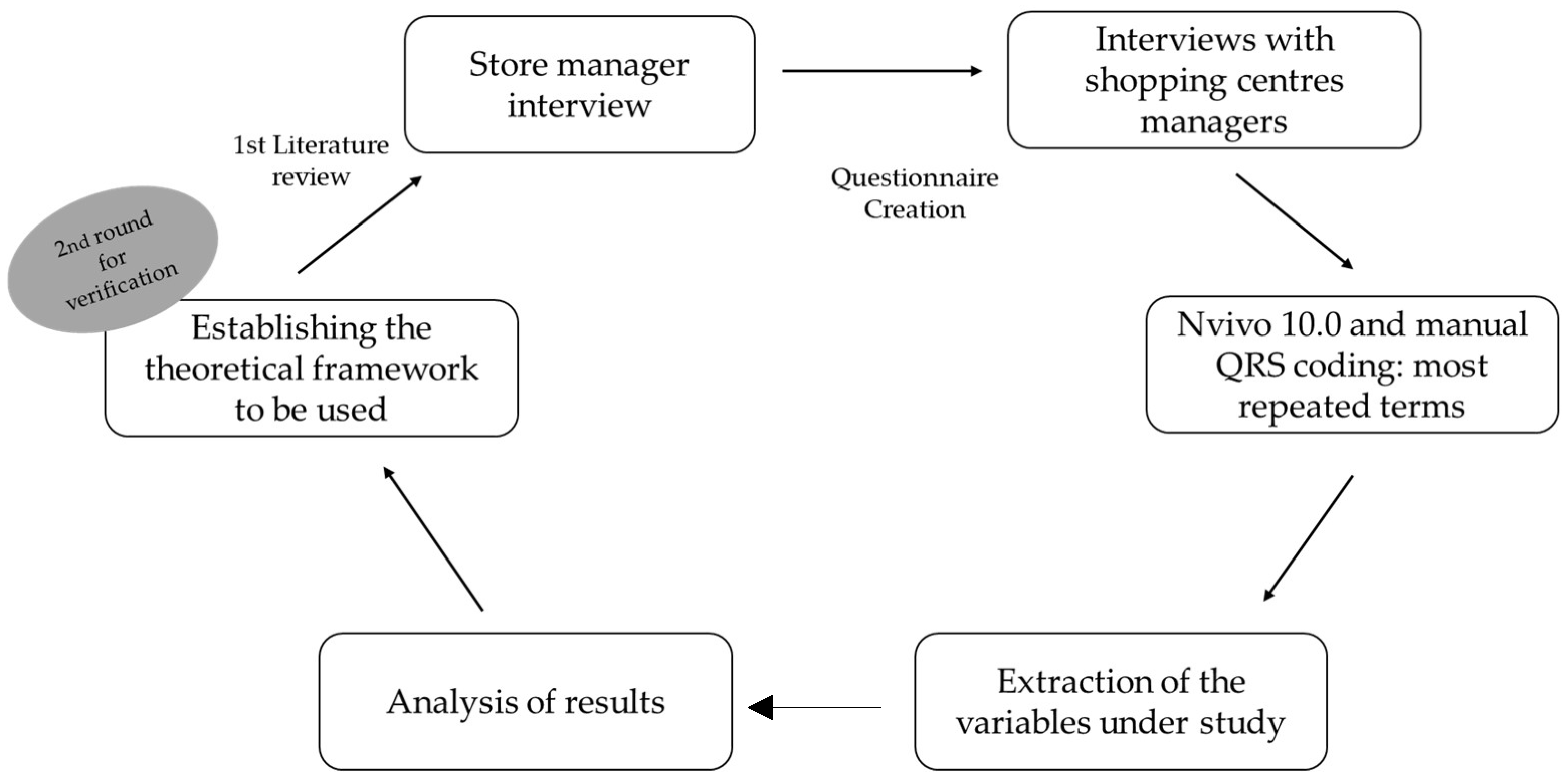

An explanatory analysis is proposed that aims to reach the conclusions of the study through descriptions, according to the MCS factor being addressed. Firstly, the characteristics of each shopping centre are detailed, which leads to the subsequent analysis of the five factors extracted in the study, placing them in a framework of comparison for the three cases presented. This allows for establishing the final investigation conclusions.

