Can Direct Subsidies or Tax Incentives Improve the R&D Efficiency of the Manufacturing Industry in China?

Abstract

:1. Introduction

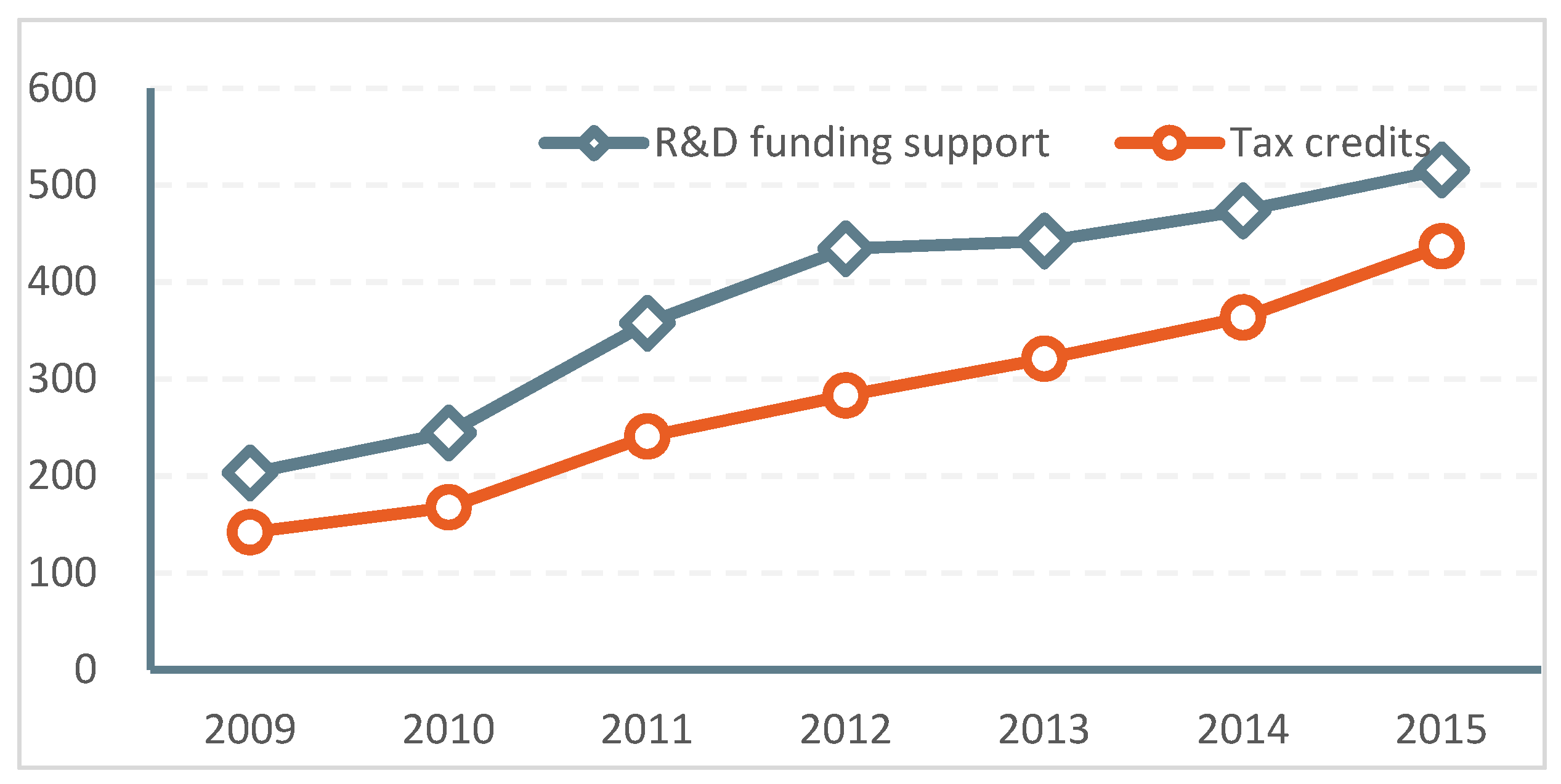

2. Literature Review

3. Methods, Variables, and Data

3.1. Methods

- (1)

- SFA model

- (2)

- Tobit model

3.2. Variables

- (1)

- SFA efficiency measurement variables

- (2)

- Panel Tobit model variables

3.3. Data

4. Results

4.1. China’s Manufacturing R&D Efficiency

4.2. The Impact of Government Support on the R&D Efficiency of China’s Manufacturing Industry

- (1)

- The impact of direct subsidies on manufacturing R&D efficiency

- (2)

