The Middle-Income Trap and the Coping Strategies From Network-Based Perspectives

Abstract

1. Introduction

2. Results

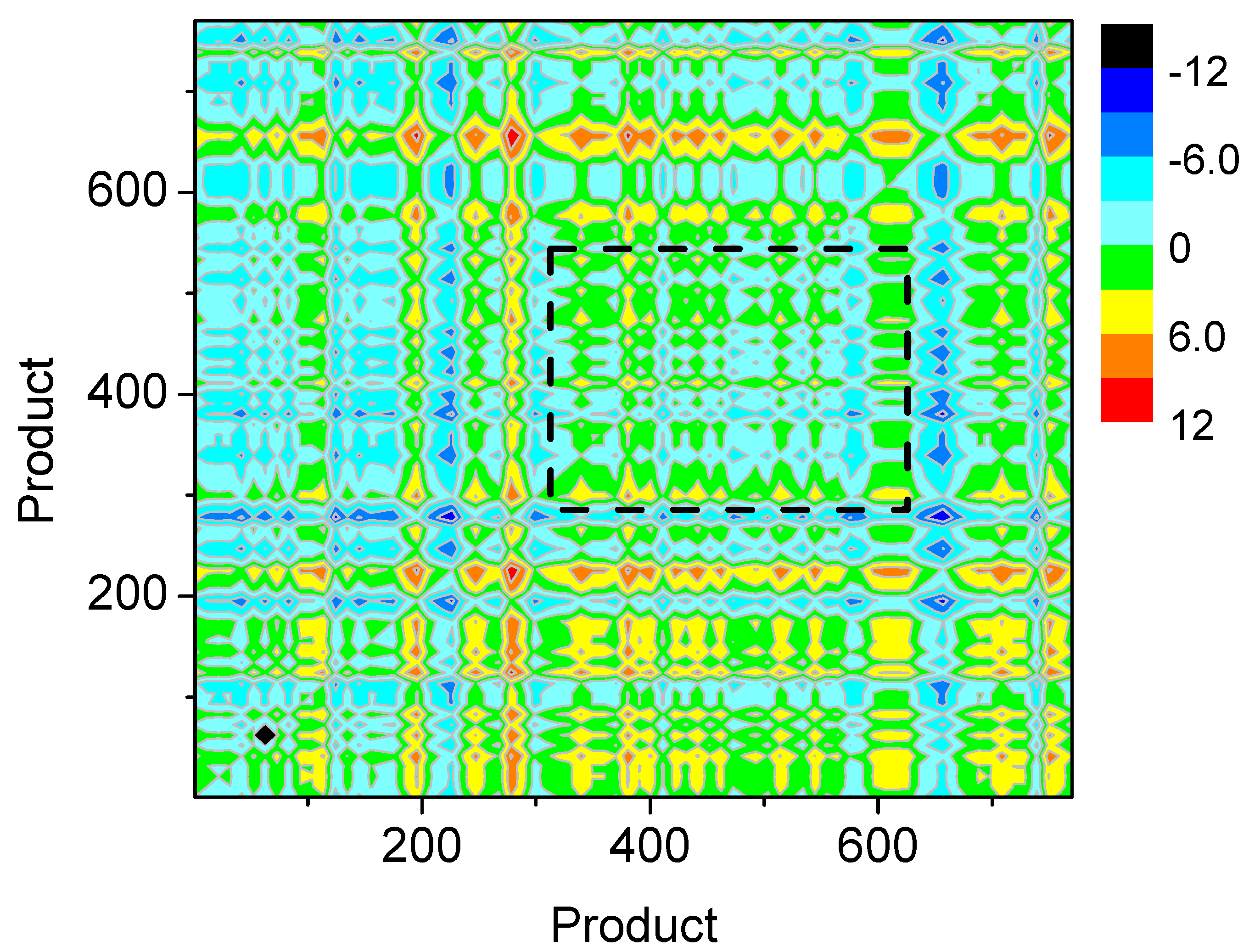

2.1. Interdependency between Products

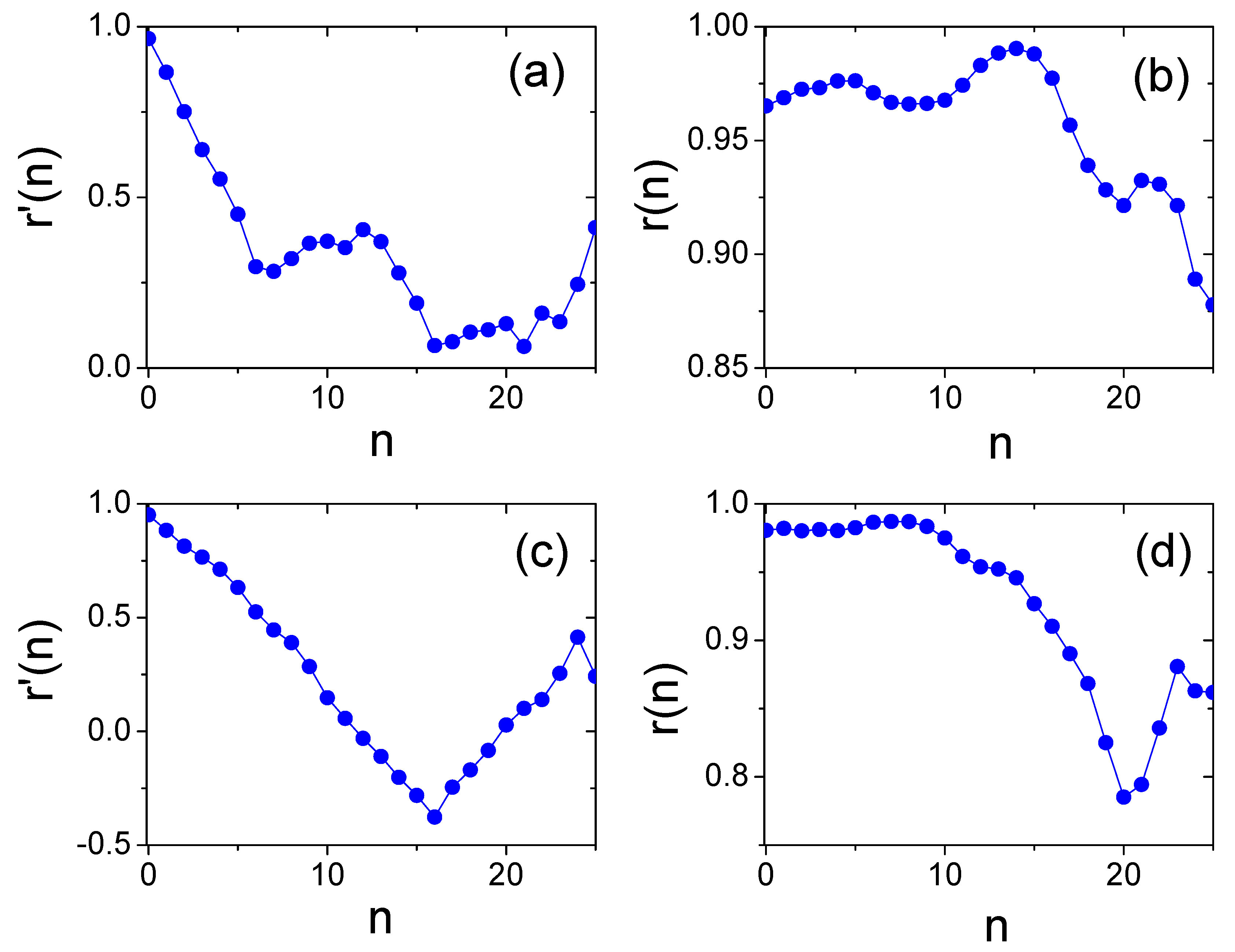

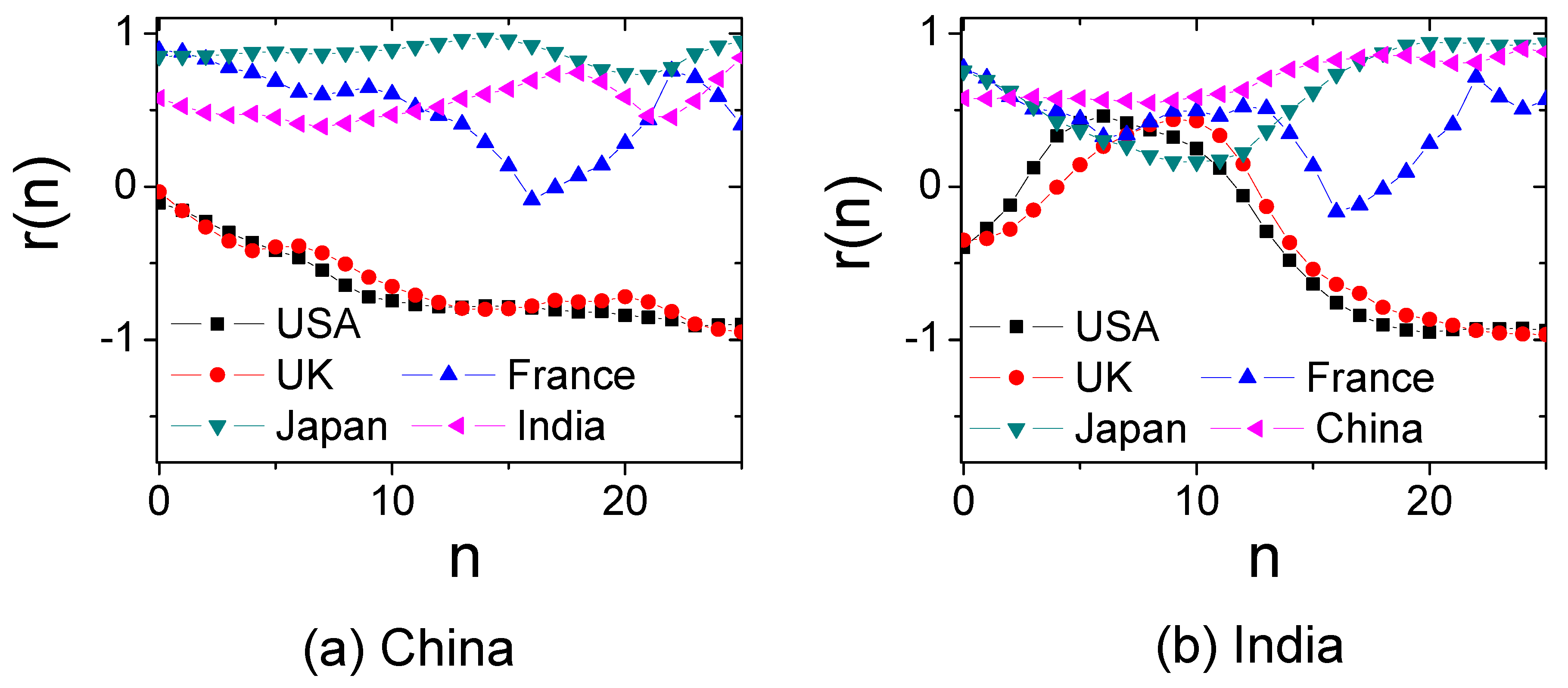

2.2. The Economic Similarity between Countries

2.3. Experimental Results

2.3.1. “Middle-Income Trap” on Product Interdependency

