2. Risk Control Considering Uncertainty

Elsewhere [

28], a preliminary framework has been proposed to guide the reduction of uncertainty; however, in practical applications, we found some deficiencies as mentioned in the introduction.

(1) The Computational Efficiency of the Model

The reduction of uncertainty is indeed important for risk control, but taking into account various factors such as cost and time, it is unrealistic to completely eliminate the uncertainty in the application. It is our goal to control the impact of uncertainty on assessment and decision-making to within an acceptable range. For tunnel engineering geological disaster risk, due to the variety of sources of uncertainty, the factors affecting the uncertainty may be as many as a dozen, but we only need to consider taking measures to reduce uncertainty in one, or several, thereof. In addition, we can take different measures even for the same factor. Therefore, it will lead to a very large number of alternatives, which not only increases the computational burden and difficulty of selection, but also easily leads to situations where multiple schemes meet the requirements. We now provide further explanation by enumerating a simple example similar to that in the literature [

27].

According to the statistical analysis of historical data, the fitting formula between the occurrence probability of incident

and the influencing factors is:

There are five influencing factors () in the above formula, the scope of risk control measures will be very wide. It will be a challenging issue to select a reasonable control measure quickly. The existing model is inefficient and has some blindness.

To compensate for the above deficiencies, we believe that sensitivity analysis is necessary for all uncertain variables (influencing factors) to determine the impact of each variable on hazard (R1). Only those variables with a larger influence will be considered. This preliminary judgment can improve the efficiency of decision-making and reduce blindness.

(2) The Relationship between Hazard and Tolerance Cost

Different combinations of uncertainties and hazards will lead to different choices for risk control.

Table 1 lists four typical combinations quoted from the literature [

28].

For the first situation, no risk control measures will be taken, and in the second case we will choose measures to reduce the hazard. What they have in common is that they do not need to take measures to reduce uncertainty. We can think that their tolerable costs should be closer (

, not too far apart; however, according to the calculation model (Formula (2), where

indicates ”decision effect”, and

is an undetermined coefficient with

[

27]), the tolerable costs obtained may vary greatly and the above phenomenon cannot be fully reflected. Similarly, for the third and fourth situations, we are all willing to provide more resources and cost to deal with the third type of situation, because it is not only of large uncertainty, but also hazardous.

In an ideal state, if the uncertainty is zero, the hazard will be a fixed value, but for tunnel engineering, because of uncertainty, such as uncertainty of geological information and uncertainty of disaster mechanism, the value of hazard is uncertain. Now we assume that there are events

and

, the degrees of uncertainty are the same, that is,

, and suppose that the maximum hazard value is 100, then according to the existing uncertain information, the hazards are:

,

, respectively. For event

, we will choose to reduce uncertainty to determine the range of hazard values: for event

, because the range of hazard values is relatively small, it will be more effective for risk control to take measures to reduce the hazard. Therefore, for case where the hazard is uncertain, the tolerance cost is not related to the hazard value, but to its range, that is

. Therefore, the following formula may be more reasonable:

(3) Determination of Risk Control Scheme

In the existing method, the control scheme is determined when judging whether or not it is necessary to reduce the uncertainty. That is, the formula has played two roles, namely, necessity judgment and scheme selection. However, in practical applications, two or more schemes may meet the requirements. Assuming a utility tolerable cost is , the implementation costs of the scheme and are: , respectively. Then how do we choose? If we do not consider other factors, we should choose , which has the lower cost. We now assume that implementation of will take less time, and its impact on environment, such as water pollution, will be relatively small. Under this situation, will we still insist on choosing ? Therefore, it may be not appropriate to consider only the decision effect, other main factors should also be considered. It will be a multi-attribute utility decision problem under uncertainty and how to choose will be discussed below.

