Abstract

The purpose of this paper is to identify econometric models likely to highlight the impact of the COVID-19 pandemic on the financial markets. The Markov-switching “GARCH and EGARCH” models are suitable for analyzing and forecasting the series of daily returns of the major global stock indices (i.e., SSE, S&P500, FTSE100, DAX, CAC40, and NIKKEI225) during the pre-COVID-19 period, from 1 June to 30 November 2019, and the post-COVID-19 period, from 31 December 2019, to 1 June 2020. The Markov-switching “GARCH and EGARCH” models allow good modeling of the conditional variance. The estimated conditional variance values by these models highlight the increase in volatility for the stock markets in our sample, during the post-COVID-19 period compared to that pre-COVID-19, with a peak in volatility in “early January 2020” for the Chinese stock market and in “March 2020” for the other five stock markets (i.e., New York, Paris, Frankfurt, London, and Tokyo). The stock exchange of Frankfurt has shown great resilience compared to other international stock exchanges (i.e., the stock exchanges in Paris, London, and New York). The modeling of the impact of the COVID-19 pandemic on the financial markets by the Markov-switching “GARCH and EGARCH” models makes it possible to simultaneously take into consideration the nonlinearity at the level of the mean and the variance, and to obtain the results of the transition probabilities, the unconditional probabilities and the conditional anticipated durations during the pre-COVID-19 period and the post-COVID-19 period.

1. Introduction

The prices of the main international

financial market portfolios experienced a plunge in March 2020 due to the COVID-19

pandemic. Pandemics can also have a substantial impact on financial systems due

to their enormous economic costs [1]. It is

true that the previous literature remains limited as to how pandemics affect

financial markets. However, some research has advanced the impact of the COVID-19

pandemic on financial volatility [2,3,4]. It

should be noted that other forms of natural disasters, such as earthquakes and

volcanoes; air disasters; as well as acts of terrorism, have a negative impact

on financial markets [1,5,6,7,8,9]. Since the

appearance of the first case of COVID-19 in Wuhan in December 2019, the virus

has quickly spread to all corners of the world. On 11 March 2020, when it has

already affected more than 100,000 people and killed thousands of people in

over 100 countries, the World Health Organization (WHO) declared the

coronavirus epidemic (COVID-19) as a global pandemic. The global spread of COVID-19,

which has saturated healthcare systems, has forced societies and economies to

shut down, causing social and economic disruption. The negative repercussions

of the COVID-19 pandemic on foreign trade, tourism, transport, and industry

were evident [10]. Its economic consequences

are likely to exceed those of the global financial crisis of 2007–2009. In

fact, in its April 2020 report, the International Monetary Fund forecasts a

global growth rate of −3% in 2020, which is lower than the lowest rate of −1.7%

recorded in 2009 during the global financial crisis of 2007–2009 [11]. The negative, substantial, and sudden impact

of the COVID-19 pandemic on major stock markets was evident in March 2020 [1,10,12,13]. Indeed, the price of the S&P 500

stock index, which reached a high value of 3386.15 points on 19 February 2020,

experienced, after almost a month, a decline of around 34% and recorded a low

value of 2237.40 points on 23 March 2020. The price of FTSE 100 also registered

a decline of about 30% for a single month and fell from 7403.9 points on 16

February 2020 to 5190.8 points on 15 March 2020. Likewise, the price of CAC 40

fell from 6111.24 points on 19 February 2020 to 3754.84 points on 18 March 2020,

a drop of around 39% for a single month. The literature explains financial

volatility through factors related to economic conditions, institutional

problems, market uncertainty, good or bad announcements, and economic policy

uncertainty [10,14,15,16,17,18,19,20,21,22,23]. There is a fair amount

of research that has focused on estimating and forecasting the economic and

financial costs of pandemics [1]. For example,

the study of the economic costs of the HIV pandemic [24],

the impact of the HIV pandemic on development [25],

the costs of growing global obesity and diabetes [26],

the work on forecasting the economic costs for possible future pandemics which

has highlighted the importance of good health system management to address the

people affected and tackling outbreaks as well as the negative impact of social

distancing on economic activity [27], with the

study indicating the need to prepare for pandemics and estimating the value of

the annual losses due to a possible pandemic at around 500 billion US dollars,

or 0.6% of global income [28]-currently

considered to be underestimated [1]-the work

highlighting the need for economic risk management versus potential probability

future pandemics [29,30]. The objective of

this paper is, therefore, to identify econometric models likely to model the

processes of the series of daily returns of the main world stock market

indices: SSE, S&P500, FTSE 100, DAX, CAC40, and NIKKEI 225, during the pre-COVID-19

