The Mediator Effect of Corporate Social Responsibility Disclosure on the Relationship between Corporate Governance and Bank Performance †

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

- Quantitative research is empirical research in which the data is presented in numerical form; this method is appropriate for studying programs, behaviors, and social interactions. It is separated into two categories: primary and secondary data [17].

- Qualitative research is empirical research in which the data is not presented in numerical form; as a result, qualitative research is well suited to social phenomena and introduces inventive new research methodologies [17].

- Mixed methods research is a method of gathering and interpreting data that combines qualitative and quantitative methodologies in one study [17].

3.1. Sampling, Research Population, and Period of Study

3.2. Research Process

3.3. Baron and Kenny Approach

3.3.1. Mediator Variable

3.3.2. Sobel Test

3.3.3. Mediator Variable

4. Results

Sensitivity Analysis (Sobel Test)

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Qaderi, S.A.; Alhmoud, T.R.; Abdulraheem Ghaleb, B.A. Audit committee features and CSR disclosure: Additional evidence from an emerging market. Int. J. Financ. Res. 2020, 11, 226–237. [Google Scholar] [CrossRef]

- Daas, A.; Alaraj, R. The complementarity between corporate social responsibility disclosure and institutional investor in Jordan. Int. J. Islamic Middle East. Financ. Manag. 2019, 12, 191–215. [Google Scholar] [CrossRef]

- Al-marayat, A.M.S. Corporate Social Responsibility Effective Determinants of the Banking Sector in Jordan. RJFA 2019, 10, 36–44. [Google Scholar] [CrossRef]

- Reverte, C.; Gómez-Melero, E.; Cegarra-Navarro, J. The influence of corporate social responsibility practices on organizational performance: Evidence from Eco-Responsible Spanish firms. J. Clean. Prod. 2016, 112, 2870–2884. [Google Scholar] [CrossRef]

- Malik, M.S.; Kanwal, L. Impact of corporate social responsibility disclosure on financial performance: Case study of listed pharmaceutical firms of Pakistan. J. Bus. Ethics 2018, 150, 69–78. [Google Scholar] [CrossRef]

- Maqbool, Z. Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Future Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Sial, M.S.; Chunmei, Z.; Khan, T.; Nguyen, V.K. Corporate social responsibility, firm performance and the moderating effect of earnings management in Chinese firms. Asia-Pac. J. Bus. Adm. 2018, 10, 184–199. [Google Scholar] [CrossRef]

- Laskar, N.; Chakraborty, T.K.; Maji, S.G. Corporate sustainability performance and financial performance: Empirical evidence from Japan and India. Manag. Labour Stud. 2017, 42, 88–106. [Google Scholar] [CrossRef]

- Allegrini, M.; Greco, G. Corporate boards, audit committees and voluntary disclosure: Evidence from Italian listed companies. J. Manag. Gov. 2013, 17, 187–216. [Google Scholar] [CrossRef]

- Yusoff, W.F.W.; Adamu, M.S. The relationship between corporate social responsibility and financial performance: Evidence from Malaysia. Int. Bus. Manag. 2016, 10, 345–351. [Google Scholar]

- Al-Samman, E.; Al-Nashmi, M.M. Effect of corporate social responsibility on nonfinancial organizational performance: Evidence from Yemeni for-profit public and private enterprises. Soc. Responsib. J. 2016, 12, 247–262. [Google Scholar] [CrossRef]

- Weshah, S.R.; Dahiyat, A.A.; Abu Awwad, M.R.; Hajjat, E.S. The impact of adopting corporate social responsibility on corporate financial performance: Evidence from Jordanian banks. Interdiscip. J. Contemp. Res. Bus. 2012, 4, 34–44. [Google Scholar]

- Khan, B.; Tariq, R. Corporate social responsibility impact on financial performance of Islamic and conventional banks: Evidence from Asian countries. Res. J. Financ. Account. 2017, 8, 20–28. [Google Scholar]

- Babalola, Y.A. The impact of corporate social responsibility on firms’ profitability in Nigeria. Eur. J. Econ. Financ. Adm. Sci. 2012, 45, 39–50. [Google Scholar]

- Mangantar, M. The influence of corporate social responsibility and corporate governance on banking financial performance. Eur. Res. Stud. J. 2019, 22, 95–105. [Google Scholar] [CrossRef]

