The Role of Promoting Agricultural and Food Products Certified with European Union Quality Schemes

Abstract

1. Introduction

2. Literature Review

2.1. EU Quality Schemes: Context, Advantages, and Challenges

2.2. Consumer Trends and Certification

2.3. Role of Certification in Decision-Making

2.4. Consumer Clustering on EU Quality Schemes Food Products

3. Materials and Methods

3.1. Variables Based on Previous Studies

3.2. Questionnaire Development

3.3. Data Gathering

3.4. Sample Representativeness

3.5. Sample Characteristics

3.6. Barriers to Non-Consumption

3.7. Data Analysis

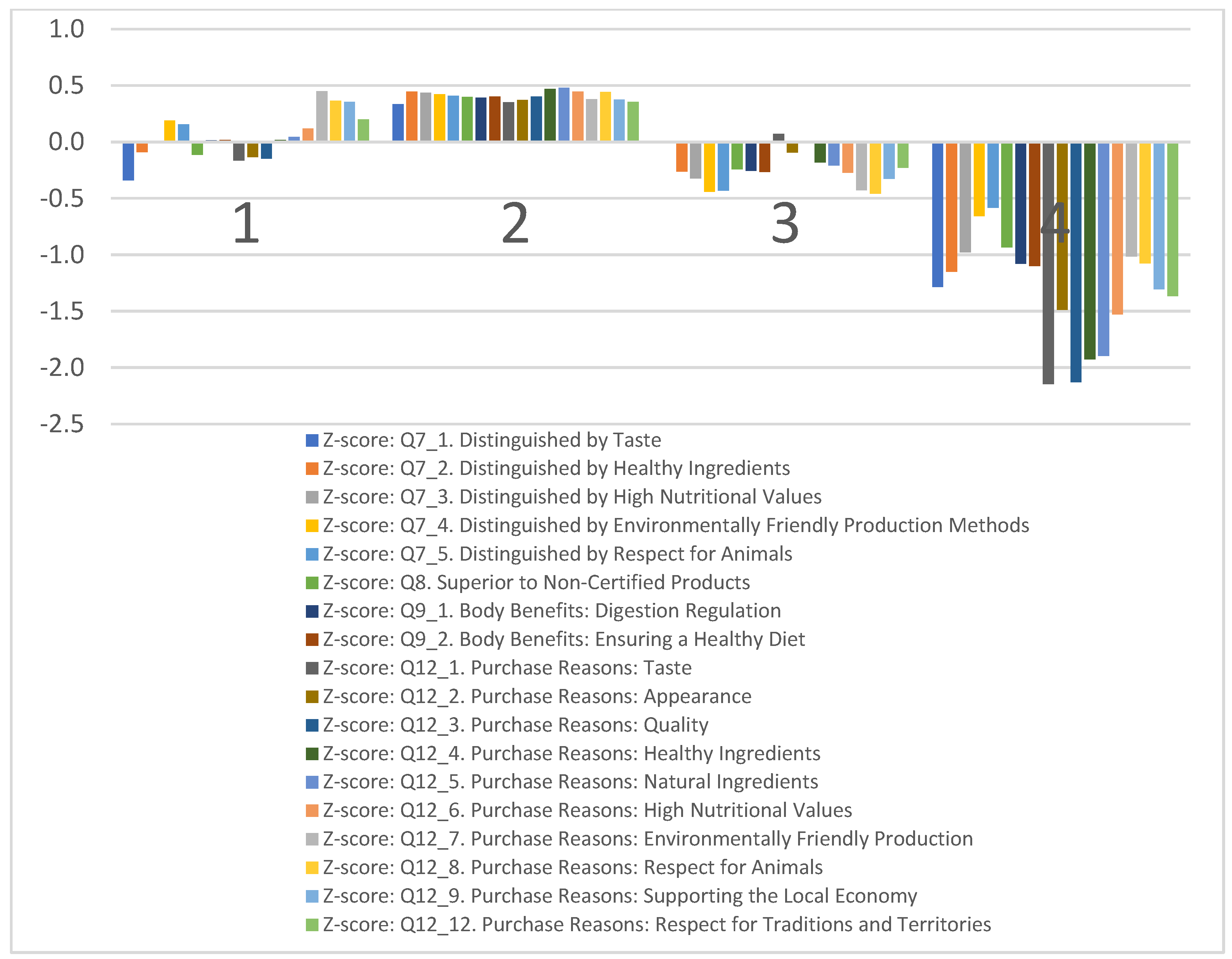

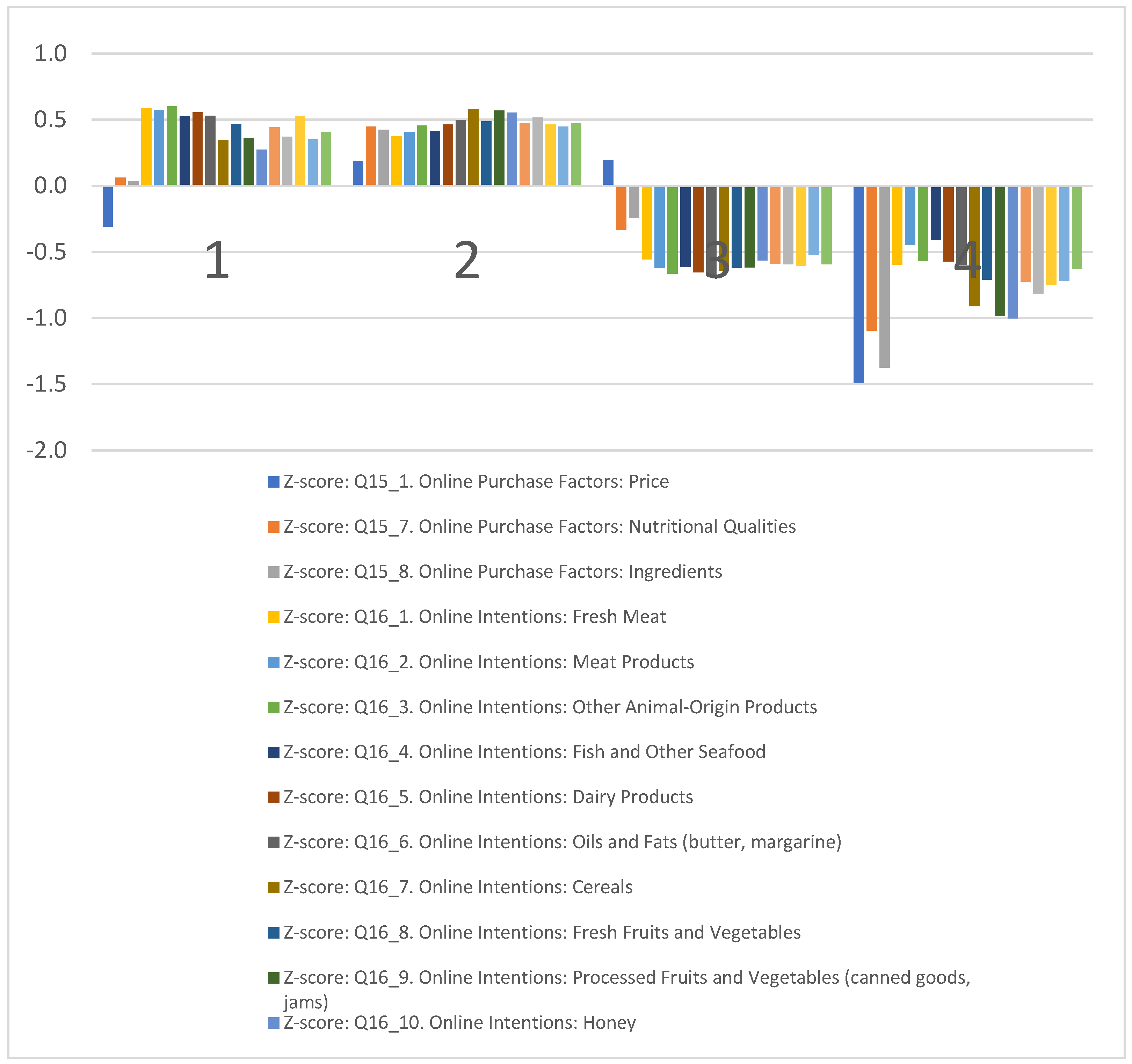

4. Results

5. Discussion

6. Conclusions

6.1. Theoretical Implications

6.2. Managerial Implications

6.3. Limitations and Suggestions for Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire

- (1)

- Have you heard of the quality schemes used for the certification of agri-food products?

- (2)

- Do you recognize the following logos?

- (3)

- How did you primarily learn about certified Romanian agri-food products?

- (4)

- How much do you think these quality schemes are promoted online among consumers?

- (5)

- To what extent do you consider these schemes an indicator of product quality?

- (6)

- How much do you trust the quality of Romanian agri-food products certified with such schemes?

- (7)

- To what extent do you think certified agri-food products distinguish themselves?

- (8)

- How much do you think certified agri-food products are superior to uncertified products in the same category?

- (9)

- What benefits do you think the consumption of certified Romanian agri-food products has for the human body?

- (10)

- Where do you most often buy certified Romanian agri-food products?

- (11)

- How often do you buy certified Romanian agri-food products online?

- (12)

- How important are the following reasons for you to buy certified Romanian agri-food products?

- (13)

- How much do you trust buying certified Romanian agri-food products online?

- (14)

- When purchasing online, is quality the first aspect you consider?

- (15)

- To what extent would the following factors influence you when buying a certified Romanian product online compared to a conventional one in the same category?

- (16)

- How much would you buy online certified agri-food products in the following categories?

