Luxembourg Fund Data Repository

Abstract

:1. Summary

2. Data Description

2.1. Database Population

2.2. Data Tables and Data Fields

- Data tables of life-cycle fields: These data tables contain fields that are life-cycle constant or may change a maximum of once during the entire life of the fund. Thus, one date maximum is associated with the values of these fields.

- Data tables of period-based fields: These data tables contain fields that change on a non-regular basis. Thus, each entry of these data tables contains the start date and the end date of the effective period.

- Data tables of time-series fields: These data tables contain fields that change on a periodic basis. The fields constitute time-series with a constant frequency. Thus, each entry of these data tables contains one effective date.

2.3. Historical Coverage

2.4. Parent–Child Relationships

3. Methods

3.1. Selection of Data Providers

3.2. Complementarity of Provided Datasets

3.3. Matching Entities and Maximizing Historical Coverage

4. User Notes

Author Contributions

Funding

Conflicts of Interest

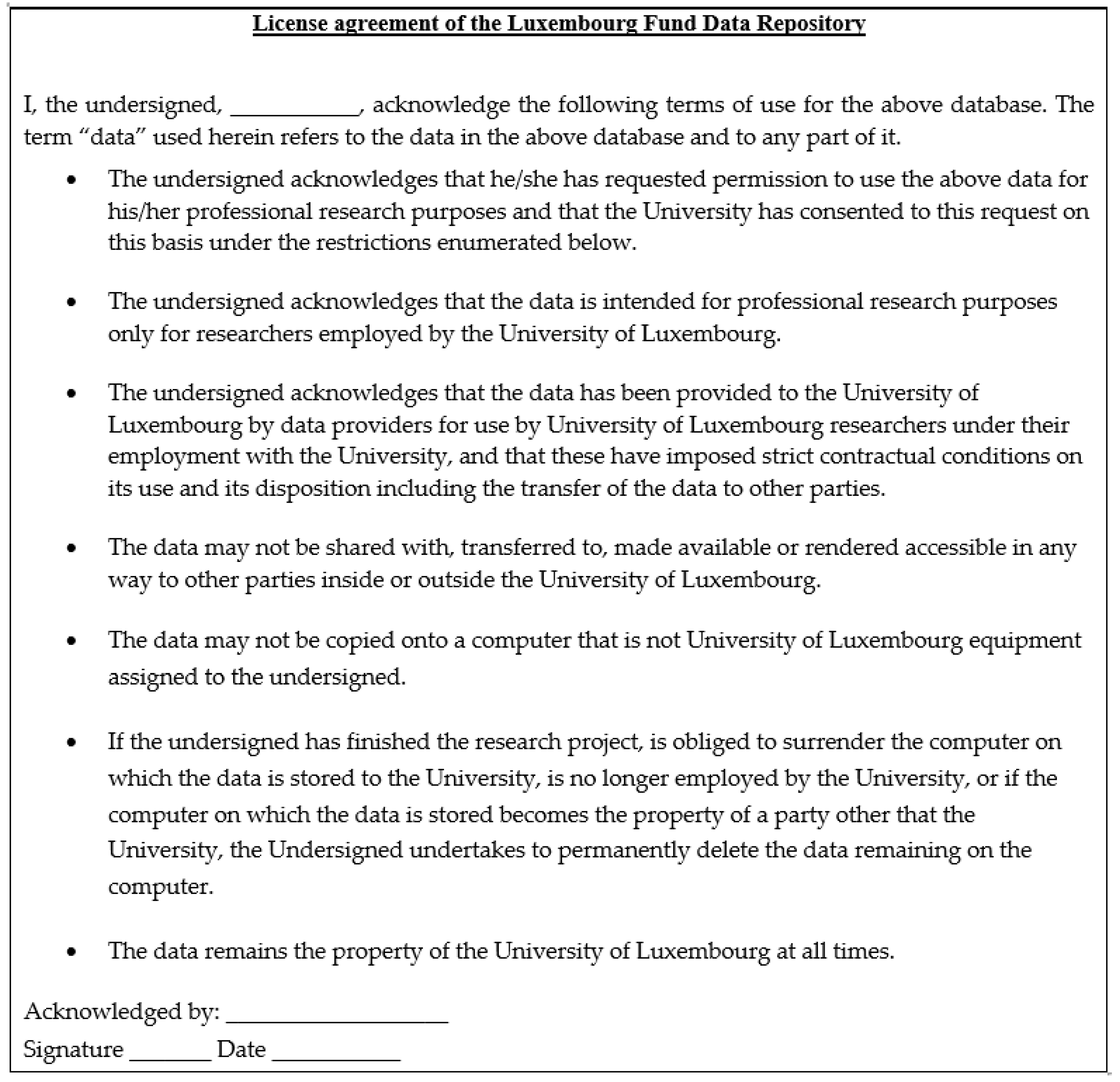

Appendix A

Appendix B

References

- Investment Company Institute Fact Book 2019: A Review of Trends and Activities in the Investment Company Industry, 59th ed.; Investment Company Institute: Washington, DC, USA, 2019; pp. 26–30.

