Crypto Asset Markets vs. Financial Markets: Event Identification, Latest Insights and Analyses

Abstract

:1. Introduction

- (a)

- Identified potential breakpoints in the prices/volumes of key crypto assets and mapped them to significant events taking place worldwide.

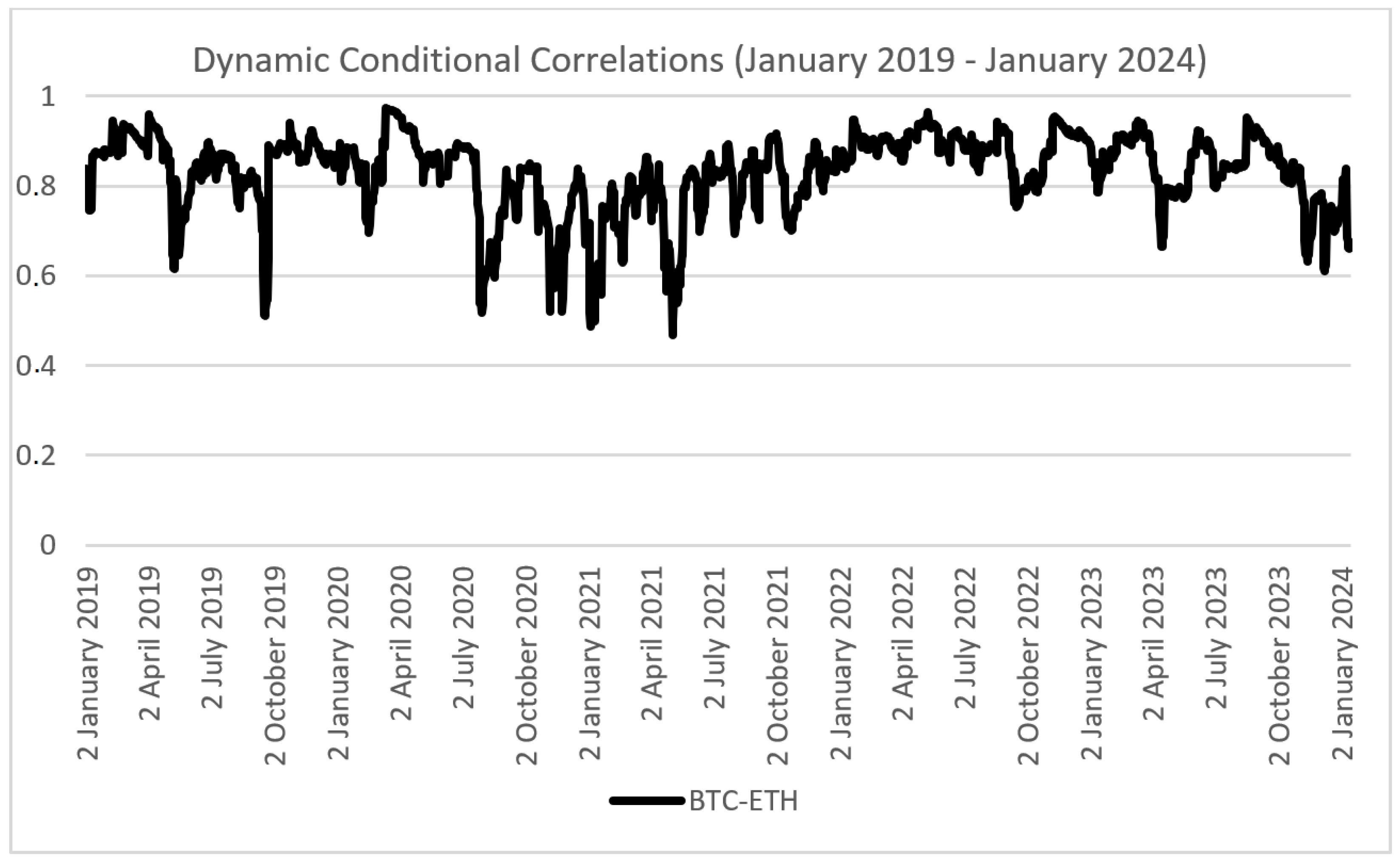

- (b)

