The Relationship between Green Innovation, Social Entrepreneurship, and Sustainable Development

Abstract

1. Introduction

2. Theoretical Aspects

3. Empirical Analyses

3.1. Data and Methods

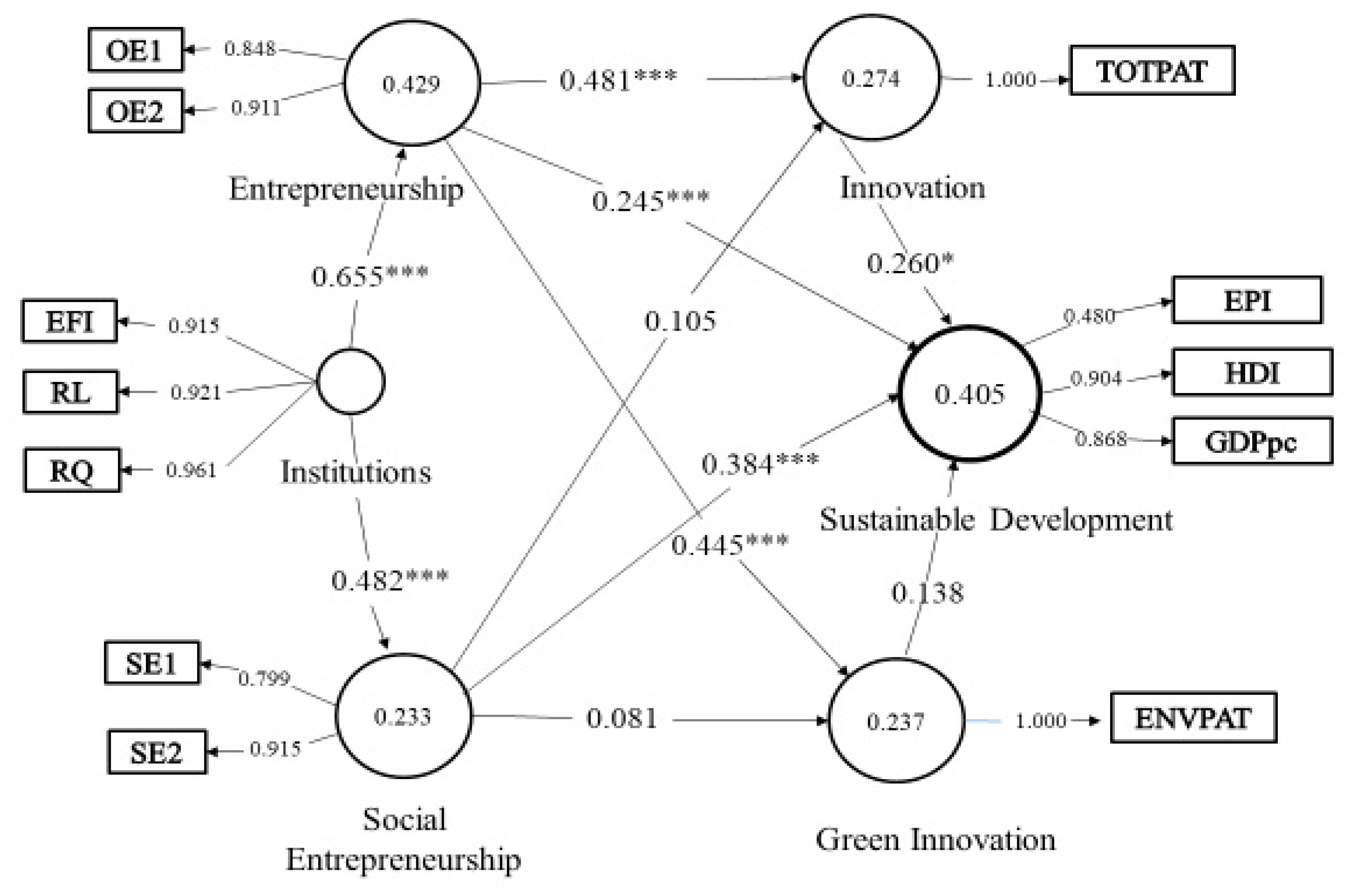

3.2. Results

4. Conclusions and Discussion

Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Hasan, I.; Tucci, C.L. The innovation–economic growth nexus: Global evidence. Res. Pol. 2010, 39, 1264–1276. [Google Scholar] [CrossRef]

