Modeling the Tripartite Coupling Dynamics of Electricity–Carbon–Renewable Certificate Markets: A System Dynamics Approach

Abstract

1. Introduction

2. Methodology and Data

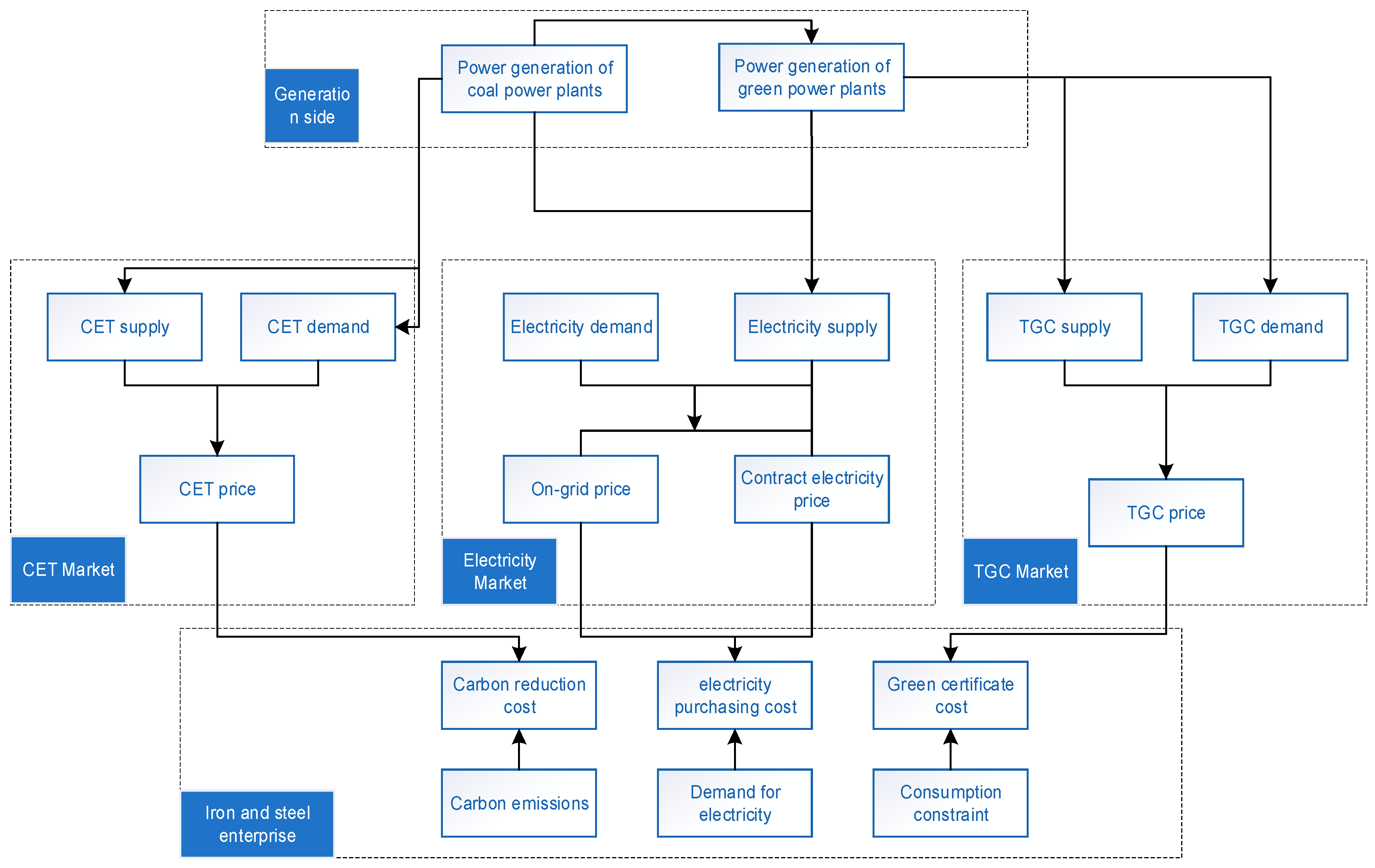

