Abstract

People’s acceptance of technological changes has escalated with time. However, the acceptance and adoption of fintech services hiked after the outbreak of the virulent coronavirus. With this breakout, the adoption of mobile fintech services (MFS) increased among general citizens and business sectors around the world, including in developed, emerging, and developing economies. This study aimed to identify the factors that impact the adoption intention of consumers to embrace and enhance the use of mobile fintech services in an emerging market, Bangladesh. A research model was developed to strengthen the objective of this paper. A total of 218 respondents responded to the questionnaire. The study utilized structural equation modeling to analyze the results in SmartPLS software. The results showed significant positive effects of social influence, trust, perceived benefit, and facilitating conditions on the adoption intention towards MFS. Mobile fintech service providers must keep their users’ needs and literacy rates in mind when designing the user interface (UI). Moreover, they should also cater more efficient services to the users and work based on the feedback received. The customers’ satisfaction will ultimately lead to customers conducting more digital transactions and will contribute to the escalation of fintech transactions, resulting in more financial inclusion.

1. Introduction

The modernization of financial transaction systems has increased the velocity of monetary transactions, resulting in knock-on effects, and leading to the growth of economies. Emerging economies, especially, have experienced significant progress as digitalization has evolved the ways in which people conducted fintech transactions. For Bangladesh’s low and middle income, mobile fintech services (MFS) have proved to be the most convenient and cost-efficient [1]. Mobile fintech services are an e-money services where the funds of the person with a mobile account are recorded on an electronic general ledger. The transactions are made either from the mobile phone or via a digital process to ensure their authenticity [2]. The foundation of Mobile Fintech Services established in 2011 by Bangladesh Bank, the central bank of Bangladesh, vigorously grew the number of account holders and the volume of transactions [2]. In 2013, the number of registered accounts for mobile fintech services rose faster than in any other country [3]. The average daily transactions increased by 3.08% from December 2021 to January 2022 [4]. The current 13 MFS providers, which are licensed scheduled banks and financial institutions, provide a range category of services, such as sending money, paying bills, cashing out, making payments to merchants, salary disbursement, and many other services. With the growth of mobile phone subscribers to 178.61 million as of August 2021, there is prodigious opportunity for mobile fintech service providers [5]. To continue the growth rate of mobile fintech service adoption, it is very crucial for the MFS providers to understand what motivates the users in Bangladesh to adopt mobile fintech services.

In Bangladesh, several studies on specific mobile payment systems have already been conducted. However, in most cases, the unified theory of acceptance and use of technology (UTAUT) [6,7] model has been incorporated to assess the behavioral intention to use mobile banking [8]. In other research, the technology acceptance model (TAM) [9,10] has been used by combining risk and trust [11]. However, rare studies have been launched using an extended valence framework [12], suggesting a research gap. The extended valence framework incorporates three important variables—trust, perceived benefit, and perceived risk. These variables are found to have a strong impact on the behavioral intention to use [12,13]. Nevertheless, unlike other popular theories of technology adoption such as UTAUT, TAM does not consider variables such as trust and risk. Therefore, this study will suggest a new research framework to address the research gaps by utilizing EVF and UTAUT models and will propose a new research framework.

The objective of the study is to identify the drivers that influence the intention of Bangladeshi people to adopt mobile fintech services to perform transactions. Previous studies used different models to examine the underlying intention relating to the adoption of mobile payment services [14]. The significance of this paper is the new research framework combining (i) the unified theory of acceptance and use of technology (UTAUT) and (ii) an extended valence framework to explain the adoption intention towards mobile fintech services. In addition, the results of these findings will assist the MFS providers in understanding the consumers’ intention and responding accordingly. Thus, it will allow fintech companies to flourish in this field through obtaining an increased market share and to contribute to the boom of the fintech sector and the digitalization of services in the country.

The rest of the paper is organized into the following sections. Section 2 includes a literature review, research framework, and hypotheses development. Section 3 outlines the methodology followed by the findings, analysis, and discussion in Section 4. Section 5 includes the conclusions, theoretical and managerial contributions, limitations, and future research directions.

2. Literature Review

Financial technologies are some of the tremendous innovations in modern science, which attract customers through more user-friendly, transparent, efficient, and automated products and services [15]. According to Putritama [16], fintech products and services comprise asset management, financing, payments, and other fintech business models. The most popular form of fintech services that people are familiar with is mobile fintech services. Mobile fintech services are a technology that enables users to conduct financial transactions using smartphones or tablets [17,18]. Globally, the rate of fintech adoption has gone up to 64% around the world, and 96% of the consumers are informed about fintech services [19]. According to the EY Fintech adoption index, seventy-five (75) per cent of consumers use fintech services for money transfers and payments, which shows the extensive consumer adoption of fintech services [19]. Several studies have been conducted on fintech service adoption. Hasan et al. [20] evaluated the determinants of fintech adoption in the Netherlands. They concluded that trust, perceived ease of use, safety, and perceived usefulness are the dominant forces in mobile fintech adoption. In addition, Ali et al. [21] studied users’ Islamic fintech adoption in Pakistan and found that perceived risk and trust significantly impact adoption intention. Moreover, a study conducted in Indonesia found that user innovativeness directly and indirectly affects fintech adoption [22]. Vasenska et al. conducted a study in Bulgaria to determine the consumption of fintech services for financial transactions during COVID-19 [23].

The unified theory of acceptance and use of technology (UTAUT) was developed by Venkatesh et al. [6] to identify the technology adoption behavior of employees. Later, Venkatesh et al. [7] extended the model to describe the behavior of consumers toward technology adoption. The UTAUT model includes performance expectancy, social influence, effort expectancy, and facilitating conditions as the predicting variables for the behavioral intention to use and actual usage of technology. The UTAUT model has been utilized in different fields [24,25]. Hoque and Sorwar [26] developed a mobile health model. This concept was applied to home telehealth services [27]. The UTAUT model, on the other hand, is based solely on the context of organizations and does not take into account characteristics at the consumer level. Performance expectancy was found to drive the behavioral intentions or acceptability of technology in previous studies. The addition of appropriate constructs to this UTAUT model [28] can aid in the understanding of crucial phenomena linked to the use of technologies by customers in general. Alshare et al. analyzed the end-user intention to change expert systems by using a modified UTAUT model [29]. In addition, to measure the continuous adoption of an e-wallet application, a modified UTAUT2 model was utilized by incorporating trust [30]. Yohanes et al. also analyzed the enhanced user acceptance of fintech applications and revealed that effort expectancy, social influence, and facilitating conditions are strong predictors behind the fintech adoption [31]. Moreover, in a study based on a blockchain application in supply chain financing, a UTUAT model was used [11]. Even in a study on fintech adoption in small businesses, a UTUAT model was employed [32]. Furthermore, Ahmed et al. utilized an extended UTAUT model in a learning management system during COVID-19 [33]. The versatile use of UTAUT reflects the significance of the model. According to Dowdy [34], UTAUT is a casual, comprehensive model that describes and predicts technology adoption in various sectors and has been empirically validated for validity and reliability.

