Complexity Analysis of Carbon Market Using the Modified Multi-Scale Entropy

Abstract

:1. Introduction

2. Methods

2.1. Moving-Average

2.2. Sample Entropy for Each Moving Average Time Series

3. Experimental Results and Discussion

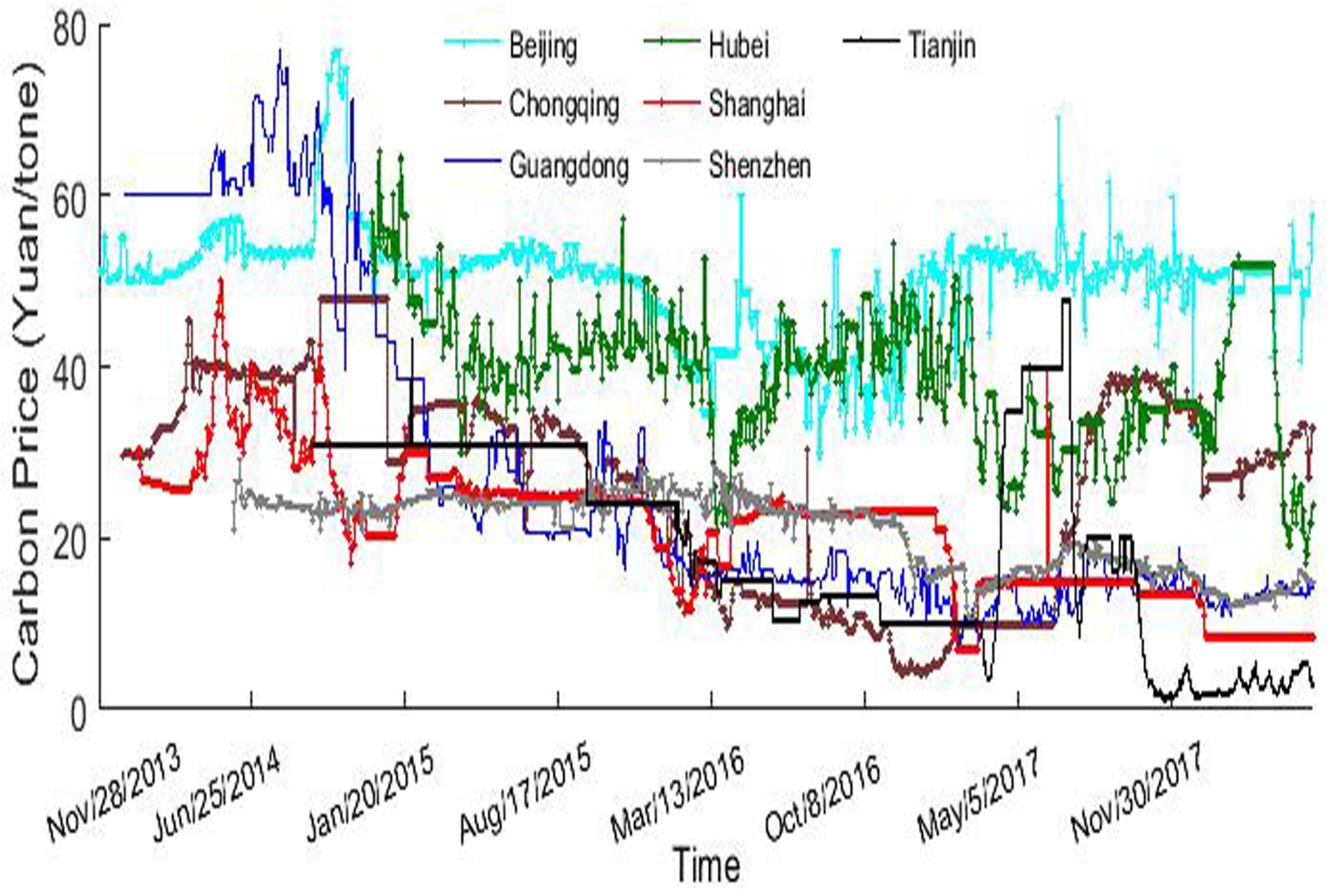

3.1. Data

3.2. Complexity Analysis in Overall Time

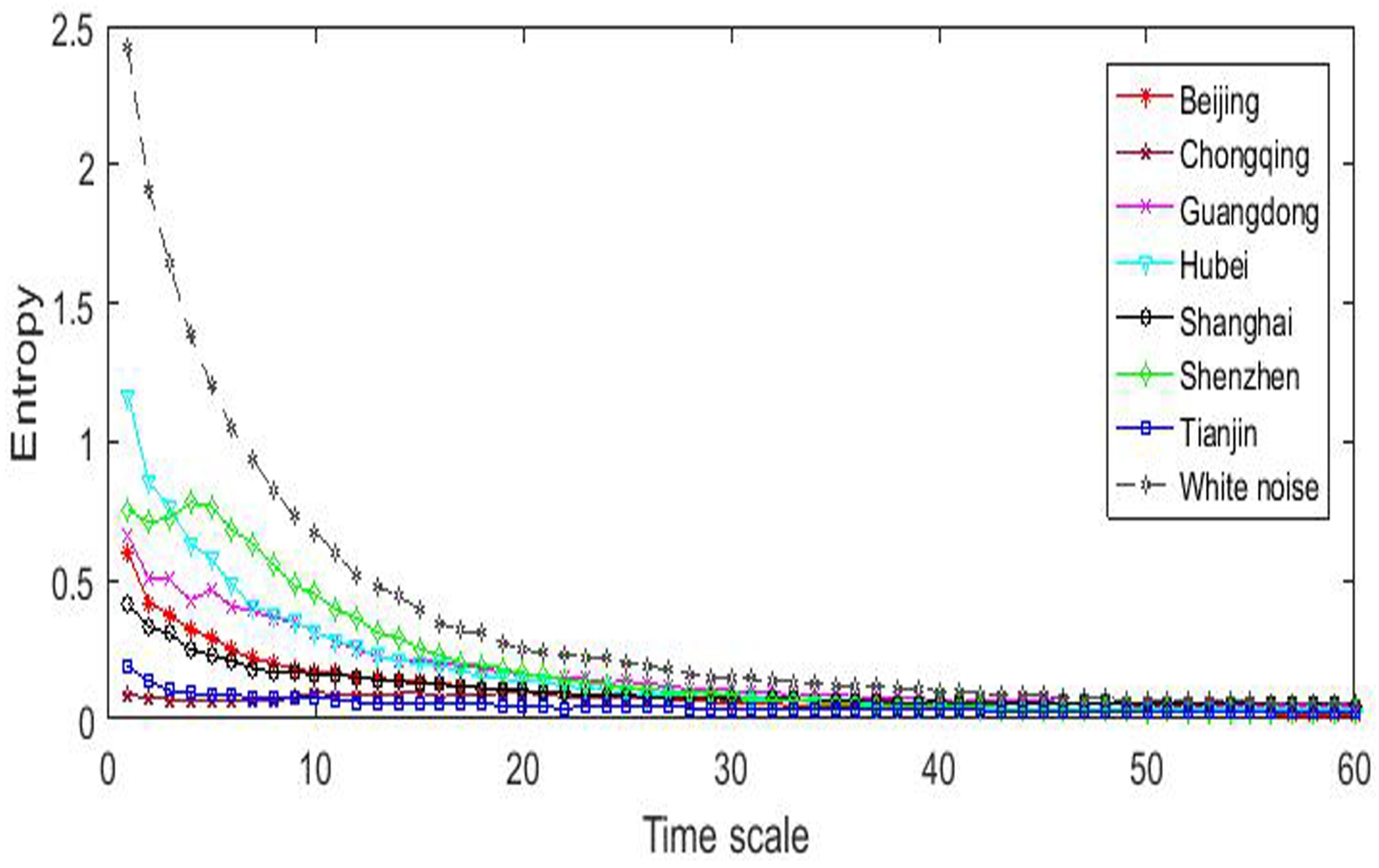

3.3. Complexity Analysis in Multiple Scales

3.4. Evolution of Complexity

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Pizer, W.A.; Zhang, X. China’s New National Carbon Market; Working Paper of Nicholas Institute for Environmental Policy Solutions; Duke: Durham, NC, USA, 2018. [Google Scholar]

- Krishnamurti, C.; Hoque, A. Efficiency of European emissions markets: Lessons and implications. Energy Policy 2011, 39, 6575–6582. [Google Scholar] [CrossRef]

- Fama, E. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Jensen, M.C. Some anomalous evidence regarding market efficiency. J. Financ. Econ. 1978, 6, 95–101. [Google Scholar] [CrossRef]