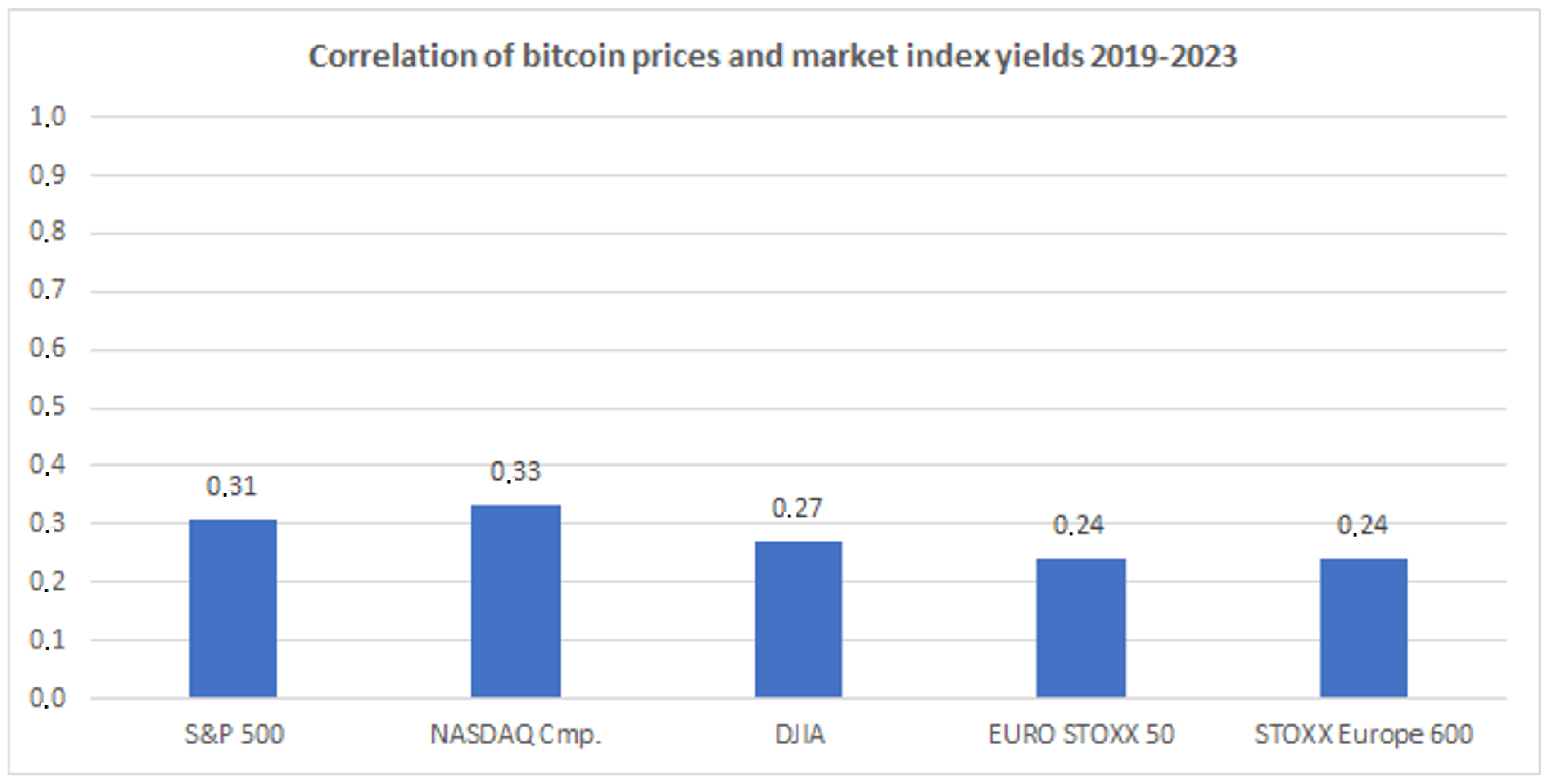

- Investigated the correlations between crypto asset prices and major stock market indices and commodities.

- (c)

- Investigated the effects of external events on crypto asset correlation.

2. Interconnections Between Traditional Financial Systems and Crypto Markets via the Analysis of Prices of Crypto Assets in Relation to Key Events