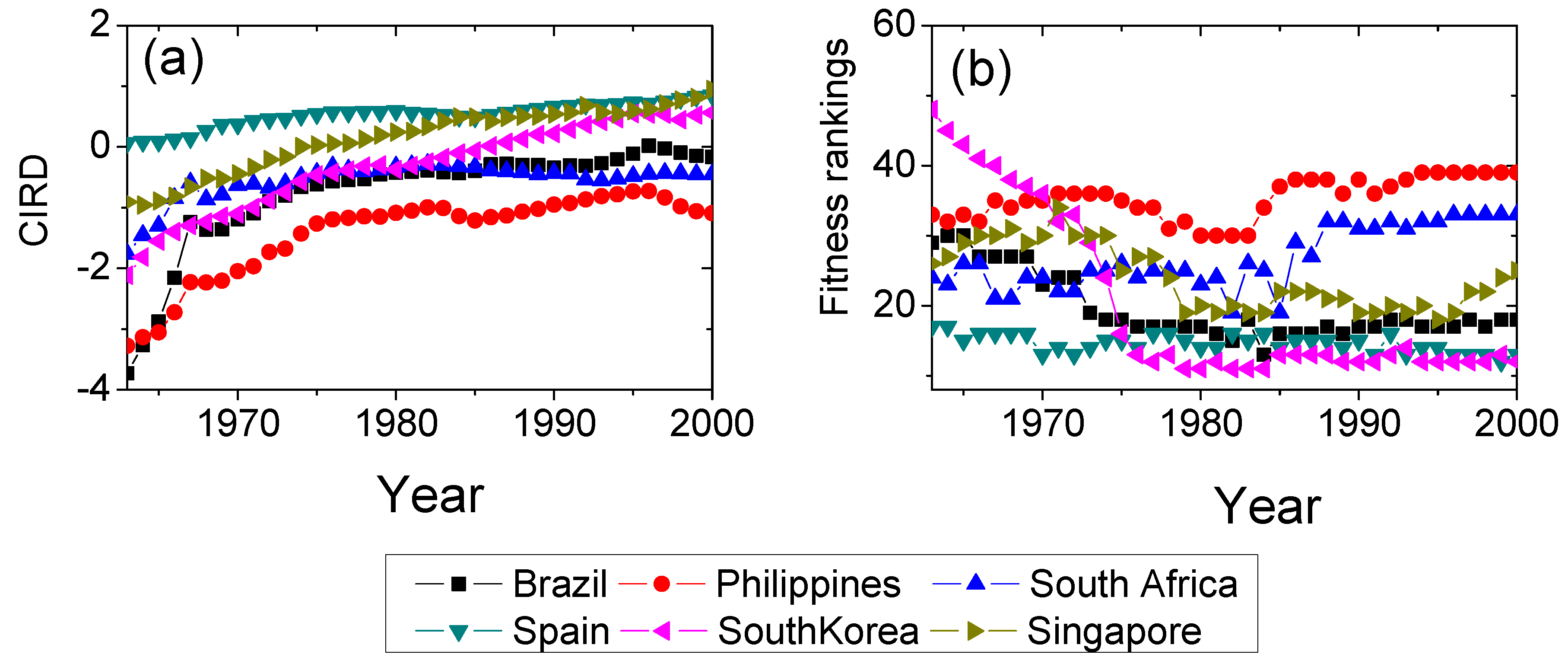

2.3.2. Economic Similarity Based on CIRD and FCM

3. Discussion

4. Materials and Methods

4.1. Dataset Description

4.2. Fitness-Complexity (FCM)

4.3. The Complex Index of Relative Development (CIRD)

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Hirschman, A.O. Development Projects Observed; Brookings Institution Press: Washington, DC, USA, 2014. [Google Scholar]

- Rodriguez, F.; Rodrik, D. Trade policy and economic growth: A skeptic’s guide to the cross-national evidence. NBER Macroecon. Annu. 2000, 15, 261–325. [Google Scholar] [CrossRef]

- Tacchella, A.; Cristelli, M.; Caldarelli, G.; Gabrielli, A.; Pietronero, L. A new metrics for countries’ fitness and products’ complexity. Sci. Rep. 2012, 2, 723. [Google Scholar] [CrossRef] [PubMed]

- Greenaway, D. International Trade Policy: From Tariffs to the New Protectionism; Macmillan: London, UK, 1983. [Google Scholar]

- Grossman, G.M.; Helpman, E. Quality ladders in the theory of growth. Rev. Econ. Stud. 1991, 58, 43–61. [Google Scholar] [CrossRef]

- Hidalgo, C.A.; Hausmann, R. The building blocks of economic complexity. Proc. Natl. Acad. Sci. USA 2009, 106, 10570–10575. [Google Scholar] [CrossRef] [PubMed]

