Non-Fungible Tokens (NFTs) and Cryptocurrencies: Efficiency and Comovements

Abstract

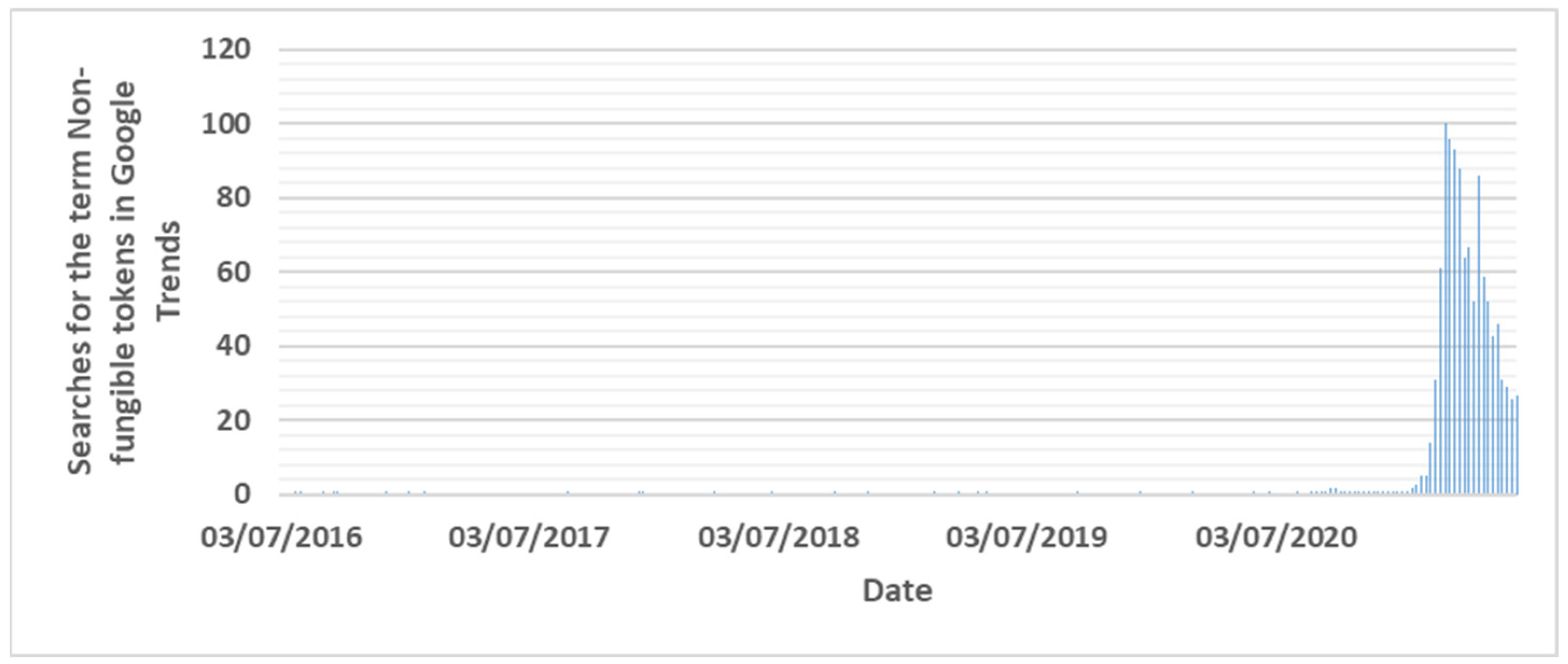

1. Introduction

2. Materials and Methods

- (i)

- Let of length , starting by the calculation of the profile , with the mean observed value;

- (ii)

- This profile is then divided into different boxes of length ;

- (iii)

- From each one, the local trend is calculated through the ordinary least squares, to detrend the profile and to calculate ;

- (iv)

- After repeating the process for the different size boxes, the log–log regression is applied between and , with the DFA being expressed by the power law , which identifies α as the Hurst exponent.

- (i)

- Based on two different time series, and , with equal length, the first step is the calculation of the profiles and , with for the mean observed values;

- (ii)

- Both profiles are divided into boxes of length n, and the local trends and are also obtained through ordinary least squares;

- (iii)

- The local trends are used to detrend the profiles and to obtain the covariance of the residuals, given by ;

- (iv)

- These residuals are the base of the calculation of the detrended covariance, given by ;

- (v)

3. Results

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Musan, D.I. NFT.Finance Leveraging Non-Fungible Tokens; Imperial College London: London, UK, 2020; Available online: https://www.imperial.ac.uk/media/imperial-college/faculty-ofengineering/computing/public/1920-ug-projects/distinguished-projects/NFT.-financeLeveraging-Non-Fungible-Tokens.pdf (accessed on 12 August 2022).