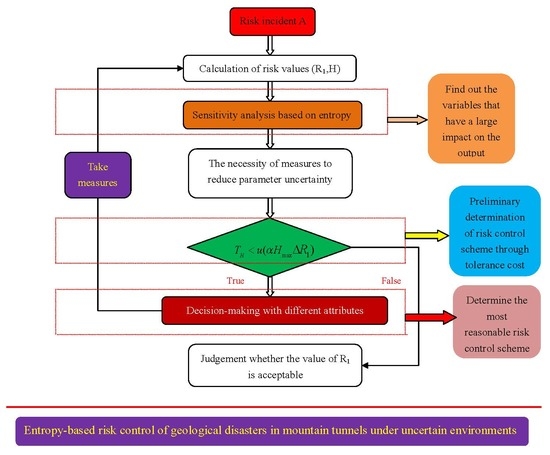

Through the above analysis, it can be seen that the existing entropy-hazard model needs to be improved when used in tunnel engineering. With regard to how to analyse, and reduce, the impact of uncertainty on risk, we believe that the following steps are more reasonable:

Step 1: Use entropy to calculate the sensitivity of variables, and narrow the scope of alternatives according to sensitivity, so as to improve decision-making efficiency.

The main purpose of sensitivity analysis (SA) is to estimate effects of each model input on the model response and to identify the primary contributors to output uncertainty [

30], which could increase the understanding of the relationships between input variables and the output [

31]. Then the variables that cause significant variability in the output results should be the focus [

32].

Variance-based SA [

33] is the most commonly used method. In addition, there are other SA methods, such as Kullback–Liebler divergence methods, screening methods, entropy-based SA, etc. [

34,

35]. In recent years, as it could reveal complementary or additional information compared to the most often variance-based method, entropy-based SA methods have received more attention [

36]. Therefore, we try to quantify the impact of input variables on the risk of geological hazards by the entropy-based SA.

Suppose there is a limit state function:

, where

represents random input variables, i.e., model parameters,

is the response function,

are the output results. So the sensitivity index formula can be as follows:

where

indicates the degree of uncertainty of the model output without considering

.

Step 2: The necessity of reducing uncertainty.

The object of this step is to determine the tolerable cost. If Formula (3) is taken, the tolerance cost is different for each scheme, but for the same risk event, the tolerance cost is relatively fixed for decision-maker, which is also consistent with decision-making habits in tunnel engineering. Therefore, Formula (3) is further modified to get Formula (5), and the decision effect (

) is considered together with other factors such as time, environment, etc. as influencing factors.

Step 3: Decision-making with different attributes.

To obtain a reasonable decision-making result, not only attribute information, but also information uncertainty, should be considered. In addition, the attitude of decision-makers to risks can also not be ignored.

For tunnel engineering, the analysis process for such uncertainty is as follows:

3. Scheme Selection under Multi-Source Attributes

As shown in

Figure 2, for the schemes that meet the tolerable cost, we need to optimise the schemes in terms of properties such as time, environmental impact, application effect, and then choose the most reasonable scheme. The impact of attributes on schemes can be viewed as a consequence of risk. Since the attribute information is uncertain, according to the definition of risk, risk and uncertainty must be considered simultaneously when decision-making. Therefore, it is a typical multi-attribute decision-making problem under risk and uncertainty, which has aroused wide interest of scholars from different industries. For example, in order to promote the research of managing information uncertainty and complexity in decision-making, Antucheviciene et al. [

37] initiated related special issue research, and got the active response from scholars with different industries. Since the decision-making issue is more and more complex in civil engineering, and the characteristics of uncertainty are very obvious, in recent years, the study of multi-criteria decision making has been becoming more and more popular in civil engineering. Such as Antucheviciene et al. [

38] have systematically summarised and analysed the research status of MADM in civil engineering from the following aspects, including the influence of uncertainty, the decision-making problem under risk, the necessity of sensitivity analysis etc, and put forward several problems that need further study in the future. To solve the problems of multi-attribute decision making under uncertainty, Yang et al. [

39] first proposed their expected utility-entropy (EU-E) model. Although the EU-E model has been applied in different fields, such as a decision-making model for large consumers on a smart grid [

40], rainfall threshold analysis [

41], stock selection [

42], etc., few people could question the rationality of the EU-E model itself. Fischera [

