Sustainable Green Economy for a Supply Chain with Remanufacturing by Both the Supplier and Manufacturer in a Varying Market

Abstract

:1. Introduction

- The majority of existing SC models take the remanufacturing of faulty products by the imperfect machinery of solely one chain partner into account. However, the consideration of the use of fresh raw materials and associated energy- and labor-related costs during the remanufacturing of faulty products by multiple chain-partners is extremely rare.

- The Paris Accord, together with the growing environmental awareness among the masses, motivates each and every chain partner to invest yearly on advanced green equipment. Nevertheless, only one chain partner had made the initial green technological investment (GTI) under the carbon cap-and-trade regulation in most existing multiechelon SC models.

- Many SC models were developed subject to the fixed cost components in an uniform market condition, irrespective of the liquidity position of various chain partners. These suppositions are contradictory to real-life scenarios.

2. Literature Review

2.1. Review of the Environmentally Sustainable SC Models

2.2. Review of SC Models with the Faulty Machinery

2.3. Review of Various Advertising Policies of SC Models

2.4. Current Contributions

- To formulate a three-echelon SSCM model with a single supplier, a single manufacturer, and multiple retailers with the faculty machinery of the supplier and manufacturer, both subject to the unilateral cooperative advertisement policy and the solitary carbon cap-and-trade regulation of the Paris Accord for each and every chain partner in uncertain market. Moreover, to consider the instantaneous remanufacturing of defective products with supplementary raw materials by incurring additional labor- and energy-related costs to the faulty machinery of both the supplier and manufacturer of the proposed model.

- Subject to certain demand rates of retail customers across retailers, to determine the ideal cooperative advertising budgets and the optimal amounts of GTI of each and every chain partner in an uncertain market, thus proposing some useful policies for the economic and environmental sustainability of the proposed SSCM model. Correspondingly, to find out the optimal cycle lengths of all chain partners, along with the production rates and numbers of dispatchable units for the supplier and manufacturer of the proposed model.

- To perform sensitivity analysis of some significant parameters of the proposed SSCM model and afterwards, to extract some managerial acumen.

