A New Perspective on the Textile and Apparel Industry in the Digital Transformation Era

Abstract

:1. Introduction

2. Fashion as a Representation of Social Life

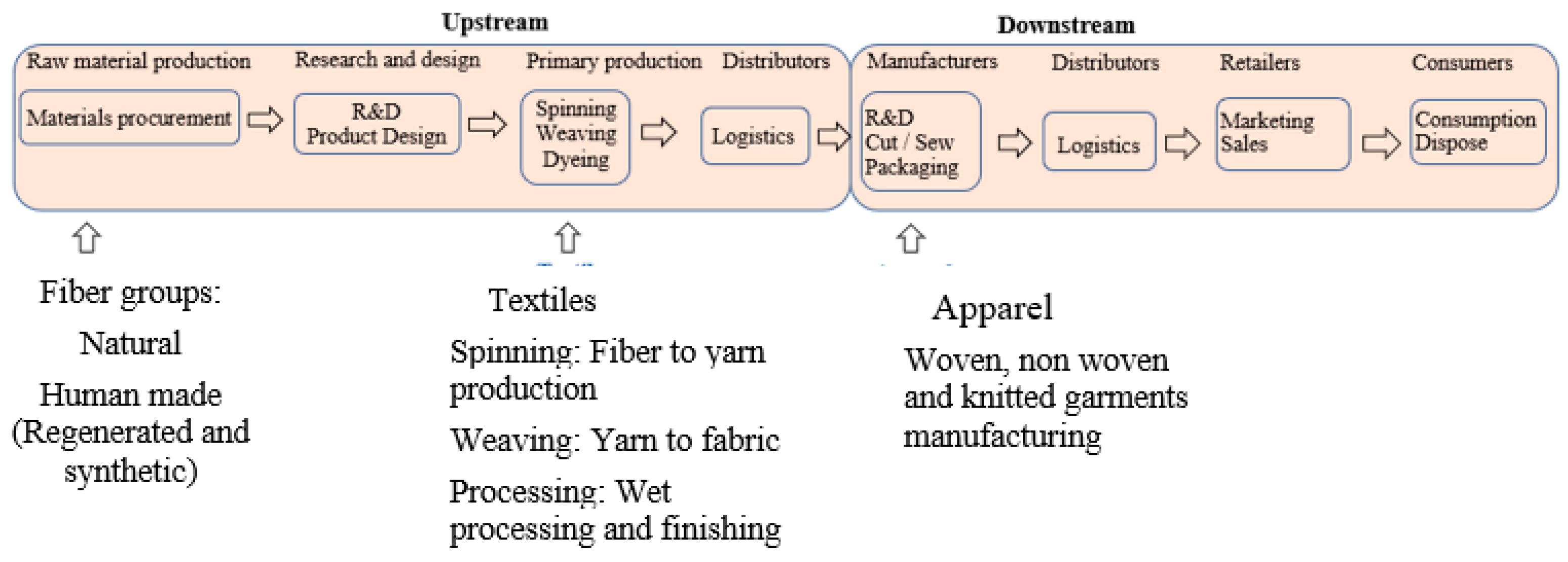

2.1. Global Fashion Industry

2.2. Historical Development of the Fashion Industry

3. Contributing Factors for Growth in Amazon’s Fashion Business

3.1. Growth of the Fashion Industry

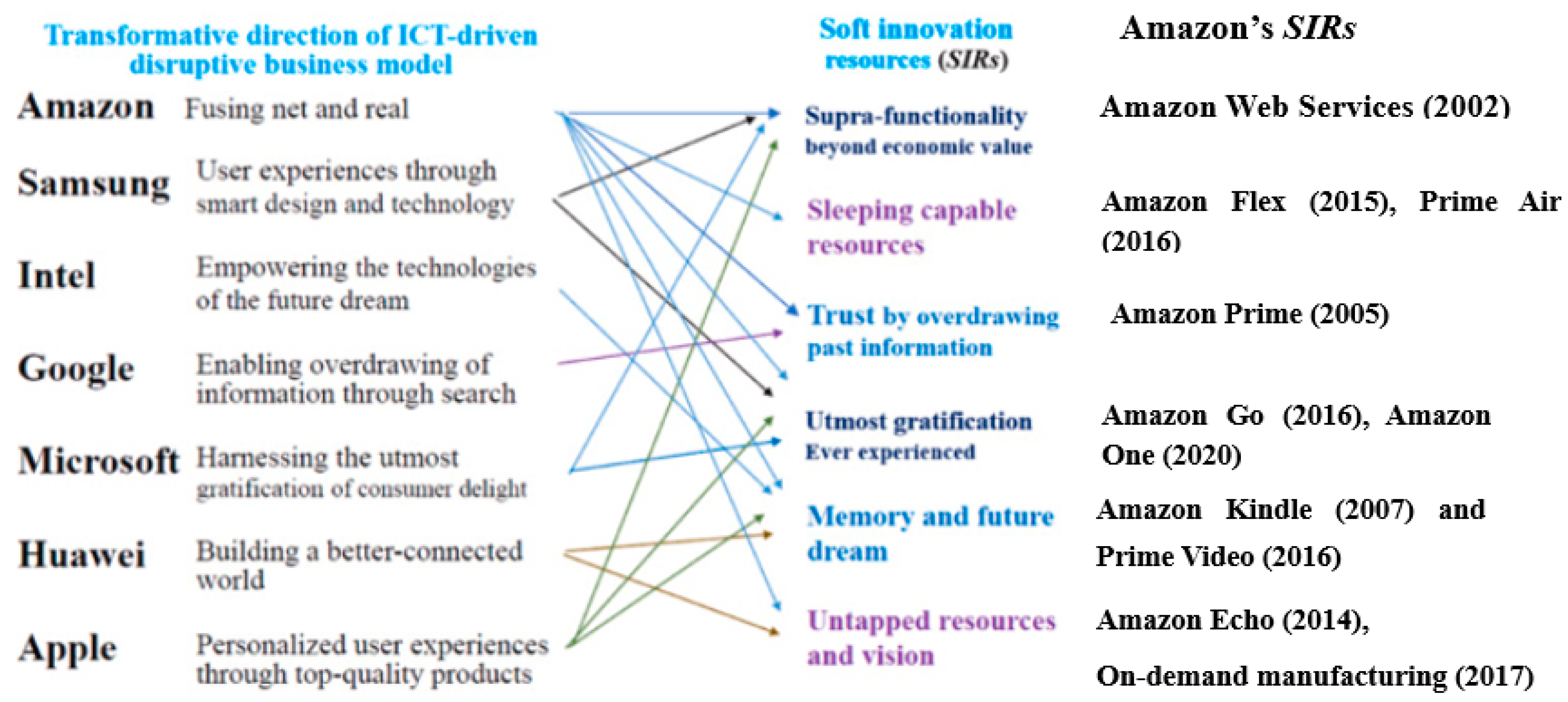