4.2. Analysis and Comparison of the Proposed Cases

The MCS in a shopping centre is fundamentally influenced by the person who manages it. In a commercial context that focuses on the customer, it is necessary for the manager to consider who the customers are, defined by all the interviewees as ownership, commercial stores, and the end consumer. The management they carry out is focused on satisfying all of these actors.

Thus, to allow comparison and to speed up the analysis of the findings obtained, a series of tables (

Table 3,

Table 4,

Table 5,

Table 6 and

Table 7) were constructed, with a more in-depth analysis of the research question to be observed, described, and analysed: the MCS of shopping centres from the perspective of the person who develops it, the Managing Director. These tables were organised according to the three cases under study: Case 1—centres A and B, urban and conventional; Case 2—centres C and D, peripheral and conventional; Case 3—centres E and F, peripheral and outlet.

This analysis begins with

Table 3, where the ownership structure and aspects influenced by this factor are analysed. In addition, it is worth noting the widespread confusion between management and ownership, which in most cases does not match in the same figure.

There are two types of ownership structure: a single owner and community of owners. These are natural or legal persons who invest in the property with the aim of generating their own profit, but who are not involved in the management of shopping centres. They generally operate only as investors. For the management of the property, they hire an external management service company.

Shopping centres A and B have a community of owners. In centre B, the ownership is divided by floors: one company owns the third floor, while a German investment fund owns first and second floors. Thus, each separately owns a percentage of the centre.

A community of owners is formed in the common areas; the German investment fund owns 70% and the other company owns 30%. It is a separate entity from the owners, and it is the community that hires the management services.

Table 3.

Ownership structure 1.

Table 3.

Ownership structure 1.

| | Elements | Case 1 | Case 2 | Case 3 |

| Ownership structure | Classification | Community of owners | C: single owner

D: single owner of the shopping centre and a community of owners with a large furniture company for the parking | E: single owner

F: investment fund owner. The managing company is also part of the ownership |

| Ownership decisions | Approval of the budget and extraordinary contributions | Approval of the budget and extraordinary contributions | Approval of the budget and extraordinary contributions

F: everything is coordinated by the owner-management company |

| Report to the owner | Monthly reports | Monthly reports | Monthly reports

F: Near-daily information |

The owners rent the commercial spaces, but it is the management that oversees putting the owners in contact with the “tenants” and engaging in negotiations. The commercial contract is signed by the owners with the store, but the companies can be chosen by the manager. There is always the possibility that the owner requires a particular brand, but this is not usually the case. The administrators propose, and the owner authorises.

Generally, the ownership structure does not affect the manager’s decisions. Owners are limited to approving manager’s proposals. However, in the community of owners, it is more complicated to approve any decision, because a board of owners must agree and vote. This applies to major decisions, such as expanding or renovating the centre, which will likely require their financial contribution. In a community of owners, communication is more formal and sporadic, while with a single owner it is simpler and more fluid.

In the activities of the manager, regarding the hiring of maintenance companies or any marketing actions, the owners usually agree or simply do not interfere. In the words of manager A, “Obviously, depending on the renovation and the project, sometimes approval is needed and sometimes not. Anything that goes outside the plan established by the board, if there is one, or together with the owner… I think it is always healthy to inform”.

The goal of the owners is to make a profit from the centre, and this profit comes from the rent paid by the stores. In some centres there are stores that pay incentives for sales. That is, in addition to the rent they pay, sales levels are established for which they pay a percentage to the owners. Therefore, the managers must worry about the sales of their stores and that the centre is doing well, because if these stores sell more, the owners’ rents and profits increase. From the management of rentals as such, the managers do not obtain any benefit. They only collect remuneration for their management services. Manager C in Case 2 explained “there is no profit sharing; the owner, that is, the owner pays a fee to the management, we are just another outsourcer”.