3. Model Specifications

3.1. Notations with Descriptions

3.2. Assumptions

3.3. Problem Definition

4. Model Formulation

4.1. Various Cost Components of the Supplier

4.1.1. Fundamental Cost Components

4.1.2. Cap-and-Trade-Related Cost Components

4.1.3. Total Cost per Unit Time

4.2. Various Cost Components of the Manufacturer

4.2.1. Fundamental Cost Components

4.2.2. Cap-and-Trade-Related Cost Components

4.2.3. Total Cost per Unit Time

4.3. Various Cost Components of Any ith Retailer

4.3.1. Fundamental Cost Components

4.3.2. Cap-and-Trade-Related Cost Components

4.3.3. Total Cost per Unit Time

4.4. Net Profit per Unit Time of the Proposed SSCM Model

5. Solution Methodology

5.1. Towards Global Optimality

5.2. Algorithm

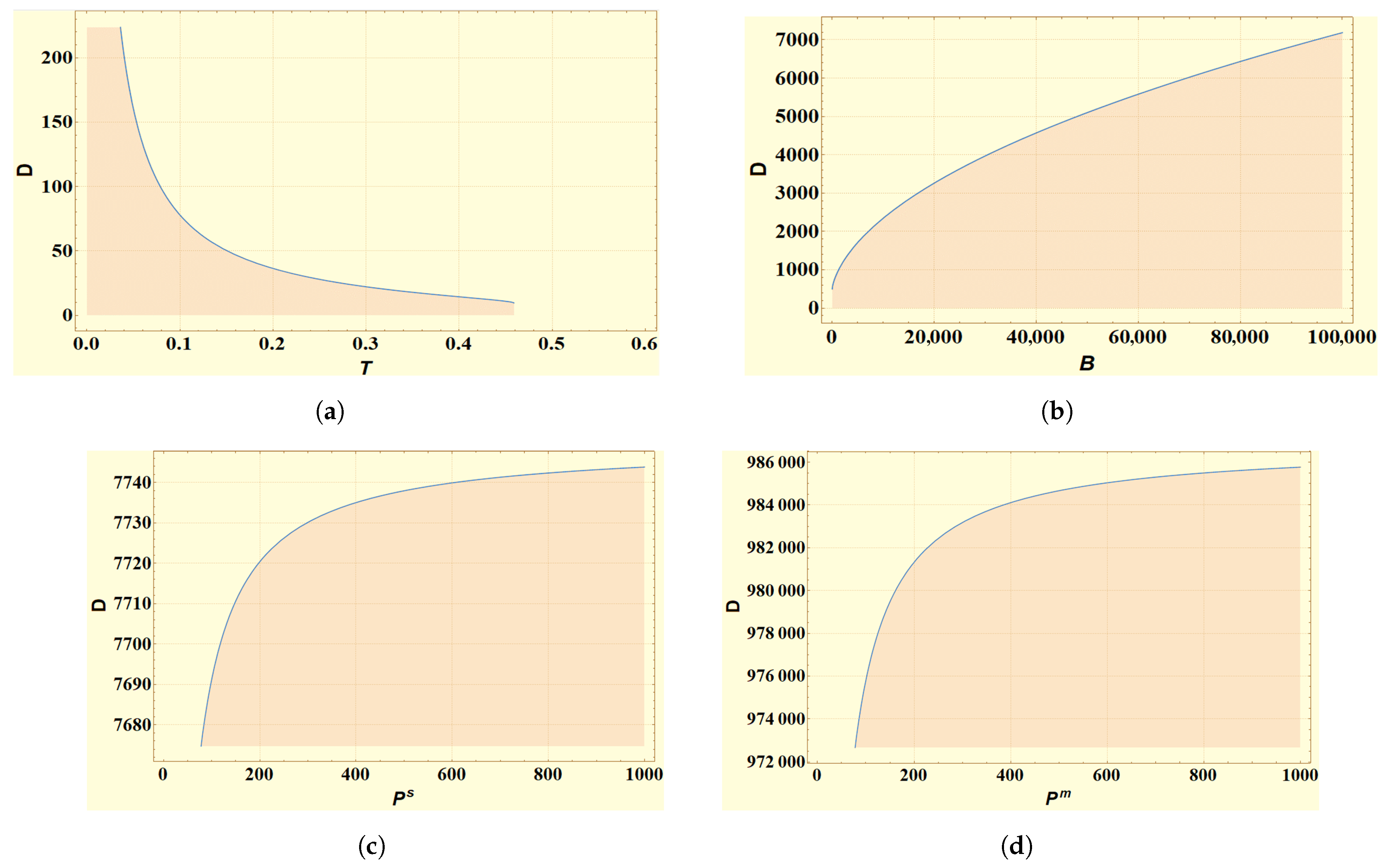

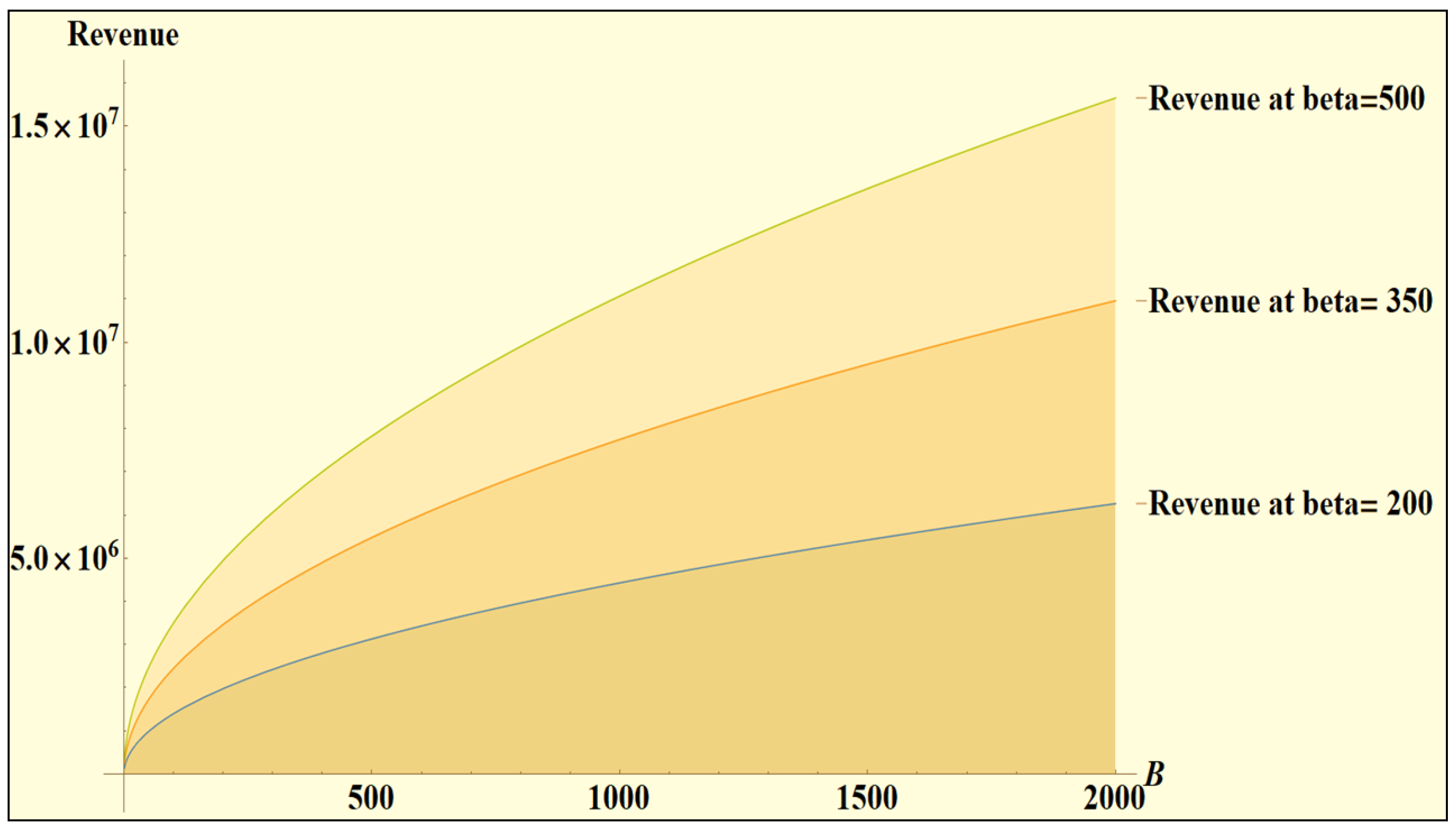

5.3. Wide-Ranging Demand Rate and Various Decisions of the Proposed Model

- Revenue and total cost

- Cycle lengths of various chain partners

- Supplier’s and manufacturer’s production rates

- Aggregate advertisement budget

6. Numerical Experiments

6.1. Experiment I

6.1.1. Results

6.1.2. Sensitivity Analysis

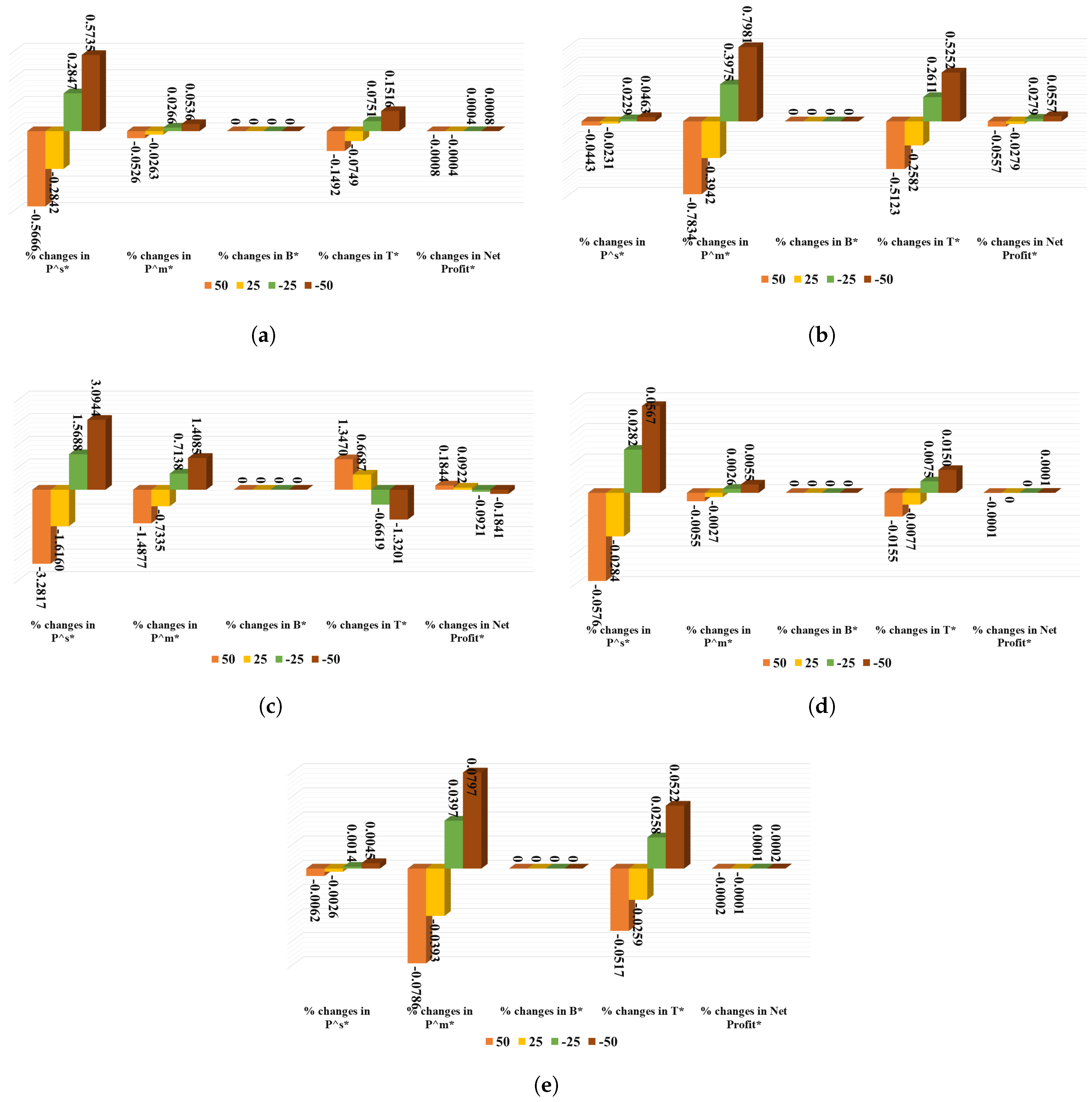

- This study finds the optimal aggregate advertisement budget () to be insensitive to any changes in values of any aforementioned parameters.

- Due to any changes in the parameter , the current results indicate an insensitive net profit per unit of time. While the production rate of the supplier () is modestly sensitive, the same for the manufacturer () is slightly sensitive with respect to all changes in values of . The retailer’s cycle length consistently shortens with systematic increases in (see Figure 8a).

- Subject to various changes in values of (see Table 6), the current analysis finds the manufacturer’s production rate () and the retailers’ cycle length ( to be moderately sensitive, while net profit per unit time and the supplier’s production rate () are lowly sensitive. Figure 8b displays these results.

- Changes in the values of the parameter cause proportionate changes in the manufacturer’s production rate () and retailers’ cycle length (. Nevertheless, the profitability of the proposed model is modestly correlative to the changes in values of , while the supplier’s production rate () is highly sensitive to those changes. One can explore Figure 8c in this regard.