- The impact of tax incentives on manufacturing R&D efficiency

- (3)

- The impact of government’s direct subsidies and tax incentives on manufacturing R&D efficiency

5. Discussion

6. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Guo, L.; Long, W.; Dai, Z. Manufacturing R&D investment efficiency and financing constraints: Evidence from China. Appl. Econ. 2021, 53, 676–687. [Google Scholar]

- Zhu, Y.W.; Xu, K.N. An empirical study on the R&D efficiency of China’s high tech. Ind. China Ind. Econ. 2006, 11, 38–45. [Google Scholar]

- Liu, W.; Bai, Y. An Analysis on the influence of R&D fiscal and tax subsidies on regional innovation efficiency: Empirical evidence from China. Sustainability 2021, 13, 12707. [Google Scholar]

- Shao, W.; Yang, K.; Bai, X. Impact of financial subsidies on the R&D intensity of new energy vehicles: A case study of 88 listed enterprises in China. Energy Strat. Rev. 2021, 33, 100580. [Google Scholar]

- Jia, L.; Nam, E.; Chun, D. Impact of Chinese Government Subsidies on Enterprise Innovation: Based on a Three-Dimensional Perspective. Sustainability 2021, 13, 1288. [Google Scholar] [CrossRef]

- Xiao, W.; Lin, G.B. Government Support, R&D management and technological Innovation Efficiency: An Empirical analysis of China’s industrial Sectors. Manag. World 2014, 4, 71–80. [Google Scholar]

- Wu, Z.; Fan, X.; Zhu, B.; Xia, J.; Zhang, L.; Wang, P. Do government subsidies improve innovation investment for new energy firms: A quasi-natural experiment of China’s listed companies. Technol. Forecast. Soc. Chang. 2022, 175, 121418. [Google Scholar] [CrossRef]

- Garcia-Quevedo, J. Do public subsidies complement business R&D? A meta-analysis of the econometric evidence. Kyklos 2004, 57, 87–102. [Google Scholar]

- Dimos, C.; Pugh, G. The effectiveness of R&D subsidies: A meta-regression analysis of the evaluation literature. Res. Policy 2016, 45, 797–815. [Google Scholar]

- Sun, Y.; Li, L.; Shi, H.; Chong, D. The transformation and upgrade of China’s manufacturing industry in Industry 4.0 era. Behav. Sci. 2020, 37, 734–740. [Google Scholar] [CrossRef]

- Jefferson, G.H.; Bai, H.M.; Guan, X.J.; Yu, X.Y. R&D performance in Chinese industry. Econ. Innov. New Technol. 2006, 15, 345–366. [Google Scholar]

- Feng, S.; Chong, Y.; Li, G.; Zhang, S. Digital finance and innovation inequality: Evidence from green technological innovation in China. Environ. Sci. Pollut. Res. 2022, 29, 87884–87900. [Google Scholar] [CrossRef]

- Klímová, V.; Žítek, V.; Králová, M. How Public R&D Support Affects Research Activity of Enterprises: Evidence from the Czech Republic. J. Knowl. Econ. 2020, 11, 888–907. [Google Scholar]

- Falk, M. What drives business Research and Development (R&D) intensity across Organisation for Economic Co-operation and Development (OECD) countries? Appl. Econ. 2006, 38, 533–547. [Google Scholar]

- Negassi, S.; Sattin, J.F. Evaluation of public R&D policy: A meta-regression analysis. Technol. Investig. 2019, 10, 1–29. [Google Scholar]

- Buravleva, Y.; Tang, D.; Bethel, B.J. Incentivizing Innovation: The Causal Role of Government Subsidies on Lithium-Ion Battery Research and Development. Sustainability 2021, 13, 8309. [Google Scholar] [CrossRef]

- Bai, X.Y.; Wang, Y.Y.; Su, X. R&D subsidy or tax incentive—The impact of government intervention on enterprise innovation performance and innovation quality. Sci. Res. Manag. 2019, 6, 9–18. [Google Scholar]

- Kou, M.T.; Wei, J.W.; Ma, W.N. Whether the national R&D fiscal and tax policies promote the R&D activities of enterprises. Sci. Res. 2019, 37, 1394–1404. [Google Scholar]

- Liu, S.; Du, J.; Zhang, W.; Tian, X. Opening the box of subsidies: Which is more effective for innovation? Eurasian Bus. Rev. 2021, 11, 421–449. [Google Scholar] [CrossRef]

- Wu, T.; Yang, S.; Tan, J. Impacts of government R&D subsidies on venture capital and renewable energy investment—An empirical study in China. Resour. Policy 2020, 68, 101715. [Google Scholar]

