A Literature Review, Container Shipping Supply Chain: Planning Problems and Research Opportunities

Abstract

:1. Introduction to CSSC

2. Freight Logistics

- selecting transport modes and carriers;

- negotiating delivery terms and freight rates;

- contracting with ocean carriers;

- arranging relevant documents and customs clearance;

- consolidation and decomposition;

- arranging inland pickup and delivery;

- container shipment routing and scheduling;

- container storage and transshipping.

- the extended gate, which links the seaport to the inland intermodal terminal using high-capacity transport such as barge and rail;

- the pull-to-push strategy, in which containers are directly transported by barges or trains from seaports to inland terminals to avoid containers waiting at seaports for collection by individual customers;

- the mode-free booking, which enables shippers to sign a container transportation contract with specified price, time of container delivery, level of service quality, but without specified transport modes in the delivery journey.

- (i)

- Haulage contracting between shippers and shipping lines. Under merchant haulage, the shipper is responsible for the inland movement of the container. Under carrier haulage, the shipping line is responsible for both the movements of the container at sea and in inland. Shippers need to assess and compare different haulage contracts.

- (ii)

- Terms of sale (delivery terms) agreement between exporter and importer. The delivery terms specify the responsibility of relevant stakeholders for arranging the movement of the container and the location where the ownership of the goods within the container is transferred from the exporter to the importer. Shippers need to evaluate different incoterms issued by the International Chamber of Commerce, considering the total logistics cost and the associated risk.

- (iii)

- Carrier and service selection. Apart from the freight rate, shippers need to consider other indirect costs, e.g., the cycle-stock cost caused by the transit time, the safety-stock cost caused by the unreliability of the service schedule, and the financial risk that may be caused by the bankruptcy of relevant stakeholders (e.g., the bankruptcy of Hanjin Shipping in 2016 caused many containers to be stranded at ports or on vessels at sea).

- (iv)

- Contracting with carriers. Shippers and freight forwarders are facing historically high freight rates for long-term contracted containers in 2021. Even when the long-term contracts are signed, they still have to face the possibility that shipping lines may break agreements and rollover cargos in order to take advantage of more lucrative spot rates. In this regard, a game theory may be used to balance long-term contract with spot contract under uncertainty.

- (v)

- The implementation of synchro-modal transport in practice. This requires collaboration and commitment among the stakeholders across multiple CSSCs.

- (vi)

- The development of ABM, CAS and MAS models for CSSCs. This can be helped by making use of innovative technologies, big data and machine learning, e.g., utilizing the real-time data from AIS (Automatic Identification System), which is a vessel tracking system fitted to all commercial vessels and transmits vessel-related data via radio signals.

3. Container Logistics

- Container fleet sizing;

- Container leasing and off-leasing;

- Laden container canvassing, routing and dispatching;

- Empty container repositioning (ECR).

- (i)

- Container logistics covers a range of planning activities such as fleet sizing, leasing and off-leasing, laden container canvassing, routing and dispatching, and empty container repositioning. It is desirable to integrate these activities together in the context of CSSC so that their interactions could be better represented. This requires the collaboration of multiple functions within the shipping company and multiple stakeholders along the CSSC.

- (ii)

- Empty container repositioning can be seriously affected by shipping lines’ strategy and port/terminals’ policies. For example, the breakout of COVID-19 and the demand drop in the first half of 2020 caused shipping lines to adopt blank sailing strategy, which left many empty containers in European and North American ports. When trade demand suddenly picked up in the second half of 2020, most Asian ports experienced a severe shortage of empty containers. Moreover, some container ports may adopt a policy of refusing empty containers entering the port due to yard congestion, which further complicates the empty container repositioning.

- (iii)

- When the laden containers reach customers, it is common that customers may overhold the containers (i.e., keep the containers longer than the agreed time). This phenomenon is called detention. Detention incurs cost to shippers and prevents shipping lines from managing the container fleet efficiently. How to set up free detention time and how to price the detention charge for overholding have a significant impact on container logistics. Moreover, containers may be damaged during the transportation processes, which leads to logistics issues such as where and when to perform maintenance, repair and cleaning. Containers differ in size, type and grade, and shippers have different preferences for container types. Hence, container logistics management could be extended to consider these operational details practically.

- (iv)

- Empty container movements not only incur costs, but also cause environmental and social impacts, e.g., emissions, pollutions, congestions, and accidents. The traditional externality of the environmental and social impacts may be internalized within the container logistics models. This leads to sustainable performance of container logistics including economic, environmental and social aspects. Different players have different perceptions of sustainable performances and may also have different risk attitude towards uncertainty.

- (v)

- From the logistics channel perspective, container logistics problems could be addressed from several categories of solution measures such as organizational measures, intra-channel measures, inter-channel measures, and technological measures. It is believed that there is a need to combine different measures (e.g., mitigating the root causes, seeking efficient organizational strategies, collaborating with channel members, collaborating with competitors, and adopting innovative technologies) to tackle the challenges in container logistics effectively [55].

4. Vessel Logistics

- (i)

- The majority of existing optimization models for vessel logistics either consider deterministic situations or implicitly assume risk-neutral performance measures. The conservative behavior and risk-averse attitude of the channel members in CSSC have been under-studied.

- (ii)

- Shipping lines have been relentlessly pursuing larger vessels to achieve economy of scale and cut operational costs, which has led to severe over-capacity and fierce competition. Some shipping lines are gradually turning to profitability strategies rather than merely cost-cutting strategies, e.g., capacity management, revenue management, diversification and differentiation. As a result, more research could be done in relation to shipping lines’ profitability strategies.

- (iii)

- The bankruptcy of Hanjin Shipping in 2016 caused chaos in CSSC because container cargos were left stranded around the world which disrupted shippers’ production and inventory worldwide. Shippers and freight forwarders became increasingly concerned over counterparty risk. As a result, shipping lines should pay more attention to ship financing and cashflow to gain competitive advantages.

- (iv)

- Many events can change the trade volume and demand patterns, e.g., the US–China trade war shifted a significant amount of US trade from China to other Asian countries; the COVID-19 pandemic triggered changes in consumption and shopping patterns resulting in a surge of containerized trade in the second half of 2020 (due to increased demand for manufactured consumer goods). Shipping lines need to manage the shipping service supply appropriately in anticipation or response to the change in trade patterns.

- (v)

- Severe disruption at ports can occur. Shipping lines have to design contingency plans for service disruption and service recovery. For example, the Port of Yantian stopped entry of export containers from 25 to 27 May 2021 for four days because of an ongoing coronavirus outbreak in the port area. The local authority ordered 14-day quarantine period for vessels with infected crew on board. Not only the owner of the infected vessel, but also other shipping lines were impacted. Up to 11 June 2021, in total 153 container vessels have been impacted and 132 have completely omitted the South China region. The ripple effects have already been felt across supply chains [87].

- (vi)

- Ship crew management became a serious issue due to COVID-19. The safety, security and welfare of crew members deserved more attention. The crew exchange became much more complicated because some ports were not allowed to exchange ship crew, and some ports did not have flights to send the crew back home. This is a new challenge that the shipping industry has to face. There is a rich literature on crew scheduling in the aviation sector. However, the research methods and results may not easily be adapted to the shipping sector.