3.2. Fashion Industry in the Digital Economy

3.3. Customer-Centric R&D-Driven Advancement in the Digital Economy

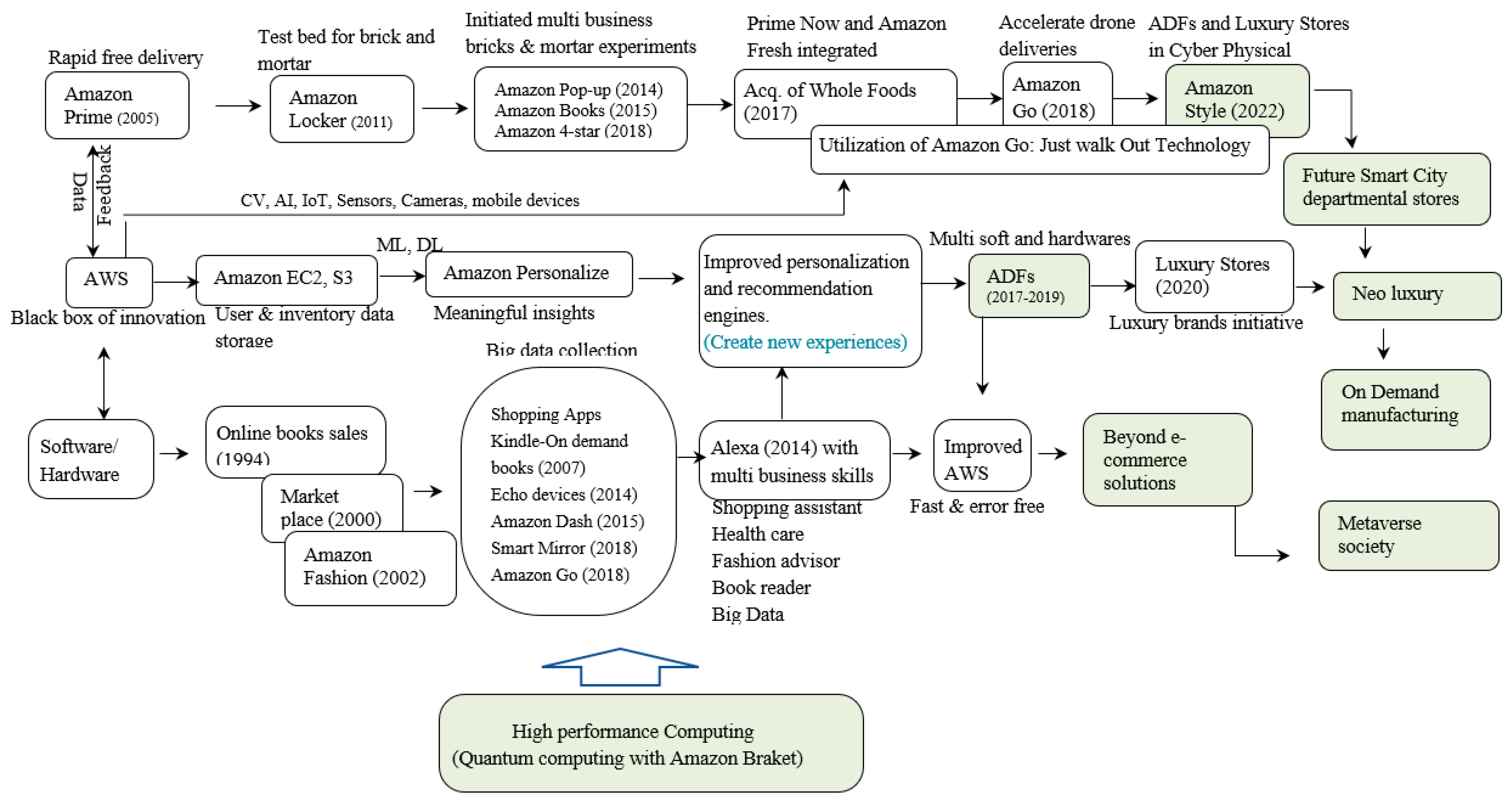

4. Amazon’s Learning Orchestration Externality in Developing Digital Fashion Business

4.1. Lessons from the Past Experiences

4.2. Creation of Advanced Digital Fashions (ADFs)

- Entered the virtual assistant (Alexa) business with the introduction of Amazon Echo (2014). It trained Alexa to be a fashion advisor.