- Tang, D.; Li, Y.; Zheng, H.; Yuan, X. Government R&D spending, fiscal instruments and corporate technological innovation. China J. Account. Res. 2022, 15, 100250. [Google Scholar]

- Xie, Z.; Xie, L.; Li, J. Direct subsidies or tax credits? The effects of different R&D policy tools. Int. J. Technol. Manag. 2021, 86, 25–43. [Google Scholar]

- Wan, Q.; Chen, J.; Yao, Z.; Yuan, L. Preferential tax policy and R&D personnel flow for technological innovation efficiency of China’s high-tech industry in an emerging economy. Technol. Forecast. Soc. Chang. 2022, 174, 121228. [Google Scholar]

- Petrin, T. A Literature Review on the Impact and Effectiveness of Government Support for R&D and Innovation. ISIGrowth. 2018, p. 5. Available online: http://www.isigrowth.eu/wp-content/uploads/2018/02/working_paper_2018_05.pdf (accessed on 1 October 2022).

- Chang, K.; Long, Y.; Yang, J.; Zhang, H.; Xue, C.; Liu, J. Effects of subsidy and tax rebate policies on green firm research and development efficiency in China. Energy 2022, 258, 124793. [Google Scholar] [CrossRef]

- Ghazinoory, S.; Hashemi, Z. Do tax incentives and direct funding enhance innovation input and output in high-tech firms? J. High Technol. Manag. Res. 2021, 32, 100394. [Google Scholar] [CrossRef]

- Kea, S.; Shahriar, S. Stochastic frontier analysis. In Encyclopedia of Tourism Management and Marketing; Edward Elgar Publishing: Cheltenham, UK, 2022; pp. 251–254. [Google Scholar]

- Diaz, M.A.; Sanchez, R. Firm size and productivity in Spain: A stochastic frontier analysis. Small Bus. Econ. 2008, 30, 315–323. [Google Scholar] [CrossRef]

- Jin, T.; Kim, J. A comparative study of energy and carbon efficiency for emerging countries using panel stochastic frontier analysis. Sci. Rep. 2019, 9, 6647. [Google Scholar] [CrossRef] [Green Version]

- Haider, S.; Mishra, P.P. Does innovative capability enhance the energy efficiency of Indian Iron and Steel firms? A Bayesian stochastic frontier analysis. Energy Econ. 2021, 95, 105128. [Google Scholar] [CrossRef]

- Kumbhakar, S.C.; Parmeter, C.F.; Zelenyuk, V. Stochastic frontier analysis: Foundations and advances I. In Handbook of Production Economics; Springer: Berlin/Heidelberg, Germany, 2020; pp. 1–40. [Google Scholar]

- Abdullahi, N.M.; Zhang, Q.; Shahriar, S.; Irshad, M.S.; Ado, A.B.; Huo, X. Examining the determinants and efficiency of China’s agricultural exports using a stochastic frontier gravity model. PLOS One 2022, 17, e0274187. [Google Scholar] [CrossRef]

- Boiko, K. R&D activity and firm performance: Mapping the field. Manag. Rev. Q. 2021, 72, 1–37. [Google Scholar]

- Liu, C.J.; Gao, J. “Supporting the Excellent” or “Helping the Poor”—Research on the incentive effect of R&D subsidy on innovation. Econ. Manag. 2019, 41, 57–74. [Google Scholar]

- Lin, B.; Luan, R. Do government subsidies promote efficiency in technological innovation of China’s photovoltaic enterprises? J. Clean. Prod. 2020, 254, 120108. [Google Scholar] [CrossRef]

- Bai, J.H. Is China’s government R&D funding effective? Empirical evidence from large and medium-sized industrial enterprises. Economics 2011, 10, 1375–1400. [Google Scholar]

- Li, Y.X.; Tan, Y.Q. The path to enhance the technological innovation capability of outsourcing enterprises under international service outsourcing-based on the perspective of spillover effect and absorptive capacity. China Ind. Econ. 2010, 12, 66–75. [Google Scholar]

- Corredoira, R.A.; Goldfarb, B.D.; Shi, Y. Federal funding and the rate and direction of inventive activity. Res. Policy 2018, 47, 1777–1800. [Google Scholar] [CrossRef]