- Net profit per unit time of the proposed model is hardly changed owing to any changes in values of and . Except for the barely sensitive cycle length of retailers for the moderate changes in values of , this study finds the retailers’ cycle length to be lowly sensitive to any changes in values of both and . However, and are lowly sensitive with respect to any changes in values of and , respectively, while turning insensitive in other cases (see Figure 8d,e for details).

6.1.3. Insights

- Observations: Any drops in remanufacturing-related labor and energy costs for the supplier and manufacturer correspondingly cause moderately higher production rates therein, while adequately prolonging the cycle length and improving profitability to a certain extent. On the other hand, when a firm (i.e., the supplier/manufacturer) utilizes fewer fresh materials during remanufacturing, there are some opportunities left to increase the production rate therein and to prolong the cycle length a little.Recommendations: SC managers should follow some best practices, including lean manufacturing principles, to improve profitability in a manufacturing–remanufacturing context. These policies focus on reducing waste and increasing efficiency throughout the manufacturing process. Moreover, lean manufacturing necessitates streamlined processes, improved quality control, and reduced inventory levels. When a firm utilizes fewer fresh materials during remanufacturing, there lie opportunities to increase production rates and prolong the cycle length. This involves exploring alternative raw materials, reconfiguring production processes, or investing in new technologies.Moreover, since the landscape related to the immediate remanufacturing of faulty products is constantly evolving, automation can reduce labor costs and improve production rates. While the upfront costs of automation can be significant, over the long term, this can lead to significant cost savings and improved efficiency for various chain partners. Ultimately, SC managers should be proactive in identifying opportunities to improve efficiency and profitability throughout the manufacturing process. By working closely with suppliers and manufacturers, monitoring costs and performance metrics, and continuously seeking ways to optimize the supply chain, they can help to drive success and growth for their organizations.