- Creswell, J.W.; Tashakkori, A. Differing Perspectives on Mixed Methods Research; Sage Publications Sage CA: Los Angeles, CA, USA, 2007. [Google Scholar]

- Tashakkori, A.; Teddlie, C. Issues and dilemmas in teaching research methods courses in social and behavioural sciences: US perspective. Int. J. Soc. Res. Methodol. 2003, 6, 61–77. [Google Scholar] [CrossRef]

- Al Fadli, A.; Sands, J.; Jones, G.; Beattie, C.; Pensiero, D. Board Gender Diversity and CSR Reporting: Evidence from Jordan. Australas. Account. Bus. Financ. J. 2019, 13, 29–52. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic confidence intervals for indirect effects in structural equation models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Başar, B.D.; Bouteska, A.; Büyükoğlu, B.; Ekşi, I.H. The effect of corporate governance on bank performance: Evidence from Turkish and some MENA countries banks. J. Asset Manag. 2021, 22, 153–162. [Google Scholar] [CrossRef]

- Nour, A.I.; Ahmad Sharabati, A.A.; Mahmoud Hammad, K. Corporate governance and corporate social responsibility disclosure. Int. J. Sustain. Entrep. Corp. Soc. Responsib. 2020, 5, 20–41. [Google Scholar] [CrossRef]

- Rehman, Z.U.; Zahid, M.; Rahman, H.U.; Asif, M.; Alharthi, M.; Irfan, M.; Glowacz, A. Do corporate social responsibility disclosures improve financial performance? A perspective of the Islamic banking industry in Pakistan. Sustain. Digit. Transform. Fintech 2020, 12, 3302. [Google Scholar] [CrossRef]