- Yu, F.; Guo, Y.; Le-Nguyen, K.; Barnes, S.J.; Zhang, W. The impact of government subsidies and enterprises’ R&D investment: A panel data study from renewable energy in China. Energy Policy 2016, 89, 106–113. [Google Scholar]

| Type | Name | Symbol | Measure |

|---|---|---|---|

| The explained variable | R&D efficiency of China’s manufacturing enterprises | EF | SFA Model |

| The explanatory variables | Government’s R&D direct subsidies | Gov | “Funds for Science and Technology Activities from the Government in R&D Expenses” in the China Science and Technology Statistical Yearbook. |

| Tax incentives | Tax | “R&D expenses plus deduction allowance” in the China Science and Technology Statistical Yearbook. | |

| Personnel | Peo | “R&D personnel” in the China Science and Technology Statistical Yearbook. | |

| Internal expenditures | Fund | “R&D internal expenditures” in the China Science and Technology Statistical Yearbook. | |

| Control variables | Enterprise scale | Sca | “Main business income” divides “number of enterprises” in the manufacturing industry of China Science and Technology Statistical Yearbook. |

| Enterprise ownership | Own | “State-Owned and State-Holding Enterprises Sales Income” divides “manufacturing industry sales income” in the manufacturing industry of China Science and Technology Statistical Yearbook. | |

| Innovation level | Inn | “Enterprises with R&D activities” divides “number of enterprises at the end of the year” in the China Science and Technology Statistical Yearbook. | |

| Management capability | Manag | “Science and Technology staff” minus “Scientists and Engineers” then divides “Science and Technology staff” in the China Science and Technology Statistical Yearbook. |

| No. | Industry | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Average | Standard Deviation |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Agricultural by products processing | 0.209 | 0.236 | 0.264 | 0.293 | 0.323 | 0.352 | 0.382 | 0.294 | 0.058 |

| 2 | Food | 0.292 | 0.321 | 0.351 | 0.380 | 0.410 | 0.440 | 0.469 | 0.380 | 0.059 |

| 3 | Beverage | 0.101 | 0.121 | 0.142 | 0.166 | 0.191 | 0.217 | 0.244 | 0.169 | 0.048 |

| 4 | Tobacco | 0.366 | 0.396 | 0.426 | 0.455 | 0.483 | 0.512 | 0.539 | 0.454 | 0.058 |

| 5 | Textile | 0.153 | 0.177 | 0.202 | 0.229 | 0.257 | 0.285 | 0.315 | 0.231 | 0.054 |

| 6 | Textile garments and hats | 0.117 | 0.138 | 0.161 | 0.186 | 0.212 | 0.239 | 0.267 | 0.188 | 0.050 |

| 7 | Leather, fur, feather products | 0.109 | 0.129 | 0.151 | 0.175 | 0.201 | 0.228 | 0.256 | 0.178 | 0.049 |

| 8 | Wood, bamboo, vine, palm, grass processing | 0.322 | 0.352 | 0.382 | 0.411 | 0.441 | 0.470 | 0.498 | 0.411 | 0.059 |

| 9 | Furniture | 0.261 | 0.289 | 0.319 | 0.348 | 0.378 | 0.408 | 0.437 | 0.348 | 0.059 |

| 10 | Paper and paper products | 0.127 | 0.149 | 0.173 | 0.199 | 0.225 | 0.253 | 0.281 | 0.201 | 0.052 |

| 11 | Prints and record media copies | 0.210 | 0.238 | 0.266 | 0.294 | 0.324 | 0.353 | 0.383 | 0.295 | 0.058 |

| 12 | Educational and sports goods | 0.308 | 0.337 | 0.367 | 0.397 | 0.426 | 0.455 | 0.484 | 0.396 | 0.059 |

| 13 | Oil and nuclear fuel processing, coking | 0.111 | 0.132 | 0.154 | 0.179 | 0.204 | 0.231 | 0.259 | 0.181 | 0.049 |

| 14 | Raw chemical materials and chemical products | 0.286 | 0.315 | 0.345 | 0.374 | 0.404 | 0.433 | 0.463 | 0.374 | 0.059 |

| 15 | Pharmaceutical | 0.414 | 0.443 | 0.472 | 0.500 | 0.528 | 0.555 | 0.581 | 0.499 | 0.056 |

| 16 | Chemical fiber | 0.116 | 0.137 | 0.160 | 0.184 | 0.210 | 0.237 | 0.266 | 0.187 | 0.050 |

| 17 | Non-metallic minerals | 0.320 | 0.350 | 0.379 | 0.409 | 0.438 | 0.467 | 0.496 | 0.409 | 0.059 |

| 18 | Ferrous metal smelting and rolling | 0.115 | 0.136 | 0.159 | 0.183 | 0.209 | 0.236 | 0.264 | 0.186 | 0.050 |