2.1. Theoretical Framework Analysis

2.2. Model Design

2.2.1. Electricity Market

2.2.2. CET Market

2.2.3. TGC Market

2.3. Data

3. Results

3.1. Simulation Results

3.2. Future Scenarios

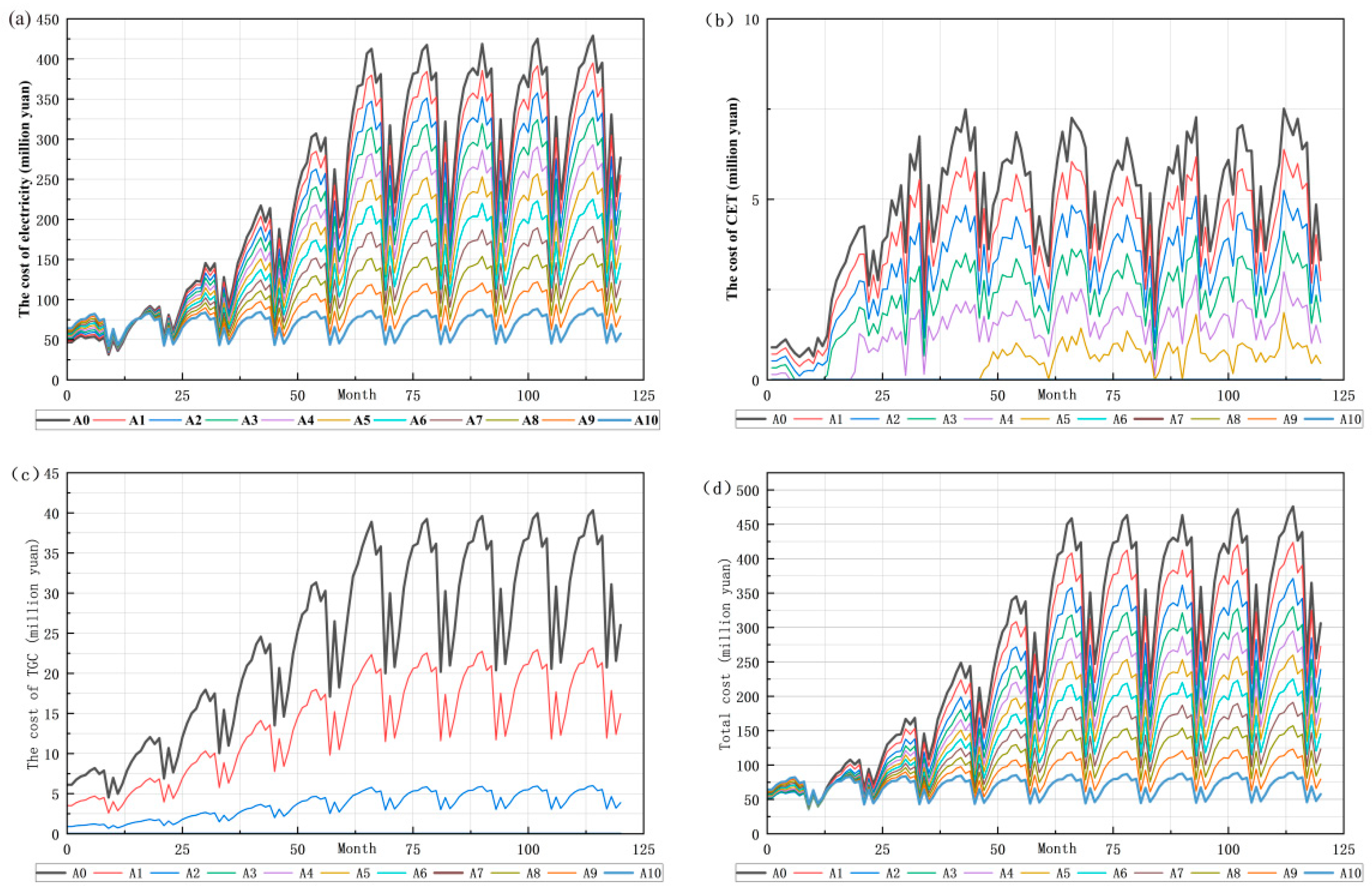