- Galindo, M.A.; Méndez, M.T. Entrepreneurship, economic growth, and innovation: Are feedback effects at work? J. Bus. Res. 2014, 67, 825–829. [Google Scholar] [CrossRef]

- Adrián Risso, W.; Sánchez Carrera, E.J. On the impact of innovation and inequality in economic growth. Econ. Innov. New Technol. 2019, 28, 64–81. [Google Scholar] [CrossRef]

- Audretsch, D.B. The knowledge spillover theory of entrepreneurship and economic growth. In The Emergence of Entrepreneurship Policy (Research on Technological Innovation, Management and Policy, Vol. 9); Springer: Boston, MA, USA, 2005; pp. 37–54. [Google Scholar]

- Alpkan, L.; Bulut, C.; Gunday, G.; Ulusoy, G.; Kilic, K. Organizational support for intrapreneurship and its interaction with human capital to enhance innovative performance. Manag. Decis. 2010, 48, 732–755. [Google Scholar] [CrossRef]

- Acs, Z.J.; Audretsch, D.B.; Braunerhjelm, P.; Carlsson, B. Growth and entrepreneurship. Small Bus. Econ. 2012, 39, 289–300. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Keilbach, M. Does entrepreneurship capital matter? Entrep. Theory Pract. 2004, 28, 419–429. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Keilbach, M. Entrepreneurship capital and economic performance. Reg. Stud. 2004, 38, 949–959. [Google Scholar] [CrossRef]

- Méndez-Picazo, M.T.; Galindo-Martín, M.A.; Ribeiro-Soriano, D. Governance, entrepreneurship and economic growth. Entrep. Reg. Dev. 2012, 24, 865–877. [Google Scholar] [CrossRef]

- Bosma, N.; Content, J.; Sanders, M.; Stam, E. Institutions, entrepreneurship, and economic growth in Europe. Small Bus. Econ. 2018, 51, 483–499. [Google Scholar] [CrossRef]

- Giampietro, M.; Mayumi, K.; Sorman, A.H. The Metabolic Pattern of Societies; Routledge: London, UK, 2012. [Google Scholar]

- Kovacic, Z.; Strand, R.; Völker, T. The Circular Economy in Europe: Critical Perspectives on Policies and Imaginaries; Routledge: London, UK, 2020. [Google Scholar]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Rennings, K.A.; Ziegler, A.; Zwick, T. The effect of environmental innovations on employment changes: An econometric analysis. Bus. Strateg. Environ. 2004, 13, 374–387. [Google Scholar] [CrossRef]

- Acs, Z.J.; Boardman, M.C.; McNeely, C.L. The social value of productive entrepreneurship. Small Bus. Econ. 2013, 40, 785–796. [Google Scholar] [CrossRef]

- Baumol, W.J. Entrepreneurship: Productive, unproductive, and destructive. J. Polit. Econ. 1990, 98, 893–921. [Google Scholar] [CrossRef]

- Fuentelsaz, L.; González, C.; Maícas, J.P.; Montero, J. How different formal institutions affect opportunity and necessity entrepreneurship. BRQ Bus. Res. Q. 2015, 18, 246–258. [Google Scholar] [CrossRef]

- Busenitz, L.W.; Gómez, C.; Spencer, W.J. Country institutional profiles: Unlocking entrepreneurial phenomena. Acad. Manag. J. 2000, 43, 994–1003. [Google Scholar] [CrossRef]

- Estrin, S.; Korosteleva, J.; Mickiewicz, T. Which institutions encourage entrepreneurial growth aspirations? J. Bus. Ventur. 2013, 28, 564–580. [Google Scholar] [CrossRef]

- Fuentelsaz, L.; González, C.; Maicas, J.P. Formal institutions and opportunity entrepreneurship: The contingent role of informal institutions. BRQ Bus. Res. Q. 2018. [Google Scholar] [CrossRef]

- Henrekson, M.; Sanandaji, T. The interaction of entrepreneurship and institutions. J. Inst. Econ. 2011, 7, 47–75. [Google Scholar] [CrossRef]

- Samadi, A.H. Institutions and entrepreneurship: Unidirectional or bidirectional causality? J. Glob. Entrep. Res. 2019, 9, 3. [Google Scholar] [CrossRef]

- World Development Report 1992-Development and the Environment; World Bank: New York, NY, USA, 1992.