- Delbecque, B.; Tilley, T.; Yang, H. Trends in the European Investment Fund Industry in the Fourth Quarter of 2019 & Results for the Full Year of 2019; European Fund and Asset Management Association: Brussels, Belgium, 2019; pp. 1–6. [Google Scholar]

- Annual Report 2018–2019; Association of the Luxembourg Fund Industry, ALFI publications: Luxembourg, 2019; pp. 3–12.

- Wermers, R.; Smith, R. Are Mutual Fund Shareholders Compensated for Active Management «bets»? Available online: http://terpconnect.umd.edu/~wermers/FAJ%20Paper%20_Post-Submitted%20Version.pdf (accessed on 18 May 2020).

- Carhart, M. On Persistence in Mutual Fund Performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Setting up in Luxembourg; Association of the Luxembourg Fund Industry, ALFI publications: Luxembourg, 2019; pp. 1–3.

- Chambost, I.; Lenglet, M.; Tadjeddine, Y. The Making of Finance: Perspectives from the Social Sciences, 1st ed.; Routledge: London, UK, 2018. [Google Scholar]

- European Commission: EU Laws and Initiatives Relating to Collective Investment Funds. Available online: https://ec.europa.eu/info/business-economy-euro/growth-and-investment/investment-funds_en (accessed on 18 May 2020).

- Luxembourg Stock Exchange: UCITS. Available online: https://www.bourse.lu/ucits (accessed on 18 May 2020).

- The UCITS Market Geographical Breakdown of Nationally Domiciled Funds; European Fund and Asset Management Association: Brussels, Belgium, 2019; pp. 1–2.

- Elton, J.E.; Gruber, M.J.; Blake, C.R. Survivor Bias and Mutual Fund Performance. Rev. Financ. Stud. 1996, 9, 1097–1120. [Google Scholar] [CrossRef]

- Documentation of CRSP Mutual Fund Database. Available online: http://www.crsp.org/products/documentation/crsp-survivor-bias-free-us-mutual-fund-guide-crspsift (accessed on 18 May 2020).

- Fund information. Available online: https://www.fundsquare.net/fund-tree?idInstr=154601 (accessed on 18 May 2020).

- Discussion Paper on UCITS Share Classes; European Securities and Markets Authority: Paris, France, 2016; pp. 3–6.

- Law of 17 December 2010 Relating to Undertakings for Collective Investment. Available online: https://www.cssf.lu/wp-content/uploads/FAQ_Law_17_December_2010_100320.pdf (accessed on 18 May 2020).

| 1 | For the rest of the paper, the terms “the LFDR” and “the database” are used interchangeable. |

| 2 | Fundsquare is a subsidiary of Luxembourg Stock Exchange. |

| 3 | In the absence of an assigned sub-fund ISIN, market practice typically requires the ISIN of the main share class to identify a sub-fund portfolio for the purposes of processing its trade settlement instructions. For the purposes of the settlement of subscription and redemption payments from and to the fund shareholder, the relevant share class ISIN is used. Thus, only share classes have ISINs in use in market operations. |

| 4 | A possible exception is an asset, such as a currency receivable, representing claims related to foreign exchange hedging transactions undertaken exclusively on behalf of a specific share class. In such a case, the asset (and its fluctuating value) insures solely to the share class and is incorporated only into that share class’s share value. |

| Total Number | Active | Obsolete | |

|---|---|---|---|

| Fund | 4591 | 2677 | 1914 |

| Sub-Funds | 18,982 | 10,017 | 8965 |

| Share Classes | 84,556 | 54,566 | 29,990 |

| Information Group | Data Table | Data Fields | Category | Total Entries |

|---|---|---|---|---|

| Fund | Fund | Fund Identifier (FundID), Identifier in Morningstar’s Database (MorningstarID), Identifier in Fundsquare’s Database (FundsquareID), Identifier in the Commission de Surveillance du Secteur Financier (CSSF’s) Database (CssfID), Legal Entity Identifier, Constitution Date, Status, and End Date | Life-Cycle | 4591 |

| Fund.Profile | FundID, Name, Legal Form, and Fiscal Year End | Period-Based | 4591 | |

| Fund.Roles | FundID, Management Company, Is Self-Managed, Investment Manager, Administrator, Custodian, Auditor, and Transfer Agent | Period-Based | 4591 | |

| Fund.Contact | FundID, Street, City, and Country of Management Company | Period-Based | 4591 | |

