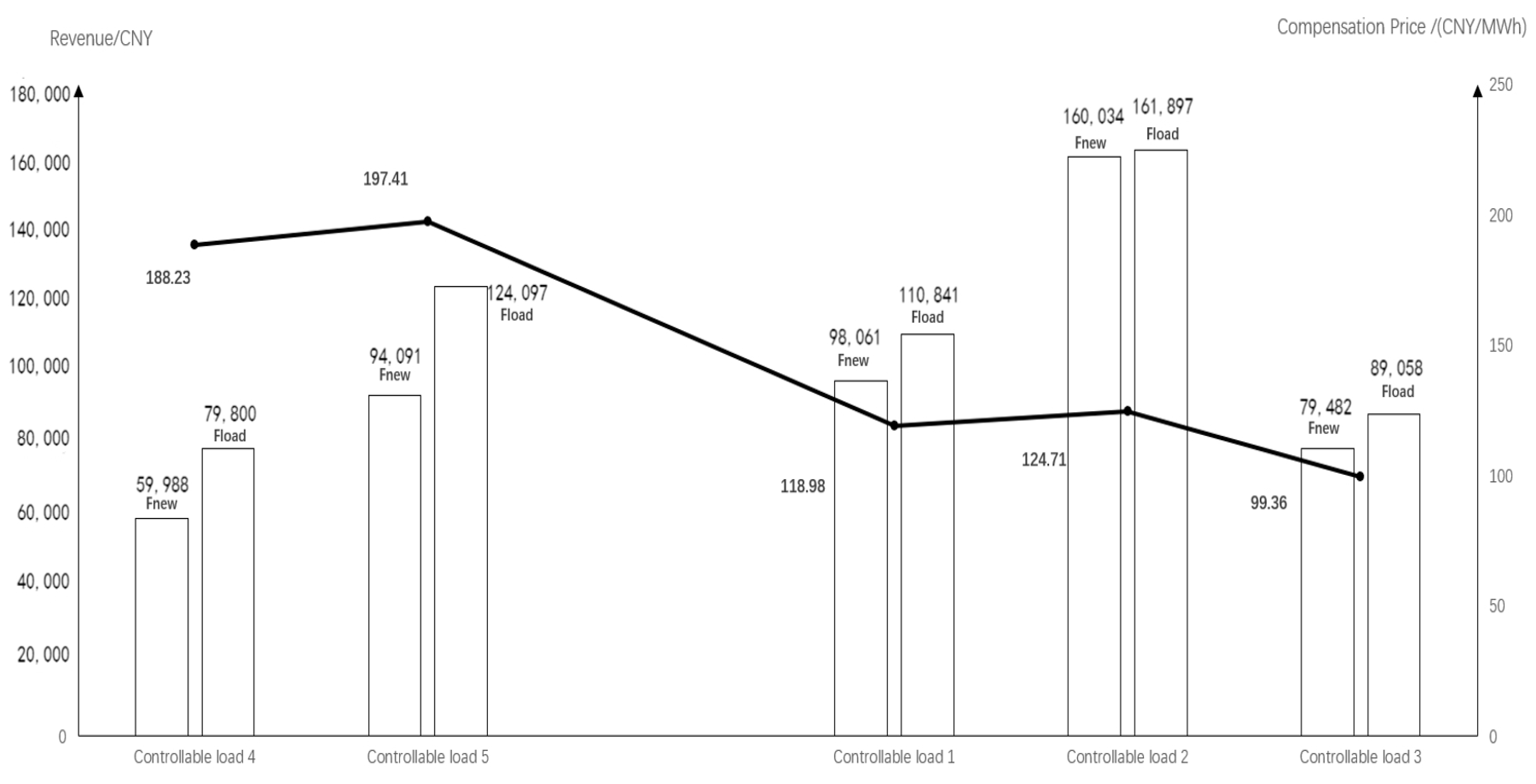

| Controllable Load Enterprises | Fnew/CNY | Fload/CNY | F/CNY | Compensation Price/(CNY/MWh) | Electricity Price after Compensation (CNY/MWh) | Shifted Electricity/MWh |

|---|---|---|---|---|---|---|

| Controllable load 5 | 94,091 | 124,097 | 30,006 | 197.41 | 302.59 | 239.65 |

| Controllable load 4 | 59,988 | 79,400 | 19,412 | 188.23 | 311.77 | 157.13 |

| Controllable load 2 | 160,034 | 161,897 | 1863 | 124.71 | 131.29 | 283.1 |

| Controllable load 1 | 98,061 | 110,841 | 12,780 | 118.98 | 137.02 | 196.96 |

| Controllable load 3 | 79,482 | 89,058 | 9577 | 99.36 | 156.64 | 168.88 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Du, W.; Liang, C.; Xu, Y.; Li, Y. Compensation Mechanism of Controllable Load Shifting during Peak-Down Period Based on Revenue Balance Method. Processes 2024, 12, 1692. https://doi.org/10.3390/pr12081692

Li Y, Du W, Liang C, Xu Y, Li Y. Compensation Mechanism of Controllable Load Shifting during Peak-Down Period Based on Revenue Balance Method. Processes. 2024; 12(8):1692. https://doi.org/10.3390/pr12081692

Chicago/Turabian StyleLi, Yalong, Wenlu Du, Chen Liang, Yuzhi Xu, and Yaxin Li. 2024. "Compensation Mechanism of Controllable Load Shifting during Peak-Down Period Based on Revenue Balance Method" Processes 12, no. 8: 1692. https://doi.org/10.3390/pr12081692