- Nissan, E.; Galindo, M.A.; Mendez-Picazo, M.T. Innovation, progress, entrepreneurship and cultural aspects. Int. Entrep. Manag. J. 2012, 8, 411–420. [Google Scholar] [CrossRef]

- Castaño-Martinez, M.S.; Méndez-Picazo, M.T.; Galindo-Martín, M.A. Policies to promote entrepreneurial activity and economic performance. Manag. Decis. 2015, 53, 2073–2087. [Google Scholar] [CrossRef]

- Abramovitz, M. Catching Up, Forging Ahead, and Falling Behind. J. Econ. Hist. 1986, 46, 385–406. [Google Scholar] [CrossRef]

- Galindo, M.A.; Méndez, M.T. Innovation, entrepreneurship and economic growth. Manag. Decis. 2013, 51, 501–514. [Google Scholar] [CrossRef]

- Castaño, M.S.; Méndez, M.T.; Galindo, M.A. The effect of public policies on entrepreneurial activity and economic growth. J. Bus. Res. 2016, 69, 5280–5285. [Google Scholar] [CrossRef]

- Nissan, E.; Galindo-Martín, M.A.; Méndez-Picazo, M.T. Relationship between organizations, institutions, entrepreneurship and economic growth process. Int. Entrep. Manag. J. 2011, 7, 311–324. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Oxford University Press: New York, NY, USA, 1911. [Google Scholar]

- Schumpeter, J.A. Capitalism, Socialism and Democracy; Harper & Brother Publishers: New York, NY, USA, 1950. [Google Scholar]

- Baregheh, A.; Rowley, J.; Sambrook, S. Towards a multidisciplinary definition of innovation. Manag. Decis. 2009, 47, 1323–1339. [Google Scholar] [CrossRef]

- Romero-Martínez, A.M.; Ortiz-de-Urbina-Criado, M.; Ribeiro Soriano, D. Evaluating European Union support for innovation in Spanish small and medium enterprises. Serv. Ind. J. 2010, 30, 671–683. [Google Scholar] [CrossRef]

- Mas-Verdu, F.; Ribeiro Soriano, D.; Roig Dobon, S. Regional development and innovation: The role of services. Serv. Ind. J. 2010, 30, 633–641. [Google Scholar] [CrossRef]

- Drucker, P.F. The discipline of innovation. Harv. Bus. Rev. 1998, 76, 149–157. [Google Scholar] [CrossRef]

- Autio, E.; Kenney, M.; Mustar, P.; Siegel, D.; Wright, M. Entrepreneurial innovation: The importance of context. Res. Policy 2014, 43, 1097–1108. [Google Scholar] [CrossRef]

- Acemoglu, D. Root causes: A historical approach to assessing the role of institutions in economic development. Financ. Dev. 2003, 40, 26–30. [Google Scholar]

- Amorós, J.E.; Bosma, N. Global Entrepreneurship Monitor 2013 Global Report; Global Entrepreneurship Monitor (GEM): London, UK, 2014. [Google Scholar]

- Dilli, S.; Elert, N.; Herrmann, A.M. Varieties of entrepreneurship: Exploring the institutional foundations of different entrepreneurship types through ‘Varieties-of-Capitalism’ arguments. Small Bus. Econ. 2018, 51, 293–320. [Google Scholar] [CrossRef]

- Lim, D.S.K.; Oh, C.H.; De Clercq, D. Engagement in entrepreneurship in emerging economies: Interactive effects of individual-level factors and institutional conditions. Int. Bus. Rev. 2016, 25, 933–945. [Google Scholar] [CrossRef]