- Chohan, U.W. Non-Fungible Tokens: Blockchains, Scarcity, and Value. Critical Blockchain Research Initiative (CBRI) Working Papers. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3822743 (accessed on 12 August 2022).

- Crow, K.; Ostroff, C. Beeple NFT Fetches Record-Breaking $69 Million in Christie’s Sale. Wall Street J. 2021. Available online: https://www.wsj.com/articles/beeple-nft-fetches-record-breaking-69-million-in-christies-sale-11615477732 (accessed on 12 August 2022).

- Ofir, M.; Sadeh, I. ICO vs IPO: Empirical Findings, Information Asymmetry and the Appropriate Regulatory Framework. Vanderbilt J. Transnatl. Law 2020, 53, 525–613. [Google Scholar] [CrossRef]

- Miglo, A. Theories of Crowdfunding and Token Issues: A Review. J. Risk Financ. Manag. 2022, 15, 218. [Google Scholar] [CrossRef]

- Dowling, M. Is non-fungible token pricing driven by cryptocurrencies? Finance Res. Lett. 2021, 44, 102097. [Google Scholar] [CrossRef]

- Heinonen, H.; Semenov, A.; Boginski, V. Collective Behavior of Price Changes of ERC-20 Tokens. In Computational Data and Social Networks; Proceedings of the 9th International Conference, CSoNet 2020, Dallas, TX, USA, 11–13 December 2020; Lecture Notes in Computer Science; Chellappan, S., Choo, K.K.R., Phan, N., Eds.; Springer: Cham, Swizerland, 2020; Volume 12575. [Google Scholar] [CrossRef]

- Treiblmaier, H. Beyond Blockchain: How Tokens Trigger the Internet of Value and what Marketing Researchers Need to Know About Them. J. Mark. Commun. 2021. [Google Scholar] [CrossRef]

- Ante, L. The Non-Fungible Token (NFT) Market and Its Relationship with Bitcoin and Ethereum. FinTech 2022, 1, 216–224. [Google Scholar] [CrossRef]

- Bao, H.; Roubaud, D. Non-Fungible Token: A Systematic Review and Research Agenda. J. Risk Financial Manag. 2022, 15, 215. [Google Scholar] [CrossRef]

- Fama, E. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Kyriazis, N. A Survey on Efficiency and Profitable Trading Opportunities in Cryptocurrency Markets. J. Risk Financ. Manag. 2019, 12, 67. [Google Scholar] [CrossRef]

- Dowling, M. Fertile LAND: Pricing non-fungible tokens. Financ. Res. Lett. 2021, 44, 102096. [Google Scholar] [CrossRef]

- Urquhart, A. The inefficiency of Bitcoin. Econ. Lett. 2016, 148, 80–82. [Google Scholar] [CrossRef]

- Sigaki, H.Y.; Perc, M.; Ribeiro, H.V. Clustering patterns in efficiency and the coming-of-age of the cryptocurrency market. Sci. Rep. 2019, 9, 1440. [Google Scholar] [CrossRef] [PubMed]

- Sensoy, A. The inefficiency of Bitcoin revisited: A high-frequency analysis with alternative currencies. Financ. Res. Lett. 2019, 28, 68–73. [Google Scholar] [CrossRef]

- Ferreira, P.; Kristoufek, L.; Pereira, É. DCCA and DMCA correlations of cryptocurrency markets. Phys. A Stat. Mech. Appl. 2020, 545, 123803. [Google Scholar] [CrossRef]

- Mnif, E.; Jarboui, A.; Mouakhar, K. How the cryptocurrency market has performed during COVID 19? A multifractal analysis. Financ. Res. Lett. 2020, 36, 101647. [Google Scholar] [CrossRef]

- Naeem, M.A.; Bouri, E.; Peng, Z.; Shahzad, S.J.H.; Vo, X.V. Asymmetric efficiency of cryptocurrencies during COVID19. Phys. A Stat. Mech. Appl. 2021, 565, 125562. [Google Scholar] [CrossRef]

- Ionescu, L. Digital Data Aggregation, Analysis, and Infrastructures in FinTech Operations. Rev. Contemp. Philos. 2020, 19, 92–98. [Google Scholar]