The extended valence framework (EVF) was developed by Kim et al. [12], which focused on technology adoption. The EVF incorporates three predicting variables: perceived trust, perceived benefit, and perceived risk. The study was conducted on electronic commerce adoption, mainly focusing on the trust-based decision-making model. The result revealed that all the factors significantly impact behavioral intention. Later, the model was utilized in different studies. Kim et al. conducted a longitudinal study using the EVF model to find successful e-commerce relationship [35]. The results showed that privacy concerns and risk are negatively related, whereas convenience and utilitarian value are positively related. In addition, in a study on the mobile application installation intention of consumers, the EVF was employed [5,36] utilized the extended valence framework to identify the factors behind mobile payment adoption. Moreover, Cui et al. integrated the valence framework and information success model to measure the seller’s acceptance of cross-border e-commerce [37]. Mou et al. utilized the valence framework to ascertain an international buyer’s repurchase decision in a Chinese cross-border e-commerce platform [38]. Furthermore, Chin et al. employed the EVF model to identify the intention of customers to adopt mobile payment systems [13].

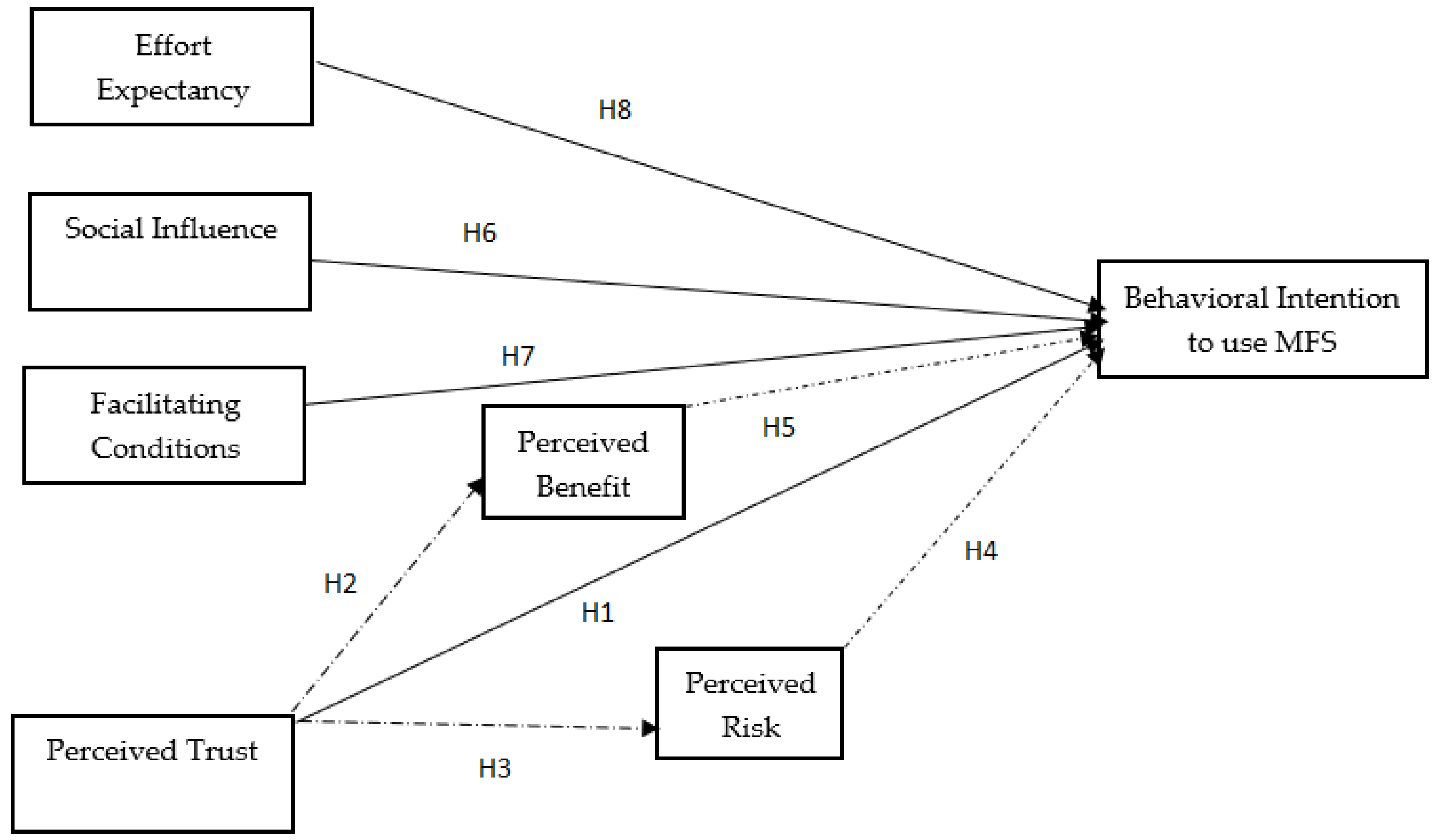

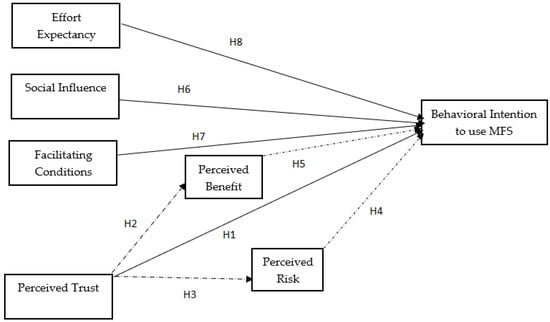

Mobile fintech services in Bangladesh are proliferating. As an emerging country in Asia, there is much scope to increase the usage of mobile fintech services, which will help increase social and financial inclusion. However, to meet the user demand, the mobile fintech providers must understand the critical factors influencing customers’ intentions to adopt a technology. Based on the previous literature and industrial requirements, this study utilizes both the extended valence framework and the UTAUT model to identify the factors influencing Bangladeshi users’ intention to adopt mobile fintech services. In addition, scant studies have been conducted on mobile fintech services, but no prior studies have utilized the extended valence framework and UTAUT model together. This study proposes the below research framework in Figure 1.