- Boudreaux, C.J.; Nikolaev, B.N.; Klein, P. Socio-cognitive traits and entrepreneurship: The moderating role of economic institutions. J. Bus. Ventur. 2019, 34, 178–196. [Google Scholar] [CrossRef]

- Simón-Moya, V.; Revuelto-Taboada, L.; Guerrero, R.F. Institutional and economic drivers of entrepreneurship: An international perspective. J. Bus. Res. 2014, 67, 715–721. [Google Scholar] [CrossRef]

- Acs, Z.J.; Estrin, S.; Mickiewicz, T.; Szerb, L. Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Bus. Econ. 2018, 51, 501–514. [Google Scholar] [CrossRef]

- Demirel, P.; Kesidou, E. Sustainability-oriented capabilities for eco-innovation: Meeting the regulatory, technology, and market demands. Bus. Strategy Environ. 2019, 28, 847–857. [Google Scholar] [CrossRef]

- Galindo-Martín, M.A.; Méndez-Picazo, M.T.; Castaño-Martínez, M.S. The role of innovation and institutions in entrepreneurship and economic growth in two groups of countries. Int. J. Entrep. Behav. Res. 2019. [Google Scholar] [CrossRef]

- Urbano, D.; Aparicio, S.; Audretsch, D.B. Twenty-five years of research on institutions, entrepreneurship, and economic growth: What has been learned? Small Bus. Econ. 2019, 53, 21–49. [Google Scholar] [CrossRef]

- Report of the World Commission on Environment and Development: Our Common Future; United Nations (UN); Oxford University Press: New York, NY, USA, 1987.

- Doran, J.; Ryan, G. The importance of the diverse drivers and types of environmental innovation for firm performance. Bus. Strategy Environ. 2016, 25, 102–119. [Google Scholar] [CrossRef]

- Liao, Z. Environmental policy instruments, environmental innovation and the reputation of enterprises. J. Clean. Prod. 2018, 171, 1111–1117. [Google Scholar] [CrossRef]

- Ambec, S.; Lanoie, P. Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar] [CrossRef]

- Dees, J.G. The Meaning of Social Entrepreneurship; Working Paper; Stanford University: Stanford, CA, USA, 1998. [Google Scholar]

- Light, P.C. Reshaping social entrepreneurship. Stanf. Soc. Innov. Rev. 2006, 4, 47–51. [Google Scholar]

- Light, P.C. The Search for Social Entrepreneurship; Brookings Institution Press: Washington, DC, USA, 2009. [Google Scholar]

- Mair, J.; Martí, I. Social entrepreneurship research: A source of explanation, prediction, and delight. J. World Bus. 2006, 41, 36–44. [Google Scholar] [CrossRef]

- Elkington, J.; Hartigan, P. The Power of Unreasonable People: How Social Entrepreneurs Create Markets That Change the World; Harvard Business School Publishing: Boston, MA, USA, 2008. [Google Scholar]

- Zahra, S.A.; Rawhouser, H.N.; Bhawe, N.; Neubaum, D.O.; Hayton, J.C. Globalization of social entrepreneurship opportunities. Strateg. Entrep. J. 2008, 2, 117–131. [Google Scholar] [CrossRef]

- Méndez-Picazo, M.T.; Ribeiro-Soriano, D.; Galindo-Martín, M.A. Drivers of social entrepreneurship. Eur. J. Int. Manag. 2015, 9, 766–779. [Google Scholar] [CrossRef]

- Miller, T.L.; Grimes, M.G.; McMullen, J.S.; Vogus, T.J. Venturing for others with heart and head: How compassion encourages social entrepreneurship. Acad. Manag. Rev. 2012, 37, 616–640. [Google Scholar] [CrossRef]

- Brooks, A.C. Social Entrepreneurship: A Modern Approach to Social value CREATION; Pearson Prentice Hall: Upper Saddle, NJ, USA, 2009. [Google Scholar]

- Nga, J.K.H.; Shamuganathan, G. The influence of personality traits and demographic factors on social entrepreneurship start up intentions. J. Bus. Ethics 2010, 95, 259–282. [Google Scholar]