- (17)

- How often do you consume the following certified Romanian agri-food products?

- (18)

- To what extent do your family members consume certified quality scheme agri-food products?

- (19)

- To what extent would you recommend certified Romanian agri-food products to other people?

- (20)

- How willing are you to pay a higher price for certified Romanian agri-food products compared to conventional products in the same category?

- (21)

- What amount would you be willing to pay extra for certified agri-food products compared to conventional ones in the same category?

- (22)

- How do you rate the following aspects of the prices of certified Romanian agri-food products?

- (23)

- How easy was it for you to buy certified quality scheme agri-food products online during the COVID-19 pandemic?

- (24)

- To what extent do you think buying certified quality scheme agri-food products online protected your health during the COVID-19 pandemic compared to buying them in-store?

- (25)

- What are your views on the following statements?

- (26)

- To what extent do you believe certified agri-food products have a positive impact on the environment?

- (27)

- How much do you read the information on food product packaging?

- (28)

- To what extent do you read/view the following information on food product packaging?

- (29)

- How often do you access the following online channels?

- (30)

- How often have you received emails informing you about certified Romanian agri-food products?

- (31)

- Have you seen ads or posts on social media that include certified Romanian agri-food products?

- (32)

- How much do you read/are interested in information received?

- (33)

- To what extent is your diet influenced by?

- (34)

- Do you suffer from any of the following conditions?

- (35)

- What is your net monthly income?

- (36)

- What is the highest level of education you have completed?

- (37)

- Gender?

- (38)

- Age range?

- (39)

- What is your current occupation?

- (40)

- Where is your permanent residence?

- (41)

- In which development region of Romania is your permanent residence?

References

- European Commission. Agriculture and Rural Development. 2023. Available online: https://agriculture.ec.europa.eu/farming/geographical-indications-and-quality-schemes/geographical-indications-and-quality-schemes-explained_en (accessed on 20 November 2023).