- Observations: Increased values of the GTI-induced CE reduction rate proportionately improve the net profit per unit time, considerably reduce the production rates at both supplier and manufacturer, and give prolonged cycle length to various chain partners.Recommendations: SC managers should consider implementing technology solutions to reduce CEs, such as energy-efficient machinery, green energy sources, and data-driven optimization tools. These solutions can help to improve efficiency and reduce emissions, while also increasing profitability. Overall, a comprehensive and collaborative approach is needed to implement green investment and increase the carbon emission reduction rate effectively. By working closely with supply chain partners, leveraging technology solutions, and continuously monitoring and adjusting the strategy, managers can achieve both environmental and financial goals.

6.2. Experiment II: Case Study

6.2.1. Results

6.2.2. Sensitivity Analysis

- This study finds the optimal aggregate advertising budget () to be insensitive to any changes in values of the aforementioned parameters.

- This study finds the net profit per unit time of the proposed model to be insensitive by contemplating various changes in the values of the parameter . Again, the cycle length of various retailers and the supplier’s production rate () are highly sensitive, while the production rate of the manufacturer () is moderately sensitive due to any changes in values of the parameter (see Figure 9a).

- Like , Table 10 finds the retailers’ cycle length ( plus the manufacturer’s production rate () to be highly sensitive, and the supplier’s production rate () to be moderately sensitive, because of any changes in the values of . Nevertheless, the net profit per unit time of the proposed model is lowly sensitive with respect to any changes in values of . Figure 9b displays these.

- Except for the lowly sensitive cycle length of various retailers because of moderate changes in the values of , all other changes to its values reasonably influence both the retailers’ cycle length and the profitability of the proposed SSCM model. However, production rates of the supplier () and manufacturer () are lowly sensitive with respect to those changes in values of (see Figure 9c).

- Net profit per unit time of the proposed model hardly changes, owing to any changes in values of and . Except for the lowly sensitive cycle length of various retailers because of moderate changes in the values of , this study finds retailers’ cycle length to be moderately sensitive to any changes in the values of both the parameters and . However, respective production rates of the supplier () and manufacturer () are modestly and lowly sensitive, subject to any changes in the values of , while these are lowly and modestly sensitive to various changes in the values of (see Figure 9d,e).

6.2.3. Managerial Insights

- Observations:

- Observations:

6.3. Current Findings in Light of Some Well-Established Articles

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Defuzzification Method

Appendix B. Proof of Theorem 1

Appendix C. Proof of Theorem 2

Appendix D. Proof of Theorem 3

Appendix E

Appendix F. NP

References

- Mondal, B.; Garai, A.; Roy, T.K. Optimization of generalized order-level inventory system under fully permissible delay in payment. RAIRO Oper. Res. 2021, 55, S195–S224. [Google Scholar] [CrossRef] [Green Version]

- Garai, A.; Chowdhury, S.; Sarkar, B.; Roy, T.K. Cost-effective subsidy policy for growers and biofuels-plants in closed-loop supply chain of herbs and herbal medicines: An interactive bi-objective optimization in T-environment. Appl. Soft Comput. 2021, 100, 106949. [Google Scholar] [CrossRef]

- Noh, J.; Kim, J.S. Cooperative green supply chain management with greenhouse gas emissions and fuzzy demand. J. Clean. Prod. 2019, 208, 1421–1435. [Google Scholar] [CrossRef]

- Nguyen, C.; Romaniuk, J.; Cohen, J.; Faulkner, M. When retailers and manufacturers advertise together examining the effect of co-operative advertising on ad reach and memorability. J. Retail. Consum. Serv. 2020, 55, 102080. [Google Scholar] [CrossRef]

- Liu, M.L.; Li, Z.H.; Anwar, S.; Zhang, Y. Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. Res. 2021, 28, 19969–19983. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Tsao, Y.C.; Tseng, M.L. Sustainable inventory system with controllable non-instantaneous deterioration and environmental emission rates. J. Clean. Prod. 2020, 244, 118807. [Google Scholar] [CrossRef]

- Homayouni, Z.; Pishvaee, M.S.; Jahani, H.; Ivanov, D. A robust-heuristic optimization approach to a green supply chain design with consideration of assorted vehicle types and carbon policies under uncertainty. Ann. Oper. Res. 2021, 324, 395–435. [Google Scholar] [CrossRef]

- Garai, A.; Sarkar, B. Economically independent reverse logistics of customer-centric closed-loop supply chain for herbal medicines and biofuel. J. Clean. Prod. 2022, 334, 129977. [Google Scholar] [CrossRef]

- Hou, Y.; Fu, Y.; Gao, K.; Zhang, H.; Sadollah, A. Modelling and Optimization of Integrated Distributed Flow Shop Scheduling and Distribution Problems with Time Windows. Expert Syst. Appl. 2021, 187, 115827. [Google Scholar] [CrossRef]

- Sarkar, B.; Omair, M.; Kim, N. A cooperative advertising collaboration policy in supply chain management under uncertain conditions. Appl. Soft Comput. 2020, 88, 105948. [Google Scholar] [CrossRef]

- Khorshidvand, B.; Soleimani, H.; Sibdari, S.; Esfahani, M.M.S. Revenue management in a multi-level multi-channel supply chain considering pricing, greening, and advertising decisions. J. Retail. Consum. Serv. 2021, 59, 102425. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M.; Astanti, R.D. Three-echelon supply chain model considering carbon emission and item deterioration. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 368–383. [Google Scholar] [CrossRef]