period, from 1 June to 30 November 2019, and the post-COVID-19 period, from 31

December 2019 to 1 June 2020, in order to highlight the substantial impact of

the COVID-19 pandemic on the financial markets. Since these series experience

phases of calm or low volatility and phases of crisis or high volatility, the

Markov-switching “GARCH and EGARCH” models constitute the econometric methods

adequate to model their volatility during the period pre-COVID-19 and the post-COVID-19

one [31,32,33,34,35,36].

2. Results and Concluding Remarks

Both the graphical examination of our

variables of interest and the unit root tests, i.e., the increased Dickey–Fuller,

Phillips–Perron, and KPSS (Kwiatkovski, Phillips, Schmidt and Shin), show that

the daily prices of the main world stock indices: SSE, S&P500, FTSE 100,

DAX, CAC40, NIKKEI 225 are not stationary, while the series of daily returns of

the same indices: RSSE, RS&P500, RFTSE 100, RDAX, RCAC40 and RNIKKEI 225,

are stationary, during the pre-COVID-19 period and the post-COVID-19 one.

Table 1, Table 2, Table 3 and Table 4

below present the results of the estimation of the Markov-switching “GARCH and

EGARCH” models during the pre-COVID-19 and post-COVID-19 periods.

Table 1.

Estimation of Markov-switching GARCH models during the pre-COVID-19 period from 1 June to 30 November 2019. Where is the independent state of the past conditional variance; , with i .

Table 2.

Estimation of Markov-switching GARCH models during the post-COVID-19 period from 31 December 2019 to 1 June 2020. . Where is the independent state of the past conditional variance; , with i .

Table 3.

Estimation of Markov-switching EGARCH models during the pre-COVID-19 period from 1 June to 30 November 2019. Where and is the independent state of the past conditional variance.

Table 4.

Estimate of EGARCH regime change models during the post-COVID-19 period from 31 December 2019 to 1 June 2020. . Where and is the independent state of the past conditional variance.