The management company is not part of the ownership in any of the centres analysed, except in centre F. According to manager E (Case 3) “The company I work for does not buy shopping centres; it only manages them. It is a services company (…) So it is very different when the centre is yours… although there are basic things such as cleaning control, security, maintenance… which is basic and common to everything. But at the accounting level, management is very different if the centre is yours”. This is where the difference is marked to centre F.

Despite these discrepancies, there are no differences at the management level, but rather in terms of communication and unity. Manager F receives guidelines from his company that he must follow. They are also part of the ownership.

Overall, the owner is not involved in the management but must be informed. All centres prepare reports, including new ideas or proposals, which are normally fully approved and carried out during the current year. In the words of manager C, “we talk to the owners. Every year we give them a set of ideas to do things and we see what is needed, and then at the end (…) they approve it or not, and if they approve it, we take it forward”; and manager D, “all this management that we do both with the end customers and with the retailers, we have to make a monthly report and we have to hold monthly meetings with the owners”.

In shopping centre D, ownership structure is somewhat more complex than in the rest, but it does not affect management decisions and is in agreement with everything analysed thus far. It is a single owner, who operates in the same way as the rest. But this centre has a particularity, that is, it is connected to a large furniture marketer, with whom it shares the parking zone. Therefore, the furniture company and shopping centre D form a community of owners that manages the parking, which the manager must oversee. He explains: “on the one hand, the centre has only one owner. On the other hand, the centre plus the furniture company form a community of owners where there are statutes that both must respect, for how the meetings are generated, how decisions are taken…”.

The only notable difference is in centre F (Case 3), as the management company is 20% owned by an investment fund. Thus, decision making is easier than in the rest of centres, because it is imposed and coordinated from the central office. In short, in centre F, everything is reduced to the managing company: “Here, as we are the owners, it is different. We have everything centralised with our bosses, we have to balance departments, interests, expenses that are imposed from above”.

It can be concluded that, in general, the ownership structure is not a determining factor when establishing the role of the director general as the delegated administrator of the centre.

Table 4 summarises the features of budget management, including the annual planning of available resources. The results and the previous literature [

18] suggest the importance of the budget for all centres as a basic planning and control tool. It depends on the ownership for its approval, since the resources it provides depend on its planning, but the preparation and control are in any case carried out by the manager.

The complexity of this process depends on the type of ownership structure. In Case 1, manager A explains in detail, “we send the budget with a report, a detailed report that explains our forecast of what is going to happen in the coming year, what we consider to be correct in each item, in terms of size, marketing campaigns... and this is presented to the co-owners, so they have a period of study of these budgets. The Board of Owners is convened and at the meeting the budget is discussed and approved or not. If it is not approved, an extraordinary Board of Owners will be convened again, with the revision of what has been agreed on this point”.

When preparing the budget, factors based on the study of the previous year are considered, adjusting for new marketing actions. As manager B says, “I do it in two very simple ways: one, I base it a lot on the consumption or expenses we have generated the previous year in each of the items, I assess whether it is maintained or not, or if it needs to be readjusted; and two, I see if something new needs to be done”. Similarly, in Case 2, manager C asserts that “We have some contracts already signed with external companies, so we distribute the budget according to these contracts. Then there are certain elements such as maintenance, everything that breaks down or needs to be fixed (...) for which we have an amount, and we distribute that amount as we see fit. In the end, what the owner approves is the total amount“.

Table 4.

Planning: budget management and control 1.

Table 4.

Planning: budget management and control 1.

| | Elements | Case 1 | Case 2 | Case 3 |

|---|

| Budget management | Development, management, and control | Manager. Approval by owners at the beginning of each financial year | Manager. Approval by owners

F: the budget is implemented by managing company |

| Control | Monthly reviews |

| Most important item | Maintenance |

| Owners decisions and contingencies | Approval of the budget and extraordinary expenses.