- (vii)

- The Suez Canal was blocked by the 20,388 TEU containership Ever Given on 23 March 2021. When the Canal was finally re-opened on 29 March 2021, more than 350 ships were already queuing at both ends and many ships diverted to the Cape of Good Hope to circumvent the Suez Canal. Its impacts have rippled to ports and shippers globally that caused port congestion and shipment delays. This accident prompted the need for research on the better planning for ships accessing capacity-constrained infrastructures, better and reliable operations on board ship, scenario analysis for major accidence, and disruption management in CSSC.

5. Port and Terminal Logistics

- (i)

- Port disruption management. Disruptive events like COVID-19, industrial action, flooding, strong winds, and hurricanes can seriously disrupt port operations and the CSSC. Pro-active and reactive strategies should be planned to improve port and supply chain resilience.

- (ii)

- Port congestion is an industry-wide problem. In the second half of 2020, many European ports (e.g., Felixstowe and Southampton) and North American west-coastal ports (e.g., Los Angeles and Long Beach) reached historically high-level of congestion with no space to put the containers that needed to be discharged from vessels. These ports were congested with empty containers to be repositioned back to Asia and with import laden containers to be moved into hinterland customers. The port congestion problem should be tackled not only by improving efficiency and productivity at ports, but also by joint effort from terminal operators, shipping lines, and inland carriers.

- (iii)

- There are a wide range of planning issues in port logistics. On the one hand, it is desirable to integrate the planning issues across different planning levels (from strategic to operational); on the other hand, it is desirable to integrate the planning issues across different logistics processes (across quayside, yard-side and landside).

- (iv)

- From an academic perspective, many optimization problems in port/terminal logistics have been proved to be NP-hard problems, e.g., berth allocation and crane scheduling, container storage and relocations. Reformulating the planning problems or designing solution algorithms in an innovative way may produce exact optimal solutions.

- (v)

- From a practical perspective, more efficient heuristic algorithms and effective rules that are readily applicable in practice should be developed. According to the feedback from industry experts, a solution for real time decisions should take no more than a second at quayside and no more than a minute at container yards. Hence, there is a balance to strike between optimality and speed when seeking solutions.

- (vi)

- Port logistics should pay more attention to environmental and social performance. The port is a pollution and emission concentration area. Congestion, pollution and emission should be factored into the decision-making process. For example, shifting road container traffic to rails and barges would significantly reduce carbon emission and road congestion.

- (vii)

- A better port community system, which requires the trust, commitment and collaboration among participated stakeholders. Through information sharing and coordinated management, a more efficient port logistics process can be achieved, especially at quayside and landside, which more directly interact with other players. In this regard, digitalization could provide innovative solutions.

6. Inland Transport Logistics

- (i)

- Since containers have import/export movement directions and their states take either laden or empty states, inland container transport should incorporate the evolution of container types and states. This requires the model to be dynamic and be able to anticipate uncertainties not only in demand but also in lead time.

- (ii)

- Inland container transport is only part of the global CSSC. Therefore, it would be desirable to coordinate or integrate the inland container transport problem into the global CSSC context. Transparency and information sharing across the CSSC is the key enabler for more efficient hinterland intermodal transportation. The concept of synchro-modality and agent-based technologies could be applied in this research direction.

- (iii)

- Note that containers are carried by moving vehicles. After a delivery of containers, it is possible that the vehicle will have an empty run. This leads to an empty vehicle (or rail-car) redistribution problem, which is under the management of inland carriers. There is a lack of research to connect empty container repositioning to empty vehicle redistribution.

- (iv)

- With the increasing green concerns, inland container transport management should evaluate energy consumption and CO2 emission by taking the well-to-wheel and life cycle assessment perspective [114]. In this regard, multiple objective optimization models from the systemwide perspective are needed

- (v)

- Horizontal integration among inland carriers is an interesting topic. By exchanging or pooling vehicles, empty vehicle runs could be reduced so that a win-win situation could be achieved. How to design an appropriate contracting mechanism between these potentially competing inland carriers requires further study. Perhaps, the concept of co-opetition between shipping lines could be applied to the inland transport carriers to achieve horizontal integration.

- (vi)

- Government and local council are likely to issue more stringent environmental regulations such as carbon tax or subsidize the use of greener vehicle. This may influence the vehicle fleet, infrastructure expansion, container flows, and pricing strategies in the inland transport network. Multi-period game models combined with stochastic dynamic programming may be applied in such situations.