Figure 1.

Research framework.

2.1. Behavioral Intention

According to Fishbein and Ajzen [39], “A person’s subjective probability that he will undertake a behavior is termed as behavioral intention”. It can be defined as “the extent to which a person has made intentional arrangements to engage in or refrain from engaging in a specific future conduct” [40]. Customers’ adaption behavior to mobile wallet services has been studied using behavioral intention as a dependent variable in several models and theories [41,42]. This study will use the behavioral intention to use mobile fintech services as the outcome variable.

2.2. Perceived Trust

Trust is crucial in financial transactions, primarily when they are conducted using technology such as smartphones or tablets. Bisdikian et al. [43] defined trust as a situation in which one party (the trustor) is reliant on the actions of another (trustee). Perception is crucial in the client adoption of technology, such as mobile banking and mobile wallet services. Perceived trust positively impacts behavioral intention [44]. Nowadays, companies place a greater emphasis on developing good commercial connections to gain client trust. This impacts not only the behavioral intention but also the perceived risk and benefit. Customers will be less hesitant to adopt a technology if they believe in it. That is not to say that customers are not involved in dangerous technology adaptation behavior. Even in earlier studies, trust was found to have a positive relationship with perceived risk [45]. In addition, trust positively influences the perceived benefit [46]. This study suggests the following hypothesis based on the preceding discussion:

H1:

Trust has a positive influence on behavioral intention.

H2:

Trust has a positive influence on the perceived benefit.

H3:

Trust has a positive influence on the perceived risk.

2.3. Perceived Risk

Risk is a barrier to technology adoption. Risk can be a crucial element in limiting users’ adoption of mobile fintech services. Based on a study on mobile wallet adoption behavior conducted by Al-Saedi and Al-Emran [47], the risk is negatively related to the intention to adopt. Studies have even used risk as a mediating variable between trust and behavioral intention [35,48]. Based on the understanding of the literature, the following hypothesis is proposed in this study:

H4:

The perceived risk has a negative influence on behavioral intention.

2.4. Perceived Benefit

The perception of how a person will gain an advantage from using any product or service is referred to as the perceived benefit. According to Madan and Yadav [49], perception positively influences adoption intention. The study is based on a developing economy like Bangladesh, so the perceived benefit can be significant for the users to adopt mobile fintech services. In addition, a mediating role of the perceived benefit is found between trust and the behavioral intention to use [13]. The following hypothesis is proposed:

H5:

The perceived benefit has a positive influence on behavioral intention.

2.5. Social Influence

Social influence can be defined as when “the important others (family, friends) think that a person should use a certain technology” [7]. A comparative study of users and non-users’ intentions to use m-banking found that social influence is positively related to intention to use [50]. A similar result was found in the case of banking technology service adoption [51,52].

H6:

Social influence has a positive influence on behavioral intention.

2.6. Facilitating Conditions

The facilitating conditions can be defined as the consumer’s perception of having resources and support available to perform an activity [7]. According to Utaminingsih and Alianto [53], the facilitating conditions positively impact the mobile wallet adoption intention. This is a vital variable influencing mobile technology adoption [54]. To perform mobile fintech transactions, a smartphone and Internet connection are considered as the facilitating conditions. A similar positive impact was found in earlier studies [55,56,57]. For this study, the following hypothesis is proposed:

H7:

The facilitating conditions have a positive influence on behavioral intention.

2.7. Effort Expectancy

According to Venkatesh et al. [7], effort expectancy can be defined as the degree of ease the customer perceives during the use of the technology. A study on the intention to adopt direct mobile purchases using social media apps concluded that effort expectancy has a positive influence [58]. Different studies found similar results [59,60]. The following hypothesis is proposed:

H8:

Effort expectancy has a positive influence on behavioral intention.

3. Methodology

This was a cross-sectional and quantitative study. The units of analysis were the users of mobile fintech services in Dhaka city. The data were collected using purposive sampling. In addition, this research employed a deductive approach. The research framework has been developed from the UTAUT model and the EVF. A questionnaire was created based on the framework to collect the respondents’ observations. The study was carried out using an explanatory research design. This research will uncover new information about the adoption intention of mobile fintech services in Bangladesh.

3.1. Data Collection

The study used primary data. Data were gathered via a survey questionnaire. The survey was administered using Google forms. The questionnaire included the measurement constructs of users’ perceptions of trust, risk, benefit, effort expectancy, facilitating conditions, social influence, and the intention to use mobile fintech services. The survey also gathered some basic demographic information. The measurement scales were redesigned from earlier studies. The measurement instruments of risk, trust, and benefit were adapted from earlier studies conducted on mobile technology adoption [13]. Moreover, the measurement items of behavioral intention, social influence, effort expectancy, and facilitating conditions were adapted from the technology adoption literature [61,62]. All of the attitude items were evaluated using a seven-point Likert scale ranging from “strongly disagree” to “strongly agree” [63]. To assess the constructs’ reliability and validity, pilot research was conducted with 50 multi-national personnel. The average variance extracted (AVE) was more significant than 0.50, and Cronbach’s alpha was greater than 0.70. As a result, no adjustments to the measurement items were required. The survey questionnaire was distributed to university students and MNC professionals. According to Barclay et al. [64], the sample should be, “Ten times the largest number of formative indicators used to measure one construct” or “ten times the largest number of inner model paths directed at a particular construct in the inner model”, whichever is higher. Finally, a sample of 218 responses was collected. The survey questionnaire is placed in the Appendix A of the paper.

3.2. Data Analysis

To perform the analysis, structural equation modelling was employed. The PLS-SEM approach is most suited to this scenario because the study is exploratory and predictive [65]. The study used SmartPLS 3.0 software to run the data analysis. According to Hair et al. [66], the SmartPLS software can provide excellent results for small data samples. The data analysis was divided into two sections, including a measurement assessment and structural assessment.

4. Findings and Analysis

Table 1 demonstrates the demographic characteristics of the respondents.

Table 1.

Demographic profile.

According to the demographic data, more than half of the respondents were male (59.17%) and majority of the respondents were aged between 18 and 34 (84.86%). More than half of the respondents (55.04%) were graduates, followed by 36.70 per cent being postgraduate respondents. Regarding ownership, most respondents (90.82 per cent) said they had a mobile fintech account. Regarding MFS usage, 48.15 per cent of respondents said they used mobile fintech services sometimes, while another 38.98 per cent said they use MFS frequently.