In case of exceptionalities, manager’s decision:

1. Reduction from other items (marketing)

2. Move as expenditure to the following year

3. Financing is requested from the property |

| Report to the owners | A: quarterly

B: monthly | Monthly | Monthly

F: continuously informed |

It is confirmed that ownership only approves the total budget that is managed by the managing director. In addition, in Case 2, according to manager D, “I have help from other departments in the company or other people working in the management team, but the responsibility lies with the Managing Director”; and for Case 3 (E): “the operating budget of the shopping centre is done here, it is managed here and just take expenses from here”.

The budget approval process only differs if it is a community of owners; they must convene a board of owners. Where it is a single owner, it is simpler: “for example, for the part of the shopping centre, as it has only one owner, the budget is sent to him, and he decides. The parking zone has two owners, because there is the single owner of the centre and there is the large furniture store, so a Board of Owners must be convened and there the budgets are presented and voted on”, according to manager D for Case 2; it is similar for all the centres analysed.

The budget factor is closely connected to maintenance and marketing. The former is at the heart of the budget, because centre maintenance is essential. It will always be the item that weighs most heavily on the budget. Within the maintenance factor, each manager gives more importance to certain functions (security, cleaning, consumption, among others). According to manager B (Case 1), “you have to balance the day-to-day running of the centre and the budget. And it depends, and try to be imaginative if you don’t have money, because if a lamp blows out you must put it back in. If the lamp is out, in the end that’s a bad service you’re giving to the client. So, you must get money from somewhere else, or you must convince, or you have to be imaginative”.

The budget is also related to the marketing item because it is the budget item that can always be reduced or modified. This conclusion is reached for all cases, regardless of the type of centre. In Case 2, manager D states, “for example, if there is a breakage of 20 pieces in the gallery that you have not budgeted for, and you cannot take them to the following year in the multi-year plan because they have to be fixed this year, and then only with that you have already spent half of the budget of spare parts, you have to get that money out of marketing”; or in Case 3, manager E notes that “it is normally carried over to the following year, as a surplus or deficit. The other option is to get it from the marketing account, because it is the only place where you can play a little more, where you can say I do one less action or I give less pieces of paper, but it is the only place. You can’t take away light, you can’t take away security, you can’t take away cleanliness. Can’t get rid of that kind of thing”.

If something unforeseen arises, the most common is to ask the owners for money. Manager A (Case 1) indicates, “If it’s something urgent, then it takes on an immediacy and need for funds. These funds can be provided directly through an extraordinary account in the budget, or it can be through a credit institution if necessary. But hey, it’s true that usually the owners of shopping centres usually have some extra money, right? If they have to face extraordinary expenses”. In any case, it is up to the manager to decide how to manage these unforeseen events.

As for budget control, this is carried out periodically, sending a monthly report to the owners. Manager E of Case 3 explains, “we monitor the budget monthly, with a monthly closing forecast. Then, in January, I compare my actual expenses for January to my projected expenses and make what would be a closing forecast for December. In February I repeat the same thing, to see if I am compensating for what I had planned or if I am overdoing it. If I see that we are going too far, well, we must slow down, see where we are drifting and correct”.

In Case 3, despite their status as outlet centres, there is little difference from the other centres. However, there seems to be increased rigidity of the approval of the budget by the owners and the importance that the manager gives to each item: “the operation is the same. In any centre you have some expenses that are obvious. Then it is true that some budget items may change in one centre or another... but not because it is an outlet, that does not matter. It depends more on the criteria of the person who manages it. But the items are the same”, says manager E for Case 3.

For Case 3, the main differences are found in centre F, where the budget is directly coordinated by the manager-owner company, and the manager can only modify it with the approval of his superiors. As manager F states, “in a normal shopping centre, the budget has to be approved by the owners. The person responsible for the budget in each centre is the manager. Here, the budgets are coordinated directly by my superiors. I send them a proposal if necessary, which they review and approve. In addition, in case of unforeseen events it is much easier to obtain extra funds”.