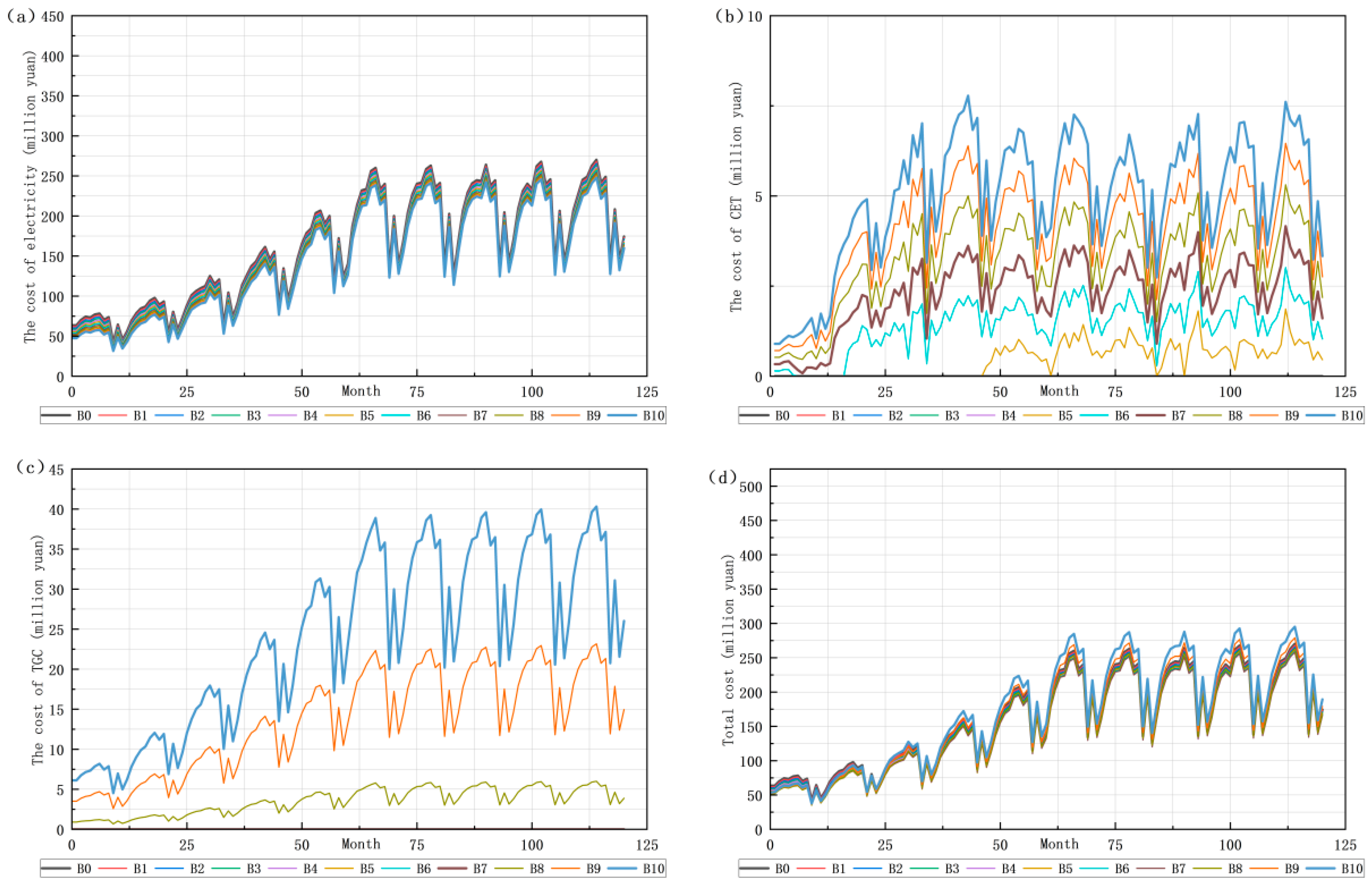

3.2.1. Single Scenario

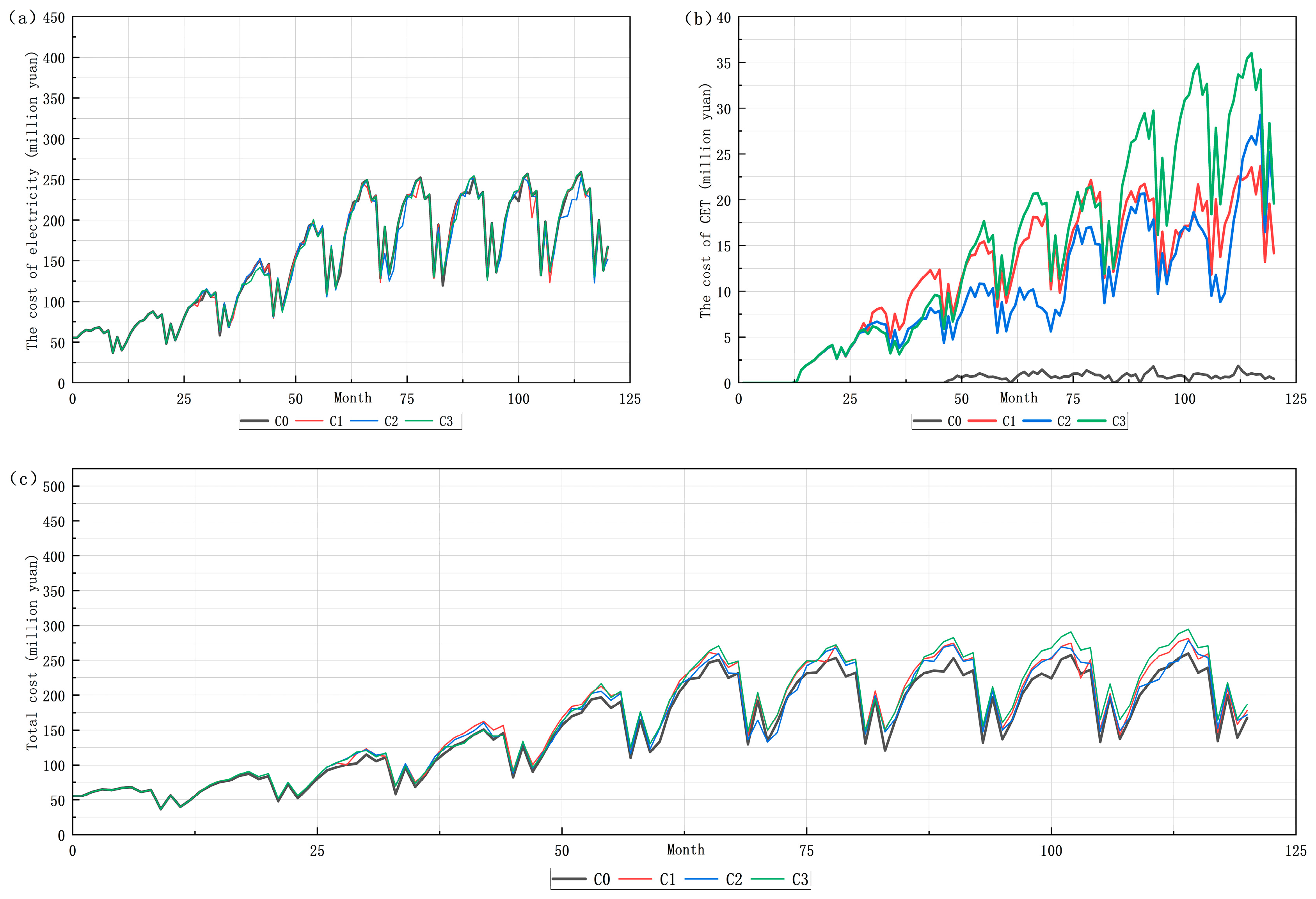

3.2.2. Comprehensive Scenario

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, W.; Xu, Y.; Streets, D.G.; Wang, C. Can new-type urbanization realize low-carbon development? A spatiotemporal heterogeneous analysis in 288 cities and 18 urban agglomerations in China. Clean. Prod. 2023, 420, 138426. [Google Scholar] [CrossRef]