- Mattas, K.; Baourakis, G.; Tsakiridou, E.; Hedoui, M.A.; Hosni, H. PDO olive oil products: A powerful tool for farmers and rural areas. J. Int. Food Agribus. Mark. 2020, 32, 313–336. [Google Scholar] [CrossRef]

- Di Vita, G.; Zanchini, R.; Spina, D.; Pappalardo, G.; Schimmenti, E.; D’Amico, M. The Hierarchical Utility of Credence Attributes of Orange Marmalade: What do Consumers Look for in a Multi-Claim Food Product? J. Mark. Commun. 2023, 1–30. [Google Scholar] [CrossRef]

- Crupi, M. Innovating within Tradition: Are PDOs and PGIs Loosening Their Link to Origin? Research Paper; European IP Institutes Network: Munich, Germany, 2020; Available online: https://www.eipin-innovationsociety.org/wp-content/uploads/2020/07/Working-paper-Maurizio-Crupi-20-01.pdf (accessed on 20 February 2024).

- Menozzi, D.; Yeh, C.H.; Cozzi, E.; Arfini, F. Consumer Preferences for Cheese Products with Quality Labels: The Case of Parmigiano Reggiano and Comté. Animals 2022, 12, 1299. [Google Scholar] [CrossRef] [PubMed]

- Panin, B. Market perspectives for Serbian PDO products in the republic of Serbia. Cent. Eur. J. Reg. Dev. Tour. 2022, 128, 14. [Google Scholar] [CrossRef]

- Facendola, R.; Ottomano Palmisano, G.; De Boni, A.; Acciani, C.; Roma, R. Profiling Citizens on Perception of Key Factors of Food Security: An Application of K-Means Cluster Analysis. Sustainability 2023, 15, 9915. [Google Scholar] [CrossRef]

- Bonetti, E.; Mattiacci, A.; Simoni, M. Communication patterns to address the consumption of PDO products. Br. Food J. 2020, 122, 390–403. [Google Scholar] [CrossRef]

- Papoutsi, G.S. Consumer Valuation of European Certification Labels on Extra Virgin Olive Oil: Assessing the Impact of Multiple Labels and Consumer Heterogeneity. J. Food Prod. Mark. 2023, 29, 291–307. [Google Scholar] [CrossRef]

- Goudis, A.; Skuras, D. Consumers’ awareness of the EU’s protected designations of origin logo. Br. Food J. 2021, 123, 1–18. [Google Scholar] [CrossRef]

- European Commission. GI and TSG Schemes Benefit Producers. 2023. Available online: https://agriculture.ec.europa.eu/news/gi-and-tsg-schemes-benefit-producers-2021-12-21_en (accessed on 20 November 2023).

- Papoutsi, G.S. The effect of single and multilabeling on extra virgin olive oil consumer choices: The case of organic and PDO labels. Agric. Econ. Res. Inst. Hellenic Agric. Organ 2023, 11528. [Google Scholar]

- Herz, M.; Diamantopoulos, A.; Riefler, P. Consumers’ use of ambiguous product cues: The case of “regionality” claims. J. Consum. Aff. 2023, 57, 1395–1422. [Google Scholar] [CrossRef]

- Simchenko, K. Protection Against Misuse, Imitation or Evocation of Geographical Indications. Doctoral Dissertation, Mykolo Romerio Universitetas, Vilniaus, Lithuania, 2023. [Google Scholar]

- Savelli, E.; Bravi, L.; Francioni, B.; Murmura, F.; Pencarelli, T. PDO labels and food preferences: Results from a sensory analysis. Br. Food J. 2021, 123, 1170–1189. [Google Scholar] [CrossRef]

- Bouhaddane, M.; Halawany-Darson, R.; Rochette, C.; Amblard, C. Legitimate or Not, Does Is Really Matter? A Reading of the PDO Label’s Legitimacy through Consumers’ Perception. Foods 2023, 12, 2365. [Google Scholar] [CrossRef] [PubMed]

- Kendall, H.; Clark, B.; Rhymer, C.; Kuznesof, S.; Hajslova, J.; Tomaniova, M.; Brereton, P.; Frewer, L. A systematic review of consumer perceptions of food fraud and authenticity: A European perspective. Trends Food Sci. Technol. 2019, 94, 79–90. [Google Scholar] [CrossRef]

- Jantyik, L. The Food Quality Schemes of the European Union and Their Implications on the Hungarian Market. Doctoral Dissertation, Budapesti Corvinus Egyetem, Budapest, Hungary, 2023. [Google Scholar]

- Cardin, M.; Cardazzo, B.; Mounier, J.; Novelli, E.; Coton, M.; Coton, E. Authenticity and typicity of traditional cheeses: A review on geographical origin authentication methods. Foods 2022, 11, 3379. [Google Scholar] [CrossRef] [PubMed]

- Di Pinto, A.; Mottola, A.; Marchetti, P.; Savarino, A.; Tantillo, G. Fraudulent species substitution in e-commerce of protected denomination origin (PDO) products. J. Food Compos. Anal. 2019, 79, 143–147. [Google Scholar] [CrossRef]

- Fusco, V.; Fanelli, F.; Chieffi, D. Recent and Advanced DNA-Based Technologies for the Authentication of Probiotic, Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI) Fermented Foods and Beverages. Foods 2023, 12, 3782. [Google Scholar] [CrossRef] [PubMed]

- Camin, F.; Bontempo, L.; Perini, M.; Piasentier, E. Stable isotope ratio analysis for assessing the authenticity of food of animal origin. Compr. Rev. Food Sci. Food Saf. 2016, 15, 868–877. [Google Scholar] [CrossRef]