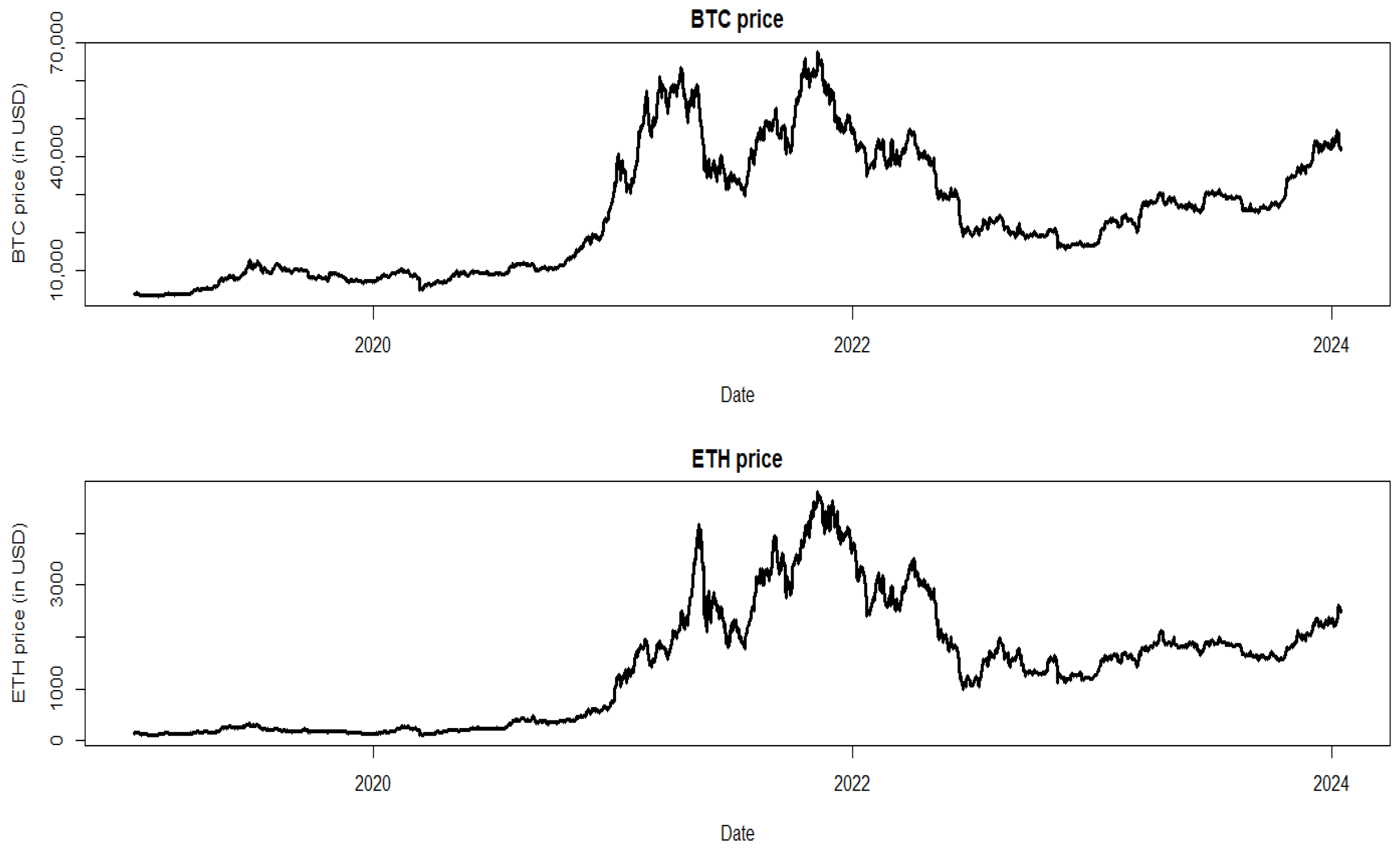

2.1. Change Points in the Price Series of Bitcoin and Ethereum and Event Identification

2.2. Results of the Event Identification Using Bayesian Model Averaging (BMA)

Event Identification

- (a)

- Oracle errors. Oracles are components of the DeFi ecosystem that provide blockchains with real-world prices. It has been shown that in some cases where oracles malfunctioned or were subject to manipulation, there was an impact on the prices or volumes of various crypto assets due to the subsequent negative reputational effects.

- (b)

- Centralized crypto exchange failures. Such failures may have a negative impact on crypto asset prices due to the subsequent lack of trust and or the adverse impact on price formation.

- (c)

- Supervisory actions and/or regulatory announcements that concern crypto exchanges or specific crypto assets may have an effect on crypto asset prices.

- (d)

- Bank failures (e.g., the failure of Silicon Valley Bank (SVB)) with a focus on high-tech industry that destabilized a stablecoin dollar peg and impacted other banks and crypto firms via contagion channels.

- (e)

- News reports (both real and fake) regarding crypto assets can have a strong impact on crypto asset prices, similar to how adverse news can affect equity prices (e.g., insider trading, market manipulation, so-called meme stocks).

- (f)

- The impact of significant geopolitical developments such as the Russian invasion of Ukraine and the Israel/Palestinian conflict can affect crypto asset prices due to investor uncertainty, supply disruptions, market volatility, etc.

- A.

- Oracle Errors

- B.

- Centralized crypto exchange market failure

- C.

- Supervisory action

- D.

- Silicon Valley Bank Failure, 10 March 2023

- E.

- News (fake and real) about regulatory developments, for example, about the approval of an application of BlackRock for a spot Bitcoin ETF

- F.

- Geopolitical Conflicts

3. Correlation Between the Prices and Yields of Crypto Assets and Major Stock Market Indices

4. Correlation Between the Prices and Yields of Crypto Assets and Commodities

5. Impact of External Events on Crypto Asset Price Correlations

6. Concluding Remarks and Further Work

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Date | Chart Label | Description |

|---|---|---|

| 21 June 2019 | BTC breaches 96 k | The price of Bitcoin reached a 400-day high. Source: coindesk.com (accessed on 4 February 2025) |

| 9 January 2020 | BTC drop US–Iran tensions | President Trump downplayed the situation in Iran, resulting in a decline in BTC price. Source: forbes.com (accessed on 4 February 2025) |

| 11 March 2020 | COVID-19 pandemic | The price of Bitcoin declined markedly following the onset of the COVID-19 pandemic. Source: cnbc.com (accessed on 4 February 2025) |

