1. Introduction

Since the advent of the 21st century, business boundaries around the world have become blurred, and the global business environment has become highly competitive [

1]. Although the boundaries among electronic, computer, automotive, bio, telecommunication, aviation, and internet industries are becoming unclear, these vague boundaries have accelerated technology innovation, which is led by technology innovation from the semiconductor industry.

Through technological innovation and new product development, firms try to acquire advantages and growth in financial performance. For technology-intensive firms, technological innovation is a necessity, and technology-intensive firms cannot compete without technology innovation. Eventually, effective management and development of technological capability decide a firm’s continuous growth. Previous researchers have analyzed the variables that affect technological capability.

For example, Leonard-Barton (1995) claimed that strong technological capability makes it easy to acquire the required technologies [

2]. According to Mowery et al. (1998), a firm must possess strong technological capability in order to absorb external technologies successfully [

3]. Also, Cohen and Levinthal (1990) asserted that weak ability to absorb can make a firm less agile in finding opportunities and changing according to evolving external technologies [

4].

However, although previous research provides valid insights regarding technological capability, many works did not provide empirical evidence for how technological capability affects financial performance. Besides, very few researchers studied the technology-intensive semiconductor industry.

Coomb and Bierly (2006) analyzed the effect of technological capability on financial performance [

5]. The index represents technological capability, which consists of technology strength, science linkage, science strength, technology cycle time, current impact index, research and development (R&D) intensity, and patents. Many other researches also reviewed technological capability.

Technological capability is an intangible asset that cannot be easily copied by competitors when viewed from a firm’s resource-based view (RBV) aspect [

5,

6,

7,

8,

9]. Technological capability is especially important for the technology-intensive firm. In previous researches, however, since the technological capability is viewed as a firm’s internal resource, only a few researches were conducted to analyze the impact of technological capability on financial performance. Therefore, in this paper, we investigate how technological capability specifically affects financial performance. Since there is little research on the topic, this study contributes to management strategy literature.

We chose the semiconductor industry because of its technology intensiveness, and because it more clearly reflects the effects of technology than do other technology-intensive industries [

10]. In addition, we selected only pure semiconductor firms that do not run the business on other electronics areas so that technological capability coming from outside semiconductors can be excluded. As a result, technological capability’s effect on financial performance can be efficiently searched by investigating semiconductor firms [

11].

Semiconductor firms can be classified into sectors such as integrated device manufacturer (IDM), fabless semiconductor firm, electronic design automation (EDA), and assay and test firm, and each sector has its distinctions. In this paper, we only considered IDM and fabless semiconductor firms so that the research area can be limited to those with similar technological characteristics.

Financial performance is the most important factor for a firm’s growth and survival. To achieve great financial performance, a firm must possess great technological capability to continue with its competitive advantage [

10]. Therefore, this research analyzes technological capability, which is important for semiconductor firms’ financial performance. In this research, the impact on financial performance of technological capability such as R&D investment or patents will be investigated.

The research question of this paper is about the factors and effects of the technological capability of semiconductor firms on financial performance. Based on the literature review, we verify the usefulness of technological capability and its variable effects in technological capability depending on technological efficiency and technological assets.

To analyze the effects of technological capability on financial performance, we used financial data of 92 semiconductor firms from 2012 to 2016 and 87,627 patents from 2005 to 2014.

The rest of the paper consists of the following. In

Section 2, literature is reviewed regarding technological capability, financial performance, and the semiconductor industry, and hypotheses are made based on the review. In

Section 3, detailed variables that consist of technological capability and financial performance are determined, and correlation and regression analyses are modeled. In

Section 4, the correlation and regression analyses are conducted, and analysis results are provided. In

Section 5, analysis results are summarized and explained. Lastly, in

Section 6, the conclusion is given, and we describe the academic and managerial contributions of this paper. We also suggest the strategic operation direction of technological capability.

2. Literature Review and Hypotheses

The semiconductor industry is dominated by technology-oriented innovation models. Currently, new applications such as artificial intelligence (AI), 5G wireless communication, and autonomous driving are emerging, and to change the market for these new applications, cutting-edge technologies are changing the semiconductor markets. In addition to making semiconductors’ level of integration higher, these new semiconductors are applied with the newest technologies such as new function, high speed, low power, microscopic process, and software to acquire technological advantage and cost advantage. Through such methods, firms can achieve higher financial performance [

12]. Because technological capability is critical in the middle and long terms as well as in the short term, continuous research and development is critical, which requires taking into account customers’ needs when developing new products. These aspects must be achieved with short development periods, effective resource management, and successful technology development, which makes management and innovation also critical for technological capability. We used this paper’s literature review to establish independent variables for testing hypotheses related to the varying impact of a semiconductor firm’s technological capability on its financial performance.