- Miska, C.; Stahl, G.K.; Mendenhall, M.E. Intercultural competencies as antecedents of responsible global leadership. Eur. J. Int. Manag. 2013, 7, 550–569. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Arena, C.; Michelon, G.; Trojanowski, G. Big egos can be green: A study of CEO Hubris and environmental innovation. Br. J. Manag. 2018, 29, 316–336. [Google Scholar] [CrossRef]

- Arranz, N.; Arroyabe, M.; Li, J.; Fernandez de Arroyabe, J.C. Innovation as a driver of eco-innovation in the firm: An approach from the dynamic capabilities theory. Bus. Strategy Environ. 2020, 1–10. [Google Scholar] [CrossRef]

- Borghesi, S.; Cainelli, G.; Mazzanti, M. Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 2015, 44, 669–683. [Google Scholar] [CrossRef]

- Costantini, V.; Crespi, F.; Palma, A. Characterizing the policy mix and its impact on eco-innovation: A patent analysis of energy-efficient technologies. Res. Policy 2017, 46, 799–819. [Google Scholar] [CrossRef]

- Towards Green Growth; Organisation for Economic Cooperation and Development (OECD): Paris, France, 2011.

- Paroussos, L.; Fragkiadakis, K.; Fragkos, P. Macro-economic analysis of green growth policies: The role of finance and technical progress in Italian green growth. Clim. Chang. 2019. [Google Scholar] [CrossRef]

- Rennings, K. Towards a Theory and Policy of Eco-Innovation—Neoclassical and (Co-) Evolutionary Perspectives; ZEW Discussion Papers 98-24: Mannheim, Germany, 1998. [Google Scholar]

- Horbach, J. Determinants of environmental innovation-New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Arranz, N.; Arroyabe, M.F.; Molina-García, A.; Fernandez de Arroyabe, J.C. Incentives and inhibiting factors of eco-innovation in the Spanish firms. J. Clean. Prod. 2019, 220, 167–176. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Alam, A.; Uddin, M.; Yazdifar, H. Institutional determinants of R&D investment: Evidence from emerging markets. Technol. Forecast Soc. Chang. 2019, 138, 34–44. [Google Scholar] [CrossRef]

- Elert, N.; Henrekson, M. Entrepreneurship and institutions: A bidirectional relationship. Found. Trends Entrep. 2017, 13, 191–263. [Google Scholar] [CrossRef]

- Acemoglu, D.; Robinson, J. The Role of Institutions in Growth and Development; Working Paper No. 10; World Bank Commission on Growth and Development: Washington, DC, USA, 2008. [Google Scholar]

- Justesen, M.K.; Kurrild-Klitgaard, P. Institutional interactions and economic growth: The joint effects of property rights, veto players and democratic capital. Public Choice 2013, 157, 449–474. [Google Scholar] [CrossRef]

- Przeworski, A.; Limongi, F. Political regimes and economic growth. J. Econ. Perspect. 1993, 7, 51–69. [Google Scholar] [CrossRef]

- Sirowy, L.; Inkeles, A. The effects of democracy on economic growth and inequality: A review. Stud. Comp. Int. Dev. 1990, 25, 126–157. [Google Scholar] [CrossRef]

- Cohen, B.; Winn, M.I. Market imperfections, opportunity and sustainable entrepreneurship. J. Bus. Ventur. 2007, 22, 29–49. [Google Scholar] [CrossRef]

- Hall, J.K.; Daneke, G.A.; Lenox, M.J. Sustainable development and entrepreneurship: Past contributions and future directions. J. Bus. Ventur. 2010, 25, 481–492. [Google Scholar] [CrossRef]

- Hockerts, K.; Wüstenhagen, R. Greening Goliaths versus emerging Davids—Theorizing about the role of incumbents and new entrants in sustainable entrepreneurship. J. Bus. Ventur. 2010, 25, 481–492. [Google Scholar] [CrossRef]

- Hair, F.J.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Los Angeles, CA, USA, 2016. [Google Scholar]

- Work on Green Growth; Organisation for Economic Cooperation and Development (OECD): Paris, France, 2019.