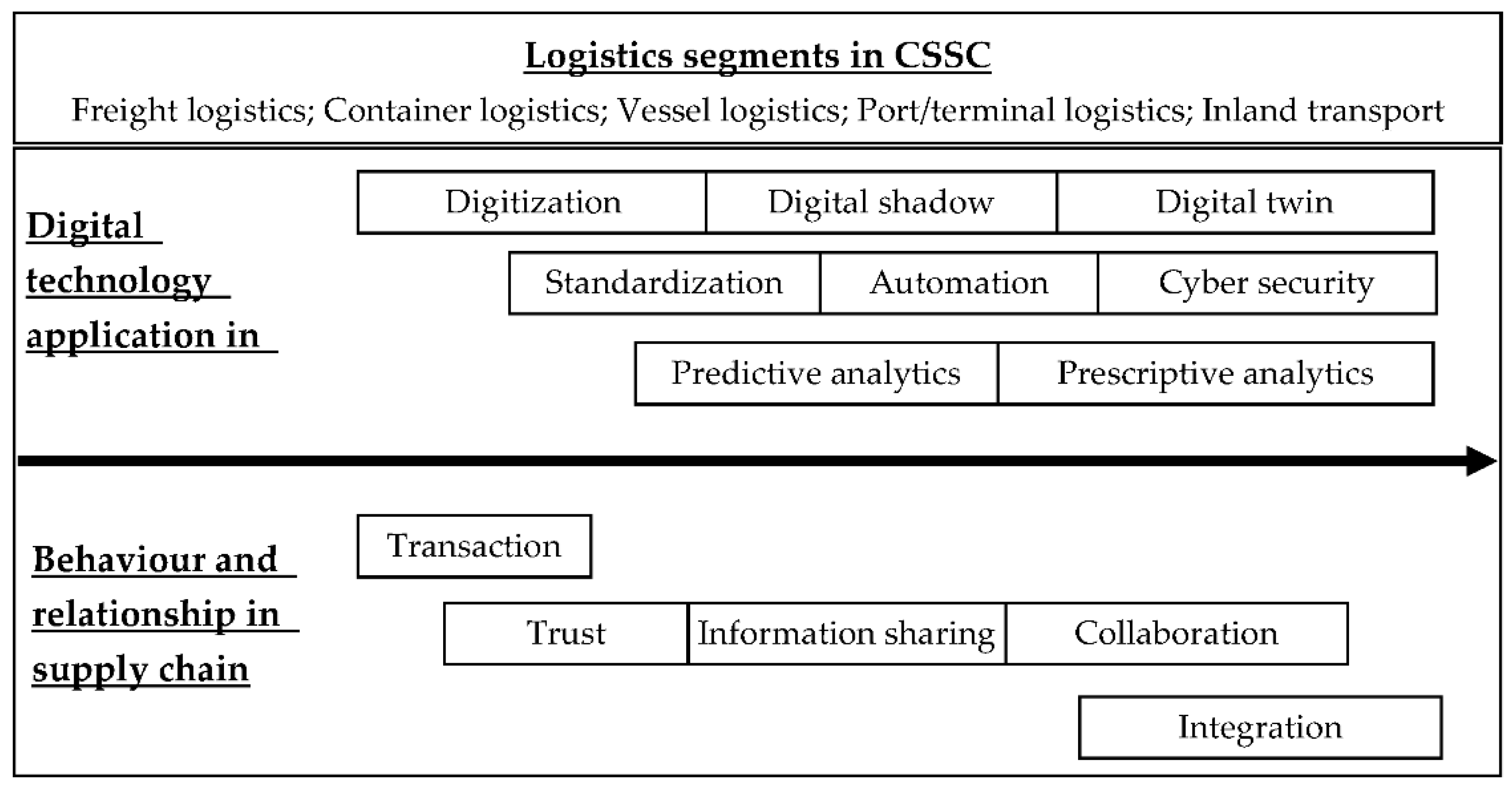

7. Challenges in CSSC: Digitalization and Decarbonization

7.1. Digitalization

- Digitization: refers to the process of converting information from a physical format to a digital one. Container shipping is a data-intensive business. It involves a significant amount of paperwork such as export documents, bills of lading, cargo manifests, invoices and receipts. Converting non-digital into digital representation requires the application of digital tools such as computer systems, e-platforms, and distributed ledger (blockchain). On the other hand, new data regarding the states of containers, handling equipment and transport vehicles should be collected through sensors, Internet of Things, 5G and AIS (automatic identification system).

- Digital shadow: refers to the representation of a physical system or object in digital form including all the data associated with the system/object. For digital shadow, there is an automatic information flow from the physical world to the digital representation, but not in the opposite direction.

- Digital Twin: refers to the digital (virtual) replication of a physical system/object emphasizing the bi-directional automatic information flow between the physical world and digital replication on a real time basis. This digital replication can be used to test new strategies and designs without wasting physical resources and feed the results into the physical world on a real time basis.

- Standardization: the early success of containerization is largely due to the standardization of shipping containers (twenty-equipment unit and forty-equipment unit boxes) so that all transport vehicles and handling equipment in the CSSC can be purposely designed to carry and handle the standardized containers efficiently. Standardization is the pre-requisite of automation. There is a need to standardize the business processes and logistics activities, where machines and robots perform better than humans.

- Automation: reduces or eliminates the need for human intervention and therefore improves operational efficiency and minimizes human errors. Robotic technology has been used to automate certain port business processes including loading and discharging ships, stacking and reshuffling containers, and operating gates, e.g., in Rotterdam and Qingdao. Autonomous ships navigate waters with little or no human interaction, where onboard computer systems monitor and manage navigation. The challenge of automation is the handling of exceptions in which human beings are usually better than machines. The regulatory constraint is another barrier for autonomous ships.

- Cyber security: concerns the protection of the internet-connected systems including hardware, software and data from malicious attacks to ensure the integrity, confidentiality, and availability of digital information. In the shipping industry, the four largest shipping lines in the world have been hit by cyber-attacks since 2017. Maersk was shut down for weeks by the NotPetya ransomware/wiper in 2017; COSCO was taken down for weeks by ransomware in 2018; MSC’s data center was brought down for days by an unnamed malware in 2020; and CMA CGM was hit by a ransomware attack and forced to take down its booking system in 2020. As digitization and automation progress, cyber security is receiving more attention.

- Predictive analytics: takes historical data from various sources and uses machine learning to train prediction models so that the model can predict what will happen in the future. Predictive analytics essentially uses a set of attributes of the data object to predict the likelihood of an unknown future outcome. This step is related to data mining, machine learning and artificial intelligence. Common techniques include classification, regressions, decision tree-based methods, support vector machine, Bayes algorithms, and neural networks.

- Prescriptive analytics: takes the results from predictive analytics and the various business rules into an optimization model to determine the best decisions and policies by optimizing the objective functions. This step takes a systematic approach using techniques such as mathematical programming, simulation and heuristics, which aims to systematically leverage the power of advanced analytics and artificial intelligence to improve the performance of business processes.

- Transaction: refers to the exchange or transfer of goods, services, or funds. A transactional relation is often called an arm’s length relationship, where price is the primary concern for two parties. The transactional relation can be a single and repeated transactions. Nevertheless, this type of relation is characterized by distrust, competition and conflict.

- Trust: refers to a range of observable behaviors and a cognitive state that encompasses predictability [125]. The predictability can be interpreted as the carrier’s reliability to deliver on time, a terminal’s handling reliability, or a shipper’ ability to make the laden container ready for loading onto vessels or to return empty containers on time. Trust is built on the information regarding whether and to what degree players keep their promises to each other within the CSSC. Trust is regarded as an essential element for successful supply chain partners’ relationship.

- Information sharing: indicates the exchange of data between processes or channel members. In the shipping industry, data is kept in silos. Even within a single shipping company, operational data (e.g., container and vessel movements) and financial data (e.g., invoices, contracts and freight rates) are kept separately in different applications. There is a need to connect multiple data sources using cloud IT. Information sharing between channel members is more difficult, mainly due to the proprietary data, and partially due to the non-portable or non-digital format of the data. Information sharing is a crucial step for supply chain visibility. It is regarded as an antecedent of collaborative channel relationships.

- Collaboration: is defined as working jointly or cooperating with channel members for mutual benefit. Collaborative channel members not only share information, but also coordinate decision making with a common goal in mind. In multimodal container transport, shipping lines often collaborate with inland carriers to secure smooth container transfer between seaborne transport and inland transport, e.g., the long-term contractual relationship between Maersk Line and Freightliner in the UK.

- Integration: refers to the incorporation of the business processes at different positions in the marketing channel. Integrative relationships include merger and acquisition, joint venture, and vertical integration. Integration is characterized by long-term partnership and mutually shared goals. Shipping lines have tried to integrate CSSC to some degree by expanding their business processes into terminal operations and inland logistics. For example, major shipping lines like Maersk, Cosco and Evergreen, are operating dedicated container terminals through leasing or joint venture with terminal operators. Maersk Line followed a container logistics integrator strategy by expanding its logistics operations. This led to a significant increase of revenue share in logistics from its top 200 ocean customers, which showed the commercial synergies between ocean transport and inland logistics [126].

7.2. Decarbonization

- Manage decarbonization risks considering technological, safety, regulatory, availability, price uncertainties in container shipping. This may require multi-stage dynamic approaches considering that information is likely to update over time and decisions are made sequentially.

- Develop decarbonization strategies by appropriately integrating technical measures, operational measures, market-based measures, and alternative fuels. A holistic and simulation-based method may be applied in this direction.

- Select the mix of fuel types and technology systems in the heterogenous ship fleet in different trade routes. Research methods from ship fleet sizing and deployment could be adapted to this direction by considering the unique characteristics of different types of future fuels.

- Evaluate the impact of decarbonization regulations that may come into force at different points of time with different requirements. In this regard, a multi-period dynamic game model could be applied.

- Establish and manage the logistics networks of new fuels including constructing infrastructure and matching supply with demand, e.g., HMM, the South Korea shipping line, has started to develop an ammonia fuel supply chain for shipping. This topic may take the fuel supply’s perspective.

- Redesign the shipping service network considering maritime fuel mix and its availability at ports. Determine ship re-fueling strategies under the new maritime fuel mix. Up to now, the primary fuel used in the shipping sector is heavy fuel oil (HFO) and low sulphur fuel oils (LSFO). Their availability is universal and sufficient in most ports. Taking the fuel demand’s perspective, shipping lines have to redesign the shipping service network and the fuel management system considering a more limited and constrained supply of new fuel.