- Activated its AWS team followed by Body Labs in the development of AI-led advanced digital fashions solutions (2017–2020).

- The acquisition of brick-and-mortar Whole Foods (2017) led to the introduction of Amazon Go (2018) technology in Whole Foods stores. This is a unique venture because Amazon’s other products and services are online and AWS-based.

- Activated Prime Video in the acquisition of the rights to the Lord of the Rings series (2017).

4.3. Learning Orchestration towards Advanced Digital Fashions (ADFs)

- (i)

- Customer-centric R&D-driven advancement.

- (ii)

- Frontier innovation and companywide experimentation.

- (iii)

- User-driven innovation.

5. Creation of Supra-Omnichannel during COVID-19

- (1)

- The millions of Amazon Prime members provide feedback. This initiates an iterative process in which users’ feedback is used for significant improvements, experimentation, and innovations.

- (2)

- In contrast to Amazon’s traditional business model the company provides freedom to luxury brands in controlling inventory, pricing, and distribution. Amazon provides digital tools and customer data for creating and personalizing content for each brand’s identity.

- (3)

- This digital store-within-a-store concept and freedom to control can build trust between Amazon and luxury brands to solve the historic internet dilemma.

- (4)

- Amazon provides luxury brand customers with an opportunity for free shipping and returns.

5.1. Involving Customers in the Co-Creation of Their Preferred Styles

5.2. Improving Brand Image by Curation Function

5.3. Capturing the Luxury Fashion Market with Digital Services

6. Learning Orchestration beyond E-commerce

- Amazon Aware (2022) represents a circular and sharing economy in a carbon-neutral society.

- Amazon Style (2022) represents on-demand manufacturing

- Luxury Stores (2020) represent co-creation and customization.

- Making the Cut (2020) for sociocultural engagement.

- Amazon Braket (2019) for quantum computing.

6.1. Amazon Aware

6.2. Amazon Style

6.3. Luxury Stores

6.4. Making the Cut

6.5. Amazon Braket

7. Conclusions and Suggestions

- (1)

- Amazon’s innovations are transforming the traditional value chain of the fashion industry into a platform that harnesses data directly from consumers to develop more customer-centric products and services.

- (2)

- The recent COVID-19 pandemic contributed as a springboard for innovations.

- (3)

- The fashion industry must accelerate digital innovations through emerging tools, such as AI, cloud computing technology, AR/VR, blockchain, etc. These digital technologies can transform the traditional fashion industry into a digital platform industry. For example, Amazon’s fashion business secured a timely digital solution by developing a series of ADFs, a supra-omnichannel, and ODM based on the digital tools described above.

- (4)

- The advancement of AWS, ADFs, and ODM led to the development of Luxury Stores in 2020, which emerged as neo-luxury. Amazon’s enthusiastic efforts to become an AI giant enabled this success. The Luxury Stores initiative has the potential to solve luxury brands’ historic e-commerce dilemma.

- (5)

- The activation of dual co-evolution among ADFs, luxury brands, and ODM is driven by advancements in AWS/AI that contribute to the development of the supra-omnichannel. This incorporates a generative function and evolves a cloud-based fashion platform that integrates internal and external stakeholders. The fashion value chain can be synchronized with ODM in real time, and stakeholders and customers can communicate within the system.

- (6)

- Amazon has been advancing AWS as an innovative, advanced composite cloud infrastructure. This infrastructure incorporates a generative function and develops a cloud-based fashion platform by integrating all stakeholders into one place. These developments have enabled Amazon to gain the outcomes of learning orchestration externalities.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aaronson, S.A. America’s Uneven Approach to AI and Its Consequence. Institute for International Economic Policy Working Paper Series Elliott School of International Affairs The George Washington University. 2020. Available online: https://www2.gwu.edu/~iiep/assets/docs/papers/2020WP/AaronsonIIEP2020-7.pdf (accessed on 19 September 2020).

- Adejeest, D.-A. Amazon’s U.S. Market Share of Clothing Soars to 14.6 Percent. 2022. Available online: https://fashionunited.com/news/retail/amazon-s-u-s-marketshare-of-clothing-soars-to-14-6-percent/2022031546520 (accessed on 20 September 2022).

- Amazon. Amazon Com. Inc. Annual Report 2017. Amazon.com, Inc., Seattle. 2018. Available online: http://www.annualreports.com/Company/amazoncom-inc (accessed on 10 September 2020).

- Amazon. Amazon.com, Inc. Annual Report 2018. Amazon.com, Inc., Seattle. 2019. Available online: https://ir.aboutamazon.com/static-files/0f9e36b1-7e1e-4b52-be17-145dc9d8b5ec (accessed on 13 September 2022).

- Amazon.com. Luxury Stores. 2022. Available online: https://www.amazon.com/stores/luxury/page/6D2D5FDF-3E7A-42C7-A1A1-F978792B5E4D (accessed on 18 September 2022).