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Rigdon, E.E.; Sarstedt, M.; Ringle, C.M. On comparing results from CB-SEM and PLS-SEM: Five perspectives and five recommendations. Marketing ZFP 2017, 39, 4–16. [Google Scholar] [CrossRef]

- Wong, K.K.-K. Partial Least Squares Structural Equation Modeling (PLS-SEM) Techniques Using SmartPLS. Mark. Bull. 2013, 24, 1–32. [Google Scholar]

- Sarstedt, M.; Bengart, P.; Shaltoni, A.M.; Lehmann, S. The use of sampling methods in advertising research: A gap between theory and practice. Int. J. Advert. 2018, 37, 650–663. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. Adv. Int. Mark. 2009, 20, 277–319. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1994. [Google Scholar]

- Diamantopoulos, A.; Riefler, P.; Roth, K.P. Advancing formative measurement models. J. Bus. Res. 2008, 61, 1203–1218. [Google Scholar] [CrossRef]

- 2018 Environmental Performance Index (EPI). Yale Center for Environmental Law and Policy (YCELP). Available online: https://doi.org/10.7927/H4X928CF (accessed on 3 September 2019).

- Human Development Data. United Nations Development Programme (UNDP). Available online: http://hdr.undp.org/en/data (accessed on 8 February 2020).

- World Development Indicators. World Bank. Available online: http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 14 November 2019).

- Global Report 2017/2018; Global Entrepreneurship Monitor (GEM): London, UK, 2018.

- APS-Global Data. Global Entrepreneurship Monitor (GEM). Available online: http://www.gemconsortium.org/data/sets (accessed on 9 May 2019).

- Index of Economic Freedom. The Heritage Foundation. Available online: https://www.heritage.org/index/ (accessed on 10 February 2020).

- Worldwide Governance Indicators. World Bank. Available online: http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 24 October 2019).

- Wendling, Z.A.; Emerson, J.W.; Esty, D.C.; Levy, M.A.; Sherbinin, A. The Environmental Performance Index; Yale Center for Environmental Law & Policy: New Haven, CT, USA, 2018. [Google Scholar]

- Kelley, D.J.; Singer, S.; Herrington, M. Global Entrepreneurship Monitor 2011 Global Report; Global Entrepreneurship Research Association, London Business School: London, UK, 2012. [Google Scholar]

- Noseleit, F. Entrepreneurship, structural change, and economic growth. J. Evol. Econ. 2013, 23, 735–766. [Google Scholar] [CrossRef]

- Aparicio, S.; Urbano, D.; Audretsch, D. Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technol. Forecast Soc. Chang. 2016, 102, 45–61. [Google Scholar] [CrossRef]

- Carlsson, B.; Braunerhjelm, P.; McKelvey, M.; Olofsson, C.; Persson, L.; Ylinenpää, H. The evolving domain of entrepreneurship research. Small Bus. Econ. 2013, 41, 913–930. [Google Scholar] [CrossRef]

- Acs, Z.J.; Szerb, L. The global entrepreneurship index (GEINDEX). Found. Trends Entrep. 2009, 5, 341–435. [Google Scholar] [CrossRef]

- Bosma, N.; Schott, T.; Terjesen, S.; Kew, P. Report on Social Entrepreneurship; Global Entrepreneurship Monitor (GEM): London, UK, 2015. [Google Scholar]

- Green Growth Indicators. Organisation for Economic Cooperation and Development (OECD). Available online: https://stats.oecd.org (accessed on 3 September 2019).