- Popping, B.; Buck, N.; Bánáti, D.; Brereton, P.; Gendel, S.; Hristozova, N.; Chaves, S.M.; Saner, S.; Spink, J.; Willis, C.; et al. Food inauthenticity: Authority activities, guidance for food operators, and mitigation tools. Compr. Rev. Food Sci. Food Saf. 2022, 21, 4776–4811. [Google Scholar] [CrossRef]

- Soucie, S.; Peštek, A. (Eds.) Counterfeiting and Fraud in Supply Chains; Emerald Publishing Limited: Bentley, UK, 2022. [Google Scholar] [CrossRef]

- Sadílek, T. Utilization of food quality labels included in the European Union quality schemes. Int. J. Food Syst. Dyn. 2020, 11, 72–83. [Google Scholar] [CrossRef]

- Sampalean, N.I.; Rama, D.; Visent, G. An investigation into Italian consumers’ awareness, perception, knowledge of European Union quality certifications, and consumption of agri-food products carrying those certifications. Bio-Based Appl. Econ. J. 2021, 10, 35–49. [Google Scholar] [CrossRef]

- Gangjee, D.S. Proving provenance? Geographical indications certification and its ambiguities. World Dev. 2017, 98, 12–24. [Google Scholar] [CrossRef]

- Ikeshoji, N. Seasonal Workers at White Asparagus Farms in Limburg, the Netherlands: Focusing on Recent Trends of Migrating Workers in Agriculture in the EU Context. Geogr. Rev. Jpn. Ser. B 2023, 96, 25–37. [Google Scholar] [CrossRef]

- Dhiman, V. Organic farming for sustainable environment: Review of existed policies and suggestions for improvement. Int. J. Res. Rev. 2020, 7, 22–31. [Google Scholar]

- European Commission. Strengthening European Food Chain Sustainability by Quality and Procurement Policy. 2023. Available online: https://cordis.europa.eu/project/id/678024 (accessed on 14 November 2023).

- Grunert, K.G.; Aachmann, K. Consumer reactions to the use of EU quality labels on food products: A review of the literature. Food Control 2016, 59, 178–187. [Google Scholar] [CrossRef]

- Lang, B.; Conroy, D.M. When food governance matters to consumer food choice: Consumer perception of and preference for food quality certifications. Appetite 2022, 168, 105688. [Google Scholar] [CrossRef]

- Glogovețan, A.I.; Dabija, D.C.; Fiore, M.; Pocol, C.B. Consumer perception and understanding of European Union quality schemes: A systematic literature review. Sustainability 2022, 14, 1667. [Google Scholar] [CrossRef]

- Kaczorowska, J.; Prandota, A.; Rejman, K.; Halicka, E.; Tul-Krzyszczuk, A. Certification labels in shaping perception of food quality—Insights from Polish and Belgian urban consumers. Sustainability 2021, 13, 702. [Google Scholar] [CrossRef]

- Petrescu, D.C.; Vermeir, I.; Petrescu-Mag, R.M. Consumer understanding of food quality, healthiness, and environmental impact: A cross-national perspective. Int. J. Environ. Res. Public Health 2020, 17, 169. [Google Scholar] [CrossRef]

- European Commission. Strategic Plan 2020–2024—Joint Research Centre. 2023. Available online: https://commission.europa.eu/publications/strategic-plan-2020-2024-joint-research-centre_en (accessed on 14 November 2023).

- Astill, J.; Dara, R.A.; Campbell, M.; Farber, J.M.; Fraser, E.D.; Sharif, S.; Yada, R.Y. Transparency in food supply chains: A review of enabling technology solutions. Trends Food Sci. Technol. 2019, 91, 240–247. [Google Scholar] [CrossRef]

- Schollweck, M.; Heidelberger, A. Understanding Certification Marks: A qualitative study on the influence of semiotics on consumers information processing of grocery certification marks. Phys. Rev. 2019, 47, 777–780. [Google Scholar]

- Schifferstein, H.N.; de Boer, A.; Lemke, M. Conveying information through food packaging: A literature review comparing legislation with consumer perception. J. Funct. Foods 2021, 86, 104734. [Google Scholar] [CrossRef]

- Mazzocchi, C.; Orsi, L.; Zilia, F.; Costantini, M.; Bacenetti, J. Consumer awareness of sustainable supply chains: A choice experiment on Parma ham PDO. Sci. Total Environ. 2022, 836, 155602. [Google Scholar] [CrossRef] [PubMed]

- Verbeke, W.; Pieniak, Z.; Guerrero, L.; Hersleth, M. Consumers’ Awareness and Attitudinal Determinants of European Union Quality Label Use on Traditional Foods. Bio-Based Appl. Econ. 2012, 1, 213–229. [Google Scholar] [CrossRef]

- Särkkä, M.; Autio, M. Finnish consumer’s awareness of EU food quality labels and labels of origin. In Worldwide Perspectives on Geographical Indications; HAL: Montpellier, France, 2022. [Google Scholar]

- Di Vita, G.; Zanchini, R.; Falcone, G.; D’Amico, M.; Brun, F.; Gulisano, G. Local, organic or protected? Detecting the role of different quality signals among Italian olive oil consumers through a hierarchical cluster analysis. J. Cleaner Prod. 2021, 290, 125795. [Google Scholar] [CrossRef]

- Bonadonna, A.; Duglio, S.; Bollani, L.; Peira, G. Mountain Food Products: A Cluster Analysis Based on Young Consumers’ Perceptions. Sustainability 2022, 14, 12511. [Google Scholar] [CrossRef]

- Dias, C.; Mendes, L. Protected designation of origin (PDO), protected geographical indication (PGI) and traditional speciality guaranteed (TSG): A bibliometric analysis. Food Res. Int. 2018, 103, 492–508. [Google Scholar] [CrossRef]

- Nistoreanu, P.; Tanase, M.O.; Gheorghe, G. PGI and PDO logos and products in the Romanian market. An exploratory study. In Proceedings of the 2019 BASIQ International Conference: New Trends in Sustainable Business and Consumption, Bari, Italy, 30 May–1 June 2019; pp. 537–542. [Google Scholar]