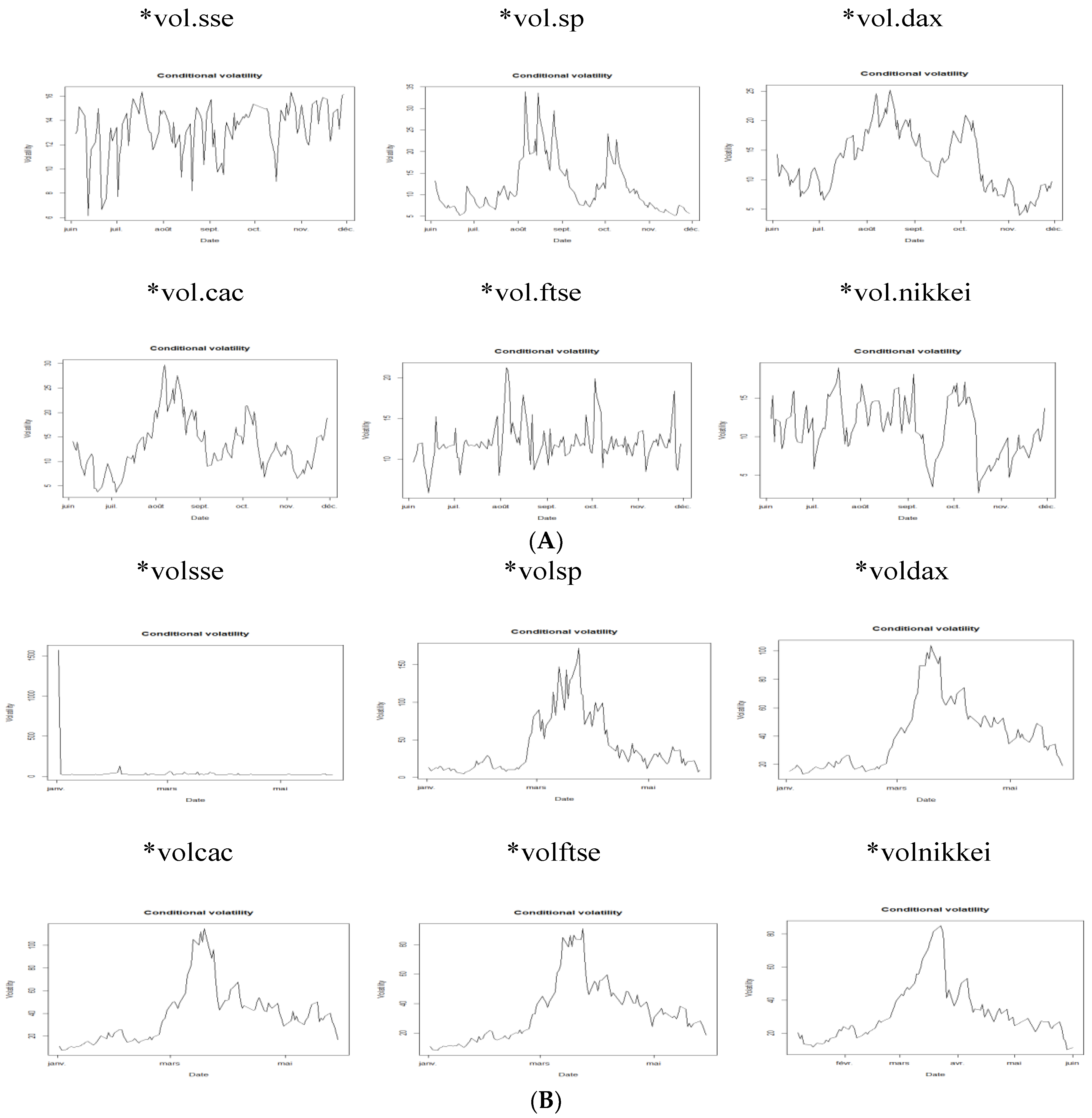

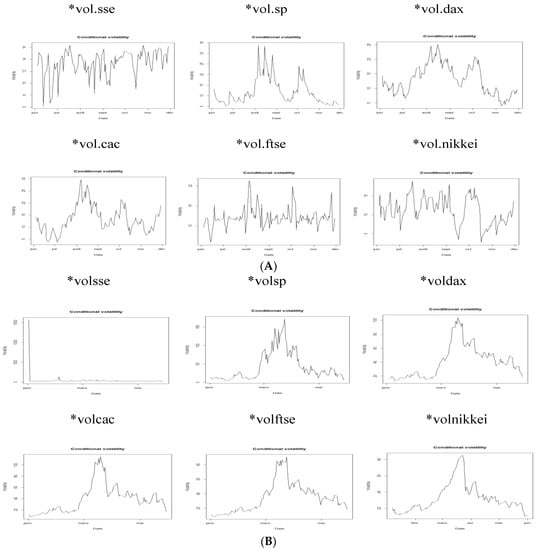

Given the results of the individual significance test of the coefficients, the information criteria (i.e., Bayesian Information Criteria (BIC)), and the Log-likelihood (Log(L)), the models suitable for modeling conditional volatility are, on the one hand, the Markov-switching EGARCH model, with normal distribution, for the RS&P500, RSSE, RDAX, RFTSE, and RNIKKEI series, the Markov-switching EGARCH model, with a generalized distribution of errors, for the RCAC series, during the pre-COVID-19 period; and, on the other hand, the Markov-switching EGARCH models, with normal distribution, for the RS&P500, RCAC, RFTSE, and RNIKKEI series, the Markov-switching EGARCH model, with a Student distribution, for the RDAX series, and the Markov-switching GARCH model, with normal distribution, for the RSSE series, during the post-COVID-19 period. Figure 1 below illustrates the graphical representations of the conditional volatilities estimated by the models indicated above, during the pre-COVID-19 period and the post-COVID-19 one, for the six series of our interest: RS&P500, RSSE, RDAX, RCAC, RFTSE, and RNIKKEI.