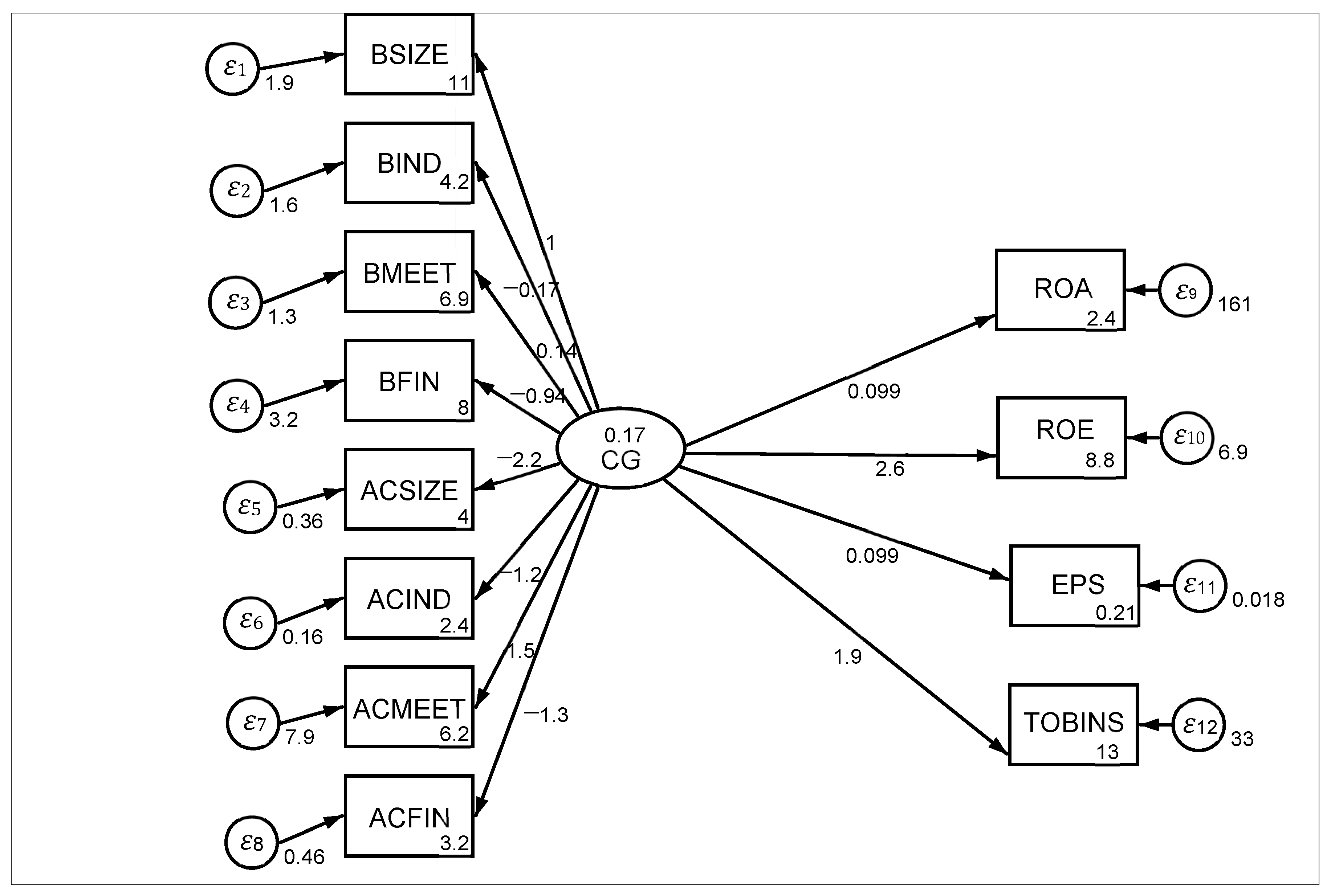

| STRUCTURAL | COEFFICIENT | P > Z |

|---|---|---|

| ROA < G | 0.0987987 | 0.975 |

| ROE < CG | 2.632945 | 0.021 |

| EPS < CG | 0.099025 | 0.045 |

| TOBIN’S < CG | 1.932218 | 0.279 |

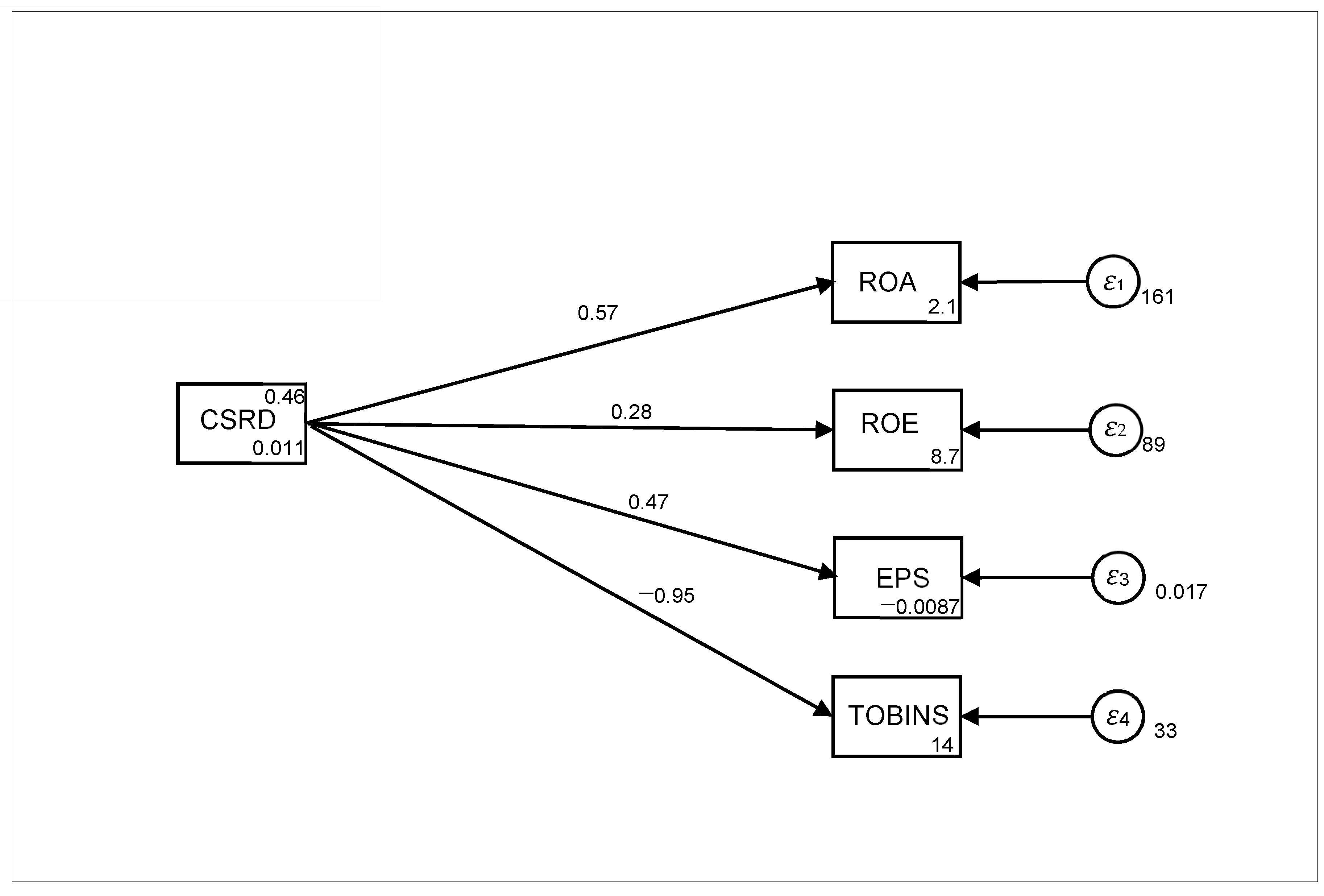

| Structural | Coefficient | P > Z |

|---|---|---|

| CSRD < -CG | 0.047006 | 0.0000 |

| Structural | Coefficient | P > Z |

|---|---|---|

| ROA < CSRD | 0.5744962 | 0.068 |

| ROE < CSRD | 0.2805739 | 0.0000 |

| EPS < CSRD | 0.4730511 | 0.0000 |

| TOBIN’S < CSRD | −0.9463632 | 0.0000 |

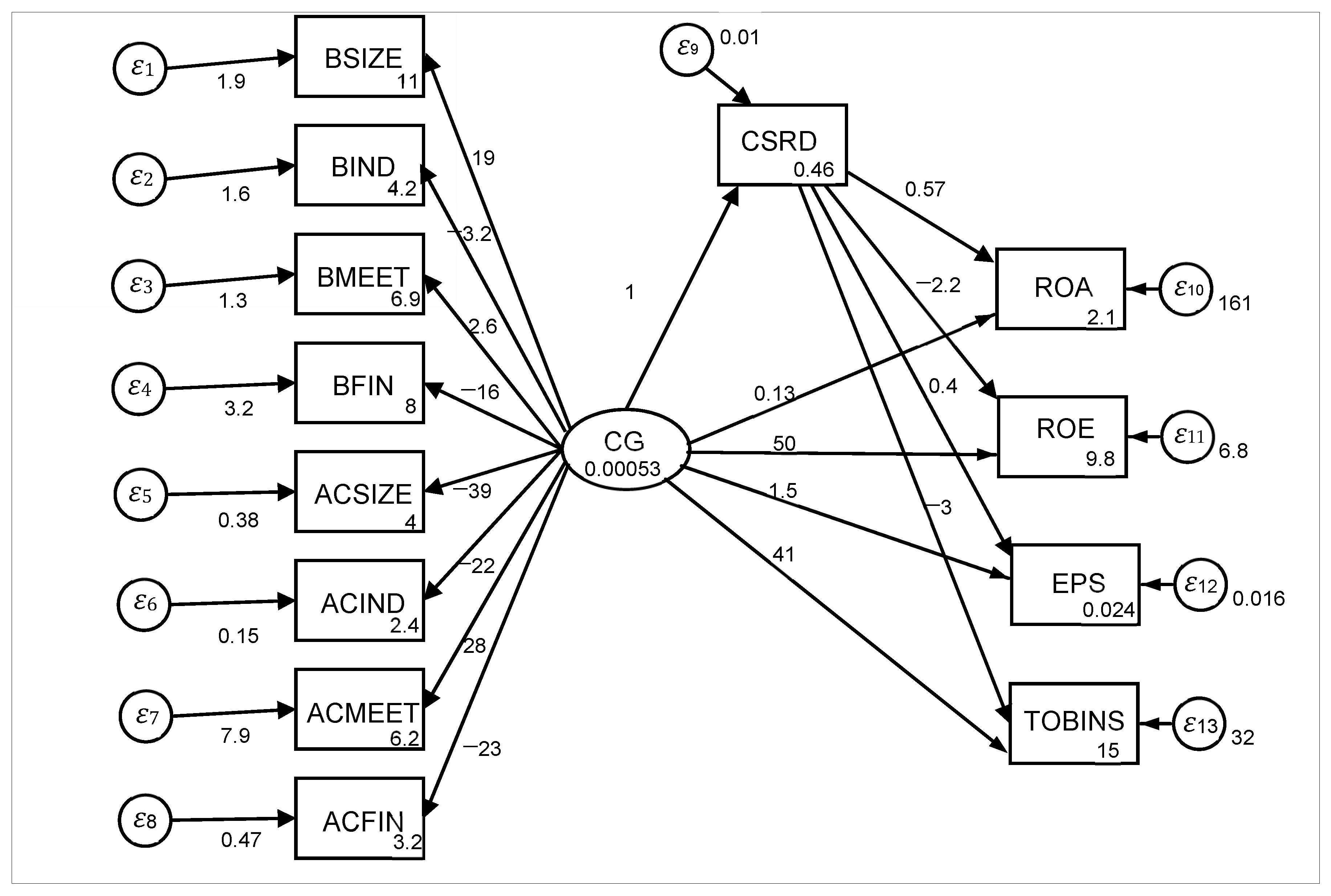

| CSRD | Coefficient | P > Z | Standard Err. |

|---|---|---|---|

| CG | 1 | 0.0000 | 0.0095563 |

| BANK PERFORMANCE | Coefficient | P > Z | Standard Err. |

| ROA | 0.568037 | 0.961 | 11.72002 |

| ROE | −2.196829 | 0.377 | 2.485405 |

| EPS | 0.4008096 | 0.001 | 0.1203536 |