4.1. Measurement Model

The first step of a measurement model assessment is to create the research framework by creating a new project. Then, the data are extracted from the excel file (csv) file. After constructing the path model initially, the path analysis is conducted to check the reliability and validity of the model. According to Hair et al. [67], the recommended value for the indicator loadings should be more than 0.708. Another important aspect to check is the internal consistency reliability. Two indicators that can verify the internal consistency reliability are Cronbach’s alpha and the composite reliability. The recommend value for the constructs is 0.70 [67]. The next phase is to check the convergent validity. The average variance extracted is the indicator used to verify the validity. The construct score should be more than 0.50 to meet the requirements. The final phase is to check the discriminant validity. Three different techniques are used to verify the discriminant validity, including the Fornell–Larcker criterion, cross-loading, and heterotrait–monotrait (HTMT) ratio. The Fornell–Lacker criterion explains whether the square root of the AVE of a particular construct is greater than other constructs [68]. For cross–loadings, a construct’s own parent construct should have higher loadings than with other constructs. In addition, Henseler et al. suggested that the threshold value for conceptually related constructs in structural models is 0.90, while 0.85 is the suggested threshold for conceptually separate constructs. A higher value indicates a lack of discriminant validity [69].

As per Table 2, the loadings of the construct are greater than 0.708. In addition, Table 3 demonstrates that all constructs show values of more than 0.70 for Cronbach’s alpha and the composite reliability. Similar results were found in earlier technology adoption studies [61,62]. Moreover, the AVE values for all constructs are greater than 0.50, which indicates that the model meets the reliability and convergent validity requirements.

Table 2.

Outer loadings values of the measurement construct.

Table 3.

Construct reliability and validity values.

Table 4 indicates that all the diagonal values are higher for a particular construct than for other constructs, which meets the Fornell–Lacker criterion. In addition, in most cases the HTMT values of the conceptually related constructs are less than 0.90. However, FC-BI, FC-EE, PB-EE, PB-FC, and PT-FC show higher HTMT values in Table 5, which indicate that no discriminant validity exists between these conceptually related constructs.

Table 4.

Discriminant validity and average variance extracted (AVE) values.

Table 5.

Discriminant validity and heterotrait–monotrait (HTMT) values.

4.2. Structural Model Assessment

By using the explanatory power and statistical significance of the path coefficients, the structural model used in the study was evaluated. Before evaluating the structural model, it was necessary to evaluate the multicollinearity among the constructs. According to Hair et al. [66], the VIF values should be less than 5 to show no multicollinearity. Table 6 illustrates that all VIF values meet the criteria.

Table 6.

Values of variance information (VIF).

To test the model’s explanatory capacity, the coefficient of determination (R2) for all endogenous constructs was calculated. The coefficient of determination (R2) results in Table 7 clearly suggest that the model has moderate explanatory power that can explain the 62.6% variance in intention to use mobile fintech services. However, the explanatory power of the perceived risk is only 7.9%, which means that trust of the people in Bangladesh in technology adoption intention can explain only around 7.9% of the variability in perceived risk.

Table 7.

Coefficient of determination (R2) values.