2.1. Financial Performance

Previous research has measured firm performance in the context of financial performance, success and failure, efficiency, and market share [

13]. Generally, financial performance is the most important factor for a firm’s survival [

14]. High financial performance is the main objective of business organizations [

15], and we used it as a dependent variable for this research because it can be clearly analyzed based on specific measurements such as revenue, market capitalization, and profitability.

Many literatures have treated revenue as a measurement for financial performance. For example, in Eggert et al. (2014), multiple industries’ performances are measured with revenue [

16]. Chung et al. (2019) analyzed the impact of firm age, firm size, and innovation factors on revenue growth for the upper quantile and lower quantile in the pharmaceutical industry [

17]. Many other literatures applied revenue as a dependent variable. However, the results did not always yield positive effects on multiple independent variables. This research used revenue as an important variable that is used to measure financial performance.

Market capitalization is also considered an important variable to represent financial performance as well as the revenue [

18]. However, due to the volatility of the stock market, short-term fluctuation compared to the revenue could be high. Also, if market capitalization is used in the dependent variable, asset value is often considered as a control variable since market capitalization would increase as the size of asset values goes up. Meanwhile, IDM and fabless semiconductor firms have different asset characteristics. IDM has fabrication but fabless semiconductor firms do not so asset structure is very different. This makes it difficult to compare directly those two sectors. Therefore, the analysis with the market capitalization as an explained variable is reviewed as a complement of our study using the revenue as a dependent variable.

2.2. Financial Input

Every year, firms plan and execute an adequate amount of financial input according to the budget. Based on this, firms can achieve targeted financial performance. This is also applied to many other previous research works. Recently, Zhong et al. (2017) studied the effect of financial input on financial performance, which includes revenue [

19]. Financial input plays role in growing semiconductor firms’ financial performance. Therefore, financial input is selected as an input variable [

20]. In the semiconductor industry, of the financial inputs, the cost is the factor that hugely affects a firm’s financial performance [

21].

2.3. Firm-Specific Factor

The resource is a necessity for a firm’s management and growth. The examples include human resources, firm age, and employees. These are the basic resources needed to operate a firm. Many works in the literature assert the importance of the strategic approach to these basic resources. By contrast, a firm’s basic resources might not have a large effect on a firm’s growth. Saridakis et al. (2018) analyzed the effect of a firm-specific factor on revenue, where firm age is used as the firm-specific factor [

22]. Also, Yasuda (2005) studied the effect of employees on a firm’s growth [

23]. Therefore, we considered firm-specific factor as an input variable.

2.4. Technological Capability

In the core competency theory, Prahalad and Hamel (1990) claimed that firms can gain and maintain continuous competitive advantages when they acquire differentiated capabilities that are hard for the competitors to copy based on the firm’s operational resources and core competencies [

24]. At a later date, regarding such operational resources and core capabilities, Barney (1991) claimed that a firm’s resources consist of an asset, ability, management system, and information, which are controlled by the firm, and the researcher also claimed that efficient management of resources is important [

7]. For such capabilities, the importance of dynamic capability is presented by Teece et al. (1997) [

25]. For a technology-intensive firm, technological capability is the core capability needed to produce products. Technological capability is an intangible capability, and other competitors cannot easily imitate technology [

5]. Currently, the semiconductor industry is the highest technology industry, making technological capability even more important compared to other industries. Many researches proved that technological capability is the core factor in reaching financial performance for technology-intensive firms [

18].

The recent semiconductor market is changing into a market that requires a variety of sophisticated technologies. For example, there are AI technology, big data technology, 5G wireless communication technology, internet of things (IoT) technology, autonomous driving technology [

26]. In particular, AI technology is expected to have a significant impact on the entire industry worldwide [

27,

28]. As semiconductor firms would research AI technology, the direction of investment in R&D by semiconductor firms will be expanded and speed up. As a result, the technological capability of semiconductor firms will be upgraded. For example, the development of the neural processing unit (NPU) and graphic processing unit (GPU) with AI technology will create a market for autonomous cars [

29]. Therefore, the market requires firms to grow their technological capabilities in a short period of time. As a result, the new strategy for technological capability is to acquire and continue with comparative advantages [

30]. Also, since R&D does not always succeed, it is very important to reach targets efficiently. Therefore, this paper defines technological capability with technological asset [

31], technological strategies [

25,

32], and technological efficiency [

33].

2.4.1. Technology Strategy (Technological Intensity and Technological Diversity)

The technological strategy is to keep technology management and innovation, which helps to acquire a competitive position with a limited technological asset for technology-intensive firms [

25]. Based on such a technological strategy, a firm can develop technological asset’s effectiveness and efficiency, which is the basis for providing competitive products to customers to reach outstanding financial performance.