Figure 1.

Conditional volatility during the pre-COVID-19 and post-COVID-19 period. (A) Pre-COVID-19 period from 1 June to 30 November 2019. (B) Post-COVID-19 period from 31 December 2019 to 1 June 2020.

From this figure, we see that the extent (maximum-minimum) is very large during the post-COVID-19 period compared to the pre-COVID-19 period. Apart from the stock market of the epicenter country of the COVID-19 pandemic (the Chinese stock market), for which conditional volatility (denoted “volsse”) reached its peak in “late December-early January” during the post-COVID-19 period, volatilities conditions of the other five stock markets (the New York, Paris, Frankfurt, London, and Tokyo stock exchanges) reached their climax in March 2020. This finding clearly illustrates the increase in volatility in the main stock markets due to the pandemic of COVID-19.

The indicators of central tendency and position (the first quartile, the median, the third quartile, the arithmetic mean), the minimum value, the maximum value, and the dispersion indicators (the standard deviation, the coefficient of variation, and the interquartile range) of conditional volatility (Table 5 and Table 6) increased during the post-COVID-19 period compared to the pre-COVID-19 period. This increase clearly illustrates the increase in volatility in major stock markets due to the COVID-19 pandemic.

Table 5.

Statistical indicators of conditional volatility during the pre-COVID-19 period.

Table 6.

Statistical indicators of conditional volatility during the post-COVID-19 period.

According to the values of the transition probability , we see that the chances of passing from the state of crisis at t-1 to the state of stability at t have greatly decreased, during the post-COVID-19 period compared to that pre-COVID-19, for all stock markets in our sample (Table 7 and Table 8). For example, this probability goes, between the pre-COVID-19 and post-COVID-19 period, from 0.355 to 0.0004 for the stock exchange of London, from 0.4064 to 0.0404 for the stock exchange of Tokyo, and from 0.0826 to 0.0004 for the stock exchange of Paris. It should be noted that the stock exchange of Frankfurt recorded the smallest decrease in this probability between the pre-COVID-19 and the post-COVID-19 period, a drop from 0.0865 to 0.0285. Based on the values of the unconditional probability in the stable state and the unconditional probability in the crisis state , we see that the COVID-19 pandemic has had a negative impact on the stock exchanges of New York, Paris, and London. In other words, the proportion of observations that should be in a state of crisis () increased significantly, during the post-COVID-19 period compared to the pre-COVID-19 period, for these three stock exchanges. Between the pre-COVID-19 and post-COVID-19 period, this proportion rose from 19.35% to 98.57% for the stock exchange of London, from 38.59% to 98.57% for the stock exchange of Paris, and from 26.84% to 58.43% for the stock exchange of New York. In return, the stock exchange of Frankfurt showed great resilience, compared to other international stock exchanges, with the recording of a very low value of the unconditional probability of the state of crisis and a very high value of the unconditional probability of the state of stability , during the post-COVID-19 period compared to the pre-COVID-19 period. In fact, the proportion of observations that should be in the state of crisis increased from 38.59%, during the pre-COVID-19 period, to 2.73%, during the post-COVID-19 period, for this stock exchange. It should also be noted that, to a lesser extent, the stock exchange of Tokyo has also shown a certain resilience, with a decrease in the proportion of observations that should be in the state of crisis during the post-COVID-19 period compared to the pre-COVID-19, or 31.64% against 55.16%. These latest results are supported by the variations in the values of the expected duration conditional on the state of crisis and the expected duration conditional on the state of stability, namely: the significant increase in the expected period of high volatility () during the post-COVID-19 period compared to that pre-COVID-19 for the stock exchanges of Paris, London, and New York, as well as the significant increase in the expected period of low volatility () during the post-COVID-19 period compared to that pre-COVID-19 for the stock exchange of Frankfurt. On the one hand, we can expect a period of high volatility equal to 2500 days, or 1.6 years, during the post-COVID-19 period against a period of high volatility equal, respectively, to almost 12 days and 3 days during the pre-COVID-19 period for stock exchanges in Paris and London. On the other hand, we can expect a period of high volatility equal to only 35 days during the post-COVID-19 period against a period of high volatility equal to almost 11 days during the pre-COVID-19 period for the stock exchange of Frankfurt. The resilience of this stock exchange in relation to the COVID-19 pandemic is illustrated by the expected period of low volatility equal to 1250 days, or 0.8 years, during the post-COVID-19 period, against an expected period of low volatility equal to 27 days, during the pre-COVID-19 period, for the German stock market.