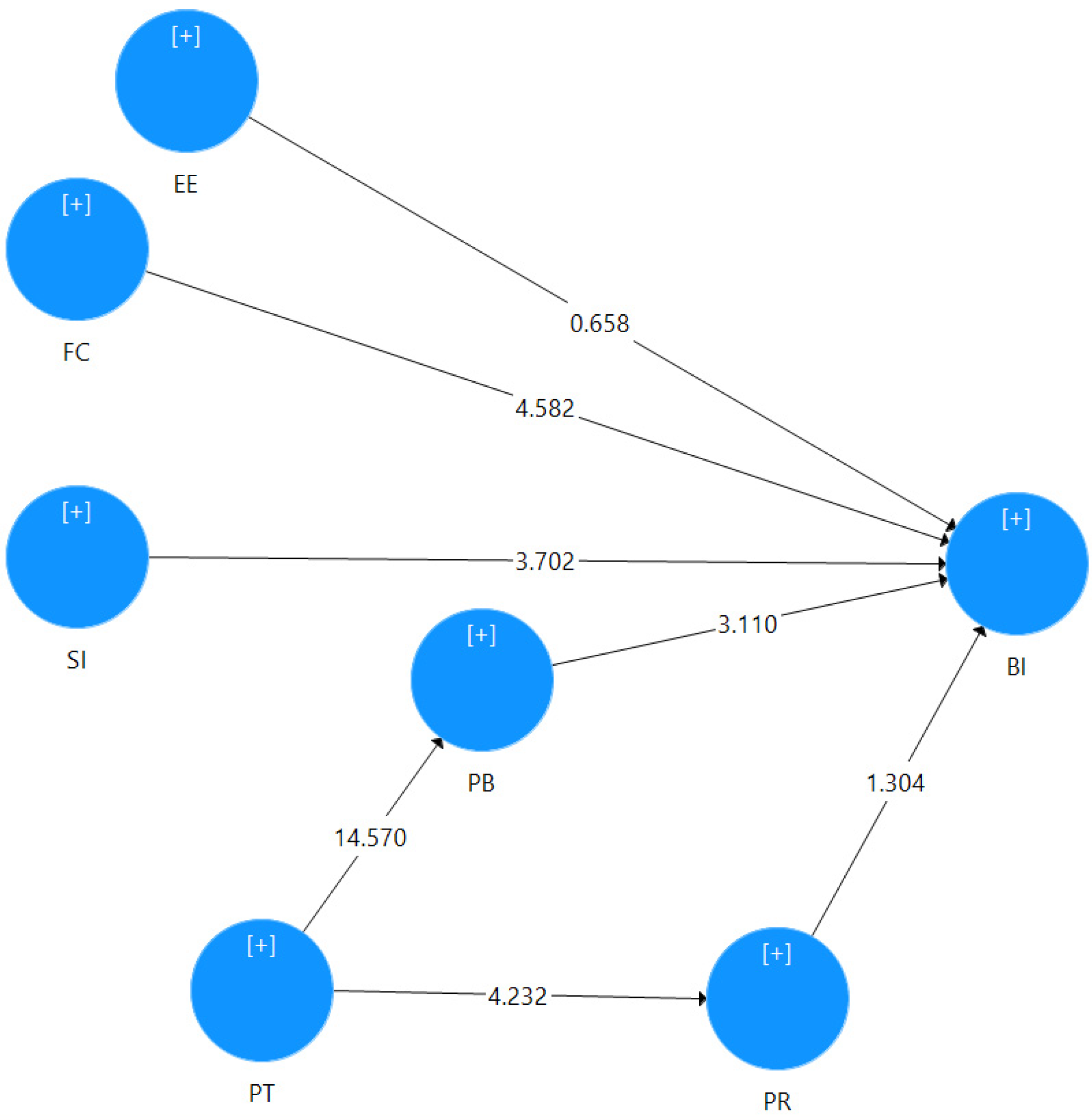

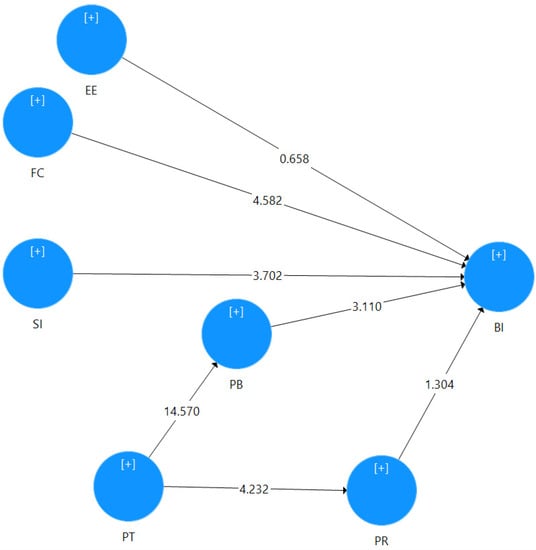

Result of T-values from SmartPLS are indicated in Figure 2. Table 8 shows that six hypotheses are supported, while the other two are rejected. The hypotheses’ acceptance depends on their p-values. If the p-value is less than 0.5, then the hypothesis is accepted. From Table 8, it can be concluded that H1, H2, H3, H5, H6, and H7 are all accepted because the p-values are below 0.05. However, hypotheses H4 and H8 are rejected because the p-values are greater than 0.05.

Figure 2.

Path coefficient (T-values) results from SmartPLS.

Table 8.

Path coefficient values.

4.3. Post Hoc Analysis

The post hoc analysis showed the specific indirect effects of the constructs. As per Table 9, there exists a mediating effect of the perceived benefit, as the p-value is less than 0.05. Therefore, the mediating effect of the perceived benefit exists between trust and the behavioral intention to use. However, the result shows that the perceived risk has no mediating effect.

Table 9.

Indirect effects.

4.4. Discussion

As an emerging market in Asia, Bangladesh ranked 78th among 83 countries in the Global Findex rankings. This means that Bangladesh is still behind in adopting new technologies, like other emerging countries. However, the number of users of mobile phones has increased significantly. As of August 2021, Bangladesh had 178.61 million mobile phone subscribers. In addition, the Internet user penetration rate is 31.5% in Bangladesh [70]. The increased users of mobile phones and the Internet have enabled fintech companies and banks to offer new platforms for customers to perform daily transactions through their mobile phones. Due to the benefits of the mobile fintech technologies, the number of users of mobile fintech apps is increasing. Mobile fintech services are now used for different purposes in Bangladesh, ranging from sending and receiving money to paying medical bill.

The primary objective of this study was to identify the drivers that influence the adoption intention of mobile fintech services in Bangladesh. We proposed a research framework by combining the EVF and UTAUT models.

The study’s outcomes indicate that consumer perceptions of trust positively and significantly affect their inclination to adopt MFS. These findings are similar to previous studies [13,36]. It is interesting to note that the perceived risk does not affect the behavioral intention. As a result, users are less hesitant to use mobile fintech service platforms. One of the key causes is a lack of understanding of the risks associated with using mobile fintech service applications. However, the findings align with those of other research conducted in emerging nations [71,72]. In addition, the perceived benefit positively influences the behavioral intention. Jun et al. found similar results [73]. This implies that users are more concerned with the perks of the mobile fintech service than the drawbacks. In addition, the facilitating conditions show a strong positive impact on behavioral intention, as the required technology, Internet connection, and call center support are essential for using mobile fintech platforms. This result is consistent with the earlier studies [74,75]. MFS providers should focus on expanding their additional offerings to improve their clients’ perceptions of value. Additionally, the perceived benefit is a mediator between perceived trust and behavioral intention.

The result for effort expectancy shows no impact, which is consistent with the result from another study [13]. This is a contrasting outcome, as effort expectancy was found to positively impact behavioral intention in most investigations [76]. The reason behind this is the availability of MFS agent shops, where a person can efficiently conduct transactions without interacting with fintech technology. On the other hand, social influence has a strong positive correlation with behavioral intention. Like most previous studies, the studies carried out by Al-Nawayseh [61] and Liu et al. [77] confirmed the effect of social influence on user behavior. People in emerging nations such as Bangladesh place high importance on their family, friends, coworkers, and peers; hence, their opinions are essential in order to purchase a product or service. The below Table 10 shows the summary of the results of the hypotheses analyzed in the study.

Table 10.

Summary of hypotheses results.

5. Conclusions

The growth of mobile fintech services in Bangladesh has been noteworthy recently, especially after the outbreak of the novel coronavirus. People around the country are getting used to new technologies such as fintech services. Almost every sector is now utilizing mobile fintech service applications to perform financial transactions, ranging from salary disbursement to utility payments. This study aimed to determine the factors influencing the consumers’ intention to adopt mobile fintech applications. To determine these factors, this study proposed a combined research framework by utilizing two models, EVF and UTAUT. According to the structural equation modelling analysis, consumers’ intentions to use MFS are influenced by several factors. The perceived benefits have a significant positive influence because consumers focus on the benefits, they can get from using a new technology. In addition, social influence showed a positive influence, as people are inspired by their family, peers, and friends’ opinions. Moreover, the facilitating conditions also demonstrated a significant positive impact, since the available resources such as smartphones and tablets and the MFS organizations’ contact center services are crucial to performing smooth financial transactions. Finally, perceived trust significantly positively impacts the intention towards MFS adoption. The trust towards MFS providers plays a significant role in online financial transactions using mobile technology. However, the perceived risk and effort expectancy did not influence the behavioral intention to use MFS. Furthermore, the post hoc analysis revealed that the perceived benefit mediates the relationship between the perceived trust and intention to utilize MFS. Mobile fintech services are expected to grow substantially in Bangladesh soon. Therefore, the MFS providers must work on the consumer expectations and preferences to boost the acceptance of mobile fintech services.

5.1. Theoretical Contribution

The major theoretical contribution of this study is the combined approach proposed to explore the drivers behind technology adoption intention. In the past, many authors had adopted, adapted, or modified the UTAUT model to facilitate their studies. However, few studies were found where the EVF framework had been combined with the UTAUT model. This study has contributed to the literature on the unified theory of acceptance and use of technology and extended the valence framework by integrating these two models. This approach can be used in future research to identify the adoption intention towards any technology.