This paper regards technological strategy as a factor of technological capability. Also, the technological strategy is classified into technological intensity and technological diversity for the analysis. Technological intensity shows how much the accumulated technology has influence and whether or not a firm possesses core technologies [

34]. Technological diversity shows the range included by a firm’s technologies [

35].

In general, it is difficult to measure a firm’s technological strategy quantitatively, since only the firm’s strategy managers can measure it with limited objectivity. Thus, the patent is selected since it can be measured quantitatively [

36]. Many previous works in the literature included patents as a part of technological capability to analyze the relationship with the financial performance [

37].

Since a technology-intensive firm’s patents clearly show the firm’s technology quality and quantity, patents possessed by a technology-intensive firm are valuable from the firm’s technological strategy aspect.

In much of the literature, the application of patents is classified into more than two methods. The first is regarding offensive patent strategy that is focused on protecting and commercializing patents, which is the result of technology innovation. By contrast, the second method regards defensive strategy that is focused on creating indirect profit through technology licensing, prevention of the technology for competitors’ uses, and creating market entry barriers [

38]. However, to achieve the result of technology innovation through protection and competitive advantage compared to competitors, both methods require selective R&D between technology diversity and technology intensity under limited resources and time. Therefore, the relationship between the two methods requires conflicting decisions regarding the use of resources.

If the technological intensity is viewed as important, the scope of technology is relatively narrow, thus weakening the scalability of protection of the patent rights. Also, such a view increases technology competitiveness but decreases usability. However, acquiring a technological competitive advantage can bring a positive effect on financial performance [

39,

40,

41].

If technological diversity is viewed as important, the scope of technology is enlarged. However, a firm’s resources are diffused, which is a concern that may lower the quality of technology and innovation. Since it is possible to acquire efficiency between resources and to create innovation in new areas, technological diversity may bring a positive effect to financial performance [

37,

42,

43].

Moorth and Polley (2010) claimed that sales growth, which is similar to revenue, is affected positively by technological intensity [

35]. It is predicted that technological intensity also brings positive effects to revenue in the semiconductor industry. The semiconductor industry has been reaching outstanding performance by developing new technologies and products based on technological intensity. Therefore, it is predicted that technological intensity affects financial performance positively in the semiconductor industry.

Kim et al. (2016) studied the effects of technological diversity on revenue [

44]. Therefore, this paper assumes that technological diversity brings a positive effect on financial performance for the semiconductor industry.

2.4.2. Technological Asset

The technological asset represents a quantitative aspect of technology that contributes to a firm’s value, which includes R&D, investment, production know-how, and the possession of industry standards [

45]. Protection and application of technological asset is an important factor that differentiates firms. Technological asset acts as a firm’s driving force for technology innovation.

Moorthy and Polley (2010) claimed that R&D investment, which is included in the technological asset, brings positive effects to revenue [

35]. However, some researches claim that the technological asset does not affect financial performance [

5]. So far, the impact of R&D investment on financial performance has not been clearly considered [

46]. In general, the more a semiconductor firm possesses technological asset, the more successful it is to develop a new product and sell the product. Based on this phenomenon, the technological asset is predicted to affect revenue positively.

2.4.3. Technological Efficiency

Technological efficiency reflects a firm’s success rate on R&D and new product development project [

47]. The modern technology-intensive firm is under severe competition. Therefore, technology innovation happens fast. Also, since technological complexity is increasing, it is difficult to acquire new products or technology. As a result, even if a firm possesses abundant technological assets, it is difficult to acquire competitive advantage with low technological efficiency. Limited technological assets may provide great revenue if technological efficiency is high [

48]. However, in some literature, researchers claim that technological invention has no positive effect on firm size. Based on this, it can be inferred that technological assets and technological efficiency do not impact financial performance much [

49]. However, in general, semiconductor firms’ technological efficiency provides a competitive advantage, making the firms better at competition against other firms, which positively affects a firm’s growth in revenue.

Hypothesis 1 (H1). The technological capability has a positive effect on financial performance.

2.4.4. Differentiated Effect of Technological Assets and Efficiency

In addition to the research regarding technological capability, this paper provides additional analysis about the effects of technological capability on financial performance by classifying technological assets and technological efficiency. Previous researches focused on the result of technological efficiency based on technological asset [

50,

51]. Recently, research results suggest that technological efficiency positively affects financial performance, where the research combined the two factors into a single variable, which usually is referred to as technological asset [

52] or technological efficiency [

53]. For modern technology-intensive firms, both the technological assets and technological efficiency are becoming important [

54]. However, only a few research works analyzed how technological assets and technological efficiency together affect financial performance [

55].