- Anderson-Connell, L.J.; Ulrich, P.V.; Brannon, E.L. A Consumer-driven Model for Mass Customization in the Apparel Market. J. Fash. Mark. Manag. 2002, 6, 240–258. [Google Scholar] [CrossRef]

- Arrigo, E. Global Sourcing in Fast Fashion Retailers: Sourcing Locations and Sustainability Considerations. Sustainability 2020, 12, 508. [Google Scholar] [CrossRef] [Green Version]

- Backs, S.; Jahnke, H.; Lüpke, L.; Stücken, M.; Stummer, C. Traditional Versus Fast Fashion Supply Chains in the Apparel Industry: An Agent-based Simulation Approach. Ann. Oper. Res. 2021, 305, 487–512. [Google Scholar] [CrossRef]

- Baker, J.; Ashill, N.; Amer, N.; Diab, E. The Internet Dilemma: An Exploratory Study of Luxury Firms’ Usage of Internet-based Technologies. J. Retail. Consum. Serv. 2018, 41, 37–47. [Google Scholar] [CrossRef] [Green Version]

- Barnard, M. Fashion as Communication; Routledge: London, UK, 2013. [Google Scholar]

- Bebchuk, L.A.; Kastiel, K.; Tallarita, R. Stakeholder Capitalism in the Time of COVID. Forthcom. Yale J. Regul. 2023, 40. [Google Scholar] [CrossRef]

- Berg, A. How Current Global Trends Are Disrupting the Fashion Industry. McKinsey & Company. 2022. Available online: https://www.mckinsey.com/industries/retail/our-insights/how-current-global-trends-are-disrupting-the-fashion-industry (accessed on 8 September 2022).

- Bloomberg. 2018 Global Innovation 1000 Study; Bloomberg: New York, NY, USA, 2018. [Google Scholar]

- Boyle, A. Amazon’s Blended-Reality Mirror Shows You Wearing Virtual Clothes in Virtual Locales. Geekwire. 2018. Available online: https://www.geekwire.com/2018/amazon-patents-blended-reality-mirrorshows-wearing-virtual-clothes-virtual-locales/ (accessed on 9 September 2022).

- Brown, R. Top Quantum Techniques to Optimize That Complex Last Mile. QCI. 2022. Available online: https://www.quantumcomputinginc.com/blog/last-mile/ (accessed on 22 September 2022).

- Burns, L.V.; Mullet, K.K.; Bryant, N.O. The Business of Fashion: Designing, Manufacturing, and Marketing, 4th ed.; Fairchild Books, Inc.: New York, NY, USA, 2011; Available online: https://salon.thefamily.co/11-notes-on-amazon-part-1-cf49d610f195 (accessed on 6 May 2022).

- Cholachatpinyo, A.; Fletcher, B.; Padgett, I.; Crocker, M. A Conceptual Model of the Fashion Process-part 1: The Fashion Transformation Process Model. J. Fash. Mark. Manag. 2002, 6, 11–23. [Google Scholar] [CrossRef]

- Christopher, M.; Lowson, R.; Peck, H. Creating Agile Supply Chains in the Fashion Industry. Int. J. Retail Distrib. Manag. 2004, 32, 367–376. [Google Scholar] [CrossRef] [Green Version]

- Chuprina, N.V.; Krotova, T.F.; Pashkevich, K.L.; Kara-Vasylieva, T.V.; Kolosnichenko, M.V. Formation of Fashion System in the XX-the beginning of the XXI century. Vlak. A Text. (Fibres Text.) 2020, 27, 48–57. [Google Scholar]

- Čiarnienė, R.; Vienažindienė, M. Management of Contemporary Fashion Industry: Characteristics and Challenges. Procedia-Soc. Behav. Sci. 2014, 156, 63–68. [Google Scholar] [CrossRef] [Green Version]

- Clark, E. Amazon Shuttering MyHabbit.com. WWD. 2016. Available online: https://wwd.com/business-news/technology/amazon-closing-myhabit-com-10415899/ (accessed on 16 September 2022).

- Clement, J. Market Value of the Largest Internet Companies Worldwide 2022. Statista. 2022. Available online: https://www.statista.com/statistics/277483/market-value-of-the-largest-internet-companies-worldwide/ (accessed on 13 September 2022).

- Clifford, S. Amazon Leaps into High End of the Fashion Pool. The Newyork Times. 2017. Available online: https://www.nytimes.com/2012/05/08/business/amazon-plans-its-next-conquest-your-closet.html (accessed on 14 September 2022).

- CNN. Amazon’s New Line Is All about Sustainable Essentials. 2022. Available online: https://edition.cnn.com/cnn-underscored/home/amazon-aware-launch (accessed on 21 September 2022).

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Coppolla, D. Annual Technology and Content Expenses of Amazon from 2016 to 2021. 2022. Available online: https://www.statista.com/statistics/991947/amazons-annual-technology-and-content-expenses/ (accessed on 12 September 2022).

- Dickerson, K.G. Textiles and Apparel in the Global Economy, 3rd ed.; Prentice hall: London, UK, 1999. [Google Scholar]

- Doeringer, P.; Crean, S. Can Fast Fashion Save the U.S. Apparel Industry? Socio-Econ. Rev. 2006, 4, 353–377. [Google Scholar] [CrossRef]

- Dubey, A.; Bhardwaj, N.; Abhinav, K.; Kuriakose, S.M.; Jain, S.; Arora, V. AI Assisted Apparel Design. arXiv 2020, arXiv:2007.04950. [Google Scholar]

- Financial Times. Can Amazon Upend the Luxury Sector? 2020. Available online: https://www.ft.com/content/bcc14d0a-a6a5-40bb-b5dc-333e6f3d7775 (accessed on 18 September 2022).