In conclusion, it is verified that the only thing that is needed in the budget factor is the approval of the owner. Although, if the management company is also an owner, it is more coordinated and not limited to the approval of the final amount by the owner, as in the rest of the centres. The fact that a centre is an outlet does not make any difference in terms of budget management.

As for the maintenance factor, we focus on

Table 5. Maintenance is the most important function that the manager must control. This is true for all three cases studied. The differences depend on the importance that each manager gives to each item, be it safety, consumption, or cleanliness. However, maintenance in general is the main factor to control. In Case 1, manager B states that “the manager of a shopping centre has several functions, the first of which is to preserve and maintain and, if possible, improve the owners’ equity”.

Maintenance has a big impact on the budget. For example, in terms of garbage and waste, centres with restaurants manage much more garbage than a centre with only fashion. The former has a higher cost that must be considered in the budget: “in waste management, fashion only brings you cardboard and plastic. If you suddenly add to that waste that from restaurants and bars, we enter into a completely different concept of waste that has many more expenses (...) So at a given moment you have to adapt the budget to this type of operation“, suggests manager B (Case 1). Manager D (Case 2) states that “having a clean centre, having a safe centre and having a well-maintained centre represents 60% of the spending budget of a shopping centre”.

The maintenance companies are outsourcers chosen by the management, without the need for approval by the owner (Case 1-B): “the shopping centre as such only has three workers: two maintenance managers and my receptionist colleague. The rest are all outsourced, absolutely all of them: security, cleaning, everyone who depends on us, the rest of the maintenance people, marketing, the tenants... they are all external”.

In Case 3, the procedures are the same as in any conventional centre. Again, there are no differences either because it is an outlet-type centre or because of its location. According to manager E, “I carry out the same functions as any other centre director, right?” or manager F: “Let’s imagine that a shopping centre is a building. A building must have a doorman, the stairs have to be cleaned, it has to open in the morning, it has to close at night, and it has to provide a series of minimum services to the tenants and owners who live there. Well this is like a large building, we are also guided by the Horizontal Property Law, we charge rent, just like the manager of a flat”.

Table 5.

Centre maintenance management 1.

Table 5.

Centre maintenance management 1.

| | Elements | Case 1 | Case 2 | Case 3 |

|---|

| Maintenance | Most important task to manage. Main control cannot be subject to budget changes or reductions. Need to be prepared for unforeseen events. |

| The most important service within the maintenance of each centre depends on the manager preferences | Security; probably due to their status as the most popular urban centres in the city and their location | Consumption and cleanliness | Organisation and cleanliness |

| Owners | Does not interfere in the management of maintenance, which is an exclusive function of the manager. Monthly reports. |

| Contingencies | Contingency item within the budget; carried forward as a deficit; other items are modified (marketing) or funding is requested from the owners. |

| Service companies in the shopping centre | Outsourced. The management company is a different entity in every case from the maintenance companies (security, cleaning, etc.). |

The marketing factor is summarised in

Table 6. The marketing policies followed by the managers depend mainly on the location of the centre and the public they want to target, but not on the price level set, which contradicts the previous literature [

15,

17].

The trend indicates that the price policy does not determine the choice of shopping centre by consumers. The outlets or factory centres are at the same level as conventional shopping centres. The variety of products and the location are the key aspects to attract the public and brands, and they maintain customer loyalty.

As for the most important marketing factors for each manager, they are mainly based on location, access to the centre, and the commercial mix in relation to the type of clients they want to attract. This is how they position the shopping centre. In Case 1, manager B states that “We try to attract clients with a medium, medium-high socioeconomic level. This does not mean that we go for elitist brands, because in some cases we have chosen a brand that has not worked. On the other hand, location is key, but marketing must also adapt to what you have, to your audience”.

Table 6.

Marketing management in shopping centres 1.

Table 6.