| Sub-fund | Subfund | Sub-fund Identifier (SubfundID), Identifier in Morningstar’s Database (MorningstarID), Identifier in Fundsquare’s Database (FundsquareID), Identifier in CSSF’s Database (CssfID), Legal Entity Identifier, Launch Date, Status, End Date, End Reason, Parent FundID, and PortfolioID | Life-Cycle | 18,982 |

| Subfund.Profile | SubfundID, Sub-fund name, Currency, Pricing Frequency, Is Index Fund, Is Exchange Traded Fund (ETF), Is Fund of Funds, Is Master Fund, Is Feeder Fund, Master Fund ID, Is Leveraged, Is Socially Conscious, Is Sharia Compliant, Investment Area, and Prospectus Benchmark | Period-Based | 18,982 | |

| Subfund.Roles | SubfundID, Asset Manager, Investor Advisor, and Distributor | Period-Based | 46,691 | |

| Subfund.DailySeries | SubfundID, Date, Total Net Assets (TNA), and Currency | Time-Series (Daily) | 7,981,759 (From 1988-10-18 to 2016-10-21) | |

| Subfund.ClassificationStatic | SubfundID, Date (Prospectus Date), and Morningstar Global Category | Period-Based | 17,003 | |

| Subfund.ClassificationDynamic | SubfundID, Morningstar Category, Morningstar Equity Style Box, and Morningstar Fixed Income Style Box | Time-Series (Monthly) | 224,593 (From 1988-03-01 to 2016-10-31) | |

| Subfund.CashFlows | SubfundID, Date, Net Amount of Subscriptions, Net Amount of Redemptions, and Currency | Time-Series (Monthly) | 984,673 (From 1988-03-01 to 2016-10-31) | |

| Portfolio | Portfolio.Summary | Portfolio Identifier (PortfolioID), Identifier in Morningstar’s Database, Currency, and List of Report Dates | Life-Cycle | 14,464 |

| Portfolio.Allocation | PortfolioID, Date, Sale Position, Number Holdings, Number Stock Holdings, Number Bond Holdings, Total Market Value, Asset Allocation Stock, Asset Allocation Bond, Stock Breakdown, and Bond Breakdown | Time-Series (Monthly) | 250,445 (From 2002-10-31 to 2016-11-16) | |

| Portfolio.Holdings | PortfolioID, Date, Name, International Securities Identification Number (ISIN), Type, Sector, Country, Currency, Market Value, Weighting, Shares Held, Maturity Date, Coupon Rate, and First Bought Date | Time-Series (Monthly) | 20,029,968 (From 2002-10-31 to 2016-11-16) | |

| Share class | Shareclass | Share class Identifier (ShareClassID), Identifier in Morningstar’s Database (MorningstarID), Identifier in Fundsquare’s Database (FundsquareID), Identifier in CSSF’s Database (CssfID), ISIN, Launch date, Parent SubfundID, Parent FundID, Status, End Date, End Reason, and Receiving Fund | Life-Cycle | 84,556 |

| Shareclass.Profile | ShareClassID, Name, Currency, Distribution Flag, Is Currency Hedged, Hedged Currency, Is Institutional, Distribution Countries, and Minimum Investment | Period-Based | 84,556 | |

| Shareclass.DailySeries | ShareClassID, Date, TNA, Net Asset Value (NAV), Shares Outstanding, Bid Price, and Offer price Currency | Time-Series (Daily) | 10,118,7743 (From 1988-03-01 to 2016-10-21) | |

| Shareclass.MonthlySeries | ShareClassID, Date, Return | Time-Series (Monthly) | 4,657,460 (From 1988-03-01 to 2016-11-30) | |

| Shareclass.ClassificationStatic | ShareClassID, Morningstar Global Category, and Prospectus Date | Period-Based | 14,337 | |

| Shareclass.ClassificationDynamic | ShareClassID, Morningstar Category, Morningstar Equity Style Box, Morningstar Fixed Income Style Box, and Date | Time-Series (Monthly) | 201,141 (From 1988-03-01 to 2016-10-31) | |

| Shareclass.FeesShareholders | ShareClassID, Subscription Fee Tier Structure, Redemption Fee Tier Structure, Switch Fee, and Prospectus Date | Period-Based | 66,217 | |

| Shareclass.FeesMaxima | ShareClassID, Max Management Fee, Max Ongoing Charge, Max Performance Fee, Total Expense Ratio, and Prospectus Date. | Period-Based | 324,076 | |

| Shareclass.FeesAnnualReport | ShareClassID, Management Fee, Ongoing Charge, Performance Fee, Total Expense Ratio, Turnover Ratio, and Annual Report Date | Time-Series (Annual) | 128,821 (From 2000-09-25 to 2016-12-09) | |