- Sarkar, B.; Sana, S.S.; Chaudhuri, K. An imperfect production process for time varying demand with inflation and time value of money—An EMQ model. Expert Syst. Appl. 2011, 38, 13543–13548. [Google Scholar] [CrossRef]

- Mondal, B.; Garai, A.; Mukhopadhyay, A.; Majumder, S.K. Inventory policies for seasonal items with logistic-growth demand rate under fully permissible delay in payment: A neutrosophic optimization approach. Soft Comput. 2020, 25, 3725–3750. [Google Scholar] [CrossRef]

- Garai, A. Fractile criterion iterative-interactive optimisation process for multi-objective stochastic linear programming problems in fuzzy environment. Int. J. Math. Oper. Res. 2021, 18, 289. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Sarkar, B. Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J. Clean. Prod. 2021, 279, 123699. [Google Scholar] [CrossRef]

- Bazan, E.; Jaber, M.Y.; Zanoni, S. A review of mathematical inventory models for reverse logistics and the future of its modeling: An environmental perspective. Appl. Math. Model. 2016, 40, 4151–4178. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Soleymanfar, V.R.; Govindan, K. Sustainable economic production quantity models for inventory systems with shortage. J. Clean. Prod. 2018, 174, 1011–1020. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. Trade credit financing and coordination for an emission-dependent supply chain. Comput. Ind. Eng. 2018, 119, 50–62. [Google Scholar] [CrossRef]

- Wu, X.Y.; Fan, Z.P.; Cao, B.B. Cost-sharing strategy for carbon emission reduction and sales effort: A nash game with government subsidy. J. Ind. Manag. Optim. 2020, 16, 1999–2027. [Google Scholar] [CrossRef]

- Babagolzadeh, M.; Shrestha, A.; Abbasi, B.; Zhang, Y.; Woodhead, A.; Zhang, A. Sustainable cold supply chain management under demand uncertainty and carbon tax regulation. Transp. Res. D Transp. Environ. 2020, 80, 102245. [Google Scholar] [CrossRef]

- Garai, A.; Roy, T.K. Multi-objective optimization of cost-effective and customer-centric closed-loop supply chain management model in T-environment. Soft Comput. 2019, 24, 155–178. [Google Scholar] [CrossRef]

- Malleeswaran, B.; Uthayakumar, R. A single-manufacturer multi-retailer sustainable reworking model for green and environmental sensitive demand under discrete ordering cost reduction. J. Manag. Anal. 2022, 10, 109–128. [Google Scholar] [CrossRef]

- Rad, M.A.; Khoshalhan, F.; Glock, C.H. Optimal production and distribution policies for a two-stage supply chain with imperfect items and price- and advertisement-sensitive demand: A note. Appl. Math. Model. 2018, 57, 625–632. [Google Scholar] [CrossRef]

- Rout, C.; Paul, A.; Kumar, R.S.; Chakraborty, D.; Goswami, A. Cooperative sustainable supply chain for deteriorating item and imperfect production under different carbon emission regulations. J. Clean. Prod. 2020, 272, 122170. [Google Scholar] [CrossRef]

- Shaw, B.K.; Sangal, I.; Sarkar, B. Joint effects of carbon emission, deterioration, and multi-stage inspection policy in an integrated inventory model. Optim. Inventory Manag. 2020, 185, 195–208. [Google Scholar] [CrossRef]

- Kishore, A.; Cárdenas-Barrón, L.E.; Jaggi, C.K. Strategic decisions in an imperfect quality and inspection scenario under two-stage credit financing with order overlapping approach. Expert Syst. Appl. 2022, 195, 116426. [Google Scholar] [CrossRef]

- Sarkar, B.; Sarkar, M.; Ganguly, B.; Barron, L.E. Combined effects of carbon emission and production quality improvement for fixed lifetime products in a sustainable supply chain management. Int. J. Prod. Econ. 2021, 231, 107867. [Google Scholar] [CrossRef]

- Sepehri, A.; Gholamian, M.R. A green inventory model with imperfect items considering inspection process and quality improvement under different shortages scenarios. Environ. Dev. Sustain. 2022, 25, 3269–3297. [Google Scholar] [CrossRef]

- Giri, B.C.; Dash, A. Optimal batch shipment policy for an imperfect production system under price-, advertisement-and green-sensitive demand. J. Manag. Anal. 2022, 9, 86–119. [Google Scholar] [CrossRef]

- Adak, S.; Mahapatra, G.S. Effect of inspection and rework of probabilistic defective production on two-layer supply chain incorporating deterioration and reliability dependent demand. Int. J. Syst. Assur. Eng. Manag. 2021, 12, 565–578. [Google Scholar] [CrossRef]

- Priyan, S.; Mala, P.; Palanivel, M. A cleaner EPQ inventory model involving synchronous and asynchronous rework process with green technology investment. Clean. Logist. Supply Chain 2022, 4, 100056. [Google Scholar] [CrossRef]

- Huang, H.; He, Y.; Li, D. Pricing and inventory decisions in the food supply chain with production disruption and controllable deterioration. J. Clean. Prod. 2018, 180, 280–296. [Google Scholar] [CrossRef]

- Ben-Daya, M.; Asad, R.; Nabi, K.A. A single-vendor multi-buyer production remanufacturing inventory system under a centralized consignment arrangement. Comput. Ind. Eng. 2019, 135, 10–27. [Google Scholar] [CrossRef]

- Kang, C.W.; Ullah, M.; Sarkar, M.; Omair, M.; Sarkar, B. A Single-Stage Manufacturing Model with Imperfect Items, Inspections, Rework, and Planned Backorders. Mathematics 2019, 7, 446. [Google Scholar] [CrossRef] [Green Version]

- Chambari, A.; Azimi, P.; Najafi, A.A. A bi-objective simulation-based optimization algorithm for redundancy allocation problem in series-parallel systems. Expert Syst. Appl. 2021, 173, 114745. [Google Scholar] [CrossRef]