- Newell, R.G.; Pizer, W.A.; Raimi, D. Carbon market lessons and global policy outlook. Science 2014, 343, 1316–1317. [Google Scholar] [CrossRef] [PubMed]

- Fan, X.; Li, S.; Tian, L. Complexity of carbon market from multi-scale entropy analysis. Physica A 2016, 452, 79–85. [Google Scholar] [CrossRef]

- Seifert, J.; Uhrig-Homburg, M.; Wagner, M. Dynamic behavior of CO2 spot prices. J. Environ. Econ. Manag. 2008, 56, 180–194. [Google Scholar] [CrossRef]

- Yang, X.; Liao, H.; Feng, X.; Yao, X. Analysis and tests on weak-form efficiency of the EU carbon emission trading market. Low Carbon Econ. 2018, 9, 1–17. [Google Scholar] [CrossRef]

- Alberto, M.; Vries, D.; Frans, P. Carbon trading thickness and market efficiency. Energy Econ. 2010, 32, 1331–1336. [Google Scholar] [Green Version]

- Daskalakis, G.; Markellos, R.N. Are the European carbon markets efficient. Rev. Futures Mark. 2008, 17, 103–128. [Google Scholar]

- Daskalakis, G. On the efficiency of the European carbon market: New evidence from Phase II. Energy Policy 2013, 54, 369–375. [Google Scholar] [CrossRef]