- Shift road container traffic to rail or barge transport mode to decarbonize inland container transport, which may require investment and collaboration between shipping lines and rail/barge operators, and/or subsidy from governments and local councils.

- Combine decarbonization with digitalization in CSSC. It is believed that digitalization is a key enabler in the process of CSSC decarbonization. In particular, digital technology-based operational measures are essential to achieve green shipping and green ports.

8. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- MergeGlobal. Insomnia—Why challenges facing the world container shipping industry make for more nightmares than they should. Am. Shipp. 2008, 7, 68–85. [Google Scholar]

- Lee, C.-Y.; Song, D.-P. Ocean container transport in global supply chains: Overview and research opportunities. Transp. Res. Part B Methodol. 2017, 95, 442–474. [Google Scholar] [CrossRef]

- Song, D.P. Container Logistics and Maritime Transport; Routledge: London, UK, 2021. [Google Scholar]

- UNCTAD. Development of Multimodal Transport and Logistics Services; The UNCTAD Secretariat: Geneva, Switzerland, 2003. [Google Scholar]

- Agbo, A.A.; Li, W.; Atombo, C.; Lodewijks, G.; Zheng, L. Feasibility study for the introduction of synchromodal freight transportation concept. Cogent Eng. 2017, 4, 1305649. [Google Scholar] [CrossRef]

- Verweij, K. Synchronic modalities: Critical success factors. In Logistics Handbook 2011; Van der Sterre, P.J., Ed.; Feico Houweling: Rotterdam, The Netherlands, 2011; pp. 75–92. [Google Scholar]

- Pfoser, S.; Treiblmaier, H.; Schauer, O. Critical Success Factors of Synchromodality: Results from a Case Study and Literature Review. Transp. Res. Procedia 2016, 14, 1463–1471. [Google Scholar] [CrossRef] [Green Version]

- Giusti, R.; Manerba, D.; Bruno, G.; Tadei, R. Synchromodal logistics: An overview of critical success factors, enabling technologies, and open research issues. Transp. Res. Part E Logist. Transp. Rev. 2019, 129, 92–110. [Google Scholar] [CrossRef]

- Liu, Z.; Meng, Q.; Wang, S.; Sun, Z. Global intermodal liner shipping network design. Transp. Res. Part E Logist. Transp. Rev. 2014, 61, 28–39. [Google Scholar] [CrossRef] [Green Version]

- Shibasaki, R.; Iijima, T.; Kadono, T.; Shishido, T.; Kawakami, T. Network assignment model of integrating maritime and hinterland container shipping: Application to Central America. Marit. Econ. Logist. 2017, 19, 234–273. [Google Scholar] [CrossRef]

- Halim, R.A.; Tavasszy, L.A.; Seck, M.D. Modeling the global freight transportation system: A multi-level modeling perspective. In Proceedings of the Winter Simulation Conference, Berlin, Germany, 9–12 December 2012. [Google Scholar]

- Huang, Y.; Rashidi, T.H.; Gardner, L. Modelling the global maritime container network. Marit. Econ. Logist. 2018, 20, 400–420. [Google Scholar] [CrossRef]

- Sinha-Ray, P.; Carter, J.; Field, T.; Marshall, J.; Polak, J.; Schumacher, K.; Song, D.; Woods, J.; Zhang, J. Container World: Global agent-based modelling of the container transport business. In Proceedings of the 4th International Workshop on Agent-Based Simulation, Montpellier, France, 28–30 April 2003. [Google Scholar]

- Caschili, S.; Medda, F.R. A Review of the Maritime Container Shipping Industry as a Complex Adaptive System. Interdiscip. Descr. Complex Syst. 2012, 10, 1–15. [Google Scholar] [CrossRef]

- Henesey, L.E.; Davidsson, P.; Persson, J.A. Agent based simulation architecture for evaluating operational policies in transhipping containers. Auton. Agents Multi-Agent Syst. 2009, 18, 220–238. [Google Scholar] [CrossRef]

- Winikoff, M.; Wagner, H.F.; Young, T.; Cranefield, S.; Jarquin, R.; Li, G.; Martin, B. Agent-Based Container Terminal Optimisation. In Multiagent System Technologies. MATES 2011. Lecture Notes in Computer Science; Klugl, F., Ossowski, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2011; Volume 6973, pp. 137–148. [Google Scholar]

- Rizaldi, A.; Wasesa, M.; Rahman, M.N. Yard Cranes Coordination Schemes for Automated Container Terminals: An Agent-based Approach. Procedia Manuf. 2015, 4, 124–132. [Google Scholar] [CrossRef] [Green Version]

- Henesey, L.E. Improved inter terminal transportation using agent technology. In Proceedings of the 30th Annual Workshop of the Swedish Artificial Intelligence Society, Karlskrona, Sweden, 15–16 May 2017; pp. 60–67. [Google Scholar]

- Song, D.P.; Dong, J.X. Empty container repositioning. In Handbook of Ocean Container Transport Logistics–Making Global Supply Chain Effective; Lee, C.Y., Meng, Q., Eds.; Springer: New York, NY, USA, 2015; pp. 163–208. [Google Scholar]

- Braekers, K.; Janssens, G.K.; Caris, A. Challenges in Managing Empty Container Movements at Multiple Planning Levels. Transp. Rev. 2011, 31, 681–708. [Google Scholar] [CrossRef]

- Kuzmicz, K.A.; Pesch, E. Approaches to empty container repositioning problems in the context of Eurasian intermodal transportation. Omega 2019, 85, 194–213. [Google Scholar] [CrossRef]

- Shen, W.; Khoong, C. A DSS for empty container distribution planning. Decis. Support Syst. 1995, 15, 75–82. [Google Scholar] [CrossRef]

- Song, D.P.; Dong, J.X. Flow balancing-based empty container repositioning in typical shipping service routes. Marit. Econ. Logist. 2011, 13, 61–77. [Google Scholar] [CrossRef]

- Cheung, R.K.; Chen, C.-Y. A Two-Stage Stochastic Network Model and Solution Methods for the Dynamic Empty Container Allocation Problem. Transp. Sci. 1998, 32, 142–162. [Google Scholar] [CrossRef]

- Erera, A.L.; Morales, J.C.; Savelsbergh, M. Robust Optimization for Empty Repositioning Problems. Oper. Res. 2009, 57, 468–483. [Google Scholar] [CrossRef] [Green Version]

- Brouer, B.D.; Pisinger, D.; Spoorendonk, S. Liner shipping cargo allocation with repositioning of empty containers. INFOR 2011, 49, 109–124. [Google Scholar] [CrossRef] [Green Version]

- Song, D.-P.; Dong, J.-X. Cargo routing and empty container repositioning in multiple shipping service routes. Transp. Res. Part B Methodol. 2012, 46, 1556–1575. [Google Scholar] [CrossRef]

- Chao, S.L.; Chen, C.C. Applying a time–space network to reposition reefer containers among major Asian ports. Res. Trans. Bus. Manag. 2015, 17, 65–72. [Google Scholar] [CrossRef]

- Di Francesco, M.; Crainic, T.G.; Zuddas, P. The effect of multi-scenario policies on empty container repositioning. Transp. Res. Part E Logist. Transp. Rev. 2009, 45, 758–770. [Google Scholar] [CrossRef]

- Di Francesco, M.; Lai, M.; Zuddas, P. Maritime repositioning of empty containers under uncertain port disruptions. Comput. Ind. Eng. 2013, 64, 827–837. [Google Scholar] [CrossRef]