43] commented on Yang’s model and pointed out its deficiencies, such as that the impact of consequences was not considered for uncertainty analysis; however, it does not propose a reasonable alternative framework or model, but simply thinks that the EU model is enough to solve decision-making problems under uncertainty. Therefore, based on the existing research, we analyse the EU-E model, and corresponding improvement measures are proposed. Yang’s EU-E model is defined as follows:

where,

is the outcome resulting from the combination of option

and state

(such as

can be numbers, and

indicates corresponding probability),

is the decision-maker’s utility function; the factor

with

expresses the weighting, or trade-off, that the decision-maker attaches to the expected utility and entropy. Some examples have been proposed in [

39,

43] to prove or refute the reliability or deficiencies of the EU-E model, but they fail to consider all possible situations. To analyse the reliability of the EU-E model under different circumstances, based on the difference in entropy values, the decision-making situations are divided into the following three categories (for the sake of this analysis, we only consider the situation with two schemes

and

):

(1) The uncertainty of the consequences is equal, , then we can further divide it into three situations.

① , are expected utility, and the related example is as follows:

If scheme is (2, 1/3; 4, 1/3; 6, 1/3), where 2, 4, 6 are numbers; 1/3 represents the corresponding probability, and the follow-up cases are similar to , then scheme can be : (0, 1/3; 1, 1/3; 11, 1/3), : (0, 1/3; 2, 1/3; 10, 1/3), : (0, 1/3; 3, 1/3; 9, 1/3), : (0, 1/3; 4, 1/3; 8, 1/3), : (0, 1/3; 5, 1/3; 7, 1/3), : (1, 1/3; 2, 1/3; 9, 1/3), : (1, 1/3; 3, 1/3; 8, 1/3), : (1, 1/3; 4, 1/3; 7, 1/3), or : (3, 1/3; 4, 1/3; 5, 1/3).

If Formula (6) is used to determine which scheme should be selected, we have , the EU-E model is invalid at this time; because the value of reflects the decision-maker’s attitude to risk, where this indicates decision-makers are risk averse, means risk neutrality, and indicates that the decision-maker is willing to take a greater risk. So different values of should be considered.

For the risk-averse, the worst consequence of scheme is 2. Compared to schemes to , is more reasonable. For schemes and , is obviously more reasonable. Since the order of variances is Var(b9) < Var(a) < Var(b1~b8), reasonable decision can be made based on variance.

For decision-makers with a risk-neutral view (), since there is no obvious risk tendency, it is difficult to make a decision between schemes and . No matter which is chosen, decision-makers can give their reasons, but intuitively, we believe it is more likely to have the same decision-result as a risk-averse manager.

Since risk seekers are willing to take higher risks for a better outcome, compared to scheme , schemes to seem more reasonable. For schemes and , decision-makers are more likely to choose .

Even when faced with the same risk decision event, decision-makers will make different decisions due to differences in their attitudes.

② and , the related example is as follows:

If scheme is (2, 1/3; 4, 1/3; 6, 1/3), as there are many schemes of that could satisfy the conditions and , we select several representative examples, such as : (0, 1/3; 1, 1/3; 17, 1/3), : (6, 1/3; 9, 1/3; 12, 1/3), : (10, 1/3; 11, 1/3; 12, 1/3).

According to Function (6), , however, decision-making results must also consider the influence of attitude to risk.

For the risk-averse, compared to , scheme is a relatively ideal result, but if it is compared to or , it would be more reasonable to choose or . Therefore, for such problems, neither the use of an EU-E model nor the variance can reach reasonable judgments.

For decision-makers with risk seeking behaviour, schemes would be the ideal choice, if compared to scheme , and the EU-E model is effective.

For decision-makers who are risk-neutral (), since the expected value , scheme is more reasonable, and the EU-E model is effective.

The EU-E model is effective in some cases, but there is no discussion of this in the literature [

37].

③ For the case where and , the analysis process and results are the same as the second type (, ) and are not described here.

(2) The uncertainty of the consequence for scheme is larger than , e.g., . Then we can further divide it into three situations.

① , then , () can be obtained based on Function (6), the related example are as follows.

Scheme : (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4); Scheme : (, 1/2; , 1/2), () and , , , according to Function (6), assuming , we have . Now we let , respectively. So scheme : (0, 1/2; 10, 1/2); scheme : (2,1/2; 8, 1/2); and scheme : (4, 1/2; 6, 1/2). Since different values of represent different attitudes to risk of the decision-maker, it is more reasonable to analyse this case considering these attitudes.