- Khara, B.; Mondal, S.K.; Dey, J.K. An imperfect production inventory model with advance payment and credit period in a two-echelon supply chain management. RAIRO Oper. Res. 2021, 55, 189–211. [Google Scholar] [CrossRef]

- Zhang, L.H.; Yao, J.; Xu, L. Emission reduction and market encroachment: Whether the manufacturer opens a direct channel or not? J. Clean. Prod. 2020, 269, 121932. [Google Scholar] [CrossRef]

- Li, M.; Zhang, X.; Dan, B. Cooperative advertising and pricing in an O2O supply chain with buy-online-and-pick-up-in-store. Int. Trans. Oper. Res. 2020, 28, 2033–2054. [Google Scholar] [CrossRef]

- Soleimani, H.; Chhetri, P.; Fathollahi-Fard, A.M.; Mirzapour Al-e Hashem, S.M.J.; Shahparvari, S. Sustainable closed-loop supply chain with energy efficiency: Lagrangian relaxation, reformulations and heuristics. Ann. Oper. Res. 2022, 318, 531–556. [Google Scholar] [CrossRef]

- Peng, X.; Tao, Y.; Wang, C.; Zhong, Z. Research on low-carbon supply chain decision-making under different incentive models. Int. J. Low-Carbon Technol. 2022, 17, 696–709. [Google Scholar] [CrossRef]

- Sarkar, B.; Bhuniya, S. A sustainable flexible manufacturing–remanufacturing model with improved service and green investment under variable demand. Expert Syst. Appl. 2022, 202, 117154. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef] [PubMed]

- Omair, M.; Ullah, M.; Ganguly, B.; Noor, S.; Maqsood, S.; Sarkar, B. The Quantitative Analysis of Workers’ Stress Due to Working Environment in the Production System of the Automobile Part Manufacturing Industry. Mathematics 2019, 7, 627. [Google Scholar] [CrossRef] [Green Version]

- Soni, H.N.; Sarkar, B.; Mahapatra, A.S.; Mazumder, S. Lost sales reduction and quality improvement with variable lead time and fuzzy costs in an imperfect production system. RAIRO Oper. Res. 2018, 52, 819–837. [Google Scholar] [CrossRef] [Green Version]

- Sepehri, A.; Mishra, U.; Sarkar, B. A sustainable production-inventory model with imperfect quality under preservation technology and quality improvement investment. J. Clean. Prod. 2021, 310, 127332. [Google Scholar] [CrossRef]

| Contributors | Production Models | Immediate Remanufacturing at | Environmental Aspects | Orientations |

|---|---|---|---|---|

| Rad et al. [24] | two-stage SC | vendor | NA | crisp |

| Noh and Kim [3] | two-echelon SC | NA | controllable CE | fuzzy |

| Rout et al. [25] | two-echelon SC | manufacturer | tax, cap-&-offset, cap-&-trade | fuzzy inference |

| Shaw et al. [26] | integrated inventory model | vendor | carbon tax | crisp |

| Kishore et al. [27] | three-tier SC with faulty stock | manufacturer | NA | crisp |

| Homayouni et al. [7] | sustainable logistics model | NA | cap-and-trade and carbon tax | stochastic |

| Sarkar et al. [28] | three-echelon SSCM | supplier | CE related various costs | crisp |

| Sepehri and Gholamian [29] | shortages-based sustainable inventory | manufacturer | carbon cap and tax | crisp |

| Giri and Dash [30] | production inventory model | retailer | greenness based demand | crisp |

| Adak and Mahapatra [31] | two-echelon SC | retailer | NA | crisp |

| Priyan et al. [32] | production inventory model | manufacturer | GTI | crisp |

| Present study | three-echelon SSCM model | remanufacturing at both the supplier and manufacturer | green investment of each chain partner | asymmetric TFN |

| • Abbreviations | |

| supply chain. | |

| sustainable supply chain management. | |

| decision makers. | |

| carbon emissions. | |

| greenhouse gases. | |

| green technological investment. | |

| triangular fuzzy number. | |

| • Decision variables | |

| initial GTI of supplier (USD). | |

| initial GTI of manufacturer (USD). | |

| initial GTI of ith retailer (USD). | |

| production rate of faulty machinery of supplier (unit/unit time). | |

| production rate of faulty machinery of manufacturer (unit/unit time). | |

| B | aggregate cooperative advertisement budget of proposed model (USD). |

| T | cycle length of retailers (years). |

| • Crisp parameters | |

| shipments of raw materials received by supplier (number). | |

| shipment of semifinished items received by manufacturer (number). | |

| integer multiple of manufacturer’s cycle length (number). | |

| integer multiple of retailers’ cycle length (number). | |

| F | fixed component of per shipment transportation cost (USD). |

| V | variable component of per shipment transportation cost (USD/unit). |

| GTI-induced CE reduction rate () (number). | |

| efficiency of green technology to lower CEs () (number). | |

| carbon tax rate (USD/kg). | |

| D | aggregate demand rate for all retailers (unit/unit time). |

| scale parameter of revenue function (number). | |

| shape parameter of revenue function (number). | |

| · supplier/manufacturer (j) | |

| shipment lot size to chain partner j (number). | |

| production rate at chain partner j (item per unit time). | |

| system reliability parameter of chain partner j, (number). | |

| variation constant related to tool and die cost (USD/unit). | |

| fixed development cost of the imperfect production system at j (USD/unit time). | |

| CEs due to holding semifinished products at chain partner j (kg/sq. ft./unit time). | |