Considering both the technological assets and technological efficiency are very important because even if a lot of technological assets are invested, if technological efficiency is low, then high technological capability cannot be achieved, which means that high financial performance cannot be achieved. Also, even with limited technological assets, if excellent technological efficiency is possessed, then great financial performance can be achieved.

The more technological assets a firm holds, the more competitive it is for the firm to develop core technology based on the abundant technological asset. Also, if successful, then a firm can acquire a high level of competitive advantage, which allows the firm to achieve superb financial performance [

56]. Therefore, if the technological asset is large, it is important to research the most core and difficult part. If the technological asset is high, then it is expected that increasing technological intensity is effective in financial performance. If the technological asset is low, then it is disadvantageous to develop a high-level of core technology. Therefore, by researching derivative technology, a firm can possess a small competitive advantage from various aspects. A firm with low technological assets may achieve positive financial performance with various small competitive advantages. Therefore, it is expected that increasing technological diversity will be effective in terms of financial performance for firms with low technological assets [

43].

If technological efficiency is high, then a firm is viewed to possess enough technological innovation, meaning the firm has the potential to succeed from multiple aspects, thus making it possible to achieve excellent technological capability by conducting R&D on multiple fields [

57]. Therefore, it is expected that increasing technological diversity is effective for financial performance if a firm possesses high technological efficiency. By contrast, a firm with low technological efficiency does not possess technological innovation, thus the firm’s competitive advantage is not enough, meaning that it is difficult to achieve good financial performance. Therefore, a firm with low technological efficiency does not have room to pursue technological diversity. A firm with low technological efficiency needs to focus on a specific field. Therefore, it is expected that increasing technological intensity is effective for financial performance for firms with low technological efficiency.

The definitions of variables and relevant references are summarized in

Appendix A.

Aside from the research that showed the positive effects of technological intensity and technological diversity on financial performance based on technological assets and technological efficiency, there also were studies that claimed either no effects or negative effects on financial performance. Thus, there is no clear managerial or academic conclusion in the semiconductor industry [

37]. Therefore, it is meaningful to analyze how technological intensity and technological diversity affect financial performance based on the technological assets’ and technological efficiency’s industry-level [

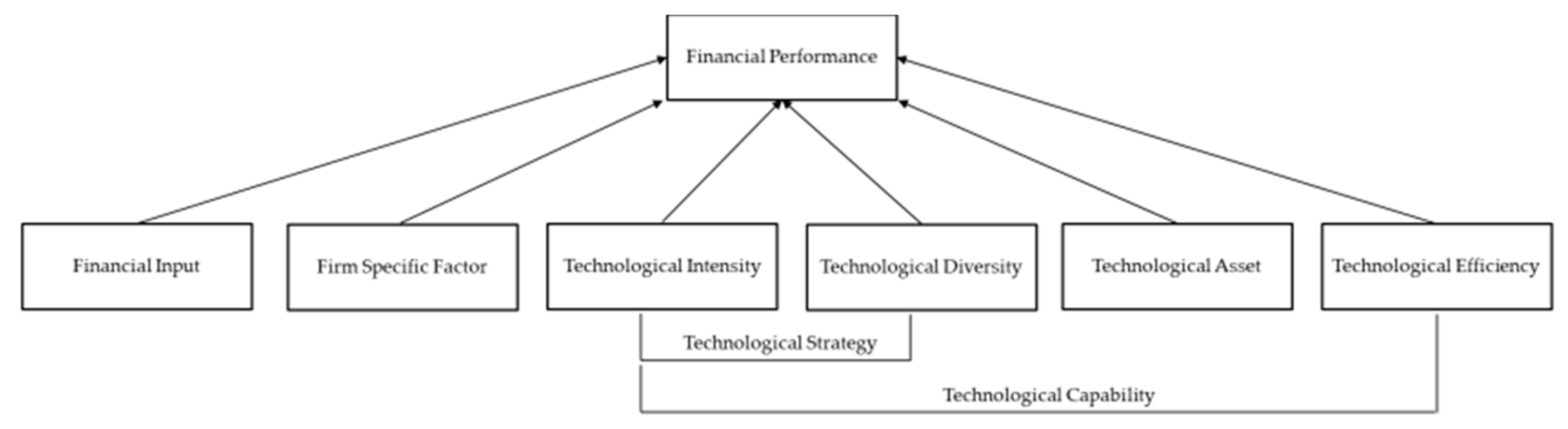

37]. The research model for this study is shown in

Figure 1 and, we derived the following hypotheses from the literature findings:

Hypothesis 2a (H2a). In a group with high technological assets, the technological intensity has a more positive effect on financial performance.