- Moon, I.-K.; Ngoc, A.-D.D.; Hur, Y.-S. Positioning empty containers among multiple ports with leasing and purchasing considerations. OR Spectr. 2010, 32, 765–786. [Google Scholar] [CrossRef]

- Long, Y.; Lee, L.H.; Chew, E.P. The sample average approximation method for empty container repositioning with uncertainties. Eur. J. Oper. Res. 2012, 222, 65–75. [Google Scholar] [CrossRef]

- Moon, I.; Ngoc, A.-D.D.; Konings, R. Foldable and standard containers in empty container repositioning. Transp. Res. Part E Logist. Transp. Rev. 2013, 49, 107–124. [Google Scholar] [CrossRef]

- Myung, Y.-S. Efficient solution methods for the integer programming models of relocating empty containers in the hinterland transportation network. Transp. Res. Part E Logist. Transp. Rev. 2017, 108, 52–59. [Google Scholar] [CrossRef]

- SteadieSeifi, M.; Dellaert, N.; Nuijten, W.; Van Woensel, T. A metaheuristic for the multimodal network flow problem with product quality preservation and empty repositioning. Transp. Res. Part B Methodol. 2017, 106, 321–344. [Google Scholar] [CrossRef]

- Shintani, K.; Konings, R.; Imai, A. Combinable containers: A container innovation to save container fleet and empty container repositioning costs. Transp. Res. Part E Logist. Transp. Rev. 2019, 130, 248–272. [Google Scholar] [CrossRef]

- Li, J.-A.; Liu, K.; Leung, S.C.; Lai, K.K. Empty container management in a port with long-run average criterion. Math. Comput. Model. 2004, 40, 85–100. [Google Scholar] [CrossRef]

- Song, D.-P.; Zhang, Q. A Fluid Flow Model for Empty Container Repositioning Policy with a Single Port and Stochastic Demand. SIAM J. Control. Optim. 2010, 48, 3623–3642. [Google Scholar] [CrossRef]

- Zhang, B.; Ng, C.T.; Cheng, T.C.E. Multi-period empty container repositioning with stochastic demand and lost sales. J. Oper. Res. Soc. 2014, 65, 302–319. [Google Scholar] [CrossRef]

- Legros, B.; Bouchery, Y.; Fransoo, J. A Time-Based Policy for Empty Container Management by Consignees. Prod. Oper. Manag. 2019, 28, 1503–1527. [Google Scholar] [CrossRef]

- Song, D.-P. Characterizing optimal empty container reposition policy in periodic-review shuttle service systems. J. Oper. Res. Soc. 2007, 58, 122–133. [Google Scholar] [CrossRef]

- Lam, S.-W.; Lee, L.-H.; Tang, L.-C. An approximate dynamic programming approach for the empty container allocation problem. Transp. Res. Part C Emerg. Technol. 2007, 15, 265–277. [Google Scholar] [CrossRef]

- Shi, N.; Xu, D. A Markov decision process model for an online empty container repositioning problem in a two-port fixed route. Int. J. Oper. Res. 2011, 8, 8–17. [Google Scholar]

- Ng, C.T.; Song, D.-P.; Cheng, E. Optimal Policy for Inventory Transfer between Two Depots with Backlogging. IEEE Trans. Autom. Control. 2012, 57, 3247–3252. [Google Scholar] [CrossRef]

- Li, J.-A.; Leung, S.C.; Wu, Y.; Liu, K. Allocation of empty containers between multi-ports. Eur. J. Oper. Res. 2007, 182, 400–412. [Google Scholar] [CrossRef]

- Song, D.-P.; Dong, J.-X. Empty Container Management in Cyclic Shipping Routes. Marit. Econ. Logist. 2008, 10, 335–361. [Google Scholar] [CrossRef]

- Dong, J.X.; Song, D.P. Container fleet sizing and empty repositioning in liner ship-ping systems. Trans. Res. Part E 2009, 45, 860–877. [Google Scholar] [CrossRef]

- Song, D.-P.; Dong, J.-X. Effectiveness of an empty container repositioning policy with flexible destination ports. Transp. Policy 2011, 18, 92–101. [Google Scholar] [CrossRef]

- Budipriyanto, A.; Novianti, M.D.; Susanto, T. Empty container reposition using max-min review system: Simulation approach. IOP Conf. Ser. Mater. Sci. Eng. 2021, 1072, 012048. [Google Scholar] [CrossRef]

- Lee, L.H.; Chew, E.P.; Luo, Y. Empty container management in multi-port system with inventory-based control. Int. J. Adv. Syst. Meas. 2012, 5, 164–177. [Google Scholar]

- Yun, W.Y.; Lee, Y.M.; Choi, Y.S. Optimal inventory control of empty containers in inland transportation system. Int. J. Prod. Econ. 2011, 133, 451–457. [Google Scholar] [CrossRef]

- Dang, Q.-V.; Nielsen, I.E.; Yun, W.-Y. Replenishment policies for empty containers in an inland multi-depot system. Marit. Econ. Logist. 2013, 15, 120–149. [Google Scholar] [CrossRef]

- Epstein, R.; Neely, A.; Weintraub, A.; Valenzuela, F.; Hurtado, S.; Gonzalez, G.; Beiza, A.; Naveas, M.; Infante, F.; Alarcon, F.; et al. A Strategic Empty Container Logistics Optimization in a Major Shipping Company. Interfaces 2012, 42, 5–16. [Google Scholar] [CrossRef] [Green Version]

- Xing, X.; Drake, P.R.; Song, D.; Zhou, Y. Tank Container Operators’ profit maximization through dynamic operations planning integrated with the quotation-booking process under multiple uncertainties. Eur. J. Oper. Res. 2019, 274, 924–946. [Google Scholar] [CrossRef]

- Wolff, J.; Herz, N.; Flamig, H. Report on Empty Container Management in the Baltic Sea Region: Experiences and Solutions from a Multi-Actor Perspective; The Baltic Sea Region Programme 2007–2013; Hamburg University of Technology: Hamburg, Germany, 2011. [Google Scholar]

- Heaver, T.; Meersman, H.; Moglia, F.; Van De Voorde, E. Do mergers and alliances influence European shipping and port competition? Marit. Policy Manag. 2000, 27, 363–373. [Google Scholar] [CrossRef]

- Panayides, P.M.; Cullinane, K. Competitive advantage in liner shipping: A review and research agenda. Int. J. Marit. Econ. 2002, 4, 189–209. [Google Scholar] [CrossRef]

- Liu, J.; Wang, J. Carrier alliance incentive analysis and coordination in a maritime transport chain based on service competition. Transp. Res. Part E Logist. Transp. Rev. 2019, 128, 333–355. [Google Scholar] [CrossRef]

- Notteboom, T.E. Container Shipping and Ports: An Overview. Rev. Netw. Econ. 2004, 3, 86–106. [Google Scholar] [CrossRef] [Green Version]

- Cariou, P. Liner shipping strategies: An overview. Int. J. Ocean Syst. Manag. 2008, 1, 2–13. [Google Scholar] [CrossRef]

- Frémont, A. Shipping Lines and Logistics. Transp. Rev. 2009, 29, 537–554. [Google Scholar] [CrossRef]

- Zhu, S.; Zheng, S.; Ge, Y.-E.; Fu, X.; Sampaio, B.; Jiang, C. Vertical integration and its implications to port expansion. Marit. Policy Manag. 2019, 46, 920–938. [Google Scholar] [CrossRef] [Green Version]