| 10 December 2020 | Mass Mutual invests in BTC | Massachusetts Mutual, a large insurance firm, invests a significant amount of money into Bitcoin. Source: Bloomberg.com (accessed on 4 February 2025) |

| 6 January 2021 | Capitol riot in the US | Capitol riot in the United States. Source: cnbc.com (accessed on 4 February 2025) |

| 21 January 2021 | BTC crash | Two-day Bitcoin sell-off results in a loss of over USD 100 billion from the entire crypto market. Source: cnbc.com (accessed on 4 February 2025) |

| 8 February 2021 | Tesla buys BTC | Tesla announced in an SEC filing on Monday that it has bought USD 1.5 billion worth of Bitcoin. The company also said it would start accepting Bitcoin as a payment method for its products. Source: cnbc.com (accessed on 4 February 2025) |

| 13 April 2021 | BTC new high above 62 k (Coinbase debut) | Bitcoin reaches new all-time high as Coinbase prepares to go public. Source: cnbc.com (accessed on 4 February 2025) |

| 26 April 2021 | Record BTC outflows | Bitcoin experiences record weekly outflow as investor sentiment turns cautious. Source: reuters.com (accessed on 4 February 2025) |

| 12 May 2021 | Tesla stops taking BTC | Elon Musk announces that Tesla will no longer accept Bitcoin for car purchases. Source: reuters.com (accessed on 4 February 2025) |

| 24 May 2021 | BTC sustainability initiative | Elon Musk meets with Bitcoin miners to discuss making cryptocurrency mining more environmentally friendly. Source: cnbc.com (accessed on 4 February 2025) |

| 26 July 2021 | BTC breaches 39 k | The price of Bitcoin breaches a USD 39 k threshold. Source: cnbc.com (accessed on 4 February 2025) |

| 30 September 2021 | China crypto crackdown | Chinese regulators ban cryptocurrency trading and mining. Source: retuers.com (accessed on 4 February 2025) |

| 21 October 2021 | BTC Binance crash | The price of Bitcoin decreased significantly on the U.S. Binance exchange. Source: Bloomberg.com (accessed on 4 February 2025) |

| 8 November 2021 | BTC and ETH reach new highs | Both BTC and ETH reach record highs based on investor concern about inflation. Source: cnbc.com (accessed on 4 February 2025) |

| 18 December 2021 | Fed announces rate increases | Federal Reserve begins to wind down pandemic-related support measures. Source: cnbctv18.com (accessed on 4 February 2025) |

| 3 February 2022 | Crypto network wormhole | Cryptocurrency platform Wormhole loses a significant amount after a cyber attack. Source: reuters.com (accessed on 4 February 2025) |

| 12 February 2022 | BTC hits two-year high on rate cuts | Price of Bitcoin increases based on expectations of interest rate cuts and favorable U.S. regulatory views on an ETF to track BTC price. Source: reuters.com (accessed on 4 February 2025) |

| 24 March 2022 | BTC reaches 3-week high | The price of BTC reaches a 3-week high on speculation that Terra will buy BTC as a reserve. Source: Bloomberg.com (accessed on 4 February 2025) |

| 9 May 2022 | Terra collapse | Date of the Terra Luna stablecoin collapse. Source: coindesk.com (accessed on 4 February 2025) |

| 13 June 2022 | BTC fall—Celsius, Fed rates | Bitcoin drops as much as 17%, falling below USD 23,000, as USD 200 billion wiped off crypto market over the weekend. Source: cnbc.com (accessed on 4 February 2025) |

| 19 August 2022 | Broad crypto sell-off | Bitcoin dropped below the USD 22,000 level, to its lowest level in more than three weeks, on the back of a broader crypto sell-off. Source: Bloomberg.com (accessed on 4 February 2025) |

| 13 January 2023 | Winklevoss twins charged | Cryptocurrency firms Gemini and Genesis have been charged by U.S. regulators with illegally selling crypto assets to hundreds of thousands of investors. Source: Bloomberg.com (accessed on 4 February 2025) |

| 17 March 2023 | BTC increase on low inflation | Bitcoin (BTC) prices broke above the strong USD 25 k resistance, reaching ~USD 27 k on Friday morning. Source: reuters.com (accessed on 4 February 2025) |

| 21 June 2023 | First 30 k breach of year | Bitcoin breaches USD 30 k mark fueled by Powell’s comments on spot ETF filings. Source: business-standard.com (accessed on 4 February 2025) |

| 17 August 2023 | Crypto crash | The crypto market crash occurred on 17 August 2023. Source: retuers.com (accessed on 4 February 2025) |

| 23 October 2023 | Increase on ETF announcement | Bitcoin soared 10% to 1-1/2-year highs on Monday, and crypto-linked stocks followed it higher after speculation about the possibility of a Bitcoin exchange-traded fund. Source: cnbc.com (accessed on 4 February 2025) |