5.2. Managerial Implications

Digital transformation is required in this era of the 4th industrial revolution. This is possible only when the people in a country are willing to adopt new technologies. The results of this study are important for both the mobile fintech service providers and designated government agencies. The mobile fintech providers should focus on the added benefits and required support services offered to customers. In addition, adequate promotion should be placed around product and service awareness. Most importantly, trust towards the service should be ensured to motivate people to adopt fintech services. Moreover, government agencies can foster the adoption of mobile fintech services among the customers by forcing people to make government0related payments through mobile fintech applications, which result in the greater adoption of mobile fintech services.

5.3. Limitations and Future Research

This study collected data from Dhaka city, especially from university students and MNC professionals currently using mobile fintech services. The major drawback of this study is the use of a small sample only from Dhaka city. This limits the generalization of the research findings across diverse demographics and geographic places in Bangladesh. In addition, the study only considered the variables from the UTAUT and EVF models. Future research studies could consider using one or two exogenous variables as moderating or mediating variables, which could display new dimensions of technology adoption intention.

Author Contributions

Conceptualization, M.S.H., M.A.I. and H.N.; methodology, M.S.H. and I.M.; software, M.S.H. and F.T.Z.; validation, F.A.S., M.A.I. and H.N.; formal analysis, M.S.H. and I.M.; investigation, F.A.S. and F.T.Z.; resources, F.A.S.; data curation, H.N.; writing—original draft preparation, M.S.H., I.M. and F.T.Z.; writing—review and editing, M.A.I., F.A.S. and H.N.; visualization, F.T.Z.; supervision, M.A.I. and H.N.; project administration, M.S.H. and F.A.S. All authors have read and agreed to the published version of the manuscript.

Funding

The research is funded by the Institute for Advanced Research Publication Grant of United International University, Ref. No.: IAR-2022-Pub-025.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Survey questionnaire.

| Variables | Measurement Constructs |

|---|---|

| Behavioral Intention to adapt MFS (BI) | BI1: I intend to adopt mobile fintech service in the future. BI2: I predict that I will frequently use mobile fintech service in the future BI3: I will strongly recommend others to use mobile fintech service. |

| Perceived Benefit (PB) | PB1: Using Mobile Fintech Services has many advantages PB2: I can easily and quickly use Mobile Fintech Services. PB3: Using Mobile Fintech Services is useful for me. |

| Perceived Trust (PT) | PT1: I trust MFS systems to be reliable. PT2: I trust MFS systems to be secure. PT3: I believe MFS systems are trustworthy |

| Perceived Risk (PR) | PR1: Using Mobile Fintech Services is associated with a high level of risk. PR2: Overall, I think that there is little benefit to using Mobile Fintech Services compared to traditional financial services. |

| Social Influence (SI) | SI1: People who are important to me think that I should use Mobile Fintech Services. SI2: People who influence my behavior think that I should use Mobile Fintech Services. SI3: People whose opinions I value prefer that I use Mobile Fintech Services. |

| Effort Expectancy (EE) | EE1: It is easy for me to understand the operation of Mobile Fintech Services EE2: I find conducting transactions through Mobile Fintech Services is convenient for me EE3: I find easy to conduct transactions through Mobile Fintech Services |

| Facilitating Conditions (FC) | FC1: I have necessary resources to use Mobile Fintech Services FC2: I have the necessary knowledge to use Mobile Fintech Services FC3: Mobile Fintech Services is compatible with other system that I use |

References

- Bangladesh Bank. Bangladesh Mobile Financial Services (MFS) Regulations, 2018. Bangladesh Bank. Available online: https://www.bb.org.bd/openpdf.php (accessed on 12 April 2022).

- Bangladesh Bank. Bangladesh Mobile Financial Services (MFS) Regulations. 2022. Available online: https://www.bb.org.bd/mediaroom/circulars/psd/feb152022psd04e.pdf (accessed on 12 April 2022).

- World Bank Group. Open Knowledge Repository. 2014. Available online: https://openknowledge.worldbank.org/handle/10986/20262?show=full (accessed on 12 April 2022).

- Bangladesh Bank. Mobile Financial Services (MFS) Comparative Summary Statement of March 2021 and April 2021. Available online: https://www.bb.org.bd/fnansys/paymentsys/mfsdata.php (accessed on 12 April 2022).

- Anik, S.A.M.; Khan, M.H.; Miah, R.H.; Kabir, F.; Alam, K. Customer Attitude towards Mobile Fintech Services: An Empirical Study on Dhaka City, Bangladesh. Int. J. Bus. Manag. Econ. Res. 2021, 12, 1918–1928. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Rahman, M.A.; Qi, X.; Jinnah, M.S. Factors affecting the adoption of HRIS by the Bangladeshi banking and financial sector. Cogent Bus. Manag. 2016, 3, 1262107. [Google Scholar] [CrossRef]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Doctoral Dissertation, Massachusetts Institute of Technology, Cambridge, MA, USA, 1985. [Google Scholar]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems. Doctoral Dissertation, Massachusetts Institute of Technology, Cambridge, MA, USA, 1986. [Google Scholar]

- Kabir, H.; Huda, S.S.M.S.; Faruq, O. Mobile financial services in the context of Bangladesh. Copernic. J. Finance Account. 2021, 9, 83–98. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Chin, A.G.; Harris, M.A.; Brookshire, R. An Empirical Investigation of Intent to Adopt Mobile Payment Systems Using a Trust-based Extended Valence Framework. Inf. Syst. Front. 2020, 24, 329–347. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Rana, N.P.; Jeyaraj, A.; Clement, M.; Williams, M.D. Re-examining the Unified Theory of Acceptance and Use of Technology (UTAUT): Towards a Revised Theoretical Model. Inf. Syst. Front. 2019, 21, 719–734. [Google Scholar] [CrossRef] [Green Version]

- Dorfleitner, G.; Hornuf, L.; Schmitt, M.; Weber, M. Definition of FinTech and Description of the FinTech Industry. In FinTech in Germany; Springer: Cham, Germany, 2017; pp. 5–10. [Google Scholar] [CrossRef]

- Putritama, A. The Mobile Payment Fintech Continuance Usage Intention in Indonesia. J. Econ. 2019, 15, 243–258. [Google Scholar] [CrossRef]

- Kim, M. The Impacts of Financial Reforms on Households’ Savings Behavior. Int. J. IT-Based Soc. Welf. Promot. Manag. 2018, 5, 7–12. [Google Scholar] [CrossRef]

- Yu, S. A Study on Developed Security Check Items for Assessing Mobile Financial Service Security. Master’s Thesis, Chung-Ang University, Seoul, Korea, 2017. [Google Scholar]

- EY Global Financial Services. Global FinTech Adoption Index 2019. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-global-fintech-adoption-index.pdf (accessed on 20 April 2022).