- Li, X.T.; Wang, J.; Cao, J.L. The Practical Experience of Low-Carbon Economic Development in the European Union and its Implications for China. Intertrade 2023, 62–74. [Google Scholar] [CrossRef]

- Georgios, X.; Evelina, T. Empirical testing of the visualizations of climate change mitigation scenarios with citizens: A comparison among Germany, Poland, and France. Glob. Environ. Change 2021, 70, 102324. [Google Scholar]

- Habib, M.A.; Nemitallah, M.A.; Afaneh, D.A. Numerical investigation of a hybrid polymeric-ceramic membrane unit for carbon-free oxy-combustion applications. Energy 2018, 147, 362–376. [Google Scholar] [CrossRef]

- Zheng, C.; Zhang, Y.F.; Long, L.J. Study on National Principal Energy Consumption Structural Modulation and Optimization in New Era. Coal Geol. China 2021, 33, 49–51. [Google Scholar]

- Chen, H.L.; Yang, X.K.; Wang, Z.B. The impact of Digital Economy on the Industrial Carbon Emission intensity and its Spillover Effect. Res. Environ. Sci. 2023, 1–20. [Google Scholar]

- Xu, X. Examining the impact of global uncertainty shocks on the digital economy’s role in China’s energy transition and green economic recovery. Econ. Chang. Restruct. 2024, 57, 184. [Google Scholar] [CrossRef]

- Feng, T. Price Discovery Function Research on EU Carbon Emission Futures Market. Trade Fair Econ. 2024, 19–22. [Google Scholar]

- Bayer, P.; Aklin, M. The European Union Emissions Trading System reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef]

- Xu, L.; Yang, J. Carbon pricing policies and renewable energy development: Analysis based on cross-country panel data. J. Environ. Manag. 2024, 366, 121784. [Google Scholar] [CrossRef]

- Wang, X.P.; Wang, X.P. Research on the Dependence Structure and Risk Spillover Effect Between EU and Domestic Carbon Trading Market. J. Ind. Technol. Econ. 2021, 40, 72–81. [Google Scholar]

- Jiang, Y.; Cao, H.; Yang, L.; Fei, F.; Li, J.; Lin, Z. Mechanism Design and lmpact Analysis of Renewable Portfolio Standard. Autom. Electr. Power Syst. 2020, 44, 187–199. [Google Scholar]

- Jiang, Y.W.; Chen, W. Review and Prospect of Coupled Electricity-Carbon-Renewable Portfolios Trading. Electr. Power Constr. 2023, 44, 1–13. [Google Scholar]

- Huang, C.; Yan, Z.; Chen, S.; Yang, L.; Li, X. Two-stage market clearing approach to mitigate generator collusion in Eastern China electricity market via system dynamics method. IET Gener. Transm. Distrib. 2019, 13, 3346–3353. [Google Scholar] [CrossRef]

- Chi, Y.Y.; Zhao, H.; Hu, Y.; Yuan, Y.K.; Pang, Y.X. The impact of allocation methods on carbon emission trading under electricity marketization reform in China: A system dynamics analysis. Energy 2022, 259, 125034. [Google Scholar] [CrossRef]

- Chinese National Committee of CIRED. CICED 2022 Conference Proceeding. In Proceedings of the China International Conference on Electricity Distribution (CICED), (2022), Changsha, China, 7–8 September 2022; pp. 1–1825. [Google Scholar]

- Xu, W.; Jiang, C.; Jia, K.; Yu, X. Did the "double carbon" policy improve the green total factor productivity of iron and steel enterprises? A quasi-natural experiment based on carbon emission trading pilot. Front. Energy Res. 2023, 11, 1307347. [Google Scholar] [CrossRef]

- Zhang, C.; Zhang, X. Climate responsibility optimization model for the cooperative game between steel sector and consumer side in China. J. Clean. Prod. 2022, 370, 133592. [Google Scholar] [CrossRef]

- Zhu, X.H.; Li, S.M.; Zeng, A.Q. A review and prospect of research on carbon emissions from the criticametal industry chain under clean energy transition. Resour. Sci. 2023, 45, 1–17. [Google Scholar]