Table 7.

Transition probabilities, unconditional probabilities, and conditional anticipated duration (the pre-COVID-19 period).

Table 8.

Transition probabilities, unconditional probabilities, and conditional anticipated duration (the post-COVID-19 period).

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available on request from the author.

Conflicts of Interest

The author declares no conflict of interest.

References

- Goodell, J.W. COVID-19 and finance: Agendas for future research. Financ. Res. Lett. 2020, 35, 101512. [Google Scholar] [CrossRef] [PubMed]

- Albulescu, C.T. Coronavirus and financial volatility: 40 days of fasting and fear. Financ. Res. Lett. 2020, 11, 454–462. [Google Scholar] [CrossRef]

- Bakas, D.; Triantafyllou, A. Commodity price volatility and the economic uncertainty of pandemics. Econ. Lett. 2020, 193, 109283. [Google Scholar] [CrossRef]

- Zaremba, A.; Kizys, R.; Aharon, D.Y.; Demir, E. Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe. Financ. Res. Lett. 2020, 35, 101597. [Google Scholar] [CrossRef]

- Chesney, M.; Reshetar, G.; Karaman, M. The impact of terrorism on financial markets: An empirical study. J. Bank. Financ. 2011, 35, 253–267. [Google Scholar] [CrossRef]

- Choudhry, T. September 11 and time-varying beta of United States companies. Appl. Financ. Econ. 2005, 15, 1227–1242. [Google Scholar] [CrossRef]

- Corbet, S.; Gurdgiev, C.; Meegan, A. Long-term stock market volatility and the influence of terrorist attacks in Europe. Q. Rev. Econ. Financ. 2018, 68, 118–131. [Google Scholar] [CrossRef]

- Hon, M.T.; Strauss, J.; Yong, S.-K. Contagion in financial markets after September 11: Myth or reality? J. Financ. Res. 2004, 27, 95–114. [Google Scholar] [CrossRef]

- Nikkinen, J.; Vähämaa, S. Terrorism and stock market sentiment. Financ. Rev. 2010, 45, 263–275. [Google Scholar] [CrossRef]

- Albulescu, C.T. COVID-19 and the United States financial markets’ volatility. Financ. Res. Lett. 2021, 38, 101699. [Google Scholar] [CrossRef]

- IMF. World Economic Outlook, April 2020: The Great Lockdown. 2020. Available online: https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020 (accessed on 1 June 2020).

- Ashraf, B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res. Int. Bus. Financ. 2020, 54, 101249. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef] [PubMed]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic co-movements of stock market returns, implied volatility and policy uncertainty. Econ. Lett. 2013, 120, 87–92. [Google Scholar] [CrossRef]

- Chen, X.; Chiang, T.C. Empirical investigation of changes in policy uncertainty on stock returns—Evidence from China’s market. Res. Int. Bus. Financ. 2020, 53, 101183. [Google Scholar] [CrossRef]

- Hartwell, C.A. The impact of institutional volatility on financial volatility in transition economies. J. Comp. Econ. 2018, 46, 598–615. [Google Scholar] [CrossRef]

- Kalyvas, A.; Papakyriakou, P.; Sakkas, A.; Urquhart, A. What drives Bitcoin’s price crash risk? Econ. Lett. 2019, 191, 108777. [Google Scholar] [CrossRef]