- Popova, Y. Economic Basis of Digital Banking Services Produced by FinTech Company in Smart City. J. Tour. Serv. 2021, 23, 86–104. [Google Scholar] [CrossRef]

- Vasenska, I.; Dimitrov, P.; Koyundzhiyska-Davidkova, B.; Krastev, V.; Durana, P.; Poulaki, I. Financial transactions using fintech during the COVID-19 crisis in Bulgaria. Risks 2021, 9, 48. [Google Scholar] [CrossRef]

- Morales, L.; Gray, G.; Rajmil, D. Emerging Risks in the FinTech Industry—Insights from Data Science and Financial Econometrics. Anal. Econ. Man. Financ. Mark. 2022, 17, 9–36. [Google Scholar]

- Peng, C.; Buldyrev, S.; Havlin, S.; Simons, M.; Stanley, E.; Goldberger, A. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685–1689. [Google Scholar] [CrossRef] [PubMed]

- Kristoufek, L. On Bitcoin markets (in)efficiency and its evolution. Phys. A Stat. Mech. Appl. 2018, 503, 257–262. [Google Scholar] [CrossRef]

- Quintino, D.; Campoli, J.; Burnquist, H.; Ferreira, P. Efficiency of the Brazilian Bitcoin: A DFA approach. Int. J. Financ. Stud. 2020, 8, 25. [Google Scholar] [CrossRef]

- Podobnik, B.; Stanley, H. Detrended Cross-Correlation Analysis: A new method for analyzing two nonstationary time series. Phys. Rev. Lett. 2008, 100, 084102. [Google Scholar] [CrossRef] [PubMed]

- Zebende, G. DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Phys. A Stat. Mech. Appl. 2011, 390, 614–618. [Google Scholar] [CrossRef]

- Kristoufek, L. Measuring correlations between non-stationary series with DCCA coefficient. Phys. A Stat. Mech. Appl. 2014, 402, 291–298. [Google Scholar] [CrossRef]

- Zhao, X.; Shang, P.; Huang, J. Several fundamental properties of DCCA cross-correlation coefficient. Fractals 2017, 25, 1750017. [Google Scholar] [CrossRef]

- Podobnik, B.; Jiang, Z.; Zhou, W.; Stanley, H. Statistical tests for power-law crosscorrelated processes. Phys. Rev. E 2011, 84, 066118. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Chen, S.; Yang, J.J.; Yang, M.Y. Random matrix theory analysis of cross-correlations in the US stock market: Evidence from Pearson’s correlation coefficient and detrended cross-correlation coefficient. Phys. A Stat. Mech. Appl. 2013, 392, 3715–3730. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Chen, Y.J.; Chen, S. Statistical properties of the foreign exchange network at different time scales: Evidence from detrended cross-correlation coefficient and minimum spanning tree. Entropy 2013, 15, 1643–1662. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Lin, M.; Stanley, H.E. Stock market contagion during the global financial crisis: A multiscale approach. Financ. Res. Lett. 2017, 22, 163–168. [Google Scholar] [CrossRef]

- Hussain, M.; Zebende, G.F.; Bashir, U.; Donghong, D. Oil price and exchange rate co-movements in Asian countries: Detrended cross-correlation approach. Phys. A Stat. Mech. Appl. 2017, 465, 338–346. [Google Scholar] [CrossRef]

- Okorie, D.I.; Lin, B. Stock markets and the COVID-19 fractal contagion effects. Financ. Res. Lett. 2021, 38, 101640. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pereira, É.; Ferreira, P.; Quintino, D. Non-Fungible Tokens (NFTs) and Cryptocurrencies: Efficiency and Comovements. FinTech 2022, 1, 310-317. https://doi.org/10.3390/fintech1040023

Pereira É, Ferreira P, Quintino D. Non-Fungible Tokens (NFTs) and Cryptocurrencies: Efficiency and Comovements. FinTech. 2022; 1(4):310-317. https://doi.org/10.3390/fintech1040023

Chicago/Turabian StylePereira, Éder, Paulo Ferreira, and Derick Quintino. 2022. "Non-Fungible Tokens (NFTs) and Cryptocurrencies: Efficiency and Comovements" FinTech 1, no. 4: 310-317. https://doi.org/10.3390/fintech1040023

APA StylePereira, É., Ferreira, P., & Quintino, D. (2022). Non-Fungible Tokens (NFTs) and Cryptocurrencies: Efficiency and Comovements. FinTech, 1(4), 310-317. https://doi.org/10.3390/fintech1040023