Hypothesis 2b (H2b). In a group with low technological assets, the technological diversity has a more positive effect on financial performance.

Hypothesis 3a (H3a). In a group with high technological efficiency, the technological diversity has a more positive effect on financial performance.

Hypothesis 3b (H3b). In a group with low technological efficiency, the technological intensity has a more positive effect on financial performance.

3. Data and Methods

3.1. Research Design

For research of this kind, there largely exist three methods, which are regression analysis, data envelopment analysis (DEA), and structural equation modeling (SEM). Structural equation modeling is an adequate method used to analyze the effects of independent variables and parameters when dependent variables, parameters, and independent variables are included. Regression analysis and DEA are adequate methods used to analyze the effects of independent variables when only dependent and independent variables are included.

Many of the works in previous literature utilized DEA [

58]. DEA is an adequate method to measure efficiency and to analyze factors that affect efficiency. However, if it is difficult to eliminate factors that bring inefficiency, then regression analysis is the better predictor of future performance [

59]. Since this research is not about eliminating factors that bring inefficiency to independent variables, regression analysis is the better method.

To analyze the effects of independent variables on dependent variables, this research utilizes regression analysis. Also, to verify the legitimacy of effects among the variables, correlation analysis and variable inflation factor (VIF) are conducted.

Also, this research limited the scope to a cross-sectional analysis. However, the time interval is added in between independent and dependent variables to focus on the verification of cause and effect.

3.2. Data

Semiconductor firm data is gathered from the Global Semiconductor Alliance. GSA analyzes and provides market insight, technology insight, and financial data for global semiconductor firms. Thus, GSA provides exact data regarding market and technology trends [

60]. This research selected firms specializing in semiconductors, and a total of 92 semiconductor firms (51 fabless semiconductor firms and 41 IDMs) were selected. The firms were selected because every financial data is available from 2012 to 2016.

Financial data used in this paper were collected from 2012 to 2016. Three years of moving averages were applied to financial data to minimize yearly data noise and outlier [

61]. For financial performance data, which are output, average data from 2014 to 2016 were used. For financial input, which is an input, average data from 2013 to 2015 were used, and a time lag of one year was applied. For technological assets, which are another input, average data from 2012 to 2014 were used, and a time lag of two years was applied. Academically, in general, 2 years of time lag were applied between financial performance and R&D investment [

62].

Patents applied to the US are used in this research because it is assumed that semiconductor firms competing in the US market, which is the world’s largest market, can continue in their businesses by acquiring a technological competitive advantage [

63]. Patent data used are collected from January 2005 to December 2014 based on the patent filing date. During this period, mobile phones were developed, and smartphones emerged. Also, as telecommunication technology developed, the world progressed from 2G wireless communication to 5G wireless communication. Moreover, vehicles were electrified, which hugely increased the demand for semiconductors. All of these changes quickly developed and advanced semiconductor technology. Based on such trends, it is logical to use data from the past 10 years to verify each firm’s technological capability [

64]. Patent data were collected from Wisdomain. Wisdomain is one of the largest patent-related agencies and has a high reputation in Korea [

65].

3.3. Variables

3.3.1. Financial Performance

In this research, as a variable for financial performance, revenue was selected. In previous literatures, revenue was often used as a dependent variable, and it is an adequate choice since, in general, mid-to-long-term variability is small. Eggert et al. (2014) studied which service strategies can achieve excellent financial performance by applying revenue as a variable for financial performance [

16]. Revenue data is averaged from 2014 to 2016 before being applied. Log and z-score are used for normalization.

Additionally, market capitalization was applied as a financial performance. We compared this result with the one using the revenue as a financial performance. Market capitalization was widely used in other researches [

18]. Market capitalization data is averaged from 2014 to 2016 before being applied. Log and z-score were used for normalization.

3.3.2. Financial Input

Financial input refers to the cost needed to operate a business from designing a product to producing and selling the product. Therefore, in this paper, total liabilities, selling, general and administrative expenses, and cost were selected. In previous literatures, total liabilities were important for a firm’s capital structure, and they were also viewed as factors that affect financial performance [

66]. Also, general and administrative expenses are researched as factors that affect financial performance [

67]. Cost is another important factor that affects a firm’s financial performance [

10]. If the cost is low, then a firm can either invest more in R&D or increase its production to achieve better financial performance. Data were averaged from 2013 to 2015 before being applied. The data were divided by revenue, and log and z-score are applied for normalization.

3.3.3. Firm-Specific Factor

Firm-specific factor refers to basic resources that every firm possesses. The firm-specific factor is selected since it does not have technological attributes. In this paper, employees are selected as a variable. In previous researches, the effect of employees on financial performance is studied [

23]. However, in this research, instead of viewing employees as firm size, employees are viewed as a basic resource to analyze firm-specific factor. The data from 2015 were used in this study. Employees were calculated by first dividing the number of employees by revenue and then normalizing with log and z-score.