- Di Vita, G.; Zanchini, R.; Gulisano, G.; Mancuso, T.; Chinnici, G.; D’Amico, M. Premium, popular and basic olive oils: Mapping product segmentation and consumer profiles for different classes of olive oil. Br. Food J. 2021, 123, 178–198. [Google Scholar] [CrossRef]

- Sampalean, N.I.; De-Magistris, T.; Rama, D. Investigating Italian consumer preferences for different characteristics of Provolone Valpadana using the conjoint analysis approach. Foods 2020, 9, 1730. [Google Scholar] [CrossRef]

- Silvestri, C.; Aquilani, B.; Piccarozzi, M.; Ruggieri, A. Consumer quality perception in traditional food: Parmigiano Reggiano cheese. J. Int. Food Agribus. Mark. 2020, 32, 141–167. [Google Scholar] [CrossRef]

- Topcu, Y.; Dağdemir, V. Turkish consumer purchasing decisions regarding PGI-labelled Erzurum civil cheese. Alinteri J. Agric. Sci. 2017, 32, 69–80. [Google Scholar] [CrossRef]

- Martinelli, E.; De Canio, F. Does PDO/PGI labels contribute to consumers’ intention to buy premium private labels products? An empirical survey. In Advances in National Brand and Private Label Marketing: Fifth International Conference; Springer International Publishing: Cham, Switzerland, 2018; pp. 37–45. [Google Scholar] [CrossRef]

- Pérez-Elortondo, F.J.; Symoneaux, R.; Etaio, I.; Coulon-Leroy, C.; Maître, I.; Zannoni, M. Current status and perspectives of the official sensory control methods in protected designation of origin food products and wines. Food Control 2018, 88, 159–168. [Google Scholar] [CrossRef]

- Lluch, D.L.; Cano-Lamadrid, M.; Lipan, L.; Martínez, R.; García-García, E.; Carbonell-Barrachina, Á.A. Building PDO and PGI awareness among high school students in order to improve their diet. In Edulearn19 Proceedings; IATED: Valencia, Spain, 2019; pp. 1898–1906. [Google Scholar] [CrossRef]

- Likudis, Z.; Dafni, M.F. Greek consumers attitudes and motivations against PDO/PGI Agrifoods. Braz. J. Sci. 2023, 2, 76–86. [Google Scholar] [CrossRef]

- Likoudis, Z.; Sdrali, D.; Costarelli, V.; Apostolopoulos, C. Consumers’ intention to buy protected designation of origin and protected geographical indication foodstuffs: The case of Greece. Int. J. Consum. Stud. 2016, 40, 283–289. [Google Scholar] [CrossRef]

- Barska, A.; Wojciechowska-Solis, J. Traditional and regional food as seen by consumers–research results: The case of Poland. Br. Food J. 2018, 120, 1994–2004. [Google Scholar] [CrossRef]

- Ophuis, P.A.O.; Van Trijp, H.C. Perceived quality: A market driven and consumer-oriented approach. Food Qual. Prefer. 1995, 6, 177–183. [Google Scholar] [CrossRef]

- Almli, V.L.; Verbeke, W.; Vanhonacker, F.; Næs, T.; Hersleth, M. General image and attribute perceptions of traditional food in six European countries. Food Qual. Prefer. 2011, 22, 129–138. [Google Scholar] [CrossRef]

- Hazenberg, C. Should Beef Have a Barcode? A Look at Traceability in Beef Production. Nuffield Canada Agricultural Scholarships. 2015. Available online: https://www.nuffieldscholar.org/reports/ca/2014/should-beef-have-barcode-look-traceability-beef-production (accessed on 17 January 2024).

- Verbeke, W.; Guerrero, L.; Almli, V.L.; Vanhonacker, F.; Hersleth, M. European consumers’ definition and perception of traditional foods. In Traditional Food; Springer: Boston, MA, USA, 2016; pp. 3–16. [Google Scholar] [CrossRef]

- Fandos-Herrera, C. Exploring the mediating role of trust in food products with Protected Designation of Origin. The case of Jamón de Teruel. Span. J. Agric. Res. 2016, 14, 102. [Google Scholar] [CrossRef]

- Martínez, A.A.; Poyatos, M.D.F. La gastronomía como recurso turístico en la provincia de Alicante. Int. J. Sci. Manag. Tour. 2017, 3, 25–45. [Google Scholar]

- Angowski, M.; Jarosz-Angowska, A. Importance of Regional and Traditional EU Quality Schemes in Young Consumer Food Purchasing Decisions. Eur. Res. Stud. 2020, 23, 916–927. [Google Scholar] [CrossRef]

- Di Vita, G.; Pippinato, L.; Blanc, S.; Zanchini, R.; Mosso, A.; Brun, F. Understanding the Role of Purchasing Predictors in the Consumer’s Preferences for PDO Labelled Honey. J. Food Prod. Mark. 2021, 27, 42–56. [Google Scholar] [CrossRef]

- González-Azcárate, M.; Maceín, J.L.C.; Bardají, I. Why buying directly from producers is a valuable choice? Expanding the scope of short food supply chains in Spain. Sustain. Prod. Consum. 2021, 26, 911–920. [Google Scholar] [CrossRef]

- Bucko, J.; Kakalejčík, L.; Ferencová, M. Online shopping: Factors that affect consumer purchasing behaviour. Cogent Bus. Manag. 2018, 5, 1535751. [Google Scholar] [CrossRef]

- Brečić, R.; Tomić Maksan, M.; Đugum, J. The case of the PDO and PGI labels in the Croatian market. Int. J. Multidiscip. Bus. Sci. 2019, 5, 63–70. [Google Scholar]