- Christiansen, M.; Fagerholt, K.; Ronen, D. Ship Routing and Scheduling: Status and Perspectives. Transp. Sci. 2004, 38, 1–18. [Google Scholar] [CrossRef]

- Christiansen, M.; Fagerholt, K.; Nygreen, B.; Ronen, D. Ship routing and scheduling in the new millennium. Eur. J. Oper. Res. 2013, 228, 467–483. [Google Scholar] [CrossRef]

- Brouer, B.D.; Alvarez, J.F.; Plum, C.E.M.; Pisinger, D.; Sigurd, M.M. A Base Integer Programming Model and Benchmark Suite for Liner-Shipping Network Design. Transp. Sci. 2014, 48, 281–312. [Google Scholar] [CrossRef] [Green Version]

- Meng, Q.; Wang, S.; Andersson, H.; Thun, K. Containership Routing and Scheduling in Liner Shipping: Overview and Future Research Directions. Transp. Sci. 2014, 48, 265–280. [Google Scholar] [CrossRef] [Green Version]

- Tran, N.K.; Haasis, H.-D. Literature survey of network optimization in container liner shipping. Flex. Serv. Manuf. J. 2013, 27, 139–179. [Google Scholar] [CrossRef]

- Dulebenets, M.A.; Pasha, J.; Abioye, O.; Kavoosi, M. Vessel scheduling in liner shipping: A critical literature review and future research needs. Flex. Serv. Manuf. J. 2021, 33, 43–106. [Google Scholar] [CrossRef]

- Agarwal, R.; Ergun, Ö. Ship Scheduling and Network Design for Cargo Routing in Liner Shipping. Transp. Sci. 2008, 42, 175–196. [Google Scholar] [CrossRef]

- Wang, T.; Wang, S.; Meng, Q. Liner Ship Fleet Planning: Models and Algorithms; Elsevier: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Qi, X.; Song, D.P. Minimizing fuel emissions by optimizing vessel schedules in liner shipping with uncertain port times. Trans. Res. Part E 2012, 48, 863–880. [Google Scholar] [CrossRef]

- Wang, S.; Meng, Q. Liner ship route schedule design with sea contingency time and port time uncertainty. Transp. Res. Part B Methodol. 2012, 46, 615–633. [Google Scholar] [CrossRef]

- Psaraftis, H.; Kontovas, C.A. Speed models for energy-efficient maritime transportation: A taxonomy and survey. Transp. Res. Part C Emerg. Technol. 2013, 26, 331–351. [Google Scholar] [CrossRef]

- Psaraftis, H.; Kontovas, C.A. Ship speed optimization: Concepts, models and combined speed-routing scenarios. Transp. Res. Part C Emerg. Technol. 2014, 44, 52–69. [Google Scholar] [CrossRef] [Green Version]

- Ng, M. Vessel speed optimisation in container shipping: A new look. J. Oper. Res. Soc. 2018, 70, 541–547. [Google Scholar] [CrossRef]

- Fagerholt, K.; Laporte, G.; Norstad, I. Reducing fuel emissions by optimizing speed on shipping routes. J. Oper. Res. Soc. 2010, 61, 523–529. [Google Scholar] [CrossRef]

- Ronen, D. The effect of oil price on containership speed and fleet size. J. Oper. Res. Soc. 2011, 62, 211–216. [Google Scholar] [CrossRef]

- Cariou, P. Is slow steaming a sustainable means of reducing CO2 emissions from container shipping? Transp. Res. Part D Transp. Environ. 2011, 16, 260–264. [Google Scholar] [CrossRef]

- Finnsgard, C.; Kalantari, J.; Roso, V.; Woxenius, J. The Shipper’s perspective on slow steaming—Study of six Swedish companies. Trans. Policy 2020, 86, 44–49. [Google Scholar] [CrossRef]

- Roberti, R.; Pacino, D. A Decomposition Method for Finding Optimal Container Stowage Plans. Transp. Sci. 2018, 52, 1444–1462. [Google Scholar] [CrossRef]

- Brouer, B.D.; Dirksen, J.; Pisinger, D.; Plum, C.E.; Vaaben, B. The Vessel Schedule Recovery Problem (VSRP)—A MIP model for handling disruptions in liner shipping. Eur. J. Oper. Res. 2013, 224, 362–374. [Google Scholar] [CrossRef]

- Li, C.; Qi, X.; Lee, C.-Y. Disruption Recovery for a Vessel in Liner Shipping. Transp. Sci. 2015, 49, 900–921. [Google Scholar] [CrossRef]

- Li, C.; Qi, X.; Song, D. Real-time schedule recovery in liner shipping service with regular uncertainties and disruption events. Transp. Res. Part B Methodol. 2016, 93, 762–788. [Google Scholar] [CrossRef]

- Cheraghchi, F.; Abualhaol, I.; Falcon, R.; Abielmona, R.; Raahemi, B.; Petriu, E. Modeling the speed-based vessel schedule recovery problem using evolutionary multiobjective optimization. Inf. Sci. 2018, 448–449, 53–74. [Google Scholar] [CrossRef]

- Yao, Z.; Ng, S.H.; Lee, L.H. A study on bunker fuel management for the shipping liner services. Comput. Oper. Res. 2012, 39, 1160–1172. [Google Scholar] [CrossRef]

- De, A.; Choudhary, A.; Turkay, M.; Tiwari, M.K. Bunkering policies for a fuel bunker management problem for liner shipping networks. Eur. J. Oper. Res. 2021, 289, 927–939. [Google Scholar] [CrossRef]

- Waters, W. Impact of Yantian Disruption ‘Exceeds the Suez Incident’. Lloyds Loading List, 11 June 2021. Available online: https://www.lloydsloadinglist.com/freight-directory/news/Impact-of-Yantian-disruption-%E2%80%98exceeds-the-Suez-incident%E2%80%99/79276.htm#.YMwqjfKSnIU (accessed on 17 June 2021).

- Steenken, D.; Voß, S.; Stahlbock, R. Container terminal operation and operations research—A classification and literature review. Contain. Termin. Autom. Trans. Syst. 2005, 26, 3–49. [Google Scholar] [CrossRef]

- Stahlbock, R.; Voß, S. Operations research at container terminals: A literature update. OR Spectr. 2008, 30, 1–52. [Google Scholar] [CrossRef]

- Carlo, H.J.; Vis, I.F.A.; Roodbergen, K.J. Seaside operations in container terminals: Literature overview, trends, and research directions. Flex. Serv. Manuf. J. 2015, 27, 224–262. [Google Scholar] [CrossRef]

- Kim, K.H.; Lee, H. Container Terminal Operation: Current Trends and Future Challenges, In Handbook of Ocean Container Transport Logistics–Making Global Supply Chain Effective; Lee, C.-Y., Meng, Q., Eds.; Springer: New York, NY, USA, 2015; pp. 43–74. [Google Scholar]

- Bierwirth, C.; Meisel, F. A survey of berth allocation and quay crane scheduling problems in container terminals. Eur. J. Oper. Res. 2010, 202, 615–627. [Google Scholar] [CrossRef]

- Bierwirth, C.; Meisel, F. A follow-up survey of berth allocation and quay crane scheduling problems in container terminals. Eur. J. Oper. Res. 2015, 244, 675–689. [Google Scholar] [CrossRef]