- Forte, D. Amazon Is America’s Most Shopped Retailer in Apparel. Multichannel Merchant. 2019. Available online: https://multichannelmerchant.com/ecommerce/amazon-americas-shopped-retailer-apparel/#:~:text=Amazon%20has%20jumped%20from%20a,from%20around%2060%25%20last%20year (accessed on 20 September 2022).

- Fraser, S.; Oberlack, U.; Wright, E. Trends and Tradition: Negotiating Different Cultural Models in Relation to Sustainable Craft and Artisan production. Bangalore, India 29th September to 1st October 2010. 2010. Available online: https://ualresearchonline.arts.ac.uk/id/eprint/4615 (accessed on 23 September 2022).

- Galloway, S. The Hidden DNA of Amazon, Apple, Facebook, and Google; Penguin Random House LLC: New York, NY, USA, 2017. [Google Scholar]

- Gereffi, G. Global Value Chains in a Post-Washington Consensus World. Rev. Int. Political Econ. 2014, 21, 9–37. [Google Scholar] [CrossRef]

- Gonzalo, A.; Harreis, H.; Altable, C.; Villepelet, C. Fashion Digital Transformation: Now or Never. Mc Kinsey & Co. 2020. Available online: https://www.mckinsey.com/industries/retail/our-insights/fashions-digital-transformation-now-or-never (accessed on 18 September 2022).

- Stone, E. The Dynamics of Fashion, 3rd ed.; Fairchild Books: New York, NY, USA, 2008. [Google Scholar]

- Sull, D.; Turconi, S. Fast Fashion Lessons. Bus. Strategy Rev. 2008, 19, 5–11. [Google Scholar] [CrossRef]

- Sun, L.; Zhao, L. Technology Disruptions: Exploring the Changing Roles of Designers, Makers, and Users in the Fashion Industry. Int. J. Fash. Des. Technol. Educ. 2018, 11, 362–374. [Google Scholar] [CrossRef] [Green Version]

- Thomassey, S.; Zeng, X. Erratum to: Artificial Intelligence for Fashion Industry in the Big Data Era. In Artificial Intelligence for Fashion Industry in the Big Data Era; Springer: Singapore, 2018; p. E1. [Google Scholar]

- Tou, Y.; Watanabe, C.; Moriya, K.; Naveed, N.; Vurpillat, V.; Neittaanmäki, P. The Transformation of R & D into Neo Open Innovation-a new Concept in R & D Endeavor Triggered by Amazon. Technol. Soc. 2019, 58, 101141. [Google Scholar]

- Vasan, S. Amazon Reimagines Instore Shopping with Amazon Style. 2022. Available online: https://www.aboutamazon.com/news/retail/amazon-reimagines-in-store-shopping-with-amazon-style (accessed on 21 September 2021).

- Gosh, P. Amazon Is Now America’s Biggest Apparel Retailer, Here’s Why Walmart Can’t Keep up. 2020. Available online: https://www.forbes.com/sites/palashghosh/2021/03/17/amazon-is-now-americas-biggest-apparel-retailer-heres-why-walmart-cant-keep-up/?sh=7aaf4b9131ce (accessed on 20 September 2022).

- Hansen, K.T. The World in Dress: Anthropological Perspectives on Clothing, Fashion, and Culture. Annu. Rev. Anthropol. 2004, 33, 369–392. [Google Scholar] [CrossRef] [Green Version]

- Hardt, M.; Chen, X.; Cheng, X.; Donini, M.; Gelman, J.; Gollaprolu, S.; Kenthapadi, K. Amazon Sagemaker Clarify: Machine Learning Bias Detection and Explainability in the Cloud. arXiv 2021, arXiv:2109.03285. [Google Scholar]

- Hartmans, A. Amazon’s New Echo Device Is a Hands-Free Camera That Helps You Decide What to Wear. Business Insider.com. 2017. Available online: http://uk.businessinsider.com/amazon-look-camera-outfit-analysis-2017- (accessed on 17 September 2022).

- Hautala, L. New Amazon CEO Andy Jassy Says Voice Is the Future. Tapping on Apps Is ‘So Circa 2005’. Cnet. 2021. Available online: https://www.cnet.com/tech/tech-industry/new-amazon-ceo-andy-jassy-says-voice-is-the-future-tapping-on-apps-so-circa-2005/ (accessed on 20 September 2022).

- Huang, M.H.; Rust, R.T. Engaged to a Robot? The Role of AI in Service. J. Serv. Res. 2021, 24, 30–41. [Google Scholar] [CrossRef]

- Huber, E. Amazons the Drop Will Sell Limited Edition Items Designed by Influencers. Refinery29.com. 2019. Available online: https://www.refinery29.com/en-us/2019/05/233447/amazon-fashion-the-drop-limited-edition-street-style-clothing (accessed on 15 September 2022).