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators: Methodology and Analytical Issues. Hague J. Rule Law 2011, 3, 220–246. [Google Scholar] [CrossRef]

- Rose-Ackerman, S.; Palifka, B.J. Corruption and Government: Causes, Consequences, and Reform; Cambridge University Press: New York, NY, USA, 2016. [Google Scholar]

- Ramesh, R.; Vinayagathasan, T. Corruption, rule of law and government effectiveness: A co-integration approach to Sri Lanka. In Proceedings of the 6th South Eastern University Arts Research Session 2017 on “New Horizons towards Human Development”, Oluvil, Sri Lanka, 26 June 2018; pp. 158–169. [Google Scholar]

- Nistotskaya, M.; Cingolani, L. Bureaucratic structure, regulatory quality, and entrepreneurship in a comparative perspective: Cross-sectional and panel data evidence. J. Public Adm. Res. Theory 2016, 26, 519–534. [Google Scholar] [CrossRef]

- Agostino, M.; Nifo, A.; Trivieri, F.; Vecchione, G. Rule of law and regulatory quality as drivers of entrepreneurship. Reg. Stud. 2020, 54, 814–826. [Google Scholar] [CrossRef]

- Jöreskog, K.G. Simultaneous factor analysis in several populations. Psychometrika 1971, 36, 409–426. [Google Scholar] [CrossRef]

- Diamantopoulos, A.; Sarstedt, M.; Fuchs, C.; Wilczynski, P.; Kaiser, S. Guidelines for choosing between multi-item and single-item scales for construct measurement: A predictive validity perspective. J. Acad. Mark. Sci. 2012, 40, 434–449. [Google Scholar] [CrossRef]

- Barclay, D.; Higgins, C.; Thompson, R. The Partial Least Squares (PLS) approach to causal modeling: Personal computer adoption and use an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Fornell, C. A second generation of multivariate analysis. An overview. In A Second Generation of Multivariate Analysis; Praeger Publishers: New York, NY, USA, 1982; pp. 1–21. [Google Scholar]

- Falk, R.F.; Miller, N.B. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Policy Brief on Social Entrepreneurship; Organisation for Economic Cooperation and Development (OECD)/European Union: Luxembourg, 2013.

- Policy Brief on Scaling the Impact of Social Enterprises; European Union/Organisation for Economic Cooperation and Development (OECD): Luxembourg, 2016.

| Latent Variable | Indicators | |

| Sustainable Development | EPI | Environmental Performance Index [93] |

| HDI | Human Development Index [94] | |

| GDPpc | GDP per capita, based on purchasing power parity (PPP) (constant 2011 international $) [95] | |

| Entrepreneurship | OE1 | Opportunity-driven (% of total entrepreneurial activity (TEA)) [96] |

| OE2 | Improvement-driven opportunity early-stage entrepreneur [96] | |

| Social Entrepreneurship | SE1 | Involved in nascent and operational social entrepreneurial activity [97] |

| SE2 | Involved in social goal operational social entrepreneurial activity [97] | |

| Green Innovation | ENVPAT | Total environmental patent per capital [98] |

| Innovation | TOTPAT | Total patent per capital [98] |

| Institutions | EFI | Economic Freedom Index [99] |

| RL | Rule of Law [100] | |

| RQ | Regulatory Quality [100] | |

| Entrepreneurship | Green Innovation | Innovation | Institutions | Social Entrepreneurship | Sustainable Development | |

|---|---|---|---|---|---|---|

| EPI | 0.317 | 0.217 | 0.139 | 0.249 | 0.107 | 0.480 |

| HDI | 0.530 | 0.641 | 0.687 | 0.756 | 0.387 | 0.904 |

| GDPpc | 0.452 | 0.386 | 0.429 | 0.573 | 0.689 | 0.868 |

| OE1 | 0.848 | 0.363 | 0.338 | 0.489 | 0.239 | 0.492 |

| OE2 | 0.911 | 0.472 | 0.544 | 0.648 | 0.315 | 0.506 |

| SE1 | 0.300 | 0.011 | 0.063 | 0.361 | 0.799 | 0.452 |

| SE2 | 0.262 | 0.320 | 0.333 | 0.457 | 0.915 | 0.509 |

| ENVPAT | 0.481 | 1.000 | 0.912 | 0.597 | 0.226 | 0.577 |

| TOTPAT | 0.514 | 0.912 | 1.000 | 0.617 | 0.258 | 0.608 |

| EFI | 0.605 | 0.393 | 0.472 | 0.915 | 0.506 | 0.598 |

| RL | 0.626 | 0.636 | 0.634 | 0.921 | 0.426 | 0.775 |

| RQ | 0.601 | 0.651 | 0.626 | 0.961 | 0.413 | 0.684 |

| Cronbach’s Alpha | rho_A | Composite Reliability | Average Variance Extracted (AVE) | R Square | |