| area in inventory at partner j (sq. ft./unit). | |

| quantity of CEs at chain partner j (kg). | |

| quantity of CEs related to set-up at chain partner j (kg). | |

| quantity of CEs related to production at chain partner j (kg/unit). | |

| environmental impact of inventory (kg/unit). | |

| contribution toward cooperative advertising budget (USD). | |

| fraction of fresh raw materials during remanufacturing at j () (number). | |

| · supplier (s) | |

| CEs due to holding of raw materials (kg/sq. ft./unit time). | |

| area in inventory for raw materials (sq. ft./unit). | |

| · manufacturer (m) | |

| CEs due to holding of raw materials (kg/sq. ft./unit time). | |

| area in inventory (sq. ft./unit). | |

| th retailer (r) | |

| carbon allowance cost of the ith retailer (USD). | |

| CEs per unit area of ith retailer (kg/sq. ft./unit time). | |

| area in inventory of ith retailer (sq. ft./unit). | |

| environmental impacts of inventory for any retailer (kg/unit). | |

| demand rate of ith retailer (number). | |

| contribution of ith retailer towards cooperative advertising (). | |

| per unit sale price of products for the ith retailer (USD/unit). | |

| contribution of ith retailer in cooperative advertisement (USD). | |

| total contributions of all retailers on cooperative advertisement (USD). | |

| • Parameters under fuzziness | |

| supplier/manufacturer (j) | |

| fuzzy material cost (USD/unit). | |

| fuzzy labor- and energy-related reworking cost of defective items (USD/unit). | |

| fuzzy setup cost (USD). | |

| fuzzy ordering cost (USD). | |

| holding cost of primary materials (USD/unit/unit time). | |

| holding cost of dispatchable products (USD/unit/unit time). | |

| ·ith retailer (r) | |

| fuzzy setup cost of the ith retailer (USD). | |

| fuzzy ordering cost of the ith retailer (USD). | |

| fuzzy holding cost of the ith retailer (USD/unit/unit time). | |

| Chain Partners | Parameters | Values | Parameters | Values | Parameters | Values | Parameters | Values |

|---|---|---|---|---|---|---|---|---|

| Supplier | 0.4 | |||||||

| 60 kg | 90 kg | 40 kg | 4 kg | |||||

| m | 4 kg/sq.ft./unit time | sq.ft./unit | 40 kg | |||||

| Manufacturer | ||||||||

| 90 kg | 135 kg | 40 kg | 4 kg/sq.ft./unit time | |||||

| sq.ft./unit | 4 kg/sq.ft./unit time | sq.ft./unit | 60 kg | |||||

| ith retailer | 300 kg | 4 kg/sq.ft./unit time | sq.ft./unit | 200 kg | ||||

| 20 kg | ||||||||

| SSCM model | F | USD | V | USD/unit | ||||

| USD/kg | D | unit/unit time | 0 | 100 | ||||

| 1 | 2 | 1 | 1 | |||||

| SC Partners | Parameters | Values as TFN | Parameters | Values as TFN |

|---|---|---|---|---|

| Supplier | ||||

| Manufacturer | ||||

| ith retailer | ||||

| Market Uncertainty | GTI USD (Integer) | Decision Variables (Continuous) | Maximum Net Profit (USD) | |||||

|---|---|---|---|---|---|---|---|---|

| Bullish | 10.00 | 10.00 | 8.00 | 104.1471 | 141.1425 | 1500.00 | 0.7338 | 2,660,517.24 |

| Stable | 10.00 | 10.00 | 8.00 | 104.8364 | 150.4160 | 1500.00 | 0.6648 | 2,654,030.78 |

| Bearish | 10.00 | 10.00 | 8.00 | 105.1193 | 157.0714 | 1500.00 | 0.6323 | 2,647,636.99 |

| Parameters | % Changes | % Changes in | % Changes in | % Changes in | % Changes in | % Changes in |

|---|---|---|---|---|---|---|

| 50 | −0.5666 | −0.0526 | 0 | −0.1492 | −0.0008 | |

| 25 | −0.2842 | −0.0263 | 0 | −0.0749 | −0.0004 | |

| −25 | 0.2847 | 0.0266 | 0 | 0.0751 | 0.0004 | |

| −50 | 0.5735 | 0.0536 | 0 | 0.1516 | 0.0008 | |

| 50 | −0.0443 | −0.7834 | 0 | −0.5123 | −0.0557 | |

| 25 | −0.0231 | −0.3942 | 0 | −0.2582 | −0.0279 | |

| −25 | 0.0229 | 0.3975 | 0 | 0.2611 | 0.0279 | |

| −50 | 0.0463 | 0.7981 | 0 | 0.5252 | 0.0557 | |

| 50 | −3.2817 | −1.4877 | 0 | 1.34 | 0.1844 | |

| 25 | −1.616 | −0.7335 | 0 | 0.6687 | 0.0922 | |

| −25 | 1.5688 | 0.7138 | 0 | −0.6619 | −0.0921 | |

| −50 | 3.0944 | 1.4085 | 0 | −1.3201 | −0.1841 | |

| 50 | −0.0576 | −0.0055 | 0 | −0.0155 | −0.0001 | |

| 25 | −0.0284 | −0.0027 | 0 | −0.0077 | 0 | |

| −25 | 0.0282 | 0.0026 | 0 | 0.0075 | 0 | |

| −50 | 0.0567 | 0.0055 | 0 | 0.0150 | 0.0001 | |

| 50 | −0.0062 | −0.0786 | 0 | −0.0517 | −0.0002 | |

| 25 | −0.0026 | −0.0393 | 0 | −0.0259 | −0.0001 | |

| −25 | 0.0014 | 0.0397 | 0 | 0.0258 | 0.0001 | |

| −50 | 0.0045 | 0.0797 | 0 | 0.0522 | 0.0002 |

| Chain Partners | Parameters | Values | Parameters | Values | Parameters | Values | Parameters | Values |