- Japan Cabinet Office. National Survey of Lifestyle Preferences; Japan Cabinet Office: Tokyo, Japan, 2019. [Google Scholar]

- Kaiser, S.B. Fashion and Cultural Studies; Berg Publishers: Oxford, UK, 2012. [Google Scholar]

- Kellie, E. Amazon Takes on Stitch Fix. Women’s Wear Daily, Los Angeles. 2019. Available online: https://search.proquest.com/docview/2319664381/AB33481834C54061PQ/4?accountid=11774 (accessed on 15 September 2022).

- Keyes, D. Amazon Opens Prime Wardrobe to More Shoppers. Business Insider. 2018. Available online: https://static3.businessinsider.com/amazon-opens-prime-wardrobe-to-more-shoppers-2018-4 (accessed on 20 September 2022).

- Knott, A.M. How Innovation Really Works: Using the Trillion-Dollar R & D Fix to Drive Growth; McGraw Hill: New York, NY, USA, 2017. [Google Scholar]

- Ko, E.; Costello, J.P.; Taylor, C.R. What is a Luxury Brand? A New Definition and Review of the Literature. J. Bus. Res. 2019, 99, 405–413. [Google Scholar] [CrossRef]

- Kohlbacher, F.; Hang, C.C. Applying the Disruptive Innovation Framework to the Silver Market. Ageing Int. 2011, 36, 82–101. [Google Scholar] [CrossRef]

- Lee, M.R.; Kim, M.S. A Study on the Digitalization of the Fashion Industry. Int. J. Costume Cult. 2001, 4, 124–137. [Google Scholar]

- Leighton, M. Amazon’s ‘Try Before You Buy’ Shopping Service, Prime Wardrobe, Is Free For Prime members and Easy to Use—Here’s How it Works. Businessinsider.com. 2020. Available online: https://www.businessinsider.com/what-is-prime-wardrobe?r=US&IR=T (accessed on 12 August 2020).

- Light, L. Amazon’s Prime Time for Luxury. Forbes. 2020. Available online: https://www.forbes.com/sites/larrylight/2020/10/16/amazons-prime-time-for-luxury/ (accessed on 21 September 2021).

- Major, J.S.; Steele, V. Fashion Industry. Encyclopedia Britannica. 2022. Available online: https://www.britannica.com/art/fashion-industry (accessed on 3 September 2022).

- Mc Kinsey and Company. Ten Trends for the Fashion Industry to Watch in 2019. Mc Kinsey & Company. 2019. Available online: https://www.mckinsey.com/industries/retail/our-insights/ten-trends-for-the-fashion-industry-to-watch-in-2019 (accessed on 5 September 2022).

- Mc Kinsey & Co. The Future of Personalization and How to Get Ready for It. 2019. Available online: https://www.mckinsey.com/business-functions/growth-marketing-and-sales/our-insights/the-future-of-personalization-and-how-to-get-ready-for-it (accessed on 16 September 2022).

- Mc Kinsey & Co. State of Fashion 2022: An Uneven Recovery and New Frontiers. 2022. Available online: https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion (accessed on 13 September 2020).

- McDonagh, D. Satisfying Needs beyond the Functional: The Changing Needs of the Silver Market Consumer. In Proceedings of the International Symposium on the Silver Market Phenomenon-Business Opportunities and Responsibilities in the Aging Society, Tokyo, Japan, 1 April 2018. [Google Scholar]

- Moore, M.E.; Rothenberg, L.; Moser, H. Contingency Factors and Reshoring Drivers in the Textile and Apparel Industry. J. Manuf. Technol. Manag. 2018, 29, 1025–1041. [Google Scholar] [CrossRef]

- Nagurney, A.; Yu, M. Fashion Supply Chain Management through Cost and Time Minimization from a Network Perspective. Fash. Supply Chain Manag. Ind. Bus. Anal. 2011, 1–20. [Google Scholar] [CrossRef]

- Nahm, K. Fast Retailing (Part 1): Transforming the Clothes Shopping Experience. AWS. 2021. Available online: https://aws.amazon.com/blogs/industries/fast-retailing-part-1-transforming-the-clothes-shopping-experience/ (accessed on 16 September 2022).

- Nakano, K. Apparel Innovators; Nihon Jitsugyou Syuppansha: Tokyo, Japan, 2020. [Google Scholar]

- Noris, A.; Nobile, T.H.; Kalbaska, N.; Cantoni, L. Digital Fashion: A Systematic Literature Review. A Perspective on Marketing and Communication. J. Glob. Fash. Mark. 2021, 12, 32–46. [Google Scholar] [CrossRef]

- Oliveira, M.; Fernandes, T. Luxury Brands and Social Media: Drivers and Outcomes of Consumer Engagement on Instagram. J. Strateg. Mark. 2022, 30, 389–407. [Google Scholar] [CrossRef]

- Polhemus, T.; Proctor, L. Fashion and Anti-Fashion: An Anthology of Clothing and Adornment; Cox & Wyman: London, UK, 1978. [Google Scholar]

- PYMNTS. Amazon Aims to Enable Purchases from TV Screens Via T-commerce. PYMNTS. 2021. Available online: https://www.pymnts.com/news/retail/2021/amazon-aims-to-enable-purchases-from-tv-screens-via-tcommerce/ (accessed on 21 September 2022).

- PYMNTS. Amazon, Walmart Battle for the Consumer’s Whole Paycheck: Who’s Winning by the Numbers. PYMNTS. 2022. Available online: https://www.pymnts.com/whole-paycheck-consumer-spending/2020/amazon-walmart-battle-for-the-consumers-whole-paycheck-whos-winning-by-the-numbers/ (accessed on 20 September 2022).