- Ewa, C.P.; Anna, S.; Dariusz, S. The Potential and Development of the Geothermal Energy Market in Poland and the Baltic States-Selected Aspects. Energies 2022, 15, 4142. [Google Scholar] [CrossRef]

- Yang, S.; Wang, M. Study on the mechanism of green power-carbon market intrinsic coupling and power sector trading strategies. Renew. Sustain. Ener. 2024, 16, 65902. [Google Scholar] [CrossRef]

- Gu, Y.; Liu, W.; Wang, B.; Tian, B.; Yang, X.; Pan, C. Analysis and Prediction of Energy, Environmental and Economic Potentials in the Iron and Steel Industry of China. Processes 2023, 11, 3258. [Google Scholar] [CrossRef]

- Zhou, S.; Gu, A.; Tong, Q.; Guo, Y.; Wei, X. Multi-scenario simulation on reducing CO2 emissions from China’s major manufacturing industries targeting 2060. Ind. Ecol. 2022, 26, 850–861. [Google Scholar] [CrossRef]

- Xu, L.; Zhao, X. The synergistic effect between Renewable Portfolio Standards and carbon emission trading system: A perspective of China. Renew. Energy 2023, 211, 1010–1023. [Google Scholar]

- Song, X.H.; Han, J.J.; Zhang, L.; Zhao, C.P.; Wang, P.; Liu, X.Y.; Li, Q.C. Impacts of renewable portfolio standards on multi-market coupling trading of renewable energy in China: A scenario-based system dynamics model. Energy Policy 2021, 159, 112647. [Google Scholar] [CrossRef]

- Zhu, B.Z.; Tang, J.J.; Jiang, M.X.; Wang, P. Simulation and regulation of carbon market risk based on system dynamics. Syst. Eng. Theory Pract. 2022, 42, 1859–1872. [Google Scholar]

- Zhao, X.G.; Zhang, Y.Z. The System Dynamics (SD) Analysis of the Government and Power Producers’ Evolutionary Game Strategies Based on Carbon Trading (CT) Mechanism: A Case of China. Sustainability 2018, 10, 1150. [Google Scholar] [CrossRef]

- Zhao, J.; Zhang, Q.; Zhou, D. Can marketed on-grid price drive the realization of energy transition in China’s power industry under the background of carbon neutrality? Energy 2023, 276, 127556. [Google Scholar] [CrossRef]

- Zhao, X.G.; Li, P.L.; Zhou, Y. Which policy can promote renewable energy to achieve grid parity? Feed-in tariff vs. renewable portfolio standards. Renew Energy 2020, 162, 322–333. [Google Scholar]

- Ahmed, T.; Bhatti, A.A. Do power sector reforms affect electricity prices in selected Asian countries? Energy Policy 2019, 129, 1253–1260. [Google Scholar] [CrossRef]

- Zheng, Y.; Meng, C.; Wang, Z.; Li, C.; Li, Q.; Wang, P.; Yang, Z.; Qing, H.; Wu, Y. Risk Control Optimization Models of Different Power Market Purchasing Combinations of Power Selling Companies. In Proceedings of the 2019 IEEE 3rd Conference on Energy Internet and Energy System Integration (EI2), Changsha, China, 8–10 November 2019; pp. 1–6. [Google Scholar]

- Wang, C.; Ni, M.; Shi, Y.; Zhang, L.; Li, W.; Li, X. Optimizing Power Market Clearing with Segmented Electricity Prices: A Bilevel Model. Sustainability 2023, 15, 13575. [Google Scholar] [CrossRef]

- Xu, S.; Xu, Q. Optimal pricing decision of tradable green certificate for renewable energy power based on carbon-electricity coupling. Clean. Prod. 2023, 410, 137111. [Google Scholar] [CrossRef]

- Yang, H.P.; Chen, X.; Yan, F.F.; Zhang, L. Study on the optimization and management of electricity purchase in Jiangxi province based on the electricity markets. In Proceedings of the 20th International Conference on Computer Supported Cooperative Work in Design (CSCWD), Nanchang, China, 4–6 May 2016; pp. 566–569. [Google Scholar]