Marketing management in shopping centres 1.

| | Elements | Case 1 | Case 2 | Case 3 |

|---|

| Marketing | As budget item | Volatile factor, which can be modified the most during the exercise, in favour of maintenance |

Marketing mix policies

Key success factors | A: Access and services

B: Location and commercial mix | C: Commercial mix

D: Access, location, and commercial mix | E: Commercial mix

F: Commercial mix |

| Monitoring of commercial staff | There is no individual control over the marketing of stores. A store cannot be forced to enter into any promotion. |

| Determining marketing actions | All centres carry out market research, focusing their marketing actions on a target audience and segmenting customers; the commercial mix depends significantly on this. |

| Services to retailers: stores are customers, distinguished from the end consumer. There are several brands that should be at the centre, considered the “locomotives” or “anchors” | General for all commercial establishments: staff room, parking, inter-store promotions | General for all commercial establishments

Difference in F: they are more involved with the shops, and they provide them with more services: sewing, window dressing, or promotions for shopping centre workers, own parking for the staff. |

For Case 1, manager A highlights the importance of this factor, defining it as the ability to attract and keep customers, since there is great competition among shopping centres in the metropolitan area: “the marketing aspect is a channel through which we have to try to maximize the benefits and satisfaction of many actors, of everything that is a shopping centre, because there are many around us”, encompassing the concept of customer at three levels: owner, commercial establishment, and final consumer. This manager focuses more on the different services offered by the centre: “perhaps that element is a differentiator, and that element makes, by the fact of having a kindergarten, this person is calmer in the shopping centre, buys more“.

The part of marketing that is the most susceptible to change is promotion and advertising, according to manager A: “there is a marketing plan prepared for everything that is going to happen in terms of marketing, what is going to happen in as for events in the city… but exceptionalities may arise that make us rethink everything or eliminate actions”.

On the other hand, Case 2 also confirms these assumptions. Manager D explains, without mentioning price or promotion factors, “in my opinion, the basis of the success of a shopping centre in general is access, the commercial mix and location. Those shopping centres that are well located, that are urban or semi-urban, close to the city centres where most of the population lives, have great access according to the volume of customers they can attract”, and manager C states that “the commercial mix is all the stores inside the shopping centre, right? So, the commercial mix is basically what makes you go to one centre or another”.

Along the same lines, the manager defends the position of centre D by referring to its commercial mix and its proximity to a large furniture retailer as the main source of customer acquisition, which places it on a par with the urban centres in Case 1: “We have a commercial mix that, although there are shopping centres in the metropolitan area that have a slightly more powerful offer, we have the big locomotives, those firms that bring a lot of people, we have large clothing retailers. We are selling a shopping complex. In that commercial complex there is the great furniture store and there is [centre D]”.

Similar to Case 1, Case 2 segments its clients according to the commercial mix and location: “our vision is to be a centre where our clients are of medium, medium-high purchasing power. Although obviously people come from everywhere, but we focus on that customer profile because that’s what our brand positioning studies tell us. Centre D is considered a brand, like a shopping centre where the level of customers is medium, medium-high” (manager D).

Among the advantages that the centre brings to commercial stores are free parking, a good location when it comes to selling, and the synergies created between stores. In this sense, manager C in Case 2 refers to customer segmentation and the basis of the success of the commercial mix of a shopping centre: “we know the stores that have pull, they are known as anchors of the centre. When you are going to open a centre, you look for the anchors, large clothing stores, a medium-sized food store, some cinemas... you look for three or four stores that raise the rest. It depends on what you have and what you want to offer“.

Finally, it is confirmed that the price variable does not have power over the attraction of clients for Case 3, highlighting their condition as outlet centres. These are centres where brand name products are offered at lower prices or cheaper products from other seasons are available. However, this does not mean that the centres are considered “cheap”. They can be on the same level as a conventional centre and attract the same type of customers.