- Mariani, M.S.; Vidmer, A.; Medo, M.; Zhang, Y.C. Measuring economic complexity of countries and products: Which metric to use? Eur. Phys. J. B 2015, 88, 293. [Google Scholar] [CrossRef]

- Gill, I.S.; Huang, Y.; Kharas, H. East Asian Visions: Perspectives on Economic Development; The World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Pugliese, E.; Chiarotti, G.L.; Zaccaria, A.; Pietronero, L. Complex economies have a lateral escape from the poverty trap. PLoS ONE 2017, 12, e0168540. [Google Scholar] [CrossRef] [PubMed]

- Kharas, H.; Gill, I. The middle-income trap turns 10. In Asia and the Middle-Income Trap; Routledge: London, UK, 2016; pp. 39–62. [Google Scholar]

- Bulman, D.; Eden, M.; Nguyen, H. Transitioning from low-income growth to high-income growth: Is there a middle-income trap? J. Asia Pac. Econ. 2017, 22, 5–28. [Google Scholar] [CrossRef]

- Wade, R.H. Industrial policy in response to the middle-income trap and the third wave of the digital revolution. Glob. Policy 2016, 7, 469–480. [Google Scholar] [CrossRef]

- Doner, R.F.; Schneider, B.R. The middle-income trap: More politics than economics. World Polit. 2016, 68, 608–644. [Google Scholar] [CrossRef]

- Evans, M. Policy Transfer in Global Perspective; Routledge: London, UK, 2017; pp. 1–9. [Google Scholar]

- Van den Berg, H. Economic Growth and Development; World Scientific Publishing Company: Hackensack, NJ, USA, 2016; pp. 833–881. [Google Scholar]

- Hidalgo, C.A.; Klinger, B.; Barabási, A.L.; Hausmann, R. The product space conditions the development of nations. Science 2007, 317, 482–487. [Google Scholar] [CrossRef] [PubMed]

- Brin, S.; Page, L. The anatomy of a large-scale hypertextual web search engine. Comput. Netw. ISDN Syst. 1998, 30, 107–117. [Google Scholar] [CrossRef]

- Page, L.; Brin, S.; Motwani, R.; Winograd, T. The PageRank Citation Ranking: Bringing Order to the Web; Technical Report; Stanford InfoLab: Stanford, CA, USA, 1999. [Google Scholar]

- Albeaik, S.; Kaltenberg, M.; Alsaleh, M.; Hidalgo, C.A. 729 new measures of economic complexity (Addendum to Improving the Economic Complexity Index). arXiv, 2017; arXiv:1708.04107. [Google Scholar]

- Felipe, J.; Kumar, U.; Abdon, A.; Bacate, M. Product complexity and economic development. Struct. Chang. Econ. Dyn. 2012, 23, 36–68. [Google Scholar] [CrossRef]

- Poncet, S.; de Waldemar, F.S. Export upgrading and growth: The prerequisite of domestic embeddedness. World Dev. 2013, 51, 104–118. [Google Scholar] [CrossRef]

- Farrell, T.S. Tailoring reflection to individual needs: A TESOL case study. J. Educ. Teach. 2001, 27, 23–38. [Google Scholar] [CrossRef]

- Hartmann, D.; Guevara, M.R.; Jara-Figueroa, C.; Aristarán, M.; Hidalgo, C.A. Linking economic complexity, institutions, and income inequality. World Dev. 2017, 93, 75–93. [Google Scholar] [CrossRef]

- Cimini, G.; Gabrielli, A.; Labini, F.S. The scientific competitiveness of nations. PLoS ONE 2014, 9, e113470. [Google Scholar] [CrossRef] [PubMed]

- Zaccaria, A.; Cristelli, M.; Tacchella, A.; Pietronero, L. How the taxonomy of products drives the economic development of countries. PLoS ONE 2014, 9, e113770. [Google Scholar] [CrossRef] [PubMed]

- Blondel, V.D.; Guillaume, J.-L.; Lambiotte, R.; Lefebvre, E. Fast unfolding of communities in large networks. J. Stat. Mech. Theory Exp. 2008, 10, 10008. [Google Scholar] [CrossRef]