- Cristobal-Fransi, E.; Montegut-Salla, Y.; Ferrer-Rosell, B.; Daries, N. Rural cooperatives in the digital age: An analysis of the Internet presence and degree of maturity of agri-food cooperatives’ e-commerce. J. Rural Stud. 2020, 74, 55–66. [Google Scholar] [CrossRef]

- Robina -Ramírez, R.; Chamorro-Mera, A.; Moreno-Luna, L. Organic and online attributes for buying and selling agricultural products in the e-marketplace in Spain. Electron. Commer. Res. Appl. 2020, 42, 100992. [Google Scholar] [CrossRef]

- Van Ittersum, K.; Candel, M.; Torelli, F. The market for PDO/PGI protected regional products: Consumers’ attitudes and behaviour. In Proceedings of the 67th Seminar of the European Association of Agricultural Economists (EAAE), Le Mans, France, 28–30 October 1999; pp. 209–221. [Google Scholar] [CrossRef]

- Fontes, M.A.; Banović, M.; Cardoso Lemos, J.P.; Barreira, M.M. PDO beef recognition: How can we improve it? J. Int. Food Agribus. Mark. 2012, 24, 288–305. [Google Scholar] [CrossRef]

- Scott, L.; Vigar-Ellis, D. Consumer understanding, perceptions and behaviours with regard to environmentally friendly packaging in a developing nation. Int. J. Consum. Stud. 2014, 38, 642–649. [Google Scholar] [CrossRef]

- Barska, A.; Wojciechowska-Solis, J. E-consumers and local food products: A perspective for developing online shopping for local goods in Poland. Sustainability 2020, 12, 4958. [Google Scholar] [CrossRef]

- Institutul Național de Statistică. Statement. Available online: https://insse.ro/cms/sites/default/files/com_presa/com_pdf/tic_r2022.pdf (accessed on 9 May 2023).

- Tempo Online. The Population by Gender, 2022, Romania. Available online: http://statistici.insse.ro:8077/tempo-online/#/pages/tables/insse-table (accessed on 14 November 2023).

- Pieniak, Z.; Verbeke, W.; Vanhonacker, F.; Guerrero, L.; Hersleth, M. Association between traditional food consumption and motives for food choice in six European countries. Appetite 2009, 53, 101–108. [Google Scholar] [CrossRef]

- Annunziata, A.; Scarpato, D. Factors affecting consumer attitudes towards food products with sustainable attributes. Agric. Econ. 2014, 60, 353–363. [Google Scholar] [CrossRef]

- Bryła, P. Regional ethnocentrism on the food market as a pattern of sustainable consumption. Sustainability 2019, 11, 6408. [Google Scholar] [CrossRef]

- Albuquerque, T.G.; Oliveira, M.B.P.; Costa, H.S. 25 years of European Union (EU) quality schemes for agricultural products and foodstuffs across EU Member States. J. Sci. Food Agric. 2018, 98, 2475–2489. [Google Scholar] [CrossRef]

- Verbeke, W. Food quality policies and consumer interests in the EU. In Consumer Attitudes to Food Quality Products; Wageningen Academic Publishers: Wageningen, The Netherlands, 2013; pp. 13–22. [Google Scholar] [CrossRef]

- Festila, A.; Chrysochou, P.; Krystallis, A. Consumer response to food labels in an emerging market: The case of Romania. Int. J. Consum. Stud. 2014, 38, 166–174. [Google Scholar] [CrossRef]

- Spognardi, S.; Vistocco, D.; Cappelli, L.; Papetti, P. Impact of organic and “Protected Designation of Origin” labels in the perception of olive oil sensory quality. Br. Food J. 2021, 123, 2641–2669. [Google Scholar] [CrossRef]

- Vecchio, R.; Annunziata, A. The role of PDO/PGI labelling in Italian consumers’ food choices. Agric. Econ. Rev. 2011, 12, 80–98. [Google Scholar]

| Concepts | References |

|---|---|

| Brand image | [15,55,56] |

| Awareness, perception, price | [45,57,58,59,60,61,62] |

| Advertising | [51,63] |

| Packaging design | [31,64,65] |

| Online purchasing | [66,67,68,69] |

| Socio-Demographic Characteristics | Categories | Frequency | % |

|---|---|---|---|

| Gender | Male | 433 | 48% |

| Female | 470 | 52% | |

| Age | 18–24 years old | 325 | 36% |

| 25–34 years old | 190 | 21% | |

| 35–44 years old | 135 | 15% | |

| 45–54 years old | 117 | 13% | |

| 55–64 years old | 73 | 8% | |

| over 65 years old | 63 | 7% | |

| Level of education | Middle school (8 grades) | 36 | 4% |

| Vocational school | 45 | 5% | |

| High school | 352 | 39% | |

| Post-secondary school | 45 | 5% | |

| Higher education (bachelor’s level) | 316 | 35% | |

| Higher education (master’s, doctoral level) | 109 | 12% | |

| Occupation | Student | 280 | 31% |

| Unemployed | 9 | 1% | |

| Homemaker | 27 | 3% | |

| Employee | 398 | 44% | |

| Freelancer | 36 | 4% | |

| Entrepreneur | 81 | 9% | |

| Retiree | 72 | 8% | |

| Income | Under RON 4000 | 542 | 60% |

| Between RON 4001 and 8000 | 244 | 27% | |

| Between RON 8001 and 15,000 | 81 | 9% | |

| Over RON 15,000 | 36 | 4% | |

| Residence | In an urban area, county capital | 352 | 39% |

| In an urban area, small town | 199 | 22% | |

| In a rural area, commune/village | 352 | 39% | |

| Development regions—Nomenclature of Territorial Units for Statistics (NUTS) | North-East Development Region | 72 | 8% |