| 3 December 2023 | BTC sees record influx | Bitcoin price sets another all-time high against record inflows into the cryptocurrency markets. Source: news.bitcoin.com (accessed on 4 February 2025) |

| Date | Chart Label | Description |

|---|---|---|

| 14 July 2019 | Crypto fall on Trump comments | Bitcoin slumped in another large weekend move after U.S. President Donald Trump’s criticism of cryptocurrencies. Source: Bloomberg.com (accessed on 4 February 2025) |

| 11 March 2020 | COVID-19 pandemic | The onset of the COVID-19 pandemic. |

| 26 July 2020 | ETH new high | The price of ETH reaches a new high for 2020. Source: cointelegraph.com (accessed on 4 February 2025) |

| 3 January 2021 | ETH price surge | Ethereum (ETH), the second leading cryptocurrency by market cap, has gained over 18.19% in the last 24 h and was trading at USD 951.85 at press time, with a current capitalization at over USD 103 billion. Source: finance.yahoo.com (accessed on 4 February 2025) |

| 23 February 2021 | ETH sell-off | The CEO of Kraken says that a sudden 50% crash in Ether’s price on the exchange on Monday was caused by a sell-off and not a system glitch. Source: Bloomberg.com (accessed on 4 February 2025) |

| 21 March 2021 | Alchemy NFT investment | Trump criticizes cryptocurrencies. Source: Bloomberg.com (accessed on 4 February 2025) |

| 3 May 2021 | ETH breaks 3000 | Cryptocurrency Ether broke past USD 3000 on Monday to set a new record high in a dazzling rally that has outshone the bigger Bitcoin, with investors betting that Ether will be of ever greater use in a decentralized future financial system. Source: reuters.com (accessed on 4 February 2025) |

| 19 May 2021 | Crypto price drop | Bitcoin and Ethereum posted their largest one-day drop since March last year on Wednesday, with losses in the market capitalization for the entire cryptocurrency sector approaching USD 1 trillion. Source: reuters.com (accessed on 4 February 2025) |

| 21 June 2021 | Mining crackdown | Bitcoin tumbled on Monday to a two-week low on China’s expanding crackdown on Bitcoin mining, as investors grew more uncertain about the future of the leading cryptocurrency. Source: reuters.com (accessed on 4 February 2025) |

| 19 July 2021 | ETH price decline | Ethereum slid by 11.67% in the week ending 18 July. Following a 7.85% decline from the previous week, Ethereum ended the week at USD 1891.46. Source: finance.yahoo.com (accessed on 4 February 2025) |

| 16 August 2021 | Crypto price rally | The crypto market topped USD 2 trillion for the first time since May. Source: cnbc.com (accessed on 4 February 2025) |

| 20 September 2021 | Crypto market sell-off | Cryptocurrency prices sank on Monday as concerns over the spillover risk to the global economy from Chinese property group Evergrande’s troubles spread across financial markets. Source: reuters.com (accessed on 4 February 2025) |

| 10 November 2021 | Crypto price rally | Bitcoin price surges to record high of more than USD 68,000. Other cryptocurrencies such as Ethereum also reach records as investors hedge against inflation. Source: theguardian.com (accessed on 4 February 2025) |

| 9 December 2021 | Evergrande default | Three days after a deadline passed, leaving bondholders with nothing but silence from the company, a major credit ratings firm declared that Evergrande was in default. Source: nytimes.com (accessed on 4 February 2025) |

| 21 January 2022 | Crypto crash | Crypto prices decline. Cryptocurrencies have had a dismal start to the year, and continue to plunge as major economies around the world look to curb their growing popularity. Source: edition.cnn.com (accessed on 4 February 2025) |

| 4 February 2022 | Wormhole token | Millions of dollars in cryptocurrency stolen late Wednesday from accounts on crypto platform Wormhole have been returned to users. Source: merklescience.com (accessed on 4 February 2025) |

| 17 February 2022 | Crypto price drop | The value of cryptocurrencies dropped rapidly on Thursday as investors try to decipher what kind of regulation is coming to the industry in the U.S. The White House appears ready to push for regulation on the cryptocurrency industry and that uncertainty alone is spooking investors. Source: fool.com (accessed on 4 February 2025) |

| 16 March 2022 | ETH criticizes Solana | Ethereum co-founder hits out at economics of fast-growing Solana blockchain. Source: ft.com (accessed on 4 February 2025) |

| 5 April 2022 | Solana as ETH alternative | Solana: the blockchain touted as an alternative to Ethereum. Source: ft.com (accessed on 4 February 2025) |

| 9 May 2022 | Luna crash | After the UST depeg, the price of UST and LUNA dramatically plummeted. Source: binance.com (accessed on 4 February 2025) |

| 16 June 2022 | Fed interest rate announce | Following the announcement of interest rate hike by the U.S. Federal Reserve, the prices of top cryptos, including Bitcoin and Ethereum, have seen some recovery even as the market sentiments remain in the “extreme fear” zone. Source: financialexpress.com (accessed on 4 February 2025) |