For the risk-averse, schemes and are offered, since scheme has one-half probability with consequence of 0, mean that they are intuitively more inclined to choose scheme . For schemes and , the latter has a higher probability of 2 than scheme , and for risk conservatives, the risk of choosing is relatively small. For schemes and , the latter is more likely to take 4, and does not take the risk of value 2, so it is more reasonable to choose scheme . Here, the EU-E model is invalid, but the variances of and are , , , and , respectively, so in these situations, a reasonable choice can be made based on the variance.

For decision-makers with a risk-neutral view (), since they do not have a clear tendency toward risk, it is difficult to make judgments for the above situations. Regardless of whether choosing or , there are reasons for their rationality, but intuitively, the results of the choice are more likely to be consistent with a risk-averse manager.

For decision-makers with risk seeking behaviour, decision-makers are willing to take higher risk. So for schemes and , and , it will be more reasonable to choose and . For schemes and , we are more inclined to choose scheme .

② , the values of and cannot be compared directly with Equation (6).

The first situation: , the decision result cannot be obtained based on EU-E model. If scheme is (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), then scheme can be (; ), (, for , and ). indicates that the decision-maker is not absolutely risk-seeking, and is more likely to be conservative or neutral. Assuming that the decision-maker is risk neutral, , then scheme is (0, 1/2; 8.6, 1/2). According to the variance: , we should choose , which is consistent with the attitude to risk of the decision-maker. For the risk-averse, scheme is more reasonable.

The second situation: . If scheme is (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), then scheme can be (0, 1/2; , 1/2), (, , for and ). When , , then we get ; when , , then we have .

For the risk-averse, such as those for whom , then . If scheme is (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), is (0, 1/2; 9.5, 1/2), then scheme should be chosen. Now we let scheme be (0, 1/4; 1, 1/4; 2, 1/4; 17, 1/4), and remains unchanged, we will be more inclined to choose scheme . The order of variance is , . Therefore, for this situation, it is reasonable to make decisions based on variance.

For a risk-neutral decision-maker (, ), it is difficult to make a reasonable decision. Now let scheme be : (0, 1/2; 4, 1/2); : (0, 1/2; 5, 1/2); : (0, 1/2; 6, 1/2); : (0, 1/2; 7, 1/2); : (0, 1/2; 8, 1/2); : (0, 1/2; 9, 1/2). Comparing and to scheme (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), then scheme is more reasonable. For schemes and , it does not violate basic decision-making behaviour if choosing or . We believe that alternatives and are more likely to be selected than . Therefore, neither the expected EU-E model nor the variance are applicable. It is rather complicated for this situation and it needs to be analysed according to the specific situation.

For a decision-maker seeking risk, such as at , , if , the probability that the consequence of scheme a exceeds 6 is 50%, then the decision-makers are more inclined to scheme . If , decision-makers will choose scheme to pursue higher reward.

The third situation: . We still let scheme have (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), then scheme can be (0, 1/2; , 1/2), (, for and ). In such a situation, it is more reasonable for decision-makers who are risk-averse or risk-neutral.

For the risk-averse, scheme is an ideal goal. For a risk-neutral decision-maker (, ), scheme should also be chosen and, in this case, the EU-E model is effective.

③ . Then according to Formula (6), we have . Assuming scheme is (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), there will be many types of scheme , such as (0, 1/2; , 1/2), (, for and ). The risk attitude of decision-makers is uncertain.

Now we let scheme be : (0, 1/2; 20, 1/2), : (1, 1/2; 19, 1/2), : (2, 1/2; 18, 1/2), : (4, 1/2; 16, 1/2), : (6, 1/2; 14, 1/2), : (8, 1/2; 12, 1/2). If we compare to , since has the possibility of consequence of zero, and offers the possibility that the consequence is smaller than that of scheme , for the risk-averse, it is more stable to choose scheme . However, when compared to to , since the minimum possible outcomes of the latter are equal to, or greater, than the possible value of scheme , so it is more consistent with the decision-making behaviour of a risk-averse manager to choose to . If we have : (0, 1/4; 1, 1/4; 2, 1/4; 17, 1/4), : (0, 1/2; 20, 1/2), since both schemes have the possibility of zero consequence, that is, the worst result is the same, then in this case, for the risk-averse, they will choose a scheme that has a larger expected utility value, that is, scheme b.