- Liao, H.; Vidmer, A. A comparative analysis of the predictive abilities of economic complexity metrics using international trade network. Complexity 2018, 2018. [Google Scholar] [CrossRef]

- Ye, L.; Robertson, P.E. On the existence of a middle-income trap. Econ. Rec. 2016, 92, 173–189. [Google Scholar] [CrossRef]

- Eichengreen, B. Escaping the middle-income trap. In Proceedings of the Economic Policy Symposium, Jackson Hole, WY, USA, 25–27 August 2011; pp. 409–419. [Google Scholar]

- Felipe, J.; Abdon, A.; Kumar, U. Tracking the Middle-Income Trap: What Is It, Who Is in It, and Why? Levy Economics Institute: New York, NY, USA, 2012. [Google Scholar]

- Eichengreen, B.; Park, D.; Shin, K. Growth Slowdowns Redux: New Evidence on the Middle-Income Trap; Technical Report; National Bureau of Economic Research: Cambridge, MA, USA, 2013. [Google Scholar]

- Kharas, H.; Kohli, H. What is the middle income trap, why do countries fall into it, and how can it be avoided? Glob. J. Emerg. Mark. Econ. 2011, 3, 281–289. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Simoes, A.J.; Hidalgo, C.A. The economic complexity observatory: An analytical tool for understanding the dynamics of economic development. In Proceedings of the 17th AAAI Conference on Scalable Integration of Analytics and Visualization, Menlo Park, CA, USA, 1 January 2011; pp. 39–42. [Google Scholar]

- Pugliese, E.; Zaccaria, A.; Pietronero, L. On the convergence of the fitness-complexity algorithm. Eur. Phys. J. Spec. Top. 2016, 225, 1893–1911. [Google Scholar] [CrossRef]

- Cristelli, M.; Gabrielli, A.; Tacchella, A.; Caldarelli, G.; Pietronero, L. Measuring the intangibles: A metrics for the economic complexity of countries and products. PLoS ONE 2013, 8, e70726. [Google Scholar] [CrossRef] [PubMed]

- Cristelli, M.; Tacchella, A.; Pietronero, L. The heterogeneous dynamics of economic complexity. PLoS ONE 2015, 10, e0117174. [Google Scholar] [CrossRef] [PubMed]

- Gabrielli, A.; Cristelli, M.; Mazzilli, D.; Tacchella, A.; Zaccaria, A.; Pietronero, L. Why we like the ECI+ algorithm. arXiv, 2017; arXiv:1708.01161. [Google Scholar]

- Domínguez-García, V.; Munoz, M.A. Ranking species in mutualistic networks. Sci. Rep. 2015, 5, 8182. [Google Scholar] [CrossRef] [PubMed]

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef]

| Target Country | Recommended Country Based on | Recommended Country Based on |

|---|---|---|

| Brazil | New Zealand | Israel |

| Russia | Romania | Saudi Arabia |

| India | South Korea | Peru |

| China | Finland | Indonesia |

| Pilipinas | Thailand | Israel |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, M.-Y.; Xiong, W.-M.; Li, X.-Y.; Liao, H. The Middle-Income Trap and the Coping Strategies From Network-Based Perspectives. Entropy 2018, 20, 803. https://doi.org/10.3390/e20100803

Zhou M-Y, Xiong W-M, Li X-Y, Liao H. The Middle-Income Trap and the Coping Strategies From Network-Based Perspectives. Entropy. 2018; 20(10):803. https://doi.org/10.3390/e20100803

Chicago/Turabian StyleZhou, Ming-Yang, Wen-Man Xiong, Xiao-Yu Li, and Hao Liao. 2018. "The Middle-Income Trap and the Coping Strategies From Network-Based Perspectives" Entropy 20, no. 10: 803. https://doi.org/10.3390/e20100803

APA StyleZhou, M.-Y., Xiong, W.-M., Li, X.-Y., & Liao, H. (2018). The Middle-Income Trap and the Coping Strategies From Network-Based Perspectives. Entropy, 20(10), 803. https://doi.org/10.3390/e20100803