- Charles, A.; Darné, O.; Fouilloux, J. Market efficiency in the European carbon markets. Energy Policy 2013, 60, 785–792. [Google Scholar] [CrossRef] [Green Version]

- Joyeux, R.; Milunovich, G. Testing market efficiency in the EU carbon futures market. Appl. Financ. Econ. 2010, 20, 803–809. [Google Scholar] [CrossRef]

- Miclăuş, P.G.; Lupu, R.; Dumitrescu, S.A.; Bobircă, A. Testing the efficiency of the European carbon futures market using event-study methodology. Int. J. Energy Environ. 2008, 2, 121–128. [Google Scholar]

- Tang, B.; Shen, C.; Gao, C. The efficiency analysis of the European CO2 futures market. Appl. Energy 2013, 112, 1544–1547. [Google Scholar] [CrossRef]

- Lo, A.Y. Carbon trading in a socialist market economy: Can China make a difference. Ecol. Econ. 2013, 87, 72–74. [Google Scholar] [CrossRef]

- Zhao, X.; Jiang, G.; Nie, D.; Chen, H. How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar] [CrossRef]

- Zhao, X.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Norden, L.; Weber, M. Informational efficiency of credit default swap and stock markets: The impact of credit rating announcements. J. Bank. Financ. 2004, 28, 2813–2843. [Google Scholar] [CrossRef]

- Tang, L.; Yu, L.; Liu, F.; Xu, W. An integrated data characteristic testing scheme for complex time series data exploration. Int. J. Inf. Technol. Decis. Making 2013, 12, 491–521. [Google Scholar] [CrossRef]

- Tang, L.; Yu, L.; He, K. A novel data-characteristic-driven modeling methodology for nuclear energy consumption forecasting. Appl. Energy 2014, 128, 1–14. [Google Scholar] [CrossRef]

- Tang, L.; Lv, H.; Yu, L. An EEMD-based multi-scale fuzzy entropy approach for complexity analysis in clean energy markets. Appl. Soft Comput. 2017, 56, 124–133. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Pincus, S.M. Approximate entropy as a measure of system complexity. Proc. Natl. Acad. Sci. USA 1991, 88, 2297–2301. [Google Scholar] [CrossRef] [PubMed]

- Eckmann, J.P.; Ruelle, D. Ergodic theory of chaos and strange attractors. Rev. Modern Phys. 1985, 57, 617–656. [Google Scholar] [CrossRef]

- Grassberger, P.; Procaccia, I. Estimation of the Kolmogorov entropy from a chaotic signal. Phys. Rev. A 1983, 28, 2591–2593. [Google Scholar] [CrossRef]

- Costa, M.; Goldberger, A.L.; Peng, C. Multiscale entropy analysis of complex physiologic time series. Phys. Rev. Lett. 2002, 89, 068102. [Google Scholar] [CrossRef] [PubMed]

- Chen, W.; Zhuang, J.; Yu, W.; Wang, Z. Measuring complexity using FuzzyEn, ApEn, and SampEn. Med. Eng. Phys. 2009, 31, 61–68. [Google Scholar] [CrossRef] [PubMed]

- Wu, S.; Wu, C.; Lee, K.; Lin, S. Modified multiscale entropy for short-term time series analysis. Physica A 2013, 392, 5865–5873. [Google Scholar] [CrossRef]

- Heurtier, A.H. The multiscale entropy algorithm and its variants : A review. Entropy 2015, 17, 3110–3123. [Google Scholar] [CrossRef] [Green Version]

- Richman, J.S.; Moorman, J. Physiological time-series analysis using approximate entropy and sample entropy. Am. J. Physiol. Heart Circ. Physiol. 2000, 278, 2039–2049. [Google Scholar] [CrossRef] [PubMed]

- Costa, M.; Peng, C.K.; Goldberger, A.L.; Hausdorff, J.M. Multiscale entropy analysis of human gait dynamics. Physica A 2003, 330, 53–60. [Google Scholar] [CrossRef]

- Pincus, S.M. Assessing Serial Irregularity and Its Implications for Health. Ann. N. Y. Acad. Sci. 2001, 954, 245–267. [Google Scholar] [CrossRef] [PubMed]

- Chou, C.M. Wavelet-based multi-scale entropy analysis of complex rainfall time series. Entropy 2011, 13, 241–253. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yin, J.; Su, C.; Zhang, Y.; Fan, X. Complexity Analysis of Carbon Market Using the Modified Multi-Scale Entropy. Entropy 2018, 20, 434. https://doi.org/10.3390/e20060434

Yin J, Su C, Zhang Y, Fan X. Complexity Analysis of Carbon Market Using the Modified Multi-Scale Entropy. Entropy. 2018; 20(6):434. https://doi.org/10.3390/e20060434

Chicago/Turabian StyleYin, Jiuli, Cui Su, Yongfen Zhang, and Xinghua Fan. 2018. "Complexity Analysis of Carbon Market Using the Modified Multi-Scale Entropy" Entropy 20, no. 6: 434. https://doi.org/10.3390/e20060434