3.3.4. Technological Intensity

Patents, to protect or commercialize technologies, must be separately filed at a large fee. Therefore, a patent must include technological impact. The importance of patent impact is defined as technological intensity [

34]. In this research, the patent h-index is selected as a variable that measures technological intensity.

As a quantitative measurement for technological intensity, the h-index is used in previous literature [

68]. Guan and Gao (2009) claimed that the patent h-index affects financial performance [

69]. Also, as a long-term variable, the patent h-index could be weak at reflecting trends. However, since patent h-index increases as technologies go near core technologies, patent h-index is useful for the analysis. In this research, the patent h-index is used to calculate patent citation counts for each firm [

57,

69,

70]. Patents from 2005 to 2014 are used. Log and z-score are applied for normalization.

3.3.5. Technological Diversity

Under the assumption that most of the technologies a firm possesses are filed as patents, technology-intensive firms protect their technologies through patents, and by using patents, firms try to increase financial performance by expanding technological areas, thus expending technological influence. Therefore, the scope of the patent is important, so it is chosen as a quantitative measurement [

36,

71]. The patent strategy differs from firm to firm. For example, some firms tend to file multiple patents for their inventions, but some firms tend to file a single patent for all of their inventions. To counter this situation, a firm’s technological diversity is measured quantitatively. Firms prefer incremental innovation, which increases performance and service based on the technologies a firm possesses by maximizing resource usage efficiency and minimizing path-dependent risk-taking.

In this research, the patent family is used to representing technological diversity. Due to the territorial principle characteristic of patents, even though technology may be the same invention, to commercialize or protect the technology in the country where the business is run, patents must be filed even at a large cost. Such an act is viewed as expanding the rights of technology. Filing patents to other countries are referred to as a patent family [

72]. A patent family is the concept included in technological diversity [

73,

74]. In this research, patents from 2005 to 2014 were used, and log and z-score are applied to the number of patent families for normalization.

3.3.6. Technological Asset

According to absorption capacity theory, the knowledge accumulated in a firm corresponds to the firm’s R&D investment and absorption capacity. From such an aspect, R&D investment is an important factor. Therefore, this paper selected the rate of R&D investment as a variable for technological assets [

75]. The rate of R&D investment is measured by dividing R&D investment by revenue [

5,

76].

According to Schumpeter’s theory, since larger firms have abundant resources, their technological capability, which helps innovation, is superb. By contrast, some researchers claim that newer and smaller firms have the technological capability that allows the firms to achieve innovation efficiently since they are better at adapting to environmental changes and are less prone to bureaucracy. This suggests that the size of technological capability brings both positive and negative effects. Therefore, it is appropriate to analyze technological capability’s technological asset with the rate of R&D investment [

77].

The data for the rate of R&D investment is the average of the data from 2012 to 2014, and it is normalized by applying log and z-score.

3.3.7. Technological Efficiency

In this paper, the concept of technological efficiency is explained by the success rate of the firm’s R&D and new product development project [

47]. To extend this concept, the success rate of patents was examined, and the ratio of granted patents was selected, which is the ratio of registered patents out of all the filed patents from a firm [

78]. This method was also applied to recent research [

79]. Patents are from 2005 to 2014, and log and z-score are used for normalization.

3.3.8. Differentiated Effect of Technological Asset and Efficiency

In this paper, the technological asset is represented by the rate of R&D investment, which is a quantitative measure, and technological efficiency is represented by the ratio of granted patents, which is a qualitative measure. To analyze the differentiated effect for each technological asset and technological efficiency, 92 firms were divided and grouped into two groups, each with 46 firms, based on the median value. With these sub-groups, the effect of technological intensity and technological diversity on financial performance was analyzed, and the difference between the two factors was analyzed [

80].

3.4. Measures

Before we conducted the regression analysis, we performed conduct correlation analysis and VIF [

81] and checked multicollinearity among the variables based on the analysis results.

Based on the variables finalized as independent variables from the results of correlation analysis, regression analysis was conducted. Since there are multiple independent variables, multiple regression is applied.

Table 1 defines each variable and Equation (1) shows the research formula [

81].

Normally, linear regression analysis is applied to analyze the relationship between financial performance and technological capability. Also, regression analysis is conducted for each of the high group and low group of technological asset and technological efficiency to assess the effect of technological intensity and technological diversity on financial performance.

We test the assumption of the linearity of the model and residual satisfy normality, independence, and homoscedasticity.

4. Results

Table 2 shows the results of correlation analysis and VIF. The results revealed that the correlation between the independent variables is not high.