| South-East Development Region | 27 | 3% | |

| South-Muntenia Development Region | 36 | 4% | |

| South-West Oltenia Development Region | 27 | 3% | |

| West Development Region | 81 | 9% | |

| North-West Development Region | 416 | 46% | |

| Centre Development Region | 208 | 23% | |

| Bucharest-Ilfov Development Region | 36 | 4% | |

| Medical conditions | Lactose intolerance | 27 | 3% |

| Gluten intolerance | 27 | 3% | |

| Chronic diseases (respiratory, cardiac, digestive, musculoskeletal disorders) | 108 | 12% | |

| None of the above | 741 | 82% |

| Number of Cases in Each Cluster | |||

|---|---|---|---|

| Cluster | 1 | 130 | 14.40% |

| 2 | 383 | 42.41% | |

| 3 | 326 | 36.10% | |

| 4 | 64 | 7.09% | |

| Valid | 903 | ||

| Missing (non-consumers) | 244 | ||

| Cluster | Category Description | Frequency | % |

|---|---|---|---|

| Eco−Advocates | This cluster focuses on environmental protection and local economy support, and their interest in packaging recyclability. They also value quality and nutritional properties over price. | 130 | 14.4% |

| Les Connaisseurs | This cluster has discerning taste and high appreciation for the superiority of certified products. These are individuals who value nutritional quality and are willing to pay extra for it. They are also frequent recommenders of such products. | 383 | 42.4% |

| Price−Sensitives | This cluster exhibits a price-driven nature and lower frequency of consumption of certified products. They would only buy online influenced by price and seem to be less informed or less interested in the certified products’ specific benefits. | 326 | 36.1% |

| Traditionalists | This cluster prefers traditional shopping methods, lack of interest in online purchases, and less attention to packaging information. They also have the highest consumption rate for specific food products like smoked fish and preserves but do not seem to care much about the certification. | 64 | 7.1% |

| Iteration History | ||||

|---|---|---|---|---|

| Iteration | Change in Cluster Centers | |||

| 1 | 2 | 3 | 4 | |

| 1 | 9.922 | 7.51 | 9.615 | 8.565 |

| 2 | 1.494 | 0.409 | 0.542 | 0.371 |

| 3 | 0.717 | 0.233 | 0.232 | 0.211 |

| 4 | 0.475 | 0.155 | 0.118 | 0.148 |

| 5 | 0.265 | 0.115 | 0.087 | 0 |

| 6 | 0.071 | 0.042 | 0.053 | 0 |

| 7 | 0 | 0.07 | 0.091 | 0 |

| 8 | 0 | 0.1 | 0.136 | 0.119 |

| 9 | 0 | 0.047 | 0.055 | 0 |

| 10 | 0 | 0.045 | 0.053 | 0 |

| 11 | 0 | 0.018 | 0.021 | 0 |

| 12 | 0 | 0 | 0 | 0 |

| Final Cluster Centers | ||||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| Zscore: Q36 | 0.06463 | 0.23704 | −0.21192 | −0.47035 |