| 19 August 2022 | Crypto price drop | Cryptocurrencies fell sharply on Friday, with sudden selling dragging Bitcoin to a three-week low, with analysts divided over the reason behind the decline. Source: reuters.com (accessed on 4 February 2025) |

| 25 October 2022 | Crypto price rally | Ethereum reaches levels unseen since soon after the merge as the wider crypto market takes a break from the doldrums. Source: decrypt.co (accessed on 4 February 2025) |

| 8 November 2022 | FTX deal to sell to Binance | FTX reached a deal to sell itself to Binance, the crypto exchange whose executive had helped trigger the selloff. Source: abcnews.go.com (accessed on 4 February 2025) |

| 12 January 2023 | Treasury calls for crypto regulation | The collapse of Bahamas-based cryptocurrency exchange FTX points to the need for the United States to cooperate with other countries to develop effective international regulations for the crypto sector, U.S. Deputy Treasury Secretary Wally Adeyemo said on Thursday. Source: reuters.com (accessed on 4 February 2025) |

| 17 March 2023 | Crypto rally | The cryptocurrency markets were trading higher in Friday’s trade, with crypto heavyweights like BTC and ETH leading the rally. Source: economictimes.indiatimes.com (accessed on 4 February 2025) |

| 18 August 2023 | Crypto price declines | Crypto traders were hit with USD 1 billion worth of liquidations over the past 24 h. Source: coindesk.com (accessed on 4 February 2025) |

| 23 October 2023 | Safereum exit scam | On 23 October 2023, Safereum experienced a severe rug pull, resulting in a loss of approximately USD 1.3 million in an exit scam. Source: immunebytes.com (accessed on 4 February 2025) |

References

- Iyer, R.; Popescu, A. New Evidence on Spillovers Between Crypto Assets and Financial Markets; International Monetary Fund Working Paper, WP/23/213; International Monetary Fund, Washington, D.C, USA. 2023. Available online: https://www.imf.org/en/Publications/WP/Issues/2023/09/30/New-Evidence-on-Spillovers-Between-Crypto-Assets-and-Financial-Markets-539476 (accessed on 4 February 2025).

- Financial Stability Board. The Financial Stability Risks of Decentralised Finance. 16 February 2023. Available online: https://www.fsb.org/2023/02/the-financial-stability-risks-of-decentralised-finance/ (accessed on 4 February 2025).

- Financial Stability Board. The Financial Stability Implications of Multifunction Crypto-Asset Intermediaries. 28 November 2023. Available online: https://www.fsb.org/2023/11/the-financial-stability-implications-of-multifunction-crypto-asset-intermediaries/ (accessed on 4 February 2025).

- Lahajnar, S.; Rozanec, A. The correlation strength of the most important cryptocurrencies in the bull and bear market. Invest. Manag. Financ. Innov. 2020, 17, 67–81. [Google Scholar] [CrossRef] [PubMed]

- Guesmi, K.; Saadi, S.; Abid, I.; Ftiti, Z. Portfolio diversification with virtual currency: Evidence from bitcoin. Int. Rev. Financ. Anal. 2019, 63, 431–437. [Google Scholar] [CrossRef]

- Ibrahim, B.A.; Elamer, A.A.; Alasker, T.H.; Mohamed, M.A.; Abdou, H.A. Volatility contagion between cryptocurrencies, gold and stock markets pre-and-during COVID-19: Evidence using DCC-GARCH and cascade-correlation network. Financ. Innov. 2024, 10, 104. [Google Scholar] [CrossRef]

- Zhang, X.; Chen, Z.; Wang, S. A study of the impact of cryptocurrency price volatility on the stock and gold markets. Financ. Res. Lett. 2024, 69, 106114. [Google Scholar] [CrossRef]

- Zhou, F. Cryptocurrency: A new player or a new crisis in financial markets?—Evolutionary analysis of association and risk spillover based on network science. Phys. A Stat. Mech. Its Appl. 2024, 648, 129955. [Google Scholar] [CrossRef]

- Kayani, U.; Hasan, F. Unveiling Cryptocurrency Impact on Financial Markets and Traditional Banking Systems: Lessons for Sustainable Blockchain and Interdisciplinary Collaborations. J. Risk Financ. Manag. 2024, 17, 58. [Google Scholar] [CrossRef]

- Kyriazis, N.A.; Daskalou, K.; Arampatzis, M.; Prassa, P.; Papaioannou, E. Estimating the volatility of cryptocurrencies during bearish markets byemploying GARCH models. Heliyon 2019, 5, e02239. [Google Scholar] [CrossRef]

- Okorie, D.I.; Lin, B. Crude oil price and cryptocurrencies: Evidence of volatility connectedness and hedging strategy. Energy Econ. 2020, 87, 104703. [Google Scholar] [CrossRef]