- Zhang, P.; Cheng, J. The price behavior characteristics of China and Europe carbon emission trading market based on the perspective of time scaling and expected returns. PLoS ONE 2024, 19, e0298265. [Google Scholar] [CrossRef] [PubMed]

- Zhang, C.; Zhang, X. Evolutionary game analysis of air pollution co-investment in emission reductions by steel enterprises under carbon quota trading mechanism. J. Environ. Manag. 2022, 317, 115376. [Google Scholar] [CrossRef]

- Wang, X.T.; Wu, Z.X.; Yuan, G.D. Carbon Emission Rights Value Assessment Model Construction—A Case Study of Datang International Power Generation Co., Ltd. Financ. Account. Mon. 2020, 37–42. [Google Scholar] [CrossRef]

- Zhang, X.; Fan, D. Carbon emission quota allocation of high energy consumption industries in undeveloped areas—A case study of Inner Mongolia Autonomous Region. Heliyon 2022, 8, e11241. [Google Scholar] [CrossRef]

- Zhao, X.; Xu, L.; Zhou, Y. How to promote the effective implementation of China’s Renewable Portfolio Standards considering non-neutral technology? Energy 2022, 238, 121748. [Google Scholar]

- Chang, X.; Wu, Z.; Wang, J.; Zhang, X.; Zhou, M.; Yu, T.; Wang, Y. The coupling effect of carbon emission trading and tradable green certificates under electricity marketization in China. Renew. Sustain. Energy Rev. 2023, 187, 113750. [Google Scholar] [CrossRef]

| Numbers | Variables | Initial Value | Unit |

|---|---|---|---|

| 1 | Regional Power Grid Emission Factor | 0.6101 | t/MWh |

| 2 | Power Demand per Unit of Product | 550 | kWh/t |

| 3 | Carbon Emission Factor per Unit of Product | 1.67 | tCO2/t |

| 4 | Contractual Power Purchase Proportion | 95 | % |

| 5 | Mid- and Long-term Green Electricity Purchase Proportion | 50 | % |

| 6 | Mid- to Long-term Thermal Power Purchase Proportion | 50 | % |

| 7 | Annual Growth Rate of Enterprise Output | 0.91 | % |

| Scenario | Parameter | Parameter Type | Adjustment Range |

|---|---|---|---|

| A | Medium and Long-Term Contract Proportion | Trading behavior | [0, 1] |

| B | Thermal Power Proportion | Trading behavior | [0, 1] |

| C | Carbon Quota Proportion | Policy change | [0, 1] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pan, Z.; Wang, Y.; Guo, J.; Zhang, X.; Xue, S.; Li, W.; Chen, Z.; Liu, Z. Modeling the Tripartite Coupling Dynamics of Electricity–Carbon–Renewable Certificate Markets: A System Dynamics Approach. Processes 2025, 13, 868. https://doi.org/10.3390/pr13030868

Pan Z, Wang Y, Guo J, Zhang X, Xue S, Li W, Chen Z, Liu Z. Modeling the Tripartite Coupling Dynamics of Electricity–Carbon–Renewable Certificate Markets: A System Dynamics Approach. Processes. 2025; 13(3):868. https://doi.org/10.3390/pr13030868

Chicago/Turabian StylePan, Zhangrong, Yuexin Wang, Junhong Guo, Xiaoxuan Zhang, Song Xue, Wei Li, Zhuo Chen, and Zhenlu Liu. 2025. "Modeling the Tripartite Coupling Dynamics of Electricity–Carbon–Renewable Certificate Markets: A System Dynamics Approach" Processes 13, no. 3: 868. https://doi.org/10.3390/pr13030868

APA StylePan, Z., Wang, Y., Guo, J., Zhang, X., Xue, S., Li, W., Chen, Z., & Liu, Z. (2025). Modeling the Tripartite Coupling Dynamics of Electricity–Carbon–Renewable Certificate Markets: A System Dynamics Approach. Processes, 13(3), 868. https://doi.org/10.3390/pr13030868