| Zscore: Q37 | −0.03003 | 0.12959 | −0.08225 | −0.29555 |

| Zscore: Q38 | −0.21029 | −0.12089 | 0.16793 | 0.29520 |

| Zscore: Q40 | 0.05828 | 0.17727 | −0.15484 | −0.39050 |

| Zscore: Q17_1 | 0.89922 | −0.24734 | −0.40685 | 1.72599 |

| Zscore: Q17_2 | 0.91560 | −0.21322 | −0.33292 | 1.11196 |

| Zscore: Q17_3 | 1.14400 | −0.18142 | −0.49457 | 1.28120 |

| Zscore: Q17_4 | 1.21704 | −0.31474 | −0.46091 | 1.75918 |

| Zscore: Q17_5 | 1.17406 | −0.31345 | −0.46815 | 1.87566 |

| Zscore: Q17_6 | 1.08171 | −0.25828 | −0.42957 | 1.53652 |

| Zscore: Q17_7 | 1.11119 | −0.20677 | −0.42360 | 1.13800 |

| Zscore: Q17_8 | 1.30686 | −0.31918 | −0.44078 | 1.50074 |

| Zscore: Q17_9 | 1.27281 | −0.30193 | −0.44849 | 1.50598 |

| Zscore: Q17_10 | 1.23123 | −0.30512 | −0.40154 | 1.37038 |

| Zscore: Q7_1 | −0.34068 | 0.33586 | −0.00644 | −1.28504 |

| Zscore: Q7_2 | −0.08959 | 0.44533 | −0.26193 | −1.14882 |

| Zscore: Q7_3 | 0.00734 | 0.43614 | −0.32306 | −0.97930 |

| Zscore: Q7_4 | 0.19089 | 0.42185 | −0.44251 | −0.65821 |

| Zscore: Q7_5 | 0.15785 | 0.40937 | −0.42938 | −0.58333 |

| Zscore: Q8 | −0.11368 | 0.40069 | −0.24183 | −0.93511 |

| Zscore: Q9_1 | 0.01614 | 0.39209 | −0.25498 | −1.08042 |

| Zscore: Q9_2 | 0.01644 | 0.40440 | −0.26578 | −1.09967 |

| Zscore: Q12_1 | −0.16304 | 0.35171 | 0.07283 | −2.14459 |

| Zscore: Q12_2 | −0.13430 | 0.37360 | −0.09333 | −1.48759 |

| Zscore: Q12_3 | −0.14750 | 0.40409 | 0.00205 | −2.12908 |

| Zscore: Q12_4 | 0.01660 | 0.46955 | −0.18022 | −1.92570 |

| Zscore: Q12_5 | 0.04343 | 0.47919 | −0.20813 | −1.89567 |

| Zscore: Q12_6 | 0.12056 | 0.44652 | −0.27270 | −1.52799 |

| Zscore: Q12_7 | 0.44881 | 0.38051 | −0.42668 | −1.01533 |

| Zscore: Q12_8 | 0.36711 | 0.44467 | −0.45773 | −1.07519 |

| Zscore: Q12_9 | 0.35462 | 0.37605 | −0.32683 | −1.30598 |

| Zscore: Q12_12 | 0.19994 | 0.35389 | −0.22728 | −1.36624 |

| Zscore: Q15_1 | −0.30917 | 0.18964 | 0.19335 | −1.49174 |

| Zscore: Q15_7 | 0.06136 | 0.44772 | −0.33561 | −1.09448 |

| Zscore: Q15_8 | 0.03447 | 0.42448 | −0.24253 | −1.37490 |

| Zscore: Q16_1 | 0.58356 | 0.37428 | −0.55532 | −0.59655 |

| Zscore: Q16_2 | 0.57340 | 0.40684 | −0.61856 | −0.44858 |

| Zscore: Q16_3 | 0.60150 | 0.45583 | −0.66348 | −0.57004 |

| Zscore: Q16_4 | 0.52455 | 0.41430 | −0.61517 | −0.41134 |

| Zscore: Q16_5 | 0.55446 | 0.46407 | −0.65414 | −0.57139 |

| Zscore: Q16_6 | 0.53018 | 0.49788 | −0.67890 | −0.59829 |

| Zscore: Q16_7 | 0.34824 | 0.57886 | −0.64020 | −0.91047 |

| Zscore: Q16_8 | 0.46663 | 0.48786 | −0.61987 | −0.70994 |

| Zscore: Q16_9 | 0.35974 | 0.56865 | −0.61809 | −0.98539 |

| Zscore: Q16_10 | 0.27324 | 0.55432 | −0.56317 | −1.00366 |

| Zscore: Q16_11 | 0.44294 | 0.47430 | −0.59122 | −0.72658 |

| Zscore: Q16_12 | 0.36949 | 0.51581 | −0.59259 | −0.81880 |

| Zscore: Q16_13 | 0.52648 | 0.46283 | −0.60712 | −0.74661 |

| Zscore: Q16_14 | 0.35111 | 0.44675 | −0.52365 | −0.71932 |

| Zscore: Q16_16 | 0.40574 | 0.47129 | −0.59226 | −0.62769 |

| Zscore: Q19 | −0.02457 | 0.45690 | −0.32740 | −1.01665 |

| Zscore: Q20 | 0.08083 | 0.46671 | −0.44222 | −0.70459 |

| Zscore: Q22_1 | 0.16134 | 0.43169 | −0.30023 | −1.38181 |

| Zscore: Q22_3 | 0.12491 | 0.40273 | −0.29437 | −1.16438 |

| Zscore: Q27 | 0.05705 | 0.45313 | −0.39314 | −0.82502 |

| Zscore: Q28_1 | 0.07687 | 0.49243 | −0.33498 | −1.39674 |

| Zscore: Q28_2 | 0.16753 | 0.47418 | −0.43771 | −0.94836 |

| Zscore: Q28_4 | 0.46540 | 0.40449 | −0.55535 | −0.53718 |

| Zscore: Q28_5 | 0.25680 | 0.43677 | −0.43978 | −0.89528 |

| Variable Code 1 | Variable Code 2 | Correlation Coefficient | Statistical Significance |

|---|---|---|---|

| Q16_3 | Q16_2 | 0.897 | ** |

| Q12_5 | Q12_4 | 0.892 | ** |

| Q16_14 | Q16_15 | 0.830 | ** |

| Q16_2 | Q16_1 | 0.827 | ** |

| Q25_4 | Q25_3 | 0.824 | ** |

| Q12_8 | Q12_7 | 0.820 | ** |

| Q22_6 | Q22_5 | 0.802 | ** |

| Q16_3 | Q16_1 | 0.786 | ** |

| Q17_10 | Q17_9 | 0.785 | ** |

| Q15_8 | Q15_7 | 0.783 | ** |

| Q25_1 | Q25_3 | 0.779 | ** |

| Q25_3 | Q25_ | 0.779 | ** |

| Q12_5 | Q12_6 | 0.775 | ** |

| Q16_4 | Q16_1 | 0.774 | ** |

| Q16_5 | Q16_3 | 0.768 | ** |

| Q12_3 | Q12_1 | 0.764 | ** |

| Q12_1 | Q12_3 | 0.764 | ** |

| Q12_4 | Q12_6 | 0.760 | ** |

| Q12_3 | Q12_4 | 0.757 | ** |

| Q16_10 | Q16_9 | 0.756 | ** |

| Q16_2 | Q16_5 | 0.755 | ** |

| Q16_6 | Q16_5 | 0.752 | ** |

| Q25_1 | Q25_4 | 0.749 | ** |

| Q16_3 | Q16_4 | 0.748 | ** |

| Q7_3 | Q7_2 | 0.748 | ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Glogovețan, A.-I.; Pocol, C.B. The Role of Promoting Agricultural and Food Products Certified with European Union Quality Schemes. Foods 2024, 13, 970. https://doi.org/10.3390/foods13060970

Glogovețan A-I, Pocol CB. The Role of Promoting Agricultural and Food Products Certified with European Union Quality Schemes. Foods. 2024; 13(6):970. https://doi.org/10.3390/foods13060970

Chicago/Turabian StyleGlogovețan, Alexandra-Ioana, and Cristina Bianca Pocol. 2024. "The Role of Promoting Agricultural and Food Products Certified with European Union Quality Schemes" Foods 13, no. 6: 970. https://doi.org/10.3390/foods13060970

APA StyleGlogovețan, A.-I., & Pocol, C. B. (2024). The Role of Promoting Agricultural and Food Products Certified with European Union Quality Schemes. Foods, 13(6), 970. https://doi.org/10.3390/foods13060970