| Shareclass.Dividends | ShareClassID, Ex-Dividend Date, Distribution Amount, Reinvestment Date, Payment Date, Declaration Date, Distribution Type, and Currency, Split Values | Time-Series | 303,968 (From 1988-03-01 to 2016-12-20) |

| Total Number of Entries | ||||

|---|---|---|---|---|

| Year | Subfund. Daily Series | Shareclass. Daily Series | Shareclass. Monthly Series | Shareclass. Dividends |

| 1988 | 17 | 35721 | 3013 | 71 |

| 1989 | 26 | 50,381 | 4211 | 121 |

| 1990 | 164 | 75,239 | 6237 | 143 |

| 1991 | 186 | 110,315 | 9024 | 219 |

| 1992 | 260 | 167,268 | 11,718 | 301 |

| 1993 | 373 | 234,591 | 15,049 | 373 |

| 1994 | 413 | 328,120 | 19,256 | 435 |

| 1995 | 498 | 423,602 | 23,153 | 556 |

| 1996 | 549 | 520,591 | 27,090 | 758 |

| 1997 | 700 | 659,915 | 32,737 | 899 |

| 1998 | 1286 | 860,097 | 40,846 | 1085 |

| 1999 | 4124 | 1,153,519 | 50,984 | 1414 |

| 2000 | 17,657 | 1,515,293 | 64,427 | 1635 |

| 2001 | 26,024 | 1,976,887 | 81,418 | 1967 |

| 2002 | 32,981 | 2,428,050 | 98,822 | 2651 |

| 2003 | 37,463 | 2,773,609 | 115,773 | 3662 |

| 2004 | 55,953 | 3,139,488 | 132,809 | 4593 |

| 2005 | 64,056 | 3,461,520 | 154,332 | 5203 |

| 2006 | 101,319 | 4,080,283 | 187,166 | 6444 |

| 2007 | 260,017 | 4,921,697 | 223,129 | 7780 |

| 2008 | 581,190 | 5,856,880 | 260,762 | 8549 |

| 2009 | 651,444 | 6,090,925 | 275,932 | 8418 |

| 2010 | 777,513 | 6,511,096 | 299,499 | 48,128 |

| 2011 | 790,429 | 7,137,134 | 331,239 | 42,191 |

| 2012 | 795,919 | 7,777,987 | 359,101 | 18,601 |

| 2013 | 877,118 | 8,689,339 | 396,759 | 24,974 |

| 2014 | 948,458 | 9,810,901 | 447,514 | 32,831 |

| 2015 | 1,044,755 | 10,955,075 | 497,283 | 39,273 |

| 2016 | 910,867 | 9,442,220 | 488,177 | 40,693 |

| Total | 7,981,759 | 101,187,743 | 4,657,460 | 303,968 |

| Information Group | Morningstar | Fundsquare | CSSF | LFDR | |

|---|---|---|---|---|---|

| Fund | Life-cycle fields | Population: 1724 History: latest values only | Population: 2742 History: latest values only | Population: 4658 History: 1988–2016 | Population: 4591 History: 1988–2016 |

| Sub-fund | Life-cycle fields | Population: 17,728 History: latest values only | Population: 17,292 History: latest values only | Population: 19,289 History: 1988–2016 | Population: 18,982 History: 1988–2016 |

| Time-series fields | Population: 9570 History: 1988–2016 | Population: 14,965 History: 2000–2016 | No data available | Population: 16,188 History: 1988–2016 | |

| Portfolio | Time-series fields | Population: 14,464 History: 2002–2016 | No data available | No data available | Population: 14,464 History: 2002–2016 |

| Share Class | Life-cycle fields | Population: 75,045 History: latest values only | Population: 82,514 History: 1988–2016 | Population: 88,462 History: 1988–2016 | Population: 84,556 History: 1988–2016 |

| Time-series fields | Population: 69,549 History: 1988–2016 | Population: 75,086 History: 2000–2016 | No data available | Population: 81,056 History: 1988–2016 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Skoura, A.; Presber, J.; Schiltz, J. Luxembourg Fund Data Repository. Data 2020, 5, 62. https://doi.org/10.3390/data5030062

Skoura A, Presber J, Schiltz J. Luxembourg Fund Data Repository. Data. 2020; 5(3):62. https://doi.org/10.3390/data5030062

Chicago/Turabian StyleSkoura, Angeliki, Julian Presber, and Jang Schiltz. 2020. "Luxembourg Fund Data Repository" Data 5, no. 3: 62. https://doi.org/10.3390/data5030062

APA StyleSkoura, A., Presber, J., & Schiltz, J. (2020). Luxembourg Fund Data Repository. Data, 5(3), 62. https://doi.org/10.3390/data5030062