Regression analysis is conducted.

Table 3,

Table 4 and

Table 5 show the results of the regression analysis for the research hypothesis.

Table 3 shows the result of Hypothesis 1, which is the analysis of the effect of technological capability on financial performance in the semiconductor industry. Financial performance is used as a dependent variable, and technological intensity, technological diversity, technological asset, and technological efficiency are used as independent variables. Financial performance is measured with revenue, technological intensity is measured with patent h-index, technological diversity is measured with patent family, the technological asset is measured with the rate of R&D investment, and technological efficiency is measured with the ratio of granted patents. Technological intensity is estimated at 0.190, which is significant. Technological diversity is estimated at 0.494, which is significant. The technological asset is measured as −0.365, which is significant. Technological efficiency is measured as 0.029, which is insignificant. The results showed that technological intensity and technological diversity has a positive effect on financial performance, but the technological asset has a negative effect on financial performance. Technological efficiency showed no statistical significance in affecting financial performance. Also, technological asset and technological efficiency are divided into sub-groups to analyze financial performance through technological intensity and technological diversity.

Table 4 shows the result of Hypothesis 2. Regression analysis is carried out for high and low technological asset groups in the semiconductor industry.

First, the result of the high technological asset group is summarized. Technological intensity is estimated at 0.221, which is significant. Technological diversity is estimated at 0.445, which is significant. The technological asset is estimated as −0.333, which is insignificant. Technological efficiency is estimated as −0.112, which is insignificant. Also, the result of the low technological asset group is summarized. Technological intensity is measured as 0.131, which is insignificant. Technological diversity is estimated at 0.526, which is significant. The technological asset is estimated as −0.485, which is significant. Technological efficiency is estimated at 0.070, which is significant. Therefore, as technological asset increases from low to high, it can be seen that technological intensity increases. Thus, Hypothesis 2a is accepted. Also, when technological asset decreases from high to low, technological diversity increases. Thus, Hypothesis 2b is accepted.

Table 5 shows the result of Hypothesis 3. Regression analysis is carried out for high and low technological efficiency groups in the semiconductor industry.

First, the result of the high technological efficiency group is summarized. Technological intensity is estimated at 0.212, which is significant. Technological diversity is estimated at 0.464, which is significant. The technological asset is estimated as –0.339, which is significant. Technological efficiency is estimated at 0.382, which is insignificant. Also, the result of the low technological efficiency group is summarized. Technological intensity is measured as 0.171, which is insignificant. Technological diversity is estimated at 0.489, which is significant. The technological asset is estimated as –0.340, which is significant. Technological efficiency is estimated at 0.031, which is insignificant. Therefore, as technological efficiency increases from low to high, no significant changes were observed for technological diversity. Thus, Hypothesis 3a is rejected. Also, as technological efficiency decreases from high to low, technological intensity was insignificant. Thus, Hypothesis 3b is also rejected.

Appendix B (

Table A1,

Table A2 and

Table A3) show the results of the additional analysis. This result is similar to the regression analysis result with the revenue as a dependent variable. However, the estimates of technological intensity for both high and low technological efficiency group are statistically significant and the estimates increase from 0.214 for the high technological efficiency group to 0.337 for low technological efficiency group. The analysis shows the difference from the result with revenue as a dependent variable. When we use revenue as a dependent variable, for the group with low technological efficiency the impact of technological intensity on the financial performance was statistically insignificant.

5. Discussion

Historically, semiconductor firms have continuously outsourced or gone through spin-offs or mergers and acquisitions (M&A) to maintain their core technologies. The spectrum of core technology can either be wide or narrow, and its complexity can also be either high or low. Therefore, semiconductor firms are strategically making choices regarding core technologies [

21]. The fact is that every semiconductor firms are focused on the core technologies they chose. Also, characteristics differ for each semiconductor firm. As a result, although a patent can become a technology innovation output, it does not necessarily guarantee financial success [

76].

The results of this research showed that technological capability affected financial performance differently in the semiconductor industry. Technological intensity affected financial performance positively. This shows that, in the semiconductor industry, when a complex core technology is developed, a firm can achieve a competitive advantage and acquire excellent financial performance. Also, the result showed that technological diversity affected financial performance positively. In the semiconductor industry, based on the technologies that are developed previously, diversification can be achieved through the patent family, which allows firms to acquire a competitive advantage and superb financial performance. The technological asset has a negative effect on financial performance. In the semiconductor industry, R&D is shown as a cost, which does not directly give positive effects in two years. However, based on technological intensity and technological diversity, the competitive product allows firms to achieve excellent financial performance. Technological efficiency did not show statistical significance. However, when the positive effect given by technological intensity and technological diversity is considered, it can be indirectly inferred that technological efficiency also has effects because if a firm does not possess a patent due to its low technological efficiency, then it cannot be measured with technological intensity and technological diversity. So, this paper carried out the analysis on the sub-groups for technological asset and technological efficiency.