- Hasan, R.; Ashfaq, M.; Shao, L. Evaluating Drivers of Fintech Adoption in the Netherlands. Glob. Bus. Rev. 2021, 1–14. [Google Scholar] [CrossRef]

- Ali, M.; Raza, S.A.; Khamis, B.; Puah, C.H.; Amin, H. How perceived risk, benefit and trust determine user Fintech adoption: A new dimension for Islamic finance. Foresight 2021, 23, 403–420. [Google Scholar] [CrossRef]

- Setiawan, B.; Nugraha, D.P.; Irawan, A.; Nathan, R.J.; Zoltan, Z. User Innovativeness and Fintech Adoption in Indonesia. J. Open Innov. Technol. Mark. Complex. 2021, 7, 188. [Google Scholar] [CrossRef]

- Vasenska, I.; Dimitrov, P.; Koyundzhiyska-Davidkova, B.; Krastev, V.; Durana, P.; Poulaki, I. Financial Transactions Using FINTECH during the COVID-19 Crisis in Bulgaria. Risks 2021, 9, 48. [Google Scholar] [CrossRef]

- Chauhan, S.; Jaiswal, M. Determinants of acceptance of ERP software training in business schools: Empirical investigation using UTAUT model. Int. J. Manag. Educ. 2016, 14, 248–262. [Google Scholar] [CrossRef]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Hoque, R.; Sorwar, G. Understanding factors influencing the adoption of mHealth by the elderly: An extension of the UTAUT model. Int. J. Med. Inform. 2017, 101, 75–84. [Google Scholar] [CrossRef]

- Cimperman, M.; Brenčič, M.M.; Trkman, P. Analyzing older users’ home telehealth services acceptance behavior—applying an Extended UTAUT model. Int. J. Med. Inform. 2016, 90, 22–31. [Google Scholar] [CrossRef] [Green Version]

- Bagozzi, R.P. The Legacy of the Technology Acceptance Model and a Proposal for a Paradigm Shift. J. Assoc. Inf. Syst. 2007, 8, 244–254. [Google Scholar] [CrossRef]

- Alshare, K.A.; AlOmari, M.K.; Lane, P.L.; Freeze, R.D. Development and determinants of end-user intention: Usage of expert systems. J. Syst. Inf. Technol. 2019, 21, 166–185. [Google Scholar] [CrossRef]

- Raihan, T.; Rachmawati, I. Analyzing Factors Influencing Continuance Intention Of E-wallet Adoption Using Utaut 2 Model (a Case Study Of Dana In Indonesia). Eproceedings Manag. 2019, 6, 3717. [Google Scholar]

- Yohanes, K.; Junius, K.; Saputra, Y.; Sari, R.; Lisanti, Y.; Luhukay, D. Unified Theory of Acceptance and Use of Technology (UTAUT) model perspective to enhance user acceptance of fintech application. In Proceedings of the 2020 International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, 13–14 August 2019; pp. 643–648. [Google Scholar] [CrossRef]

- Najib, M.; Ermawati, W.; Fahma, F.; Endri, E.; Suhartanto, D. FinTech in the Small Food Business and Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Ahmed, R.R.; Štreimikienė, D.; Štreimikis, J. The extended utaut model and learning management system during COVID-19: Evidence from Pls-sem and conditional process modeling. J. Bus. Econ. Manag. 2021, 23, 82–104. [Google Scholar] [CrossRef]

- Dowdy, A.E.A. Public Librarians’ Adoption of Technology in Two Southeastern States. Doctoral Dissertation, Walden University, Minneapolis, MN, USA, 2020. [Google Scholar]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. Trust and Satisfaction, Two Stepping Stones for Successful E-Commerce Relationships: A Longitudinal Exploration. Inf. Syst. Res. 2009, 20, 237–257. [Google Scholar] [CrossRef] [Green Version]

- Azizah, N.; Handayani, P.W.; Azzahro, F. Factors Influencing Continuance Usage of Mobile Wallets in Indonesia. Int. Conf. Inf. Manag. Technol. (ICIMTech) 2018, 92–97. [Google Scholar] [CrossRef]

- Cui, Y.; Mou, J.; Cohen, J.; Liu, Y. Understanding information system success model and valence framework in sellers’ acceptance of cross-border e-commerce: A sequential multi-method approach. Electron. Commer. Res. 2019, 19, 885–914. [Google Scholar] [CrossRef]

- Mou, J.; Cohen, J.; Dou, Y.; Zhang, B. International buyers’ repurchase intentions in a Chinese cross-border e-commerce platform. Internet Res. 2019, 30, 403–437. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research; Addison-Wesley: Reading, MA, USA, 1975; p. 39. [Google Scholar]

- Warshaw, P.R.; Davis, F.D. Disentangling behavioral intention and behavioral expectation. J. Exp. Soc. Psychol. 1985, 21, 213–228. [Google Scholar] [CrossRef]

- Li, H.; Schein, D.; Ravi, S.P.; Song, W.; Gu, Y. Factors influencing residents’ perceptions, attitudes and behavioral intention toward festivals and special events: A pre-event perspective. J. Bus. Econ. Manag. 2018, 19, 288–306. [Google Scholar] [CrossRef] [Green Version]

- Silva, J.; Pinho, J.C.; Soares, A.; Sá, E. Antecedents of online purchase intention and behaviour: Uncovering unobserved heterogeneity. J. Bus. Econ. Manag. 2019, 20, 131–148. [Google Scholar] [CrossRef] [Green Version]

- Bisdikian, C.; Gibson, C.; Chakraborty, S.; Srivastava, M.B.; Sensoy, M.; Norman, T.J. Inference management, trust and obfuscation principles for quality of information in emerging pervasive environments. Pervasive Mob. Comput. 2014, 11, 168–187. [Google Scholar] [CrossRef]

- Wang, S.W.; Ngamsiriudom, W.; Hsieh, C.-H. Trust disposition, trust antecedents, trust, and behavioral intention. Serv. Ind. J. 2015, 35, 555–572. [Google Scholar] [CrossRef]

- Yang, Q.; Pang, C.; Liu, L.; Yen, D.C.; Tarn, J.M. Exploring consumer perceived risk and trust for online payments: An empirical study in China’s younger generation. Comput. Hum. Behav. 2015, 50, 9–24. [Google Scholar] [CrossRef]