- Richter, F. Amazon: Not That Big after All. Statista. 2019. Available online: https://www.statista.com/chart/18755/amazons-estimated-market-share-in-the-united-states/ (accessed on 20 September 2022).

- Runfola, A.; Guercini, S. Fast Fashion Companies Coping with Internationalization: Driving the Change or Changing the Model? J. Fash. Mark. Manag. 2013, 17, 190–205. [Google Scholar]

- Shen, B.; Zhu, C.; Li, Q.; Wang, X. Green Technology Adoption in Textiles and Apparel Supply Chains with Environmental Taxes. Int. J. Prod. Res. 2021, 59, 4157–4174. [Google Scholar] [CrossRef]

- Singh, G. The Apparel Market Is Growing Faster Than the Global Economy. 2017. Available online: https://fee.org/articles/fast-fashion-has-changed-the-industry-and-the-economy/ (accessed on 10 September 2022).

- Statista. Top Internet Companies: Global Market Value 2018. Statista, Hamburg. 2019. Available online: https://www.statista.com/statistics/264621/market-value-of-the-top-20-internet-companies-in-japan/ (accessed on 13 September 2022).

- Statista. Apparel Sales of Amazon as a Percentage of Total Apparel Sales in the United States from 2011 to 2016. 2021. Available online: https://www.statista.com/statistics/755262/us-amazon-share-of-total-apparel-sales-market/ (accessed on 20 September 2022).

- Statista. Market Growth of the Apparel Industry Worldwide from 2012 to 2020. Statista. 2022. Available online: https://www.statista.com/statistics/727541/apparel-market-growth-global/#:~:text=Global%20apparel%20market%20growth%202012%2D2020&text=It%20was%20estimated%20in%202017,6.2%20percent%20expected%20in%202020 (accessed on 6 September 2022).

- Steele, V. Encyclopedia of Clothing and Fashion; Charles Scribner’s Sons: New York, NY, USA, 2005; Volume 1. [Google Scholar]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital Transformation: A Multidisciplinary Reflection and Research Agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Watanabe, C.; Tou, Y. Transformative Direction of R & D: Lessons from Amazon’s Endeavor. Technovation 2020, 88, 102081. [Google Scholar]

- Watanabe, C. Innovation-consumption Co-emergence Leads a Resilience Business. Innov. Supply Chain Manag. 2013, 7, 92–104. [Google Scholar] [CrossRef] [Green Version]

- Watanabe, C.; Akhtar, W.; Tou, Y.; Neittaanmäki, P. Amazon’s New Supra-omnichannel: Realizing Growing Seamless Switching for Apparel During COVID-19. Technol. Soc. 2021, 66, 101645. [Google Scholar] [CrossRef]

- Watanabe, C.; Akhtar, W.; Tou, Y.; Neittaanmäki, P. Amazon’s Initiative Transforming a non-contact Society-Digital Disruption Leads the Way to Stakeholder Capitalization. Technol. Soc. 2021, 65, 101596. [Google Scholar] [CrossRef]

- Watanabe, C.; Akhtar, W.; Tou, Y.; Neittaanmäki, P. A New Perspective of Innovation Toward a Non-contact Society-Amazon’s Initiative in Pioneering Growing Seamless Switching. Technol. Soc. 2022, 69, 101953. [Google Scholar] [CrossRef]

- Watanabe, C.; Akhtar, W.; Tou, Y.; Neittaanmäki, P. Fashion-driven Textiles as a Crystal of New Stream for Stakeholder Capitalism: Amazon’s Endeavor. Int. J. Manag. Inf. Technol. 2020, 12, 19–24. [Google Scholar]

- Watanabe, C.; Naveed, K.; Zhao, W. New Paradigm of ICT Productivity–Increasing role of Un-captured GDP and Growing Anger of Consumers. Technol. Soc. 2015, 41, 21–44. [Google Scholar] [CrossRef]

- Watanabe, C.; Naveed, N.; Neittaanmäki, P. Digitalized Bioeconomy: Planned Obsolescence-driven Circular Economy Enabled by Co-Evolutionary Coupling. Technol. Soc. 2019, 56, 8–30. [Google Scholar] [CrossRef] [Green Version]

- Watanabe, C.; Zhu, B.; Griffy-Brown, C.; Asgari, B. Global Technology Spillover and its Impact on Industry’s R & D Strategies. Technovation 2001, 21, 281–291. [Google Scholar]

- Wichser, J.D.; Hart, C.; Yozzo, J. 2019 U.S. Retail Forcast: An FTI Consulting Report. FTI Consulting. 2019. Available online: https://www.fticonsulting.com/~/media/Files/us-files/insights/reports/2019-us-online-retail-forecast.pdf (accessed on 20 September 2022).