- Hsu, S.-H.; Sheu, C.; Yoon, J. Risk spillovers between cryptocurrencies and traditional currencies and gold under different global economic conditions. N. Am. J. Econ. Financ. 2021, 57, 101443. [Google Scholar] [CrossRef]

- Nakagawa, K.; Sakemoto, R. Cryptocurrency network factors and gold. Financ. Res. Lett. 2022, 46, 102375. [Google Scholar] [CrossRef]

- Naeem, M.A.; Karim, S.; Abrar, A.; Yarovaya, L.; Shah, A.A. Non-linear relationship between oil and cryptocurrencies: Evidence from returns and shocks. Int. Rev. Financ. Anal. 2023, 89, 102769. [Google Scholar] [CrossRef]

- Huang, L. The relationship between cryptocurrencies and convention financial market: Dynamic causality test and time-varying influence. Int. Rev. Econ. Financ. 2024, 91, 811–826. [Google Scholar] [CrossRef]

- Yan, K.; Yan, H.; Gupta, R. Are GARCH and DCC Values of 10 Cryptocurrencies Affected by COVID-19? J. Risk Financ. Manag. 2022, 15, 113. [Google Scholar] [CrossRef]

- Alexakis, C.; Anselmi, G.; Petrella, G. Flight to cryptos: Evidence on the use of cryptocurrencies in times of geopolitical tensions. Int. Rev. Econ. Financ. 2024, 89, 498–523. [Google Scholar] [CrossRef]

- Kayral, I.E.; Jeribi, A.; Loukil, S. Are Bitcoin and Gold a Safe Haven during COVID-19 and the 2022 Russia-Ukraine War? J. Risk Financ. Manag. 2023, 16, 222. [Google Scholar] [CrossRef]

- Nie, C.-X. Analysis of critical events in the correlation dynamics of cryptocurrency market. Phys. A Stat. Mech. Its Appl. 2022, 586, 126462. [Google Scholar] [CrossRef]

- Coulter, K.A. The impact of news media on Bitcoin prices: Modelling data driven discourses in the crypto-economy with natural language processing. R. Soc. Open Sci. 2022, 9, 220276. [Google Scholar] [CrossRef]

- Jobst, A.; Atzberger, D.; Henker, R.; Vollmer, J.; Scheibel, W.; Döllner, J. Examining Liquidity of Exchanges and Assets and the Impact of External Events in Centralized Crypto Markets: A 2022 Study. In Proceedings of the 2023 IEEE International Conference on Blockchain and Cryptocurrency (ICBC), Dubai, United Arab Emirates, 1–5 May 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Can Ergün, Z. The Impact of International Conflicts on the Cryptocurrency Market: The Case of Israel-Palestine Conflict. Polit. Ekon. Kuram. 2024, 8, 67–76. [Google Scholar] [CrossRef]

- Dyhrberg, A.H. Hedging capabilities of bitcoin. Is it the virtual gold? Financ. Res. Lett. 2016, 16, 139–144. [Google Scholar] [CrossRef]

- Gronwald, M. The Economics of Bitcoins—Market Characteristics and Price Jumps; CESifo Working Paper 5121; ifo Institute—Center for Economic Studies, Munich, Germany. 2014. Available online: https://www.cesifo.org/node/18925 (accessed on 4 February 2025).

- Klein, T.; Hien, P.T.; Walther, T. Bitcoin Is Not the New Gold: A Comparison of Volatility, Correlation, and Portfolio Performance. Int. Rev. Financ. Anal. 2018, 59, 105–116. [Google Scholar] [CrossRef]

- Gharbi, W.; Chaari, L.; Benazza-Benyahia, A. Unsupervised Bayesian change detection for remotely sensed images. Signal Image Video Process. 2021, 15, 205–213. [Google Scholar] [CrossRef]

- Zhao, K.; Wulder, M.A.; Hu, T.; Bright, R.; Wu, Q.; Qin, H.; Li, Y.; Toman, E.; Mallick, B.; Zhang, X.; et al. Detecting change-point, trend, and seasonality in satellite time series data to track abrupt changes and nonlinear dynamics: A Bayesian ensemble algorithm. Remote Sens. Environ. 2019, 232, 111181. [Google Scholar] [CrossRef]

- Mueller, L. Revisiting seasonality in cryptocurrencies. Financ. Res. Lett. 2024, 64, 105429. [Google Scholar] [CrossRef]

- Engle, R. Dynamic Conditional Correlation—A Simple Class of Multivariate GARCH models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Appiah-Otoo, I. The Impact of the Russia-Ukraine War on the Cryptocurrency Market. Asian Econ. Lett. 2023, 4, 1–5. [Google Scholar] [CrossRef]

- Wang, P.; Liu, X.; Wu, S. Dynamic linkage between bitcoin and traditional financial assets: A comparative analysis of different time frequencies. Entropy 2022, 24, 1565. [Google Scholar] [CrossRef]

- English, W.; Loretan, M. Special feature: Evaluating changes in correlations during periods of high market volatility. BIS Q. Rev. 2000, 2, 29–36. Available online: https://www.bis.org/publ/r_qt0006e.pdf (accessed on 4 February 2025).