On the other hand, manager F expresses that he would improve his position if they were in another metropolitan area and not in a peripheral industrial estate: “we are doing very well because we have know-how, we have knowledge of the points of sale that few people in Europe do. We are already the number 2 outlet in Europe, but another location would make us better”.

Regarding the services offered to stores as customers in Case 3, manager F states that “instead of cleaning the aisle and putting a doorman at the door, here we have more functions. We get into the store a bit; we have our own window dressers who visit and help the stores. In a normal centre there is usually a people counter at the entrance. Apart from that, we implement one in each store, so we know the people they attract, and we help them with sales. We can tell a store the attractiveness of its window, what percentage of people who come here enter them and compare this to the purchases made”.

It is thus verified that the most important marketing item when it comes to attracting customers for outlet centres is the product, which includes the commercial mix (brands) and the services offered to the stores so that they stay in the centre. A better location would be beneficial.

Lastly, the image factor is analysed in depth. The image of the centre is the projection of unity that the manager wants to show in the minds of his three clients and is developed directly by the marketing factor. This factor is summarized in

Table 7.

Today, the image is very much based on the type of shopping centre under analysis, on its direct competition, and on the criteria of each manager. The renovation of the centre is essential and is directly related to the aesthetics of the building and its maintenance, as well as the commercial mix. In most cases, this meant the near decline of some of the centres studied (centres A and E, which have turned their image around). Manager B clearly expresses this idea: “a shopping centre is a building that has to be constantly updated. You have to innovate”.

The objective of all managers is to give a corporate image of the centre as an organisation. A vision of unity. This does not mean that all stores must be the same, but rather that they must be focused on the same customer. This is indicated by manager B when he says that “as much as the location, is to have an offer that fits well with what the client demands”. The success of its shopping centre lies precisely in providing an image that the centre projects for a specific client: “I don’t know of a shopping centre in the city that is so central with as many cinemas as this one, but our strong point is still fashion. We have less supply, fewer stores than other centres, but our client values fashion and a certain level of fashion. The client looks for a plus when buying in centre B that they cannot find elsewhere. Perhaps it is the location, the commercial offer that we have… but the positioning in the mind of the consumer is that it is a centre for a medium-high socioeconomic level”.

In relation to the image of the centre in the mind of the commercial stores, according to manager D, “you must take care of the tenant in many aspects, right? When you must reform the premises, when they have to enter the centre during closed hours, when they ask you to expand the store, when they ask you to change their location because they are not selling where they are... the merchant is another of our clients”. For the merchants to feel part of the commercial complex, they must be treated like one more customer, and this is achieved by providing them with a series of services and facilities. According to manager C (Case 2), “in our case, in addition to the workers’ room, we have a kind of quarterly communication in which we tell the employees about the things that are being done, the things that are going to be done, so that they also feel immersed in the operation of the centre and that they are part of centre D”.

This idea is also confirmed in Case 3, in which manager F highlights his relationship with store employees: “that is the difference between our centre and other centres. I know all the store managers, I know their names, they all have my mobile phone, we see each other quite often. We are very close to shops. We have a very good relationship”.

In addition, the manager makes sure that all stores are integrated into the management and feel that they are not only part of their store brand but also part of their shopping centre brand. Manager A in Case 1 comments that “the employees of the centre not only have the identity of the store itself, but also the identity of the centre where they work. In other words, if I work at centre X and at shoe company Z, then I am a staff member of shoe company Z, but I am also proud to work at centre X, because centre X gives me advantages, it gives me services, it gives me information”. This engagement depends on the managers and their ability to involve the store staff.

Being in a certain location or using the city’s own resources, from agents such as the City Council, can help to create a good corporate image. A good example is the case of centre B (Case 1) and centre E (Case 3), whose names are in accordance with the part of the city where they are located. Centre B projects such an image in the consumer’s mind that when someone thinks of going to that part of town, they think directly of that centre. In this line, manager F in Case 3 refers to the use of some resources that are not his own but which he uses to form an image: “If you go out to the parking, you will realize that we have parking lot 1 and parking lot 2 and the roundabout, which is not really ours, but it seems that it is ours. In the roundabout there is our logo, we have put it with our lawn, and we have even changed the streetlights. We have asked the City Council for permission to do so and to be able to give an image of unity. What does the City Council gain? A clean roundabout, that they don’t have to pay for or clean, and we win in image”.