- Williamson, B.; Gulson, K.N.; Perrotta, C.; Witzenberger, K. Amazon and the New Global Connective Architectures of Education Governance. Harv. Educ. Rev. 2022, 92, 231–256. [Google Scholar] [CrossRef]

- Xue, J.; Liang, X.; Xie, T.; Wang, H. See Now, Act Now: How to Interact with Customers to Enhance Social Commerce Engagement. Inf. Manag. 2020, 57, 103324. [Google Scholar] [CrossRef]

- Yenipazarli, A. The Marketplace Dilemma: Selling to the Marketplace vs. Selling on the Marketplace. Nav. Res. Logist. (NRL) 2021, 68, 761–778. [Google Scholar] [CrossRef]

- Yeung, J.; Wong, S.; Tam, A.; So, J. Integrating Machine Learning Technology to Data Analytics for E-commerce on Cloud. In Proceedings of the 2019 Third World Conference on Smart Trends in Systems Security and Sustainability (WorldS4), 30–31 July 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 105–109. [Google Scholar]

- Zhang, C.; Dong, M.; Ota, K. Employ AI to Improve AI services: Q-Learning based Holistic Traffic Control for Distributed Co-inference in Deep Learning. IEEE Trans. Serv. Comput. 2021, 15, 627–639. [Google Scholar] [CrossRef]

- Zhang, L.; Qi, Z.; Meng, F. A Review on the Construction of Business Intelligence System Based on Unstructured Image Data. Procedia Comput. Sci. 2022, 199, 392–398. [Google Scholar] [CrossRef]

- Zhuang, Y.T.; Wu, F.; Chen, C.; Pan, Y.H. Challenges and Opportunities: From Big Data to Knowledge in AI 2.0. Front. Inf. Technol. Electron. Eng. 2017, 18, 3–14. [Google Scholar] [CrossRef]

| ADFs | Functionality | Preceding Innovations | Core Technology |

|---|---|---|---|

| Prime Wardrobe (2017) | Try at home before purchase service, customers can receive up to 15 items at home and pay only for the selected outfit. Sizing and returns are the biggest online shopping barriers; this feature has removed such barriers. | Endless.com, my habit.com, Body Labs, 3D body modeling AI (ML), IoT, VR/AR, and mobile devices. | AI-based matching recommendations, Amazon fashion catalog, recommender system |

| AI Algo. fashion designer (2017) | The algorithm learns about a particular style of fashion from the web, and social media (images, videos), and generates new items in similar styles. | Body labs based on ADFs technologies | ML and DL-based Generative Adversarial Networks (GAN) |

| EchoLook (2017) | Smart speaker, voice assistant, and hands-free camera. It was introduced to train Alexa in becoming a fashion advisor. | Echo Look (2017) has emerged from the classic Echo (2014) device and is similar to Echo Dot (2016). Its features are based on previous, Outfit Compare (share photos), and Style Check (second opinion) | Based on AI, Echo Look (2017) incorporates CV, NLP, and ML. |

| AR Mirror (2018) | A mirror-based display system that enables users to interact with virtual objects. The blended AR systems combine images reflected by a mirror with the images that are transmitted from the screen behind the mirror. | Further development of Echo Look. BodyLabs software, and Lab 123 hardware. | Two-way mirror with electronic display, depth-sensing camera, projectors, CV algorithms, blended reality |

| Personal Shopper (2019) | Customized clothing box. Incorporates curation function, consumers co-create with Amazon’s designers. This curation function satisfies customers’ personalized requirements. | Further evolution of Prime Wardrobe, sophisticated curation ability accumulated through the series of ADFs development. | With the addition of the Personal Shopper (2019) to Prime Wardrobe (2017), the company uses ML and personalized recommendation algorithms along with personal human stylists. |

| Style Snap (2019) | Fashion recommendations are based on user-submitted photos in real-time. Connects high-profile social media fashion influencers to Amazon fashion and customers. | Amazon Associates, Amazon influencers. | CV and DL identify apparel in a photo. DL classifies the apparel items in the image. |

| The Drop (2019) | Social media fashion influencers and Amazon fashion designers co-create limited edition apparel available only for 30 h. | Amazon influencers program, Influencers drove the fashion line. | SM, BDA |

| Artificial intelligence (AI) | Fashion design, real-time, recommendation, forecasting, and trend analysis |

| Machine learning (ML) | Product development, demand forecasting, complex data analysis |

| Virtual reality/Augmented reality (VR/AR) | Creates virtual world, 3D body scanning, customer experience monitoring, virtual stores, and metaverse society |

| Big data analysis (BDA) | Enables real-time personalization based on purchase history and preferences |

| Social media | Explores influencers to enhance curation function. |

| On-demand manufacturing | Satisfies every individual customer’s needs, automation |

| AWS | Locomotive for innovations by providing cloud computing platforms. |

| IoT | Enable wearables, optimize product assortment and customize recommendations. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Akhtar, W.H.; Watanabe, C.; Tou, Y.; Neittaanmäki, P. A New Perspective on the Textile and Apparel Industry in the Digital Transformation Era. Textiles 2022, 2, 633-656. https://doi.org/10.3390/textiles2040037

Akhtar WH, Watanabe C, Tou Y, Neittaanmäki P. A New Perspective on the Textile and Apparel Industry in the Digital Transformation Era. Textiles. 2022; 2(4):633-656. https://doi.org/10.3390/textiles2040037

Chicago/Turabian StyleAkhtar, Waleed Hassan, Chihiro Watanabe, Yuji Tou, and Pekka Neittaanmäki. 2022. "A New Perspective on the Textile and Apparel Industry in the Digital Transformation Era" Textiles 2, no. 4: 633-656. https://doi.org/10.3390/textiles2040037

APA StyleAkhtar, W. H., Watanabe, C., Tou, Y., & Neittaanmäki, P. (2022). A New Perspective on the Textile and Apparel Industry in the Digital Transformation Era. Textiles, 2(4), 633-656. https://doi.org/10.3390/textiles2040037