- Chin, A.G.; Harris, M.A.; Brookshire, R. A bidirectional perspective of trust and risk in determining factors that influence mobile app installation. Int. J. Inf. Manag. 2018, 39, 49–59. [Google Scholar] [CrossRef]

- Al-Saedi, K.; Al-Emran, M. A Systematic Review of Mobile Payment Studies from the Lens of the UTAUT Model. Recent Adv. Technol. Accept. Models Theor. 2021, 79–106. [Google Scholar] [CrossRef]

- Kaur, S.; Arora, S. Role of perceived risk in online banking and its impact on behavioral intention: Trust as a moderator. J. Asia Bus. Stud. 2020, 15, 1–30. [Google Scholar] [CrossRef]

- Madan, K.; Yadav, R. Behavioural intention to adopt mobile wallet: A developing country perspective. J. Indian Bus. Res. 2016, 8, 227–244. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G. Factors That Determine the Adoption Intention of Direct Mobile Purchases through Social Media Apps. Information 2021, 12, 449. [Google Scholar] [CrossRef]

- Makanyeza, C. Determinants of consumers’ intention to adopt mobile banking services in Zimbabwe. Int. J. Bank Mark. 2017, 35, 997–1017. [Google Scholar] [CrossRef]

- Singh, S.; Srivastava, R. Predicting the intention to use mobile banking in India. Int. J. Bank Mark. 2018, 36, 357–378. [Google Scholar] [CrossRef]

- Utaminingsih, K.T.; Alianto, H. The Influence of UTAUT Model Factors on the Intension of Millennials Generation in Using Mobile Wallets in Jakarta. In Proceedings of the 2020 International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, 13–14 August 2019; pp. 488–492. [Google Scholar] [CrossRef]

- Islam, S.; Karia, N.; Khaleel, M.; Fauzi, F.B.A.; Soliman, M.M.; Khalid, J.; Bhuiyan, Y.A.; Al Mamun, A. Intention to adopt mobile banking in Bangladesh: An empirical study of emerging economy. Int. J. Bus. Inf. Syst. 2019, 31, 136. [Google Scholar] [CrossRef]

- Blaise, R.; Halloran, M.; Muchnick, M. Mobile Commerce Competitive Advantage: A Quantitative Study of Variables that Predict M-Commerce Purchase Intentions. J. Internet Commer. 2018, 17, 96–114. [Google Scholar] [CrossRef]

- Chang, C.-M.; Liu, L.-W.; Huang, H.-C.; Hsieh, H.-H. Factors Influencing Online Hotel Booking: Extending UTAUT2 with Age, Gender, and Experience as Moderators. Information 2019, 10, 281. [Google Scholar] [CrossRef] [Green Version]

- Sobti, N. Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model. J. Adv. Manag. Res. 2019, 16, 472–497. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G.; Katarachia, A. A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information 2022, 13, 30. [Google Scholar] [CrossRef]

- Rosnidah, I.; Muna, A.; Musyaffi, A.M.; Siregar, N.F. Critical factor of mobile payment acceptance in millen-nial generation: Study on the UTAUT model. In International Symposium on Social Sciences, Education, and Humanities (ISSEH 2018); Atlantis Press: Cirebon, Indonesia, 2019. [Google Scholar] [CrossRef] [Green Version]

- Sair, S.A.; Danish, R.Q. Effect of performance expectancy and effort expectancy on the mobile commerce adoption intention through personal innovativeness among Pakistani consumers. Pak. J. Commer. Soc. Sci. (PJCSS) 2018, 12, 501–520. [Google Scholar]

- Al Nawayseh, M.K. FinTech in COVID-19 and Beyond: What Factors Are Affecting Customers’ Choice of FinTech Applications? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- Chen, W.-C.; Chen, C.-W.; Chen, W.-K. Drivers of Mobile Payment Acceptance in China: An Empirical Investigation. Information 2019, 10, 384. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.V.; Chotimapruek, W.; Ha, Q.-A.; Widjaja, A.E. Investigating Female Customer’s Impulse Buying in Facebook B2C Social Commerce: An Experimental Study. Contemp. Manag. Res. 2021, 17, 65–96. [Google Scholar] [CrossRef]

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to causal modeling: Personal computer adoption and use as an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Karim, W.; Chowdhury, M.A.M.; Al Masud, A. Arifuzzaman Analysis of Factors Influencing Impulse Buying Behavior towards e-Tailing Sites: An application of S-O-R model. Contemp. Manag. Res. 2021, 17, 97–126. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Thiele, K.O. Mirror, mirror on the wall: A comparative evaluation of composite-based structural equation modeling methods. J. Acad. Mark. Sci. 2017, 45, 616–632. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Kemp, S. Digital 2022: Bangladesh. Datareportal. Available online: https://datareportal.com/reports/digital-2022-bangladesh#:~:text=There%20were%2052.58%20million%20internet,percent)%20between%202021%20and%202022 (accessed on 9 July 2022).

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef] [Green Version]

- Jenkins, P.; Ophoff, J. Factors influencing the intention to adopt NFC mobile payments-A South African perspective. In CONF-IRM 2016 Proceedings; Association for Information Systems (AIS): Capetown, South Africa, 2016; p. 45. [Google Scholar]

- Jun, J.; Cho, I.; Park, H. Factors influencing continued use of mobile easy payment service: An empirical investigation. Total Qual. Manag. Bus. Excel. 2018, 29, 1043–1057. [Google Scholar] [CrossRef]

- Khan, I.U.; Hameed, Z.; Khan, S.U. Understanding Online Banking Adoption in a Developing Country: UTAUT2 with cultural moderators. J. Glob. Inf. Manag. 2017, 25, 43–65. [Google Scholar] [CrossRef] [Green Version]

- Widodo, M.; Irawan, M.I.; Sukmono, R.A. Extending UTAUT2 to Explore Digital Wallet Adoption in Indonesia. In Proceedings of the 2019 International Conference on Information and Communications Technology (ICOIACT), Yogyakarta, Indonesia, 24–25 July 2019; pp. 878–883. [Google Scholar] [CrossRef]

- Tak, P.; Panwar, S. Using UTAUT 2 model to predict mobile app based shopping: Evidences from India. J. Indian Bus. Res. 2017, 9, 248–264. [Google Scholar] [CrossRef]

- Liu, Z.; Ben, S.; Zhang, R. Factors affecting consumers’ mobile payment behavior: A meta-analysis. Electron. Commer. Res. 2019, 19, 575–601. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).