| TOBIN’S Q | −2.976764 | 0.581 | 5.391648 |

| CG WITH ROA | 0.1302887 | 0.988 | 58.77497 |

| CG WITH ROE | 0.4992941 | 0.047 | 0.2514511 |

| CG WITH EPS | 1.455955 | 0.103 | 0.8928138 |

| CG WITH TOBIN’S Q | 0.4092057 | 0.264 | 0.3660848 |

| Sobel Test | Coef. | Standard Error | One-Tailed Probability | Two-Tailed Probability |

|---|---|---|---|---|

| CG- CSRD-ROA | 1 0.568037 | 0.0095563 11.72002 | 0.48067214 | 0.96134429 |

| CG CSRD-ROE | 1 −2.19682 | 0.0095563 2.485405 | 0.18838849 | 0.37677698 |

| CG -CSRD-EPS | 1 0.4008096 | 0.0095563 0.1203536 | 0.00043641 | 0.00087283 |

| CG-CSRD–TOBIN’S Q | 1 −2.976764 | 0.0095563 5.391648 | 0.29044410 | 0.58088821 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alnohoud, I.; Saat, M.B.M.; Ramakrishnan, S.A/L. The Mediator Effect of Corporate Social Responsibility Disclosure on the Relationship between Corporate Governance and Bank Performance. Proceedings 2022, 82, 83. https://doi.org/10.3390/proceedings2022082083

Alnohoud I, Saat MBM, Ramakrishnan SA/L. The Mediator Effect of Corporate Social Responsibility Disclosure on the Relationship between Corporate Governance and Bank Performance. Proceedings. 2022; 82(1):83. https://doi.org/10.3390/proceedings2022082083

Chicago/Turabian StyleAlnohoud, Ibrahim, Maisarah Binti Mohammed Saat, and Suresh A/L Ramakrishnan. 2022. "The Mediator Effect of Corporate Social Responsibility Disclosure on the Relationship between Corporate Governance and Bank Performance" Proceedings 82, no. 1: 83. https://doi.org/10.3390/proceedings2022082083

APA StyleAlnohoud, I., Saat, M. B. M., & Ramakrishnan, S. A/L. (2022). The Mediator Effect of Corporate Social Responsibility Disclosure on the Relationship between Corporate Governance and Bank Performance. Proceedings, 82(1), 83. https://doi.org/10.3390/proceedings2022082083