- Li, T.; Ma, F.; Zhang, X.; Zhang, Y. Economic policy uncertainty and the Chinese stock market volatility: Novel evidence. Econ. Model. 2020, 87, 24–33. [Google Scholar] [CrossRef]

- Mei, D.; Zeng, Q.; Zhang, Y.; Hou, W. Does US Economic Policy Uncertainty matter for European stock markets volatility? Phys. A Stat. Mech. Its Appl. 2018, 512, 215–221. [Google Scholar] [CrossRef]

- Onan, M.; Salih, A.; Yasar, B. Impact of macroeconomic announcements on implied volatility slope of SPX options and VIX. Financ. Res. Lett. 2014, 11, 454–462. [Google Scholar] [CrossRef]

- Su, Z.; Fang, T.; Yin, L. Understanding stock market volatility: What is the role of U.S. uncertainty? N. Am. J. Econ. Financ. 2019, 48, 582–590. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Jana, R.; Roubaud, D. The policy uncertainty and market volatility puzzle: Evidence from wavelet analysis. Financ. Res. Lett. 2019, 31. [Google Scholar] [CrossRef]

- Zhu, S.; Liu, Q.; Wang, Y.; Wei, Y.; Wei, G. Which fear index matters for predicting US stock market volatilities: Text-counts or option based measurement? Phys. A Stat. Mech. Its Appl. 2019, 536, 122567. [Google Scholar] [CrossRef]

- Haacker, M. The Impact of HIV/AIDS on Government Finance and Public Services; IMF: Washington, DC, USA, 2004. [Google Scholar]

- Santaeulalia-Llopis, R. Aggregate Effects of AIDS on Development. Washington University in St. Louis Working Paper. 2008. Available online: http://www.eco.uc3m.es/temp/agenda/Santaeulalia_LlopisRaul_jmp1.pdf (accessed on 15 May 2020).

- Yach, D.; Stuckler, D.; Brownell, K.D. Epidemiologic and economic consequences of the global epidemics of obesity and diabetes. Nat. Med. 2006, 12, 62–66. [Google Scholar] [CrossRef] [PubMed]

- Bloom, D.E.; Cadarette, D.; Sevilla, J.P. Epidemics and economics: New and resurgent infectious diseases can have far-reaching economic repercussions. Financ. Dev. 2018, 55, 46–49. [Google Scholar]

- Fan, V.Y.; Jamison, D.T.; Summers, L.H. Pandemic risk: How large are the expected losses? Bull. World Health Organ. 2018, 96, 129–134. [Google Scholar] [CrossRef] [PubMed]

- Lewis, M. The Economics of Epidemics. Georget. J. Int. Aff. 2001, 2, 25–31. [Google Scholar]

- Tam, C.C.; Khan, M.S.; Legido-Quigley, H. Where economics and epidemics collide: Migrant workers and emerging infections. Lancet 2016, 388, 1374–1376. [Google Scholar] [CrossRef] [PubMed]

- Cai, J. A Markov Model of Switching-Regime ARCH. J. Bus. Econ. Stat. 1994, 12, 309. [Google Scholar] [CrossRef]

- Hamilton, J.D.; Susmel, R. Autoregressive conditional heteroskedasticity and changes in regime. J. Econ. 1994, 64, 307–333. [Google Scholar] [CrossRef]

- Ardia, D. Financial Risk Management with Bayesian Estimation of GARCH Models: Theory and Applications; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Marcucci, J. Forecasting stock market volatility with regime-switching GARCH models. Stud. Nonlinear Dyn. Econ. 2005, 9, 1558–3708. [Google Scholar] [CrossRef]

- Hansen, P.R.; Lunde, A. A forecast comparison of volatility models: Does anything beat a GARCH(1,1)? J. Appl. Econ. 2005, 20, 873–889. [Google Scholar] [CrossRef]

- Ouchen, A. Is the ESG portfolio less turbulent than a market benchmark portfolio? Risk Manag. 2022, 24, 1–33. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).