|---|---|---|---|---|---|---|---|---|

| Supplier | 0.4 | |||||||

| 150 kg | 696 kg | 25 kg | kg/sq.m/unit time | |||||

| sq.m/unit | kg/sq.m/unit time | sq.m/unit | 464 kg | |||||

| Manufacturer | ||||||||

| 150 kg | 696 kg | 25 kg | kg/sq.m/unit time | |||||

| sq.m/unit | kg/sq.m/unit time | sq.m/unit | 464 kg | |||||

| ith retailer | 696 kg | kg/sq.m/unit time | sq.m/unit | 150 kg | ||||

| 464 kg | ||||||||

| SSCM model | F | USD 226 | V | |||||

| USD/kg | D | 57 unit/unit time | 0 | 100 | ||||

| 1 | 2 | 1 | 1 | |||||

| SC Partners | Parameters | Values as TFN | Parameters | Values as TFN |

|---|---|---|---|---|

| Supplier | ||||

| Manufacturer | ||||

| ith retailer | ||||

| Market Uncertainty | GTI (USD) (Integer) | Decision Variables (Continuous) | Maximum Net Profit (USD) | |||||

|---|---|---|---|---|---|---|---|---|

| Bullish | 34.00 | 34.00 | 34.00 | 16.3386 | 30.6288 | 1700.00 | 4.9207 | 208,679.57 |

| Stable | 33.00 | 33.00 | 33.00 | 17.0535 | 32.2926 | 1700.00 | 4.0330 | 207,589.38 |

| Bearish | 33.00 | 33.00 | 32.00 | 17.2112 | 32.7757 | 1700.00 | 3.6296 | 206,554.74 |

| Parameters | % Changes | % Changes in | % Changes in | % Changes in | % Changes in | % Changes in |

|---|---|---|---|---|---|---|

| 50 | 0 | 0 | 0 | 0 | 0 | |

| 25 | 9.2161 | 0.0298 | 0 | 1.8928 | 0.0089 | |

| −25 | −7.1638 | −0.1901 | 0 | −1.5313 | −0.008 | |

| −50 | 0 | 0 | 0 | 0 | 0 | |

| 50 | −0.4705 | −6.8116 | 0 | −4.0892 | −0.0938 | |

| 25 | −0.2364 | −3.6303 | 0 | −2.2018 | −0.0473 | |

| −25 | 0.2313 | 4.2259 | 0 | 2.6350 | 0.0483 | |

| −50 | 0.4386 | 9.2848 | 0 | 5.9043 | 0.0980 | |

| 50 | −0.0223 | −0.028 | 0 | −0.197 | 0.6523 | |

| 25 | −0.0113 | −0.0138 | 0 | −0.0955 | 0.3261 | |

| −25 | 0.0096 | 0.013 | 0 | 0.0862 | −0.326 | |

| −50 | 0.0182 | 0.0236 | 0 | 0.1556 | −0.6519 | |

| 50 | −0.7949 | −0.0198 | 0 | −0.1669 | −0.0008 | |

| 25 | −0.4001 | −0.0099 | 0 | −0.0839 | −0.0004 | |

| −25 | 0.4045 | 0.0101 | 0 | 0.0848 | 0.0004 | |

| −50 | 0.8152 | 0.0200 | 0 | 0.1705 | 0.0008 | |

| 50 | −0.0470 | −0.7681 | 0 | −0.4704 | −0.0023 | |

| 25 | −0.0237 | −0.3868 | 0 | −0.2372 | −0.0012 | |

| −25 | 0.0235 | 0.3928 | 0 | 0.2415 | 0.0012 | |

| −50 | 0.0470 | 0.7919 | 0 | 0.4875 | 0.0024 |

| Contributors | Formulation | Methodology | Results and Insights | ||

|---|---|---|---|---|---|

| Model type | Remanufacturing policy | Variables and Analysis | Defuzzification | ||

| Sarkar et al. [13] | EPQ model | time-varying malfunctioning rate of manufacturer | classical optimization | NA |

|

| Soni et al. [45] | EPQ model | product quality improvement by manufacturer | optimization algorithm | modified graded mean integration representation |

|

| Sarkar et al. [10] | three-echelon SC | NA | sequential quadratic programming | signed distance method |

|

| Mishra et al. [6] | inventory model | NA | classical optimization | NA |

|

| Rout et al. [25] | sustainable SC | reworking on imperfect production at manufacturer | nondominated shorting | Mamdani fuzzy inference |

|

| Present study | economic and ecofriendly three-echelon SC model | remanufacturing with labor and fresh materials by both supplier and manufacturer | classical optimization method | degree-of-optimism-based total -integral method |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karmakar, R.; Mazumder, S.K.; Hossain, M.B.; Illes, C.B.; Garai, A. Sustainable Green Economy for a Supply Chain with Remanufacturing by Both the Supplier and Manufacturer in a Varying Market. Logistics 2023, 7, 37. https://doi.org/10.3390/logistics7030037

Karmakar R, Mazumder SK, Hossain MB, Illes CB, Garai A. Sustainable Green Economy for a Supply Chain with Remanufacturing by Both the Supplier and Manufacturer in a Varying Market. Logistics. 2023; 7(3):37. https://doi.org/10.3390/logistics7030037

Chicago/Turabian StyleKarmakar, Rimi, Sanat K. Mazumder, Md Billal Hossain, Csaba Balint Illes, and Arindam Garai. 2023. "Sustainable Green Economy for a Supply Chain with Remanufacturing by Both the Supplier and Manufacturer in a Varying Market" Logistics 7, no. 3: 37. https://doi.org/10.3390/logistics7030037

APA StyleKarmakar, R., Mazumder, S. K., Hossain, M. B., Illes, C. B., & Garai, A. (2023). Sustainable Green Economy for a Supply Chain with Remanufacturing by Both the Supplier and Manufacturer in a Varying Market. Logistics, 7(3), 37. https://doi.org/10.3390/logistics7030037