Regarding the commercial mix, the offer and variety of stores gives an image to the centre for customers. Here, Case 3 does not mark any difference from the rest, as might be thought at first. Despite being outlet centres, customers visit these centres for the brands they offer and not for the prices. The image of these centres has undergone a process of change in order to compete with conventional centres [

27], moving away from the strict concept of an outlet: “we sell cheap, so that is still your badge, right? That we continue to sell cheap and so on, but we can no longer say that we are an outlet, we are a Factory as is known, that we have a guaranteed minimum discount all year round”, in the words of manager E.

From this it can be concluded that the price factor does not significantly affect the image, which has more to do with the commercial mix and the location, including the infrastructure of the building itself.

Table 7.

The image of the centre to be projected and how it works 1.

Table 7.

The image of the centre to be projected and how it works 1.

| | Elements | Case 1 | Case 2 | Case 3 |

|---|

| Image | Kind of image-segmentation of the targeted audience | Customers with a medium-high socio-economic level | Customers with a medium-high socio-economic level | Outlet concept does not affect image. They segment customers according to the brands they offer and not the price. |

| Centre spirit integrated among retailers | The managers care about the comfort of the commercial staff and maintaining the corporate image of the centre. Making it easy for stores. | In centre F, because of the ideology of the owner-manager company, it is more involved with the person in charge of the store. |

| Owner decision | Owners do not affect the image that the managers aim to project. | F: Corporate image of all the shopping centres it manages globally. |

| Advantages of locating in a shopping centre rather than at street level | Services as such parking, security, external cleaning. Higher customer attraction: even if customers do not specifically go to a shop, they walk by and enter. Uninterrupted opening hours. Unified marketing campaigns. |

Finally, all the managers highlighted the advantages for both the stores and the final consumer of settling in a shopping centre instead of on the street. Thus, for Case 1, manager B, “the main advantage is that the customer is in a centre and can find different consumption alternatives in the same place, and feels very comfortable buying, or spending time here”. Case 3, manager E states “the stores ensure a series of annual visitors that they do not have at street level”.

This premise confirms everything analysed in the interview with the manager of the store: “since it is located in a shopping centre, customers cannot go specifically to buy in your store, but to other stores, to eat in a restaurant that is located there, to the movies… but when they see the store, they come in out of curiosity, to see the new season… that way it’s easier to attract customers. Being in a centre, there are more offers or the products can be even cheaper”.

As a summary of the above, in

Table 8 all the results obtained are summarized, and a general comparison is made with the interview with the store manager and with the review of the literature, to better explain the conclusions obtained.

Table 8.

Analysis of result 1.

Table 8.

Analysis of result 1.

| | Ownership Structure | Budget

Management | Maintenance | Marketing | Image (Identity, Unity) |

|---|

| Case 1: A and B | Investors—

authorization | Manager | Most important factor (+security) | Subject to modifications. Highlights location and commercial mix | Maintenance, access, and services |

| Case 2: C and D | Investors—

authorization | Manager | Most important factor (+consumption and cleanliness) | Subject to modifications. Highlights accesses and commercial mix | Maintenance, access, and services |

| Case 3: E and F | F owners-

managers | Directed by the managing company | Most important factor (+order and cleanliness) | Subject to modifications. Highlights commercial mix. F: greater involvement as owners | Maintenance and commercial mix—big change. The price is not decisive |

| Contrast with previous studies | Agreed | Agreed | Agreed | In disagreement | In disagreement |

| Contrast with the interview with the store manager | Agreed | Agreed | Agreed | Agreed | Agreed |

| Influence on MCS | Low | High | High | Medium | High |