- Hacibedel, B.; Peres-Saiz, H. Assessing Macro-Financial Risks from Crypto Assets; IMF Working Paper No. 214; International Monetary Fund: Washington, DC, USA, 2023. [Google Scholar] [CrossRef]

| Market Index | Description |

|---|---|

| S&P 500 | Market capitalization-weighted index of 500 largest companies publicly traded in the U.S. |

| NASDAQ | Market capitalization-weighted index of more than 2500 stocks listed on the Nasdaq stock exchange |

| Dow Jones Industrial Average | Price-weighted index of 30 blue-chip companies publicly traded in the U.S. |

| EURO STOXX 50 | Market capitalization-weighted index of 50 blue-chip Eurozone companies |

| STOXX Europe 600 | Market capitalization-weighted index of 600 European companies |

| Period | S&P 500 | NASDAQ Composite | DJIA | EURO STOXX 50 | STOXX Europe 600 |

|---|---|---|---|---|---|

| 2019–2023 | 0.83866 | 0.88571 | 0.81610 | 0.68225 | 0.74723 |

| Year | S&P 500 | NASDAQ Composite | DJIA | EURO STOXX 50 | STOXX Europe 600 |

|---|---|---|---|---|---|

| 2019 | 0.54838 | 0.51711 | 0.48500 | 0.49232 | 0.39176 |

| 2020 | 0.76843 | 0.82619 | 0.66559 | 0.38349 | 0.37799 |

| 2021 | 0.27787 | 0.26774 | 0.29137 | 0.31681 | 0.25583 |

| 2022 | 0.86853 | 0.89245 | 0.66081 | 0.59438 | 0.75695 |

| 2023 | 0.72871 | 0.74193 | 0.67251 | 0.58099 | 0.29293 |

| Period | S&P 500 | NASDAQ Composite | DJIA | EURO STOXX 50 | STOXX Europe 600 |

|---|---|---|---|---|---|

| 2019–2023 | 0.30954 | 0.33474 | 0.27226 | 0.24135 | 0.24125 |

| Year | S&P 500 | NASDAQ Composite | DJIA | EURO STOXX 50 | STOXX Europe 600 |

|---|---|---|---|---|---|

| 2019 | −0.11837 | −0.10737 | −0.13234 | −0.09215 | −0.10558 |

| 2020 | 0.42884 | 0.45009 | 0.41194 | 0.39465 | 0.40996 |

| 2021 | 0.26195 | 0.27115 | 0.21605 | 0.23580 | 0.22664 |

| 2022 | 0.56321 | 0.59582 | 0.50229 | 0.36012 | 0.36445 |

| 2023 | 0.15211 | 0.18917 | 0.13925 | 0.03591 | 0.01363 |

| Period | Gold | WTI Crude Oil |

|---|---|---|

| 2019–2023 | 0.55325 | 0.48013 |

| Year | Gold | WTI Crude Oil |

|---|---|---|

| 2019 | 0.70581 | −0.03252 |

| 2020 | 0.51006 | 0.33613 |

| 2021 | −0.42462 | 0.30959 |

| 2022 | 0.75959 | 0.37128 |

| 2023 | 0.68466 | −0.18470 |

| Period | Gold | WTI Crude Oil |

|---|---|---|

| 2019–2023 | 0.13686 | 0.05634 |

| Year | Gold | WTI Crude Oil |

|---|---|---|

| 2019 | 0.21508 | −0.03558 |

| 2020 | 0.27742 | 0.11551 |

| 2021 | −0.05118 | 0.05014 |

| 2022 | 0.09909 | 0.10582 |

| 2023 | 0.11218 | −0.08165 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koutrouli, E.; Manousopoulos, P.; Theal, J.; Tresso, L. Crypto Asset Markets vs. Financial Markets: Event Identification, Latest Insights and Analyses. AppliedMath 2025, 5, 36. https://doi.org/10.3390/appliedmath5020036

Koutrouli E, Manousopoulos P, Theal J, Tresso L. Crypto Asset Markets vs. Financial Markets: Event Identification, Latest Insights and Analyses. AppliedMath. 2025; 5(2):36. https://doi.org/10.3390/appliedmath5020036

Chicago/Turabian StyleKoutrouli, Eleni, Polychronis Manousopoulos, John Theal, and Laura Tresso. 2025. "Crypto Asset Markets vs. Financial Markets: Event Identification, Latest Insights and Analyses" AppliedMath 5, no. 2: 36. https://doi.org/10.3390/appliedmath5020036

APA StyleKoutrouli, E., Manousopoulos, P., Theal, J., & Tresso, L. (2025). Crypto Asset Markets vs. Financial Markets: Event Identification, Latest Insights and Analyses. AppliedMath, 5(2), 36. https://doi.org/10.3390/appliedmath5020036