- Yang, C.; Wang, X.; Li, Z. An optimisation approach for coupling problem of berth allocation and quay crane assignment in container terminal. Comput. Ind. Eng. 2012, 63, 243–253. [Google Scholar] [CrossRef]

- Ursavas, E. A decision support system for quayside operations in a container terminal. Decis. Support Syst. 2014, 59, 312–324. [Google Scholar] [CrossRef]

- Zhen, L.; Jiang, X.; Lee, L.H.; Chew, E.P. A Review on Yard Management in Container Terminals. Ind. Eng. Manag. Syst. 2013, 12, 289–304. [Google Scholar] [CrossRef]

- Covic, F. A literature review on container handling in yard blocks. In Computational Logistics. ICCL 2018. Lecture Notes in Computer Science; Cerulli, R., Raiconi, A., Voß, S., Eds.; Springer: Cham, Switzerland, 2018; Volume 11184. [Google Scholar]

- Luo, J.; Wu, Y.; Mendes, A.B. Modelling of integrated vehicle scheduling and container storage problems in unloading process at an automated container terminal. Comput. Ind. Eng. 2016, 94, 32–44. [Google Scholar] [CrossRef]

- Feng, Y.; Song, D.-P.; Li, D.; Zeng, Q. The stochastic container relocation problem with flexible service policies. Transp. Res. Part B Methodol. 2020, 141, 116–163. [Google Scholar] [CrossRef]

- Chen, G.; Govindan, K.; Yang, Z. Managing truck arrivals with time windows to alleviate gate congestion at container terminals. Int. J. Prod. Econ. 2013, 141, 179–188. [Google Scholar] [CrossRef]

- Ambrosino, D.; Siri, S. Comparison of solution approaches for the train load planning problem in seaport terminals. Transp. Res. Part E 2015, 79, 65–82. [Google Scholar] [CrossRef]

- Xie, Y.; Song, D.-P. Optimal planning for container prestaging, discharging, and loading processes at seaport rail terminals with uncertainty. Transp. Res. Part E Logist. Transp. Rev. 2018, 119, 88–109. [Google Scholar] [CrossRef]

- Song, D.-W. Port co-opetition in concept and practice. Marit. Policy Manag. 2003, 30, 29–44. [Google Scholar] [CrossRef]

- Asadabadi, A.; Miller-Hooks, E. Co-opetition in enhancing global port network resiliency: A multi-leader, common-follower game theoretic approach. Transp. Res. Part B Methodol. 2018, 108, 281–298. [Google Scholar] [CrossRef]

- Lagoudis, I.N.; Theotokas, I.; Broumas, D. A literature review of port competition research. Int. J. Shipp. Transp. Logist. 2017, 9, 724. [Google Scholar] [CrossRef]

- Wan, Y.; Zhang, A.; Li, K.X. Port competition with accessibility and congestion: A theoretical framework and literature review on empirical studies. Marit. Policy Manag. 2017, 45, 239–259. [Google Scholar] [CrossRef]

- Mclaughlin, H.; Fearon, C. Understanding the development of port and regional relationships: A new cooperation/competition matrix. Marit. Policy Manag. 2013, 40, 278–294. [Google Scholar] [CrossRef]

- Notteboom, T.; Rodrigue, J.P. Port regionalization: Towards a new phase in port development. Marit. Policy Manag. 2005, 32, 297–313. [Google Scholar] [CrossRef]

- Mwemezi, J.J.; Huang, Y. Inland container depot integration into logistics networks based on network flow model: The Tanzanian perspective. Afr. J. Bus. Manag. 2012, 6, 7149–7157. [Google Scholar]

- Lam, J.S.L.; Gu, Y. Port hinterland intermodal container flow optimisation with green concerns: A literature review and research agenda. Int. J. Shipp. Transp. Logist. 2013, 5, 257. [Google Scholar] [CrossRef]

- Bouchery, Y.; Fazi, S.; Fransoo, J.C. Hinterland Transportation in Container Supply Chains. In Handbook of Ocean Container Transportation Logistics; Lee, C.Y., Meng, Q., Eds.; Springer: New York, NY, USA, 2015; pp. 497–520. [Google Scholar]

- Wang, W.F.; Yun, W.Y. Scheduling for inland container truck and train transportation. Int. J. Prod. Econ. 2013, 143, 349–356. [Google Scholar] [CrossRef]

- Fazi, S.; Roodbergen, K.J. Effects of demurrage and detention regimes on dry-port-based inland container transport. Transp. Res. Part C Emerg. Technol. 2018, 89, 1–18. [Google Scholar] [CrossRef]

- Tao, X.; Wu, Q. Energy consumption and CO2 emissions in hinterland container transport. J. Clean. Prod. 2021, 279, 123394. [Google Scholar] [CrossRef]

- Notteboom, T.E. The Time Factor in Liner Shipping Services. Marit. Econ. Logist. 2006, 8, 19–39. [Google Scholar] [CrossRef]

- Bush, D. Logistics Industry Calls for UK Government Help on Port Congestion. Lloyds List, 9 December 2020. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1135070 (accessed on 17 June 2021).

- Porter, J. LA/Long Beach Anchorages Full as Cargo Surge Clogs Californian Supply Chains. Lloyds List, 29 December 2020. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1135250 (accessed on 17 June 2021).

- Tirschwell, P. Fewer ’No Shows’ Key to Service Contract Evolution. The Journal of Commerce Online, 8 May 2017. Available online: https://www.joc.com/maritime-news/container-lines/predictability-cargo-flows-vital-cost-savings_20170508.html (accessed on 17 June 2021).

- Johnson, E. Maersk Revives No-Show Fees for Bookings. The Journal of Commerce Online, 25 June 2019. Available online: https://www.joc.com/maritime-news/container-lines/maersk-line/maersk-revives-no-show-fees-bookings_20190625.html (accessed on 17 June 2021).

- Feibert, D.C.; Hansen, M.S.; Jacobsen, P. An Integrated Process and Digitalization Perspective on the Shipping Supply, Chain—A Literature Review. In Proceedings of the 2017 IEEE International Conference on Industrial Engineering and Engineering Management, Singapore, 10–13 December 2017. [Google Scholar]

- Egloff, C.; Sanders, U.; Georgaki, K.; Riedl, J. The Digital Imperative in Container Shipping. BCG Shipping Portal, 2 February 2018. Available online: https://www.bcg.com/publications/2018/digital-imperative-container-shipping (accessed on 17 June 2021).

- Lambrou, M.; Watanabe, D.; Iida, J. Shipping digitalization management: Conceptualization, typology and antecedents. J. Shipp. Trade 2019, 4, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Yang, C.-S. Maritime shipping digitalization: Blockchain-based technology applications, future improvements, and intention to use. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 108–117. [Google Scholar] [CrossRef]

- Anwar, M.; Henesey, L.; Casalicchio, E. Digitalization in container terminal logistics: A literature review. In Proceedings of the 27th Annual Conference of International Association of Maritime Economists, Athens, Greece, 25–28 June 2019; pp. 1–25. [Google Scholar]

- Rossiter, C.M.; Pearch, B.W. Communicating Personally; Macmillan: New York, NY, USA, 1975. [Google Scholar]

- Baker, J. Maersk’s Integration Strategy begins to Pay off. Lloyds List, 5 May 2021. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1136678 (accessed on 17 June 2021).