|---|---|---|---|---|---|

| Entrepreneurship | 0.712 | 0.743 | 0.872 | 0.774 | 0.429 |

| Green Innovation | 1.000 | 1.000 | 1.000 | 1.000 | 0.237 |

| Innovation | 1.000 | 1.000 | 1.000 | 1.000 | 0.274 |

| Institutions | 0.925 | 0.926 | 0.953 | 0.870 | |

| Social Entrepreneurship | 0.655 | 0.725 | 0.848 | 0.737 | 0.233 |

| Sustainable Development | 0.664 | 0.797 | 0.809 | 0.601 | 0.590 |

| Green Innovation | Innovation | Sustainable Development | |

|---|---|---|---|

| Entrepreneurship | 0.186 | ||

| Institutions | 0.337 | 0.365 | 0.486 |

| Social Entrepreneurship | 0.038 |

| Specific Indirect Effects | |

|---|---|

| Institutions -> Entrepreneurship -> Green Innovation | 0.298 |

| Institutions -> Social Entrepreneurship -> Green Innovation | 0.039 |

| Institutions -> Entrepreneurship -> Innovation | 0.314 |

| Institutions -> Social Entrepreneurship -> Innovation | 0.051 |

| Institutions -> Entrepreneurship -> Sustainable Development | 0.161 |

| Entrepreneurship -> Green Innovation -> Sustainable Development | 0.061 |

| Institutions -> Entrepreneurship -> Green Innovation -> Sustainable Development | 0.040 |

| Social Entrepreneurship -> Green Innovation -> Sustainable Development | 0.011 |

| Institutions -> Social Entrepreneurship -> Green Innovation -> Sustainable Development | 0.005 |

| Entrepreneurship -> Innovation -> Sustainable Development | 0.125 |

| Institutions -> Entrepreneurship -> Innovation -> Sustainable Development | 0.082 |

| Social Entrepreneurship -> Innovation -> Sustainable Development | 0.027 |

| Institutions -> Social Entrepreneurship -> Innovation -> Sustainable Development | 0.013 |

| Institutions -> Social Entrepreneurship -> Sustainable Development | 0.185 |

| Cronbach’s Alpha | rho_A | Composite Reliability | Average Variance Extracted (AVE) | R Square | |

|---|---|---|---|---|---|

| Entrepreneurship | 0.712 | 0.726 | 0.873 | 0.775 | 0.345 |

| Institutions | 0.925 | 0.926 | 0.953 | 0.870 | 0.506 |

| Social Entrepreneurship | 0.655 | 0.665 | 0.852 | 0.743 | 0.306 |

| Sustainable Development | 0.774 | 0.820 | 0.868 | 0.687 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Galindo-Martín, M.-A.; Castaño-Martínez, M.-S.; Méndez-Picazo, M.-T. The Relationship between Green Innovation, Social Entrepreneurship, and Sustainable Development. Sustainability 2020, 12, 4467. https://doi.org/10.3390/su12114467

Galindo-Martín M-A, Castaño-Martínez M-S, Méndez-Picazo M-T. The Relationship between Green Innovation, Social Entrepreneurship, and Sustainable Development. Sustainability. 2020; 12(11):4467. https://doi.org/10.3390/su12114467

Chicago/Turabian StyleGalindo-Martín, Miguel-Angel, María-Soledad Castaño-Martínez, and María-Teresa Méndez-Picazo. 2020. "The Relationship between Green Innovation, Social Entrepreneurship, and Sustainable Development" Sustainability 12, no. 11: 4467. https://doi.org/10.3390/su12114467

APA StyleGalindo-Martín, M.-A., Castaño-Martínez, M.-S., & Méndez-Picazo, M.-T. (2020). The Relationship between Green Innovation, Social Entrepreneurship, and Sustainable Development. Sustainability, 12(11), 4467. https://doi.org/10.3390/su12114467