| 19 | Non-ferrous metal smelting and rolling | 0.166 | 0.191 | 0.217 | 0.244 | 0.273 | 0.302 | 0.331 | 0.246 | 0.055 |

| 20 | Metal products | 0.261 | 0.290 | 0.319 | 0.349 | 0.379 | 0.408 | 0.438 | 0.349 | 0.059 |

| 21 | General machinery | 0.277 | 0.306 | 0.335 | 0.365 | 0.395 | 0.424 | 0.454 | 0.365 | 0.059 |

| 22 | Special equipment | 0.369 | 0.399 | 0.428 | 0.457 | 0.486 | 0.514 | 0.541 | 0.456 | 0.058 |

| 23 | Transportation equipment | 0.183 | 0.209 | 0.236 | 0.264 | 0.293 | 0.322 | 0.352 | 0.266 | 0.056 |

| 24 | Electrical machinery and equipment | 0.439 | 0.468 | 0.497 | 0.524 | 0.551 | 0.577 | 0.603 | 0.523 | 0.054 |

| 25 | Communication, computer, and electrical devices | 0.797 | 0.811 | 0.824 | 0.837 | 0.848 | 0.859 | 0.869 | 0.835 | 0.024 |

| 26 | Parameter optimization and cultural, OA equipment | 0.411 | 0.440 | 0.469 | 0.497 | 0.525 | 0.552 | 0.578 | 0.496 | 0.056 |

| 27 | Handicrafts and others | 0.262 | 0.290 | 0.320 | 0.349 | 0.379 | 0.409 | 0.438 | 0.349 | 0.059 |

| 28 | Waste materials and resources recycle | 0.197 | 0.223 | 0.251 | 0.279 | 0.308 | 0.338 | 0.368 | 0.281 | 0.057 |

| 29 | Average | 0.261 | 0.286 | 0.313 | 0.340 | 0.368 | 0.396 | 0.423 | 0.341 | 0.054 |

| 30 | Max | 0.797 | 0.811 | 0.824 | 0.837 | 0.848 | 0.859 | 0.869 | —— | —— |

| 31 | Min | 0.101 | 0.121 | 0.142 | 0.166 | 0.191 | 0.217 | 0.244 | —— | —— |

| 32 | Medium | 0.261 | 0.290 | 0.319 | 0.349 | 0.378 | 0.408 | 0.437 | —— | —— |

| Type | Name | Model I | Model II | Model III |

|---|---|---|---|---|

| The explained variable | EF | EF | EF | |

| The explanatory variables | LnTax | 0.014 *** (3.157) | 0.014 *** (3.131) | |

| LnGov | 0.035 (0.362) | 0.002 (0.338) | ||

| LnPeo | 0.009 (0.583) | −0.110 *** (−7.663) | −0.112 *** (−7.319) | |

| LnFund | −0.001 (−0.064) | 0.148 *** (10.794) | 0.149 *** (10.806) | |

| Control variables | LnSca | 0.076 *** (4.233) | −0.039 *** (−4.320) | −0.039 *** (−4.251) |

| LnOwn | −0.031 *** (−4.033) | −0.007 (−0.957) | −0.008 (−0.992) | |

| LnInn | 0.120 *** (11.253) | 0.048 *** (5.393) | 0.048 *** (5.369) | |

| LnManag | 0.077 ** (2.464) | −0.042 (−1.158) | −0.044 (−1.196) | |

| LnGov(t-2) | 0.009 *** (3.052) | |||

| Constants | −0.379 ** (−2.107) | −0.340 ** (−2.240) | −0.352 ** (−2.261) | |

| sigma_u | 0.123 *** (6.905) | 0.140 *** (7.422) | 0.141 *** (7.415) | |

| sigma_e | 0.014 *** (14.661) | 0.023 *** (18.317) | 0.023 *** (18.314) | |

| N | 1372 | 1372 | 1568 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.; Zhou, X. Can Direct Subsidies or Tax Incentives Improve the R&D Efficiency of the Manufacturing Industry in China? Processes 2023, 11, 181. https://doi.org/10.3390/pr11010181

Liu Z, Zhou X. Can Direct Subsidies or Tax Incentives Improve the R&D Efficiency of the Manufacturing Industry in China? Processes. 2023; 11(1):181. https://doi.org/10.3390/pr11010181

Chicago/Turabian StyleLiu, Zhen, and Xijun Zhou. 2023. "Can Direct Subsidies or Tax Incentives Improve the R&D Efficiency of the Manufacturing Industry in China?" Processes 11, no. 1: 181. https://doi.org/10.3390/pr11010181