- Olmer, N.; Comer, B.; Roy, B.; Mao, X.; Rutherford, D. Greenhouse Gas Emissions from Global Shipping, 2013–2015; International Council on Clean Transportation: Washington, DC, USA, 2017. [Google Scholar]

- Bouman, E.A.; Lindstad, E.; Rialland, A.I.; Strømman, A.H. State-of-the-art technologies, measures, and potential for reducing GHG emissions from shipping—A review. Transp. Res. Part D Transp. Environ. 2017, 52, 408–421. [Google Scholar] [CrossRef]

- Shi, W.; Xiao, Y.; Chen, Z.; McLaughlin, H.; Li, K.X. Evolution of green shipping research: Themes and methods. Marit. Policy Manag. 2018, 45, 863–876. [Google Scholar] [CrossRef]

- Lagouvardou, S.; Psaraftis, H.N.; Zis, T. A Literature Survey on Market-Based Measures for the Decarbonization of Shipping. Sustainability 2020, 12, 3953. [Google Scholar] [CrossRef]

- Rutherford, D.; Comer, B. The International Maritime Organization’s Initial Greenhouse Gas Strategy; International Council on Clean Transportation: Washington, DC, USA, 2018. [Google Scholar]

- DNV. Maritime Forecast to 2050—Energy Transition Outlook 2020; DNV GL: Hovik, Norway, 2020. [Google Scholar]

- Englert, D.; Losos, A.; Raucci, C.; Smith, T. The Role of LNG in the Transition toward Low- and Zero-Carbon Shipping; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Tan, H.H. Shipowners Rank LNG as Top Fuel in Energy Transition. Lloyds List, 5 May 2021. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1136674 (accessed on 17 June 2021).

- Adamopoulos, A. Shipping Leaders Disagree on Future of LNG in Shipping. Lloyds List, 12 May 2021. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1136761 (accessed on 17 June 2021).

- GEF-UNDP-IMO. Port Emissions Toolkit, Guide No.1, Assessment of Port Emissions. Global Maritime Energy Efficiency Partnerships (GloMEEP) and International Association of Ports and Harbors (IAPH); Elephant Print: Lewes, UK, 2018. [Google Scholar]

- GEF-UNDP-IMO. Port Emissions Toolkit, Guide No.2, Development of Port Emissions Reduction Strategies. Global Maritime Energy Efficiency Partnerships (GloMEEP) and International Association of Ports and Harbors (IAPH); Elephant Print: Lewes, UK, 2018. [Google Scholar]

- Iris, Ç.; Lam, J.S.L. A review of energy efficiency in ports: Operational strategies, technologies and energy management systems. Renew. Sustain. Energy Rev. 2019, 112, 170–182. [Google Scholar] [CrossRef]

| Planning Level | Planning Activities |

|---|---|

| Strategic level planning | Trade lane and market coverage selection and expansion; Horizontal integration & strategic alliance; Shipping line competition; Vertical integration; Long-term contracting strategy; Ship design; Fuel and energy system selection; Ship fleet size and mix; Ship chartering |

| Tactical planning level | Shipping network design and redesign; Fleet deployment & redeployment; Ship routing and adjustment; Ship scheduling and timetabling; Ship speed & service frequency planning; Ship laying-up; Ship recycling; Inventory routing; Shipment routing; Container fleet management |

| Operational planning level | Spot-market pricing; Empty container repositioning; Ship speed optimization; Slow steaming; Ship rescheduling; Ship repositioning; Environmental/weather routing; Disruption event management; Container stowage planning; Ship bunkering; Ship loading/unloading |

| Quayside | Yardside | Landside | Across Processes | |

|---|---|---|---|---|

| Strategic | Berth layout Quay crane selection | Yard layout Yard equipment | Gate layout Rail terminal layout | Port competition, Port cooperation, Integration, Multi-modal interfaces, Terminal layout, IT systems |

| Tactical | Berth allocation Quay crane assignment | Storage planning Resource assignment | Vehicle booking system Rail service planning | |

| Operational | Quay crane scheduling Loading/unloading Workforce scheduling Internal truck scheduling | Yard crane scheduling Container relocation Workforce scheduling Internal truck scheduling | External truck handling Wagon shunting Workforce scheduling Equipment scheduling |

| Logistics Sectors | Planning Activities |

|---|---|

| Truck operations | Truck fleet management; Truck pooling and sharing; Container drayage; Vehicle booking system; Empty vehicle repositioning; Empty container repositioning; Truck routing and scheduling; Disruptive event management. |

| Rail & barge service | Rail/barge route design; Service timetable design; Wagon shunting; Barge vessel stowage planning; Rail-car fleet management; Empty rail-car repositioning; Container loading and unloading; Transport mode choice; Carrier selection. |

| Inland depot | Depot/dry port location; Inland container transport network design; Depot layout; Container storage; Container repair and maintenance; Container substitution; Demurrage and detention; Loading and unloading; Consolidation and unpacking. |

| % of Energy | 2030 | 2040 | 2050 |

|---|---|---|---|

| VLSFO/MGO | 46% | 12% | 1% |

| LNG | 25% | 48% | 19% |

| Heavy fuel oil | 17% | 10% | 0% |

| e-MGO | 10% | 10% | 23% |

| e-LNG | 2% | 3% | 3% |

| e-ammonia | 0% | 10% | 40% |

| bio-LNG | 0% | 5% | 11% |

| e-methanol | 0% | 2% | 3% |

| Low-carbon fuels | Petroleum-based fuels with carbon capture and sequestration systems; LNG; LPG; Methanol; Ethanol; Biofuel |

| Carbon-neutral fuels | Bio-MGO; e-MGO; Bio-LNG; e-LNG; Synthetic fuels by hydrogenating carbon dioxide; Biofuels through photosynthesis; Renewable natural gas; Renewable diesel fuel |

| Zero-carbon fuels | Hydrogen; e-ammonia; Bio-methanol; e-methanol; Fuels produced from renewable electricity, biomass and natural gas with CCS |

| Fuel choice determinants | Economic performance: Commercial interest of stakeholders; Future price of energy sources (renewable electricity, natural gas and biomass); Future fuel prices; Energy density; Compatibility with conventional marine engines Environmental considerations: CO2 emission; other emissions (SOx/NOx, particulate matters); life cycle emission Regulations and policies: International, regional, national and even port-based emission regulations and policies; Safety regulations; Market-based measures; Entering into force over short and medium term; Technology considerations: Technology readiness level; Safety and security; Ship design technology; Technology for generating power; Engine technologies; Operational measures: Ship types and sizes; Trade routes; Digitalization to reduce GHG; Transport modal shift; Ability to comply with regulations; Logistics considerations: Fuel supply infrastructure; Fuel availability; Fuel storage and transport; Ship re-fuelling |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, D. A Literature Review, Container Shipping Supply Chain: Planning Problems and Research Opportunities. Logistics 2021, 5, 41. https://doi.org/10.3390/logistics5020041

Song D. A Literature Review, Container Shipping Supply Chain: Planning Problems and Research Opportunities. Logistics. 2021; 5(2):41. https://doi.org/10.3390/logistics5020041

Chicago/Turabian StyleSong, Dongping. 2021. "A Literature Review, Container Shipping Supply Chain: Planning Problems and Research Opportunities" Logistics 5, no. 2: 41. https://doi.org/10.3390/logistics5020041

APA StyleSong, D. (2021). A Literature Review, Container Shipping Supply Chain: Planning Problems and Research Opportunities. Logistics, 5(2), 41. https://doi.org/10.3390/logistics5020041