We drew the following specific conclusions:

First, compared with the low technological asset group, the high technological asset group is more effective in increasing financial performance through technological intensity. Firms in high technological asset group possess a high rate of R&D investment. High technological intensity means that a firm must invest a high ratio of money to develop core technologies, which usually are complex and difficult. This can be interpreted in a way that a firm is trying to develop technologies in-depth so that it can acquire a competitive advantage by increasing entry barriers [

37]. For example, it may be the development of 5G wireless communication, DisplayPort (DP), or HDMI (High Definition Multimedia Interface) interfaces that are not supported by older products.

Second, compared with the high technological asset group, the low technological asset group is more effective in increasing financial performance through technological diversity. Firms in the low technological asset group have a low rate of R&D investment. High technological diversity means that a firm tries to increase its competitive advantage by acquiring new markets by expanding its patent family for its core technologies. For example, it may be running the business in multiple nations by registering the firm’s patents to multiple countries.

Third, compared with the low technological efficiency group, the high technological efficiency group did not show a significant difference in increasing financial performance through technological diversity. There is no difference between the groups because both high and low technological efficiency groups are already making good use of the patent family. This confirms that both firms with a high and low ratio of a granted patent, which is technological efficiency, should focus on patent family, which is technological diversity, to increase financial performance. Since semiconductor firms generally run a global business, it is essential to carry out the patent family.

Fourth, compared with the high technological efficiency group, the low technological efficiency group did not show statistically significant effects of technological intensity on financial performance. The low technological efficiency group includes firms with low patent productivity. The analysis result statistically implies that the low technological efficiency group does not have a positive effect on financial performance when investing in in-depth technology. On the contrary, firms in high technological efficiency group showed an increase in financial performance through technological intensity. This implies that firms with high technological efficiency, which are the firms with a high ratio of granted patent, have superb technology innovation output, meaning that these firms possess the excellent capability to develop core technologies that are difficult to develop.

Lastly, the difference is that the impact of technological intensity on financial performance is statistically significant and the estimated value is also increased for the group with low technological efficiency. When we use revenue as a dependent variable, the impact of technological intensity on the financial performance was statistically insignificant. We assume that the difference of the result comes from the characteristic of market capitalization which reflects the expected future value as well as current revenue.

6. Conclusions

In this paper, we conducted a number of experiments to draw conclusions from our overall analysis results. First of all, we analyzed a semiconductor firm’s technological capability which we analyzed with technological intensity, technological diversity, technological asset, and technological efficiency. Patent h-index was used for technological intensity, and it was found that technological intensity positively affects financial performance. Also, for technological diversity, the patent family was used, and it was found that technological diversity affects financial performance positively. By contrast, technological assets, where the rate of R&D investment was used, have a negative effect on financial performance. For technological efficiency, the ratio of granted patent was applied, but the effect on financial performance was not statistically significant. In addition, to analyze how technological asset and technological efficiency affect financial performance through technological intensity and technological diversity, technological asset and technological efficiency were divided into sub-groups for the analysis.

Second, when the technological asset was divided into sub-groups, firms in the high group had more effect on financial performance through technological intensity when compared to firms in the low group, whereas firms in the low group had more effect on financial performance through technological diversity when compared to firms in the high group. Based on this, the role of technological asset as a moderator variable is confirmed.

Third, when technological efficiency was divided into sub-groups, both firms in the high group and low group had an effect on financial performance through technological diversity, but the difference between the groups was negligible. Only the firms in the high group showed the positive effect of technological intensity on financial performance. When technological efficiency was low, there was no statistical significance of technological intensity on financial performance. On the other hand, when market capitalization was used as financial performance, the impact of technological intensity on financial performance was statistically significant and the estimated value also increased for the group with low technological efficiency.

Unlike previous literature, this research proposed the moderator effect in the semiconductor industry from two aspects, which were the technological asset and technological efficiency. Compared to previous researches about the impact of technological intensity and technological diversity based on the technological asset or the effect of technological efficiency on financial performance, this paper took a step further for the research. Also, the research results are empirically provided by analyzing financial data of massive semiconductor firms and patents.

In this paper, the effect of technological capability on financial performance was analyzed for semiconductor firms. However, this research has limitations in that only the semiconductor industry was analyzed. Future analysis of both semiconductor and set production firms may provide more robust findings. Also, if other industries are analyzed and a comparison with the semiconductor industry is undertaken, this would provide academic insights.