For a risk-neutral decision-maker (), as decision-makers have no obvious risk tendencies, it is difficult to judge whether to choose scheme or , but we can confirm that with the increasing value of x, the probability of selecting scheme will increase. It can be considered to be similar to a risk-averse decision-making behaviour.

For a risk-seeking decision-maker, to pursue higher consequences, scheme is an ideal goal. In this case, the EU-E model is effective.

(3) The uncertainty of the consequence for is smaller than , e.g., . Then we can further divide it into three situations.

① , then we have , (). The principle of analysis is the same as the situation whereby . For example, if we have scheme : (10 − x, 1/2; x, 1/2), scheme : (2, 1/4; 4, 1/4; 6, 1/4; 8, 1/4), then the analysis result is the same as that with .

Similarly, for case , the result is the same as that with . For case , the result is the same as that with .

Through the above analysis, we can see that for multi-attribute decision-making issues under an uncertain environment, it could not solve all situations by simply relying on the expected utility-entropy model. It not only needs to consider the expected utility, uncertainty measure, variance, etc., but more importantly, the influence of the risk attitude of the decision-maker cannot be ignored, different risk attitudes will lead to different results. Assume that there are two schemes

and

, the minimum value and its probability, the maximum value and its probability in each scheme are: (

), (

), (

), (

), respectively. Based on the above analysis, we recommend discriminant methods for the different types of scheme combinations in

Table 2.

The decision problem is fundamentally a subjective judgment of the decision-maker. Therefore, subjective factors affecting a decision-maker are important. Due to external environmental factors and their own knowledge level, the decision result is often a bounded rational entity. Decision-making issues must take into account the risk attitudes (

Table 2), different risk attitudes exert a decisive influence on decision-making results. The EU-E model or variance-average model can only solve some parts of the problems. By classifying decision-making problems, it is more reasonable to propose different methods according to different situations.

The well-known Allais paradox (

Table 3) has been discussed elsewhere [

39] to prove the validity of EU-E model. We will analyse the paradox based on the proposed method.

Problem 1: Select or ?

The entropy and expected values are:

,

,

,

,

and

. When

, then

, so the

should be chosen, and Yang believes the EU-E model is reasonable; however, why is it not considered with

? Now we analyse the issue by the proposed method: as

,

, according to

Table 3, we know that there will be three cases:

,

or

.

, which means that decision-maker is biased towards risk conservatism. Using

Table 3, the result can be obtained based on variance. Since

, we should choose

.

, which indicates risk-aversion; the variance is the recommended method in

Table 3 and

is our option.

, when

, it is risk neutral, and the EU-E model is valid (

Table 3). For the case of

, decision-makers are risk-seekers, and are willing to take corresponding risks for higher reward. In this case, decision-making based on expected or expected utility value is more consistent with decision-making behaviour. Therefore, it is more likely that

is chosen.

Many experiments have shown that a majority of subjects have a preference pattern of over ; however, it does not prove that the EU-E model is effective, because in reality, $1 million is very important to many people, or many people may not have $1 million in assets at all. Therefore, when faced with the above problem, there is generally a risk-averse tendency. According to our recommended method, the choice is for those who are risk-averse. Of course, there will be a small number of people who are risk-seeking and choose . The results of the above analysis are in agreement with the results of the experiment in which many people chose , while a few chose . This further proves the reliability of the proposed method.

Problem 2: select or ?

Similarly, we have

,

,

,

,

,

. For any

,

. For problem 2, we must first realise that regardless of whether we choose

or

, the possibility of zero consequence is almost the same and much greater than the non-zero value. Taking into account the above factors, decision-makers are most likely to show risk-seeking behaviour. According to

Table 3, the EU-E model is reasonable, and we should choose

.

Based on the recommended method, we discuss the Allais paradox, and through theoretical analysis, the results obtained by the experiment were reasonably explained.